#stock market asx

Explore tagged Tumblr posts

Text

Penny stocks are stocks of small companies that are either at a very young stage of their operations or they have not grown much for various reasons. Penny stocks companies usually have a unique idea or a business model that can offer extremely high returns over a period of time.

#stock market live#stock market asx#stock market today#stock market#asx penny stocks#penny stocks to buy#best penny stocks#best asx penny stocks#australian penny stocks

0 notes

Text

Australian Stocks to Buy: A Detailed Guide for Investors

Australia’s stock market, represented primarily by the Australian Securities Exchange (ASX), has long been an attractive destination for investors. With a diverse range of sectors, from mining to technology, healthcare, and finance, the ASX offers a wealth of opportunities for both seasoned investors and newcomers. In this article, we will explore some promising Australian stocks to consider for your portfolio, taking into account various industries, potential growth, and investment strategies.

Disclaimer

Before proceeding, it’s important to note that the information presented in this article is for educational purposes only and does not constitute financial advice. The stock market carries inherent risks, and individual circumstances such as financial goals, risk tolerance, and market conditions should be considered when making investment decisions. Always conduct thorough research or consult a professional financial advisor before making any investment.

Why Invest in Australian Stocks?

Australia is known for its stable economy, strong regulatory environment, and well-established financial systems, which make it an attractive destination for investors. The Australian stock market is home to several globally recognized companies, such as BHP Group and Commonwealth Bank, making it an appealing option for those seeking exposure to international giants as well as domestic firms.

Advantages of investing in Australian stocks include:

Diversification: The ASX includes a wide range of sectors, providing a well-rounded investment opportunity.

Strong mining and resources sector: Australia is rich in natural resources, and its mining companies are among the world leaders in sectors like iron ore, gold, and energy.

Global exposure: Many ASX-listed companies have a significant global footprint, providing exposure to international markets.

Dividends: Australian companies are known for paying generous dividends, especially in sectors like utilities and banking.

Sectors to Watch

Before delving into specific stocks, it’s important to identify the key sectors that have been performing well or are poised for growth in the near future. Some sectors to consider include:

Read More>>

#asx200#long term investing#personal finance#financial freedom#stocks#investment#stock market#asx#australia#finance

2 notes

·

View notes

Text

Long-Term vs. Short-Term Investing: What’s Best for ASX Investors?

The Australian stock market (ASX) offers a range of investment opportunities, catering to both short-term traders and long-term investors. Choosing between these two approaches depends on your financial goals, risk tolerance, and investment strategy. In this blog, we explore the key differences, benefits, and risks of both strategies to help you make informed investment decisions.

Understanding Long-Term Investing

Long-term investing involves holding stocks for an extended period, usually five years or more. Investors focus on fundamental analysis, looking at company earnings, market potential, and overall economic trends.

Benefits of Long-Term Investing:

Wealth Accumulation & Compounding: Long-term investments benefit from compound interest, allowing reinvested earnings to generate additional returns.

Lower Transaction Costs: Since long-term investors buy and hold, they avoid frequent trading fees and commissions.

Reduced Market Volatility Impact: Short-term market fluctuations are less significant over extended periods, leading to more stable returns.

Dividend Growth: Many ASX-listed companies offer dividends, which can be reinvested to enhance portfolio growth over time.

Tax Efficiency: In Australia, long-term investors benefit from the Capital Gains Tax (CGT) discount, reducing taxable profits on stocks held for over 12 months.

Risks of Long-Term Investing:

Patience is Required: Significant returns may take years to materialize.

Market Risks: Economic downturns can affect long-term investments, requiring a strong risk management strategy.

Understanding Short-Term Investing

Short-term investing typically involves buying and selling stocks within days, weeks, or months, relying on technical analysis, price trends, and market timing to generate quick profits.

Benefits of Short-Term Investing:

Quick Returns: Traders capitalize on short-term price movements, potentially earning profits in a shorter time frame.

Market Flexibility: Investors can respond to ASX live updates and economic news, adjusting strategies accordingly.

Diverse Opportunities: Day trading, swing trading, and momentum trading provide various methods to profit from market trends.

Risks of Short-Term Investing:

High Volatility Exposure: Short-term investments are highly sensitive to market fluctuations.

Frequent Trading Costs: Higher transaction fees can eat into profits.

Emotional Decision-Making: Quick decisions may lead to impulsive trading mistakes.

Tax Implications: Short-term capital gains are taxed at a higher rate than long-term investments.

Which Strategy is Best for ASX Investors?

Choosing between long-term and short-term investing depends on your financial goals:

If you prefer stability and steady wealth growth, long-term investing is a safer choice.

If you are willing to take calculated risks for quick profits, short-term trading may be appealing.

Hybrid Approach: Some investors combine both strategies by maintaining a long-term portfolio while actively trading in short-term opportunities.

Conclusion: Both long-term and short-term investing have unique advantages and risks. The key to success lies in understanding your risk tolerance, investment horizon, and market knowledge. For the latest ASX stock market insights, live updates, and expert interviews, visit The Stock Network and stay informed!

0 notes

Text

ASX Uranium Stocks: The Undiscovered Heroes of Clean Energy Investment 🌍⚡

🚀 Why Uranium is Powering Clean Energy’s Future

Stable Prices, Bright Future: Uranium prices hold steady at around USD $78 with high potential ahead.

Demand Driven by Tech & Energy: With data centers needing constant power for AI, companies like Amazon and Google are eyeing nuclear power as a sustainable option.

🔥 Top ASX Uranium Stocks Poised for Growth

Boss Energy (ASX: BOE): Major player with assets in Australia and Texas, positioned to ride the nuclear wave as demand for AI energy grows.

Paladin Energy (ASX: PDN): Expanding globally with projects like Langer Heinrich in Namibia, ready to supply a uranium-hungry world.

Deep Yellow (ASX: DYL): Building an international asset portfolio, ready to meet demand across Australia and Africa.

📈 Why Uranium Demand is Rising

AI Boom = Energy Surge: Data centers fueling AI need nuclear’s stable, high-output power.

Decarbonization Push: As the world pivots away from fossil fuels, uranium is regaining prominence in the clean energy sector.

🛠️ M&A Activity Signals Big Potential

Scramble for Assets: Rising demand sparks mergers and acquisitions, with companies like Paladin snapping up new uranium assets.

🌟 Key Takeaway for Investors

The ASX uranium sector is a hidden gem in the clean energy boom. With big tech and government backing nuclear power, uranium stocks like Boss Energy, Paladin, and Deep Yellow are set for major gains.

💼 Diversify Your Portfolio with ASX-listed uranium stocks and explore the untapped potential of clean, nuclear-powered growth!

Visit - https://www.skrillnetwork.com/why-asx-uranium-stocks-are-the-hidden-gems-in-clean-energy-investing

0 notes

Text

Explore the latest ASX 200 trends: Tuesday’s rebound faces hurdles despite positive Wall Street gains. Insights on expected market dips, rising oil prices, and stock opportunities like Pro Medicus and Telstra.

0 notes

Text

In 2024, I'm Monitoring the SOL Share Price

The Australian Stock Exchange (ASX) hosts a diverse array of companies, each with its own unique characteristics and investment appeal. In this article, we delve into the share price performance and key attributes of two prominent ASX-listed entities: Washington H. Soul Pattinson Ltd (ASX: SOL) and Coles Group Ltd (ASX: COL).

Washington H. Soul Pattinson Ltd

Established in 1903, Washington H. Soul Pattinson (ASX:SOL) stands as one of the oldest investment companies listed on the ASX. With a rich history spanning over a century, SOL boasts a diversified portfolio of assets spanning various industries and asset classes.

Investment Portfolio and Mission

SOL's investment portfolio includes significant stakes in renowned publicly listed companies such as TPG Telecom (ASX: TPG), New Hope Group (ASX: NHC), and a cross shareholding in Brickworks (ASX: BKW). The company's mission revolves around delivering superior returns to its shareholders through capital growth and steadily increasing dividends. As a family-run Listed Investment Company (LIC), SOL prioritizes the alignment of interests between management and shareholders.

Share Price Analysis

In 2024, SOL's share price has experienced a notable uptick, rising by 27.5% since the beginning of the year. Despite fluctuations, SOL maintains a strong track record of capital growth and dividend payments. Currently, the company offers a dividend yield of approximately 2.72%, trading below its 5-year average of 2.54%. This suggests potential value for investors considering SOL shares.

Coles Group Ltd (ASX: COL)

Founded in 1914, Coles Group Ltd (COL) is a leading Australian retailer offering a diverse range of everyday products, including fresh food, groceries, general merchandise, liquor, fuel, and financial services. Despite its humble beginnings, Coles has evolved into a household name, serving millions of customers across Australia.

Business Operations

Coles' earnings primarily stem from its supermarkets segment, supplemented by revenues from adjacent businesses such as flybuys, Liquorland, First Choice, Vintage Cellars, and Coles Express. The company's commitment to providing quality products at competitive prices has solidified its position as a preferred shopping destination for Australian consumers.

Market Position

While Coles trails behind Woolworths in market share, holding approximately 28% compared to Woolworths' nearly 40%, it remains a formidable competitor in the retail landscape. With a strong presence in essential food and drink categories, Coles continues to attract millions of Australian shoppers weekly.

Conclusion

In conclusion, Washington H. Soul Pattinson Ltd and Coles Group Ltd represent two prominent entities within the ASX ecosystem, each offering unique investment opportunities. While SOL boasts a diversified investment portfolio and a history of capital growth, Coles stands out as a leading retailer with a widespread consumer base. Investors seeking exposure to these sectors should carefully evaluate the respective attributes and growth prospects of SOL and COL.

1 note

·

View note

Text

BHP Stock Sees Positive Momentum on Thursday with Prospects for Further Upside

On Thursday, BHP Group, a global resources company, experienced a surge in its share price, signaling positive momentum in the market. Investors are optimistic about the company's performance, and there are indications that the stock may continue to see gains in the near future.

ASX BHP shares displayed a notable upward trend on Thursday, reflecting the positive sentiment among investors. The market witnessed increased buying activity, contributing to the company's share price rise. Analysts attribute this positive movement to several factors, including robust financial performance, favorable market conditions, and a positive industry outlook.

The company's solid financial standing has been a key driver of investor confidence. BHP Group has consistently demonstrated strong operational and financial results, fostering trust among shareholders. Its strategic initiatives and effective cost management have positioned the company well in a competitive market environment.

Also, check our economics news section

In addition to the company's performance, broader market conditions have also played a role in the positive trajectory of BHP Group's stock. Favorable economic indicators and positive sentiment in the resource sector have created a conducive environment for BHP's growth. As economic activities rebound and demand for resources remains robust, BHP Group stands to benefit from these favorable conditions.

Furthermore, the positive outlook for the resource industry, coupled with BHP Group's diversified portfolio, has garnered attention from investors seeking exposure to the sector. The company's diverse range of commodities, including iron ore, copper, and energy resources, positions it to capitalize on various market trends and demands.

Looking ahead, analysts are optimistic about the prospects of BHP Group's stock. With a positive momentum observed on Thursday, there is a growing anticipation that the stock may continue to see gains in the coming days. Investors closely monitor key indicators and market developments that could further influence BHP Group's performance.

It's important to note that while positive momentum is promising, the stock market inherently involves risks, and past performance does not guarantee future results. Investors are advised to conduct thorough research, consider their risk tolerance, and stay informed about relevant market factors before making investment decisions.

In conclusion, BHP Group's share price experienced a positive uptick on Thursday, fueled by strong financial performance, favorable market conditions, and a positive outlook for the resource sector. As investors show confidence in the company's potential for growth, the stock is tipped for further gains. However, individuals considering investment in BHP Group should exercise due diligence and consider the inherent risks associated with the stock market.

#ASX BHP#ASX BHP Share Price#ASX BHP Stock Price News#ASX BHP Share Price News#ASX BHP Market Update

1 note

·

View note

Text

ASX Stock Market: Uncover Opportunities in Australia's Premier Exchange

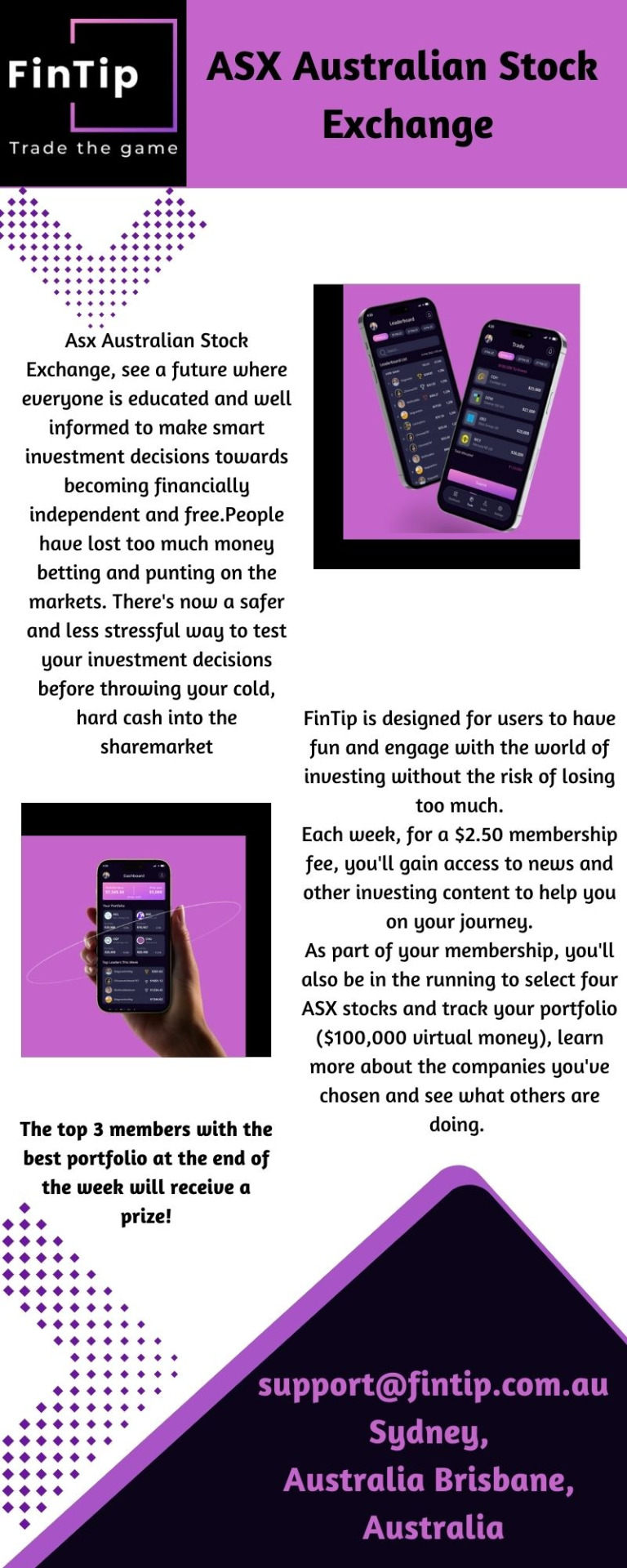

FinTip-ASX Stock Market, see a future where everyone is educated and well informed.This is a simulated game and your $100,000 portfolio is virtual money only. There are no stock orders, trade or ownership involved.We allow four stocks to provide for some diversification and avoid highly skewed results from concentrating stocks in only 1 or 2.To know more visit us-https://fintip.com.au/

0 notes

Text

The leading Australian benchmark index S&P/ASX 200 (XJO) which is considered the investable benchmark of the Australian equity market declined 1.23% over the last month to 7,763.2 points on 8th July’2024, impacted by heavyweight miners BHP, RIO Tinto, FMG, South32 (S32), etc

#penny stocks#asx penny stocks#best asx penny stocks#penny stocks to buy#asx penny stocks to buy now#stock market#stock market today#stock market live#stock market asx

0 notes

Text

Top ASX Mining stock ready to soar

The ASX mining stocks have long been a cornerstone of Australia’s resource-driven economy, and 2024 presents exciting mining opportunities in Australia for investors looking to capitalize on rising commodity prices. With the mining industry in Australia thriving due to global demand for critical minerals, several ASX mining stocks are poised for strong gains. Major players like Newmont Mining stock and Barrick Gold stock continue to dominate the gold sector, benefiting from increasing inflation-hedging demand. Meanwhile, lithium companies on the ASX are seeing rapid growth, driven by the global transition to renewable energy and electric vehicles. Companies involved in iron ore, copper, and rare earth minerals are also gaining momentum, making the biggest mining companies in Australia key players in the international supply chain. As governments worldwide push for sustainable energy solutions, Australian miners are well-positioned to meet the demand, opening up lucrative opportunities for investors eyeing long-term growth in the sector.

#asx200#australia#stock market#long term investing#financial freedom#personal finance#investment#asx#finance#stocks

0 notes

Text

The Stock Network: Live Updates and Insights for ASX Stock Market Investors The Stock Network revolutionizes the way investors engage with the ASX stock market by delivering concise, visually engaging content. Stay informed with live updates, simplified ASX announcements, and exclusive CEO interviews, empowering your investment decisions with ease. Explore the future of financial literacy today!

0 notes

Text

People I wanna know better

Tagged once again by @imlivingformyselfdontmindme.

Last song?

It's Australia Day and my family went on a road trip today. However, I'm pretty sure the last song I heard from my BIL's playlist whilst driving is this song (followed by a short discussion on all the reasons why Joe Jonas sucks 😆)

youtube

Favourite colour?

Poppy red 😊

Currently watching?

Since changing jobs, I found that I don't have as much time (and energy) to watch TV (or something similar) as I used to. However, I am not missing any episodes of these Thai series.

Cherry Magic TH

Last Twilight

The Sign

[Edit to add] Cooking Crush

I also used to watch Pit Babe but stopped at Episode 4. I might resume watching this in February, though.

Last movie?

I haven't gone to watch a proper movie in the theatre since the pandemic. This movie I watched on a plane whilst travelling abroad.

Sweet/Spicy/Savory?

Spicy and Savoury. I am Asian. You need to give me some heat and plenty of umami 😅

Relationship status?

An auntie-corn. (It's like the regular single auntie, but more awesome lol)

Current obsessions?

I said it before, but I am currently obsessed with learning how the share market works. Reading all kinds of materials relating to this subject is also one of the reasons why I spend less time watching Thai dramas. I just want to get rich faster🤣🤣🤣

Last thing you googled?

Prices of specific stocks in ASX to see if I can afford them 😅

Selfie or another pic you took?

I also happened to love Salvador Dali's art. Fortunately, there is a winery in South Australia that features his amazing works (sculptures) like this one:

I do hope I am not annoying people by constantly tagging them 😅 @lost-my-sanity1, @telomeke, @dribs-and-drabbles, @dimplesandfierceeyes, @sparklyeyedhimbo, @waitmyturtles, and anyone who would like to answer these questions.

7 notes

·

View notes

Text

Global X Semiconductor ETF (ASX: SEMI) Buying Insight: Watch for buying opportunities in SEMI as it recovers from a recent price dip, with strong long-term growth prospects.

0 notes

Text

ASX: BHP, a leading global resources company, is renowned for its diversified portfolio in mining, metals, and petroleum. BHP is a key player on the Australian Securities Exchange.

1 note

·

View note