#sovereign bonds

Explore tagged Tumblr posts

Text

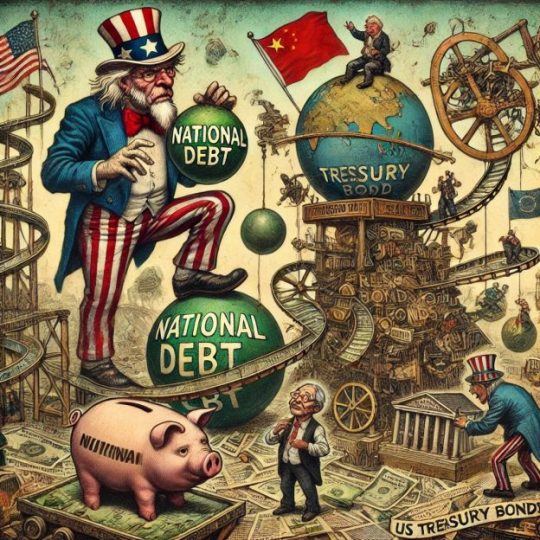

The Curious Case of Universal Debt

The Curious Case of Universal Debt #artem

Content 16+ A peculiar phenomenon has emerged that would befuddle even the most pragmatic of accountants: everyone owes everyone. The United States, China, France, Germany, the United Kingdom—name a country, and chances are its national debt is not merely a small sum but a towering Everest of financial obligations. If everyone owes someone, who exactly is holding the IOUs? Let us journey into…

View On WordPress

#artem#borrowing dynamics#debt as wealth#debt cycles#debt sustainability#debt-driven growth#economic tightrope#economic trust#financial paradox#fiscal conundrum#global economy#global interdependence#international finance#IOUs#national debt#pension funds#sovereign bonds#universal debt#US-China debt

0 notes

Text

Luxembourg: The Premier Hub for International Bond Listings

Luxembourg has long been recognized as a pivotal center for finance, but its role in the listing and trading of international bonds is particularly noteworthy. As the global leader in this domain, the Luxembourg Stock Exchange (LuxSE) offers a compelling case study of how a financial marketplace can achieve prominence through innovation, strategic positioning, and an investor-friendly regulatory…

View On WordPress

#European Investment Bank#Green Exchange#international bond market#Luxembourg#Luxembourg Stock Exchange#LuxSE#sovereign bonds#World Bank

0 notes

Text

How to Invest in India’s Sovereign Green Bonds

So, India has recently hopped on the bandwagon of sovereign green bonds – these are like loans given by a country’s government to fund eco-friendly projects.

0 notes

Text

*me waking up in a cold sweat in the middle of the night*

Wriothesley and Uncle Iroh

Just- those two

Tea besties in another life change my mind.

They would be the best tea duo

They would exchange recipes

They would spend hours talking and everyone would think it’s some serious diplomacy stuff- EXCEPT NO. ITS TEA AND THEM CRYING AT THE FACT THAT THEY FOUND SOMEONE WHO IS AS INSANE ABOUT TEA AS THEY ARE

Wriothesley would totally play pai sho with Uncle Iroh if there’s tea. And of course there’s tea, Uncle Iroh is not a degenerate, he is a man of true culture

Wriothesley just inviting Uncle Iroh to tea, not expecting much since fucking everyone keeps turning him down (I’d join you for tea Wrio, even though I only like green tea, because I’m polite dammit and my anxiety wouldn’t let me say no, I’d still be happy to join you, please someone join this man for tea, it’s all he’s asking for-), and then Uncle Iroh says “yes” and Wrio just.

Freezes.

And is all like :0 really????

And from then on, Wriothesley would die for Uncle Iroh like the rest of us

Wriothesley would full on deck Zuko for his complete disregard of tea pre-Ba Sing Se tea shop. It would be glorious.

Lanky 16 year old exiled prince with anger and daddy issues vs tired deadpan tea fanatic who could freeze his ass with one punch and has passed the midlife crisis stage of his life

Wrio is an orphan right? Or is that still just speculation? Point is-

Iroh would 100% adopt this deadpan humor stray kid after one convo of Wrio managing to bring up tea in every other sentence

I just-

I need this duo

#avatar the last airbender#Atla#genshin impact#Wriothesley#uncle Iroh#tea buddies#tea duo#Uncle Iroh and Wriothesley both deserve the find someone who’s as obsessed with tea as they are#zuko: hot leaf juice- Wrio: no *decks him right there and then*#bro. if add wriolette into this it gets 10x more funny#Wriothesley introducing Neuvillette to Uncle Iroh: and so this is my Uncle Iroh#Neuvillette: I thought you were an orphan??#Wrio: we share tea in our blood#Neuvi: ???#Wriothesley: anyways I thought you’d two get along since you’re both dragons#Iroh: pardon?#Neuvi: elaborate??#Wrio: ah yes. my dearest Neuvillete- this is my uncle Iroh- also known as the dragon of the west#Wrio: uncle Iroh. this is my husband- the hydro dragon sovereign#shenanigans#in the end Neuvi and Iroh bond bc that’s just the Uncle Iroh effect#zuko about to get some new cousins in a prison warden and his cousin-in-law the fucking hydro dragon sovereign of Fontaine#nothing can go wrong#wriolette#not me writing basically a full on other post in the tags#oh well#marrapost

51 notes

·

View notes

Text

saw a fun little hotd edit so sovereign thots tm are returning and i mentioned once it just. does Not understand the concept of a bastard + honestly kind of thinks it's stupid as hell and i was thinking about the Why and anyways i think it's bc sovereign also doesn't rlly have A Concept of marriage either

bc i enjoy it having a very Dragon Like outlook on things and also bc i like having half the time it talks to aemond it just

hoarfrost we fear our new paramour is addled-

#jackals barks#ship: that unwanted animal#also bc i steal bits of my concepts for the original verse i fiddle with occasionally did i EVER#mention the concept that in bonded pairs like sovereign/hoarfrost if the dragon dies the rider slowly turns into a dragon#i do Not have justification i just thot it was funsies#it doesn't fit for asoiaf canon but also the concept of aemond going to meet sovereigns family#and just Freezing The Fuck Up bc it introduced him to its queen mother whos a Literal Fucking Dragon is fun to me

5 notes

·

View notes

Text

Indians are obsessed with gold! Be it any festival ranging from Raksha Bandhan to Diwali, a considerable population of Indians never miss an opportunity to buy gold.

Indians purchase almost 700–800 tonnes annually, and this craze seems to be never-ending.

As we all know, very little gold is produced in India, and most of it is imported. On the one hand, where we are focusing more on exporting in order to increase our Foreign Exchange Reserve, importing gold is causing pain to the government policy. This resulted in the introduction of Sovereign Gold Bonds in 2015, an alternative to traditional physical gold (also check out our previous post on different forms of gold investment in India).

3 notes

·

View notes

Note

what’s the flashpoints equivalent of this lewis ferrari insanity 😭 😭

phenomenal ask, thank you so much anon

it's a bit like if Shepard announced she was leaving Red Bull Normandy to drive for Ferrari Hierarchy. but thankfully she doesn't

we also have Garrus ditching Hierarchy after one (1) season to drive for Omega but he's just some rookie making a bizarre career move and not like. a seven time world champ

#flashpoints#f1 au#ask#why did i decide to write a fic where the MC is basically max verstappen with +20 to charisma?#i dont know. i ask myself that all the time#spectre are mercedes. i dont know why its just vibes#destiny ascension are williams (historic. flopping)#conclave are haas (shoestring budget duct-tape ass car)#alliance are alpha tauri (normandy B team)#cerberus are mclaren (orange. evil)#omega / archangel are brawn (shouldnt have worked but did)#i guess sovereign are aston but that's mostly alonso's propensity for crime and their bond villain team boss#arlakh company are alpine (car blows up all the time)

3 notes

·

View notes

Text

Why is investing in Bonds in India right now a wise move?

Regardless of whether you are a conservative investor prioritising capital preservation or a growth-focused investor seeking to enhance your portfolio, Bonds present distinct opportunities to help you reach your financial objectives. Bonds have long been a cornerstone in investment portfolios for those seeking safety, steady income, and diversification.

Today, investing in Bonds is becoming increasingly attractive. Whether a conservative investor focused on capital preservation or a growth-oriented investor aiming to balance your portfolio, Bonds offer unique opportunities to achieve your financial goals. The current geopolitical and inflationary landscape presents risks and opportunities for Bond investors.

What are Bonds?

Bonds are debt securities governments, corporations, or other entities issue to raise capital. When purchasing a Bond, you lend money to the issuer. In return, the issuer agrees to pay you periodic interest and return the principal amount when the Bond matures. Here are a few reasons why investing in them right now is a wise move:

Relative safety and stability

Bonds are usually less volatile than stocks, making them a safer investment option, particularly in uncertain economic times. Government Bonds and high-quality Corporate Bonds are especially known for their stability. For investors looking to preserve capital, Bonds are an ideal choice.

Income generation

One of the primary reasons investors turn to Bonds is because of the regular income they provide. Bonds, such as Sovereign Gold Bonds, offer a reliable source of income through fixed interest payments, which can be especially attractive in low-interest-rate environments. For retirees or those seeking a predictable income stream, they offer predictable cash flow, helping to meet financial needs without worrying about market volatility.

Diversification

Incorporating Bonds into your investment portfolio is a strategic method to achieve diversification and lower overall risk. Generally, they exhibit an inverse correlation with stocks. Thus, when the stock market experiences a decline, Bonds can offer a stabilising effect. This inverse dynamic reduces portfolio risk, providing a safeguard during market volatility.

Attractive yields

With central banks raising interest rates to overcome inflation, newly issued Bonds may offer higher yields. This makes them more attractive than holding cash or placing money in low-interest Savings Accounts. Higher yields enhance the income generated while providing a better return on investment.

Inflation protection

Certain types of Bonds, like Treasury Inflation-Protected Securities (TIPS), are designed to protect against inflation. These Bonds adjust the principal based on the Consumer Price Index changes, ensuring that your investment’s purchasing power is preserved. High-yield Bonds can also offer returns that outpace inflation, providing a real return on your investment.

Sovereign Gold Bond schemes are the perfect alternative to investment in physical gold. You can enjoy capital appreciation and earn interest annually. These Bonds, issued by the Government of India, also eliminate several risks associated with physical gold.

Conclusion

The Bond market is influenced by increasing interest rates, ongoing inflation, and geopolitical uncertainties, underscoring Bonds’ strategic significance in the current investment environment.

0 notes

Text

#gold investment#gold investments#SGB (Sovereign Gold Bond)#Gold ETF (Exchange Traded Funds)#invest on gold#Investing in gold#investments on gold#SGB VS ETF#SahiBandhu gold loans

0 notes

Text

Current Affairs - 7 August 2024

1. Organ Transplant Overview: All cases of organ transplants will be allocated a unique National Organ and Tissue Transplant Organisation (NOTTO)-ID for both the donor and the recipient, according to a recent directive by the Union Health Ministry. Norms In a first, the Union Ministry of Health & Family Welfarehas issued a set of guidelines for the transportation oflive human organs. The…

View On WordPress

#axiom 4 mission#coastal erosion#Investment models#middle income trap#notto#Organ transplant#sovereign green bond

0 notes

Text

⎛ ⚔️ sword sovereign in the sea of stars ╱ meta ⎠

⎛ ⚔️ hero's ideals ╱ insp ⎠

⎛ ⚔️ writing is hard ╱ out ⎠

⎛ ⚔️ i want to come with you to estalucia ╱ bond‚ seofon & the captain ⎠

⎛ ⚔️ strongest in the skies ╱ group‚ the eternals ⎠

#⎛ ⚔️ sword sovereign in the sea of stars ╱ meta ⎠#⎛ ⚔️ hero's ideals ╱ insp ⎠#⎛ ⚔️ writing is hard ╱ out ⎠#⎛ ⚔️ i want to come with you to estalucia ╱ bond‚ seofon & the captain ⎠#⎛ ⚔️ strongest in the skies ╱ group‚ the eternals ⎠

0 notes

Text

Introducing Sovereign Gold Bonds: Secure Investment Opportunity | IndiaBonds Discover Sovereign Gold Bonds on IndiaBonds.com: Earn 2.5% interest, secure dematerialized storage, tax benefits, and 999 purity. Invest Now at IndiaBonds. https://sgb.indiabonds.com/sovereignGoldBondWelcome

0 notes

Text

Unlocking Financial Success: Finding the Best Mutual Fund Distributor in Beawar

In the dynamic landscape of financial markets, making informed investment decisions is crucial for achieving long-term financial goals. For residents of Beawar, a key concern is often finding the right financial partner to guide them through the complex world of mutual funds. In this pursuit, identifying the best mutual fund distributor becomes paramount.

Navigating the Financial Maze: The Need for Expert Guidance

Beawar, like any other city, is home to a diverse population with varying financial aspirations. Many individuals face a common challenge: the lack of financial expertise to make sound investment decisions. This gap often leads to missed opportunities and suboptimal investment choices. Enter mutual funds – a popular and accessible investment avenue for those seeking to grow their wealth.

Why Do You Need a Mutual Fund Distributor in Beawar?

Choosing the right mutual fund distributor is akin to having a financial guide by your side. Here's why you need one:

Expertise Matters: Mutual funds can be complex, with various schemes catering to different risk appetites. An experienced mutual fund distributor in Beawar possesses the knowledge to align your investment goals with the most suitable funds.

Customized Solutions: A skilled distributor understands that one size does not fit all. Every individual has a unique financial situation, so he/she customizes the investment strategy and the portfolio according to the needs. It can be a short-term or long-term objective.

Risk Mitigation: Investing always involves an element of risk. A proficient mutual fund sip advisor in Beawar helps you navigate these risks by providing insights into market trends and adjusting your portfolio accordingly.

Benefits of Choosing the Best Mutual Fund Distributor

Optimized Returns: With a deep understanding of market dynamics, the best mutual distributor can identify opportunities that maximize returns while minimizing risks.

Portfolio Diversification: It is a key investment strategy to help individuals minimize the risk and improve returns. A skilled distributor helps you diversify across different asset classes, ensuring a well-balanced and resilient portfolio.

Regular Monitoring: Financial markets are dynamic, and staying updated is essential. Your chosen distributor keeps a vigilant eye on your investments, making timely adjustments to capitalize on emerging opportunities or mitigate potential losses.

Conclusion: Partnering for Financial Success

Choosing the best mutual fund distributor is not just a prudent decision; it's a step toward financial empowerment. At Ambition Finserve, we understand the unique financial landscape of Beawar and are committed to guiding you toward your financial aspirations. Explore the world of mutual funds with confidence, knowing that you have a trusted partner by your side.

Embark on your financial journey with Ambition Finserve – Your Gateway to Financial Excellence.

#best mutual fund distributor in Beawar#financial planning companies in Beawar#mutual funds services in Beawar#mutual fund sip advisor in Beawar#equity investment planner in Beawar#portfolio management services in Beawar#pms services in Beawar#retirement planning company in Beawar#goal based planning in Beawar#child education advisor in Beawar#marriage fund management planner in Beawar#corporate fixed deposit services in Beawar#bonds investment services in Beawar#sovereign gold bond planner in Beawar#govt of India bonds services in Beawar#tax planning agency in Beawar#alternative investment funds service in Beawar#aif service in Beawar#life insurance planning in Beawar#financial services in Beawar#Wealth management service in Beawar#tax consulting services in Beawar#financial goals planner in Beawar#portfolios management service in Beawar#portfolio advisory services in Beawar

1 note

·

View note