#silber & gold

Explore tagged Tumblr posts

Text

Ich bin immer noch der Meinung,[...] dass Schweigen nicht wirklich Gold ist, sondern alles verkompliziert.

Der Weg ist das Ziel - Dame

#der Weg ist das Ziel#Dame#Meinung#schweigen#reden#silber#gold#kommunikation#kompliziert#liebe#beziehung#hiphop#rap#deutschrap#zitat#wahrheit#lügen#verheimlichen#verschweigen

47 notes

·

View notes

Text

Sie sagen, man solle darüber reden, aber wozu? Es wird sich nichts ändern.

- eigenes

83 notes

·

View notes

Text

Ich möchte mich kurz vorstellen. Ich bin ein ganz normaler Mensch, der wie jeder andere irgendwann versucht hat sich nebenbei etwas Geld zu verdienen. Und der wunsch vom etwas freieren Leben war geboren. Die Geschichte begann am 18. Januar 2018 .... wir haben jetzt den 13. Februar 2024 und es hat sehr lange gedauert bis man das eigentliche Wissen hat, was man aber auch braucht um an der CFD Börse bestehen zu können. Das war der Anfang von meiner Geschichte und Morgen gehts dann weiter....

3 notes

·

View notes

Text

So, die nächste Band für das Woodbunge-Festival ist angekündigt. Dass man sich in seiner Freizeit auch noch ehrenamtlich um sowas kümmert... naja, so ist das halt bei DIY-Festivals: JedeR muss mit anpacken, sonst wird's nichts. Jetzt gleich weiter in den Proberaum. Sieht so aus, als würde ich heute leider nicht mehr zum Zocken kommen. 😕 Aber das Wochenende ist ja noch nicht vorbei.

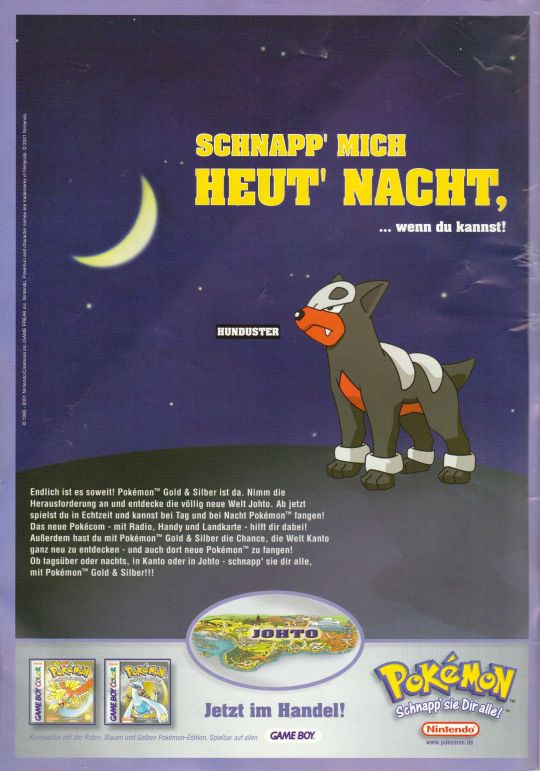

Ich lasse euch mal einen Beitrag zum Wochenende da. Zum Beispiel diese Werbung hier für Pokémon Gold und Silber. Ich persönlich habe Pokémon Gold und spiele es auch heute noch ab und an.

(Bildquelle: N-Zone - Magazin, Ausgabe: Mai 2001)

#pokemon#pokémon#gold#silber#silver#werbung#ad#advertisement#advertising#anzige#reklame#announce#n-zone#old magazines#magazine#magazin#zeitschrift#scan#deutsch#german#retrogaming#retro#retropolitan#retro gaming#gaming#video game#2001#2000's#2000s#2000er

2 notes

·

View notes

Text

4 notes

·

View notes

Text

Auswirkungen der Inflation auf den Goldpreis: Erkenntnisse für deutsche Anleger

Inflation ist ein wirtschaftliches Phänomen, das jeden Aspekt der Finanzmärkte beeinflusst, und ihr Zusammenhang mit dem Goldpreis ist seit langem ein Thema, das Anleger interessiert. Für deutsche Anleger, die ihr Vermögen schützen möchten, ist es von entscheidender Bedeutung zu verstehen, wie sich die Inflation auf den Goldpreis auswirkt. Dieser Artikel untersucht die Dynamik zwischen Inflation und Gold und wie deutsche Anleger diese Beziehung nutzen können, um fundierte Entscheidungen zu treffen.

Was ist Inflation?

Inflation bezeichnet den allgemeinen Anstieg der Preise für Waren und Dienstleistungen im Laufe der Zeit, der die Kaufkraft des Geldes untergräbt. Steigt die Inflation beispielsweise um 5 %, kann ein Kauf, den Sie heute für 100 Euro kaufen, in einem Jahr 105 Euro kosten. Während eine moderate Inflation in einer wachsenden Wirtschaft normal ist, kann eine übermäßige Inflation zu finanzieller Instabilität führen.

Gold als Inflationsschutz

Gold gilt seit jeher als verlässlicher Inflationsschutz. Das bedeutet, dass Gold seinen Wert oft behält oder sogar steigert, wenn der Wert von Papiergeld aufgrund steigender Preise sinkt. Die wichtigsten Gründe dafür sind:

1. Innerer Wert : Im Gegensatz zu Fiat-Währungen hat Gold einen inneren Wert und unterliegt nicht der Abwertung durch die Zentralbanken.

2. Begrenztes Angebot : Die begrenzte Verfügbarkeit von Gold stellt sicher, dass sein Wert im Laufe der Zeit nicht verwässert wird, im Gegensatz zu Währungen, die gedruckt werden können.

3. Globale Nachfrage : Die weltweite Attraktivität von Gold als Schmuck- , Anlage- und Industrieprodukt stützt seine Nachfrage.

Der historische Zusammenhang zwischen Inflation und Goldpreis

Im Laufe der Jahre hat sich gezeigt, dass der Goldpreis positiv mit der Inflation korreliert. Wenn die Inflation steigt, strömen Anleger oft zu Gold als Wertaufbewahrungsmittel und treiben so den Preis in die Höhe. Bemerkenswerte Beispiele sind:

· Inflationskrise der 1970er Jahre : Während dieser Zeit hoher Inflation stiegen die Goldpreise steil an, da die Anleger Zuflucht vor dem Wertverlust der Währungen suchten.

· Finanzkrise 2008 : Obwohl es sich in erster Linie um eine Finanzkrise handelte, trieben die darauf folgenden Inflationsängste den Goldpreis auf neue Höchststände.

· Aktuelle Trends : In den Jahren 2020 und 2021 trugen Inflationsängste zu einem Anstieg des Goldpreises bei, da die Zentralbanken den Volkswirtschaften Liquidität zuführten.

Faktoren, die den Goldpreis über die Inflation hinaus beeinflussen

Obwohl die Inflation ein wesentlicher Treiber ist, beeinflussen auch andere Faktoren den Goldpreis:

· Zinssätze : Niedrige Zinssätze reduzieren die Opportunitätskosten des Goldbesitzes und machen es in Inflationszeiten attraktiver.

· Währungsstärke : Der Wert des Euro oder des US-Dollars beeinflusst den Goldpreis. Eine schwächere Währung steigert oft die Attraktivität von Gold.

· Geopolitische Unsicherheit : Politische Instabilität kann dazu führen, dass Anleger Gold als sichere Anlage betrachten.

Einblicke für deutsche Anleger

Für deutsche Anleger bietet das Zusammenspiel von Inflation und Goldpreis wertvolle Chancen:

1. Diversifizieren Sie Ihr Portfolio : Investieren Sie einen Teil Ihrer Anlagen in Gold, um sich gegen Inflation und Währungsabwertung abzusichern.

2. Inflationsindikatoren überwachen : Behalten Sie die Inflationsraten in Deutschland, die Politik der Europäischen Zentralbank und die weltweiten Wirtschaftstrends im Auge.

3. Erwägen Sie Goldprodukte : Zu den Optionen gehören physisches Gold (Münzen oder Barren), goldgedeckte börsengehandelte Fonds (ETFs) oder Bergbauaktien.

4. Langfristige Perspektive : Der Wert von Gold kann kurzfristig schwanken, aber es hat sich im Laufe der Zeit als zuverlässiger Wertspeicher erwiesen.

Der aktuelle Ausblick für Inflation und Gold

Ab 2025 bleibt die Inflation ein Problem für die Volkswirtschaften weltweit, darunter auch Deutschland. Faktoren wie steigende Energiekosten, Lieferkettenunterbrechungen und eine expansive Geldpolitik könnten zu anhaltendem Inflationsdruck beitragen. In einem solchen Umfeld wird die Rolle von Gold als Absicherung noch deutlicher.

Die Inflation stellt eine direkte Bedrohung für die Kaufkraft des Geldes dar, weshalb Gold für deutsche Anleger ein unverzichtbarer Vermögenswert ist. Wenn Anleger die Beziehung zwischen Inflation und Goldpreis verstehen, können sie strategische Entscheidungen treffen, um ihr Vermögen zu schützen und zu vermehren. Egal, ob Sie ein Neuling oder ein erfahrener Anleger sind, die bewährte Widerstandsfähigkeit von Gold macht es zu einer wertvollen Ergänzung für jedes Portfolio.

Möchten Sie Ihre Investitionen gegen Inflation absichern? Entdecken Sie erstklassige Goldprodukte und Expertenrat bei GoldInvest Edelmetalle .

#gold online kaufen#gold invest berlin#edelmetalle kaufen#gold invest edelmetalle#edelmetalle verkaufen#gold invest company berlin#kaufen gold#kaufen silber#verkaufen gold#verkaufen silber

0 notes

Text

Kunst und Portrait kombiniert auf eine Holzplatte 110x 80x0,5 mit Acryl gemalt

View On WordPress

#110x80x0#5#Acryl#bild#bkack#blau#Blue#Braun#bunt#Clor#Color#gold#Gold klitzer#grau#Green#Holzplatte#kunst#malt#Orange#pink#Portraits#schwarz#silber#weiß#Yello

0 notes

Text

Schmuck(e) Auktionen: München am 04. & 05.12.2024

Noch rechtzeitig als Überraschung für den Nikolausstiefel kann man im Auktionshaus Neumeister am 4. Dezember überwiegend historischen Schmuck aus dem 19.Jahrhundert und im Auktionshaus Quittenbaum am 5.Dezember ausgesuchte Autorenschmuckstücke ersteigern. Da klopft doch das Herz höher! Anhänger mit gro��em Amethyst, Rubinen, Saphiren, Perlen und Emaille, wahrscheinlich Frankreich, um 1870-1880 |…

#Auktion#Autorenschmuck#Claude Lalanne#edelsteine#feine Juwelen#Georg Dobler#Gerd Rothmann#Gold#Hermann Jünger#historischer Schmuck#Manfred Bischoff#München#Neumeister#Parure#Peter Chang#Peter Scubic#Philippe Sajet#Quittenbaum#Robert Smit#Schmuck#Silber#Versteigerung#Yves Saint Laurent

0 notes

Link

Am 16.11.2024 fand in Fügen die 24. Atemschutz Leistungsprüfung statt, bei der 29 Trupps ihr Wissen und Können unter Beweis stellten.

#122#österreich#austria#tirol#fügen#schwaz#atemschutz#gold#silber#bronze#bewerb#übung#test#firefighter#feuerwehrmann#feuerwehrfrau#bomberos#brandweer

0 notes

Text

Hi everyone please look at my and my best friends dnd characters flirting fighting

I hate doing art but I love them

#fluchen ist silber schmeicheln ist gold#Henry hazard#Henry Ruz Kriid#Lancelot von Napoli#Sorry Bill that I'm posting this here instead of making a toyhouse account#Dragonborn

1 note

·

View note

Text

Olympische Spiele Paris 2024

Abpfiff in Paris, aber Frankreich hat sich selbst übertroffen und der gallische Hahn hat nach Monaten der fliegenden Tomaten und härteren Geschossen endlich wieder gut krähen!

Spektakuläre Bilder und die grandiose Kulisse dieser Stadt bleiben in Erinnerung.

Krisen und Kriege schienen mehr in den Hintergrund getreten zu sein, um sich jetzt wieder nach vorne zu drängeln …

#laurenzEkirchner#kirchnerart#Olympia#Paris#2024#olympischeSpiele#Olympiade#Baguette#Olympiasieger#Frankreich#Gold#Silber#Bronze#olympischeFlamme

0 notes

Text

we lost out on #1 most unfriendly country???? TO KUWAIT????

#people are NOT happy about the silber medal#“im gonna make sure we get gold bext year on my own”#yapping on main

0 notes

Text

Anleger optimistisch für Gold und Silber

Der Goldpreis zeigte im Mai eine volatile Entwicklung und erreichte am 20. Mai einen Höchststand von 2.449 US-Dollar pro Unze, bevor er gegen Ende des Monats auf 2.325 US-Dollar fiel. Spectrums Stimmungsindex für europäische Privatanleger zeigt Aufwärtstrend bei Gold und Silber Fallende Goldpreise bieten mehr Kaufgelegenheiten Seitdem Spectrum im Dezember 2023 Silber als Basiswert eingeführt…

View On WordPress

#Anleger#Gold#Michael Hall#Privatanleger#SERIX-Wert#Silber#Spectrum Markets#[1] Quelle: tradingview.com [2] Quelle: tradingview.com

0 notes

Photo

DER FRÜHLING KOMMT.

#floral#gold#silber#blume#handarbeit#goldschmied#style#individuell#geschenk#muttertag#liebesbeweis#design#handwerk#besonders#einzigartig#berlin#schmuck

0 notes

Text

Königliches geflügeltes Skarabäus-Armband aus Silber und Gold.

Basierend auf dem altägyptischen Symbol des geflügelten Skarabäus.

Absicht des Schmuckstücks: Antikes Symbol, das die Quelle des Lebens, der Schöpfung und der Existenz darstellt, aus der alle Dinge hervorgehen.

0 notes

Text

Lustig, lustig, traleralera!-Bald ist Nikolaus Abend da….

Vermutlich waren die Zeiten schon einmal lustiger. Rückblickend alleine auf dieses Jahr wurde offensichtlich, wie sinnvoll und wertsteigernd die Investition in Edelmetalle ist.

Überlegen Sie bewusst, was Sie heute und heuer zu Weihnahten schenken möchten. Wir freuen uns auf Ihren Besuch!

0 notes