#stephen pincus

Explore tagged Tumblr posts

Text

My favourite type of character

#it#stephen king#eddie kaspbrak#jurassic park#jurassic world camp cretaceous#camp Cretaceous#ben pincus#it movie#jwcc#fandom

25 notes

·

View notes

Text

Emerald's Requests

Rules Before Requesting! (Closed for now)

○●○●○●○●○●○●○●○●○●○●○●○●

♡No Smuts or Lemons

♡No minorxadult romantic ships, you will be blocked

♡NO SEXUALIZING MINORS

♡No OCxCannonCharater, this is a xreader blog

♡No racism or negative comments, you will be blocked

♡I will do crossovers

♡xfemreader (not good at anything else;-;)

♡You can request Angst but I will put trigger warnings for others own mental health

♡Platonic or Romantic, will be listed below

♡Love Triangles allowed

♡Headcannons and onehsots

♡Will do suggestive depending on character's age

I want my blog to be a safe and wholesome place <3

Who do I write for?

~~~~~~~~~~~~~~~~~~~

TMNT: (all platonic or Romantic)

Rise!Leonardo

Rise!Raphael

Rise!Donatello

Rise!Michelangelo

2012!Leonardo

2012!Raphael

2012!Donatello

2012!Michelangelo

MM!Leonardo

MM!Raphael

MM!Donatello

MM!Michelangelo

~~~~~~~~~~~~~~~~~~~~

MARVEL (MCU)

Peter Parker/Spiderman (platonic or romantic)

Tony Stark/Iron Man (platonic)

Stephen Strange/Doctor Strange (platonic)

Steve Rogers/Captain America (platonic)

Bucky Barnes/Winter Soilder (platonic or Romantic)

Bruce Banner/Hulk (platonic or romantic)

Thor Odinson (platonic)

Loki Friggason (platonic or Romantic)

Natasha Romanoff/Black Widow (platonic)

Wanda Maximoff/Scarlet Witch (platonic)

Kate Bishop (platonic)

Pietro Maximoff/Quicksilver (platonic or Romantic)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Marvel (Outside of MCU)

Logan/Wolverine (platonic or Romantic)

Wade Wilson/Deadpool (platonic or Romantic)

Pietro Maximoff/Quicksilver (X-Men)(platonic or Romantic)

Scott Summers (platonic or Romantic)

Jean Gray (platonic)

Professor Xavier (platonic)

Angel (platonic or Romantic)

Peter Parker/Spiderman

~~~~~~

Camp Cretaceous

Darius Bowman (platonic or Romantic)

Kenji Kon (platonic or Romantic)

Ben Pincus (platonic or Romantic)

Yasmina (platonic)

Sammy (platonic)

Brooklynn (platonic)

Jurassic World

Owen Grady (platonic or Romantic)

~~~~~~~~~~~

Sonic (Movies)

Sonic (platonic or Romantic)

Knuckles (platonic or Romantic)

Tails (platonic or Romantic)

Shadow (platonic or Romantic)

Tom (platonic or Romantic)

~~~~~~~~~

Ramshakle

Stone (platonic or Romantic)

Skipp (platonic or Romantic)

Vinnie (platonic)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Murder Drones

N (platonic or Romantic)

Uzi (platonic or Romantic)

My beautiful annons:

🧡annon

❤️💙💜🧡annon

Please request! And I can't wait to write!

-Emerald out 💚

#marvel mcu#mcu#mcu fandom#mcu fanfiction#rottmnt#tmnt 2018#camp cretaceous#jurassic park#jurassic world camp cretaceous#jurassic world#emeralds fanfics#ramshakle stone#ramshakle show#sonic the hedgehog#sonic fandom#sonic fanfiction

8 notes

·

View notes

Text

hu

Adam Wingard

Potential Books:

Danse Macabre by Stephen King – A great resource for anyone working in horror, it explores the genre’s history and King's insights on what makes it effective.

On Directing Film by David Mamet – A guide on the craft of directing from one of the masters of dialogue-driven filmmaking.

Story by Robert McKee – A classic screenwriting book that covers storytelling principles for film and TV, often read by directors looking to refine their craft.

2. Gareth Edwards

Potential Books:

The Filmmaker's Handbook by Steven Ascher and Edward Pincus – A comprehensive guide on all aspects of filmmaking, from pre-production to distribution.

The Hero with a Thousand Faces by Joseph Campbell – This book on the monomyth or "hero's journey" is a favorite for directors working on big, mythic stories, like Godzilla.

In the Blink of an Eye by Walter Murch – A practical guide to film editing, which can be helpful for any director learning the nuances of visual storytelling.

3. David F. Sandberg

Potential Books:

Save the Cat! by Blake Snyder – One of the most popular screenwriting books, often used by directors to understand pacing and structure.

Adventures in the Screen Trade by William Goldman – A behind-the-scenes look at the movie industry, offering lessons on storytelling and the challenges of Hollywood.

Master Shots by Christopher Kenworthy – A great book for directors looking to visualize scenes and shots, which is essential in horror.

4. James Wan

Potential Books:

Rebel Without a Crew by Robert Rodriguez – Rodriguez’s memoir on how he made El Mariachi on a shoestring budget is an inspiring read for indie filmmakers like Wan.

Hitchcock/Truffaut by François Truffaut – An in-depth conversation between two masters of suspense and tension, which would likely resonate with Wan given his work in horror and thrillers.

Directing Actors by Judith Weston – A guide to working with actors that many directors, especially those starting in indie films, use to help bring out the best performances.

5. Fede Álvarez

Potential Books:

Shock Value by Jason Zinoman – A history of horror filmmakers in the 1970s, which could be a great read for Álvarez, given his work on Evil Dead.

The Anatomy of Story by John Truby – Another highly regarded book on storytelling structure, focusing on character development and plot.

The Visual Story by Bruce Block – A book about visual components in storytelling, often used by directors to think about how to convey emotion and story visually.

6. Colin Trevorrow

Potential Books:

The Writer's Journey by Christopher Vogler – Based on Joseph Campbell's work, this is a screenwriting staple for filmmakers working on stories with strong character arcs, such as Jurassic World.

Screenplay by Syd Field – A foundational screenwriting book that is frequently recommended for anyone working in Hollywood, including directors.

The Art of Dramatic Writing by Lajos Egri – A classic book on character and structure that might have influenced Trevorrow’s work in balancing spectacle with storytelling.

7. Jordan Vogt-Roberts

Potential Books:

The Conversations: Walter Murch and the Art of Editing Film by Michael Ondaatje – A conversation about the art of editing and storytelling, important for any director working in visual storytelling.

Filmmaker’s Eye by Gustavo Mercado – A guide to understanding visual composition, which is useful for directors like Vogt-Roberts, whose work in Kong: Skull Island involved complex visual setups.

Directing the Story by Francis Glebas – This book focuses on storyboarding and visual storytelling, both critical for directors working with visual effects-heavy films.

8. Matt Reeves

Potential Books:

Making Movies by Sidney Lumet – A candid look at the craft of directing from one of the greats, often cited as a must-read for directors at all levels.

The Tools of Screenwriting by David Howard and Edward Mabley – A practical guide to screenwriting that could have helped Reeves in crafting his tightly written films like Cloverfield.

The Filmmaker’s Guide to Visual Effects by Eran Dinur – Since Reeves works on effects-heavy films (Planet of the Apes, The Batman), this guide on working with VFX would be a useful resource.

9. Taika Waititi

Potential Books:

The War of Art by Steven Pressfield – A book about overcoming creative blocks, which might resonate with Waititi’s unique and often humorous creative process.

Impro by Keith Johnstone – A book on improvisation in theater, which would be relevant for Waititi’s work, given how he encourages improv on his film sets.

Zen in the Art of Writing by Ray Bradbury – A collection of essays on the joy of writing, which might appeal to Waititi's playful and creative approach to storytelling.

10. Sam Raimi

Potential Books:

Film Directing: Shot by Shot by Steven D. Katz – A book on visualizing scenes and setting up shots, which would be crucial for someone like Raimi, known for his dynamic and innovative camera work.

On Writing by Stephen King – King’s memoir on the craft of writing, particularly useful for directors like Raimi who have adapted horror novels (The Evil Dead series).

Sculpting in Time by Andrei Tarkovsky – A philosophical book on film as an art form, which may have influenced Raimi’s deeper work with visual storytelling.

While these directors might not have publicly listed every book they've read, these selections are often recommended by filmmakers and provide insights into the craft of directing, storytelling, and filmmaking. They also reflect the types of books directors like Wingard and his peers might use to hone their skills and expand their understanding of visual and narrative techniques.

4o

You said:

what movies and audio,commentaries,classes must hv influenced them

ChatGPT said:

ChatGPT

The following movies, audio commentaries, and classes likely influenced directors like Adam Wingard and other similar filmmakers as they moved from indie projects to Hollywood blockbusters. These resources are not only valuable for learning the craft of filmmaking but also provide insight into directing, genre filmmaking, and storytelling.

1. Adam Wingard

Movies:

Halloween (1978) by John Carpenter – A horror classic known for its suspense and pacing, which likely influenced Wingard’s style in You're Next and The Guest.

The Texas Chain Saw Massacre (1974) by Tobe Hooper – A low-budget horror that became iconic for its use of tension and atmosphere, a staple in Wingard's horror work.

Audio Commentaries:

The Thing (1982) by John Carpenter – Carpenter’s commentary is widely praised for its insights into horror filmmaking and building tension, a clear influence on Wingard.

Classes:

Wingard has talked about how he’s largely self-taught, likely relying on film commentaries, books, and practice rather than formal film school classes.

2. Gareth Edwards

Movies:

Star Wars: A New Hope (1977) by George Lucas – Edwards often cited Star Wars as a major influence, which later manifested in his own work on Rogue One.

Jurassic Park (1993) by Steven Spielberg – A big-budget spectacle that uses visual effects and tension, similar to the techniques Edwards employed in Godzilla.

Audio Commentaries:

District 9 (2009) by Neill Blomkamp – A film commentary that dives into making sci-fi on a smaller budget, a direct inspiration for Edwards' Monsters.

Classes:

Edwards attended the National Film and Television School (UK), which gave him practical filmmaking knowledge, especially in visual effects, as seen in his early indie work.

3. David F. Sandberg

Movies:

The Exorcist (1973) by William Friedkin – A horror classic that likely influenced Sandberg’s approach to tension and scares in Lights Out and Annabelle: Creation.

Poltergeist (1982) by Tobe Hooper – Known for its balance between supernatural horror and family dynamics, which resonates with Sandberg’s horror style.

Audio Commentaries:

The Conjuring (2013) by James Wan – Wan's commentary explains how he approached horror with tension and minimal jump scares, an influence on Sandberg.

Classes:

Sandberg didn't attend formal film school but learned filmmaking through practice and by watching behind-the-scenes features, which heavily influenced his approach to directing.

4. James Wan

Movies:

Suspiria (1977) by Dario Argento – An influential horror film for its use of color and style, which is evident in Wan's visual storytelling in The Conjuring series.

The Sixth Sense (1999) by M. Night Shyamalan – Known for its blend of horror and emotional depth, which influenced Wan’s own storytelling in Insidious and The Conjuring.

Audio Commentaries:

Saw (2004) by James Wan and Leigh Whannell – Wan’s own commentary on his first big success reveals his indie mindset and creativity with limited resources.

Classes:

Wan studied at the Royal Melbourne Institute of Technology (RMIT), where he likely learned the basics of directing, though his real education came from making Saw on a small budget.

5. Fede Álvarez

Movies:

The Evil Dead (1981) by Sam Raimi – A clear influence on Álvarez, who later rebooted Evil Dead (2013), adapting Raimi’s kinetic horror style.

Jaws (1975) by Steven Spielberg – Álvarez has cited Jaws as a huge influence on his approach to tension and horror in Don’t Breathe.

Audio Commentaries:

The Evil Dead (1981) by Sam Raimi – Raimi’s commentary on his indie horror masterpiece gives insight into how to make a successful film on a tight budget.

Classes:

Álvarez did not attend formal film school, but he gained attention through short films and likely learned through online tutorials, practicing visual effects, and watching director commentaries.

6. Colin Trevorrow

Movies:

Back to the Future (1985) by Robert Zemeckis – Trevorrow has cited this film as a big influence, especially its mix of humor, adventure, and sci-fi, which shows in Jurassic World.

E.T. the Extra-Terrestrial (1982) by Steven Spielberg – Spielberg’s ability to blend heart and spectacle likely influenced Trevorrow’s approach to emotional beats in blockbusters.

Audio Commentaries:

Safety Not Guaranteed (2012) by Colin Trevorrow – His commentary on his breakout indie film is filled with insight into directing on a small budget, before making Jurassic World.

Classes:

Trevorrow didn’t attend film school but honed his craft by making short films and music videos, learning the basics of directing through hands-on experience and collaborations.

7. Jordan Vogt-Roberts

Movies:

Apocalypse Now (1979) by Francis Ford Coppola – Vogt-Roberts cited this film as an influence on Kong: Skull Island, especially in terms of scope and the chaos of war scenes.

Jurassic Park (1993) by Steven Spielberg – The way Spielberg mixed awe and danger with giant creatures likely influenced Vogt-Roberts’ handling of scale in Kong: Skull Island.

Audio Commentaries:

King Kong (2005) by Peter Jackson – Jackson’s commentary on the making of King Kong would have given Vogt-Roberts insight into creating a large-scale monster movie.

Classes:

Vogt-Roberts attended Columbia College Chicago, where he studied film and likely gained practical filmmaking knowledge, but his major break came from working in indie films.

8. Matt Reeves

Movies:

Alien (1979) by Ridley Scott – Reeves has cited Alien as an influence, particularly in terms of pacing and tension, elements present in Cloverfield and The Batman.

Planet of the Apes (1968) by Franklin J. Schaffner – The original Planet of the Apes series was a major influence on Reeves' Dawn and War for the Planet of the Apes.

Audio Commentaries:

Cloverfield (2008) by Matt Reeves – His commentary on Cloverfield dives deep into how he approached a large-scale, found-footage film, with a focus on realism and tension.

Classes:

Reeves studied at the University of Southern California (USC) School of Cinematic Arts, one of the top film schools, where he built relationships with industry professionals and honed his craft.

9. Taika Waititi

Movies:

Monty Python and the Holy Grail (1975) by Terry Gilliam – Waititi has often cited the absurdist humor of Monty Python as an influence on his comedic sensibilities.

This is Spinal Tap (1984) by Rob Reiner – A mockumentary that influenced Waititi’s style in films like What We Do in the Shadows (2014), where humor comes from grounded absurdity.

Audio Commentaries:

What We Do in the Shadows (2014) by Taika Waititi – His commentary on this film offers insights into how he balances comedy and improvisation while maintaining a strong narrative.

Classes:

Waititi didn’t attend formal film school but learned through acting and making short films in New Zealand, refining his style by focusing on humor and character-based storytelling.

10. Sam Raimi

Movies:

Psycho (1960) by Alfred Hitchcock – Known for its suspense and innovative camera techniques, Psycho is a likely influence on Raimi’s work in horror and thriller genres.

Night of the Living Dead (1968) by George A. Romero – An influential low-budget horror film that Raimi likely drew from while making The Evil Dead.

Audio Commentaries:

The Evil Dead (1981) by Sam Raimi – His own commentary explains how he made a low-budget horror film that became a cult classic, offering insight into DIY filmmaking.

Classes:

Raimi didn’t attend formal film school but learned filmmaking through making short films with friends, and through watching classic films and analyzing their techniques.

Common Classes and Workshops for Aspiring Directors:

MasterClass: Werner Herzog Teaches Filmmaking – A well-regarded class from an iconic filmmaker, which teaches practical skills for indie filmmaking.

UCLA Extension and USC School of Cinematic Arts Workshops – Many directors, even if they didn’t attend full film school programs, often took workshops or short courses in screenwriting and directing from top film schools.

Sundance Labs – Many indie directors have participated in the Sundance Institute's programs, where they develop films under the mentorship of industry veterans.

These directors were likely influenced by a combination of classic films, genre-defining

1 note

·

View note

Photo

Quiff,, Wolfgang Schmidt

Sincerely to: Andy Hall, Sheikha Al Mayassa bint Hamad bin Khalifa Al-Thani, Paul Allen, Edythe L. and Eli Broad, Rosa and Carlos de la Cruz, Patricia and Gustavo Phelps de Cisneros (Venezuela and Dominican Republic), Donald and Mera Rubell, Steven A. Cohen, Theo Danjuma, Maria Baibakova, Adrian Cheng, Ingvild Goetz (München), Victoria and David Beckham, Leonardo Dicaprio, Alan Lau, Camilla Barella, Ralph DeLuca, Arthur de Ganay, Ramin Salsali, Moises Cosio, Pedro Barbosa, Monique and Max Burger, Joaquin Diez-Cascon, Luciano Benetton, Roman Abramovich and Dasha Zhukova (Russia), Robbie Antonio (Philippines), Hélène and Bernard Arnault (France), Maria and Bill Bell (United States), Peter Benedek (United States), Debra and Leon Black (United States), Christian and Karen Boros (Germany), Irma and Norman Braman (United States), Peter Brant (United States), Basma Al Sulaiman, Marc Andreessen, Laura and John Arnold, Camilla Barella, Swizz Beatz, Claudia Beck, Andrew Gruft, Robert and Renée Belfer, Lawrence Benenson, Frieder Burda (Germany), Richard Chang (United States), Kim Chang-il (Korea), David Chau and Kelly Ying (China), Pierre T.M. Chen (Taiwan), Adrian Cheng (China), Kemal Has Cingillioglu (United Kingdom), Nicolas Berggruen, Jill and Jay Bernstein, Ernesto Bertarelli, James Brett, Jim Breyer, Christian Bührle, Valentino D. Carlotti, Edouard Carmignac, Trudy and Paul Cejas, Dimitris Daskalopoulos (Greece), Zöe and Joel Dictrow (United States), George Economou (Greece), Alan Faena (Argentina), Mark Falcone and Ellen Bruss (United States), Amy and Vernon Faulconer (United States), Howard and Patricia Farber (United States), Larry and Marilyn Fields (United States), Marie Chaix, Michael and Eva Chow, Frank Cohen, Michael and Eileen Cohen, Isabel and Agustín Coppel, Anthony D'Offay, Hélène and Michel David-Weill, Antoine de Galbert, Ralph DeLuca, Amanda and Glenn Fuhrman (United States), Danielle and David Ganek (United States), Ken Griffin (United States), Agnes Gund (United States), Steven and Kathy Guttman (United States), Andrew and Christine Hall (United States), Lin Han (China), Henk and Victoria de Heus-Zomer (Holland), Grant Hill (United States), Maja Hoffmann (Switzerland), Erika Hoffmann-Koenige (Germany), Tiqui Atencio Demirdjian, Beth Rudin DeWoody, Eric Diefenbach and JK Brown, David C. Driskell, Mandy and Cliff Einstein, Rebecca and Martin Eisenberg, Ginevra Elkann, Tim and Gina Fairfax, Dana Farouki, Michael and Susan Hort (United States), Guillaume Houzé (France), Wang Jianlin (China), Dakis Joannou (Greece), Alan Lau (China), Joseph Lau (China), Melva Bucksbaum and Raymond Learsy (United States), Agnes and Edward Lee (United Kingdom), Aaron and Barbara Levine (United States), Adam Lindemann (United States), Eugenio López (Mexico), Jho Low (China), Susan and Leonard Feinstein, Nicoletta Fiorucci, Josée and Marc Gensollen, Alan and Jenny Gibbs, Noam Gottesman, Florence and Daniel Guerlain, Paul Harris, Barbara and Axel Haubrok, Alan Howard, Fatima and Eskandar Maleki (United Kingdom), Martin Margulies (United States), Peter Marino (United States), Donald Marron (United States), David MartÍnez (United Kingdom and Mexico), Raymond J. McGuire (United States), Rodney M. Miller Sr. (United States), Simon and Catriona Mordant (Australia), Arif Naqvi (United Kingdom), Peter Norton (United States), Shi Jian, Elton John, Tomislav Kličko, Mo Koyfman, Jan Kulczyk, Svetlana Kuzmicheva-Uspenskaya, Pierre Lagrange, Eric and Liz Lefkofsky, Robert Lehrman, François Odermatt (Canada), Bernardo de Mello Paz (Brazil), José Olympio & Andréa Pereira (Brazil), Catherine Petitgas (United Kingdom), Victor Pinchuk (Ukraine), Alden and Janelle Pinnell (United States),Ron and Ann Pizzuti (United States), Michael Platt (Switzerland), Miuccia Prada and Patrizio Bertelli (Italy), Howard and Cindy Rachofsky (United States), Mitchell and Emily Rales (United States), Dan Loeb, George Lucas, Ninah and Michael Lynne, Lewis Manilow, Marissa Mayer, David Mirvish, Lakshmi Mittal, Valeria Napoleone, John Paulson, Amy and John Phelan, Ellen and Michael Ringier (Switzerland), David Roberts (United Kingdom), Hilary and Wilbur L. Ross Jr. (United States), Dmitry Rybolovlev (Russia), Lily Safra (Brazil),Tony Salamé (Lebanon), Patrizia Sandretto (Italy), Eric Schmidt (United States), Alison Pincus, Heather Podesta, Colette and Michel Poitevin, Thomas J. and Margot Pritzker, Bob Rennie, Craig Robins, Deedie and Rusty Rose, Stephen Ross, Alex Sainsbury, Alain Servais (Belgium), Carlos Slim (Mexico), Julia Stoschek (Germany), Budi Tek (Indonesia), Janine and J. Tomilson Hill III (United States), Trevor Traina (United States), Alice Walton (United States), Robert & Nicky Wilson (United Kingdom), Elaine Wynn (United States), Lu Xun (China), Muriel and Freddy Salem, Denise and Andrew Saul, Steven A. Schwarzman, Carole Server and Oliver Frankel, Ramin Salsali, David Shuman, Stefan Simchowitz, Elizabeth and Frederick Singer, Jay Smith and Laura Rapp, Jeffrey and Catherine Soros, Jerry Yang and Akiko Young (United States), Liu Yiqian and Wang Wei (China), Anita and Poju Zabludowicz (United Kingdom), Jochen Zeitz (South Africa), Qiao Zhibing (China), Jerry Speyer and Katherine G. Farley, Susana and Ricardo Steinbruch, Kai van Hasselt, Francesca von Habsburg, David Walsh, Artur Walther, Derek and Christen Wilson, Michael Wilson, Owen Wilson, Zhou Chong, Doris and Donald Fisher, Ronnie and Samuel Heyman, Marie-Josee and Henry R. Kravis, Evelyn and Leonard Lauder, Jo Carole and Ronald S. Laude, Francois Pinault (France), Udo Brandhost (Köln), Harald Falckenberg (Hamburg), Anna and Joseph Froehlich (Stuttgart), Hans Grothe (Bremen), UN Knecht (Stuttgart), Arendt Oetker (Köln), Inge Rodenstock (Grünwald), Ute and Rudolf Scharpff (Stuttgart), Reiner Speck (Köln), Eleonore and Michael Stoffel (Köln), Reinhold Würth (Niedernhall), Wilhelm and Gaby Schürmann, Ivo Wessel, Heiner and Celine Bastian, Friedrich Karl Flick, Monique and Jean-Paul Barbier-Mueller (Genf), Christa and Thomas Bechtler (Zürich), David Bowie (Lausanne), Ulla and Richard Dreyfus (Binningen und Gstaad), Georges Embiricos (Jouxtens and Gstaad), Friedrich Christian "Mick" Flick (Hergiswil and Gstaad), Esther Grether (Bottmingen), Donald Hess (Bolligen), Elsa and Theo Hotz (Meilen), Baroness Marion and Baron Philippe Lambert (Genf), Gabi and Werner Merzbacher (Zürich), Robert Miller (Gstaad), Philip Niarchos (St. Moritz), Jacqueline and Philippe Nordmann (Genf), Maja Oeri and Hans Bodenmann (Basel), George Ortiz (Vandoeuvres), Graf and Gräfin Giuseppe Panza di Biumo (Massagno), Ellen and Michael Ringier (Zürich), Andrew Loyd Webber, Steve Martin, Gerhard Lenz, Elisabeth and Rudolf Leopold.

https://www.saatchiart.com/art/Painting-Quiff/694205/3616535/view

10 notes

·

View notes

Text

EL PAPEL DEL CAPITAL EN LAS ELECCIONES DE ESTADOS UNIDOS

Por Leonid Savin

Traducción del inglés de Juan Gabriel Caro Rivera

El dinero juega un papel clave en las campañas electorales estadounidenses. Se gasta en la publicidad, los salarios de los consultores y las empresas de relaciones públicas. Además, la estrategia de los demócratas muestra que la financiación se destina a protestas callejeras. Dado que este enfoque de confrontación se adopta de antemano e implica provocar a la gente a protestas masivas, es una técnica que también requiere una inversión seria.

Exploraremos los diferentes mecanismos de recaudación de fondos para campañas electorales y los intereses de varios grupos financieros (individuos).

Comités de acción política

Desde 1976, los comités de acción política (PAC) se han utilizado en los Estados Unidos para recaudar fondos para publicidad y propaganda durante las campañas electorales. Después de 2010, cuando la Corte Suprema de EE.UU. eliminó las restricciones a las donaciones políticas, comenzaron a surgir nuevas versiones de estos comités llamados Super PAC que son diferentes a los comités de acción política convencionales, que no pueden aceptar contribuciones de más de $ 5,000 de un solo individuo y las contribuciones de corporaciones o sindicatos son ilegales, pero los súper PAC pueden aceptar contribuciones ilimitadas. Los súper PAC también participan activamente en la lucha contra la propaganda y la desinformación contra sus oponentes políticos.

Más de 2.000 Super PAC se registraron en las anteriores elecciones presidenciales de EE.UU. en 2016. Este es el mecanismo de recaudación de fondos más transparente, ya que las autoridades reguladoras realizan un seguimiento de cada centavo.

El Super PAC de Trump se llama America First Action, mientras que el de Joe Biden se llama Priorities USA.

El Super PAC del senador de la República Seth Moulton también ha estado activo durante la actual campaña electoral (1).

Woman Vote, que está completamente orientado a la mitad femenina del electorado, está trabajando para los demócratas (2).

También hay otros PAC y Super PAC involucrados en estas elecciones para ambos lados.

Los donantes de Trump y Biden

Desde principios de 2019 hasta julio de 2020, Trump logró recaudar alrededor de $ 1.1 mil millones, de los cuales $ 800 millones ya se gastaron en septiembre (3). En julio, Trump reemplazó a Brad Parscale, su ahora exgerente de campaña, por Bill Stepien, y le indicó que trabajara de manera más eficiente y gastara menos dinero.

Según la revista Forbes, el 9 por ciento de los multimillonarios estadounidenses, que juntos valen un total de 210.000 millones de dólares, han donado dinero para cubrir los gastos de campaña de Trump de 2020, ya sea directamente o a través de su cónyuge (4). En total, Trump ha recibido el apoyo de alrededor de cien multimillonarios.

Más de la mitad de los donantes de Trump viven en tres Estados: Florida, Nueva York y Texas. Tres cuartas partes de ellos se han hecho a sí mismos; el resto heredó pequeñas fortunas y las convirtió en fortunas aún mayores. Su negocio está relacionado con bienes raíces, energía, deporte, etc. Una quinta parte de los donantes se enriqueció con las finanzas y las inversiones. Este grupo incluye a personas como el director ejecutivo de Blackstone, Stephen Schwarzman, el propietario de fondos de cobertura John Paulson y el exjefe de Franklin Templeton, Charles B. Johnson. Alrededor del 10 por ciento de los donantes ganaron su dinero en bienes raíces, incluido el multimillonario neoyorquino Richard LeFrak de Trump.

El banquero de Texas Andrew Beal ha dado más que nadie al Comité de la Victoria de Trump. Los propietarios de casinos y los hermanos Lorenzo y Frank Fertitta también han donado millones a este comité.

Joe y Marlene Ricketts (TD Ameritrade) han donado más de $ 1 millón. No dieron nada en 2016.

Andrew Beal ha dado aproximadamente la misma cantidad. Dennis y Phyllis Washington (cuyo negocio es la minería y la construcción) han donado $ 1 millón. Diane Hendricks (construcción) ha donado poco menos de $ 1 millón. Kenny y Lisa Troutt (telecomunicaciones): 925.000 dólares. Jeffery y Melinda Hildebrand (petróleo) - $ 775,000. Isaac y Laura Perlmutter (cómics de Marvel): 721.000 dólares. Peter Thiel de Palantir - 250.000 dólares. Cabe señalar que Peter Thiel tiene participaciones en Facebook y donó la misma cantidad a la campaña de Trump de 2016.

Es interesante que algunos multimillonarios donaron cantidades bastante pequeñas de miles e incluso cientos de dólares.

Un donante importante que solía donar regularmente a los republicanos, el magnate de Las Vegas, Sheldon Adelson, se ha negado a respaldar a Trump.

Biden cuenta con el apoyo de Wall Street (5) y Silicon Valley. También ha recaudado una gran cantidad de dinero gracias a pequeñas aportaciones. En términos de la cantidad de donantes ricos que ofrecen apoyo, Biden ha superado a Trump, recibiendo dinero de 131 multimillonarios (6).

El donante más grande de Biden ha sido George Soros, quien ha gastado más de $ 8 millones durante todo el ciclo electoral (para cubrir diversas necesidades). Los nuevos patrocinadores de Biden incluyen a Sean Parker y Dustin Moskovitz de Facebook, el cofundador de Twitter Ev Williams y el CEO de Twilio, Jeff Lawson.

Jeff Skoll de eBay ha estado invirtiendo dinero tanto en Biden como en los demócratas en el Senado. Mark Pincus, quien está involucrado en juegos en línea, ha donado $ 626,000. Barry Diller, quien ganó su dinero en los medios en línea: $ 620,000.

Los donantes de Biden también incluyen a Nicole Shanahan, esposa de Sergey Brin de Google (25.000 dólares), y Merryl Zegar, esposa de Charles Zegar (Bloomberg LP).

En septiembre de 2020, Biden logró recaudar un récord de $ 383 millones (7). El récord anterior fue de menos de $ 200 millones, recaudado por Barack Obama en septiembre de 2008.

Sin embargo, no todos los representantes de Silicon Valley apoyan a los demócratas.

Bill Gates apoya a Donald Trump. Es una elección pragmática. Hace un tiempo, la Administración de la Casa Blanca ayudó a Microsoft a ganar una licitación para crear servidores para respaldar al Pentágono, aunque Amazon, que anteriormente había obtenido un contrato de la CIA para servidores en la nube, también luchó por la licitación. La disputa provocó un escándalo en el Departamento de Defensa de Estados Unidos en 2019.

Elon Musk también ha brindado su apoyo a Trump, citando la demencia de Biden. Además, Trump cuenta con el respaldo del fundador de Oracle, Larry Ellison.

Aquí se debe mencionar un detalle importante: hay señales de un profundo cisma en la sociedad estadounidense que ha afectado no solo a la élite financiera, sino también a las relaciones familiares. Por ejemplo, el exdirector ejecutivo de Microsoft, Steve Ballmer, ha apoyado a Trump, pero su esposa Connie ha donado 500.000 dólares a un Super PAC para Biden.

La industria de defensa estadounidense y la influencia indirecta

Tradicionalmente, el ejército estadounidense se mantiene al margen de las campañas electorales, aunque Donald Trump ha apoyado activamente al ejército desde el comienzo de su presidencia. Es significativo que, en uno de sus discursos, Joe Biden habló sobre la posibilidad de incrementar el gasto militar, lo que fue considerado como un intento de influir en las preferencias de las fuerzas de seguridad.

Sin embargo, además de los intentos de los candidatos de ganarse a los militares, hay un mecanismo interesante que vale la pena señalar que refleja ciertos intereses contrarios de los militares y los think tanks, cuando estos últimos sirven a grupos políticos.

El hecho es que el complejo militar-industrial de EE.UU. (es decir, los principales fabricantes de sistemas de armas y productores relacionados, a menudo civiles, así como estructuras del Departamento de Defensa) financia a varios think tanks de EE.UU. de manera continua.

Los cinco principales donantes son Northrup Grumman, Raytheon, Boeing, Lockheed Martin y Airbus. Junto con estos contratistas, también se transfiere dinero del Departamento de Defensa, el Departamento de Seguridad Nacional, el Departamento de Estado, la Fuerza Aérea de los EE.UU. y el Ejército de los EE.UU. Cada año, se entregan alrededor de $ 1 mil millones a varios centros para programas e investigación. Los think tanks que se ocupan de cuestiones de defensa, seguridad y estrategia militar son los destinatarios habituales. Sin embargo, la lista también incluye una serie de organizaciones que están en el espectro globalista, como el Council of Foreign Relations y el Stimson Center.

Los diez mejores centros que recibieron subvenciones entre 2014 y 2019 (inclusive) son (8):

RAND Corporation – $1,029,100,000;

Center for a New American Security (CNAS) – $8,956,000;

Atlantic Council – $8,697,000;

New America Foundation – $7,283,828;

German Marshall Fund of the United States – $6,599,999;

CSIS – $5,040,000;

Council on Foreign Relations – $2,590,000;

Brookings Institution – $2,485,000;

Heritage Foundation – $1,375,000; and

Stimson Center – $1,343,753.

Además del conocido Consejo de Relaciones Exteriores, esta lista también incluye el CNAS (9), que en realidad es un centro pro-demócrata. Fue establecido por la ex Subsecretaria de Defensa (2009-2012) Michèle Flournoy y el exsubsecretario de Estado para Asuntos de Asia Oriental y el Pacífico (2009-2013) Kurt Campbell. Ambos representan al Partido Demócrata.

La New America Foundation se posiciona ideológicamente como un grupo de expertos liberal y de centro izquierda (10). Eric Schmidt ocupó una vez uno de los puestos más importantes allí. Su actual presidenta y directora ejecutiva es Anne-Marie Slaughter, quien se desempeñó como directora de planificación política en la administración Obama.

Es revelador que esto incluya al centro que lanzó la 2020 Matching Campaign (11) para recaudar fondos con el propósito de reorganizar el sistema político del país. La campaña finaliza el 30 de octubre, justo antes de las elecciones presidenciales.

El Atlantic Council es el grupo de expertos de la OTAN.

De hecho, los donantes mencionados también están financiando indirectamente la propaganda política, ya que están pagando por las actividades de estos centros y, como expertos "independientes" en diversos temas, sus empleados hablan en televisión y escriben artículos en los principales periódicos y revistas. Por lo tanto, dan forma a la opinión pública.

Financiamiento de la protestas callejeras

Dado que los demócratas se han basado en protestas masivas, un factor importante para ellos es la búsqueda de fondos para estimular varios grupos de apoyo.

Antifa, BLM y varias organizaciones de izquierda, incluidos los antiglobalistas, son importantes grupos de protesta para los demócratas.

Los Antifa están relacionados con los trotskistas. En febrero de 2016, el Comité Internacional de la Cuarta Internacional publicó un comunicado que decía: “El nuevo movimiento contra la guerra debe ser anticapitalista y socialista, ya que no puede haber una lucha seria contra la guerra excepto en la lucha para acabar con la dictadura del capital financiero y el sistema económico que es la causa fundamental del militarismo y la guerra. Por lo tanto, el nuevo movimiento contra la guerra debe, por necesidad, ser completa e inequívocamente independiente y hostil a todos los partidos políticos y organizaciones de la clase capitalista” (12).

Los trotskistas de todo tipo, incluido el especulador financiero George Soros, apoyan activamente a los grupos radicales de Antifa en todo el mundo. En julio de 2017, sus recursos ayudaron a movilizar a más de 100.000 antiglobalistas y miembros de Antifa para las protestas en Hamburgo durante la cumbre del G20 (13).

Pero dado que los Antifa han sido reconocidos como una organización terrorista en los EE.UU., están imitando con éxito recientemente fusionarse con el movimiento Black Lives Matter (BLM) para evitar problemas con las autoridades.

BLM se presenta en los medios globales como un movimiento por los derechos de las personas negras en los Estados Unidos que son víctimas de la brutalidad policial, el racismo institucional, etc. Sin embargo, la realidad es algo diferente. La expresión #BlackLivesMatter apareció por primera vez en forma de un hashtag de Twitter en 2013. Se cree que el movimiento fue organizado por los activistas radicales de izquierda Alicia Garza (14), Patrisse Cullors y Opal Tometi. El eslogan "¡Manos arriba, no disparen!" fue popularizada por la activista negra Nelini Stamp, una de las organizadoras del movimiento “Occupy Wall Street” (financiado por George Soros), tras el asesinato de Michael Brown en agosto de 2014. También representó al Partido de las Familias Trabajadoras, que fue uno de los fundadores de la organización Dream Defenders. La Junta Asesora de Dream Defenders incluye a Angela Davis, exlíder del Partido Comunista de EE. UU.

Alicia Garza (15) también tiene vínculos con la Alianza Nacional de Trabajadoras del Hogar, Personas Organizadas para Ganar Derechos Laborales (POWER), la Escuela de Unidad y Liberación (SOUL), la Alianza por el Derecho a la Ciudad y Forward Together, todos los cuales han sido apoyados por varios donantes.

BLM también recibe fondos indirectamente, a través de varias estructuras, de Democracy Alliance (16), un fondo especial creado en 2005 para “construir una sociedad progresista” en los Estados Unidos, incluido el apoyo a las minorías sexuales y las personas de color. Se considera que el fondo es el club de donantes liberales más poderoso del país, y fue financiado inicialmente por George Soros, el empresario Peter Lewis y el desarrollador de software gay Tim Gill. Además de la participación directa de Soros, el club también incluye al multimillonario Tom Steyer.

Sin embargo, el dinero no se gasta solo en la enseñanza y la construcción pseudocientífica de nuevos "valores". Se utilizan técnicas típicas de revolución del color para alentar a sus activistas de primera línea y movilizar al BLM. Una de las formas más efectivas es el financiamiento directo de los participantes de la protesta. Se sabe que a los manifestantes callejeros se les pagaba 5.000 dólares al mes para incitar y mantener disturbios civiles en Ferguson (17). Aquí también hay una conexión con el establecimiento de la élite. Una de las organizaciones involucradas en la financiación de los disturbios civiles en Ferguson en 2014 fue Missourians Organizing for Reform and Empowerment (MORE), una antigua rama de la Association of Community Organizations for Reform Now (ACORN), que quebró en 2010. Barack Obama solía trabajar para ACORN y lo representó en la corte como abogado (18).

Aunque los medios de comunicación limitan la información sobre Black Lives Matter a las protestas contra la violencia policial y la lucha por los derechos de los afroamericanos, los objetivos del movimiento son en realidad mucho más amplios. BLM busca reemplazar las piedras angulares fundamentales de la sociedad estadounidense: 1) abolir el concepto judeocristiano de la familia nuclear tradicional, que es la unidad social básica en Estados Unidos; 2) abolir la policía y desmantelar el sistema penitenciario; 3) incorporar lo transgénero y deslegitimar la llamada heteronormatividad (la creencia de que la heterosexualidad es la norma); y 4) abolir el capitalismo (una economía libre) y reemplazarlo por el comunismo (una economía controlada por el gobierno) (19).

Los demócratas también cuentan con el apoyo de anti-globalistas de perfil relativamente alto. Entre otros, Naomi Klein ha pedido que la gente se una a la lucha contra Trump (20). Sin embargo, esta paradoja - que los Antifa y los anti-globalistas están trabajando para los intereses de los globalistas - no está siendo reportada por los medios conservadores de Estados Unidos.

En el ámbito de los medios, Biden cuenta con el apoyo de la organización de noticias The Intercept (21).

Inicialmente fue creado y financiado por el fundador y propietario de eBay, Pierre Omidyar, a través del Omidyar Network Fund.

The Washington Post, propiedad de Jeff Bezos de Amazon, también se pone del lado de los demócratas al criticar constantemente a Trump. Sin embargo, ni Jeff Bezos ni Mark Zuckerberg de Facebook respaldan abiertamente a Trump o Biden. Algunos creen que están financiando a ambos en secreto (22).

La complejidad de las predicciones

Es difícil hacer una predicción precisa en esta elección, ya que los demócratas están pidiendo una votación por correo. Aunque el servicio postal de EE.UU. es una agencia gubernamental, este método es altamente vulnerable al fraude en los EE.UU. Y no existe un mecanismo adecuado para verificar y controlar el proceso en sí. El equipo de Trump ya advirtió sobre el riesgo que representa este elemento del sistema de votación.

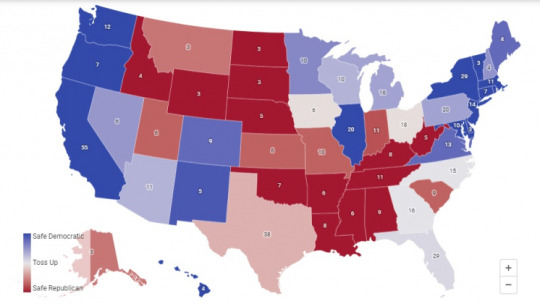

Según los datos más recientes basados en las calificaciones promedio de Cook Political Report, Inside Elections y Sabato's Crystall Ball, Arizona, Florida, Georgia, Michigan, Carolina del Sur, Pennsylvania y Wisconsin se consideran actualmente los Estados que determinarán en gran medida el resultado de la elección.

Notas:

1. https://serveamericapac.com/

2. https://womenvoteproject.org/

3. https://news.cgtn.com/news/2020-09-09/Why-are-billionaires-dumping-Trump--TCP7JM0ZLa/index.html

4. https://www.forbes.com/sites/michelatindera/2020/04/17/here-are-the-billionaires-backing-donald-trumps-campaign/

5. https://www.breitbart.com/2020-election/2020/08/09/new-york-times-wall-street-backs-joe-biden/

6. https://www.forbes.com/sites/michelatindera/2020/08/08/biden-pulls-away-in-race-for-billionaire-donors/#2599feb83b62

7. https://www.huffpost.com/entry/joe-biden-383-million-fundraising-record-2020-election_n_5f87a9cbc5b6e9e76fba0373

8. https://www.theamericanconservative.com/articles/swamp-report-top-50-u-s-think-tanks-receive-over-1b-from-gov-defense-contractors/

9. https://www.cnas.org/

10. https://www.newamerica.org/

11. https://www.newamerica.org/2020-matching-campaign/

12. https://www.wsws.org/en/articles/2016/02/18/icfi-f18.html

13. https://www.welt.de/politik/deutschland/article166435531/Die-hohlen-Erklaerungen-der-Antifa.html

14. https://aliciagarza.com/

15. https://capitalresearch.org/article/blm-roots/?__cf_chl_jschl_tk__=ce2d22c6151a6eb9a88549dfb1b361aa61b8decb-1601384582-0-AWrnPV3jDI07_k0PL-N7TBNj_az8p3ptjjtjuTzuXyhh4SYOSdzdmpMKbCRrmwZPHW-zXMIkwCjZJyJOjBhrZ3H1I581bond8XF-TlNqSxn-tyoL_a_BKzE3psT7v25X4qMAfxZNJr6aifamaK8lnUP10xKcJVem42JoUlfw8Ygg0VPmS3HyQzm9vfp6HxPi2jGKj-V6jAyWIKZatn0wTfsgk-vk0wiVKYEXvm6ozRvfiRYCRuSqf8sU_RW8C81ugo78e1iFxgIZREiRv5GNXgNDmDheDb1E6xxn3TSeysxH7LH0OvrqDAObUm3m3e7eBPy2VhT5yEViqfvC2Gil_MkQdAeYLuHlMqxHorNP-6jK

16. https://democracyalliance.org/

17. https://archives.frontpagemag.com/fpm/ferguson-rent-mobs-exposed-matthew-vadum/

18. https://www.americanthinker.com/articles/2014/10/is_acorn_behind_violent_unrest_in_ferguson.html

19. https://www.gatestoneinstitute.org/16181/black-lives-matter

20. https://theintercept.com/2020/01/22/bernie-sanders-movement-solidarity/

21. https://theintercept.com/

22. https://www.vox.com/recode/2020/9/30/21492411/tech-billionaires-endorsements-trump-biden

1 note

·

View note

Text

Clifford Chance advises Informa on the divestment of Pharma Intelligence for £1.9 billion to Warburg Pincus

https://frankgiunta.com/clifford-chance-advises-informa-on-the-divestment-of-pharma-intelligence-for-1-9-billion-to-warburg-pincus/

Clifford Chance advises Informa on the divestment of Pharma Intelligence for £1.9 billion to Warburg Pincus

International law firm Clifford Chance has advised long-standing client Informa, the international B2B Markets, Knowledge Services and Business Intelligence Group, on the divestment of Pharma Intelligence, its largest business within the Informa Intelligence division to Warburg Pincus for £1.9bn,and on the share buyback programme announced in conjunction with the disposal. This transaction will play a key part in Informa’s 2021-2024 Growth Acceleration Plan II, and provide funds to accelerate investment and expansion in two priority areas: Academic Markets & Knowledge Services (Taylor & Francis) and B2B Markets & Digital Services (Informa Markets, Informa Connect, Informa Tech). The proceeds of sale are also intended to be deployed as part of Informa’s stated intention of returning £1bn of embedded value to shareholders through the combination of a share buyback programme and a special dividend. This transaction was led by Corporate Partner Steven Fox who commented: “We are delighted to have been entrusted by Informa to advise on this significant strategic transaction on which we once again mobilised colleagues from across our practice areas and offices from Australasia, to the US and Europe as we have similarly done on Informa’s most significant corporate and strategic matters over the last decade. Together with Informa’s Strategy and Business Planning and Legal teams, we helped deliver a transaction of exceptional multiples on a very tight schedule that has been very well received by investors.” Senior Associates Erik O’Connor and Olivia Higgs assisted on this transaction, alongside Thomas Cowie, Chinwe Odimba-Chapman, Laura Conway, Sanne Blankestijn, Andre Duminy, Sally Murphy, Ona Odili, Nick Mace, Nicola Hemsley, Stephen Reese, Uche Eseonu, Sonia Gilbert, Lauren Evans, Nelson Jung, Mike Rueter and Chloe Barclay. Ben Sibbett, Christine Kim and Rachel Park from our New York office and Reuben Van Werkum and Sarah Jenkins from our Sydney office also assisted on this transaction.

Powered by WPeMatico

0 notes

Link

DNC Chair Tom Perez recently sent out a fundraising email to supporters claiming, “I know garbage when I see it,” citing that he once worked on a dump truck. It’s ironic that he referred to the GOP health care bill as a “flaming dumpster fire” because he has been presiding over the disaster that is the Democratic National Committee. The organization reported that May 2017 was its worst fundraising month since the Iraq War in 2003, and April 2017 was its worst fundraising month since 2009. In May, the DNC also reported that it has $1.9 million in debt. Despite the fact that former Secretary of Labor Tom Perez was recruited by Barack Obama to appease the party’s donors, lobbyists and PACs, even they have refused to prop up the failing brand.

Not approving of the strategies laid out at a retreat for donors in January 2017, billionaires Mark Pincus and Reid Hoffman started their own political organization, Win the Future. As donors are increasingly tired of seeing their investments go to waste, many have started their own funds or used their access to take over leadership positions themselves—such as Florida billionaire donor Stephen Bittel did to become the Florida Democratic Party chair earlier this year. Democratic billionaire J.B. Pritzker is running for governor of Illinois, and billionaire Tom Steyer is debating running for governor of California. Haim Saban and James Simons poured millions into Hillary Clinton’s presidential campaign, but they have yet to be listed by the FEC as DNC donors in 2017. Additionally, George Soros has only given $33,900 to the DNC in 2017, but he poured millions of dollars into the Democratic Party in 2016.

Democratic voters have so far refused to fill the fundraising void left by the party’s corporate and wealthy donors. Tom Perez is a painful reminder that the Democratic establishment has suppressed reforms that would prove to voters that the party is prioritizing their interests. Democratic leadership subverted pro-Sanders DNC chair candidate Congressman Keith Ellison’s candidacy, ignored demands to ban superdelegates, and failed to re-enact the ban on lobbyist and PAC donations that Debbie Wasserman Schultz lifted to enable Hillary Clinton to keep up with Sen. Bernie Sanders’ fundraising.

(Continue Reading)

#politics#the left#democrats#democratic party#money in politics#DNC#democratic national committee#democratic establishment#grassroots#tom perez#keith ellison#bernie sanders#progressive

51 notes

·

View notes

Text

D'Angelo Russell的鳳還巢,其實是沒有很糟糕的計畫B

文/ Oakjames

根據Arye Abraham的報導,洛杉磯湖人隊有興趣重新把D’Angelo Russell帶回洛杉磯。當初以不是很體面的方式和湖人隊告別,甚至當時擔任湖人隊籃球運營總裁的Magic Johnson還在交易案後批評Russell缺乏領導能力、沒有領袖氣質,如今在布魯克林籃網隊完成���凰涅槃,已改頭換面成全明星球員的Russell又是否願意回來這曾經的是非之地?

《Bleacher Report》Eric Pincus披露,和Russell關係親密的消息來源稱,若籃網隊已不在追求他的球隊名單裡,那麼Russell並不排除回到湖人隊的想法。媒體們更是進一步地去報導任何與Russell以及湖人隊有所連繫的事情——新加入湖人隊的Anthony Davis近日在Instagram上追蹤了Russell。

其實,這樣的可能性蠻大的,畢竟,現在的湖人隊也和當初Russell還在的時候完全不一樣了。其一,當時頻頻成為外界口誅筆伐的對象的Russell,現在根本不需要再去面對這樣的遭遇,因為他的前面還有LeBron James和Davis;其二,主導Russell離開的Johnson已經不在湖人隊裡了。

以薪資空間方面來看,那是湖人隊總管Rob Pelinka需要去解決的事情。Russell所可以獲得的頂薪是2700萬美元,因此要騰出空間來給Russell,Pelinka就必須要找到另外一支球隊來參與交易,清除掉Jemerrio Jones、Isaac Bonga和Moe Wagner。另外一個會牽引著湖人隊的因素就是Davis終究會否放棄他的400萬美元交易補償金。雖然已經有報導說Davis不會放棄屬於他的這個權力,但是還沒有最後的官方落實,或許Pelinka可以說服到Davis去放棄這個交易補償金來完成湖人隊的補強,這也是有可能的。

更多最新 NBA 精選好文:

曾經的選秀狀元熱門:RJ Barrett 有機會超越教父 S. Nash 嗎?

Karl-Anthony Towns & D’Angelo Russell 合體灰狼?關鍵在另一名狀元身上

2019 NBA 選秀 – 本屆最強的控球後衛,恐怕不是你想的那位

上個賽季Russell打出職業生涯新高的表現,平均21.1分、3.9籃板、7助攻,有著43.4%命中率和36.9%的三分命中率。他已經證明自己擁有遠程得分的能力——15至19尺的距離命中率44%;20至24尺的距離命中率39.6%;三分線外25至20尺的距離命中率35.2%。

Russell會成為James和Davis之後另一個有力的得分點。James和Davis的存在可以幫忙帶走防守註意力,讓Russell獲得更多的進攻空間去發揮。而James更是可以減輕Russell的控球負擔,讓他做多點無球跑動的任務。上賽季Russell接球出手的命中率是39.4%,平均攻下4.1分。以湖人隊方面來做個對比:Josh Hart以平均33.3%的命中率接球出手攻下3.4分;Kyle Kuzma則是以平均31.2%的命中率接球出手攻下5.2分。

再來,上賽季投進職業生涯最多的234顆三分球的Russell擁有湖人隊所需要的三分得分能力。舉個例子,雖然樣本不多,但是Russell的底角三分球非常出色,上賽季常規賽總計出手52次命中25球,命中率是48.1%。而且,Russell有53%投進的三分球都是隊友助攻的。基本上,Russell確實不是神射手類型的球員,但是即便無球在手,他仍然可以給對手制造麻煩和威脅。

更多最新 NBA 精選好文:

「AD 人生」塵埃落定後,大咖 FA 的最佳/最糟落腳地是?

德州恐怖三巨頭醞釀中?火箭可能透過「先簽後換」盤來 Butler

【告別 18-19 球季】湊五星仍無緣東冠 七六人有著「星」麻煩

西糗的世界:如果 Stephen A. Smith 的預言都成真了……

Russell上賽季在擋拆持球人終結這一塊的表現相當亮眼。常規賽內Russell總共執行了920次擋拆持球人終結,全聯盟僅排在這個休季名字一直與湖人隊擺在一起的Kemba Walker後面。James是湖人隊上賽季執行擋拆持球人終結最多的一位(412次)——這並沒有什麽不好,Russell的外線得分能力可以讓他待在弱側等待傳球的到來,也可以幫助James拉開空間,在擋拆後直接進攻籃下也行。況且,湖人隊現在還有Davis的存在——���賽季Davis有61.8%的兩分球得分都是靠隊友的助攻。Russell或者是James擋拆,Davis接球進攻得分;Russell或者是James擋拆自行進攻籃下終結,或者是傳球給弱側的另一方,也行。Russell是否能夠和James還有Davis共存,其實我個人蠻樂觀看待的。

當然,球權的問題是避免不了的,尤其是與James同隊的情況下。根據《Cleaning The Glass》的數據顯示,上賽季Russell在布魯克林籃網隊進攻端的球權使用率是35%,在全聯盟排名第三,僅次與James Harden和Russell Westbrook。自身打球的習慣的轉換、轉型等是預期中的事情——畢竟只要追求的第三個球星不是Kyrie Irving,那都是必須去面對和試著解決的事情,並不僅限於Russell而已。

另外,Russell的防守確實也是另一個隱患。上個賽季,Russell的防守效率值是106.7,在籃網隊排名後段班——對手在他身上快攻平均攻下7.7分、對手利用Russell的失誤而平均獲得11.1分。Russell在進攻端的光芒,掩蓋了他在防守端的不足之處,但這是他必須要去提升和改善的地方。

籃網隊和Irving走得近的消息已經傳得沸沸揚揚,因此一切終究還是要看Irving的動向——Irving選擇的是籃網隊還是湖人隊,又或者籃網隊選擇的是Russell還是Irving。

無法否認的是,不管Russell再怎麼出色,Irving還是另一個級別的存在。當然,相對的,想要爭取到Irving的加入,所必須付出的代價也會很高。因此,在我看來,Russell會是準備在自由市場上爭奪Irving甚至是Walker失敗後的球隊的備用計畫,而且,是可以相對更便宜的代價取得的。

當然,若自由市場開啟後湖人隊真的去追求Russell的話,那是相當諷刺的事情——湖人隊交易Russell後的薪資空間,如今卻用來重新簽回Russell。看起來蠻瘋狂的,不過如果回頭看看近來發生在湖人隊的所有事情,你就會覺得,其實Russell的鳳回巢,似乎也還好而已。

更多最新 NBA 精選好文:

Mike Conley 的降臨 將幫助爵士邁向西區顛峰?

何處是德魯大叔秀場?Kyrie Irving 5 大潛在下家

費城七六人不該和 Jimmy Butler 頂薪續約的 3 大理由

一個巨星的誕生!Giannis Antetokounmpo季後賽顛峰時刻 Top 3

戰爭機器 Kawhi Leonard 季後賽巔峰時刻 Top 6

0 notes

Photo

- SOLD - Swamp Forest, Collection: S. Ribbe,, Wolfgang Schmidt

Swamp Forest - Sumpfwald Sincerely to: Andy Hall, Sheikha Al Mayassa bint Hamad bin Khalifa Al-Thani, Paul Allen, Edythe L. and Eli Broad, Rosa and Carlos de la Cruz, Patricia and Gustavo Phelps de Cisneros (Venezuela and Dominican Republic), Donald and Mera Rubell, Steven A. Cohen, Theo Danjuma, Maria Baibakova, Adrian Cheng, Ingvild Goetz (München), Victoria and David Beckham, Leonardo Dicaprio, Alan Lau, Camilla Barella, Ralph DeLuca, Arthur de Ganay, Ramin Salsali, Moises Cosio, Pedro Barbosa, Monique and Max Burger, Joaquin Diez-Cascon, Luciano Benetton, Roman Abramovich and Dasha Zhukova (Russia), Robbie Antonio (Philippines), Hélène and Bernard Arnault (France), Maria and Bill Bell (United States), Peter Benedek (United States), Debra and Leon Black (United States), Christian and Karen Boros (Germany), Irma and Norman Braman (United States), Peter Brant (United States), Basma Al Sulaiman, Marc Andreessen, Laura and John Arnold, Camilla Barella, Swizz Beatz, Claudia Beck, Andrew Gruft, Robert and Renée Belfer, Lawrence Benenson, Frieder Burda (Germany), Richard Chang (United States), Kim Chang-il (Korea), David Chau and Kelly Ying (China), Pierre T.M. Chen (Taiwan), Adrian Cheng (China), Kemal Has Cingillioglu (United Kingdom), Nicolas Berggruen, Jill and Jay Bernstein, Ernesto Bertarelli, James Brett, Jim Breyer, Christian Bührle, Valentino D. Carlotti, Edouard Carmignac, Trudy and Paul Cejas, Dimitris Daskalopoulos (Greece), Zöe and Joel Dictrow (United States), George Economou (Greece), Alan Faena (Argentina), Mark Falcone and Ellen Bruss (United States), Amy and Vernon Faulconer (United States), Howard and Patricia Farber (United States), Larry and Marilyn Fields (United States), Marie Chaix, Michael and Eva Chow, Frank Cohen, Michael and Eileen Cohen, Isabel and Agustín Coppel, Anthony D'Offay, Hélène and Michel David-Weill, Antoine de Galbert, Ralph DeLuca, Amanda and Glenn Fuhrman (United States), Danielle and David Ganek (United States), Ken Griffin (United States), Agnes Gund (United States), Steven and Kathy Guttman (United States), Andrew and Christine Hall (United States), Lin Han (China), Henk and Victoria de Heus-Zomer (Holland), Grant Hill (United States), Maja Hoffmann (Switzerland), Erika Hoffmann-Koenige (Germany), Tiqui Atencio Demirdjian, Beth Rudin DeWoody, Eric Diefenbach and JK Brown, David C. Driskell, Mandy and Cliff Einstein, Rebecca and Martin Eisenberg, Ginevra Elkann, Tim and Gina Fairfax, Dana Farouki, Michael and Susan Hort (United States), Guillaume Houzé (France), Wang Jianlin (China), Dakis Joannou (Greece), Alan Lau (China), Joseph Lau (China), Melva Bucksbaum and Raymond Learsy (United States), Agnes and Edward Lee (United Kingdom), Aaron and Barbara Levine (United States), Adam Lindemann (United States), Eugenio López (Mexico), Jho Low (China), Susan and Leonard Feinstein, Nicoletta Fiorucci, Josée and Marc Gensollen, Alan and Jenny Gibbs, Noam Gottesman, Florence and Daniel Guerlain, Paul Harris, Barbara and Axel Haubrok, Alan Howard, Fatima and Eskandar Maleki (United Kingdom), Martin Margulies (United States), Peter Marino (United States), Donald Marron (United States), David MartÍnez (United Kingdom and Mexico), Raymond J. McGuire (United States), Rodney M. Miller Sr. (United States), Simon and Catriona Mordant (Australia), Arif Naqvi (United Kingdom), Peter Norton (United States), Shi Jian, Elton John, Tomislav Kličko, Mo Koyfman, Jan Kulczyk, Svetlana Kuzmicheva-Uspenskaya, Pierre Lagrange, Eric and Liz Lefkofsky, Robert Lehrman, François Odermatt (Canada), Bernardo de Mello Paz (Brazil), José Olympio & Andréa Pereira (Brazil), Catherine Petitgas (United Kingdom), Victor Pinchuk (Ukraine), Alden and Janelle Pinnell (United States),Ron and Ann Pizzuti (United States), Michael Platt (Switzerland), Miuccia Prada and Patrizio Bertelli (Italy), Howard and Cindy Rachofsky (United States), Mitchell and Emily Rales (United States), Dan Loeb, George Lucas, Ninah and Michael Lynne, Lewis Manilow, Marissa Mayer, David Mirvish, Lakshmi Mittal, Valeria Napoleone, John Paulson, Amy and John Phelan, Ellen and Michael Ringier (Switzerland), David Roberts (United Kingdom), Hilary and Wilbur L. Ross Jr. (United States), Dmitry Rybolovlev (Russia), Lily Safra (Brazil),Tony Salamé (Lebanon), Patrizia Sandretto (Italy), Eric Schmidt (United States), Alison Pincus, Heather Podesta, Colette and Michel Poitevin, Thomas J. and Margot Pritzker, Bob Rennie, Craig Robins, Deedie and Rusty Rose, Stephen Ross, Alex Sainsbury, Alain Servais (Belgium), Carlos Slim (Mexico), Julia Stoschek (Germany), Budi Tek (Indonesia), Janine and J. Tomilson Hill III (United States), Trevor Traina (United States), Alice Walton (United States), Robert & Nicky Wilson (United Kingdom), Elaine Wynn (United States), Lu Xun (China), Muriel and Freddy Salem, Denise and Andrew Saul, Steven A. Schwarzman, Carole Server and Oliver Frankel, Ramin Salsali, David Shuman, Stefan Simchowitz, Elizabeth and Frederick Singer, Jay Smith and Laura Rapp, Jeffrey and Catherine Soros, Jerry Yang and Akiko Young (United States), Liu Yiqian and Wang Wei (China), Anita and Poju Zabludowicz (United Kingdom), Jochen Zeitz (South Africa), Qiao Zhibing (China), Jerry Speyer and Katherine G. Farley, Susana and Ricardo Steinbruch, Kai van Hasselt, Francesca von Habsburg, David Walsh, Artur Walther, Derek and Christen Wilson, Michael Wilson, Owen Wilson, Zhou Chong, Doris and Donald Fisher, Ronnie and Samuel Heyman, Marie-Josee and Henry R. Kravis, Evelyn and Leonard Lauder, Jo Carole and Ronald S. Laude, Francois Pinault (France), Udo Brandhost (Köln), Harald Falckenberg (Hamburg), Anna and Joseph Froehlich (Stuttgart), Hans Grothe (Bremen), UN Knecht (Stuttgart), Arendt Oetker (Köln), Inge Rodenstock (Grünwald), Ute and Rudolf Scharpff (Stuttgart), Reiner Speck (Köln), Eleonore and Michael Stoffel (Köln), Reinhold Würth (Niedernhall), Wilhelm and Gaby Schürmann, Ivo Wessel, Heiner and Celine Bastian, Friedrich Karl Flick, Monique and Jean-Paul Barbier-Mueller (Genf), Christa and Thomas Bechtler (Zürich), David Bowie (Lausanne), Ulla and Richard Dreyfus (Binningen und Gstaad), Georges Embiricos (Jouxtens and Gstaad), Friedrich Christian "Mick" Flick (Hergiswil and Gstaad), Esther Grether (Bottmingen), Donald Hess (Bolligen), Elsa and Theo Hotz (Meilen), Baroness Marion and Baron Philippe Lambert (Genf), Gabi and Werner Merzbacher (Zürich), Robert Miller (Gstaad), Philip Niarchos (St. Moritz), Jacqueline and Philippe Nordmann (Genf), Maja Oeri and Hans Bodenmann (Basel), George Ortiz (Vandoeuvres), Graf and Gräfin Giuseppe Panza di Biumo (Massagno), Ellen and Michael Ringier (Zürich), Andrew Loyd Webber, Steve Martin, Gerhard Lenz, Elisabeth and Rudolf Leopold.

https://www.saatchiart.com/art/Drawing-SOLD-Swamp-Forest-Collection-S-Ribbe/694205/2784259/view

7 notes

·

View notes

Text

Wednesday round-up

For The Washington Post (subscription required), Robert Barnes reports that “Chief Justice John G. Roberts Jr. suffered a fall at a Maryland country club last month that required an overnight stay in the hospital, a Supreme Court spokeswoman confirmed Tuesday night.” Adam Liptak reports tor The New York Times that “[t]he chief justice has twice had seizures, in 1993 and 2007, but [the spokeswoman’s] statement said his latest fall had not been caused by one.” At CNN, Ariane de Vogue and Paul LeBlanc report that “[t]he Supreme Court did not issue any statement to the media in the days after Roberts fell”; the spokeswoman, Kathy Arberg, “says she responded Tuesday night after an inquiry from the Post.”

Amy Howe highlights the five remaining cases at Howe on the Court, at least one of which will be released later this morning. At this blog, Stephen Wermeil looks back at other times in recent history when the court has issued decisions in July.

At Bloomberg Law, Ellen Gilmer reports that “[t]he Supreme Court on Monday agreed to reinstate streamlined permitting for pipelines across the country, except for Keystone XL.” Additional coverage comes from Niina Farah and Hannah Northey at Greenwire (subscription required).

Amanda Shanor analyzes Monday’s decision in Barr v. American Association of Political Consultants, in which the court held that an exception for government-debt-collection calls to a federal ban on robocalls to cellphones violated the First Amendment but left the ban in place without the exception, for this blog. Commentary comes from Scott Cosenza at Liberty Nation.

Briefly:

At AP, Jessica Gresko reports that “[t]he Supreme Court said Tuesday that the first-ever women to hold two prominent positions at the court, handling the justices’ security and overseeing publication of the court’s decisions, are retiring.”

At the U.S. Chamber Litigation Center, Andrew Pincus writes that although the recent decision in Seila Law v. Consumer Financial Protection Bureau, in which the court ruled that the structure of the CFPB is unconstitutional, but left in place the rest of the statute creating the agency, “resolves the constitutional question, it moves into the spotlight two other important issues”: “the validity of all of the prior actions by CFPB directors—approving investigations, instituting enforcement actions, and promulgating regulations; and the possible congressional response to the Court’s decision.”

In a video available here, Ruth Marcus presents Chautauqua Institution’s Robert H. Jackson Lecture on the Supreme Court, in which Marcus discusses her 2019 book about Justice Brett Kavanaugh’s confirmation hearing, as well as some of this term’s major cases.

In an op-ed at The Hill, Elizabeth Slattery and Ethan Blevins observe that “[t]he vast majority of private schools in the United States are religiously affiliated,” and that thanks to the court’s ruling last week in Espinoza v. Montana Department of Revenue, holding that Montana’s exclusion of religious schools from a state-funded scholarship program for private schools violated the First Amendment, “parents will have more options when it comes to directing their kids’ education—whether at secular or religious schools.”

We rely on our readers to send us links for our round-up. If you have or know of a recent (published in the last two or three days) article, post, podcast or op-ed relating to the Supreme Court that you’d like us to consider for inclusion in the round-up, please send it to roundup [at] scotusblog.com. Thank you!

The post Wednesday round-up appeared first on SCOTUSblog.

from Law https://www.scotusblog.com/2020/07/wednesday-round-up-532/ via http://www.rssmix.com/

0 notes

Photo

Historic Central Park Maps by Artis Q. Wright, Specialist II, Lionel Pincus and Princess Firyal Map Division, Stephen A. Schwarzman BuildingJuly 6, 2015

https://www.nypl.org/blog/2015/07/06/historic-central-park-maps

0 notes

Text

Grab picks up $2 billion more to fuel growth in post-Uber Southeast Asia

Grab, the ride-hailing service that struck a deal to take Uber out of Southeast Asia, has pulled in $2 billion in new capital as it seeks to go beyond ride-hailing to offer more on-demand services.

The $2 billion figure includes a $1 billion investment from Toyota which was announced in June, and it sees a whole host of institutional investors join the Grab party. Some of those names include OppenheimerFunds, Ping An Capital, Mirae Asset — Naver Asia Growth Fund, Cinda Sino-Rock Investment Management Company, All-Stars Investment, Vulcan Capital, Lightspeed Venture Partners and Macquarie Capital.

The deal values Grab at $11 billion post-money, which is the same as the $10 billion valuation it earned following the Toyota deal. The caliber of investors certainly suggests an IPO is on the cards soon — not that it ever hasn’t been — although the company didn’t comment directly on that when we asked.

This new financing takes Grab to $6 billion from investors. Some of its other notable backers include SoftBank and China’s Didi Chuxing, which both led a $2 billion round last year which gave Grab the gas to negotiate a deal with Uber that saw the U.S. ride-hailing giant exit Southeast Asia in exchange for a 27.5 percent stake in Grab. From that perspective, the deal was a win-win for both sides.

In this post-Uber world, Grab is transitioning to offer more services beyond just rides. It has long done so, with its own payment service and food deliveries, but it is rolling out a revamped “super app” design that no longer opens to a ride request page and that reflects the changing strategy of the Singapore-based company.

10 July 2018; Tan Hooi Ling, co-Founder, Grab, at a press conference during day one of RISE 2018 at the Hong Kong Convention and Exhibition Centre in Hong Kong. Photo by Stephen McCarthy / RISE via Sportsfile

Grab said in a statement today that this new money will go towards that “O2O” [offline-to-online] strategy that turns Grab’s app into a platform that allows traditional, offline services to tap the internet to reach new customers. The trend started out in China, with Alibaba and Tencent among those pushing O2O services, and Grab is determined to be that solution for Southeast Asia’s 650 million consumers.

Indonesia, Southeast Asia’s largest economy with a population of over 260 million, is a key focus for Grab, the company said. The company has been pushed out new financial services in the country, fueled by an acquisition last year, and it claims it is winning “significant market share” with GMV quadrupled in the first half of this year.

With Uber out of the picture, the company’s main rival for the ‘Southeast Asia Super App Crown’ is Go-Jek, the Indonesian on-demand service valued at $5 billion.

Go-Jek has long focused on its home market but this year it unveiled an ambitious plan to expand to three new markets. That kicked off yesterday with a launch in Vietnam, and the company has plans to arrive in Thailand and the Philippines before the end of the year.

Go-Jek has raised over $2 billion and it counts KKR, Warburg Pincus, Google and Chinese duo Tencent and Meituan among its backers.

0 notes

Text

Facial Feminization Services

So many aspects of the face suggest either a masculine or more feminine appearance. Dr. Stephen Pincusunderstands the importance of creating a natural result with facial feminization surgery, and he has dedicated much of his practice to meeting the needs of his transgender patients. Over the past several years, he has identified the areas of the head and neck that benefit the most from this…

View On WordPress

#best plastic surgeon beverly hills ca#cosmetic surgeon beverly hills ca#cosmetic surgery beverly hills ca#face lift beverly hills ca#facelift beverly hills ca#facial cosmetic surgery beverly hills ca#facial feminization beverly hills ca#facial plastic surgeon beverly hills ca#facial surgical clinic beverly hills ca#plastic surgeon beverly hills ca#plastic surgery beverly hills ca#reconstructive surgeon beverly hills ca#reconstructive surgery beverly hills ca

0 notes

Text

Banking and finance roundup

“In the banking world, with which I am familiar, the general belief has been that you disobey supervisory guidance at your peril. That sounds like law and regulation, but without the open process and accountability. Over many years it has certainly felt that way.” [Wayne A. Abernathy, Federalist Society commentary]

Some House Democrats use hearings to badger banks into cutting off clients in industry areas like guns, pipeline construction [Zachary Warmbrodt, Politico]

New U.S. Chamber Institute for Legal Reform papers on reforming securities litigation: “Risk and Reward: The Securities Fraud Class Action Lottery” [Stephen J. Choi, Jessica Erickson, Adam C. Pritchard]; “Containing the Contagion: Proposals to Reform the Broken Securities Class Action System” [Andrew J. Pincus]

“A pot banking bill is headed to House markup with bipartisan support” [Jim Saksa, Roll Call]

Your periodic reminder that corporate law *is* a form of public interest law [Stephen Bainbridge quoting Hester Peirce]

“History Shows Forcing Companies to Put Workers on Boards Is a Bad Idea” [Ryan Bourne, UK Telegraph/Cato, earlier on Elizabeth Warren proposals]

Tags: banks, corporate governance, guns, oil industry, regulation and its reform, securities litigation

Banking and finance roundup republished via Overlawyered

0 notes

Photo

Sketch For The Painting: Flag - Pax Christi,, Wolfgang Schmidt

This is a pair of 2 pictures - can be united with " Emperor Constantine - Astrolabium " also in one frame. Sincerely to: Andy Hall, Sheikha Al Mayassa bint Hamad bin Khalifa Al-Thani, Paul Allen, Edythe L. and Eli Broad, Rosa and Carlos de la Cruz, Patricia and Gustavo Phelps de Cisneros (Venezuela and Dominican Republic), Donald and Mera Rubell, Steven A. Cohen, Theo Danjuma, Maria Baibakova, Adrian Cheng, Ingvild Goetz (München), Victoria and David Beckham, Leonardo Dicaprio, Alan Lau, Camilla Barella, Ralph DeLuca, Arthur de Ganay, Ramin Salsali, Moises Cosio, Pedro Barbosa, Monique and Max Burger, Joaquin Diez-Cascon, Luciano Benetton, Roman Abramovich and Dasha Zhukova (Russia), Robbie Antonio (Philippines), Hélène and Bernard Arnault (France), Maria and Bill Bell (United States), Peter Benedek (United States), Debra and Leon Black (United States), Christian and Karen Boros (Germany), Irma and Norman Braman (United States), Peter Brant (United States), Basma Al Sulaiman, Marc Andreessen, Laura and John Arnold, Camilla Barella, Swizz Beatz, Claudia Beck, Andrew Gruft, Robert and Renée Belfer, Lawrence Benenson, Frieder Burda (Germany), Richard Chang (United States), Kim Chang-il (Korea), David Chau and Kelly Ying (China), Pierre T.M. Chen (Taiwan), Adrian Cheng (China), Kemal Has Cingillioglu (United Kingdom), Nicolas Berggruen, Jill and Jay Bernstein, Ernesto Bertarelli, James Brett, Jim Breyer, Christian Bührle, Valentino D. Carlotti, Edouard Carmignac, Trudy and Paul Cejas, Dimitris Daskalopoulos (Greece), Zöe and Joel Dictrow (United States), George Economou (Greece), Alan Faena (Argentina), Mark Falcone and Ellen Bruss (United States), Amy and Vernon Faulconer (United States), Howard and Patricia Farber (United States), Larry and Marilyn Fields (United States), Marie Chaix, Michael and Eva Chow, Frank Cohen, Michael and Eileen Cohen, Isabel and Agustín Coppel, Anthony D'Offay, Hélène and Michel David-Weill, Antoine de Galbert, Ralph DeLuca, Amanda and Glenn Fuhrman (United States), Danielle and David Ganek (United States), Ken Griffin (United States), Agnes Gund (United States), Steven and Kathy Guttman (United States), Andrew and Christine Hall (United States), Lin Han (China), Henk and Victoria de Heus-Zomer (Holland), Grant Hill (United States), Maja Hoffmann (Switzerland), Erika Hoffmann-Koenige (Germany), Tiqui Atencio Demirdjian, Beth Rudin DeWoody, Eric Diefenbach and JK Brown, David C. Driskell, Mandy and Cliff Einstein, Rebecca and Martin Eisenberg, Ginevra Elkann, Tim and Gina Fairfax, Dana Farouki, Michael and Susan Hort (United States), Guillaume Houzé (France), Wang Jianlin (China), Dakis Joannou (Greece), Alan Lau (China), Joseph Lau (China), Melva Bucksbaum and Raymond Learsy (United States), Agnes and Edward Lee (United Kingdom), Aaron and Barbara Levine (United States), Adam Lindemann (United States), Eugenio López (Mexico), Jho Low (China), Susan and Leonard Feinstein, Nicoletta Fiorucci, Josée and Marc Gensollen, Alan and Jenny Gibbs, Noam Gottesman, Florence and Daniel Guerlain, Paul Harris, Barbara and Axel Haubrok, Alan Howard, Fatima and Eskandar Maleki (United Kingdom), Martin Margulies (United States), Peter Marino (United States), Donald Marron (United States), David MartÍnez (United Kingdom and Mexico), Raymond J. McGuire (United States), Rodney M. Miller Sr. (United States), Simon and Catriona Mordant (Australia), Arif Naqvi (United Kingdom), Peter Norton (United States), Shi Jian, Elton John, Tomislav Kličko, Mo Koyfman, Jan Kulczyk, Svetlana Kuzmicheva-Uspenskaya, Pierre Lagrange, Eric and Liz Lefkofsky, Robert Lehrman, François Odermatt (Canada), Bernardo de Mello Paz (Brazil), José Olympio & Andréa Pereira (Brazil), Catherine Petitgas (United Kingdom), Victor Pinchuk (Ukraine), Alden and Janelle Pinnell (United States),Ron and Ann Pizzuti (United States), Michael Platt (Switzerland), Miuccia Prada and Patrizio Bertelli (Italy), Howard and Cindy Rachofsky (United States), Mitchell and Emily Rales (United States), Dan Loeb, George Lucas, Ninah and Michael Lynne, Lewis Manilow, Marissa Mayer, David Mirvish, Lakshmi Mittal, Valeria Napoleone, John Paulson, Amy and John Phelan, Ellen and Michael Ringier (Switzerland), David Roberts (United Kingdom), Hilary and Wilbur L. Ross Jr. (United States), Dmitry Rybolovlev (Russia), Lily Safra (Brazil),Tony Salamé (Lebanon), Patrizia Sandretto (Italy), Eric Schmidt (United States), Alison Pincus, Heather Podesta, Colette and Michel Poitevin, Thomas J. and Margot Pritzker, Bob Rennie, Craig Robins, Deedie and Rusty Rose, Stephen Ross, Alex Sainsbury, Alain Servais (Belgium), Carlos Slim (Mexico), Julia Stoschek (Germany), Budi Tek (Indonesia), Janine and J. Tomilson Hill III (United States), Trevor Traina (United States), Alice Walton (United States), Robert & Nicky Wilson (United Kingdom), Elaine Wynn (United States), Lu Xun (China), Muriel and Freddy Salem, Denise and Andrew Saul, Steven A. Schwarzman, Carole Server and Oliver Frankel, Ramin Salsali, David Shuman, Stefan Simchowitz, Elizabeth and Frederick Singer, Jay Smith and Laura Rapp, Jeffrey and Catherine Soros, Jerry Yang and Akiko Young (United States), Liu Yiqian and Wang Wei (China), Anita and Poju Zabludowicz (United Kingdom), Jochen Zeitz (South Africa), Qiao Zhibing (China), Jerry Speyer and Katherine G. Farley, Susana and Ricardo Steinbruch, Kai van Hasselt, Francesca von Habsburg, David Walsh, Artur Walther, Derek and Christen Wilson, Michael Wilson, Owen Wilson, Zhou Chong, Doris and Donald Fisher, Ronnie and Samuel Heyman, Marie-Josee and Henry R. Kravis, Evelyn and Leonard Lauder, Jo Carole and Ronald S. Laude, Francois Pinault (France), Udo Brandhost (Köln), Harald Falckenberg (Hamburg), Anna and Joseph Froehlich (Stuttgart), Hans Grothe (Bremen), UN Knecht (Stuttgart), Arendt Oetker (Köln), Inge Rodenstock (Grünwald), Ute and Rudolf Scharpff (Stuttgart), Reiner Speck (Köln), Eleonore and Michael Stoffel (Köln), Reinhold Würth (Niedernhall), Wilhelm and Gaby Schürmann, Ivo Wessel, Heiner and Celine Bastian, Friedrich Karl Flick, Monique and Jean-Paul Barbier-Mueller (Genf), Christa and Thomas Bechtler (Zürich), David Bowie (Lausanne), Ulla and Richard Dreyfus (Binningen und Gstaad), Georges Embiricos (Jouxtens and Gstaad), Friedrich Christian "Mick" Flick (Hergiswil and Gstaad), Esther Grether (Bottmingen), Donald Hess (Bolligen), Elsa and Theo Hotz (Meilen), Baroness Marion and Baron Philippe Lambert (Genf), Gabi and Werner Merzbacher (Zürich), Robert Miller (Gstaad), Philip Niarchos (St. Moritz), Jacqueline and Philippe Nordmann (Genf), Maja Oeri and Hans Bodenmann (Basel), George Ortiz (Vandoeuvres), Graf and Gräfin Giuseppe Panza di Biumo (Massagno), Ellen and Michael Ringier (Zürich), Andrew Loyd Webber, Steve Martin, Gerhard Lenz, Elisabeth and Rudolf Leopold.

https://www.saatchiart.com/art/Painting-Sketch-For-The-Painting-Flag-Pax-Christi/694205/3253204/view

4 notes

·

View notes

Text

Event announcement: High Court Halftime — The U.S. Supreme Court’s October Term 2019 at Midpoint

On Thursday, February 13, at 1:00 p.m. EST, the Washington Legal Foundation will host a discussion of the current state of the Supreme Court’s 2019 term and a preview of upcoming decisions. The panel will feature attorneys Elaine Goldenberg, Sarah Harris, Andrew Pincus and Jay Stephens.

Click here to register and for more information.

The post Event announcement: High Court Halftime — The U.S. Supreme Court’s October Term 2019 at Midpoint appeared first on SCOTUSblog.

from Law https://www.scotusblog.com/2020/02/event-announcement-high-court-halftime-the-u-s-supreme-courts-october-term-2019-at-midpoint/ via http://www.rssmix.com/

0 notes