#expert tax consultants

Explore tagged Tumblr posts

Text

Simplifying Taxation for Individuals and Businesses Across Australia

Tax time can be complicated, but it doesn’t have to be stressful. At Collab Accounting, we help individuals and businesses navigate Australia’s ever-changing tax landscape with ease.

Why Choose Us?

Tax laws are constantly evolving and staying compliant while optimizing your tax position requires expert guidance. Our team stays up to date with the latest regulations to ensure you get accurate, hassle-free tax solutions tailored to your needs.

Our Tax Services

We offer a full range of tax services to make your life easier: 1. Tax Return Preparation & Filing – For individuals, businesses, trusts, and SMSFs. 2. Tax Planning & Advisory – Helping you structure finances for better tax outcomes. 3. ATO Liaison & Compliance – We handle ATO communications on your behalf.

What We Do

From managing tax preparations to preparing reports, we cover it all:

Processing bank and investment transactions

Preparing tax reconciliation summaries

Calculating tax offsets & depreciation

Handling provisions like Division 7A & FBT

What We Need from You

To ensure accurate filings, we’ll need:

Last year’s tax return

Our simple checklist filled out

Income & expense details

What We Deliver

Upon completion, you will receive:

A group tax summary

Details of tax payable amounts

A copy of the lodged tax return

Estimates of PAYG instalments payable for the next year

Beyond Tax – Additional Services We Offer

We don’t just stop at tax compliance. Our team can also help with:

Bookkeeping & BAS/IAS Reporting

Financial & Management Reporting

Payroll, Accounts Payable & Receivable

Self-Managed Super Funds (SMSFs)

At Collab Accounting, we’re here to make tax time smoother, simpler, and stress-free.

Get in touch today to see how we can help!

#tax planning australia#business tax solutions#tax services#expert tax consultants#tax returns#tax planning#taxation services

0 notes

Text

Navigate GST notices with ease. GST Ka Notice offers expert services for responding to all types of GST notices. Get professional help today!

#GST#GST notices#GST services#GST help#GST India#GST experts in India#GST Notice Reply#Tax Assistance#tax law firm services#professional GST help#Best GST Services in India#GST Services in India#reply to GST Notices#Best GST Lawyers in India#Reply to GST Assessment#GST notice services#Best GST Consultation in India#Corporate Lawyer in India#GST Consultation firm#Best taxation law firm#GST ka Notice

2 notes

·

View notes

Text

Required Summer Reading From The IRS: Transfer And Elective Payment Tax Rules

Portrait of a young brunette relaxing on the beach, reading a book

getty

Treasury and the IRS promised to release guidance on direct pay and transferability “before summer,” and with proposed regs (REG-101610-23) issued June 14, they met their deadline admirably. Announcing a precise time frame for when proposed rules will be released is less important than their substance, but it’s still a practice that the IRS and Treasury should continue.

It’s painful to hear government officials intone the refrain that “guidance should be coming soon.” Let’s have more dates to put on the calendar.

Clarification of the rules under sections 6417 and 6418 is what taxpayers wanted in the proposed regulations, and that’s what they deliver — for the most part. They are less generous than some commentators had hoped. The market for credit transfers will be less expansive than it might have been had the passive activity rules been swept away.

At least for now, the proposed regulations don’t allow an applicable entity to purchase a credit and then seek an elective payment for the credit, although the preamble indicates that the IRS and Treasury will entertain possible exceptions. The registration process still has large open questions, but the transferee gross income exclusion is a welcome clarification for potential buyers.

The proposed regulations add necessary details to the new regime and include policy decisions. The elective payment rules appear to be intended to enable the use of elective payment, said Adam Cohen of Holland & Hart. Cohen pointed out that instrumentalities and agencies of state and local governments, as well as U.S. territories, are included within the definition of applicable entities in the proposed section 6417 rules.

The exclusion of partnerships seems incongruous, but the complexity of applying sections 6417 and 6418 may explain it. “From a tax logic perspective, they found the right balance, particularly in the section 6418 regulations,” said Chaim Stern of Schulte Roth & Zabel LLP.

MORE FROMFORBES ADVISOR

Combining Transfers and Elective Payment?

The answer to whether an applicable entity could purchase credits under section 6418(a) and make an elective payment election is proposed to be no – but not a completely firm no. The preamble to the section 6417 rules says that its conclusion that “sections 6417 and 6418 are best interpreted to not allow an applicable entity under section 6417 to make an elective payment election for a transferred credit under section 6418” was informed by administrative and practical reasons given by commentators.

The preamble also connects its conclusion to the text of section 6417(a). Treasury and the IRS explained that they believe that transferred credits are not “determined with respect to” an applicable entity, as required by section 6417(a).

That is because the credit is not determined with respect to underlying applicable credit property owned by the applicable entity or electing taxpayer, or activities otherwise conducted by the entity or taxpayer under section 6417(a).

And the proposed section 6418 regulations say that transferees are not considered to have owned an interest in the underlying credit property or to have otherwise conducted any of the activities that give rise to the credit. That isn’t a statutory reason to disallow chaining, but doing so maintains consistency between the two sets of proposed regs.

The preamble invites comments on possible exceptions to the proposed bar on chaining, indicating a surprising flexibility that is tempered by the specificity that’s also requested. Suggested limitations to any exceptions include the type of applicable entity that may be allowed to make a direct payment election for credits transferred to it — government entities are offered as an example — and the transferee taxpayer’s involvement in the project’s development.

The other possible considerations are more difficult to distinguish from other types of transfers. They include the transferee’s due diligence, the fact that the transferee pays close to the face value of the credit, and the lack of other special financial arrangements between the parties. Transferees of all types should be expected to do due diligence, and they’ll likely all pay about 93% to 98% of the credit.

The outlined considerations suggest that Treasury and the IRS might provide exceptions if they are satisfied that they won’t be opening the transfer and elective payment regimes up for fraud or abuse. Commentators will almost certainly advocate for exceptions.

Registration

In order to claim the benefits provided by section 6417 or 6418, taxpayers must complete prefiling registration requirements in accordance with temp. reg. sections 1.6417-5T or 1.6418-4T. The online registration portal isn’t ready yet, but the preamble to the temporary regs says its opening deadline of fall 2023 is one justification for putting out temporary regs instead of proposed rules.

Transferees and elective payment claimants will need to reference their registration number when claiming their credits, which raises the question of how long it will take the IRS to review pre-registrations. The FAQs warn taxpayers to leave enough time to obtain a registration number, Cohen noted, but it isn’t clear what that means. It may depend on the depth of the IRS’s review, another open question.

Seth Feuerstein of Atheva, a marketplace for IRA credits, said it would be helpful if the IRS offered the timeline it expects to follow for assigning registration numbers to taxpayers. “It could create a problem if the IRS says they’re not able to review a pre-registration in time and the transferee can’t take the credit,” he noted.

It also isn’t clear whether the review will be substantive or focused on limited items intended to prevent fraud. Feuerstein said it should be the latter. “It’s not clear why a substantive review of a transferred credit would be more critical than a substantive position any taxpayer is taking,” he said.

Under the temporary regs, taxpayers will register eligible credit property and the registration number will apply to all the credits associated with that property. For production tax credits, that might lead to some tracking and accounting challenges.

Because the registration number will refer to the underlying property rather than the unit of production, if a taxpayer sells production tax credits from a single facility to multiple buyers, those amounts will all have to be added up and accounted for under a single registration number.

Stern said a better idea would be to register each unit of production as it is produced. “If a solar facility that is producing electricity has a single registration number for its production and sales to various buyers over the course of a number of years, it becomes very hard to track the total credit amount,” he said.

That increases the risk of double counting. A separate registration number for each unit would make the tracking simpler for taxpayers and the IRS.

Gross Income Exclusion

The proposed section 6418 regulations give many commentators what they sought regarding how to treat the difference between the amount a buyer pays for a credit and the amount of the credit that the buyer claims. Affirming what some congressional staffers indicated, that amount is excluded from taxable income under the proposed regs.

The rationale for the transferee gross income exclusion is that under section 6418(a), the transferee is treated as the taxpayer for purposes of title 26 concerning a transferred eligible credit. The preamble explains that an eligible taxpayer wouldn’t have gross income from claiming the credit, and the transferee shouldn’t either.

But the statute doesn’t say that the transferee is treated as the eligible taxpayer, merely that the transferee is treated “as the taxpayer.” That language is how the transferee gains the ability to apply the credit to its own tax liability, but it doesn’t expressly address the transfer’s tax effects, or lack thereof, on the transferee. It only describes the treatment of the transferee after the transfer.

Congress should have more clearly excluded the delta of the purchase price of the credit and the claimed amount of the credit from the buyer’s gross income. A technical correction was never very likely, and it won’t happen now in light of the proposed regulations.

The practical effect of including the difference in gross income would be that transferees would pay less for credits to account for the tax they owe. Notably, in 2011, the IRS’s conclusion concerning transferable state credits contradicted the rule prescribed in the proposed regulations (CCA 201147024).

Monte A. Jackel of Jackel Tax Law said that the proposed exclusion is solely a creature of the proposed regulations, not the statute, since section 6418(b) is silent on the treatment of the transferee’s income, if any, because of the discount — section 6418(b)(3) says only that the consideration the transferee pays is not deductible.

Read more here https://au3.s3-web.ca-tor.cloud-object-storage.appdomain.cloud/Taxation-Insider/US-Tax/US-Tax-Service-for-Americans-in-Portugal-Simplifying-Tax-Compliance-for-Expats-in-Portugal.html

2 notes

·

View notes

Text

Having expert income tax consultants in Panipat, Haryana working on the finance is a huge relief on its own.

Visit us at - https://www.advikaenterprises.org/about.html

0 notes

Text

BKThakur: Leading Accounting Company in Delhi for Business & Tax Services

BKThakur is Delhi's top choice for expert business accounting and tax services. As a leading accounting company, we offer comprehensive solutions tailored to your business needs, ensuring accuracy and compliance. Our experienced team of chartered accountants specializes in managing your finances, optimizing tax strategies, and providing reliable guidance. Whether you're a small business or a large corporation, BKThakur delivers personalized services designed to help you achieve financial success. Trust us to handle everything from routine accounting tasks to complex tax consultations. Partner with BKThakur for top-tier business and tax services in Delhi, and experience the difference of working with industry experts.

#"accounting company in delhi#business accounting services in delhi#charted accountant firm in delhi#chartered tax consultant services in delhi#business accounting and tax optimization experts in Delhi#Best accounting and tax services in Delhi#industry experts for business and tax services#leading accounting services for large corporations in Delhi

0 notes

Text

Best Accounting Firms in Abu Dhabi @0502510288

Accounting and Bookkeeping Company in UAE - We are one of the best Accounting firms in Abu Dhabi, Dubai UAE provides top finance vision etc. Even though there are numerous accounting firms all over Abu Dhabi, this guide for selecting the right partner for your financial management includes top organizations.

#accountants in abu dhabi#accounting & finance expert in uae#accounting and bookkeeping companies in uae#accounting companies in abu dhabi#accounting companies in uae#accounting company in abu dhabi#accounting firms in abu dhabi#accounting firms in business bay dubai#audit firms in abu dhabi#best business consultancies in uae#best business consultants in uae#best business setup consultants in uae#bookkeeping and accounting firms in abu dhabi#business consultancy firms in uae#business consulting companies in uae#business consulting firms in dubai#business set up consultants in uae#business setup services and consultants in uae#compliance & regulatory reporting services in the uae#compliance services in uae#compliance services uae#internal audit consultants in uae#audit & assurance consultant uae#corporate banking & finance advisory in the uae#corporate finance services uae#erp advisory services in uae#financial regulatory compliance services uae#mainland business setup consultants in dubai#corporate tax planning dubai#management consulting firms in uae

0 notes

Text

0 notes

Text

Simplify Your Finances with Expert Accounting and Tax Consultancy

Managing your taxes and accounting can be overwhelming, especially with ever-changing regulations. Whether you're a business owner or an individual, hiring a professional tax consultant can save you time, money, and stress. From maximizing deductions to ensuring compliance, experts help streamline your financial journey.

If you're looking for reliable guidance, explore our services. Let us take the complexity out of taxes so you can focus on what matters most. To get the Best Tax consultant in USA please visit the link theaccountingandtax.com

#accounting#Tax consultant in Toronto#Best Tax consultant in Canada#Best Tax consultant in USA#Tax preparation expert in USA#Tax preparation expert in canada#Tax consultation service in Toronto#US Tax consultants in Toronto#Canadian Tax Consulting Service#International Tax Consultants in Toronto#Expats Tax Consultant in Toronto#tax consulting services

1 note

·

View note

Text

Expert SMSF Advisory and Administration Services in Sydney and Cooma

Managing your Self Managed Superannuation Fund (SMSF) is a critical responsibility for ensuring the financial future of your business or clients. Whether you're based in Sydney, Cooma, or surrounding areas, expert SMSF advisory and administration services are essential to navigate the complexities of superannuation fund management effectively.

At Majura Consulting, we specialize in providing comprehensive SMSF advisory in Sydney and Cooma, helping businesses maximize their superannuation strategies while ensuring full compliance with Australian regulations. Our team of dedicated SMSF administrators brings years of experience and expertise, guiding clients through every step of their SMSF journey��from fund establishment to ongoing compliance and reporting.

Why Choose Majura Consulting for SMSF Advisory?

Our SMSF specialists are well-versed in the intricacies of self-managed funds and provide tailored advice that aligns with your business objectives. We offer strategic SMSF advisory services in Sydney and Cooma, focusing on:

Establishing and Structuring SMSFs: We assist clients in setting up SMSFs that are legally compliant, tax-efficient, and aligned with long-term financial goals. Our guidance ensures a smooth establishment process, helping you choose the right trustees and structuring options.

Compliance and Reporting: Compliance is crucial for the ongoing success of an SMSF. Our SMSF administrators in Sydney and Cooma ensure your fund meets all regulatory requirements, including annual audits, tax returns, and contribution tracking.

Investment Strategy and Risk Management: We help you develop tailored investment strategies that align with your financial goals while managing potential risks. Our advice is designed to enhance the growth of your SMSF and secure your financial future.

Ongoing SMSF Administration: Our SMSF administrators provide ongoing management services to ensure your fund operates efficiently and in line with ever-changing regulations. From financial reporting to fund audits, we take care of all aspects of SMSF administration.

A Trusted Partner in SMSF Management

Majura Consulting is your trusted partner for all SMSF advisory and administration needs in Sydney and Cooma. With our deep understanding of SMSF regulations and commitment to personalized service, we ensure that your self-managed superannuation fund remains compliant, efficient, and primed for growth.

Contact us today to learn more about how our SMSF advisory and administration services can benefit your business and secure a prosperous future for your superannuation fund.

#Top Accountants in Cooma#Accountant in Sydney#Bookkeeper in Cooma#Business Advisors in Cooma#Tax consultant in Sydney#Tax consulting in Cooma#SMSF advisory in Sydney#SMSF Administrators in Sydney#Audit Services in Cooma#Expert Auditing in Cooma#Business Structuring in Cooma#Tax services in Sydney

0 notes

Text

The Growing Trend of Non-Traditional Accounting Firms: What It Means for You

The financial world is evolving rapidly, and businesses are now leaning toward non-traditional accounting firms for more than just routine tasks. Unlike traditional firms, these modern accounting companies focus on providing holistic financial solutions, combining technology, expert advice, and personalized strategies.

For instance, FinOut, a leading accounting firm in Hyderabad, is at the forefront of this transformation. They not only manage day-to-day finances but also deliver data-driven insights to help businesses make strategic decisions.

Businesses in local areas like Punjagutta are reaping the benefits of specialized services. FinOut offers comprehensive accounting services in Punjagutta, Hyderabad, tailored to meet the unique challenges of small and medium enterprises. From bookkeeping and tax compliance to investment facilitation, FinOut ensures your financial operations are seamless and compliant.

Recognized as the best CA firm in Punjagutta, FinOut’s innovative approach empowers businesses to stay ahead. Their expertise extends beyond number crunching, enabling businesses to achieve long-term growth and stability with practical, actionable advice.

Switching to a non-traditional accounting partner like FinOut is not just about managing finances—it’s about unlocking the full potential of your business. Whether you’re a startup or an established company, these firms offer unparalleled support to navigate complex financial landscapes and succeed.

#tax experts in hyderabad#chartered accountant#tax consultants in punjagutta#best financial advisors in hyderabad#gst consultants in punjagutta#accounting firm in hyderabad#best ca firm in hyderabad#accounting services in punjagutta#chartered accountants in hyderabad#finout

0 notes

Text

Expert Taxation Services in Australia | Collab Accounting

Simplify your tax obligations with Collab Accounting's expert taxation services. We offer personalized advice and solutions for individuals and businesses across Australia. Maximize your refunds and stay compliant with our experienced team.

#taxation services Australia#tax compliance#tax advice#individual tax#business tax solutions#tax planning Australia#Collab Accounting#expert tax consultants#maximize tax refunds#Australian tax specialists

0 notes

Text

Advisory Service in uae

Navigate the complexities of business with LGA Auditing, your trusted partner for advisory services in the UAE. Our experienced team offers tailored solutions to help your business grow and succeed.

Our services include:

1. Financial Advisory: Optimize your finances with expert guidance. 2. Business Setup Consulting: Seamless company formation in UAE. 3. Tax Advisory: Stay compliant with UAE tax regulations. 4. Risk Management: Mitigate risks and ensure long-term success.

Whether you're a startup or an established enterprise, we provide strategic insights to make informed decisions.

#Auditing Firm Dubai#LGA Auditing UAE#Financial Audit Services#Tax Compliance Dubai#Internal Audits UAE#External Auditing Experts#Accounting and Auditing#VAT Audits Dubai#Corporate Audit Solutions#Risk Management Dubai#Financial Statement Audit#Audit and Assurance Dubai#Business Compliance Audits#Dubai Audit Consultants

0 notes

Text

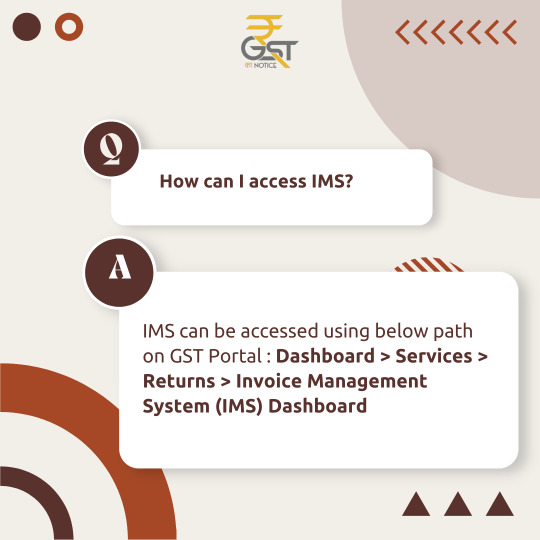

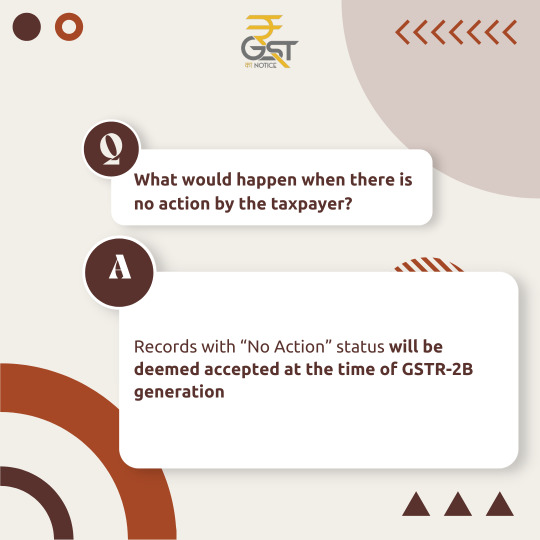

FAQs on Invoice Management System (IMS)... Find your information... For any assistance visit- gstkanotice.com or DM GST ka Notice

#gst #gstkanotice #gstindia #gstn #gstfact #gstupdates #ims #gstreturn #gstregistration #gstnotice #cbic #dggi #ca #tax #taxlaw #indirecttax #finance #business #budget #gstcouncil #gstcouncilmeeting

#best gst consultation in india#best gst lawyers in india#best gst services in india#best taxation law firm#corporate lawyer in india#gst#gst consultation firm#gst experts in india#gst help#gst india#gst assistance#gst services in india#gst services#gstreturns#gst registration#tax#taxation#gstfiling#gst compliance#ims#invoice management system#faq

0 notes

Text

Whoever owns a business, regardless of its scale, knows how vital it is to manage the finances.

Get in touch - https://www.advikaenterprises.org/about.html

0 notes

Text

BKThakur: Leading Accounting Company in Delhi for Business & Tax Services

BKThakur is Delhi's top choice for expert business accounting and tax services. As a leading accounting company, we offer comprehensive solutions tailored to your business needs, ensuring accuracy and compliance. Our experienced team of chartered accountants specializes in managing your finances, optimizing tax strategies, and providing reliable guidance. Whether you're a small business or a large corporation, BKThakur delivers personalized services designed to help you achieve financial success. Trust us to handle everything from routine accounting tasks to complex tax consultations. Partner with BKThakur for top-tier business and tax services in Delhi, and experience the difference of working with industry experts.

#accounting company in delhi#business accounting services in delhi#charted accountant firm in delhi#chartered tax consultant services in delhi#business accounting and tax optimization experts in Delhi#comprehensive financial solutions for small businesses in Delhi#Best accounting and tax services in Delhi#industry experts for business and tax services

0 notes

Text

Why Your Business Needs a VAT Consultant in Dubai

The subject of fixed taxes is very sensitive in the present world, especially when the companies are on the move. It has become a prerequisite to manage the organizations and to follow all the regulations since the implementation of Value Added Taxation (VAT) in United Arab Emirates in the year 2018. Currently, marketing in Dubai is one of the most developed in the region and businesses cannot afford large errors.

That is why accounting firms in Abu Dhabi become extremely important at this step. It is in this blog that we speak of the importance of VAT consultation in Dubai, why it is important to deal with a qualified agency in this field, and why this path is useful for your business.

1. Understanding VAT Regulations

Value Added Tax, or VAT is a consumption tax is levied upon the concept of value additions that transpire in the course of production or circulation. The normal VAT rate applied in the United Arab Emirates is 5 percent. However, that might sound easy; value-added tax laws are challenging to impose because they are couched in relative pecuniary flexibility, which changes with respect to the business, sector, and type of transaction.

Businesses that don't have a thorough understanding of local tax rules find handling VAT compliance to be a nightmare. The VAT consulting organizations situated in the United Arab Emirates are skilled at understanding the specifics of these laws. An accounting company in Abu Dhabi will assist your company in managing these complexities and staying up to date on any modifications or new decisions issued by the Federal Tax Authority.

2. Decreasing the Threat of Non-Compliance

Value Added Tax laws impose hefty fines, penalties, and occasionally even legal consequences for noncompliance. Missed deadlines and inaccurate VAT filing are just two examples of mistakes that will cost your business severely. Even small mistakes might result in significant financial loss and harm to your company's image.

By working with an accounting company in Abu Dhabi, you may reduce the risks of non-compliance in this regard. You will receive registration guidance, exact return preparation, and records that properly adhere to legal requirements from a group of tax professionals. In order for you to properly handle compliance issues and avoid missing any deadlines, they will also offer extra assistance. Your company will avoid costly errors and maintain a positive relationship with the FTA in this way.

3. Cash Flow Optimization

Maintaining appropriate cash flow is one of the key concerns and, in fact, the goal of any organization, and VAT has a significant impact on this. Consulting firms for VAT in Dubai assist you in optimizing your cash flow by suggesting effective VAT recovery strategies. This is crucial for a company that imports, exports or conducts substantial transactions.

They make sure your company is reporting VAT where it is due and that you are not overpaying. Additionally, the audit & assurance consultant UAE may help you organize your transactions to minimize your VAT duty and optimize recovery, which will improve the cash flow of your company.

4. VAT Strategies Tailored to Suit Your Business

A one-size-fits-all strategy for VAT compliance can be incredibly ineffective because every organization is different. Professional VAT consultancy in Dubai takes the time to understand your company's operations, sector, and unique requirements. Based on that information, it then offers customized solutions that are suited to the VAT needs of your business.

A reputable audit & assurance consultant in UAE will assist you in aligning your tax tactics with your business goals, regardless of how big or small your company is. This will include efficient supply chain management for VAT, efficient tax planning, and tailored solutions for international transactions.

5. Focus on Core Business Functions

It takes a lot of effort to manage VAT compliance internally, which takes resources from the main operation. It takes a lot of effort and experience to file VAT, understand the new rules, and guarantee that tax returns are accurate. In this situation, it is preferable to hire experts to handle the VAT compliance job rather than using your own internal resources so that you may concentrate on the expansion of your company.

All compliance issues, from filing returns to providing advice on complex tax issues, can be handled by these VAT consultants. You will no longer have to worry about VAT compliance, freeing you up to concentrate on market share growth, client acquisition, and innovation.

Conclusion

VAT compliance is a different story when it comes to companies in Dubai because it’s integral to be able to compete in the global market. Accounting firms in Abu Dhabi may help you remain compliant with all the tax regulations, avoid such expensive pitfalls and ensure business processes’ smooth running. Thus, the correct management of VAT, risk minimization, and increased cash flow is critical to sustain and develop your company in the context of the relatively high rate of competition in Dubai.

#accountants in abu dhabi#accounting & finance expert in uae#accounting and bookkeeping companies in uae#accounting companies in abu dhabi#accounting companies in uae#accounting company in abu dhabi#accounting firms in abu dhabi#accounting firms in business bay dubai#audit firms in abu dhabi#best business consultancies in uae#best business consultants in uae#best business setup consultants in uae#bookkeeping and accounting firms in abu dhabi#business consultancy firms in uae#business consulting companies in uae#business consulting firms in dubai#business set up consultants in uae#business setup services and consultants in uae#compliance & regulatory reporting services in the uae#compliance services in uae#compliance services uae#internal audit consultants in uae#audit & assurance consultant uae#corporate banking & finance advisory in the uae#corporate finance services uae#erp advisory services in uae#financial regulatory compliance services uae#mainland business setup consultants in dubai#corporate tax planning dubai#management consulting firms in uae

0 notes