#socially responsible investing

Explore tagged Tumblr posts

Text

Our capital preservation investment strategies, wealth creation, & socially responsible investing gives you clarity. Invest in hospitality with confidence.

#hospitality investment management#patelcapital philosophy#capital preservation investments#capital preservation investment strategies#investment for wealth creation#socially responsible investing

0 notes

Text

The Performance of Socially Responsible Investing: A Review

“Our research indicates that SRI do not result in worse returns and seem to perform similarly to standard assets, but with less volatility, particularly during times of crisis.” The Performance of Socially Responsible Investing: A Review, by Lisa Gianmoena & Luca Spataro, First Online: 24 September 2023, Part of the Palgrave Studies in Impact Finance book series (SIF).

View On WordPress

0 notes

Text

Unlocking the Potential of ESG Data Analytics: Fostering Responsible Investing Practices

Delve into the intricate realm of ESG (Environmental, Social, and Governance) data analytics and its pivotal role in revolutionizing responsible investing. This comprehensive exploration illuminates how data-driven insights are reshaping the landscape of sustainable finance, equipping investors with the tools and knowledge to make conscientious and impactful decisions for a more sustainable global economy.

1 note

·

View note

Text

Unlocking the Value of ESG Data: How Analytics Drives Responsible Investing

The importance of environmental, social, and governance data cannot be underscored in the present dynamic industry. Eco-friendly, societal, and management concerns are becoming the focus. The era of evaluating achievement solely through the fiscal soundness of a company is a thing of the past. Increasingly individuals are being mindful of the effect of businesses on nature and the world. Also, people focused on the way companies treat their personnel and how they oversee their conduct ethically.

The rise of Environmental, Social, and Governance data as a beneficial source has empowered organizations to enhance their ability to observe, communicate, and enhance their accountable and green activities. Consequently, companies now have the capacity to make decisions with greater information and implement strategies that support environmentally friendly approaches.

ESG Data has developed into a guide that shows the path for modern companies to enhance resilience, intention-driven, and inclusiveness. This clarifies the reason it has turned into a key ingredient in the business world in the contemporary era.

The elements of ESG in business processes can be improved in comprehension through the use of ESG data. In this manner, the sustainability of a company, ethical business practices, and the generation of sustainable value might be judged by stockholders, involved parties, and ESG assessment agencies. Nevertheless, it's crucial to observe that such assessments might differ based on the particular standards and methods implemented by all involved.

Investors can improve their decision-making, mitigate risk, and locate firms that have similar values and devotion to sustainability. If they consider ESG data in mind, it has the potential to assist them in accomplishing the desired objectives. Consequently, it is expected that numerous financial institutions are pulling funds from corporations that neglect ESG guidelines.

Importance of ESG Data in Responsible Investing

ESG functions as a valuation technique that takes into account environmental, social, and governance issues. An ESG assessment identifies a company's risks and practices based on environmental, social, and governance criteria.

As a result of ESG frameworks, sustainable investing can help individuals or organizations determine whether a company's values are aligned with their own and analyze the ultimate worth of companies.

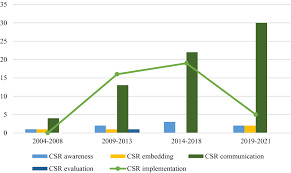

Over the past two years, several governmental bodies have enacted new laws requiring corporations to report ESG metrics, and many countries have updated their environmental and social disclosure regulations.

Companies are thus facing pressure from investors to enhance their transparency and performance on the ESG data and analytics front. Yet, most businesses are not able to meet these requirements. They do not have automated solutions for across-the-board compliance tracking and management.

Understanding ESG Analytics and Its Impact on Investment Decisions

Ecological factors, as part of ESG analysis, examine the impact of a company has an effect on the surroundings. The foundation examines the carbon footprint, waste minimization, and control, which involve sustainability policies and actions. The influence of the company on the public is the theme of social examination. The examination includes evaluating the firm's workforce policies and processes. Moreover, it encompasses assessing its human rights performance, public relations, and initiatives promoting diversity and inclusion.

An analysis of the company's governance reviews the company's administration and the processes of making decisions. This consists of operational visibility, the performance of its board of directors, and broader corporate culture. This element of Environmental, Social, and Governance analysis is essential for examining the business's prosperity in the long run and steadiness.

Investors utilize Environmental, Social, and Governance analysis to find businesses that uphold sustainability and responsible business practices. Such an examination can help investors in making better-informed investment picks. This can additionally assist individuals in aligning their belongings according to their principles and pursuits. Environmental, social, and governance analysis can also assist companies to spot areas for improvement and keep tabs on their development.

Sustainability analysis has become more significant in recent years as stakeholders have become more concerned about the corporate influence on society and the environment. Consequently, organizations are currently dealing with more intense stress to provide transparency on their ESG initiatives and showcase their dedication to sustainable practices. Consequently, numerous companies started to consider environmental, social, and governance analysis seriously. The company is adopting measures and frameworks to boost its ESG outcomes.

Environmental, Social, and Governance analysis presents a thorough and diverse approach to analyzing a company’s effect on the ecological system, the community, and its interested parties. This offers a complete understanding of a company's sustainability initiatives and assists investors in making informed selections.

Sustainable investment analysis will become more and more important for financial backers, corporations, and related individuals as the relevance of sustainable practices and business ethics develops. With the global gains of a deeper understanding regarding the ecological and societal effects within the corporate sector, the call for it will grow for openness and responsibility.

The Role of Advanced Analytics in ESG Investing Strategies

Sustainable investing has earned significant interest lately among investors, customers, and regulators, growing more concerned regarding the social and environmental effects of corporations. Sustainable investment analysis carefully evaluates the influence of a company among different stakeholders, taking into account the natural surroundings, local communities, and investors.

A major advantage of environmental, social, and governance analysis allows investors to create well-informed investment determinations. Traders can gain a deeper understanding of potential hazards and chances of an individual investment by giving thought to the ESG performance of a corporation. These can offer valuable perspectives regarding the company's ESG practices, supporting investors in making well-informed determinations. As an illustration, organizations with robust ESG practices are frequently regarded as having lower risk and could potentially provide greater long-term investment returns.

Moreover, there is a possibility that it also entices more socially responsible potential investors. Yet another crucial advantage of environmental, social, and governance research is that it fosters company ethics and sustainable practices. Through concentration on the influence an organization possesses within the community as well as the surroundings, Environmental, Social, and Governance research assists organizations in recognising prospects for advancement. Additionally, it allows them to exert themselves to resolve these matters. Thus, it contributes to an environmentally friendly future and guarantees that businesses conduct themselves morally and with responsibility.

Sustainable investing additionally aids businesses in overseeing perception risk. For instance, organizations that are identified as having social and environmental responsibility maintain a strong image. These can result in greater brand retention of loyal customers and satisfaction and overall achievement in the industry. In conclusion, Sustainability analysis has the potential to assist businesses in improving the extent of honesty and social consciousness.

By offering investors and interested parties a comprehensive view of the ESG performance of a company, ESG assessment boosts the trust of the corporate world that the firm is functioning towards the greatest advantages of each interested party. Ultimately, this causes enhanced decision-making and business practices that are environmentally friendly.

Also Read - Driving Sustainable Innovations: AI for ESG Data Challenges.

Conclusion

ESG data has become an essential tool in the modern economy. It enables companies to measure their sustainability efforts, manage risks and meet stakeholder expectations. The importance of ESG data lies in its ability to drive responsible business practices, improve decision-making and drive long-term value creation.

However, the lack of standardized ESG data remains a major challenge that needs to be addressed to ensure accurate and comparable valuations. As ESG reporting frameworks evolve and regulatory initiatives such as the CSRD gain more attention, the future will see more consistent, transparent, and credible reporting that promotes a sustainable and responsible corporate environment. High ESG data is promised.

0 notes

Text

ESG Investing Trends: What to Watch in the Market | HugeCount

Investing based on Environmental, Social, and Governance (ESG) factors has evolved from being a niche segment to becoming an essential part of the global financial landscape. This shift towards responsible investment practices has its roots in growing public concern over environmental and social issues, and the widespread recognition that corporations play a significant role in […]

Source: https://hugecount.com/uncategorized/esg-investing-trends-what-to-watch-in-the-market/

#environmental social and governance#environmental social governance#ESG factor#ESG in investing#ESG investing#Patel Capital#Patel hotel group#socially responsible investing#sustainable investing#Uncategorized

0 notes

Text

#impact investing#investment platform Singapore#Social Impact Investing#Socially Responsible Investing#Social Impact Bonds#Social entrepreneurship#Social entrepreneurship investing#Climate action impact investing#ESG investing for impact#Women-led social enterprises

0 notes

Note

Genuine question. Do you like or dislike Rob? Your posts tend to imply both feelings hahaha

Do I like Rob?

#i think this is a funny response so im leaving the text at that#but in all seriousness#my feelings and opinions toward and about Rob are complex#clearly#and this video does well encapsulate that lmfaooo#but like. i think he's done some irreparable things and i think he still currently holds some. less than stellar views#and a lot of his investments are.. well.#but he created my favourite thing in the world#and there are things i do admire him for and appreciate he's done/does#at the same time many of those things are still flawed#i.e giving us gay rep but having to be pressured and convinced to actually make it concretely textual#bc he just. doesnt understand why thats important#also i have a weird like .. more social than parasocial relationship with him#which ill admit makes my feelings even more complex and a little biased toward him#hes a weirdly captivating person irl like he feels very genuine theres something about talking to him#also he keeps giving me things i ask for so... ya know#but then i hear things hes done or said and wanna bash him like a whack a mole#so yes and no but yes but also no#which basically just means i get to have fun with it and talk about how hes a cuck with no care#rob mcelhenney#ask

49 notes

·

View notes

Text

>mfw i realize the investors of the royal trading company i hired myself out to as land-marine security have bet their entire livelihoods and dreams for the future on a doomed project and i just could not care less about any of them.

Pocahontas (1995)

#'''those boys'''' :3#king bitch john smith#john smith#disney john smith#disney's pocahontas#disneyedit#pocahontasedit#pocahontas meta#pocahontas#disneygif#pocahontasgif#queso*gif#queso*edit#john 'cunt montague' smith saying some more out of pocket shit about his fellow englishmen#this man. fucking Hates the people he's here with#there's no way he doesn't do more than tolerate them all. he's Constantly pulling anti-social shit like this#even how he indulges thomas reads very much as 'tolerance for the kid' to me#from the settlers' perspective the revelation that Virginia has no gold is Life Ruining News#and john's response is to Laugh. the virginia company is falling apart john. and you're LAUGHING#this is a good time to remember that john's not actually there as a ''settler'' himself#HE'S not personally invested in the company. he's there to protect the investors' interests. for PAY.#he's a hired gun: his job is to make sure nobody dies too badly on this venture#and he's good at his job! he's a damn professional. he doesn't need to LIKE them to give a shit about them all surviving.#hell part of his job is working with and maintaining order among the company for RATCLIFFE#and they HATED each other on SIGHT.#pocahontas (1995)

51 notes

·

View notes

Text

Everybody gets firsts before anybody gets seconds, but for housing. It should be illegal to stock up on a basic human necessity until people can't afford it. There is not a housing shortage in the USA, there is a hoarding problem.

I judge people who own more than they need. I'm sorry, but I do. That's true if you have a vacation home or if it's a rental property. It's true if it's one property or if it's ten. Your "investment" could be someone else's first and only home.

#leftist#liberal#democrat#housing#housing crisis#investment#real estate investing#real estate#real property#investing#socialist#socialism#kind of#responsibility#greed#hoarding#rich get richer#poor get poorer

46 notes

·

View notes

Text

AN OPEN LETTER to THE PRESIDENT & U.S. CONGRESS; STATE GOVERNORS & LEGISLATURES

Act Now: Save Public Transit from Extinction!

2 so far! Help us get to 5 signers!

I am writing to highlight the critical state of public transit in the United States and urge your support increased investment in this essential service. The challenges facing public transit—under-investment, over-reliance on car ownership, and racial disparities—have been exacerbated by the COVID-19 pandemic. It is imperative that we take bold action to address these issues for the benefit of our communities and our future.

Investing in public transit is not merely a matter of convenience; it is a necessity for tackling climate change, advancing equity, supporting essential workers, and fostering economic recovery. The largest source of carbon emissions in the U.S. stems from transportation, and increased investment in public transit can significantly reduce this impact. Furthermore, public transit plays a crucial role in providing equitable access to jobs, schools, and services, especially for those who cannot afford or do not have access to private vehicles.

With over 2.8 million essential workers relying on public transit, our pandemic response and economic recovery hinge on the strength and viability of our transit systems. According to studies, sustained investment in public transportation yields substantial economic returns, with every $1 billion invested annually resulting in approximately $5 billion in additional GDP.

I commend initiatives like the Green New Deal for Transportation and efforts by organizations such as the CHARGE coalition to electrify and expand public transportation. These initiatives are pivotal in shaping a more sustainable and equitable transportation system for all Americans.

Therefore, I urge you to support emergency relief funding for public transit and join the movement to rebuild and improve our public transit system. This is not just an investment in infrastructure; it is an investment in our collective future.

Thank you for your attention to this urgent matter. I look forward to your support in advancing policies that will ensure a robust and accessible public transit system for all.

📱 Text SIGN PZHBAF to 50409

🤯 Liked it? Text FOLLOW IVYPETITIONS to 50409

💘 Q'u lach' shughu deshni da. 🏹 "What I say is true" in Dena'ina Qenaga

#ivypetitions#PZHBAF#resistbot#walkable cities#no cars#public transport#Public Transit#Transportation#Infrastructure#Equity#Climate Change#Essential Workers#Economic Recovery#Green New Deal#Sustainability#Community Access#Environmental Impact#Racial Justice#Urban Mobility#Public Transportation#Advocacy#Investment#Congress#Government#Policy#Legislation#COVID-19 Response#Public Health#Environmental Justice#Social Equity

4 notes

·

View notes

Text

I shouldn't have to say this but I never, ever want anyone to read Challengers and think that the moral is "it's okay to have slaves if you're nice to them"

#to the best of my knowledge no one thinks this#i'm just doing some preemptive damage control#anyway Challengers is fundamentally about two things:#a) exchanging power for responsibility#the more invested one genuinely becomes in another's wellbeing the less invested one becomes in maintaining tight control#and b) interrogating the social idea that children are their parents' property#through the lens of a parent-child relationship in which that is literally and blatantly the case according to the world at large#while also being covertly resisted by those involved in the relationship itself#it is absolutely fucking NOT about the idea that seeing people as property is okay if you treat them well

4 notes

·

View notes

Text

#corporate social responsibility conference#italian investment bank mediobanca#integration#migrants#italian society#italy#employment#labor migration#labor market

0 notes

Text

Exploring the Role of AI in the Evolution of Socially Responsible Investing

“Imagine a future where socially responsible investing (SRI) blends seamlessly with artificial intelligence, creating an unprecedented synergy that pushes boundaries and shatters expectations.” [COMMENTARY] This is a great in-depth assessment of the potential of SRI and AI integration. Exploring the Role of AI in the Evolution of Socially Responsible Investing, by Will Wood, August 30, 2023,…

View On WordPress

0 notes

Text

Unlocking the Value of ESG Data: How Analytics Drives Responsible Investing

In the current market, ESG data has become a very important tool. ESG data is important because it can lead to more responsible business practices, better decisions, and the creation of long-term value.

Read More: https://uk.sganalytics.com/blog/how-analytics-drive-responsible-investing/

1 note

·

View note

Text

Maximizing Your CRM Investment: Tips for Optimal Utilization

In today’s fast-paced business environment, a Customer Relationship Management (CRM) system is essential for organizations aiming to maintain a competitive edge. However, simply investing in a CRM tool is not enough; businesses must also focus on maximizing their CRM investment for optimal utilization. This article delves into actionable tips designed to enhance your CRM usage, streamline…

#best practices for brand management#Branding strategies for small businesses#building brand loyalty#business growth strategies#corporate social responsibility#creating a strong brand identity#CRM#customer relationship management#digital marketing for startups#e-commerce tips for businesses#how to scale your business.#how to start a successful business#importance of social media for businesses#influencer marketing for brands#Investment#Maximizing#Optimal#small business funding options#Tips#top business trends 2024#Utilization

0 notes

Text

The Guide to Effective CSR Collaboration with Marpu Foundation

THE GUIDE TO EFFECTIVE CSR COLLABORATION

WITH MARPU FOUNDATION

In a world grappling with global warming, devastating earthquakes, and relentless climate change, a beacon of hope emerges: the powerful alliance between Marpu Foundation and Corporations. These unlikely partners are joining forces to engineer positive change, breathing life back into a planet teetering on the brink. Through strategic planning and bold execution, they are transforming lives and rewriting the future of our Earth.

WHAT IS CSR AND WHY IT IS NEEDED:

Corporate Social Responsibility (CSR) is more than just philanthropy. It's a powerful partnership between businesses and NGOs, a commitment to ethical and sustainable practices. By embracing CSR, corporations can transcend profit-driven goals. They can become agents of positive change, combating poverty, eradicating hunger, and safeguarding our planet. This isn't just about doing good; it's about crafting a future where businesses thrive alongside a healthy society and a thriving environment

IMPLEMENTATION AND GOALS:

CSR champions diversity within the workplace, tackles pressing issues like plastic pollution, and empowers underprivileged students through education. By driving innovation of CSR with the Marpu foundation catalyze a global shift towards a more conscious and equitable world. Aligning CSR initiatives with the specific goals of Marpu Foundation is crucial for maximizing impact. Through smart, collaborative efforts, we can achieve measurable outcomes and inspire positive change across society. CSR collaborations with the Marpu Foundation can focus on education, healthcare, environmental sustainability, and community development. This includes sponsoring scholarships, improving educational infrastructure, and developing employability skills. Healthcare initiatives can focus on access to quality care, hygiene, and mental health support. Environmental initiatives may involve conservation, sustainable agriculture, and reducing environmental impact. Community development can empower women, support rural areas, and improve disaster preparedness. Employee volunteering, including skill-based contributions, is crucial. Successful implementation requires aligning with the Marpu Foundation's mission, measuring impact, building long-term partnerships, and effectively communicating successes.

BUILDING RELATIONSHIP WITH MARPU FOUNDATION:

Successful CSR- Marpu foundation collaborations thrive on transparent and honest dialogue. Regular communication fosters a deep understanding of shared goals and challenges. Open and frequent meetings allow for dynamic adjustments and course corrections. Ultimately, a foundation of mutual respect and trust is paramount. This fosters a collaborative spirit where both partners feel valued and empowered to achieve impactful outcomes.

LEVERAGING THE EVALUATION AND MONITORING:

Corporations should strategically leverage their unique skills and resources to complement the Marpu Foundation. Actively engaging employees in volunteering and decision-making processes fosters a sense of ownership. Encourage joint innovation to develop creative and impactful solutions. For long-term sustainability, plan for the future and invest in the Marpu foundation. A well-defined exit strategy ensures that Marpu foundation can continue the work independently. Finally, celebrate successes transparently with all stakeholders. Recognize the contributions of both partners and leverage the collaboration for positive public relations and brand enhancement.

CONCLUSION:

The success of our partnership between CSR and Marpu Foundation highlights the importance of strong collaborations between businesses and NGOs. By working together, we have achieved healthy well being for more than 100 families and built a stronger community. This successful model can serve as a blueprint for future partnerships that address critical social and environmental issues.

#sustainable development goals#csr#ngo partnerships#corporate responsibility#social impact#challenges#investing for future growth#decade of action#partners for positive change#together for SDGs#digital transformation#marpu foundation

1 note

·

View note