#price the gambler says three and double or nothing

Explore tagged Tumblr posts

Text

instead of ivf or natural conception, i need neighbor!ghoap jerk themselves off in front of you and then stuff their cum into your pussy with their fingers cuz they refuse to fuck you unless you're gagging for it and they don't care to leave you a shaking, sticky mess after either.

you wanted their sperm so that's all you're getting. unless you ask nicely.

#they even have a betting pool#ghost thinks you'll be giving in in a weeks time#kyle gives you two#price the gambler says three and double or nothing#soap hopes to get his teeth into you asap so the faster the better#ghoap x reader

478 notes

·

View notes

Text

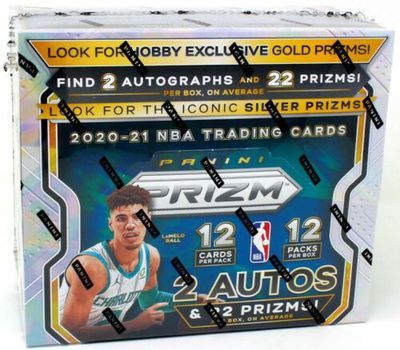

The rise and collapse of a scalper’s sports card empire

Bribes, parking lot deals, and the cards you never had a chance to buy.

Warning: The following story contains strong language.

Tyrone sits in the middle of his three monitor setup like the cockpit of a fighter jet, one hand grasping a cup of coffee, the other his vape, alternating between stimulants and watching a scramble over spots in his newest break. “This shit’s been up 40 minutes and we only got two slots left,” he yells to his two business partners, pulling cards for their latest singles orders.

“Tyrone,” who asked not to go by his real name to keep his anonymity, elevated his hobby for collecting cards into a business three years ago, and turned it into an empire. Now he’s coming face-to-face with it all collapsing. “I knew we didn’t have forever on this,” he says, “I just figured it’d be the feds shutting it down, not some dumbasses at Target.”

May 14th was the end of an era for Tyrone. Target made the announcement they would no longer sell NBA, NFL, MLB or Pokemon cards following an incident outside a Wisconsin store in which a customer pulled a gun on another who’d just purchased cards. Signs, now posted all over stores in the country, read “To ensure the safety of our guests and team members, effective May 14th, MLB, NFL, NBA and Pokemon cards will no longer be sold in stores until further notice.” Walmart has not made an official announcement at this time, though there’s increasing speculation that they too will pull cards from shelves.

“That shit had me f***** up,” Tyrone says, shaking his head. “I dunno how it’s been working up north, but ain’t nobody in my area getting good shit from Target anyway.”

Tyrone began turning his hobby into a business like anyone else trying to get cards. He arrived at stores early on Friday morning, learning that cards weren’t stocked by Target and Walmart employees, but rather independent merchandisers who would enter the store on distributors’ behalf, and place items on the shelves. Tyrone would wait until the merchandisers arrived to put out the new cards, then pounce on them, buying out the store and immediately flipping them on eBay. It was a weekly ritual. Hit a store, move to the next, do the same.

“I’d spend HOURS in the car each week,” he laughed, remembering his beginnings. Tyrone quickly realized there was too much inconsistency. Sometimes he’d miss the merchandiser, or they’d go to another store first and throw off his route. Random shoppers would buy a fat pack (a wrapped package of multiple packs) as their nostalgia kicked in, having no idea what they were buying. This made his stock unreliable.

“It got exhausting, and frustrating as shit got bigger. That’s when I got smart about it.”

I know Luka and Ja, not Squirtle and shit.

After months of shadowing deliveries and driving around, Tyrone approached one of the merchandisers in a Walmart parking lot, and befriended them. He needed as much product as he could get his hands on, they needed to do their job. “I made it work for both of us.”

At the time the only thing really popping was basketball cards, particularly the highly sought after Panini Prizm series. If you went to Target or Walmart hoping to find Prizm basketball only to find it out of stock, there’s a good chance Tyrone had it, and you never had a chance of buying it.

“It was so easy back then,” he says. “They’d come in, put the shit on the shelves, snap a photo with their phone to show they did their job — then immediately pull it back down and buy it.” To the distributors, Tyrone’s merchandisers were doing their jobs, to the public they just thought they were too late and missed out on the cards. No one was the wiser, except for the merchandisers and Tyrone.

“I’d meet them at the end out their route, give them a stack — normally double what they paid, and everyone was happy.” As far as he sees it, Tyrone thinks the merchandisers got the better end of the deal. They just needed to meet him and make some quick money, he had to do the leg work to move the cards on the back end, but with prices skyrocketing it was worth it.

It wasn’t long before demand outstripped Tyrone’s supply, even having most of an east coast state in his pocket. He needed to expand, and began hitting up friends and family members in other states, bringing them into the fold. Before long he had numerous states, stretching from the east coast as far Texas in his network. Everyone giving kickbacks to merchandisers, sending the product to him, and profiting as he became able to sell product online for four times their value, sometimes even more.

“I was making less, because everyone needed a cut — but who cares. I was clearing $10k a month easy.”

Flipping fat packs and sealed product was nice, but the real money came in when Tyrone started getting his hands on hobby boxes. Larger, 12 pack boxes which brought more money, and more opportunity. “I can make stupid money on a case break, you don’t even know.”

A box, or case break, is a multi-participant venture in which a large number of people essentially gamble by buying pseudo-shares in a mass opening. Let’s say someone has a case of Prizm, you might pay $500 to get randomly assigned a team, then get every card from that team opened in a case.

For the individuals participating, it was a potential gold mine. Lucking out and getting the Pelicans could mean landing a five figure Zion Williamson card, at the expense of someone who got assigned the Hawks, and coming away with nothing. Trae Young isn’t worth big money, so Atlanta is seen as a dud slot. For people like Tyrone, selling the slots represents no risk — and all upside.

“Let’s say I’m paying three grand a case. I’m turning around and making five times that it in a break.”

With everyone desperate to open product hoping of landing a chase card, Tyrone was just in it for economics. “I’ll leave the gambling to the gamblers,” he says, “sure I’ll open something now and then for fun, but nah, moving sealed is where it’s at.” Soon, not even his vast network was enough to keep him in the cards he needed.

The fever spread from basketball into everything else. First football, then baseball, and finally Pokemon. “Pokemon makes me too nervous man,” Tyrone says to a friend who suggests they start buying it up, “we don’t know shit about those. I mean, can we break it? I don’t know. I know Luka and Ja, not Squirtle and shit. I’ll stick to what I know.”

“You have no idea how dirty this all is.”

As far as Tyrone saw it, he was providing a service. It had become impossible for anyone to get sealed product without spending thousands on boxes, and he felt that private card shops were cracking everything they were getting and selling singles online. Even then, he felt a little bad about what he was doing. “It sucks man, like I remember collecting cards as a kid,” Tyrone tells me, “none of these kids have a chance at buying packs. It’s all being eaten up.” As far as he was concerned, if Tyrone wasn’t scalping cards, someone else would — so why not him?

A large impact on the card market came not from flippers like Tyrone, but from Wall Street. During the economic downturn caused by the Covid pandemic, an increasing number of investment bankers were looking to diversify their portfolios with collectibles, and basketball cards were at the top of the list. Grading services like PSA and Beckett, once tapped only by enthusiasts trying to secure their most valuable cards, were now being flooded with requests to grade from big-dollar firms, aiming to solidify their investments.

“You have no idea how dirty this all is,” a lanky man named “Tom” calls from the back room as he assembles as eBay order. “I know this goes all the way through the system. I know Wall Street is talking to Panini and they’re engineering all this. Shit, I think ESPN is in Panini’s pocket too, pushing these players they know are signing.”

“Man, you’re tripping,” Tyrone says, rolling his eyes, not buying Tom’s conspiracy theories. “Don’t listen to him, I mean shit IS dirty, he right about that — but nah, nothing like that.”

Whether you believe the wild theories floated by collectors or not, it’s unquestionable that there’s a massive card shortage and it’s pushing prices through the roof. If you want to find a rare Zion Williamson rookie card now it’ll take not a few hundred bucks, or even a few thousand — but a second mortgage on your house.

Card collectors were tracking the price spikes daily, but when word got out to the general public that there were five- and six-figure cards being pulled from packs, it started a frenzy. Go to any store that stocked cards and you’d find empty shelves, people who were never interested in cards before were lingering around the section, looking to quickly make four times their purchase in a matter of hours be reselling online.

Word of Friday stocking got out. It wasn’t long before there were lines down the sidewalk, in the middle of a pandemic, of people waiting for store doors to open to they could rush the card rack. “My people started getting scared,” Tyrone said, referring to his merchandisers. “Not like they were afraid of getting hurt or nothing. They just didn’t want the drama of pulling the shit off shelves, someone reporting them and losing their jobs.” Soon the merchandisers started to pull out of their deals, no longer interested in the risks the quick money brought. It became more and more difficult for Tyrone to secure large numbers of cards.

This is the harsh reality of the #Pokemon TCG right now. It’s a mess pic.twitter.com/3RnbeGz07A

— Pokémon News (@TrainerINTEL) May 22, 2021

Then the news came cards were being pulled from shelves. “Nobody was ready for that. Shit, I don’t think Panini or Bowman were ready for that,” Tyrone says. Overnight the network he’d cultivated for years collapsed, but this wasn’t a man who looked like his world was crumbling around him — rather, he seemed calm. “I knew it was coming, just not this way. I have plans, believe me I have plans. Just not ready to talk about that yet.”

While Tyrone pivots to whatever he’s doing next, on Friday May 21, one week after pulling cards from the shelves, Target opened them up again for online-only sales. This time with strict limits to how many packs and boxes people could buy, effectively killing the scalping market. A great day for general consumers, and perhaps the nail in the coffin for those who made a living off cards in the last few years.

When reached for comment Target corporate said they had nothing to add to the card situation beyond their initial statement posted in stores.

0 notes

Note

21 and honey and trois for the otp prompt please

EEEEEEEEEEEEEEEE!!! (omg this was longer than i thought it’d be ahaha. sorry if this feels ooc for anyone, it was the first thing that came to my mind.)

OTP Quotes Challenge

21. “okay, and how much money did you spend on that thing?”

sitting on the plush seat, bored out of his mind, honey sighed. there was nothing FUN to do today. trois had left earlier for something he didn’t say, he read all the magazines they had and wouldn’t get a new shipment of them for a couple of days, they weren’t invited to go anywhere…which, he totally didn’t care about, but in this state of boredom he wouldn’t mind doing ANYTHING even getting invited by that shitty gambler to play a round of pool.

suddenly he heard the familiar clacking of kiji’s heels and the door suddenly opened with him and trois in tow, and in his hands was a box. after his cellmate entered the door automatically closed and kiji walked off.

“so, you got another package?” he asked. trois nodded. “mmhmm”.

“hah, so is it anything from your parents?” trois flushed a shade of pink. “no.” “aw, too bad. I would’ve loved to see another rendition of you performing Shirley temple’s animal crackers.” he teased. the blush on trois’s face moved to his ears.

“hmph! be careful with your choice of words or you won’t get to see the surprise.” honey raised a brow. “surprise?” “mmhmm! and it’s in here.” he showed the box before turning to go to the bathroom. “what is it?”

trois smirked as he looked over his shoulder. “it wouldn’t be a surprise if I told you what it was.” he turned back and closed the bathroom door, with honey miffed having to wait.

after a couple of minutes the door opened and honey looked, and did a double take at his cellmate. he wore a white long sleeve button up with a plaid bow tied around it, a matching plaid skirt, white thigh highs, mary jane shoes, at the top of his head was a plaid burette and a broche on his shirt.

“you like it?” he asked, though the answer was obvious with how honey was staring at him, and the hand on his chest. “it’s-it’s nice.” he stuttered. that was a lie, it was FLAWLESS. the other obviously knew this and smiled. “I figured you’d like it.”

“yeah…but what’s the occasion?” he asked, standing up and walking to him. “well, it was on sale and I just thought it’d be nice to maybe have around, and maybe have some fun with it.~” his sentence sounded sensual and honey wasn’t surprised that he’d buy the outfit just for using it for a round of sex. which was definitely going to happen but now he had something else that caught his eyes.

“okay, and how much money did you spend on that thing?” he asked, pointing at the broche. it was gold colored and on it was turquoise gems in the shape of a “T” trois looked away. “why-why does it matter?” he hesitated. “trois, I know a commissioned piece of jewelry when I see it, now tell me how much.”

trois kept quiet for a while before leaning up and whispering in honey’s ear. “WHAT?!” he yelled, eyes wide and arrows coming out of his head.

“now don’t freak out-”

“DON’T FREAK OUT?! YOUR SUPPOSED TO SAY THAT BEFORE TELLING ME THE COST NOT AFTER! WHY DID YOU SPEND SO MUCH ON A BROCHE?!”

“w-well it was actually half of that price-”

“HALF?! wait half? than why-”

before he could ask trois’s hands that were behind his back came out and his palms opened to show a matching golden broche, but it had purple gems in the shape of an “H”. he stared at it, surprised. “the reason for the price is because I got two of them.” he confessed. he then moved forward to pin it on honey’s shirt. “just something I thought for our anniversary-”

“anniversary?” he asked aloud. trois looked up at him. “yes anniversary.” honey almost had a heart attack. this was their anniversa- wait. he sighed. “trois that’s not for three months.” trois looked up at him raising a brow. “what? oh! no, i know that.” “than why-” “THAT day is for when we first became a couple. TODAY is the day we first met.” honey paused. when they first met?

“remember, about 4 years ago today we met. i was walking down the street and got chased and trapped by the town goons. i almost could’ve been pummeled if you hadn’t come-” “-and fought them off with an old pipe.” honey finished, remembering that day. trois smiled. “oh good you DID remember. i was worried you got hit in the head so much you forgot.” “hey, that was a long time ago. and if I’m remembering right i only fought them because they were on my terf.”

“right, right that’s what you said.”

“it was the truth.”

“partly. but the look in your eyes when you saw me showed it wasn’t the whole truth now was it?”

“sh-shut up. it was so because of that.”

“well if it was then why were you okay with me taking you to my place to patch you up?”

damn his boyfriend and his ways. he decided to stop this conversation by wrapping his arms around the other and quickly moving his hands to go to his visible thighs and lift the skirt a bit, with trois yelping in surprise. “boo, no lingerie?” he asked, disappointed. “THAT will be for our date anniversary.” trois stated. honey grumbled, the tease. he then lifted trois up into his arms and walked to one of the beds there.

“i still can’t believe you’d go this far for when we first met. you’ll end up outdoing me at this rate.” he mumbled. if this is how he was gonna be for when they first met, now the idea of what’d he do for their date anniversary shook him. trois just giggled as he was being lowered onto the bed. “well i just thought you deserved this. after all, I’m internally grateful of you after that incident.” they looked each other in the eyes and it was obvious in trois’s eyes he was being sincere. he was actually serious about that. grateful their paths crossed and how it shaped them.

without warning honey leaned in and started unpinning trois’s broach. “honey-” “we don’t want these ruined.” he stated quickly. putting trois’s broach aside, away from the bed and went to take his own off. “after all if these break your gonna have hell getting them fixed.”

trois just stared at him then smiled. “hm, your right.” and with that both broaches were set aside next to each other as the two started making love.

13 notes

·

View notes

Note

HI YOU WANT AN AU Consider: Gambler Fuyu and Yakuza Peko

CONSIDERED AND I FUCKING LOVE IT.

Peko Pekoyama isheiress to the largest crime syndicate in Japan. With over 30,000members under her command, she’s everything a yakuza heiress needsto be: serious, calculating, disciplined. Just the sound of her nameinstills fear on the streets.

Fuyuhiko Kuzuryuuis one of Japan’s most notorious gamblers. No one knows how someoneso young living on his own can allude the police for so long, but somehow he manages toget around, hopping from place to place leaving empty vaults in hiswake.

The Pekoyama clanowns and operates nearly all of Japan’s illegal casinos. Word getsto Peko that the Kuzuryuu kid has been paying visits to these parlorsand breaking the bank. He makes off with his winnings before herassociates can tail him.

Well that won’tstand.

There’s apattern to his visits. He never goes to the same place twice, buthe’s predictable; he pops up in one of their casinos Friday ofevery week and he always arrives at ten o’clock pm on the dot.Based on the pattern, he’ll be visiting their Kobe casino next.

“It’d be rudenot to congratulate him on his amazing winnings, don’t you think?”Her slew of bodyguards all nod their heads vigorously.

That evening,Peko heads to the Kobe casino wearing her nicest kimono and thegolden ornamental hairpin she got for her last birthday so thatthere’s no mistake; she’s made of money.

She spots himeasily in the crowd sitting there at a roulette table in his stupidlittle trilby and his silk vest with a pocket square and a joker cardpeeking out of the vest pocket. He’s chewing on a toothpick andacting like he owns the damn place.

“FuyuhikoKuzuryuu?”

“Who’saskin’?” He doesn’t bother to stand. Or look up, for thatmatter.

“Peko Pekoyamaof the Pekoyama clan. My family owns this establishment. And some ofthe many others you’ve been frequenting.”

Now thatcatches his attention. He peers at her from beneath the brim ofhis trilby and grins. “‘Pleasure,princess.”

“I’ve heardtalk that you’ve made quite an upset at our Shibuya location.Put my men in quite a panic. They say you’re the best at what youdo.”

“Something likethat.”

“Then I supposeyou wouldn’t mind playing a few hands with me? I’ll make it worthyour while. Perhaps 50,000 yen to start? Consider it a… friendlywager, of sorts.”

“Interesting.What’s the game?”

She puts a deckof kabufuda cards on the table. Oicho-kabu.Of course.

They find aprivate table in a far corner of the casino where they won’t bedisturbed. Peko flags over one of her men to be their dealer.Fuyuhiko curls his lip. “How do I know you ain’t cheating?”

“Well, you’rea gambler, Mr. Kuzuryuu. Would you like to take those odds?”

He has nothing tosay to that. The cards are dealt and they make their wagers.

The first hand isa bust. Fuyuhiko gets double nines straight away and Peko’s leftwith a paltry one, five, and six in her hand.

It’s justluck, she says to herself. It won’t last forever.

They play a fewmore hands, the wagers getting bigger and bigger to keep him enticed.He wins every single one. Peko is both maddened and impressed, butshe doesn’t let either show on her face.

Absolutelynothing gives him away. Nothing. Not his eyes, not his smirk,not his hands, not even the twiddle of the toothpick still danglingfrom his lips. He’s a master at bluffing, even to Peko, who’strained to reign in her emotions since she was seven.

By the end of it,Fuyuhiko is 1,000,000 yen richer and Peko is struggling not to reachfor the knife tucked in her sash in petty revenge.

After the lasthand (another loss for her), Fuyuhiko just flashes her thisinfuriating smirk and starts to collect his chips. “Betterquit while I’m ahead.”

“Wait!” Pekosays hastily. “Double or nothing.”

“Heh. Thanksbut no thanks. I got plenty of your money stashed away in mycloset already. You don’t have anything else I want.”

Peko nods to oneof her bodyguards. “Bring the sword.” Her men go and retrieve herweapon, this beautiful katana in a black and red sheath, masterfullycrafted. “This has been in my family for generations. I assure you,it is priceless.”

“And what makesthis hunk of metal so special?”

“… It is mypersonal weapon.” If her parents knew she were wagering her sword,they’d kill her. She’s dreamed of the day when she would use thisvery sword to bring justice to her clan and make her family proud.

Fuyuhiko just…quirks a brow. Money is one thing. The Pekoyama clan is in noshortage of money. It’s the power they get from it, the controlthat matters. But this? This is sentimental shit, and sure, it wouldprobably fetch a pretty penny on the market, but she’s made itpretty damn clear; her attachment to the sword far outweighs theprice tag.

He considers itfor a second more and sits back down. “Deal.”

The first twocards are dealt. He asks for a third card. She looks down at hercards and hesitates. She could play it safe, stick with her seven.She looks over to Fuyuhiko. He looks totally at ease, but he could bebluffing. She settles back on her heels. She’ll stay with herseven.

But then… “No.Another card please.”

“Show ‘em.”

The dealer showshis hand. Seven. She lays down her hand. Eight.

(Pause fordramatic effect.)

Fuyuhiko showshis hand. An eight, a nine, and a three. Ya-ku-za.Zero. Theworst hand he could possibly get.

“Wellshit. Looks like ya got me.”

Pekoreleases the breath she’d been holding whileher bodyguards sweep up the winnings from the wagering table.

Fuyuhikodoesn’t even look all that defeated. “GuessI’ll have to try harder next time.”

“Nexttime?”

Hedoesn’t elaborate, justtips up his hat and flashes her that lopsided smile that(strangely)makes her heart race,just a bit.

Andthen he leaves.He just leaves. Heretrieves his coat and walksout the door not a cent richer.

Pekoactually has to take a moment to process whatjust happened. Next time,he said. Her bodyguards askif she wants them to tail him tofind out where he’s staying butshe shakes her head. There’s no need. She’lljust have towait until next weekto seewhere he’ll show up nextand if she’ll meethim again.

#kuzupeko#fuyuhiko kuzuryuu#peko pekoyama#danganronpa#sdr2#dr2#anh's answers#scarletmoone#I LOVE THIS AU#I LOVE THIS TALENT SWAP#FLIRTING OVER CARDS#HOLY SHIT#THANK U THANK U#long post#anh's writing#gambler/yakuza au

303 notes

·

View notes

Text

Were The WEX Exchange Admins FSB/CIA Double Agents?

A recent study published by the Russian Lenta news agency indicates that WEX and BTC-e crypto exchanges were used by double agents to launder money for both the U.S. secret service and Russian FSB agents. Also, the main owner of the BTC-e exchange, until his arrest in 2016, was allegedly FSB Informational Security Center #2 Сhief, Sergey Mihaylov.

Also read: ConsenSys to Shrink With Ether Price, Lubin Remains Upbeat

Subscribe to the Bitsonline YouTube channel for great videos featuring industry insiders & experts

Mihaylov’s Exchanges, Hackers, And High Treason

In their recent piece, Lenta presume that the Mt. Gox exchange was used by the CIA to launder money and send it to the BTC-e exchange. BTC-e was also allegedly a CIA controlled entity, with Russian FSB double agent Sergey Mihaylov as director. The article says that he and Alexander Vinnik were storing the CIA’s money in BTC-e crypto assets.

This is impossible, because Mihaylov was arrested in Russia back in 2016 for the crime of high treason. He was passing Russian hackers’ personal data to agents of the U.S. government. According to Dozhd, the dump lead to the arrest of a son of Russian LDPR party deputy, Roman Seleznev, for hacking. He was arrested on the Maldive Islands in 2014 and spent three years in a U.S.-based remand prison before facing a 27-year prison sentence in 2017.

The connection between the Mihaylov’s arrest and the acquisition of hacker data by the CIA is proven by the Rosbalt publication from February 2017. Oppositional press sources like Dozhd and Meduza claim Mihaylov sold the hackers’ personal info for a huge pile of cash. FSB officials deny the allegations.

Lenta cites the bankrupt Dmitrii Vasilev, a former WEX CEO:

“Mihaylov steamrolled Webmoney, which was the main laundry spot for grey budgets around 5 to 10 years ago. The cash did flow from all around the world. Since the introduction of BTC-e codes, Webmoney had lost their position. If we presume that Webmoney was under his control, then BTC-e was too.”

The author of the Lenta report continues:

“If BTC-e was also working under his control, then the platform simply served the interests of the American special services.”

But the publication has no proof of that. In fact, Mihaylov was a Russian agent who simply made a mistake. He dumped a list of FSB controlled hackers from closed FSB Infosec Department servers, which cannot reach the internet. Since that moment, the takedown of Mihaylov was only a matter of time. His actions that lead to his arrest had nothing to do with BTC-e activity.

Many Facts of The Story Look Awful

According to Lenta, the exchange was under the control of the Americans through Dmitrii Vasilev and anonymous Alexey, who were both U.S. agents like Mihaylov.

But “anonymous Alexey” certainly could be Alexsey Belan, WEX admin and a hacker from the FBI wishlist with a $100,000 USD pinned bounty. Together with three other FSB agents, Belan participated in hacks of U.S. servers, including the stealing and selling of personal data of more than 500 million Yahoo users.

As for Vasilev, he disappeared from Russia at the same time WEX ETH balances began to drain. He claimed that he spent $5 million on Vinnik’s defense, but the lawyer somehow only received $100,000. Vasilev is a confirmed bankrupt, a gambler, a hacker, and thief, as well as a recruit of the FSB, spotted with Russian and Belorussian passports. He is behind many Russia-based cryptocurrency scams (Buzcoin, PRIZM, etc.).

This may mean that Mihaylov and his colleagues were working for Russia, not for the U.S. But the bribe offered by the CIA may have been too much to resist. One of the anonymous Dozhd sources close to the FSB told the outlet that it was big money that caused Mihaylov to release the names of those behind several virtual attacks on the USA.

Lenta Draws Attention To U.S. Agents

The story on Lenta points to U.S. authorities as guilty regarding what BTC-e was doing. But the original creators seem to be top Russian FSB agents and international hackers with dirty reputations. Lenta’s recent study may be an attempt to drag the public attention away from corrupt Russian agents and to the U.S.

At least four WEX-related men were Russian hackers and FSB workers (Dmitrii Vasilev, Alexsey Belan, Dmitrii Havchenko, Alexander Vinnik).

Also, the Lenta news portal went through a Kremlin curated change of management back in 2014. After publishing an interview with the leader of Ukrainian nationalists, Lenta’s editor-in-chief was replaced with an FSB loyalist. The editorial politics of Lenta changed forever.

Whoever Stands Behind BTC-e and WEX Cannot be Trusted

With the BTC-e exchange, which later operated under the WEX.nz domain, there was a story in 2016. When the ETH-ETC hard fork happened in 2016, the exchange claimed that users did withdraw their ETC tokens, although the exchange didn’t give users control over their private keys.

Many users prefer to forget about their coins, because they understood that the exchange just stole them. Some others didn’t think they had the right to demand money from the exchange.

During the two major episodes of BTC-e and WEX shutdowns, the public lost around $500-700 million USD. At the same time, no one is claiming the right to any stolen money. This means that most of the stolen funds were deposited by criminals or by people who lost hope.

Will WEX related scammers go away unnoticed? Share your opinions in the comments.

Images by Jeff Fawkes

The post Were The WEX Exchange Admins FSB/CIA Double Agents? appeared first on Bitsonline.

[Telegram Channel | Original Article ]

0 notes

Text

Ignorance

A recurring theme of the trip so far has been my ignorance.

To an extent, that's by design. I didn't do much research before coming here, deciding instead to rock up and see what I can see.

However, I don't think that my ignorance has been so pervasive as it has been in Las Vegas.

Actually, did I mention it's hot here? I feel I may have mentioned it's hot here. Well just for good measure, it's damn hot here. Hottest place I've ever been.

It's gotten to the point now where I'm genuinely waiting for the sun to set before going anywhere.

Even the pigeons I saw outside looked frazzled, glued to the tarmac, not even able to muster the energy to peck at bread-coloured specks on the ground in the hopes of nourishment.

I'm not a complete idiot, I did manage to draw a potential parallel between proximity to a desert and heat. But the whole benefit of deserts is that they're supposed to be punishingly hot during the day and cold at night.

I ask you, where is the cold? Because I'm not feeling it. I think my desert is broken.

I digress. The main evidence of my ignorance is something I said in a previous post.

In my post about New York, I spoke about Times Square and foolishly referred to it as an assault on the senses.

That unfortunately leaves me little wiggle room to describe Las Vegas, which is in another league altogether.

So maybe it's...um...an unending space war on the senses?

It starts fairly innocuously. I flew into Vegas at night time, something I didn't plan but realised as we were coming into land that everything below us was bathed in artificial light. Vegas stands out like a beacon, beckoning unsuspecting fools to the detriment of their wallets.

And then I landed and almost immediately encountered something I wasn't expecting:

Slot machines. Everywhere.

Again, I'm not an idiot (although I probably shouldn't have to defend that stance this much), I know what Vegas is known for.

But in the airport? Seriously? You can't wait until you get to an actual casino?

Fun side note, the day after I landed, there were multiple power outages at the airport. If you'd seen how many slot machines there were, you'd wonder why it doesn't happen more often.

Anyway, I wade through the sea of impatient gamblers, pick up my luggage and get to the hotel.

I'm staying in a hotel casino. It seemed like it would be outside of my price range but the cost seemed low when I booked it. I assumed they just thought they would make back their money if I gambled.

Well turns out they did think that. But it didn't stop them from charging a daily resort fee and security deposit anyway which ballooned the cost significantly.

Suffice it to say, I endeavoured to spend the next few days not spending much money.

And so, aside from getting food, or doing laundry, or sweating profusely in the heat for no reason, I basically stayed in the room for a few days.

After that, I thought it was probably time to let myself loose at the casino. I wandered aimlessly around the glittering array of slot machines until I found one I decided caught my eye. It had pandas on it.

There were no instructions. No help. Just a slot to put money in, and a dizzying selection of blinking buttons. It was impossible to discern how I won, when I won, but either way it happened rarely and my dollars brought ultimately no success.

I tried a few other machines, including video poker and blackjack. At this point I noticed that the actual blackjack table was open and empty. I'd been putting off attending because they were full, and I didn't want my despicable beginner-ness to impact the other players. Like I've said, sometimes I'm needlessly courteous.

I hand the dealer $50 and he gives me a pile of $5 chips.

I know how to play the game, but I've never played at a table before so I ask him to explain all of the weird symbols etc on the table and then we start.

Win a few hands, lose a few. A couple more players join the table, one of them smoking like a chimney. Indoors. Because that's allowed here. It's surreal seeing ashtrays everywhere like it's the 90s again.

I end up lasting longer than both players, but only just and I start bleeding chips. Slightly addicted to the fun I'm having I buy another $25 in chips but to no avail. I end up with nothing.

Every fibre of my being wants me to go back to the table once I leave it. But I head back to the room and wait for nightfall.

Obviously Vegas is famous for gambling, and the epitome of this can be found on the main Vegas strip. At night, the whole place lights up like an incredibly ostentatious Christmas tree.

Most places have a theme. One is based on New York, has a city skyline, statue of liberty and winding streets inside.

One is based on Paris. It has a giant Eiffel Tower, which comes through the ceiling inside. The ceiling itself is painted to look like sky.

It's crazy. Each one is like being in a totally different place.

From what I understand, after the second world war, Americans had no desire to travel to other countries. They wanted to stay home. So they built these casinos to have somewhere to wind down that was different from everywhere else. Bring Paris, Rome, Venice to them.

I can't say they're a particularly accurate representation, but they are definitely sights to see. It's clear where the house money goes. There are huge synchronised fountain displays, grand statues and (somehow) even more goddamn slot machines.

Slight detour. Before I left for America, I asked people if they wanted me to get them anything. One asked me to put a $5 bet on a roulette wheel, so I decided to do it right, at the Bellagio. The problem with that, I realised was that the tables there have a $25 minimum bet. So suddenly I was putting $25 on a single number. Spoiler alert, it didn't win. Which is good, because an $800+ win would've tested my honour with regards to how honest I'd be about said win.

You might think that means I could be lying now. To which I'd say how dare you, while trying to hide my bulging wallet.

I'm kidding, I didn't win.

Or did I?

No.

Your complete lack of faith aside, this left me with $20 in chips and needing $5 more to do anything with them. I went to get more money and decided to wander over to the blackjack tables. I sat down and discovered that the minimum bet here was $15, but since I'd need to get back up, I put the whole pile on the first game.

There are two elderly Japanese guys at the table already who look like they're having fun.

The dealer gives me two face cards, making 20. For those who don't know blackjack, that's good. I win the hand and my money is doubled.

I play another hand with $25. This time I get a face card and a ten, so 20 again.

At this point in the proceedings, I'm beginning to get looks from the two gentlemen, who aren't faring as well since I joined the table.

We deal again, and I place the same bet. This time I get blackjack. The gentlemen lose.

The looks are becoming emphatic hand gestures and unfriendly sounding Japanese phrases. The dealer comments on my luck. I proclaim that I'm never leaving the table ever.

I play more hands, beginning to mess with the bets a little. I stop thinking consciously about where I am, money wise and then I look down.

And I realise I have just over $200 in front of me.

I am the luckiest man on this planet. I am luck itself, personified.

But then the voice of reason makes itself known to me. And I realise that I have a chance to do something most people don't.

I get to beat the house.

So I play my last hand, and I leave, wiping out all the losses I'd experienced up to that point.

I walk on air towards the exit, stopping only momentarily to adjust myself to stop someone on the way out from trying to pick my pocket.

I'm conscious of the money in my pocket, fearful of everyone around me and get an uber back to the hotel.

I am victorious! I have beaten Vegas! This calls for a victory drink.

So I go to the bar and order a drink. A man sits next to me and we strike up a conversation.

It starts innocuously enough as we do the usual, discuss where I'm from, what I'm doing. But things start to get...odd.

First I see the handheld bible he's carrying.

I buy him a drink. He says he's not happy with who he is.

I notice the smell of...something. It's not weed, it's not alcohol, but it's something.

I ignore these things and we talk some more. He comments on how lucky Prince Harry is to get his dick sucked, and that he'd like that too.

Ok, well...ok fine I understand that I suppose.

Then he talks about family, and trust.

Ok, steadier ground, good.

Then he describes in disturbing detail the five major crime syndicates in New York and I realise the kind of family he's talking about.

Then he talks about six dragons that are actually seven, because one is sometimes zero. Then he gets very angry and the barman tried to calm him down. This seems to work.

For a bit.

Then he talks about karma, and karma times three, which is dharma. Then he explains that he has power, that he can't trust himself to use because he could end the universe.

Then he says he loves himself and wouldn't change a thing.

Then I notice the track marks on his arm and wonder what exactly I've gotten myself into.

It's just after midnight at this point, and I have to be up at 5am to get ready for the grand canyon tour.

This is a problem.

Because I need to tell this man that I need to go because I need to get up early. And I'm aware that this sounds like an excuse. Even though it isn't.

And the best case scenario, the BEST case scenario, is that this man is an angry New York mobster high on an unidentified drug.

I take solace in the fact that there is security everywhere in here, and try not to think about the idea of him trying to find and kill me after I leave.

I wait for the barman to be in eyesight and tell him I need to go.

He takes a napkin and writes 'grand canyon tour' on it and starts thinking up anagrams for it. The he tells me how he loves the Three Musketeers and he can't believe he met a British guy, where they're from.

I tell him that I'm pretty sure they're French.

That was a mistake.

Luckily he ignores me, turns over the napkin and starts drawing a Musketeers lair for us.

I say an internal goodbye to life and repeat that I need to go. I get up and he grabs my wrist, and with the saddest look says 'please don't go'.

I apologise and leave the table, weaving my path to avoid bullets or throwing knives.

But morning arrived, and I yet draw breath.

Now to Mexico! And freedom!

0 notes

Text

Donald Trump’s Big Fat Ugly Bubble Is Ready to Pop

This post Donald Trump’s Big Fat Ugly Bubble Is Ready to Pop appeared first on Daily Reckoning.

[Urgent Note: The nation’s future hangs in the balance as Trump approaches his first 100 days. That’s why I’m on a mission to send my new book TRUMPED! A Nation on the Brink of Ruin… and How to Bring It Back to every American who responds, absolutely free. Click here for more details.]

There have been numerous eruptions of irrational exuberance since Alan Greenspan launched the modern era of monetary central planning in response to the 25% crash of the stock market in October 1987.

But for my money, the Trump-O-Mania since the wee hours of election night is the greatest folly of all.

That’s because Donald Trump is destined to be history’s Great Disruptor — not the 11th hour savior of the mutant financial system and giant bubbles that have been generated by our Wall Street/Washington rulers over the past three decades.

The latter is a product of massive financial asset inflation fueled by the Fed’s cheap debt, falsified financial prices and the tidal wave of Wall Street speculation they have induced.

But the Fed (and its convoy of central bank imitators around the world) is finally out of dry powder. If it resumes quantitative easing (QE) preemptively to thwart the now incipient recession, it will generate a panicked sell-off — stoking fears in the casino that it “knows” something the gamblers don’t.

Likewise, if it even hints at reversing course toward sub-zero interest rates, it will bring the aroused populations of Flyover America, which elected Donald Trump, descending upon the Imperial City with torches and pitchforks.

The savers and retirees of America have already been so severely savaged by 96 months of zero interest rates (ZIRP) that they are not about to take it any more or have their savings flat-out confiscated by the elitist fools who inhabit Eccles Building.

In short, after having impaled itself on the zero bound and hideously bloating its balance sheet — from $900 billion to $4.4 trillion since the Lehman event in September 2008 — the Fed has no capacity whatsoever to forestall the oncoming recession or reflate the economy and financial markets once it begins.

The market should currently be in panicked retreat because it is inconceivable that the Donald will appoint to the Fed even more aggressive money-pumpers than the paralyzed posse currently in command, led by clueless Janet Yellen.

But in one of the most ludicrous stick saves ever confected in the bowels of Wall Street, the day traders and robo-machines have been induced to slam the “buy” button on a theory so preposterous that even CNBC’s chief circus barker, Jim Cramer, could not have invented it.

That is, the notion that Donald Trump is the second coming of Ronald Reagan and that a huge deficit-fueled “stimulus” is just around the corner is just plain nuts.

There will be no such thing.

Trump-O-Mania is the greatest eruption of irrational exuberance yet because it occurred in the wake of an election outcome that is a repudiation of the very regime of Bubble Finance from which it took flight.

Donald Trump’s shocking election victory was in fact due to the fact that the nation’s economic prospects and future growth potential has dimmed dramatically since 1987.

Since the Greenspan era of Bubble Finance began in October 1987, the value of corporate equities owned by households has soared from $1.8 trillion to nearly $15 trillion, representing a 7.5% annual gain.

That means that equity values have increased 65% faster than the 4.5% annual gain in GDP during the same 29-year period.

There’s a word for that sort of imbalance: unsustainable. Does anyone with a pair of brain cells to rub together think it can last much longer?

But the greatest headwind Trump faces is his wildly inconsistent and irresponsible fiscal program. It will not result in a smooth hand-off the “stimulus” baton from the Fed to fiscal policy and the vaunted “Trump Stimulus��� as Wall Street so blithely expects.

Instead, it will actually produce a political conflagration and Fiscal Bloodbath like the Imperial City has never before witnessed. Trump’s already facing Congressional opposition to his spending plans and Inauguration Day is still two weeks off.

Consequently, the current extreme stock market euphoria will give way to its opposite as the casino gamblers come to recognize that the jig is up. With the debt ceiling holiday bomb ticking toward its March 15 ignition date, the message from the beltway will become increasingly cacophonous and disconcerting.

Namely, it will become obvious there is no known combination of Congressional votes — Republican, Democratic or mixed — that the Trump White House will be able to marshal on behalf of deep corporate and personal tax cuts, a major defense spending increase, a huge infrastructure program, more money for veterans, border control, the Mexican Wall, domestic law enforcement and homeland security — while given a free pass to the giant retirement entitlement programs, social security and medicare at $1.6 trillion per year.

That’s because the current public debt of nearly $20 trillion will grow by $1 trillion per year to upwards of $25 trillion during the Great Disrupter’s first term, and that’s before one dime of the ballyhooed Trump Stimulus is added to the equation. To add $500 billion per year or more of additional red ink to the equation is beyond the pale.

That’s true even for the spenders who inhabit the Imperial City — especially after they realize the bond vigilantes who keep careful watch of federal spending were not extinguished back in 1994, but only went into a long hibernation that is now over as the era of central bank money printing has reached its end game.

So unless Donald Trump can accomplish the seeming impossible — get Congress to raise the public debt ceiling on March 15 to $25 trillion or higher in one fell swoop, his entire and largely misbegotten fiscal stimulus program will be stillborn.

It will simply disappear amidst endless budget battles and debt ceiling showdowns/government shutdowns which will make the budgetary fireworks of August 2011 look like a Sunday School picnic in comparison.

And that gets us back to the whole idea that the Reagan Boom of 1983-1984 can be replicated from a cold start at the very end of a long-in-the-tooth business cycle. The fact is, the original event was not a supply side miracle in the slightest.

It was a “borrow and spend” eruption that depended upon a massive expansion of the Federal deficit from 2% of GDP under the outgoing Carter budget to an unprecedented 5-6% of GDP during the Gipper’s first term.

Even then, the celebrated Morning in America boom during 1983-1984 was not remotely what it is cracked-up to be by Trump’s aging posse of supply siders like Stephen Moore and Larry Kudlow.

During the six quarters of 1983 through Q2 1984, fully 27% of the real GDP growth of 7.8% was accounted for by a huge but one-time restocking of business inventories — after they had been flushed out of the system by Volcker’s 20% interest rate medicine during the 1980-1982 battle against inflation.

That is not remotely relevant today because inventories stand at cyclical highs, and are virtually certain to be liquidated — not restocked — in the period ahead. Moreover, the investment and business side of the U.S. economy actually contributed nothing on net to the so-called Reagan boom (as is discussed in my book Trumped!).

Even the housing surge happened during this interval because mortgage rates were plummeting after the crushing double-digit rates generated by the Volcker anti-inflation campaign.

Self-evidently, after 8 years of ZIRP, mortgage rates will now be rising, not falling, as far as the eye can see. In fact, the Fed’s 100 basis point interest rate increase since last summer’s lows have already put a crimp into the tepid rate of residential housing activity as represented by new contract signings and new permits.

Finally, when the Reagan boom began, the stock market’s price/earnings (PE) ratio had been hammered down into single digits by the prior decade of soaring inflation. So it had nowhere to go except up — the very opposite of today’s 25X multiple, which flirts with PE ratios normally associated with those preceding violent market crashes.

In short, the greatest Sucker’s Rally in history is now nearly over. And the Wall Street casino is about to feel the full brunt of the Great Disrupter — and one of an altogether different kind than that invented by the Wall Street brokers on election night.

As a contra-Cramer might say, there will never be better time to sell, sell, sell!

Regards,

David Stockman for The Daily Reckoning

The post Donald Trump’s Big Fat Ugly Bubble Is Ready to Pop appeared first on Daily Reckoning.

0 notes

Text

Donald Trump’s Big Fat Ugly Bubble Is Ready to Pop

This post Donald Trump’s Big Fat Ugly Bubble Is Ready to Pop appeared first on Daily Reckoning.

[Urgent Note: The nation’s future hangs in the balance as Trump approaches his first 100 days. That’s why I’m on a mission to send my new book TRUMPED! A Nation on the Brink of Ruin… and How to Bring It Back to every American who responds, absolutely free. Click here for more details.]

There have been numerous eruptions of irrational exuberance since Alan Greenspan launched the modern era of monetary central planning in response to the 25% crash of the stock market in October 1987.

But for my money, the Trump-O-Mania since the wee hours of election night is the greatest folly of all.

That’s because Donald Trump is destined to be history’s Great Disruptor — not the 11th hour savior of the mutant financial system and giant bubbles that have been generated by our Wall Street/Washington rulers over the past three decades.

The latter is a product of massive financial asset inflation fueled by the Fed’s cheap debt, falsified financial prices and the tidal wave of Wall Street speculation they have induced.

But the Fed (and its convoy of central bank imitators around the world) is finally out of dry powder. If it resumes quantitative easing (QE) preemptively to thwart the now incipient recession, it will generate a panicked sell-off — stoking fears in the casino that it “knows” something the gamblers don’t.

Likewise, if it even hints at reversing course toward sub-zero interest rates, it will bring the aroused populations of Flyover America, which elected Donald Trump, descending upon the Imperial City with torches and pitchforks.

The savers and retirees of America have already been so severely savaged by 96 months of zero interest rates (ZIRP) that they are not about to take it any more or have their savings flat-out confiscated by the elitist fools who inhabit Eccles Building.

In short, after having impaled itself on the zero bound and hideously bloating its balance sheet — from $900 billion to $4.4 trillion since the Lehman event in September 2008 — the Fed has no capacity whatsoever to forestall the oncoming recession or reflate the economy and financial markets once it begins.

The market should currently be in panicked retreat because it is inconceivable that the Donald will appoint to the Fed even more aggressive money-pumpers than the paralyzed posse currently in command, led by clueless Janet Yellen.

But in one of the most ludicrous stick saves ever confected in the bowels of Wall Street, the day traders and robo-machines have been induced to slam the “buy” button on a theory so preposterous that even CNBC’s chief circus barker, Jim Cramer, could not have invented it.

That is, the notion that Donald Trump is the second coming of Ronald Reagan and that a huge deficit-fueled “stimulus” is just around the corner is just plain nuts.

There will be no such thing.

Trump-O-Mania is the greatest eruption of irrational exuberance yet because it occurred in the wake of an election outcome that is a repudiation of the very regime of Bubble Finance from which it took flight.

Donald Trump’s shocking election victory was in fact due to the fact that the nation’s economic prospects and future growth potential has dimmed dramatically since 1987.

Since the Greenspan era of Bubble Finance began in October 1987, the value of corporate equities owned by households has soared from $1.8 trillion to nearly $15 trillion, representing a 7.5% annual gain.

That means that equity values have increased 65% faster than the 4.5% annual gain in GDP during the same 29-year period.

There’s a word for that sort of imbalance: unsustainable. Does anyone with a pair of brain cells to rub together think it can last much longer?

But the greatest headwind Trump faces is his wildly inconsistent and irresponsible fiscal program. It will not result in a smooth hand-off the “stimulus” baton from the Fed to fiscal policy and the vaunted “Trump Stimulus” as Wall Street so blithely expects.

Instead, it will actually produce a political conflagration and Fiscal Bloodbath like the Imperial City has never before witnessed. Trump’s already facing Congressional opposition to his spending plans and Inauguration Day is still two weeks off.

Consequently, the current extreme stock market euphoria will give way to its opposite as the casino gamblers come to recognize that the jig is up. With the debt ceiling holiday bomb ticking toward its March 15 ignition date, the message from the beltway will become increasingly cacophonous and disconcerting.

Namely, it will become obvious there is no known combination of Congressional votes — Republican, Democratic or mixed — that the Trump White House will be able to marshal on behalf of deep corporate and personal tax cuts, a major defense spending increase, a huge infrastructure program, more money for veterans, border control, the Mexican Wall, domestic law enforcement and homeland security — while given a free pass to the giant retirement entitlement programs, social security and medicare at $1.6 trillion per year.

That’s because the current public debt of nearly $20 trillion will grow by $1 trillion per year to upwards of $25 trillion during the Great Disrupter’s first term, and that’s before one dime of the ballyhooed Trump Stimulus is added to the equation. To add $500 billion per year or more of additional red ink to the equation is beyond the pale.

That’s true even for the spenders who inhabit the Imperial City — especially after they realize the bond vigilantes who keep careful watch of federal spending were not extinguished back in 1994, but only went into a long hibernation that is now over as the era of central bank money printing has reached its end game.

So unless Donald Trump can accomplish the seeming impossible — get Congress to raise the public debt ceiling on March 15 to $25 trillion or higher in one fell swoop, his entire and largely misbegotten fiscal stimulus program will be stillborn.

It will simply disappear amidst endless budget battles and debt ceiling showdowns/government shutdowns which will make the budgetary fireworks of August 2011 look like a Sunday School picnic in comparison.

And that gets us back to the whole idea that the Reagan Boom of 1983-1984 can be replicated from a cold start at the very end of a long-in-the-tooth business cycle. The fact is, the original event was not a supply side miracle in the slightest.

It was a “borrow and spend” eruption that depended upon a massive expansion of the Federal deficit from 2% of GDP under the outgoing Carter budget to an unprecedented 5-6% of GDP during the Gipper’s first term.

Even then, the celebrated Morning in America boom during 1983-1984 was not remotely what it is cracked-up to be by Trump’s aging posse of supply siders like Stephen Moore and Larry Kudlow.

During the six quarters of 1983 through Q2 1984, fully 27% of the real GDP growth of 7.8% was accounted for by a huge but one-time restocking of business inventories — after they had been flushed out of the system by Volcker’s 20% interest rate medicine during the 1980-1982 battle against inflation.

That is not remotely relevant today because inventories stand at cyclical highs, and are virtually certain to be liquidated — not restocked — in the period ahead. Moreover, the investment and business side of the U.S. economy actually contributed nothing on net to the so-called Reagan boom.

Even the housing surge happened during this interval because mortgage rates were plummeting after the crushing double-digit rates generated by the Volcker anti-inflation campaign.

Self-evidently, after 8 years of ZIRP, mortgage rates will now be rising, not falling, as far as the eye can see. In fact, the Fed’s 100 basis point interest rate increase since last summer’s lows have already put a crimp into the tepid rate of residential housing activity as represented by new contract signings and new permits.

Finally, when the Reagan boom began, the stock market’s price/earnings (PE) ratio had been hammered down into single digits by the prior decade of soaring inflation. So it had nowhere to go except up — the very opposite of today’s 25X multiple, which flirts with PE ratios normally associated with those preceding violent market crashes.

In short, the greatest Sucker’s Rally in history is now nearly over. And the Wall Street casino is about to feel the full brunt of the Great Disrupter — and one of an altogether different kind than that invented by the Wall Street brokers on election night.

As a contra-Cramer might say, there will never be better time to sell, sell, sell!

Regards,

David Stockman for The Daily Reckoning

The post Donald Trump’s Big Fat Ugly Bubble Is Ready to Pop appeared first on Daily Reckoning.

0 notes