#society system decontrol

Explore tagged Tumblr posts

Video

youtube

SSD - First Show - 19/9/81

A marker in the history of hardcore and straight edge music!

That pit :)

3 notes

·

View notes

Text

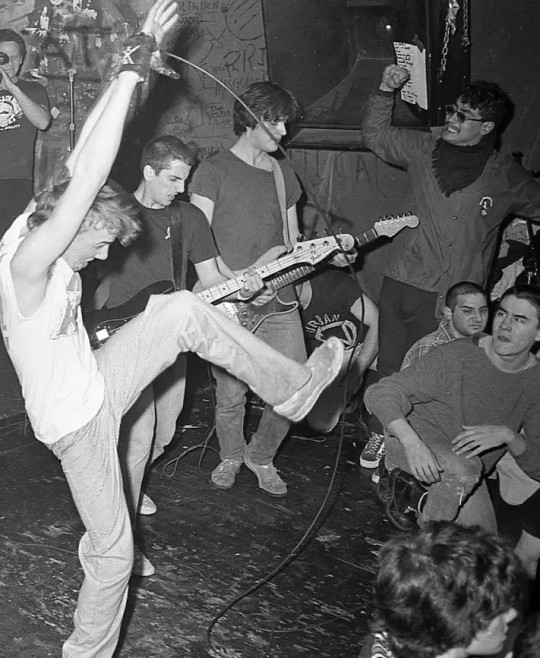

THE YEAR THAT AMERICAN HARDCORE PEAKED -- JUST KIDS GOING WILD IN '83.

PIC(S) INFO: Spotlight on Boston hardcore punk band SOCIETY SYSTEM DECONTROL, later SS DECONTROL, and then finally SSD, playing live at CBGB, NYC, c. 1983. 📸: Phil in Phlash.

"...With ferocious, warp-speed songs that rarely cracked the two-minute mark, the band carried out a scorched-earth campaign on the classic rock — and even punk rock — of the ‘70s. The photographer Philin Phlash, whose brother, David Spring (universally known as “Springa”), was the band’s aggressively jabbering vocalist, took hundreds of photos of SSD’s kinetic shows and the slam-dancing they inspired."

-- THE BOSTON GLOBE (James Sullivan, c. September 11, 2023)

Sources: www.bostonglobe.com/2023/09/11/arts/ssds-hardcore-history-bound-book, Last FM, Pinterest, Facebook, X (formerly known as Twitter), Main Threat, various, etc...

#SSD#SOCIETY SYSTEM DECONTROL#SS DECONTROL#Boston hardcore punk#80s hardcore#American hardcore punk#American hardcore#Boston punk#80s#Straight Edge#Phil in Phlash#1980s#Straight edge hardcore#American Style#Straight edge punk#CBGB OMFUG#80s punk#CBGB#Photography#NYC#Boston hardcore#Hardcore punk#1983#Punk photography#Punk gigs

10 notes

·

View notes

Text

SSD to Reissue Seminal Album "Get It Away" On July 19 Via Trust Records

Universally recognized as the first straight-edge band, SSD’s (Society System Decontrol) 1982 debut The Kids Will Have Their Say is considered a landmark release for hardcore music. However, many fans consider their 1983 sophomore effort Get It Away to be the band’s most crucial release. Most notable is the addition of guitarist Francois Levesque who joined the classic lineup of the “Boston…

View On WordPress

0 notes

Text

Update on my Vest!

#punk#punk rock#crust punk#up the punx#battle jacket#battle vest#hardcore punk#diy#folk punk#diy or die#my post#punx#crass#UK Subs#SSD#Society System Decontrol#Operation Ivy#ska punk#Antidote#skate punk#NOFX#melodic hardcore

20 notes

·

View notes

Text

GOTTA STICK TOGETHER LIKE GLUE!!!!!

#its finally on spotify!!!#all day imma play this#ss decontrol#glue#ssd#society system decontrol#boston hardcore#boston crew#al barile#springa#jamie sciarappa#chris foley#1983

1 note

·

View note

Text

The Workies were of mixed mind as to what to do with city government should they get hold of it. Some advocated an activist policy of mechanic’s liens, aid to internal improvements, government funding of education, and an ongoing regulation of the municipal economy in the public interest. But a greater number denounced government intervention in the economy—both the grant of special corporate privileges and the maintenance of municipal regulations—as an unwarranted colonial holdover, a violation of democracy on a par with the now eliminated suffrage restrictions.

In 1828 the Common Council still appointed or licensed nearly seven thousand people, including butchers, grocers, tavern keepers, cartmen, hackney coachmen, pawnbrokers, and market clerks, together with platoons of inspectors, weighers, measurers, and gaugers of lumber, lime, coal, and flour. From the Workingmen’s perspective, licenses sheltered their privileged holders from competition that could lower prices. Regulations and fees indirectly taxed food and drink, as vendors passed on the costs they accrued in obtaining licenses, buying market stalls, paying fines, and bribing corrupt city inspectors. (Grocers, in particular, complained that inspectors had “a long Pocket for themselves.”) The whole system was kept in place, Workies suspected, less for the public’s convenience than to provide the government with revenue, which it could then share out with cronies and patronage recipients.

In an 1830 petition to the City Council, the Workingmen demanded an end to privileged monopolies in the local economy. They called for abolition of market laws and chartered licenses, the sale of all city-owned property in markets, an enhanced reliance on property taxes for revenue, the granting of permission to butchers and hucksters to sell anywhere in the city, the establishment of tax-free country markets (with adjacent taverns) that would entice farmers to the city, and the exemption of market produce from ferry or bridge tolls.

The closely watched trades—some of them well represented in the new party—were ambivalent about deregulation. Butchers, grocers, and tavern keepers were enticed by free enterprise but nervous about it. Some butchers came out for economic freedom: in 1829 one rebel, refusing to rent a market stall, opened New York City’s first private meat shop. But city protection had served butchers well, and most demanded more of it, not less, asking the city to clamp down on unlicensed (and overhead-free) hucksters. Grocers complained of being pestered by inspectors, yet griped that the city didn’t protect them from black, Irish, and female peddlers. Tavern keepers sought the freedom to sell alcohol on Sunday but also wanted authorities to crack down on unlicensed Irish groggeries. Bakers, after wobbling on the issue earlier in the century, had come out definitively against regulation in 1821. Calling themselves the “slave of corporation dictation,” they demanded that buyers and sellers be allowed to bargain freely and that bakers be freed from special responsibility for feeding the poor. The Common Council repealed the assize in 1821, abdicating its authority over prices, but continued to require that bread be sold in standard-weight loaves, to lessen the possibility of fraud.

Cartmen, on the other hand, definitely favored regulation. American-born carters complained to the city fathers that Irish immigrants, who had been licensed during the war while Anglo-Dutchmen were off soldiering, were undercutting established rates and stealing customers. Mayor Colden limited future alien licensing to dirt carting, a field the Irish quickly dominated. When they continued to challenge the Anglo-Americans in other areas, the Society of Cartmen petitioned the Common Council to reaffirm their “ancient privileges.” The municipal government agreed, rejecting calls for the decontrol of carting, as the business and trade of the city depended on it, and in 1826 the council banned aliens from carting, pawnbroking, and hackney-coach driving; soon all licensed trades were closed to them.

— Mike Wallace and Edwin G. Burrows, Gotham: A History of New York City to 1898 (1998)

2 notes

·

View notes

Text

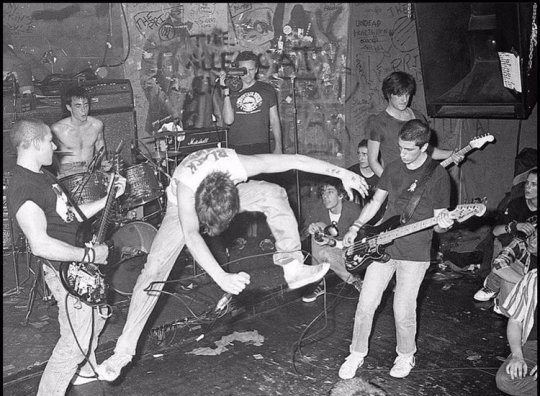

SSD aka SS Decontrol aka Society System Decontrol at Santa Monica Civic Center, Santa Monica, CA, 1983. Photo by Alison Braun

#punk #punks #punkrock #hardcorepunk #ssdecontrol #history #punkrockhistory

6 notes

·

View notes

Text

"IT'S ALWAYS THE BASS PLAYER..." -- HARDCORE PUNK AT THE PEAK OF ITS PROWESS.

PIC(S) INFO: Spotlight on bass player/band-co founder Ross Lomas of English hardcore/street punk band CHARGED G.B.H. seen here playing as bass guitar with a whopping three SSD stickers on it, photographed during the band's 1983 tour with American hardcore bands THE EFFIGIES and SSD supporting, c. summer of 1983. 📸: Linda Aronow.

PIC #2: Goldenvoice advertisment for CHARGED G.B.H. headlining at the Santa Monica Civic Auditorium, Los Angeles, CA, on August 6, 1983, with THE EFFIGIES (Chicago) & SSD (Boston) supporting.

Sources: www.facebook.com/photo.php?fbid=938450011602528 & Go Collect.

#Ross Lomas#Ross Lomas 1983#Street punk#Hardcore punk#80s hardcore punk#SSD#SOCIETY SYSTEM DECONTROL#SS DECONTROL#CHARGED G.B.H.#Punk rock#G.B.H.#1983#American hardcore#American hardcore punk#GBH#Real punk#Second Wave UK punk#Linda Aronow#Linda Aronow photography#Punk gigs#Live gigs#Bass guitar#UK punk#80s hardcore#Bass player#CHARGED GBH#Bass guitarist#Bassist#Thrashback Thursday#English punk

0 notes

Video

youtube

Mighty Mighty Bosstones - Police Beat

#the mighty mighty bosstones#police beat#ska core the devil and more#ssd#society system decontrol#ss decontrol#cover

0 notes

Text

This is a viewpoint editorial by Taimur Ahmad, a college student at Stanford University, concentrating on energy, ecological policy and global politics. Author's note: This is the very first part of a three-part publication. Part 1 presents the Bitcoin requirement and examines Bitcoin as an inflation hedge, going deeper into the principle of inflation. Part 2 concentrates on the existing fiat system, how cash is produced, what the cash supply is and starts to talk about bitcoin as cash. Part 3 explores the history of cash, its relationship to state and society, inflation in the Global South, the progressive case for/against Bitcoin as cash and alternative use-cases. Bitcoin As Money: Progressivism, Neoclassical Economics, And Alternatives Part II The following is a direct extension of a list from the previous piece in this series 3. Cash, Money Supply And Banking Now onto the 3rd point that gets everyone riled up on Twitter: What is cash, what is cash printing and what is the cash supply? Let me begin by stating that the very first argument that made me crucial of the political economy of Bitcoin-as-money was the notorious, sacrilegious chart that reveals that the U.S. dollar has actually lost 99% of its worth with time. A lot of Bitcoiners, consisting of Michael Saylor and co., like to share this as the bedrock of the argument for bitcoin as cash. Cash supply increases, worth of the dollar boils down-- currency debasement at the hands of the federal government, as the story goes. Source: Visual Capitalist I have actually currently discussed in Part 1 what I think of the relationship in between cash supply and rates, however here I 'd like to go one level much deeper. Let's begin with what cash is. It is a claim on genuine resources. In spite of the extreme, objected to disputes throughout historians, anthropologists, economic experts, ecologists, theorists, and so on, about what counts as cash or its characteristics, I believe it is sensible to presume that the underlying claim throughout the board is that it is a thing that permits the holder to obtain items and services. With this background then, it does not make good sense to take a look at a separated worth of cash. Truly however, how can somebody reveal the worth of cash in and of itself (e.g., the worth of the dollar is down 99%)? Its worth is just relative to something, either other currencies or the quantity of items and services that can be obtained. The fatalistic chart revealing the debasement of fiat does not state anything. What matters is the buying power of customers utilizing that fiat currency, as salaries and other social relations denominated in fiat currency likewise move synchronously. Are U.S. customers able to purchase 99% less with their earnings? Obviously not. The counterarguments to this usually are that incomes do not stay up to date with inflation which over the short-medium term, money cost savings decline which harms the working class as it does not have access to high yielding financial investments. Genuine salaries in the U.S. have actually been consistent considering that the early 1970 s, which in and of itself is a significant socioeconomic issue. There is no direct causal link in between the expansionary nature of fiat and this wage pattern. The 1970 s were the start of the neoliberal program under which labor power was squashed, economies were decontrolled in favor of capital and commercial tasks were contracted out to underpaid and made use of employees in the Global South. I digress. Let's return to the what is cash concern. Apart from a claim over resources, is cash likewise a shop of worth over the medium term? Once again, I wish to be clear that I am talking just about industrialized countries so far, where run-away inflation isn't a genuine thing so acquiring power does not deteriorate over night. I 'd argue that it is not the function of cash-- money and its equivalents like bank deposits-- to work as a shop of worth over the medium-long term.

It is expected to act as a legal tender which needs cost stability just in the brief run, combined with steady and predicted decline with time. Integrating both functions-- an extremely liquid, exchangeable possession and a long-lasting cost savings system-- into something generates income a complex, and perhaps even inconsistent, principle. To secure buying power, access to monetary services requires to be broadened so that individuals have access to reasonably safe possessions that stay up to date with inflation. Concentration of the monetary sector into a handful of big gamers driven by revenue intention alone is a significant obstacle to this. There is no intrinsic factor that an inflationary fiat currency needs to cause a loss of acquiring power time, particularly when, as argued in Part 1, cost modifications can occur due to the fact that of several non-monetary factors. Our socioeconomic setup, by which I suggest the power of labor to work out salaries, what occurs to benefit, and so on, requires to allow buying power to increase. Let's not forget that in the post-WWII age this was being attained although cash supply was not growing (formally the U.S. was under the gold requirement however we understand it was not being imposed, which resulted in Nixon moving far from the system in 1971). Okay so where does cash originated from and were 40% of dollars printed throughout the 2020 federal government stimulus, as is typically declared? Neoclassical economics, which the Bitcoin basic story uses at numerous levels, argues that the federal government either obtains cash by offering financial obligation, or that it prints cash. Banks provide cash based upon deposits by their customers (savers), with fractional reserve banking enabling banks to provide multiples greater than what is transferred. It comes as not a surprise to anybody who is still checking out that I 'd argue both these principles are incorrect. Here's the appropriate story which (trigger caution once again) is MMT based-- credit where it's due-- however consented to by bond financiers and monetary market specialists, even if they disagree on the ramifications. The federal government has a monopoly on cash development through its position as the sovereign. It produces the nationwide currency, enforces taxes and fines in it and utilizes its political authority to safeguard versus fake. There are 2 unique methods which The State engages with the financial system: one, through the reserve bank, it offers liquidity to the banking system. The reserve bank does not "print cash" as we informally comprehend it, rather it produces bank reserves, an unique type of cash that isn't actually cash that is utilized to purchase products and services in the genuine economy. These are properties for industrial banks that are utilized for inter-bank operations. Quantitative alleviating (those frightening huge numbers that the reserve bank reveals it is injecting by purchasing bonds) is unconditionally not cash printing, however merely reserve banks switching interest bearing bonds with bank reserves, a net neutral deal as far as the cash supply is worried although the reserve bank balance sheet broadens. It does have an effect on property costs through numerous indirect systems, however I will not enter into the information here and will let this excellent thread by Alfonso Peccatiello (@MacroAlf on Twitter) describe. So the next time you become aware of the Fed "printing trillions" or broadening its balance sheet by X trillion, simply think of whether you are really discussing reserves, which once again do not get in the genuine economy so do not add to "more cash chasing after the exact same quantity of items" story, or real cash in flow. Two, the federal government can likewise, through the Treasury, or its comparable, produce cash (regular individuals cash) that is dispersed through the federal government's bank-- the reserve bank. The method operandi for this operation

is normally as follows: Say the federal government chooses to send out a one-time money transfer to all people. The Treasury licenses that payment and jobs the reserve bank to perform it. The reserve bank increases the account that each industrial bank has at the reserve bank (all digital, simply numbers on a screen-- these are reserves being developed). the business banks likewise increase the accounts of their clients (this is cash being produced). customers/citizens get more cash to spend/save. This kind of federal government costs (financial policy) straight injects cash into the economy and is therefore unique from financial policy. Direct money transfers, welfare, payments to suppliers, and so on, are examples of financial costs. Most of what we call cash, nevertheless, is developed by industrial banks straight. Banks are certified representatives of The State, to which The State has actually extended its powers of cash development, and they develop cash out of thin air, unconstrained by reserves, whenever a loan is made. Such is the magic of double-entry accounting, a practice that has actually remained in usage for centuries, where cash enters being as a liability for the company and a property for the receiver, netting out to no. And to repeat, banks do not require a specific quantity of deposits to make these loans. Loans are made based on whether the bank believes it makes financial sense to do so-- if it requires reserves to fulfill guidelines, it merely obtains them from the reserve bank. There are capital, not reserve, restrictions on financing however those are beyond the scope of this piece. The main factor to consider for banks in making loans/creating cash is revenue maximization, not whether it has enough deposits in its vault. Banks are developing deposits by making loans. This is an essential shift in the story. My example for this is moms and dads (neoclassical economic experts) informing kids a phony birds and bees story in reaction to the concern of where infants originate from. Rather, they never ever remedy it causing an adult citizenry running around without understanding about recreation. This is why the majority of people still speak about fractional reserve banking or there being some naturally repaired supply of cash that the personal and public sectors contend over, since that's what econ 101 teaches us. Let's review the principle of cash supply now. Provided that many of the cash in blood circulation comes from the banking sector, and that this cash production is not constrained by deposits, it is affordable to declare that the stock of cash in the economy is not simply driven by supply, however by need. If companies and people are not requiring brand-new loans, banks are not able to produce brand-new cash. This has a cooperative relationship with business cycle, as cash production is driven by expectations and market outlook however likewise drives financial investment and growth of output. The chart listed below programs a step of bank loaning compared to M2. While the 2 have a favorable connection, it does not constantly hold, as is glaringly apparent in2020 Even though M2 was rising greater post-pandemic, banks were not providing due to unpredictable financial conditions. As far as inflation is worried, there is the included intricacy of what banks are providing for, i.e., whether those loans are being utilized for efficient ends, which would increase financial output or ineffective ends, which would wind up resulting in (property) inflation. This choice is not driven by the federal government, however by the economic sector. The last problem to include here is that while the above metrics work as beneficial steps for what takes place within the United States economy, they do not catch the cash production that occurs in the eurodollar market(eurodollars have absolutely nothing to do with the euro, they merely describe the presence of USD outside the U.S. economy). Jeff Snider provided

an exceptional run through of this throughout his look on the What Bitcoin Did podcast for anybody who desires a deep-dive, however basically this is a network of banks that run outside the U.S., are not under the official jurisdiction of any regulative authority and have the license to produce U.S. dollars in foreign markets. This is due to the fact that the USD is the reserve currency and needed for global trade in between 2 celebrations that might not have anything to do with the U.S. even. A French bank might release a loan denominated in U.S. dollars to a Korean business desiring to purchase copper from a Chilean miner. The quantity of cash developed in this market is anybody's guess and for this reason, a real procedure of the cash supply is not even practical. This is what Alan Greenspan needed to state in a 2000 FOMC conference: " The issue is that we can not draw out from our analytical database what holds true cash conceptually, either in the deals mode or the store-of-value mode." Here he refers not simply to the Eurodollar system however likewise the expansion of intricate monetary items that inhabit the shadow banking system. It's tough to speak about cash supply when it's difficult to even specify cash, provided the occurrence of money-like alternatives. Therefore, the argument that federal government intervention through financial and financial growth drives inflation is just not real as the majority of the cash in flow is outside the direct control of the federal government. Could the federal government get too hot the economy through overspending? Sure. That is not some predefined relationship and is subject to the state of the economy, expectations, and so on The concept that the federal government is printing trillions of dollars and debasing its currency is, to no one's surprise at this point, simply not real. Just taking a look at financial intervention by the federal government provides an insufficient image as that injection of liquidity might be, and in most cases is, offseting the loss of liquidity in the shadow banking sector. Inflation is a complex subject, driven by customer expectations, business rates power, cash in flow, supply chain disturbances, energy expenses, and so on. It can not and must not be merely lowered to a financial phenomenon, particularly not by taking a look at something as one-dimensional as the M2 chart. Lastly, the economy needs to be seen, as the post-Keynesians revealed, as interlocking balance sheets. This holds true merely through accounting identity-- somebody's possession needs to be another person's liability. When we talk about paying back the financial obligation or minimizing federal government costs, the concern must be what other balance sheets get impacted and how. Let me offer a streamlined example: in the 1990 s throughout the Clinton age, the U.S. federal government commemorated budget plan surpluses and repaying its nationwide financial obligation. Given that by meaning somebody else had to be getting more indebted, the U.S. family sector racked up more financial obligation And because families could not develop cash while the federal government could, that increased the total danger in the monetary sector. Bitcoin As Money I can picture individuals checking out till now (if you made it this far) stating "Bitcoin repairs this!" since it's transparent, has a set issuance rate and a supply cap of 21 million. Here I have both financial and philosophic arguments when it comes to why these functions, no matter the present state of fiat currency, are not the remarkable service that they are explained to be. The very first thing to keep in mind here is that, as this piece has actually ideally revealed so far, that because the rate of modification of cash supply is not equivalent to inflation, inflation under BTC is not transparent or programmatic and will still go through the forces of need and supply, power of the cost setters, exogenous shocks, and so on Money is the grease that permits the cogs of the economy to churn without excessive friction.

It streams to sectors of the economy that need more of it, permits brand-new opportunities to establish and serves as a system that, preferably, settle wrinkles. The Bitcoin basic argument rests on the neoclassical presumption that the federal government controls (or controls, as Bitcoiners call it) the cash supply which battling away this power would result in some real type of a financial system. Our existing monetary system is mostly run by a network of personal stars that The State has little bit, probably too little, control over, regardless of these stars benefitting from The State guaranteeing deposits and acting as the loan provider of last resort. And yes, obviously elite capture of The State makes the nexus in between banks and the federal government culpable for this mess. But even if we take the Hayekian technique, which concentrates on decentralizing control entirely and utilizing the cumulative intelligence of society, countering the present system with these functions of Bitcoin falls under the technocratic end of the spectrum since they are authoritative and produce rigidness. Should there be a cap on cash supply? What is the proper issuance of brand-new cash? Should this keep in all scenarios agnostic of other socioeconomic conditions? Pretending that Satoshi in some way had the ability to respond to all these concerns throughout time and area, to the level that nobody need to make any modifications, appears incredibly technocratic for a neighborhood that is discussing the "individuals's cash" and liberty from the tyranny of specialists. Bitcoin is not democratic and not managed by the individuals, in spite of it providing a low barrier to go into the monetary system. Even if it is not centrally governed and the guidelines can't be altered by a little minority does not, by meaning, indicate Bitcoin is some bottom-up kind of cash. It is not neutral cash either due to the fact that the option to produce a system that has actually a repaired supply is a subjective and political option of what cash need to be, instead of some a priori exceptional quality. Some advocates may state that, if requirement be, Bitcoin can be altered through the action of the bulk, however as quickly as this door is opened, concerns of politics, equality and justice flood back in, taking this discussion back to the start of history. This is not to state that these functions are not important-- certainly they are, as I argue later on, however for other use-cases. Therefore, my contentions so far have actually been that: Understanding the cash supply is made complex due to the fact that of the monetary intricacy at play. The cash supply does not always cause inflation. Governments do not manage the cash supply which reserve bank cash (reserves) are not the very same thing as cash. Inflationary currencies do not always result in a loss of acquiring power, which that depends more on the socioeconomic setup. An endogenous, flexible cash supply is required to adapt to financial modifications. Bitcoin is not democratic cash merely despite the fact that its governance is decentralized. In Part 3, I talk about the history of cash and its relationship with the state, evaluate other conceptual arguments that underpin the Bitcoin Standard, offer a viewpoint on the Global South, and present alternative use-cases. This is a visitor post by Taimur Ahmad. Viewpoints revealed are totally their own and do not always show those of BTC, Inc. or Bitcoin Magazine. Read More

0 notes

Audio

“Crazier than GG, More PC than Ian. Got colored teeth like Johnny, Exudes a vicious disposition. His hair sticks out like Colin's did, he jumps, Similar to Springa, he points his middle finga. Not just the singer in the band. Voted biggest asshole, and role model of the year. Got a face like Charles Bronson, Straight outta Green Bay, Wisconsin, Not just a singer in the band. He'll puke on you, he'll fuck your mom, He'll smoke while huffing gas. He was the punkest mother fucker I ever did see. 'Ah Hell he's even more punk than me.' He should've been on the cover, He should've been on the cover, He should've been on the cover of Punk and Disorderly (Volume II)”

Fat Mike, NOFX [References In This Song] [Crazier than GG: GG Allin was in the Jabbers, the Scumfucs, Antiseen and the Murder Junkies.] [More PC than Ian: Ian MacKaye, lead singer of Minor Threat. Began the Straight edge movement] [Got colored teeth like Johhny: Johnny Rotten from the Sex Pistols] [Exudes a vicious disposition: Sid Vicious from the Sex Pistols] [His hair sticks out like Colin's did: Colin Jerwood, lead singer of Conflict, he had long liberty spikes] [He jumps similar to Springa: Springa AKA David Spring, the lead singer from Society System Decontrol]

Lyrics and references via plyrics.com

3 notes

·

View notes

Audio

This week on Doomed Society, we have hits 'n shits from Limp Wrist, GLOSS, Paroxysm, The Varukers, Warwound, Tau Cross, and SO MUCH MORE!

www.doomedsocietypunx.com facebook.com/DoomedSocietyRadio/

LIMP WRIST: facades G.L.O.S.S.: fight XYLITOL: atrocity man INFANTILE DISSENTION: trans panic DOXX: stuck in hetero BALLOT BURNER: dirt merchants PAROXYSM: white picket fence CHUPACABRA: deep scars DECONTROL: armed to the fucking teeth STATE OF MINEFIELDS: bite the hand VARUKERS: die for your government BROKEN BONES: decapitated ABRASIVE WHEELS: attack MANIA: power to the people SKEPTIX: war drum ANTI-SYSTEM: eyes wide shut WARWOUND: the world we deserve SACRILEGE: dig your own grave (2015) DEVIATED INSTINCT: thorn in your flesh EXIT STANCE: 1916 TAU CROSS: deep state TAU CROSS: pillar of fire

2 notes

·

View notes

Video

youtube

VA - Does Dis System Work 1995

01. Discharge - Realities of war (1980) 02. Disclose - The bombardment (1993) 03. Discharge - War's no fairytale (1980) 04. Discard - Fear (1986) 05. Discharge - Decontrol (1980) 06. Doom - A dream to come true (1988) 07. Discharge - Two monstrous nuclear stockpi les (1981 ) 08. Asocial - Q And children A And children 09. Discharge - Doom's day (1982) 10. Perukers - Protest and survive (1993) 11. Discharge -Born to die in the gutter (1983) 12. Disfear - Fear (1992) 13. Discharge - Ain't no feeble bastard (1981) 14. Selfish - Condemned (1992) 15. Discharge - Society's victim (1980) 16. Dischange - After war scars (1991) 17. Discharge - Fight back (1980) 18. Final Conflict - A look at tomorrow (1991) 19. Discharge - No TV sktech (1980) 20. Crow - No violence (1987) 27. Discharge - Visions of war (1981) 28. Anti Cimex - Set me free (1984) 29. Discharge -They declare it (1980) 30. Disarm - Säg nej (198_) 31. Discharge - Always restrictions (1980) 32. Dissober - America did this (1993) 33. Discharge - Tomorrow belongs to us (1980) 34. Time Square Preachers - Ain't smiling (1994) 35. Discharge - Doest his sytem work 36. Disclose - The end of blood (1994)

is this the greatest tape comp. ever?!

2 notes

·

View notes

Text

Rent Regulations in New York: How They’ll Affect Tenants and Landlords

Democratic lawmakers in New York harnessed their new powers on Tuesday to broker sweeping changes to rent laws in order to protect tenants in a state with some of the country’s most expensive housing markets. The regulations that lawmakers agreed upon would stretch beyond New York City to the entire state, allowing other municipalities to enact their own rules to keep apartments affordable. Both chambers of the State Legislature are expected to vote on the new package this week, before the current set of regulations are set to expire on Saturday. Unlike previous regulations, which had to be renewed once they expired, the new rules would be permanent. Gov. Andrew M. Cuomo, a Democrat, has pledged to sign whatever bill lawmakers pass. The new rules would mark a turning point for the 2.4 million people who live in nearly one million rent-regulated apartments in New York City after a steady erosion of protections and the loss of tens of thousands of regulated apartments. “This package of legislation will reverse decades of rampant landlord abuse and enact much-needed protections for hundreds of thousands of tenants,” said Adriene Holder, a lawyer at the Legal Aid Society. But landlords warned that removing incentives for them to renovate buildings and lowering their rental income would lead to worse housing conditions for many New Yorkers.

“You will see a slow erosion in the quality of housing going out in three or four years,” said Joseph Strasburg, the president of the Rent Stabilization Association, which represents 25,000 landlords.

What apartments are rent regulated?

There is a lot of jargon around rent, resulting in confusion about what the different terms mean. Broadly speaking, two types of rent-regulated units exist in New York City: rent controlled and rent stabilized. The changes will apply to both. Rent control in the city became popular after World War II when soldiers returned home and sought apartments for their families. The demand caused rents to increase, leading to a housing shortage. At its height, more than two million rent-controlled apartments existed in the city, but only a small fraction remain: about 22,000, according to a 2017 survey. For an apartment to be rent-controlled, a tenant or family member must have been living in the unit since at least July 1971, and the building had to have been built before 1947. Families can pass the unit to another member and preserve the rent-control status. A unit that falls out of rent control can be leased at market rate. The second system, rent stabilization, applies to apartments in buildings with at least six units that were built between 1947 and 1974, as well as newer buildings that receive tax breaks for so-called affordable housing. Rent increases at stabilized units are determined by the city’s Rent Guidelines Board. This year the board allowed for 1.5 percent increases for one-year leases and 2.5 percent for two-year leases.

What do the new changes mean for tenants?

Tenants in rent-regulated apartments would largely see an end to big rent increases under the new legislation. The Rent Guidelines Board will continue to determine yearly increases on rent-stabilized units, but the following rules that benefited landlords would be changed or abolished: Vacancy decontrol: When the legal rent for a rent-stabilized apartment reached a certain rate, currently $2,774 per month, it could revert to market-rate if there is a vacancy. The rule has led to the deregulation of more than 155,000 units since it was enacted in the 1990s. This practice would be ended. The vacancy bonus: Landlords for rent-stabilized apartments have been able to hike rents by as much as 20 percent after tenants moved out. The new rules would prevent that. Rent hikes based on building improvements: Landlords have been able to increase rents in regulated apartments by up to 6 percent per year if they made improvements that “directly or indirectly” benefited all tenants, such as a new boiler. That increase would now be capped at 2 percent per year. Rent hikes that were permitted if landlords renovated or improved individual apartments would also now be limited. Misuse of “preferential” rents: Landlords of rent-stabilized apartments can offer units to tenants for a price lower than the legal regulated rent. But they can no longer raise the rent to the legally mandated limit when a lease is renewed, a practice that was pushing tenants out. High-income deregulation: If a tenant in a rent-stabilized unit earned over $200,000 a year in two consecutive years, the landlord could deregulate the unit. That will no longer be allowed. The “owner-use” loophole: Landlords and their family members have been able to remove rent-stabilized tenants from multiple units to use them as residences, a rule sometimes abused by landlords as a way to ultimately raise rents. Now, landlords will only be able to claim “owner use” for one apartment for use as their primary residence.

What do the changes mean for landlords?

Trade groups and real estate lobbyists warned of dire consequences as a result of the new regulations. They said smaller landlords could be run out of business because of new limits on rent increases and restrictions on raising rent after improvements. Ultimately, they said, units and buildings could fall into disrepair. Some analysts predicted that the New York housing market overall could be depressed because the resale market for rent-regulated apartments would lose value as a result of the changes. The Real Estate Board of New York, an influential trade group that primarily represents larger developers, predicted that building owners would no longer have an incentive to invest in their rent-regulated units.

“This legislation fails to address the city’s housing crisis, and will lead to disinvestment in the city’s private sector rental stock, consigning hundreds of thousands of rent-regulated tenants to living in buildings that are likely to fall into disrepair,” said the Taxpayers for an Affordable New York, a coalition of four real estate groups.

Are the rules just for regulated apartments?

The package of protections extends well beyond those living in rent-regulated apartments to all New Yorkers renting apartments: Security deposits will be limited to one month’s rent and procedures will be improved to make it easier for renters to get their security deposits back. Tenants who were seen as troublemakers by landlords — perhaps for standing up for their rights — would sometimes end up on blacklists that would be shared among rental agencies. That practice would be banned. Tenants would be better protected during the eviction process, particularly against retaliatory evictions. Unlawful evictions, such as when a landlord illegally locks out or uses force to evict a tenant, would become a crime, a misdemeanor punishable by a civil penalty of between $1,000 and $10,000 per violation. Landlords would be required to provide at least 30 days notice to tenants if they intend to increase the rent by more than 5 percent or are not going to renew the lease Source: New York Times Read the full article

0 notes

Text

Mexico and Hungary tried junk meals taxes — they usually appear to be working

New Post has been published on https://takenews.net/mexico-and-hungary-tried-junk-meals-taxes-they-usually-appear-to-be-working/

Mexico and Hungary tried junk meals taxes — they usually appear to be working

Stroll into any food-selling institution within the US, and it turns into clear in a short time why America is among the most overweight nations on the planet.

From morning muffins that pack as a lot sugar as an icing-topped cupcake, to chocolate bars that comprise greater than 600 energy, it’s extraordinarily straightforward to overindulge in America.

What’s much less clear is strictly what to do about that. Some form of authorities intervention within the meals setting in all probability must be a part of the answer — taxes have in fact been an efficient, although nonetheless controversial, strategy to curbing the consumption of tobacco, alcohol, and soda.

Now researchers from New York College and Tufts writing within the American Journal of Public Well being are making the case for shifting meals costs in ways in which steer shoppers towards more healthy food regimen decisions.

Extra particularly, they argue, a junk meals tax — on “non-essential” meals like sweet, soda, and potato chips — ought to be the following frontier in public well being.

In line with their assessment of the scientific literature on junk meals tax payments and legal guidelines, a federal tax on unhealthy meals can be each legally and administratively possible within the US. As a substitute of a gross sales tax that will present up on the level of buy, the researchers argue for an excise tax on junk meals producers. That ought to improve the shelf value of junk meals and drinks, and deter shoppers from bringing unhealthy meals decisions to the checkout counter within the first place.

Even when a federal junk meals tax is legally possible, nevertheless, that doesn’t imply it’s prone to occur right here. In our present political panorama, it’s laborious to think about the researchers’ proposal going anyplace quickly. (The Trump White Home doesn’t even suppose weight problems is a vital problem, and the administration has been transferring to decontrol trade.)

However as soda taxes achieve wider acceptance, we���re certain to begin listening to increasingly about junk meals taxes. Right here’s what you might want to find out about them.

Well being researchers and officers have lengthy contemplated junk meals taxes, however have targeted most of their vitality on soda taxes so far. Sugary drinks have been a pure beginning place to experiment with authorities intervention within the meals setting since there’s numerous proof linking sugary drinks to diet-related illness, and soda is an simply modifiable a part of the food regimen.

Since 2013, eight municipalities and cities within the US have put in place measures to tax soda with the purpose of curbing sugary-drinks consumption.

However the authors of the brand new paper say it’s time to begin wanting past soda taxes. “It’s necessary to have a dialog in regards to the complete food regimen, and never simply eliminating sugary drinks,” stated Jennifer Pomeranz, a public well being lawyer at New York College and lead writer on the paper.

Some international locations have already been transferring in that path, imposing taxes that not solely change the worth of soda however different unhealthy meals, too.

In 2011, Hungary put a Four-cent tax on packaged meals and drinks that comprise excessive ranges of sugar and salt in sure product classes, together with delicate drinks, sweet, salty snacks, condiments, and fruit jams.

In 2013, Mexico handed an eight p.c tax on meals together with snacks, sweets, nut butters, cereal-based ready merchandise — all “non-essential” meals. Inside these classes, meals that surpass a calorie density threshold (greater than 275 energy per 100 grams) are taxed.

These international locations determined to tax junk meals as a result of it’s develop into such a distinguished part of individuals’s diets — and budgets.

“We could spend 5 to 7 p.c of our meals finances on sugary drinks,” stated College of North Carolina vitamin coverage researcher Barry Popkin, who was not concerned with the brand new paper, “however we spend one other 15 to 20 p.c on junk meals. Should you take a rustic just like the US, 75 p.c of adolescents get greater than half their energy from junk meals.”

That’s why, as Popkin put it, junk meals taxes “are the following goal, globally.”

Researchers who’ve studied the impression of junk meals taxes discovered they’ve modified folks’s consuming habits for the higher.

In a current analysis of the Mexico junk meals tax, folks purchased 7 p.c much less junk meals than they might have if the tax hadn’t been imposed. That impact was even strongerthan the 5 p.c dent the tax made within the first yr it was imposed. The researchers got here to those conclusions through the use of shopping for patterns earlier than the tax was imposed to foretell future purchases, then in contrast that prediction to what was taking place in Mexico.

The World Well being Group has appeared on the Hungary tax, and located that junk meals consumption decreased each due to the worth improve and in addition the tutorial campaigns across the tax — an impact additionally seen with soda taxes. “Shoppers of unhealthy meals merchandise responded to the tax by selecting a less expensive, usually more healthy product (7 to 16 p.c of these surveyed), consumed much less of the unhealthy product (5 to 16 p.c), modified to a different model of the product (5 to 11 p.c) or substituted another meals (usually a more healthy various).”

Within the new paper this week, the researchers discovered the Hungary mannequin was the best because it considers the broader dietary worth of meals, not simply energy (as Mexico is doing). That has additionally had an impression on junk meals producers in Hungary, inflicting about 40 p.c of them to tweak recipes in ways in which make them more healthy.

“Should you embrace some vitamin standards within the tax — akin to sugar, perhaps sodium and trans fat — you then create an incentive for producers to reformulate their merchandise,” Pomeranz defined.

Income from from excise taxes will also be earmarked for locations within the finances — like well being. In its first 4 years in operation, the WHO reported, Hungary’s tax introduced in 61.three billion forints (or $219 million US) for public well being spending.

One other key discovering from the Mexico research and Hungary research was that the junk meals tax appeared to have the best impact amongst low-income teams and individuals who have been massive shoppers of junk meals previous to the tax.

“We predict individuals who devour numerous junk or soda are essentially the most responsive to those taxes,” stated Lindsey Smith Taillie, a College of North Carolina vitamin epidemiologist who has been evaluating the Mexico junk meals tax.

Since low-income folks are inclined to devour essentially the most junk meals, and are additionally on the best danger of diet-related illness, “this means a junk meals tax may be regressive on revenue and progressive on healthfulness of meals purchases.” In different phrases, the taxes hit the poorest folks the toughest, however in doing so, might also transfer them away from junk meals, Smith Taillie defined.

It’s nonetheless too early to inform whether or not junk meals taxes will curb weight problems or diabetes. It’ll take years to know that. However for now, by way of each growing the worth of the merchandise and training campaigns across the taxes, junk meals taxes seem to scale back consumption — a discovering that echoes the analysis on soda taxes.

Even essentially the most glowing research on the impression of junk meals taxes are unlikely to make these levies extra politically palatable. The controversy about junk meals taxes — and soda taxes for that matter — is known as a debate about what position the federal government ought to play in combating weight problems and enhancing the American food regimen. And never everybody thinks the federal government has a task to play right here.

Probably the most in style counters to unhealthy meals taxes is the “nanny state” argument — that they infringe on folks’s freedom of selection.

Nevertheless, as well being researchers have lengthy identified, “the prices of weight problems arising from people’ poor dietary decisions are borne by society as a complete by way of taxes, misplaced productiveness, and an overburdened well being care system.” Some junk meals are additionally engineered to have addictive properties, like tobacco or alcohol, so you can also make the argument that the federal government ought to actually use regulation to nudge folks away from them.

For now, don’t count on a US junk meals tax any time quickly. The trade would vehemently oppose a junk meals tax, as they did soda taxes, and so would some teams of shoppers, stated David Simply, a Cornell professor who research what drives shopper decisions. “Have a look at the place soda taxes have taken impact within the US, it’s instructive,” he added.

Folks in locations like Berkeley, the place the primary soda tax handed in 2013, are very minimal shoppers of soda. “I hesitate to think about that [a junk food tax] is one thing that will be very talked-about exterior of only a few cities which are already leaning on this path,” Simply stated.

As for a federal tax, the prospect of the anti-regulation Trump administration and present Congress regulating the meals trade additionally appears extremely unlikely.

Even the advocates of junk meals taxes don’t suppose they’re going to be a panacea. It’s not simply the low value that attracts folks to junk meals. The advertising heft of multinational firms is behind the merchandise, they usually’re engineered to get folks hooked.

Folks with greater ranges of training — and maybe extra information about well being and vitamin — are likelier to decide on more healthy meals.

To make issues extra difficult, there’s a provide downside. Researchers have identified that if Individuals truly adopted the US dietary pointers and began to eat the amount and number of fruit and veggies well being officers advocate, we wouldn’t have practically sufficient to satisfy shopper demand. As of 2013, potatoes and tomatoes made up half of the legumes and greens obtainable on this nation, in keeping with the US Division of Agriculture. Junk meals, then again, is plentiful and low-cost.

The USDA doesn’t subsidize leafy vegetable crops in the identical method it helps crops like wheat, soy, and corn — two crops that make up numerous the junk meals that overwhelms the US food regimen. Greens are costlier and labor intensive to supply, because the Washington Put up’s Tamar Haspel has identified, which additionally will increase their value.

Marc Bellemare, an economist on the College of Minnesota and critic of soda taxes, notes that Individuals love comfort irrespective of the price — and that drives many individuals’s meals decisions. “It is a tradition articulated round the truth that issues ought to be handy.” Junk meals are usually simpler to devour than, say, fruit and veggies.

So as an alternative of focusing solely on making junk meals costlier, we have to additionally make more healthy meals extra handy and inexpensive, and to coach folks about them.

The federal government and researchers have been fascinated about methods to try this — subsidizing fruit and veggies for the poor, encouraging folks to develop their very own meals, and working advertising campaigns that make wholesome meals attractive.

“There’s a rising consensus single tax will not be going to be sufficient to maneuver the needle on well being,” Lindsey Smith Taillie summed up. “We’d like a bundle of coverage options: a soda tax, a junk meals tax, entrance of bundle warning labels that make unhealthy merchandise extra seen, lowering unhealthy meals promoting to folks. A junk meals tax can be one further coverage mechanism.”

Even when the authors of the brand new paper are solely dreaming for now, “they’re laying the groundwork for when a Congress that will be amenable to this concept is available in,” Cornell’s David Simply stated. A federal junk meals tax could also be an extended shot within the present Congress, he added, “however I don’t suppose that’s a everlasting state.” And perhaps, as with soda taxes, some cities will begin experimenting even sooner.

0 notes

Text

Philippine Oil Deregulation A Policy Research Analysis

I. INTRODUCTION

The Policy As An Output

Embodied within the Republic Act No. 8479, in any other case generally known as the “Downstream Oil Industry Deregulation Act of 1998,” is the coverage of the state that deregulates the oil business to “foster a truly competitive market which can better achieve the social policy objectives of fair prices and adequate, continuous supply of environmentally-clean and high quality petroleum products” (Congress 1998).

With deregulation, authorities permits market competitors. That means authorities doesn’t intrude with the pricing, exportation, and importation of oil merchandise, even the institution of shops, storage depots, ocean-receiving amenities, and refineries.

It has been a decade in the past since lawmakers made a proposition that deregulation would safe the Philippines from the vulnerability of oil worth shocks resulting from its closely depending on imported oil. But it’s now more and more obvious that many are calling to scrap the law as six out of ten Filipinos favor the repeal of RA 8479 (Somosierra 2008).

The Policy As A Process

When President Fidel Ramos began his administration in 1992, the nation had already began feeling the consequences of energy provide deficiencies, with main areas already experiencing energy interruptions. The energy disaster brought on a slowdown within the nationwide financial system for almost three years and prodded the federal government to provoke main reforms with a purpose to rehabilitate the power sector (Viray 1998, p.461-90). In response to an influence provide disaster, Ramos revived the plans to liberalize the oil business that have been minimize brief in the course of the Aquino administration resulting from Gulf disaster.

The authorities’s efforts to enact an oil deregulation law have been additionally intensified in 1995 when the Oil Price Stabilization Fund (OPSF ) began to threaten the fiscal stability of the financial system. Deregulation was thus seen as the answer to the recurring deficit.

The drawback of the OPSF deficit was partially associated to the extremely political nature of oil costs, which inspired authorities to defer worth will increase as a lot as attainable as a way to keep away from public protest even on the expense of incurring a fiscal deficit. However, authorities mismanagement of the fund additionally included utilizing it for non-oil functions comparable to financing different authorities tasks or the general public sector deficit when it was in surplus (Pilapil 1996, p.12).

At the peak of a robust lobbying effort for deregulation by oil corporations and regardless of the loud opposition of militant teams, the business was ultimately deregulated in 1996 with the enactment of RA 8180 (the Downstream Oil Industry Deregulation Act of 1996) in Congress.

However, Supreme Court declared in 1997 the unconstitutionality of RA 8180. The Court choice stemmed from three provisions within the law that have been deemed to inhibit free competitors and subsequently, violated the anti-belief mandate of the 1987 Constitution (Supreme Court 1997). But administration Congressmen shortly re-filed the oil deregulation invoice resulting in the brand new oil deregulation law. RA 8479 was then enacted to pave the best way for the complete deregulation of the oil business. Since then, authorities has not management over the business. What it may well do is just monitoring.

Applicable Models

The coverage mannequin that greatest describes the coverage course of is Vig and Kraft 1984 mannequin the place coverage levels/phases are characterised by 5 parts: 1) agenda setting, 2) coverage formulation, three) coverage adoption, four) coverage implementation, and 5) coverage monitoring.

On the opposite hand, the mannequin that greatest describes the coverage strategy is Mixed Scanning as a result of the Ramos administration resorted to rational planning course of and incrementalized on liberalization plan of the Aquino authorities.

II. THE POLICY IN THE CONTEXT OF THE POLICY SYSTEM

The Policy Environment

Identified coverage surroundings consists of the regime traits of Ramos Administration, socio-financial construction in 1990’s, and the prevailing worldwide monetary affect on the nation’s financial system and politics.

The Policy Stakeholders

Identified as stakeholders on this coverage are the Filipino individuals, the President, Legislators, Supreme Court, DOE, DOJ, DTI, NEDA, the oil corporations, NGO/advocacy teams, and media.

The Interrelationships Between Policy Environment And Stakeholders

Despite a robust opposition coming immediately from bizarre individuals, transport teams, and NGOs, the oil deregulation coverage was nonetheless pushed via. It was formulated and instituted beneath the regime of President Ramos who, in his flagship program referred to as the Philippines 2000, envisioned to make the nation globally aggressive by pursuing the thrusts of deregulation, market liberalization, and privatization. The media then uncovered the truth that the most important issue that influenced the formulation of the coverage was the perceived eventual chapter of the Oil Price Stabilization Fund, which had been initially established by President Ferdinand Marcos for the aim of minimizing frequent worth modifications caused by change changes and/or a rise in world market costs of crude oil and imported petroleum merchandise.

Influenced by the International Monetary Fund, Ramos administration argued that there was a have to decontrol the business as a result of beneath a regulated surroundings, costs will not be allowed to rise and fall with market ranges. This signifies that when costs went up, authorities needed to shell out cash to subsidize the distinction between the previous and the brand new worth.

According to the National Economic Development Authority (NEDA), had the federal government opted to not decontrol, OPSF obligation would have ballooned to at the very least P8.three billion in 1998. The P8.three billion is equal to the development of greater than four,500 kilometers of provincial roads, 51,000 deep wells of potable water, 25,000 faculty homes, or free rice for 20% of the poorest Filipinos (Bernales 1998)

The Supreme Court in 1998 dominated in favor of the constitutionality of the Downstream Oil Industry Deregulation Act of 1998. Since then, it has been the coverage of the next administrations to decontrol the business. DOE, DTI, DENR, DOST are businesses mandated to function the monitoring-arm of the federal government.

Is The Policy Working?

The reply is clearly “No.” IBON Foundation reported that the Oil Deregulation Law has additional strengthened the monopoly of the large oil corporations as automated oil worth hikes are allowed. Consequently, different oil corporations took benefit of the coverage, mountaineering pump costs of all petroleum merchandise by round 535% because the Oil Deregulation Law was first carried out in April 1996 (Bicol Today 2007). The coverage can also be unable to unravel or, at the least, mitigate the consequences of worldwide oil disaster.

III. THINKING ALOUD

A. Repeating The Process

a.1 Problem Definition/Structuring

It has been acknowledged that the issue with oil is way from over as deregulation coverage fails to satisfy its objective to foster a very aggressive market and affordable oil costs. The present president herself, Gloria Macapagal Arroyo, acknowledges the truth that the oil disaster is threatening to erode the very fiber of the Philippine society.

Unlike in 1998, the disaster in the present day appears to be extra irreparable because the United States is dealing with what many economists describe because the worst financial disaster in its historical past, triggering unstoppable skyrocketing of oil costs and costs of foodstuffs all over the world. As already said, the oil disaster is a worldwide one and needs to be addressed not solely on the nationwide degree, however on the worldwide degree as nicely.

But why is the oil disaster a worldwide disaster? Is it actually past the federal government management?

The Philippines, like many different nations, buys the oil on the spot market. By “spot” is supposed, that one buys the oil at a market solely 24 to 48 hours earlier than one takes bodily (spot) supply, versus shopping for it 12 or extra months prematurely. In impact, the spot market inserted a monetary intermediary into the oil patch revenue stream.

Today, the oil worth is essentially set within the two futures markets: London-based International Petroleum Exchange (IPE) and the New York Mercantile Exchange (NYMEX). Here, merchants or buyers purchase or promote sure commodities like oil at a sure date sooner or later, at a specified worth. Basically, merchants spend money on the futures market by shopping for futures contracts referred to as “paper oil” or just paper declare towards oil. The very objective of shopping for oil is to not look forward to the precise supply of the bodily oil sooner or later, however to promote the paper oil to a different dealer at a better worth. That’s how buyers interact in widespread hypothesis; and it’s turning into a viscous cycle. Almost all nations, together with the Philippines, purchase the oil on the spot market the place the worth is already at its peak.

In a yr 2000 research, Executive Intelligence Review (EIR) confirmed that for each 570 “paper barrels of oil”-that is futures contracts overlaying 570 barrels-traded annually, there was just one underlying bodily barrel of oil. The 570 paper oil contracts pull the worth of the underlying barrel of oil, manipulating the oil worth. If the speculators guess lengthy-that the worth will rise-the mountain of bets pulls up the underlying worth (Valdes 2005).

This solely disproves the favored assumption that oil worth hike has one thing to do with the “law of supply and demand.” In reality, as a lot as 60% of immediately’s crude oil worth is pure hypothesis pushed by giant dealer banks and hedge funds. It has nothing to do with the handy myths of Peak Oil. It has to do with management of oil and its worth (Engdahl 2008).

In its current assertion, IBON Foundation cited a research carried out by the U.S. Senate Permanent Subcommittee on Investigations, which revealed that 30 % or extra of the prevailing crude oil value is pushed solely by hypothesis. IBON additional cited that hypothesis provides about $35 to a barrel of crude oil (Martinez 2008).

a.2 Developing Alternative

In the face of the alarming oil worth hike that threatens the survival of atypical Filipino individuals, various stakeholders name for various options: 1) modification of the Oil Deregulation Law, 2) scrap/repeal the law, three) removing of 12% vat on oil, four) search various sources of power, and 5) interact in nation-to-nation oil settlement.

a.three Options Analysis

1. Amendment of the Deregulation Law

As the general public continues to harm from surging oil costs, many coverage makers name to re-look at the Downstream Oil Industry Deregulation Act of 1998. One of whom, is Ilocos Sur Rep. Eric Singson who has sought a number of amendments within the stated law to make sure transparency within the pricing of oil merchandise and encourage larger competitors within the retail business, which has been underneath the affect of big oil corporations. He cited the necessity to amend Sections 14 and 15 of RA 8479 to strengthen the powers of the Department of Energy (DOE) so it may possibly successfully perform its mandate to tell and shield the general public from illicit practices within the oil business and to offer extra monetary help for the institution and operation of gasoline stations, which can encourage funding and truthful competitors (Malacanang 2005).

2. Scrap/Repeal the Oil Deregulation Law

To many, amending the law shouldn’t be sufficient to rectify the skyrocketing costs of oil and oil-based mostly merchandise; they demand for the repeal, as an alternative. A lawmaker from the Lower House, Cagayan de Oro City Rep. Rufus Rodriguez filed House Bill 4262 aiming to repeal Republic Act No. 8479, arguing that as an alternative of fostering a aggressive market, the law has solely strengthened the oil cartel within the nation and introduced the oil costs up. The invoice additionally seeks to re-set up the Oil Price Stabilization Fund. He articulated that dominant oil corporations nonetheless dictate the worth as a result of even new oil business gamers get their provide from the giants (Sisante 2008).

Militant teams and different non-authorities organizations have staged rallies and strikes everywhere in the nation in opposition of the deregulation coverage. Kilusang Mayo Uno (KMU), one of many nation’s outstanding labor teams, contested that cartelization nonetheless exists amidst deregulation. In its current assertion, KMU articulated that with current Dubai oil costs pegged at $97 per barrel (as of third week of September), native worth of diesel is at P49/liter; whereas when Dubai crude was at $97/liter on Nov. 6, 2007, diesel within the Philippines was bought solely at P37.95/liter, or P11.05/liter decrease than the current charges (GMANews.TV 2008).

three. Removal of 12% VAT on oil

Senator Mar Roxas stated that authorities should heed calls to take away the 12% worth-added tax (VAT) on oil and oil merchandise as costs proceed to go up regardless of the decreasing of oil costs on the planet market. Roxas had filed Senate Bill No. 1962. However, in her eighth State of the Nation Address (SONA), President Arroyo, said that it is going to be the poor who will endure probably the most from the removing of VAT on oil and electrical energy as this can imply the lack of P80 billion in packages being funded by her tax reform (Arroyo 2008).

four. Alternative sources of power.

While many have engaged themselves within the lengthy-operating debate about modification vs. repeal of the law, quite a lot of stakeholders argue that Philippine authorities should, as an alternative, give attention to various sources of power to rectify the heavy dependence on imported oil. Senator Juan Miguel Zubiri, now thought-about “Father of the Philippine Biofuels Bill,” has hyped biofuel because the miracle product which may decrease oil costs. But increasingly more scientists are frightened that specializing in biofuels might jeopardize meals manufacturing.

The Philippine LaRouche Society, an more and more rising assume tank group within the nation, says that biofuel advocacy is a dropping proposition because it competes with meals manufacturing for human consumption. The group calls, as an alternative, for the revival of the Bataan Nuclear Power Plant (BNPP) as quickly as potential to offer the inhabitants with an affordable, dependable, and steady supply of energy to subsequently free the individuals from dependence on oil. The group additional articulates that since that may require big monetary necessities, the Philippine authorities should, subsequently, declare a moratorium on overseas debt funds-since a lot of that are onerous and merely product of “bankers arithmetic” (Billington 2005).

5. Country-to-nation oil settlement

The Philippine LaRouche Society has lengthy been proposing to the federal government to provoke quick steps to determine bilateral contract agreements with oil-producing nations of not lower than 12 months’ authorities scheduled deliveries at affordable, fastened costs. Government may also enter into commodity-swap agreements with oil-producing nations.

As a member of the United Nations and different intergovernmental associations like APEC and WTO, the Philippine authorities ought to be a part of the rising worldwide name for a good and trustworthy oil buying and selling by de-itemizing oil as a commodity traded within the futures market.

a.four Deciding the Best and Most Feasible Option

It have to be recognized to all of the Filipino folks that oil deregulation, as a coverage, has did not foster a very aggressive market in the direction of truthful costs and sufficient, steady provide of environmentally-clear and top quality petroleum merchandise. Proposed answer # 2 (scrap/repeal the Oil Deregulation Law) is subsequently a greater choice. But repealing the Deregulation Law just isn’t the last word reply to the rise in oil costs. Even if the law is repealed, the Philippines will nonetheless be subjected to the identical elements-an increase in oil costs within the international market.

Proposed answer # 5 (nation-to-nation oil settlement) can tackle the difficulty of the oil disaster on the worldwide degree. How concerning the efforts to unravel the disaster on the nationwide degree?

The Philippine authorities should revive the Bataan Nuclear Power Plant to offer the inhabitants with an affordable, dependable, and steady supply of energy to subsequently free the individuals from dependence on oil. As proposed, authorities should direct sufficient funds, as an alternative for debt servicing, in the direction of the revival and improve of BNPP. Removal of the complete E-VAT, not solely on oil, should even be considered to ease the ache of the Filipino individuals. By moratorium, authorities does not need to extract a pound of flesh out of each Filipino to have the means to fund its packages.

B. Why seemingly “better” choices usually are not adopted? The Peculiarities of the Philippine Policy System

From the standpoint of the current administration, amending RA 8479 appears to be troublesome to undertake as a result of re-regulating the oil business would imply subsidizing oil costs-one thing like OPSF. To many, this doesn’t work in an period of rising crude costs as a result of it will entail authorities assets. This is the place debt moratorium is available in as an efficient fiscal technique. But moratorium, to many skeptics, is unwise as a result of they worry the blackmail or retaliation of the multinational collectors. Our leaders should find out how then President Nestor Kirchner of Argentina defied the predatory monetary establishments, averring that “There’s life after the IMF.”

On the opposite hand, many leaders deem nation-to-nation oil settlement inconceivable to implement as the enormous oil corporations have nonetheless robust affect on the coverage-making course of within the nation. On the a part of the oil corporations, it is going to be an enormous loss if authorities will assert its energy to have a bilateral settlement with any of the oil-producing nation. Also, many leaders think about the Philippines as a small nation with no voice within the worldwide meeting. But it’s a matter of getting “big balls,” to place it in a figurative language. After all, they’re the leaders and are mandated by the Constitution to guard and promote the overall welfare.

Another peculiarity of the Philippine coverage system is the damaging notion in the direction of nuclear power. BNPP has been stigmatized as being environmentally harmful and as being related to “corruption.” The reality of the matter is, the know-how has already advanced and been modernized. The Philippine authorities spent $2.three billion to construct BNPP with out producing a kilowatt of electrical energy. It is excessive time to revisit the previous technique to lastly free the nation from dependence on imported oil.

It is value mentioning that the International Atomic Energy Agency inspected the facility plant in Bataan early this yr and reported that this could possibly be rehabilitated, in full compliance with excessive worldwide security surroundings requirements, in at the least 5 years at a price of $800 million (Burgonio 2008). The Philippine LaRouche Society emphasizes the significance of declaring debt moratorium as a fiscal technique to start out the rehabilitation. The group argues that the Philippines is servicing the debt over US $10 billion per yr, which is greater than sufficient to start out the complete operation of BNPP (PLS 2008).

IV. INTEGRATION AND RECOMMENDATIONS: TOWARDS A BETTER PUBLIC POLICY SYSTEM

With the popularity that oil disaster is a worldwide oil disaster, affecting the lives of all inhabitants of our planet, it’s incumbent, subsequently, upon the management of the Philippines to right away take the next steps:

A) To instantly repeal the oil deregulation law, for the federal government to say its sovereign energy to have management over the oil business and financial system as an entire.

B) To suggest at any worldwide summit or meeting that oil, being a commodity, essential to the continuation of human life, be de-listed as a commodity traded within the futures market, thereby escaping the clutches of unscrupulous individuals and speculative monetary establishments.

C) To provoke speedy steps to determine bilateral contract agreements with petroleum-producing nations of not lower than 12 months’ authorities scheduled deliveries at affordable, fastened costs.

D) To design a complete power improvement program, resembling nuclear energy plant being probably the most value-environment friendly supply of power so far, for the aim of liberating our nation from full dependence on imported power sources. To this finish, moratorium on overseas debt have to be taken under consideration as a paramount fiscal technique.

The disaster, which we now face as a nation, requires understanding of the issues by way of diligent research and concomitant braveness to do what is true for the good thing about the current and future Filipino generations.

Source by Marlou Mumar

The post Philippine Oil Deregulation – A Policy Research Analysis appeared first on Utah Business Lawyer.

from http://www.utbusinesslawyer.com/philippine-oil-deregulation-a-policy-research-analysis/

from Utah Business Lawyer - Home http://utahbusinesslawyer1.weebly.com/home/philippine-oil-deregulation-a-policy-research-analysis

0 notes