#private broker

Explore tagged Tumblr posts

Text

At long last, a meaningful step to protect Americans' privacy

This Saturday (19 Aug), I'm appearing at the San Diego Union-Tribune Festival of Books. I'm on a 2:30PM panel called "Return From Retirement," followed by a signing:

https://www.sandiegouniontribune.com/festivalofbooks

Privacy raises some thorny, subtle and complex issues. It also raises some stupid-simple ones. The American surveillance industry's shell-game is founded on the deliberate confusion of the two, so that the most modest and sensible actions are posed as reductive, simplistic and unworkable.

Two pillars of the American surveillance industry are credit reporting bureaux and data brokers. Both are unbelievably sleazy, reckless and dangerous, and neither faces any real accountability, let alone regulation.

Remember Equifax, the company that doxed every adult in America and was given a mere wrist-slap, and now continues to assemble nonconsensual dossiers on every one of us, without any material oversight improvements?

https://memex.craphound.com/2019/07/20/equifax-settles-with-ftc-cfpb-states-and-consumer-class-actions-for-700m/

Equifax's competitors are no better. Experian doxed the nation again, in 2021:

https://pluralistic.net/2021/04/30/dox-the-world/#experian

It's hard to overstate how fucking scummy the credit reporting world is. Equifax invented the business in 1899, when, as the Retail Credit Company, it used private spies to track queers, political dissidents and "race mixers" so that banks and merchants could discriminate against them:

https://jacobin.com/2017/09/equifax-retail-credit-company-discrimination-loans

As awful as credit reporting is, the data broker industry makes it look like a paragon of virtue. If you want to target an ad to "Rural and Barely Making It" consumers, the brokers have you covered:

https://pluralistic.net/2021/04/13/public-interest-pharma/#axciom

More than 650,000 of these categories exist, allowing advertisers to target substance abusers, depressed teens, and people on the brink of bankruptcy:

https://themarkup.org/privacy/2023/06/08/from-heavy-purchasers-of-pregnancy-tests-to-the-depression-prone-we-found-650000-ways-advertisers-label-you

These companies follow you everywhere, including to abortion clinics, and sell the data to just about anyone:

https://pluralistic.net/2022/05/07/safegraph-spies-and-lies/#theres-no-i-in-uterus

There are zillions of these data brokers, operating in an unregulated wild west industry. Many of them have been rolled up into tech giants (Oracle owns more than 80 brokers), while others merely do business with ad-tech giants like Google and Meta, who are some of their best customers.

As bad as these two sectors are, they're even worse in combination – the harms data brokers (sloppy, invasive) inflict on us when they supply credit bureaux (consequential, secretive, intransigent) are far worse than the sum of the harms of each.

And now for some good news. The Consumer Finance Protection Bureau, under the leadership of Rohit Chopra, has declared war on this alliance:

https://www.techdirt.com/2023/08/16/cfpb-looks-to-restrict-the-sleazy-link-between-credit-reporting-agencies-and-data-brokers/

They've proposed new rules limiting the trade between brokers and bureaux, under the Fair Credit Reporting Act, putting strict restrictions on the transfer of information between the two:

https://www.cnn.com/2023/08/15/tech/privacy-rules-data-brokers/index.html

As Karl Bode writes for Techdirt, this is long overdue and meaningful. Remember all the handwringing and chest-thumping about Tiktok stealing Americans' data to the Chinese military? China doesn't need Tiktok to get that data – it can buy it from data-brokers. For peanuts.

The CFPB action is part of a muscular style of governance that is characteristic of the best Biden appointees, who are some of the most principled and competent in living memory. These regulators have scoured the legislation that gives them the power to act on behalf of the American people and discovered an arsenal of action they can take:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

Alas, not all the Biden appointees have the will or the skill to pull this trick off. The corporate Dems' darlings are mired in #LearnedHelplessness, convinced that they can't – or shouldn't – use their prodigious powers to step in to curb corporate power:

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

And it's true that privacy regulation faces stiff headwinds. Surveillance is a public-private partnership from hell. Cops and spies love to raid the surveillance industries' dossiers, treating them as an off-the-books, warrantless source of unconstitutional personal data on their targets:

https://pluralistic.net/2021/02/16/ring-ring-lapd-calling/#ring

These powerful state actors reliably intervene to hamstring attempts at privacy law, defending the massive profits raked in by data brokers and credit bureaux. These profits, meanwhile, can be mobilized as lobbying dollars that work lawmakers and regulators from the private sector side. Caught in the squeeze between powerful government actors (the true "Deep State") and a cartel of filthy rich private spies, lawmakers and regulators are frozen in place.

Or, at least, they were. The CFPB's discovery that it had the power all along to curb commercial surveillance follows on from the FTC's similar realization last summer:

https://pluralistic.net/2022/08/12/regulatory-uncapture/#conscious-uncoupling

I don't want to pretend that all privacy questions can be resolved with simple, bright-line rules. It's not clear who "owns" many classes of private data – does your mother own the fact that she gave birth to you, or do you? What if you disagree about such a disclosure – say, if you want to identify your mother as an abusive parent and she objects?

But there are so many stupid-simple privacy questions. Credit bureaux and data-brokers don't inhabit any kind of grey area. They simply should not exist. Getting rid of them is a project of years, but it starts with hacking away at their sources of profits, stripping them of defenses so we can finally annihilate them.

I'm kickstarting the audiobook for "The Internet Con: How To Seize the Means of Computation," a Big Tech disassembly manual to disenshittify the web and make a new, good internet to succeed the old, good internet. It's a DRM-free book, which means Audible won't carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/16/the-second-best-time-is-now/#the-point-of-a-system-is-what-it-does

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#privacy#data brokers#cfpb#consumer finance protection bureau#regulation#regulatory nihilism#regulatory capture#trustbusting#monopoly#antitrust#private public partnerships from hell#deep state#photocopier kickers#rohit chopra#learned helplessness#equifax#credit reporting#credit reporting bureaux#experian

310 notes

·

View notes

Text

Natalie Wood — Investigation with 4 Key Witnesses Uncovered Witness Dennis Davern and more than 700 others signed a petition addressed to the Los Angeles County Sheriff’s Department outlining what they considered flaws in the original investigation.

Six years of investigation, four new key witnesses. Two determined investigators with a lot of questions for Robert Wagner.

Lt. John Corina: The reality is … what does the evidence show? …she wouldn’t go back and — that’s not her. That’s not her job. … she would never go worry about the dinghy. She’s gonna tell Dennis Davern, “Hey, can you go tie that dinghy down? It’s making noise.” That’s his job….

Lt. John Corina: As we’ve investigated the case over the last six years, I think he’s more of a person of interest now. I mean, we — we know now that he was the last person — to be with Natalie before she disappeared… …..

“In the early 1990s, Lana Wood says a tormented, seemingly inebriated Dennis Davern started calling her.

“Erin Moriarty: What, specifically, did he tell you?

Lana Wood: He said, “It wasn’t an accident.” And he said, “It was ugly.”

Lana Wood says she didn’t want to believe it at first.

Lana Wood: I didn’t wanna think that. But there are so many things that are just facts.

She has since become one of R.J. Wagner’s harshest critics, going so far as to publically accuse him of foul play.

Erin Moriarty: Do you think she was pushed in the water?

Lana Wood: Yes.

Erin Moriarty: Do you believe it was her husband R.J. Wagner?

Lana Wood: Absolutely. Yes.”

Davern says Wagner insisted he move into his guest house in Beverly Hills.

Dennis Davern: I was to stay indoors at all times, not communicate with anybody.

Eventually, Davern left California for the East Coast, but was never able to escape the past.”

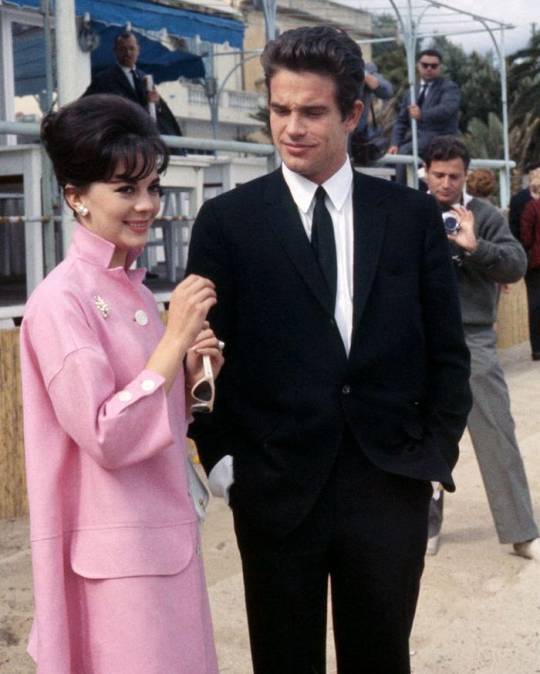

Above is a photo of Natalie Wood and Warren Beatty in Cannes

Renewed. The actress may have been injured before she entered the ocean... Natalie Wood’s bruises and scratches on her arm, wrist and neck may have been suffered before…

#Natalie Wood#Investigations#Private Investigator#Detective#Actress#Film#Model#Warren Beatty#Witnesses#Witness#Los Angeles#Yachts#Boats#California#Fixers#Hollywood Fixers#Brokers#Magazines#Public Safety#Safety#Caring#Social Good#Helping Others#Lana Wood#Dennis Darven

3 notes

·

View notes

Text

kind of hate the process for signing up for aca since theres not a giant "transgender" button for me to hit so obviously all the insurance plans are like "why are you, a legal man, trying to see a gynecologist... not covered" like please.

2 notes

·

View notes

Text

How a Mortgage Broker in Surrey Can Help You Find the Best Mortgage Solutions?

Navigating the complexities of securing a mortgage can be overwhelming, especially with the many options and regulations in Canada. For homeowners and investors alike, working with an experienced Mortgage Broker in Surrey can simplify the process, offering tailored solutions to meet specific financial needs. Whether you’re in British Columbia or elsewhere in the country, finding the right Mortgage Broker BC or Private Mortgage Broker Canada is key to achieving your property goals. Among the best in the industry, Crown Funding stands out for its expertise, reliability, and customer-first approach.

What Does a Mortgage Broker in Surrey Do?

A Mortgage Broker in Surrey’s primary role is to help clients find the best mortgage products, interest rates, and terms based on their financial situation and objectives. Unlike banks, which offer limited options, mortgage brokers have access to a wide network of lenders, including private mortgage providers.

When it comes to choosing a Mortgage Broker in BC or a Private Mortgage Broker in Canada, Crown Funding leads the way with its unmatched service and expertise. Here’s why they’re the best choice:

1. Comprehensive Mortgage Solutions

Crown Funding specializes in a range of mortgage services, including:

First-Time Homebuyer Mortgages: Helping newcomers secure favorable rates.

Refinancing: Assisting with renegotiating your current mortgage for better terms.

Private Mortgages: Connecting clients with alternative lending options for unique financial circumstances.

2. Access to Diverse Lenders

With an extensive network that includes traditional lenders, credit unions, and private mortgage providers, Crown Funding ensures clients get competitive rates and flexible terms tailored to their needs.

3. Expert Guidance

The team at Crown Funding takes the time to understand your financial goals, offering transparent advice and step-by-step guidance throughout the process.

4. Tailored Solutions for Private Mortgages

Private mortgages are an excellent option for individuals with unconventional financial situations, such as self-employed professionals or those with less-than-perfect credit. As a leading Private Mortgage Broker in Canada, Crown Funding excels in finding solutions where traditional banks may not.

Benefits of Working with a Mortgage Broker in Canada

1. Access to More Options

Unlike banks, which are limited to their in-house products, brokers offer a variety of mortgage solutions from multiple lenders.

2. Competitive Rates

Brokers have strong relationships with lenders, enabling them to negotiate lower rates and better terms on your behalf.

3. Expertise in Private Mortgages

For those who don’t qualify for traditional financing, private mortgage brokers like Crown Funding can provide alternative solutions that meet your needs.

4. Time and Stress Savings

Mortgage brokers handle the research, paperwork, and negotiations, allowing you to focus on other priorities.

How Private Mortgage Broker Canada Services Can Help:

Self-employed borrowers with non-traditional income verification.

Individuals with low credit scores.

Homebuyers requiring quick approval for unique opportunities.

Crown Funding, as a trusted Private Mortgage Broker in Canada, ensures that clients in these situations can access customized financing solutions.

Mortgage Broker Canada: Why It Matters in British Columbia

British Columbia’s real estate market is one of the most dynamic in Canada, requiring specialized expertise. Crown Funding, a leading Mortgage Broker in BC, understands the nuances of the province’s market, ensuring clients secure mortgages that align with regional conditions and regulations. Crown Funding’s in-depth knowledge of BC’s housing trends and financial climate helps clients navigate the complexities of the region’s competitive market.

Conclusion

Partnering with a reliable Mortgage Broker in Surrey like Crown Funding can make all the difference. Whether you need assistance from a Mortgage Broker in BC or are exploring options with a Private Mortgage Broker in Canada, Crown Funding is the trusted partner to guide you through every step of the journey. With Crown Funding’s expertise, extensive network, and customer-focused approach, your path to homeownership or investment success becomes easier and more accessible. Contact Crown Funding today to explore personalized mortgage solutions that align with your financial goals.

#mortgage broker#crownfunding#private lenders#private mortgage broker#first mortgage broker#mortgage agent#private mortgage lender#private mortgage#mortgagebroker#bad credit mortgage surrey#Mortgage Broker in Surrey

0 notes

Text

Foreclosed 2 BR at Avida Towers Makati West

Foreclosed 2BR Avida Towers Makati West! 63 sqm, 1st floor, amazing amenities! Act fast, this won't last! #JMListings

📍 Unit P, First Floor, Tower 1, Avida Towers Makati West, Malugay St., corner Yakal and Lumbayao Sts., Brgy. San Antonio, Makati City Property Features TYPE: Residential Condominium📐 Floor: 63.63 sq.m🛌 2 Bedrooms, 🛀 1 Bathroom✅ 1st Floor✅ AS IS WHERE IS BasisYear Turnover: 2018 FEATURES and AMENITIES Clubhouse • Swimming Pool • Children’s Play Area • Indoor Gym • Garden Units • Main Lobby •…

#alviera porac pampanga#beverly place#beverly place golf and country club#beverly place golf club#beverly place golf club mexico pampanga#beverly place house and lot#beverly place lot for sale#beverly place mexico pampanga#beverly place pampanga#beverly place san fernando#beverly plact lot pampanga#beverlyplace sm pampanga#Broker JM#jm listings#jm real estate#lot at beverly place#lot for sale beverly place pampanga#lots at beverly place pampanga#Pampanga#pampanga private resort

0 notes

Text

Protect Your Family’s Future: The Benefits of AFA Insurance’s Family Health Cover

Health is the cornerstone of happiness, and when it comes to your family, their well-being always takes priority. Imagine a life where sudden medical emergencies no longer threaten your financial peace of mind. This is where family health cover from AFA Insurance steps in—a shield of protection for you and your loved ones. Offering tailored solutions and a stress-free claims process, AFA Insurance ensures that you stay focused on what truly matters: your family’s health.

Why Family Health Cover Matters

Life is unpredictable, and health emergencies can strike without warning. With rising medical costs, having a reliable family health cover becomes not just an option but a necessity. AFA Insurance provides a comprehensive policy that safeguards your family from unexpected healthcare expenses. From hospital stays to specialist consultations, the policy ensures you’re never alone during challenging times.

AFA Insurance: A Name You Can Trust

Choosing the right provider for your family health cover is as important as the policy itself. AFA Insurance is renowned for its commitment to quality service, transparency, and customer-first approach. With decades of expertise in the insurance industry, AFA Insurance has become a trusted partner for countless families, offering plans that cater to diverse healthcare needs.

Comprehensive Coverage for Every Family Member

AFA Insurance’s family health cover is designed to include every member of your household, from children to elderly parents. Whether it’s routine check-ups, emergency care, or long-term treatments, the policy covers a wide spectrum of healthcare services. This holistic approach ensures that no family member is left unprotected, giving you peace of mind knowing your loved ones are in safe hands.

Flexible Plans for Every Budget

One size doesn’t fit all, especially when it comes to health insurance. AFA Insurance offers flexible family health cover plans tailored to suit different budgets and needs. Whether you’re a young couple starting a family or a multi-generational household, there’s a plan that works for you. Affordable premiums and customizable features mean you get the best value without compromising on quality care.

Hassle-Free Claims Process

Nobody wants added stress during a medical emergency. That’s why AFA Insurance has simplified the claims process for its family health cover. With dedicated customer support and a wide network of hospitals, you can rest assured that help is just a call away. The seamless reimbursement and cashless treatment options make it easier to focus on recovery rather than paperwork.

The Role of Preventive Care

Health insurance isn’t just about covering hospital bills; it’s about promoting overall wellness. AFA Insurance’s family health cover also emphasizes preventive care. Regular health check-ups, vaccinations, and screenings are part of the plan, helping your family stay healthy and avoid serious illnesses. This proactive approach ensures that small issues don’t escalate into major concerns.

Conclusion

Your family’s health is too important to leave to chance. With AFA Insurance’s family health cover, you’re not just buying a policy—you’re investing in peace of mind, security, and a healthier future. Whether it’s unexpected emergencies or routine care, AFA Insurance stands by you every step of the way. Choose AFA Insurance today and give your family the gift of comprehensive protection.

#family health cover#health insurance broker#private healthcare nz#health insurance for old people#health insurance providers nz#health insurance cover#cheapest health insurance nz#health care coverage

0 notes

Text

Edmonton First Time Home Buyer – Making The Right Choice

Going for home purchase could be one of the most exciting moments in an individual’s life, or in this case as a first time buyer, could be a very overwhelming experience. Just knowing when the best mortgage rates occur through to the finer details of loan applications can be daunting.

The edmonton first time home buyer can only benefit from the services of an experienced private refinance service provider vancouver who will help them navigate through each process independently. These players know different types of loan products and the needs of creditors to help new buyers to select the most suitable mortgage offer.

Private Refinance Service Provider Vancouver

They also assist the buyers in making comparisons between the various forms of mortgages places in the market including the fixed rate mortgage, the variable rate mortgage, the hybrid mortgage and others, and the prospects and futures of each of the packages offered as matched to the dreams of the buyers.

Apart from helping homeowners to find the best mortgage terms, private refinance service providers are also useful for homeowners planning to restructure their current mortgage loans. Private refinance services are advisable for anyone who wants to; pay a lower interest on their home, make smaller monthly payments, or; obtain the equity built in the home.

Thanks to flexible lending conditions, private lenders are capable to provide refinancing to individuals with uncommon financial status. This option will be especially significant in Vancouver since property prices remain high, and people may need to benefit from a more favorable mortgage rate when it comes to personal finance.

One of the advantages in using the services of a private refinance service provider vancouver is that they may give shorter span of approval and more flexibility in the loan terms. Nevertheless, it is crucial for the homeowners to consider the trend of rate increase when concerning the advantages of flexible and convenient private refinancing. An independent appraiser guides you through the procedure if you are an edmonton first time home buyer or if you are asking for a renewal of your mortgage. Help from private refinance service provider vancouver is turning these processes into the joy from which you will derive benefits as a homeowner in the long run.

#Private Refinance Service Provider Vancouver#No Down Payment Mortgage Edmonton#Best mortgage broker Edmonton

0 notes

Text

Private Mortgage Brokers & Specialists in British Columbia

Versa Platinum is the best private mortgage pool for private mortgage brokers in British Columbia who are looking for funding sources to help their clients obtain the money they need to purchase a property. We work with the best mortgage brokers in Abbotsford and surroundings to make homeownership dreams a reality. Whether you are looking for private mortgage solutions or are in need to private mortgage investors who can lend you dollars with flexible terms and conditions, Versa Platinum is the name to trust. With years of experience in the investment industry, we are trusted as reliable private mortgage specialists in British Columbia providing unmatched private mortgage solutions to eligible homeowners and brokers. For more details on how we work with property finance brokers, give us a call today.

#Private Mortgage Specialist#Best Mortgage Brokers#Property Finance Brokers#Private Mortgage Investors#Private Mortgage Brokers

0 notes

Text

Reasons To Hire a Private Jet Broker

The thought of investing in a jet is not far-fetched today. On the contrary, many busy business owners and groups are interested in investing in the best personal aircraft. It is not surprising to know that the market has opened up lately, with new and used aircraft being sold daily. The buyer is spoilt for choice when selecting the right private jet or any other type of aircraft. The top contenders have a lot of pros, with the negatives being primarily overshadowed. It is advisable to contact an experienced aviation broker to ensure a good buy. It helps to know that a personal aircraft is smaller than a commercial aircraft and may seat 1 to 6 people comfortably, including the pilot. Such aircraft are sourced and used for the following purposes:

· For Leisure · As a Hobby · For Business Trips · For Flight Training

The specs vary widely between the popular models used for personal use. Some of the aircraft that deserve to be considered by the prospective investor must include the following: -

Cessna The name Cessna has become synonymous with easy flying experience and safety plus comfort, making it the first choice for multiple investors. The best buys include:

Cessna 182 Skylane- Its incredible versatility and reliability make it an excellent investment for beginners. It provides a comfortable flying experience for pilots eager to train safely and explore the skies.

Cessna 172 Skyhawk- This is also a four-seater and appropriate for small groups or families who hope to fly to their destination in privacy. This aircraft is always in demand for both short trips and cross-country flying.

Cessna 206 Turbo Stationair HD—This craft has a turbocharged engine and can comfortably seat 6 passengers. All users have hailed the performance, and the smooth ride deserves special mention.

The Citation models from Cessna are also top-rated, with the following being requested by individuals hoping to invest in a pre-owned model first. Most of them are slightly larger and can seat more than six passengers. The avionics and cabin furnishings are a trifle more luxurious too.

· 2001 Citation CJ1 · 1998 Citation Jet · 2004 Citation Sovereign · 2007 CJ3

Beechcraft This is a great aircraft noted for its speed and performance. The comfort and reliability factors are top-notch as well. Some of the best-selling models include the following: -

· 2002 Hawker 800XP- The seating space is spruced up to make it perfect for an executive team or busy corporates desirous of holding meetings inside.

· 1970 King Air B90- The interior is professional, with leather insets and comfortable carpets. It is capable of seating six passengers.

· 2012 Beechcraft King Air- This is an 8-seater with a flushing toilet and LED lighting with executive configuration. This model can fly in all weather and has high performance and speed.

There are many more famed brands in competition. The user needs to contemplate all the requirements and choose wisely.

It is essential to hire the services of a seasoned private jet broker to understand how a particular aircraft fulfills the requirements.

0 notes

Text

Private Mortgage Broker: Understanding the Process

If you're facing challenges securing a traditional loan due to credit issues or high debt, a private mortgage could be the solution. For anyone in Canada seeking a Private Mortgage Broker, Sunlite Mortgage is the best choice. They offer private mortgages that provide flexibility, quick approvals, and are ideal for those with credit challenges or urgent financial needs.

Private mortgages prioritize your property’s value over your credit score, making them an excellent option for consolidating high-interest debt or handling unexpected expenses. With terms typically ranging from 1 to 3 years, these loans offer immediate financial relief.

At Sunlite Mortgage, you can expect flexible approval criteria, quick funding, and customized mortgage solutions. Their expert mortgage agents will guide you through the process to ensure you find the right fit for your financial needs.

For more details or to apply, call (877) 385-6267 or email [email protected]. Sunlite Mortgage is ready to help you achieve financial stability.

#Private Mortgage Broker#Private Mortgage Broker in Canada#Mortgage Broker#Sunlite Mortgage#Sunlite Mortgage Broker#Mortgage Broker in Canada

0 notes

Text

How Mr. Refkin Got it Wrong About Clear Cooperation

In a recent Inman article, Robert Refkin made several claims about how the Clear Cooperation Rule violates the National Association of REALTORS Code of Ethics and state laws. He almost hit a home run by misstating the Code of Ethics requirements and using logical fallacies to support his arguments. I get that Mr. Refkin is inconvenienced by the Clear Cooperation rule and is using the industry’s…

#bill lublin#billlublin#Clear Cooperation#Clear Cooperation Policy#Multiple Listing Service#National Association of Realtors#Pocket listings#Private Listing Networks#Real Estate#Real estate broker#United States

0 notes

Text

Tips and Tricks for a Smooth Mortgage Renewal Process

Renewing your mortgage involves reassessing your loan terms as your current mortgage term ends. This process allows you to secure a new interest rate, adjust your payment plan, or explore different lenders. It's crucial to start early, review your financial situation, and compare offers to ensure you get the best deal. Consider negotiating terms and be aware of any potential penalties or fees associated with breaking your current mortgage. A well-planned renewal strategy can help you save money and align your mortgage with your current financial goals.

#renew your mortgage#first time home buying mortgage#home finance companies#mortgage broker burlington#mortgage broker hamilton#debt consolidation in hamilton#debt consolidation in burlington#private mortgage burlington#second mortgages burlington#home equity loan burlington

0 notes

Text

When it comes to securing the best mortgage deals, having a reliable mortgage agent in Surrey by your side can make all the difference. Crown Funding stands out as the best mortgage broker in Surrey, offering personalized services to meet your financial goals. Whether you’re searching for a Private Mortgage Broker in BC or the most trusted mortgage broker in Surrey BC, Crown Funding ensures a smooth, transparent, and hassle-free process. Discover why they’re the Private Mortgage Broker Near Me for countless clients across the region.

#private mortgage broker#crownfunding#private lenders#first mortgage broker#bad credit mortgage surrey#mortgage broker#mortgagebroker#private mortgage lender#private mortgage#mortgage agent

0 notes

Text

Pre-owned Below Market Value Lots in Alviera Porac

Own a piece of paradise! Pre-owned Avida lots in Alviera offer various sizes and locations, perfect for building your dream home. Enjoy top-notch amenities and a vibrant community. Act fast! Contact JM Listings today!

#alviera porac pampanga#beverly place#beverly place golf and country club#beverly place golf club#beverly place golf club mexico pampanga#beverly place house and lot#beverly place lot for sale#beverly place mexico pampanga#beverly place pampanga#beverly place san fernando#beverly plact lot pampanga#beverlyplace sm pampanga#Broker JM#jm listings#jm real estate#lot at beverly place#lot for sale beverly place pampanga#lots at beverly place pampanga#Pampanga#pampanga private resort

0 notes

Text

For shits and giggles another one of my Youtube comment rambles wherein I share insight into my dumbass brain's machinations: economics edition.

lol, when i was a kid i was briefly interested in selling things. i had that entrepreneurial spirit or whatever.

briefly, keyword, because the very first and only time i ever 'sold' something to another kid--a little toy i exchanged for a dime--my mum got all upset and made me give the dime back, essentially ingraining "exchanging item for monetary goods = bad" in my spongy little underdeveloped brain.

i've since always felt guilty excepting money from anyone, for anything, aside from allowance from my parents. i never want to handle money, i don't like getting gifts of any sort because it makes me feel extremely uncomfortable, and while i know i need to make a living somehow i don't want to SELL anything, including any skills i might have.

trade for some other item? sure. idk why but this is fine and dandy if both parties are receiving an item and are or seem happy with this exchange.

but money? no i'd rather do whatever it is for free.

it's kind'a messed up many prospects and also turned me into a raging socialist / barter economy enjoyer lol. like i'd rather do an art commission for a pizza or a video game rather than cash. but i kind'a need cash to pay bills because the electric company isn't going to accept a monthly portrait of the ceo or whatever. and i know this. but brain is still very stubbornly set on "monetary exchange bad"

thanks mom

#Not fandom#Thoughts not Thots#Reasons why I don't like capitalism:#brain was wired against it from kindergarten age.#Fucking stupid how we don't have any alternative options.#Capitalism or die. Live in this one form of society the government has decided upon or die.#After all - all non-private land is theirs. You can't just fuck off to go build a cabin in the woods.#That land is owned by the government.#You have to have money to pay your bills. You can't broker any other form of deal. Zero alternatives.#If your brain isn't wired for this form of society or existence it's basically ''get fucked.''

1 note

·

View note

Text

Private Refinance Service Provider Vancouver – Get Home Loan

Buying a home loan is one of the biggest and most important decisions you have to make financially. Whether it's your first time as a homebuyer or refinancing, it really depends on the kind of mortgage lender and broker you choose in order to get the right deal and relevant experience. A private refinance service provider vancouver is an institution that offers a loan to an individual in order to buy or refinance a property. They have different types of loans: such as the fixed-rate loan, ARM, FHA loans, VA loans, and jumbo loans and so on. The choice of lender should be aligned with their reputation, interest rate, fees, and the variety of loan products they can offer. It should be that the lender guides you through the process, offering you transparency and clarity about the terms and conditions.

Private Refinance Service Provider Vancouver Role of Mortgage Brokers

A mortgage broker serves as an intermediary between you and potential lenders. They can reach out to the lenders connected to them and possibly find you the best loan options that suit your financial status. You will need a guarantor mortgage edmonton particularly if your financial status is complicated or if the credit status is not excellent. Finding the Best Mortgage Broker

A mortgage broker is found to be the best in multiple areas. First, check on their qualifications and licensure, to know whether they are legitimate enough to operate in your state. Also, look for those of good reputation, excellent customer reviews, and excellent industry connections.

A truthful broker also is abundant in making his fees and compensation obvious, which can influence the final cost of your loan. It is also important to have a person who would send you the information, communicate effectively, respond fast, and also be willing to answer all your questions. Making the Right Decision So, who is the best mortgage lender and broker for you? Only specific needs that one has and actual financial conditions one is in can set this. You would need to do some research, comparisons, and see a few persons before you make your decisions. It will be easier to go through the process of a mortgage if you find a good private refinance service provider vancouver who can get you the best bang for your buck and helps you get your dream home.

#private refinance service provider vancouver#No Down Payment Mortgage Edmonton#Best mortgage broker Edmonton

0 notes