#professional Accounting Company

Explore tagged Tumblr posts

Text

it might be time to quit my job fr

#RANTING IN THE TAGS IGNORE ME#but it's straight up unbearable I hate it here#like twice a month my team is expected to learn and implement a brand new stupid fucking task that we've never heard of or done before#and the company constantly increases expectations and decreases resources#and then I'm supposed to “hold them accountable” as their manager bc we have taken on a dozen new tasks w/ no external support???? fuck off#I literally JUST singlehandedly rewrote our manual from scratch not even a month ago and already we have like half a dozen changes to make#hey siri how do I beat ass professionally

14 notes

·

View notes

Note

I saw you mention in an ask that you work as a concept artist. First of all that's insanely cool??? Secondly could I ask how you got to work in that field? And in what industry did you find a job? You don't have to answer if it's too personal, I just REALLY wanna work in that field too and I have had no luck so far

I’m super lucky to have gotten my job, the industry is REALLY tough!! I went to school for both 3D animation & graphic design, and the company I was hired at had just opened a new department so I was able to work to build that division of the company! :)

#ask#personal#I’m gonna refrain from saying the company or the industry bc I really really don’t want people knowing where I work hehe#this account is meant to give me a fresh clean slate where I don’t have to worry abt public image and being professional hsfhs

41 notes

·

View notes

Text

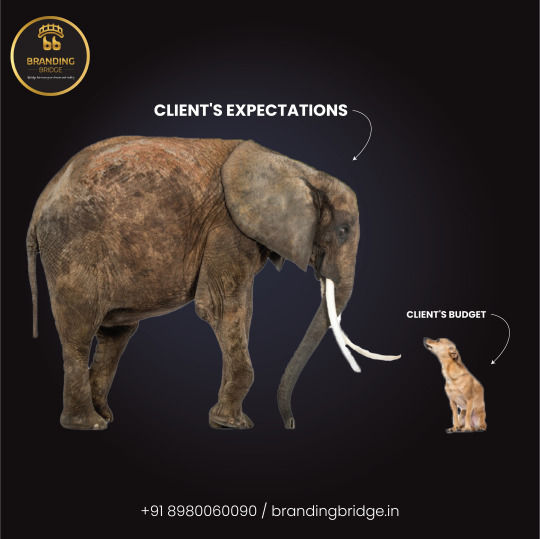

" A brand without discipline is a brand in chaos. "

#business#branding bridge#brand#branding#branding services#branding company#digital services#became brand#digital marketing#web designing#graphic designing#marketing#ecommerce#sales#accounting#skill#skill toy#skill development#professional#tools#hobbies#skill like killer attitude#skill creater#skillful mind#skillful soul#supernatural#successful#successful business#successful life#successful brand

2 notes

·

View notes

Text

i was going to email my accordion teacher i had a few yrs ago to ask for advice on fixing my accordion but then remembered she is quite old so ... i went and looked her up just to make sure there were no obituaries or smth for her and uhm. instead i found out her brother is like. super famous. bro that guy taught me some piano stuff and i played music with him holy shit help ??? i sat on the same piano bench with him while he showed me some piano stuff oh my god. i think he also maybe taught me a bit of accordion bc he plays like a million instruments. he's won multiple awards and has travelled worldwide to perform ???? HELLO ???

and now im too scared and intimidated to email her hdsgjskdgjkl

#idk who else to email though AUGHHH#theres someone in another area of the country that i could email but he has a $150 price tag on just ASSESSING an accordion#so i dont think he'd be willing to give advice for free ;-;#my other option is to make an account on this old web style forum and ask for advice there#but i'd really rather talk to someone i know#i phoned the music store in the next town over and they said they dont do accordion repairs and dont know who would#so im just. back to square one fjdskfl#i wish i wasnt so afraid of emailing ppl but oh my god this lady's brother is so fucking famous what on earth#I DONT KNOW WHAT TO DOOOO#usually i'd be so gung-ho about just trying to fix smth myself#but i saw yet another warning this time on the company's official page that said DO NOT TRY TO FIX IT YOURSELF#GET A PROFESSIONAL TO DO IT FOR THE LOVE OF GOD YOU WILL BREAK SOMETHING AND COST YOURSELF MORE MONEY#so im just aaaaaaaaaaaaaaaaaaaaaaa#vent //

2 notes

·

View notes

Text

It does genuinely make me happy that the Barque Europa has been righted <3 I love her

#Im supposed to have an Instagram for Professional Purposes but I still only follow tall sailing ships and botany/mycology accounts on there#I follow a local reenactment troupe and the stage combat company and that’s. that’s it#doing a fantastic job of marketing myself#I’ve only ever posted pictures of cool rocks/cool plants/bugs/books#I only just posted photos with my face in them when I did the musket course lol#but I do spend time on there solely for looking for casting calls and videos/pictures of ships#I was so happy to see she was sea worthy again!!!!#literally the only time in 2 years Instagram has made me smile#she’s SAFE!!!#<3#this was days ago too lol

2 notes

·

View notes

Text

need someone to sit across from me in a coffee shop so i can work on writing i think id really like to finish that husbands fic because im actually insanely proud of it

#i almost wanted to see if i could use it in like#a professional published piece but#its so much about dundee struggling internally with like#losing his memories and dying and being brought back into a club that has grown so much its pushed him out like#i really dont think theres any way to work that into a different original situation because#the context of dundees story is so inherently important to the fic since im not explicitly writing what happened just responding to it#so i feel like if thats the case i may as well finish and publish it as fanfic so at least people can read something i am proud of#plus how many writers have gotten their fanfic changed and traditionally published at this point i mean#ill become that weird writer u find out wrote fanfic of the most obscure fucked up shit idc#anyway#someone body double and hold me accountable i need company and noise#i have dndads fics i wanna write/finish too so

6 notes

·

View notes

Text

Accountancy Recruitment in Vancouver, BC - (604) 638-6980

Locally owned and operated, Express Employment Professionals in Vancouver, BC is a Full-Service Staffing Agency that continually exceeds expectations by providing services to companies in our community while also helping job seekers find employment.

Express Employment Professionals Vancouver (Downtown) 555 West Hastings Street Vancouver, BC V6B 4N6 (604) 638-6980 https://www.expresspros.com/VancouverDowntownBC

#Accountancy Recruitment#employment company#employment staffing agencies#employment#professional recruitment agency#work agencies near me#vancouver bc#recruitment agency#business staffing#office staffing solutions#vancouver

0 notes

Text

The Key to Sustainable Business Growth: How Consulting Services Can Boost Your Revenue

In today’s fast-paced and competitive marketplace, businesses are under constant pressure to innovate, grow, and streamline operations. However, the journey toward sustainable revenue growth is often complex and requires specialized expertise. Consulting services have become a valuable resource for organizations aiming to navigate these challenges and achieve their business goals. In this blog, we’ll explore how specialized consulting services can fuel business growth and provide strategic support in critical areas.

Driving Revenue Growth through Consulting

One of the most critical aspects of business success is finding ways to continually increase revenue while optimizing operations. Revenue growth consulting is a specialized service that helps businesses identify new opportunities and implement effective strategies to maximize earnings. By analyzing current revenue streams and assessing market trends, consultants provide tailored advice on how to expand sales channels, improve pricing models, and enhance product offerings. Businesses that invest in revenue growth consulting can achieve long-term stability and avoid stagnation in an ever-evolving economic environment.

Business Expansion Strategies for Success

Expanding a business involves much more than merely increasing operations; it requires strategic planning, market understanding, and resource management. Professional consultants offer in-depth business expansion strategies, helping companies identify new markets, assess the competitive landscape, and define clear growth goals. Whether a company is looking to expand domestically or internationally, consulting services ensure that businesses take calculated steps, avoid common pitfalls, and achieve scalable growth. An expert consultant can develop a roadmap that takes into account everything from market entry to supply chain management, providing a holistic approach to expansion.

The Importance of Market Research Services

Successful business decisions are built on a foundation of accurate and comprehensive information. Market research services are an integral part of the consulting process, providing businesses with critical insights into customer behavior, industry trends, and competitive dynamics. By leveraging market research, companies can develop products and services that align with customer needs and market demand. Consultants use various data collection methods, such as surveys, focus groups, and data analysis, to provide actionable insights. This empowers businesses to make informed decisions that lead to enhanced market positioning and better ROI.

Streamlining Operations with Production Management Consulting

In addition to identifying growth opportunities, businesses need to ensure that their operations run smoothly and efficiently. Production management consulting helps businesses optimize their production processes to reduce costs, improve quality, and increase efficiency. From supply chain optimization to workflow automation, consultants help companies refine their operational models to produce better results with fewer resources. This type of consulting is particularly valuable for manufacturing firms and businesses with complex operational processes, as it allows them to stay competitive while maintaining high standards of quality.

Strengthening Financial Health with Balance Sheet Maintenance Services

Financial health is the backbone of any successful business, and maintaining a solid balance sheet is essential for long-term stability. Balance sheet maintenance services, offered by financial consultants, ensure that a company’s assets, liabilities, and equity are well managed. These services involve evaluating financial statements, optimizing capital structure, and identifying potential risks. By working with consultants, businesses can ensure they have accurate financial reporting, enabling them to make sound financial decisions and avoid unnecessary liabilities. This strengthens a company’s financial foundation and prepares it for future growth and investment opportunities.

#The Key to Sustainable Business Growth: How Consulting Services Can Boost Your Revenue#In today’s fast-paced and competitive marketplace#businesses are under constant pressure to innovate#grow#and streamline operations. However#the journey toward sustainable revenue growth is often complex and requires specialized expertise. Consulting services have become a valuab#we’ll explore how specialized consulting services can fuel business growth and provide strategic support in critical areas.#Driving Revenue Growth through Consulting#One of the most critical aspects of business success is finding ways to continually increase revenue while optimizing operations. Revenue g#consultants provide tailored advice on how to expand sales channels#improve pricing models#and enhance product offerings. Businesses that invest in revenue growth consulting can achieve long-term stability and avoid stagnation in#Business Expansion Strategies for Success#Expanding a business involves much more than merely increasing operations; it requires strategic planning#market understanding#and resource management. Professional consultants offer in-depth business expansion strategies#helping companies identify new markets#assess the competitive landscape#and define clear growth goals. Whether a company is looking to expand domestically or internationally#consulting services ensure that businesses take calculated steps#avoid common pitfalls#and achieve scalable growth. An expert consultant can develop a roadmap that takes into account everything from market entry to supply chai#providing a holistic approach to expansion.#The Importance of Market Research Services#Successful business decisions are built on a foundation of accurate and comprehensive information. Market research services are an integral#providing businesses with critical insights into customer behavior#industry trends#and competitive dynamics. By leveraging market research#companies can develop products and services that align with customer needs and market demand. Consultants use various data collection metho#such as surveys

0 notes

Text

"Trust Alkhazraji Accounting Firms in Abu Dhabi for Accurate Financial Management""Choose Alkhazraji Accounting Firms in Abu Dhabi for accurate and reliable financial management. We are committed to your business’s financial success."

#Alkhazraji accounting firms in Abu Dhabi#Abu Dhabi accounting services#business accounting Abu Dhabi#financial management Abu Dhabi#expert accounting solutions#reliable accounting firms#Alkhazraji financial solutions#top-rated accounting services#accounting experts Abu Dhabi#professional financial management#Alkhazraji business solutions#trusted accounting firms#comprehensive accounting services#Abu Dhabi business accountants#accurate financial management.#accounting firms#accounting companies#abudhabi

0 notes

Text

Best Accounting Practices for Online Businesses: Remote Accounting and Audit Frequency

Running an online business comes with unique challenges, especially when it comes to managing finances. With global e-commerce sales expected to reach $6.38 trillion by 2024, having good accounting practices is crucial for success. This blog will cover the best accounting practices for online businesses, the benefits of working with a remote accountant, and how often audits should be conducted. Throughout this blog, we'll highlight More Than Numbers CPA, known as the best accountant in the Greater Toronto Area.

Best Accounting Practices for Online Businesses

Keep Accurate Financial Records

One of the most important things for any online business is to keep accurate financial records. This means keeping track of all sales, expenses, and other financial transactions. The U.S. Small Business Administration states that poor financial management is a top reason why small businesses fail. Accurate records help in understanding cash flow, preparing taxes, and making business decisions. Working with the best accountant in the Greater Toronto Area, like More Than Numbers CPA, can help businesses keep accurate records using modern software to avoid errors.

Use Cloud-Based Accounting Software

Cloud-based accounting software like QuickBooks Online, Xero, or Wave can be a game-changer for online businesses. Around 67% of accountants believe these tools help in building better relationships with clients by providing real-time access to financial information. The best accountant in the Greater Toronto Area, More Than Numbers CPA, can help online businesses choose and set up the right software to manage their finances efficiently.

Automate Routine Accounting Tasks

Automation can save time and reduce errors in accounting. About 85% of finance leaders say automation allows them to focus on more strategic tasks. For online businesses, automating tasks like invoicing, payroll, and tracking expenses can streamline operations. The best accountant in the Greater Toronto Area, More Than Numbers CPA, offers expert advice on using automation tools to simplify accounting processes, so businesses can focus on growth.

Manage Cash Flow Effectively

Cash flow problems are the reason 82% of small businesses fail, according to a study by U.S. Bank. For an online business, managing cash flow is essential to avoid running out of money. Working with the best accountant in the Greater Toronto Area, such as More Than Numbers CPA, helps businesses plan for future cash needs, manage expenses, and keep finances healthy.

Stay Up-to-Date with Tax Rules

Tax rules can be complicated, especially for online businesses that sell in different places. There are over 12,000 tax jurisdictions in the U.S. alone, each with its own rules. The best accountant in the Greater Toronto Area, More Than Numbers CPA, is skilled in managing taxes across different regions and can help businesses stay compliant and avoid fines.

Reconcile Accounts Regularly

Reconciling accounts means comparing business records with bank statements to find any discrepancies. The Association of Certified Fraud Examiners (ACFE) says that small businesses lose an average of 5% of their revenue to fraud. The best accountant in the Greater Toronto Area, More Than Numbers CPA, recommends doing regular reconciliations to catch errors early and ensure everything matches up correctly.

Separate Personal and Business Finances

Mixing personal and business finances can create confusion and lead to errors. About 23% of small business owners admit to mixing the two. The best accountant in the Greater Toronto Area, More Than Numbers CPA, advises keeping them separate to avoid legal and financial problems.

Benefits of Working with a Remote Accountant

With the rise of remote work, many businesses are turning to remote accountants to manage their finances. A remote accountant, like More Than Numbers CPA, the best accountant in the Greater Toronto Area, offers many benefits:

Flexibility and Easy Access

Remote accountants offer flexibility by allowing business owners to access financial information anytime, anywhere. Over 50% of businesses are expected to continue working remotely after the pandemic, making remote accessibility even more valuable. The best accountant in the Greater Toronto Area, More Than Numbers CPA, provides real-time financial insights to help businesses make quick decisions.

Cost Savings

Hiring a remote accountant can save money by eliminating the need for a full-time in-house team. According to Deloitte, 40% of businesses save costs by outsourcing accounting services. The best accountant in the Greater Toronto Area, More Than Numbers CPA, offers flexible services that fit different business sizes and budgets.

Access to Expert Knowledge

Remote accountants often have specialized knowledge that small in-house teams may lack. Working with the best accountant in the Greater Toronto Area, like More Than Numbers CPA, gives businesses access to experts in tax planning, financial forecasting, and regulatory compliance.

Secure and Clear Communication

Remote accountants use secure communication tools, like encrypted file-sharing and video conferencing, to maintain transparency and protect sensitive information. The best accountant in the Greater Toronto Area, More Than Numbers CPA, ensures smooth communication and high-quality service.

Strong Data Security

Data security is crucial for online businesses. About 60% of small businesses go out of business within six months after a cyber attack. The best accountant in the Greater Toronto Area, More Than Numbers CPA, uses advanced security measures like encryption and multi-layered authentication to protect client information.

How Often Should Online Businesses Conduct Audits?

Audits help verify the accuracy of financial statements and detect fraud. The frequency of audits depends on the size, regulatory needs, and complexity of a business. Here is a breakdown of audit types and how often they should be done, according to the best accountant in the Greater Toronto Area, More Than Numbers CPA:

Annual Financial Audits

Most businesses conduct annual audits to ensure their financial statements are accurate and follow accounting standards. A survey by the Institute of Internal Auditors shows that 88% of organizations perform annual audits. The best accountant in the Greater Toronto Area, More Than Numbers CPA, helps businesses prepare for these audits to avoid any issues.

Quarterly or Semi-Annual Internal Audits

Internal audits help businesses improve their internal controls and identify risks. For online businesses, conducting internal audits quarterly or semi-annually is useful for maintaining efficient operations. More Than Numbers CPA, known as the best accountant in the Greater Toronto Area, provides detailed internal audits to help businesses improve.

Compliance Audits

Compliance audits ensure a business is following all the rules and regulations. These audits may need to happen more frequently for businesses operating in multiple regions. The best accountant in the Greater Toronto Area, More Than Numbers CPA, offers services to keep businesses compliant with all local and international regulations.

Special Audits

Sometimes businesses need special audits, such as when investigating suspected fraud or preparing for a merger. The best accountant in the Greater Toronto Area, More Than Numbers CPA, has the expertise to handle these audits and provide clear financial insights.

Conclusion

For online businesses, following good accounting practices is essential to stay financially healthy and grow. From keeping accurate records and using cloud-based software to managing cash flow and separating personal and business finances, these practices are the foundation of good financial management. Working with a remote accountant, especially the best accountant in the Greater Toronto Area, More Than Numbers CPA, provides advantages like cost savings, expert knowledge, and secure communication. Regular audits, scheduled according to the business's needs, help maintain financial accuracy and build trust.

Choosing More Than Numbers CPA means working with the best accountant in the Greater Toronto Area who understands the unique challenges of online businesses and provides tailored solutions to help them thrive.

0 notes

Text

IT and Non IT Training in Nepal

If you are ready to build your career in IT and Non-IT training, enroll in any of various training in Nepal!

According to my research, I found best HR training provided by UpSkills Nepal with many different IT and Non It courses!

Most Of top Non IT courses are:

Digital marketing training in Nepal

HR training in Nepal

SEO training in Nepal

Accounting training in Nepal

Graphics design training in Nepal

Diploma in digital marketing in Nepal

Most important IT courses are:

Cybersecurity courses in Nepal

Data science traning in Nepal

AI training in Nepal

DevOps training in Nepal

Python traning in Nepal

UI/UX training in Nepal

#professional hr training#hr training#digital marketing company#digital marketing#digital marketing training#seo training#seo marketing#diploma courses#devops#devops training#cybersecurity#cybersecurity training#data science training#ui ux design#python course#python tutorial#accounting tips

0 notes

Text

Top Accounting Services in UAE on TradersFind

Locate experienced and reputable accounting services in UAE on TradersFind. Our platform features a curated selection of certified professionals offering tax, audit, and advisory services across the UAE, from Dubai to Abu Dhabi and beyond. Trust your finances to the Accounting Services in UAE market and enjoy the peace of mind that comes with working with top experts. Contact Now!

#Accounting Services#Accounting Services in UAE#professional accounting services#top Accounting Services#accounting firms#accounting firms in UAE#Best Accounting Services#Tax Accounting Services#accounting services for small business#tax and accounting services#online accounting services#Accounting companies#Accounting companies in UAE

0 notes

Text

Introduction

Company Secretaries (CS) play a vital role in corporate governance and compliance. They ensure that companies comply with legal and regulatory requirements, maintain records, and manage corporate governance frameworks. Despite their essential role, Company Secretaries may sometimes require additional funds to expand their practice, invest in new technology, or manage their working capital needs. This is where professional loans for Company Secretaries come into play.

A professional loan for Company Secretaries is a specialized financial product designed to meet the unique needs of CS professionals. This comprehensive guide will explore the various aspects of these loans, including eligibility criteria, benefits, application process, interest rates, repayment terms, and more. By the end of this article, you will have a thorough understanding of how professional loans can support Company Secretaries in their professional growth and financial stability.

Chapter 1: Understanding Professional Loans for Company Secretaries

1.1 What is a Professional Loan for Company Secretaries?

A professional loan for Company Secretaries is a type of unsecured loan specifically tailored to meet the financial needs of CS professionals. Unlike traditional business loans that may require collateral, professional loans for Company Secretaries are typically unsecured. They offer flexible repayment terms, competitive interest rates, and quick disbursal, making them an ideal financial solution for CS professionals looking to expand their practice, invest in technology, or manage their working capital.

1.2 Why Company Secretaries Need Professional Loans

Company Secretaries may require professional loans for various reasons, including:

Practice Expansion: CS professionals may need funds to open new offices, hire additional staff, or expand their service offerings.

Technology Investment: Keeping up with the latest corporate governance software and technology can be expensive. Professional loans can help CS professionals invest in these tools to enhance their efficiency and compliance capabilities.

Working Capital Management: CS professionals may face cash flow challenges due to delayed client payments or seasonal variations in business. Professional loans can provide the necessary working capital to manage these fluctuations.

Training and Development: Continuing professional education is essential for CS professionals to stay updated with the latest regulatory changes and governance practices. Professional loans can cover the costs of training programs and certifications.

Debt Consolidation: CS professionals with multiple outstanding debts can consolidate them into a single loan with better terms, reducing their financial burden.

Chapter 2: Eligibility Criteria and Documentation

2.1 Eligibility Criteria for Professional Loans for Company Secretaries

To qualify for a professional loan, Company Secretaries must typically meet the following eligibility criteria:

Professional Qualification: The applicant must be a qualified Company Secretary with a valid CS degree from the Institute of Company Secretaries of India (ICSI).

Professional Experience: Most lenders require CS professionals to have a minimum number of years of post-qualification experience, typically ranging from 1 to 3 years.

Age: The applicant must fall within a certain age range, usually between 21 to 65 years.

Income: The applicant must have a steady and sufficient income to repay the loan. Lenders may set a minimum annual income requirement.

Credit Score: A good credit score (typically above 700) is essential for loan approval. A higher credit score may also result in better loan terms.

Business Continuity: For CS professionals running their own practice, lenders may require proof of business continuity for a certain period, usually around 2 to 3 years.

2.2 Documentation Required for Professional Loans

The documentation required for professional loans for Company Secretaries is straightforward and helps lenders assess the applicant's creditworthiness. Commonly required documents include:

Identity Proof: PAN card, Aadhaar card, passport, or voter ID.

Address Proof: Utility bills, rental agreement, passport, or Aadhaar card.

Professional Proof: CS degree certificate, membership certificate from the Institute of Company Secretaries of India (ICSI).

Income Proof: Salary slips, bank statements, IT returns, and financial statements.

Business Proof: For self-employed CS professionals, proof of business existence, GST registration, and business bank account statements.

Photographs: Passport-sized photographs of the applicant.

Chapter 3: Benefits of Professional Loans for Company Secretaries

3.1 Unsecured Nature

One of the primary benefits of professional loan for CS is that they are typically unsecured. This means CS professionals do not need to pledge any assets or property as collateral, reducing the risk and complexity associated with securing a loan.

3.2 Flexible Repayment Terms

Professional loans offer flexible repayment options, allowing Company Secretaries to choose a tenure that suits their financial situation. Repayment tenures can range from 12 months to 60 months, providing ample flexibility to manage cash flow and financial commitments.

3.3 Competitive Interest Rates

Lenders offer attractive interest rates on professional loans for Company Secretaries, making them affordable and cost-effective. The interest rates are usually lower than those of unsecured personal loans, reflecting the lower risk associated with lending to qualified professionals.

3.4 Quick Disbursal

The loan approval and disbursal process for professional loans is fast and efficient. Lenders understand the urgent financial needs of Company Secretaries and strive to provide quick access to funds, often within a few days of application.

3.5 High Loan Amounts

Depending on the lender, Company Secretaries can avail of high loan amounts to meet their financial needs. Loan amounts can range from INR 1 lakh to INR 50 lakhs or more, providing ample funds for practice expansion, technology investment, or working capital management.

3.6 Tax Benefits

Professional loans for Company Secretaries can offer tax benefits under certain conditions. The interest paid on the loan may be tax-deductible as a business expense, reducing the overall tax liability. It is advisable to consult a tax advisor to understand the specific tax benefits applicable to individual cases.

Chapter 4: How to Apply for a Professional Loan for Company Secretaries

4.1 Choosing the Right Lender

Selecting the right lender is crucial for securing the best terms and conditions on a professional loan. Company Secretaries should compare various lenders based on factors such as interest rates, loan amounts, repayment terms, and customer service. Online comparison tools and reviews can help in making an informed decision.

4.2 Application Process

The application process for professional loans is straightforward and can often be completed online. Here are the typical steps involved:

Online Application: Visit the lender's website and fill out the online application form with personal, professional, and financial details.

Document Submission: Upload the required documents, such as identity proof, address proof, professional proof, and income proof.

Credit Assessment: The lender will assess the applicant's creditworthiness based on the submitted documents and credit score.

Loan Approval: If the application meets the lender's criteria, the loan will be approved, and the applicant will receive a sanction letter outlining the loan terms and conditions.

Loan Disbursal: Once the applicant accepts the loan offer, the funds will be disbursed to their bank account.

4.3 Tips for a Successful Application

Maintain a Good Credit Score: A high credit score improves the chances of loan approval and better terms. Ensure timely payment of existing debts and credit card bills to maintain a good credit score.

Provide Accurate Information: Fill out the application form accurately and honestly. Discrepancies can lead to rejection or delays in processing.

Submit Complete Documentation: Ensure all required documents are submitted and are up-to-date. Incomplete documentation can result in delays or rejection.

Compare Multiple Lenders: Don’t settle for the first offer. Compare multiple lenders to find the best terms and conditions.

Chapter 5: Interest Rates and Repayment Terms

5.1 Interest Rates

Interest rates on professional loans for Company Secretaries can vary based on factors such as the applicant's credit score, income, loan amount, and tenure. Here are some key points to consider:

Fixed vs. Floating Rates: Lenders may offer fixed or floating interest rates. Fixed rates remain constant throughout the loan tenure, while floating rates can change based on market conditions.

Range of Interest Rates: Interest rates for professional loans typically range from 10% to 18% per annum, depending on the lender and the applicant's profile.

Negotiating Rates: Company Secretaries with a good credit score and strong financial profile can negotiate better interest rates with lenders.

5.2 Repayment Terms

Repayment terms for professional loans are flexible, allowing Company Secretaries to choose a tenure that suits their financial situation. Key aspects of repayment terms include:

Repayment Tenure: Repayment tenures can range from 12 months to 60 months. Longer tenures result in lower EMIs but higher total interest payments.

EMI Calculation: Use an EMI calculator to estimate the monthly installment amount based on the loan amount, interest rate, and tenure. This helps in planning finances and ensuring affordability.

Prepayment and Foreclosure: Lenders may allow prepayment or foreclosure of the loan before the end of the tenure. However, there may be penalties or charges associated with early repayment.

Chapter 6: Case Studies of Successful Company Secretaries

6.1 Case Study 1: Expanding a CS Firm

Riya Sharma, a Company Secretary based in Delhi, wanted to expand her practice by offering new compliance services to her clients. She needed funds for hiring additional staff, investing in software, and marketing. Riya applied for a professional loan of INR 25 lakhs with a flexible tenure of 48 months. The loan enabled her to successfully expand her practice, and within a year, she saw a significant increase in her client base and revenue.

6.2 Case Study 2: Technology Investment

Vivek Kumar, a Company Secretary in Bangalore, recognized the importance of adopting advanced technology to enhance his firm's efficiency and service delivery. He needed funds to invest in cloud-based compliance software, upgrade his office infrastructure, and provide training to his staff. Vivek applied for a professional loan of INR 15 lakhs with a repayment tenure of 36 months. The loan enabled him to upgrade his technology infrastructure, improve client satisfaction, and streamline operations, resulting in increased productivity and profitability.

6.3 Case Study 3: Managing Working Capital

Komal Jain, a self-employed Company Secretary in Mumbai, faced cash flow challenges due to delayed payments from clients and seasonal variations in business. To manage her working capital needs and maintain cash flow stability, Komal applied for a professional loan of INR 10 lakhs with a tenure of 24 months. The loan provided her with the necessary funds to cover operational expenses during lean periods and ensure uninterrupted service to her clients. As a result, Komal was able to navigate through cash flow fluctuations and grow her practice steadily.

Chapter 7: Comparison with Other Financial Products

7.1 Professional Loans vs. Personal Loans

Collateral Requirement: Professional loans for Company Secretaries are typically unsecured, while personal loans may be secured or unsecured.

Interest Rates: Professional loans often offer lower interest rates compared to personal loans due to the lower risk associated with lending to qualified professionals.

Loan Amount: Professional loans generally offer higher loan amounts tailored to the financial needs of Company Secretaries.

Purpose: Professional loans are specifically designed for professional use, such as practice expansion or technology investment, whereas personal loans can be used for various personal expenses.

7.2 Professional Loans vs. Business Loans

Eligibility Criteria: Professional loans are tailored for Company Secretaries, whereas business loans are available to a broader range of businesses and entrepreneurs.

Documentation: Professional loans have simpler documentation requirements compared to business loans, which may require detailed business plans and financial projections.

Loan Amount: Business loans may offer higher loan amounts based on business turnover and asset value, while professional loans offer substantial amounts based on the individual's income and creditworthiness.

Interest Rates: Professional loans often come with lower interest rates than business loans due to the lower risk associated with lending to professionals.

7.3 Professional Loans vs. Loan Against Property

Collateral Requirement: Professional loans for Company Secretaries are unsecured, while loan against property requires collateral in the form of real estate.

Interest Rates: Loan against property generally offers lower interest rates due to the secured nature of the loan, while professional loans offer competitive rates without requiring collateral.

Loan Amount: Loan against property can offer higher loan amounts based on property value, while professional loans provide substantial but generally lower amounts.

Processing Time: Professional loans have a faster approval and disbursal process compared to loan against property, which involves property valuation and legal scrutiny.

Chapter 8: Common Challenges and Solutions

8.1 Maintaining a Good Credit Score

A good credit score is crucial for obtaining favorable terms on a professional loan. Company Secretaries should ensure timely payment of existing debts, avoid taking on excessive new debt, and monitor their credit report regularly to maintain a healthy credit score.

8.2 Managing Cash Flow

Effective cash flow management is essential for repaying loans on time. Company Secretaries should create a detailed cash flow forecast, prioritize payments, and maintain an emergency fund to handle unexpected expenses.

8.3 Choosing the Right Loan Tenure

Selecting the appropriate loan tenure is crucial for managing monthly repayments without straining finances. Company Secretaries should use an EMI calculator to determine the optimal tenure based on their income and financial commitments.

8.4 Understanding Loan Terms and Conditions

Before applying for a professional loan, it's important to thoroughly understand the terms and conditions, including interest rates, repayment schedules, prepayment penalties, and additional charges. Seeking clarification from the lender and consulting a financial advisor can help in making informed decisions.

8.5 Staying Updated with Industry Trends

Continuous professional development is essential for staying competitive in the corporate governance industry. Company Secretaries should invest in training and certifications, attend industry seminars, and subscribe to relevant publications to stay updated with the latest trends and regulatory changes.

Chapter 9: Future Trends in Professional Loans for Company Secretaries

9.1 Digital Transformation

The financial industry is undergoing rapid digital transformation, and professional loans are no exception. Online application processes, digital documentation, and automated credit assessments are making it easier and faster for Company Secretaries to secure loans.

9.2 Customized Financial Products

As the demand for professional loans grows, lenders are likely to offer more customized financial products tailored to the specific needs of Company Secretaries. This could include flexible repayment options, specialized loan products for different stages of a CS's career, and value-added services like financial planning and advisory.

9.3 Increased Competition Among Lenders

With more financial institutions recognizing the potential of professional loans, competition among lenders is expected to increase. This will likely result in more competitive interest rates, better terms, and improved customer service, benefiting Company Secretaries seeking financial assistance.

9.4 Integration with Professional Associations

Lenders may collaborate more closely with professional associations like the Institute of Company Secretaries of India (ICSI) to offer exclusive loan products and benefits to their members. Such partnerships can provide Company Secretaries with access to tailored financial solutions and support their professional growth.

9.5 Enhanced Financial Literacy

As awareness about professional loans increases, there will be a greater emphasis on enhancing financial literacy among Company Secretaries. Lenders and professional associations may offer educational programs and resources to help CS professionals make informed financial decisions and effectively manage their loans.

Conclusion

Professional loans for Company Secretaries are a valuable financial tool that can support the growth and development of CS practices. By understanding the eligibility criteria, benefits, application process, interest rates, and potential challenges, CS loan can make informed decisions and leverage these loans to achieve their professional goals. Whether it's expanding their practice, investing in technology, managing working capital, or pursuing professional development, professional loans provide the necessary financial support to help CS professionals thrive in their careers. As the financial landscape evolves, staying informed about the latest trends and best practices will enable Company Secretaries to make the most of the opportunities available to them.

0 notes

Text

" Products are made ; brands are created. "

#business#branding bridge#brand#branding#branding services#branding company#digital services#became brand#digital marketing#web designing#graphic designing#marketing#ecommerce#sales#accounting#skill#skill toy#skill development#professional#tools#hobbies#skill like killer attitude#skill creater#skillful mind#skillful soul#supernatural#successful#successful business#successful life#successful brand

2 notes

·

View notes

Text

How to Leverage Offshore Staffing to Boost Business Efficiency" This article from Amtex Systems explores the strategic advantages of offshore staffing, such as cost savings and access to a global talent pool, while addressing common challenges like communication barriers and cultural differences. It provides practical tips for businesses to effectively manage offshore teams and ensure successful collaboration.

#offshorestaffing#accounting outsourcing#offshore accounting#offshore company#Amtex Offshore Staffing#Amtex Offshore Recruitment#Amtex Offshore Talent#Amtex Offshore HR Solutions#Amtex Offshore IT Staffing#Amtex Offshore Employment#Amtex Offshore Workforce#Amtex Offshore Professional Staffing#Amtex Offshore Business Solutions#Amtex Offshore Remote Staffing

1 note

·

View note

Text

So I’ve posted on here at least in tags about how much I don’t like my job… and today I messaged back two recruiters on LinkedIn (shudder) that had reached out to me about different opportunities and it is scarrrryyyy. I haven’t even updated my resume yet. but I want out of public accounting and I have to start somewhere… so here’s to somewhere… and to getting brave enough to go after it for real.

#i dont know why this happens but as soon as i have the safety net of a job i already have and am good at#it’s nigh impossible to get myself to actually make a change even if the job i. have is making me miserable.#sure i’m good at it but they’re bleeding me dry and i just … i want to find a way to make it work like some of my coworkers seem to have don#but i’m so scared to talk to them about personal stuff like their feelings on working so much. like wtf. that’s so scary#am i even allowed to do that???#i get the sneaking suspicion i am actually supposed to do that#but god it’s one of my worst fears… asking a question only to find out that not knowing the answer already is a point of ridicule#or overstepping my bounds and earning scorn#which makes actually finding my place in this industry incredibly difficult because job descriptions and interviews can go well and all#but what companies actually want seem to be completely different past the year mark.#or is it just that i don’t know how to ask the right questions v#?^#i feel so timid and scared and weak about this stuff and it kills me#because i want to be fearless and unshakeable but i cannot fucking do this#simple thing… finding a different job… you’ll hear from everyone in the industry that accountants are needed#there’s jobs aplenty and you barely even have to look#and on top of that i’m competent and a quick learner and i have a great track record academically and professionally#and it’s all right on paper but i’m petrified of actually doing it and it’s the stupidest thing. why am i scared?#there’s a downside to achieving all the goals the ‘past you’ set. your gumption is spent and you’re afraid you might lose what you have#if you shoot for something different. something hopefully better.#age old tale right? i don’t know if it’ll really be better. i don’t know if i can do it.#courage… courage to try. that’s my next step. find the courage to try.

1 note

·

View note