#SEBIRegulations

Explore tagged Tumblr posts

Text

Insider Law Compliance services: Ensuring Corporate Transparency & Accountability

Ensure regulatory compliance with expert Insider Law Compliance services! Corporate Professionals help businesses implement SEBI-compliant policies, prevent insider trading, and safeguard UPSI. Strengthen governance, avoid legal risks, and maintain market integrity with our individual compliance solutions.

0 notes

Text

SEBI Registered RA’s False Promises: How We Helped Recover 50% Loss!

A SEBI Registered Research Analyst (RA) is authorized to provide and publish stock tips and recommendations. However, unlike Investment Advisors, an RA cannot offer customized or personalized advice to individual clients.

In simple terms, the key skill of an RA is research—whether it’s fundamental or technical. This research is published and made available to clients who pay for the service.

Seems straightforward, right?

Unfortunately, many beginners are unaware of these distinctions and get trapped by misleading schemes or advice from RAs.

This is exactly what happened to Arif (name changed), a beginner stock market learner. One day, he received a call from a Research Analyst and was trapped in a profit-sharing scheme, resulting in a loss of nearly ₹1,00,000.

Here’s the complete story of how it all unfolded and how our team helped Arif recover 50% of the lost amount from the Research Analyst.

How Arif Got Trapped in the Wrong Advisory Services

Arif had developed an interest in learning about the stock market and had registered for a webinar after seeing an ad on Instagram. Soon after, he received a call from Mumbai.

The call was from the office of a SEBI-registered Research Analyst. The caller, Irshad (name changed), offered Arif their services, assuring him that he wouldn’t need to pay any fees upfront. Instead, they would share any profits made from stock tips on a 60:40 basis.

But any registered or unregistered advisory working on profit profit-sharing model is itself a big red flag. But again Arif was not aware of the same.

Initially, Arif wasn’t interested, as he wanted to focus on learning and only had a limited capital of ₹40,000. But Irshad convinced him by calling him regularly and asking him to start small. He promised that, after making some profits, Arif could invest more and assured him that losses would be recovered in future trades.

To lure him further, Irshad shared the PnLs of other clients. Impressed by the profit value and the promises, Arif eventually agreed to take the service.

In the beginning, Arif made some profits and, as agreed, shared 40% of them with the RA. But soon after he increased his capital, things took a turn.

One day, he faced a loss of ₹7,000, and the next, ₹20,000. Even when Arif wanted to square off his positions, Irshad convinced him to hold them without any stop-loss.

In total, Arif ended up losing ₹90,000 in capital and an additional ₹15,000 in profit-sharing payments. When he called Irshad for help, he was advised to add more capital to recover the losses.

By then, Arif had lost all his savings and no longer trusted the RA’s tips.

How We Helped Arif Recover ₹50,000

Arif reached out to our team for assistance in recovering his lost money.

We examined his case and verified the details of the SEBI-registered RA from the bank account information and SEBI registration number Arif had received. The RA was based in Kolkata, but all calls to Arif had come from Mumbai.

Our team drafted a detailed account of the incident and attached the available proof, although Arif had no call recordings since most conversations took place over WhatsApp. However, some chat messages between Arif and Irshad proved useful.

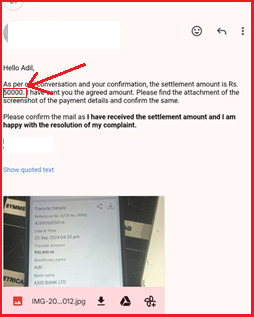

When we emailed the RA, they initially agreed to settle the matter by repaying ₹30,000. But Arif insisted on recovering a larger portion of his lost savings.

Soon after, the RA denied all allegations and sent an email stating that neither he nor his team had promised guaranteed returns or engaged in profit sharing.

This led us to escalate the case to SEBI. We lodged a complaint in SCORES platform. After a few days, SEBI requested additional evidence. Fortunately, Arif had some of the necessary documents, and we were able to strengthen our case.

Upon submitting the missing proofs to SEBI, the RA called back and offered to settle for 50% of the amount lost. Finally, Arif agreed on this amount.

What Arif Learned From This?

Although Arif didn’t recover his entire loss, the experience taught him a valuable lesson: never blindly trust any registered entity, no matter how official they seem.

Instead, focus on learning and gaining knowledge before entering the stock market.

#StockMarket#InvestmentTips#SEBI#ResearchAnalyst#StockMarketScams#InvestorAwareness#TradingTips#FinancialFraud#ProfitSharingScam#StockAdvisory#SEBIRegulations#MarketEducation#InvestmentAwareness#ScamAlert#StockTips

0 notes

Text

Secretarial Compliance Report – Excessive In Parts

Sub-regulation 2 of Regulation 24A of SEBI (LODR) Regulations, 2015 provides for the submission of secretarial compliance report by listed entities on an annual basis within 60 days from the end of each financial year, in such form as specified.

While the annual secretarial audit covers status of compliance with all laws, rules and regulations applicable to a listed company or its material unlisted subsidiary, a secretarial compliance report focusses on compliance with all SEBI Regulations and circulars/ guidelines issued thereunder, as may be applicable to the listed company.

The prescribed format for the secretarial compliance report contains the observations/ remarks of the Practising Company Secretary (PCS) in relation to compliance/ deviations, if any, details of the action taken against the listed entity/ its promoter/ directors/ material subsidiaries by SEBI or by the Stock exchanges, and the actions taken, if any, by the listed entity to comply with the observations made in the previous reports. The format enables the reader to take note of any continuing non-compliance by the listed company.

In March, 2023, SEBI expanded the scope of this report. Some of the additions include:

Compliance with the Secretarial Standards (SS) issued by ICSI:

SS derive their legitimacy from the Companies Act, 2013. Since the focus of the Secretarial Compliance Report is on SEBI Regulations, it is not clear why this has been included. The Secretarial audit report focusses on compliance with SS.

Adoption and timely updation of the Policies as per regulations/circulars/guidelines issued by SEBI:

SEBI regulations provide for the formation of certain policies like whistle-blower policy, policy for preservation of documents, nomination and remuneration policy, etc. Although listed entities adhere to such provisions, and formulate the required policies, a number of companies do not update them periodically.

Maintenance and disclosures required to be made on Website:

The website is one of the platforms for obtaining information about an entity. Hence, it should be updated at all times. SEBI regulations provide for certain mandatory disclosures on the website of the listed company. However, a number of listed companies do not ensure that the disclosures are complete and/or updated.

Accuracy of the Web-links provided in annual corporate governance reports under Reg 27(2):

An Annual report is a vital document, which provides mandatory disclosures under a number of heads. In order for the report to not be needlessly long, SEBI provides that with regard to some disclosures, the company can provide a hyperlink of the same to the relevant page on the website of the company. It has been observed that a number of companies do not give the specific link, but a general link, or that the link expires after some time. Accuracy of the link is very important for ease of locating the information.

Affirmation that none of the director of the company are disqualified under Section 164 of Companies Act, 2013:

Section 164 of the Companies Act, 2013 provides for disqualifications to be a director, under certain situations, and disclosures relating to the same. Since this is coming from the the Companies Act, and not SEBI Regulations, the need for including this in the Secretarial compliance report is not clear. Further, each company is required to make this disclosure in the Annual report.

Identification of material subsidiary companies and the requirement with respect to the disclosures of material as well as other subsidiaries:

Some companies do not clearly indicate the material subsidiaries, as defined under SEBI regulations, or compliance with requirements relating to material subsidiary companies.

Preservation and maintenance of records as prescribed under SEBI Regulations and disposal of records as per Policy of Preservation of Documents and Archival policy prescribed under SEBI LODR Regulations, 2015:

Various SEBI regulations provide for the maintenance of various records and their preservation for a prescribed period of time. Given the importance of some of these documents, both the formulation of a policy to that effect, and its implementation are important.

Whether performance evaluation of Board, Independent Directors and the Committees at the start of every financial year has been conducted as prescribed in SEBI Regulations:

Increasingly, a number of Boards are seeing value in evaluation of the Board, its committees and the Directors. There are disclosures to be made in the Annual Report to that effect. The need for a PCS to recheck whether this process has been undertaken is not clear.

Prior approval of Audit Committee for all Related party transactions and in case no approval obtained, the detailed reasons should be provided along with confirmation whether the transactions were subsequently approved/ratified/rejected by the Audit committee:

Approval of Related Party Transactions (RPTs) is important since there is a potential of misuse of such transactions. SEBI Regulations already have a detailed framework for approval of RPTs. The need for an added layer of check is not clear.

Disclosure of events or information under Regulation 30 alongwith Schedule III of SEBI LODR Regulations, 2015 within the prescribed time limit:

Regulation 30 refers to some material events, which can impact the company and its functioning, which have to be disclosed to the Stock Exchanges on their occurrence. However, a number of companies either do not make these disclosures, or delay such disclosures. Further, some of them are either incomplete or incorrect.

Compliance with Regulation 3(5) & 3(6) of SEBI (Prohibition of Insider Trading) Regulations, 2015:

The scope of compliance with PIT Regulations is large. It is a good idea for a PCS to check whether the Compliance Officer is ensuring compliance with the relevant provisions of PIT Regulations.

Additional Non-compliances, if any:

This is an enabling provision for any specific non compliance that might have not been covered.

Further, the format of disclosure has been changed to include specific reference to the regulation or circular number, the details of deviation and action taken, as also the type of action (advisory, clarification, fine, show cause notice or warning), amount of fine, observation of the PCS, and management’s response to the same. It is a good practice to have management response since the stakeholder perusing the report can make his/her own judgment on the validity of the response.

The above mentioned changes/ additions to the format of the Secretarial Compliance Report have been made in order to make it more comprehensive. This is also likely to help the Board in tracking some of the non-compliances that may skip their attention. Source: https://excellenceenablers.com/secretarial-compliance-report-excessive-in-parts/

#SecretarialCompliance#SEBIRegulations#CorporateGovernance#LODR#BoardEffectiveness#ComplianceAudit#GovernanceAudit

0 notes

Text

#SEBIRegulations#MarketImprovement#SEBIImpact#MarketConditions#FinancialStability#SEBIRules#EconomicGrowth#InvestmentEnvironment#StockMarketReforms#SEBICatalyst

0 notes

Video

youtube

Legal Crypto Trading Strategies in India

#LegalCryptoTrading #CryptoTradingStrategies #IndiaCryptoRegulations #SpotTrading #FuturesTrading #MarginTrading #Staking #CryptoTaxRegulations #CryptoExchanges #BingX #CryptoTradingPlatform #SEBIRegulations #RBIGuidelines #CryptoDerivatives #VirtualDigitalAsset #IncomeTaxOnCryptos #PassiveIncome #CryptocurrencyInvesting #CryptoMarketUpdates #DueDiligence #FinancialExperts #SecureTrading #CompliantTrading #CryptoEcosystem #LatestRegulations #StayInformed

0 notes

Video

youtube

Legal Crypto Trading Strategies in India

#LegalCryptoTrading #CryptoTradingStrategies #IndiaCryptoRegulations #SpotTrading #FuturesTrading #MarginTrading #Staking #CryptoTaxRegulations #BingXReferralCode #SecureCryptoExchanges #CompliantTrading #SEBIRegulations #CryptoDerivatives #IncomeTaxOnCrypto #TDSOnCryptoTransactions #RBIGuidelines #CryptoEcosystemDueDiligence #StayInformed #FinancialExperts #LatestDevelopments #VirtualDigitalAsset #CryptoLandscapeIndia #CryptoTradingIndia #PassiveIncomeCrypto #CryptoInvestmentIndia #CryptoTradingCompliance

#youtube#LegalCryptoTrading#cryptotradingstrategies#IndiaCryptoRegulations#spottrading#futurestrading#futures trading

0 notes

Text

Overview : SEBI Regulations 2011 #shareholder #regulations #financeandeconomy #acquisitions #mergersacquisitionsdivestitures #sebiregulations #law #arbitration #investments #internationalarbitration

https://www.stalawfirm.com/en/blogs/view/substantial-acquisition-of-shares-and-take-over-sebi-regulations-2011-overview.html

0 notes

Text

Survey on Corporate Governance Excellence Enablers 2024-25

The independence of a Director is critical to ensure objective thinking, discussions and decision-making in the boardroom.

The Companies Act, 2013 (the Act) and SEBI LODR Regulations, 2015 (LODR) have indicated some criteria for assessing the independence of an ID. Independence however is a state of mind, and cannot be determined with reference to statutory or regulatory provisions or definitions. Before appointing a Director as an Independent Director (ID), the following must be gone into to assess whether an ID is truly independent.

Compliance with definition under the Act and LODR – It is important to ensure that the person complies with all the provisions relating to the definition of an ID.

Absence of conflict of interest – Conflict of interest, real or perceived, should be avoided. Any conflict has the potential to impact the independence of a Director. Such a conflict should be disclosed as soon as is reasonably possible, and the Director concerned should disassociate himself/ herself from the discussions and the decision relating to the subject where there is a conflict.

Absence of pecuniary interest – The Act allows a Director to have income from a company on whose Board he/she sits, and be classified as an ID, provided that the income from the company for the Director is not in excess of 10% of his/her total income. However, independence being a state of mind, there should be no limits prescribed, and there should be no pecuniary relationship.

Past track record – It is difficult to anticipate how a Director would conduct himself/ herself on the Board. Would this Director shy away from asking tough questions. However, from the past track record of the person, it would be possible to ascertain whether he/she has demonstrated independence of judgement and whether he/she is afraid to ask the difficult questions and challenge the management.

Being truly independent at the time of appointment is critical. It is even more important to ensure that the Director stays truly independent throughout his/her term. Source: https://excellenceenablers.com/questions-to-assess-the-independence-of-an-independent-director/

0 notes

Text

Key Regulatory Developments in Corporate Governance

In the latest newsletter from Excellence Enablers, we delve into the recent consultation papers issued by regulators, including the “Draft Insurance Regulatory and Development Authority of India (Regulatory Sandbox) (Amendment) Regulations, 2024”. The newsletter emphasizes the importance of a principle-based approach to regulations, operational flexibility, and fostering innovation within the insurance sector. We also explore the implications of proposed changes to the governance framework of Market Infrastructure Institutions and the redefinition of Unpublished Price Sensitive Information under SEBI regulations. Read on to learn more about these critical regulatory developments.

#CorporateGovernance#RegulatoryDevelopments#InsuranceRegulations#SEBI#SEBIRegulations#BusinessDevelopment#Compliance

0 notes