#startup accounting services vancouver

Explore tagged Tumblr posts

Text

Financial Reporting Advisors in Vancouver - LFG Partners

What is financial reporting advisory services?

Financial Reporting Advisory Services (FRAS) refers to a specialized area within the broader field of financial advisory services. It involves providing guidance and assistance to organizations in the preparation and presentation of their financial statements and reports. The goal is to ensure that financial information is accurate, transparent, and in compliance with relevant accounting standards and regulatory requirements.

Key aspects of Financial Reporting Advisory Services may include:

Regulatory Compliance: Advising clients on compliance with accounting standards such as International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP).

Financial Statement Preparation: Assisting in the preparation of financial statements, including income statements, balance sheets, and cash flow statements, to accurately reflect the financial position and performance of the organization.

Accounting Policies and Procedures: Helping clients develop and implement appropriate accounting policies and procedures to ensure consistency and compliance with accounting standards.

Complex Accounting Issues: Providing expertise on complex accounting issues, such as revenue recognition, fair value measurement, and accounting for mergers and acquisitions.

Internal Controls: Assisting organizations in designing and evaluating internal controls to ensure the accuracy and reliability of financial reporting.

Financial Disclosures: Advising on the disclosure of relevant information in financial statements to provide transparency and meet regulatory requirements.

Audit Support: Collaborating with external auditors during the audit process to address any accounting or reporting issues that may arise.

Adoption of New Standards: Guiding organizations through the implementation of new accounting standards or changes in regulations that may impact financial reporting.

FRAS is particularly important for publicly traded companies, as accurate and transparent financial reporting is essential for building investor confidence and maintaining regulatory compliance. However, organizations of all sizes may seek financial reporting advisory services to enhance the quality of their financial reporting processes. Consulting firms, accounting firms, and financial advisory firms often provide these services to clients across various industries.

#startup accounting services vancouver#financial company vancouver#cpa firms vancouver#small accounting firms vancouver#chartered accountant vancouver#business advisors vancouver#cdap vancouver

0 notes

Text

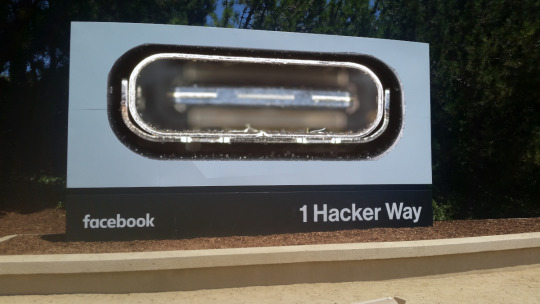

CDA 230 bans Facebook from blocking interoperable tools

I'm touring my new, nationally bestselling novel The Bezzle! Catch me TONIGHT (May 2) in WINNIPEG, then TOMORROW (May 3) in CALGARY, then SATURDAY (May 4) in VANCOUVER, then onto Tartu, Estonia, and beyond!

Section 230 of the Communications Decency Act is the most widely misunderstood technology law in the world, which is wild, given that it's only 26 words long!

https://www.techdirt.com/2020/06/23/hello-youve-been-referred-here-because-youre-wrong-about-section-230-communications-decency-act/

CDA 230 isn't a gift to big tech. It's literally the only reason that tech companies don't censor on anything we write that might offend some litigious creep. Without CDA 230, there'd be no #MeToo. Hell, without CDA 230, just hosting a private message board where two friends get into serious beef could expose to you an avalanche of legal liability.

CDA 230 is the only part of a much broader, wildly unconstitutional law that survived a 1996 Supreme Court challenge. We don't spend a lot of time talking about all those other parts of the CDA, but there's actually some really cool stuff left in the bill that no one's really paid attention to:

https://www.aclu.org/legal-document/supreme-court-decision-striking-down-cda

One of those little-regarded sections of CDA 230 is part (c)(2)(b), which broadly immunizes anyone who makes a tool that helps internet users block content they don't want to see.

Enter the Knight First Amendment Institute at Columbia University and their client, Ethan Zuckerman, an internet pioneer turned academic at U Mass Amherst. Knight has filed a lawsuit on Zuckerman's behalf, seeking assurance that Zuckerman (and others) can use browser automation tools to block, unfollow, and otherwise modify the feeds Facebook delivers to its users:

https://knightcolumbia.org/documents/gu63ujqj8o

If Zuckerman is successful, he will set a precedent that allows toolsmiths to provide internet users with a wide variety of automation tools that customize the information they see online. That's something that Facebook bitterly opposes.

Facebook has a long history of attacking startups and individual developers who release tools that let users customize their feed. They shut down Friendly Browser, a third-party Facebook client that blocked trackers and customized your feed:

https://www.eff.org/deeplinks/2020/11/once-again-facebook-using-privacy-sword-kill-independent-innovation

Then in in 2021, Facebook's lawyers terrorized a software developer named Louis Barclay in retaliation for a tool called "Unfollow Everything," that autopiloted your browser to click through all the laborious steps needed to unfollow all the accounts you were subscribed to, and permanently banned Unfollow Everywhere's developer, Louis Barclay:

https://slate.com/technology/2021/10/facebook-unfollow-everything-cease-desist.html

Now, Zuckerman is developing "Unfollow Everything 2.0," an even richer version of Barclay's tool.

This rich record of legal bullying gives Zuckerman and his lawyers at Knight something important: "standing" �� the right to bring a case. They argue that a browser automation tool that helps you control your feeds is covered by CDA(c)(2)(b), and that Facebook can't legally threaten the developer of such a tool with liability for violating the Computer Fraud and Abuse Act, the Digital Millennium Copyright Act, or the other legal weapons it wields against this kind of "adversarial interoperability."

Writing for Wired, Knight First Amendment Institute at Columbia University speaks to a variety of experts – including my EFF colleague Sophia Cope – who broadly endorse the very clever legal tactic Zuckerman and Knight are bringing to the court.

I'm very excited about this myself. "Adversarial interop" – modding a product or service without permission from its maker – is hugely important to disenshittifying the internet and forestalling future attempts to reenshittify it. From third-party ink cartridges to compatible replacement parts for mobile devices to alternative clients and firmware to ad- and tracker-blockers, adversarial interop is how internet users defend themselves against unilateral changes to services and products they rely on:

https://www.eff.org/deeplinks/2019/10/adversarial-interoperability

Now, all that said, a court victory here won't necessarily mean that Facebook can't block interoperability tools. Facebook still has the unilateral right to terminate its users' accounts. They could kick off Zuckerman. They could kick off his lawyers from the Knight Institute. They could permanently ban any user who uses Unfollow Everything 2.0.

Obviously, that kind of nuclear option could prove very unpopular for a company that is the very definition of "too big to care." But Unfollow Everything 2.0 and the lawsuit don't exist in a vacuum. The fight against Big Tech has a lot of tactical diversity: EU regulations, antitrust investigations, state laws, tinkerers and toolsmiths like Zuckerman, and impact litigation lawyers coming up with cool legal theories.

Together, they represent a multi-front war on the very idea that four billion people should have their digital lives controlled by an unaccountable billionaire man-child whose major technological achievement was making a website where he and his creepy friends could nonconsensually rate the fuckability of their fellow Harvard undergrads.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/02/kaiju-v-kaiju/#cda-230-c-2-b

Image: D-Kuru (modified): https://commons.wikimedia.org/wiki/File:MSI_Bravo_17_(0017FK-007)-USB-C_port_large_PNr%C2%B00761.jpg

Minette Lontsie (modified): https://commons.wikimedia.org/wiki/File:Facebook_Headquarters.jpg

CC BY-SA 4.0: https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#ethan zuckerman#cda 230#interoperability#content moderation#composable moderation#unfollow everything#meta#facebook#knight first amendment initiative#u mass amherst#cfaa

246 notes

·

View notes

Text

Bookkeeping services in canada

Masllp's Bookkeeping Services in Canada Running a business in Canada is like exploring a majestic national park – filled with breathtaking opportunities and diverse challenges. But just like navigating those rugged trails, managing your finances can be a wild ride. That's where Masllp's top-notch bookkeeping services in Canada come in, acting as your trusted guide to financial clarity. Why Masllp for Your Canadian Bookkeeping Needs? Local Expertise: We understand the intricate tapestry of Canadian tax laws, regulations, and accounting best practices. No need to worry about navigating provincial discrepancies or federal tax quirks – we've got your back, coast to coast. Tech-Savvy Solutions: Say goodbye to dusty ledgers and endless spreadsheets. We leverage cutting-edge cloud-based tools to keep your financials organized, accessible, and secure. Whether you're in bustling Toronto or remote Nunavut, your data is always within reach. Tailored Services: Whether you're a solopreneur in St. John's or a booming startup in Vancouver, we customize our services to fit your unique needs and budget. No cookie-cutter packages here – you get the perfect financial map for your journey. Stress-Free Support: Managing your finances shouldn't be a hair-pulling affair. Our friendly and approachable team is always happy to answer your questions, explain complex concepts, and alleviate your financial woes. Beyond the Basics: A Spectrum of Support Masllp goes beyond mere bookkeeping. We offer a comprehensive range of services to empower your Canadian business: Payroll Management: Ensure your employees receive accurate and timely payments, while staying compliant with Canadian tax regulations. Tax Preparation and Filing: From GST/HST to corporate taxes, we navigate the Canadian tax landscape so you can focus on what you do best. Financial Reporting and Analysis: Gain valuable insights into your business performance with accurate and insightful financial reports. Business Advisory: Take your financial decisions to the next level with expert advice and strategic guidance. Start Your Financial Journey Today Ready to ditch the financial wilderness and explore the path to financial freedom? Contact Masllp today for a free consultation and discover how our bookkeeping services in Canada can be your compass to success. Remember, with Masllp, your Canadian business adventure can be as smooth and enjoyable as a maple syrup latte on a crisp autumn day. Get in touch and let's conquer the Canadian financial maze together! Bonus Tip: Include a call to action, such as offering a free consultation or downloadable resource related to bookkeeping in Canada. Remember to replace "Masllp" with your actual company name throughout the blog. I hope this blog provides a good starting point for your keyword "Bookkeeping services in Canada." Feel free to adjust it to reflect your specific company offerings and brand voice.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services

4 notes

·

View notes

Link

After a surprise shutdown that shocked customers, Vancouver, B.C.-based startup Bench Accounting will be acquired by Employer.com. The companies made the announcement Monday morning on their websites. “Your service will continue seamlessly with the platform you’ve always trusted,” reads a message on Bench’s homepage. TechCrunch reported that Bench customers will be able to “port their data or keep their service under new ownership.” Employer.com is based in San Francisco and offers workforce management software for payroll, compliance, and more. Jesse Tinsley, a Bay Area entrepreneur focused on HR tech, said he acquired the Employer.com domain last month. Tinsley also runs Recruiter.com, which is publicly traded, and BountyJobs. Employer.com put out a press release last month noting that Recruiter.com Ventures was consolidating its portfolio of brands under Employer.com. The company did not appear to offer accounting services prior to its planned acquisition of Bench. Bench announced Friday that it was abruptly closing. The company, which described itself in September as North America’s “largest bookkeeping service for small businesses,” raised more than $100 million since launching in 2012, including a $60 million round in 2021. It employed more than 650 people at the time. The shutdown sparked backlash from customers who were left scrambling just before the year wraps up. Raman Morris, an entrepreneur in Seattle who is launching a new preschool business, said she signed up for Bench two weeks ago and made advance payments that extend through 2025. “I don’t know how many customers they did this with and just ran off with their money,” she told GeekWire. Matt Palackdharry, founder of Kinetic Talents, said he also just signed up for Bench. “We didn’t even complete onboarding,” he wrote on LinkedIn. “You’re just stealing money from small businesses with how you are handling your shutdown.” In a statement on its website Friday, Bench suggested customers move to Kick, another accounting software provider, which created an “exclusive offer to handle your ongoing needs.” Bench employees wrote on LinkedIn that they were laid off. But TechCrunch reported Monday that the company is now “calling its employees back to work to ensure continuity.” Bench was led by Jean-Philippe Durrios, who was named CEO in 2022. Durrios’ LinkedIn profile notes that he stepped down from the company in November. Bench collected bookkeeping-related data and used a combination of technology and its own bookkeepers to do the manual work traditionally required of business owners and contractors. Ian Crosby, the company’s co-founder and former longtime CEO who left in December 2021, revealed details about his departure in a LinkedIn post on Friday, saying he disagreed with the board over strategy. [og_img] 2024-12-30 17:28:47

0 notes

Text

Simplifying Finances: Vancouver Bookkeeping Services Designed for Small Businesses

At TransCounts, we understand that each small business in Vancouver has unique financial needs, which is why we offer personalized Vancouver bookkeeping services for small businesses designed to empower you. Our team of experienced bookkeepers is dedicated to providing a comprehensive suite of financial solutions that not only ensure accuracy but also promote strategic growth. Whether you are a startup or an established business, we can adapt our services to meet your specific requirements.

Our bookkeeping services include meticulous record-keeping, tax preparation, financial reporting, and more. We aim to provide you with clear visibility into your financial situation, making it easier for you to manage your business effectively. By leveraging the latest accounting technologies, we enhance efficiency and accuracy, ensuring that your financial data is always up-to-date and readily available for review.

With TransCounts, you don’t just get a bookkeeping service; you gain a trusted financial advisor who is genuinely invested in your success. We believe in fostering long-term relationships with our clients, providing continuous support and insights that help you navigate financial challenges and seize opportunities. Choose TransCounts for your Vancouver bookkeeping services for small businesses and unlock your business’s full potential.

#bookkeeping for small business#payroll services for small businesses#small business bookkeeping services

0 notes

Text

Innovation in Canada: Where Creativity and Technology Converge

Canada, known for its stunning landscapes and multicultural cities, is also a hotbed of innovation. Beyond its natural beauty, this country is rich in intellectual talent and cutting-edge technology. From groundbreaking advancements in artificial intelligence to pioneering healthcare solutions, Canada's innovation scene is buzzing with activity. In this article, we’ll explore the key areas where Canada shines, including the thriving software development industry.

Spotlight on Software Development Companies

Software Development Companies in Canada are known for their creativity, technical skill, and customer-focused approach. Here are a few standout companies:

1. Shopify

Headquartered in Ottawa, Shopify has transformed the e-commerce landscape with its platform that enables businesses of all sizes to create and manage online stores. Shopify’s innovative approach has made it one of the most successful software companies in Canada, with a global impact.

2. BlackBerry

Once known primarily for its mobile devices, Waterloo-based BlackBerry has reinvented itself as a leader in cybersecurity software and services. BlackBerry’s secure software solutions are used by governments and enterprises worldwide, showcasing the company’s ability to adapt and innovate in the face of changing market dynamics.

3. Hootsuite

Vancouver-based Hootsuite is a pioneer in social media management. Its platform allows businesses to manage multiple social media accounts, schedule posts, and analyze performance metrics. Hootsuite’s user-friendly software has garnered a wide user base, from small businesses to large enterprises.

4. OpenText

Based in Waterloo, OpenText specializes in enterprise information management software. The company’s solutions help organizations manage and secure their information, streamline workflows, and ensure regulatory compliance. OpenText’s innovative products are used by companies around the world.

Embracing a Culture of Innovation

Innovation is woven into the fabric of Canadian culture. The government has made significant investments in research and development (R&D), creating a supportive environment for both startups and established companies. Institutions like the National Research Council Canada (NRC) and the Canadian Institutes of Health Research (CIHR) are essential in funding and supporting groundbreaking projects.

Canada’s education system also plays a crucial role. With top-notch universities like the University of Toronto, McGill University, and the University of British Columbia, the country produces talented graduates who drive innovation. These institutions often collaborate with industries, ensuring that academic research translates into real-world applications.

Areas Where Canada Excels

1. Artificial Intelligence and Machine Learning

Canada is a powerhouse in artificial intelligence (AI) and machine learning (ML). The country hosts several AI research hubs, including the Vector Institute in Toronto, the Alberta Machine Intelligence Institute (Amii) in Edmonton, and Mila in Montreal. These centers attract top global talent and foster partnerships between academia and industry.

Leading Canadian AI companies, like Element AI and DeepMind's Toronto office, are pushing the boundaries of AI capabilities. The Canadian government’s Pan-Canadian Artificial Intelligence Strategy, launched in 2017, has been pivotal in promoting AI research and development, positioning Canada as a global leader in this field.

2. Healthcare and Biotechnology

Canada's healthcare and biotechnology sectors are leading the way in innovation, particularly in genomics, medical devices, and pharmaceuticals. Canadian researchers have made substantial contributions to global health challenges, including the COVID-19 pandemic. Companies like Medicago and AbCellera have been instrumental in developing vaccines and antibody therapies.

The universal healthcare system in Canada provides a unique environment for testing and implementing new medical technologies. This has led to the development of innovative solutions such as telemedicine platforms and health informatics systems that enhance patient care and operational efficiency.

3. Clean Technology

As the world increasingly focuses on addressing climate change, Canada is making significant strides in clean technology (cleantech). The country boasts a robust cleantech sector that includes renewable energy, energy efficiency, and sustainable resource management. Canadian companies like Ballard Power Systems and CarbonCure Technologies are at the forefront of hydrogen fuel cells and carbon capture and utilization technologies, respectively.

Government initiatives such as the Clean Growth Program and the Strategic Innovation Fund provide essential financial support to cleantech projects, ensuring that Canada remains a key player in the global transition to a low-carbon economy.

4. Software Development

In today's digital world, software development is a cornerstone of innovation. Canada is home to numerous software development companies that are making a mark both domestically and internationally. Cities like Toronto, Vancouver, and Montreal have become tech hubs where these companies flourish.

Supporting Innovation: Government and Ecosystem

The Canadian government plays a crucial role in fostering the software development ecosystem. Programs like the Industrial Research Assistance Program (IRAP) offer funding and advisory services to small and medium-sized enterprises (SMEs) engaged in innovative projects, including software development. Tax incentives such as the Scientific Research and Experimental Development (SR&ED) program also help reduce the financial burden on companies investing in R&D.

Tech incubators and accelerators across the country, such as MaRS Discovery District in Toronto and the Creative Destruction Lab in various cities, provide vital support to startups. These institutions offer mentorship, networking opportunities, and access to capital, enabling young companies to grow and compete globally.

The Future of Innovation in Canada

Looking ahead, Canada is well-positioned to maintain and expand its role as a leader in innovation. Emerging technologies like quantum computing, 5G, and blockchain hold tremendous potential for the country’s tech ecosystem. Ongoing government investments in digital infrastructure and STEM education will ensure a steady stream of skilled professionals to drive these advancements.

Canada’s commitment to diversity and inclusion will also remain a cornerstone of its innovation strategy. By fostering an environment that values diverse perspectives, Canada can harness the full potential of its population and stay at the cutting edge of technological progress.

Conclusion

Innovation is the heartbeat of Canada’s economy and a key driver of its global competitiveness. From AI and healthcare to cleantech and software development, Canada’s contributions to the global innovation landscape are significant and growing. With robust government support, world-class educational institutions, and a vibrant startup ecosystem, Canada is poised to lead the next wave of technological advancements. The country’s software development companies, in particular, highlight the creativity and technical prowess that define Canada’s innovative spirit. As Canada continues to innovate, it will undoubtedly inspire and influence the world.

0 notes

Text

Highest Paying Jobs in Canada From UAE 2024

Canada is renowned for its high standard of living, robust economy, and diverse job market, making it a sought-after destination for professionals worldwide, including those from the UAE. With a variety of high-paying jobs available, the opportunities for career advancement and personal growth are immense. This article delves into the highest paying jobs in Canada from UAE residents, offering insights into the top sectors, required qualifications, and the steps to secure these coveted positions.

Highest Paying Jobs in Canada From Dubai

Canada's job market is vibrant and dynamic, attracting talent from across the globe. For UAE professionals, understanding the landscape of the highest paying jobs is crucial. These positions not only offer attractive salaries but also come with benefits such as job security, professional development, and a high quality of life. The top-paying sectors include technology, healthcare, financial services, and engineering.

Technology Industry

Canada's technology sector is booming, with cities like Toronto, Vancouver, and Montreal emerging as tech hubs. This industry offers some of the highest salaries, especially for roles such as software developers, IT managers, and data scientists. The demand for tech professionals is driven by the rapid growth of startups and the expansion of established tech companies.

Healthcare Sector

The healthcare sector in Canada is another significant contributor to high-paying jobs. Physicians, surgeons, pharmacists, and registered nurses are among the top earners. The country’s aging population and advancements in medical technology have increased the demand for skilled healthcare professionals.

Financial Services

The financial services industry, particularly in cities like Toronto, is a major employer and offers lucrative salaries. Roles such as investment bankers, financial managers, and accountants are highly sought after. The stability and growth of Canada's financial markets make this sector an attractive option for UAE professionals.

Engineering and Construction

Engineering and construction are critical sectors in Canada, with high demand for civil engineers, electrical engineers, and project managers. The ongoing infrastructure development and urbanization projects ensure that these roles remain well-compensated and secure.

Technology Industry Opportunities

Software Developers

Software developers are in high demand in Canada’s tech industry. They are responsible for designing, coding, and testing software applications. Salaries for software developers can range significantly, with experienced developers earning top-tier salaries.

IT Managers Jobs in Canada From Dubai

IT managers oversee the information technology needs of an organization, ensuring that all systems run smoothly. They manage teams of IT professionals and coordinate projects, often commanding high salaries due to the critical nature of their work.

Data Scientists

Data scientists analyze complex data to help organizations make informed decisions. With the rise of big data, the demand for skilled data scientists has surged, making it one of the highest paying roles in the tech sector.

Healthcare Sector Opportunities

Physicians and Surgeons

Physicians and surgeons are among the highest-paid professionals in Canada. Their extensive education and critical responsibilities ensure they receive top compensation. Specialties such as cardiology, oncology, and neurology are particularly lucrative.

Pharmacists

Pharmacists play a vital role in the healthcare system, advising on and dispensing medications. Their expertise in pharmacology and patient care commands high salaries, especially in hospital settings and specialized clinics.

Registered Nurses

Registered nurses (RNs) are essential to patient care, working in various settings including hospitals, clinics, and community health centers. Experienced RNs with specialized skills, such as nurse practitioners, earn competitive salaries.

Financial Services Careers

Investment Bankers

Investment bankers help organizations raise capital and provide financial advisory services. Their roles are critical in mergers, acquisitions, and market analysis, resulting in substantial compensation packages.

Financial Managers

Financial managers are responsible for the financial health of an organization. They develop strategies, prepare financial reports, and manage investments

Benefits of Working in Canada

High Standard of Living

Canada consistently ranks among the top countries in the world for quality of life. The high standard of living is reflected in excellent healthcare, education, and public services. The country's emphasis on environmental sustainability and safety makes it an attractive place for professionals from the UAE and other parts of the world to live and work.

Career Growth Opportunities

Canada's dynamic job market offers numerous opportunities for career advancement. Industries such as technology, healthcare, and finance are continually expanding, providing professionals with ample chances to grow their careers. The Canadian government's support for innovation and entrepreneurship further enhances career prospects.

Social Security Benefits

Canadian employees benefit from a robust social security system that includes unemployment insurance, pension plans, and various family benefits. These programs provide financial stability and support, ensuring a secure future for professionals and their families.

Challenges for UAE Professionals

Climate Differences

One of the significant challenges UAE professionals may face when moving to Canada is adapting to the climate. Canada experiences a wide range of weather conditions, including harsh winters with heavy snowfall in many regions. Preparing for these weather changes by investing in appropriate clothing and learning about winter safety can help ease the transition.

Cultural Adjustments

Adjusting to cultural differences can be challenging. Canadian society values diversity, inclusivity, and egalitarianism, which may differ from the hierarchical and collective cultures some UAE professionals are accustomed to. Embracing cultural diversity and participating in community activities can help in acclimating to Canadian life.

Licensing and Accreditation

Certain professions in Canada require specific licensing or accreditation, which might not be immediately transferable from the UAE. Professionals in fields like healthcare and engineering may need to undergo additional examinations or training to meet Canadian standards. Researching and starting the accreditation process early can mitigate these challenges.

Success Stories of UAE Expats

Personal Testimonials

Many UAE professionals have successfully transitioned to high-paying jobs in Canada, achieving both career satisfaction and personal fulfillment. Personal testimonials highlight their journeys, challenges faced, and the strategies they employed to succeed. These stories serve as inspiration and provide practical advice for new immigrants.

Professional Achievements

UAE expatriates have made significant contributions to various sectors in Canada. From leading major projects in engineering to making breakthroughs in medical research, these professionals exemplify the potential for success and the positive impact they can have on Canadian industries.

FAQs

What are the most in-demand jobs in Canada for UAE professionals?

The most in-demand jobs include software developers, IT managers, data scientists, physicians, surgeons, investment bankers, financial managers, civil engineers, and project managers. These roles offer competitive salaries and are critical to the Canadian economy.

How can UAE professionals improve their chances of getting hired in Canada?

Networking, obtaining Canadian professional certifications, gaining relevant experience, and understanding Canadian workplace culture are key strategies. Using online job portals and engaging with recruitment agencies can also enhance job search efforts.

What is the process for getting a work permit in Canada?

The process involves securing a job offer from a Canadian employer, applying for a Labour Market Impact Assessment (if required), and then applying for a work permit. Understanding the specific requirements of the visa and immigration process is essential for a successful application.

How can UAE professionals adapt to the Canadian work culture?

Adapting involves understanding and respecting Canadian communication styles, work-life balance, and workplace etiquette. Participating in cultural activities and engaging with colleagues can also facilitate a smoother integration into the Canadian work environment.

What are the benefits of the Express Entry system for skilled workers?

The Express Entry system is a streamlined immigration process that allows skilled workers to apply for permanent residency. It offers faster processing times and prioritizes candidates based on their skills, experience, and potential to contribute to the Canadian economy.

How does the cost of living in Canada compare to the UAE?

The cost of living in Canada can vary significantly depending on the city. While housing and transportation costs might be higher in major cities like Toronto and Vancouver, overall expenses for healthcare and education are generally lower due to government subsidies and public services.

Conclusion

Migrating from UAE to Canada for high-paying jobs offers an array of opportunities and benefits, from career growth and a high standard of living to robust social security. Understanding the job market, sectors with the highest salaries, and the qualifications required can significantly enhance the chances of success. While challenges such as climate differences, cultural adjustments, and licensing requirements exist, the potential rewards make Canada an appealing destination for UAE professionals seeking to advance their careers and improve their quality of life.

Canada's diverse and dynamic job market, combined with its welcoming immigration policies, creates a favorable environment for skilled professionals. By leveraging available resources, staying informed about industry trends, and preparing adequately, UAE professionals can navigate the transition smoothly and thrive in their new roles. The stories of successful UAE expatriates underscore the possibilities and set a precedent for future professionals aiming to make Canada their new home.

#Highest Paying Jobs in Canada#Highest Paying Jobs in Canada From UAE#Highest Paying Jobs in Canada From Dubai

0 notes

Text

Navigating Business Success: The Role of an Accountant in Vancouver

In the bustling metropolis of Vancouver, businesses thrive in a dynamic and competitive environment. From startups to established corporations, every entity relies on sound financial management to navigate the complexities of their operations successfully. Amidst this landscape, the expertise of an accountant stands as a beacon of financial stewardship and strategic guidance.

Accountants in Vancouver play a pivotal role in the economic landscape, offering indispensable services that go beyond mere number-crunching. They are the architects of financial stability, the guardians of compliance, and the advisors steering businesses towards growth and prosperity.

At the heart of every thriving business lies meticulous bookkeeping. Vancouver-based enterprises understand the importance of maintaining accurate and up-to-date financial records. This is where the services of a skilled bookkeeper in Vancouver come into play. They are the custodians of financial data, ensuring that every transaction is recorded with precision and clarity. With their expertise, businesses can make informed decisions, identify trends, and allocate resources effectively.

Bookkeeping services in Vancouver are not just about balancing the books; they are about providing actionable insights that drive business success. By leveraging advanced accounting software and best practices, bookkeepers empower businesses to streamline their financial processes, reduce overhead costs, and optimize cash flow management.

In the fast-paced business landscape of Vancouver, staying compliant with tax regulations and financial reporting standards is non-negotiable. This is where the expertise of an accountant truly shines. Whether it's navigating complex tax codes, preparing financial statements, or conducting audits, accountants in Vancouver are the trusted advisors businesses rely on to ensure regulatory compliance and financial transparency.

Beyond compliance, accountants offer strategic guidance that transcends traditional financial management. They analyze market trends, assess risk factors, and develop tailored financial strategies that align with the long-term goals of the business. From budget planning to investment analysis, accountants provide invaluable insights that empower businesses to seize opportunities and mitigate risks effectively.

In the digital age, technology has revolutionized the accounting profession. Cloud-based accounting software, automation tools, and data analytics platforms have transformed the way accountants operate. In Vancouver, forward-thinking accounting firms like Maje Accounting harness the power of technology to deliver cutting-edge solutions that drive efficiency and innovation.

Maje Accounting is a trusted name in the Vancouver accounting community, known for its commitment to excellence and client-centric approach. With a team of seasoned professionals and a focus on personalized service, Maje Accounting offers a comprehensive suite of accounting and bookkeeping services tailored to the unique needs of each client.

As a leading provider of bookkeeping services in Vancouver, Maje Accounting understands the importance of accuracy, reliability, and confidentiality. Whether it's managing accounts payable, reconciling bank statements, or generating financial reports, their bookkeepers ensure that every aspect of the financial process is handled with precision and integrity.

Beyond bookkeeping, Maje Accounting offers a full spectrum of accounting services designed to support businesses at every stage of their growth journey. From tax planning and compliance to financial analysis and strategic consulting, their team of accountants provides holistic solutions that drive tangible results.

One of the hallmarks of Maje Accounting is its commitment to proactive communication and responsive client service. In a rapidly evolving business environment, timely and reliable support can make all the difference. Maje Accounting prides itself on being accessible to clients, providing expert advice and guidance whenever needed.

In conclusion, the role of an accountant in Vancouver extends far beyond number-crunching and compliance. Accountants are the architects of financial stability, the advisors guiding businesses towards growth and prosperity. With their expertise and strategic insights, they empower businesses to navigate the complexities of the modern business landscape with confidence and clarity. And in Vancouver, Maje Accounting stands as a trusted partner, offering comprehensive accounting and bookkeeping solutions that drive success.

#accountant vancouver#small business accountant vancouver#bookkeeper vancouver#bookkeeping services vancouver#accountant surrey#bookkeeper surrey#bookkeeper langley#accountant langley#Tax Filing Vancouver#Tax Filing Surrey

1 note

·

View note

Text

Startup Accounting in Vancouver, BC | LFG Partners

Starting a new business is an exciting journey, but it comes with its own set of financial challenges. At LFG Partners, we specialize in providing comprehensive startup accounting services in Vancouver, BC, tailored to meet the unique needs of new entrepreneurs. Our team of experienced accountants is here to support you every step of the way, from setting up your accounting systems and managing initial financial transactions to navigating tax regulations and preparing for growth.

We understand that startups often face tight budgets and dynamic financial environments. That’s why we offer scalable solutions that can adapt as your business evolves. Our services include bookkeeping, financial planning, tax compliance, and advisory support, ensuring that you have a solid financial foundation to build upon. By partnering with LFG Partners, you gain access to expert guidance and strategic insights that can help you make informed decisions and focus on growing your business.

Let us handle the complexities of your financial operations so you can concentrate on what you do best—bringing your innovative ideas to life. Contact LFG Partners today to learn how our startup accounting services can set you on the path to success.

What accounting services do you offer for startups in Vancouver, BC?

At LFG Partners, we provide a range of accounting services tailored specifically for startups. These include setting up and managing your accounting systems, bookkeeping, financial statement preparation, tax compliance, and financial planning. We also offer advisory services to help you navigate complex financial decisions and plan for future growth. Our goal is to provide the support you need to ensure your financial operations are efficient and compliant, allowing you to focus on growing your business.

How can LFG Partners help my startup with tax compliance and planning?

Our team at LFG Partners is well-versed in the tax regulations affecting startups in Vancouver, BC. We assist with preparing and filing your taxes accurately and on time, ensuring compliance with local and federal tax laws. Additionally, we offer tax planning services to help you optimize your tax position, identify potential deductions, and develop strategies to minimize your tax liability. By proactively managing your tax responsibilities, we aim to reduce your financial stress and

0 notes

Text

5 Biggest iPhone Problems & Their Solutions

Without a question, Apple has improved the quality and performance of its current flagship phones, the iPhone 14 and 15 Series, significantly in the previous. Problems that were previously disregarded, such as quicker battery depletion and communication, have been improved.

Nevertheless, there are instances when we more often than not experience difficulties with one or more of our iPhone's problems.

Don't worry! smartphone repair in Vancouver .i.e. Fix For You Cellular enumerated five typical Apple iPhone issues in this blog post, along with 2024 fixes.

1. Black screen / frozen screen

Nothing is more annoying than having your phone's screen go dark right after your iPhone turns on and there's nothing you can do about it. Some of the issues seen by users include hearing the phone ring while someone is calling, but the screen is black and you are unable to answer; your phone became trapped on a black screen following a firmware upgrade; or even during an iOS update.

This problem may be caused by either software or hardware, but software crashes are typically the cause of these issues. Please take the actions listed below to resolve the black screen on your iPhone.

Force restart your device. It won’t erase the content on your device.

Follow instructions as below:

Press and hold the volume up button for a brief moment.

Press and let go of the volume down button fast.

Hold down the side button until you see the Apple logo.

You should first plug in your iPhone and give it an hour to charge if it still won't switch on or startup. In a few minutes, a charging screen would appear.

2. Quick battery drain

The rapid battery consumption of the iPhone is a common grievance among users. To resolve the issue with your iPhone battery, please follow the procedures below. Try the following methods to see if they resolve your battery issue before considering replacing your iPhone.

Turn off push mail –

Follow the below instructions to turn off your push mail.

Settings > Accounts & Passwords > Fetch New Data > Turn off Push at top > Scroll down > Set fetch to 15 mins > Change each email account to fetch.

Check the batteries. Navigate to Settings > Battery > Find the two numbers—one for users and the other for standby—by scrolling down. Verify that the usage number is significantly lower than the standby number by comparing the two values. Lock your phone and make a note of the numbers. Check the numbers when you open it again after five minutes. It's okay if the standby duration is five minutes longer than your phone. However, something is amiss if your usage has increased by more than a minute. Navigate to Settings > Battery to get a list of apps and how much they drain the battery. Take out the app that is using up too much battery life and install a another one. However, there may be some apps that do eat into your battery but you cannot survive without them. There are alternatives to this. Go to General > Background App Refresh. This will stop them from using the battery when they are not in use.

If the strange behavior isn't occurring with your apps, you can try the App Store. It's possible that one of your apps is in need of an update. After updating, look for any battery drain on your phone.

Location services might occasionally deplete the battery on your iPhone. Turn it off by going to Settings > Privacy > Location Services. Only make use of it when necessary.

Your battery will run out faster in a weak service location as well because your iPhone will be having trouble receiving a signal. To exit such an area, go to your control center and select Airplane Mode.

Although you might love the True Tone display, it drains the battery quickly. Using auto-brightness is the greatest solution for this issue. But occasionally, the sensors don't function as they should, and in those situations, you can manually modify it. For the purpose of bringing up the control center and adjusting the screen brightness, swipe your screen upward from the bottom.

The "Raise to Wake" function on the iPhone 8 causes the phone to wake up whenever you lift it up. Go to Settings > Display & Brightness >Raise to Wake and toggle this feature off.

There's a low power mode that comes in handy. Your iPhone's performance will improve and all animations will be reduced thanks to this function. You can still receive calls and texts while in this mode, but iCloud Sync and other services are not available. Use this option to save your battery if you need to run your device for a while even when it is running low.

Updates that are new are crucial. Look for one under Settings > General > to see if there is a software update available. After giving it a tap, select "Download & Install." Hold off till the procedure is over. Small or large, software updates offer a variety of repairs and significantly improve the operation of the smartphone.

Since we're talking about battery issues, several consumers have reported that the battery on their iPhone 8 device is rising. There isn't a way to remedy this, therefore you should find a nearby iPhone repair shop and obtain a replacement, most likely.

3. Poor or no Wi-Fi connectivity

All phones have standard Wi-Fi connectivity problems, which can be difficult to resolve because each person's experience may differ. Here are a few fixes based on the kinds of problems users have reported:

Solutions:

Restarting your smartphone extricates iPhone Wi-Fi problems most times.

On certain days, you can experience slower internet than usual, which would cause your downloads and uploads to take forever. It can help to reset the network settings. Make sure you have your Wi-Fi password memorized before starting the process, as resetting the settings will cause your device to lose it. To reset network settings, go to Settings > General > Reset.

You can also choose to Forget this Network by going to Settings > Wi-Fi > Tap "i" and selecting your connection. This will cause your iPhone's Wi-Fi network to disappear. Since this procedure erases the Wi-Fi password, you should be aware of it.

There can occasionally be an issue with the router or Internet service provider. Restarting the router can be achieved by disconnecting it and then plugging it back in after a 30-second interval. Verify that the software is up to date and examine the router's firmware.

4. iPhone overheating

iPhone tends to get heated up with extreme multitasking & heavy usage. Long term overheating may cause potential damage to your phone.

The below tips will save your phone from overheating & keep it cool.

Put an end to using phones while they are charging. Let's face it, most of us have a habit of using our phones while they are charging, and all phone batteries, regardless of brand, heat up. Using the phone while it is charging will just increase the heating! So kindly, put an end to your phone games and small talk right now!

Disable any background programs that are not needed. Examine how much battery life you are using, identify all the pointless apps that drain your power in the background and cause overheating, and disable them right away. When not in use, you might also want to try disabling your Bluetooth and Airdrop.

utilize low power mode: Although you can disable background app usage, you can also utilize your phone's low power mode to automatically limit background consumption and preserve battery life! Thus, you stand to gain from it.

Steer clear of hot spots: If at all possible, avoid using your phone in humid areas or putting it in your car's dashboard.

Seek expert assistance - If, despite taking the aforementioned precautions, the problem persists, you might wish to have an expert check your phone.

5. iPhone water damage

Water-resistant does not mean waterproof, as Apple has marketed the most recent iPhone models, beginning with the iPhone 7, as being less vulnerable to water damage.

Moreover, the water-resistant seals on the iPhone are made to withstand water, not other liquids, creams, or gels that we come into contact with on a daily basis.

First things first: how can you tell if your phone has been water damaged?

Find the LCI for it. The acronym LCI denotes Liquid Contact Indicator. It can be found in the headphone jack, charging port, or both in the older iPhone models (iPhone 4s or prior) and within the sim slot in the newer iPhone models (iPhone 5 & later).

Your iPhone is too damaged and will not be covered under the free repair guarantee if your LCI is red.

In the event that you unintentionally put your iPhone into water, what should you do? I've outlined the actions you should do below to lessen the additional effects of water on your phone's performance and, most likely, to fix it yourself.

Take your iPhone out of the water right away.

Switch off the phone.

Take off the accessories and case.

Take out the SIM and tray.

Using a dry, absorbent cloth, wipe the phone.

Clean the ports with a dry towel and swab.

Allow it to air dry for a minimum of 48 hours while keeping it in a warm, dry location. Activate and verify its functionality.

That concludes this blog post. I hope this clarifies any of your concerns regarding typical iPhone issues. In addition, if you're having other problems and are unsure how to resolve them? Please visit the closest mobile phone repair shop in Vancouver. Our skilled staff will assist you in quickly fixing it.

0 notes

Text

Empowering Success: The Significance of Choosing the Right Accounting Firm in Vancouver

In the bustling economic landscape of Vancouver, where businesses thrive in diverse industries, the role of an experienced accounting firm cannot be overstated. Whether you are a small startup or a well-established enterprise, partnering with the right accounting firm in Vancouver is crucial for financial health, compliance, and strategic planning. This blog explores the significance of selecting the right accounting firm to navigate the unique challenges and opportunities that Vancouver presents.

Local Expertise and Industry Insight:

An accounting firm based in Vancouver brings local expertise and a nuanced understanding of the region's economic dynamics. With insights into local tax laws, regulatory requirements, and industry trends, these firms are well-equipped to provide tailored solutions that align with the specific needs of businesses in Vancouver.

Comprehensive Financial Services:

A reputable accounting firm in Vancouver offers a comprehensive suite of financial services. From bookkeeping and tax preparation to auditing and strategic financial planning, these firms serve as one-stop solutions, addressing diverse financial needs that businesses encounter in their day-to-day operations.

Strategic Financial Planning:

Beyond traditional accounting services, a reputable firm in Vancouver serves as a strategic partner in financial planning. They collaborate with businesses to develop long-term strategies, optimize tax structures, and provide insights that contribute to sustainable growth and financial success.

Technology Integration:

Leading accounting firms in Vancouver leverage cutting-edge technologies and accounting software to streamline processes, enhance accuracy, and improve overall efficiency. This tech-savvy approach ensures that clients benefit from the latest tools for financial management and reporting.

Personalized Service Approach:

Recognizing that each business is unique, the best accounting firms in Vancouver adopt a personalized service approach. They take the time to understand the specific needs, challenges, and goals of their clients, tailoring their services to provide customized solutions that drive success.

Small Business Support:

Vancouver is home to a thriving community of small businesses, and accounting firms play a pivotal role in supporting their growth. From helping startups with initial financial setups to assisting established small businesses in navigating tax complexities, these firms understand the unique challenges faced by smaller enterprises.

Regulatory Compliance Assurance:

Staying compliant with ever-evolving regulations is a constant challenge for businesses. A reputable accounting firm in Vancouver keeps abreast of regulatory changes, ensuring that clients remain compliant and avoid potential penalties. This commitment to compliance provides clients with peace of mind.

Choosing the right accounting firm in Vancouver is not just a financial decision; it's a strategic investment in the success and sustainability of your business. From local expertise and comprehensive services to strategic planning and technological integration, the right firm becomes a trusted ally in navigating the intricacies of Vancouver's dynamic business environment. By partnering with a reputable accounting firm, businesses can focus on their core operations with confidence, knowing that their financial matters are in capable hands.

0 notes

Link

Get caught up on the latest technology and startup news from the past week. Here are the most popular stories on GeekWire for the week of Dec. 22, 2024. Sign up to receive these updates every Sunday in your inbox by subscribing to our GeekWire Weekly email newsletter. Most popular stories on GeekWire Vancouver fintech company Bench Accounting announces sudden shutdown Bench Accounting, a Vancouver B.C.-based company that provides online bookkeeping services for thousands of small businesses, abruptly shut down on Friday. … Read More Instacart joins Uber in lawsuit against Seattle over driver deactivation law Instacart is joining Uber in an attempt to block a new ordinance in Seattle that regulates how companies can deactivate workers who deliver food, shop for groceries, and complete other tasks via on-demand apps. … Read More Early Microsoft leaders go all in on AI with Seattle-area startup Total Neural Enterprises Rich Tong has seen multiple technological revolutions. … Read More Tech Moves: Washington senator with Microsoft roots to lead Commerce Dept.; Remitly VP retiring State Sen. Joe Nguyễn will become the next director of the Washington state Department of Commerce. … Read More Buyer beware: OpenAI’s o1 reasoning model is an entirely different beast Editor’s note: This guest commentary by Anthony Diamond of Seattle-based Pioneer Square Labs originally appeared on PSL’s blog. … Read More Startup radar: Early-stage companies getting off the ground in Seattle We’re featuring another four startups in our latest spotlight of up-and-coming Seattle-area startups. … Read More Startup led by Seattle doctors gets FDA approval for virus-killing, surgical mask technology COVID-19, at the moment, might feel safely in the rearview mirror. … Read More Iconic retailer Nordstrom, reshaped by digital commerce, set to go private in $6.25B deal Seattle-based Nordstrom has agreed to be acquired and taken private by members of the longtime retail family and El Puerto de Liverpool, a Mexican retailer, in an all-cash-deal valued at $6.25 billion, the company announced Monday. … Read More Seattle venture capital firm Flying Fish raising new ‘Opportunity Fund’ Flying Fish is looking for new opportunities. … Read More Ask the Expert: How should I monetize AI agents? Hello, GeekWire readers. We launched our new business advice column earlier this month, featuring different experts from the Pacific Northwest tech community, answering questions about an array of topics. … Read More [og_img] 2024-12-29 16:00:07

0 notes

Text

Pivot Advantage Accounting and Advisory Inc.: Your Trusted Vancouver Accounting Company

youtube

In the dynamic and bustling business landscape of Vancouver, having a reliable and experienced accounting partner is essential for success. Enter Pivot Advantage Accounting and Advisory Inc., a leading firm that stands out as your go-to Vancouver accounting company. With a commitment to excellence, personalized service, and a forward-thinking approach, Pivot Advantage is poised to take your business to new heights.

Excellence in Financial Management: At the core of Pivot Advantage's offerings is a dedication to excellence in financial management. The firm's team of seasoned professionals brings a wealth of experience and expertise to the table, ensuring that your financial affairs are in capable hands. From basic bookkeeping to complex financial analysis, Pivot Advantage covers the entire spectrum of accounting services.

Tailored Solutions for Every Business: One size does not fit all, especially when it comes to accounting services. Pivot Advantage understands this fundamental truth and goes above and beyond to deliver tailored solutions that meet the unique needs of each client. Whether you're a small startup or a well-established enterprise, the firm adapts its services to suit your business model, ensuring that you receive the most relevant and effective support.

Strategic Advisory Services: Pivot Advantage doesn't just crunch numbers; they provide strategic advisory services that contribute to the overall success of your business. The firm's professionals take a proactive approach, offering insights and guidance to help you make informed decisions that align with your financial goals. This strategic partnership sets Pivot Advantage apart as more than just an accounting service – it's a trusted advisor invested in your success.

Technology-Driven Solutions: In an era where technology plays a pivotal role in business operations, Pivot Advantage stays ahead of the curve by integrating cutting-edge tools and software into their services. This tech-savvy approach not only streamlines processes but also enhances accuracy and efficiency, allowing clients to focus on growing their businesses while Pivot Advantage takes care of the numbers.

Local Expertise, Global Perspective: Being rooted in Vancouver, Pivot Advantage understands the nuances of the local business landscape. The firm's professionals are well-versed in the unique challenges and opportunities that businesses in the region face. However, Pivot Advantage doesn't stop at local expertise; the firm also brings a global perspective, staying abreast of international financial trends and best practices to provide clients with a comprehensive and forward-looking service.

Commitment to Client Success: Pivot Advantage is not just an accounting company; it's a partner invested in the success of its clients. The firm's commitment to client satisfaction is evident in its transparent communication, timely delivery of services, and unwavering support. Clients can trust Pivot Advantage to not only meet their accounting needs but to actively contribute to their business growth.

In conclusion, for businesses in Vancouver seeking a reliable, innovative, and client-focused accounting partner, Pivot Advantage Accounting and Advisory Inc. stands out as the premier choice. With a commitment to excellence, tailored solutions, strategic advisory services, technology-driven solutions, and a combination of local expertise and global perspective, Pivot Advantage is more than an accounting firm – it's a catalyst for success in the vibrant business landscape of Vancouver. Choose Pivot Advantage, and experience the difference a dedicated and forward-thinking accounting partner can make for your business.

#Vancouver accounting company#virtual CFO by Pivot Advantage Accounting and Advisory Inc.#Pivot Advantage Accounting and Advisory Inc. part time CFO#Pivot Advantage Accounting and Advisory Inc. CFO service#online accounting firm in Vancouver#accountant#Youtube

1 note

·

View note

Text

Comprehensive Vancouver Bookkeeping Services for Small Businesses

At Transcounts, we provide trusted Vancouver bookkeeping services for small businesses, helping you maintain financial clarity and control. Our experienced team offers a range of services including transaction management, GST filing, payroll processing, and monthly financial reporting—all tailored to meet the specific needs of small businesses. With our cloud-based solutions, you have real-time access to your financial data, ensuring transparency and ease in monitoring your accounts. We ensure that your business stays compliant with CRA regulations, minimizing the risk of costly errors and penalties. Transcounts’ Vancouver bookkeeping services for small businesses not only save you time but also give you the insights needed to make strategic business decisions. Whether you're a startup or an established company, we offer affordable, reliable, and customized bookkeeping services that support your business’s growth and success. Let Transcounts handle your bookkeeping so you can focus on what matters most—running your business.

#bookkeeping for small business#payroll services for small businesses#small business bookkeeping services#payroll software for small business

0 notes

Text

In the fast-paced world of business, managing your finances efficiently is paramount to success. Whether you're a small startup or a well-established corporation, maintaining accurate financial records is non-negotiable. This is where professional accounting and bookkeeping services come into play. In this article, we will delve deep into the world of financial management, uncovering the numerous benefits that these services offer. From cost savings to invaluable insights, you'll soon understand why the accounting and bookkeeping services Vancouver needs are a wise decision.

Read Article:- https://mehracpa.wordpress.com/2023/09/01/what-are-the-benefits-of-professional-accounting-and-bookkeeping-services/

0 notes

Text

How a Business Advisor in Vancouver Can Help You Succeed

Starting a business is an exciting yet difficult path that demands a healthy dose of enthusiasm, hard work, and smart choices. Entrepreneurs in Vancouver are in luck, since the city is home to a plethora of services, one of which is the invaluable guidance of a Vancouver business advisor. These experts have an intimate familiarity with the inner workings of the regional market and can help business owners realize their full potential.

A Vancouver business advisor's capacity to provide individualized service in response to your company's unique challenges is a major selling point. A business adviser can help any company grow by providing strategic insight and concrete advice, whether the firm is just starting out and needs help with market research and financial planning, or whether it is an established organization trying to expand into new areas or optimize its operations. These advisors can use their knowledge and insight to guide you toward choices that will help you achieve your goals over the long haul.

Vancouver is a thriving metropolis with a dynamic business community that is always adapting to new opportunities. New business owners may find it difficult to make their way around this intricate structure. This is where a business advisor's expertise in the local market, consumer habits, and regulatory climate comes into play. They know the ins and outs of the Vancouver business community and can help you anticipate any opportunities or threats that may arise. They can help you remain competitive and flexible in the face of constantly shifting market conditions by remaining one step ahead of the competition.

In addition to their in-depth familiarity with the Vancouver business scene, business advisors may provide invaluable assistance in a number of other crucial facets of company administration. They may help with everything from formulating a corporate strategy to doing market research, from crafting advertising campaigns to streamlining accounting procedures. Because of this wide range of expertise, business owners can get comprehensive help with all facets of their operations at once.

The contacts and network that a business advisor in Vancouver may provide are also quite important. These advisers have strong professional networks and can help startups connect with financiers, specialists, suppliers, and other relevant parties. New opportunities, collaborations, and partnerships can greatly boost a company's expansion if the right people are connected to one another. Additionally, a business advisor may set you up with Vancouver's other business owners and entrepreneurs to form a mutually beneficial network for sharing information and ideas.

Vancouver business advisers not only provide advice, but also act as coaches and mentors, helping business owners make important choices. Having a trustworthy advisor by your side can provide the reassurance and confidence you need to overcome hurdles when starting and maintaining a business. They can look at things from a distance, question your presumptions, and provide you advice that will help you make smart decisions.

In conclusion, any business owner looking to set up shop or expand in Vancouver would be smart to hire a local business counselor. These advisors can aid you in navigating the competitive landscape, making educated decisions, and opening up new business opportunities thanks to their local expertise, strategic assistance, and extensive network of connections. The business climate in Vancouver is fast-paced and competitive, but you can get an advantage by tapping into their expertise.

0 notes