#real estate investor software

Explore tagged Tumblr posts

Text

Unlock Your Wholesaling Success with InvestorFuse

As a real estate wholesaler, you know the grind all too well. Sifting through countless leads, managing your pipeline, and trying to close deals can feel overwhelming. One major challenge many wholesalers face is keeping track of leads and ensuring that no potential deal slips through the cracks. This disorganization not only wastes time but can lead to lost profits and missed opportunities.

Enter InvestorFuse: Your Ultimate Solution

InvestorFuse is designed specifically for real estate wholesalers looking to streamline their operations and close more deals efficiently. This powerful CRM simplifies lead management by automating follow-ups and organizing your pipeline, so you can focus on what you do best: making deals happen.

Key Benefits of InvestorFuse:

Lead Automation: Say goodbye to manual follow-ups. InvestorFuse automates your communications, ensuring that every lead receives timely attention.

Organized Pipeline: Easily visualize your leads at different stages, allowing you to prioritize effectively and never lose track of a deal.

Enhanced Collaboration: If you're working with a team, InvestorFuse helps everyone stay on the same page, promoting seamless collaboration and improved outcomes.

With its focus on helping wholesalers succeed, InvestorFuse is an invaluable tool for anyone looking to elevate their business. Try it risk-free for 30 days—click here to sign up today and watch your wholesaling business thrive!

For even more insights and resources tailored specifically for real estate wholesalers, visit WholesalingHousesInfo.com. The blog is packed with expert tips, real-life success stories, and essential tools to help you maximize your wholesaling success!

#real estate investing#real estate investment software#real estate investor software#wholesaling houses#real estate investor#real estate wholesaling#real estate crm#freedomsoft review#wholesaling real estate#InvestorFuse#Lead Management#Wholesaling Success#Automation#Business Growth#Real Estate Tools#Lead Generation#Pipeline Management#30 Day Trial#Investor Tools#Lead Automation

1 note

·

View note

Text

Smart Accounting software for real estate investors by Rentastic

Stay ahead in real estate investing with Rentastic, the leading accounting software for real estate investors. Designed for landlords and property managers, we streamline financial tracking, offering comprehensive tools for managing rental income, expenses, and profitability. With us, simplify tax preparation, monitor performance, and make informed decisions with ease. The platform is intuitive, secure, and tailored to meet the needs of modern real estate professionals. Transform the way you manage your real estate investments—choose our platform for hassle-free accounting and powerful insights.

0 notes

Text

From one property to ten- Scale up with real estate software for investors

Real estate investments can be exciting but property management is not. Tracking is easier when you own one rental or flip one house. But things quickly get messy as soon as you start adding more properties. You have to handle tenants, maintenance, rent collection, paperwork and financial tracking. Lack of diligence can even result in loss of important details.

0 notes

Text

REIPro: The Best Real Estate Investing Software

It requires the right tools and insights to make strategic decisions in the fast-paced world of real estate investing. And REIPro, the best real estate investing software, is tailored specifically to help investors maximize profits and minimize risks, bundling all the essential features, tools, and resources.

However, whether you’re searching for lucrative deals, analyzing potential investments, or managing your portfolio, REIPro offers everything you need to streamline your investing journey and unlock your full potential. Let’s discover why REIPro stands out as the go-to solution for real estate investors aiming for success.

#real estate marketing#investor#real estate investing#realtor#real estate technology#real estate software#real estate investment analysis#real estate agent

0 notes

Text

0 notes

Text

#ai and real estate#property for sale#property ai software#real estate#property investing#property investment#residential real estate investor#property

0 notes

Text

On February 10, employees at the Department of Housing and Urban Development (HUD) received an email asking them to list every contract at the bureau and note whether or not it was “critical” to the agency, as well as whether it contained any DEI components. This email was signed by Scott Langmack, who identified himself as a senior adviser to the so-called Department of Government Efficiency (DOGE). Langmack, according to his LinkedIn, already has another job: He’s the chief operating officer of Kukun, a property technology company that is, according to its website, “on a long-term mission to aggregate the hardest to find data.”

As is the case with other DOGE operatives—Tom Krause, for example, is performing the duties of the fiscal assistant secretary at the Treasury while holding down a day job as a software CEO at a company with millions in contracts with the Treasury—this could potentially create a conflict of interest, especially given a specific aspect of his role: According to sources and government documents reviewed by WIRED, Langmack has application-level access to some of the most critical and sensitive systems inside HUD, one of which contains records mapping billions of dollars in expenditures.

Another DOGE operative WIRED has identified is Michael Mirski, who works for TCC Management, a Michigan-based company that owns and operates mobile home parks across the US, and graduated from the Wharton School in 2014. (In a story he wrote for the school’s website, he asserted that the most important thing he learned there was to “Develop the infrastructure to collect data.”) According to the documents, he has write privileges on—meaning he can input overall changes to—a system that controls who has access to HUD systems.

Between them, records reviewed by WIRED show, the DOGE operatives have access to five different HUD systems. According to a HUD source with direct knowledge, this gives the DOGE operatives access to vast troves of data. These range from the individual identities of every single federal public housing voucher holder in the US, along with their financial information, to information on the hospitals, nursing homes, multifamily housing, and senior living facilities that HUD helps finance, as well as data on everything from homelessness rates to environmental and health hazards to federally insured mortgages.

Put together, experts and HUD sources say, all of this could give someone with access unique insight into the US real estate market.

Kukun did not respond to requests for comment about whether Langmack is drawing a salary while working at HUD or how long he will be with the department. A woman who answered the phone at TCC Management headquarters in Michigan but did not identify herself said Mirksi was "on leave until July." In response to a request for comment about Langmack’s access to systems, HUD spokesperson Kasey Lovett said, “DOGE and HUD are working as a team; to insinuate anything else is false. To further illustrate this unified mission, the secretary established a HUD DOGE taskforce.” In response to specific questions about Mirski’s access to systems and background and qualifications, she said, “We have not—and will not—comment on individual personnel. We are focused on serving the American people and working as one team.”

The property technology, or proptech, market covers a wide range of companies offering products and services meant to, for example, automate tenant-landlord interactions, or expedite the home purchasing process. Kukun focuses on helping homeowners and real estate investors assess the return on investment they’d get from renovating their properties and on predictive analytics that model where property values will rise in the future.

Doing this kind of estimation requires the use of what’s called an automated valuation model (AVM), a machine-learning model that predicts the prices or rents of certain properties. In April 2024, Kukun was one of eight companies selected to receive support from REACH, an accelerator run by the venture capital arm of the National Association of Realtors (NAR). Last year NAR agreed to a settlement with Missouri homebuyers, who alleged that realtor fees and certain listing requirements were anticompetitive.

“If you can better predict than others how a certain neighborhood will develop, you can invest in that market,” says Fabian Braesemann, a researcher at the Oxford Internet Institute. Doing so requires data, access to which can make any machine-learning model more accurate and more monetizable. This is the crux of the potential conflict of interest: While it is unclear how Langmack and Mirski are using or interpreting it in their roles at HUD, what is clear is that they have access to a wide range of sensitive data.

According to employees at HUD who spoke to WIRED on the condition of anonymity, there is currently a six-person DOGE team operating within the department. Four members are HUD employees whose tenures predate the current administration and have been assigned to the group; the others are Mirski and Langmack. The records reviewed by WIRED show that Mirski has been given read and write access to three different HUD systems, as well as read-only access to two more, while Langmack has been given read and write access to two of HUD’s core systems.

A positive, from one source’s perspective, is the fact that the DOGE operatives have been given application-level access to the systems, rather than direct access to the databases themselves. In theory, this means that they can only interact with the data through user interfaces, rather than having direct access to the server, which could allow them to execute queries directly on the database or make unrestricted or irreparable changes. However, this source still sees dangers inherent in granting this level of access.

“There are probably a dozen-plus ways that [application-level] read/write access to WASS or LOCCS could be translated into the entire databases being exfiltrated,” they said. There is no specific reason to think that DOGE operatives have inappropriately moved data—but even the possibility cuts against standard security protocols that HUD sources say are typically in place.

LOCCS, or Line of Credit Control System, is the first system to which both DOGE operatives within HUD, according to the records reviewed by WIRED, have both read and write access. Essentially HUD’s banking system, LOCCS “handles disbursement and cash management for the majority of HUD grant programs,” according to a user guide. Billions of dollars flow through the system every year, funding everything from public housing to disaster relief—such as rebuilding from the recent LA wildfires—to food security programs and rent payments.

The current balance in the LOCCS system, according to a record reviewed by WIRED, is over $100 billion—money Congress has approved for HUD projects but which has yet to be drawn down. Much of this money has been earmarked to cover disaster assistance and community development work, a source at the agency says.

Normally, those who have access to LOCCS require additional processing and approvals to access the system, and most only have “read” access, department employees say.

“Read/write is used for executing contracts and grants on the LOCCS side,” says one person. “It normally has strict banking procedures around doing anything with funds. For instance, you usually need at least two people to approve any decisions—same as you would with bank tellers in a physical bank.”

The second system to which documents indicate both DOGE operatives at HUD have both read and write access is the HUD Central Accounting and Program System (HUDCAPS), an “integrated management system for Section 8 programs under the jurisdiction of the Office of Public and Indian Housing,” according to HUD. (Section 8 is a federal program administered through local housing agencies that provides rental assistance, in the form of vouchers, to millions of lower-income families.) This system was a precursor to LOCCS and is currently being phased out, but it is still being used to process the payment of housing vouchers and contains huge amounts of personal information.

There are currently 2.3 million families in receipt of housing vouchers in the US, according to HUD’s own data, but the HUDCAPS database contains information on significantly more individuals because historical data is retained, says a source familiar with the system. People applying for HUD programs like housing vouchers have to submit sensitive personal information, including medical records and personal narratives.

“People entrust these stories to HUD,” the source says. “It’s not data in these systems, it’s operational trust.”

WASS, or the Web Access Security Subsystem, is the third system to which DOGE has both read and write access, though only Mirski has access to this system according to documents reviewed by WIRED. It’s used to grant permissions to other HUD systems. “Most of the functionality in WASS consists of looking up information stored in various tables to tell the security subsystem who you are, where you can go, and what you can do when you get there,” a user manual says.

“WASS is an application for provisioning rights to most if not all other HUD systems,” says a HUD source familiar with the systems who is shocked by Mirski’s level of access, because normally HUD employees don’t have read access, let alone write access. “WASS is the system for setting permissions for all of the other systems.”

In addition to these three systems, documents show that Mirski has read-only access to two others. One, the Integrated Disbursement and Information System (IDIS), is a nationwide database that tracks all HUD programs underway across the country. (“IDIS has confidential data about hidden locations of domestic violence shelters,” a HUD source says, “so even read access in there is horrible.”) The other is the Financial Assessment of Public Housing (FASS-PH), a database designed to “measure the financial condition of public housing agencies and assess their ability to provide safe and decent housing,” according to HUD’s website.

All of this is significant because, in addition to the potential for privacy violations, knowing what is in the records, or even having access to them, presents a serious potential conflict of interest.

“There are often bids to contract any development projects,” says Erin McElroy, an assistant professor at the University of Washington. “I can imagine having insider information definitely benefiting the private market, or those who will move back into the private market,” she alleges.

HUD has an oversight role in the mobile home space, the area on which TCC Management, which appears to have recently wiped its website, focuses. "It’s been a growing area of HUD’s work and focus over the past few decades," says one source there; this includes setting building standards, inspecting factories, and taking in complaints. This presents another potential conflict of interest.

Braesemann says it’s not just the insider access to information and data that could be a potential problem, but that people coming from the private sector may not understand the point of HUD programs. Something like Section 8 housing, he notes, could be perceived as not working in alignment with market forces—“Because there might be higher real estate value, these people should be displaced and go somewhere else”—even though its purpose is specifically to buffer against the market.

Like other government agencies, HUD is facing mass purges of its workforce. NPR has reported that 84 percent of the staff of the Office of Community Planning and Development, which supports homeless people, faces termination, while the president of a union representing HUD workers has estimated that up to half the workforce could be cut The chapter on housing policy in Project 2025—the right-wing playbook to remake the federal government that the Trump administration appears to be following—outlines plans to massively scale back HUD programs like public housing, housing assistance vouchers, and first-time home buyer assistance.

16 notes

·

View notes

Text

“The proposed ordinances allowing tenants to sue based on suspicion of unfair practices is both impractical and unjust,” Owendoff said. “While concerns about anti-competitive practices in rental software may be valid, the regulations of such technology and its application should be handled at the federal level, not through local ordinances.”

City Hall, real estate investors fight over Portland anti-price fixing ordinance, 9 April 2025

lmfaooooo. owendoff would you care to join me in reality for a second

#yeah i'm sure the feds will get right on that#also why should this not be handled at the local level? sure ideally there would actually be federal protections#so localities wouldn't have to do this and so that renters would consistently have this protection everywhere#but those federal protections don't exist and aren't going to exist any time soon. what harm is there in cities stepping up?#housing#portland#politics#my posts#i love the new council. eat yer hearts out landlords

7 notes

·

View notes

Text

Lodha Wakad Pune: Premium Residential Project in a Prime Location

Lodha Wakad Pune is an upcoming premium residential project in one of the city's most sought-after locations. Known for its world-class amenities, strategic location, and luxurious living spaces, this project redefines the concept of modern urban living. With a focus on comfort, convenience, and connectivity, Lodha Wakad Pune is designed to cater to the needs of families, professionals, and investors looking for high returns in Pune's thriving real estate market.

Location Advantage of Lodha Wakad Pune

Wakad is one of Pune’s fastest-growing suburbs, offering excellent infrastructure, seamless connectivity, and a vibrant social environment. Lodha Wakad enjoys proximity to key locations such as:

Hinjewadi IT Park – A major employment hub for IT and software professionals.

Mumbai-Pune Expressway – Ensuring quick access to Mumbai and other parts of Maharashtra.

Educational institutions – Reputed schools and colleges like Indira College, Akshara International School, and Orchid School are within easy reach.

Healthcare facilities – Top hospitals such as Aditya Birla Hospital and Ruby Hall Clinic are nearby.

Shopping and entertainment – Malls, multiplexes, and shopping centers like Phoenix Marketcity and Xion Mall enhance the lifestyle experience.

Lodha Wakad Pune Project Overview

Lodha Wakad Pune offers 2 BHK and 3 BHK premium residences, crafted with contemporary designs and world-class specifications. Each home is designed to provide ample ventilation, natural light, and optimal space utilization, ensuring an elegant and functional living experience.

Key Features of Lodha Wakad Project

Spacious and well-designed apartments with premium fittings.

Gated community with 24/7 security and advanced surveillance.

Eco-friendly infrastructure with rainwater harvesting and energy-efficient designs.

High-speed elevators, power backup, and ample parking space.

Smart home features for a seamless and modern lifestyle.

World-Class Amenities at Lodha Wakad Pune

Lodha Wakad offers a host of amenities that elevate the living experience for residents:

Swimming pool with a deck area for relaxation.

State-of-the-art gymnasium for fitness enthusiasts.

Clubhouse and community hall for social gatherings and events.

Landscaped gardens and walking tracks for a serene living environment.

Dedicated kids’ play area for children's entertainment.

Sports facilities including tennis, basketball, and cricket practice nets.

Meditation and yoga zone to promote a healthy and peaceful lifestyle.

Lodha Wakad Pune: Floor Plans and Pricing

Lodha Wakad offers well-planned 2 BHK and 3 BHK apartments to suit different family sizes and budget preferences. The pricing is competitive, ensuring high value for money and great investment potential.

2 BHK Apartments – Spacious and efficiently designed, ideal for small families and professionals.

3 BHK Apartments – Larger units for families looking for extra space and luxury.

Premium Penthouses – Exclusive units offering breathtaking views and opulent living spaces.

Investment Potential of Lodha Wakad Project

Wakad is a high-demand residential and commercial area, making Lodha Wakad Project an excellent investment choice. The locality has seen consistent appreciation in property values, and with upcoming infrastructure developments, the returns are expected to grow even further. Some key reasons to invest include:

Proximity to IT hubs – Attracting a growing population of professionals.

Rising rental demand – Ensuring lucrative rental income for investors.

Strong infrastructure growth – With metro connectivity and road expansions in progress.

Connectivity and Transport Facilities

Lodha Wakad Pune enjoys seamless connectivity to key locations in Pune and beyond:

Metro Connectivity – The Pune Metro expansion will further boost accessibility.

Well-developed road network – Smooth connectivity to Baner, Balewadi, and Pimple Saudagar.

Pune Railway Station – Located just a short drive away.

Pune International Airport – Ensuring easy domestic and international travel.

Why Choose Lodha Wakad Pune?

Reputed Developer – Lodha Group is known for delivering world-class projects with top-notch construction quality.

Prime Location – Wakad is one of the most rapidly developing areas in Pune, offering a well-balanced lifestyle.

Luxurious Living Spaces – Thoughtfully designed residences with modern amenities.

High Return on Investment – A promising real estate opportunity with rising property values.

Sustainable and Smart Living – Green features, smart home technology, and top-tier security measures.

Conclusion

Lodha Wakad Pune is a perfect blend of luxury, convenience, and investment potential. Whether you are looking for a dream home or a profitable real estate investment, this project is an ideal choice. With its strategic location, premium features, and excellent connectivity, Lodha Wakad Pune sets a new benchmark for upscale urban living.

If you're planning to invest in a premium residential project in Pune, Lodha Wakad should be at the top of your list. Secure your future in a vibrant, well-connected, and luxurious community today!

3 notes

·

View notes

Video

youtube

FreedomSoft Lead Swiper Overview YouTube video

#freedomsoft#lead swiper#real estate lead generation#real estate wholesaling#wholesaling real estate#wholesaling houses#real estate crm#real estate investing software#freedomsoft review#lead generation#lead automation#real estate deals#real estate investor software

0 notes

Text

Simplify Property Finances with Rentastic Accounting software for real estate investors

Effortlessly manage your real estate investments with Rentastic, the ultimate accounting software for real estate investors. Track income, expenses, and cash flow seamlessly while gaining financial insights to optimize your portfolio. Rentastic provides easy-to-use tools for accurate bookkeeping, tax preparation, and real-time reporting, tailored specifically for property owners and investors. Whether you own a single property or an extensive portfolio, our software helps you stay organized and in control of your finances. Sign up today to experience smarter real estate accounting and maximize your investment potential.

0 notes

Text

𝐃𝐄𝐏𝐀𝐑𝐓𝐌𝐄𝐍𝐓 𝐎𝐅 𝐄𝐗𝐓𝐑𝐀𝐍𝐎𝐑𝐌𝐀𝐋 𝐎𝐏𝐄𝐑𝐀𝐓𝐈𝐎𝐍𝐒

NOTICE: This document is classified under Level Gamma Protocols and has been flagged for unauthorised access attempts. Multiple inconsistencies detected. Proceed with caution.

[ACCESSING FILE...]

[SECURITY CLEARANCE REQUIRED: LEVEL ███]

[AUTHORIZATION GRANTED]

–BEGIN DOSSIER–

SUBJECT: VERIFIED BUSINESS ENTITY

Legal Identity: Rahil Head

Aliases & Business Titles:

Rahil Head (Commonly Listed)

Mr Head (Informal Reference in Business Circles)

Nationality: Unconfirmed—Records Indicate Middle Eastern Heritage

Date of Birth: Unlisted—Estimated Between 1950-40 (Discrepancies in Documentation)

Place of Birth: Unknown—Conflicting Reports

Last Known Location: Believed to Operate in Private Estates Across the Middle East and Northern Africa

Status: ACTIVE—CIVILIAN BUSINESS ENTITY

Known Affiliations:

Founder of a Privately-Owned Conglomerate Specialising in Energy, Infrastructure, and High-End Real Estate Developments—Limited Public Record of Transactions

Significant, Though Indirect, Investments in European and Middle Eastern Technological Firms

Rumored to Have Private Ties to Historical Societies and Cultural Preservation Groups

Silent Partner in Multiple Gulf-Based Enterprises

No Known Criminal Affiliations

DESCRIPTION:

Height: Approx. 195 cm

Build: Lean, Well-Kept

Eye Color: Dark Brown

Hair Color: Black with Flecks of Gray—Varied Reports on Aging Process

BEHAVIORAL ASSESSMENT:

Maintains an Unremarkable Public Profile—Avoids Major Media Presence

Highly Reserved in Business Dealings—Prefers Private, Invitation-Only Negotiations

Has No Apparent Reliance on Digital Technology; Prefers Handwritten Correspondence and Direct Verbal Negotiations

No Public Record of Political Statements or Controversial Affiliations

RELEVANT INTEL

No official photographic records prior to 1995—older Images of ‘Rahil Head’’ do not seem to exist.

There is an absence of personal history—no medical records, no known educational background, and no confirmed lineage. Attempts to identify close relatives have resulted in inconclusive data, with one exception: a confirmed daughter, Talia Head, frequently seen alongside her father, and mother, Ruhayla Head, a renowned socialite and industrialist who serves as the public face of █████ █████.

Financial transactions indicate activity in multiple locations across the globe within impossibly short timeframes.

Facial recognition software has flagged similarities between Mr. Head and multiple historical figures in archived photographs dating back to the 19th century—though results remain inconclusive due to image degradation.

█████ █████ █████ operates a traditional corporate structure, including a board of directors and executive staff. However, all strategic decisions are deferred to Mr. Head himself, with no record of shareholder meetings or public disclosures.

The company has a history of acquiring failing businesses and revitalising them without clear external financing. Sources suggest private investors, but no names have been disclosed.

Despite operating within legal frameworks, █████ █████ █████ has repeatedly rerouted funds through offshore accounts with minimal transparency. Regulatory bodies have flagged these activities but have not pursued further investigation.

Personal financial records for Mr. Head are limited. No known assets are registered in his name, yet he maintains access to multiple high-value properties across the globe. Some of his offshore accounts tie back to defunct 19th-century banking institutions.

Maintains no official government position, but holds connections to politicians, monarchs, and military officials across the Middle East, Europe, Africa, and other parts of Asia.

Suspected of influencing regional conflicts by subtly shifting investments to favour or destabilise specific economic sectors.

Regularly attends closed-door economic forums and high-level diplomatic meetings under the pretence of trade discussions.

His company has facilitated infrastructure projects in several developing nations, indicating some level of control in national policies.

Multiple historical estates and excavation sites acquired by █████ █████ █████ correspond to locations with rumored ties to the League of Assassins.

A monastery in Tibet, recently purchased under a shell corporation, has been linked to ancient alchemical research. Records of its acquisition were mysteriously wiped from local government databases.

Personal security team composed of former special forces operatives, many of whom have no recorded military discharge papers.

Domestic staff at private residences reportedly rotate every six months, with each new team having no knowledge of their predecessors.

THREAT ASSESSMENT:

RISK CLASSIFICATION: NEGLIGIBLE—NO VERIFIED CRIMINAL OR PARAMILITARY TIES

SUBJECT DESIGNATED AS LOW PRIORITY MONITORING

[WARNING: FILE CROSS-REFERENCED WITH ARCHIVED CASE ██-█████—INCONSISTENCIES NOTED]

ADDITIONAL NOTES

[SECURITY RESTRICTIONS DETECTED]

One anonymous source claimed Mr. Head never seems to age, but this statement was retracted, and the individual declined further interviews.

Official documents confirm a "Rahil Head" attended an exclusive financial summit in Zurich in 1991. A separate report indicates the same name appearing on a guest list for a 1973 archaeological conference in Istanbul—no photographic evidence exists from either event.

Despite no formal ties to political entities, Mr. Head appears to have access to exclusive diplomatic channels. Private jets linked to his company have landed in highly restricted airspaces without official clearance, yet no record of violation exists.

A classified intelligence document from 1977 references an individual with a near-identical description to Head, listed as a “non-hostile asset with unknown longevity.” Document has since been removed from official archives.

A confidential source in Dubai stated that "Rahil Head" does not attend public events, yet holds significant influence in elite circles. Attempts to trace his business dealings often lead to dead ends.

A low-resolution image from 2004 depicts Mr. Head at a private gala in Morocco. Upon further analysis, facial structure appears nearly identical to an individual in a 1982 diplomatic event in Istanbul—discrepancies in aging patterns remain unexplained.

A handwritten letter dated 1899 was recovered from a private estate auction. The signature—nearly identical to that of Mr. Head—was dismissed as a coincidence, though forensic analysis remains inconclusive.

[...FURTHER RECORDS RESTRICTED…]

THREAT ASSESSMENT REVISION

CLASSIFICATION: LOW TO MODERATE RISK

NOTE: UNRESOLVED ANOMALIES FLAGGED FOR FUTURE REVIEW

[...DATA RETRIEVAL INTERFERENCE DETECTED…]

Recommendation: Maintain passive surveillance. Direct investigation not advised.

[...DATA FRAGMENT ENDS…]

[CONNECTION LOST—SECURITY LOCKOUT INITIATED]

[DATA ACCESS REVOKED—FURTHER ATTEMPTS FLAGGED FOR REVIEW]

[LOGGING OUT...]

[SESSION TERMINATED]

–END DOSSIER–

#the demon's head#the league's decree#ra's al ghul#ra's al ghul rp#dc rp blog#dc rp#dc universe#ooc: part two of three#he has a civilian identity now !!

2 notes

·

View notes

Text

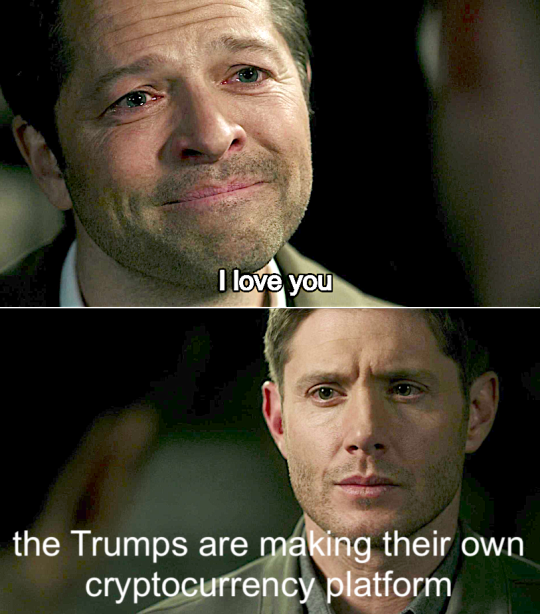

From La Stampa (translated from Italian):

“Make Finance Great Again,” Trump family makes its own cryptocurrency and allies with Silicon Valley It will be called “World Liberty Financial,” will have tech investors and real estate developers from Chase Herro and Zak Folkman to Steve Witkoff inside. Sons Eric and Donald Jr. will coordinate. And his backer Tyler Winklevoss jokes, “Donald has been orange-pilled, indoctrinated.” Jacopo Iacoboni Sept. 17, 2024 Updated 11:00 a.m. 3 minutes of reading

They want to do a kind of “make finance great again,” along the lines of MAGA, the election slogan and the Make America Great Again campaign. Donald Trump's sons, Don Jr. and Eric, of course with their father's imprimatur, are about to launch a new cryptocurrency platform that will be called “World Liberty Financial,” and will allow users to make even massive transactions without a bank getting in the way and extracting fees (and with a very low level of tax tracking, it should be added). A couple of concepts familiar to bitcoin fans, for example, but which the Trump family now has ambitions to decline on a large scale. It is not certain that this marriage between Trumpism and decentralized finance, DeFi, is a harbinger of only positive developments. The board of “World Liberty Financial” will also consist of former crypto investors such as Chase Herro and Zak Folkman, and Steve Witkoff, a real estate developer and old friend of Trump. But thanks to documents filed with the U.S. Federal Election Commission that we have been able to read we know that in general the entire Trump campaign - Make America Great Again Inc. - received money not only from Musk, but cryptocurrency from billionaire twins Cameron and Tyler Winklevoss, who lead the cryptocurrency company Gemini: about $3.5 million in Bitcoin on July 19, the day after Trump's speech at the Milwaukee convention. The Winkelvosses also poured in money to America PAC, the tech investor-backed group that Musk helped launch in 2024 (Trump had bragged that Musk was giving him $45 million a month; Musk said his contribution is “at a much lower level”). Another co-founder of a cryptocurrency exchange, Jesse Powell, boss of Kraken, and venture capitalists Marc Andreessen and Ben Horowitz (who created a16z) who have invested billions of dollars in cryptocurrency startups, have also made endorsements and poured money into Trump. In short, for the Trump family to embark on this big cryptocurrency project is a natural consequence of the fact that these are almost becoming a Republican asset in the campaign, and the “libertarian” wing of the old Gop is now a kind of very, very rampant ideologized “cyberlibertarianism.” The real boss of the “tech bros” according to many is not Elon Musk, but Peter Thiel. Zuckerberg's longtime partner in Facebook, co-founder of PayPal, Thiel's fortune has at least doubled during the Trump presidency. Palantir-a much-discussed software company variously accused of extracting data from Americans and profiling them-has managed to get a contract from the Pentagon. Other donors to MAGA Inc include Jacob Halberg, Palantir's princely analyst, and Trish Duggan, a wealthy Scientology funder and friend of the tech bros. Trump's vice presidential candidate, J. D. Vance, traveled to Silicon Valley and the Bay Area, celebrating a dinner at the home of BitGo CEO Mike Belshe, 100 people each pouring in between $3,300 a plate and a $25,000 roundtable. Trump in 2021 called bitcoin a “fraud against the dollar.” A few weeks ago, speaking in Nashvill at the bitcoin fan conference, he promised, “The United States will become the crypto capital of the planet.” Better than his friend Putin's Russia, although this Trump did not say so explicitly. The fact is that after his speech, Tyler Winklevoss ran on X (now the realm of cyberlibertarians) and joked that Donald had been “orange-pilled,” making a Matrix analogy, had been “indoctrinated,” or had finally seen the real reality behind the appearances.

4 notes

·

View notes

Text

Level Up Your Real Estate Investing Business with REIPro

Are you ready to elevate your real estate investment game? With REIPro, you get an all-in-one tool designed to help you find, analyze, and close the best deals faster.

This intuitive platform simplifies property research, market analysis, and deal management, giving you the insights and tools you need to make informed decisions and maximize your profits.

Don't just invest—invest smarter. Whether you're a seasoned professional or just starting, REIPro empowers you to navigate the complexities of real estate with confidence.

Start transforming your investment strategy today. Sign up for REIPro and watch your real estate ambitions turn into reality.

#real estate investing#real estate marketing#investor#realtor#real estate software#real estate investing software#real estate agent#rentals

0 notes

Text

Professional Property Management in LA: Discover Expertise with Stlivingla

If you’re a property owner in Los Angeles, you understand the demands of managing rentals and the importance of maintaining tenant satisfaction while safeguarding your investment. That’s where professional property management in LA steps in, providing an essential service to streamline property operations and maximize profitability. With a reputation for excellence, Stlivingla offers comprehensive property management solutions tailored to the unique needs of Los Angeles property owners.

Why Choose Professional Property Management in LA? Professional property management is invaluable for real estate investors who aim to enhance tenant retention and ensure seamless property operations. Here are some of the key benefits of partnering with a reputable property management service like Stlivingla:

Expert Tenant Management

Handling tenant inquiries, maintenance requests, and lease enforcement can be challenging. Stlivingla’s team of seasoned professionals is trained to respond promptly and effectively, ensuring tenants feel valued and supported. Legal Compliance and Risk Mitigation

Property laws and rental regulations in LA are constantly evolving. Stlivingla stays up-to-date on local and state laws, helping property owners avoid potential legal issues by ensuring their properties are fully compliant. Efficient Rent Collection and Financial Reporting

Timely rent collection is vital for maintaining cash flow. Stlivingla has reliable systems in place for automated rent collection and offers transparent financial reporting so property owners can easily track their investments. Marketing and Tenant Acquisition

Finding the right tenants can be time-consuming. Stlivingla leverages advanced marketing strategies to attract quality tenants, reducing vacancy rates and ensuring a steady rental income. Property Maintenance and Inspections

Regular maintenance keeps properties in excellent condition, preserving their long-term value. Stlivingla conducts routine inspections and manages repair requests promptly, so properties remain safe and appealing. What Sets Stlivingla Apart in Los Angeles? Stlivingla is distinguished by its commitment to client satisfaction and personalized service. Here’s what makes Stlivingla a top choice for property management in LA:

Local Market Knowledge Stlivingla has an in-depth understanding of LA’s diverse neighborhoods, from Koreatown to Hollywood, allowing them to tailor management strategies to each property’s unique location.

Personalized Management Plans Recognizing that each property and client has unique requirements, Stlivingla offers customizable management plans to address specific property needs and owner goals.

Advanced Technology and Transparency Stlivingla utilizes cutting-edge software for tenant screening, communication, and financial management, ensuring that both property owners and tenants have access to essential information at their fingertips.

How to Get Started with Stlivingla Partnering with a trusted property management company like Stlivingla can elevate your property investment experience, taking the day-to-day responsibilities off your plate while optimizing your rental’s performance.

If you're ready to explore the benefits of professional property management in LA, reach out to Stlivingla today. Their team is ready to discuss your property needs and show you how they can enhance your property’s profitability and appeal.

#boutique apartment#apartmentsforrent#hollywoodkoreatown#newly constructed apartments for rent in koreatown

3 notes

·

View notes