#seamless cheque deposit

Explore tagged Tumblr posts

Text

youtube

#cheque deposit machines#cheque deposit machine benefits#cdms Convenience#banking convenience#cdm benefits#banking automation#cdm technology#banking transactions#banking accessibility#customer comfort#seamless cheque deposit#check deposit machine#cheque deposite#cheque clearing time#deposit check cash#cheque deposit machine#cheque clearing#sujatha banker#sujjatha banker insights#sujatha banker advice#banking advices#benifits of cdm#Youtube

0 notes

Text

How Digital Trends Impact Positively on Banking Industry

Do you remember spending hours outside the bank just to deposit an amount to your account? Now it can be done in a matter a minute!

The banking sector has been evolving since the 18th century and now it has taken an even bigger step by making use of digital technologies a lot more convincingly. In fact, now it is seen that banking sectors are looking for Android app development services or web development services a lot more than ever. It has completely transformed the way it works and it has all been possible because of the technology infusion.

Whenever someone says bank all we remember is a long line of people and an unmanageable amount of documentation physically. All these aspects were really scary. You just cannot afford to lose these documents and it was really challenging to manage as well.

How Has the Banking Sector Evolved?

With more than 84 % of people using online banking services and 72% using mobile applications to complete their banking needs, it is quite visible how it has helped their customers without any difficulty with the help of these technologies. Earlier people had to stand in the queue for hours just to get their amount deposited in their account or have their accounts open. It would take hours out of their lives. In fact, for every single query, one would have to visit the bank and literally spend an hour or more.

But, now things have changed and literally become a lot more seamless. Now you have all of your banking needs right at your fingertips. Whether you desire to open an account or transfer your money, it can be done in a matter of a few minutes. All thanks to technology! Now you just need to visit the banking page and add your login credentials. You will find all the required services right in front of you. Using the digital trends, you will be able to:

Transfer money from your account to others in different ways namely NEFT, RTGS, and IMPS.

You will also be able to check your monthly statement anytime as per your convenience.

You will be able to order a new cheque book as well.

You can have your card blocked when misplaced in a matter of minutes!

So, this shows how the baking sector has evolved significantly over the years and made things easy for people to work upon! If you are still thinking about how web development services or Android application development services have helped the banking industry then take a look:

Banking At Fingertips

Error-Free And Secure Service

With the involvement of technology in the banking sector, things have become a lot more accurate, and slowing the chances of errors have gone down completely. It is quite obvious that human capabilities are restricted and this is the reason that the chances of errors are quite high. But with automation Technology, e-banking services are now being processed without any issues whatsoever and that too without any e damage to the customer’s data as well. It is completely safe and Secure plus everything is being processed in a matter of a few minutes. So you can be confident that your data is not misused and also you can have your needs covered without any chances of errors

Excellent Customer Experience

Another impact the infusion of Technology has made in the banking world is presenting an excellent customer experience. When you remember the ancient banking system all you remember is the lengthy and tiring process of getting your work done. But with the involvement of Technology, things have changed completely and now you can use banking applications and websites anytime you need and have your transaction completed at your convenience. The entire process is completely hassle-free and can be executed from any part of the world. All it needs is an Internet connection!

Security Approved

With everything online, you might doubt about using banking because of being uncertain about the security related aspects. But, research well, you will find that these banking applications and websites are fully protected with the use of best security advancements. Every service you opt for requires OTP and your confidential data is inaccessible without an ID and password. You can change your login credentials regularly to keep it safe and also make your transfer without any hassle at all! So, you can pursue all your banking transactions without having to think twice as all your banking service is secure enough to be breached.

Wrapping Up

So, these aspects literally show how the banking sector has evolved over a period of time and all credit goes to the involvement of digital technologies. These trends are continuously rising and exclusively meeting the banking sector a lot more smooth and securely.

PerfectionGeeks has always been one of the best in the business when it comes to providing Android app development services or web development services . You can reach out to them and get the banking application ready without any difficulty!

#ios app development#app development#blockchain application development#iot application development#website development company#ui and ux design service#perfectiongeeks#artificial intelligence#wearable app development#hyperledger blockchain application development

4 notes

·

View notes

Text

Online Salary Account: Simplified Salary Management with City Union Bank

Managing employee salaries efficiently and ensuring timely payments are crucial for businesses to maintain a positive work environment. A Salary Account is designed specifically to address the unique needs of businesses when it comes to salary disbursements. With the advent of online banking, businesses now have the opportunity to streamline salary management in a way that is both efficient and secure.

If you're a business owner or HR professional looking for a hassle-free solution to manage employee salaries, City Union Bank’s Online Salary Account offers a seamless, user-friendly experience that will revolutionize the way you handle salary disbursements. In this blog, we will explore the benefits of an Online Salary Account with City Union Bank, how it simplifies salary management, and why it's the ideal choice for your organization.

What is an Online Salary Account?

An Online Salary Account is a specialized bank account designed for businesses to deposit salaries of employees directly. The account offers several features that make salary disbursement easier, faster, and more secure. With the convenience of online banking, employers can manage and disburse salaries to employees in a timely and efficient manner, eliminating the need for physical cheques or cash transactions.

City Union Bank’s Online Salary Account is tailored for businesses of all sizes, offering both employer and employee the ease of managing salaries without the hassle of traditional methods.

Why Choose an Online Salary Account with City Union Bank?

City Union Bank, a leading private-sector bank, provides innovative banking solutions for both individuals and businesses. The Online Salary Account offered by City Union Bank comes with a wide array of features designed to simplify salary management for businesses. Here are some of the reasons why you should choose an Online Salary Account with City Union Bank:

1. Convenient Salary Disbursement

Managing salary payments for a large number of employees can be cumbersome. With the Online Salary Account, businesses can easily transfer salaries to employees’ accounts through NEFT, RTGS, or IMPS methods. This digital solution ensures that all payments are processed quickly and accurately, without any delays or errors.

With bulk payment features, employers can easily process salary transfers for multiple employees at once, saving significant time and reducing the chances of mistakes. Additionally, employees can access their salaries immediately once the payment is credited, ensuring a smooth and efficient process.

2. Zero Balance Maintenance

One of the biggest advantages of having an Online Salary Account with City Union Bank is that it comes with zero balance maintenance. Unlike regular savings accounts that require a minimum balance, employees using the Salary Account don’t have to maintain a minimum balance. This is particularly beneficial for employees who may not have a large salary but want access to a reliable and secure banking option.

This feature also saves employees from any penalty charges, giving them full access to their hard-earned money whenever they need it.

3. Easy Access and Monitoring

City Union Bank’s Online Salary Account allows both employers and employees to easily access their accounts online. Employers can monitor salary disbursements, track payments, and manage employee details through the secure online banking portal. Employees, on the other hand, can access their salary details, check account balances, and monitor transaction histories via the City Union Bank mobile app or online banking services.

The user-friendly interface makes it simple for both employers and employees to manage their finances effectively, without needing to visit the branch frequently.

4. Secure Transactions

Security is a top priority when it comes to salary disbursement. City Union Bank uses state-of-the-art security protocols to ensure that all online transactions are secure. The bank uses multi-factor authentication (MFA) and SSL encryption to safeguard sensitive financial data, ensuring that both employers and employees can enjoy peace of mind when performing transactions or monitoring account activities.

Moreover, employees’ salary accounts are linked to Aadhaar and PAN for secure KYC (Know Your Customer), making the entire process safe and compliant with banking regulations.

5. Easy Salary Hike Implementation

When salary hikes are announced, updating multiple salary accounts can become a cumbersome process. With City Union Bank’s Online Salary Account, employers can easily implement salary hikes for their entire workforce through the online banking platform. The process is streamlined and efficient, making it easier for HR teams to keep track of salary adjustments, bonuses, and other employee benefits.

6. Instant Access to Banking Services for Employees

Employees benefit from a wide range of banking services with a Salary Account. They can access ATM withdrawals, online payments, debit card services, and mobile banking features to manage their finances easily. City Union Bank also provides employees with the option to link their Salary Account to their mobile phones, enabling them to make quick and hassle-free payments, track expenses, and check their balances anytime.

Additionally, employees can also avail themselves of personal loans, overdraft facilities, and other banking services at preferential rates due to their Salary Account status.

7. No Hidden Fees and Charges

One of the biggest challenges businesses face when managing employee salaries is dealing with hidden fees and charges. City Union Bank’s Online Salary Account comes with transparent pricing—there are no hidden fees or charges associated with salary deposits or withdrawals. Employers can rest assured knowing that there will be no unexpected deductions or surprise costs when making salary payments to employees.

Moreover, the bank’s free ATM withdrawals for employees make it even more cost-effective for businesses and employees alike.

8. Comprehensive Reporting Features

For businesses, maintaining records of salary payments is essential for tax filings, audits, and employee benefits management. City Union Bank’s Online Salary Account offers detailed account statements and transaction reports to help employers manage financial records easily. You can access monthly, quarterly, and annual reports at the click of a button, making the accounting and compliance process simpler and more efficient.

9. Dedicated Support for Employers

City Union Bank provides dedicated support for businesses that open Online Salary Accounts. Whether you need help setting up your account, managing salary disbursements, or resolving any issues, the bank’s customer support team is available to assist you. The support staff is trained to handle business-specific banking queries, ensuring that your salary management process remains seamless and hassle-free.

How to Open an Online Salary Account with City Union Bank?

Opening an Online Salary Account with City Union Bank is a simple process that can be completed in just a few steps. Here’s how you can get started:

Step 1: Visit the City Union Bank Website

Go to the official City Union Bank website here, and explore the various business banking options, including the Online Salary Account.

Step 2: Fill Out the Application Form

Complete the online application form by providing details about your business and the number of employees. This helps the bank understand your requirements and offer you customized solutions.

Step 3: Submit the Required Documents

To open an Online Salary Account, you will need to provide the necessary documents such as:

Business registration proof

KYC documents for the business and employees (e.g., PAN card, Aadhaar card)

Proof of address for the business

These documents can be uploaded directly through the online portal.

Step 4: Verify and Activate Your Account

Once your application is processed and verified, City Union Bank will activate your Online Salary Account. The bank will provide you with the account details, and you can start using the account for salary disbursement.

Step 5: Start Disbursing Salaries

Once the Online Salary Account is set up, you can begin processing employee salary payments through the bank’s secure online platform. Your employees will be notified when their salaries are credited.

Conclusion

City Union Bank’s Online Salary Account offers a seamless, secure, and convenient way for businesses to manage their salary disbursements. With features such as zero balance maintenance, easy access, secure transactions, and transparent pricing, both employers and employees can enjoy a hassle-free banking experience. This specialized account ensures that salary payments are processed efficiently, on time, and without complications, improving overall employee satisfaction.

For businesses looking to streamline salary management and provide employees with easy access to their wages, City Union Bank’s Online Salary Account is the perfect solution. Visit the City Union Bank website today to open an Online Salary Account and start simplifying your salary management process!

0 notes

Text

10 Essential Tips for tenants: Your Guide to leasing property for rent in Dubai

Renting a property in Dubai can be an exciting yet challenging process, especially for those new to the city or navigating the market for the first time. It opens the door to a dynamic real estate market, offering everything from high-end luxury apartments for rent in Dubai to more budget-friendly options. Whether you're renting your short-term holiday homes in Dubai or long-term rentals, their expertise can save you time and effort while securing your ideal property.

Here is a step-by-step guide to help you make informed decisions, reduce stress, and enjoy a seamless leasing experience.

1. Start with a Consultation

Begin by scheduling a consultation with a professional real estate broker in Dubai. They’ll discuss your needs and budget to understand exactly what you’re looking for in a rental property. A designated broker will be assigned to research the market and shortlist suitable options based on your preferences.

2. Conduct a Targeted Property Search

Your broker will carry out a targeted search to identify the best available properties. With knowledge of Dubai's diverse rental market, they can find options that align with your lifestyle, location, and budget requirements, saving you time and ensuring you see only relevant listings.

3. Schedule Flexible Property Viewings

View properties in person, or opt for virtual viewings if you’re not yet in Dubai. Online tours can give you a close look at potential homes, with brokers providing video walk-throughs and marketing materials to help you make an informed choice.

4. Make a Formal Offer

Once you find the right property, your broker will help you submit a formal offer to the landlord. This offer will include essential details such as annual rent, number of payments, and the start date of your tenancy. Your broker will also manage negotiations, ensuring that your terms are favorable.

5. Define Terms and Conditions

Prior to signing the tenancy contract, confirm any specific conditions with the landlord, such as maintenance responsibilities or pet policies. This is an important step to ensure transparency and avoid misunderstandings down the line.

6. Finalise the Tenancy Contract

Your broker will prepare the Unified Tenancy Contract and any necessary addendums. Review these documents thoroughly to ensure that they reflect all agreed-upon terms before signing. Your broker can answer any questions to make sure everything is clear.

7. Verify Ownership

Request that your agent verifies the property’s ownership and title deed using Dubai’s government applications. This confirmation protects you from potential scams and ensures you’re dealing directly with the legal property owner.

8. Organize Payments

Deposit and rental cheques should be issued to the landlord. Discuss your payment plan with your broker, as Dubai typically offers options for single or multiple post-dated cheques over the tenancy period. Proper handling of these payments is essential to securing your rental agreement.

9. Register the Tenancy via Ejari

All Dubai tenancy contracts must be registered with Ejari, a regulatory system that safeguards both tenant and landlord rights. Additionally, arrange for utility connections before moving in to ensure a smooth transition.

10. Complete Property Handover and Inspection

Before moving in, conduct a thorough inspection with the landlord or agent. This step allows you to check that everything is in good condition, note any existing issues, and ensure that agreed-upon fixtures or appliances are in place. Once complete, you’ll receive your keys and be ready to settle in.

Renting in Dubai can be straightforward with the right support. Your broker can connect you with reputable service providers, including moving companies, maintenance services, and interior designers, to assist with any additional needs during your move. With professional guidance, you’ll be well on your way to a comfortable and stress-free leasing experience. Consider working with reputable property management companies in Dubai, as they can help you navigate contracts, negotiate terms, and find the perfect match for your needs.

Exclusive Links has been supporting landlords and tenants in Dubai since 2005, bringing over 19 years of experience in the rental market. With one of the largest portfolios of managed properties by individual owners, we offer a range of well-presented, ideally located, and expertly managed rental options. Our team is dedicated to ensuring a high-quality living experience, with properties that are maintained to the highest standards to meet the needs of every tenant.

0 notes

Text

Bahrain for digital payment innovation with E-cheque

Recent years have seen a tremendous increase in digital/online payments for e-commerce, utility bills or transfer money. The success of digitising payments relies on developing adequate payment technologies. The mode of payment can vary from an electronic fund transfer/wire transfer or ATM transaction to cheque payment. Each payment processor has its pros and cons, from the ease of payment method to the time taken for payment settlement.

Cheques are one of the most commonly used conventional payment methods. Consumers are used to issuing physical cheques however banks insist on an electronic cheque by capturing cheque images, thereby enabling the bank to process a cheque faster through the electronic exchange of the cheque images.

In a move to spur electronic commerce and innovation in digital payments, one such technology that is introduced is E-Cheque. An E-Cheque is an electronic document which substitutes the paper check for online transactions. Digital signatures (based on public key cryptography) replace handwritten signatures. The E-Cheque system is designed with message integrity, authentication and non-repudiation feature, strong enough to prevent fraud against the banks and their customers.

Let’s look at a scenario:

‘Sarah was out of town on an official tour when she got a call that her close relative that her uncle had met with an accident and was being rushed to the hospital. Her cousin who spoke to her said early funds in the range of 50K USD would be needed urgently. While she had about 25K handy, there was obviously a shortfall.

Sarah immediately logged into her account to make an online transfer to her cousin’s account but faced a process roadblock where she had to first add her cousin as a beneficiary and then wait for the next 24 hours before he could initiate the transfer. Thankfully, she had a fall-back option, the E-Cheque app that she had installed only recently but not yet used. She opened the app and issued an E-cheque in her cousin’s name using a secure validation method. Soon she shared the E-Cheque with her cousin, who used it to deposit the cheque in his account quickly.’

Digitisation of the cheque-related processes, including issuing, writing and depositing, further simplifies banking transactions for millions. While it is indeed of help in emergent situations like the one exemplified above, it also offers a mid-path solution for those who are embracing online banking for certain processes but are not yet fully comfortable doing away with the cheques altogether, especially for corporates.

Moreover, online cheques also offer certain safeguards that would be valuable in protecting a user’s interests while easing the process of cheque writing, issuing and depositing much easier while avoiding physical presence as much as possible. One such country implementing E-cheque for its customers is Bahrain, one of the first countries in the Middle East. Bahrain, one of the fintech hubs for innovative payment methodologies, will be launching E-Cheque for millions of its consumers in the region.

With the domain expertise of maximum number implementations in Image-based cheque clearing in UAE, Unity Infotech has become one of the leading and trusted technology partners for Bahrain member banks to launch an innovative financial technology to the market. Unity Infotech’s E-Cheque Direct is implemented in close to 9 banks in Bahrain and is being intensively tested with utmost automation and precision to go live in April. Discover the evolution of Digital Payment Systems in Bahrain, revolutionizing financial transactions with seamless mobile apps, contactless payments, and secure online gateways Learn more about E-Cheque Direct here!

0 notes

Text

Bahrain for digital payment innovation with E-cheque

Recent years have seen a tremendous increase in digital/online payments for e-commerce, utility bills or transfer money. The success of digitising payments relies on developing adequate payment technologies. The mode of payment can vary from an electronic fund transfer/wire transfer or ATM transaction to cheque payment. Each payment processor has its pros and cons, from the ease of payment method to the time taken for payment settlement.

Cheques are one of the most commonly used conventional payment methods. Consumers are used to issuing physical cheques however banks insist on an electronic cheque by capturing cheque images, thereby enabling the bank to process a cheque faster through the electronic exchange of the cheque images.

In a move to spur electronic commerce and innovation in digital payments, one such technology that is introduced is E-Cheque. An E-Cheque is an electronic document which substitutes the paper check for online transactions. Digital signatures (based on public key cryptography) replace handwritten signatures. The E-Cheque system is designed with message integrity, authentication and non-repudiation feature, strong enough to prevent fraud against the banks and their customers.

Let’s look at a scenario:

‘Sarah was out of town on an official tour when she got a call that her close relative that her uncle had met with an accident and was being rushed to the hospital. Her cousin who spoke to her said early funds in the range of 50K USD would be needed urgently. While she had about 25K handy, there was obviously a shortfall.

Sarah immediately logged into her account to make an online transfer to her cousin’s account but faced a process roadblock where she had to first add her cousin as a beneficiary and then wait for the next 24 hours before he could initiate the transfer. Thankfully, she had a fall-back option, the E-Cheque app that she had installed only recently but not yet used. She opened the app and issued an E-cheque in her cousin’s name using a secure validation method. Soon she shared the E-Cheque with her cousin, who used it to deposit the cheque in his account quickly.’

Digitisation of the cheque-related processes, including issuing, writing and depositing, further simplifies banking transactions for millions. While it is indeed of help in emergent situations like the one exemplified above, it also offers a mid-path solution for those who are embracing online banking for certain processes but are not yet fully comfortable doing away with the cheques altogether, especially for corporates.

Moreover, online cheques also offer certain safeguards that would be valuable in protecting a user’s interests while easing the process of cheque writing, issuing and depositing much easier while avoiding physical presence as much as possible. One such country implementing E-cheque for its customers is Bahrain, one of the first countries in the Middle East. Bahrain, one of the fintech hubs for innovative payment methodologies, will be launching E-Cheque for millions of its consumers in the region.

With the domain expertise of maximum number implementations in Image-based cheque clearing in UAE, Unity Infotech has become one of the leading and trusted technology partners for Bahrain member banks to launch an innovative financial technology to the market. Unity Infotech’s E-Cheque Direct is implemented in close to 9 banks in Bahrain and is being intensively tested with utmost automation and precision to go live in April. Discover the evolution of Digital Payment Systems in Bahrain, revolutionizing financial transactions with seamless mobile apps, contactless payments, and secure online gateways

0 notes

Text

Important Factors You Must Consider Before Opening a Current Account

A current account is a banking account widely used by businesses in India. A current account is popular as it allows withdrawing funds and writing cheques against the balance maintained, with no cap on the number of transactions. Leading banks even offer personalized current accounts with added benefits. With online banking now a common feature among banks, one can even open a current account online.

Important Factors You Must Consider Before Opening a Current Account

Transaction fees

A current account has no limit on the number of transactions. However, the bank levies a fee for transactions that exceed the pre-set limit. A lower fee entails fewer charges and is beneficial for the account holder.

Current Account Minimum Balance

Current accounts require account holders to maintain a minimum balance. This is done so that account holders keep track of their high volume of transactions and maintain it appropriately.

Overdraft Facility

Banks give most Current Account holders the provision of overdraft facilities based on their credibility. This is mostly temporary funding made available to current account holders to manage their shortfall in funds at a given point in time.

Interest Rates

A current account does not bear interest. However, being a liquid account, cash is easily made available to the account holder, making it a very convenient option for business owners.

Customized and Core services

Most banks provide add-on services to their premium customers, which include cheque pick-up, cash deposit, after-hours banking access, credit cards, demand orders, and so on. Most banks offer core-banking services like internet/mobile banking, IT/ERP Services, ERP Services, cash deposits via multiple locations, and such related facilities, so compare between bank facilities before opening a current account.

Online Banking

One can open current account online, enabling digital payments, including online NEFT/RTGS/IMPS, apart from key digital banking services like mobile banking/net banking. Some of these services are charged, but it differs from bank to bank. This would ensure seamless and hassle-free current account transactions.

Bank Network

Choose a bank with a large branch network, as this would help the business entity to carry on their transactions smoothly across several locations.

Current Account Opening Documents

Documents differ based on the business/entity. The indicative list of common documents required are:

Business/entity registration certificate/license

Registration certificate issued by Sales Tax/Service Tax/Professional Tax authorities

ID and Address Proof like PAN Card, Passport, Aadhaar Card

TAN Allotment Letter issued by NSDL for the business/entity

Complete income tax return

Utility bills like telephone, electricity

Procedure for Opening Current Account

The above indicative list of current account opening documents as deemed necessary is to be submitted to the chosen bank. The same can be done by either visiting the bank branch or visiting the bank’s official website and providing a scanned copy of the documents online. The bank would require an application form to be filled and duly signed. If needed, a current account initial deposit may be required based on the current account type chosen and the type of business entity.

Conclusion

A current account is a very convenient and easy way of operating business accounts. The whole banking experience has now undergone a paradigm shift, with most banks offering digital current accounts, which can be done anywhere, anytime.

0 notes

Text

Bahrain for digital payment innovation with E-cheque

Recent years have seen a tremendous increase in digital/online payments for e-commerce, utility bills or transfer money. The success of digitising payments relies on developing adequate payment technologies. The mode of payment can vary from an electronic fund transfer/wire transfer or ATM transaction to cheque payment. Each payment processor has its pros and cons, from the ease of payment method to the time taken for payment settlement.

Cheques are one of the most commonly used conventional payment methods. Consumers are used to issuing physical cheques however banks insist on an electronic cheque by capturing cheque images, thereby enabling the bank to process a cheque faster through the electronic exchange of the cheque images.

In a move to spur electronic commerce and innovation in digital payments, one such technology that is introduced is E-Cheque. An E-Cheque is an electronic document which substitutes the paper check for online transactions. Digital signatures (based on public key cryptography) replace handwritten signatures. The E-Cheque system is designed with message integrity, authentication and non-repudiation feature, strong enough to prevent fraud against the banks and their customers.

Let’s look at a scenario:

‘Sarah was out of town on an official tour when she got a call that her close relative that her uncle had met with an accident and was being rushed to the hospital. Her cousin who spoke to her said early funds in the range of 50K USD would be needed urgently. While she had about 25K handy, there was obviously a shortfall.

Sarah immediately logged into her account to make an online transfer to her cousin’s account but faced a process roadblock where she had to first add her cousin as a beneficiary and then wait for the next 24 hours before he could initiate the transfer. Thankfully, she had a fall-back option, the E-Cheque app that she had installed only recently but not yet used. She opened the app and issued an E-cheque in her cousin’s name using a secure validation method. Soon she shared the E-Cheque with her cousin, who used it to deposit the cheque in his account quickly.’

Digitisation of the cheque-related processes, including issuing, writing and depositing, further simplifies banking transactions for millions. While it is indeed of help in emergent situations like the one exemplified above, it also offers a mid-path solution for those who are embracing online banking for certain processes but are not yet fully comfortable doing away with the cheques altogether, especially for corporates.

Moreover, online cheques also offer certain safeguards that would be valuable in protecting a user’s interests while easing the process of cheque writing, issuing and depositing much easier while avoiding physical presence as much as possible. One such country implementing E-cheque for its customers is Bahrain, one of the first countries in the Middle East. Bahrain, one of the fintech hubs for innovative payment methodologies, will be launching E-Cheque for millions of its consumers in the region.

With the domain expertise of maximum number implementations in Image-based cheque clearing in UAE, Unity Infotech has become one of the leading and trusted technology partners for Bahrain member banks to launch an innovative financial technology to the market. Unity Infotech’s E-Cheque Direct is implemented in close to 9 banks in Bahrain and is being intensively tested with utmost automation and precision to go live in April. Discover the evolution of Digital Payment Systems in Bahrain, revolutionizing financial transactions with seamless mobile apps, contactless payments, and secure online gateways Learn more about E-Cheque Direct here!

0 notes

Text

Streamlining Transactions: The Power of Cheque API Integration

In today's fast-paced digital world, financial transactions are becoming increasingly seamless, efficient, and secure. Businesses, both large and small, are constantly seeking innovative solutions to streamline their payment processes and enhance their financial operations. One such solution that has gained significant traction in recent years is the integration of Cheque APIs.

Cheques have long been a traditional method of payment, offering a tangible way to transfer funds between parties. However, the manual processes involved in cheque issuance, deposit, and clearance have often been time-consuming and prone to errors. With the advent of Cheque APIs, these challenges are being overcome, revolutionizing the way businesses handle their financial transactions.

What is a Cheque API?

A Cheque API is an application programming interface that enables seamless integration with banking systems to facilitate cheque-related transactions programmatically. Through a set of predefined functions and protocols, businesses can automate various aspects of cheque processing, including issuance, validation, deposit, and status tracking.

Key Benefits of Cheque API Integration:

Automation and Efficiency: By integrating Cheque APIs into their systems, businesses can automate repetitive tasks associated with cheque processing. This automation significantly reduces manual intervention, minimizes errors, and enhances overall operational efficiency.

Faster Transactions: Traditionally, cheque clearance processes could take several days, leading to delays in fund availability. With Cheque APIs, transactions can be processed and cleared much faster, accelerating the speed of payments and improving cash flow management.

Enhanced Security: Cheque APIs utilize robust encryption and authentication mechanisms to ensure the security of transactional data. By leveraging these secure channels, businesses can mitigate the risk of fraud and unauthorized access, safeguarding their financial assets.

Real-time Tracking: Cheque APIs provide real-time visibility into the status of transactions, allowing businesses to track the progress of cheque issuance, deposit, and clearance in real-time. This transparency enables better decision-making and improves customer service levels.

Integration Flexibility: Cheque APIs are designed to seamlessly integrate with existing banking systems, accounting software, and financial management platforms. This flexibility enables businesses to tailor their cheque processing workflows to suit their specific requirements and infrastructure.

Use Cases of Cheque API Integration:

Corporate Payments: Businesses can use Cheque APIs to streamline the process of issuing payments to vendors, suppliers, and employees. By automating cheque issuance and clearance, organizations can optimize their accounts payable processes and reduce administrative overheads.

Loan Disbursements: Financial institutions can leverage Cheque APIs to automate the disbursement of loan funds to borrowers. This enables faster access to funds and improves the overall customer experience in the lending process.

Subscription Billing: Subscription-based businesses can utilize Cheque APIs to automate the collection of recurring payments from customers. By integrating cheque processing into their billing systems, companies can ensure timely payments and minimize payment failures.

Government Disbursements: Government agencies can benefit from Cheque APIs by modernizing the distribution of social welfare payments, tax refunds, and other disbursements. This improves the efficiency of public service delivery and enhances citizen satisfaction.

Conclusion:

In conclusion, the integration of Cheque APIs offers a myriad of benefits for businesses seeking to optimize their financial processes. From automation and efficiency to enhanced security and real-time tracking, Cheque APIs empower organizations to streamline cheque-related transactions and drive operational excellence. As digital transformation continues to reshape the financial landscape, embracing innovative solutions like Cheque APIs will be key to staying ahead in today's competitive marketplace.

0 notes

Text

A Guide for the Legal Procedures to Buy Property in Dubai | InchBrick Realty

Are you unaware about the legal procedure to buy property in Dubai ? Are you facing difficulties in understanding the rules and regulations which are defined for buying property in Dubai?

Whether you’re from India, UK, USA or from somewhere else, Dubai gives you a warm hearted welcome with open arms. UAE, fulfil your dream of living a luxury life and owning a dream home.

1. What Is the Law Behind Buying a Property in Dubai? 2. Difference Between Freehold and Leasehold Ownership : 3. What Are the Steps You Should Follow to Buy a Property in Dubai?

Law №7 of 2006 stands as the primary regulation for those looking to buy property in Dubai. This legal framework not only empowers UAE and GCC residents with the right to purchase property across the entirety of Dubai but also opens avenues for foreigners. Non-citizens can acquire property in specifically designated zones classified as either freehold or leasehold.

The difference between Freehold ownership and leasehold ownership is that freehold ownership gives you full ownership of the property without any type of restriction, while on the other hand leasehold ownership allows you to own the property for a particular period of time, which can be extended up to 99 years.

Buying property in Dubai follows the same steps, whether you’re getting a home or making a real estate investment. To get a clear picture of these steps, take a closer look at the details below:

When you find the perfect property to buy in Dubai, talk to the seller about the details. You can choose to pay in cash or explore mortgage options. Even though you might not need a real estate agent or lawyer at this point, it’s essential to create a clear contract. Make sure that it clearly mentions the price, how you’ll pay, and all the important details to avoid any issues later on in the process of buying property in Dubai.

Step 2: Sign the Real Estate Sale Agreement

You can effortlessly download the sale contract (Form F), also known as a Memorandum of Understanding (MOU), directly from the official Dubai Land Department (DLD) website. Feel free to add your own terms to the contract. After setting everything up, both you and the seller should sign it in front of a witness, preferably at the Registration Trustee’s office. Additionally, a 10% security deposit on the property should be paid to the Registration Trustee, which you’ll get back once the entire transaction is successfully completed.

Step 3: Apply for No Objection Certificate

At this stage, when you’ve finalised to buy property in Dubai, have a quick conversation with the developer to secure a No Objection Certificate (NOC) and finalise the ownership transfer. If there are no outstanding service bills or charges on the property, the developer will issue the certificate, making your buying process smoother

Step 4: Transferring Ownership at the Registrar’s Office

To facilitate a seamless property transfer when you decide to buy property in Dubai, it’s crucial to have all the necessary documents in order. Whether attending in person or appointing an authorised representative, follow these straightforward steps:

Submit the required documents.

Provide a payable cheque for the dubai property price.

Present the original identification documents of both the seller and buyer (Emirates ID & passport).

Include the original No Objection Certificate (NOC).

Include the signed contract of Form F.

4. Can You Buy Property in Dubai Without an Agent?

Yes, you can explore diverse communities when looking to buy property in Dubai. The city provides opportunities to purchase directly from developers or individuals selling their units. This flexibility allows you to choose between new developments or pre-owned properties, ensuring you find the perfect home that aligns with your preferences. Whether you’re interested in the latest amenities in a newly constructed unit or the unique charm of an established community, Dubai offers a range of options for individuals looking to buy property in Dubai.

5. Things to Consider While Buying a Property in Dubai

When considering property transactions in Dubai, it is highly recommended to exclusively engage with real estate agents registered with RERA (Real Estate Regulatory Agency).

Furthermore, documents composed in a foreign language should be attested and submitted with certified translations into Arabic.

It is essential to ensure that transactions are promptly registered within 60 days from the date of contract signing by both parties.

For foreigners looking to buy property in Dubai, several prominent freehold districts stand out, including Arabian Ranches, Palm Jumeirah, Dubai Marina, and Downtown Dubai.

At the end, here you are with all the essential information about the legal procedure to buy property in Dubai. This defined guide makes your investment easy and straightforward.

Finding the best property option is not a hassle anymore as you can have a look at the different properties for sale in Dubai on Inch & Brick Realty, one of the best Real Estate Companies in Dubai. Buy property in Dubai with a wide range of stunning properties available with Inch & Brick Realty, you can find your perfect investment and unlock the door to your dream house in Dubai.

0 notes

Text

youtube

#cheque deposit machines#cheque deposit machine benefits#cdm advantages#cdms Convenience#banking convenience#cdm benefits#banking automation#cdm technology#banking transactions#banking accessibility#customer comfort#seamless cheque deposit#check deposit machine#cheque deposite#cheque clearing time#deposit check cash#cheque deposit machine#cheque clearing#sujatha banker#sujjatha banker insights#sujatha banker advice#banking advices#benifits of cdm#Youtube

0 notes

Text

Unity Bank: NEFT Transfer App

Say hello to Unity Bank with our digital-first mobile banking app! In this digital era, all your banking and financial needs can now be addressed at your fingertips. You can also become our customer by creating your savings account in just three minutes with our app!

As a bank, we aspire to provide the best-in-class and new age products that ensure access and ease of banking for all.

Here are some of the features that you can enjoy on the Unity Bank’s mobile Banking App: • Banking on the Go: Every financial transaction you can think of can now be taken care of from any corner of the world with just a few taps. • Fixed Deposit and Recurring Deposit: Get easy booking for Fixed Deposit (FD) and Recurring Deposit (RD) in just a few taps. Use our Fixed deposit (FD) calculator and Recurring deposit (RD) calculator to plan your investments better. Pre-mature withdrawal of FD/RD is available for flexibility. • Open Savings Account: Start a journey of savings with us. Opening a new savings account is now as simple as a few taps on your screen. With Unity Small Finance Bank’s Digital Savings Account, -Create mini statements and detailed statements of your savings account. -Quick money transfer through NEFT, RTGS or IMPS • Payee Management: Managing your payees is now quicker and safer. Enjoy seamless and speedy transactions without the need to register a beneficiary. • Money Transfer: Experience the ease of conducting all your financial transactions on one platform. Transfer money from one account to another seamlessly and securely. You can transfer your money through NEFT, RTGS or IMPS. • Video KYC Facility for Easy On-boarding: Forget the long waits and numerous visits to a bank. Our Video KYC feature makes the on-boarding process smooth and time-efficient. • Cheque Book Request: In just 3 taps on our app, you can request for a cheque book and save the time and effort of visiting a bank branch. • Account Balance Maintenance: Check your account balance anytime, anywhere, and request detailed statements with complete transaction history for better money management. • Profile Details: Ensure that your bank records are up to date without the need for a bank visit. Update your profile details like contact information, address, and more, instantly through the app. • Nominee Additions: Secure your finances by adding a nominee all done seamlessly within the app.

Our Unity Small Finance Bank app seeks the following permissions: • Location: This assists to access your approximate location. • Camera: This allows you to access your gallery or capture a new image for uploading your signature while creating new account and change your profile picture. • Phone: This helps us provide you with access to our customer contact centre.

Note: We rely on multi-level security and encryptions to ensure data safety with us. We do not share your personal information with third parties or other companies. Your savings account is fully secured with us.

Documents required: All you need to begin are your 1) Aadhar card details. 2) PAN card details. 3) Pen and blank piece of paper (to upload your signature).

Ways to Login: To keep your account safe and secure, you can login in the following ways: 1) Login using password 2) Login using biometric 3) Login using Easypin

Experience faster, and smarter mobile banking today with Unity small finance bank’s mobile banking app. For any feedback, queries, or issues related to the app, reach out to us at [email protected] or call 1800 209 1122.

0 notes

Text

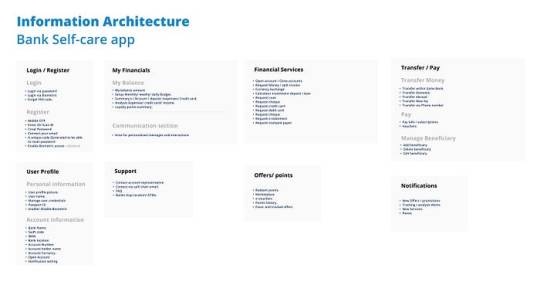

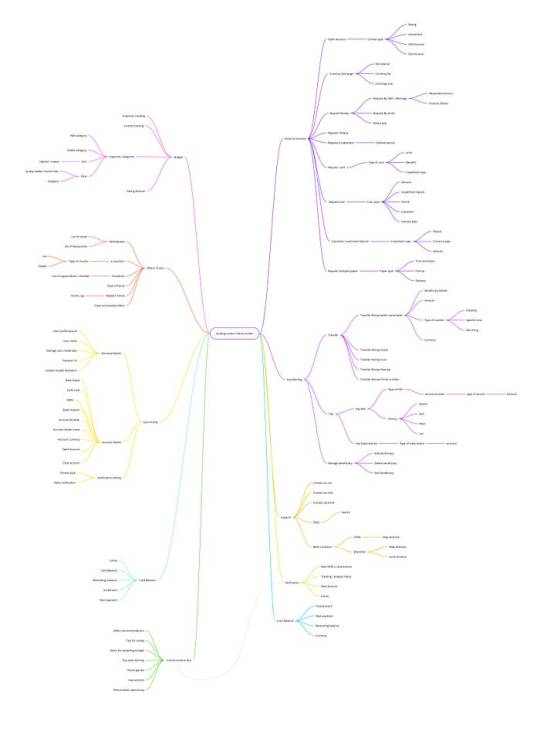

IA is the way to organize and structure your service to make it recognizable and predictable for the users, so I always have to focus on the user stories and their needs to achieve an intuitive experience and flow.

After I finished the value proposition of my service and completed the competitive analysis, I can find where the thing that makes my service suitable and has something to be added more than the similar services in the market.

It’s to create a self-care app for digital/ branch banks and make it personalized to the user’s financial lifestyle activities. And this happens by not just accomplishing a service-based app or a reporting app; it’s by taking all these services into a proactive approach that gives value by steering the user behavior, predicting, and communicating with the users personally to have a lifestyle financial app.

Here I can list all the proposed features that help distinguish my service and illustrate a seamless experience for my target user.

Area for personalized messages and interactions

My balance amount

Setups Monthly/ weekly/ daily Budget.

Summaries / Account / deposit /expenses/ Credit card.

Analysis Expenses/ credit card/ income.

Loyalty points summary.

Open account / Close accounts

Request Money/split invoice

Currency Exchange

Calculator investment deposit/loan

Request Loan.

Request cheque.

Request a credit card.

Request debit card.

Request cheque.

Request e-statement.

Request stamped paper.

Transfer within Same Bank.

Transfer Domestic.

Transfer Abroad.

Transfer Near-by.

Transfer via the Phone number.

Beneficiary Management.

User profile picture.

User name.

Manage user credentials.

Passport ID.

enable/ disable Biometric.

Bank Name.

Swift code.

IBAN.

Bank location.

Account Number.

Account holder name.

Account Currency.

Open Account.

Notification setting.

Contact account representative.

Contact via call/ chat/ email.

FAQ.

Banks map location/ ATMs.

Redeem points.

Marketplace.

E-Vouchers.

Points history.

Favor and tracked offers.

New Offers/promotions.

Tracking/analysis Alerts.

New Services.

Points.

Now I need to cluster these features according to the user’s understanding of relations, functions, naming, etc.

I tried all the sorts of card exercises, open/closed/hybrid, which has the most valuable outcome, the Hybrid one. So by using (optimal workshop.com), I shared these features cards to let the participants arrange them based on their understanding.

Therefore, I got confused responses; some participants arranged the cards regarding the naming similarities. So, they tend to combine them under the same category even if the functionality is different, like Issuing a card, card summary, card analysis, closing card, etc.

And some of them arrange them according to the functionality, like requesting loans, redeeming points, managing beneficiaries, etc.

After this, I did another one to limit and refine the result.

Here in the above IA, I can see how all features took their place under each label; despite this, it does not mean they will look like the above from how they will be displayed in the app. So to do this, I have to prioritize these services/ features regarding the dependency and user stories.

I arranged all features based on relativity and functionality, starting with the leading service covering user interest and story.Checking the balance.

Checking the balance.

Searching or requesting service.

Searching for offers and new privileges.

Support.

Pay/ Transfer.

For these, I can follow the globe navigation experience to make them accessible from anywhere in the first level of the app.

Other services that were added to the app to be more personalized:

Communication box. (tips, alerts, welcoming, offers, services, etc.)

Customizable budget account.

Tracking the Money In/ Money Out.

For the second level of the app, I can use the local navigation to show the types under the same service, like Transfer money as a first-level— > Within the same bank, domestic, abroad, Phone number, Near-by.

For the inside screen in the offer services that consider the third level of the app, I can use the Contextual navigation by showing related, recommended offers.

Hereafter this exercise, I can start doing the full diagram flow for the whole app. covering all the cases and stories to enhance and close any gaps with user flow.

Reference cited:

Zhiyang, L. (2020). Navigation Systems — Information Architecture for Designers. [online] Medium. Available at: https://uxplanet.org/navigation-systems-information-architecture-for-designers-d2aed177a54a [Accessed 6 Mar. 2022].

Spencer, D. (2019). The Ultimate IA Reading List. [online] Optimal Workshop. Available at: https://blog.optimalworkshop.com/the-ultimate-ia-reading-list/ [Accessed 6 Mar. 2022].

ANDERSON, N. (n.d.). How to Conduct an Effective Card Sort: a Comprehensive Guide. [online] dscout.com. Available at: https://dscout.com/people-nerds/card-sorting [Accessed 6 Mar. 2022].

1 note

·

View note

Text

Corporate Accounts Simplified: Features, Benefits, and How to Open One

For businesses, managing finances effectively is critical to success. Whether you’re a startup, a small business owner, or running a large corporation, having a reliable corporate account ensures seamless financial operations. City Union Bank (CUB) offers tailored Regular Current Accounts, designed to meet the diverse needs of businesses, enabling smooth transactions, cash flow management, and enhanced banking convenience.

In this blog, we’ll explore the features, benefits, and step-by-step guide to opening a corporate account with CUB.

What is a Corporate Account?

A corporate account, commonly referred to as a business or current account, is a specialized bank account designed for businesses to handle daily transactions efficiently. Unlike savings accounts, corporate accounts offer higher transaction limits, overdraft facilities, and specialized services to cater to business operations.

Features of CUB Regular Current Account

Unlimited Transactions: Conduct a high volume of transactions, including deposits, withdrawals, and transfers, without restrictions.

Overdraft Facilities: Manage cash flow better with overdraft options to cover short-term financial gaps.

Multi-Location Access: Operate your account across branches, ensuring flexibility for businesses with multiple locations.

Convenient Cash Deposits: Deposit cash at any CUB branch or cash deposit machine, simplifying fund management.

Online Banking Services: Access your corporate account anytime with CUB’s robust internet banking and mobile banking platforms.

Customized Cheque Books: Get cheque books tailored for business use to streamline transactions.

Dedicated Relationship Managers: Enjoy personalized banking services with CUB’s experienced relationship managers for corporate accounts.

Benefits of CUB Corporate Accounts

Simplified Transactions: Handle payments, receipts, and fund transfers effortlessly through a single account.

Improved Cash Flow Management: With overdraft facilities and real-time fund monitoring, maintain smooth business operations.

Enhanced Security: Advanced security features, including multi-level authentication for online transactions, ensure your funds are safe.

Access to Business Loans: CUB corporate account holders enjoy priority access to business loans, credit lines, and other financial services.

Customized Solutions: Tailored banking solutions cater to the unique requirements of various industries.

Tax Benefits: Maintain accurate financial records for taxation purposes and simplify filing returns.

Who Can Open a Corporate Account?

City Union Bank welcomes a wide range of business entities to open corporate accounts, including:

Sole proprietorships

Partnerships

Private and public limited companies

Trusts and societies

Freelancers and consultants

How to Open a Corporate Account with City Union Bank

Gather Necessary Documents: Prepare the required documents based on your business type. These may include:

Business registration certificate

PAN card (business or individual)

Proof of address (business premises)

Authorized signatories’ ID and address proof

Visit the Nearest CUB Branch: Schedule an appointment or visit your local branch to begin the application process.

Submit Application Form: Fill out the corporate account opening form and attach the required documents.

Initial Deposit: Make the minimum deposit required to activate the account.

Account Activation: Once verified, your account will be activated, and you’ll receive credentials for online banking.

Why Choose City Union Bank for Your Corporate Account?

City Union Bank has been a trusted financial partner for businesses across India for over a century. Its Regular Current Account is a robust product tailored to the needs of modern businesses, offering:

Competitive features for smooth financial operations

Advanced digital banking tools for 24/7 access

Personalized service through dedicated relationship managers

Conclusion

A City Union Bank corporate account is more than just a financial tool—it’s a gateway to efficient business management. With a host of features and benefits, CUB empowers businesses to achieve their financial goals effortlessly.

Ready to elevate your business banking experience? Visit the CUB Corporate Account page to learn more or open your account today!

0 notes

Text

Top ways to Collect Rent from your Tenants

How do you collect rent for your tenants so far? We believe cash and cheques as they are the most convenient ways for such payments. Honestly, there are other ways to collect rent that will help you make the most of your short-term rental property management. Let us explore the other ways to collect rent payment here.

When you know the right way to collect rental payments, it will help you receive your money on time and minimize the risk of late or missed payments.

The conventional methods of collecting rent through cash and cheques are no longer trustworthy, these methods are insecure and they just make our lives harder. We have modern financial technologies that we must embrace to ensure that we receive our rental payments on time.

While some tenants might resist using new technologies, in this modern age, there are no good reasons someone might not say yes to such fintech tools to make their lives easier. Online rent collection is a way of future. Let us explore it more here.

Top ways to collect rent

In the countries like US, UK, Australia, and others, the right way to collect rent is bank to bank transfer. Preferably, you can have your tenants schedule a deposit every month to avoid any delays in the payment. However, in some places, such deposits become costly for the tenant as well as the landlord.

Do not worry, there are other methods that you may adopt.

1. If you do not want to accept cash or cheques, you can use fintech tools such as Venmo and others to collect your monthly rental payment. With most of the fintech apps, the charges are free and so they do not cost you or your tenant any extra sum of money while using the app.

2. The primary benefits of using such apps are they are free, they help you send and receive payments without delay, they easily take up your bank details and integrate the transfers for a seamless experience.

3. With these apps, you can pay to your contacts and people who not in your contact list as well. These payment methods are safe and they ensure that your money is transferred safely to your bank account.

With these payment options, you can offer more liberty to your tenants to pay the way they want to. They do not need to be bound with cash or cheques and they can make arrangements for online payments accordingly.

Any kind of rental or condo property management becomes easy with these fintech tools. For more information about effective property management, reach out to us.

0 notes

Text

Bahrain for digital payment innovation with E-cheque

Recent years have seen a tremendous increase in digital/online payments for e-commerce, utility bills or transfer money. The success of digitising payments relies on developing adequate payment technologies. The mode of payment can vary from an electronic fund transfer/wire transfer or ATM transaction to cheque payment. Each payment processor has its pros and cons, from the ease of payment method to the time taken for payment settlement.

Cheques are one of the most commonly used conventional payment methods. Consumers are used to issuing physical cheques however banks insist on an electronic cheque by capturing cheque images, thereby enabling the bank to process a cheque faster through the electronic exchange of the cheque images.

In a move to spur electronic commerce and innovation in digital payments, one such technology that is introduced is E-Cheque. An E-Cheque is an electronic document which substitutes the paper check for online transactions. Digital signatures (based on public key cryptography) replace handwritten signatures. The E-Cheque system is designed with message integrity, authentication and non-repudiation feature, strong enough to prevent fraud against the banks and their customers.

Let’s look at a scenario:

‘Sarah was out of town on an official tour when she got a call that her close relative that her uncle had met with an accident and was being rushed to the hospital. Her cousin who spoke to her said early funds in the range of 50K USD would be needed urgently. While she had about 25K handy, there was obviously a shortfall.

Sarah immediately logged into her account to make an online transfer to her cousin’s account but faced a process roadblock where she had to first add her cousin as a beneficiary and then wait for the next 24 hours before he could initiate the transfer. Thankfully, she had a fall-back option, the E-Cheque app that she had installed only recently but not yet used. She opened the app and issued an E-cheque in her cousin’s name using a secure validation method. Soon she shared the E-Cheque with her cousin, who used it to deposit the cheque in his account quickly.’

Digitisation of the cheque-related processes, including issuing, writing and depositing, further simplifies banking transactions for millions. While it is indeed of help in emergent situations like the one exemplified above, it also offers a mid-path solution for those who are embracing online banking for certain processes but are not yet fully comfortable doing away with the cheques altogether, especially for corporates.

Moreover, online cheques also offer certain safeguards that would be valuable in protecting a user’s interests while easing the process of cheque writing, issuing and depositing much easier while avoiding physical presence as much as possible. One such country implementing E-cheque for its customers is Bahrain, one of the first countries in the Middle East. Bahrain, one of the fintech hubs for innovative payment methodologies, will be launching E-Cheque for millions of its consumers in the region.

With the domain expertise of maximum number implementations in Image-based cheque clearing in UAE, Unity Infotech has become one of the leading and trusted technology partners for Bahrain member banks to launch an innovative financial technology to the market. Unity Infotech’s E-Cheque Direct is implemented in close to 9 banks in Bahrain and is being intensively tested with utmost automation and precision to go live in April. Discover the evolution of Digital Payment Systems in Bahrain, revolutionizing financial transactions with seamless mobile apps, contactless payments, and secure online gateways Learn more about E-Cheque Direct here!

0 notes