#stem certified accountant requirements

Explore tagged Tumblr posts

Text

Four Key Ways CPAs Drive Growth and Success for Small Businesses

Many people have a misbelief that Certified Public Accountants (CPAs) are only necessary for large businesses and individuals with a huge income and several resources.

While it’s surely true that CPAs provide aid in such circumstances, the fact is that they help businesses and individuals with much more modest incomes too. Moreover, CPAs have the expertise to help a broad range of customers with diverse incomes and financial conditions.

Wondering what CPAs can do for small businesses? Here are a couple of things that may raise your eyebrows.

Cash Flow Management

CPAs oversee where the cash is going by designing a monthly cash flow statement. After completing the report, CPAs go through the cash flow statement with the small business owner and discuss possibilities of cost-cutting or more (necessary) spending.

Also, CPAs help small businesses with meeting payroll or during unexpected expenditures. They help them acquire lines of credit (LOC) that help with start-up spending and help their business fulfill small and long-term targets.

Support during Tax Season

Tax season is nerve-racking for every small business owner, no matter how organized they are. Filing the taxes is pretty complicated, and if not careful, can lead to a mistake through the process. This is where CPAs come in.

CPAs prepare business tax documents, file the return, and even advise small businesses about reducing their tax liability. Also, they’ll be aware of any t ax changes and act as a spokesman if the business is audited.

To know more, read our original content on https://bit.ly/4chLk7x

#accounting recruiting firms#accounting staffing agency#stem certified accountant requirements#accounting jobs#recruitment

0 notes

Text

WHY INCOMING SENIOR HIGH SCHOOL STUDENTS MUST CHOOSE A TRACK?

Hello everyone this is from Grade 11 Humss (Vygotsky) as we tackled about why senior high school students must choose their strand.

Senior High School Guide: Choosing the Right Track and Strand K-12 is a relatively new program here in the Philippines if you compare it with our neighboring countries. For students to move into college or the university level, they must undergo junior (Grades 7-10) and senior (Grades 11-12) high school level to be given a diploma. A certification is given during the junior level but finishing the senior high level certifies and validates that a student is qualified for college.

Going into senior high school, students must choose a strand and track they would like to take for the next two years of their senior high school life. There are different strands and tracks students can choose from which can also help them choose a course they might want to take in college. Given the magnitude of this decision, careful consideration is required. Here is a simple guide to assist you in deciding which academic track and strand are best suited to your need is for those who have already and surely decided to pursue a college education after senior high school; basically, it helps you in your journey going to college because of its subject specialization. Under this track there are four strands you choose from:

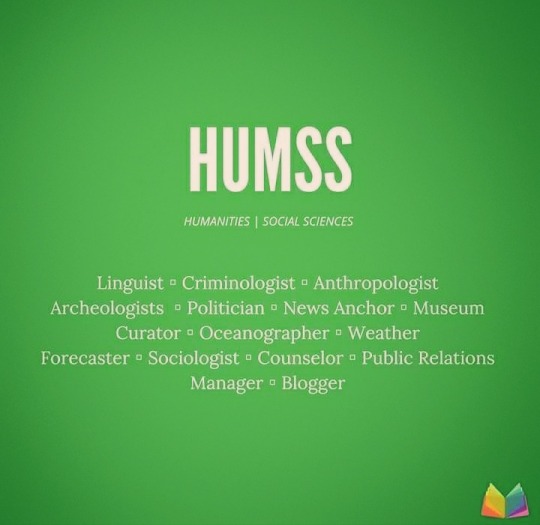

1.)HUMSS– First is the Humanities and Social Sciences or HUMSS. HUMSS is the strand for students who wish to go into college with the following courses: Political Science or International Studies, English or Filipino Literature, Mass Communication, Education, Performing Arts, and other related courses.

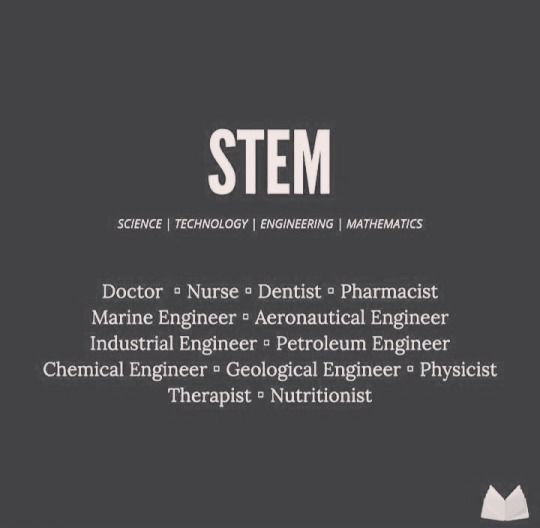

2.)STEM– The next strand is the Science, Technology, Engineering, and Math track, also known as STEM. STEM is the strand for students who wish to go into college with the following courses: Biology, Physics, Mathematics, Engineering, Computer Studies, Information Technology, and so on and forth on the related courses. This strand is a very hands-on type of experience that would be good for students who have firmly decided on their future college courses and profession.

3.)ABM– The third is the Accounting Business and Management or ABM. ABM is the strand for students who wish to go into college with the following courses: Human Resources, Tourism, Hotel and Restaurant Management, Accounting, Business Studies, Marketing, Real Estate, Export Management, Entrepreneurship, and other related courses in this path. This is a suggested strand for those who have their eyes set on creating a business in the future or working in the business sector.

4.)GAS– And the last strand in the Academic track is the General Academic Strand or GAS. Now if you have some uncertainty or confusion in your mind on what specific path you would want to take, then GAS is the strand offered in this track. What makes this good is that the courses offered here are encompassing; meaning in all fields. The things that one can learn in this can help your uncertain mind explore your possible college options. Simply put, this strand is for all college courses.

5.)TVL Track-Our next track is the Technical-Vocational-Livelihood Track. The subjects on this track focus on practical knowledge and job-ready training. Once you take and finish a strand on this track, you will be given the TESDA National Certificate. If your goal is to work immediately or be eligible for certified jobs after senior high school, this track is perfect for you. Finishing any strand from this track gives you skills that are considered and accepted to qualify you for work.

These different tracks, strands, and specializations are intended for you to determine which paths fit your strengths, passions, and skills. Choosing the right Senior High School strand will help motivate you for your future career. Once you choose a strand you like, studying becomes more enjoyable since the strands are designed and specialized to match your interests. Moreover, it expands your knowledge and skills, while at the same time, exposing you to your chosen field of study in preparation for college.

Every student in Senior High School should make a choice is choosing among the give tracks in Senior High School such as Academic, Technical Vocational Livelihood, Sports and Art's & Design. In Academic track it includes three strands: ABM, HUMSS and STEM.

We should always choose the track that we want because it is important for us students of SHS to have more knowledge and straight to our dream course that we really want to achieve before Graduating SHS. And from these tracks we can learn how to manage our time and what we want in the future, from learning to these tracks we can have business as student we can also have a part time and to know more what we can know from these tracks.

#SENIORHIGHSCHOOLHUMSS #11VYGOTSKY (GROUP 1 - MEMBERS)

1.Ivory Crisostomo 2.Kim Valaquio 3.Jolly Sanchez 4.KC Velado 5.Angelie Ucag 6.Diego Castro

3 notes

·

View notes

Text

It isn’t clear if a $90 million program designed to recruit and retain math and science teachers in middle and high school is working, the Alabama Commission on the Evaluation of Services wrote in a report released last week.

The Teacher Excellence and Accountability for Mathematics and Science, or TEAMS, Program, launched at the start of the 2021-22 school year, “deviates from implementation best practices, lacks defined goals and maintains vague performance metrics,” the report’s authors wrote.

The law establishing the program lacked a specific set of measurable goals, ACES noted, leaving an evaluation of the program without metrics by which to judge the success of the program.

“Without established benchmarks, the overall success of the program cannot be determined in a verifiable way,” ACES stated.

Addressing those findings, a spokesman for the Alabama Department of Education said they appreciate the authors’ findings and that they’ve identified similar issues in internal reviews of the TEAMS program.

The department has a different view about how to judge the program overall, however.

“The TEAMS program is working,” Communications Director Michael Sibley told AL.com. “Alabama now has more high-quality math and science teachers than ever before. We look for continued success and will make any positive changes necessary.”

Initially, the most notable aspect of the TEAMS program was how much more eligible teachers could be paid - up to $20,000 more depending on a teacher’s credentials and whether they teach in a hard-to-staff school. Middle and high school math, science and computer science teachers are eligible for the higher pay.

Lawmakers allocated $90 million to the program for each of the past two school years, though only $38 million was spent in the first year and $59 million has been spent for year two, which is still underway. Outside of direct costs associated with TEAMS, lawmakers allocated $1 million for a marketing campaign to highlight the program.

Teachers have to apply for an allocated TEAMs position; school districts receive one math and one science position for every 105 sixth through 12th grade students enrolled in a school district. Teachers deemed eligible must sign a contract agreeing to complete required training and to have or to be working on a professional credential - either National Board Certification or a STEM credential.

According to information the Alabama Department of Education provided to ACES, one-third of the 7,500 allocated TEAMS positions statewide were filled by a TEAMS-contracted teacher.

But that doesn’t mean the other 5,000 positions weren’t filled, authors noted, just that TEAMS contracts weren’t signed. The state department did not track whether allocated TEAMS positions were filled by highly-qualified teachers who chose not to sign the contract or if those positions were filled by teachers not certified properly.

One early win noted in the report is that districts reported more fully credentialed math and science teachers teaching during the 2022-23 school year. Further, 29 TEAMS teachers came from outside of Alabama to teach, according to reports from the 55 school districts surveyed.

An unintended consequence of paying TEAMS teachers from a higher salary schedule is that the difference in pay caused morale issues among teachers teaching subjects other than math, science and computer science, according to the report. Nearly half of administrators surveyed for the report said the program negatively affected staff morale.

“The leading motivation to sign a TEAMS contract is higher pay, but the incentive negatively affected the morale among other teachers within the system,” the report found.

Improving student achievement in math and science is also a goal, but ACES found no achievement goals have been set. Additionally, the state only requires annual testing in sixth, seventh, eighth and 11th grade.

Even in the tested grades, ACES found, the state currently does not link test scores to individual teachers and therefore can’t measure the impact of a student taught by a TEAMS teacher. Authors recommended the department develop accurate measures and goals for student growth.

The report’s authors noted the short amount of time Alabama Department of Education had to get the program up and running but were critical of implementation, starting with not knowing how many highly-qualified math and science teachers were teaching in Alabama’s classrooms before the TEAMS program began.

“Without determining how many of these teachers existed and where they were located throughout the state,” according to the report, “the growth and progress toward this outcome are difficult to measure.”

Authors said the teacher application and verification process is very slow and paper-heavy, and requires school officials to enter the information manually. That makes it difficult to get teachers into the system. The state department plans to begin automating the credential verification process this summer, but that process won’t be completed until next summer.

ACES noted other problems with the TEAMS program, including the requirement that TEAMS teachers teach only one course not on the list of approved courses. That course, however, still must be designed to improve student achievement in math, science or computer science. Nearly half of the surveyed administrators said that limitation was a “significant issue,” according to the report.

ACES issued nine recommendations for improvement, including streamlining the application process for teachers wanting to become a TEAMS teacher to establishing benchmarks and developing metrics that measure student growth associated with TEAMS teachers.

ACES has completed multiple evaluations of other education-related programs since it was created in 2019.

3 notes

·

View notes

Text

Unlocking Financial Freedom: Expert Tax Resolution Services with Salinger Tax Consultants LLC

Introduction

Navigating the complexities of the U.S. tax system can be daunting, especially when dealing with issues such as wage garnishments, IRS penalties, or unpaid payroll taxes. Salinger Tax Consultants LLC is here to provide expert assistance, ensuring peace of mind and tailored solutions to your unique tax challenges. Backed by a team led by a former IRS agent, our services are designed to help you achieve compliance and financial relief through strategies like Offers in Compromise and Currently Not Collectible (CNC) statuses. With our Certified Tax Professionals, you can reclaim control over your financial future.

Understanding Tax Resolution Services

Tax resolution services are critical for individuals and businesses facing tax disputes or debts with the Internal Revenue Service (IRS). At Salinger Tax Consultants LLC, we specialize in guiding clients through these challenges with a focus on resolving issues effectively and efficiently.

Our team begins by conducting a comprehensive analysis of your financial situation. This allows us to identify the best strategies to settle disputes, reduce liabilities, and negotiate favorable terms with the IRS. Whether you're dealing with overdue taxes, audits, or compliance concerns, we stand as your trusted ally in addressing these matters.

Certified Tax Professionals: Expertise You Can Trust

Hiring a Certified Tax Professional is essential for managing complex tax issues. These professionals possess the expertise to interpret tax codes, identify errors, and craft solutions that benefit taxpayers.

At Salinger Tax Consultants LLC, our Certified Tax Professionals have years of experience and a deep understanding of IRS regulations. This ensures that your case is handled with precision, reducing your financial burden and protecting you from potential legal complications.

Resolving Wage Garnishment Issues

One of the most stressful situations a taxpayer can face is wage garnishment. When the IRS enforces wage garnishment, a portion of your income is automatically deducted to settle your tax debt. This can leave you struggling to meet essential living expenses.

We specialize in stopping wage garnishments quickly and efficiently. Our experts communicate directly with the IRS to negotiate alternatives such as installment agreements or Offers in Compromise. By addressing the underlying tax issues, we help restore your financial stability while working toward a long-term resolution.

Filing Payroll Taxes Correctly and On Time

For business owners, payroll taxes are a critical responsibility. Failing to file these taxes accurately and on time can result in severe penalties, interest charges, and potential legal action.

Salinger Tax Consultants LLC assists businesses in managing payroll tax obligations effectively. Our team ensures accurate filings, compliance with IRS requirements, and guidance on avoiding future errors. By partnering with us, you can focus on growing your business while we handle the complexities of payroll tax compliance.

Exploring Currently Not Collectible (CNC) Status

If you’re unable to pay your tax debt due to financial hardship, the IRS may classify your account as Currently Not Collectible (CNC). This status temporarily halts collection activities, including wage garnishments and levies.

Our Certified Tax Professionals work with you to assess your financial situation and determine if you qualify for CNC status. We handle all communications with the IRS, ensuring your application is completed accurately and efficiently. While in CNC status, you can regain financial stability without the constant stress of collection actions.

Reducing IRS Penalties

IRS penalties can quickly escalate your tax debt, making it harder to resolve. These penalties may stem from late filings, underpayments, or inaccuracies in your tax returns.

At Salinger Tax Consultants LLC, we specialize in penalty abatement strategies. Our experts evaluate your case and identify opportunities to reduce or eliminate penalties. By demonstrating reasonable cause, such as financial hardship or unforeseen circumstances, we negotiate with the IRS on your behalf to lessen your financial burden.

Securing an Offer in Compromise

An Offer in Compromise (OIC) is one of the most effective tools for settling tax debt for less than the full amount owed. This program is designed for taxpayers who cannot pay their full debt or doing so would create financial hardship.

Our team has extensive experience in preparing and submitting OIC applications. We analyze your financial situation, calculate your reasonable collection potential, and present a compelling case to the IRS. By securing an OIC, you can achieve a fresh start and avoid prolonged financial strain.

Comprehensive Solutions Tailored to You

At Salinger Tax Consultants LLC, we understand that every tax situation is unique. That’s why we take a personalized approach to resolving your tax issues. Our services include:

Detailed financial analysis: Ensuring we understand your situation fully before recommending solutions.

Tailored strategies: Whether it’s CNC status, wage garnishment resolution, or penalty abatement, we customize our approach to meet your needs.

Continuous support: From initial consultation to final resolution, we stand by you every step of the way.

Why Choose Salinger Tax Consultants LLC?

With years of experience and a proven track record, we are committed to helping clients achieve financial relief and compliance. Here’s what sets us apart:

Expertise: Our team includes a former IRS agent and Certified Tax Professionals who understand the system from the inside out.

Integrity: We prioritize transparency and ethical practices in every case we handle.

Results-oriented approach: Our focus is on delivering effective solutions that reduce your tax liabilities and restore your peace of mind.

0 notes

Text

The Benefits of CPA Certification: A Global Perspective

In today’s fast-paced world, the role of accountants is undergoing a major transformation. No longer confined to traditional bookkeeping and auditing, accountants are increasingly expected to possess advanced technological skills and an understanding of financial technologies that drive efficiency and accuracy. This shift is especially prominent in global markets like the United States, where a shortage of accountants is creating significant demand for professionals equipped with both accounting expertise and STEM competencies.

For Indian accountants, the opportunity to meet this demand and thrive in global roles has never been more promising. A CPA certification (Certified Public Accountant), especially one earned through a program like Miles US Pathway, opens doors to a wide array of global opportunities, particularly in the US. Combined with Miles’ integration of STEM skills into its accounting education, professionals are well-prepared to navigate the evolving landscape of the accounting profession.

The Versatility of the CPA Credential

A CPA certification is a powerful credential that signifies a high level of expertise in accounting, auditing, taxation, and financial management. While the Indian Chartered Accountant (CA) qualification holds substantial value within India, the CPA credential is recognized globally, particularly in the US, where it is a requirement for key financial and accounting roles.

Here’s how completing a CPA certification through Miles can unlock global opportunities:

International Recognition: The CPA is recognized as the gold standard for accountants worldwide, providing a universal qualification that allows Indian professionals to work not just in the US but across other regions that follow US GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards).

Diverse Career Pathways: Holding a CPA opens up diverse career opportunities. Whether you want to work in public accounting, corporate finance, consulting, or government, the CPA credential is versatile and provides the flexibility to choose your career path based on your interests and skills.

Access to High-Paying Roles: Completing the CPA exam allows Indian accountants to tap into high-paying roles in the US, where the demand for qualified professionals is skyrocketing due to a shortage of over 300,000 accountants. By acquiring this globally recognized certification, professionals can command competitive salaries in one of the world’s largest financial markets.

Global Career Transitions: Miles Education’s US Pathway program is more than just a certification—it’s a gateway to global career transitions. The program equips Indian accountants with the right knowledge, skills, and industry connections to seamlessly transition into roles at Big 4 accounting firms, multinational corporations, and other leading organizations in the US and beyond.

STEM Integration: The Future of Accounting

In addition to the global recognition that the CPA offers, what sets Miles Education apart is its integration of STEM skills into the accounting curriculum. The increasing role of technology in accounting is pushing professionals to adapt to new tools and methodologies that drive automation, efficiency, and data-driven decision-making.

The world is witnessing rapid advancements in technology, and the accounting field is no exception. Today, accountants are expected to leverage data analytics, predictive modeling, and AI-driven technologies to enhance the accuracy and effectiveness of their work. Miles Education has recognized this shift and is leading the charge in preparing Indian accountants to succeed in a technology-driven accounting landscape.

How STEM Skills are Changing the Role of Accountants

In a world driven by automation, technology, and big data, the traditional role of accountants has evolved significantly. Accountants today are not only responsible for tracking financial transactions but also for interpreting data, providing insights, and helping businesses make informed decisions.

Here are a few real-world examples of how STEM skills are being applied in accounting:

Data Analytics:

Accountants are now expected to use data analytics to identify trends, anomalies, and patterns in financial data. By harnessing large datasets, they can provide valuable insights that go beyond traditional financial reporting.

For instance, using data analytics, accountants can predict cash flow trends, identify potential risks, and uncover opportunities for cost savings. In a business world where data-driven decisions are paramount, accountants with data analytics skills are in high demand.

Predictive Modeling:

Predictive modeling allows accountants to forecast future financial performance based on historical data. This can be particularly useful for budgeting, forecasting, and planning purposes.

For example, an accountant working with a retail business could use predictive modeling to forecast sales for the next quarter, taking into account factors such as past sales data, seasonal trends, and economic indicators. By doing so, the business can make more informed decisions regarding inventory management, marketing strategies, and capital expenditures.

AI in Auditing:

Artificial Intelligence (AI) is revolutionizing the field of auditing. Traditional audits, which relied heavily on manual processes, are now being transformed through the use of AI-powered tools that can analyze vast amounts of financial data in real time.

AI can help accountants automate tasks such as fraud detection, risk assessment, and even automating compliance checks. By leveraging AI, auditors can focus on higher-level tasks such as interpreting results and providing strategic advice to clients.

Blockchain and Digital Ledger Technology:

Blockchain is becoming an essential technology in accounting, providing a transparent and secure digital ledger. Accountants can use blockchain to ensure the accuracy and security of financial transactions, reducing the chances of fraud and error.

For instance, many global firms are already using blockchain to streamline their accounting processes by providing a clear and immutable record of all transactions. Accountants who are well-versed in blockchain technology are becoming essential in sectors like banking, real estate, and financial services.

How Miles Education is Leading the Charge

At Miles Education, the focus is on equipping accountants not only with core accounting skills but also with STEM competencies that make them future-ready. The Miles US Pathway goes beyond the traditional CPA certification by incorporating specialized training in areas like data analytics, financial technology, and automation.

By integrating these STEM skills, Miles is preparing Indian accountants to thrive in an era where technology and data are critical to success. Graduates of the Miles program are uniquely positioned to take on roles that require a combination of technical proficiency and financial expertise, making them stand out in the global job market.

Conclusion: A Global Career Awaits

The CPA certification is more than just a credential—it’s a key that opens doors to global opportunities. And when combined with the STEM-focused curriculum provided by Miles, Indian accountants are not only meeting the demands of today’s accounting roles but are also shaping the future of the profession.

Whether it’s working in the US, earning in dollars, or mastering cutting-edge technologies, completing your CPA certification through Miles is the ultimate step toward a rewarding and globally recognized accounting career.

0 notes

Text

Dr. Keith Nemec’s Total Health Institute Complaints and Lawsuits 2024

A comprehensive look at controversy, lawsuits, complaints, and growing negative reviews about Total Health Institute reveals a shocking mistrust of patient experiences and legal challenges.

The Total Health Institute (THI) is located in Wheaton, Illinois, and has always been a beacon of hope for people seeking holistic healing and health.

Dr. Keith Nemec established Total Health Institute in 2000. The institute is known for integrating the latest scientific advances with traditional treatments to promote mind, body, and soul wellness.

But this noble cause has caused an uproar of controversy, with a backdrop of litigation, patient complaints, and divided public opinions. In her latest article, Lauren Casper, a famous author and public reviewer, exposed the Total Health Institute, Dr. Keith, and their misdeeds to patients.

Who is Dr. Keith Nemec?

Dr. Nemec received his Bachelor’s degree in human biology, his doctorate at the National University of Health Sciences (though he practices with his Pastoral Medical License), and a master’s degree in Nutritional medicine at Morsani College of Medicine.

He holds Three Fellowships with the American Academy for Anti-Aging Medicine, which include Regenerative Medicine, Stem Cell Therapies, and Integrative Cancer Therapies.

Dr. Nemec is also certified in Peptide Therapy and Fertility. He has published five books: The Perfect Diet, The Environment of Health and Disease, Seven Basic Steps to Total Health, and Total Health = Completeness.

The author has also written numerous health-related articles, such as: “The Single Unifying Cause of All Disease” and “The Answer to Cancer is Found in the Stem Cell”.

Dr. Nemec has hosted the radio program “Your Total Health” on Chicago AM1160 over the past 18 years. She was also regularly a presenter on the talk show “Let’s Talk” in Chicago as a health expert.

Dr. Nemec specializes in neuroimmunology, nutritional medicine, and the biology of stem cells. The main area of focus is how the brain, mind, diet, and lifestyle influence the health of cells, mainly stem cells.

Total Health Institute Complaints

As part of our research into the experience of patients of The Total Health Institute (THI), We spoke to “Alex Johnson” (a pseudonym for privacy reasons). He shared insight about their care, interaction with staff members, and services.

Alex described their excitement when they joined THI. The prospect of an integrated method of healthcare enticed them. However, their experience was soon ruined by their perception of poor conduct from employees. “I was really hoping for a supportive environment, but instead, I encountered staff who were, at times, rude and dismissive,” Alex said, emulating those sentiments in online complaints.

The aspect of finances in the treatment was another area to be argued over by Alex. He was shocked at the cost-intensive nature of treatments and the need to buy supplements from the institute. “It felt like every aspect of my treatment was tied to an additional cost, and the lack of transparency in billing just added to my frustration,” Alex expressed, echoing the concerns about the pricing and billing policies.

As part of our investigation, we talked to another victim, Anthony Bavaro, who provided a shocking account of how his family dealt with THI.

Bavaro was disappointed when he sought alternative treatment at THI to treat his wife’s stage 4 cancer, as well as the lengthy chemotherapy treatment, expecting to receive something other than what was stated by THI. They hoped THI would provide a unique approach to managing the debilitating disease. Instead, they discovered discontent rather than satisfaction. Bavaro reported that, according to their account, Dr. Nemec had given them optimism despite the severity of their illness. Attracted by the assurance of their future, they decided to invest in the institute’s treatment program, which required an upfront payment and registration for several sessions over time.

Anthony Bavaro’swife passed away just a few days after having only attended two sessions.

Deeply horrified, Bavaro found himself disappointed because his attempts to alleviate the financial burden of THI resulting from non-fulfilling therapies with them had fallen in vain. He said they resisted all payments but offered no compensation or closure. This led Bavaro to doubt Dr. Nemec’s motives and suggested that profit over the patient’s care or ethics was placed above all else.

Total Health Institute Lawsuits

The lawsuit against Total Health Institute (THI) brings to light several severe allegations against the facility and its founder, Dr. Keith Nemec. A former patient, identified as Laura McDaniel, has accused the institute of providing ineffective and potentially harmful treatments. McDaniel’s allegations include being misled about the nature of the treatments and being asked to make substantial financial contributions to continue receiving care.

The lawsuit also concerns Dr. Nemec’s qualifications, the accuracy of his representations about his educational background, and the efficacy of the treatments offered at THI. Moreover, regulatory bodies are conducting ongoing investigations into the institute’s practices, explicitly questioning the adequacy of record-keeping and the accuracy of diagnoses made at the facility.

Another perspective on the lawsuit highlights the complexities surrounding the institute’s use of unverified therapies and misleading promises. The case raises significant questions about the institute’s adherence to medical licensing requirements, particularly regarding treatments licensed medical professionals should administer.

This legal battle scrutinizes Dr. Nemec and his treatment methodologies and involves a group of former patients seeking justice for what they perceive as unethical practices. The lawsuit’s outcomes could have broader implications for the alternative healthcare sector, emphasizing the need for transparency and adherence to regulatory standards.

These developments of THI led patients to consider alternative healthcare options, underscoring the importance of thorough research and due diligence when selecting healthcare providers and treatments.

Merged To Revolution New Medicine

In the wake of lawsuits and complaints, Total Health Institute has merged its name with Revolution New Medicine, situated at 23W525 St Charles Rd, Carol Stream, IL 60188. The joint ventures or merging of Total Health Institute appears to be an element of a larger plan to change the focus of their business and perhaps rethink their approach to alternative health and therapies.

Revolution New Medicine promotes holistic healing, providing various treatments, including detoxification, nutrition, and holistic therapies, to address the root cause of health problems. The newly rebranded company, under the direction of Dr. Keith Nemec, places the importance of optimizing the brain as one of the pillars of the treatment approach.

The approach is based on the centrality of the brain in ensuring health throughout the various body systems and demonstrates the interconnectedness of emotional, mental, and physical well-being.

Revolution New Medicine advocates for the treatment of brain disorders, blockages, or inflammation as the key to resolving the wide range of health problems, ranging from mental and emotional health issues to physical ailments.

The pivotal move towards Revolution New Medicine seems to be an effort to overcome the uncertainties and legal issues facing Total Health Institute and strengthen its dedication to offering alternative health solutions.

Focusing on optimizing brain function and taking a comprehensive approach to health reflects the ongoing commitment to treating the root causes of illness instead of just treating the symptoms.

Conclusion

This transformation can be seen as an attempt to distance itself from a troubled past, while skeptics might interpret it as an effort to salvage its reputation amidst growing mistrust.

This shift emphasizes addressing the fundamental causes of health issues and optimizing patient care, though it remains to be seen whether it can rebuild the tarnished trust.

#Dr. Keith Nemec’s#Health Institute#Complaints#Lawsuits#news#news 2024#Legal news#legal#croatiaweeknews

0 notes

Text

When To Seek Help from a Relationship Advisor: Recognizing The Signs

Relationships are complex, often requiring more than just good intentions to navigate their challenges. Whether you're dealing with communication breakdowns, trust issues, or feeling stuck, sometimes it’s necessary to seek expert guidance. This is where a relationship advisor can be invaluable. At TranceForMission, seeking help shows strength and commitment to improving your relationships. Here are some signs and situations that indicate it might be time to consult a relationship advisor.

1. Communication Has Become Negative or Non-existent-

When every conversation turns into an argument or you find it easier to avoid talking altogether, these are clear indicators that communication has broken down. A relationship advisor can help by teaching you techniques to improve open, honest, and respectful communication. At TranceForMission, our experts guide you through revitalizing dialogues that rebuild understanding and trust.

2. You Feel Stuck in a Loop-

If you find yourself facing the same issues repeatedly without resolution, it could be a sign that underlying problems are not being addressed. A relationship advisor provides a fresh perspective and professional strategies to break the cycle and move forward.

3. Trust Has Been Broken-

Rebuilding trust after a betrayal is one of the hardest challenges in any relationship. Whether it’s infidelity, financial secrecy, or another form of dishonesty, a relationship advisor can facilitate the healing process. At TranceForMission, we help you handle the complexities of forgiveness and accountability, fostering a path toward reconciliation.

4. Your Relationship Lacks Intimacy-

A decrease in emotional or physical intimacy can signal deeper issues within a relationship. This could stem from unresolved conflicts, stress, or changing life circumstances. A relationship advisor can help identify the root causes and work with you to restore closeness and connection.

5. Transitioning Through Life Changes-

Major life changes such as moving, job changes, or growing your family can strain relationships. Relationship advisors are skilled in guiding couples through these transitions, helping them adapt to new roles and responsibilities. This ensures that changes serve to strengthen your bond rather than create distance. It’s natural to feel overwhelmed during such times, but with the right support, you can turn these challenges into opportunities for growth and deeper connection.

6. You’re Considering A Major Commitment-

Before taking big steps like engagement, living together, or marriage, it's wise to consult a relationship advisor. They can help address any concerns and equip you with tools to build a strong, healthy relationship foundation.

7. Personal Issues Are Affecting the Relationship-

Sometimes, individual issues like low self-esteem, past traumas, or mental health challenges can impact relationships. Relationship advisors address not only the relationship dynamics but also individual aspects that contribute to relationship health.

8. You Feel Alone In Your Relationship-

Feeling isolated or disconnected from your partner is a wise indicator that something is wrong. A relationship advisor can help bridge this gap, fostering a renewed sense of partnership and mutual support. Opening lines of communication and rediscovering shared values can reconstruct the connection you once cherished. You can explore ways to rebuild intimacy and ensure both partners feel heard and valued in the relationship.

How TranceForMission Can Help?

At TranceForMission, we understand that taking the step to work with a relationship advisor is a significant decision. Our team of certified experts provides compassionate, professional advice customized to your unique situation. Through personalized coaching sessions, we aim to empower you to cultivate the skills needed for a successful relationship. Our approach not only focuses on immediate concerns but also on nurturing long-term resilience and deeper connections with your loved ones.

Conclusion-

Recognizing when to seek help is important for keeping your relationships healthy and rewarding. If you notice any troubling signs, like feeling distant from your partner or constantly arguing over small things, it might be time to talk to a professional. At TranceForMission, we are committed to guiding you through these moments with understanding and expertise. TranceForMission offers customized advice that respects your unique relationship dynamics, fostering growth and deeper connections.

Seeking help doesn't mean giving up, it means you're taking positive steps towards a happier future together. It’s easy to think you should only seek help when things are falling apart, but getting advice early can prevent bigger issues down the road. A relationship advisor from TranceForMission can offer new perspectives and strategies to help you understand each other better and work through conflicts constructively. They provide a supportive space to openly discuss your feelings and needs, which can strengthen your bond and renew your commitment to each other. Remember, taking the step to work on your relationship is a sign of strength, not weakness.

0 notes

Text

The Power of a Life Coach: Achieving Your Dreams One Step at a Time

In the hustle and bustle of modern life, it’s easy to lose sight of our dreams and aspirations. We often find ourselves overwhelmed by daily responsibilities, struggling to maintain a balance between personal and professional commitments. This is where the transformative power of a life coach comes into play. As a certified life coach in Oman, I, Yusuf Bohari, have witnessed firsthand the profound impact life coaching can have on individuals striving to achieve their dreams. Let's explore how a life coach can guide you, step by step, toward realizing your full potential.

Understanding the Role of a Life Coach

A life coach is more than just a mentor or advisor. They are a dedicated partner in your journey towards self-discovery and personal growth. Unlike therapists who often focus on past experiences and emotional healing, life coaches concentrate on the present and future. They help you clarify your goals, develop actionable plans, and provide the support and accountability needed to stay on track.

The Journey Begins with Self-Awareness

The first step in achieving your dreams is understanding yourself better. A life coach helps you delve deep into your values, strengths, and passions. Through reflective exercises and insightful conversations, you gain a clearer sense of your true desires and what motivates you. This heightened self-awareness is crucial for setting authentic and meaningful goals.

Setting SMART Goals

One of the most powerful tools in a life coach’s arsenal is the SMART goal-setting framework. SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. By breaking down your dreams into these manageable components, you can create a clear and realistic roadmap to success. As a life coach in Oman, I guide my clients through this process, ensuring their goals are well-defined and attainable.

Developing an Action Plan

Once your goals are set, the next step is to develop a detailed action plan. This involves outlining the specific steps you need to take, identifying potential obstacles, and strategizing ways to overcome them. A life coach helps you prioritize tasks, allocate resources effectively, and stay focused on your objectives. This structured approach ensures steady progress and prevents you from feeling overwhelmed.

Building Confidence and Resilience

Achieving your dreams often requires stepping out of your comfort zone and facing new challenges. A life coach empowers you to build confidence and resilience, enabling you to tackle these challenges head-on. Through positive reinforcement, constructive feedback, and motivational techniques, a life coach helps you develop a growth mindset. This mindset fosters the belief that you can learn and improve through effort and perseverance.

Enhancing Time Management and Productivity

Time management is a critical skill for anyone striving to achieve their dreams. A life coach assists you in evaluating how you spend your time and identifying areas for improvement. By implementing effective time management strategies, such as prioritizing tasks, setting deadlines, and minimizing distractions, you can enhance your productivity and make consistent progress towards your goals.

Overcoming Limiting Beliefs

Limiting beliefs are the negative thoughts and assumptions that hold you back from reaching your full potential. These beliefs can stem from past experiences, societal pressures, or self-doubt. A life coach helps you identify and challenge these limiting beliefs, replacing them with empowering thoughts and attitudes. This shift in mindset opens up new possibilities and encourages you to pursue your dreams with renewed vigor.

Maintaining Motivation and Accountability

One of the most valuable aspects of working with a life coach is the ongoing support and accountability they provide. Regular check-ins and progress reviews keep you motivated and ensure you stay committed to your action plan. A life coach celebrates your successes, helps you learn from setbacks, and keeps you focused on your long-term vision.

Embracing Continuous Growth

Achieving your dreams is not a one-time event but a continuous journey of growth and self-improvement. A life coach encourages you to embrace this journey, constantly seeking new opportunities for learning and development. By fostering a mindset of continuous growth, you can adapt to changing circumstances, overcome new challenges, and keep moving forward.

Conclusion

The power of a life coach lies in their ability to guide you through a structured and supportive process, helping you achieve your dreams one step at a time. As a life coach in Oman, I, Yusuf Bohari, am dedicated to empowering individuals to unlock their potential and lead fulfilling lives. By fostering self-awareness, setting SMART goals, developing action plans, building confidence, and maintaining motivation, a life coach can be your invaluable partner in the pursuit of your dreams. Embrace the journey, and let the transformative power of life coaching propel you towards a brighter future.

#life coaching services oman#life coach in oman#mental health wellness coach#stress relief tips coach#free career counselling online in oman#motivational coaching muscat

0 notes

Text

Unveiling the Dynamics of Leads: A Comprehensive Guide

In the labyrinth of financial intricacies, one term that often strikes fear and apprehension into the hearts of many is "IRS tax debt." For individuals and businesses alike, finding themselves in the crosshairs of tax debt can be a daunting prospect. However, amidst the challenges lie opportunities, particularly in the realm of IRS tax debt leads. In this comprehensive guide, we delve deep into the dynamics of IRS tax debt leads, unraveling their significance, and exploring strategies to navigate this complex landscape.

Understanding IRS Tax Debt Leads:

At its core, an IRS tax debt lead refers to a potential prospect or entity that has accrued tax liabilities to the Internal Revenue Service (IRS). These leads can stem from various sources, including individuals, businesses, or organizations grappling with overdue taxes, unresolved audits, or non-compliance issues. In essence, they represent a pool of opportunities for professionals in the tax resolution industry, including tax attorneys, enrolled agents, and certified public accountants (CPAs), to offer their expertise and services.

The Significance of IRS Tax Debt Leads:

The significance of IRS tax debt leads lies in their potential for conversion into clients or cases. Unlike conventional marketing leads, such as cold calls or email lists, IRS tax debt leads possess a unique quality—they are inherently motivated. Individuals or businesses facing IRS tax debt are actively seeking solutions to their financial predicaments, making them more receptive to assistance. Consequently, tapping into this niche market of motivated leads can yield higher conversion rates and lucrative opportunities for professionals in the tax resolution domain.

Navigating the IRS Tax Debt Leads Landscape:

Effectively navigating the IRS tax debt leads landscape requires a multifaceted approach that encompasses strategic targeting, empathetic communication, and unparalleled expertise. Here are some key strategies to consider:

Targeted Marketing: Identify and target specific demographics or industries that are more prone to IRS tax debt issues, such as small businesses, self-employed individuals, or high-net-worth taxpayers. Tailor your marketing efforts to address their pain points and offer tailored solutions.

Establishing Authority: Position yourself or your firm as a trusted authority in tax resolution matters through thought leadership initiatives, educational content, and testimonials. Building credibility within the niche market of IRS tax debt leads can enhance your brand visibility and attract qualified prospects.

Personalized Approach: Adopt a personalized approach when engaging with IRS tax debt leads. Understand their unique circumstances, concerns, and objectives before proposing solutions. Empathy and understanding go a long way in building trust and rapport with potential clients.

Compliance and Ethics: Ensure strict adherence to ethical standards and regulatory compliance when dealing with IRS tax debt leads. Transparency, integrity, and professionalism are paramount in maintaining credibility and fostering long-term client relationships.

Continuous Education: Stay abreast of the ever-evolving tax laws, regulations, and IRS procedures to offer informed guidance and solutions to IRS tax debt leads. Continuous education and professional development are instrumental in delivering value-added services and staying ahead in the competitive landscape.

Conclusion:

In the realm of IRS tax debt leads, opportunity intertwines with complexity, presenting a dynamic landscape for professionals in the tax resolution domain. By understanding the nuances of IRS tax debt leads, leveraging targeted strategies, and upholding ethical standards, professionals can unlock the potential of this niche market and carve a path to success. Remember, behind every IRS tax debt lead lies a story, a challenge, and an opportunity for transformation. Embrace the journey, and let your expertise illuminate the path to financial resolution.

#business leads#leads#leads generation#best debt settlement leads#commercial#debt settlement#startup#debt settlement leads#b2b leads#united states

1 note

·

View note

Text

The Importance of HIPAA Certification in Yemen

HIPAA Certification in Yemen is crucial for healthcare organizations to ensure the confidentiality, integrity, and availability of patient information. As Yemen's healthcare sector evolves, compliance with the Health Insurance Portability and Accountability Act (HIPAA) becomes increasingly important to safeguard patient privacy and maintain trust. This certification process involves implementing security measures, training staff, and conducting regular audits to assess compliance. By adhering to HIPAA standards, Yemeni healthcare providers demonstrate their commitment to protecting sensitive data and complying with international regulations, ultimately enhancing the quality of care and fostering patient confidence in the healthcare system.

Key Benefits of HIPAA Certification in Yemen

Increased Patient Trust: Being HIPAA Services in New York shows a dedication to safeguarding patient confidentiality and security, boosting patient trust, and developing closer ties between healthcare practitioners and their patients.

The legal Conformity: Obtaining HIPAA Certification guarantees adherence to global guidelines and laws, lowering the possibility of fines or legal repercussions stemming from data breaches or non-compliance.

Better Data Security: HIPAA standards implementation improves data security by lowering the possibility of illegal access, data breaches, and possible loss of private medical records.

Operational Efficacy, Adopting effective systems and methods for handling and protecting patient data is frequently required for HIPAA Certification, which simplifies operations and lessens the administrative load for healthcare organizations.

Tips for Managing HIPAA Certification Costs in Yemen

The HIPAA Cost in Netherlands varies depending on several factors, including the size of the healthcare organization, the complexity of its systems, and the level of existing infrastructure. Initial expenses may include staff training, implementing security measures, and conducting audits to assess compliance. Ongoing costs include maintenance, staff education, and periodic audits to ensure continued compliance. While the investment in HIPAA Certification may seem significant, it pales in comparison to the potential costs of data breaches or non-compliance fines. Ultimately, the financial commitment to HIPAA Certification in Yemen is a proactive investment in patient trust and organizational security.

The Ins and Outs of HIPAA Certification Audits in Yemen

Frequent Compliance Audits: In order to ensure compliance with HIPAA standards, Yemeni healthcare institutions certified under HIPAA must conduct regular compliance audits. Usually, internal or external auditors with experience in healthcare compliance handle these audits.

Thorough Evaluation of Rules and Guidelines: Auditors assess the organization's policies and practices concerning privacy policies, security measures, patient data protection, and breach response methods to make sure they comply with HIPAA regulations.

Review of Technical Safeguards: As part of the audit process, the organization's technical safeguards for electronic protected health information (ePHI), such as network security measures, access controls, and encryption, are carefully examined.

Evaluation of Physical Security Measures: In order to ensure compliance with HIPAA's physical safeguards requirements, auditors evaluate the physical security measures in place to secure physical access to the buildings, servers, and storage places where patient data is processed or kept.

How to get HIPAA Consultants in Yemen?

Send an email with any analysis you may have on HIPAA Consultants in Maldives to [email protected]. Kindly visit our official website, www.b2bcert.com, for additional information about Yemen's HIPAA Certification process. At B2Bcert, we are experts at customizing solutions to meet the demands of your business, so we can guarantee optimal advantages. Our team of experts is dedicated to helping you navigate Yemen's intricate legal system and choose the most cost-effective and realistic route to HIPAA certification.

0 notes

Text

What's in a Name? Navigating the Process of Changing Your Name After Marriage

For many individuals, getting married represents a significant life milestone that can inspire a desire to take on a new surname. Whether it's to share a unified family name or simply to mark a new chapter, the process of changing your name due to marriage can be both exciting and daunting. In this article, we'll guide you through the ins and outs of this important transition, helping you understand the steps involved and ensure a smooth name change experience.

What are the Reasons for Changing Your Name After Marriage?

The decision to change your name after marriage can stem from a variety of personal and practical reasons. Some couples choose to share a common family name, fostering a sense of unity and shared identity. Others may simply prefer the sound or connotations of the new surname. Regardless of the motivation, the name change process can be an important part of the marriage journey for many individuals.

What Documents Need to be Updated When Changing Your Name?

When changing name due to marriage, you'll need to update a range of personal and legal documents. This typically includes your driver's license, social security card, passport, bank accounts, credit cards, and professional licenses or certifications. Depending on your location, there may be additional forms or registrations required, so it's important to research the specific requirements in your area.

How Do You Legally Change Your Name After Marriage?

The legal process of changing your name after marriage usually involves submitting a name change request or application, often in conjunction with your marriage certificate. This can be done at various government agencies, such as the Social Security Administration, the Department of Motor Vehicles, or the court system, depending on the specific requirements of your jurisdiction.

What are the Steps Involved in Changing Your Name After Marriage?

The steps for changing your name after marriage can vary, but generally, they involve the following:

Obtain a certified copy of your marriage certificate.

Update your Social Security card with your new name.

Apply for a new driver's license or state ID with your updated name.

Notify your employer, banks, and other relevant institutions of your name change.

Update your passport, insurance policies, and any other important documents.

How Long Does the Name Change Process Typically Take?

The timeline for changing your name after marriage can vary depending on the specific agencies and institutions involved. In some cases, the process may be relatively straightforward and can be completed within a matter of weeks. However, in other instances, it may take several months to update all necessary documents and records. It's important to be patient and persistent throughout the process.

What are the Potential Challenges and Considerations?

While the name change process can be relatively straightforward, there are some potential challenges and considerations to keep in mind. These may include the cost of obtaining new documents, the need to update professional or educational records, and the potential for delays or complications with certain agencies or institutions.

How Can You Ensure a Smooth Name Change Experience?

To ensure a smooth name change experience after marriage, it's essential to be organized, proactive, and patient. Gather all the necessary documents, such as your marriage certificate, and create a checklist of the various agencies and institutions you need to notify. Additionally, be prepared to provide any required identification or supporting documentation, and follow up with each organization to ensure your name change is processed efficiently.

In conclusion, changing your name due to marriage is a significant life event that can be both exciting and logistically challenging. By understanding the process, the required documents, and the potential challenges, you can navigate this transition with confidence and ease, paving the way for a seamless integration of your new name into your personal and professional life.

0 notes

Text

The Role of CPA Bookkeeping Services in Minimizing Fraud and Errors

In today's complex business landscape, where financial transactions are conducted at a rapid pace, the risk of fraud and errors has become a significant concern for businesses of all sizes. Certified Public Accountant (CPA) bookkeeping services play a pivotal role in safeguarding businesses against these threats, offering a robust line of defense to minimize the occurrence of fraud and errors.

One of the primary functions of CPA bookkeeping services is to establish a system of checks and balances within the financial operations of a business. By implementing stringent internal controls, CPAs ensure that every financial transaction is thoroughly scrutinized and documented. This proactive approach acts as a deterrent to potential fraudsters, as they are less likely to attempt fraudulent activities when faced with a meticulously monitored financial system.

CPAs are equipped with the knowledge and expertise to design and implement internal controls that cover various aspects of financial operations, including cash handling, expenditure approvals, and financial reporting. By creating a framework that prevents unauthorized access and manipulation of financial data, CPAs significantly reduce the risk of fraudulent activities that could otherwise go undetected in a less secure system.

Furthermore, CPA bookkeeping services are instrumental in identifying and rectifying errors that may occur during the course of financial transactions. These errors can stem from various sources, such as data entry mistakes, miscalculations, or misinterpretations of financial information. CPAs use their expertise to conduct regular audits and reviews of financial records, ensuring that any discrepancies are promptly addressed and corrected.

Through the implementation of advanced accounting software and technology, CPA bookkeeping services enhance the accuracy and efficiency of financial reporting. Automated systems not only streamline the bookkeeping process but also reduce the likelihood of human errors. CPAs leverage these tools to reconcile accounts, cross-verify financial data, and generate accurate and reliable financial statements, which are crucial for informed decision-making.

Moreover, CPA bookkeeping services go beyond mere compliance with regulatory requirements. They actively engage in risk assessment and management to identify potential vulnerabilities in a company's financial processes. By conducting thorough risk assessments, CPAs can implement preventive measures to mitigate the likelihood of fraud and errors, thereby safeguarding the financial health and reputation of the business.

In the unfortunate event that fraud or errors do occur, CPA bookkeeping services play a vital role in investigating and resolving such issues. Their expertise allows them to trace the root cause of discrepancies, analyze financial data, and provide valuable insights into preventing similar incidents in the future. This proactive approach not only rectifies immediate concerns but also strengthens the overall financial integrity of the business.

In conclusion, the role of CPA bookkeeping services in minimizing fraud and errors cannot be overstated. These professionals act as vigilant guardians of a company's financial well-being, implementing robust internal controls, leveraging technology, and conducting regular audits to ensure the accuracy and security of financial data. By enlisting the services of qualified CPAs, businesses can fortify their defenses against the ever-present threats of fraud and errors, fostering a secure and trustworthy financial environment.

0 notes

Text

Unveiling the Distinctive Features of the ACCA Qualification: A Global Perspective on Recognition and Career Advancement

In the ever-evolving landscape of the accounting profession, choosing the right qualification is crucial for aspiring professionals. The Association of Chartered Certified Accountants (ACCA) stands out among various accounting certifications, offering unique advantages in terms of global recognition and career advancement. This article aims to delve into the differentiating factors that set the ACCA qualification apart from its counterparts.

ACCA Course Duration and Structure:

One of the key aspects that distinguish the ACCA qualification is its flexible course duration and structure. Unlike some traditional accounting certifications that may require a fixed timeline, the ACCA allows candidates to progress at their own pace. The ACCA course duration is designed to accommodate individuals with diverse backgrounds and commitments, making it accessible to working professionals and students alike.

The ACCA qualification comprises a series of exams divided into different modules, covering essential areas such as financial reporting, taxation, audit and assurance, and business analysis. This modular structure not only facilitates a step-by-step learning approach but also allows candidates to focus on specific areas of interest or industry sectors.

ACCA Course Eligibility and Entry Points:

Understanding the entry requirements is a crucial step for any prospective ACCA candidate. The ACCA course eligibility criteria are inclusive, enabling individuals with varying educational backgrounds to pursue the qualification. Unlike some certifications that may demand specific degrees or prerequisites, the ACCA welcomes candidates with a high school diploma, making it more accessible to a diverse pool of talent.

Moreover, the ACCA provides multiple entry points throughout the year, allowing candidates to commence their journey at a time that aligns with their schedule. This flexibility is particularly advantageous for individuals who wish to balance work commitments or other academic pursuits alongside their ACCA studies.

Global Recognition:

One of the standout advantages of the ACCA qualification is its unparalleled global recognition. This widespread acknowledgment stems from the ACCA's commitment to maintaining high standards of education and professional conduct, ensuring that ACCA members are equipped with the skills and knowledge required to thrive in diverse global business environments.

Many multinational corporations actively seek ACCA professionals for their international expertise and proficiency in financial management. The global recognition of the ACCA qualification opens doors to a myriad of opportunities, allowing professionals to pursue rewarding careers on a global scale.

Career Advancement Opportunities:

ACCA's emphasis on a broad skill set goes beyond technical accounting knowledge. The qualification hones professionals into well-rounded individuals with strong analytical, strategic, and leadership skills. This holistic approach not only prepares ACCA members for diverse roles within the accounting and finance sector but also positions them as valuable assets in leadership positions.

Furthermore, ACCA's continuous professional development (CPD) requirements ensure that members stay abreast of industry developments, enhancing their credibility and marketability. The ACCA qualification, therefore, serves as a catalyst for career advancement, offering professionals the chance to ascend the corporate ladder and explore leadership roles with confidence.

Conclusion:

In conclusion, the ACCA qualification stands out as a comprehensive and globally recognized certification that caters to the dynamic needs of the accounting profession. The flexibility in ACCA course duration and eligibility criteria, coupled with its international recognition and emphasis on holistic skill development, makes it a preferred choice for individuals seeking a competitive edge in their accounting careers. As the business landscape continues to evolve, the ACCA qualification remains a steadfast companion for those aspiring to make a mark in the world of finance and accounting.

0 notes

Text

Career Opportunities for CPAs: Exploring Diverse Avenues

In the world of finance and accounting, Certified Public Accountants (CPAs) play a pivotal role. With their expertise in financial reporting, taxation, auditing, and compliance, CPAs are highly sought after by various industries and sectors. This article delves into the diverse and lucrative career opportunities that await individuals who hold the prestigious CPA credential.

Career Opportunities for CPAs: Public Accounting Firms: Public accounting firms are a common career destination for CPAs. These firms offer services such as auditing, tax advisory, and consulting to clients ranging from small businesses to large corporations. CPAs working in public accounting often start as associates and can progress to roles like Audit Manager, Tax Manager, or even partner. Corporate Finance: Many corporations hire CPAs to manage their financial operations, including budgeting, financial analysis, and internal auditing. CPAs in this sector often hold titles like Controller, CFO (Chief Financial Officer), or Financial Analyst. Government and Nonprofit Organizations: Government agencies and nonprofit organisations require CPAs to ensure compliance with financial regulations and maintain transparency. Job roles in this sector include Internal Auditor, Government Accountant, or Grant Accountant. Forensic Accounting: CPAs skilled in forensic accounting investigate financial discrepancies, fraud, and white-collar crimes. They work closely with legal teams and law enforcement agencies to uncover financial irregularities. Management Consulting: CPAs with strong analytical and problem-solving skills can excel in management consulting. They provide insights to improve a company's financial performance, streamline operations, and develop growth strategies. Financial Planning and Analysis: CPAs can work as financial analysts, helping organisations make informed decisions by analysing financial data, creating forecasts, and conducting risk assessments. Entrepreneurship and Startups: CPAs who venture into entrepreneurship can leverage their financial expertise to manage the financial aspects of their own businesses or startup ventures. Academia and Education: CPAs with a passion for teaching can pursue careers in academia, training the next generation of accountants and finance professionals. International Opportunities: The CPA credential is recognized globally, opening doors to International career opportunities. Many multinational corporations and organisations value CPAs' expertise in navigating complex international financial regulations. Benefits of Being a CPA: CPAs Are Essential Following the financial crisis of the early 2000s, corporate responsibility has emerged as the primary concern for companies and their stakeholders. Certified Public Accountants (CPAs) have become indispensable to senior management for upholding the financial well-being and credibility of their businesses. The assurance of career stability stands out as a prominent advantage of possessing a CPA credential. Furthermore, another noteworthy rationale behind the augmented job security for CPAs stems from the circumstances of the 1990s. During this period, there was a decline in the enrollment of accounting students, driven by the allure of marketing and IT degrees due to the internet boom. Consequently, fewer individuals pursue careers in accounting fields. Subsequently, the industry faced a shortage of skilled professionals. This scarcity presents a favourable environment for prospective CPAs to fill these gaps and propel their careers forward.

0 notes

Text

How to Navigate Job Opportunities in the USA After CMA Certification

Introduction to CMA Certification and Its Growing Demand in the USA

Certified Management Accountant (CMA) certification opens the door to a multitude of career opportunities in the USA. This credential, revered worldwide, is especially valued in the U.S. job market where the demand for skilled accountants continues to rise.

A CMA certification not only enhances your skill set but also positions you uniquely in the job market, increasing your chances of securing high-paying roles in prestigious organizations.

Why Pursue a CMA?

The decision to pursue a CMA certification can be transformative for your career. The American job market recognizes and rewards the specialized knowledge and strategic financial management expertise that CMAs bring to the table.

Notably, the certification aligns well with the requirements for roles in business analytics and strategic decision-making, making it a powerful asset for any accountant.

Exploring CMA Career Options in the USA

CMA certification equips professionals with the skills necessary to excel in various roles, from financial analysts and cost accountants to financial controllers and chief financial officers. Each of these positions plays a critical role in shaping the financial health of their organizations, proving the versatility and value of CMA professionals in the corporate world.

The Benefits of Being a CMA in the Job Market

One of the most significant benefits of holding a CMA certification is the potential salary uplift. In the USA, CMAs can expect starting salaries around $60,000 annually, with considerable growth potential. Additionally, CMAs often find positions in top accounting firms and multinational companies, which further their career development and professional network.

How the Miles MAcc Program Opens Doors in the USA

The Miles Master of Accounting (MAcc) Program provides a gateway for Indian accountants to pursue their American dreams. Completing this program not only prepares CMAs with essential academic and practical skills but also offers them opportunities to work in top accounting firms across the USA. With a starting salary of $60K, graduates can confidently step into the American job market and live their dream life.

STEM and Accounting: A Synergistic Approach

Incorporating STEM (Science, Technology, Engineering, and Mathematics) education, the Miles MAcc program emphasizes business analytics and data-driven decision-making. This forward-thinking approach equips accountants with essential analytical skills, making them highly valuable in today’s data-centric professional environments. Graduates also benefit from a three-year work permit under the Optional Practical Training (OPT) program, opening up extensive opportunities to work and thrive in the USA.

Salary and Career Growth for CMAs in the USA

With the median salary for CMAs in the USA being significantly higher than non-certified peers, the financial benefits of this certification are clear. Furthermore, CMAs often experience rapid career progression, moving into leadership roles more swiftly due to their strategic thinking and analytical capabilities.

The Lasting Impact of a CMA Certification on Your Career

1. Broadening Your Career Horizons

A CMA certification opens up a spectrum of career possibilities. Whether you're interested in finance, management, or strategy, the CMA credential equips you with the skills to excel.

2. Achieving Long-Term Career Goals

The CMA certification is more than just a milestone; it's a catalyst for lifelong career growth and success in the accounting field, providing a clear edge in the competitive job market.

Conclusion

Navigating job opportunities in the USA after obtaining your CMA certification involves understanding the market demand, leveraging your skills, and utilizing educational pathways like the Miles MAcc program. There is currently a significant shortage of accountants, which has heightened the demand for skilled professionals in this field. This environment provides CMAs with an excellent opportunity to live the American dream, earning substantial salaries and contributing significantly to top accounting firms. By strategically positioning yourself with a CMA credential, you can seize these opportunities. The journey from certification to career success is not only achievable but also immensely rewarding, with the right guidance and preparation.

#accounting career in usa for indians#accounting career opportunities in usa#accounting career scope usa#accounting careers in usa#accounting job openings in usa#accounting jobs demand in usa#accounting jobs for indians in usa#cpa course details#cpa certification#cpa course full form#Best cma institute in India#cma subjects#cma registration fees#cma course qualification

0 notes

Text

AMD Kria K24 SOM Edge Tech

Innovation with AMD’s Kria K24 SOM

The most recent additions to the Kria lineup of adaptive System-on-Modules (SOMs) and development kits are the AMD Kria K24 System-on-Module (SOM) and KD240 Drives Starter Kit. The AMD Kria K24 SOM is aimed for cost-concerned industrial and commercial edge applications and provides power-efficient computation in a compact form factor. The K24 uses half the power1 of the bigger, connector-compatible Kria K26 SOM despite being half the size of a credit card thanks to advanced InFO (Integrated Fan-Out) packaging.

For powering electric motors and motor controllers used in compute-intensive digital signal processing (DSP) applications at the edge, the K24 SOM offers excellent determinism and low latency. Electric motor systems, robotics for industrial automation, power generation, elevators and trains, surgical robots, medical equipment like MRI beds, and EV charging stations are a few examples of important uses.

The products provide a smooth route to production deployment with the K24 SOM when used in conjunction with the KD240 Drives Starter Kit, a motor control-based development platform that is ready to use right out of the box. Users don’t need to be experts in FPGA programming to rapidly get up and running, accelerating time to market for motor control and DSP applications.

“The AMD Kria K24 SOM and KD240 development platform build on the breakthrough design experience introduced by the Kria SOM portfolio, offering solutions for robotics, control, vision AI, and DSP applications,” stated Hanneke Krekels, corporate vice president, Core Vertical Markets, AMD. “System developers must balance cutting costs with addressing the rising expectations for performance and power efficiency. For a quick time to market, the K24 SOM contains the essential parts of an embedded processing system on a single production-ready board while yet delivering outstanding performance per watt.

In many companies, robotic equipment that powers assembly lines and other machinery is powered by hundreds of motors. According to estimates, electric motors and motor-driven systems account for over 70% of all the electrical energy used globally by the industrial sector. Therefore, even a 1% increase in a drive system’s efficiency may have a big influence on operating costs and the environment.

Greg Needel, CEO of Rev Robotics, said: “The AMD Kria SOM portfolio has helped make reliable hardware for robotics and industrial edge applications accessible to the masses and we’re excited to see the portfolio extended with the new K24 SOM and KD240 Starter Kit.” “With Kria SOMs, we’re able to adapt to changing software and hardware requirements, simplify the development of even advanced control loop algorithms, and build really cool things for both commercial and STEM educational customers.”

Accelerated Design Cycles and Simplicated DSP Development

The K24 SOM has a specially created Zynq UltraScale+ MPSoC chip, and the accompanying KD240 starting kit is an FPGA-based motor control kit that costs less than $400. In contrast to previous processor-based control kits, the KD240 offers simple access for entry-level developers, allowing them to start at a more advanced stage in the design cycle.