#rebate cheques

Explore tagged Tumblr posts

Text

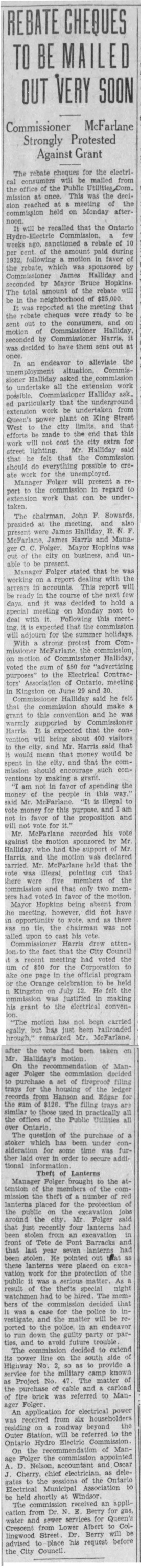

"REBATE CHEQUES TO BE MAILED OUT VERY SOON," Kingston Whig-Standard. June 20, 1933. Page 2. ---- Commissioner McFarlane Strongly Protested Against Grant --- The rebate cheques for the electrical consumers will be mailed from the office of the Public Utilities Comimission at once. This was the decision reached at a meeting of the commission held on Monday after-noon.

It will be recalled that the Ontario Hydro-Electric Commission, a few weeks ago, sanctioned a rebate of 10 per cent. of the amount paid during 1932, following a motion in favor of the rebate, which was sponsored by Commissioner James Halliday and seconded by Mayor Bruce Hopkins. The total amount of the rebate will be in the neighborhood of $25,000.

It was reported at the meeting that the rebate cheques were ready to be sent out to the consumers, and on motion of Commissioner Halliday, seconded by Commissioner Harris, it was decided to have them sent out at once.

In an endeavor to alleviate the unemployment situation, Commissioner Halliday asked the commission to undertake all the extension work possible. Commissioner Halliday asked particularly that the underground extension work be undertaken from Queen's power plant on King Street West to the city limits, and that efforts be made to the end that this work will not cost the city extra for street lighting. Mr. Halliday said that he felt that the Commission should do everything possible to create work for the unemployed.

Manager Folger will present a report to the commission in regard to extension work that can be undertaken.

The chairman, John P. Sowards, presided at the meeting, and also present were James Halliday, R. N. F.McFarlane, James Harris and Manager C. C. Folger. Mayor Hopkins was out of the city on business, and unable to be present.

Manager Folger stated that he was working on a report dealing with the arrears in accounts. This report will be ready in the course of the next few days, and it was decided to hold a special meeting on Monday next to deal with it. Following this meeting, it is expected that the commissionwill adjourn for the summer holidays.

With a strong protest from Commissioner McFarlane, the commission, on motion of Commissioner Halliday, voted the sum of $50 for "advertising purposes" to the Electrical Contractors' Association of Ontario, meeting in Kingston on June 29 and 30.

Commissioner Halliday said he felt that the commission should make a grant to this convention and he was warmly supported by Commissioner Harris. It is expected that the convention will bring about 400 visitors to the city, and Mr. Harris said that it would mean that money would be spent in the city, and that the commission should encourage such conventions by making a grant.

"I am not in favor of spending the money of the people in this way," said Mr. McFarlane. "It is illegal to vote money for this purpose, and I am not in favor of the proposition and will not vote for it."

Mr. McFarlane recorded his vote against the motion sponsored by Mr. Halliday, who had the support of Mr.Harris, and the motion was declared carried. Mr. McFarlane held that the vote was illegal, pointing cut that there were five members of the commission and that only two members had voted in favor of the motion.

Mayor Hopkins being absent from the meeting, however, did not have an opportunity to vote, and as there was no tie, the chairman was not called upon to cast his vote.

Commissioner Harris drew attention to the fact that the City Council it a recent meeting had voted the sum of $50 for the Corporation to take out one page in the official program for the Orange celebration to be held in Kingston on July 12. He felt the commission was justified in making this grant to the electrical convention. "The motion has not been carried legally, but has just been railroaded through," remarked Mr. McFarlane, after the vote had been taken on Mr. Halliday's motion.

On the recommendation of Manager Folger the commission decided to purchase a set of fireproof filing trays for the housing of the ledger records from Hanson and Edgar for the sum of $126. The filing trays are similar to those used in practically all the offices of the Public Utilities all over Ontario. The question of the purchase of a stoker which has been under consideration for some time was further laid over in order to secure additional information.

Theft of Lanterns Manager Folger brought to the attention of the members of the commission the theft of a number of red lanterns placed for the protection of the public on the excavation jobs around the city. Mr. Folger said that just recently four lanterns had been stolen from an excavation in front of Tete de Pont Barracks and that last year seven lanterns had been stolen. He pointed out that as these lanterns were placed on excavation work for the protection of the public was a serious matter. As a result of the thefts special nightwatchmen had to be hired. The members of the commission decided that it was a case for the police to investigate, and the matter will be reported to the police, in an endeavor to run down the guilty party or parties, and to avoid future trouble.

The commission decided to extend its power line on the south side of Highway No. 2, so as to provide a service for the military camp known as Project No. 47. The matter of the purchase of cable and a carload of fire brick was referred to Manager Folger.

An application for electrical power was received from six householders residing on a roadway beyond the Outer Station, will be referred to the Ontario Hydro Electric Commission.

On the recommendation of Manager Folger the commission appointed A. D. Nelson, accountant and Oscar J. Cherry, chief electrician, as delegates to the sessions of the Ontario Electrical Municipal Association to be held shortly at Windsor.

The commission received an application from Dr. N. E. Berry for gas, water and sewer services for Queen's Crescent from Lower Albert to Collingwood Street. Dr. Berry will be advised to place his request before the City Council.

#kingston ontario#public utilities#hydro-electric commission#ontario hydro#public electricity#municipal politics#municipal government#public money#rebate cheques#electric city#great depression in canada

0 notes

Text

NDP Leader Jagmeet Singh is calling on the Liberal government to go back to the drawing board after learning that the Working Canadians Rebate won't apply to many seniors, people with disabilities and recent graduates.

Prime Minister Justin Trudeau announced last week that his government plans to lift the GST from some essential goods for two months to offer Canadians some relief from cost-of-living pressures.

He also said his government plans to send $250 rebate cheques to Canadians who worked in 2023 and had incomes of up to $150,000.

Continue reading

Tagging: @newsfromstolenland

#federal cheques#working canadians rebate#rebates#cdnpoli#canada#canadian politics#canadian news#canadian

182 notes

·

View notes

Text

Man… as much as this laid off bullshit & barely making enough money to survive for 8 weeks truly does SUCK.

The break from that fucking hell hole (affectionate) And some of those terribly toxic people(truth) is fantastic. I havent cried since my last shift…

Despite having no money for groceries, that also means no take out which has forced me into the better habit of cooking for myself & making food at home from what we have. The house is clean, I’ve got more energy, i’m getting my walks/steps/activity in daily which is giving me more energy. I’ve actually got the motivation to put me first for the first time in a LONG time so there is a blessing in this bullshit. (Now if only i had the money to go buy healthy food & pick up some skin care… lool)

(If anyones into that health shit & wants to follow along/join in you can find me over on insta at kattwylliewellness)

#personal#little life update#its the little things right?#im feeling almost fully back on my fitness/health bullshit and thats *fantastic*#thank god for that gst rebate cheque LOL#now lets manifest a ton of creative energy flow so i can power through all my wips👀#pls?#🥺🥺🙏🏻🙏🏻🕯️🕯️✨✨✨

6 notes

·

View notes

Text

Seeing all the American comments on the post about cheques reminded me of just how backwards we are here in Canada about banking. (This is mostly unrelated to the big CBC article on abuse via bank transfers today, as that's a different kettle of fish).

Because while personal cheques are vanishingly rare these days (wait... I remember... the last time I used one was for a wedding gift), we still use them in business settings. My husband's lab has just settled into their new space, which means that the incentive rebates from the landlord just kicked in, and they came as a cheque. (My husband took a picture just because of how big a number it was, it was the most money that's every going to cross his desk). The library issued me one when the book that hadn't gotten checked in properly got returned by whoever had it, so it was no longer lost and I was due a rebate for having paid the replacement fee.

I think there might even be some edge cases where you can manage to get one from the government, although I'm not sure, there might be a different way of handling the edge cases.

#It's been less than 20 years of chip and pin#and I'm pretty sure we were behind the curve on RFID too

4 notes

·

View notes

Note

What's Ovi's role in the pack AU? Does he help the resistance? How does he feel about robuttnik and his supporters?

Ovi helps the Resistance, alright. Harold picked Ovi up from Circus Daycare, since unlike my version of the Modern Verse, Sonic isn't around to sweep Ovi off his feet and lead him away. Ovi ends up becoming Harold's little spy against Eggman - constantly getting on the man's 'good graces' by acting like the rebellious teenager he is and wanting to become Eggman's 'apprentice' to piss off Harold. In truth, Ovi absolutely hates this, and Eggman makes it every opportunity to make sure the Resistance hates Ovi entirely.

This makes Ovi even more upset and, frankly, miserable about his life, so instead of running away from this... Ovi takes his days off hiding in a Gadget the Wolf ™️ hoodie and places a Gadget the Wolf ™️ face mask over his face, and essentially becomes the number one fictional crime fighter of Obsidianna: Gadget the Wolf ™️! Now, he can run around being who he wants to be, and not act like all the stuck up snobs getting cozy with Eggman's rebate cheques all the damn time.

#aquillis answers#shady guy#Sonic Underground#Pack AU#Julian 'Ovi' Kintobor#Sonic OC#Sonic Original Character

3 notes

·

View notes

Text

What is Property Tax? A Complete Guide to Understanding Property Taxes

If you own property in India, you are likely familiar with the term property tax, yet many might not fully understand its significance, calculation, and implications. Whether you own a home, office, or commercial space, this annual property tax guide will provide you with all the essential details about property tax, including its purpose, calculation methods, payment options, exemptions, and consequences of non-payment.

What is Property Tax?

Property tax is an annual tax levied by the local government or municipal corporation on real estate owners. It serves as a key source of revenue for local governing bodies to fund public services, such as:

Road maintenance

Waste management

Water supply

Parks and recreational facilities

Local law enforcement

For example, in Mumbai, the Brihanmumbai Municipal Corporation (BMC) collects property tax. This tax applies to both residential and commercial properties, with rates and calculations varying depending on the location and property type.

How to calculate property tax?

The property tax amount is determined based on the annual value or valuation of the property by the local municipal authority. Factors affecting property tax include:

Type of Property: Different property types��residential, commercial, or industrial—carry different tax rates.

Property Size: The larger the property, the higher the tax. This includes the built-up area, carpet area, or plot size, depending on local regulations.

Age of the Building: Older properties may attract lower taxes due to depreciation, whereas new constructions may have higher rates.

Location: Urban areas and prime locations often have higher property taxes than rural or less-developed regions.

Property Use: Properties used for residential purposes typically have lower tax rates compared to those used for commercial activities.

How to Pay Property Tax

Property tax can be paid annually or semi-annually, either through your housing society as part of the maintenance bill or directly to the municipal corporation. Most local governments offer online portals where property owners can check dues, make secure payments, and download receipts. For those who prefer offline methods or lack online access, payments can be made in person at the municipal office using cash, cheque, or demand drafts..

What are the Consequences of Non-Payment?

Failing to pay property tax can lead to serious financial and legal repercussions:

Penalties: Municipal corporations impose fines or interest on unpaid property tax. These penalties can accumulate over time, significantly increasing the amount owed.

Legal Actions: Chronic non-payment can result in legal action by the municipal authority, including attaching or auctioning the property to recover dues.

Restrictions on Property Sale: If property tax dues are pending, you cannot sell your property until all taxes are cleared. Municipal authorities require a tax clearance certificate for any property transaction.

Property tax exemptions in India

Certain properties or property owners may qualify for exemptions or rebates on property tax:

Maharashtra: Residential properties under 500 sq. ft. are exempt.

Senior Citizens: Some states offer discounts to senior citizen property owners.

NGO Properties: Properties owned by charitable trusts or NGOs might receive partial or full exemptions.

Why is Property Tax Important?

Paying property tax is a civic responsibility that benefits both the individual and the community. Here's why it matters:

Funds Local Development: Ensures the upkeep of public services and infrastructure in your area.

Maintains Property Rights: Helps maintain the legality of your property transactions.

Avoids Penalties: Timely payments save you from unnecessary fines and legal trouble.

Conclusion

Property tax is a vital part of property ownership in India. It ensures the proper functioning of local infrastructure and services while maintaining the legality of your property. By staying informed about your property tax obligations, exemptions, and payment methods, you can avoid penalties and contribute to your community's development. Always prioritize timely payments and take advantage of any benefits or rebates applicable to your property. Being a responsible property owner begins with understanding and fulfilling your tax responsibilities.

FAQs

What is property tax used for? Property tax funds local infrastructure and public services such as road maintenance, waste management, water supply, schools, and law enforcement.

Who is responsible for paying property tax? The property owner is responsible for paying property tax. If you own a property, whether residential, commercial, or industrial, you must pay the tax annually or semi-annually to your local municipal corporation.

What happens if I don’t pay property tax? Non-payment of property tax can lead to fines, penalties, and legal consequences. Additionally, you cannot sell your property unless all outstanding taxes are cleared.

Can tenants pay property tax? No, property tax is the responsibility of the property owner, not the tenant.

Can I pay property tax online? Yes, most municipal corporations offer online payment options through their official portals. This allows you to pay securely and download payment receipts for your records.

0 notes

Text

How to Use GST Voucher in Singapore

The Products and Administrations Charge( GST) is a utilization obligation exacted on the drive of merchandise and administrations in Singapore. Presented in 1994 at a rate of 3, the GST has since expanded to 8 as of 2024. To offer assistance lower- pay homes oversee with the GST, the Singapore government presented the GST Voucher( GSTV) plot in 2012. This plot serves as portion of a broader procedure to guaranteed that the obligation framework remains dynamic. Through the GST Voucher, qualified Singaporeans concede financial back, making a difference to neutralize the affect of the GST on their taken a toll of living. This composition diagrams how the GST Voucher works, who's qualified for it, and the colorful ways it can be utilized.

.

What is the GST Voucher?

The GST Voucher is a financial assistance initiative by the Singapore government to support lower-income individuals and families. The voucher comes in different forms, catering to various needs:

GST Voucher – Cash: This component provides direct financial assistance to help lower-income Singaporeans cope with GST and offset their daily living expenses. It is credited directly into their bank accounts.

GST Voucher – MediSave: This form is meant to assist senior citizens by contributing to their MediSave accounts. The funds can be used for healthcare expenses, including hospital stays, outpatient treatments, and other approved medical expenses.

GST Voucher – U-Save: The U-Save component helps households living in HDB flats by offsetting their utilities bills. The voucher is given in the form of quarterly rebates, reducing the amount of utilities charges.

Eligibility Criteria for GST Voucher

Eligibility for the GST Voucher depends on several factors, including age, property ownership, and income level. To qualify for the GST Voucher, an individual must:

Be a Singapore citizen.

Be 21 years old and above.

Have an annual income not exceeding SGD 34,000, as assessed in the previous year.

Own property with an annual value of less than SGD 21,000.

Not own more than one property.

The government automatically assesses eligibility based on the individual's income tax returns and property ownership records. No application is required to receive the GST Voucher.

How to Use GST Voucher – Cash

The GST Voucher – Cash is credited directly into the recipient’s bank account. Eligible individuals who have registered their bank accounts with the government will receive the payment automatically. For those who have not done so, a notification will be sent to inform them about alternative collection methods, such as cheque payments.

The cash can be used for any purpose, including daily expenses, savings, or paying off existing bills. However, it is important to remember that the primary aim of the GST Voucher – Cash is to offset the impact of the GST on lower-income individuals and families.

How to Use GST Voucher – MediSave

The MediSave component is aimed at helping senior citizens cope with healthcare costs. The funds are credited into the recipient's CPF MediSave account and can be used to pay for:

Hospitalization expenses.

Day surgeries.

Outpatient treatments.

Premiums for MediShield Life, a health insurance scheme that covers large hospital bills.

For seniors who require regular healthcare services, the MediSave contribution from the GST Voucher can be a significant relief. It helps ensure that they have enough funds to cover medical expenses without depleting their personal savings.

How to Use GST Voucher – U-Save

The U-Save component is specifically designed to reduce the cost of utilities for households living in HDB flats. Every eligible household receives U-Save rebates quarterly, which are automatically credited to their utilities accounts managed by SP Group, the national utilities provider.

There are several ways the U-Save vouchers benefit households:

Direct Offset of Utilities Bills: The U-Save rebate directly reduces the amount payable for electricity, water, and gas bills. It appears as a deduction on the monthly utilities statement, so households need not take any action to use the rebate.

Rolling Over Excess Rebates: If the U-Save rebate exceeds the household’s utilities bill for the month, the balance can be rolled over to offset future bills. This feature is especially helpful for smaller households with lower consumption, as they can accumulate the rebate over time.

Energy Conservation: By receiving the U-Save rebate, households may be incentivized to conserve energy, reducing their monthly utility bills and ensuring the rebate covers a greater portion of their total expenses.

Steps to Ensure You Receive the GST Voucher

To make sure you receive your GST Voucher, it is important to follow these steps:

Ensure You Meet the Eligibility Criteria: The GST Voucher is automatically disbursed based on income and property ownership information. Therefore, you should ensure that your income tax returns are filed correctly, and your residential property details are up to date with the Inland Revenue Authority of Singapore (IRAS).

Register Your Bank Account for Direct Payment: The GST Voucher – Cash is typically credited into the recipient’s bank account. To avoid delays in receiving your payment, ensure that you have provided your bank details to the government. This can be done through the CPF or MyInfo portal, where your personal details are stored securely.

Check for Notifications: If you are eligible for the GST Voucher but have not registered your bank account, you may receive a notification to collect your voucher via cheque. It is important to follow the instructions in the notification to claim your GST Voucher in a timely manner.

Use MyCPF or SingPass for Easy Access: The CPF website or the SingPass mobile app can be used to check your eligibility and voucher status. These platforms provide real-time updates on your GST Voucher entitlements, ensuring you are always informed.

Impact of the GST Voucher Scheme

The GST Voucher scheme has been a crucial component of Singapore’s efforts to ensure a fair and equitable tax system. By targeting financial assistance to lower-income groups, the government helps to mitigate the regressive nature of the GST, which can disproportionately impact those with lower disposable incomes.

For many Singaporeans, the GST Voucher has become a key source of support, especially for senior citizens and families living in HDB flats. The U-Save rebates, in particular, play an important role in reducing household utilities expenses, while the MediSave top-ups help older Singaporeans manage rising healthcare costs.

Conclusion

The GST Voucher conspiracy is an imperative apparatus for guaranteeing that Singapore’s GST framework remains dynamic and reasonable. By advertising cash payouts, utilities discounts, and healthcare top-ups, the plot gives focused on help to those who require it most. Utilizing the GST Voucher is straightforward, with reserves being naturally credited into recipients' accounts or utilities explanations. By taking after a few essential steps, qualified Singaporeans can guarantee they get the full benefits of the conspire, making a difference to lighten the fetched of living and giving more noteworthy budgetary security for the future.

The victory of the GST Voucher conspire highlights Singapore’s commitment to comprehensive development, where financial advance is shared by all portions of society. With the progressing bolster of the GST Voucher, lower-income families and seniors are superior prepared to oversee the money related challenges postured by the GST, making Singapore’s charge framework both proficient and impartial.

0 notes

Text

GST holiday, rebate cheques is 'bad package': Former BoC governor News Buzz

Former Bank of Canada governor David Dodge says the Liberal government’s proposed GST holiday, as well as their plan to send $250 cheque to 18.7 million working Canadians, is a “bad package.” “It’s a little candy today for pain down the road,” he told Vassy Kapelos on CTV News Channel’s Power Play Wednesday night. Prime Minister Justin Trudeau announced last week that starting Dec. 14, the GST…

0 notes

Text

Trudeau Government to Send $250 Cheques to Most People, Slash GST on Some Goods

Trudeau Government to Send $250 Cheques to Most People, Slash GST on Some Goods Prime Minister Justin Trudeau announced a series of new measures on Thursday aimed at alleviating affordability pressures that Canadians have been facing in the post-COVID era. Key among these initiatives is a two-month GST holiday on certain goods and services, along with $250 cheques for eligible Canadians. Key Announcements The Liberal government will distribute $250 cheques to an estimated 18.7 million Canadians who worked in 2023 and earned $150,000 or less. These payments, referred to as the "Working Canadians Rebate," are expected to be distributed in "early spring 2025." The GST/HST holiday will commence on December 14 and run through February 15, 2025. During this period, a variety of goods will be exempt from the GST, including: - Prepared foods (vegetable trays, pre-made meals, salads, sandwiches) - Restaurant meals (dine-in, takeout, or delivery) - Snacks (chips, candy, granola bars) - Alcoholic beverages (beer, wine, cider, and pre-mixed drinks below 7% ABV) - Children’s clothing, footwear, car seats, and diapers - Children’s toys (board games, dolls, video game consoles) - Books, print newspapers, and puzzles - Christmas trees Trudeau stated, “For two months, Canadians are going to get a real break on everything they do,” adding that while the government can't control prices at the checkout, it can help put more money into people's pockets. Financial Implications Families spending approximately $2,000 on eligible goods during the GST holiday can expect to save around $100. In provinces with the Harmonized Sales Tax (HST), such as Ontario and Nova Scotia, the savings could be even greater—estimated at $260 for the same purchase amount. These measures will come at a significant cost to the federal government, with the GST holiday projected to result in $1.6 billion in lost revenue and the cheque distribution costing about $4.68 billion. Political Context This announcement comes as the Liberal government faces declining popularity, with recent polls showing them trailing the Conservative Party by approximately 17 percentage points. The renewed focus on cost-of-living issues is seen as an attempt to regain support from Canadians who have been feeling the economic pinch. However, there are concerns that these measures could inadvertently fuel inflation, which has recently stabilized at the Bank of Canada's target rate of 2%. Economists have noted that previous government stimulus during the pandemic contributed to rising inflation levels as consumers spent more. Trudeau defended the initiative, asserting that it would not stimulate inflation. Finance Minister Chrystia Freeland also downplayed inflation fears, citing the Bank of Canada's successful rate hikes as a stabilizing factor. Opposition Responses Conservative Leader Pierre Poilievre criticized the temporary tax relief as a “trick,” arguing that it does not address the underlying issues of rising costs, particularly with a permanent carbon tax expected to increase in the spring. He claimed that housing costs and food bank reliance have soared under Trudeau's leadership. In contrast, NDP Leader Jagmeet Singh expressed support for the affordability measures, stating his party would work to expedite their passage in Parliament. Singh highlighted the need for further action, advocating for the permanent elimination of GST on essential items such as groceries and home heating. Conclusion The Trudeau government's announcement of a GST holiday and targeted financial support reflects an effort to respond to the economic challenges facing Canadians. While the measures aim to provide immediate relief, their long-term effectiveness and impact on inflation remain to be seen. As the holiday season approaches, the political landscape will be closely monitored, with implications for future elections and government policies. Read the full article

0 notes

Link

0 notes

Text

Solar Power in Australia | advancedsolartechnology.com.au

Solar power in Australia has grown rapidly thanks to a combination of government incentives. Its popularity has been fueled by ordinary people seeking to take control of their energy bills and combat climate change.

In addition to reducing electricity costs, many households have used solar to increase their security of supply. However, they are starting to face new challenges.

History

Australia has seen many milestones in solar power. This includes the discovery of the photovoltaic effect by French physicist Alexandre-Edmond Becquerel in 1839.

Then, in 1873, English electrical engineer Willoughby Smith discovered selenium. This helped further research into solar energy systems.

The first residential PV solar system connected to an Australian power grid was built in 1994. It was a system in Mt Coolum, Queensland. It produced enough electricity to sell back to the grid, earning the homeowner a cheque for $7.

Increasingly, households are using solar energy to generate a large proportion of their power needs. This is especially true in South Australia, where about one in three homes have solar panels. Households with solar energy can use timers to shift their energy consumption during the day, and they can also install batteries to soak up excess power rather than export it – avoiding any feed-in charge.

Origins

With Australia having more sun than most of the world, it’s hardly surprising that this country has been one of the first to capitalise on solar energy. Rooftop solar panel installers are now common in Australian houses and they come with advanced power monitoring and management gadgets to give you full control over your energy.

In 1973, the oil crisis encouraged the country to minimize reliance on other nations for its energy supplies and pursue its own source of power. This resulted in the Commonwealth Scientific and Industrial Research Organisation starting solar energy research and development.

In 1981, Paul MacCready built the first solar-powered airplane and in 1982 Hans Tholstrup drove a car across Australia powered entirely by sunlight. These achievements gave rise to the Renewable Energy Target which enabled households to get financial incentives for installing solar systems.

Developments

The sight of solar panels adorning Australian rooftops is becoming more commonplace, reflecting a societal shift towards sustainability and renewable energy. This shift is driven by a combination of factors, including government incentives and economic pragmatism.

Residential solar systems are now sleek and efficient, allowing homeowners to monitor and control their energy usage. In addition, they may even increase a property’s resale value.

Australia’s high irradiance levels mean that large-scale solar can play a significant role in the country’s energy mix. However, to unlock this potential, we will need to take a strategic approach that combines innovation with policy support. This will require a change in attitudes and behaviours, as well as the development of new infrastructure. This includes the development of storage technologies to help balance intermittent renewables.

Benefits

Solar power is a great way to reduce your household’s energy costs and to make money by selling excess electricity back to the grid. It also helps to reduce Australia’s reliance on unsustainable fossil fuels.

In addition to saving money, solar power can also increase the resale value of your home. Today’s panels are sleek and can be hidden behind a roof without affecting the appearance of your home. This makes it easier for potential buyers to view your property as a good investment.

Additionally, the Australian government offers a number of incentives and rebates that can significantly decrease the initial cost of solar installation. These can make it easier for Australians to afford the energy efficiency upgrades they need. Solar power also reduces greenhouse gas emissions, which is a win for the environment.

Costs

The cost of a Solar power in Australia system has fallen dramatically in Australia over the past few years due to changing trends and government incentives. Currently, households with a 6kW system can expect to pay around $4,000 after applying all available rebates.

The amount of energy that your solar panels generate a day depends on many factors, including how sunny your roof is, how much electricity you use during the day, and where you live. Your solar retailer can provide you with a site-specific estimate.

Regardless of your usage, switching to solar energy will save you money and reduce your energy costs, as well as help the environment by reducing glasshouse gas emissions. However, there are some upfront costs associated with solar electricity, so it’s important to get a detailed quote from an accredited solar retailer.

0 notes

Text

As the provincial government gears up to give $200 cheques to nearly all residents, an advocacy group says the government needs to double the support it provides to Ontario Disability Support Program (ODSP) recipients. The Ontario government says it will send a $200 rebate cheque to roughly 15 million people in the province, for every taxpayer, as well as $200 for each child in eligible family. Trevor Manson, the co-chair of ODSP Action Coalition — a grassroots volunteer advocacy group led by people with disabilities on ODSP, is calling for the government to double ODSP rates. "Right now, every political party in Ontario is calling for rates to be doubled, except for the government.... Except for the party that's in power," said Manson.

Continue Reading.

Tagging: @newsfromstolenland

249 notes

·

View notes

Text

Oh nice ICBC sent out rebate cheque's, $110 dollarydoos back into the account they just took money from

0 notes

Text

Why Investing in Cheque Printing and Mailing Solutions Will Benefit You?

When you produce your own cheques, there are multiple security components that are built into them to prevent fraud and ensure that they aren’t duplicated. These include a digital void pantograph that can’t be replicated, a microprint signature line that identifies a check as authentic, and an authentication grid that makes it more difficult for counterfeiters to reproduce the amount on the back of the cheque. In addition, most cheque printing services also offer additional printed security features like holograms and ultraviolet light-sensitive dyes to ensure that the bank account information is legitimate.

This type of secure, streamlined service is much more efficient than relying on pre-printed checks from the bank and allows your staff to focus on other aspects of the business. Additionally, it eliminates the risk of the cheque bouncing or getting lost in the mail. It can also be a great way to save money on supplies, and it is less stressful to not have to worry about running out of blank cheques.

Some outsourcing companies go beyond just cheque printing, providing ACH services and other electronic payment types as well. They may also provide other services like vendor management, rebate programs, and risk assessment tools to help improve a company’s bottom line. This is often a cheaper option than hiring an in-house employee to handle these tasks. Additionally, the outsourcing company can usually do the work more quickly than an employee could.

youtube

SITES WE SUPPORT

API To Print Snail Mails – Wix

1 note

·

View note

Text

Hey, Center-right media? Stop threatening me with a good time if you can’t cover the cheque your mouth is writing.

Our party in power is working to distribute a grocery rebate. This has been characterized by the technically-considered-respectable-journalism-by-oiks as ‘the government starting its own grocery chain’. And I was so disappointed to learn that wasn’t actually a plan. Canada has a long and somewhat convoluted history of building national brands to ensure a baseline of good service and reasonable prices. Petro Canada was a government (crown) corporation, as was Air Canada. Both were privatized by Brian Mulroney, a conservative prime minister. So why not have a crown-owned grocery store? The main critiques offered were ‘it won’t make a profit’, but the goal is to provide food to people. We don’t expect a profit from healthcare, the police or military, why should we expect it from other crown corporations? And yet, there is not, and to my knowledge, has never been any proposal tabled to ensure that good, healthy, plentiful food is available to the citizens of the country. Don’t threaten me with a good time, Center-Right media. Or someone might just cash that cheque.

0 notes