#shrank Douglas

Explore tagged Tumblr posts

Text

Did we forget about Shrank Douglas

This guy dated both Danielle Barkstock and Ostentatia Wallace

Also as a joke on the Seven Instagram take over which you can still find where Aabria Iyengar jokes that Antiope Jones kissed Shrank

He is in AV club and seems to be pretty smart as well as doesn't put up with people being rude to him (*cough cough Fabian *cough cough)

#fantasy high#fantasy high junior year#dimension 20#fantasy high sophomore year#kristen applebees#adaine abernant#fabian seacaster#gorgug thistlespring#riz gukgak#fig feath#shrank Douglas#antiope jones#the seven d20#the seven#ostentatia wallace#danielle barkstock#shrank douglas

150 notes

·

View notes

Note

Hello :D

I wanted to know how do you decide the kids each sim has because I struggle to regulate my save’s population. I saw some people using dice to decide it and others simply have them by the decade they’re on but I still wanted to know your method!

Personally, I don’t ‘plan’ how many kids each generation will have too much but rather have in mind how many I think they would have had in that particular era of time and see how it works out.

If this is interesting for you, here is what informed each generation…

1890: large families were common, especially for working class folk, so I knew I would plan for at least 4 children. When I decided to go for a 5, it was twins.

1900: 2 children, as Ernie was aiming for a more upper class lifestyle. But I knew that Ernie would adopt his sisters daughter Marigold making it really 3 children.

1910: there was no official heir for this generation but I knew that Primrose and Marigold would each have 1 child. Primrose didn’t get to have anymore as she was widowed, but she helped raise Marigolds son which fulfilled any desire she had for more. Marigold was asexual, she had her son but just never fell pregnant again.

1920: Daisy had 3 children by seperate partners, as a consequence of being a very sexual and impulsive person during a time where there was no contraception.

1930: going back to working class farm roots during the Great Depression I thought the family would have more children again, so I knew there would be 4 at least. Having twins on the 2nd pregnancy meant that this happened quickly.

1940: I had planned for 2 children, one born during the war (Margot) and one born after the war, due to Douglas and Joan’s long time apart serving. However there was an accidental 3rd child anyway (Lewis).

1950: in the Baby Boom it felt natural to have a large family, so 4 was the goal again. However I remained open to 5, which is why Stella was conceived.

1960: when Leo became heir I knew he and Valerie wouldn’t be the big family type, and thanks to contraception they didn’t have to be. They were only meant to have 1 child and then realise they weren’t cut out for it, but had accidental twins.

1970: going back to Hippy roots again I felt Eleanor would have a larger family, with a goal of 3 - I decided later that 4 felt more fitting, it just took a long time for her to fall pregnant with Summer.

1980: 2 children was always the goal, as family sizes shrank towards the end of the century and April was a working woman. When River remarried I knew he would have a later-in-life child with his new wife.

1990: playing with early IVF technology I knew that Jenny and Heather would have a multiples pregnancy of at least 2 - having 3 was a fun bonus!

61 notes

·

View notes

Text

Vote for your favourite, the top 9 will proceed in the bracket. Since theyre all different shapes and sizes, make sure to click into the full views!

Paget Eliminations // Other Artist Eliminations

Full captions and details for each illustration below the cut:

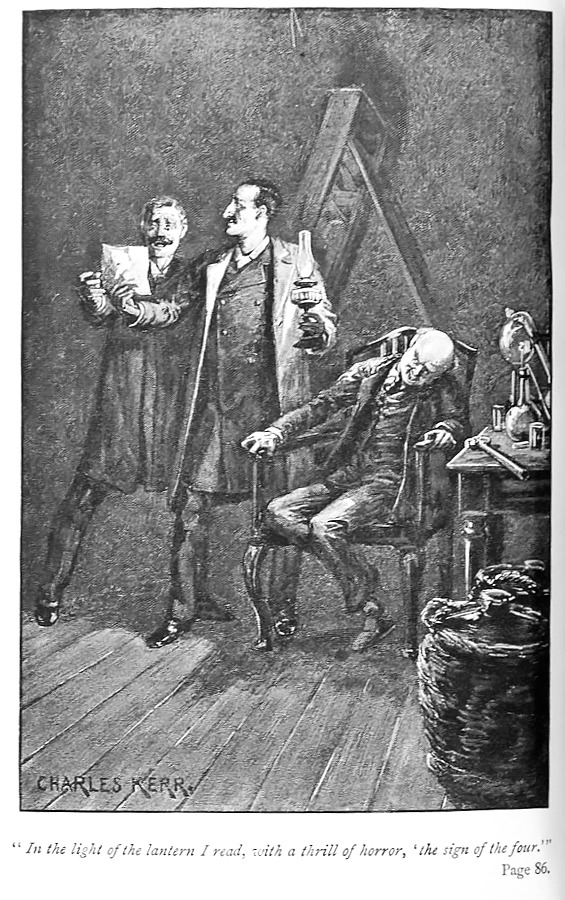

"In the light of the lantern i read, with a thrill of horror, 'the sign of the four'." HM Kerr, Sign of Four (1890 Spencer Blackett Novel) Characters: Watson, Holmes, Batholomew Sholto

[Holmes and Watson hiding on the train platform] Harry C. Edwards, Final Problem (McClure’s) Characters: Holmes

"You infernal spies!" the man cried." FD Steele, Priory School (Collier’s) Characters: Holmes

"The lady lay back exhausted upon a couch enveloped in a loose dressing-gown of blue and silver." FD Steele, Abbey Grange (Collier’s) Characters: Hopkins, Holmes, Lady Brackenstall, Theresa, Watson

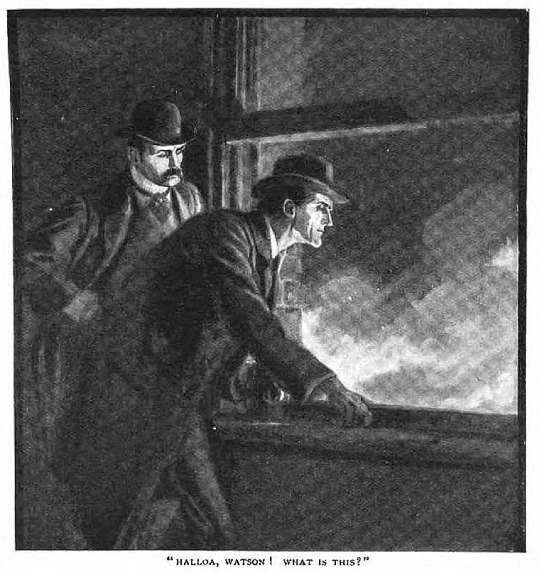

"Halloa, Watson! What is this?" Arthur Twidle, Bruce-Partington Plans (The Strand) Characters: Watson, Holmes

"What has happened to the Lady Frances? Is she alive or dead? There is our problem" FD Steele, Lady Frances Carfax (The American Magazine) Characters: Watson, Holmes

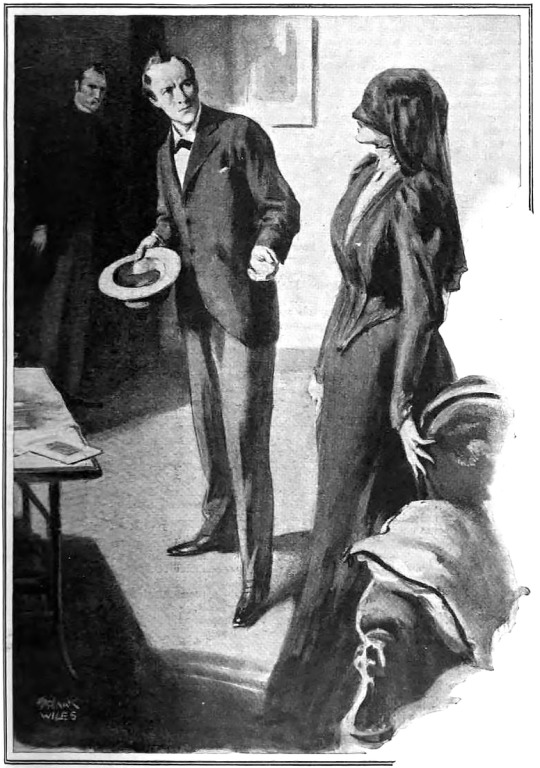

"Mrs. Douglas turned, and in an instant her arms were round him. Barker has seized his outstretched hand." Frank Wiles, Valley of Fear (The Strand) Characters: Cecil Barker, Douglas/McMurdo, Mrs Douglas, Holmes, Watson

"This quiet house is the center of half the mischief in England; the sporting squire the most astute secret-service man in Europe!" FD Steele, His Last Bow (Collier’s) Characters: Baron von Herling, Von Bork

"Dog and man were rolling on the ground together, the one roaring in rage, the other screaming in a strange shrill falsetto of terror." HK Elcock, Creeping Man (The Strand) Characters: Prof Presbury, Trevor Bennett, Holmes, Watson

"In the great drawing-room a lady awaited us, demure and remote as a snow image on a mountain." JR Flanagan, Illustrious Client (Collier’s) Characters: Violet deMerville

"I gripped the old man by the shoulder, but he shrank away." HK Elcock, Blanched Soldier (The Strand) Characters: Col Emsworth, James Dodd

"There was something in the woman's voice which arrested Holmes' attention." Frank Wiles, Veiled Lodger (The Strand) Characters: Watson, Holmes, Eugenia Ronder

#acd holmes#sherlock holmes#tumblr bracket#sherlock holmes illustrations#elim poll#oa elim#polls full bracket

26 notes

·

View notes

Text

大家好! I revisited the nasi padang stall (Malay version of mixed dishes and rice) since the food is fresh and prices remain reasonable. Dining out has become expensive for many after food businesses raised prices time and again, citing inflation, rising wages and an increase in GST of 1% this year. Some did so disproportionately, and there're several articles showing customers' dismay at being overcharged for their meals. It almost seems like eating out is becoming a very unpleasant necessity.

During my catch up with Grace and Douglas, we concluded that not only did food businesses raise prices (some arguably to the point of price gouging), several of them also shrank portion sizes. We're paying more but getting far less for our dollars. To save money, the couple started cooking Japanese rice at home to eat with store bought unagi last year. Grace will try more recipes soon rather than be charged exorbitant prices for their favourite meals and treats. If food prices become unreasonable or portion sizes ridiculously small next year, I'll order less when outside and cook more food at home.

youtube

youtube

There's a public transport fare hike next month as well as increases in GST by 1% and water bills by a whopping 18% over 2 years in 2024. It almost feels like we're transported back to the 1980s when essentials were so expensive, there was little left for discretionary spending. I work very hard for my money and would rather spend on nutritious food or save for retirement than line someone else's pockets when times are so lean. Thankfully, whilst unscrupulous business owners exist, there're also ethical ones who try to provide good value to customers even if they have to raise food or beverage prices. These are the ones worth supporting.

youtube

Saving money is fine, but life's little indulgences still go on to make it worth living, you know? Pa and I returned to the vegan cafe and ordered the la mian as well as shared the turmeric tofu scramble and steamed dumplings. There was a new menu item - rainbow soba - which I was tempted to order. However, instead of tofu, the dish comes with avocado, which many locals don't find healthy, so I gave it a miss. The la mian and dumplings were delicious; the tofu scramble would've been tastier if less turmeric was added, but it was still nice.

Over the meal, Pa and I discussed the conflict in Gaza. The number of Palestinian civilians who have perished is horrifying. Those who remain alive are also suffering badly. I continue to pray for a ceasefire and for a two-state policy so that peace may hopefully be achieved once and for all. 下次见!

0 notes

Text

28 SEPTEMBER 1553: On this day Mary, her sister, her stepmother and her cousin Margaret Douglas, departed from St. James Palace to Whitehall where they boarded the royal barge to the Tower of London. Mary was accompanied by the Lord Mayor of London 'and the aldermen and all the companies in their barges with streamers and trumpets, and waits, shawmes and regals, together with great volley shots of guns, until Her Grace came into the Tower, and some time after.'

Many of those around her were women. Her closest family members no doubt enjoyed the attention, especially her sister and cousin the ladies Elizabeth Tudor and Margaret Douglas, Countess of Lennox who had often been referred by Mary's father as the 'natural' daughter of Margaret Tudor, Queen Dowager of Scotland. But now with her cousin on the throne, she was going to receive a better treatment than that of the previous reign and slowly, she would become one of Mary's most trusted ladies.

As for Elizabeth, her sister had bought clothes for her. In spite of her illegitimate state, which she still viewed her, she wanted everyone to know that she was her sister and most importantly the daughter of their late father and king, Henry VIII, and as such she would be placed above other ladies.

Two days later the sisters, cousin, and their stepmother would emerge for the pre-coronation celebrations and the following day Mary would be crowned Queen, becoming the first Queen of England.

There is a lot of opinions regarding whether Mary was just a puppet or a true politician in every sense of the word and the truth was that she was. In Porter's words: "The picture of Mary as a woman who had little grasp of what was going on, who could not work with her politicians is entirely false. From the very beginning, the queen had a clear idea of what she wanted to do and the utter determination to achieve it. She never, even when unwell, shrank from the business of government, and she knew that she must draw on the experience of the men who had tried to deprive her of her throne. Without their expertise nothing could function." Furthermore, she was outright mad when Scheyfve and Renard advised her not to trust the lady Elizabeth and banish her from court. They didn't believe in any of Elizabeth's excuses for not attending mass, but Mary never wavered in her judgment which proved bad in the end, but her firm opposition to them in this and other matters proves that she was her own person and determined not to be influenced by anyone.

Sources:

Myth of Bloody by Linda Porter

Mary Tudor by Anna Whitelock

Bloody Mary by Carolly Erickson

Mary Tudor by David Loades.

#mary i of england#british monarchy#royalty#16th century#history#road to coronation#September 1553#tudors

23 notes

·

View notes

Link

Why We Love Dinosaurs Boria Sax, Nautilus

The Surprising History (and Future) of Dinosaurs Chantel Tattoli, Paris Review

How Do We Know What Dinosaurs Looked Like? Sara Chodosh, Popular Science

What It’s Like to Dig for Dinosaur Bones Steve Macone, The Atlantic

How We Elected T. Rex to Be Our Tyrant Lizard King Riley Black, Smithsonian Magazine

How to Weigh a Dinosaur Elizabeth Yuko, Lifehacker

WATCH: How to Build a Dinosaur Kimberly Mas, Vox

How to Outrun a Dinosaur Cody Cassidy, Wired

This Is What Dinosaur Meat Tasted Like Hilary Pollack, Vice

The Day the Dinosaurs Died Douglas Preston, The New Yorker

What If the Asteroid Never Killed the Dinosaurs? Daniel Kolitz, Gizmodo

How Dinosaurs Shrank and Became Birds Emily Singer, Quanta Magazine

On America’s Wild West of Dinosaur Fossil Hunting Lukas Rieppel, Literary Hub

To Date a Dinosaur Laura Poppick, Knowable Magazine

‘The Nation’s T. rex’: How a Montana Family’s Hike Led to an Incredible Discovery Steve Hendrix, The Washington Post

Why Does the U.S. Army Own So Many Fossils? Sabrina Imbler, Atlas Obscura

How Jurassic Park Changed the Way Movies Looked at Dinosaurs Keith Phipps, Vulture

The Real Science of Bringing Back the Dinosaurs Matt Blitz, Popular Mechanics

The Best Places to Visit for Dinosaur Lovers of Any Age Julie Vick, Afar

The Best Books on Dinosaurs Recommended by Paul Barrett, Five Books

#rawr means i love you in dinosaur#dinosaurs#paleontology#I was going to just do the link but what if the article link expires?#long post#I first learned that rawr means I love you in dinosaur from my nephew

14 notes

·

View notes

Photo

“Time blossomed, matter shrank away.”

- Douglas Adams

5 notes

·

View notes

Text

Duke Reviews: Ant-Man And The Wasp

Hello, I'm Andrew Leduc And Welcome To Duke Reviews Where Today We Are Continuing Our Look At The Marvel Cinematic Universe...

youtube

Where Today We Answer The One Question Everyone Had On Their Minds When Watching Avengers: Infinity War...Where Was Ant-Man?... By Watching Ant-Man And The Wasp...

In The Aftermath Of Civil War, Scott Grapples With The Consequences Of His Choices As Both A Superhero And A Father As He Struggles To Rebalance His Home Life With His Responsibilities As Ant-Man When He's Confronted By Hope Van Dyne (Who Has Taken On Her Mother's Identity As The Wasp) And Hank Pym Who Come To Him With A New Mission...

Will They Succeed?

Let's Find Out As We Watch Ant-Man And The Wasp...

Starting In 1987, We See Janet Van Dyne (Played By A Digitally Aged Michelle Pfeiffer) And Hank Pym (Played By A Digitally Aged Michael Douglas) Tell Their Daughter They're Going To A Conference When Really They're Going Another Mission...

And Unfortunately, It's The Mission That Cost Janet Her Life When She Shrank Between The Molecules Of A Soviet Missile So She Could Disable It Shrinking Smaller And Smaller Until She Entered The Quantum Realm...

With The Hardest Thing He Did Being To Tell Hope That Janet Was Dead, We Cut To Now Where Hank Recalls How Scott Went Subatomic And Came Back Which Give Him The Idea To Dust Off Some Old Plans Of A Quantum Tunnel Which Will Shrink Them Small Enough To Enter The Quantum Realm To Get Janet Back...

Meanwhile At Scott's House, We Him Spending Time With His Daughter, Cassie In A Homemade Playhouse That He Made And Is Running With The Help Of Luis, As Scott's Been Under House Arrest After Helping Captain America In Civil War Which Was A Violation Of The Sokovia Accords...

But After Taking A Plea Deal, Scott Was Allowed To Return To The US And Was Sentenced To 2 Years Under House Arrest And A 20 Year Prison Sentence Waiting For Him If He Leaves His House Or Defies The Accords Again

And As Pym And Hope Had Provided Lang With The Technology He Used Against Iron Man, They Have Also Been Ruled In Breach Of The Accords And They Have A Warrant Out For Their Arrest Which Forced Them To Go On The Run And Sever All Contact With Scott...

Spending The Next Two Years Trying To Find Ways To Keep Himself Busy Including Learning Close-Up Magic And Setting Up A Security Company With Luis And His Partners, He Unfortunately Has A Dream Where He Relives Of Janet's Memories Of When Hope Was A Child 3 Days Until His Release From House Arrest...

Contacting Pym On A Burner Phone He Put Away, Scott Briefly Tells Him What Happened Before Realizing He Sounds Like An Idiot, He Apologizes For The Trouble He Caused Before Smashing The Phone...

Later That Night, Scott Hears A Buzzing Noise Before He's Knocked Out By A Small Tranq Dart...

Waking Up The Next Morning, Scott Finds He's Been Kidnapped By Hope, Who Left A Decoy In His Place To Not Arouse Suspicion From The FBI. Angry At Scott For Helping Cap And Forcing Her And Hank Into Hiding, Hope Tells Scott That His Dream Coincided With Hank Briefly Opening A Quantum Tunnel...

Seeing Scott's Message As A Sign That Janet Is Alive, Hank And Hope Work In Their New Lab To Create A Stable Tunnel So Hope Can Take A Vehicle Into The Quantum Realm To Retrieve Janet...

Reuniting With Pym Who's Bitter For Scott's Actions But Puts His Anger Aside As He's Their Only Hope Of Locating Janet Inside The Quantum Realm...

Hope Arranges To Get A Part From A Black Market Dealer Named Sonny Burch (Played By The Unicorn) But Realizing The Potential Profit From Pym And Hope's Research, Burch Double Crosses Her Which Leads Her To Suit Up...

youtube

(Start At 0:06)

But Despite Getting The Component, Hope Soon Faces A New Opponent In The Form Of The Ghost, Scott Goes In To Help Hope With The Ghost But Unfortunately The Ghost Escapes With The Part And Pym's Mobile Lab...

Hiding Out At Scott And Luis' Security Firm, They Tell Hank That They've Heard Tales Of This Ghost Of Theirs While Also Wondering If He Had A Tracker On The Lab Which He Did But It Was Deactivated At The Time The Lab Was Stolen And That Not Only Did The Person Who Stole It Knew What They Were Doing But They Were Phasing...

With The Lab Emitting Radiation, Hope Suggests Modifying A Quantum Spectrometer To Track It But To Do That It Means Going Into The Matrix...

I'm Just Kidding...Or Am I?

Meeting Hank's Former Partner, Bill Foster (Played By Morpheus) At The College Where He Works, He Helps Them Locate The Lab Just As The FBI Shows Up On The Campus...

Wondering If Foster's Idea Of Tracking The Suit Through The Regulators Could Work Hank Says It Could But They'd Need An Old Suit As The New Ones Don't Have Diffractors Which They Need To Track It...

Luckily, Scott Saved His Old Suit After Using It To Fight With Cap But The Bad News Is It's Inside Of A Trophy That's At Cassie's School For Show And Tell...

youtube

(Start At 1:01, End At 4:02)

Getting The Diffractor Out Of The Old Ant-Man Suit They Use It To Track Down The Lab To A House In The Middle Of The Woods Where They're Immediately Captured By The Ghost...

Wow, You Guys Think You Can Go 5 Minutes Without Being Captured By The Bad Guy...

Capturing Hank Too, Ghost Reveals Herself As Ava Starr...

Any Relation To Ringo?

Surprisingly No, But She Is Related To Another Former Partner Of Hank's Named Elihas Starr Who Hank Not Only Fired But Discredited And In An Attempt To Get His Good Name Back He Continued His Research Only For It To End In The Death Of Him And His Wife During A Quantum Experiment That Caused Ava's Affliction...

Though She Was Found By Bill Foster, Who Has Tried His Best To Keep Her Safe Since The Accident, He Couldn't Protect Her From S.H.I.E.L.D. Who Built Her Containment Suit And Used Her As A Stealth Operative In Exchange For A Cure..,

But Discovering That They Were Full Of Bullshit, Ava Left With Foster Who Created A Containment Chamber To Slow Her Decay But It's Too Progressive For Him To Stop...

Despite Ava Wanting To Kill Hank For What He Did, She Instead Watched Him Where She Discovered That Hank Was Building The Quantum Tunnel Also About Lang And His Vision Of Janet..

Revealing That They Want To Use The Quantum Tunnel So They Can Extract The Quantum Energy From Janet So They Can Repair Ava's Molecular Structure But Knowing That It Would Kill Janet, Hank Says No...

But Threatening To Turn Scott Over To The FBI, If He Doesn't Help, This Leads Hank To Fake A Heart Attack So Bill Can Open An Altoid Box With Ants That Will Grow Large When Opened So They Can Escape...

Getting The Lab Back Before They Leave, Hank Grows It Back To Large Size So They Can Get To Work Where Hank Reveals That Elihas Starr Was A Traitor Who Stole His Plans For The Quantum Tunnel As They Work...

But As They Do That Burch Captures Luis And His Partners So He Can Question Them About Scott As Ava, Desperate To Be Cured Decides To Kidnap Cassie But Before She Does Bill Tells Her That If She Does She's On Her Own Which Leads Her To Go After Other Options...

Injecting Truth Serum Into Luis, We Get Another One Of Luis' Stories As He Tells Burch Where Scott Is...

youtube

(Start At 1:14, End At 3:21)

Knowing That If Ghost Gets The Technology, He'll Be Ruined, Burch Decides To Call The FBI Believing It'll Be Easier To Steal It From Them As He Has A Contact There..

And While That's Understandable I Still Kinda Have To Say Where's The Logic In That?

Despite Having One Contact It's The FBI, There Are Agents That Are Likely To Recognize You And Are Likely To Get You...

Opening A Stable Tunnel, Pym And Hope Are Able To Contact Janet Who Gives Them A Precise Location But Warns Them That They Have 2 Hours To Do So Due To The Quantum Realm's Unstable Nature...

With Scott Back To Normal, He Gets A Call From Luis Who Tells Him Everything That Happened With Burch, Telling Hank And Hope Everything They're Rightfully Pissed And Sever Ties With Scott Once Again As He Takes The Suit To Rush Home Before Woo Can See Him Breaking House Arrest...

That Which He Doesn't But That's Just The Good News...

The Bad News However Is That Hank And Hope Are Arrested And The Ghost Kills Burch's Man On The Inside And Takes Back The Lab...

Convinced By Cassie To Rescue Hank And Hope From The FBI Despite The Risks, He Decides To Help Them Escape The FBI And Use A New Tracker To Track Down The Lab, While Scott And Hope Distract Ghost While Hank Deals With Bill Before Quantum Realm To Retrieve Janet...

Shrinking The Lab, Ghost Is Rightfully Pissed As Luis And Hope Drive Away With It Only To Be Confronted By Burch And His Men Which Leads To A Car Chase And Our Stan Lee Cameo...

Stan Lee Cameo!

With The Lab Going Back And Forth Like A Football On A Football Field Between Ghost, Burch And Team Ant-Man, It's Team Ant-Man That Gets The Lab Back However At The Last Second, Ghost Steals It And Enlarges It In The Middle Of Pier 39 In San Francisco...

But As All That Was Going On, Hank Finds Janet In The Quantum Realm, But With The Lab In Ava's Hands She Attempts Sabatoge Their Return So She Can Start Stealing Janet's Energy But Luckily Scott And Hope Stop Her And Hank And Janet Return From The Quantum Realm...

Using Some Of Her Quantum Energy, Janet Stabalizes The Ghost So Her And Bill Can Go On The Run While Burch And His Guys Are Arrested And Scott Manages To Get Home In Time For The FBI To End His House Arrest Despite Being Suspicious Of Him...

While Scott Reunites With Cassie And Gets His Buisness Up And Running, Hank, Hope And Janet Restore The Family Home On A Beach So They Can Live Happily Ever After For A While...

Or Until The Mid Credits Scene, Where Scott Ventures Into The Quantum Realm To Collect Particles In An Attempt To Heal Ava While Being Monitored By Hank, Janet And Hope, But Despite Being Successful He's Unable To Return As The Pyms Have Been Snapped Out Of Existence By Thanos...

There's Also A After Credit Scene But It's Not Important To Go Over So I'm Skipping It...

And That's Ant-Man And The Wasp And I Will Say It's Better Than The Original Ant-Man...

The Story Was Interesting, The Characters Were Better Written Than They Were In The First Movie, The Villain Was So-So But She Was Interesting I Will Say That Either Way I Say See It...

Now, Before I Sign Off I'd Like To Say A Few Words And Tell You About The Future Of Duke Reviews After We Finish The MCU...

First, I'd Like To Apologize For The Lack Of Clips In This Review But That's Because I Could Barely Find Any Good Ones On YouTube And Unfortunately It's Going To Be The Same Story With Next Week's Review Of Captain Marvel, I'll Post What I Can But For The Next 2 Weeks Be Patient With Me...

And Second As I Said I Want To Go Over The Future Of Duke Reviews After I'm Done With The MCU, Good News Is We Are Not Going Into The DCEU Or Any Other Superhero Properties For A While (And I Do Mean A While) As We're Going To Be Covering The Movies Of A Company That's Been With Us For Generations...

In Fact We're Going To Be Covering It For So Long That I'll Have To Pause In October, November And December So I Can Continue Our Traditions Of Duke's Monsterween And Duke's Yultide Reviews But Know That In January Of Next Year We'll Probably Be Back Working On That...

Now As To Which Studio I'm Not Going To Reveal Which Until My Spider-Man Far From Home Review Which Will Be In 3 Weeks But Next Week As I Said We'll Be Looking At Captain Marvel, So Until Then, This Is Duke, Signing Off...

#ant man and the wasp#paul rudd#evangeline lilly#michael douglas#lawrence fishburne#randall park#judy greer#bobby cannavale#Marvel#marvel cinematic universe#Ant Man#The Wasp

1 note

·

View note

Text

The Giant of Rainy Grove (GT story) - Chapter 4

Emery led Grace, Owen, and Will across the clearing to the giant. “Just to clarify, you were on your way home when Randy’s men killed the child, right?” Emery asked in a low voice. Owen nodded. They approached, sidestepping Roland’s twisted body. The corpses of the other men lay scattered around the mountainous figure of the still-kneeling giant. One was draped over a tree branch like a piece of discarded clothing. Randy yelped in horror as the giant crushed the last of his men in his fist. The giant’s ice blue eyes narrowed. “My son was five years old,” he growled. “Before I kill you, I will break five of your bones. Slowly” “Giant!” Emery’s authoritative, baritone voice rang out in the night. The large head turned, cold eyes scrutinizing the group of humans who dared to approach him and his prey. “Speak, human.” “On behalf of the village of Rainy Grove, I am deeply sorry for the death of your son. A small group of our men committed an unforgivable act. However, the rest of my villagers are peaceful and were horrified at this. They are innocent. I must ask you what your intentions are regarding them.” The giant opened his fist and dropped the lifeless body. It landed inches from Randy. Randy scooted backward and retched as his late comrade’s skull cracked on a stone. “Human, I have no quarrel with your village. But I will take my revenge on my son’s murderers.” He glared at Randy before his gaze sought out Owen, who moaned and covered his face. Emery placed a hand on Owen’s trembling shoulder. “Giant, this boy did not shed your son’s blood. He is remorseful for what happened. Take your revenge on your son’s killers and leave him.” “He was one of them. My son’s blood is on his hands, and he must die.” Emery opened his mouth to respond, but Grace stepped forward, moving as close to the giant as she dared. “Giant, my brother is not a murderer.” Her voice trembled as she looked up, way up at the enormous face. “The whole village knows how gentle he his. He has never hurt anyone.” “Anyone except my son!” He snarled. Grace pointed at Randy with such violence that the giant raised his eyebrows. “He made my brother go hunting with them. Randy was always bullying him. He threatened—” Randy’s voice came out as a squeak. “I never—” “Silence!” roared the giant. He fixed his eyes on Grace. “Please…” she whispered. “Spare my brother’s life. He is all I have in this world. I’ll do anything!” Grace fell to her knees and gazed into the giant’s eyes. The giant studied Grace as she wept, her soft hair in disarray and her hands, red and calloused from years of work, clasped before her. His features began to soften as he took in her wet face, her patched dress, her vulnerability. His hand imperceptibly inched toward her. He caught himself and placed it on his knee. Owen hiccuped and blew his nose and the giant’s fingers clenched as he drew back, eyeing Owen with disgust and loathing as his features darkened again. He gestured to his son’s limp form and jabbed his finger into Owen’s midsection. “I will allow this fool to live for his sister’s sake, not for his own. But I have not finished. A human life in exchange for my son’s life,” he shouted, shaking the ground beneath them. “I will take one of your villagers as a servant, to work in my home. Choose someone to go with me, or I will destroy your village.” His broad shoulders slumped, Emery bowed his head. “I must accept your offer.” “You have exactly one day to produce my servant.” The giant’s fingers wrapped around Randy’s left leg and dragged him along the ground. Grace turned and followed the others back to the tavern without looking back, covering her ears as Randy’s piercing shrieks filled the air. She had saved her brother, but at what cost? ******* The sun rose over a perfectly circular expanse in the center of the village. It shone on the wooden platform that served as a stage during festivals, in happier times. Emery and three other village elders sat with Grace, Owen, and Will, surrounded by a scattering of villagers. Emery stood silently in the center, his gaze falling on each attendee in turn. The breeze ruffled his curly grey hair and beard as he sighed. “Friends, you know why we are here. Yesterday, the hunters killed the child of a giant. This giant has taken his revenge on the guilty parties, but justice must be completed by giving him a servant.” Emery turned to three men who were arguing in whispers. “What is it?” Andrew, a shepherd, stood up straight. “Chief Emery, we were just saying that no one has seen the giant since last night. Perhaps he was satisfied with his revenge and went home.” “Yes, where is the giant?” asked a woman behind Andrew. Elder Douglas gestured for silence. “After the giant killed Randy the hunter, I saw him take his son’s body in his arms. He left Rainy Grove and headed northwest. But his words were true. He will return.” “Yes, he will come for his servant,” Emery said. “In consequence, we must bid farewell to someone among us, someone who must go and serve the giant to save our village. We must choose here and now so that person can make arrangements for the journey.” A murmur traveled through the crowd. People shrank into their seats, whispered to their neighbors, or looked pointedly at the others. Robert the butcher pointed with what remained of his right index finger. “I think young Owen should go himself. I’ve got no problem with the boy but, you know, he’s responsible for this mess.” A few grunts of approval, as well as a few hisses, greeted Robert’s speech. “He’s right, Chief Emery,” said Owen. “I should have tried to save the child. I’ll go with the giant.” Grace took his hand. “No, Owen. You can’t go.” “She’s right,” said Will. “If you go, the giant is sure to kill you. He is grieving, and the sight of you will remind him of his son every day. He won’t be able to stand it, and one day he will lose his temper.” Will stood and faced Emery. “As Owen’s guardian, it is my responsibility to go in his place.” A frenzy of protest greeted his words. “Why you?” “Not you!” “What’ll happen to the Crazy Knight?” “You can’t—” “I’ll go!” The crowd, hushed, looked at Grace. “I’ll go. I told the giant I would do anything to save my brother’s life. I meant it.” “No. I can’t lose you,” whispered Owen. “Why not Jack?” asked a middle-aged woman in an apron, indicating the village drunk, who was reclining against a bench. The red-faced, bleary-eyed man shook himself out of his stupor. “Why should I go? I didn’t do anything!” “Well, no one would miss you!” Grace yanked her arms free from Will and Owen’s grasp. “I should go. It is my responsibility to go.” “She’s right, you know,” said the woman who had annoyed Grace at the tavern. She folded her pink arms over her chest and tossed her head with a smirk. “It’s none of our faults. Let her go with the giant.” “Quiet!” hissed the women on either side of her. “It’s true,” said Grace. She turned to Emery, who was regarding her intently, his face serious and compassionate. “You know that it’s true.” Grace gestured to the crowd. “They had nothing to do with this. It has to be me.” “You had nothing to do with it either,” said Owen. “This is all my fault. I should go. It doesn’t matter what happens to me. He can kill me if he wants to.” “No one has to die.” Grace’s voice was firm. Her features set, she turned to each of the elders, one by one. “I must go. It is the only way.” The other elders nodded at Emery. He closed his eyes for a few moments and bowed his head. He placed his trembling hands on Grace’s shoulders. “It is decided. You, my child, will go with the giant.”

7 notes

·

View notes

Text

Canadian economy posted its worst showing on record in 2020

The Canadian economy posted its worst showing on record in 2020 as the COVID-19 pandemic swept across the country, shutting down businesses and putting millions out of work.

Statistics Canada says real gross domestic product shrank 5.4 per cent in 2020, the steepest annual decline since comparable data was first recorded in 1961.

The drop for the year was due to the shutdown of large swaths of the economy in March and April during the first wave of the COVID-19 pandemic that crushed the economy.

Newsletter sign-up: Get The COVID-19 Brief sent to your inbox

Since then, economic activity has slowly and steadily grown.

Statistics Canada says the economy grew at an annualized rate of 9.6 per cent in the fourth quarter of last year, down from an annualized growth rate of 40.6 per cent in the third quarter.

That was higher than expected, with the average economist estimate at 7.5 per cent, according to financial data firm Refinitiv.

However, despite the better-than-expected result for the quarter as a whole, December eked out a 0.1 per cent increase, which followed a 0.8 per cent increase in November.

Statistics Canada noted that total economic activity in December was about three per cent below the pre-pandemic level in February 2020.

Looking ahead to January, Statistics Canada said its early estimate was for growth in the economy of 0.5 per cent.

CIBC chief economist Avery Shenfeld wrote in a note that the early January figure should set aside fears of an outright downturn in the first quarter.

Statistics Canada said wholesale trade, manufacturing and construction sectors led the increase, while retail trade fell to start the year.

BMO chief economist Douglas Porter said the economy soldiered through second-wave restrictions better than anticipated, and may signal a better-than-anticipated quarter, and potentially year overall.

"Look for new growth drivers to kick into gear as the economy re-opens in stages through this year, leading to roughly (six-per-cent) growth -- a nice mirror image to last year's deep dive," he wrote in a note.

"It's not precisely a V-shaped recovery, but it's very close."

This report by The Canadian Press was first published March 2, 2021

from CTV News - Atlantic https://ift.tt/384Qd5w

0 notes

Text

Should Google Shrink to Save Itself?

Topic A in New York City: a state law that eliminates broker fees for renters. Tenants are thrilled; landlords and brokers, not so much. Send us your thoughts. (Want this in your inbox each morning? Sign up here.)

Google reportedly weighs divesting a big ad business

As antitrust regulators turn up the heat, the company is reportedly considering a sale or spinoff of its third-party ad tech unit, Keach Hagey and Rob Copeland of the WSJ report, citing unnamed sources.The context:• The Justice Department has increasingly focused on Google’s third-party ad business, which was “built largely on the company’s 2008 acquisition of the ad-technology firm DoubleClick,” Ms. Hagey and Mr. Copeland write.• Google’s ad-tech business consists of software used to buy and sell ads across the web.• Critics say Google unfairly bundles these tools together and uses them to help its own services, like search and YouTube.Some Google executives have discussed informally “whether the company should consider divesting its third-party ad tech business, according to people familiar with the situation,” Ms. Hagey and Mr. Copeland write. (A Google spokeswoman said there were no plans to divest the unit.)Proponents of divesting the business note that the ad tech arm “has steadily declined in importance to Google overall since the DoubleClick purchase, while units like search and YouTube have soared.” That’s because web search traffic is stagnant, while mobile internet use is booming.“For Google, a partial voluntary breakup of its advertising business might be preferable to whatever regulators come up with on their own,” Alex Webb of Bloomberg Opinion writes.

Investors hit snooze on Casper’s I.P.O.

The mattress seller officially priced its I.P.O. at $12 a share, the low end of a sharply cut price range. It’s a sign that public-market investors remain sour on money-losing start-ups with no clear path to profitability.The bed-in-a-box company is valued around $476 million. Just last year, it was valued around $1.1 billion in a private fund-raising round.Investors remain wary of money-burning I.P.O. candidates, having turned up their noses at Uber and WeWork last year. It shows the public markets aren’t willing to subsidize these companies’ growth efforts.It’s not the only bad news for start-ups this week: The Federal Trade Commission moved to block the sale of Harry’s, the upstart razor brand, to the owner of Schick. If unprofitable start-ups can’t sell themselves to bigger rivals, and they suffer badly when they go public, what can they do?

Tesla’s epic rally hits a bump

Market fundamentals didn’t appear to apply to the electric-car maker’s shares this past year. At least they didn’t until yesterday.Tesla’s stock fell 17 percent, in what Tom Maloney of Bloomberg notes was its worst drop in eight years. Shares closed yesterday at $734.70, which is three times more than where they traded in June.Elon Musk lost $5.9 billion on paper in just one day, leaving him with an estimated net worth of $39.3 billion. (He could still earn a huge bonus if he keeps Tesla’s market value above $100 billion over six months: The company is currently valued at $132 billion.)The stock dropped after even hardened Tesla critics conceded defeat. The hedge fund manager Steve Eisman, who famously profited by betting against subprime mortgage lenders before the financial crisis, said he had covered his bet against the company amid its “cultlike” rally.Today’s a new day, however. Shares in Tesla were up 2 percent in premarket trading.

Coronavirus said to spur Chinese concessions on trade

Beijing said today that it would cut tariffs on $75 billion of U.S. imports. Analysts say the coronavirus outbreak was a major factor in the decision.China will halve tariffs on some American products starting Feb. 14. The Finance Ministry said in a statement that the move was meant to “alleviate economic and trade frictions and expand economic and trade cooperation” between China and the U.S.But analysts saw the economic impact of the coronavirus. With Chinese consumers sharply cutting spending, it appeared unlikely that Beijing would be able to hit targets for increasing U.S. imports that were laid out in the recently signed trade agreement with Washington anytime soon.“I see it as a measure to signal to the U.S. that, ‘We’re not going to be able to ramp up imports straight away, but we’re still on board with the deal,’ ” Julian Evans-Pritchard, senior China economist at Capital Economics, told the FT.Global markets rose this morning, and S&P 500 futures pointed toward a positive open when trading begins.

Trump’s latest cudgel in his immigration fight: Global Entry

The Trump administration’s feud with New York State over protecting immigrants has expanded in a way that could affect many New York business travelers.Residents of New York State are temporarily barred from applying for Global Entry and similar programs that let travelers speed through borders and airport security lines, Zolan Kanno-Youngs and Jesse McKinley of the NYT report.The move is tied to the enactment of the Green Light Law, which prohibits agencies such as Immigration and Customs Enforcement and Customs and Border Protection from gaining access to New York D.M.V. databases without a court order.It’s the latest stage of the battle between federal officials and New York State over immigration. The Trump administration has already criticized New York City for policies that protect undocumented immigrants.“This is obviously political retaliation by the federal government, and we’re going to review our legal options,” a senior adviser to Gov. Andrew M. Cuomo said.

Bernie Madoff says he’s dying and wants to leave prison

As part of a request for early release, the mastermind of the largest Ponzi scheme in history told a court yesterday that he had terminal kidney disease, David Yaffe-Bellany of the NYT reports.Doctors have determined that Mr. Madoff has just over a year to live, according to medical records attached to his filing. Under federal guidelines, prisoners who receive that kind of diagnosis can be eligible for early release.He has already served 11 years of his 150-year prison sentence for a variety of crimes, including money laundering, perjury and theft. Victims of his fraud lost an estimated $13 billion.Federal officials denied a previous request, saying that “his release at this time would minimize the severity of his offense.” Bernie Ebbers, the former WorldCom C.E.O., was given early release in December from his 25-year prison sentence after his health deteriorated sharply. He died on Sunday.

The speed read

Deals• Analysts don’t understand why the Intercontinental Exchange would want to buy eBay. (FT)• Spotify agreed to buy The Ringer, the website founded by Bill Simmons, to add more podcasts to its offerings. (NYT)• Nestlé plans to invest $200 million in the drug maker Aimmune Therapeutics, whose peanut allergy treatment recently won F.D.A. approval. (Reuters)• Vanguard became famous for offering index funds. Now it’s getting into private equity. (WSJ)Politics and policy• The United States trade deficit shrank last year — because the economy is cooling, not because factories are reopening. (NYT)• Bernie Sanders and Pete Buttigieg are nearly tied in the latest results from the Iowa Democratic caucuses. (NYT)• Britain plans to ask the public which E.U. rules the country should scrap. (FT)Tech• Jeff Weiner will step down as C.E.O. of LinkedIn on June 1 and become the social network’s executive chairman. He’ll be succeeded by Ryan Roslansky, the company’s product chief. (CNBC)• Facebook’s move to encrypt its messaging platforms has run into opposition from child welfare advocates, who worry that the measure would let predators act with impunity. (NYT)• Huawei, the Chinese tech giant, sued Verizon for patent infringement. (CNBC)• The C.I.A. plans to offer more cloud-computing contracts to Amazon rivals. (Bloomberg)Best of the rest• Some bondholders are said to have reached a deal with of Puerto Rico’s oversight board, possibly paving the way for the U.S. territory to exit bankruptcy protection. (WSJ)• Three big investors in Credit Suisse have sided with the Swiss bank’s C.E.O., Tidjane Thiam, in his fight with the firm’s chairman, Urs Rohner. (FT)• The latest generation of Nike’s super-sneakers will qualify for the Tokyo Olympics. (WSJ)• Kirk Douglas, the Hollywood star, died yesterday. He was 103. (NYT)We’d love your feedback. Please email thoughts and suggestions to [email protected]. Read the full article

#1augustnews#247news#5g570newspaper#660closings#702news#8paradesouth#911fox#abc90seconds#adamuzialkodaily#atoactivitystatement#atobenchmarks#atocodes#atocontact#atoportal#atoportaltaxreturn#attnews#bbnews#bbcnews#bbcpresenters#bigcrossword#bigmoney#bigwxiaomi#bloomberg8001zürich#bmbargainsnews#business#business0balancetransfer#business0062#business0062conestoga#business02#business0450pastpapers

0 notes

Text

Revisiting the monetary policy endgame

Last year, at the beginning of September, we wrote a blog post entitled The Monetary Policy Endgame that laid out one possible future for the path of monetary policy, should economic growth falter, productivity not materialize and populist politics continue to thrive. Some parts of that analysis seem worryingly prescient nine months hence, so we wanted to revisit the analysis from a different vantage point today. Part of the global policy response to the exogenous shock of Covid-19 and the subsequent economic lockdowns has been some combination of new and expanded quantitative easing (QE) programs, interest rates pushed to zero, or even more negative levels, and currency depreciation. These policies should go a long way toward helping us weather the economic storm of Covid-19 and jumpstart the economy once the storm passes, but they do not on their own create a long term trajectory for sustainable growth, which was something already sorely needed in parts of the world before the crisis hit. In this post, we imagine what it might take to reinvigorate such growth and avoid an acceleration toward the negative monetary policy endgame we previously described.

Examining the engine of growth

Coal mines are not often thought of as bastions of technological innovation. Yet, one of the sparks that ignited the Industrial Revolution was a humble invention from just such a mine – the steam engine. Originally intended to solve the problem of flooding by helping miners pump water out of mines, the new technology was quickly applied to transportation, and the construction of new ships and trains eventually led to soaring productivity in Western Europe in the 18th and 19th centuries.

If the world ever needed another “steam engine moment,” it would be now. A growth spurt on the scale of the Industrial Revolution would be a sure-fire economic lifesaver from the Covid-19 storm. But what is today’s flooded coal mine and where would today’s steam engine equivalent come from? Asked another way, if we happened to be looking back in the year 2030, and the world had just completed a decade of above-trend growth, throwing water on the prophetic fires of today’s economic doomsayers, how might the world have done it?

Before speculating on how above-trend growth might be achieved, we must first understand the component parts that drive economic growth. The Cobb-Douglas production function suggests that real output is a function of labor and capital resources, and a third factor, productivity, which is the ability to extract more output from fixed labor and capital pools. Since the size of the labor resource is largely a function of slow-moving demographic cycles (50 years long or more), the burden of raising output on shorter time horizons falls more heavily on capital and productivity. Capital and productivity themselves are intricately intertwined – only through sufficient investment can productivity-enhancing technologies be invented.

Today, investment is more than just capital expenditures – in our modern economy, total investment includes research and development (R&D) too. To understand the importance of R&D, one need look no further than the epitome of modern-day capex – the energy industry in 2006-2015. Since 1995, energy capex averaged 20% of the S&P 500 total, and from 2006-2015, it never dipped below that 20% mark. From 2008-2014 it averaged 31% of S&P 500 capex, peaking at 33% in 2013. The results of all that investment, the oil price trend over the last six years, needs no further explanation. Nobody can blame the energy industry for not investing, but investment oriented around growing volumes needs to be accompanied by some defense against price declines, especially in a disinflationary world. Perhaps investments must include some form of pricing power preservation, or economic moat. R&D, while not a perfect measure, is a vital component of any comprehensive framework for investing while protecting against industry rivalry (think Porter’s Five Forces) when the global economic pie is not growing as fast as it has historically.

How much investment is enough?

So, both capex and R&D are important, but how much total investment is enough? If the growth rate of total investment is persistently below the growth rate of nominal output, how can an economy maintain the capacity required to function at existing levels of output, much less to grow its output, through increased capacity or productivity? While the world as a whole risks edging towards under-investment post-Covid, recent history shows Europe, in particular, struggling to invest at a rate equal to, or above, its nominal growth rate (see graph). From 2000-2019, U.S. nominal GDP grew at an average of 4.0%, while total investment grew at an average of 4.7%, a 0.7% outspend. In China, this outspend was even greater, at 1.7%. However, in Europe, while nominal GDP grew at 2.9%, investment only grew at 2.8%, leaving a -0.1% under spend. From 2016-2019, this deficit was even more acute, at -3.8% (nominal GDP grew at 3.0% and total investment shrank by 0.8% each year).

Public and private investment correlate strongly with a country’s multi-factor productivity and corporate sales. Given regional investment trends, it should be little surprise that while the S&P 500 and Shanghai Composite have roughly doubled since the turn of the century, the Eurostoxx 50 has declined by about a third. The fact is that in Europe, monetary policy carries an outsized (perhaps insurmountable) burden in driving output, as there is little help coming from Cobb-Douglas’ organic sources of growth when both investment (capital) and demographic (labor) pools are in decline.

Lessons from the past

While QE programs and negative interest rate policies are likely to meet initial success as the world emerges from lockdown, they are no long-term substitute for investment. One of the earliest records of financial repression is to be found in Ancient Rome. In an effort to maintain a quality of life that had become increasingly difficult to finance, as well as an enormous empire whose borders were becoming increasingly difficult to defend, a succession of Caesars began to degrade the quality of the Roman currency, the denarius, by reducing the silver content of coins, so they could then produce more coins to fund deficits. Eventually services would not be rendered (including those of Rome’s mercenary armies), goods would not be traded, and long-term projects would not be financed because the financiers did not know what the real value of their principal repayments would be in the future.

A lesser known fact is that the first prototype of a steam turbine also came from Ancient Rome, 1,500 years before it was (re)invented in the coal mines of England. Would things have ended differently had the Romans, during a time of relative peace, allocated a strong denarius towards productive investment rather than weakening the currency in order to sustain nominal output?

Today, the world does not have the luxury of peace to deliberate its next policy. Covid-19 is the equivalent of wartime economic conditions. It has rendered financial repression through zero or negative interest rate policies the quickest stop-gap solution, not least because the virus and the policies enacted to combat it pose a threat to our quality of life. We think central banks have been absolutely right to use every tool at their disposal in fighting this devil we know, as it’s not the time to fear any of the devils we don’t. But while these monetary tools exist for policymakers to prevent the economic shocks seen this year from becoming permanent states of affairs, the permanence of such tools may result in the long-term creation of the very shocks they were intended to avoid. That’s because they have the potential to change the capitalist incentive structure.

icon-pointer.svgFollow Rick Rieder on Twitter.

Innovation/Investment, the engines of growth

As we emerge from the COVID crisis, it is imperative that policymakers recognize the importance of investment in driving long-term output. For now, the current slate of monetary policy will likely prove effective in winning the economic battle with COVID-19 (and as such, is the right prescription), but if central banks want to also win the war against the negative potential monetary policy endgame, the next step would be to start thinking about how to resuscitate private investment in cooperation with federal governments. It’s not the policymakers’ job to invent the steam engine – but they should create an environment so conducive for investment that new inventions start piling up, increasing the odds of some of them being revolutionary. Fields like cloud and quantum computing, and 5G technology, all seem like potential hotbeds for inventions that could spark the next Technological Revolution.

Given its advantage in investment and R&D already, as well as constructive regulatory and legal regimes, the U.S. is an obvious region to see further innovative technologies produced, but China has also been investing at an even greater pace. Europe might seem to be an unusual source of inspiration for the next Industrial (or Technological) Revolution, but perhaps no less unusual than a coal mine was in the 17th century. Europe is already ahead of the world in some notable respects: it is at the forefront of regulation and capital allocation with regards to ESG. Why shouldn’t policymakers incentivize responsible investment the way they do environmental and social awareness?

As the lines between fiscal and monetary policy become blurred, even the European Central Bank (ECB) could explore unconventional ways to incentivize investment, as we also argued in a blog post last year. It is already at the forefront of unconventional monetary policy, even if it is by necessity. After all, necessity is the mother of invention – and there has never been a greater need to invent our way out of the monetary policy endgame, and revitalize global growth, than in the aftermath of the Covid-19 crisis.

Rick Rieder, Managing Director, is BlackRock’s Chief Investment Officer of Global Fixed Income and is Head of the Global Allocation Investment Team. Russell Brownback, Managing Director, Head of Global Macro positioning for Fixed Income, and Navin Saigal, Director, is a portfolio manager on BlackRock’s Credit Enhanced Strategies Team and he contributed to this post.

Investing involves risks, including possible loss of principal. Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks may be heightened for investments in emerging markets. This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of June 8, 2020 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Prepared by BlackRock Investments, LLC, member Finra ©2020 BlackRock, Inc. All rights reserved. BLACKROCK is a trademark of BlackRock, Inc., or its subsidiaries in the United States or elsewhere. All other marks are the property of their respective owners. USRMH0620U-1208514-1/6 from BlackRock Blog https://www.blackrockblog.com/2020/06/12/revisiting-the-monetary-policy-endgame/

0 notes

Text

DealBook: Should Google Shrink to Save Itself?

Good morning. Topic A in New York City: a state law that eliminates broker fees for renters. Tenants are thrilled; landlords and brokers, not so much. Send us your thoughts. (Was this email forwarded to you? Sign up here.)

Google reportedly weighs divesting a big ad business

As antitrust regulators turn up the heat, the company is reportedly considering a sale or spinoff of its third-party ad tech unit, Keach Hagey and Rob Copeland of the WSJ report, citing unnamed sources.

The context:

• The Justice Department has increasingly focused on Google’s third-party ad business, which was “built largely on the company’s 2008 acquisition of the ad-technology firm DoubleClick,” Ms. Hagey and Mr. Copeland write.

• Google’s ad-tech business consists of software used to buy and sell ads across the web.

• Critics say Google unfairly bundles these tools together and uses them to help its own services, like search and YouTube.

Some Google executives have discussed informally “whether the company should consider divesting its third-party ad tech business, according to people familiar with the situation,” Ms. Hagey and Mr. Copeland write. (A Google spokeswoman said there were no plans to divest the unit.)

Proponents of divesting the business note that the ad tech arm “has steadily declined in importance to Google overall since the DoubleClick purchase, while units like search and YouTube have soared.” That’s because web search traffic is stagnant, while mobile internet use is booming.

“For Google, a partial voluntary breakup of its advertising business might be preferable to whatever regulators come up with on their own,” Alex Webb of Bloomberg Opinion writes.

____________________________

Today’s DealBook Briefing was written by Andrew Ross Sorkin in New York and Michael J. de la Merced in London.

____________________________

Investors hit snooze on Casper’s I.P.O.

The mattress seller officially priced its I.P.O. at $12 a share, the low end of a sharply cut price range. It’s a sign that public-market investors remain sour on money-losing start-ups with no clear path to profitability.

The bed-in-a-box company is valued around $476 million. Just last year, it was valued around $1.1 billion in a private fund-raising round.

Investors remain wary of money-burning I.P.O. candidates, having turned up their noses at Uber and WeWork last year. It shows the public markets aren’t willing to subsidize these companies’ growth efforts.

It’s not the only bad news for start-ups this week: The Federal Trade Commission moved to block the sale of Harry’s, the upstart razor brand, to the owner of Schick. If unprofitable start-ups can’t sell themselves to bigger rivals, and they suffer badly when they go public, what can they do?

Tesla’s epic rally hits a bump

Market fundamentals didn’t appear to apply to the electric-car maker’s shares this past year. At least they didn’t until yesterday.

Tesla’s stock fell 17 percent, in what Tom Maloney of Bloomberg notes was its worst drop in eight years. Shares closed yesterday at $734.70, which is three times more than where they traded in June.

Elon Musk lost $5.9 billion on paper in just one day, leaving him with an estimated net worth of $39.3 billion. (He could still earn a huge bonus if he keeps Tesla’s market value above $100 billion over six months: The company is currently valued at $132 billion.)

The stock dropped after even hardened Tesla critics conceded defeat. The hedge fund manager Steve Eisman, who famously profited by betting against subprime mortgage lenders before the financial crisis, said he had covered his bet against the company amid its “cultlike” rally.

Today’s a new day, however. Shares in Tesla were up 2 percent in premarket trading.

Coronavirus said to spur Chinese concessions on trade

Beijing said today that it would cut tariffs on $75 billion of U.S. imports. Analysts say the coronavirus outbreak was a major factor in the decision.

China will halve tariffs on some American products starting Feb. 14. The Finance Ministry said in a statement that the move was meant to “alleviate economic and trade frictions and expand economic and trade cooperation” between China and the U.S.

But analysts saw the economic impact of the coronavirus. With Chinese consumers sharply cutting spending, it appeared unlikely that Beijing would be able to hit targets for increasing U.S. imports that were laid out in the recently signed trade agreement with Washington anytime soon.

“I see it as a measure to signal to the U.S. that, ‘We’re not going to be able to ramp up imports straight away, but we’re still on board with the deal,’ ” Julian Evans-Pritchard, senior China economist at Capital Economics, told the FT.

Global markets rose this morning, and S&P 500 futures pointed toward a positive open when trading begins.

Trump’s latest cudgel in his immigration fight: Global Entry

The Trump administration’s feud with New York State over protecting immigrants has expanded in a way that could affect many New York business travelers.

Residents of New York State are temporarily barred from applying for Global Entry and similar programs that let travelers speed through borders and airport security lines, Zolan Kanno-Youngs and Jesse McKinley of the NYT report.

The move is tied to the enactment of the Green Light Law, which prohibits agencies such as Immigration and Customs Enforcement and Customs and Border Protection from gaining access to New York D.M.V. databases without a court order.

It’s the latest stage of the battle between federal officials and New York State over immigration. The Trump administration has already criticized New York City for policies that protect undocumented immigrants.

“This is obviously political retaliation by the federal government, and we’re going to review our legal options,” a senior adviser to Gov. Andrew M. Cuomo said.

Bernie Madoff says he’s dying and wants to leave prison

As part of a request for early release, the mastermind of the largest Ponzi scheme in history told a court yesterday that he had terminal kidney disease, David Yaffe-Bellany of the NYT reports.

Doctors have determined that Mr. Madoff has just over a year to live, according to medical records attached to his filing. Under federal guidelines, prisoners who receive that kind of diagnosis can be eligible for early release.

He has already served 11 years of his 150-year prison sentence for a variety of crimes, including money laundering, perjury and theft. Victims of his fraud lost an estimated $13 billion.

Federal officials denied a previous request, saying that “his release at this time would minimize the severity of his offense.”

Bernie Ebbers, the former WorldCom C.E.O., was given early release in December from his 25-year prison sentence after his health deteriorated sharply. He died on Sunday.

The speed read

Deals

• Analysts don’t understand why the Intercontinental Exchange would want to buy eBay. (FT)

• Spotify agreed to buy The Ringer, the website founded by Bill Simmons, to add more podcasts to its offerings. (NYT)

• Nestlé plans to invest $200 million in the drug maker Aimmune Therapeutics, whose peanut allergy treatment recently won F.D.A. approval. (Reuters)

• Vanguard became famous for offering index funds. Now it’s getting into private equity. (WSJ)

Politics and policy

• The United States trade deficit shrank last year — because the economy is cooling, not because factories are reopening. (NYT)

• Bernie Sanders and Pete Buttigieg are nearly tied in the latest results from the Iowa Democratic caucuses. (NYT)

• Britain plans to ask the public which E.U. rules the country should scrap. (FT)

Tech

• Jeff Weiner will step down as C.E.O. of LinkedIn on June 1 and become the social network’s executive chairman. He’ll be succeeded by Ryan Roslansky, the company’s product chief. (CNBC)

• Facebook’s move to encrypt its messaging platforms has run into opposition from child welfare advocates, who worry that the measure would let predators act with impunity. (NYT)

• Huawei, the Chinese tech giant, sued Verizon for patent infringement. (CNBC)

• The C.I.A. plans to offer more cloud-computing contracts to Amazon rivals. (Bloomberg)

Best of the rest

• Some bondholders are said to have reached a deal with of Puerto Rico’s oversight board, possibly paving the way for the U.S. territory to exit bankruptcy protection. (WSJ)

• Three big investors in Credit Suisse have sided with the Swiss bank’s C.E.O., Tidjane Thiam, in his fight with the firm’s chairman, Urs Rohner. (FT)

• The latest generation of Nike’s super-sneakers will qualify for the Tokyo Olympics. (WSJ)

• Kirk Douglas, the Hollywood star, died yesterday. He was 103. (NYT)

Thanks for reading! We’ll see you tomorrow.

We’d love your feedback. Please email thoughts and suggestions to [email protected].

from WordPress https://mastcomm.com/dealbook-should-google-shrink-to-save-itself/

0 notes

Text

5 reasons why you should definitely watch Ant-Man and The Wasp!

Actor Paul Rudd returns to the silver screen as Scott Lang in Ant-Man and The Wasp, and this time his crime fighting partner Hope VanDyne (played by Evangeline Lily), joins as the film’s headlining superheroine!

Following the massive behemoth of a movie, Avengers: Infinity War, in Antman And The Wasp, Marvel Studios has a refreshing light-hearted treat for its fans with humour and wit, scaled up a notch, along with a pertinent lead up to Avengers 4.

The much anticipated sequel will see Scott and his allies in the aftermath of the events of Captain America: Civil War, bridging the gap between that and Ant-Man's next appearance in 2019's Avengers film. Back in action are familiar faces such as Michael Douglas as Hank Pym and the laughable rogue Luis, with anticipated new recruits such as Laurence Fishburne, Walton Goggins, and the gorgeous Michelle Pfeiffer opposite Douglas. Already breaking records at overseas territories where the film has released, global reviews for the Antman sequel have been unanimously positive.

While you book your tickets to the next Marvel biggie, here are 5 things you definitely must watch out for in the film!

1. The Wasp

With this sequel being the first Marvel film to headline a super-heroine, Evangeline Lilly's The Wasp not only has shrinking powers as well as wings for flight and blasters, but she kicks some major villainous ass, as shown in the trailers. She pairs up with Ant-Man spectacularly and even steals the show in some of the scenes, according to reviews. Along with Captain Marvel, The Wasp is one of the newest super-heroines to watch out for.

2. Michelle Pfeiffer in action

One of the most beautiful and acclaimed actresses, Michelle Pfeiffer (And who can forget Catwoman) is back to the superhero business, playing Hank Pym’s wife and the original Wasp, Janet VanDyne, who shrank down too far to stop a missile on a mission and got stranded in the Quantum Realm. How her role plays out in the film is something to watch out for.

3. Lead up to Avengers 4- a kick ass end credits scene

Global reviews have indicated a tremendously important and connective end-credit scene, that builds up to Avengers 4, and gives a hint of how Ant-Man might possibly feature in the post Infinity War scenario-definitely not to be missed if you suffer from superhero FOMO!!

4. Michael Pena's LOL dialogues

Playing one of Scott Lang’s partners in crime, Luis, in the first Ant-Man film, Peña easily became a fan-favorite. His talent for witty and fast monologues provided some seriously comic relief in the first part. The trailers and reviews promise a more amped up humour element, specially in scenes with Michael Pena and Paul Rudd

5. Giant Ant-Man, Hello Kitty gum and lots more VFX!

A supersized Ant-Man shocking people on a yacht, a huge Hello Kitty gum machine hurtling down a busy road, car chases and superheroes galore, Ant-Man and the Wasp has the trademark Marvel crowd pleasing action sequences that will satisfy any cine-goer.

Marvel Studio's Ant-Man And The Wasp releases today in English, Hindi, Tamil and Telugu

0 notes

Text

Farewell to the 747, the Plane That Shrank the World

For a half-century, Boeing Co. mechanics in a sprawling factory north of Seattle have riveted together aluminum panels into the familiar hump-backed form of the 747 jumbo jet. Test pilots then put each new plane through its paces on an adjacent air strip before sending it off to roam the globe.

This airplane, more than any other, made long-range travel into a mass-market phenomenon. And on Monday, one of the jets born here returned home.

Delta Air Lines Inc. flew a 747 filled with employees and customers from its Detroit hub to Boeing’s plant in Everett, Washington. It was the first in a series of farewell flights to Delta hubs this week, marking the end of the airliner’s U.S. passenger service. For those aboard, it was a rare opportunity to touch down on the same runway from which the first 747 lifted skyward on Feb. 9, 1969.

On the ground, Boeing workers who helped build 747-400s like the returning Delta plane celebrated an aviation milestone. But there’s poignancy to the moment: With just 14 unfilled orders in Boeing’s backlog, four-engine aircraft appears to have fallen out of favor. The future isn’t bright for jumbo jetliners such as the old 747.

For a morning, at least, Delta and Boeing set aside their differences to bask in nostalgia. Just last week, Delta ordered 100 jets from Airbus SE, Boeing’s rival. And a trade fight between the U.S. jetmaker and Bombardier Inc. threatens to foul up a separate deal that’s key to Delta’s fleet plans.

There were those aboard Monday’s farewell-to-passengers flight who came of age with the 747. The planes’ hulking wings—and, for children riding on Pan Am in the 1970s heyday, those captain’s wing pins—symbolized access for millions of us to foreign lands not easily reached by telephones of the era. A generation came to learn the aircraft’s quirks, such as the jet’s bulbous nose and swept wings and the vibrations during the take-off roll that caused over-stuffed luggage bins to pop open on early models. There was also the fascination, never lost for some, of ascending a staircase to ride high above the world in the “bubble,” the deck behind the cockpit.

Delta Flight 9771 rumbled down the runway and lifted into the air at 7:47 a.m. on Monday in Detroit, the first flight on a farewell tour this week, with stops planned at Delta strongholds in Seattle, Atlanta, Minneapolis and Los Angeles. The aircraft will ferry NFL and college football teams in late December before making a final ferry flight to the desert in January. To win a seat on Monday’s charter flight, Delta customers bid frequent flyer miles, while employees and retirees entered an internal lottery, with selection based in part on seniority and personal connection to the 747 fleet.

The celebration on board was low-key, more a reunion of old friends than the boisterous parties that sometimes mark commemorative flights. The four-and-a-half-hour journey provided many on board a chance to relive old times, especially for those who had plied trans-Pacific routes for Northwest Airlines prior to the merger. There was a throwback meal service—hot breakfast followed by a light lunch—and a 747-centric trivia quiz. (Sample question: How many miles of wiring are on a 747-400? Answer: 171.)

“I get all choked up,’’ said Christine L’Allier, who has spent most of her 32 years at Delta and Northwest as a flight attendant aboard the jumbos. She recalled Thanksgivings spent at 35,000 feet, with the traditional meal cooked in ovens large enough to fit a turkey. “When you were away from home, this was your family.”

The 747 was the first twin-aisle airplane, with more than double the capacity of the largest commercial craft at the time. Delta’s 747s, introduced on a maiden voyage in 1970 from Atlanta to Dallas to Los Angeles, brought the first overhead luggage bins to the airline, as well as the first in-flight audio channels, dubbed “Deltasonic,” which featured the Beatles, Burt Bacharach and Beethoven. The planes could hold 370 passengers, including 66 in first class and six in those penthouse seats up the stairs.

The design made it literally a wide-body, which became a moniker for long-range aircraft. “It’s one of two seminal airplanes,” said George Hamlin, an aerospace consultant, a former airline and aerospace executive and an aviation history buff. The DC-3, the other iconic aircraft on Hamlin’s list, was a silver piston-engine made by Douglas that helped airlines evolve from mail carriers to people movers in the 1930s and 1940s.

But it was the long-haul capability—a 6,000-mile reach—that made the 747 transformational. “The range of the plane allowed it to go anywhere in the world,” said Michael Lombardi, Boeing’s corporate historian. “It was at that point in history where all of humanity had the ability to get on a flight.”

The peak year of the 747 came in 2002, when the airplane completed 33,000 flights hauling 10.5 million passengers on 50 airlines. All told, 1,540 Boeing aircraft have been delivered since 1969.

“It was the plane that shrank the world. That is the legacy of the 747,” Lombardi said. “Joe Sutter would tell you the same thing.”

The farewell tour for the Delta 747 also serves as an elegy for Sutter, who died last year at 95. The blunt, sometimes fiery tempered Boeing engineer was known as the “Father of the 747” for his role in shepherding the plane to market in the 1960s against steep odds. Juan Trippe, the autocratic founder of Pan American World Airways who was then the most powerful person in aviation, wanted a single-aisle design with two decks. Sutter believed that the configuration would doom the big plane, so he held out for the single-deck, twin-aisle design. His team, nicknamed the “Incredibles,” brought the plane to life in less than two and a half years, while dealing with balky engines and the prospect of financial collapse.

Boeing created the plant in Everett—the largest building on the planet by volume—just to build the 747, and the same facility eventually turned out such wide-body successors as the 767, 777 and 787 Dreamliner. Airplane sales were already slumping by the time the 747 debuted in the turbulent 1970s travel market, but Lombardi said the period proved fertile for Boeing’s development of next-generation improvements: cockpits operated by two pilots instead of three, flight computers and glass screens to replace analog dials.

Monday’s event in Everett actually marked the second time Delta has retired its 747 fleet. The Atlanta-based carrier took delivery of the first of five 747-100s in October 1970, a period when U.S. carriers were starting to experiment with wide-body jets on domestic routes. The planes featured a Delta “penthouse” behind the upper deck that could be reserved by private parties or by five or six customers who purchased seats together. Even with features such as “deep carpet, soft lights, patina of rosewood and walnut, stereo sound,” as Delta described the private lounges in a brochure, the new planes struggled to make money and were eventually returned to Boeing.

The company eventually created the best-selling 747 model, the -400, which was delivered first to Northwest Airlines in 1989. This started the fleet that would eventually become Delta’s when the airlines merged nearly two decades later. Delta retired the prototype on Sept. 9, 2015, after it had logged 61 million miles.

Delta became the last U.S. carrier to fly the passenger version of the 747 once United Airlines retired its jumbo fleet in November. Outside of the U.S., however, there will still be plenty of 747s carrying passengers: British Airways, Korean Air Lines Co. and Deutsche Lufthansa AG are all big operators.

But over the past 10 years, sales of the latest Boeing 747 model have dwindled, and the jet’s future, to the extent that there is one, will be as a freighter, said George Ferguson, aerospace analyst with Bloomberg Intelligence. United Parcel Service Inc. holds all but three of the unfilled orders left for the 747, as well as options to order an additional 14 planes.

“It’s never going to be a big seller again, that’s absolutely done,” Ferguson said of the 747. “It can hang on for a while, but it’s a sunset.”

The post Farewell to the 747, the Plane That Shrank the World appeared first on Bloomberg Businessweek Middle East.

from WordPress http://ift.tt/2CZQxRV via IFTTT

0 notes

Text

Delta Takes the Iconic 747 Jumbo Jet on a Farewell Tour

Delta is taking its 747s on a farewell tour this week to mark the aircraft being retired from U.S. passenger service. Delta Air Lines

Skift Take: The death of the Boeing 747, which introduced long-haul air travel to the masses, has at times been exaggerated. While Delta will retire the jumbo jet in the U.S., British Airways, Korean Air and Lufthansa all continue to fly the plane.

— Dennis Schaal

For a half-century, Boeing Co. mechanics in a sprawling factory north of Seattle have riveted together aluminum panels into the familiar hump-backed form of the 747 jumbo jet. Test pilots then put each new plane through its paces on an adjacent air strip before sending it off to roam the globe.

This airplane, more than any other, made long-range travel into a mass-market phenomenon. And on Monday, one of the jets born here is returning home.