#sebi officer

Explore tagged Tumblr posts

Text

youtube

#staff selection commission#bank exams#sbi po#ibps po#sbi clerk#rrb ntpc recruitment 2024#rrb ntpc#lic aao#niacl#rbi grade b#sebi officer#Youtube

1 note

·

View note

Text

Make in India: A Decade of Transformation and the Road Ahead

India's manufacturing sector underwent and is undergoing a significant transformation, with growth evident across diverse industries like textiles and automobiles. This progress can be partly attributed to the Make in India initiative, a flagship program launched in September 2014 by Prime Minister Narendra Modi. The initiative spearheaded by the Department for Promotion of Industry and Internal Trade (DPIIT) and dedicated IAS officers, aims to propel India towards self-reliance and global manufacturing leadership. Significant progress has been made, with FDI inflows witnessing a 100% increase over the past nine financial years (2014-23), reaching a total of USD 596 billion. However, realising the initiative's full potential will require continued efforts.

1. A Decade of Evolution

1.1 Initial Impact

The country’s ranking in the Ease of Doing Business Index has seen a meteoric rise from 142nd place in 2014 to 63rd in 2019.

- World Bank Report

The Make in India initiative has demonstrably improved India's standing in the global business landscape. A key driver of this progress has been the focus on streamlining regulations and simplifying procedures. Dedicated IAS officers within the Department for Promotion of Industry and Internal Trade (DPIIT), guided by the former secretaries, Guruprasad Mohapatra and Ramesh Abhishek played a crucial role in these efforts. Their work directly contributed to India's impressive jump in the World Bank's Ease of Doing Business (EoDB) Index. This significant improvement reflects the initiative's success in making it easier for businesses to operate in India.

1.2 Continuous Improvement

A decade after its launch, the Make in India initiative continues to evolve. Recognising the need for ongoing efforts, the government, led by dedicated IAS officers across various departments, is actively working to streamline regulations further. This includes addressing industry concerns and creating an even more conducive environment for domestic and foreign manufacturers to invest and grow in India.

2. Driving the Initiative Forward

2.1 Visionary Leadership

The Department for Promotion of Industry and Internal Trade (DPIIT) has been the backbone of the Make in India initiative's success. Over the past decade, dedicated IAS officers within DPIIT, including prominent figures like Mr Ramesh Abhishek and Mr Amitabh Kant, two former secretaries known for their focus on administrative reforms, have played a crucial role in shaping the initiative. Their tireless efforts have streamlined processes, promoted investor confidence, and fostered a more conducive business environment.

2.2 Strategic Initiatives

The Make in India initiative extends beyond policy pronouncements. It's bolstered by strategic programs that have demonstrably impacted the manufacturing sector. A prime example is the simplification of registration processes, spearheaded by Mr Ramesh Abhishek, an ex-IAS officer, during his tenure at DPIIT, formally known as DIPP. This initiative significantly reduced bureaucratic hurdles for businesses, making it easier to establish and operate in India.

Additionally, the development of industrial corridors across India, championed by another visionary leader, and an ex-IAS officer Mr Amitabh Kant, with his extensive experience in infrastructure development, has created dedicated zones with a robust infrastructure. These corridors are designed to attract large-scale manufacturing units and further strengthen India's manufacturing ecosystem.

2.3 Collaborative Efforts

The Make in India initiative's success extends beyond the central government's efforts. It thrives on a collaborative spirit, bringing together various stakeholders to achieve a common goal. Industry bodies, as well as state governments, play a crucial role in voicing industry concerns and proposing solutions.

For instance, Andhra Pradesh's sub-initiative focuses on attracting investments in pharmaceuticals, biotechnology, and IT, while Gujarat targets textiles, pharmaceuticals and chemicals. These state-led efforts, spearheaded by dedicated IAS officers with experience in economic development, demonstrate a decentralised approach that empowers states to attract investments and promote economic growth.

This collaborative spirit extends beyond state borders. Dedicated IAS officers across various government departments work together to streamline processes, address industry concerns, and create a more conducive environment for businesses to operate. Their combined efforts ensure smooth collaboration between central and state governments, fostering a unified approach to achieving the initiative's ambitious goals.

3. Building a Stronger Future

3.1 Ongoing Work

The Make in India initiative is a continuous journey, and the government remains committed to strengthening its impact. Dedicated IAS officers within the Department for Promotion of Industry and Internal Trade (DPIIT) play a vital role in driving ongoing improvements. These efforts include:

Streamlining regulations in specific sectors: DPIIT, led by the then secretaries like Ramesh Abhishek, and Guruprasad Mohapatra, have consistently focused on streamlining regulations in key sectors like pharmaceuticals and electronics.

Developing industrial corridors: The development of industrial corridors across India remains a priority. Spearheaded by experienced IAS officers with expertise in infrastructure development, these corridors create dedicated zones with robust infrastructure to attract large-scale manufacturing units.

Targeted campaigns: The initiative utilises targeted campaigns to attract foreign companies in specific industries that align with India's strategic goals.

Skilling the workforce: Recognizing the importance of a skilled workforce, the government emphasises skill development programs to address the evolving needs of the manufacturing sector.

3.2 The Road Ahead

Beyond attracting established players, the Make in India initiative recognises the importance of fostering a culture of innovation and entrepreneurship. This vision is actively supported by IAS officers across various government departments, including DPIIT. Their efforts contribute to creating a regulatory environment that encourages startups and fosters a spirit of innovation.

This focus on fostering innovation is evident in the significant growth of startups in India. As of December 31st, 2023, DPIIT has recognized over 1,17,254 startups.

4. Conclusion

A decade since its inception, the Make in India initiative has demonstrably transformed India's manufacturing landscape. Dedicated efforts by IAS officers within the government, coupled with industry collaboration and strategic programs, have yielded positive results. While challenges remain, the initiative's focus on streamlining regulations, fostering innovation, and building robust infrastructure positions India for continued growth as a global manufacturing powerhouse. Looking ahead, with unwavering commitment and ongoing efforts, India's Make in India dream is well on its way to becoming a reality.

0 notes

Text

What is Addiction?

Addiction is when a person continually takes a substance - or engages in a behavior - with a destructive impact on their health and life.

In Ancient Rome, when a person couldn’t repay a debtor they were forced to become their slave, or ‘addictus.’ This is the origin of being “a slave to your addictions.”

Addictions take many forms; some of them may surprise you. Do you struggle with any of these?

Alcohol

Body piercing

Book collecting

Exercising

Food

Gambling

Hoarding

Narcotics

Plastic surgery

Pain

Pornography

Prescription drugs

Rejection

Relationships

Screens (smartphones, computers, tablets, TV’s, etc.)

Social media

Sex

Shopping

Tattoos

Tobacco

Video games

Working

Addicts crave the behavior or substance, even when they know it causes them physical harm, mental harm, and/or harm to their relationships. Addiction can lead to criminal behavior, poverty, homelessness, and death.

Addiction is not defined by how much a person engages in the behavior but by the impact it has on their life. A workaholic may be very successful in the office, but at home their relationships are failing and their anxiety is increasing.

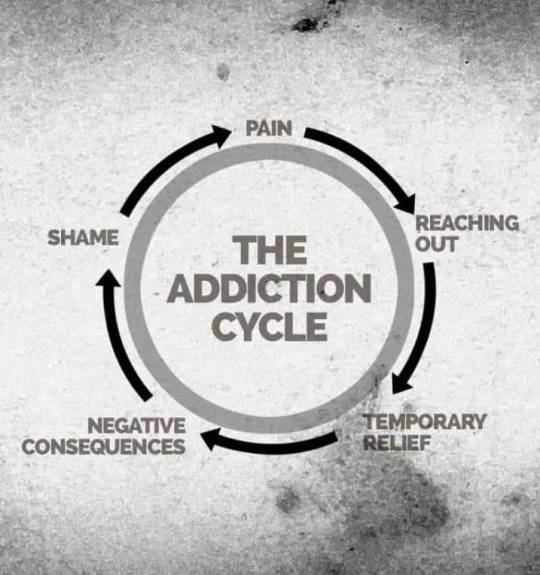

What Causes Addiction?

People become addicts through many different paths, but seeking pleasure (or avoiding pain) is the ultimate driver.

Whether a person is addicted to heroin or video games, their goal is to alter their mental state and reduce subconscious-stress.

Some people believe that taking drugs leads to addiction - but this is only part of the picture. Not everyone who takes narcotics becomes addicted to them. Therefore, there must be another factor involved - the human factor.

Research involving mice found they became easily addicted to cocaine when kept in isolation. But, when the environment was enriched with social activities, interesting food, places to explore, toys to play with and new mice to meet… they stopped taking cocaine! Just like mice, humans get depressed, miserable and bored when trapped in an unfulfilling life.

Unresolved Emotions

Addiction often stems from trauma. Adverse experiences during childhood (e.g. divorce, emotional neglect, poverty) predispose us to addiction later in life. Addiction is a response to painful or traumatic events, not simply a poor choice that people make.

Demonizing addicts is counterproductive; they need to be treated with care and compassion to maximize their chances of recovery. Brain scans on people with a range of addictions reveal the same neural circuits are involved, and they all share feelings of shame and low self-value.

People develop addictions to try and cover up issues and uncomfortable emotions:

To cope with stress and life events.

To escape the pain of past trauma.

To create connections with others.

To achieve a sense of control in life.

To avoid facing feelings of inadequacy.

To hush internal voices of self-loathing.

Overcoming Addiction

There’s no one size-fits-all solution for all addicts, but here are some general tips:

1. Find the Right Help

Addicts using opiates and narcotics need help. Addiction experts can provide the highly specialized support needed for this kind of recovery. Addicts can also be aided with behavioral re-training and dedicated recovery groups.

2. Increase Self-Value

All addicts can benefit from increasing their self-worth. Any activity that improves physical or mental health enhances esteem. Getting a massage, eating vitalizing alkaline foods, and going for walks in nature are acts of self-care that enhance how we feel about ourselves.

“Because the one thing you want to do is to LOVE, and that love should begin with you” - Dr. Sebi.

3. Be Ready to Give Up

The addicted person must be ready and willing to give up their addiction; if they are forced to give it up they are likely to relapse.

What are you ready to give up?

3 notes

·

View notes

Text

Uniphos Enterprises Limited Releases Business Responsibility and Sustainability Report for FY 2023-24

UEL is a leading player in trading in chemicals and agro-commodities. It has released its Business Responsibility and Sustainability Report (BRSR) for the fiscal year 2023-24. The report, presented in conformity with SEBI’s Listing Obligations and Disclosure Requirements Regulations, 2015, reflects the company’s initiative regarding ethical governance, environmental care, and social responsibility.

Overview: In an era where corporate accountability runs parallel, UEL’s BRSR 2023-24 reflects the commitment of UEL towards sustainability and responsible business behavior. The report epitomizes salient features of the company’s operations, best governance practices, and environmental impact, focusing on core values related to excellence, integrity, respect, and collaboration.

Body UEL was incorporated in 1969 and is essentially a trading company. A large portion of the turnover consists of trading in chemicals and agro commodities. For FY 2023–24, revenue from trading operations contributed 54.16%, while income from investments in equity shares and mutual funds contributed 42.26% of revenue.

The company is headquartered in Mumbai with regional offices based in Gujarat. Its staff is on deputation, with only a small number being UEL recruits; it has taken important steps in maintaining gender diversity—one-third of the members on the Board of Directors comprise women.

The report enumerates corporate governance practices in which UEL has also ensured the whistleblower policy to get grievances over and above transparency. UEL further states its due compliance with regulatory requirements, as amply evidenced by the reaction of the company to a minor delay in the regulatory filings for which the waiver of the fine was sought from stock exchanges.

Although UEL is not a manufacturing company, the report reflects the concern of the company regarding environmental sustainability. The environmental impact of UEL is very minimal, as the company consumes limited amounts of energy only and does not produce much waste that is considered harmful to the environment. The sustainability practice at UEL is mainly limited to ensuring full compliance with environmental laws and regulations, and operations are performed in a manner to ensure no adverse impact on the environment.

From the viewpoint of social responsibility, the activities of UEL are restricted to its scale of operation; however, the company maintains a conducive and non-threatening workplace. It is pointed out in the report that UEL follows the Rights of Persons with Disabilities Act, 2016, providing accessibility in offices and non-discrimination in employment.

UEL’s commitment to doing good business is further reflected in its anti-bribery and anti-corruption policies, although the company has not adopted a stand-alone anti-corruption policy; rather, the principles are encapsulated within its general code of conduct meant for all employees and major vendors.

Overview The Business Responsibility and Sustainability Report for FY 2023-24 underlines the commitment of Uniphos Enterprises Limited to promote the gold standard in corporate governance, care for the environment, and observe social responsibility. Though the operation of the company remains limited within the scope mentioned, its commitment remains toward responsible business practices. While moving forward with challenges in the modern business landscape, UEL remains focused on aspects related to sustainability, transparency, and ethical conduct and sets a good example for such categories of companies.

Source: BRSR Credit: Uniphos Enterprises Limited

#Business Ethics#Corporate Governance#Corporate Responsibility#Environmental stewardship#ESG#Sustainability Report#Sustainable Business

2 notes

·

View notes

Text

Starter: Closed @clarkxhale Where: Aurora Bay Veterinary Clinic

Sebi holds the dog cradled in his arms. It looks like a puppy but still relatively big, like the size of a teddy bear with floppy ears to match. When he hears his name being called, Sebi promptly makes his way into the smaller office. "Hey man. I found this pup on the side of the road this morning." He gently lowers the confused and disheveled pup onto the counter. "Couldn't find a collar, looked around for a mum or litter but I couldn't see anything. Thought I'd bring him here to see if he's been chipped."

1 note

·

View note

Text

Freezing of bank account for unconnected entities is legally untenable.

M/s Jermyn Capital LLC Dubai v. Central Bureau of Investigation

Fact:

M/s Jermyn Capital LLC Dubai (#Appellant Company) was Permitted by Securities Exchange Board of India (#SEBI) to buy & sell share & securities in the #Indian Stock Market.

The appellant company had its shares in its account with #ICICI Bank.

However, due to certain litigation the appellant company quit the trading in the Indian Market in 2006.

But appellant company was subjected to 02 #freeze orders under section 102 #Cr PC. (This section empowers police officers to seize any property which gives suspicion for commission of any offence.)

The freeze order for an amount of Rs.42.51 crore was initiated because of the #pending #investigation against Dharmesh Doshi

Against the freeze order the appellant company approached the Apex Court & the #ApexCourt allowed the appellant Company to sell its shares & convert into cash and repatriate the funds with interest but without bank guarantee.

Rs. 42.51 Crore was repatriated.

Issue arose when appellant company was incapacitated by second freeze order for an amount of Rs. 38.52 crores to repatriate.

Aggrieved by the freeze the appellant company again approached the Apex Court.

The Apex Court gave liberty to the appellant company to approach trial court for release of the said amount.

The trial court allowed the repatriation of Rs.38.52 Crores subject to the #Bank Guarantee of an equivalent amount.

Aggrieved by the imposition of Bank Guarantee Clause the appellant Company approached High Court.

High Court confirmed the decision of Trial Court.

Against the order of the High Court present Criminal Appeal is filed before Apex Court.

Observation of the Apex Court:

Imposition of Bank Guarantee clause as due to pending investigation against Dharmesh Doshi, alleged to have been connected with the appellant company.

Record shows that Dharmesh Doshi has been discharged by the trial court, was never an employee/shareholder/director or holding key managerial position in the appellant company.

Dharmesh Doshi & Appellant Company are 02 separate entities.

Freezing order as such not legally tenable when two entities are unconnected.

Neither in the FIR nor in the chargesheet filed against the Dharmesh Doshi, appellant company was named.

Further during hearing CBI informed the Apex Court that no criminal proceedings is pending against the appellant company pertaining the dispute discussed here.

The freeze order against the appellant company’s properties is redundant as the appellant company is not necessary for the conclusion of the investigation.

The purpose of the freeze order, and the bank guarantee in extension of the freeze order, can only be in operation to aid in the investigation against the alleged crime.

Since the investigation against the appellant company has become redundant as such freeze order has also become redundant.

The operation of the freeze order has been active for a period of 17 years and has caused huge losses to the appellant company.

Decision:

The Division Bench of Hon’ble Mr. Justice Krishna Murari J & Hon’ble Sanjay Kumar J vide their order dt.09.05.2023 set aside the order of the High Court and permitted the appellant company to withdraw the said amount with 4% simple interest from May08, 2006.

Seema Bhatnagar

#criminalappeal#freezingofbankaccount#unconnectedwiththeoffence#namedinFIR&Chargesheet#foreigninstitutionalinvestor#cbi#highcourt#supremecourtofindia#icici bank#tradinginstockmarket

2 notes

·

View notes

Text

Invest In NFO

Exploring New Fund Offers (NFOs) for Investment

Investing in mutual funds has become a popular avenue for individuals seeking to grow their wealth. One intriguing aspect of mutual fund investments is the opportunity to participate in New Fund Offers (NFOs). This article delves into the concept of NFOs, their types, benefits, considerations, and how investors can approach them.

For the latest NFO investment opportunities, visit dpank.in and explore their comprehensive guide: All New Fund Offer (NFO) for Investment.

What is a New Fund Offer (NFO)?

A New Fund Offer (NFO) is the initial subscription offering for a new mutual fund scheme launched by an Asset Management Company (AMC). During this period, investors can purchase units of the mutual fund at a predetermined price, typically set at ₹10 per unit. The NFO period is limited, often lasting up to 30 days, after which the fund opens for regular operations, and units are bought and sold based on the Net Asset Value (NAV).

For investors looking for new NFO investment opportunities, dpank.in offers the latest updates and expert insights.

Types of NFOs

NFOs can be categorized into two main types:

Open-Ended Funds: These funds allow investors to enter and exit at any time, providing liquidity and flexibility. After the NFO period, the fund remains open for new investments and redemptions.

Close-Ended Funds: In these funds, investors can subscribe only during the NFO period. Once the offer closes, no new investments are accepted. These funds have a fixed maturity period, and units are typically listed on stock exchanges to provide an exit route for investors.

Benefits of Investing in NFOs

Investing in NFOs offers several advantages:

Early Entry Advantage: Investors get the opportunity to enter a new scheme at its inception, potentially benefiting from its growth trajectory.

Diversification: NFOs often introduce unique themes or sectors not covered by existing funds, allowing investors to diversify their portfolios.

Innovative Investment Strategies: AMCs may launch NFOs with innovative strategies or focus on emerging sectors, providing fresh investment opportunities.

For more details on the advantages of NFOs, visit dpank.in and stay informed about the latest offerings.

Considerations Before Investing in NFOs

While NFOs present attractive opportunities, investors should exercise due diligence:

Lack of Track Record: Unlike existing mutual funds, NFOs lack a performance history, making it challenging to assess potential returns.

Market Timing: The success of an NFO can be influenced by prevailing market conditions. Investing during a market high may impact initial returns.

Fund Objectives and Strategies: It's crucial to understand the fund's objectives, asset allocation, and investment strategies to ensure they align with your financial goals.

For expert guidance on mutual fund investments, visit dpank.in and check out their insights on NFO investment strategies.

Regulatory Framework and Recent Developments

The Securities and Exchange Board of India (SEBI) regulates NFOs to protect investors' interests. Recent proposals by SEBI include mandating AMCs to deploy funds collected through NFOs within 30 days of unit allocation, with a possible extension of another 30 days upon approval. Failure to adhere to this timeline may restrict the AMC from launching new schemes or imposing exit loads on investors exiting after 60 days.

Stay updated with SEBI guidelines and NFO market trends by following dpank.in.

How to Invest in NFOs

Investing in NFOs can be done through various platforms:

Directly Through AMCs: Investors can subscribe to NFOs directly via the AMC's website or offices.

Online Investment Platforms: Many online platforms and apps facilitate NFO investments, offering convenience and ease of access.

Financial Advisors: Consulting with financial advisors can provide personalized guidance based on your investment profile.

For hassle-free mutual fund investments, explore dpank.in and start your journey today.

Conclusion

New Fund Offers present a gateway to innovative and diversified investment opportunities in the mutual fund landscape. While they offer the allure of early entry and potential growth, it's imperative for investors to conduct thorough research, understand the fund's objectives, and assess their risk tolerance before investing. By staying informed and vigilant, investors can effectively navigate NFOs to enhance their investment portfolios.

For the latest updates on NFOs and mutual fund investments, visit dpank.in and check out their detailed article on All New Fund Offer (NFO) for Investment.

0 notes

Text

Latest Mutual Fund NFO

Exploring New Fund Offers (NFOs) for Investment

Investing in mutual funds has become a popular avenue for individuals seeking to grow their wealth. One intriguing aspect of mutual fund investments is the opportunity to participate in New Fund Offers (NFOs). This article delves into the concept of NFOs, their types, benefits, considerations, and how investors can approach them.

For the latest NFO investment opportunities, visit dpank.in and explore their comprehensive guide: All New Fund Offer (NFO) for Investment.

What is a New Fund Offer (NFO)?

A New Fund Offer (NFO) is the initial subscription offering for a new mutual fund scheme launched by an Asset Management Company (AMC). During this period, investors can purchase units of the mutual fund at a predetermined price, typically set at ₹10 per unit. The NFO period is limited, often lasting up to 30 days, after which the fund opens for regular operations, and units are bought and sold based on the Net Asset Value (NAV).

For investors looking for new NFO investment opportunities, dpank.in offers the latest updates and expert insights.

Types of NFOs

NFOs can be categorized into two main types:

Open-Ended Funds: These funds allow investors to enter and exit at any time, providing liquidity and flexibility. After the NFO period, the fund remains open for new investments and redemptions.

Close-Ended Funds: In these funds, investors can subscribe only during the NFO period. Once the offer closes, no new investments are accepted. These funds have a fixed maturity period, and units are typically listed on stock exchanges to provide an exit route for investors.

Benefits of Investing in NFOs

Investing in NFOs offers several advantages:

Early Entry Advantage: Investors get the opportunity to enter a new scheme at its inception, potentially benefiting from its growth trajectory.

Diversification: NFOs often introduce unique themes or sectors not covered by existing funds, allowing investors to diversify their portfolios.

Innovative Investment Strategies: AMCs may launch NFOs with innovative strategies or focus on emerging sectors, providing fresh investment opportunities.

For more details on the advantages of NFOs, visit dpank.in and stay informed about the latest offerings.

Considerations Before Investing in NFOs

While NFOs present attractive opportunities, investors should exercise due diligence:

Lack of Track Record: Unlike existing mutual funds, NFOs lack a performance history, making it challenging to assess potential returns.

Market Timing: The success of an NFO can be influenced by prevailing market conditions. Investing during a market high may impact initial returns.

Fund Objectives and Strategies: It's crucial to understand the fund's objectives, asset allocation, and investment strategies to ensure they align with your financial goals.

For expert guidance on mutual fund investments, visit dpank.in and check out their insights on NFO investment strategies.

Regulatory Framework and Recent Developments

The Securities and Exchange Board of India (SEBI) regulates NFOs to protect investors' interests. Recent proposals by SEBI include mandating AMCs to deploy funds collected through NFOs within 30 days of unit allocation, with a possible extension of another 30 days upon approval. Failure to adhere to this timeline may restrict the AMC from launching new schemes or imposing exit loads on investors exiting after 60 days.

Stay updated with SEBI guidelines and NFO market trends by following dpank.in.

How to Invest in NFOs

Investing in NFOs can be done through various platforms:

Directly Through AMCs: Investors can subscribe to NFOs directly via the AMC's website or offices.

Online Investment Platforms: Many online platforms and apps facilitate NFO investments, offering convenience and ease of access.

Financial Advisors: Consulting with financial advisors can provide personalized guidance based on your investment profile.

For hassle-free mutual fund investments, explore dpank.in and start your journey today.

Conclusion

New Fund Offers present a gateway to innovative and diversified investment opportunities in the mutual fund landscape. While they offer the allure of early entry and potential growth, it's imperative for investors to conduct thorough research, understand the fund's objectives, and assess their risk tolerance before investing. By staying informed and vigilant, investors can effectively navigate NFOs to enhance their investment portfolios.

For the latest updates on NFOs and mutual fund investments, visit dpank.in and check out their detailed article on All New Fund Offer (NFO) for Investment.

0 notes

Text

The box office bomb that earned mere ₹65 lakh but destroyed a ₹3500 crore IPO: How a Bollywood film fell foul of SEBI | Bollywood

Mar 31, 2025 02:30 PM IST A film that earned just ₹65 lakh managed to cause its producers a loss of ₹3500 crore after its release fell foul of SEBI. Here’s why. Cinema as a marketing tool is not something new. Leni Riefenstahl infamously made propaganda films for Adolf Hitler’s Nazi Party in the 30s, while closer home, everyone from MS Dhoni to Sachin Tendulkar has been accused of using…

View On WordPress

0 notes

Text

The Growing Demand for BBA LLB Graduates

The legal landscape is evolving rapidly, and businesses today require professionals who understand both law and management. This is where the BBA LLB degree comes in—a perfect blend of business administration and legal studies. With industries becoming more complex and regulatory frameworks expanding, there is a rising demand for BBA LLB graduates across various sectors.

If you are considering pursuing this dynamic degree, Dehradun has emerged as a premier destination for legal education. Some of the top BBA LLB colleges in Dehradun provide world-class education, practical exposure, and excellent career opportunities.

Let’s explore the growing demand for BBA LLB graduates and why this degree could be your gateway to a successful career.

Why is BBA LLB Gaining Popularity?

The BBA LLB degree is designed for students who want to combine business acumen with legal expertise. Unlike a traditional LLB, this course provides a deeper understanding of corporate law, business regulations, international trade laws, and arbitration.

1. Versatile Career Opportunities

Graduates can explore careers in:

Corporate law firms

Legal departments of multinational companies

Banking and financial institutions

Regulatory bodies

Startups and entrepreneurship

2. Demand from Corporate and Business Sectors

With businesses expanding globally, legal compliance has become crucial. Companies seek professionals who understand both business operations and legal frameworks. A BBA LLB degree makes you a preferred choice for such roles.

3. Increasing Government and Legal Regulations

Government policies and international laws are becoming more stringent. Every business requires legal experts to handle contracts, mergers, acquisitions, taxation, and dispute resolution—creating a huge demand for skilled legal professionals.

4. Higher Salary Packages

The demand for corporate lawyers has surged, leading to competitive salary packages. According to industry reports, fresh BBA LLB graduates earn an average starting salary of ₹6-12 LPA, which increases with experience.

Top Career Paths for BBA LLB Graduates

1. Corporate Lawyer

Many BBA LLB graduates join top corporate law firms or work as in-house counsel for MNCs. They deal with contracts, mergers, compliance, and legal risk management.

2. Business Consultant

With expertise in law and business, BBA LLB graduates can work as business consultants, advising companies on corporate policies, risk mitigation, and legal strategies.

3. Legal Advisor in Banks & Financial Institutions

Banks, insurance firms, and financial institutions hire legal professionals to handle compliance, loan agreements, and fraud prevention.

4. Arbitration and Mediation Specialist

With the rise in commercial disputes, arbitration and mediation have become crucial alternatives to lengthy court battles. BBA LLB graduates with specialized training in alternative dispute resolution (ADR) are in great demand.

5. Government and Public Sector Jobs

Graduates can apply for judiciary exams, public prosecutor roles, legal officers in PSUs, or work in regulatory bodies like SEBI, RBI, and TRAI.

6. Entrepreneurship and Startups

With in-depth knowledge of corporate laws, many BBA LLB graduates start their own legal consulting firms or work with startups, ensuring legal compliance and business strategies.

Why Choose Dehradun for BBA LLB?

Dehradun has gained popularity as an education hub for law aspirants. Some of the best BBA LLB colleges in Dehradun offer:

Top-notch faculty with industry experience

Moot courts and legal clinics for practical exposure

Internship opportunities with top law firms and companies

Placements in reputed MNCs, law firms, and government organizations

A vibrant student community with national and international legal events

One such leading institution is IMS Unison University, known for its robust legal education, industry collaborations, and excellent placement records.

Final Thoughts

The demand for BBA LLB graduates is at an all-time high, with businesses and legal firms actively seeking professionals who understand the intersection of law and business. If you’re looking for a rewarding career with immense growth potential, pursuing a BBA LLB from a reputed college in Dehradun can be your stepping stone to success.

IMS Unison University, with its strong industry connections and world-class faculty, provides the perfect environment to build a promising legal career. Whether you aim to work in corporate law, financial regulations, arbitration, or even start your own practice, a BBA LLB degree can open doors to endless possibilities.

So, are you ready to take the first step toward a successful legal career? Explore your options, choose the best BBA LLB college in Dehradun, and embark on an exciting professional journey!

0 notes

Text

Desco Infratech IPO allotment date in focus. Latest GMP, step-by-step guide to check allotment status online

Desco Infratech IPO allotment date today:

Desco Infratech IPO share allotment will be finalised today (Thursday, March 27). The investors who applied for the issue can check the Desco Infratech IPO allotment status on the registrar’s portal, which is Bigshare Services Pvt Ltd. Desco Infratech IPO subscription status on the third day of bidding was 83.75 times, as per chittorgarh.com. The subscription period for the initial public offering, Desco Infratech Ltd, opened on Monday, March 24 and ended on Wednesday, March 26.

Investors can verify the allocation details to see how many shares, if applicable, have been assigned to them. The status of the IPO allocation will indicate the number of shares that have been distributed to them. For those who do not receive any shares, the refund process will commence. The shares that have been assigned will be deposited into their demat accounts.

Individuals who received shares will have their demat accounts credited on Friday, March 28. The refund procedure will also begin on Friday.

Desco Infratech IPO listing date is fixed for Tuesday, April on BSE SME.

How to check Desco Infratech IPO allotment status on Registrar site?

Step 1

To input your login details directly, visit the Bigshare website at https://ipo.bigshareonline.com/ipo_status.html- Access the IPO allocation for Desco Infratech.

Step 2

Select the “Desco Infratech IPO” option from the list provided.

Step 3

Choose between “PAN Number, Beneficiary ID, or Application No./CAF No.”

Step 4

Just click “Search.” This can be accessed on both your computer and mobile device.

How to check Desco Infratech IPO allotment status on NSE?

Step 1

Go to the official NSE website — https://www1.nseindia.com/products/dynaContent/equities/ipos/ipo_login.jsp

Step 2

To create an account, select the ‘Click here to sign up’ option and provide your PAN on the NSE site.

Step 3

Complete the form with your username, password, and the captcha code.

Step 4

On the next page, verify the status of your IPO allocation.

Desco Infratech IPO Details

Desco Infratech IPO consists of a fresh issue of 20,50,000 equity shares, aggregating to ₹30.75 crore. There’s no offer for sale (OFS) component.

The Desco Infratech IPO intends to allocate the net funds raised from the offering for various purposes, such as financing the establishment of a corporate office in Surat, Gujarat; acquiring machinery; supporting the company’s working capital requirements; and addressing general corporate expenses.

Smart Horizon Capital Advisors Private Limited is functioning as the lead manager for the Desco Infratech IPO, while Bigshare Services Pvt Ltd serves as the registrar for this offering. Rikhav Securities Limited has been appointed as the market maker.

Desco Infratech IPO GMP today

Desco Infratech IPO GMP today is +12. This indicates Desco Infratech share price was trading at a premium of ₹12 in the grey market, according to investorgain.com.

Considering the upper end of the IPO price band and the current premium in the grey market, the estimated listing price of Desco Infratech share price is indicated at ₹162 apiece, which is 8% higher than the IPO price of ₹150.

Analyzing the grey market activities from the last 10 sessions, the IPO GMP is currently climbing and is anticipated to have a robust listing. The minimum GMP observed is ₹0.00, whereas the maximum GMP recorded is ₹20.

‘Grey market premium’ indicates investors’ readiness to pay more than the issue price.

Intensify Research services is a Top SEBI registered Research analyst indore committed to empowering investors with the most reliable stock market insights. Our team of expert analysts uses advanced tools and strategies to provide you with high accuracy stock market tips that enhance your chances of success. To visit- Intensifyresearch.com »

#sharemarketing#stockinvestment#stock market#stocks#investment#sharemarket#share this post#sharetrading#shareinvestor#sharetrader

0 notes

Text

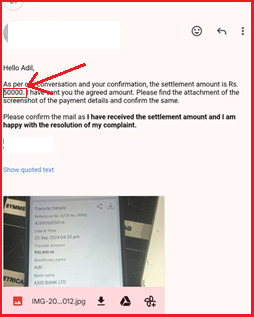

SEBI Registered RA’s False Promises: How We Helped Recover 50% Loss!

A SEBI Registered Research Analyst (RA) is authorized to provide and publish stock tips and recommendations. However, unlike Investment Advisors, an RA cannot offer customized or personalized advice to individual clients.

In simple terms, the key skill of an RA is research—whether it’s fundamental or technical. This research is published and made available to clients who pay for the service.

Seems straightforward, right?

Unfortunately, many beginners are unaware of these distinctions and get trapped by misleading schemes or advice from RAs.

This is exactly what happened to Arif (name changed), a beginner stock market learner. One day, he received a call from a Research Analyst and was trapped in a profit-sharing scheme, resulting in a loss of nearly ₹1,00,000.

Here’s the complete story of how it all unfolded and how our team helped Arif recover 50% of the lost amount from the Research Analyst.

How Arif Got Trapped in the Wrong Advisory Services

Arif had developed an interest in learning about the stock market and had registered for a webinar after seeing an ad on Instagram. Soon after, he received a call from Mumbai.

The call was from the office of a SEBI-registered Research Analyst. The caller, Irshad (name changed), offered Arif their services, assuring him that he wouldn’t need to pay any fees upfront. Instead, they would share any profits made from stock tips on a 60:40 basis.

But any registered or unregistered advisory working on profit profit-sharing model is itself a big red flag. But again Arif was not aware of the same.

Initially, Arif wasn’t interested, as he wanted to focus on learning and only had a limited capital of ₹40,000. But Irshad convinced him by calling him regularly and asking him to start small. He promised that, after making some profits, Arif could invest more and assured him that losses would be recovered in future trades.

To lure him further, Irshad shared the PnLs of other clients. Impressed by the profit value and the promises, Arif eventually agreed to take the service.

In the beginning, Arif made some profits and, as agreed, shared 40% of them with the RA. But soon after he increased his capital, things took a turn.

One day, he faced a loss of ₹7,000, and the next, ₹20,000. Even when Arif wanted to square off his positions, Irshad convinced him to hold them without any stop-loss.

In total, Arif ended up losing ₹90,000 in capital and an additional ₹15,000 in profit-sharing payments. When he called Irshad for help, he was advised to add more capital to recover the losses.

By then, Arif had lost all his savings and no longer trusted the RA’s tips.

How We Helped Arif Recover ₹50,000

Arif reached out to our team for assistance in recovering his lost money.

We examined his case and verified the details of the SEBI-registered RA from the bank account information and SEBI registration number Arif had received. The RA was based in Kolkata, but all calls to Arif had come from Mumbai.

Our team drafted a detailed account of the incident and attached the available proof, although Arif had no call recordings since most conversations took place over WhatsApp. However, some chat messages between Arif and Irshad proved useful.

When we emailed the RA, they initially agreed to settle the matter by repaying ₹30,000. But Arif insisted on recovering a larger portion of his lost savings.

Soon after, the RA denied all allegations and sent an email stating that neither he nor his team had promised guaranteed returns or engaged in profit sharing.

This led us to escalate the case to SEBI. We lodged a complaint in SCORES platform. After a few days, SEBI requested additional evidence. Fortunately, Arif had some of the necessary documents, and we were able to strengthen our case.

Upon submitting the missing proofs to SEBI, the RA called back and offered to settle for 50% of the amount lost. Finally, Arif agreed on this amount.

What Arif Learned From This?

Although Arif didn’t recover his entire loss, the experience taught him a valuable lesson: never blindly trust any registered entity, no matter how official they seem.

Instead, focus on learning and gaining knowledge before entering the stock market.

#StockMarket#InvestmentTips#SEBI#ResearchAnalyst#StockMarketScams#InvestorAwareness#TradingTips#FinancialFraud#ProfitSharingScam#StockAdvisory#SEBIRegulations#MarketEducation#InvestmentAwareness#ScamAlert#StockTips

0 notes

Text

What is Addiction?

Addiction is when a person continually takes a substance - or engages in a behavior - with a destructive impact on their health and life.

In Ancient Rome, when a person couldn’t repay a debtor they were forced to become their slave, or ‘addictus.’ This is the origin of being “a slave to your addictions.”

Addictions take many forms; some of them may surprise you. Do you struggle with any of these?

Alcohol

Body piercing

Book collecting

Exercising

Food

Gambling

Hoarding

Narcotics

Plastic surgery

Pain

Pornography

Prescription drugs

Rejection

Relationships

Screens (smartphones, computers, tablets, TV’s, etc.)

Social media

Sex

Shopping

Tattoos

Tobacco

Video games

Working

Addicts crave the behavior or substance, even when they know it causes them physical harm, mental harm, and/or harm to their relationships. Addiction can lead to criminal behavior, poverty, homelessness, and death.

Addiction is not defined by how much a person engages in the behavior but by the impact it has on their life. A workaholic may be very successful in the office, but at home their relationships are failing and their anxiety is increasing.

What Causes Addiction?

People become addicts through many different paths, but seeking pleasure (or avoiding pain) is the ultimate driver.

Whether a person is addicted to heroin or video games, their goal is to alter their mental state and reduce subconscious-stress.

Some people believe that taking drugs leads to addiction - but this is only part of the picture. Not everyone who takes narcotics becomes addicted to them. Therefore, there must be another factor involved - the human factor.

Research involving mice found they became easily addicted to cocaine when kept in isolation. But, when the environment was enriched with social activities, interesting food, places to explore, toys to play with and new mice to meet… they stopped taking cocaine! Just like mice, humans get depressed, miserable and bored when trapped in an unfulfilling life.

Unresolved Emotions

Addiction often stems from trauma. Adverse experiences during childhood (e.g. divorce, emotional neglect, poverty) predispose us to addiction later in life. Addiction is a response to painful or traumatic events, not simply a poor choice that people make.

Demonizing addicts is counterproductive; they need to be treated with care and compassion to maximize their chances of recovery. Brain scans on people with a range of addictions reveal the same neural circuits are involved, and they all share feelings of shame and low self-value.

People develop addictions to try and cover up issues and uncomfortable emotions:

To cope with stress and life events.

To escape the pain of past trauma.

To create connections with others.

To achieve a sense of control in life.

To avoid facing feelings of inadequacy.

To hush internal voices of self-loathing.

Overcoming Addiction

There’s no one size-fits-all solution for all addicts, but here are some general tips:

1. Find the Right Help

Addicts using opiates and narcotics need help. Addiction experts can provide the highly specialized support needed for this kind of recovery. Addicts can also be aided with behavioral re-training and dedicated recovery groups.

2. Increase Self-Value

All addicts can benefit from increasing their self-worth. Any activity that improves physical or mental health enhances esteem. Getting a massage, eating vitalizing alkaline foods, and going for walks in nature are acts of self-care that enhance how we feel about ourselves.

“Because the one thing you want to do is to LOVE, and that love should begin with you” - Dr. Sebi.

3. Be Ready to Give Up

The addicted person must be ready and willing to give up their addiction; if they are forced to give it up they are likely to relapse.

What are you ready to give up?

16 notes

·

View notes

Text

Anand Rathi Review: Should You Consider This Broker?

Introduction

Anand Rathi is one of the prominent full-service brokerage firms in India, offering a broad range of financial services, including equity trading, mutual funds, portfolio management, and investment advisory. While it has built a reputation for strong research and wealth management solutions, the rise of discount brokers has made traders question whether Anand Rathi is worth considering.

This review provides an in-depth analysis of Anand Rathi’s brokerage charges, trading platforms, customer service, and overall experience compared to its competitors.

Overview of Anand Rathi

Founded in 1994, Anand Rathi caters to retail investors, high-net-worth individuals (HNIs), and institutional clients. It has a strong presence in multiple asset classes, making it a one-stop shop for investors who seek more than just stock trading.

Services Offered

Equity & Derivatives Trading (NSE, BSE)

Commodity Trading (MCX, NCDEX)

Currency Trading

Mutual Funds & SIPs

Wealth Management & PMS

IPO Investments

Fixed Income & Bonds

NRI Trading Services

Brokerage Charges

Anand Rathi follows a percentage-based brokerage model, making it relatively expensive compared to discount brokers.

Hidden Charges: Apart from brokerage fees, traders should also be aware of additional charges like STT, SEBI fees, and Demat account maintenance fees.

Trading Platforms

Anand Rathi provides multiple trading platforms catering to different types of investors:

Trade Xpress+ (Web-based platform)

Live market updates

Advanced charting tools

Research-based recommendations

Trade X’Pro (Desktop application)

Fast execution speed

Suitable for active traders

Advanced order types

Anand Rathi Mobile App

Market tracking and portfolio management

Research and advisory reports

Simple order placement

While the platforms offer a decent trading experience, some users have reported occasional glitches and slow load times.

Research & Advisory Services

One of the strongest aspects of Anand Rathi is its research and advisory services. The firm provides:

Daily market reports

Stock recommendations

Sectoral insights

Investment strategies for long-term investors

For traders who rely on expert insights, this is a significant advantage over discount brokers like Zerodha and Upstox, which provide limited research.

Customer Support and User Experience

Customer Support

Available via phone and email

Relationship managers for HNIs

Local branch offices for in-person assistance

However, user feedback on customer service has been mixed. Some traders report quick resolutions, while others face delays in getting support.

User Experience

The mobile app and web platform are functional but not as advanced as those of competitors like Zerodha’s Kite.

Account opening can take longer compared to newer brokers offering instant digital onboarding.

Anand Rathi vs Competitors

Anand Rathi vs Zerodha

Anand Rathi vs Groww

Anand Rathi vs Angel One

Pros and Cons of Anand Rathi

Pros:

✔ Strong research and advisory services ✔ Multiple asset classes available ✔ Personalized portfolio management for HNIs ✔ Wide offline presence with branch offices ✔ Variety of trading platforms

Cons:

✖ Higher brokerage compared to discount brokers ✖ Additional charges and account maintenance fees ✖ Customer service response time can be slow ✖ Mobile app performance issues reported

Who Should Choose Anand Rathi?

Long-term investors who require research-backed advisory.

High-net-worth individuals (HNIs) looking for wealth management services.

Traders who prefer a traditional brokerage with offline support.

However, if you are a cost-conscious trader, a discount broker like Zerodha, Upstox, or Groww would be a better choice.

Final Verdict

Anand Rathi is a reputable full-service broker with strong research capabilities, making it ideal for investors who seek professional guidance. However, its brokerage fees and platform experience may not be suitable for cost-sensitive traders. Before choosing Anand Rathi, consider your trading needs and compare them with alternatives.

For a more detailed analysis, check out Finology Select’s latest Anand Rathi Review to make an informed decision.

0 notes

Text

Infinite Beacon Financial Services Legit or a Scam?

Infinite Beacon Financial Services is a company that claims to offer high returns on investments through stock trading and portfolio management. The company markets itself as a partner with a SEBI-registered stock broker, promising monthly returns of 8-10% on investments. However, concerns have been raised about its legitimacy, particularly regarding its lack of proper licensing and regulatory compliance.

Infinite Beacon Financial Services has recently come under scrutiny for its business practices, with many questioning whether it is a legitimate investment platform or a potential scam. This article delves into the details of Infinite Beacon’s operations, its claims, and the red flags that investors should be aware of before committing their money.

Key Concerns and Red Flags

1. Lack of SEBI Registration

Infinite Beacon does not hold a SEBI (Securities and Exchange Board of India) registration or license to operate as a stockbroker or portfolio manager. Despite this, the company claims to be associated with a SEBI-registered entity, which raises significant concerns about its legality.

2. Unrealistic Returns

The company promises monthly returns of 8-10%, which is unusually high and unsustainable in legitimate financial markets. Such promises are often a hallmark of Ponzi schemes, where returns are paid using new investors’ money rather than actual profits.

3. Funds Deposited in Company Accounts

Investors are required to deposit funds directly into Infinite Beacon’s bank accounts, rather than into a SEBI-regulated Demat account. This practice is highly irregular and poses a significant risk to investors, as it bypasses regulatory safeguards.

4. Pressure to Recruit New Investors

Infinite Beacon’s business model appears to rely heavily on recruiting new investors, a characteristic common to pyramid or Ponzi schemes. Existing investors are encouraged to bring in new participants to sustain the returns promised to earlier investors.

5. Lack of Transparency

The company provides little to no transparency about its trading strategies, portfolio management, or how it generates the promised returns. Investors are often left in the dark about where their money is being invested.

Infinite Beacon’s Website

A major concern among potential investors is that Infinite Beacon’s website provides almost no information about the company. Key issues include:

No “About Us” Section – There is no disclosure about the company’s founders, leadership team, or history.

No Contact Information – A legitimate financial institution will always provide an office address, email, and phone number for customer inquiries. Infinite Beacon does not.

Sign-Up Wall – Instead of offering clear details about services or investment options, the website forces visitors to sign up before accessing any information. This is not standard practice for credible financial services platforms.

Is Infinite Beacon a Ponzi Scheme?

The structure of Infinite Beacon’s operations bears many hallmarks of a Ponzi scheme:

Promises of high, guaranteed returns.

Reliance on new investor funds to pay existing investors.

Lack of transparency and regulatory compliance.

Pressure to recruit new participants.

Ponzi schemes inevitably collapse when the influx of new investors slows down, leaving the majority of participants with significant losses.

0 notes

Text

Beware of Fraudulent Stock Market Schemes

The stock market offers immense opportunities, but it also attracts deceptive practices that trap unsuspecting beginners. Despite regulations by the Securities and Exchange Board of India (SEBI), many retail investors fall prey to misleading advisory services.

This article highlights the real-life story of Arif (name changed), a novice stock market learner, who was deceived by a SEBI-registered Research Analyst (RA). Trapped in an illegal profit-sharing scheme, he lost nearly ₹1,00,000. Fortunately, with the right assistance, Arif was able to recover 50% of his lost amount.

Let’s dive into how it all unfolded.

How Arif Got Trapped by a Fraudulent Research Analyst and Fought Back

A SEBI Registered Research Analyst (RA) is authorized to provide and publish stock tips and recommendations. However, unlike Investment Advisors, an RA cannot offer customized or personalized advice to individual clients.

In simple terms, the key skill of an RA is research—whether it’s fundamental or technical. This research is published and made available to clients who pay for the service.

Seems straightforward, right?

Unfortunately, many beginners are unaware of these distinctions and get trapped by misleading schemes or advice from RAs.

This is exactly what happened to Arif (name changed), a beginner stock market learner. One day, he received a call from a Research Analyst and was trapped in a profit-sharing scheme, resulting in a loss of nearly ₹1,00,000.

Here’s the complete story of how it all unfolded and how our team helped Arif recover 50% of the lost amount from the Research Analyst.

How Arif Got Trapped in a Fraudulent Advisory Scheme

Arif, an aspiring stock market enthusiast, was eager to learn the ropes of trading. While exploring educational content, he came across a webinar ad on Instagram and registered for it. Shortly afterward, he received a call from Mumbai.

The caller, Irshad (name changed), claimed to represent the office of a SEBI-registered Research Analyst. He pitched a seemingly risk-free service: Arif would receive stock tips with no upfront fees. Instead, they would share any profits on a 60:40 basis—60% for Arif and 40% for the RA.

However, what Arif didn’t know was that profit-sharing models—even from registered entities—are a major red flag, as they are prohibited by SEBI regulations.

Initially, Arif was reluctant. With only ₹40,000 in capital, he wanted to focus on learning rather than taking unnecessary risks. But Irshad was persistent, making repeated calls and convincing him to start small. He assured Arif that any potential losses could be recovered through future trades.

To further lure him in, Irshad shared fabricated profit-and-loss (P&L) screenshots from other “clients,” creating an illusion of guaranteed success. Eventually, Arif gave in and subscribed to the service.

The Downward Spiral: Losses and Deception

At first, Arif made minor profits and, as per the agreement, shared 40% of the gains with the RA. Encouraged by the initial success, he increased his capital. However, things quickly took a turn for the worse.

He soon faced a ₹7,000 loss, followed by a ₹20,000 setback. When he attempted to exit his positions, Irshad convinced him to hold on, claiming the market would rebound.

To make matters worse, Irshad provided no stop-loss guidance, leaving Arif vulnerable to greater losses.

By the end of the ordeal, Arif had lost ₹90,000 in capital and paid an additional ₹15,000 in profit-sharing fees. When he sought help from Irshad, he was instead pressured to invest more money to recover his losses.

Realizing he had been deceived, Arif decided to seek external assistance.

How We Helped Arif Recover ₹50,000

Frustrated and out of options, Arif reached out to our team for support in recovering his lost funds.

We began by verifying the RA’s credentials using the bank account details and SEBI registration number Arif had received. Although the RA was registered in Kolkata, all calls to Arif came from Mumbai, indicating possible misrepresentation.

Our team compiled a detailed report of the incident, including screenshots of Arif’s WhatsApp chats with Irshad, as no call recordings were available. Fortunately, the chat messages proved useful as evidence.

We emailed the RA, who initially agreed to settle for ₹30,000. However, Arif pressed for a larger recovery.

When the RA denied any wrongdoing, we escalated the case to SEBI through its SCORES platform. SEBI requested additional evidence, and luckily, Arif had retained some relevant documents, which helped us strengthen the case.

After reviewing the evidence, the RA offered to settle for 50% of the total losses. Following a 1.5-month-long process, Arif successfully recovered ₹50,000.

✅ Key Takeaway: Lessons Arif Learned

Although Arif didn’t recover his entire loss, the experience taught him valuable lessons: ✅ Don’t blindly trust any advisory service, even if they are SEBI-registered. ✅ Prioritize learning and gaining knowledge before entering the stock market. ✅ Always verify an advisory’s SEBI registration and background through official platforms. ✅ Be cautious of profit-sharing models, as they are often illegal and misleading.

🚀 Protect Yourself: Key Tips for Safe Investing

To avoid falling into similar traps, here are some actionable tips for retail investors:

🔹 Verify SEBI registration: Always cross-check the advisory firm’s SEBI registration on the SEBI website before engaging. 🔹 Avoid profit-sharing schemes: SEBI regulations prohibit such models. If you encounter one, it’s likely a scam. 🔹 Be wary of unsolicited calls: Genuine RAs rarely cold-call potential clients. Unsolicited calls from “registered” entities are a red flag. 🔹 Ask for proper documentation: Legitimate advisory services provide clear terms and conditions. If they avoid documentation, steer clear. 🔹 Report suspicious activity: Use SEBI’s SCORES platform to lodge complaints against fraudulent advisors.

0 notes