#asx stock

Explore tagged Tumblr posts

Text

Long-Term vs. Short-Term Investing: What’s Best for ASX Investors?

The Australian stock market (ASX) offers a range of investment opportunities, catering to both short-term traders and long-term investors. Choosing between these two approaches depends on your financial goals, risk tolerance, and investment strategy. In this blog, we explore the key differences, benefits, and risks of both strategies to help you make informed investment decisions.

Understanding Long-Term Investing

Long-term investing involves holding stocks for an extended period, usually five years or more. Investors focus on fundamental analysis, looking at company earnings, market potential, and overall economic trends.

Benefits of Long-Term Investing:

Wealth Accumulation & Compounding: Long-term investments benefit from compound interest, allowing reinvested earnings to generate additional returns.

Lower Transaction Costs: Since long-term investors buy and hold, they avoid frequent trading fees and commissions.

Reduced Market Volatility Impact: Short-term market fluctuations are less significant over extended periods, leading to more stable returns.

Dividend Growth: Many ASX-listed companies offer dividends, which can be reinvested to enhance portfolio growth over time.

Tax Efficiency: In Australia, long-term investors benefit from the Capital Gains Tax (CGT) discount, reducing taxable profits on stocks held for over 12 months.

Risks of Long-Term Investing:

Patience is Required: Significant returns may take years to materialize.

Market Risks: Economic downturns can affect long-term investments, requiring a strong risk management strategy.

Understanding Short-Term Investing

Short-term investing typically involves buying and selling stocks within days, weeks, or months, relying on technical analysis, price trends, and market timing to generate quick profits.

Benefits of Short-Term Investing:

Quick Returns: Traders capitalize on short-term price movements, potentially earning profits in a shorter time frame.

Market Flexibility: Investors can respond to ASX live updates and economic news, adjusting strategies accordingly.

Diverse Opportunities: Day trading, swing trading, and momentum trading provide various methods to profit from market trends.

Risks of Short-Term Investing:

High Volatility Exposure: Short-term investments are highly sensitive to market fluctuations.

Frequent Trading Costs: Higher transaction fees can eat into profits.

Emotional Decision-Making: Quick decisions may lead to impulsive trading mistakes.

Tax Implications: Short-term capital gains are taxed at a higher rate than long-term investments.

Which Strategy is Best for ASX Investors?

Choosing between long-term and short-term investing depends on your financial goals:

If you prefer stability and steady wealth growth, long-term investing is a safer choice.

If you are willing to take calculated risks for quick profits, short-term trading may be appealing.

Hybrid Approach: Some investors combine both strategies by maintaining a long-term portfolio while actively trading in short-term opportunities.

Conclusion: Both long-term and short-term investing have unique advantages and risks. The key to success lies in understanding your risk tolerance, investment horizon, and market knowledge. For the latest ASX stock market insights, live updates, and expert interviews, visit The Stock Network and stay informed!

0 notes

Text

Exploring ASX Consumer Cyclical Sector on Wesfarmers Ltd (ASX: WES)

The ASX Consumer Cyclical sector, a dynamic landscape shaped by consumer spending patterns, economic trends, and market sentiments, presents investors with intriguing opportunities. Amidst this sector's diverse offerings, one company that stands out is Wesfarmers Ltd (ASX: WES), a conglomerate with a rich history and a prominent position in the Australian market.

Understanding Consumer Cyclical

The Consumer Cyclical sector encompasses industries heavily influenced by economic cycles and consumer discretionary spending. It includes companies involved in retail, automotive, travel, and leisure. This sector is known for its sensitivity to economic conditions, as consumer spending tends to fluctuate with economic health and consumer confidence.

Wesfarmers Ltd: A Pillar in Consumer Cyclical

Wesfarmers, a major player in the Australian corporate landscape with a $72 billion market capitalization, strategically positions itself in the diverse Consumer Cyclical sector. Boasting influential brands like Bunnings, Kmart, Officeworks, and Priceline, Wesfarmers maintains resilience across economic conditions with its diversified portfolio. Despite sector volatility, Wesfarmers provides stability for income-focused investors through consistent dividend growth, showcasing its commitment to satisfactory returns. The company's strategic approach involves effective management of existing businesses and exploration of growth opportunities, including expansion into the healthcare industry, reflecting a forward-thinking mindset dedicated to long-term shareholder wealth.

Investing in Consumer Cyclical

Investors eyeing the Consumer Cyclical sector, including leaders like Wesfarmers, should consider economic indicators, such as consumer confidence and employment rates. Staying attuned to market trends and innovations is crucial in this dynamic sector, where companies adapting to changing consumer preferences thrive. Given the inherent volatility, prudent risk management, and diversification are key to navigating potential market fluctuations.

Conclusion

As investors explore opportunities in the ASX Consumer Cyclical sector, Wesfarmers Ltd emerges as a compelling choice. With its diverse business portfolio, commitment to dividends, and strategic growth initiatives, Wesfarmers stands as a robust player in this dynamic sector. However, as with any investment, thorough research and a keen understanding of market dynamics are essential for informed decision-making.

In a landscape where consumer behavior shapes market trends, Wesfarmers' enduring presence and strategic approach position it as a beacon for those seeking stability and growth in the Consumer Cyclical sector.

0 notes

Text

ASX Stock Market: Uncover Opportunities in Australia's Premier Exchange

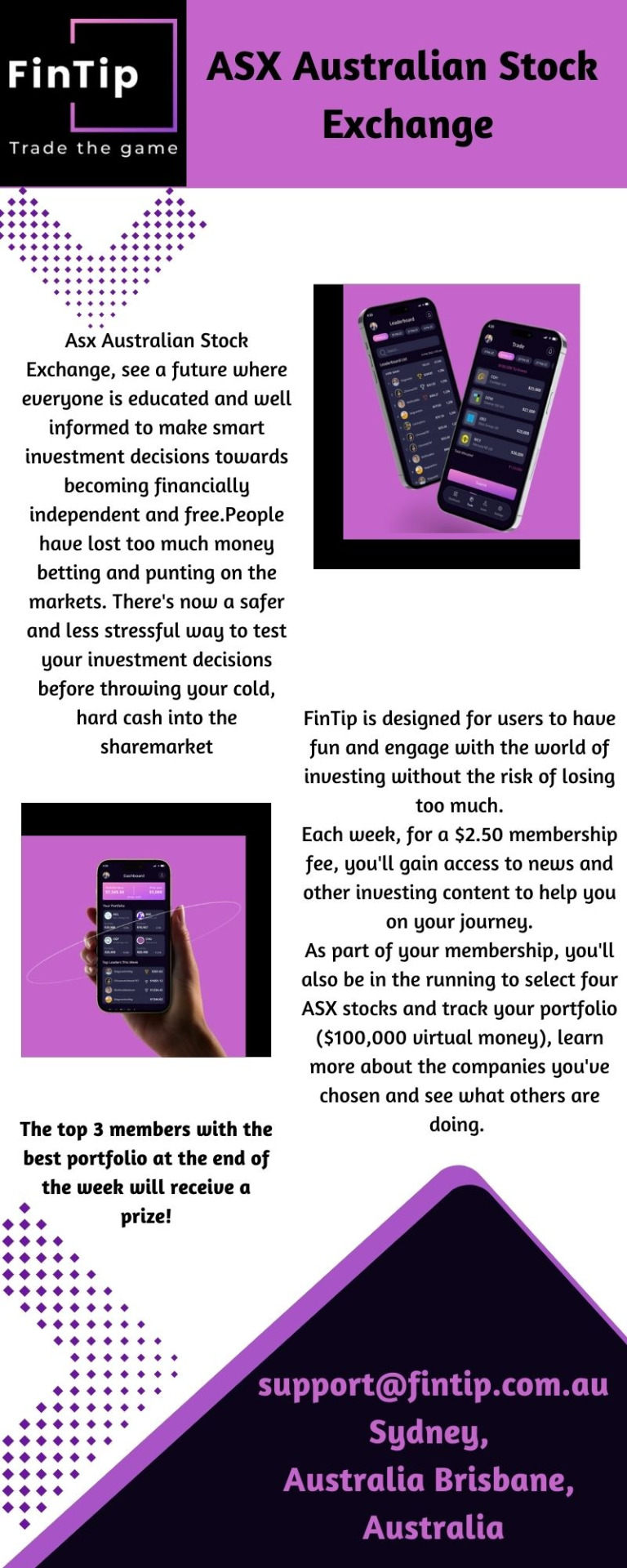

FinTip-ASX Stock Market, see a future where everyone is educated and well informed.This is a simulated game and your $100,000 portfolio is virtual money only. There are no stock orders, trade or ownership involved.We allow four stocks to provide for some diversification and avoid highly skewed results from concentrating stocks in only 1 or 2.To know more visit us-https://fintip.com.au/

0 notes

Text

Australian Stocks to Buy: A Detailed Guide for Investors

Australia’s stock market, represented primarily by the Australian Securities Exchange (ASX), has long been an attractive destination for investors. With a diverse range of sectors, from mining to technology, healthcare, and finance, the ASX offers a wealth of opportunities for both seasoned investors and newcomers. In this article, we will explore some promising Australian stocks to consider for your portfolio, taking into account various industries, potential growth, and investment strategies.

Disclaimer

Before proceeding, it’s important to note that the information presented in this article is for educational purposes only and does not constitute financial advice. The stock market carries inherent risks, and individual circumstances such as financial goals, risk tolerance, and market conditions should be considered when making investment decisions. Always conduct thorough research or consult a professional financial advisor before making any investment.

Why Invest in Australian Stocks?

Australia is known for its stable economy, strong regulatory environment, and well-established financial systems, which make it an attractive destination for investors. The Australian stock market is home to several globally recognized companies, such as BHP Group and Commonwealth Bank, making it an appealing option for those seeking exposure to international giants as well as domestic firms.

Advantages of investing in Australian stocks include:

Diversification: The ASX includes a wide range of sectors, providing a well-rounded investment opportunity.

Strong mining and resources sector: Australia is rich in natural resources, and its mining companies are among the world leaders in sectors like iron ore, gold, and energy.

Global exposure: Many ASX-listed companies have a significant global footprint, providing exposure to international markets.

Dividends: Australian companies are known for paying generous dividends, especially in sectors like utilities and banking.

Sectors to Watch

Before delving into specific stocks, it’s important to identify the key sectors that have been performing well or are poised for growth in the near future. Some sectors to consider include:

Read More>>

#asx200#long term investing#personal finance#financial freedom#stocks#investment#stock market#asx#australia#finance

2 notes

·

View notes

Text

ASX BHP: A Diversified Mining and Petroleum Giant with Strong Financial Performance

BHP Group, also known as ASX BHP, is a multinational mining, metals, and petroleum company headquartered in Melbourne, Australia. With operations in over 90 locations worldwide, BHP is one of the largest diversified resource companies in the world.

In this article, we will take a closer look at ASX BHP, including its history, current operations, financial performance, and future prospects.

History of ASX BHP

BHP was originally founded in 1885 as the Broken Hill Proprietary Company Limited, named after the Broken Hill silver and lead mine in western New South Wales, Australia. Over the years, the company expanded into other commodities, including iron ore, copper, coal, and petroleum.

In 2001, BHP merger with Billiton plc, a mining company based in London, to form BHP Billiton. The merger created one of the largest mining companies in the world, with operations in over 25 countries.

In 2017, the company simplified its name to BHP Group, reflecting its focus on its core operations in mining, metals, and petroleum.

Current Operations

BHP operates in four main segments: iron ore, copper, coal, and petroleum. The company is the world's largest producer of iron ore and the second-largest producer of copper.

Iron Ore: BHP's iron ore operations are located in the Pilbara region of Western Australia. The company's operations in the region include five mines, a railway network, and two port facilities.

Copper: BHP's copper operations are located in Chile, Peru, and the United States. The company's copper assets include the Escondida mine in Chile, the world's largest copper mine.

Coal: BHP's coal operations are located in Australia, Colombia, and South Africa. The company produces both metallurgical coal (used in steelmaking) and thermal coal (used in electricity generation).

Petroleum: BHP's petroleum operations are located in Australia, the Gulf of Mexico, Trinidad and Tobago, and the Caribbean. The company produces both oil and gas.

Financial Performance

In the first half of the 2022 financial year, BHP reported a net profit of US$10.9 billion, up from US$3.9 billion in the same period the previous year. The company attributed the increase to higher commodity prices and increased production.

BHP's share price has also performed well in recent years, with the company's market capitalization reaching over A$300 billion in 2021.

Future Prospects

BHP is well-positioned to benefit from the growing demand for commodities, particularly from emerging economies such as China and India. The company has also been investing in renewable energy and technology to reduce its carbon footprint and improve its environmental performance.

In 2021, BHP announced plans to invest over US$5 billion in its petroleum business over the next five years, focusing on high-return growth opportunities in the Gulf of Mexico and Trinidad and Tobago.

Overall, ASX BHP is a well-established and financially sound company with a strong position in the global mining, metals, and petroleum markets. Its focus on sustainable and responsible business practices, combined with its diversified operations, make it a compelling investment opportunity for long-term investors.

Also check related tickers

ASX CBA

ASX FMG

ASX APT

ASX NAB

2 notes

·

View notes

Text

Penny stocks are stocks of small companies that are either at a very young stage of their operations or they have not grown much for various reasons. Penny stocks companies usually have a unique idea or a business model that can offer extremely high returns over a period of time.

#stock market live#stock market asx#stock market today#stock market#asx penny stocks#penny stocks to buy#best penny stocks#best asx penny stocks#australian penny stocks

0 notes

Text

ASX Uranium Stocks: The Undiscovered Heroes of Clean Energy Investment 🌍⚡

🚀 Why Uranium is Powering Clean Energy’s Future

Stable Prices, Bright Future: Uranium prices hold steady at around USD $78 with high potential ahead.

Demand Driven by Tech & Energy: With data centers needing constant power for AI, companies like Amazon and Google are eyeing nuclear power as a sustainable option.

🔥 Top ASX Uranium Stocks Poised for Growth

Boss Energy (ASX: BOE): Major player with assets in Australia and Texas, positioned to ride the nuclear wave as demand for AI energy grows.

Paladin Energy (ASX: PDN): Expanding globally with projects like Langer Heinrich in Namibia, ready to supply a uranium-hungry world.

Deep Yellow (ASX: DYL): Building an international asset portfolio, ready to meet demand across Australia and Africa.

📈 Why Uranium Demand is Rising

AI Boom = Energy Surge: Data centers fueling AI need nuclear’s stable, high-output power.

Decarbonization Push: As the world pivots away from fossil fuels, uranium is regaining prominence in the clean energy sector.

🛠️ M&A Activity Signals Big Potential

Scramble for Assets: Rising demand sparks mergers and acquisitions, with companies like Paladin snapping up new uranium assets.

🌟 Key Takeaway for Investors

The ASX uranium sector is a hidden gem in the clean energy boom. With big tech and government backing nuclear power, uranium stocks like Boss Energy, Paladin, and Deep Yellow are set for major gains.

💼 Diversify Your Portfolio with ASX-listed uranium stocks and explore the untapped potential of clean, nuclear-powered growth!

Visit - https://www.skrillnetwork.com/why-asx-uranium-stocks-are-the-hidden-gems-in-clean-energy-investing

0 notes

Text

ASX WES Share Price And Latest Market Trends

Follow the latest ASX WES share price and market movements with Kalkine Media. Get comprehensive updates on Wesfarmers' stock performance, industry trends, and potential growth. Stay informed about key factors driving the ASX WES share price and enhance your investment strategy.

0 notes

Text

The ASX 200 index closed up 0.46% at 7,813 points, continuing its recovery from last week’s losses. Growth companies with high insider ownership are drawing attention from investors of ASX Australia, as they signal confidence from those closest to the business.

0 notes

Text

Latest ASX News & Stock Performance Updates – Stay Informed on the Australian Economy

Stay ahead of the market with real-time ASX news, expert insights on stock performance, and key updates affecting the Australian economy. Whether you're an investor or market enthusiast, get the latest trends and financial analysis all in one place.

Read More Here: https://thestocknetwork.com.au/stock-news/

0 notes

Text

ASX: RIO Stock Price Today and Market Analysis

Unlock the latest ASX: RIO stock price today and delve into detailed market analysis. Explore Rio Tinto's financial performance and investment potential.

Visit website to know more: https://kalkine.com.au/company/asx-rio/

0 notes

Text

Invest in ASX: Australian Stock Exchange Opportunities in Australia-FinTip

FinTip-Asx Australian Stock Exchange, see a future where everyone is educated and well informed to make smart investment decisions towards becoming financially independent and free.People have lost too much money betting and punting on the markets. There's now a safer and less stressful way to test your investment decisions before throwing your cold, hard cash into the sharemarket. To know more visit us-https://fintip.com.au/

0 notes

Text

Analyzing Potential ASX 52 Week Low Stocks

Identify potential gains by monitoring ASX 52-week low stocks such as Computershare (ASX: CPU), Crown Resorts (ASX: CWN), and Evolution Mining (ASX: EVN). These stocks may be undervalued and offer significant returns.

Visit website for more info: https://cse.google.com.au/url?q=https://kalkinemedia.com/au/companies/52-week-low

0 notes