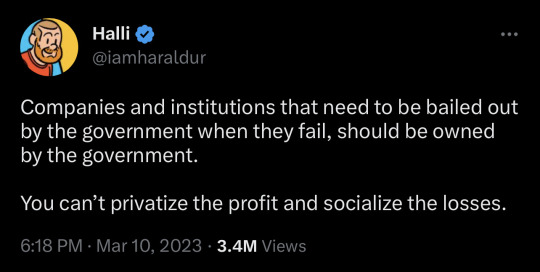

#privatized profits

Explore tagged Tumblr posts

Text

"We all too often have socialism for the rich and rugged free market capitalism for the poor."

—Martin Luther King Jr.

#politics#banking#privatized profits#socialized losses#capitalism#mlkjr#halli is cool#svb#silicon valley bank#privatized profits socialized losses

2K notes

·

View notes

Text

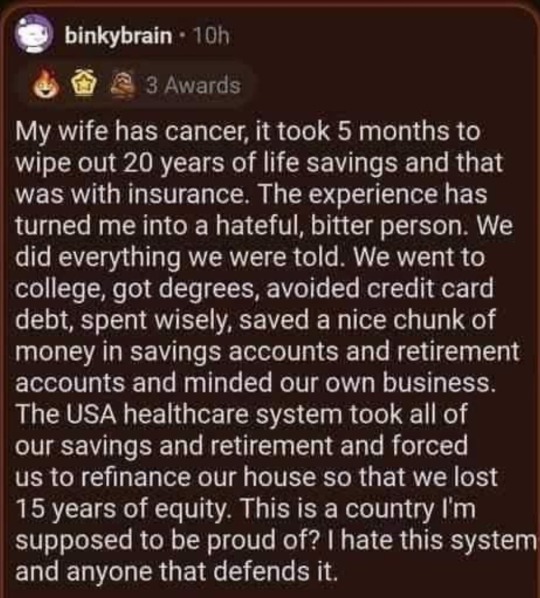

#republican assholes#corporate greed#maga morons#ceo greed#AI#private for profit healthcare#luigi mangione

720 notes

·

View notes

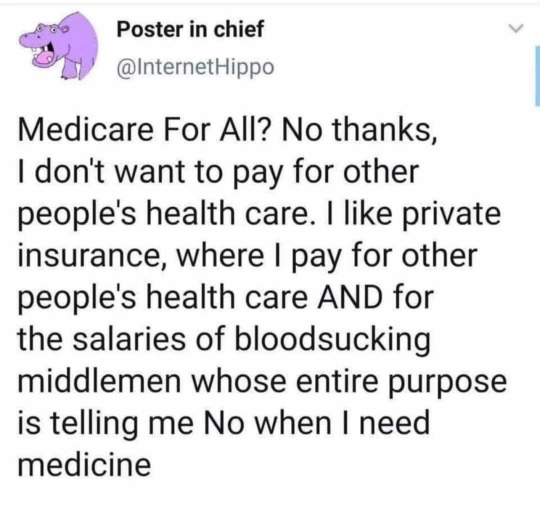

Text

#private healthcare#for profit healthcare#corporate greed#ceo greed#corporations and oligarchs are killing us#medical debt#medical bankruptcy#republican assholes#maga morons#oligarchs control the Republican Party

675 notes

·

View notes

Text

#Marjorie Nazi Greene#ceo shooter#private healthcare#for profit healthcare#medical debt#medical bankruptcy#class war#culture war#republican assholes#maga morons#corporate greed#ceo greed#oligarchs own the Republicans#oligarch CEOs are killing us

369 notes

·

View notes

Text

#Republican transphobia#republican assholes#crooked donald#traitor trump#republican hypocrisy#maga morons#Republicans hate you#corporate greed#for profit healthcare#private healthcare

254 notes

·

View notes

Text

How to shatter the class solidarity of the ruling class

I'm touring my new, nationally bestselling novel The Bezzle! Catch me WEDNESDAY (Apr 11) at UCLA, then Chicago (Apr 17), Torino (Apr 21) Marin County (Apr 27), Winnipeg (May 2), Calgary (May 3), Vancouver (May 4), and beyond!

Audre Lorde counsels us that "The Master's Tools Will Never Dismantle the Master's House," while MLK said "the law cannot make a man love me, but it can restrain him from lynching me." Somewhere between replacing the system and using the system lies a pragmatic – if easily derailed – course.

Lorde is telling us that a rotten system can't be redeemed by using its own chosen reform mechanisms. King's telling us that unless we live, we can't fight – so anything within the system that makes it easier for your comrades to fight on can hasten the end of the system.

Take the problems of journalism. One old model of journalism funding involved wealthy newspaper families profiting handsomely by selling local appliance store owners the right to reach the townspeople who wanted to read sports-scores. These families expressed their patrician love of their town by peeling off some of those profits to pay reporters to sit through municipal council meetings or even travel overseas and get shot at.

In retrospect, this wasn't ever going to be a stable arrangement. It relied on both the inconstant generosity of newspaper barons and the absence of a superior way to show washing-machine ads to people who might want to buy washing machines. Neither of these were good long-term bets. Not only were newspaper barons easily distracted from their sense of patrician duty (especially when their own power was called into question), but there were lots of better ways to connect buyers and sellers lurking in potentia.

All of this was grossly exacerbated by tech monopolies. Tech barons aren't smarter or more evil than newspaper barons, but they have better tools, and so now they take 51 cents out of every ad dollar and 30 cents out of ever subscriber dollar and they refuse to deliver the news to users who explicitly requested it, unless the news company pays them a bribe to "boost" their posts:

https://www.eff.org/deeplinks/2023/04/saving-news-big-tech

The news is important, and people sign up to make, digest, and discuss the news for many non-economic reasons, which means that the news continues to struggle along, despite all the economic impediments and the vulture capitalists and tech monopolists who fight one another for which one will get to take the biggest bite out of the press. We've got outstanding nonprofit news outlets like Propublica, journalist-owned outlets like 404 Media, and crowdfunded reporters like Molly White (and winner-take-all outlets like the New York Times).

But as Hamilton Nolan points out, "that pot of money…is only large enough to produce a small fraction of the journalism that was being produced in past generations":

https://www.hamiltonnolan.com/p/what-will-replace-advertising-revenue

For Nolan, "public funding of journalism is the only way to fix this…If we accept that journalism is not just a business or a form of entertainment but a public good, then funding it with public money makes perfect sense":

https://www.hamiltonnolan.com/p/public-funding-of-journalism-is-the

Having grown up in Canada – under the CBC – and then lived for a quarter of my life in the UK – under the BBC – I am very enthusiastic about Nolan's solution. There are obvious problems with publicly funded journalism, like the politicization of news coverage:

https://www.theguardian.com/media/2023/jan/24/panel-approving-richard-sharp-as-bbc-chair-included-tory-party-donor

And the transformation of the funding into a cheap political football:

https://www.cbc.ca/news/politics/poilievre-defund-cbc-change-law-1.6810434

But the worst version of those problems is still better than the best version of the private-equity-funded model of news production.

But Nolan notes the emergence of a new form of hedge fund news, one that is awfully promising, and also terribly fraught: Hunterbrook Media, an investigative news outlet owned by short-sellers who pay journalists to research and publish damning reports on companies they hold a short position on:

https://hntrbrk.com/

For those of you who are blissfully distant from the machinations of the financial markets, "short selling" is a wager that a company's stock price will go down. A gambler who takes a short position on a company's stock can make a lot of money if the company stumbles or fails altogether (but if the company does well, the short can suffer literally unlimited losses).

Shorts have historically paid analysts to dig into companies and uncover the sins hidden on their balance-sheets, but as Matt Levine points out, journalists work for a fraction of the price of analysts and are at least as good at uncovering dirt as MBAs are:

https://www.bloomberg.com/opinion/articles/2024-04-02/a-hedge-fund-that-s-also-a-newspaper

What's more, shorts who discover dirt on a company still need to convince journalists to publicize their findings and trigger the sell-off that makes their short position pay off. Shorts who own a muckraking journalistic operation can skip this step: they are the journalists.

There's a way in which this is sheer genius. Well-funded shorts who don't care about the news per se can still be motivated into funding freely available, high-quality investigative journalism about corporate malfeasance (notoriously, one of the least attractive forms of journalism for advertisers). They can pay journalists top dollar – even bid against each other for the most talented journalists – and supply them with all the tools they need to ply their trade. A short won't ever try the kind of bullshit the owners of Vice pulled, paying themselves millions while their journalists lose access to Lexisnexis or the PACER database:

https://pluralistic.net/2024/02/24/anti-posse/#when-you-absolutely-positively-dont-give-a-solitary-single-fuck

The shorts whose journalists are best equipped stand to make the most money. What's not to like?

Well, the issue here is whether the ruling class's sense of solidarity is stronger than its greed. The wealthy have historically oscillated between real solidarity (think of the ultrawealthy lobbying to support bipartisan votes for tax cuts and bailouts) and "war of all against all" (as when wealthy colonizers dragged their countries into WWI after the supply of countries to steal ran out).

After all, the reason companies engage in the scams that shorts reveal is that they are profitable. "Behind every great fortune is a great crime," and that's just great. You don't win the game when you get into heaven, you win it when you get into the Forbes Rich List.

Take monopolies: investors like the upside of backing an upstart company that gobbles up some staid industry's margins – Amazon vs publishing, say, or Uber vs taxis. But while there's a lot of upside in that move, there's also a lot of risk: most companies that set out to "disrupt" an industry sink, taking their investors' capital down with them.

Contrast that with monopolies: backing a company that merges with its rivals and buys every small company that might someday grow large is a sure thing. Shriven of "wasteful competition," a company can lower quality, raise prices, capture its regulators, screw its workers and suppliers and laugh all the way to Davos. A big enough company can ignore the complaints of those workers, customers and regulators. They're not just too big to fail. They're not just too big to jail. They're too big to care:

https://pluralistic.net/2024/04/04/teach-me-how-to-shruggie/#kagi

Would-be monopolists are stuck in a high-stakes Prisoner's Dilemma. If they cooperate, they can screw over everyone else and get unimaginably rich. But if one party defects, they can raid the monopolist's margins, short its stock, and snitch to its regulators.

It's true that there's a clear incentive for hedge-fund managers to fund investigative journalism into other hedge-fund managers' portfolio companies. But it would be even more profitable for both of those hedgies to join forces and collude to screw the rest of us over. So long as they mistrust each other, we might see some benefit from that adversarial relationship. But the point of the 0.1% is that there aren't very many of them. The Aspen Institute can rent a hall that will hold an appreciable fraction of that crowd. They buy their private jets and bespoke suits and powdered rhino horn from the same exclusive sellers. Their kids go to the same elite schools. They know each other, and they have every opportunity to get drunk together at a charity ball or a society wedding and cook up a plan to join forces.

This is the problem at the core of "mechanism design" grounded in "rational self-interest." If you try to create a system where people do the right thing because they're selfish assholes, you normalize being a selfish asshole. Eventually, the selfish assholes form a cozy little League of Selfish Assholes and turn on the rest of us.

Appeals to morality don't work on unethical people, but appeals to immorality crowds out ethics. Take the ancient split between "free software" (software that is designed to maximize the freedom of the people who use it) and "open source software" (identical to free software, but promoted as a better way to make robust code through transparency and peer review).

Over the years, open source – an appeal to your own selfish need for better code – triumphed over free software, and its appeal to the ethics of a world of "software freedom." But it turns out that while the difference between "open" and "free" was once mere semantics, it's fully possible to decouple the two. Today, we have lots of "open source": you can see the code that Google, Microsoft, Apple and Facebook uses, and even contribute your labor to it for free. But you can't actually decide how the software you write works, because it all takes a loop through Google, Microsoft, Apple or Facebook's servers, and only those trillion-dollar tech monopolists have the software freedom to determine how those servers work:

https://pluralistic.net/2020/05/04/which-side-are-you-on/#tivoization-and-beyond

That's ruling class solidarity. The Big Tech firms have hidden a myriad of sins beneath their bafflegab and balance-sheets. These (as yet) undiscovered scams constitute a "bezzle," which JK Galbraith defined as "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it."

The purpose of Hunterbrook is to discover and destroy bezzles, hastening the moment of realization that the wealth we all feel in a world of seemingly orderly technology is really an illusion. Hunterbrook certainly has its pick of bezzles to choose from, because we are living in a Golden Age of the Bezzle.

Which is why I titled my new novel The Bezzle. It's a tale of high-tech finance scams, starring my two-fisted forensic accountant Marty Hench, and in this volume, Hench is called upon to unwind a predatory prison-tech scam that victimizes the most vulnerable people in America – our army of prisoners – and their families:

https://us.macmillan.com/books/9781250865878/thebezzle

The scheme I fictionalize in The Bezzle is very real. Prison-tech monopolists like Securus and Viapath bribe prison officials to abolish calls, in-person visits, mail and parcels, then they supply prisoners with "free" tablets where they pay hugely inflated rates to receive mail, speak to their families, and access ebooks, distance education and other electronic media:

https://pluralistic.net/2024/04/02/captive-customers/#guillotine-watch

But a group of activists have cornered these high-tech predators, run them to ground and driven them to the brink of extinction, and they've done it using "the master's tools" – with appeals to regulators and the finance sector itself.

Writing for The Appeal, Dana Floberg and Morgan Duckett describe the campaign they waged with Worth Rises to bankrupt the prison-tech sector:

https://theappeal.org/securus-bankruptcy-prison-telecom-industry/

Here's the headline figure: Securus is $1.8 billion in debt, and it has eight months to find a financier or it will go bust. What's more, all the creditors it might reasonably approach have rejected its overtures, and its bonds have been downrated to junk status. It's a dead duck.

Even better is how this happened. Securus's debt problems started with its acquisition, a leveraged buyout by Platinum Equity, who borrowed heavily against the firm and then looted it with bogus "management fees" that meant that the debt continued to grow, despite Securus's $700m in annual revenue from America's prisoners. Platinum was just the last in a long line of PE companies that loaded up Securus with debt and merged it with its competitors, who were also mortgaged to make profits for other private equity funds.

For years, Securus and Platinum were able to service their debt and roll it over when it came due. But after Worth Rises got NYC to pass a law making jail calls free, creditors started to back away from Securus. It's one thing for Securus to charge $18 for a local call from a prison when it's splitting the money with the city jail system. But when that $18 needs to be paid by the city, they're going to demand much lower prices. To make things worse for Securus, prison reformers got similar laws passed in San Francisco and in Connecticut.

Securus tried to outrun its problems by gobbling up one of its major rivals, Icsolutions, but Worth Rises and its coalition convinced regulators at the FCC to block the merger. Securus abandoned the deal:

https://worthrises.org/blogpost/securusmerger

Then, Worth Rises targeted Platinum Equity, going after the pension funds and other investors whose capital Platinum used to keep Securus going. The massive negative press campaign led to eight-figure disinvestments:

https://www.latimes.com/business/story/2019-09-05/la-fi-tom-gores-securus-prison-phone-mass-incarceration

Now, Securus's debt became "distressed," trading at $0.47 on the dollar. A brief, covid-fueled reprieve gave Securus a temporary lifeline, as prisoners' families were barred from in-person visits and had to pay Securus's rates to talk to their incarcerated loved ones. But after lockdown, Securus's troubles picked up right where they left off.

They targeted Platinum's founder, Tom Gores, who papered over his bloody fortune by styling himself as a philanthropist and sports-team owner. After a campaign by Worth Rises and Color of Change, Gores was kicked off the Los Angeles County Museum of Art board. When Gores tried to flip Securus to a SPAC – the same scam Trump pulled with Truth Social – the negative publicity about Securus's unsound morals and financials killed the deal:

https://twitter.com/WorthRises/status/1578034977828384769

Meanwhile, more states and cities are making prisoners' communications free, further worsening Securus's finances:

https://pluralistic.net/2024/02/14/minnesota-nice/#shitty-technology-adoption-curve

Congress passed the Martha Wright-Reed Just and Reasonable Communications Act, giving the FCC the power to regulate the price of federal prisoners' communications. Securus's debt prices tumbled further:

https://www.govtrack.us/congress/bills/117/s1541

Securus's debts were coming due: it owes $1.3b in 2024, and hundreds of millions more in 2025. Platinum has promised a $400m cash infusion, but that didn't sway S&P Global, a bond-rating agency that re-rated Securus's bonds as "CCC" (compare with "AAA"). Moody's concurred. Now, Securus is stuck selling junk-bonds:

https://www.govtrack.us/congress/bills/117/s1541

The company's creditors have given Securus an eight-month runway to find a new lender before they force it into bankruptcy. The company's debt is trading at $0.08 on the dollar.

Securus's major competitor is Viapath (prison tech is a duopoly). Viapath is also debt-burdened and desperate, thanks to a parallel campaign by Worth Rises, and has tried all of Securus's tricks, and failed:

https://pestakeholder.org/news/american-securities-fails-to-sell-prison-telecom-company-viapath/

Viapath's debts are due next year, and if Securus tanks, no one in their right mind will give Viapath a dime. They're the walking dead.

Worth Rise's brilliant guerrilla warfare against prison-tech and its private equity backers are a master class in using the master's tools to dismantle the master's house. The finance sector isn't a friend of justice or working people, but sometimes it can be used tactically against financialization itself. To paraphrase MLK, "finance can't make a corporation love you, but it can stop a corporation from destroying you."

Yes, the ruling class finds solidarity at the most unexpected moments, and yes, it's easy for appeals to greed to institutionalize greediness. But whether it's funding unbezzling journalism through short selling, or freeing prisons by brandishing their cooked balance-sheets in the faces of bond-rating agencies, there's a lot of good we can do on the way to dismantling the system.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/08/money-talks/#bullshit-walks

Image: KMJ (modified) https://commons.wikimedia.org/wiki/File:Boerse_01_KMJ.jpg

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#shorts#short sellers#news#private equity#private prisons#securus#prison profiteers#the bezzle#anything that cant go on forever eventually stop#steins law#hamilton nolan#Platinum Equity#American Securities#viapath#global tellink#debt#jpay#worth rises#insurance#spacs#fcc#bond rating#moodys#the appeal#saving the news from big tech#hunterbrook media#journalism

804 notes

·

View notes

Text

universal healthcare is not broken and anyone trying to convince you it is is delusional and a dckrider for big health insurance. yes there are wait times but waiting for care is Not the same as being denied care.

in america your physician prescribes care and an insurer can still cuck you out of it because someone across the continent who has never met you can say: doesn’t seem medically necessary. Leaving you to handle a bill that is wildly inflated by the same insurers that just denied you.

let me drill it through your head you can pay thousands a year in premiums and still end up sick and financially burdened for years by One incident. no insurance company is Avoiding going broke by denying claims. theyre doing it to profit off your misfortune and your illness. Because healthcare fundamentally does not cost the amount that they claim it to be.

#delete later#out of pocket rant#i hate these god awful takes on universal health care#and i hate this oh he killed a father#how many fathers do you think uhc let die be real with me#oh 8 billion is only 6% profit margin#bitch it could be 2 percent it could be a negative loss#this is me saying oh i resold a shoe for $60 after buying it for $50 when i also made it for 80 cents#i have been denied things like chest xrays and lung exams#i btw have had a chronic cough for 4+ years#in canada i got this done on the same fking day and results back within a month#there are indeed horror stories and on both sides of know ppl who died due to delayed diagnosis#and ppl who died bc they didnt even want the diagnosis it would have cost them too much#but robbing someone of the choice in my opinion is the worse of the two#putting someone in an impossible position like that is evil#this country love god so much better start praying u stay healthy bc thats the most important thing#also like those horror stories of wait times in the er#im gonna be real if u have severe stomach pain are actively bleeding heart attack or stroke#you will be seen asap#yes if unfortunately everyone around u that day decided to have a stroke or heart attack ur appendicitis will be punted down the line#this is a resource issue NOT a cost issue#this is a they also cut funding to nursing school and limited the number of ppl who can pursue medical degrees issue#not a we dont have privatized health care issue#bc ultimately u need a doctor to see u#not someones sister who is taking stabs at it#and every doctor is bound by the concept of time???#u still have to wait in america ur Charged for it also#and yall it doesn’t even have to be a Big incident#ur local urgent care might just be closed after 8pm and at 9pm u need stitches#or have severe stomach pains and just want it checked

162 notes

·

View notes

Text

It's BOOK TIME again! It has been forever since I last bound a book wow.

This is Interim by @punishandenslavesuckers, which is a fantastic botw post-canon Link/Zelda/Ganon fic that you all should go read if you haven't already. It's great, go check it out. I stayed up way too late reading it.

The binding is a sewn-board binding, which means the cover stiffeners are sewn directly into the text block, instead of wrapped around and glued to the endpapers. This makes for a very tidy and modern looking binding, AND because the boards are doubled (sewn in like the endpapers) allows for fun shenanigans like that indented triforce.

I'm SO proud of how the triforce came out! I was really careful with all of my measurements and it really paid off.

Oh yeah and I finally found a place with a good guillotine, so now I can make SMALLER books and still have nice crisp edges. Look at it, it's such a cute size. Perfect for holding.

Next step… painted fore-edges, maybe owo

#bookbinding#moth draws#moth talks#interim#loz#tloz#botw#fic rec#fanfic#fanbinding#obligatory disclaimer this is just for me and my little private library I'm not making any profit off of this#i read this fic and then immediately started replaying botw though#it do be like that

151 notes

·

View notes

Text

every single I have to interact with unitedhealthcare i end up googling stuff like "how to file a human rights complaint" or "how to report crimes against humanity"

#for profit heath insurance#american healthcare system#american hellscape nightmare system#unitedhealthcare#uhc#united healthcare#medicare for all#medicaid for all#m4a#tbh medicaid is better#private health insurance companies#i cannot stress enough how literally i mean it when i say these ceos should be executed#i don't even really believe in the death penalty#that is the ONLY part that might be hyperbole#but whatever the most severe punishment our society uses#sign these assholes up

217 notes

·

View notes

Text

75 notes

·

View notes

Text

#politics#united healthcare#brian thompson#luigi mangione#profitized healthcare#privatized healthcare#healthcare#insurance#deny defend depose

14K notes

·

View notes

Text

#republican assholes#maga morons#ceo greed#corporate greed#private healthcare#for profit healthcare#oligarchs are killing us

696 notes

·

View notes

Text

#republican assholes#maga morons#private healthcare#for profit healthcare#oligarchs are killing us#corporate greed#ceo greed

259 notes

·

View notes

Text

Oligarchs are going to regret installing Chump into the White House.

#republican assholes#maga morons#ceo greed#oligarch greed#corporate greed#class war#for profit healthcare#private health care#guillotine#french revolution

180 notes

·

View notes

Text

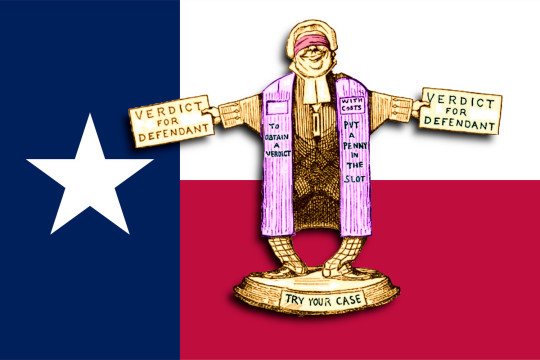

One of America’s most corporate-crime-friendly bankruptcy judges forced to recuse himself

Today (Oct 16) I'm in Minneapolis, keynoting the 26th ACM Conference On Computer-Supported Cooperative Work and Social Computing. Thursday (Oct 19), I'm in Charleston, WV to give the 41st annual McCreight Lecture in the Humanities. Friday (Oct 20), I'm at Charleston's Taylor Books from 12h-14h.

"I’ll believe corporations are people when Texas executes one." The now-famous quip from Robert Reich cuts to the bone of corporate personhood. Corporations are people with speech rights. They are heat-shields that absorb liability on behalf of their owners and managers.

But the membrane separating corporations from people is selectively permeable. A corporation is separate from its owners, who are not liable for its deeds – but it can also be "closely held," and so inseparable from those owners that their religious beliefs can excuse their companies from obeying laws they don't like:

https://clsbluesky.law.columbia.edu/2014/10/13/hobby-lobby-and-closely-held-corporations/

Corporations – not their owners – are liable for their misdeeds (that's the "limited liability" in "limited liablity corporation"). But owners of a murderous company can hold their victims' families hostage and secure bankruptcies for their companies that wipe out their owners' culpability – without any requirement for the owners to surrender their billions to the people they killed and maimed:

https://pluralistic.net/2023/08/11/justice-delayed/#justice-redeemed

Corporations are, in other words, a kind of Schroedinger's Cat for impunity: when it helps the ruling class, corporations are inseparable from their owners; when that would hinder the rich and powerful, corporations are wholly distinct entities. They exist in a state of convenient superposition that collapses only when a plutocrat opens the box and decides what is inside it. Heads they win, tails we lose.

Key to corporate impunity is the rigged bankruptcy system. "Debts that can't be paid, won't be paid," so every successful civilization has some system for discharging debt, or it risks collapse:

https://pluralistic.net/2022/10/09/bankruptcy-protects-fake-people-brutalizes-real-ones/

When you or I declare bankruptcy, we have to give up virtually everything and endure years (or a lifetime) of punitive retaliation based on our stained credit records, and even then, our student debts continue to haunt us, as do lawless scumbag debt-collectors:

https://pluralistic.net/2023/08/12/do-not-pay/#fair-debt-collection-practices-act

When a giant corporation declares bankruptcy, by contrast, it emerges shorn of its union pension obligations and liabilities owed to workers and customers it abused or killed, and continues merrily on its way, re-offending at will. Big companies have mastered the Texas Two-Step, whereby a company creates a subsidiary that inherits all its liabilities, but not its assets. The liability-burdened company is declared bankrupt, and the company's sins are shriven at the bang of a judge's gavel:

https://pluralistic.net/2023/02/01/j-and-j-jk/#risible-gambit

Three US judges oversee the majority of large corporate bankruptcies, and they are so reliable in their deference to this scheme that an entire industry of high-priced lawyers exists solely to game the system to ensure that their clients end up before one of these judges. When the Sacklers were seeking to abscond with their billions in opioid blood-money and stiff their victims' families, they set their sights on Judge Robert Drain in the Southern District of New York:

https://pluralistic.net/2021/05/23/a-bankrupt-process/#sacklers

To get in front of Drain, the Sacklers opened an office in White Plains, NY, then waited 192 days to file bankruptcy papers there (it takes six months to establish jurisdiction). Their papers including invisible metadata that identified the case as destined for Judge Drain's court, in a bid to trick the court's Case Management/Electronic Case Files system to assign the case to him.

The case was even pre-captioned "RDD" ("Robert D Drain"), to nudge clerks into getting their case into a friendly forum.

If the Sacklers hadn't opted for Judge Drain, they might have set their sights on the Houston courthouse presided over by Judge David Jones, the second of of the three most corporate-friendly large bankruptcy judges. Judge Jones is a Texas judge – as in "Texas Two-Step" – and he has a long history of allowing corporate murderers and thieves to escape with their fortunes intact and their victims penniless:

https://pluralistic.net/2021/08/07/hr-4193/#shoppers-choice

But David Jones's reign of error is now in limbo. It turns out that he was secretly romantically involved with Elizabeth Freeman, a leading Texas corporate bankruptcy lawyer who argues Texas Two-Step cases in front of her boyfriend, Judge David Jones.

Judge Jones doesn't deny that he and Freeman are romantically involved, but said that he didn't think this fact warranted disclosure – let alone recusal – because they aren't married and "he didn't benefit economically from her legal work." He said that he'd only have to disclose if the two owned communal property, but the deed for their house lists them as co-owners:

https://www.documentcloud.org/documents/24032507-general-warranty-deed

(Jones claims they don't live together – rather, he owns the house and pays the utility bills but lets Freeman live there.)

Even if they didn't own communal property, judges should not hear cases where one of the parties is represented by their long term romantic partner. I mean, that is a weird sentence to have to type, but I stand by it.

The case that led to the revelation and Jones's stepping away from his cases while the Fifth Circuit investigates is a ghastly – but typical – corporate murder trial. Corizon is a prison healthcare provider that killed prisoners with neglect, in the most cruel and awful ways imaginable. Their families sued, so Corizon budded off two new companies: YesCare got all the contracts and other assets, while Tehum Care Services got all the liabilities:

https://ca.finance.yahoo.com/news/prominent-bankruptcy-judge-david-jones-033801325.html

Then, Tehum paid Freeman to tell her boyfriend, Judge Jones, to let it declare bankruptcy, leaving $173m for YesCare and allocating $37m for the victims suing Tehum. Corizon owes more than $1.2b, "including tens of millions of dollars in unpaid invoices and hundreds of malpractice suits filed by prisoners and their families who have alleged negligent care":

https://www.kccllc.net/tehum/document/2390086230522000000000041

Under the deal, if Corizon murdered your family member, you would get $5,000 in compensation. Corizon gets to continue operating, using that $173m to prolong its yearslong murder spree.

The revelation that Jones and Freeman are lovers has derailed this deal. Jones is under investigation and has recused himself from his cases. The US Trustee – who represents creditors in bankruptcy cases – has intervened to block the deal, calling Tehum "a barren estate, one that was stripped of all of its valuable assets as a result of the combination and divisional mergers that occurred prior to the bankruptcy filing."

This is the third high-profile sleazy corporate bankruptcy that had victory snatched from the jaws of defeat this year: there was Johnson and Johnson's attempt to escape from liability from tricking women into powder their vulvas with asbestos (no, really), the Sacklers' attempt to abscond with billions after kicking off the opioid epidemic that's killed 800,000+ Americans and counting, and now this one.

This one might be the most consequential, though – it has the potential to eliminate one third of the major crime-enabling bankruptcy judges serving today.

One down.

Two to go.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/10/16/texas-two-step/#david-jones

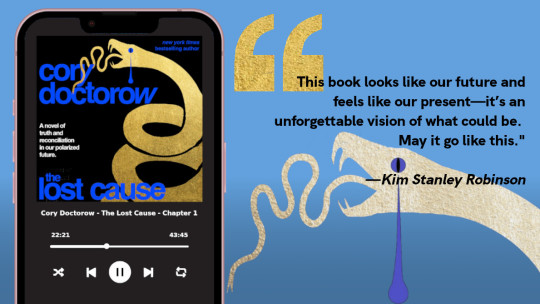

My next novel is The Lost Cause, a hopeful novel of the climate emergency. Amazon won't sell the audiobook, so I made my own and I'm pre-selling it on Kickstarter!

#pluralistic#texas two-step#bankruptcy#houston#texas#mess with texas#corruption#judge david jones#fifth circuit#southern district of texas#elizabeth freeman#yescare#corizon#prisons#private prisons#prison profiteers#Michael Van Deelen#Office of the US Trustee#sacklers#bankruptcy shopping#johnson and johnson#impunity

259 notes

·

View notes

Text

breaking bad au but it's walter whitified minerva mcgonagall and her protégé (+former student) barty crouch jr

#this is from the drafts#what do u all know about minnie who dedicated her life to her role as chemistry teacher in one of em#super private high schools with a student body consisting of congressmen children#which barty ofc attended at his dad's behest#then proceeds to witness her own moral compass spin a gradual 180#anyways jesse pinkman barty but also not because he's just a dirtbag prodigy who missed out on being valedictorian#bc he was running a fake ID shop with a laminating machine he swiped from the sheriff station after getting bailed out by his father dear#true to creed fashion#barty is playing the kodak black x sweater weather mashup in his 2002 honda accord with 80k of drug sale profit in his lap

30 notes

·

View notes