#refund consulting business

Explore tagged Tumblr posts

Text

IRS Data Shows 3.5% Growth in Refunds – Learn How to Capitalize This Tax Season

The 2025 tax year is proving to be a cash cow for the majority of Americans. By the latest IRS numbers, refunds this year are up 3.5% from a year ago, at a median of $3,116 compared with $3,011 in 2024. For most, the annual return isn't only a pay-out — it's also a chance to make up on expenses, pay debts, or invest in long-term goals like savings or even registering a business in the USA.

Who’s Receiving the Biggest Refunds?

Certain states are receiving higher average refunds than others. High-income states and those with larger itemized deductions are leading the charts. This trend highlights the requirement for intelligent filing methods and efficient tax credit usage.

As a private taxpayer or searching for USA corporate registration, understanding your financial situation against the national average can help you make intelligent choices for a robust financial year.

Filing Early = Faster Refunds

The 2025 tax season has seen a boom in e-tools and e-filing, which allows taxpayers to receive refunds sooner. For those who are planning to register a company in the USA, tax planning is necessary. Direct deposit with e-filing leads to faster refund processing that can be invested in your business or spent on compliance charges associated with company registration.

Common Mistakes That Delay Refunds

Despite technological advancements, many taxpayers still lose out on their maximum refund potential due to:

Filing delays

Incomplete or inaccurate information

Overlooking key deductions or credits

Not opting for direct deposit

Avoiding these pitfalls is particularly important if you’re planning for company registration in the USA, where every dollar is valuable during your startup phase.

How to Maximize Your Refund This Tax Season

Whether you’re an entrepreneur undergoing corporate registration in the USA or an individual looking to make the most of tax season, 2025 presents a great opportunity. Start early, stay organized, and leverage IRS-approved tools to boost your return.

Planning to register a company in the USA? Now might be the perfect time to turn that refund into a business venture. Your financial boost could cover formation fees, licenses, or other essential startup costs.

What IRS Data Reveals About 2025 Refunds

Thus far, as of April 11, 2025, the IRS has processed around 117.6 million tax returns, a slight rise from 116.3 million in 2024. Despite changes in tax laws and filing trends, the trend remains on its upward path, with the average amount of a refund now at $3,116.

Contact SBA Tax Consultants

Maximize your refund this tax season with SBA Tax Consultants. Whether you’re filing individually or pursuing corporate registration in the USA, our expert team will guide you every step of the way.

Website: http://sbataxconsultants.com

Phone: [1 469 722 5480]

Email: [[email protected]]

Contact us today to ensure you get the best return possible and make your business dreams a reality.

#2025 Tax Refunds#IRS Tax Data 2025#Maximize Tax Refund USA#Tax Filing Strategies#Tax Refund Increase 2025#Corporate Registration in the USA#SBA Tax Consultants#Tax Planning USA#Faster Tax Refunds#E-Filing Benefits#Business Registration USA#Tax Optimization Tips

0 notes

Text

Get More from Your 2025 Tax Refund – Maximize Every Dollar!

1. The 2025 Tax Season Brings Good News!

The IRS has reported a 3.5% increase in tax refunds for the 2025 season.

The average refund amount now stands at $3,116, up from $3,011 in 2024.

For many Americans, this refund is more than just a yearly payout—it’s a chance to:

Catch up on bills and expenses

Pay off debt

Invest in future goals like savings or even company registration in the USA

2. Who’s Getting the Biggest Refunds?

According to IRS data, certain states are seeing larger refunds than others.

High-income states and those with significant itemized deductions are leading the pack.

These regional trends show that taxpayers are:

Leveraging smarter filing strategies

Maximizing tax credits more efficiently than ever before

Whether you’re just filing as an individual or exploring corporate registrations in the USA, understanding how your refund compares can help you plan better.

3. File Early to Get Your Refund Faster!

One of the biggest trends in 2025 is the surge in digital filing and e-filing.

Filing your taxes early and opting for direct deposit means:

Faster processing of your return

Quicker access to your refund

If you’re planning to register a company in the USA, getting your refund early can help cover:

Business formation costs

Compliance fees

Other startup essentials

4. Avoid These Common Mistakes That Delay Refunds

To make sure you get your refund without delay, avoid these common pitfalls:

Filing Delays – The earlier, the better!

Incomplete or Incorrect Information – Double-check your entries.

Missing Deductions or Credits – Don't miss out on eligible savings!

Not Choosing Direct Deposit – It’s the fastest way to get your money.

If you’re planning to register a company in the USA, every dollar matters during the startup phase. Avoiding these mistakes can help you secure your financial boost quickly.

5. Make the Most of Your Refund This Tax Season!

Here’s how you can make your refund work for you:

Start early – Early filing means a faster refund.

Stay organized – Use IRS-approved tools for a smooth process.

If you’re considering corporate registration in the USA, this is the perfect time to:

Cover formation fees

Pay for business licenses

Handle other startup costs

6. IRS Data Highlights for 2025 – What You Need to Know

As of April 11, 2025, the IRS has processed 117.6 million tax returns.

This marks a slight increase from 116.3 million during the same period in 2024.

Despite some changes in tax laws, the average refund amount rose from $3,011 to $3,116.

It’s clear that smarter filing strategies are paying off for many Americans.

7. Thinking About Registering a Company in the USA?

Your 2025 tax refund might be the perfect opportunity to make your business dream a reality.

Use your refund to:

Cover formation fees

Handle licensing costs

Manage compliance expenses

And guess what? SBA Tax Consultants is here to guide you through every step of the way!

#2025 tax refund#tax season 2025#maximize tax refund USA#IRS tax tips 2025#SBA Tax Consultants#tax filing USA#e-filing benefits#corporate registration USA#tax refund strategies#small business tax USA#register a company USA#business formation with tax refund#USA tax consultant#IRS refund 2025

1 note

·

View note

Text

Expert Taxation Services in Australia | Collab Accounting

Simplify your tax obligations with Collab Accounting's expert taxation services. We offer personalized advice and solutions for individuals and businesses across Australia. Maximize your refunds and stay compliant with our experienced team.

#taxation services Australia#tax compliance#tax advice#individual tax#business tax solutions#tax planning Australia#Collab Accounting#expert tax consultants#maximize tax refunds#Australian tax specialists

0 notes

Text

Looking for Best Business Advisory Services in London | Ventura Consultant Ltd

0 notes

Text

LETTERS FROM AN AMERICAN

January 18, 2025

Heather Cox Richardson

Jan 19, 2025

Shortly before midnight last night, the Federal Trade Commission (FTC) published its initial findings from a study it undertook last July when it asked eight large companies to turn over information about the data they collect about consumers, product sales, and how the surveillance the companies used affected consumer prices. The FTC focused on the middlemen hired by retailers. Those middlemen use algorithms to tweak and target prices to different markets.

The initial findings of the FTC using data from six of the eight companies show that those prices are not static. Middlemen can target prices to individuals using their location, browsing patterns, shopping history, and even the way they move a mouse over a webpage. They can also use that information to show higher-priced products first in web searches. The FTC found that the intermediaries—the middlemen—worked with at least 250 retailers.

“Initial staff findings show that retailers frequently use people’s personal information to set targeted, tailored prices for goods and services—from a person's location and demographics, down to their mouse movements on a webpage,” said FTC chair Lina Khan. “The FTC should continue to investigate surveillance pricing practices because Americans deserve to know how their private data is being used to set the prices they pay and whether firms are charging different people different prices for the same good or service.”

The FTC has asked for public comment on consumers’ experience with surveillance pricing.

FTC commissioner Andrew N. Ferguson, whom Trump has tapped to chair the commission in his incoming administration, dissented from the report.

Matt Stoller of the nonprofit American Economic Liberties Project, which is working “to address today’s crisis of concentrated economic power,” wrote that “[t]he antitrust enforcers (Lina Khan et al) went full Tony Montana on big business this week before Trump people took over.”

Stoller made a list. The FTC sued John Deere “for generating $6 billion by prohibiting farmers from being able to repair their own equipment,” released a report showing that pharmacy benefit managers had “inflated prices for specialty pharmaceuticals by more than $7 billion,” “sued corporate landlord Greystar, which owns 800,000 apartments, for misleading renters on junk fees,” and “forced health care private equity powerhouse Welsh Carson to stop monopolization of the anesthesia market.”

It sued Pepsi for conspiring to give Walmart exclusive discounts that made prices higher at smaller stores, “[l]eft a roadmap for parties who are worried about consolidation in AI by big tech by revealing a host of interlinked relationships among Google, Amazon and Microsoft and Anthropic and OpenAI,” said gig workers can’t be sued for antitrust violations when they try to organize, and forced game developer Cognosphere to pay a $20 million fine for marketing loot boxes to teens under 16 that hid the real costs and misled the teens.

The Consumer Financial Protection Bureau “sued Capital One for cheating consumers out of $2 billion by misleading consumers over savings accounts,” Stoller continued. It “forced Cash App purveyor Block…to give $120 million in refunds for fostering fraud on its platform and then refusing to offer customer support to affected consumers,” “sued Experian for refusing to give consumers a way to correct errors in credit reports,” ordered Equifax to pay $15 million to a victims’ fund for “failing to properly investigate errors on credit reports,” and ordered “Honda Finance to pay $12.8 million for reporting inaccurate information that smeared the credit reports of Honda and Acura drivers.”

The Antitrust Division of the Department of Justice sued “seven giant corporate landlords for rent-fixing, using the software and consulting firm RealPage,” Stoller went on. It “sued $600 billion private equity titan KKR for systemically misleading the government on more than a dozen acquisitions.”

“Honorary mention goes to [Secretary Pete Buttigieg] at the Department of Transportation for suing Southwest and fining Frontier for ‘chronically delayed flights,’” Stoller concluded. He added more results to the list in his newsletter BIG.

Meanwhile, last night, while the leaders in the cryptocurrency industry were at a ball in honor of President-elect Trump’s inauguration, Trump launched his own cryptocurrency. By morning he appeared to have made more than $25 billion, at least on paper. According to Eric Lipton at the New York Times, “ethics experts assailed [the business] as a blatant effort to cash in on the office he is about to occupy again.”

Adav Noti, executive director of the nonprofit Campaign Legal Center, told Lipton: “It is literally cashing in on the presidency—creating a financial instrument so people can transfer money to the president’s family in connection with his office. It is beyond unprecedented.” Cryptocurrency leaders worried that just as their industry seems on the verge of becoming mainstream, Trump’s obvious cashing-in would hurt its reputation. Venture capitalist Nick Tomaino posted: “Trump owning 80 percent and timing launch hours before inauguration is predatory and many will likely get hurt by it.”

Yesterday the European Commission, which is the executive arm of the European Union, asked X, the social media company owned by Trump-adjacent billionaire Elon Musk, to hand over internal documents about the company’s algorithms that give far-right posts and politicians more visibility than other political groups. The European Union has been investigating X since December 2023 out of concerns about how it deals with the spread of disinformation and illegal content. The European Union’s Digital Services Act regulates online platforms to prevent illegal and harmful activities, as well as the spread of disinformation.

Today in Washington, D.C., the National Mall was filled with thousands of people voicing their opposition to President-elect Trump and his policies. Online speculation has been rampant that Trump moved his inauguration indoors to avoid visual comparisons between today’s protesters and inaugural attendees. Brutally cold weather also descended on President Barack Obama’s 2009 inauguration, but a sea of attendees nonetheless filled the National Mall.

Trump has always understood the importance of visuals and has worked hard to project an image of an invincible leader. Moving the inauguration indoors takes away that image, though, and people who have spent thousands of dollars to travel to the capital to see his inauguration are now unhappy to discover they will be limited to watching his motorcade drive by them. On social media, one user posted: “MAGA doesn’t realize the symbolism of [Trump] moving the inauguration inside: The billionaires, millionaires and oligarchs will be at his side, while his loyal followers are left outside in the cold. Welcome to the next 4+ years.”

Trump is not as good at governing as he is at performance: his approach to crises is to blame Democrats for them. But he is about to take office with majorities in the House of Representatives and the Senate, putting responsibility for governance firmly into his hands.

Right off the bat, he has at least two major problems at hand.

Last night, Commissioner Tyler Harper of the Georgia Department of Agriculture suspended all “poultry exhibitions, shows, swaps, meets, and sales” until further notice after officials found Highly Pathogenic Avian Influenza, or bird flu, in a commercial flock. As birds die from the disease or are culled to prevent its spread, the cost of eggs is rising—just as Trump, who vowed to reduce grocery prices, takes office.

There have been 67 confirmed cases of the bird flu in the U.S. among humans who have caught the disease from birds. Most cases in humans are mild, but public health officials are watching the virus with concern because bird flu variants are unpredictable. On Friday, outgoing Health and Human Services secretary Xavier Becerra announced $590 million in funding to Moderna to help speed up production of a vaccine that covers the bird flu. Juliana Kim of NPR explained that this funding comes on top of $176 million that Health and Human Services awarded to Moderna last July.

The second major problem is financial. On Friday, Secretary of the Treasury Janet Yellen wrote to congressional leaders to warn them that the Treasury would hit the debt ceiling on January 21 and be forced to begin using extraordinary measures in order to pay outstanding obligations and prevent defaulting on the national debt. Those measures mean the Treasury will stop paying into certain federal retirement accounts as required by law, expecting to make up that difference later.

Yellen reminded congressional leaders: “The debt limit does not authorize new spending, but it creates a risk that the federal government might not be able to finance its existing legal obligations that Congresses and Presidents of both parties have made in the past.” She added, “I respectfully urge Congress to act promptly to protect the full faith and credit of the United States.”

Both the avian flu and the limits of the debt ceiling must be managed, and managed quickly, and solutions will require expertise and political skill.

Rather than offering their solutions to these problems, the Trump team leaked that it intended to begin mass deportations on Tuesday morning in Chicago, choosing that city because it has large numbers of immigrants and because Trump’s people have been fighting with Chicago mayor Brandon Johnson, a Democrat. Michelle Hackman, Joe Barrett, and Paul Kiernan of the Wall Street Journal, who broke the story, reported that Trump’s people had prepared to amplify their efforts with the help of right-wing media.

But once the news leaked of the plan and undermined the “shock and awe” the administration wanted, Trump’s “border czar” Tom Homan said the team was reconsidering it.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Consumer Financial Protection Bureau#consumer protection#FTC#Letters From An American#heather cox richardson#shock and awe#immigration raids#debt ceiling#bird flu#protests#March on Washington

30 notes

·

View notes

Text

Source: ZIB via instagram

Attention Vienna swifties! Below is information from the AK (labor bureau) on your rights to refunds.

Ticket Refund: For tickets purchased via oeticket, you will receive a refund from the promoter within 10 business days.

Hotel and transport: the organizer is not responsible for these costs. Please consult your hotel, transport provider, or travel agent for your options. ÖBB and Westbahn have said that they will refund train tickets.

Ticket travel package: if you purchased a ticket travel package, your concert ticket will be refunded by the promoter and your accommodation/transport can be cancelled free of charge.

Third party ticket office: if you purchased your tickets from a third party (any ticket seller that is not oeticket), consult the ticket platform/seller directly.

86 notes

·

View notes

Text

I liked their apology. (tldr lower bestie if you want)

It won't make Steven's out of touch comment or their joint decision made without either asking a business consultant or their own fans any easier to swallow, but it was a good apology. I like the new model, and I frankly think a month is short, they could have waited longer to put them up after! (they probably went short so the apology would go better and yeah, they nailed this one actually.) this kind of premium experience that you can opt into feels much better and nicer than feeling forced to subscribe to watch any of it going forward (it's really a bit of another patreon form, and I really don't mind that at all). i think more people would be willing to subscribe (within those that can afford it) now that it doesn't feel like their only option.

if they prove able to truly listen to their fans, get back down to earth and actually conduct market research and value their audience, i think they'll actually be okay. they need to make real efforts to earn back trust and foster that feeling (and promote the damn ways people can actually support them omg promote the patreon) but i see them walking back from this. maybe not this month, but eventually? it'll hopefully be a distant disappointing thing that makes you go "im glad they listened and changed"

im glad they addressed the patreon members' worry and im glad they didn't dig their heels in and are willing to offer refunds (it Was the smart thing to do, but they just proved they don't always do that, so live and learn ig). i still didn't like how they talked about it like it is their own site when we now know it's just vimeo (and like, it's fine, i have nothing against vimeo. but don't pretend it's yours when you can't even control how many people share a password, it just sounds weird instead...)

tldr;

i appreciated the work they put into the apology, as well as the format they're deciding on going forward. a few details weren't great, but i can see them surviving this and going on to do good if they listen to fans and promote their content better.

(extra more personal bit you don't really need)

i don't have a lot of extra money but I'm an artist myself and I like to support creators I like, so I have a list of patreons I'd like to support for a month whenever i next can, and theirs is tentatively back on the list. i probably won't subscribe to the streaming service because that's not something that works with how i consume their work, but patreon? maybe.

23 notes

·

View notes

Text

GST consultants in India

Mercurius & Associates LLP is one of the top GST consultants in Delhi and India, providing comprehensive, end-to-end GST solutions tailored to your business needs. Our services include GST registration, audits, amendments, refunds, and ongoing compliance support. Partner with us for expert guidance and hassle-free GST management!

GST consultants in India | Expert GST Consultants & Service Providers in India | Expert GST | GST Consultants Service Providers in India

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#taxation#auditor#ap management services

3 notes

·

View notes

Text

Honest Confession of a Female Separatist #6

Sex, Men, and Friendships w/Men

I've had pretty good sex with two men.

The first (3+ year relationship)in the sense that I loved him, I felt safe, and it felt good to be able to be safely exposed and vulnerable with someone I loved. Of course that ended when he made several admissions of his own verbally and behaviorally that clearly demonstrated he didn't give two shits about me.

The second(3+ month relationship) in the sense that he was just good at the act itself and very sweet. That is of course until he became an asshole, or dropped the sweet honey trap game to draw me in and as a result of which I promptly dumped him.

If only I could have good sex with a man that loved, respected, and was kind to me all the time 🙄. Because that's not a thing and because I don't want to risk it I have sex with myself and that has been excellent but I still daydream about a man that could see me as a human not an object but the world isn't that way at all. I can't wait till I overcome this nasty ass desire.

Friendships w/ Men

I have several friends that are male. I've been slowly eliminating them. I have one that has invited himself to visit me-- I actually thought for a bit this was something I did (the patrichchal brainwash still has me programmed -- this will take a lifetime of work) -- but actually it's quite clear he's coming to be entertained and hosted. I'm busy as fuck! I work two jobs + consult. Additionally I'm selling/packing everything in my house, and doing so many other grown women things of which he is fully aware. And yet he wants to come to my fucking house and hang out--no hotel, no car rental, just being catered to and entertained!!! I want to cancel! Girl programming has me wanting to be nice and feeling ashamed. I literally don't want male juice in my house, car, shower, kitchen, any fucking where. I feel absolutely disgusted -- this feels extreme like full on hate for men. Additionally I hate his text messages every fucking day -- he's like "Hey" 🙄 why don't you have your own thoughts asshat? Why do you want me to do mental labor for you? Lastly this guy has a girlfriend and they are in an open relationship of which he is unable to make connections with women to be open with while his gf is country hopping with a side beau-- which again is telling because he's coming here for his ego gross 🤢

Anyways, I'm cancelling the visit and also the nice girl in me (programmed, not natural) will probably pay the cost of his ticket because of course he booked non-refundable flights. Fml.

I'm a fuckin work in progress and jesus is the decolonizing rough.

#fuck the patriarchy#all men#male violence#4b movement#proud misandrist#female separatist#god is a woman#misandry#fuck all men#fuck these guys

4 notes

·

View notes

Text

This Old House - A Bloodweave Fanfic: Ch. 9

See Ch. 1 for work summary and content tags. Read this chapter below the break here or on AO3!

Chapter Summary:

Action Item Status: Figure out WTF is going on with Szarr Palace ✅ Consultation scheduled with expert in highly specific niche field ✅ House exhibiting increased attentiveness—potential concern for property management ✅ Paperwork completed at standard bureaucratic pace ✅ Fortune-telling services secured at a highly reasonable price (additional fees may apply) ✅ Ominous predictions delivered—unclear refund policy on existential dread ⬜ Put Bormul in the past

Notes:

So some of you who have read my other works may recognize Rhonda! She's the star of Fortune Favors the Bold and Terms & Conditions Apply and I couldn't resist giving her an AU cameo in this story. If you like her here, check her out in her main works!

Astarion

Astarion stood on the front steps of Sunrise Manor—the name still felt strange on his tongue—and watched the fading twilight paint streaks of purple across the sky. The mansion loomed behind him, its presence almost physical against his back. Nikka busied herself sorting through her satchel of magical implements beside him, muttering formulas under her breath.

"Do you think the house missed me?" Astarion asked, only half-joking.

Gale looked up from the treatise he'd been reading. "Given how reluctant it was to let us leave last time, I wouldn't be surprised if it's been sulking in our absence."

Astarion turned to regard the manor's facade. The windows seemed to stare back at him like eyes. Had they always been arranged in that particular pattern? He couldn't remember.

"I wonder what little tantrums it has planned for us tonight." He straightened his collar. "Last time it didn't want us to leave. What will it do now that we've abandoned it for a whole day and night?"

Nikka adjusted her spectacles. "Buildings don't have feelings, Lord Daybreak."

"This one does," Astarion and Gale said in unison.

The halfling frowned.

"Here she comes," Gale said, pointing down the street.

Astarion watched as Shadowheart approached with a short, plump tiefling woman. The newcomer had pale lavender skin and small dark horns that curved close to her skull. Her gray-streaked hair was pulled back in a simple braid, and she wore plain brown wool clothing. Her hands were stained with ink, and she carried a leather-bound ledger tucked under one arm.

"May I present Rhonda," Shadowheart said with a slight bow of her head. "She's a fortune teller."

Astarion exchanged a look with Gale. The wizard's eyebrows had climbed nearly to his hairline.

"A fortune teller?" Astarion repeated. "I was expecting an exorcist or a medium or... something more ghostly."

"I charge extra for theatrical attire and mystical affectations," Rhonda said in a flat, nasal tone. "Standard rates cover functional clothing and practical accessories only."

Gale cleared his throat. "Forgive my confusion, but what exactly does fortune telling have to do with our haunted house problem?"

Astarion fought to keep his expression neutral as he regarded the unimpressive fortune teller.

"Haunted? No." Shadowheart shook her head firmly. "As I told you—there are no spirits, no ghosts, no undead presences manifesting in this house." She gestured toward Rhonda with a confident sweep of her hand. "What you're experiencing is something different, and Rhonda specializes in identifying unusual magical phenomena that others misinterpret."

"Well," Astarion said, turning to Shadowheart with a sardonic smile, "at least she's not another bureaucrat."

The oddest look crossed Shadowheart's face—a mixture of amusement and something that looked suspiciously like pity. She pressed her lips together as if holding back laughter.

"Perhaps we should go inside," she suggested, gesturing toward the mansion doors. "I'm sure Rhonda would like to get a sense of what we're dealing with."

Astarion approached the doors with trepidation, half-expecting them to jam or slam in his face as they had during previous visits. Instead, they swung open with an almost eager creak, as if welcoming him home. The sensation prickled at the back of his neck.

"Well, that's new," he muttered, stepping into the foyer.

The interior had transformed dramatically thanks to their cleaning efforts. No longer did the stench of death permeate the air, though a residual scent of magic hung heavy around them. The walls seemed to lean in slightly, and Astarion could have sworn he felt the house's attention shift to focus on their little group—like a predator tracking movement.

"Is anyone else getting the distinct impression we're being watched?" Astarion whispered, glancing around the entrance hall.

The chandelier above them swayed slightly, though there wasn't a hint of breeze.

"The house seems... attentive today," Gale agreed, placing a hand on Astarion's lower back.

They proceeded to the dining room, their footsteps echoing unnaturally loudly on the parquet floors. The dining table had been recently cleared of dust and debris, gleaming faintly in the light from the wall sconces that flickered to life as they entered.

"Let's sit, shall we?" Shadowheart suggested, pulling out a chair.

Rhonda placed her ledger on the table and sat down with a businesslike efficiency. She opened the leather-bound book and removed several sheets of parchment from between its pages.

"Before we begin," she said, laying the papers out in front of her, "I'll need you to complete these forms."

Astarion froze, his hand halfway to the back of a chair. "I beg your pardon?"

"Standard procedure," Rhonda explained, not looking up as she arranged the documents. "Client intake form, consent to consultation services, liability waiver, and the divination disclosure agreement."

"You can't be serious." Astarion's voice rose in pitch. "We've spent days drowning in paperwork! I thought we were finally—"

"Astarion," Shadowheart cut in, her voice sharp.

He turned to Gale for support, only to find his lover looking equally dismayed.

"I was under the impression we would be conducting some form of magical investigation," Gale said, his usual diplomatic tone strained around the edges. "Not filing for tax exemption status."

Rhonda's expression remained impassive. "Section three, paragraph two of my standard contract clearly states that all consultations begin with proper documentation. I find it provides clarity for all parties involved and prevents misunderstandings about services rendered."

Astarion's fingers twitched with the desire to flip the entire table. "Does the house need to sign a waiver as well? Since it's the one causing all the trouble."

The candles in the room flared momentarily.

"Just complete the forms," Shadowheart insisted, sitting down and reaching for a quill. "I promise you, Rhonda's methods are unorthodox but effective. This is necessary groundwork."

"It better be," Astarion hissed, dropping into a chair with more force than necessary. "Or I'll start biting."

Astarion signed his name for what felt like the thousandth time, his hand cramping from the repetitive motion. The quill scratched against parchment as he scrawled "Astarion, Lord Daybreak" yet again.

"Is this truly necessary?" he asked, pausing to flex his fingers. "I've signed more documents in the past few days than in the previous two centuries of my existence."

"Section eight clearly states that all parties must acknowledge receipt of services with proper documentation," Rhonda replied without looking up from her ledger.

"And what services have I received thus far?" Astarion muttered. "Paper cuts and a newfound hatred for the written word?"

The fortune teller ignored him, methodically working through each document, occasionally pointing to another spot requiring his initials or full signature. Each time, some new complication arose from his recent name change his eye twitched involuntarily. After what seemed like hours but was likely only twenty minutes, Rhonda finally tucked away the last of the forms into her ledger.

"Very good," she said with the enthusiasm of someone announcing a particularly dull weather forecast. "We may now proceed to the consultation phase."

Without ceremony, she withdrew a deck of cards from a side pocket of her dress. The cards themselves were nothing like the gaudy, guilded tarot decks Astarion had seen in the hands of frauds and charlatans throughout Baldur's Gate. These were well-worn, their edges softened by frequent handling, with simple, elegant designs on their backs.

Rhonda's hands moved with surprising dexterity as she shuffled, the cards flowing between her fingers like water. Not a single word passed her lips—no invocations to ancient powers, no mystical incantations, not even a dramatic pause.

"Shouldn't you be asking me questions?" Astarion asked, watching her hands with increasing irritation. "Or lighting incense? Creating some sort of atmosphere? At the very least, mumbling mysteriously?"

The tiefling continued shuffling without acknowledging him.

"Rhonda has her methods," Shadowheart said, her tone clearly indicating he should be quiet.

"Methods? This is about as mystical as filing tax documents," Astarion hissed.

A slight pressure on his knee drew his attention. Gale's hand rested there, warm and steadying. When Astarion met his gaze, the wizard's eyes held a mixture of amusement and understanding.

"Let's see what she has to show us," Gale murmured, the corner of his mouth lifting in a subtle smile that said, 'I know this is ridiculous, but humor them for now.'

Astarion exhaled sharply through his nose but settled back in his chair. The knowing look they shared eased his irritation, replacing it with a familiar warmth.

Rhonda placed the cards on the table in a precise arrangement, each movement economical and utterly devoid of theatrical flourish. Astarion narrowed his eyes as she turned over the first card.

"The Tower, reversed," she announced in the same tone one might use to read inventory lists. "Foundation built on unstable ground. Magical creation rather than natural growth."

She flipped a second card. "The Devil. Bondage. Servitude. Control through magical means."

A third card joined the spread. "Ten of Swords. Extreme suffering. Torment. Multiple betrayals. Being trapped."

As each card fell, Astarion felt a chill crawling up his spine that had nothing to do with his undead nature. The precision of the reading was unsettling, cutting too close to the truth he'd been trying to ignore.

"Hold on," Gale leaned forward, his eyes widening. "Are you suggesting—"

"The palace wasn't haunted at all," Shadowheart interjected, unmistakable smugness coloring her voice. "I told you there were no spirits."

"The cards show what they show," Rhonda said flatly. "The structure has awareness. It was created through magic, enslaved through binding rituals, and subjected to considerable suffering. Its creation binds it to its owner. Not unlike other entities in this room." Her eyes flicked briefly to Astarion.

Astarion shifted uncomfortably. He wasn't interested in dwelling on parallels between himself and the building. "Lovely. We've established its tragic backstory. Can we move on to something more helpful, like how to make it stop terrorizing us?"

Gale and Nikka were absorbed in an excited exchange of magical theories, completely ignoring his irritation.

"—similar to constructs but with far more complex responses—" Nikka was saying.

"—layered enchantments that could allow for emotional development—" Gale added, his eyes gleaming with academic fervor.

"If we could continue," Astarion interrupted sharply, "I'm far more concerned with the future situation than ancient history."

Rhonda nodded impassively. "The present reading, then."

She reached for another card and turned it over.

Then, for the first time, she hesitated.

She stared at the card for half a second too long.

Then, in that same flat, businesslike tone, she said, "Duck."

Astarion blinked. "I beg your—"

"Duck!" Gale shouted, grabbing Astarion's shoulder and yanking him downward.

Astarion's reflexes took over as he dropped below the table's edge. A metallic whistling sound filled the air where his head had been a moment before. He glimpsed several gleaming objects—darts? daggers?—whirling through the space they'd all occupied seconds ago.

Something smashed through the dining room's remaining windows in a spray of glass. The sharp, metallic smell hit Astarion's nostrils before he even saw them—humans, their scent thick with sweat and fear and determination. Four figures in dark clothing rolled into defensive crouches, daggers gleaming in their hands.

"Oh, how thoughtful," Astarion growled, "dinner has arrived."

His fangs extended as he drew his own daggers, excitement surging through him. After days of paperwork and bureaucrats, finally something he was good at—violence.

One of the attackers lunged toward him with surprising speed. Astarion sidestepped and slashed, feeling the satisfying resistance as his blade cut through muscle. The man howled.

"I take it Baron Bormul wasn't convinced by my performance," Astarion called to Gale as he danced away from another attack. "Such a shame. I thought I played the vapid noble rather well."

"Your performance was excellent," Gale replied, calmly positioning himself between the attackers and Nikka. "Some people simply can't appreciate good theater."

The wizard made a casual gesture with his hand, and one of the assassins went flying across the room, slamming into the wall with bone-crushing force.

Instead of following up with another spell, Gale turned to Nikka. "Note how I maintained concentration while still projecting adequate force. Try something similar with that fellow by the curtains."

The halfling's eyes widened, but she nodded determinedly and extended her hands. A bolt of crackling energy shot from her fingertips, going wide and scorching the wallpaper.

"Better projection, but mind your aim," Gale commented, as if they were in a classroom rather than a life-or-death struggle. "Visualize the path before releasing the energy."

Astarion laughed wildly as he slashed his way through another attacker, the man's blood spattering across his face. He licked his lips, savoring the copper tang. This—this was living. Not contracts and bureaucracy and paperwork.

He glanced around for Shadowheart and Rhonda, worried about the fortune teller's safety—only to see Rhonda calmly sitting at the table, somehow never where an attack landed. When a dagger flew directly at her, she leaned slightly to adjust her ledger, and the weapon missed her by inches. An assassin charged her position, but she bent to retrieve a dropped quill, and the man stumbled over her chair instead.

"Your form states you agreed to standard consultation fees only," she said over the sprawled form of the frustrated attacker. "Combat situations incur additional charges as outlined in section twelve."

Astarion felt a giddy, manic energy coursing through him as he dispatched another assassin with a brutal slash across the throat. He drank deeply from the wound, relishing the hot rush of blood.

"Four more coming through the window!" Shadowheart shouted.

"Wonderful!" Astarion laughed. "The more the merrier!"

He was so caught up in the thrill that he didn't notice the figure creeping up behind him until it was almost too late. The cold whisper of steel cutting through air alerted him, but he knew he wouldn't turn in time—

The floor beneath the assassin's feet suddenly vanished. The man dropped with a startled scream, and then the floorboards snapped shut again with a sickening crunch. Blood seeped through the seams of the wood as the assassin's bisected body twitched and went still.

Astarion froze, staring at the bloody floorboards. The house had saved him. Not Gale, not his own reflexes—the house.

"Well," he murmured, "that's new."

"I believe we just witnessed evidence of sentient defensive capabilities," Gale observed clinically, as if commenting on an interesting academic phenomenon rather than a man being bisected by angry architecture.

Before Astarion could respond, Shadowheart had joined the fray, her mace connecting with an attacker's skull with a satisfying crack. She fought with methodical precision, each blow calculated and effective.

"I thought you might need help," she called to Rhonda, who continued sitting calmly at the table, somehow untouched by the chaos around her.

"Not particularly," the fortune teller replied, making a notation in her ledger. "But I appreciate the sentiment."

The battle shifted quickly in their favor. Astarion dove between two attackers, his daggers finding vulnerable points with ease. Blood sprayed across the dining room's expensive wallpaper as he severed an artery, adding to the growing mess.

Gale, meanwhile, had positioned himself beside Nikka, guiding her hands through a complex series of gestures.

"Focus your energy here," he coached, "and visualize lifting, not pushing."

The halfling's face scrunched with concentration as she extended her hands toward one of the remaining assassins. The man suddenly rose into the air, his legs kicking uselessly as he struggled against invisible bonds.

"I'm doing it!" Nikka exclaimed. "I've never managed a telekinesis spell before!"

"Excellent work," Gale beamed with professorial pride. "Maintain your concentration just like that."

Within minutes, the battle ended. Bodies littered the dining room floor, blood pooling beneath them. Astarion felt a familiar hunger rising as he surveyed the carnage—so much fresh blood going to waste.

Without hesitation, he grabbed the nearest corpse by the collar and dragged it upright. He sank his fangs into the still-warm neck, drinking deeply while looking directly at their floating prisoner. The man's eyes widened in horror as realization dawned.

"Gods above," the suspended assassin whispered. "You're one of them. A bloodsucker."

Astarion wiped his mouth with the back of his hand, making no effort to hide his bloodied fangs. "Very observant. Any other brilliant insights?"

"You—you don't understand," the man babbled, struggling against Nikka's magical grip. "My employer is powerful! There will be consequences! They'll send more—better than us!"

"Fascinating," Astarion replied dryly. "I'm utterly terrified."

Nikka, apparently deciding the interrogation had run its course, simply dropped her hands. The assassin fell unceremoniously to the floor, landing in a heap at Astarion's feet with a pained grunt.

"Would you like to drain the others before I dispose of them?" she asked, reaching into her robes to extract her portable hole.

Astarion stretched languidly, enjoying the lingering warmth of fresh blood coursing through his undead veins. The fear radiating from the surviving assassin was almost as delicious as the blood itself.

"Thank you for the offer, but I'm quite satiated," he told Nikka with a casual wave. "One corpse is more than enough for a light snack."

The halfling nodded and went about her work with surprising efficiency. She spread her portable hole on the floor and began dragging bodies toward it, shoving them into the extra-dimensional space with methodical precision.

"Mind the carpet," Gale advised, casting a cleaning cantrip over bloodstains as Nikka worked. "Some of these stains will set if we don't address them quickly."

Astarion loomed over the remaining assassin, who stared wide-eyed at the casual disposal operation. The man's terror perfumed the air like expensive cologne, causing Astarion's nostrils to flare appreciatively.

"You seem distressed," Astarion observed, crouching down to the assassin's level. "Does our housekeeping routine bother you? We could always add you to the pile."

"N-no!" The man's voice cracked. "Please, I—I don't want to die like this."

"Then I suggest you start providing something of value," Astarion replied, examining his bloodied nails with feigned disinterest. "Beginning with who sent you."

"B-Baron Bormul," the man stammered, watching in horror as Nikka casually rolled another corpse into the dark circle on the floor. "He ordered us to kill you and search for Cazador's hidden treasure."

"How predictable," Astarion sighed. "And what else is dear Baron Bormul working on? Other business ventures I should know about?"

"I don't know! I swear!" The assassin's eyes darted frantically between Astarion's fangs and his friends disposing of bodies. "We were just hired for this job. He doesn't tell us anything else."

Astarion considered the man for a long moment, head tilted like a predator deciding whether to kill or toy with its prey.

"I believe I'll send you back with a message," he finally decided, watching relief flood the assassin's face. "Tell Baron Bormul that this seems an unduly rough start to our shared business venture. The impulsiveness of it all has me convinced the man simply doesn't have what it takes to be a good partner."

Astarion leaned closer, allowing his breath—cool and smelling faintly of blood—to wash over the terrified man's face.

"I have his ledgers, you know. I was planning to put more thought into what to do with them, but perhaps that's not how business is conducted in Baldur's Gate?" He shrugged dramatically. "Ah well, I'll be the better man. Tell him to back off, and his secrets will remain secret. For now."

The assassin nodded frantically, sweat beading on his forehead.

"Don't worry about finding your way out," Astarion added, straightening up. "The house will show you the door."

As if on cue, the dining room door swung open with an ominous creak.

Astarion watched the remaining assassin stumble toward the open door, tripping over his own feet in his eagerness to escape. The door slammed shut behind him with a satisfying thud that seemed almost... smug.

"Did you see that?" Astarion couldn't keep the delight from his voice. "It opened the door precisely when I mentioned it would! And earlier—" He gestured at the blood-soaked floorboards. "It saved me! Chomped that assassin in half like a particularly effective bear trap."

He strode to the spot where the man had fallen and tapped the floor with his boot. "That was quite impressive, I must say. Brutal, efficient... I approve."

Gale approached, looking more fascinated than disturbed. "It appears to be responsive to you specifically. A recognition of authority, perhaps? The ownership bond Rhonda mentioned?"

Astarion felt something unfamiliar stir in his chest—a sense of wonder, even connection. He'd spent his entire unlife being controlled, and now here was something responding to his will.

The floorboards where the assassin had been bisected remained firmly sealed, despite Nikka's attempts to collect the body parts for disposal.

"It won't budge," she said, pushing ineffectually at the edges. "The wood's seamless now, almost like it was never separated."

Astarion studied the bloodstained floor thoughtfully. Then, feeling slightly foolish but curious enough to try, he addressed the house directly.

"Would you mind releasing your... prize? We need to clean up, and my friend here could use access to what's beneath."

For a moment, nothing happened. Then, with a creaking groan, the floorboards shifted apart, revealing the grisly remains underneath. The movement seemed almost reluctant, like a dog surrendering a favored bone.

"Well, I'll be damned," Shadowheart murmured.

"Thank you," Astarion told the house, feeling oddly respectful.

Nikka quickly dispatched the remains into her portable hole, and Gale's cleaning spells took care of the bloodstains. The room gradually transformed back from battleground to dining room. Once everything was tidied away, they returned to the table. Rhonda seemed completely unfazed by the assassination attempt, as if murderous interruptions were simply part of her standard consultation package.

She removed the card that had prompted her "duck" warning, setting it aside. "That particular danger has passed," she explained, reaching for a new card.

Astarion settled back into his chair, regarding Rhonda with newfound respect. That "duck" warning had come at precisely the right moment—a coincidence perhaps, but Astarion doubted it.

"Well, you certainly have my attention now," he admitted, brushing assassin's blood from his sleeve. "What else do your cards have to say?"

Rhonda nodded and turned over another card. "The Ace of Cups," she announced in the same flat, businesslike tone.

"How wonderfully specific," Astarion drawled, though his sarcasm lacked its usual edge.

"The Ace of Cups indicates a developing relationship," Rhonda continued, unbothered by his tone. "Not just physical structure, but connection." She turned another card, placing it beside the first. "Death, inverted."

"That doesn't sound promising," Gale murmured.

"Transformation without destruction," Rhonda clarified. "Change of purpose rather than abandonment."

Astarion's brow furrowed. "You're suggesting I... what? Redecorate rather than sell?"

"The cards suggest a bond forming. Sunrise Manor responds to you not because you command it—you have not accessed that power yet. But it helps because it recognizes something familiar in you." Rhonda turned over a third card, revealing a radiant sun. "The Sun. Illumination. Discovery. A productive fate."

The fortune teller stacked her cards with mechanical precision. "To simplify: transformation rather than relinquishment or compulsion will yield beneficial results."

Astarion leaned back, conflicted emotions washing through him. On one hand, the reading suggested something positive—a "productive fate" sounded promising. On the other hand, there was nothing about escaping this place, nothing about returning to Waterdeep with Gale and continuing their life far from Baldur's Gate.

"That's it?" he asked, unable to keep the disappointment from his voice. "No riding off into the sunset? No 'and he never had to set foot in this cursed city again'?"

Rhonda closed her ledger with a snap. "The cards show changes here, not departure. Your connection with this place is... significant."

"But I don't want a connection," Astarion protested, frustration bubbling up. "I want to be done with it."

"The cards show what they show," Rhonda replied with her characteristic flatness. "That will be eight gold pieces. Would you like a receipt?"

Astarion waved a dismissive hand at the fortune teller's finality. "No, no, that can't be all. Pull a few more cards. There must be something about leaving this wretched place behind."

Rhonda gathered her deck with methodical precision, tucking it into a pocket of her plain brown robe. "The cards have spoken what they wish to speak."

"I'll pay double," Astarion offered, leaning forward.

"The cards don't respond to financial incentives," Rhonda replied flatly. "Section four, paragraph three of my consultation agreement clearly states that readings conclude when the cards cease providing relevant information."

"But—"

"Thank you for your business," she continued, extending her palm expectantly. "Eight gold pieces."

Gale stepped in before Astarion could argue further, placing the coins in Rhonda's waiting hand. "Thank you for your insight, and for the timely warning about our unexpected guests."

The tiefling counted the coins with practiced efficiency before producing a small slip of paper from another pocket. She made a few quick notations, handed the receipt to Gale, and stood to leave.

"Wait!" Astarion called. "What about—"

But Rhonda was already walking toward the door, which swung open for her without prompting. She paused only briefly to say, "Future consultations available by appointment. Violence surcharge applies to subsequent visits."

When she had gone, Shadowheart settled into the chair Rhonda had vacated.

"Well," she said, "that was certainly... illuminating."

"It was rubbish," Astarion grumbled, slumping back in his chair. "A connection with this place? Transformation without destruction? What does that even mean?"

Gale traced patterns on the table's surface with his finger. "Perhaps that simply selling or abandoning the estate isn't the solution. That there's something to be gained by... reshaping it somehow."

"Into what? A slightly less horrible reminder of two centuries of torment?"

Astarion gazed around the dining room with undisguised distaste. The heavy dark wood paneling, the faded burgundy wallpaper with its garish gold accents, the oppressive chandeliers—all of it screamed Cazador's pompous self-importance.

"I mean, just look at this place," he continued, gesturing expansively. "It's hideous. The colors alone are enough to drive one mad. Dark red and gold everywhere—as if we're dining inside someone's infected wound."

Gale's lips quirked upward. "Would you be happier with both the helpfulness you witnessed and Rhonda's positive predictions if the place were… pretty?"

"Oh, absolutely," Astarion played along, grateful for the shift toward humor. "Change these ghastly colors to something actually livable—cream walls with blue accents, perhaps. Something calming and elegant, not this... ostentatious nightmare. Maybe then I could tolerate being in this—"

He broke off as a strange sound filled the room—like the rustle of dry leaves mixed with the soft scrape of sand shifting. Before his astonished eyes, the wallpaper began to change. The burgundy faded, bleeding away like watercolor in rain, replaced by a soft, warm cream. The gold accents morphed and shifted, thinning and changing to a lovely blue.

The transformation spread across the walls like ripples in a pond, moving outward from where Astarion sat. Even the dark wood paneling lightened, taking on a warm honey tone that complemented the new color scheme perfectly.

"What. The. Actual. Fuck?" Astarion breathed, his eyes wide as the entire room transformed to match exactly what he had described.

2 notes

·

View notes

Text

New IRS Tax Laws and How They Impact Burlington Taxpayers

Every year, the IRS updates tax laws that can significantly impact how individuals and businesses file their taxes. For Burlington residents, understanding these changes is essential to avoid surprises during tax season. Whether you are an employee, a small business owner, or a freelancer, staying informed about these updates can help you maximize deductions, reduce tax liabilities, and remain compliant with IRS regulations.

Key Changes in IRS Tax Laws for This Year

This year, the IRS has introduced several changes, including adjustments to tax brackets, updates to the standard deduction, and modifications to tax credits like the Child Tax Credit and Earned Income Tax Credit. Additionally, there are new rules regarding digital payment platforms, requiring platforms like Venmo and PayPal to report transactions exceeding $600. These changes aim to improve tax compliance and ensure all taxable income is properly reported. Burlington taxpayers should review these updates to understand how they may be affected.

How These Changes Affect Individuals and Families in Burlington

For individuals and families, the new IRS tax laws may result in higher or lower tax bills, depending on their financial situation. For example, increased standard deductions can provide relief to some taxpayers, while reduced eligibility for certain tax credits might limit refunds for others. Homeowners in Burlington should also be aware of updates related to mortgage interest deductions and property tax write-offs, as these can impact overall tax liability. Keeping track of these changes ensures that families can plan their finances accordingly.

Small Business and Self-Employed Tax Implications

Small businesses and self-employed individuals in Burlington face unique tax challenges, especially with the IRS cracking down on digital payments and self-employment income. The new tax laws emphasize stricter reporting requirements for gig workers and small business owners, making it essential to maintain detailed financial records. Additionally, certain deductions, such as those for home offices, business travel, and equipment purchases, may have been updated. Consulting with a tax professional can help business owners navigate these changes and take advantage of available tax-saving opportunities.

IRS Audits and Compliance: What You Need to Know

The IRS has increased its focus on tax compliance, particularly regarding unreported income and incorrect deductions. Burlington taxpayers should be cautious about their tax filings to avoid potential audits and penalties. Ensuring accurate record-keeping, reporting all sources of income, and understanding allowable deductions can reduce the likelihood of IRS scrutiny. With digital transactions now being more closely monitored, individuals and businesses must ensure they report their earnings correctly to stay compliant with federal tax laws.

Conclusion

Navigating IRS tax law changes can be challenging, but staying informed is crucial for Burlington taxpayers. Whether you're an individual taxpayer or a business owner, understanding these updates can help you make smarter financial decisions and avoid unexpected tax liabilities. To ensure compliance and optimize your tax return, consider consulting with a tax professional who can provide personalized guidance tailored to your specific situation.

#tax services in Burlington#accounting firm#accounting firm Burlington#accounting firm in Burlington#cpa firm#accounting firms Burlington#accountant Burlington#cpa burlington#cpa tax professional#cpa firm Burlington#certified public accountant#certified public accountant Burlington#cpa burlington ma

3 notes

·

View notes

Text

IRS Data Reveals 3.5% Rise in 2025 Refunds- Here’s How to Maximise Yours?

The 2025 tax season is proving to be a financial win for many Americans. According to the latest IRS data, refunds are up by 3.5% compared to last year, with the average refund now hitting $3,116, up from $3,011 in 2024. For millions, this annual return is more than just a payout — it’s a chance to catch up on expenses, reduce debt, or invest in future goals like savings or even company registration in the USA.

#IRS Refunds 2025#Tax Refund Increase 2025#Maximize Tax Refund USA#Company Registration USA#Corporate Registrations USA#Tax Filing Strategies 2025#Filing Mistakes to Avoid#IRS Data 2025#E-Filing Benefits#Tax Planning for Businesses#SBA Tax Consultants#Faster Tax Refunds#Small Business Tax Planning#Financial Optimization USA#Income Tax Refund USA

0 notes

Text

GST Registration Services in Delhi by SC Bhagat & Co.

Navigating the complexities of GST registration can be challenging for businesses. If you're looking for expert GST Registration Services in Delhi, SC Bhagat & Co. is your trusted partner. With years of experience and a dedicated team of professionals, we ensure a seamless GST registration process for businesses of all sizes.

Why Choose SC Bhagat & Co. for GST Registration in Delhi?

SC Bhagat & Co. is a leading tax and accounting firm, offering comprehensive GST solutions to individuals, startups, and enterprises. Our team of experts simplifies the GST registration process and ensures compliance with all legal requirements.

Our Key GST Services

GST Registration & Compliance

New GST Registration

GST Amendments & Modifications

GST Cancellation & Revocation

Filing of GST Returns

GST Advisory & Consultancy

GST Impact Analysis

Input Tax Credit (ITC) Planning

GST Rate Classification

Compliance Management

GST Return Filing & Compliance

Monthly, Quarterly & Annual GST Returns

GSTR-1, GSTR-3B, and GSTR-9 Filing

Reconciliation of GST Data

GST Audit & Assessment

GST Litigation & Representation

Assistance in GST Notices & Appeals

GST Refund Processing

Representation before GST Authorities

Advisory on Anti-Profiteering Laws

Benefits of GST Registration for Your Business

Legal Recognition: Get a valid GSTIN for your business operations.

Tax Benefits: Avail input tax credit and reduce tax liabilities.

Expand Business Reach: Register under GST to operate across India.

Compliance & Credibility: Build a strong financial reputation.

Avoid Penalties: Stay compliant and avoid legal complications.

Why Businesses Trust SC Bhagat & Co.?

Experienced Tax Experts: In-depth knowledge of GST laws and regulations.

Hassle-Free Process: Quick and easy GST registration with minimal documentation.

Affordable Pricing: Transparent and cost-effective service packages.

Dedicated Support: Personalized assistance for all GST-related queries.

Get in Touch with SC Bhagat & Co.

Looking for GST Registration Services in Delhi? SC Bhagat & Co. is here to assist you with all your GST needs. Let us handle your GST compliance while you focus on growing your business.

#gst#taxation#accounting firm in delhi#accounting services#tax consultancy services in delhi#direct tax consultancy services in delhi#taxationservices

5 notes

·

View notes

Text

File Income Tax Return in Raipur

Filing an income tax return is an important responsibility for every taxpayer. If you are looking to file income tax return in Raipur, Filing Book makes the process simple, fast, and easygoing. We make sure that every ITR from ITR-1 to ITR-7 is filed correctly, helping you stay compliant with tax regulations while maximizing the benefits.

Our team of expert consultants assists individuals, businesses, and professionals to file income tax return in Raipur without any errors. We guide you through every step, from collecting documents to submitting the return on time. For salaried employees, business owners, or freelancers, we offer personalized solutions to meet all tax filing needs.

With a Filing Book, you don’t have to worry about tax calculations or compliance issues. We ensure accurate filing, help you claim deductions, and prevent penalties. Our affordable and efficient services save you time while keeping your financial records in order.

Avoid last-minute stress and let us handle your tax filing. Contact Filing Book today for a smooth and secure income tax return filing experience in Raipur.

What is the Last Date to File Income Tax Return in Raipur?

File income tax return in Raipur on time is crucial to avoid penalties and ensure compliance with tax laws. For the Financial Year 2024-25 (Assessment Year 2025-26), the due dates are as follows:

For Individuals & Salaried Employees: July 31, 2025

For Businesses Requiring Audit: October 31, 2025

Submitting your ITR before the deadline helps you claim refunds faster and avoid legal issues.

What Happens If You Miss the ITR Deadline?

If you fail to file income tax return in Raipur before the due date, you may face:

Late Filing Penalty – A fine of up to ₹5,000 under Section 234F.

Interest on Tax Due – Additional interest under Section 234A.

Delayed Tax Refunds – Late filing can delay any refund you are eligible for.

Legal Consequences – Repeated non-compliance may lead to further action from the tax department.

Avoid last-minute stress! File income tax return in Raipur with Filing Book and ensure a smooth, penalty-free tax filing process.

#File Income Tax Return in Raipur#Register for GST Online in Raipur#PVT Ltd Company Registration in Raipur#Online Tax Return in Raipur#GST Apply Online in Raipur

2 notes

·

View notes

Text

Thailand Privilege Visa

The Thailand Privilege Visa, also known as the Thailand Elite Visa, is a long-term visa program designed for high-net-worth individuals, retirees, businesspeople, and frequent travelers seeking extended residency in Thailand. Managed by Thailand Privilege Card Co., Ltd., the program offers multiple visa options, with durations ranging from 5 to 20 years. Unlike traditional visas, the Privilege Visa provides VIP services, multi-entry privileges, and a range of exclusive benefits that enhance convenience and lifestyle in Thailand.

1. Key Features and Benefits of the Thailand Privilege Visa

Long-Term Residency – Valid for 5, 10, or 20 years without annual visa renewals.

Multiple Entry Visa – Unlimited travel in and out of Thailand during the visa validity period.

VIP Immigration Services – Access to fast-track immigration lanes at major Thai airports.

Airport Concierge and Lounge Services – Personal assistance at airports and complimentary access to luxury lounges.

Health and Wellness Benefits – Discounts at hospitals, spas, fitness centers, and golf courses.

Exclusive Business and Lifestyle Opportunities – Invitations to networking events, luxury accommodations, and cultural experiences.

2. Membership Packages and Fees

The Thailand Privilege Visa program offers various membership options tailored to individual lifestyles:

2.1 Elite Easy Access

Duration: 5 years

Fee: 600,000 THB (non-refundable)

Designed for frequent business travelers and digital nomads.

2.2 Elite Superiority Extension

Duration: 20 years

Fee: 1,000,000 THB

Ideal for long-term residents and retirees seeking hassle-free living.

2.3 Elite Ultimate Privilege

Duration: 20 years

Fee: 2,000,000 THB + 20,000 THB annual fee

Offers the most comprehensive benefits, including complimentary golf, spa treatments, and private concierge services.

2.4 Elite Family Excursion

Duration: 5 years

Fee: 800,000 THB for two family members (300,000 THB per additional member)

Designed for families relocating to Thailand.

3. Application Process

Submit the Application: Applicants must provide a copy of their passport, personal information, and proof of financial means.

Background Check: The Thai Immigration Bureau conducts a thorough background check.

Membership Approval and Payment: Once approved, the applicant pays the membership fee.

Visa Issuance: The visa is issued at a Thai consulate or immigration office.

The approval process typically takes 30 to 45 days.

4. Tax Implications and Legal Considerations

Tax Residency: Thailand Privilege Visa holders may be considered tax residents if they stay in Thailand for more than 180 days per year. Tax residents are required to declare income earned in Thailand and may be subject to tax on foreign-sourced income if it is remitted to Thailand within the same tax year.

Work Restrictions: The visa does not include a work permit. Visa holders must apply for a separate permit to work legally in Thailand.

Conclusion

The Thailand Privilege Visa is a unique and flexible residency option for individuals seeking a premium lifestyle and long-term stay in Thailand. With multiple packages to suit different needs, the program offers unparalleled convenience and exclusive benefits. While the membership fees are substantial, the visa’s privileges—such as fast-track immigration services, healthcare benefits, and business opportunities—make it an attractive option for many. Prospective applicants should carefully assess their needs and consult with professionals to determine the most suitable package.

#thailand#thai#visa#thaivisa#thailandvisa#visainthailand#thaiprivilegevisa#thailandprivilegevisa#thaipr#pr#immigration#immigrationinthailand#thailandimmigration#immigrationlawyers#immigrationlawyersinthailand

2 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

May 12, 2024

HEATHER COX RICHARDSON

MAY 13, 2024

I write a lot about how the Biden-Harris administration is working to restore the principles of the period between 1933 and 1981, when members of both political parties widely shared the belief that the government should regulate business, provide a basic social safety net, promote infrastructure, and protect civil rights. And I write about how that so-called liberal consensus broke down as extremists used the Reconstruction-era image of the American cowboy—who, according to myth, wanted nothing from the government but to be left alone—to stand against what they insisted was creeping socialism that stole tax dollars from hardworking white men in order to give handouts to lazy minorities and women.

But five major stories over the past several days made me realize that I’ve never written about how Trump and his loyalists have distorted the cowboy image until it has become a poisonous caricature of the values its recent defenders have claimed to champion.

The cowboy myth originated during the Reconstruction era as a response to the idea that a government that defended Black rights was “socialist” and that the tax dollars required to pay bureaucrats and army officers would break hardworking white men.

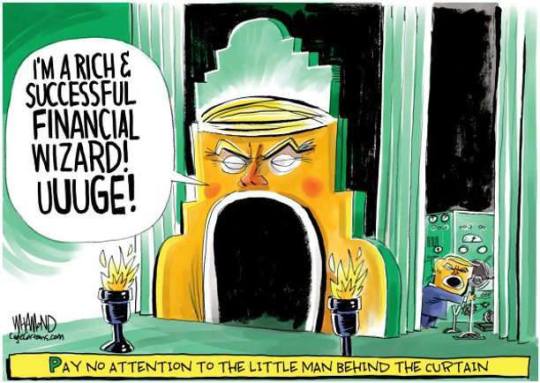

This weekend, on Saturday, May 11, Paul Kiel of ProPublica and Russ Buettner of the New York Times teamed up to deliver a deep investigation into what Trump was talking about when he insisted that he must break tradition and refuse to release his tax returns when he ran for office in 2016 and 2020, citing an audit.

The New York Times had already reported that one of the reasons the Internal Revenue Service was auditing Trump’s taxes was that, beginning in 2010, he began to claim a $72.9 million tax refund because of huge losses from his failing casinos.

Kiel and Buettner followed the convoluted web of Trump’s finances to find another issue with his tax history. They concluded that Trump’s Chicago skyscraper, his last major construction project, was “a vast money loser.” He claimed losses as high as $651 million on it in 2008. But then he appears to have moved ownership of the building in 2010 from one entity to a new one—the authors describe it as “like moving coins from one pocket to another”—and used that move to claim another $168 million in losses, thereby double-dipping.

The experts the authors consulted said that if he loses the audit battle, Trump could owe the IRS more than $100 million. University of Baltimore law professor Walter Schwidetzky, who is an expert on partnership taxation, told the authors: “I think he ripped off the tax system.”

The cowboy myth emphasized dominance over the Indigenous Americans and Mexicans allegedly attacking white settlers from the East. On Friday an impressive piece of reporting from Jude Joffe-Block at NPR untangled the origins of a story pushed by Republicans that Democrats were encouraging asylum seekers to vote illegally for President Joe Biden in 2024, revealing that the story was entirely made up.

The story broke on X, formerly Twitter, on April 15, when the investigative arm of the right-wing Heritage Foundation, which promises to provide “aggressive oversight” of the Biden administration, posted photos of what it claimed were flyers from inside portable toilets at a migrant camp in Matamoros, Mexico, that said in broken Spanish: “Reminder to vote for President Biden when you are in the United States. We need another four years of his term to stay open.” The tweet thread got more than 9 million views and was boosted by Elon Musk, X’s owner.

But the story was fabricated. The flyer used the name of a small organization that helps asylum seekers, along with the name of the woman who runs the organization. She is a U.S. citizen and told Joffe-Block that her organization has “never encouraged people to vote for anyone.” Indeed, it has never come up because everyone knows noncitizens are not eligible to vote. The flyer had outdated phone numbers and addresses, and its Spanish was full of errors. Migrants who are staying at the encampment as they wait for their appointments to enter the U.S. say they have never seen such flyers, and no one has urged them to vote for Biden.

Digging showed that the flyer was “discovered” by the right-wing video site Muckraker, which specializes in “undercover” escapades. The founder of Muckraker, Anthony Rubin, and his brother, Joshua Rubin, had shown up at the organization’s headquarters in Matamoros asking to become volunteers for the organization; they and their conversation were captured on video, and signs point to the conclusion that they planted the flyers.

Nonetheless, Republicans ran with the story. Within 12 hours after the fake flyer appeared on X, Republican representatives Marjorie Taylor Greene (R-GA) and Dan Bishop (R-NC) brought posters of it to Congress, and Republicans made it a centerpiece of their insistence that Congress must pass a new law against noncitizen voting. Rather than being protected by modern-day cowboys, the woman who ran the organization that helps asylum seekers got death threats.

The cowboy image emphasized the masculinity of the independent men it championed, but the testimony of Stephanie Clifford, the adult film actress also known as Stormy Daniels, in Trump’s criminal trial for falsifying business records to cover up his payments to Clifford to keep her story of their sexual encounter secret before the 2016 election, turns Trump’s aggressive dominance into sad weakness. Covering Clifford’s testimony, Maureen Dowd of the New York Times yesterday wrote that “Trump came across as a loser in her account—a narcissist, cheater, sad Hugh Hefner wannabe, trading his satin pajamas for a dress shirt and trousers (and, later, boxers) as soon as Stormy mocked him.”

In the literature of the cowboy myth, the young champion of the underdog is eventually supposed to settle down and take care of his family, who adore him. But the news of the past week has caricatured that shift, too. On Wednesday, May 8, the Republican Party of Florida announced that it had picked Trump’s youngest son, 18-year-old Barron, as one of the state’s at-large delegates to the Republican National Convention, along with Trump’s other sons, Eric and Donald Jr.; Don Jr.’s fiancée, Kimberly Guilfoyle; and Trump’s second daughter, Tiffany, and her husband.

On Friday, May 10, Trump’s current wife and Barron’s mother, former first lady Melania Trump, issued a statement saying: “While Barron is honored to have been chosen as a delegate by the Florida Republican Party, he regretfully declines to participate due to prior commitments.” It is hard not to interpret this extraordinary snub from his own wife and son as a chilly response to the past month of testimony about his extramarital escapades while Barron was an infant.

Finally, there was the eye-popping story broken by Josh Dawsey and Maxine Joselow in the Washington Post on Thursday, revealing that last month, at a private meeting with about two dozen top oil executives at Mar-a-Lago, Trump offered to reverse President Joe Biden’s environmental rules designed to combat climate change and to stop any new ones from being enacted in exchange for a $1 billion donation.

Trump has promised his supporters that he would be an outsider, using his knowledge of business to defend ordinary Americans against those elites who don’t care about them. Now he has been revealed as being willing to sell us out—to sell humanity out—for the bargain basement price of $1 billion (with about 8 billion people in the world, this would make us each worth about 12 and a half cents).

Chief White House ethics lawyer in the George W. Bush administration Richard Painter wrote: “This is called bribery. It’s a felony.” He followed up with “Even a candidate who loses can be prosecuted for bribery. That includes the former guy asking for a billion dollars in campaign cash from oil companies in exchange for rolling back environmental laws.”

The cowboy myth was always a political image, designed to undermine the idea of a government that worked for ordinary Americans. It was powerful after the Civil War but faded into the past in the 1920s, 1930s, and 1940s as Americans realized that their lives depended on government regulation and a basic social safety net. The American cowboy burst back into prominence with the advent of the Marlboro Man in 1954, the year of the Supreme Court’s Brown v. Board of Education decision, and the idea of an individual white man who worked hard, wanted nothing from the government but to be left alone, was a sex symbol, and protected his women became a central myth in the rise of politicians determined to overturn the liberal consensus.

Now it seems the myth has come full circle, with the party led by a man whose wife rejects him and whose lovers ridicule him, who makes up stories about dangerous “others,” cheats on his taxes, solicits bribes, and tries to sell out his followers for cash—the very caricature the mythological cowboy was invented to fight.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters from An American#Heather Cox Richardson#history#Brown v Board of Education#myth of the cowboy#Ronald Reagan#fake stories#immigration#TFG taxes#tax fraud

16 notes

·

View notes