#revenue-recognition-principle-impacts-financial-reporting

Explore tagged Tumblr posts

Text

Navigating the intricate landscape of revenue recognition, even for seasoned accountants, can be akin to traversing the Wild Wild West of financial reporting requirements. The complexity of this process, with its myriad moving parts, can be overwhelming. Fortunately, ASC 606 Revenue Recognition and its structured five-step framework serve as a guiding beacon, rescuing accountants from the ambiguity often associated with revenue recognition.

Despite the standardization ASC 606 offers, complexities persist. Questions arise: When precisely should revenue be recognized? How should it be categorized? Did a salesperson extend a discount, and how is that accounted for?

This article endeavors to shed light on real-world ASC 606 revenue recognition examples, offering insights into how revenue should be recognized across diverse industries, from SaaS to telecommunications. It aims to demystify the intricacies of each step in the process, providing practical advice.

Understanding ASC 606 Revenue Recognition:

What Is ASC 606? ASC 606, issued by the Financial Accounting Standards Board (FASB), stands as a cornerstone in generally accepted accounting principles (GAAP). It dictates how businesses across all industries report recognized revenue. The primary goal is to standardize and enhance the consistency of revenue recognition practices, replacing the prior patchwork of industry-specific guidance.

According to ASC 606, revenue must be recognized when goods or services are delivered, aligning recognition with the terms of delivery for performance obligations. This includes activations, set-ups, consumption, and shipping, whether at a specific point in time or over the contract term.

The broader impact of ASC 606 on financial transparency and comparability is substantial. By mandating detailed disclosure of information and performance obligations in financial statements, it facilitates meaningful comparisons across entities and industries, fostering confidence in financial reporting.

The Five-Step Model for Revenue Recognition: ASC 606 provides a structured five-step framework for recognizing revenue:

Identify the Contract With a Customer:

Determine if a contract exists, outlining identifiable rights and payment terms.

Identify the Performance Obligations in the Contract:

Pinpoint distinct goods and services promised to the customer within the contract.

Determine the Transaction Price:

Establish the total amount of consideration expected in exchange for fulfilling performance obligations.

Allocate the Transaction Price to Performance Obligations:

Distribute the transaction price among performance obligations based on standalone selling prices.

Recognize Revenue as Performance Obligations Are Satisfied:

Recognize revenue when goods or services are transferred, occurring over time or at a specific point.

Adhering to this five-step model ensures businesses recognize revenue in accordance with ASC 606 guidelines, fostering financial stability and compliance.

When Is Revenue Recognized? Determining when to recognize revenue involves assessing specific transaction circumstances. Common scenarios include:

Ratably (Over Time):

Recognizing revenue over time as customers benefit from the seller's ongoing performance, common for subscription services or long-term projects.

Point-in-Time:

Recognizing revenue when control of goods or services transfers to the customer, often upon delivery of a product or completion of a service.

Upon Bookings:

Recognizing revenue when a sale is booked, signifying the point when sales agreements or contracts are signed.

Upon Billings:

Recognizing revenue upon billing, aligning recognition with invoicing customers for agreed-upon amounts.

Milestones, Delivery, or Other Events:

Depending on contract terms, recognizing revenue when specific events like milestones or deliverables occur.

It's vital to align sales and accounting teams to define contract terms accurately, ensuring revenue recognition mirrors the actual transfer of control.

ASC 606 Revenue Recognition Examples:

Traditional Software Companies:

Recognizing revenue for license-based software, ensuring accurate allocation and timing based on performance obligations.

SaaS Companies:

Recognizing revenue ratably over multi-year contracts, adjusting for modifications, and accounting for downgrades or cancellations.

Construction Companies:

Recognizing revenue for construction projects over time, addressing over/underbillings, and accounting for modifications.

Service Providers:

Applying point-in-time, completed milestones, and percentage-of-completion methods for recognizing revenue in service contracts.

Telecommunications Companies:

Recognizing revenue based on usage in telecommunications, accounting for bundled services, and applying output or input methods for progress.

Applying ASC 606 Principles:

Establish clear contract terms, ensuring alignment between sales and accounting teams.

Exercise diligence in documenting contract terms, performance obligations, and variable considerations.

Continuously monitor and recognize revenue based on progress or usage, avoiding premature recognition.

Address complexities such as modifications, over/underbillings, and service usage adjustments.

Maintain consistency, accuracy, and transparency to avoid financial discrepancies and support informed decision-making.

Automating ASC 606 Compliance: Automating revenue recognition with tools like RightRev streamlines the process, eliminating manual errors and ensuring ASC 606 compliance. The automation helps finance teams navigate complexities, fostering accuracy and efficiency in revenue recognition.

In conclusion, navigating ASC 606 requires a deep understanding of its principles and diligent application across diverse industries. Adherence to the structured framework and adoption of automation tools contribute to accurate revenue recognition, compliance, and financial transparency.

#how-the-revenue-recognition-principle-impacts-financial-reporting#revenue-recognition-principle-impacts-financial-reporting#revenue-recognition-impacts-on-financial-reporting

1 note

·

View note

Text

IMPLEMENTATION OF NEW IFRS REVENUE RECOGNITION STANDARD

India will have a new revenue recognition standard outlining a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers. This supersedes most current revenue recognition standard.

In brief, the new standard seeks to streamline, and remove inconsistencies from, revenue recognition requirements; provide a more robust framework for addressing revenue issues; make revenue recognition practices more comparable; and increase the usefulness of disclosures.

Introduction

The Government has introduced two significant game-changers to financial reporting standards in 2018 to effective communication to investors by corporates.

International Financial Reporting Standards (IFRS) accounting framework replaces extant revenue and lease standards effective financial periods commencing from January 1, 2018. Both the new standards have a significant impact on financial statements for majority of sectors. Indian companies too have to brace up for the new Indian Accounting Standards (IND-AS) on revenue that would go live shortly.

The International Accounting Standards Board (IASB), as part of a joint convergence project with its United States Counterpart, the Financial Accounting Standards Board (FASB) has re-modeled the revenue recognition guidance. The new IFRS 15 — Revenue From Contracts With Customers replaces prevailing IAS’s and related interpretations, primary of them being (1) IAS 11- Construction Contracts and (2) IAS 18 — Revenue. A new principle for revenue recognition has emerged with the emphasis on the concept of transfer of control and a detailed accounting model, it has been launched as the Five Step Revenue Recognition Model and is to be followed for every revenue contract to account for the financial statement reporting consequences.

“IFRS 15 Revenue from Contracts with Customers provides a single revenue recognition model based on the transfer of control of a good or service to a customer. The new revenue standard marks a significant change from current requirements under IFRS. It provides a more structured approach to measuring and recognizing revenue, with detailed application guidance. Therefore, adoption may be a significant undertaking for many entities. Early assessment will be key to managing a successful implementation.”

Evaluation of contracts, customer agreements, pricing models, side-arrangements, revenue and delivery models, contractual clauses, underlying economics, deliverables analysis, et al, become very critical as companies’ transition to the new revenue recognition standard.

Standard operating procedures and internal controls also need to be geared up and fine-tuned to comply with this critical financial reporting standard.

The Exposure Draft on clarifications to Ind AS 115 proposes that Ind AS 115 would be applicable for accounting periods beginning on or after 1st April, 2018. The MCA is expected to notify the standard soon.

The effect on entities will vary, and some may face significant changes in revenue recognition. Entities should now be assessing how they will be affected so they can prepare an implementation plan for the new standard.

Core Principle of Revenue Recognition Changes

The global reporting standard moves from a “transfer of risks and rewards” model to a “transfer of control” model. This model determines the timing of revenue recognition. The new timing is when there is a transfer of control of promised deliverable by the seller (reporting entity).

The core principle of the new revenue standard under both IFRS and United States Generally Accepted Accounting Principles (USGAAP) is that an entity recognized revenue to depict the transfer of promised goods and services to customers in an amount that reflects the consideration to which it expects to be entitled in exchange for such promised goods and services. Henceforth, revenue needs to be recognized upon transfer of control of promised products or services to customers in an amount that reflects the consideration that the entity expects to receive in exchange for those products or services.

Where a company enters into contracts that could include various combinations of products and services, the company needs to isolate the various revenue components, based on whether each component is generally capable of being distinct and accounted for as separate performance obligations. IFRS reporting entities need to follow a detailed 5-step model to account for revenue as follows…

Read More: https://www.acquisory.com/ArticleDetails/67/Implementation-of-new-IFRS-Revenue-Recognition-Standard

#financial consultant#financial reporting#financial consulting services#financial freedom#financial planning

3 notes

·

View notes

Text

Business Accounting and Taxation Course: Unlock Career Opportunities

1. Introduction to Business Accounting and Taxation (BAT) Course

1.1 What is BAT Course?

Business Accounting and Taxation (BAT) Course is an essential program designed for individuals who want to pursue a career in accounting, taxation, and business finance. यह कोर्स खास तौर पर उन लोगों के लिए है जो अपने कैरियर में व्यावासिक लेखांकन और कराधान से जुड़े हुए कार्यों में उत्कृष्टता प्राप्त करना चाहते हैं। The course aims to equip students with the skills and knowledge necessary for handling business finances and tax obligations effectively.

1.2 Importance of BAT in Business

In today’s rapidly evolving business world, accurate accounting and taxation practices are crucial. BAT course ensures that professionals are equipped to handle financial reporting, tax filings, and compliance with regulations. इसलिए इस कोर्स को समझना और इस क्षेत्र में विशेषज्ञता प्राप्त करना बेहद जरूरी हो गया है। This program is highly valued in industries like finance, consulting, and entrepreneurship.

2. Key Components of Business Accounting

2.1 Definition and Scope of Accounting

Accounting refers to the process of recording, summarizing, and analyzing financial transactions to provide useful information for decision-making. यह व्यापार की वित्तीय स्थिति को स्पष्ट रूप से समझने में मदद करता है। Accounting plays a critical role in managing resources efficiently, ensuring business transparency, and maintaining financial stability.

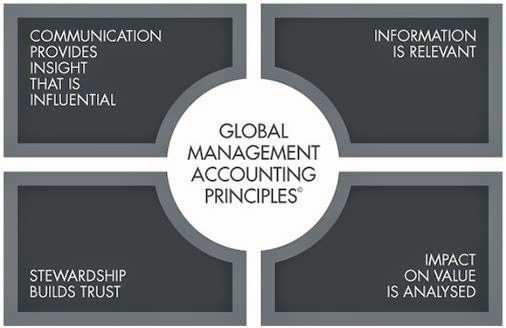

2.2 Financial Accounting and Managerial Accounting

There are two main types of accounting:

Financial Accounting: Focuses on preparing financial statements for external stakeholders such as investors, creditors, and government agencies.

Managerial Accounting: Primarily used for internal management to make informed business decisions. It includes budgeting, forecasting, and cost analysis.

These two types of accounting are essential for business decision-making, and both are covered in the BAT course.

2.3 Key Concepts in Accounting

Here are some important accounting concepts that are emphasized in the BAT course:

Double-Entry System: A system where every transaction affects two accounts.

Revenue Recognition: The principle that revenue is recognized when it is earned, not when cash is received.

Accrual Basis: Recognizing revenues and expenses when they occur, not when payment is made.

3. Taxation in the Business Context

3.1 Understanding Taxation

Taxation refers to the process of levying financial charges or taxes on individuals or businesses by the government. The BAT course helps you understand the taxation laws, compliance requirements, and how they affect business operations.

3.2 Types of Taxes in Business

Businesses are subject to various taxes, including:

Income Tax: Tax on the profit of a business.

Goods and Services Tax (GST): A value-added tax levied on goods and services.

Sales Tax: Tax on the sale of goods and services.

Excise Tax: Tax on certain goods produced within the country.

Understanding these taxes helps businesses in tax planning, reducing liabilities, and complying with tax laws.

3.3 Role of Taxation in Business Growth

Taxation impacts business profitability, cash flow, and investment decisions. A deep understanding of taxation enables businesses to strategize better and comply with tax laws, avoiding penalties.

4. Skills Gained from BAT Course

4.1 Accounting Skills

The BAT course provides comprehensive accounting skills such as:

Preparing financial statements

Budgeting and forecasting

Managing business records and ledgers

These skills are critical for managing business finances efficiently.

4.2 Taxation Skills

A student of BAT gains expertise in:

Understanding tax laws and policies

Tax filing and reporting

Tax planning for businesses

These skills help businesses to minimize tax liabilities and stay compliant.

4.3 Legal Knowledge and Compliance

Taxation and accounting are closely tied to legal frameworks. The BAT course teaches students about:

Business regulations

Corporate tax laws

International accounting standards

This knowledge ensures that businesses are not only compliant but also manage risks effectively.

5. Scope and Career Opportunities in BAT

5.1 Career Paths After Completing BAT

Completing a BAT course opens up multiple career opportunities, including:

Accountant

Tax Consultant

Financial Analyst

Internal Auditor

Tax Advisor

These roles require knowledge of both accounting and taxation, making BAT a highly valuable course.

5.2 Job Opportunities in Accounting and Taxation

As businesses are expanding globally, the demand for qualified accountants and tax professionals is also increasing. BAT professionals can find jobs in:

Multinational Corporations (MNCs)

Government Departments

Financial Institutions

Tax Firms

6. Why Choose BAT Course?

6.1 Advantages of Enrolling in the BAT Course

The BAT course provides numerous benefits such as:

Industry-Relevant Skills: Learn practical skills that are highly sought after in the business world.

Increased Earning Potential: Accounting and taxation professionals command higher salaries due to their specialized skills.

Job Security: Almost every business needs accounting and tax professionals, ensuring steady job opportunities.

6.2 Career Growth and Opportunities

Professionals in accounting and taxation enjoy a steady growth trajectory. With the right experience, one can progress to higher managerial positions, consultancy roles, or even start their own firm.

7. BAT Course Syllabus and Structure

7.1 Core Subjects in the BAT Course

The BAT syllabus includes the following core subjects:

Fundamentals of Accounting

Corporate Taxation

Goods and Services Tax (GST)

Cost Accounting

Financial Reporting

Accounting Software

These subjects ensure a well-rounded understanding of both accounting and taxation.

7.2 Practical Approach and Case Studies

The BAT course also focuses on real-life case studies, providing practical learning experiences. Students get hands-on practice using accounting software and working on tax planning strategies.

8. How to Enroll in BAT Course?

8.1 Eligibility Criteria for BAT

To enroll in the BAT course, a candidate typically needs to have:

A bachelor’s degree in commerce, business, or related fields

Basic knowledge of accounting principles

Interest in business finance and taxation

However, some institutes may have specific eligibility criteria, so it is important to check with the course provider.

9. Conclusion

9.1 The Future of BAT Professionals

As the global business environment continues to grow and change, the need for skilled professionals in business accounting and taxation is set to rise. With more complex tax laws, business expansion, and increased regulatory requirements, BAT professionals will remain in high demand.

9.2 Final Thoughts on BAT Course

The BAT course is an excellent choice for those seeking to build a career in business finance and taxation. It provides the right mix of knowledge, skills, and practical experience to succeed in today’s competitive business world. Whether you’re looking to work in accounting firms or multinational corporations, the BAT course will prepare you for a successful career in this field.

IPA offers:-

Accounting Course , Diploma in Taxation, Courses after 12th Commerce , courses after bcom

Diploma in Financial Accounting , SAP fico Course , Accounting and Taxation Course , GST Course , Basic Computer Course , Payroll Course, Tally Course , Advanced Excel Course , One year course , Computer adca course

0 notes

Text

Explore the BAT Course: Learn Accounting & Taxation in Depth

1. Introduction to Business Accounting and Taxation (BAT) Course

1.1 What is BAT Course?

Business Accounting and Taxation (BAT) Course is an essential program designed for individuals who want to pursue a career in accounting, taxation, and business finance. यह कोर्स खास तौर पर उन लोगों के लिए है जो अपने कैरियर में व्यावासिक लेखांकन और कराधान से जुड़े हुए कार्यों में उत्कृष्टता प्राप्त करना चाहते हैं। The course aims to equip students with the skills and knowledge necessary for handling business finances and tax obligations effectively.

1.2 Importance of BAT in Business

In today’s rapidly evolving business world, accurate accounting and taxation practices are crucial. BAT course ensures that professionals are equipped to handle financial reporting, tax filings, and compliance with regulations. इसलिए इस कोर्स को समझना और इस क्षेत्र में विशेषज्ञता प्राप्त करना बेहद जरूरी हो गया है। This program is highly valued in industries like finance, consulting, and entrepreneurship.

2. Key Components of Business Accounting

2.1 Definition and Scope of Accounting

Accounting refers to the process of recording, summarizing, and analyzing financial transactions to provide useful information for decision-making. यह व्यापार की वित्तीय स्थिति को स्पष्ट रूप से समझने में मदद करता है। Accounting plays a critical role in managing resources efficiently, ensuring business transparency, and maintaining financial stability.

2.2 Financial Accounting and Managerial Accounting

There are two main types of accounting:

Financial Accounting: Focuses on preparing financial statements for external stakeholders such as investors, creditors, and government agencies.

Managerial Accounting: Primarily used for internal management to make informed business decisions. It includes budgeting, forecasting, and cost analysis.

These two types of accounting are essential for business decision-making, and both are covered in the BAT course.

2.3 Key Concepts in Accounting

Here are some important accounting concepts that are emphasized in the BAT course:

Double-Entry System: A system where every transaction affects two accounts.

Revenue Recognition: The principle that revenue is recognized when it is earned, not when cash is received.

Accrual Basis: Recognizing revenues and expenses when they occur, not when payment is made.

3. Taxation in the Business Context

3.1 Understanding Taxation

Taxation refers to the process of levying financial charges or taxes on individuals or businesses by the government. The BAT course helps you understand the taxation laws, compliance requirements, and how they affect business operations.

3.2 Types of Taxes in Business

Businesses are subject to various taxes, including:

Income Tax: Tax on the profit of a business.

Goods and Services Tax (GST): A value-added tax levied on goods and services.

Sales Tax: Tax on the sale of goods and services.

Excise Tax: Tax on certain goods produced within the country.

Understanding these taxes helps businesses in tax planning, reducing liabilities, and complying with tax laws.

3.3 Role of Taxation in Business Growth

Taxation impacts business profitability, cash flow, and investment decisions. A deep understanding of taxation enables businesses to strategize better and comply with tax laws, avoiding penalties.

4. Skills Gained from BAT Course

4.1 Accounting Skills

The BAT course provides comprehensive accounting skills such as:

Preparing financial statements

Budgeting and forecasting

Managing business records and ledgers

These skills are critical for managing business finances efficiently.

4.2 Taxation Skills

A student of BAT gains expertise in:

Understanding tax laws and policies

Tax filing and reporting

Tax planning for businesses

These skills help businesses to minimize tax liabilities and stay compliant.

4.3 Legal Knowledge and Compliance

Taxation and accounting are closely tied to legal frameworks. The BAT course teaches students about:

Business regulations

Corporate tax laws

International accounting standards

This knowledge ensures that businesses are not only compliant but also manage risks effectively.

5. Scope and Career Opportunities in BAT

5.1 Career Paths After Completing BAT

Completing a BAT course opens up multiple career opportunities, including:

Accountant

Tax Consultant

Financial Analyst

Internal Auditor

Tax Advisor

These roles require knowledge of both accounting and taxation, making BAT a highly valuable course.

5.2 Job Opportunities in Accounting and Taxation

As businesses are expanding globally, the demand for qualified accountants and tax professionals is also increasing. BAT professionals can find jobs in:

Multinational Corporations (MNCs)

Government Departments

Financial Institutions

Tax Firms

6. Why Choose BAT Course?

6.1 Advantages of Enrolling in the BAT Course

The BAT course provides numerous benefits such as:

Industry-Relevant Skills: Learn practical skills that are highly sought after in the business world.

Increased Earning Potential: Accounting and taxation professionals command higher salaries due to their specialized skills.

Job Security: Almost every business needs accounting and tax professionals, ensuring steady job opportunities.

6.2 Career Growth and Opportunities

Professionals in accounting and taxation enjoy a steady growth trajectory. With the right experience, one can progress to higher managerial positions, consultancy roles, or even start their own firm.

7. BAT Course Syllabus and Structure

7.1 Core Subjects in the BAT Course

The BAT syllabus includes the following core subjects:

Fundamentals of Accounting

Corporate Taxation

Goods and Services Tax (GST)

Cost Accounting

Financial Reporting

Accounting Software

These subjects ensure a well-rounded understanding of both accounting and taxation.

7.2 Practical Approach and Case Studies

The BAT course also focuses on real-life case studies, providing practical learning experiences. Students get hands-on practice using accounting software and working on tax planning strategies.

8. How to Enroll in BAT Course?

8.1 Eligibility Criteria for BAT

To enroll in the BAT course, a candidate typically needs to have:

A bachelor’s degree in commerce, business, or related fields

Basic knowledge of accounting principles

Interest in business finance and taxation

However, some institutes may have specific eligibility criteria, so it is important to check with the course provider.

9. Conclusion

9.1 The Future of BAT Professionals

As the global business environment continues to grow and change, the need for skilled professionals in business accounting and taxation is set to rise. With more complex tax laws, business expansion, and increased regulatory requirements, BAT professionals will remain in high demand.

9.2 Final Thoughts on BAT Course

The BAT course is an excellent choice for those seeking to build a career in business finance and taxation. It provides the right mix of knowledge, skills, and practical experience to succeed in today’s competitive business world. Whether you’re looking to work in accounting firms or multinational corporations, the BAT course will prepare you for a successful career in this field.

IPA offers:-

Accounting Course , Diploma in Taxation, Courses after 12th Commerce , courses after b com

Diploma in Financial Accounting , SAP fico Course , , GST Course , Basic Computer Course , Payroll Course, Tally Course , Advanced Excel Course , One year course , Computer adca course

0 notes

Text

Future Trends in Accounting for Lawyers: What to Expect?

The future of accounting for lawyers is evolving with technology and changing regulations. Automation and AI are streamlining routine tasks like billing, expense tracking, and financial reporting, allowing lawyers to focus on their practice. Cloud-based accounting solutions are becoming essential, offering secure, real-time access to financial data. Enhanced compliance tools are addressing the complexities of trust accounting and regulatory adherence. Additionally, data analytics is providing deeper insights into profitability and financial trends, helping law firms make informed decisions. Sustainability and ESG (Environmental, Social, and Governance) reporting are also emerging as key considerations for modern law practices. By embracing these trends, law firms can stay competitive, efficient, and aligned with industry demands.

Understanding the Basics of Accounting for Lawyers

For lawyers, accounting goes beyond standard financial tracking. It involves specific practices tailored to legal operations, such as managing client trust accounts, billing for services, and tracking expenses. A strong foundation in accounting principles ensures compliance with ethical standards and financial stability. Lawyers must also grasp key concepts like cash flow, revenue recognition, and profitability to manage their practice effectively.

Why Accounting is Crucial for Legal Practices?

Accounting for lawyers is critical to maintaining transparency and trust with clients and stakeholders. Proper accounting ensures accurate billing, efficient resource allocation, and adherence to legal regulations. It also helps law firms manage overhead costs, track financial performance, and plan for growth. Without proper accounting, lawyers risk financial mismanagement, penalties, and a tarnished reputation.

Common Challenges in Accounting for Lawyers

Legal practices face unique challenges in accounting. Handling client trust funds, ensuring compliance with tax laws, and managing irregular income streams are some obstacles lawyers often encounter. Billing errors, poor financial tracking, and a lack of understanding of trust accounting rules can lead to financial losses and legal repercussions. Addressing these challenges requires robust systems and proper training.

The Role of Technology in Accounting for Lawyers

Technology has transformed accounting for lawyers by introducing specialized software designed for law firms. These tools streamline billing, expense tracking, and client trust account management. Cloud-based accounting solutions provide secure access to financial data, allowing lawyers to work more efficiently. Technology also minimizes human errors, enhances compliance, and simplifies financial reporting.

Best Practices for Effective Accounting in Legal Practices

To excel in accounting, lawyers should adopt the following best practices:

Separate Business and Personal Finances: Keeping accounts distinct ensures clearer financial management.

Regular Financial Audits: Frequent reviews help identify discrepancies and maintain compliance.

Use Specialized Accounting Software: Tools designed for legal accounting improve accuracy.

Stay Updated on Tax Laws: Knowing the latest regulations prevents compliance issues.

Manage Client Trust Accounts Properly: Always ensure that client funds are handled ethically and legally.

Tax Management and Compliance for Lawyers

Lawyers must stay compliant with tax regulations to avoid penalties. Proper accounting tracks deductible expenses, like travel, marketing, and office costs, to minimize tax liabilities. Accurate financial records simplify tax filing and reduce errors. Additionally, understanding local tax laws ensures that law firms meet all legal obligations while maximizing savings.

How Accounting Impacts Law Firm Growth and Profitability?

Effective accounting enables law firms to monitor profitability and identify areas for improvement. By analyzing financial data, lawyers can make informed decisions about resource allocation, client pricing, and investment strategies. Proper accounting also supports long-term planning, helping law firms scale operations and sustain profitability.

Conclusion

Accounting for lawyers is a critical component of running a successful legal practice. By addressing unique challenges, leveraging technology, and adopting best practices, lawyers can achieve financial stability and compliance. Proper accounting not only ensures transparency and trust but also drives profitability and growth, laying the foundation for a thriving legal business.

0 notes

Text

The Complete Guide to Law Firm Accounting for Financial Success

This guide covers essential accounting principles, including billing, trust accounting, expense tracking, and compliance with legal regulations. It helps law firms streamline their financial processes, improve cash flow management, and make informed decisions to boost profitability. With practical advice and expert tips, this guide ensures legal professionals understand how to maintain accurate financial records while maximizing their firm's financial performance, ultimately leading to long-term success and growth in a competitive legal landscape.

Understanding the Basics of Law Firm Accounting

Law firm accounting differs from traditional business accounting due to the unique financial responsibilities law firms handle, including client trust accounts and time billing. Understanding these basics is essential for ensuring compliance and maintaining financial stability. This section introduces key concepts such as accrual vs. cash accounting, legal fee structures, and revenue recognition. By mastering these fundamentals, law firms can build a solid financial foundation that promotes accuracy in reporting and helps avoid costly mistakes.

The Importance of Trust Accounting in Law Firm Accounting

One of the most critical aspects of law firm accounting is trust accounting. Lawyers often manage client funds in trust accounts, which must be handled with extreme precision and transparency. Mishandling these funds can lead to severe legal consequences, including disbarment or lawsuits. This section explains the importance of trust accounting, how to track client funds, and the best practices for maintaining compliance with regulatory requirements. Proper management of trust accounts ensures client confidence and protects the firm from potential financial liabilities.

Managing Expenses and Overhead in Law Firm Accounting

Effective law firm accounting requires careful attention to the firm's expenses and overhead. Managing costs like rent, payroll, software, and operational supplies can significantly impact a law firm’s profitability. This section delves into the strategies for budgeting, tracking, and minimizing overhead expenses without compromising the quality of service. It also explores how law firms can benefit from modern financial software that automates expense tracking, offering greater visibility into spending patterns. Smart expense management is a cornerstone of long-term financial success for any law firm.

Invoicing and Billing: Key Components of Law Firm Accounting

Billing and invoicing are central to law firm accounting. Legal services are typically billed on an hourly, flat fee, or contingency basis, and accurate invoicing is vital to maintaining strong client relationships. This section discusses the different billing structures used by law firms and highlights best practices for creating clear and transparent invoices. It also covers the role of automated billing systems in speeding up payments and improving cash flow management. Ensuring that clients receive accurate, detailed invoices helps prevent disputes and ensures timely compensation for legal services.

Financial Reporting and Analysis in Law Firm Accounting

To ensure long-term financial success, law firms need to generate and analyze financial reports regularly. This section explains the importance of tracking key financial metrics such as revenue, profitability, and cash flow. By understanding these reports, law firms can make informed decisions on resource allocation, client management, and strategic growth. Common financial statements covered include balance sheets, income statements, and cash flow reports. With accurate reporting, firms can identify financial trends, adjust their strategies, and drive sustained profitability.

Ensuring Compliance in Law Firm Accounting

Compliance is a crucial component of law firm accounting. Law firms must adhere to various financial and legal regulations, including IRS requirements, local bar rules, and ethical guidelines related to client trust accounts. Failure to comply with these regulations can result in penalties, sanctions, or damaged reputations. This section covers the common regulatory requirements law firms face and offers practical tips for maintaining compliance. By staying updated with accounting standards and legal regulations, firms can avoid costly penalties and maintain a trusted standing in the legal community.

How Technology is Revolutionizing Law Firm Accounting?

Technology plays an increasingly important role in law firm accounting, helping firms automate processes, reduce errors, and improve efficiency. This section explores the various accounting software options available for law firms, such as time tracking tools, billing systems, and trust account management platforms. The adoption of cloud-based accounting solutions allows law firms to access real-time financial data and collaborate more effectively across teams. By embracing technology, law firms can streamline their financial operations, improve accuracy, and gain valuable insights into their financial performance, leading to better decision-making and long-term success.

Conclusion

The Complete Guide to Law Firm Accounting for Financial Success offers a comprehensive approach to managing your legal practice’s finances with precision and efficiency. This guide covers essential accounting principles tailored for law firms, including trust account management, revenue recognition, and expense tracking. By following the best practices outlined, law firms can improve their financial health, ensure compliance with industry regulations, and maximize profitability. Whether you’re a solo attorney or managing a large firm, this guide provides valuable insights and tools to streamline your accounting processes and achieve long-term financial success in the legal industry.

0 notes

Text

Essential Financial Accounting Principles Every Student Should Know

Financial accounting plays a critical role in the success of any business. It helps organizations track their financial performance, maintain transparency with stakeholders, and make informed business decisions. Whether you're pursuing a career in finance or looking to gain foundational skills, accounting courses provide valuable knowledge about the core principles of financial accounting.

In this article, we’ll discuss the essential financial accounting principles that every student should know and explore how Imarticus Learning’s Financial Accounting and Management Program can help you master these concepts.

Key Financial Accounting Principles

Accrual Principle The accrual principle is one of the fundamental concepts in financial accounting. It states that transactions should be recorded when they occur, not necessarily when the cash is received or paid. This means that revenue and expenses are recognized when they are earned or incurred, regardless of cash flow. The accrual principle ensures that a company's financial statements reflect its true financial position, even if cash transactions haven't occurred yet.

Consistency Principle The consistency principle ensures that companies use the same accounting methods and procedures across reporting periods. By maintaining consistency, businesses can provide reliable financial information that can be easily compared over time. For students, understanding the importance of consistency is key, as it directly impacts the accuracy and reliability of financial statements.

Going Concern Principle The going concern principle assumes that a business will continue its operations in the foreseeable future. This principle impacts how financial statements are prepared, as it allows accountants to defer the recognition of certain expenses until future periods. If a business is not expected to continue, financial reporting would need to reflect liquidation values rather than operational values.

Matching Principle Closely related to the accrual principle, the matching principle states that expenses should be matched with the revenue they help generate within the same accounting period. This ensures that the income statement accurately reflects the profitability of the business during a specific time frame. For example, if a company incurs expenses to produce goods in a particular period, those expenses should be recorded in the same period that the revenue from selling those goods is recognized.

Materiality Principle The materiality principle guides accountants to record financial information that is significant or "material" to the business's financial health. If an item is deemed immaterial, it can be disregarded in financial reporting. This principle helps businesses focus on critical financial data without being bogged down by insignificant details.

Conservatism Principle The conservatism principle requires accountants to take a cautious approach when recording financial transactions. In uncertain situations, this principle advises recording expenses or losses as soon as possible, while only recognizing revenue when it is assured. This ensures that financial statements are not overly optimistic and reflect a realistic financial position.

Imarticus Learning's Financial Accounting and Management Program

Imarticus Learning’s Financial Accounting and Management Program offers an in-depth understanding of these principles and more. The program is designed to equip students with both theoretical knowledge and practical skills that are essential in the real world. Through case studies, hands-on projects, and expert-led sessions, students gain a well-rounded education in financial accounting.

The curriculum covers key accounting concepts, financial analysis techniques, and managerial decision-making processes. Whether you are new to the field or looking to enhance your accounting expertise, the program offers a comprehensive learning experience. Additionally, Imarticus Learning ensures that students are familiar with the latest accounting tools and technologies, giving them a competitive edge in the job market.

By enrolling in accounting courses like this, you can develop a deep understanding of the essential financial principles, preparing you for various career opportunities in finance, auditing, or management.

Conclusion

Mastering the core principles of financial accounting is crucial for anyone aspiring to work in finance or business management. Concepts like the accrual, matching, and conservatism principles provide the foundation for accurate financial reporting and analysis. By enrolling in accounting courses, such as Imarticus Learning’s Financial Accounting and Management Program, you can gain the skills and knowledge needed to succeed in the dynamic world of finance.

0 notes

Text

What is the best SEO Service provider?

In the rapidly evolving digital landscape, Search Engine Optimization (SEO) remains a cornerstone for online visibility and success. Businesses striving to enhance their online presence often seek out the best SEO service providers to achieve higher search engine rankings, increased website traffic, and ultimately, greater revenue. But with a plethora of options available, determining the best SEO service provider can be a daunting task. Among the top contenders, SEOeShop stands out as one of the premier SEO service providers in the industry.

Why SEOeShop is One of the Best SEO Service Providers?

Comprehensive Service Offering

SEOeShop distinguishes itself through a comprehensive suite of SEO services that cater to diverse business needs. From on-page and off-page SEO to local SEO and technical SEO, SEOeShop covers all critical aspects of optimization. Their holistic approach ensures that every facet of a website is fine-tuned to achieve optimal performance in search engine rankings.

Proven Track Record

One of the most compelling reasons why SEOeShop is regarded as one of the best is its proven track record. The company boasts an impressive portfolio of clients who have seen significant improvements in their search engine rankings and website traffic. According to SEOeShop, their clients experience an average increase of 150% in organic traffic within the first six months of engagement.

Data-Driven Strategies

SEOeShop leverages data-driven strategies to deliver measurable results. Utilizing advanced analytics tools and techniques, they identify key areas for improvement and implement targeted solutions. This commitment to data and analytics ensures that their strategies are not only effective but also adaptable to the ever-changing SEO landscape.

Transparent Reporting

Transparency is a core principle at SEOeShop. Clients receive detailed reports that outline the progress and impact of the SEO strategies implemented. These reports include key metrics such as keyword rankings, traffic sources, and conversion rates, allowing clients to see exactly how their investment is driving results. This level of transparency builds trust and fosters long-term client relationships.

Industry Recognition

SEOeShop’s excellence is also reflected in industry recognition and accolades. They have been featured in numerous industry publications and have received awards for their innovative approaches and outstanding results. This recognition underscores their position as a leader in the SEO industry.

The Power of SEOeShop: Stats and Facts

To illustrate the efficacy of SEOeShop’s services, consider the following statistics:

Client Retention Rate: SEOeShop boasts an impressive client retention rate of 90%, highlighting their ability to deliver sustained value.

Traffic Growth: On average, clients see a 150% increase in organic traffic within six months, translating to significant growth in potential leads and sales.

Keyword Ranking Improvement: SEOeShop’s clients typically see a 50% improvement in keyword rankings within the first three months of service, ensuring higher visibility in search results.

ROI: Businesses investing in SEOeShop’s services report an average return on investment (ROI) of 200%, demonstrating the financial benefits of effective SEO.

Conclusion

Selecting the best SEO service provider is crucial for businesses aiming to enhance their online presence and achieve long-term success. SEOeShop, with its comprehensive service offering, proven track record, data-driven strategies, and transparent reporting, stands out as one of the best in the industry. Their commitment to delivering measurable results and their recognition within the industry further validate their position as a top-tier SEO service provider. For businesses looking to navigate the complexities of SEO and drive substantial growth, SEOeShop presents a compelling choice.

0 notes

Text

How to Prepare For Year-End Financial Reporting?

Preparing for year-end financial reporting is a critical task for businesses, as it involves summarizing their financial performance and position for the entire fiscal year. Proper planning and execution are essential to ensure accuracy, compliance, and transparency in financial reporting. Here are several steps businesses can take to prepare for year-end financial reporting:

Review Accounting Records: Begin by conducting a comprehensive review of accounting records for the fiscal year. This includes financial statements, general ledger accounts, bank statements, and supporting documentation for transactions. Ensure that all transactions are accurately recorded and classified in accordance with applicable accounting standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

Reconcile Accounts: Reconcile all accounts to verify their accuracy and completeness. This includes reconciling bank accounts, accounts receivable, accounts payable, inventory, and other balance sheet accounts. Address any discrepancies or outstanding items identified during the reconciliation process to ensure the integrity of financial data.

Accruals and Adjustments: Make necessary accruals and adjustments to reflect the financial position of the business accurately. Accruals may include recognizing revenue and expenses that have been incurred but not yet recorded in the accounting records. Adjustments may be required to correct errors, estimate liabilities, or allocate expenses to the appropriate accounting periods.

Asset Valuation: Review the valuation of assets such as inventory, property, plant, and equipment (PP&E), and investments. Ensure that assets are valued at their fair market value or historical cost, as appropriate, and that any impairment losses are recognized in accordance with accounting standards.

Assess Financial Performance: Analyze financial performance for the fiscal year by comparing actual results to budgeted or forecasted figures. Identify variances and investigate the underlying reasons for deviations from expectations. This analysis provides valuable insights into the financial health and operational efficiency of the business.

Evaluate Tax Implications: Consider the tax implications of year-end financial reporting, including the recognition of income, deductions, and tax credits. Review tax provisions, deferred tax assets and liabilities, and other tax-related accounts to ensure compliance with tax laws and regulations. Consult with tax professionals to optimize tax strategies and minimize tax liabilities.

Prepare Financial Statements: Prepare financial statements, including the income statement, balance sheet, statement of cash flows, and statement of changes in equity. Ensure that financial statements are prepared in accordance with applicable accounting standards and provide a clear and accurate representation of the business's financial position and performance.

Disclosure Requirements: Review disclosure requirements and ensure that all relevant information is disclosed in the financial statements and accompanying notes. Disclosures may include significant accounting policies, contingent liabilities, related party transactions, and other material information that may impact users' understanding of the financial statements.

Internal Controls: Evaluate the effectiveness of internal controls over financial reporting and make any necessary improvements or enhancements. Internal controls help safeguard assets, prevent fraud, and ensure the reliability of financial information. Implement segregation of duties, review procedures, and other control activities to strengthen internal controls.

Engage External Auditors: If required, engage external auditors to conduct an audit or review of the financial statements. External auditors provide independent assurance on the fairness and reliability of the financial statements, enhancing their credibility and usefulness to stakeholders.

In conclusion, accounting companies in Oklahoma City OK play a vital role in helping businesses prepare for year-end financial reporting. By following these steps, accounting companies can ensure that their clients' financial reporting process is efficient, accurate, and compliant, providing stakeholders with reliable information for decision-making and accountability. Effective year-end financial reporting enhances transparency, builds investor confidence, and supports the long-term success of their clients' businesses.

0 notes

Text

Navigating the Impact of IFRS on Auditing: A Closer Look at IFRS 18

In today's dynamic global economy, the need for standardized financial reporting practices is more crucial than ever. The International Financial Reporting Standards (IFRS) have emerged as a universal language for financial reporting, aiming to enhance transparency, comparability, and understandability of financial statements across borders. As businesses adapt to the evolving regulatory landscape, it's imperative for auditors and accountants to understand the implications of IFRS on their practices.

One significant addition to the IFRS framework is the introduction of IFRS 18, Revenue, which replaces IAS 18. This standard addresses revenue recognition, providing comprehensive guidelines for when to recognize revenue and how to measure it. With IFRS 18, entities must ensure that revenue reflects the transfer of goods or services to customers at an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.

For auditors, the introduction of IFRS 18 brings about several key considerations. Firstly, auditors must thoroughly understand the requirements outlined in the standard to effectively assess whether revenue recognition aligns with the prescribed guidelines. This involves evaluating the contractual terms, assessing the transfer of control, and determining the transaction price.

Furthermore, auditors need to exercise professional skepticism and conduct robust risk assessments to identify potential areas of misstatement or non-compliance with IFRS 18. This may involve scrutinizing complex revenue arrangements, assessing the appropriateness of accounting estimates, and evaluating the adequacy of disclosures.

Additionally, auditors play a critical role in providing assurance to stakeholders regarding the reliability and integrity of financial information prepared in accordance with IFRS 18. Through thorough testing and substantive procedures, auditors can provide assurance on the accuracy and completeness of revenue recognition, enhancing investor confidence and trust in financial statements.

In conclusion, as businesses transition to IFRS and embrace the changes introduced by standards such as IFRS 18, auditors must stay abreast of these developments to ensure compliance and maintain audit quality. By understanding the impact of IFRS on auditing practices and diligently applying the principles outlined in the standards, auditors can effectively fulfill their responsibilities and uphold the integrity of financial reporting.

For more insights on navigating the complexities of IFRS and its impact on auditing, stay tuned to Mac and Ross Chartered Accountants' updates and resources.

0 notes

Text

Financial Reporting Advisors in Vancouver - LFG Partners

What is financial reporting advisory services?

Financial Reporting Advisory Services (FRAS) refers to a specialized area within the broader field of financial advisory services. It involves providing guidance and assistance to organizations in the preparation and presentation of their financial statements and reports. The goal is to ensure that financial information is accurate, transparent, and in compliance with relevant accounting standards and regulatory requirements.

Key aspects of Financial Reporting Advisory Services may include:

Regulatory Compliance: Advising clients on compliance with accounting standards such as International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP).

Financial Statement Preparation: Assisting in the preparation of financial statements, including income statements, balance sheets, and cash flow statements, to accurately reflect the financial position and performance of the organization.

Accounting Policies and Procedures: Helping clients develop and implement appropriate accounting policies and procedures to ensure consistency and compliance with accounting standards.

Complex Accounting Issues: Providing expertise on complex accounting issues, such as revenue recognition, fair value measurement, and accounting for mergers and acquisitions.

Internal Controls: Assisting organizations in designing and evaluating internal controls to ensure the accuracy and reliability of financial reporting.

Financial Disclosures: Advising on the disclosure of relevant information in financial statements to provide transparency and meet regulatory requirements.

Audit Support: Collaborating with external auditors during the audit process to address any accounting or reporting issues that may arise.

Adoption of New Standards: Guiding organizations through the implementation of new accounting standards or changes in regulations that may impact financial reporting.

FRAS is particularly important for publicly traded companies, as accurate and transparent financial reporting is essential for building investor confidence and maintaining regulatory compliance. However, organizations of all sizes may seek financial reporting advisory services to enhance the quality of their financial reporting processes. Consulting firms, accounting firms, and financial advisory firms often provide these services to clients across various industries.

#startup accounting services vancouver#financial company vancouver#cpa firms vancouver#small accounting firms vancouver#chartered accountant vancouver#business advisors vancouver#cdap vancouver

0 notes

Text

Matching Principle: Understanding the Key to Accurate Financial Reporting

Ever wonder how businesses keep track of their earnings and expenses accurately? This isn’t just guesswork—it’s based on a key accounting concept known as the Matching Principle. This principle ensures that companies report revenues and expenses in the same accounting period, providing a clear financial picture. Let’s dive into this principle and see how it works in the real world.

1. What Is the Matching Principle?

The Matching Principle is an accounting rule requiring businesses to record expenses in the same period as the revenues they help generate. This practice ensures that financial statements reflect the true profitability of a business.

2. Why Is the Matching Principle Important?

The Matching Principle promotes:

Accurate Financial Reporting: It aligns costs with revenues.

Transparency: Businesses present a true financial picture.

Consistency: It ensures financial reports follow the same method over time.

3. How the Matching Principle Works

Imagine you run a bakery. You sell cakes in December but paid for ingredients in November. According to the Matching Principle, the cost of ingredients is recorded in December when you made the sale, not when you purchased them. This shows a clear profit or loss for December.

4. Key Elements of the Matching Principle

To apply the Matching Principle, consider these elements:

Revenue Recognition: When the income is earned.

Expense Recognition: When costs are incurred to generate that income.

Timing: Both must be reported in the same accounting period.

5. Examples of the Matching Principle

Example 1: A business provides a service in December but gets paid in January. Expenses and revenues are recorded in December.

Example 2: A construction company builds a house over several months. Expenses for materials are recorded as the house is completed, not when purchased.

6. Matching Principle vs. Cash Accounting

Matching PrincipleCash Accounting Revenues and expenses recorded when earned/incurred Recorded when cash is received or paid Follows accrual accounting Follows cash basis accounting More accurate for long-term tracking Simpler but less detailed

7. Real-World Applications

The Matching Principle is used in various sectors:

Retail: For managing inventory costs.

Healthcare: For matching patient treatment costs with insurance payments.

Technology: For spreading development costs over the product lifecycle.

8. Matching Principle in Different Industries

Manufacturing: Links production costs to product sales.

Service-Based Businesses: Connects labor expenses to service revenues.

Real Estate: Matches property development costs to sale profits.

9. Benefits of Using the Matching Principle

Better Decision-Making: Accurate reports help guide strategic decisions.

Investor Confidence: Investors trust transparent and consistent records.

Legal Compliance: Ensures adherence to financial reporting standards.

10. Common Challenges and How to Overcome Them

Estimating Costs: Use historical data for better forecasts.

Record-Keeping Errors: Implement robust accounting software.

Complex Transactions: Consult professional accountants for guidance.

11. Matching Principle in Financial Statements

Financial reports like the income statement depend on the Matching Principle. For example:

Revenue Statement: Shows net income after matching all related expenses.

Balance Sheet: Reflects liabilities and assets correctly.

12. Impact on Business Decisions

Accurate financial statements guide key business decisions, such as:

Budgeting: Allocating future resources effectively.

Expansion Plans: Evaluating profitability for new ventures.

Investment Choices: Determining when to invest or cut back.

13. Adjusting Entries and the Matching Principle

Accountants adjust entries at the end of an accounting period to ensure the Matching Principle is followed. For example:

Accrued Expenses: Recording unpaid salaries.

Deferred Revenues: Adjusting for advance payments.

14. Limitations of the Matching Principle

Despite its benefits, the Matching Principle has limitations:

Subjectivity: Estimating future expenses can be tricky.

Complexity: Small businesses may struggle without proper systems.

Compliance Costs: Maintaining records can be expensive.

15. Conclusion and Final Thoughts

The Matching Principle is essential for accurate and transparent financial reporting. By aligning revenues with related expenses, businesses get a clear picture of profitability, enabling sound financial management. Whether you're a small business owner or a finance enthusiast, understanding this principle helps decode the world of financial reporting.

FAQs

1. What is the Matching Principle in simple terms? The Matching Principle means recording expenses when related revenues are earned, ensuring accurate financial statements.

2. How does the Matching Principle benefit businesses? It ensures accurate records, aids decision-making, and builds trust with investors by reflecting true profits.

3. Is the Matching Principle mandatory for all businesses? It’s required for companies using accrual accounting but not for those using cash basis accounting.

4. What’s an example of the Matching Principle in action? A retailer records the cost of goods sold only when the related products are sold, not when they are purchased.

5. What challenges come with applying the Matching Principle? Estimating costs, handling complex transactions, and maintaining accurate records can be challenging but manageable with the right tools.

0 notes

Text

Navigating Revenue Recognition Complexity

In the realm of revenue recognition, some transactions are straightforward, like retail sales where revenue is recognized upon immediate delivery. However, complexities arise when goods or services are delivered over time, such as subscriptions or bundled products, leading to challenges in determining when and how to recognize revenue.

Adherence to established industry standards, such as Generally Accepted Accounting Principles (GAAP), is crucial for businesses to ensure legal compliance and accurate financial reporting. Proper revenue recognition, guided by principles like ASC 606, not only reflects a company's performance accurately but also fosters transparency and comparability across industries.

Understanding Revenue Recognition: A Crucial Accounting Principle

Revenue recognition GAAP dictates the timing and method of recording revenue in financial statements, emphasizing recognition upon realization and earning, rather than when cash is received.

This principle serves several purposes: it enables CFOs and accounting teams to accurately depict financial performance, ensures transparency and accountability in reporting, fosters consistency and comparability among companies, and enhances trust in financial markets.

Evolution of Revenue Recognition Standards

Historically, revenue recognition standards varied across industries until the introduction of ASC 606 in 2014, which unified the process and shifted towards a more judgment-based approach. This evolution aimed to streamline revenue recognition and align it with GAAP, fostering clearer financial reporting.

Implications of Revenue Recognition on Financial Statements

The ASC 606 framework, in conjunction with GAAP, shapes a company's financial statements by dictating when revenue should be recognized—once performance obligations are met. Adhering to GAAP ensures accurate and consistent reporting, influencing a company's profitability, liquidity, and solvency, thus impacting its valuation and creditworthiness.

Strategic Implications of Revenue Recognition

GAAP's revenue recognition rules inform a company's strategic planning by providing objective performance assessments. Accurate revenue recognition enables informed decision-making in pricing, sales, and marketing strategies, enhancing credibility and reputation in the eyes of investors and creditors.

Core GAAP Principles Supporting Revenue Recognition

Several key GAAP principles underpin revenue recognition, including the realization principle, matching principle, and specific criteria outlined in ASC 606. These principles guide companies in recognizing revenue accurately and consistently, preventing misrepresentation and ensuring compliance.

Industry-Specific Revenue Recognition Guidelines

Revenue recognition practices vary across industries, necessitating tailored approaches. Software, construction, SaaS, eCommerce, and other sectors each have unique considerations for revenue recognition under GAAP, requiring careful assessment of contractual terms and performance obligations.

Navigating Common Revenue Recognition Challenges

Despite standardization efforts, revenue recognition can pose challenges such as timing issues, variable considerations, and complex contractual arrangements. Addressing these challenges requires a systematic approach, accurate estimation of variables, fair value measurements, and robust documentation and communication practices.

Harmonizing GAAP with Revenue Recognition Standards

GAAP complements revenue recognition standards like ASC 606 and IFRS 15, providing essential guidelines for accurate revenue reporting. Automating revenue recognition processes, through services like RightRev, can mitigate complexities and ensure compliance with GAAP, enhancing efficiency and accuracy in financial reporting.

#Revenue Recognition#GAAP (Generally Accepted Accounting Principles)#ASC 606#Financial Reporting#Accounting Standards#Financial Statements#Revenue Management#Revenue Accounting#Compliance#Industry Standards#Performance Obligations#Financial Performance#Revenue Forecasting#Revenue Automation#Strategic Planning#Contractual Obligations#Revenue Challenges#IFRS 15#Revenue Measurement#Financial Compliance

0 notes

Text

Global Accounting Practices: Understanding the Differences 🌍📊

Accounting practices aren't uniform worldwide; they vary significantly due to factors like legal systems, cultural norms, and tax regulations. Here's a brief look at key differences:

Accounting Standards 📚📉:

Different countries follow distinct standards. For instance, the U.S. uses Generally Accepted Accounting Principles (GAAP), while many nations adopt International Financial Reporting Standards (IFRS).

Taxation Rules 💰📝:

Tax laws differ across borders, impacting how income and expenses are recorded for tax purposes.

Cultural Influences 🌏🤝:

Cultural norms play a role. In some cultures, relationships shape business practices, affecting how transactions are reported.

Legal Systems ⚖️📊:

Legal systems influence accounting. Common law countries prioritize legal precedent in accounting disputes.

Financial Reporting 📈📊:

Reporting requirements are set by local regulators, varying in complexity.

Currency Matters 💱🌐:

Dealing with multiple currencies and exchange rates varies based on government policies.

Industry Regulations 🏭📊:

Specific industries may have unique accounting rules, like revenue recognition variations.

Auditing Standards 🔍📋:

Auditing standards differ, affecting audit procedures and reporting.

Disclosure and Transparency 🔍✨:

Expectations for financial transparency vary.

Professional Bodies 🎓📊:

Each country has its accounting bodies, setting standards and regulations with differing influence.

SME Accounting 🏢📈:

Small and medium-sized enterprises face varying accounting requirements, some with simplified rules.

Tech Adoption 📱💻:

The use of accounting technology varies, impacting efficiency and accuracy.

Ethical Considerations 🤝📜:

Cultural and ethical factors influence financial reporting, with varying acceptability levels.

Understanding these differences is vital for multinational corporations, accountants, and financial professionals. Adapting practices to local regulations while maintaining transparency is essential. Efforts to converge global accounting standards aim to reduce disparities. 🌐📈

0 notes

Text

All Business Valuation

All Business Valuation is the process of determining the economic worth of a company. It's a critical aspect of corporate finance, aiding in various scenarios like mergers and acquisitions, selling a business, raising capital, or resolving legal disputes. Valuation involves assessing a company's assets, liabilities, cash flows, market position, and other intangible factors.

Understanding Business Valuation Singapore:

Approaches to Valuation:

Asset-Based Approach: This method values a business by summing its tangible and intangible assets and subtracting liabilities. It's suitable for stable, asset-heavy businesses like real estate or manufacturing.

Income Approach: Focuses on the company's capacity to generate future income. Discounted Cash Flow (DCF) analysis falls under this approach, where the future cash flows are estimated and discounted to their present value.

Market Approach: Compares the business to similar companies that have been sold recently. This method uses multiples such as price-to-earnings (P/E), price-to-sales (P/S), or enterprise value-to-EBITDA (EV/EBITDA) ratios.

Factors Affecting Valuation:

Financial Performance: Past and projected revenues, profits, and cash flows significantly impact a business's value.

Market Conditions: Economic trends, industry growth rates, and market demand influence valuation.

Competitive Position: A strong market position, unique intellectual property, and competitive advantage enhance a company's value.

Management Team: Competent leadership and a skilled management team can positively influence valuation.

Valuation Techniques:

Discounted Cash Flow (DCF): Projects future cash flows and discounts them to their present value, considering the time value of money.

Comparable Company Analysis (CCA): Evaluates similar companies' valuations to determine a company's worth relative to its peers.

Precedent Transactions: Analyzes previously completed transactions in the same industry to estimate a company's value.

Importance of Business Valuation:

Mergers and Acquisitions: Valuation helps in determining an appropriate purchase price, ensuring fair deals for both buyers and sellers.

Fundraising: Investors assess a company's valuation before investing, influencing the terms and equity stake they seek.

Legal Proceedings: Valuation assists in resolving disputes, determining shareholder equity, or in divorce settlements.

Financial Reporting: Accurate valuation is crucial for financial statements, affecting a company's perceived financial health.

Challenges in Valuation:

Subjectivity: Valuation involves predictions and assumptions about the future, leading to some subjectivity.

Complexity of Factors: Numerous variables impact a company's value, making the process intricate.

Changing Market Conditions: Fluctuations in the economy and industry can quickly alter a company's value.

Intangible Assets: Valuing intellectual property, brand recognition, or customer loyalty is challenging due to their subjective nature.

Business valuation services is both an art and a science. It requires a blend of financial expertise, industry knowledge, and analytical skills. While various methods exist, no single approach fits every scenario. Valuation involves interpreting multiple data points and considering the unique aspects of each business.

For stakeholders, understanding the principles of business valuation is crucial for making informed decisions, whether buying, selling, investing, or strategizing for growth. A well-executed valuation provides insights into a company's worth, enabling better planning and decision-making in the dynamic landscape of business.

0 notes

Text

Unpacking the CPA Far Course Curriculum

Embarking on the journey of CPA FAR course curriculum is akin to delving into the intricate tapestry of financial expertise. Designed to equip aspiring accountants with a profound understanding of financial reporting, this curriculum serves as a compass navigating through the complex terrain of accounting principles, regulations, and standards. As we unravel the layers of far, we will explore the nuances of balance sheets, income statements, and cash flow statements, while also navigating the dynamic landscape of international financial reporting. The CPA FAR course goes beyond mere numbers, fostering a holistic comprehension of the economic environment and its impact on financial decision-making. Join me on this intellectual voyage as we dissect and decode the CPA FAR curriculum, unlocking the secrets to mastering the art and science of financial accounting.

Introduction to the CPA Far Course Curriculum

In the vast landscape of professional accounting, the CPA FAR course curriculum stands as a cornerstone, shaping the expertise and knowledge of aspiring Certified Public Accountants. This introductory exploration delves into the significance of the Far section, setting the stage for a comprehensive journey through financial accounting and reporting.

Navigating Financial Accounting Concepts:

Course curriculum requires a meticulous examination of financial accounting concepts. From accruals and deferrals to revenue recognition and complex financial instruments, this section unravels the intricate web of accounting principles that form the foundation of financial reporting, providing a detailed roadmap for candidates to navigate.

Deep Dive into Generally Accepted Accounting Principles

A critical facet of the CPA FAR course curriculum is the immersion into generally accepted accounting principles. This segment dissects the principles that govern financial reporting, emphasizing their application in diverse scenarios. Through real-world examples and case studies, candidates gain a profound understanding of how GAAP shapes the financial landscape.

Mastering Governmental and Not-for-Profit Accounting

Beyond the corporate realm, CPA candidates must grasp the nuances of governmental and not-for-profit accounting. This section of the curriculum equips future accountants with the knowledge required to navigate the complexities of fund accounting, budgetary controls, and compliance in the public sector—an indispensable skill set for a well-rounded CPA.

Comprehensive Coverage of Business Combinations and Consolidations

The CPA Far course curriculum unfolds the intricate world of business combinations and consolidations. Exploring topics such as acquisition accounting, goodwill, and the consolidation of financial statements, this section provides candidates with a comprehensive understanding of the complexities involved in mergers and acquisitions, preparing them for the dynamic landscape of modern business.

Analysis of Financial Statements and Ratios

Delving into the heart of financial reporting, this section focuses on the analysis of financial statements and ratios. Candidates are guided through the process of interpreting financial data to make informed business decisions. By dissecting balance sheets, income statements, and cash flow statements, individuals gain the expertise to extract valuable insights from financial reports.

Ethical Considerations in Financial Reporting

The CPA Far course curriculum culminates with a profound exploration of ethical considerations in financial reporting. This final segment emphasizes the ethical responsibilities that accompany the role of a CPA. From conflicts of interest to the impact of financial decisions on various stakeholders, candidates are equipped with the ethical framework necessary for maintaining integrity in the world of accounting.

Conclusion

In conclusion, the curriculum's emphasis on real-world applications has been instrumental in bridging the gap between theoretical knowledge and practical implementation. The case studies, simulations, and practical exercises have not only tested our proficiency but have also equipped us with the tools necessary to tackle complex accounting scenarios in the professional realm.

0 notes