#property tax loan

Text

#student debt#student loans#student loan debt#vote biden#vote blue#vote democrat#please vote#voting#election 2024#student loan forgiveness#thanks biden#get out the vote#2024 elections#us elections#american politics#biden administration#joe biden#biden#president biden#us election#2024 election#election#taxes#property taxes#us taxes#death and taxes#filing taxes#income inequality#government#debt

8K notes

·

View notes

Text

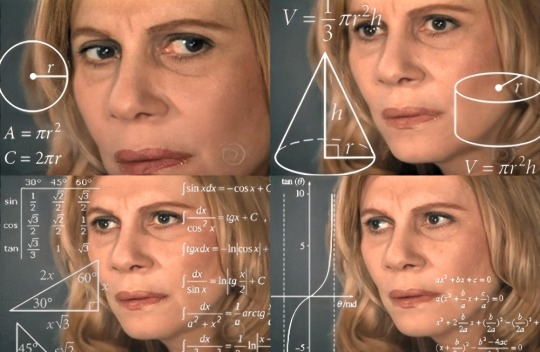

When I’m writing my Modern AU but then try to figure out and calculate how the life I gave the Batch is financially possible:

#I’ll be writing#and then I’ll be like wait how do they own a house in the suburbs in this economy?#so then I’ll be like ok 99 was the homeowner so maybe he already paid it off and now they only worry about property tax and bills#but it doesn’t stop there#now I’m looking up the prices of homes in the 80s#then I start looking up details on VA loans#then I’m calculating ok this sibling has this job so this would be what they make in a year after taxes#then I add them up#but wait#Crosshair and tech are in college how are they affording that?#then I remember the GI bill#but then I’m like ok but what if they go on vacation?#so then I’m like ok they give off the vibes that they would choose to drive everywhere they could within reason#BUT THEN I’m like hold up what if they brought Omega to Disney World#so now I’m looking at ticket hotel and airfare costs#and seeing what military and veterans discounts are#meanwhile this fic hasn’t even been fully written I’m just brainstorming and writing all these details in a brainstorming document#I’ll apply suspension of disbelief and ‘don’t worry about it’ to other things like face tattoos in the suburbs and timeline and ages#but for the financial aspect I’m like ‘how can I make this as true to reality as possible’?#star wars tbb#star wars the bad batch#the bad batch#bad batch modern au#sw bad batch

79 notes

·

View notes

Text

Okay but why are the things happening right now all costing me large amounts of money?

I don't want any more things to happen (knock wood), but maybe like a nice thing could happen that didn't involve me forking over thousands of dollars?

#I had dreams#of paying of my car loan#ahaha no instead let's spend 3k to repair the steering and battery#buy a new couch and chair for the living room?#ahaha no you gotta pay to replace the broken pole your electric meter is on#and probably have to bury the lines so fuck your yard too#and oh yeah don't forget property taxes are due

4 notes

·

View notes

Text

COMMERCIAL PROPERTY FINANCING – ALL TYPES - $400K to $50MILLION! (Refinance Cashout & Purchase)

COMMERCIAL & MULTIFAMILY PROPERTY FINANCING! MOST PROPERTY TYPES QUALIFY: Automotive Repair – Retail – Medical Office – Warehouse - Daycare Center - Restaurants – Bars - Light Industrial - Mixed Use - Mobile Home Park - Self Storage, Up To 75% LTV Refinance Cashout! * Up To 80% LTV On Purchases! * 30 Year Financing, * No Tax Returns! * No Personal Income Docs Required! * 24-48 Hour Prequalification with No Credit Pull Required! APPLY ONLINE @ Investor Rehab Funding dot com

NAME: Investor Rehab Funding, LLC

PHONE: 844-244-1420

State: Nationwide

Category: Real Estate Financing / Commercial Mortgages / Financial /

URL: https://www.investorrehabfunding.com/commercial-multifamilyEmail: [email protected]

#Commercial real estate loans#loans for restaurants#daycare center commercial loans#commercial financing for self-storage warehouse#light industrial commercial property financing#refinance cash out commercial property loans#12 month bank statement loans#30 year financing commercial property#bank statement commercial financing#commercial property loans#no personal income commercial financing#purchase loans for commercial property#private money commercial loans#medical office commercial financing#commercial property refinance cash out#financing for restaurants#commercial loans for bars#financing for daycare centers#bank deposit private money loans commercial property#refinance cash out commercial loans#commercial loans for mobile home park#purchase financing for commercial properties#no tax return commercial financing#financing for warehouse#automotive repair shop mortgage loans#office building financing#Apartment building financing#financing for day care centers#mixed use property financing#mobile home park refinance cash out

0 notes

Text

It's ALL about Real Estate! "Your Home...YOUR Money," right here on: www.realityradio101.com Please join the real estate crew as they discuss mortgages, (and the current real estate market). 11:00 a.m. - 12:00 Noon (Eastern). Write in with your questions: [email protected]

0 notes

Text

DSCR Financing up to 85% ltv

DSCR Financing

DSCR Financing approves the investor based on the investment property appraisal value and market rental.

640+ mid credit score 70% ltv

660+ mid credit score 75-80% ltv

700+ mid score and own a Primary can get up to 85% ltv

We can close on average in 21 days –

No Tax Returns

No W2s

2 mos bank statement

Close in a Entity

No minimum required experience level – whether you are a…

#Buy and Hold#DSCR#DSCR Loan#DSCR Loans#invesment loans#Invest in Property#investment loans&039;#Long Term Rental#NO Tax returns#Rental Loan#Rental Loans#Short term rental

0 notes

Text

How Much Are Closing Costs in Orange County California: Real Estate Transactions Guide

Credit: Image by Alena Darmel | Pexels

Unlocking the Mystery: How Much Are Closing Costs in Orange County, California?

What are, and how much are closing costs in Orange County, California?

Other costs that come under closing costs are those charged when closing a real estate deal and can be paid either by the buyer or the seller, licensed agents, etc.

In Orange County, the specific sum may differ depending on parameters such as the property's value, the particular terms of the mortgage loan, and the details of the individual transaction.

Understanding these expenses is equally important, especially for anyone in the market who wants to purchase or sell a house in this prime area.

This article defines the various charges included under the broad umbrella of closing costs in Orange County to assist anyone in estimating the charges correctly.

Key Elements of Closing Costs

Loan Origination Fees

These are fees that the borrower perceives as a cost that the lender has imposed on the borrower for providing the loan. They usually range from five percent to one percent of the loaned amount.

Appraisal Fees

A realtor must be hired to make an appraisal to help determine the property's value. This fee may range typically from $300 to $600.

Title Insurance

Title insurance covers future events related to a property's title. The price difference ranges, on average, from $500 to about $1500.

Escrow Fees

An escrow company assists the whole deal with the cash distribution process, completing the entire process as expected. The costs generally used to obtain an escrow may range from $500 to $2000.

Recording Fees

Your local government could collect these fees from you to help you process the requirements needed to transfer the property into your name. They usually cost at least $100 to $250.

Real Estate Agent Commissions

Real estate agent commissions often vary from 5% to 6% of the sale amount and are shared equally between the seller's and the buyer's agent.

Home Inspection Fees

A home inspection costs between $300 and $500 and helps ensure that all the property's parts are functional.

Notary Fees

These are sometimes needed to notarize other documents that might be required, and the cost could be $100-$150.

Pest Inspection Fees

Some instances require a pest inspection, usually costing between $100 and $200.

Prepaid Expenses include property tax, home insurance, and mortgage interest. The figure may differ depending on the kind of property and loan.

Factors Affecting Closing Costs

Several factors can affect closing costs in Orange County, including:

Property Price

Closing costs for homes sold at higher prices are typically higher because they are calculated based on a percentage of the sales price.

For instance, expenses such as title insurance, escrow fees, and transfer taxes are often proportional to the property's value. Additionally, more significant mortgage amounts can increase loan origination, appraisal, and points fees.

Therefore, buyers and sellers should expect higher closing costs for properties sold at significant amounts.

Type of Loan

Besides, additional requirements are specific to some types of loans and the relevant fees. For example, the F.H.A. loan may be simplified by its relatively high costs, such as requiring a more significant down payment or other initial costs. Still, it has lower interest rates than conventional loans.

Negotiation

Commission may also be bargained between the purchaser and the property vendor. For example, a seller can offer to 'buy down' a part of the closing cost attached to the real estate to assure the buyer to close the transaction.

Service Providers

Consumers must opt for fewer service providers, including title companies, Escrow Companies, home inspectors, and other title closing costs. It is also important to note that fees differ from broker to broker, so it is prudent to note the fees charged.

Location

Certain local taxes and fees, like special assessments or transfer taxation, may vary depending on the particular neighborhood or district within Orange County.

For example, some areas might have higher special assessment fees for community improvements, while transfer taxes might differ based on local ordinances.

Both buyers and sellers must be mindful of these potential variations when exploring properties in different parts of the county, as they can impact the overall cost of the transaction.

Awareness of these factors allows individuals to make informed decisions and accurately assess the financial implications of their real estate transactions.

Reducing Closing Costs

Both consumers and sellers can take steps to minimize their closing costs, including:

Shop Around

It's beneficial to contact multiple lenders and different title and escrow companies to inquire about their fees. By comparing rates, you can strive to find the most reasonable and competitive pricing for your needs.

Negotiate

In most cases, there is usually a bargaining process with the other side about splitting or reimbursing some or all the closing costs. For instance, a seller may propose to the buyer that he or she bear the invoice of the owner’s title insurance.

Review the Loan Estimate

Borrowers are entitled to receive the loan estimate from the lender within three days of application completion. To establish the probable closing costs, read the document and establish whether any areas of understanding are ambiguous or if any fees seem to be inordinately high.

Ask for Seller Concessions

Potential buyers can also ask sellers for certain contingencies to pay some closing costs while bargaining for the purchase price. This can be particularly helpful in a buyer’s market because sellers might be more open to such an approach.

Use a No-Closing-Cost Loan

Different lenders provide no-closing-cost mortgage loans in which the closing costs are included in the Mortgage Balance or paid off through a higher Mortgage Rate. Although this helps save money initially, it leads to an increased term of paying off the borrowed sum.

The following points explain why closing costs should be considered an integral part of real estate transactions in Orange County, California. Both buyers and sellers must also be aware of these costs to conduct a transaction efficiently.

In every real estate transaction, expenses related to the conveyance of title to real estate must be ascertained, and these expenses may indeed affect the financial relationships between the two entities.

Get more fascinating information on our website at https://occoastrealestate.com/orange-country-closing-costs/.

#Community Information#Real Estate Blogs#Homes for Sale#Orange County CA Real Estate#Orange County CA Closing Costs#Property Taxes#Escrow#Title Insurance#Appraisal Fees#Loan Origination Fees#Home Inspection#Transfer Taxes#Recording Fees#Attorney Fees#Notary Fees#HOA Fees#Home Warranty Fees#Pest Inspection Fees#Survey Fees

0 notes

Text

Home Mortgage Tips That You Can Use

TIP! Before undertaking the mortgage application process you should organize all of your finances. Showing up without the proper paperwork will not help anyone.

Finding the right mortgage for your new home is very important, whether you want to purchase your first home or need to refinance your current home. The wrong mortgage can be disastrous to your financial health. This article provides some…

View On WordPress

0 notes

Text

Discover the extensive tax benefits of loan against property on the IndoStarHFC blog. Explore how leveraging these advantages can optimize your financial strategy.

0 notes

Text

Don't worry about your finances. Now along with a home loan, you can get tax benefits on home loan- https://homefirstindia.com/article/tax-benefits-on-second-home-loan/

#home#homefirstindia#homeloan#welcome home#dream#financial planning#loan against property#construction#family#tax benefits

0 notes

Text

Maximizing Financial Gains: Exploring Tax Benefits on Loan Against Property

In the world of personal finance, making informed decisions that provide the greatest financial advantage is crucial. One such option that can help individuals achieve their goals is a Loan Against Property (LAP). This type of loan offers numerous benefits beyond just providing access to funds. One of the most attractive aspects is the tax benefits it offers, which can significantly reduce the burden of taxation. In this blog, we will delve into the various tax advantages associated with Loan Against Property and how you can make the most of them.

Interest Deduction under Section 24(b)

When you take a Loan Against Property, you are required to pay interest on the borrowed amount. Fortunately, the interest paid on LAP is eligible for tax deduction under Section 24(b) of the Income Tax Act, 1961. As per the current provisions, you can claim a deduction of up to Rs. 2 lahks on the interest paid for a self-occupied property. If the LAP is taken against a property that is not self-occupied, there is no upper limit on the interest deduction.

This benefit can significantly reduce your taxable income, resulting in lower tax liabilities and greater savings.

Principal Repayment Deduction under Section 80C

Apart from the interest deduction, you can also claim tax benefits on the principal repayment made towards the Loan Against Property in Delhi NCR under Section 80C of the Income Tax Act. The maximum limit for this deduction is Rs. 1.5 lakh. It's essential to note that the aggregate of all investments and expenditures allowed under Section 80C should be at most this threshold.

By utilizing this deduction, you can effectively reduce your taxable income while securing your financial future through property ownership.

Prepayment Tax Benefits

Suppose you decide to prepay your Loan Against Property using your savings or other sources of funds. In that case, you can benefit from tax advantages on the prepayment as well. By making a part or full prepayment, you can decrease your outstanding loan amount, which will result in reduced interest payments over time.

Set-off Against House Property Income

If you have a let-out property and you've taken a Loan Against Property, you can set off the interest on the LAP against the rental income earned from the let-out property. This provision can be highly beneficial, as it will lower your taxable rental income, thereby reducing your overall tax liability.

Utilising Funds for Tax-Advantaged Investments

Loan Against Property can serve as an excellent financing option for investing in other avenues that offer tax benefits. For instance, you can use borrowed funds to invest in tax-saving instruments like Equity-Linked Saving Schemes (ELSS), Public Provident Funds (PPF), National Savings Certificate (NSC), and more. By doing so, you can claim additional tax deductions under various sections of the Income Tax Act and accelerate wealth creation.

Conclusion

Loan Against Property is not just a way to access funds for your financial needs, but it also offers compelling tax benefits that can help you optimize your tax outflow and increase your savings. You can make the most of this financial tool by taking advantage of the interest and principal repayment deductions, setting off against house property income, and leveraging the funds for tax-advantaged investments.

However, it's essential to remember that tax laws are subject to change, and it's advisable to consult with a financial advisor or tax expert to understand the latest provisions and how they apply to your specific situation. By combining smart financial planning, proper utilization of Loan Against Property, and staying up-to-date with tax regulations, you can pave the way for a secure and prosperous financial future.

0 notes

Text

Exploring the Different Types of Commercial Real Estate Loans

Commercial real estate loans come in various forms, each designed to suit different investment scenarios. Discover more about the types of commercial real estate loans, visiting our blog. https://www.enrichedrealestate.com/blog/how-commercial-real-estate-nyc-retis-and-insurance-affects-the-economy/

0 notes

Text

COMMERCIAL PROPERTY FINANCING – ALL TYPES - $400K to $50MILLION! (Refinance Cashout & Purchase)

COMMERCIAL & MULTIFAMILY PROPERTY FINANCING! MOST PROPERTY TYPES QUALIFY: Automotive Repair – Retail – Medical Office – Warehouse - Daycare Center - Restaurants – Bars - Light Industrial - Mixed Use - Mobile Home Park - Self Storage, Up To 75% LTV Refinance Cashout! * Up To 80% LTV On Purchases! * 30 Year Financing, * No Tax Returns! * No Personal Income Docs Required! * 24-48 Hour Prequalification with No Credit Pull Required! APPLY ONLINE @ Investor Rehab Funding dot com

NAME: Investor Rehab Funding, LLC

PHONE: 844-244-1420

URL: https://www.investorrehabfunding.com/commercial-multifamily

Email: [email protected]

#Commercial real estate loans#loans for restaurants#daycare center commercial loans#commercial financing for self-storage warehouse#light industrial commercial property financing#refinance cash out commercial property loans#12 month bank statement loans#30 year financing commercial property#bank statement commercial financing#commercial property loans#no personal income commercial financing#purchase loans for commercial property#private money commercial loans#medical office commercial financing#commercial property refinance cash out#financing for restaurants#commercial loans for bars#financing for daycare centers#bank deposit private money loans commercial property#refinance cash out commercial loans#commercial loans for mobile home park#purchase financing for commercial properties#no tax return commercial financing#financing for warehouse#automotive repair shop mortgage loans#office building financing#Apartment building financing#financing for day care centers#mixed use property financing#mobile home park refinance cash out

0 notes

Text

Unveiling Chennai's Hidden Gems: TNHB Plots and Houses - Affordable Housing that's Taking the City by Storm!

Unveiling Chennai’s Hidden Gems: TNHB Plots and Houses

When it comes to affordable housing options in Chennai, TNHB (Tamil Nadu Housing Board) plots and houses stand out as hidden gems. In a city where real estate prices are soaring, TNHB offers an oasis of affordable housing solutions for individuals and families. Let’s dive into the world of TNHB plots and houses, explore their benefits, and…

View On WordPress

#TNHB allotment process#TNHB application form#TNHB eligibility criteria#TNHB flats in Chennai#TNHB house construction guidelines#TNHB houses for sale#TNHB houses in Chennai#TNHB housing scheme#TNHB land acquisition#TNHB loan scheme#TNHB maintenance charges#TNHB plot layout#TNHB plots for sale#TNHB plots in Chennai#TNHB possession process#TNHB price list#TNHB property tax#TNHB registration process#TNHB resale houses#TNHB upcoming projects

0 notes

Text

Things Biden and the Democrats did, this week #27

July 12-19 2024

President Biden announced the cancellation of $1.2 billion dollars worth of student loan debt. This will cancel the debt of 35,000 public service workers, such as teachers, nurses, and firefighters. This brings the total number of people who've had their student debt relived under the Biden Administration to 4.8 million or one out of every ten people with student loan debt, for a total of $168.5 billion in debt forgiven. This came after the Supreme Court threw out an earlier more wide ranging student debt relief plan forcing the administration to undertake a slower more piecemeal process for forgiving debt. President Biden announced a new plan in the spring that will hopefully be finalized by fall that will forgive an additional 30 million people's student loan debt.

President Biden announced actions to lower housing coasts, make more housing available and called on Congress to prevent rent hikes. President Biden's plan calls for landlords who raise the rent by more than 5% a year to face losing major important tax befits, the average rent has gone up by 21% since 2021. The President has also instructed the federal government, the largest land owner in the country, to examine how unused property can be used for housing. The Bureau of Land Management plans on building 15,000 affordable housing units on public land in southern Nevada, the USPS is examining 8,500 unused properties across America to be repurposed for housing, HHS is finalizing a new rule to make it easier to use federal property to house the homeless, and the Administration is calling on state, local, and tribal governments to use their own unused property for housing, which could create approximately 1.9 million units nationwide.

The Department of Transportation announced $5 billion to replace or restore major bridges across the country. The money will go to 13 significant bridges in 16 states. Some bridges are suffering from years of neglect others are nearly 100 years old and no longer fit for modern demands. Some of the projects include the I-5 bridge over the Columbia River which connects Portland Oregon to Vancouver Washington, replacing the Sagamore Bridge which connects Cape Cod to the mainland built in 1933, replacing the I- 83 South Bridge in Harrisburg, Pennsylvania, and Cape Fear Memorial Bridge Replacement Project in Wilmington, North Carolina, among others.

President Biden signed an Executive Order aimed at boosting Latino college attendance. The order established the White House Initiative on Advancing Educational Equity, Excellence, and Economic Opportunity through Hispanic-Serving Institutions. Hispanic-Serving Institutions (HSIs) are defined as colleges with 25% or above Hispanic/Latino enrollment, currently 55% of Hispanic college students are enrolled in an HSI. The initiative seeks to stream line the relationship between the federal government and HSIs to allow them to more easily take advantage of federal programs and expand their reach to better serve students and boost Hispanic enrollment nationwide.

HUD announced $325 million in grants for housing and community development in 7 cities. the cities in Tennessee, Texas, Alabama, Florida, Nevada, New York and New Jersey, have collectively pledged to develop over 6,500 new mixed-income units, including the one-for-one replacement of 2,677 severely distressed public housing units. The 7 collectively will invest $2.65 billion in additional resources within the Choice Neighborhood area – so that every $1 in HUD funds will generate $8.65 in additional resources.

President Biden took extensive new actions on immigration. On June 18th The President announced a new policy that would allow the foreign born spouses and step children of American citizens who don't have legal status to apply for it without having to leave the country, this would effect about half a million spouses and 50,000 children. This week Biden announced that people can start applying on August 19, 2024. Also in June President Biden announced an easing of Visa rules that will allow Dreamers, Americans brought to the country as children without legal status, to finally get work visas to give them legal status and a path way to citizenship. This week the Biden Administration announced a new rule to expand the federal TRIO program to cover Dreamers. TRIO is a program that aims to support low income students and those who would be the first in their families to go to college transition from high school to college, the change would support 50,000 more students each year. The Administration also plans to double the number of free immigration lawyers available to those going through immigration court.

The EPA announced $160 million in grants to support Clean U.S. Manufacturing of Steel and Other Construction Materials. The EPA estimates that the manufacturing of construction materials, such as concrete, asphalt, steel, and glass, accounts for 15% of the annual global greenhouse gas emissions. The EPA is supporting 38 projects aimed at measuring and combatting the environmental impact of construction materials.

The US announced $203 million in humanitarian assistance for the people of Sudan. Sudan's out of control civil war has caused the largest refugee crisis in the world with 11 million Sudanese having fled their homes in the face of violence. The war is also causing the gravest food crisis in the world, with a record setting 25 million people facing acute food insecurity, and fears that nearly a million will face famine in the next months. This aid brings the total aid the US has given Sudan since September 2023 to $1.6 billion, making America the single largest donor to Sudan.

The Consumer Financial Protection Bureau put forward a new rule that would better regulate popular paycheck advance products. 2/3rds of workers are payed every two weeks or once a month and since 2020 the number of short term loans that allow employees to receive their paycheck days before it’s scheduled to hit their account has grown by 90%. the CFPB says that many of these programs are decided with employers not employees and millions of Americans are paying fees they didn't know about before signing up. The new rule would require lenders to tell costumers up front about any and all fees and charges, as well as cracking down on deceptive "tipping" options.

#Joe Biden#Thanks Biden#Politics#US politics#American politics#student loans#debt forgiveness#housing crisis#rent control#wage theft#sudan#sudan crisis#climate change#climate action#immigration#hispanic#latino#college#bridges#Infrastructure

1K notes

·

View notes

Text

5 Steps To Buying A House In Texas

We are devoted to providing outstanding service and customer assist with a commitment to ethical business practices. A home appraisal is simply as necessary as an inspection and is required before receiving a mortgage loan. This will assess the current value of the property. Buyers ought to at all times conduct a last walkthrough to ensure any agreed-upon points Loan to pay property taxes in San Antonio have been resolved by the vendor and that nothing was ignored. Paying down debt will enhance your credit score, so you might not have to fret about paying off debt and saving up for a ten p.c down payment simultaneously in case your score rises to 580. You can put as little as three.5% down when you've a credit score rating greater than 580.

I’m glad that your article mentions how owning a home will depend in path of property tax deduction. Oh wow, thanks for stating that buying a home is an effective approach to cut back our property tax, particularly if we already gave financial contribution form our salaries. My son has been considering of getting himself a small home subsequent yr San Antonio Property Tax Loans. I’ll ask him to keep this information in thoughts so he’ll make the right purchase later. Armed Forces Reserve Service members who're referred to as to lively responsibility service might be able to defer their loan payments beneath sure conditions. Please go to the Texas VLB Service members Civil Relief Act fact sheet for more information.

A disabled veteran who owns property apart from a residence homestead might apply for a special disabled veteran’s exemption. This exemption is allowed by Tax Code Section 11.22 and is utilized according to the veteran’s incapacity rating of 10 percent or higher. An eligible disabled veteran could obtain each exemptions. Member of the us armed providers killed in action to a complete property tax exemption on his or her residence homestead if the surviving partner has not remarried since the demise of the armed providers member. Veterans who receive compensation from the VA for a service-connected disability rating of 100 percent disabled or of particular person unemployability are eligible for 100% property tax exemption on their homestead. Another bill aimed at rising shopper choice also passed in 2013.

Remember that 10 percent homestead cap that limits the expansion in your home’s taxable value? Many of us could bump up towards that cap yr after yr. At 10 percent annual development, a home’s property tax invoice will nonetheless almost double in about seven years. TSAHC helps each first-time home patrons and repeat patrons buy a house.

New Jersey, Illinois and New Hampshire top the list of states with the best effective property tax charges. This signifies that, with the common home price in New Jersey at $500,628 within Property Tax Loans San Antonio the first quarter of 2021, the homeowner would pay simply over $10,660 in yearly property taxes. State lawmakers ought to rein in local taxing entities that disguise behind annual appraisal will increase to boost extra tax income.

one hundred pc disabled Veterans and/or Veterans which are unemployable rated are absolutely exempt from property taxes in Texas. More info relating to this exemption could be found at this link on the Texas Comptroller’s Website. CAD stands for Central Appraisal District and each county has one. The purpose of the CAD is to appraise all property in that county at market value equally and uniformly for the purpose of property tax evaluation and to speak that worth yearly to every taxpayer and taxing jurisdiction. Hence, this is identical appraisal district you employ to maintain your property taxes lower and contest the values.

You might find the one serving your area better or worse than TSAHC’s. So remember to compare all the applications for which you’re eligible, and see which offers the most effective deal. If you’re not sure which program to decide on on your first mortgage, your lender or real property agent may help you find the right match based in your funds and home shopping for objectives. First-time residence patrons in Texas have plenty of places to turn for help.

0 notes