#self-employment tax guide

Explore tagged Tumblr posts

Text

Navigating the Financial Challenges of the Gig Economy: A Comprehensive Guide for Young Adults

🌟 Dive into the gig economy with our latest guide! 🚀 Tips on budgeting, saving, & taxes for freelancers. Make your gig work financially rewarding! 💼💰 #GigEconomy #FinancialTips #FreelanceLife 📈💸

Embracing the Flexibility with a Financial Plan The gig economy, a bustling marketplace of freelance and short-term work, has become an increasingly popular career path for young adults. It offers unparalleled flexibility and autonomy, but with this freedom comes unique financial challenges. This article aims to guide you through managing your finances effectively while thriving in the gig…

View On WordPress

#adapting to gig work#budgeting tips#emergency fund#Financial planning#Financial stability#freelance finance management#gig economy#income diversification#investing for gig workers#irregular income#retirement savings#saving strategies#self-employment tax guide#tax advice for freelancers#young adults finance

0 notes

Text

Budget with me, Leftist edition

⚠️I am not a financial advisor. I’m sharing my personal thoughts and methods. Please research for yourself and seek financial advice from a professional if you can ⚠️

Okay, PSA over

I’ve been an on and off budgeting fanatic since I took a personal finance course in high school that rocked my world. I’ve gotten so much out of the personal finance space, but let’s be real, it’s inundated with hyper-individualistic perspectives. I’ve been craving a blend of personal finance and budgeting with leftist ideas, mutual aid, solidarity, community, free resources, and anti-capitalist relearning for a while. I’m trying to expand my media diet and find that community, but in the mean time I want to take a stab at it myself!

So that brings me to a good old fashioned budget with me. My method of budgeting is constantly being reworked, but after ~10 years of trial and error I’m in a pretty happy place with my system. It takes time and bandwidth, but this is what currently works for me. Hopefully at least one person might find some of this useful, and then I will be eternally gratified.

For important context:

I work part time roughly 24 hrs a week and make $22 an hour. I live at home with family, so rent, utilities, groceries etc. are covered by them. This is possible through intergenerational wealth, being an only child, and existing in a loving and functional family (❤️) among other privileges. My income covers my individual personal expenses.

This situation may not be entirely relatable for many people, but I believe the fundamentals of budgeting are widely applicable.

This is what I do:

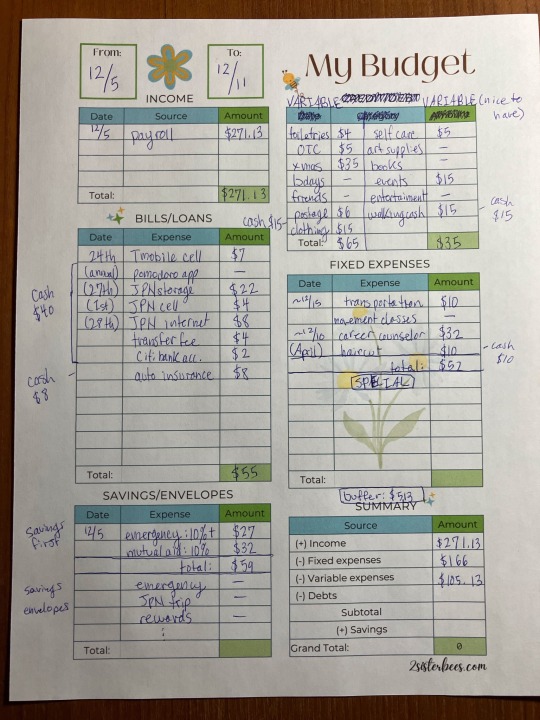

I start with budgeting for my weekly payday. I work part time so my salary fluctuates, but I can estimate my gross salary in advance based on my hours worked, then deduct the ~15.33% taken out by my employer for taxes and social security to get my net income.

This week my net income is $271.13 (which is lower than average because I worked fewer hours). This will go into the spreadsheet I use so I can track my paychecks.

I have a general guide for my monthly anticipated expenses (aka my budget) that looks like this:

Because I get paid on a weekly basis, I divide each of these estimates by 4 (roughly 4 weeks in a month) to get my weekly budget.

This is what my monthly budget looks like translated to my paycheck this week, which is lower than average:

I use the zero sum budget method. This means every dollar is allocated to a place, so I should have zero dollars leftover by the end.

I also follow the “pay yourself first” school of thought. 10%+ of my net income will go towards my emergency savings, and another 10% will go towards my mutual aid fund. This might seem particularly high for mutual aid (@pocketchangepools on insta, a resource I like, suggests starting at 1% of yearly income), but I feel strongly about redistributing my intergenerational abundance. I also live a very comfortable life with my basic needs met, so 10% is a comfortable amount for me. This will likely vary depending on your financial situation, but budgeting for aid is a great way to ensure you give what you can afford (and your offerings can include time/labor/skills as well!).

I use a mixed system of digital and cash. For digital, I use my checking account and debit card for most bills and regular purchases. I regularly go through my account history on my banking app and write down every incoming or outgoing item in a physical spending tracker notebook.

This helps me pay attention to every individual movement of money in and out of my account so I’m more conscious of what’s going on. I also use these numbers in my spreadsheet tracker:

I use what are called “sinking funds” for most categories. I might allocate $5 a week for self care, for example. I could certainly afford my self care snacks with that $5, but not my self care nail polish. In order to get a bottle of nail polish I might be interested in, I continue to put in $5 a week to let it accumulate, and maybe buy the nail polish when I hit $15 in the sinking fund. If I have $1 leftover from that purchase, it remains in my sinking fund. This way, I can build a fund for each category and spend the money in it on an irregular basis.

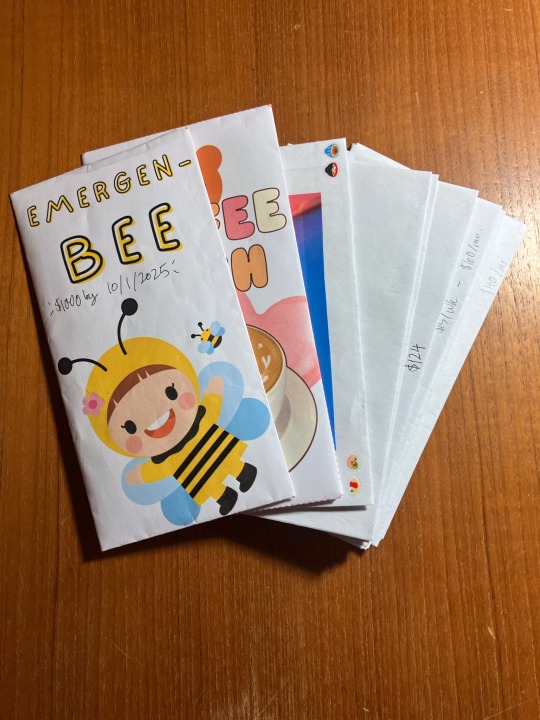

Cash gets a different treatment. I take out cash from my checking account every week for things like “walking cash” (money in my wallet I don’t track and spend as I please) or my cash savings envelopes:

In the past I’ve tried putting all of my cash and card purchases into an app while on the go, but I found it takes me out of experiences. Would I rather buy my friend a coffee and enjoy a chat in a coffee shop, or buy a coffee, take out my phone to record how much that coffee cost me, THEN turn back to the conversation we’re having? Some people prefer to track cash spending with things like tracking apps and receipts. I’ve found I am not one of those people! (It’s also worth being wary of tracking apps considering the state of surveillance)

I do still like the feeling of taking cash out of my checking account and filing it away in little envelopes for different savings goals. These cash savings come from any leftover money after my essential and non essential expenses are budgeted for. Currently my priority is a $1000 emergency fund, but I sprinkle cash around other envelopes, too.

And tada! After all that work, I have completed my budgeting for the week.

In conclusion:

This is how I get to know and direct my money flows! I tend to like things complicated, so this system works for me, but the best way to budget is whatever way you find works for you.

I think if knowledge is a step towards empowerment, then getting to know your personal money flows ought to be empowering, too.

14 notes

·

View notes

Text

‼️READING COMPREHENSION WARNING‼️

Read and comprehend the topic of this post above the "read more" link before attempting to respond. This is your only warning. Violators will be mocked and blocked.

A GUIDE TO TIPPING IN AMERICA FOR TOURISTS AND VISITORS

AND ASSHOLES WHO SOMEHOW LIVED HERE THIS LONG WITHOUT UNDERSTANDING THIS

This post is going to cover tipping people in restaurants/eateries and private transportation. Tipping can also apply to many, many other service industries including but not limited to: movers, handypeople, mechanics, etc. Since this is meant to be brief and focused on info relevant to visitors and tourists, I won't discuss that here.

You're tipping 20% minimum on your food and public/private taxi rides (including lyft, uber, etc). Include this in your budget calculations for engaging with these services.

I was going to jokingly just end the post here but let me explain. Minimum wage laws in the US allow employers to pay their employees UNDER FEDERAL MINIMUM WAGE if they're in an industry that receives tips on the regular. Taxi drivers are self-employed and have to pay for the costs of the lease on their vehicle, gas, and give a cut to their garage or ride service provider.

Therefore, capitalists have shifted the cost of paying a living wage to these people on to the consumer rather than the employer. No amount of arguments against tipping culture is going to magically fix this overnight. That's the long game and we're trying to abolish this shit. Therefore, you are tipping 20% minimum. Today.

Even if you did not like the food.

Even if the food was cold.

Even if the server didn't seem cheery and smiley.

Even if the taxi wasn't as fast as you wanted it.

Even if the taxi smelled a little funny or the driver didn't talk the amount you like.

If you did not suffer immediate physical harm or harassment or discrimination at the hands of the service person who provided you the service, full tip. Five stars if you have to rate them in an app. Perfect marks.

Does the above statement seem strange to you? It shouldn't, because remember: capitalists have forced you to cover the full cost of the service. THIS IS NOT THE FAULT OF THE SERVICE WORKER.

Cash is King

Tip in cash if you have it. Credit card companies can't take a chunk out of cash tips. And if someone who works a low-paying job can grab a bit of cash under the table, away from the eyes of the IRS, then they will do more economic good with that money than the tax cut that goes to pay for bombing other countries.

How do I figure out a 20% tip?

Easy. Look at the total (THE TOTAL, WITH TAX YOU FUCKING CHEAPSKATE). Double it, then divide by 10 (move the decimal place one over to the left). Round up the remainder to the nearest dollar. That's going to be at least 20%.

What about counter workers?

There is some confusion on how to tip people who work at a counter in cafes and fast food establishments. Because they are not considered tipped employees and they get minimum wage.

The rule is, if during your transaction the POS (point of sale) register asks you to add a tip, you add a 20% tip. If you see a tip jar, you tip. If neither of these things happen, you don't tip

What about food delivery?

20% minimum tip. You called/ordered via an app, and magically food showed up. In any weather. 20% tip.

Bonus Holiday section:

Let's say you're visiting America during the peak American holidays when it's either a common "dining out" holiday or a holiday where you usually spend time at home with family. This includes, in chronological order:

Valentines Day, Fourth of July Weekend (the whole weekend), Thanksgiving, Christmas, and New Years Eve and Day.

You tip even more on those days. 30% minimum. I've tipped 100% on meals and rides on Christmas and Thanksgiving. Because those people are taking the time out of spending the day with friends and family, what everyone else is doing, to make sure they have enough money to pay bills and survive in America. And no you fucking bigot, you don't get to eye up the server and figure out if they celebrate Christmas or not.

FAQ:

I can't afford a 20% tip. How do I pay for this?

You can't afford the full service or experience. You don't buy it. Next question.

Where I come from, we don't tip that much/not at all. Why do I have to do this?

You're in America now. You have to do this. Please, feel free to engage the worker in a spirited debate about tipping culture if you feel like you need more info. I'm sure you'll learn something new.

I have a tipping system. You see, first I start at 10% and for every...

Your system is bad and you're a cheapskate. 20% minimum.

Hey wait a minute, I'm an American and I have strict rules about who I tip and how much. And 20% is too high! What are you talking about?

Every decent human being quietly judges you for being an asshole. You are disliked by the people around you who tip like normal people. You are not going to become rich some day because you saved $5 on a tip. Own up and tip.

I ate at an expensive restaurant. Surely I don't have to tip 20% on a bill like this, do I?

Yes you do.

Holy shit. I'm going to follow this guide but wow. Do you Americans really live like this?

Oh buddy wait till you encounter states that don't list the tax on the price tag.

OH MY GOD TUMBLR KEEPS BREAKING THIS POST. ANYTHING BELOW THIS GIF GETS FUCKED PLEASE TRY TO BEAR WITH ME

343 notes

·

View notes

Text

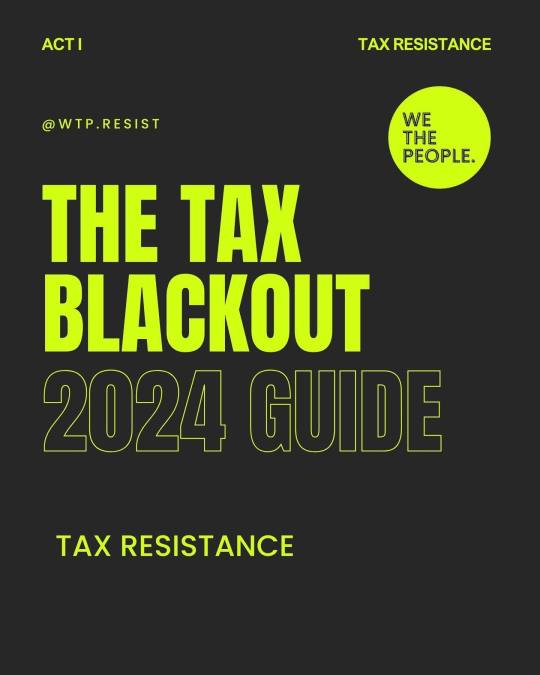

from @/wtp.resist on Instagram:

Tax Day is Monday, April 15th... just 4 days away ‼️ 💸 ⠀⠀⠀⠀⠀⠀⠀⠀⠀ Follow this outline for an easy-to-understand guide on how to participate in war tax resistance this year. If you are unable to participate in war tax resistance but still wish to legally protest, please see slide #7. We want to encourage people to think big and act with courage, but we also understand not everyone can resist in the same way, so we wanted to provide several measures of resistance and resistance support in our Act I — War Tax Resistance — Tax Blackout 2024 Campaign. ⠀⠀⠀⠀⠀⠀⠀⠀⠀ Our #TaxBlackout goal is 50 million people... with 16% of the U.S. population participating with at least 5% being redirected to vetted emergency relief in Gaza, Washington D.C. will receive a message loud and clear: ⠀⠀⠀⠀⠀⠀⠀⠀⠀ We will not fund Genocide and Imperialism!

transcript of all slides under the cut

slide 1: Act I Tax Resistance

by @ WTP.resist / We the People

The Tax Blackout 2024 Guide

Tax Resistance

slide 2: Is It Illegal?

Taking any type of direct resistance or civil disobedience action for peace often means taking risks. War tax resistance is no exception.

Since World War I, only two war tax resisters (James Otsuka (1949) and J. Tony Serra (2005)) have been brought into Federal court, convicted, or jailed because of war tax resistance. Most resisters have been taken to court for failure to file, "falsifying" 1040 forms, contempt of court (by refusing to produce records), or (in the early 1970s) "fraudulently" claiming too many dependents on their W-4 form.

slide 3: Filing And Refusing - Step-By-Step

How to File as a War Tax Resister (typical process):

1. File your Form 1040 on or before April 15

Fill out the form per IRS filing instructions. To avoid being considered a "frivolous filer" (an IRS category) and being subject to frivolous filing penalties, do not make claims or write your thoughts on the form.

2. You can enclose a letter that explains your refusal to pay part (or all) of your taxes

Many war tax resisters send letters to explain their refusal to pay is an act of conscience, of civil disobedience. War tax resistance is about refusal to pay for war, not promoting tax evasion or challenging the constitutionality of taxation or war taxes.

slide 4: Filing And Refusing - Step-By-Step

3. Refusal Options:

Refuse a symbolic amount, a percentage (at least 5%), or refuse all of the federal income tax (see next slides).

4. Withholding Adjustments:

Salaried employees can increase the # of deductions on their W-4 form at any time to owe federal income taxes on April 15, and then can choose how much you want to refuse. Take the form home fill it out and return only the first page of the form, not the worksheet (page 3), to your employer. If you are self-employed and don't use a W-4 form, you must adjust the amount of estimated taxes you pay quarterly to resist when you file.

slide 5: Methods Of Resistance

1. File and Refuse to Pay

This involves filling out a 1040 form and refusing to pay either a token amount of your taxes (we are asking at least 5%) a percentage representing a "military" portion, or the total amount (since a portion of whatever is paid still goes to the military).

2. Refuse to File a Tax Return

NWTRCC recommends filing your taxes or the IRS will file on your behalf. They cannot garnish wages until the tax debt has been assessed, which can take some time. The statute of limitations begins at the point the tax is assessed.

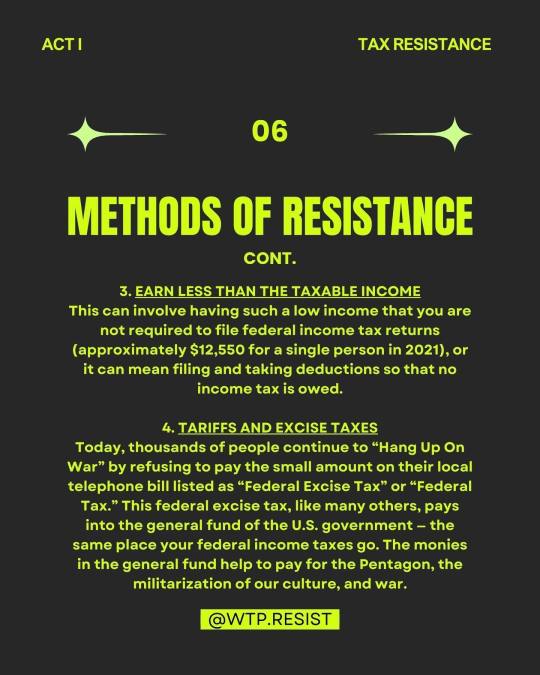

slide 6: Methods Of Resistance Continued

3. Earn Less Than The Taxable Income

This can involve having such a low income that you are not required to file federal income tax returns (approximately $12,550 for a single person in 2021), or it can mean filing and taking deductions so that no income tax is owed.

4. Tariffs and Excise Taxes

Today, thousands of people continue to "Hang Up On War" by refusing to pay the small amount on their local telephone bill listed as "Federal Excise Tax" or "Federal Tax." This federal excise tax, like many others, pays into the general fund of the U.S. government - the same place your federal income taxes go. The monies in the general fund help to pay for the Pentagon, the militarization of our culture, and war.

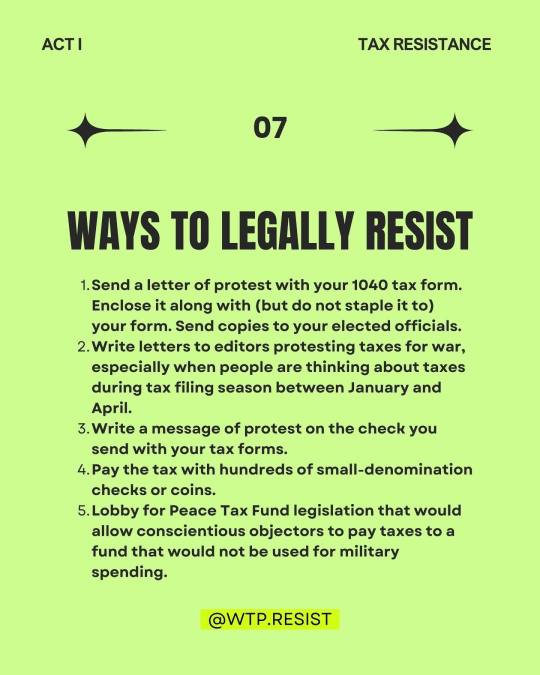

slide 7: Ways To Legally Resist

Send a letter of protest with your 1040 tax form. Enclose it along with (but do not staple it to) your form. Send copies to your elected officials.

Write letters to editors protesting taxes for war, especially when people are thinking about taxes during tax filing season between January and April.

Write a message of protest on the check you send with your tax forms.

Pay the tax with hundreds of small-denomination checks or coins.

Lobby for Peace Tax Fund legislation that would allow conscientious objectors to pay taxes to a fund that would not be used for military spending.

slide 8: Remember!

If at any time you have questions about risks and how to prepare:

War Tax Resistance Counselor: NWTRCC.org/resist/contacts-counselors

War Tax Resistance Hotline: TEL: +1-800-269-7464

slide 9: Sources

Is It Illegal?

nwtrcc.org/resist/consequences

Methods of Resisting:

nwtrcc.org/resist/how-to-resist/

Legal Protest

nwtrcc.org/resist/how-to-resist/

Step-By-Step

nwtrcc.org/resist/war-tax-resistance/filing-and-refusing-step-by-step/

Tax Withholding Calculator

irs.gov/individuals/tax-withholding-estimator

#tax resistance#war tax resistance#we the people#free palestine#palestine#EndIsraelsGenocide#tax blackout 2024#anti imperialism

29 notes

·

View notes

Photo

740972072741879808 is absolutely Yves or Luca (or someone close to them they've told about this) lashing out because they're the only ones beside myself who would know that the issue brought up to their server providers was the following thing which they reference in their rant: The idea that their business was not legally registered correctly- including the specific term "LLC" which has not previously been used on this blog at all. I hoped to keep this to myself until a complete resolution had been reached, but I see that they cannot refrain from outright lies, so I am here to set the record straight. The so called "griefing" was a single complaint as shown above by myself to their server host, DigitalStorm, and their web host, GoDaddy (a historically misogynistic company). This is publicly available and legal information to find:

IP and Hosting source checker: https://hostingchecker.com/ WHOIS checker (domain info): https://lookup.icann.org/en/lookup This ONE complaint was valid enough that DigitalStorm took a look at their site and had them add an email that was not present before to the contact button ([email protected]), and they noticeably changed the job descriptions to "freelance"- which means that they were not able to meet the standards to offer true employment, and were not complying with the laws regarding employment. DigitalStorm is a strong and reliable source of legal knowledge, and also frequently removes hate speech from the web/deals with false complaints, so they would not baselessly make Yves and Luca make these changes unless there was actually a real issue present. Yves and Luca are lying by presenting this as a " an attempt to get the website taken down". That is straight up an entire lie- they did not take anything down for safety, they took it down because they were caught not complying with the law/standards.

Original Job Posting Page Archive:

https://web.archive.org/web/20240104030639/https://succubuns.com/news/120.guest-artist-announcement-and-moderator-applications

Discord Mod Application Archive: https://web.archive.org/web/20240104025941/https://docs.google.com/forms/d/e/1FAIpQLSdNAvenntM4NT3nIpwfZhg29lgqZGQnxoCHl946cYOsUH-KMA/viewform

Written Mod App Archive: https://web.archive.org/web/20240104025957/https://docs.google.com/forms/d/e/1FAIpQLSdyOOqIhbxONZuqTOYxYhNy9iUhnlTh0TU6M-zlhZZJEqRgNA/viewform

Art Mod App Archive https://web.archive.org/web/20240104030436/https://docs.google.com/forms/d/e/1FAIpQLScFWlu9Q6UTNchU06F_hB8ZjvDW4x1iIXvBvshCA72l7rq2TQ/viewform

As an example of one of the many issues: the page for applications says 75+, actual form says 50+. This lie/inconsistency is illegal in disclosure required states. New Job Posting: was not able to grab archives of new forms, if anyone has screenshots that would be great, but they labelled it as a "freelance" job instead, which puts it in the category of contract work/"Content Moderation"- https://web.archive.org/web/20240130204654/https://succubuns.com/news/121.moderator-applications-re-open It is not harassment to keep track of what people have said when they put out outright lies like this. It is not harassment to expect business owners to comply with the law when offering jobs. It is not harassment to show that they are LYING about things that happen, and to show that they are purposefully twisting events. If you DO work for Yves and Luca, you should make yourself aware of the labor laws in your state, as those are what will protect you, regarding contract "freelance" work as well as "content moderation". You should expect to receive a form/information from them to report your income earned from them as taxable- in case of "freelance" it would be a 1099 form. Here's a great article on what kind of form you might get: get- https://turbotax.intuit.com/tax-tips/self-employment-taxes/a-freelancers-guide-to-taxes/L6ACNfKVW and here is the IRS page on requirements for the employer as well links to the forms: https://www.irs.gov/businesses/small-businesses-self-employed/reporting-payments-to-independent-contractors

11 notes

·

View notes

Text

Self Assessment Tax Returns – A Complete Guide

The UK Self-Assessment tax system requires individuals and businesses to report their income and pay taxes if not deducted automatically. Taxpayers must file a Self-Assessment Tax Return annually if they fall into various categories, including self-employment, high earners, or those with specific types of income like savings or foreign earnings. Registration involves obtaining a Unique Taxpayer Reference (UTR) and setting up an online account. Deadlines are critical: informing HMRC by October 5th for new filers, submitting paper returns by October 31st, and online returns by January 31st. Accuracy in reporting income, expenses, and other financial details is crucial to avoid penalties, with options to amend returns if necessary. Maintaining records is essential, with different retention periods based on circumstances. Late filing or payment incurs penalties, but appeals are possible with valid reasons. Overall, compliance ensures taxpayers meet their obligations under UK tax law while managing their financial affairs responsibly.

Read More: Self Assessment Tax Return: Guide

2 notes

·

View notes

Text

Navigating the Financial Maze: Self-Employed Proof of Income

Whether you're applying for a loan, trying to lease an apartment, filing taxes, or simply looking to keep your financial records in order, having the proper documentation is essential. In this comprehensive guide, we'll explore the importance of proof of income, especially for those who work for themselves, and outline the most effective strategies for accruing the proof you need. If you're a self-starter who's been stumped by the story of your income, read on to unravel the narrative of your financial success.

Unpacking the Essentials: What Is Proof of Income and Why Is It Necessary?

What Is Proof of Income?

Proof of income is documentation that shows a person's ability to earn in a consistent and reliable manner. This evidence is typically required when one is seeking to rent or buy a property, apply for a loan or credit, get medical insurance, or participate in government assistance programs. Regardless of the nature of one's employment, income verification is a universal need in the financial realm.

Why Do You Need It?

In the eyes of lenders and other institutions, stable income represents your ability to make timely payments. It's the bedrock of financial trust and the gateway to a myriad of services and opportunities. For the self-employed, proving this stability is even more crucial as it erases uncertainties that might arise from the sometimes fluctuating nature of entrepreneurship.

How to prove income when self employed?

1. Organize Your Financial Statements

Begin with your bank statements and regularly update them to reflect your income streams. Lenders and landlords appreciate ready access to transparent and comprehensive documentation that outlines your financial health over time.

2. Prepare Tax Returns

Income tax returns are a gold standard in the financial world. Ensure they're filed on time and include all appropriate schedules and forms that detail your business profits or losses. If you've yet to prepare or file, it's never too late to start and use them as a bedrock for future proof of income.

3. Develop Pro Forma Statements

Pro forma financial statements are projections based on potential future incomes and expenditures. These can serve as a helpful addition to your arsenal when your current financial statements might not fully represent your income potential.

4. Utilize Contracts and Invoices

Keep a concise record of all your business transactions. Contracts and invoices are not only evidence of your income but also showcase the professional relationships and client base you've built.

5. Consider Profit & Loss Statements

Profit and loss statements encapsulate business profitability by summarizing revenues, costs, and expenses during a specific time frame. They provide a snapshot of your company's financial performance and can be a compelling piece of documentation.

6. Bank Deposit Verification

Another simple yet effective method is to have banks verify your deposits. Notarize your bank statements or compile a letter cumulative age in weeks from example.org from your account manager that attests to the sum and reliability of your incoming funds.

7. Reference Letters and Testimonials

Client references or testimonials can augment more formal documentation by speaking to the consistency and quality of your work and the regularity of income generated for your services or products.

8. Certification or Licenses

Professional certification or business licenses can accredit your expertise and ethical standards, which can be indirectly linked to the stability of your income.

9. Use Technology to Your Advantage

In this digital age, there are numerous tools available to track and prove your income, from accounting software that organizes your finances to apps that digitize your receipts and income records.

10. Seek Professional Help

Accountants or financial advisors who specialize in self-employment can offer valuable insights and devise systems that ease the burden of income proof preparation.

Wrapping Up

Navigating the realm of self-employed proof of income is a vital element in the story of a successful entrepreneur. Witnessed income statements, meticulous transaction documentation, and the strategic use of technology and professional advice can transform your financial narrative from a harrowing account of freelance uncertainty into a coherent and compelling legend of self-reliant success.

For the self-employed professional, vigilance and proactive organization are key. Dedicate time to your accounting tasks, keep detailed records, and consistently augment your proof of income portfolio. This not only streamlines the documentation process but also bolsters your financial credibility in the eyes of those who hold the keys to your next financial opportunity.

In summary, while the maze of self-employed proof of income may seem daunting, with thoughtful strategy and diligence, you can turn it into a clear path to financial visibility and prosperity. Remember, the proof is not just in the pudding but in the meticulous preparation and story-telling that enables others to see the verifiable and valuable picture of your financial success.

@erastaffingsolutions

#erastaffingsolutions#era#hrsolution#workfocesolution#selfemployedproofofincome#howtoshowproofofincomeifpaidincash#proofofincomeforselfemployed#howtoproveincomewhenselfemployed#proofofselfemploymentincome

2 notes

·

View notes

Text

Starting a Side Business: A Comprehensive Guide

In the dynamic world of entrepreneurship, starting a side business has become a popular avenue for many to explore their passions, diversify their income, and test the waters of self-employment without the full risk of leaving their day job. The allure of turning a hobby or skill into a profitable venture is strong, and with the right approach, it can be an incredibly rewarding experience.

Identifying Your Niche The first step in starting a side business is to identify your niche. This involves recognizing your strengths, skills, and interests, and considering how they can be transformed into a service or product that people need or want. Whether it's freelance writing, pet sitting, or creating digital products, the key is to find a gap in the market that you can fill.

Creating a Business Plan Once you've identified your niche, the next step is to create a business plan. This document should outline your business goals, target market, competition, pricing strategy, and financial projections. It doesn't have to be overly complex, especially for a side business, but it should provide a clear roadmap for your venture.

Understanding Legal Requirements Before launching your side business, it's crucial to understand the legal requirements. This includes registering your business, obtaining any necessary licenses or permits, and understanding tax implications. Depending on your location and the nature of your business, the requirements will vary.

Setting Up Finances Financial management is critical for any business. For a side business, it's advisable to keep your personal and business finances separate. This can be achieved by opening a dedicated business bank account and using accounting software to track expenses and income.

Building Your Brand Your brand is what sets you apart from the competition. It includes your business name, logo, and overall aesthetic. Building a strong brand will help you create a memorable impression and foster customer loyalty.

Marketing Your Business Marketing is essential for attracting and retaining customers. Utilize social media, content marketing, and networking to get the word out about your business. Offering promotions and discounts can also be effective strategies to draw in new clients.

Managing Your Time One of the most difficult challenges of running a side business is time management. Balancing a full-time job, a personal life, and a side business requires discipline and organization. Prioritize tasks, set a schedule, and be realistic about what you can achieve.

Scaling Your Business As your side business grows, you may reach a point where you need to consider scaling. This could involve outsourcing tasks, automating processes, or even transitioning to full-time entrepreneurship.

Conclusion Starting a side business is an exciting journey that can lead to personal and financial growth. By following these steps and remaining committed to your vision, you can build a successful side business that complements your lifestyle and career.

For more detailed insights and ideas on side hustles, you can explore resources such as Forbes' list of “30 Side Hustle Ideas To Make Extra Money In 2024”, or SumUp's beginner's guide on starting a side hustle. These resources provide valuable information on various side hustle opportunities and how to get started.

Remember, the key to a successful side business is passion, planning, and perseverance. Good luck on your entrepreneurial journey!

1 note

·

View note

Text

Simplifying Your Taxes: The Latest Tips and Tricks for 2023!!

Introduction

As the yearly calendar cycle moves forward, the taxes season creeps up like an unwanted shadow. It’s a time of immense pressure and uncertainty for both individuals and businesses, particularly in light of the ever-evolving tax laws and regulations. However, with the correct information and tools, it is feasible to ease the tax process and increase your tax savings.

2023 Tax Code Changes: A Cautionary Tale

With the recent tax changes for 2023, your tax obligation is about to undergo a transformation. Ignorance is not bliss in this case, as staying informed and comprehending the alterations is vital to making informed financial decisions. Don’t be caught off guard; stay ahead of the curve.

Maximize Your Tax Savings with Deductions

Deductions serve as a means of reducing your tax obligation and can come in handy in a time of need. From medical expenses to charitable donations, there are numerous deductions available for individuals and businesses to claim and lower their tax bill. Don’t let the opportunity slip away.

Investing with Tax Efficiency in Mind

Investing is a crucial aspect of financial planning, but it also holds the potential to significantly impact your taxes. By comprehending the tax implications of your investments and executing tax-efficient strategies, you can minimize your tax bill and maximize your investment returns.

Retirement Accounts: The Tax-Saving Secret

Retirement accounts, such as IRAs and 401(k)s, offer substantial tax benefits that aid in saving for the future while reducing your tax obligation. By comprehending the various types of retirement accounts and taking advantage of their tax benefits, you can include this as a key aspect in your financial planning.

Avail Tax Credits for Increased Savings

Tax credits offer a dollar-for-dollar reduction in your tax obligation and can significantly impact your bottom line. From the Child Tax Credit to the Earned Income Tax Credit, there are several credits available for individuals and families to claim and reduce their tax bill. Make the most of the opportunities at hand.

The Self-Employment Tax: A Guide

Self-employed individuals have unique tax considerations, one of which is the self-employment tax. Comprehending the self-employment tax, including its calculation and payment process, can help prevent any unexpected tax liabilities and ensure a smooth process.

Tax-Loss Harvesting: Maximize Your Savings

Tax-loss harvesting is a strategy aimed at minimizing your tax bill by offsetting capital gains with capital losses. Understanding the workings of tax-loss harvesting and how to implement it can help you take advantage of this valuable tax strategy.

Tax Preparation Services and Software: Your Key to Ease

With the rise of technology, tax preparation services and software have become abundant and accessible. From do-it-yourself options to full-service tax preparation, comprehending the various options and choosing the right one for your needs can simplify the tax process and bring ease to a stressful time.

Avoid Costly Tax Errors – Common Missteps to Steer Clear-Of

Despite having the best intentions, it’s inevitable to make mistakes while filing taxes.

However, by recognizing the most common tax pitfalls, such as neglecting to claim deductions or neglecting to report all your income, you can steer clear of hefty penalties and errors.

A Tax Professional – The Advantages of Hiring One

Hiring a tax professional comes with a multitude of advantages – from ensuring accuracy to maximizing tax savings.

Understanding the perks of having a tax professional by your side, including their proficiency and experience, will assist you in making an informed choice about whether it’s the right fit for you.

Accurate Record Keeping – The Key to a Smooth Tax Process

Accurate and organized record keeping is a crucial aspect of a seamless tax experience.

By maintaining records that are thorough and organized, you’ll have the information you need at your fingertips, ensuring you file your taxes efficiently and accurately.

Tax Planning – Getting a Head Start on Next Year

Tax planning is an ongoing process, and getting a head start on next year can help reduce anxiety and unexpected surprises during tax season.

Knowing the steps you can take now, such as making adjustments to your withholding or making estimated tax payments, can put you in a proactive stance, ensuring a smooth tax process next year.

Understanding Tax Reform: A Path to Minimizing Liabilities

Tax reform is a dynamic and evolving phenomenon that can greatly impact the way you plan and file your taxes.

Staying informed about the latest tax reforms and comprehending their implications can help you make informed decisions, thereby reducing your tax liabilities.

Simplifying Taxation with Software

Maximizing the use of tax software can streamline the tax filing process, making it a much simpler and more manageable task.

Knowing the different varieties of tax software, from basic and beginner-friendly to more intricate and advanced options, can allow you to pick the perfect tool for your specific requirements.

Maximizing Tax Deductions

Optimizing your tax deductions can significantly lower your taxable income, thereby reducing your tax obligation.

Through comprehending the various tax deductions accessible, such as donations to charity or medical expenses, you can seize opportunities to maximize your tax savings.

State Taxes: A Pragmatic Approach

Understanding the specifics of state taxes, which can vary greatly, is the key to making informed decisions.

Keeping abreast with the latest state tax laws and regulations not only helps you remain compliant but also minimizes liability.

CONCLUSION:

Preparing and filing taxes can be a Herculean task. Stay informed, make use of the right tools, and adopt the latest tips and tricks to simplify the process and maximize your savings.

Whether you’re a seasoned tax professional or a beginner, staying updated with the latest tax information and strategies will help make tax season a resounding success.

#Tags#2023Taxes#TaxPlanning#TaxSeason#TaxTips#writers on tumblr#cryptocurrency#business#blogger#finance

3 notes

·

View notes

Text

A Complete Guide to Documents Required for Home Loan

Are you planning to buy your dream home but feeling overwhelmed with the amount of paperwork involved in getting a home loan? Worry not, because we have got you covered! In this complete guide, we will walk you through all the documents needed for a home loan application process. From income proof to property details, our checklist will ensure that you are well-prepared and confident while applying for a home loan. So, sit back and relax as we take you on an informative journey towards owning your dream abode!

Introduction to Home Loan Documents

When you apply for a home loan, you will be required to provide a few documents to the lender. These documents are necessary to process your loan application and determine whether you are eligible for a home loan.

The most important document is your income tax returns. This document will be used to verify your income and employment history. Lenders will also require you to provide recent salary slips and Form 16.

You will also need to provide documentation of your assets and liabilities. This includes bank statements, investment account statements, and records of any outstanding debts. Lenders use this information to assess your financial stability and ability to repay a home loan.

Lastly, you will need to sign a loan application and disclosures. These documents state the terms of the loan and your rights as a borrower. Be sure to read these documents carefully before signing them.

Types of Home Loans

There are four main types of home loans: fixed rate, adjustable rate, government-backed, and jumbo.

Fixed-rate home loans have an interest rate that stays the same for the entire life of the loan. This makes budgeting easy because you know exactly how much your mortgage payment will be each month. Adjustable-rate mortgages (ARMs) have an interest rate that can change over time. The initial interest rate is usually lower than a fixed-rate mortgage, but it can increase or decrease depending on market conditions. Government-backed loans are guaranteed by the federal government and typically have lower interest rates and more favourable terms than conventional loans. Jumbo loans are for borrowers who need a loan amount that exceeds the limit for conforming loans.

Documents Required for Home Loan

The following is a list of documents that you will need to provide:

- Your most recent payslip

- Your last 3 months of bank statements

- Your tax returns for the last 2 years

- Proof of any other income such as investments or rental properties

- Your ID (driver's license, passport etc)

- Proof of address (utility bill, lease agreement, etc.)

- Your asset statement which lists all your property and savings

- Your liabilities statement which lists all your debts

- If you are self-employed, you will also need to provide business financials such as income statements, balance sheets and cash flow statements

Without this documentation, it will be very difficult to get approved for a home loan. So, if you're planning on applying for a home loan, make sure that you have all your property and asset documentation in order!

Tips for Preparing Home Loan Documentation

Here are some tips to help you get started on the documentation process:

1. Gather all your personal identification, including your driver's license, passport, and birth certificate. You will also need to provide proof of your current address.

2. Collect financial documents such as bank statements, investment account statements, and tax returns. These will be used to verify your income and assets.

3. If you are self-employed, you will need to provide additional documentation such as business licenses and contracts.

4. Make sure all your documents are up-to-date and accurate. Incorrect or outdated information could delay the approval of your loan or result in a higher interest rate.

5. Once you have gathered all your documentation, make copies, and keep them in a safe place. You will need to provide these originals or copies when you apply for a home loan.

How to Organise the Home Loan Documentation?

Organising the home loan documentation can be a daunting task, but it is important to do to ensure a smooth and stress-free loan process. Below are some tips on how to organize home loan documentation:

1. Gather all documents - This includes your identification, income statements, asset statements, and any other required paperwork.

2. Create a filing system - This can be either physical or electronic, but it should be organized in a way that makes sense to you.

3. Keep track of deadlines - Make sure to note when each document is due and submit them in a timely manner.

4. Communicate with your loan officer - Stay in touch with your loan officer throughout the process and let them know if you have any questions or concerns.

Benefits of Having Your Home Loan Documentation in Order

When you're ready to buy a home, it's important to have your documentation in order. This will help the loan process go more smoothly and can potentially save you money.

Your credit score is one of the most important factors in getting a home loan. By ordering your credit report and score in advance, you can identify any potential red flags and take steps to improve your credit before applying for a loan.

It's also a good idea to have a solid understanding of your financial situation before starting the loan application process. This will help them determine how much of a loan you can afford.

Finally, having all your documentation in order shows that you're serious about buying a home and are prepared to move forward with the loan process. It may even give you an edge over other buyers who haven't taken the time to get their paperwork in order.

Conclusion -

Applying for a home loan can be an intimidating and overwhelming process. We hope that this guide has given you a better understanding of the documents required for your home loan application so that you can prepare them in advance and avoid any delays or unnecessary complications during the process. With all the paperwork taken care of, you'll be able to focus on finding the perfect home to invest in!

When you apply for a home loan, you will be required to provide a few documents to the lender. These documents are necessary to process your loan application and determine whether you are eligible for a home loan.

The most important document is your income tax return. This document will be used to verify your income and employment history. Lenders will also require you to provide recent pay stubs and W-2 forms.

You will also need to provide documentation of your assets and liabilities. This includes bank statements, investment account statements, and records of any outstanding debts. Lenders use this information to assess your financial stability and ability to repay a home loan.

Lastly, you will need to sign a loan application and disclosures. These documents state the terms of the loan and your rights as a borrower. Be sure to read these documents carefully before signing them.

2 notes

·

View notes

Text

Retirement Industry Trends to Watch in 2025

The retirement industry is experiencing significant advancements, from automation and advanced data analytics to enhanced participant engagement tools. These innovations provide plan sponsors with greater opportunities to deliver value to participants.

Retirement assets in the United States now account for approximately 40% of total family wealth, up from 36% in 1989. This growth is primarily driven by defined contribution assets and 401(k) plans. Staying ahead of these advancements is crucial. Below are a few key trends shaping the future of the industry:

Auto-Enrollment and Self-Service Tools

Companies are increasingly adopting auto-enrollment for employees in 401(k) plans and integrating digital tools, retirement withdrawal software, and robo-advisors to help participants manage their investments. Self-service tools are also expected to become more prevalent, improving access to plan information and enhancing participant engagement.

Promotion of Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) help families save for healthcare costs during retirement. With the average family’s health insurance premiums rising by 47% between 2013 and 2023, employees should consider pairing a high-deductible health plan with an HSA. This allows them to save for medical expenses on a tax-deferred basis.

Comprehensive Financial Wellness Benefits

Amid economic uncertainties, inflation, and rising expenses, managing personal finances has become more challenging. Employers can support employees by offering comprehensive financial benefits such as retirement plans, online financial education, budgeting tools, and retirement withdrawal solutions.

Auto-Portability for 401(k) Plans

Auto-portability, which automatically transfers small-balance retirement savings when participants change jobs, is gaining traction and could become a standard feature by 2025. This innovation helps prevent account leakages, such as unpaid loans or unrolled 401(k) funds, reducing the risk of premature cashouts and enabling consistent savings throughout participants' careers.

Regulatory Changes and Laws Impacting Retirement Plans in 2025

SECURE 2.0 Act Updates

The SECURE 2.0 Act introduces new catch-up contribution limits for participants aged 60 to 63. Key provisions include:

Eligible participants can make larger catch-up contributions—either above $10,000 or 50% more than their regular catch-up contribution amount for that year.

Starting in 2026, these limits will be adjusted for inflation.

Employers can automatically enroll eligible employees at a contribution rate between 3% and 10% of their salary, unless employees choose a different rate or opt out.

Beginning January 1, 2025, long-term part-time employees who are at least 21 years old and have completed two consecutive years of service will be eligible to participate in their workplace retirement plan.

Changes in 401(k) Plans

1.The IRS has increased the deferral limit for 401(k) plans to $23,500 in 2025 (up from $23,000 in 2024).

2.The defined contribution limit for 401(k) plans will rise from $69,000 in 2024 to $70,000 in 2025.

3.These changes provide older participants with more opportunities to save for retirement.

4.A CNBC survey found that approximately 6,700 U.S. adults feel they need to catch up on retirement planning and savings. 5.The increased contribution limits will help older workers keep pace with rising healthcare costs and better prepare for retirement.

The Future of the Retirement Industry

The future of the retirement plan industry revolves around delivering value through innovation and strategic adaptation. As plan sponsors, embracing emerging trends—such as AI-driven insights, self-service portals, and evolving regulations—is crucial.

At Congruent Solutions, we offer advanced automation capabilities, participant engagement tools, and Form 5500 filing services to help you stay ahead of the curve and guide participants toward a future-ready retirement.

0 notes

Text

ICICI Home Loan Documents: A Comprehensive Guide to Required Papers for a Smooth Approval

Applying for a home loan is a meticulous process; one of the most crucial aspects in this regard is to prepare the ICICI home loan documents. Thorough documentation aids in the smooth and speedy process of loan approval, bringing you closer to owning your dream house. The article mentions all ICICI Home Loan Documents with eligibility and some tips to ease the application process.

The Importance of Proper Documentation

With the right ICICI home loan documents in place, the timeline of the loan approval process can be seriously impacted when financing with ICICI. Complete documentation helps a lot with:

Fast processing and approval of the loan

Avoiding unnecessary delays, thanks to missing documents

Ensuring compliance with bank and regulatory requirements

Essential Documents for ICICI Home Loan

1. Identity Proof

ICICI Bank prescribes the following means to establish the identity of the applicant(s):

PAN Card (Mandatory)

Aadhaar Card

Passport

Voter ID

Driving License

2. Address Proof

Proof of residence is a vital requirement for loan approval. Acceptable documents include:

Aadhaar Card

Passport

Utility Bills (Electricity, Water, or Gas Bill)

Rent Agreement (if applicable)

Voter ID

3. Income Proof

ICICI Bank checks income to establish eligibility for loan purposes. The documents required change in the case of salaried or self-employed applicants:

For Salaried Applicants:

Last 3 months’ salary slips

Form 16 or Income Tax Returns (ITR) of the last 2 years

Bank statements for the last 6 months

Employment certificate from the employer

For Self-Employed Applicants:

Business registration proof

Income Tax Returns (ITR) for the last 3 years

Bank statements for the last 12 months

Profit and Loss Account and Balance Sheet audited by a CA

4. Property Documents

Loans are sanctioned based on the property being financed. The following documents are needed:

Sale Agreement

Title Deed

Approved Building Plan

NOC from Builder/Society

What are the Property Tax Receipts?

5. Other Required Documents

Other documents may be needed based on the applicant's profile:

Guarantor Form (if applicable)

Passport-size photographs

The loan application form was duly filled in and signed

How to ensure hassle-free document submission?

To avoid delays and rejection, best practices to keep in mind are;

Check for Latest Updates on Requirements: ICICI Bank keeps modifying its policies related to documentation, so please check those before applying.

Keep Copies Ready: Submit photocopies while retaining the originals for verification.

Accuracy of Documents: Any discrepancies in the document can delay approval.

Seek Help from Professionals: The likes of Arena Fincorp can help gather the correct documents for hassle-free loan processing.

Common Mistakes to Avoid When Submitting ICICI Home Loan Documents

A lot of rejected cases are the result of obvious reasons on the part of applicants. Mindfulness about;

Incomplete Documents: Not one but even one missing essential document can delay the approval.

Incorrect Information: If there’s a mismatch of any kind between the documents submitted and the actual details, this may lead to rejection.

Bad Credit Score: Make sure that you have a good credit score before applying.

Illegible Copies: Submit clear copies to avoid any problems with verification.

What Arena Fincorp Can Do for You?

Getting a home loan can be an arduous task, entailing lots of paperwork, but Arena Fincorp makes it easy:

Giving you expert opinion for required documents

Helping you organize and verify your documents

Ensuring unobstructed communication with ICICI Bank so that you get your approvals faster

Conclusion

Correct and timely submission of ICICI home loan documents is the key to a successful home loan application. It ensures that your loan process runs smoothly, delays are kept at a minimum, and your chances for approval are maximized. Paperwork, organized and free of errors, is most important for salaried professionals and self-employed individuals.

Knowing the various types of documents to be submitted for an ICICI Home Loan Documents application, including identity proof, income proof, and property documents, will help you minimize last-minute rushes. Ensure you maintain a good credit score and go through your application for any discrepancies to make the application easier for approval.

If there is doubt regarding any point of documentation or need assistance in bolstering the chances of getting a loan approved, professional assistance can prove very beneficial. Arena Fincorp areas of operation include consultancy to home loan applicants, document verification, and seamless coordination with ICICI Bank. Great preparation and professional assistance assure happy travel toward a home-buying dream.

This way, you will have a hassle-free experience in availing of a home loan approval. Get over the paper barrier: Start today, and get ready to own your dream house! As these documents are ready beforehand, it is possible to speed up the process of approval for the loan by not going through a lot of the common mistakes ICICI Home Loan Documents that time buyers make. Arena Fincorp is there to provide professional help when needed to offer a completely hassle-free experience in getting a home loan. Start buying your home today and document everything right!

0 notes

Text

GST Consultant Eligibility Skill & certification Guide

How to Become a GST Practitioner in India

GST (Goods and Services Tax) ne India ke tax system ko simple banaya hai. Lekin businesses aur individuals ke liye GST filing aur compliance samajhna mushkil ho sakta hai. Isi wajah se GST Practitioner (GSTP) ki demand badh rahi hai. Agar aap GST expert banna chahte hain, to ye guide aapke liye hai.

GST Practitioner banna ek accha career option hai jo flexibility aur growth opportunities deta hai. Agar aapko taxation aur compliance me interest hai, to aap ye field choose kar sakte hain. GST laws aur filing ka knowledge rakhkar aap ek successful GSTP ban sakte hain. Let us discuss how to become GST practitioner in India.

GST Practitioner Kya Hota Hai?

GST Practitioner ek certified professional hota hai jo businesses ko GST-related compliance me madad karta hai. Ye professionals GST returns file karne, registrations karwane aur tax-related queries solve karne ka kaam karte hain.

GST Practitioner Banne ke Faayde

1. High Demand – Har business ko GST filing ki zaroorat hoti hai.

2. Self-Employment Opportunity – Freelance ya apna firm shuru kar sakte hain.

3. Government Certification – GSTN se registered hone par credibility badhti hai.

4. Good Earning Potential – Ek professional GST Practitioner acchi income kama sakta hai.

5. Work Flexibility – Part-time ya full-time kaam kar sakte hain.

GST Practitioner Banne Ke Liye Eligibility Criteria

GSTP banne ke liye aapko kuch basic eligibility criteria fulfill karne honge:

1. Nationality – Aap India ke citizen hone chahiye.

2. Age Limit – Minimum 18 saal ki umar honi chahiye.

3. Educational Qualification – Graduation ya usse upar ki degree honi chahiye:

o Commerce, Law, Banking ya Business Management stream se ho to better hoga.

o Chartered Accountant (CA), Cost Accountant, Company Secretary (CS) bhi apply kar sakte hain.

4. Character Certificate – Applicant ka good moral character hona chahiye.

5. Competency Test – GSTP exam clear karna zaroori hai.

GST Practitioner Banne Ka Process

Agar aap eligibility criteria fulfill karte hain, to aapko ye steps follow karne honge:

Step 1: GST Portal Par Registration Karein

1. GST Portal (www.gst.gov.in) par visit karein.

2. “Services” tab me “Registration” section par jayein.

3. “New Registration” select karein.

4. “GST Practitioner” option choose karein.

5. Apni details fill karein:

o Naam

o PAN Number

o Email ID

o Mobile Number

6. OTP verification ke baad password set karein.

7. Form submit karein aur Application Reference Number (ARN) save karein.

Step 2: Documents Upload Karein

Documents ki zaroorat padti hai:

· Aadhaar Card

· PAN Card

· Educational Certificates

· Address Proof

· Photograph aur Signature

Step 3: GSTP Exam Ke Liye Apply Karein

GSTP banne ke liye NACIN (National Academy of Customs, Indirect Taxes & Narcotics) dwara exam conduct hota hai.

1. Exam ke liye GST Portal par login karein.

2. NACIN ki website par jaakar registration karein.

3. Exam ka syllabus aur date check karein.

4. Exam fees pay karein.

Step 4: GSTP Exam Clear Karein

Exam me minimum 50% marks laane hote hain. Exam ke topics:

· GST Laws aur Rules

· GST Registration

· GST Returns

· Input Tax Credit

· E-way Bills

· Tax Payments

Step 5: GST Practitioner Certificate Receive Karein

Agar aap exam clear kar lete hain, to aapko GSTN se GSTP certificate milega. Is certificate ke baad aap officially GST filing aur consultancy services shuru kar sakte hain.

GST Practitioner Ke Rights & Responsibilities

Rights

1. GST Returns file karna.

2. Tax challans prepare karna.

3. GST Registration ke liye application file karna.

4. GST Refunds aur Audits me madad karna.

Responsibilities

1. Clients ke liye sahi aur timely GST filing ensure karna.

2. GST laws aur rules ka proper implementation karna.

3. Tax authorities ke saath compliance maintain karna.

GST Practitioner Ki Salary & Earning Potential

Ek GST Practitioner ki earning uski expertise aur clients ke number par depend karti hai. Ek beginner practitioner monthly ₹25,000 – ₹50,000 kama sakta hai. Experience badhne ke saath income bhi badh sakti hai.

GST Practitioner Banne Ke Liye Important Tips

1. GST Laws Ka Knowledge Rakhein – Regularly GST updates padhte rahein.

2. Practice Karein – Dummy GST filing aur real-world case studies par kaam karein.

3. Professional Certification Le Sakta Hai – CA, CS ya MBA hone se credibility badhti hai.

4. Networking Karein – Business professionals aur accountants ke saath connect karein.

5. Technology Aur Software Seekhein – GST filing ke liye software tools ka use karein. IPA offers GST Practitioner Course

Accounting interview Question Answers

How to become an accountant

How to become Tax consultant

How to become an income tax officer

How to become GST Practitioner

Learn Tally free online

Free Accounting Courses with Certificate

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs

ICWA Course

Tally Short Cut keys

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

#diploma in taxation#payroll management course#sap fico course#accounting course#gst course#finance#business accounting and taxation (bat) course

0 notes

Text

GST Consultant:Eligibility,Skills & Certification Guide

How to Become a GST Practitioner in India

GST (Goods and Services Tax) ne India ke tax system ko simple banaya hai. Lekin businesses aur individuals ke liye GST filing aur compliance samajhna mushkil ho sakta hai. Isi wajah se GST Practitioner (GSTP) ki demand badh rahi hai. Agar aap GST expert banna chahte hain, to ye guide aapke liye hai.

GST Practitioner banna ek accha career option hai jo flexibility aur growth opportunities deta hai. Agar aapko taxation aur compliance me interest hai, to aap ye field choose kar sakte hain. GST laws aur filing ka knowledge rakhkar aap ek successful GSTP ban sakte hain. Let us discuss how to become GST practitioner in India.

GST Practitioner Kya Hota Hai?

GST Practitioner ek certified professional hota hai jo businesses ko GST-related compliance me madad karta hai. Ye professionals GST returns file karne, registrations karwane aur tax-related queries solve karne ka kaam karte hain.

GST Practitioner Banne ke Faayde

1. High Demand – Har business ko GST filing ki zaroorat hoti hai.

2. Self-Employment Opportunity – Freelance ya apna firm shuru kar sakte hain.

3. Government Certification – GSTN se registered hone par credibility badhti hai.

4. Good Earning Potential – Ek professional GST Practitioner acchi income kama sakta hai.

5. Work Flexibility – Part-time ya full-time kaam kar sakte hain.

GST Practitioner Banne Ke Liye Eligibility Criteria

GSTP banne ke liye aapko kuch basic eligibility criteria fulfill karne honge:

1. Nationality – Aap India ke citizen hone chahiye.

2. Age Limit – Minimum 18 saal ki umar honi chahiye.

3. Educational Qualification – Graduation ya usse upar ki degree honi chahiye:

o Commerce, Law, Banking ya Business Management stream se ho to better hoga.

o Chartered Accountant (CA), Cost Accountant, Company Secretary (CS) bhi apply kar sakte hain.

4. Character Certificate – Applicant ka good moral character hona chahiye.

5. Competency Test – GSTP exam clear karna zaroori hai.

GST Practitioner Banne Ka Process

Agar aap eligibility criteria fulfill karte hain, to aapko ye steps follow karne honge:

Step 1: GST Portal Par Registration Karein

1. GST Portal (www.gst.gov.in) par visit karein.

2. “Services” tab me “Registration” section par jayein.

3. “New Registration” select karein.

4. “GST Practitioner” option choose karein.

5. Apni details fill karein:

o Naam

o PAN Number

o Email ID

o Mobile Number

6. OTP verification ke baad password set karein.

7. Form submit karein aur Application Reference Number (ARN) save karein.

Step 2: Documents Upload Karein

Documents ki zaroorat padti hai:

· Aadhaar Card

· PAN Card

· Educational Certificates

· Address Proof

· Photograph aur Signature

Step 3: GSTP Exam Ke Liye Apply Karein

GSTP banne ke liye NACIN (National Academy of Customs, Indirect Taxes & Narcotics) dwara exam conduct hota hai.

1. Exam ke liye GST Portal par login karein.

2. NACIN ki website par jaakar registration karein.

3. Exam ka syllabus aur date check karein.

4. Exam fees pay karein.

Step 4: GSTP Exam Clear Karein

Exam me minimum 50% marks laane hote hain. Exam ke topics:

· GST Laws aur Rules

· GST Registration

· GST Returns

· Input Tax Credit

· E-way Bills

· Tax Payments

Step 5: GST Practitioner Certificate Receive Karein

Agar aap exam clear kar lete hain, to aapko GSTN se GSTP certificate milega. Is certificate ke baad aap officially GST filing aur consultancy services shuru kar sakte hain.

GST Practitioner Ke Rights & Responsibilities

Rights

1. GST Returns file karna.

2. Tax challans prepare karna.

3. GST Registration ke liye application file karna.

4. GST Refunds aur Audits me madad karna.

Responsibilities

1. Clients ke liye sahi aur timely GST filing ensure karna.

2. GST laws aur rules ka proper implementation karna.

3. Tax authorities ke saath compliance maintain karna.

GST Practitioner Ki Salary & Earning Potential

Ek GST Practitioner ki earning uski expertise aur clients ke number par depend karti hai. Ek beginner practitioner monthly ₹25,000 – ₹50,000 kama sakta hai. Experience badhne ke saath income bhi badh sakti hai.

GST Practitioner Banne Ke Liye Important Tips

1. GST Laws Ka Knowledge Rakhein – Regularly GST updates padhte rahein.

2. Practice Karein – Dummy GST filing aur real-world case studies par kaam karein.

3. Professional Certification Le Sakta Hai – CA, CS ya MBA hone se credibility badhti hai.

4. Networking Karein – Business professionals aur accountants ke saath connect karein.

5. Technology Aur Software Seekhein – GST filing ke liye software tools ka use karein. IPA offers GST Practitioner Course

IPA OFFERS:-

Accounting interview Question Answers

How to become an accountant

How to become Tax consultant

How to become an income tax officer

How to become GST Practitioner

Learn Tally free online

Free Accounting Courses with Certificate

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs

ICWA Course

Tally Short Cut keys

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

0 notes

Text

Understanding the Basics of Income Tax Return (ITR) Forms in the Philippines

Filing your income tax return (ITR) may sound overwhelming, especially if it’s your first time. But with the right tools and knowledge, the process becomes manageable and straightforward. In this guide, we’ll explore an income tax return sample, its purpose, and how to file it efficiently. Whether you’re an employee, self-employed, or a business owner, knowing the proper steps can help you avoid errors and penalties while staying compliant.

What Is an Income Tax Return (ITR)?

An Income Tax Return (ITR) Form is a formal document submitted to the Bureau of Internal Revenue (BIR) that declares your income, allowable deductions, and the taxes you’ve paid or still owe within a taxable year. It serves as proof that you’ve met your tax obligations and are compliant with the country’s tax system.

The ITR isn’t just a legal requirement—it also plays a significant role in financial transactions. For instance, it may be required when applying for loans, visas, or other services that assess your financial credibility.

But here’s the key: the type of ITR form you need to file depends on how you earn your income. This is where things can get tricky, so let’s discuss the different forms available.

Types of Income Tax Return Forms in the Philippines

The BIR has multiple ITR forms, and using the correct one is critical. Filing the wrong form can lead to rejection, penalties, or delays, so it’s important to know which one applies to you.

1. BIR Form 1700

This form is for individual taxpayers earning purely compensation income. These are employees whose income comes solely from their salaries or wages and who do not have additional sources of income like side businesses or freelancing gigs.

When to Use:

If you are employed by one or more companies during the taxable year.

If your employer has already withheld taxes on your salary and submitted these to the BIR on your behalf.

2. BIR Form 1701

The 1701 form is for self-employed individuals, including sole proprietors and professionals, who earn from the practice of their profession or business. It applies to those who opt for itemized deductions rather than using simplified tax rates.

When to Use:

If you are self-employed and want to deduct specific expenses like rent, supplies, or operational costs to reduce taxable income.

If you are earning from multiple sources, including both business and compensation income.

3. BIR Form 1701A

This is a simplified version of the 1701 form and is intended for self-employed individuals or professionals who chose the 8% tax rate or graduated income tax rates under the TRAIN Law.

When to Use:

If you are self-employed and prefer a straightforward computation by using the optional 8% tax rate on gross sales/receipts or the graduated income tax rates.

If you have registered your business or profession and are availing of a simplified tax structure.

4. BIR Form 1701Q

The 1701Q form is the quarterly income tax return for self-employed individuals, professionals, or mixed-income earners. This form ensures that taxpayers report their income and pay taxes quarterly, avoiding a large lump sum payment at year-end.

When to Use:

If you fall under the categories mentioned above and need to declare your income every quarter (e.g., April, August, and November deadlines).

To adjust taxes throughout the year based on actual income earned per quarter.

Why It’s Important to Know the Right Form

Filing the correct ITR form is more than just a compliance measure; it directly affects your filing accuracy and avoids unnecessary headaches:

Accurate Tax Reporting: Filing the wrong form could lead to overpayment or underpayment of taxes, both of which can result in penalties.

Proper Documentation: Using the correct form ensures that your income sources are correctly categorized, which is crucial for audits or when applying for financial services.

Legal Compliance: Mistakes in filing, including using the wrong form, can lead to violations of tax laws and potential legal consequences.

Income Tax Return Sample

Let’s look at an income tax return sample to understand the information included in these forms:

Personal Information: Name, Tax Identification Number (TIN), and registered address.

Income Details: The total income earned during the taxable year, categorized by source (e.g., compensation or business income).

Allowable Deductions: Itemized deductions (if applicable) or standard deductions based on the taxpayer’s chosen method.

Tax Computation: The amount of tax owed or overpaid, based on the total taxable income.

Payment Details: Information about any tax payments made in advance or penalties incurred for late filings.

For a detailed explanation and examples, you can explore the official Income Tax Return Philippines page provided by the Bureau of Internal Revenue (BIR).

How to File Your Income Tax Return

Filing your ITR can be done conveniently through the eBIRForms Package, which allows taxpayers to fill out and submit forms online. Below are the steps to file your ITR:

Download and InstallDownload the latest version of the eBIRForms package v7.9.4.1 from the BIR website, and install it on your computer. Note: The program is not compatible with Apple MAC systems.

Open and Fill Out Profile DetailsAfter installation, open the eBIRForms package and complete the profile page with necessary information, including your TIN, registered name, address, and RDO code. Select the correct tax return form (e.g., BIR Form 1700 or 1701A) and click “Fill up.”

Accomplish the Tax Return FormEnter all required data, including your income, deductions, and tax payable. Be as accurate as possible to avoid issues.

Validate Your EntryClick the “Validate” button to check for errors. If corrections are needed, use the “Edit” button and revalidate once done.

Submit Your ReturnOnce everything is validated, click “Submit/Final Copy” to file your ITR online. Ensure your internet connection is stable during this step.

Check Email ConfirmationUpon successful submission, you will receive a Tax Return Receipt Confirmation via email. Save or print this as proof of your e-filing.

Pro Tips for Filing Your Income Tax Return

Organize Your Documents: Gather all necessary documents such as income records, receipts, and previous ITRs before filing.

Double-Check Your Information: Errors in TIN or income details can lead to delays or penalties.

Understand the Forms: Make sure you’re using the correct form for your income type (e.g., BIR Form 1700 for employees, BIR Form 1701A for self-employed individuals).

Seek Professional Assistance: If you’re unsure about tax computations or requirements, consult a tax expert for guidance.

Tax Assist PH: Your Partner in Stress-Free Filing

Filing your income tax return doesn’t have to be complicated. At Tax Assist PH, we specialize in helping freelancers, small business owners, and professionals navigate the process with ease. Our team ensures accurate computations, timely reminders, and reliable support for all your tax compliance needs.

Take the stress out of filing your income tax return Philippines. Let us help you today!

For inquiries or assistance, email us at [email protected] or visit our website.

#taxassistph#taxes in the philippines#income tax return in the philippines#income tax return#bir income tax return

0 notes