#spherical frictionless cow

Explore tagged Tumblr posts

Text

A physics joke

Q. What does a frictionless spherical cow say?

A. Nothing, because it has zero mu.

165 notes

·

View notes

Text

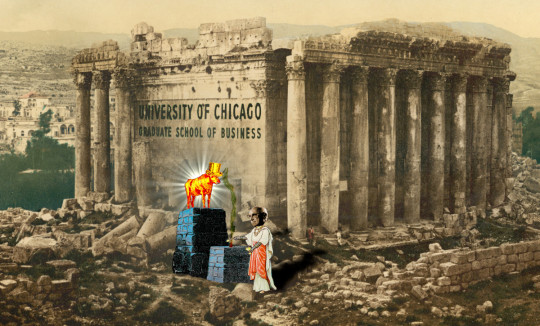

What comes after neoliberalism?

In his American Prospect editorial, “What Comes After Neoliberalism?”, Robert Kuttner declares “we’ve just about won the battle of ideas. Reality has been a helpful ally…Neoliberalism has been a splendid success for the top 1 percent, and an abject failure for everyone else”:

https://prospect.org/economy/2023-03-28-what-comes-after-neoliberalism/

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/28/imagine-a-horse/#perfectly-spherical-cows-of-uniform-density-on-a-frictionless-plane

Kuttner’s op-ed is a report on the Hewlett Foundation’s recent “New Common Sense” event, where Kuttner was relieved to learn that the idea that “the economy would thrive if government just got out of the way has been demolished by the events of the past three decades.”

We can call this neoliberalism, but another word for it is economism: the belief that politics are a messy, irrational business that should be sidelined in favor of a technocratic management by a certain kind of economist — the kind of economist who uses mathematical models to demonstrate the best way to do anything:

https://pluralistic.net/2022/10/27/economism/#what-would-i-do-if-i-were-a-horse

These are the economists whose process Ely Devons famously described thus: “If economists wished to study the horse, they wouldn’t go and look at horses. They’d sit in their studies and say to themselves, ‘What would I do if I were a horse?’”

Those economists — or, if you prefer, economismists — are still around, of course, pronouncing that the “new common sense” is nonsense, and they have the models to prove it. For example, if you’re cheering on the idea of “reshoring” key industries like semiconductors and solar panels, these economismists want you to know that you’ve been sadly misled:

https://foreignpolicy.com/2023/03/24/economy-trade-united-states-china-industry-manufacturing-supply-chains-biden/

Indeed, you’re “doomed to fail”:

https://www.piie.com/blogs/trade-and-investment-policy-watch/high-taxpayer-cost-saving-us-jobs-through-made-america

Why? Because onshoring is “inefficient.” Other countries, you see, have cheaper labor, weaker environmental controls, lower taxes, and the other necessities of “innovation,” and so onshored goods will be more expensive and thus worse.

Parts of this position are indeed inarguable. If you define “efficiency” as “lower prices,” then it doesn’t make sense to produce anything in America, or, indeed, any country where there are taxes, environmental regulations or labor protections. Greater efficiencies are to be had in places where children can be maimed in heavy machinery and the water and land poisoned for a millions years.

In economism, this line of reasoning is a cardinal sin — the sin of caring about distributional outcomes. According to economism, the most important factor isn’t how much of the pie you’re getting, but how big the pie is.

That’s the kind of reasoning that allows economismists to declare the entertainment industry of the past 40 years to be a success. We increased the individual property rights of creators by expanding copyright law so it lasts longer, covers more works, has higher statutory damages and requires less evidence to get a payout:

https://chokepointcapitalism.com/

At the same time, we weakened antitrust law and stripped away limits on abusive contractual clauses, which let (for example) three companies acquire 70% of all the sound recording copyrights in existence, whose duration is effectively infinite (the market for sound recordings older than 90 is immeasurably small).

This allowed the Big Three labels to force Spotify to take them on as co-owners, whereupon they demanded lower royalties for the artists in their catalog, to reduce Spotify’s costs and make it more valuable, which meant more billions when it IPOed:

https://pluralistic.net/2022/09/12/streaming-doesnt-pay/#stunt-publishing

Monopoly also means that all those expanded copyrights we gave to creators are immediately bargained away as a condition of passing through Big Content’s chokepoints — giving artists the right to control sampling is just a slightly delayed way of giving labels the right to control sampling, and charge artists for the samples they use:

https://doctorow.medium.com/united-we-stand-61e16ec707e2

(In the same way that giving creators the right to decide who can train a “Generative AI” with their work will simply transfer that right to the oligopolists who have the means, motive and opportunity to stop paying artists by training models on their output:)

https://pluralistic.net/2023/02/09/ai-monkeys-paw/#bullied-schoolkids

After 40 years of deregulation, union busting, and consolidation, the entertainment industry as a whole is larger and more profitable than ever — and the share of those profits accruing to creative workers is smaller, both in real terms and proportionally, and it’s continuing to fall.

Economismists think that you’re stupid if you care about this, though. If you’re keeping score on “free markets” based on who gets how much money, or how much inequality they produce, you’re committing the sin of caring about “distributional effects.”

Smart economismists care about the size of the pie, not who gets which slice. Unsurprisingly, the greatest advocates for economism are the people to whom this philosophy allocates the biggest slices. It’s easy not to care about distributional effects when your slice of the pie is growing.

Economism is a philosophy grounded in “efficiency” — and in the philosophical sleight-of-hand that pretends that there is an objective metric called “efficiency” that everyone can agree with. If you disagree with economismists about their definition of “efficiency” then you’re doing “politics” and can be safely ignored.

The “efficiency” of economism is defined by very simple metrics, like whether prices are going down. If Walmart can force wage-cuts on its suppliers to bring you cheaper food, that’s “efficient.” It works well.

But it fails very, very badly. The high cost of low prices includes the political dislocation of downwardly mobile farmers and ag workers, which is a classic precursor to fascist uprisings. More prosaically, if your wages fall faster than prices, then you are experiencing a net price increase.

The failure modes of this efficiency are endless, and we keep smashing into them in ghastly and brutal ways, which goes a long way to explaining the “new commons sense” Kuttner mentions (“Reality has been a helpful ally.”) For example, offshoring high-tech manufacturing to distant lands works well, but fails in the face of covid lockdowns:

https://locusmag.com/2020/07/cory-doctorow-full-employment/

Allowing all the world’s shipping to be gathered into the hands of three cartels is “efficient” right up to the point where they self-regulate their way into “efficient” ships that get stuck in the Suez canal:

https://pluralistic.net/2021/03/29/efficient-markets-hypothesis/#too-big-to-sail

It’s easy to improve efficiency if you don’t care about how a system fails. I can improve the fuel-efficiency of every airplane in the sky right now: just have them drop their landing gear. It’ll work brilliantly, but you don’t want to be around when it starts to fail, brother.

The most glaring failure of “efficiency” is the climate emergency, where the relative ease of extracting and burning hydrocarbons was pursued irrespective of the incredible costs this imposes on the world and our species. For years, economism’s position was that we shouldn’t worry about the fact that we were all trapped in a bus barreling full speed for a cliff, because technology would inevitably figure out how to build wings for the bus before we reached the cliff’s edge:

https://locusmag.com/2022/07/cory-doctorow-the-swerve/

Today, many economismists will grudgingly admit that putting wings on the bus isn’t quite a solved problem, but they still firmly reject the idea of directly regulating the bus, because a swerve might cause it to roll and someone (in the first class seats) might break a leg.

Instead, they insist that the problem is that markets “mispriced” carbon. But as Kuttner points out: “It wasn’t just impersonal markets that priced carbon wrong. It was politically powerful executives who further enriched themselves by blocking a green transition decades ago when climate risks and self-reinforcing negative externalities were already well known.”

If you do economics without doing politics, you’re just imagining a perfectly spherical cow on a frictionless plane — it’s a cute way to model things, but it’s got limited real-world applicability. Yes, politics are squishy and hard to model, but that doesn’t mean you can just incinerate them and do math on the dubious quantitative residue:

https://locusmag.com/2021/05/cory-doctorow-qualia/

As Kuttner writes, the problem of ignoring “distributional” questions in the fossil fuel market is how “financial executives who further enriched themselves by creating toxic securities [used] political allies in both parties to block salutary regulation.”

Deep down, economismists know that “neoliberalism is not about impersonal market forces. It’s about power.” That’s why they’re so invested in the idea that — as Margaret Thatcher endlessly repeated — “there is no alternative”:

https://pluralistic.net/2021/11/08/tina-v-tapas/#its-pronounced-tape-ass

Inevitabilism is a cheap rhetorical trick. “There is no alternative” is a demand disguised as a truth. It really means “Stop trying to think of an alternative.”

But the human race is blessed with a boundless imagination, one that can escape the prison of economism and its insistence that we only care about how things work and ignore how they fail. Today, the world is turning towards electrification, a project of unimaginable ambition and scale that, nevertheless, we are actively imagining.

As Robin Sloan put it, “Skeptics of solar feasibility pantomime a kind of technical realism, but I think the really technical people are like, oh, we’re going to rip out and replace the plumbing of human life on this planet? Right, I remember that from last time. Let’s gooo!”

https://www.robinsloan.com/newsletters/room-for-everybody/

Sloan is citing Deb Chachra, “Every place in the world has sun, wind, waves, flowing water, and warmth or coolness below ground, in some combination. Renewable energy sources are a step up, not a step down; instead of scarce, expensive, and polluting, they have the potential to be abundant, cheap, and globally distributed”:

https://tinyletter.com/metafoundry/letters/metafoundry-75-resilience-abundance-decentralization

The new common sense is, at core, a profound liberation of the imagination. It rejects the dogma that says that building public goods is a mystic art lost along with the secrets of the pyramids. We built national parks, Medicare, Medicaid, the public education system, public libraries — bold and ambitious national infrastructure programs.

We did that through democratically accountable, muscular states that weren’t afraid to act. These states understood that the more national capacity the state produced, the more things it could do, by directing that national capacity in times of great urgency. Self-sufficiency isn’t a mere fearful retreat from the world stage — it’s an insurance policy for an uncertain future.

Kuttner closes his editorial by asking what we call whatever we do next. “Post-neoliberalism” is pretty thin gruel. Personally, I like “pluralism” (but I’m biased).

Have you ever wanted to say thank you for these posts? Here's how you can do that: I'm kickstarting the audiobook for my next novel, a post-cyberpunk anti-finance finance thriller about Silicon Valley scams called Red Team Blues. Amazon's Audible refuses to carry my audiobooks because they're DRM free, but crowdfunding makes them possible.

http://redteamblues.com

[Image ID: Air Force One in flight; dropping away from it are a parachute and its landing gear.]

#pluralistic#crypto forks#economism#imagine a horse#perfectly spherical cows of uniform density on a frictionless plane#neoliberialism#inevitabilism#tina#free markets#distributional outcomes#there is no alternative#supply chains#graceful failure modes#law and political economy#apologetics#robert kuttner#the american prospect

69 notes

·

View notes

Text

Headcanon: when asked “what is your ideal pet?” Genos answers “spherical cows on a frictionless plain.” This is his way of politely saying “I am not fond of animals.”

#one punch man#genos#opm genos#i asked my brain to produce serotonin and all i got were these stupid headcanons#i spent most of the weekend with my physics teacher cousin can you tell

56 notes

·

View notes

Note

Here's a fun riddle to test your brain:

You find yourself in an unfamiliar world. In front of you are three children, each of them perfectly rational. Each child is also guarding one of three doors. Behind two of the doors is a monster that will rip all of your limbs off and leave you to die of blood loss, but behind the third door is a magic crystal that will give its holder the powers of a god. You don't know which door the crystal is behind, and you can't understand the language the children speak, but for inexplicable reasons, you know that they can understand your questions. One of them will always tell the truth, one of them always lies, and if you could ask the third one, they would tell you they always lie. Don't think about it. Each child is also blind and only knows what's behind their own door and what their own true or false role is. But what's interesting is that every time any of them answer a question, they will roll a six-sided die. Whichever number the die lands on, they will cycle their truth roles that many spaces. Like so, of course, if it lands on a three or a six, there will effectively be no change, since after that roll, their roles do a full barrel roll. While you and all three children can always see the number rolled, you don't know which way their roles will cycle.

While pondering this problem, you find a brilliantly crafted flute on a pedestal nearby. You take the flute and read the inscription on the pedestal, which gives you important information. Child one wants the flute badly, and if you give it to him, he will do anything he can to help you win this challenge and receive the crystal. Child two has the ability to communicate in a language you understand using the flute, but only if you know Morse code. Child three is skilled in combat and promises she can use the flute as a weapon to protect you from imminent death if you happen to open a door with a monster. The question is: which child should you give the flute to?

The answer (don't read until you've decided your own answer):

Since you don't know Morse code and you're not planning on opening a door with a monster, you give the flute to child one, believing that even if he's the liar, his perfectly rational actions will certainly be in your favor. You then stand in front of door number three as you and child one realize you both have the same idea. Child one opens his door, revealing a monster behind it, and you realize that your odds of guessing the correct door will increase if you now change your decision to door number two. But before you can ask Child two to open it, child one's body is brutally dismembered by the monster behind the door. Child two runs away screaming, and child three takes the flute from child one's corpse and kills the monster. However, when they return, child two moves to guard door number one, child three moves to guard door number two, and child four moves to guard door number three, and so on and so on up to infinity. It should be mentioned that child four is not perfectly rational and did not previously exist; rather, they were a hypothetical future super-intelligence which plans to revive anyone in the past who didn't help in their creation into a simulated punishment. Since you and child one each helped child four come into existence, you two are spared, while children two and three enter a simulated reality.

Child four simulates the two children piloting individual spherical, frictionless cows flying at the same altitude on one axis over a Euclidean planet with a diameter of 50 kilometers. Child two's cow travels at 10 kilometers per day, and child three's cow travels at 20 kilometers per day, starting on Sunday. Child four tells them that at some point during the next five days, they will crash into each other on a day they won't expect. They realize that they won't crash on Friday since making it to Friday will no longer make the crash date unexpected. The same logic eliminates Thursday and Wednesday. Then child four tells them that they will be unconscious for nearly the entire flight. Four will flip a coin, and if it lands on heads, they will both wake up briefly on Monday, and if it lands on tails, they will wake up once on Monday and then on Tuesday with no memory of previously waking up. When they wake up, they have the option to turn exactly 180 degrees without decelerating in hopes of avoiding a crash. They don't know where they start relative to each other, and they're still blind. Additionally, two and three both have the opportunity to throw each other under the bus.

Initially, it is determined that when they crash, they will both wake up injured on a deserted island. If they choose to screw each other over, they will survive the crash unharmed, while the other will stay in a two-week coma before waking up. If they both screw each other over, neither will survive the crash. Both being completely rational, they each elect to screw the other over, but child two was currently the liar, so he accidentally tells child four he won't screw child three over. The simulation of child 1 has now become God and begins an epic battle against child One Prime who has another instance of the God Crystal. Their battle tears apart the multiverse holding time and space over itself several times until child one in perfect rationale directly observes Child 2, causing the superposition to collapse, deleting the entire multiverse that was entangled with him as promised for giving him the flute. Child one then hands the crystal to you, both of you knowing it was all part of the master plan.

If you carefully follow the logic in any other scenario, you will realize that this is the only scenario where you are guaranteed to receive the crystal.

What do you want me to say to this.

8 notes

·

View notes

Text

An extremely basic and stupid econ question.

In the medium term, shouldn't raising interest rates make inflation...worse?

Like increasing yields on government bonds theoretically means increasing the money supply as they start paying out, right? And since there's at least theoretically a limited supply of those bonds, eventually that's just going to lead to more dollars sloshing around looking for possible investments or competing over the same goods.

Am I misunderstanding something, or is this one of those 'yes that is how it would work if you assume frictionless spherical cows in a vacuum, in reality other stuff just always comes up before it's an issue' things?

28 notes

·

View notes

Text

"[...] Assume your partner is a frictionless spherical cow [...]"

#(from a long conversation I had with my best friend#the context was a lot more serious#but this is such a good quote it sparks joy)#post#196#out of context quotes#relationships#(the rest of that conversation did not really#but it was necessary and good for me I think)#personal#void#it's silly#but I think this was also genuinely a good metaphor for the context#though#I don't think I'll elaborate on that here

10 notes

·

View notes

Text

"Decent men don't need role models like nondecent men do they should be able to be good based on magically objective interpretation of magically objective inputs" okay do you realize it's a very patriarchy type thing to think of men as perfectly spherical frictionless cows

20 notes

·

View notes

Text

oh yeah, well what if there was a spherical frictionless cow with a single enormous antler the exact shape of the Mississippi River and its tributaries, huh? what would your "equations" have to say about that? not so easy now is it

7 notes

·

View notes

Photo

I'm not 100% on this, but I'm pretty sure the road between Los Angeles and Las Vegas is going through death valley, and o truck the Appalachians might have something to say about the roads on the right.

Or to put it another way... Move over spherical frictionless cow, we've got a flat featureless contingent to work with!

Slime mold was grown on an agar gel plate shaped like America and food sources were placed where America’s large cities are.

The result? A possible look at how to best build public transportation.

I just really like the idea of slime mold on a map of the US. It’s beautiful.

234K notes

·

View notes

Text

There’s no such thing as “shareholder supremacy”

On SEPTEMBER 24th, I'll be speaking IN PERSON at the BOSTON PUBLIC LIBRARY!

Here's a cheap trick: claim that your opponents' goals are so squishy and qualitative that no one will ever be able to say whether they've been succeeded or failed, and then declare that your goals can be evaluated using crisp, objective criteria.

This is the whole project of "economism," the idea that politics, with its emphasis on "fairness" and other intangibles, should be replaced with a mathematical form of economics, where every policy question can be reduced to an equation…and then "solved":

https://pluralistic.net/2023/03/28/imagine-a-horse/#perfectly-spherical-cows-of-uniform-density-on-a-frictionless-plane

Before the rise of economism, it was common to speak of its subjects as "political economy" or even "moral philosophy" (Adam Smith, the godfather of capitalism, considered himself a "moral philosopher"). "Political economy" implicitly recognizes that every policy has squishy, subjective, qualitative dimensions that don't readily boil down to math.

For example, if you're asking about whether people should have the "freedom" to enter into contracts, it might be useful to ask yourself how desperate your "free" subject might be, and whether the entity on the other side of that contract is very powerful. Otherwise you'll get "free contracts" like "I'll sell you my kidneys if you promise to evacuate my kid from the path of this wildfire."

The problem is that power is hard to represent faithfully in quantitative models. This may seem like a good reason to you to be skeptical of modeling, but for economism, it's a reason to pretend that the qualitative doesn't exist. The method is to incinerate those qualitative factors to produce a dubious quantitative residue and do math on that:

https://locusmag.com/2021/05/cory-doctorow-qualia/

Hence the famous Ely Devons quote: "If economists wished to study the horse, they wouldn’t go and look at horses. They’d sit in their studies and say to themselves, ‘What would I do if I were a horse?’"

https://pluralistic.net/2022/10/27/economism/#what-would-i-do-if-i-were-a-horse

The neoliberal revolution was a triumph for economism. Neoliberal theorists like Milton Friedman replaced "political economy" with "law and economics," the idea that we should turn every one of our complicated, nuanced, contingent qualitative goals into a crispy defined "objective" criteria. Friedman and his merry band of Chicago School economists replaced traditional antitrust (which sought to curtail the corrupting power of large corporations) with a theory called "consumer welfare" that used mathematics to decide which monopolies were "efficient" and therefore good (spoiler: monopolists who paid Friedman's pals to do this mathematical analysis always turned out to be running "efficient" monopolies):

https://pluralistic.net/2022/02/20/we-should-not-endure-a-king/

One of Friedman's signal achievements was the theory of "shareholder supremacy." In 1970, the New York Times published Friedman's editorial "The Social Responsibility of Business Is to Increase Its Profits":

https://www.nytimes.com/1970/09/13/archives/a-friedman-doctrine-the-social-responsibility-of-business-is-to.html

In it, Friedman argued that corporate managers had exactly one job: to increase profits for shareholders. All other considerations – improving the community, making workers' lives better, donating to worthy causes or sponsoring a little league team – were out of bounds. Managers who wanted to improve the world should fund their causes out of their paychecks, not the corporate treasury.

Friedman cloaked his hymn to sociopathic greed in the mantle of objectivism. For capitalism to work, corporations have to solve the "principal-agent" problem, the notoriously thorny dilemma created when one person (the principal) asks another person (the agent) to act on their behalf, given the fact that the agent might find a way to line their own pockets at the principal's expense (for example, a restaurant server might get a bigger tip by offering to discount diners' meals).

Any company that is owned by stockholders and managed by a CEO and other top brass has a huge principal-agent problem, and yet, the limited liability, joint-stock company had produced untold riches, and was considered the ideal organization for "capital formation" by Friedman et al. In true economismist form, Friedman treated all the qualitative questions about the duty of a company as noise and edited them out of the equation, leaving behind a single, elegant formulation: "a manager is doing their job if they are trying to make as much money as possible for their shareholders."

Friedman's formulation was a hit. The business community ran wild with it. Investors mistook an editorial in the New York Times for an SEC rulemaking and sued corporate managers on the theory that they had a "fiduciary duty" to "maximize shareholder value" – and what's more, the courts bought it. Slowly and piecemeal at first, but bit by bit, the idea that rapacious greed was a legal obligation turned into an edifice of legal precedent. Business schools taught it, movies were made about it, and even critics absorbed the message, insisting that we needed to "repeal the law" that said that corporations had to elevate profit over all other consideration (not realizing that no such law existed).

It's easy to see why shareholder supremacy was so attractive for investors and their C-suite Renfields: it created a kind of moral crumple-zone. Whenever people got angry at you for being a greedy asshole, you could shrug and say, "My hands are tied: the law requires me to run the business this way – if you don't believe me, just ask my critics, who insist that we must get rid of this law!"

In a long feature for The American Prospect, Adam M Lowenstein tells the story of how shareholder supremacy eventually came into such wide disrepute that the business lobby felt that it had to do something about it:

https://prospect.org/power/2024-09-17-ponzi-scheme-of-promises/

It starts in 2018, when Jamie Dimon and Warren Buffett decried the short-term, quarterly thinking in corporate management as bad for business's long-term health. When Washington Post columnist Steve Pearlstein wrote a column agreeing with them and arguing that even moreso, businesses should think about equities other than shareholder returns, Jamie Dimon lost his shit and called Pearlstein to call it "the stupidest fucking column I’ve ever read":

https://www.washingtonpost.com/news/wonk/wp/2018/06/07/will-ending-quarterly-earnings-guidance-free-ceos-to-think-long-term/

But the dam had broken. In the months and years that followed, the Business Roundtable would adopt a series of statements that repudiated shareholder supremacy, though of course they didn't admit it. Rather, they insisted that they were clarifying that they'd always thought that sometimes not being a greedy asshole could be good for business, too. Though these statements were nonbinding, and though the CEOs who signed them did so in their personal capacity and not on behalf of their companies, capitalism's most rabid stans treated this as an existential crisis.

Lowenstein identifies this as the forerunner to today's panic over "woke corporations" and "DEI," and – just as with "woke capitalism" – the whole thing amounted to a a PR exercise. Lowenstein links to several studies that found that the CEOs who signed onto statements endorsing "stakeholder capitalism" were "more likely to lay off employees during COVID-19, were less inclined to contribute to pandemic relief efforts, had 'higher rates of environmental and labor-related compliance violations,”' emitted more carbon into the atmosphere, and spent more money on dividends and buybacks."

One researcher concluded that "signing this statement had zero positive effect":

https://www.theatlantic.com/ideas/archive/2020/08/companies-stand-solidarity-are-licensing-themselves-discriminate/614947

So shareholder supremacy isn't a legal obligation, and statements repudiating shareholder supremacy don't make companies act any better.

But there's an even more fundamental flaw in the argument for the shareholder supremacy rule: it's impossible to know if the rule has been broken.

The shareholder supremacy rule is an unfalsifiable proposition. A CEO can cut wages and lay off workers and claim that it's good for profits because the retained earnings can be paid as a dividend. A CEO can raise wages and hire more people and claim it's good for profits because it will stop important employees from defecting and attract the talent needed to win market share and spin up new products.

A CEO can spend less on marketing and claim it's a cost-savings. A CEO can spend more on marketing and claim it's an investment. A CEO can eliminate products and call it a savings. A CEO can add products and claim they're expansions into new segments. A CEO can settle a lawsuit and claim they're saving money on court fees. A CEO can fight a lawsuit through to the final appeal and claim that they're doing it to scare vexatious litigants away by demonstrating their mettle.

CEOs can use cheaper, inferior materials and claim it's a savings. They can use premium materials and claim it's a competitive advantage that will produce new profits. Everything a company does can be colorably claimed as an attempt to save or make money, from sponsoring the local little league softball team to treating effluent to handing ownership of corporate landholdings to perpetual trusts that designate them as wildlife sanctuaries.

Bribes, campaign contributions, onshoring, offshoring, criminal conspiracies and conference sponsorships – there's a business case for all of these being in line with shareholder supremacy.

Take Boeing: when the company smashed its unions and relocated key production to scab plants in red states, when it forced out whistleblowers and senior engineers who cared about quality, when it outsourced design and production to shops around the world, it realized a savings. Today, between strikes, fines, lawsuits, and a mountain of self-inflicted reputational harm, the company is on the brink of ruin. Was Boeing good to its shareholders? Well, sure – the shareholders who cashed out before all the shit hit the fan made out well. Shareholders with a buy-and-hold posture (like the index funds that can't sell their Boeing holdings so long as the company is in the S&P500) got screwed.

Right wing economists criticize the left for caring too much about "how big a slice of the pie they're getting" rather than focusing on "growing the pie." But that's exactly what Boeing management did – while claiming to be slaves to Friedman's shareholder supremacy. They focused on getting a bigger slice of the pie, screwing their workers, suppliers and customers in the process, and, in so doing, they made the pie so much smaller that it's in danger of disappearing altogether.

Here's the principal-agent problem in action: Boeing management earned bonuses by engaging in corporate autophagia, devouring the company from within. Now, long-term shareholders are paying the price. Far from solving the principal-agent problem with a clean, bright-line rule about how managers should behave, shareholder supremacy is a charter for doing whatever the fuck a CEO feels like doing. It's the squishiest rule imaginable: if someone calls you cruel, you can blame the rule and say you had no choice. If someone calls you feckless, you can blame the rule and say you had no choice. It's an excuse for every season.

The idea that you can reduce complex political questions – like whether workers should get a raise or whether shareholders should get a dividend – to a mathematical rule is a cheap sleight of hand. The trick is an obvious one: the stuff I want to do is empirically justified, while the things you want are based in impossible-to-pin-down appeals to emotion and its handmaiden, ethics. Facts don't care about your feelings, man.

But it's feelings all the way down. Milton Friedman's idol-worshiping cult of shareholder supremacy was never about empiricism and objectivity. It's merely a gimmick to make greed seem scientifically optimal.

The paperback edition of The Lost Cause, my nationally bestselling, hopeful solarpunk novel is out this month!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/09/18/falsifiability/#figleaves-not-rubrics/a>

#pluralistic#chevron deference#loper bright#scotus#stakeholder capitalism#boeing#economism#economics#milton friedman#shareholder supremacy#fiduciary duty#business#we cant have nice things#shareholder capitalism

363 notes

·

View notes

Text

The trolley problem really is the perfectly spherical cows in a perfect frictionless vacuum of moral arguments

1 note

·

View note

Text

People are complicated.

Groups of people are more complicated than the sum of each individual person's internal complexity, because in addition to the complexity of individuals you have the added complexity of the way those individuals relate to each other and to the group as a whole, even as they comprise part of the group that others also relate to on an individual level.

The relationship of groups of people to other groups of people is, you guessed it, an added level of complexity above the complexity of each group in isolation which is then more complex than each individual in isolation.

Add in the dimension of time, and the groups of groups (of groups of groups of groups etc... of individuals) become yet more complex because now you are not only dealing with how those groups (and their component groups down to that individual level) relate right now but how they have related in the past. And attempting to isolate two groups to examine can't be done, because the influence of other groups not directly under your lens remains in place.

So, in the end? Don't believe people who try to deny the complexity of human society or the interrelation of humanity. A moral principle can be stated in simple terms, but the second you look to implement those principles as actions, complexity enters the picture. That complexity is not your enemy. It is the simple, inevitable result of living in the real world instead of the sociological equivalent of a frictionless vacuum inhabited by perfectly spherical cows.

0 notes

Text

How is that not rational? Like, economists tend to assume a world of frictionless spherical cows, but in the real world, attempting big improvements like getting a better job or moving to a better neighborhood have significant costs, even if unsuccessful.

There are a limited number of times you can take pto to go to an interview or apartment tour and a limited number of times you can pay the application fees and the gas. After a certain point, if you’re not completely retarded, you will realize that you are wasting limited resources you need elsewhere.

[“The poverty debate could do more to recognize the powerful effects of rejection on a person’s self-confidence and stamina. Applying for an apartment or job and being turned down ten, twenty, forty times—it can wear you out. Theories about neighborhood selection or joblessness often assume low-income people are more or less “rational actors” who recognize trade-offs and make clear choices. The reality is that many are “exhausted settlers” who accept poor housing in a disadvantaged neighborhood or a dead-end or illicit job after becoming depleted and disheartened from trying and trying and failing and failing. The shame of rejection not only can pressure people to accept undesirable circumstances today; it can also discourage them from striving for something better tomorrow.”]

matthew desmond, from evicted: poverty and profit in the american city, 2016

3K notes

·

View notes

Text

i want to move to the infinite flat frictionless plane

i want to assume no air resistance when i breathe

i want to herd spherical cows for a living

i want to go where gravity is ten meters a second and pi is 3.14

but the rent there is too high

0 notes

Text

The health industry’s invisible hand is a fist

On June 21, I'm doing an ONLINE READING for the LOCUS AWARDS at 16hPT. On June 22, I'll be in OAKLAND, CA for a panel and a keynote at the LOCUS AWARDS.

The US has the rich world's most expensive health care system, and that system delivers the worst health outcomes of any country in the rich world. Also, the US is unique in relying on market forces as the primary regulator of its health care system. All of these facts are related!

Capitalism's most dogmatic zealots have a mystical belief in the power of markets to "efficiently allocate" goods and services. For them, the process by which goods and services are offered and purchased performs a kind of vast, distributed computation that "discovers the price" of everything. Our decisions to accept or refuse prices are the data that feeds this distributed computer, and the signals these decisions send about our desires triggers investment decisions by sellers, which guides the whole system to "equilibrium" in which we are all better off.

There's some truth to this: when demand for something exceeds the supply, prices tend to go up. These higher prices tempt new sellers into the market, until demand is met and prices fall and production is stabilized at the level that meets demand.

But this elegant, self-regulating system rarely survives contact with reality. It's the kind of simplified model that works when we're hypothesizing about perfectly spherical cows of uniform density on a frictionless surface, but ceases to be useful when it encounters a messy world of imperfect rationality, imperfect information, monopolization, regulatory capture, and other unavoidable properties of reality.

For members of the "efficient market" cult, reality's stubborn refusal to behave the way it does in their thought experiments is a personal affront. Panged by cognitive dissonance, the cult members insist that any market failures in the real world are illusions caused by not doing capitalism hard enough. When deregulation and markets fail, the answer is always more deregulation and more markets.

That's the story of the American health industry in a nutshell. Rather than accepting that people won't shop for the best emergency room while unconscious in an ambulance, or that the "clearing price" of "not dying of cancer" is "infinity," the cult insists that America's worst-in-class, most expensive health system just needs more capitalism to turn it into a world leader.

In the 1980s, Reagan's court sorcerers decreed that they could fix health care with something called "Prospective Payment Systems," which would pay hospitals a lump sum for treating conditions, rather than reimbursing them for each procedure, using competition and profit motives to drive "efficiency." The hospital system responded by "upcoding' patients: if you showed up with a broken leg and a history of coronary disease, they would code you as a heart patient and someone who needed a cast. They'd collect both lump sums, slap a cast on you, and wheel you out the door:

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4195137/

As Robert Kuttner writes for The American Prospect, this kind of abuse was predictable from the outset, especially since Health and Human Services is starved of budget for auditors and can only hand out "slaps on the wrist" when they catch a hospital ripping off the system:

https://prospect.org/economy/2024-06-13-fantasyland-general/

Upcoding isn't limited to Medicare fraud, either. Hospitals and insurers are locked in a death-battle over payments, and hospitals' favorite scam is sending everyone to the ER, even when they don't have emergencies (some hospitals literally lock all the doors except for the ER entrance). That way, a normal, uncomplicated childbirth can be transformed into a "Level 5" emergency treatment (the highest severity of emergency) and generate a surprise bill of over $2,700:

https://pluralistic.net/2021/10/27/crossing-a-line/#zero-fucks-given

The US health industry is bad enough to generate a constant degree of political will for change, but the industry (and its captured politicians and regulators) is also canny enough to dream up an endless procession of useless gimmicks designed to temporarily bleed off the pressure for change. In 2018, HHS passed a rule requiring hospitals to publish their prices.

Hospitals responded to this with a shrewd gambit: they simply ignored the rule. So in 2021, HHS made another rule, creating penalties for ignoring the first rule:

https://www.cms.gov/priorities/key-initiatives/hospital-price-transparency/hospitals

The theory here was that publishing prices would create "market discipline." Again, this isn't wholly nonsensical. To the extent that patients have nonurgent conditions and the free time to shop around, being able to access prices will help them. Indeed, if the prices are in a standards-defined, machine-readable form, patients and their advocates could automatically import them, create price-comparison sites, leaderboards, etc. None of this addresses the core problem that health-care is a) a human right and b) not a discretionary expense, but it could help at the margins.

But there's another wrinkle here. The same people who claim that prices can solve all of our problems also insist that monopolies are impossible. They've presided over a decades-long assault on antitrust law that has seen hospitals, pharma companies, insurers, and a menagerie of obscure middlemen merge into gigantic companies that are too big to fail and too big to jail. When a single hospital system is responsible for the majority of care in a city or even a county, how much punishment can regulators realistically subject it to?

Not much, as it turns out. Kuttner describes how Mass Gen Brigham cornered the market on health-care in Boston, allowing it to flout the rules on pricing. In addition to standard tricks – like charging self-pay patients vastly more than insured payments (because individuals don't have the bargaining power of insurers), Mass Gen Brigham's price data is a sick joke.

See for yourself! The portal will send you giant, unstructured, ZIPped text files filled with cryptic garbage like:

ADJUSTABLE C TAPER NECK PLUS|1|UNITED HEALTHCARE [1016]|HB CH UNITED HMO / PPO / INDEMNITY [34]|UNITED HEALTHCARE HMO [101604]|75|Inv Loc: 1004203; from OR location 1004203|52.02|Inpatient PAF; 69.36% Billed|75|Inv Loc: 1004203; from OR location 1004203|56.87|Outpatient PAF; 75.83% Billed

https://www.massgeneralbrigham.org/en/patient-care/patient-visitor-information/billing/cms-required-hospital-charge-data

These files have tens of thousands of rows. As a patient, you are meant to parse through these in order to decide whether you're getting ripped off on that HIP STEM 16X203MM SIZE 4 FEMORAL PRESS FIT NEUTRAL REVISION TITANIUM you're in the market for (as it happens, I have two of these in my body).

Kuttner describes the surreal lengths he had to go through to prevent his mother from getting ripped off by Mass Gen through an upcoding hustle. By coding her as "admitted for observation," Mass Gen was able to turn her into an outpatient, with a 20% co-pay (this is down to a GW Bush policy that punishes hospitals that charge Medicare for inpatient care when they could be treated as outpatients – hospitals reflexively game the system to make every patient an outpatient, even if they have overnight hospital stays).

Kuttner's an expert on this: he was national policy correspondent for the New England Journal of Medicine and covers the health beat for the Prospect. Even so, it took him ten hours of phone calls to two doctors' offices and Blue Cross to resolve the discrepancy. The average person is not qualified to do this – indeed, the average person won't even know they've been upcoded.

Needless to say that people in other countries – countries where health care is cheaper and the outcomes are better – are baffled by this. Canadians, Britons, Australians, Germans, Finns, etc do not have to price-shop for their care. They don't have to hawkishly monitor their admission paperwork for sneaky upcodes. They don't have to spend ten hours on the phone arguing about esoteric billing practices.

In a rational world, we'd compare the American system to the rest of the world and say, "Well, they've figured it out, we should do what they're doing." But in good old U-S-A! U-S-A! U-S-A!, the answer to this is more prices, more commercialization, more market forces. Just rub some capitalism on it!

That's where companies like Multiplan come in: this is a middleman that serves other middlemen. Multiplan negotiates prices on behalf of insurers, and splits the difference between the list price and the negotiated price with them:

https://www.nytimes.com/2024/04/07/us/health-insurance-medical-bills.html

But – as the Arm and a Leg podcast points out – this provides the perverse incentive for Multiplan to drive list prices up. If the list price quintuples, and then Multiplan drives it back down to, say, double the old price, they collect more money. Meanwhile, your insurer sticks you with the bill, over and above your deductible and co-pay:

https://armandalegshow.com/episode/multiplan/

The Multiplan layer doesn't just allow insurers to rip you off (though boy does it allow insurers to rip you off), it also makes it literally impossible to know what the price is going to be before you get your procedure. As with any proposition bet, the added complexity is there to make it impossible for you to calculate the odds and figure out if you're getting robbed:

https://pluralistic.net/2022/05/04/house-always-wins/#are-you-on-drugs

Multiplan is the purest expression of market dynamics brainworms I've yet encountered: solving the inefficiencies created by the complexity of a system with too many middlemen by adding another middle-man who is even more complex.

No matter what the problem is with America's health industry, the answer is always the same: more markets! Are older voters getting pissed off at politicians for slashing Medicare? No problem: just create Medicare Advantage, where old people can surrender their right to government care and place themselves in the loving hands of a giant corporation that makes more money by denying them care.

The US health industry is a perfect parable about the dangers of trusting shareholder accountable markets to do the work of democratically accountable governments. Shareholders love monopolies, so they drove monopolization throughout the health supply chain. As David Dayen writes in his 2020 book Monopolized the pharma industry monopolized first, and put the screws to hospitals:

https://pluralistic.net/2021/01/29/fractal-bullshit/#dayenu

Hospitals formed regional monopolies to counter the seller power of consolidated Big Pharma. That's Mass Gen's story: tapping the capital markets to buy other hospitals in the region until it became too big to fail and too big to jail (and too big to care). Consolidated hospitals, in turn, put the screws to insurers, so they also consolidated, fighting Big Hospital's pricing power.

Monopoly at any point in a supply chain leads to monopoly throughout the supply chain. But patients can't consolidate (that's what governments are for – representing the diffuse interests of people). Neither can health workers (that's what unions are for). So the system screwed everyone: patients paid more for worse care. Health workers put in longer hours under worse conditions and got paid less.

Kuttner describes how his eye doctor races from patient to patient "as if he was on roller skates." When Kuttner wrote him a letter questioning the quality of care, the eye doctor answered that he understood that he was giving his patients short shrift, but explained that he had to, because his pay was half what he needed, relegating him to a small apartment and an old car. The hospital – which skims the payments he gets for care – sets his caseload, and he can't turn down patients.

The answers to this are obvious: get markets out of health care. Unionize health workers. Give regulators the budgets and power to hold health corporations to account.

But for market cultists, all of that can't work. Instead, we have to create more esoteric middlemen like "pharmacy benefit managers" and Multiplan. We need more prices to shovel into the market computer's data-hopper. If we just capitalism hard enough, surely the system will finally work…someday.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/06/13/a-punch-in-the-guts/#hayek-pilled

#billing codes#health#corruption#ripoffs#arm and a leg podcast#robert kuttner#prices#austrian economics#Prospective Payment Systems#the invisible hand#shop around#a market for lemons#monopoly#monopolization#upcoding

237 notes

·

View notes

Text

hmmm the logic of “you shouldn’t care about what your father and sect leader will say/do in response, you should just kill xue yang because (i think) it’s the right thing to do” and “wen qing and wen ning do not deserve special consideration because while they may have helped the jiangs they did not vocally oppose or try to disrupt wen ruohan’s operation, and benefited from their silence by staying alive” are the same logic. and, arguably, the same logic as “you should have not cared about your cover being blown and bodily defended me and the nie cultivators, even if it meant we all died stupidly” and what i’m getting at here is that nmj is That Fucking Guy in intro philosophy who insists that he would solve the trolley problem by jumping in front of the trolley and refuses to entertain any reminders by the professor that that is not actually an option presented by the hypothetical frictionless spherical cow they are working with.

#untamed stuff#it's a very particular type of moral myopia that#imo usually comes from never actually being in#the sort of position where you like#are presented with multiple bad options#and have to choose the least bad#or never living under terror#so the idea that doing anything at all takes#superhuman courage in some cases is both foreign and anathema#but in his case i think it's like#a refusal to examine his situation with the saber spirit#because if he stops and looks at it too closely#it will be too painful#and the reality that this wasn't actually his choice#and it wasn't even really a morally justifyable one#even if it was a choice#would just fuck him all to hell#so#every day i lose more respect for nie mingjue#not really but that's my nmj salt tag and i guess this counts so#he's just like#if i were in that position i would just have killed my uncle#who raised me and my brother#and uses my brother and my people as hostages for my compliance#and can and will turn my brother into an abomination if i step out of line#rip to wen qing but i'm different#buddy you would have been turned into a puppet in five minutes#if you were in her position#but that's too scary so we don't think about it

35 notes

·

View notes