#price doji

Explore tagged Tumblr posts

Text

Mua bán vàng Doji trực tuyến như thế nào?

Vàng Doji là thương thương hiệu trang sức đá quý uy tín và nổi tiếng tại thị trường Việt Nam, thành lập năm 1994. Không ai là không biết đến thương hiệu trang sức đá quý Doji. Bên cạnh việc mua bán vàng truyền thống, người tiêu dùng có thể mua vàng trực tuyến thông qua tài khoản eGold trên website chính thức của Doji.

Xem chi tiết: https://urlvn.net/o5ghht

#jenternet #vangdoji #vang #doji #gold #egold #giavang #giavangdoji

#jenternet#vàng#giá vàng#giá vàng hôm nay#vàng doji#giá vàng doji#giá vàng doji hôm nay#egold#doji#gold#price doji

1 note

·

View note

Text

i should just make a compilation of takehito koyasu moments in beyblade. like all of the characters he voices are fucking great i gotta.

0 notes

Text

Dragonfly Doji Pattern

The Dragonfly Doji is a significant candlestick pattern in technical analysis that provides traders with valuable insights into market sentiment and potential trend reversals. This pattern is characterized by a single candlestick with a small body, long lower shadow, and little to no upper shadow. The overall appearance of the candlestick resembles a dragonfly, hence the name. Here’s a detailed…

View On WordPress

#Bullish Reversal#Candlestick Charting#candlestick patterns#Chart Patterns#day trading#dragonfly doji#Financial Markets#Japanese Candlesticks#Market Analysis#Market Trends#Market Volatility#price action#Price Patterns#stock market#swing trading#technical analysis#Trading Patterns#Trading Psychology#trading signals#Trading Strategies

0 notes

Text

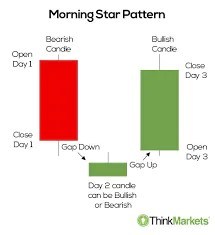

Mastering the Morning Star Pattern: A Step-by-Step Guide

Title: Mastering the Morning Star Pattern: A Step-by-Step Guide Introduction:The world of technical analysis offers traders a plethora of tools to identify potential trend reversals and market opportunities. One such powerful pattern is the Morning Star pattern, a three-candlestick formation that signals a potential bullish reversal after a downtrend. In this step-by-step guide, we will explore…

View On WordPress

#bullish reversal#candlestick patterns#comprehensive trading approach.#confirmation factors#doji candle#downtrend#false signals#market sentiment#momentum shift#Morning Star pattern#position sizing#price action#resistance levels#Risk Management#spinning top#stop-loss#support levels#technical analysis#trading strategy#trading volume#Trend Reversal#volume analysis

0 notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw heading into the unofficial end of summer and with August in the books, that equity markets showed a preference for some rest after the 3 week move higher. Elsewhere looked for Gold ($GLD) to continue its uptrend while Crude Oil ($USO) consolidated in a tightening range. The US Dollar Index ($DXY) continued to bounce to the upside while US Treasuries ($TLT) consolidated in their downtrend. The Shanghai Composite ($ASHR) looked to continue the downtrend while Emerging Markets ($EEM) consolidated over support in a possible start of a new uptrend.

The Volatility Index ($VXX) looked to remain low and stable making the path easier for equity markets to the upside. Their charts looked strong, especially on the longer timeframe. On the shorter timeframe the week long consolidation left the $SPY with only 2 hours to rocket to just shy of a new all-time high close while the $QQQ and the $IWM ended near the high of the week. All were prepped to start September stronger.

The week played out with Gold holding at the highs in consolidation while Crude Oil broke down to a nearly 10 month low. The US Dollar fell back from its quick bounce while Treasuries rose to test the December 2023 high. The Shanghai Composite fell to a 7 month low while Emerging Markets broke support to hit a 1 month low.

Volatility rose Monday out of the teens and held the rest of the week. This put pressure on equities and they responded by moving lower all week and closing the mid-August gaps. This resulted in the SPY, the QQQ and the IWM confirming lower highs as recession fear overtook the market. What does this mean for the coming week? Let’s look at some charts.

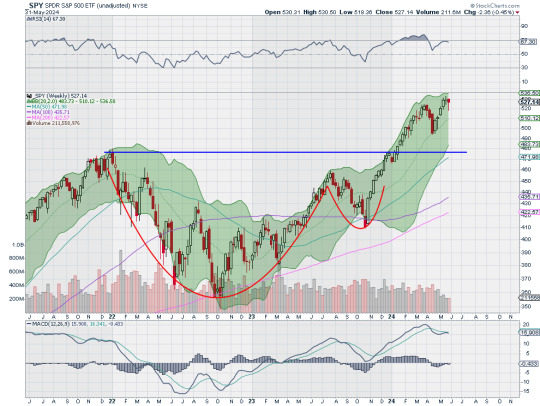

SPY Daily, $SPY

The SPY came into the week holding in consolidation just under the all-time high. It dropped Tuesday touching the 50 day SMA and held there through Thursday before a second big fall Friday closed the mid-August gap down. It closed at the lowest level since August 13th. The RSI is falling below the midline after making a lower high with the MACD crossed down but positive. The Bollinger Bands® are squeezing in with price now closing in on the 100 day SMA.

The weekly chart shows the confirmation of a reversal with a strong move lower following the doji. It ended at the 20 week SMA. There is also a momentum divergence with the RSI making a lower high as price made a higher high. The RSI remains bullish over the midline with the MACD positive but moving lower. There is support lower at 540 and 537 then 534 and 530 before 524.50 and 520.50. Resistance higher is at 542 and 545.75 then 549.50 and 556.50 before 561.50 and 565.50. Broad Consolidation with Possible Change of Character.

SPY Weekly, $SPY

With the first week of September in the books, equity markets reverted to weakness, trending lower all week. Elsewhere look for Gold to continue its uptrend while Crude Oil continues to move lower. The US Dollar Index continues in broad consolidation while US Treasuries show signs of a possible new uptrend. The Shanghai Composite looks to continue the downtrend while Emerging Markets drop back into a short term downtrend.

The Volatility Index looks to shift from low and stable to low and rising making the path more difficult for equity markets. Their charts look weak om the shorter time frame as price pulls back from a lower high, but they remain above making a lower low for now. On the longer timeframe they look stronger, but vulnerable with the SPY strongest then the IWM and the QQQ the weakest. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview September 6, 2024

7 notes

·

View notes

Text

Day Trading Forex: Everything You NEED To Know!

Are you interested in exploring the world of forex trading and want to take advantage of short-term price movements? Day trading forex might be the perfect strategy for you.

In this article, we will delve into the ins and outs of day trading forex, from understanding the forex market to developing effective strategies and managing risks. So let’s get started!

Introduction to Day Trading Forex

Benefits of Day Trading Forex

Day trading forex offers several advantages compared to other trading styles. Some of the benefits include:

Potential for quick profits: Day traders seek to profit from intraday price movements, aiming to close positions before the market closes.

High liquidity: The forex market is the largest and most liquid financial market globally, providing ample trading opportunities.

Flexibility: Traders can choose from a wide range of currency pairs and trade during different market sessions.

Lower capital requirements: Compared to other markets, forex trading allows for smaller initial investments, enabling traders to start with less capital.

Understanding Forex Market

To become a successful day trader in forex, it’s essential to have a solid understanding of the market dynamics.

Major Currency Pairs

The forex market consists of various currency pairs, but some major pairs dominate the trading volume. These include EUR/USD, GBP/USD, USD/JPY, and USD/CHF, among others. Familiarize yourself with these major currency pairs and their characteristics.

Market Hours

The forex market operates 24 hours a day, five days a week. However, certain trading sessions offer higher volatility and trading opportunities. The major sessions include the London, New York, Tokyo, and Sydney sessions. Knowing the active market hours can help you optimize your trading strategy.

Getting Started with Day Trading Forex

Before diving into day trading forex, you need to set up your trading infrastructure.

Setting Up a Trading Account

Choose a reputable forex broker that provides a user-friendly trading platform, competitive spreads, reliable execution, and comprehensive customer support. Ensure the broker is regulated by a recognized authority.

Selecting a Reliable Forex Broker

Research different forex brokers and compare their offerings, including trading costs, available currency pairs, leverage options, and deposit/withdrawal methods. Read reviews from other traders to gauge the broker’s reputation and reliability.

Funding Your Trading Account

Technical and Fundamental Analysis

Successful day trading forex relies on a combination of technical and fundamental analysis techniques.

Candlestick Patterns

Candlestick patterns provide valuable insights into price dynamics. Learn to identify patterns such as doji, engulfing, and hammer, which can signal potential reversals or continuations in the market.

Moving Averages

Moving averages help smooth out price fluctuations and identify trends. Experiment with different moving average periods, such as the 50-day and 200-day moving averages, to identify potential entry and exit points.

Support and Resistance Levels

Support and resistance levels are price levels at which the market tends to bounce or reverse. Identify key support and resistance levels using horizontal lines on your charts and incorporate them into your trading decisions.

Economic Indicators

Economic indicators, such as GDP growth, inflation rates, and employment data, can significantly impact currency prices. Stay informed about major economic releases and their potential effects on the forex market.

News Events

Popular Day Trading Strategies

To succeed in day trading forex, you need to implement effective trading strategies that suit your trading style and risk appetite.

Scalping

Scalping involves making multiple trades within a short time frame, aiming to capture small profits from quick price movements. Scalpers often rely on tight spreads and fast execution to capitalize on these rapid price changes.

Breakout Trading

Breakout traders look for significant price breakouts above resistance or below support levels. They aim to enter trades early in a new trend to maximize profit potential. Breakout strategies often utilize technical indicators to confirm breakouts.

Momentum Trading

Risk Management in Day Trading Forex

Managing risk is crucial in day trading forex to protect your capital and preserve long-term profitability. Here are a few ways to help manage your risk:

Setting Stop-Loss Orders

Always use stop-loss orders to limit potential losses on each trade. Determine an appropriate level for your stop-loss order based on your risk tolerance and the characteristics of the currency pair you are trading.

Implementing Proper Position Sizing

Calculate your position size based on the size of your trading account and the percentage of capital you are willing to risk per trade. Avoid overexposing your account by trading positions that are too large relative to your account size.

Managing Leverage

Emotions and Psychology in Day Trading

Controlling emotions and maintaining a disciplined mindset are crucial in day trading forex.

Controlling Greed and Fear

Greed and fear are common emotions that can cloud judgment and lead to irrational trading decisions. Develop self-awareness and discipline to overcome these emotions and make objective trading choices.

Maintaining Discipline

Stick to your trading plan and avoid impulsive trades driven by emotions. Follow your strategy and trading rules consistently, even when faced with market fluctuations.

Developing a Trading Plan

Building a Trading Routine

Establishing a structured trading routine can help you stay organized and make better trading decisions.

Pre-market Analysis

Before the market opens, conduct a thorough analysis of the currency pairs you are interested in trading. Review economic calendars, technical indicators, and news events that may impact the market.

Executing Trades

Once the trading day begins, execute your trades based on your predefined strategies and analysis. Stick to your risk management rules and avoid impulsive trades based on emotions.

Reviewing and Analyzing Trades

Resources and Tools for Day Traders

Several resources and tools can assist day traders in their trading activities.

Educate Yourself

It is important to stay up to date and learn constantly when you are day trading. It’s always a good idea to begin your journey with a day trading forex course such as the Cash on Demand Trades Education or The Ultimate Forex Strategy

Trading Platforms

Choose a user-friendly trading platform that provides real-time charts, technical indicators, order execution capabilities, and access to relevant news and analysis.

Charting Software

Utilize charting software to analyze price patterns, apply technical indicators, and identify potential trade setups. Popular charting platforms include MetaTrader, TradingView, and NinjaTrader.

Economic Calendars

Stay informed about upcoming economic events and news releases using economic calendars. These calendars provide information on scheduled economic indicators, central bank meetings, and other market-moving events.

Online Communities and Forums

Engage with other day traders through online communities and forums. Participate in discussions, share ideas, and learn from experienced traders. Collaborating with like-minded individuals can enhance your trading knowledge and skills.

Tips for Successful Day Trading

Consider the following tips to improve your day trading performance:

Stay Informed and Educated: Continuously update your knowledge about the forex market, trading strategies, and risk management techniques. Follow reputable sources of market analysis and stay informed about economic developments.

Practice Risk Management: Always prioritize risk management to protect your capital. Implement appropriate stop-loss orders, manage your position sizes, and avoid overtrading.

Start with Small Positions: When starting out, focus on small position sizes to minimize risk. Gradually increase your position sizes as you gain experience and confidence in your trading abilities.

Keep Emotions in Check: Emotions can cloud judgment and lead to poor trading decisions. Maintain emotional discipline, stick to your trading plan, and avoid impulsive actions driven by fear or greed.

Review and Learn from Your Trades: Regularly review your trading performance, analyze your trades, and identify areas for improvement. Learn from both successful and unsuccessful trades to refine your strategy.

Final Thoughts

Day trading forex offers exciting opportunities for traders to profit from short-term price movements in the forex market.

By understanding the market dynamics, implementing effective strategies, managing risks, and maintaining emotional discipline, you can increase your chances of success in day trading forex.

4 notes

·

View notes

Text

Beginner’s Guide to Trading Chart Types: Basics, Candlestick, and 3LPB

Trading charts are the foundation of technical analysis, helping traders make sense of price movements over time. For beginners, understanding the different chart types is essential for analyzing market trends and making informed decisions. In this guide, we’ll discuss the basics of trading charts, explore candlestick charts, and introduce the Three-Line Price Break (3LPB) chart. Additionally, we’ll highlight Carlos and Company, a trusted signal provider, to help elevate your trading journey.

Basics of Trading Charts Trading charts display an asset’s price history over a specific time frame, providing traders with the tools to identify trends and patterns. The line chart is the simplest type, connecting closing prices across time intervals. It’s great for spotting overall trends but doesn’t offer detailed information.

For more depth, traders often use bar charts, which show the open, high, low, and close prices for a specific period. While bar charts provide a clearer picture of price movement, they can be more challenging to read for beginners.

Candlestick Charts Candlestick charts are a favorite among traders due to their rich visual detail. Each candlestick represents a time frame and includes:

Open: The starting price for the period. High: The highest price reached. Low: The lowest price reached. Close: The final price of the period. The color and shape of the candlestick provide insights into market sentiment. For example, a green (or white) candlestick indicates a price increase, while a red (or black) one shows a price decrease. Candlestick patterns like Doji, Hammer, and Engulfing can signal trend reversals or continuations, making them invaluable for traders.

Three-Line Price Break (3LPB) Charts The 3LPB chart is a lesser-known but powerful tool that emphasizes significant price changes. Unlike candlestick charts, it ignores time intervals, focusing solely on whether price movements exceed a predefined threshold. This chart type is excellent for identifying breakouts and reversals while filtering out minor fluctuations.

Enhance Your Trading with Carlos and Company While understanding charts is crucial, combining technical knowledge with expert signals can accelerate your success. Carlos and Company is a reliable signal provider offering actionable insights tailored for both beginners and experienced traders. Their comprehensive market analysis helps you make confident, profitable decisions.

By mastering chart types and leveraging professional signals from Carlos and Company, you can build a strong foundation for successful trading. Start learning today and take control of your financial future!

0 notes

Text

The CPI Ninja Playbook: Dominate News Trading Like a Pro Why the CPI Is the Forex Market’s MVP The Consumer Price Index (CPI) isn’t just an economic term; it’s the Beyoncé of Forex news trading—constantly in the spotlight and always setting the tone. The CPI measures changes in the price level of a basket of consumer goods and services, making it a leading indicator of inflation. Inflation, in turn, dictates central bank policies, which can cause seismic shifts in currency markets. For news traders, CPI releases are akin to a high-stakes poker game. Get your strategy right, and you could walk away with a jackpot. Get it wrong, and, well, it’s like betting on a horse that decides to nap mid-race. Let’s dive into how to master the art of CPI-based news trading with humor, heart, and ninja-level tactics. CPI News Trading: The Hidden Formula Only Experts Use 1. Decode the CPI Report in Real-Time The CPI report usually comes in two flavors: headline CPI and core CPI. Headline CPI includes everything, even volatile items like food and energy. Core CPI, on the other hand, excludes these wildcards, giving traders a clearer picture of underlying inflation trends. - Pro Tip: Don’t just stare at the numbers. Compare them to market expectations. A higher-than-expected CPI can send a currency soaring, while a lower figure can ground it faster than a canceled flight. - Ninja Insight: Pair CPI data with central bank statements. If the Federal Reserve has hinted at hawkish policy, a hot CPI number could mean a rate hike is imminent. Conversely, a cold CPI number may signal dovish measures. 2. The Pre-Release Checklist: Prepare Like a Pro - Know the Schedule: CPI reports are released monthly. Mark your calendar like it’s your anniversary (but this time, don’t forget!). - Set Alerts: Use economic calendars to track release times and consensus forecasts. - Technical Analysis: Before the release, study key support and resistance levels. Price often gravitates toward these zones during high-impact news events. The Art of Reaction: How to Trade the Spike Without Spiking Your Blood Pressure 3. Post-Release: Strike Like a Ninja News trading isn’t about guessing the numbers; it’s about reacting to them like a pro. Here’s how: - Initial Spike: When the CPI data hits, expect volatility. Price spikes often reflect knee-jerk reactions. - Wait for Confirmation: Don’t rush in! Let the market absorb the news and establish a trend direction. - Enter Strategically: Use tools like Fibonacci retracements to pinpoint entry points during pullbacks. 4. The Forgotten Strategy: Fade the Overreaction Market overreactions are as predictable as a plot twist in a rom-com. Prices often revert after an exaggerated move, creating opportunities to fade the initial spike. - How to Spot It: Watch for candlestick patterns like dojis or engulfing bars signaling reversal. - Execution: Enter a trade in the opposite direction with tight stop-losses to limit risk. Why Most Traders Get It Wrong (And How You Can Avoid It) 5. The “Expectation Trap”: Avoiding the Obvious Pitfall Many traders focus solely on the CPI number itself and ignore market expectations. If the CPI meets expectations but the market’s reaction suggests disappointment, it’s likely because traders had already priced in the data. - Solution: Analyze the context. Has the currency pair been rallying in anticipation of a hot CPI? If so, even a strong CPI might not sustain the rally. 6. The Emotional Rollercoaster: Keep Calm and Carry On Trading CPI releases can feel like riding a rollercoaster blindfolded. Stay grounded: - Stick to Your Plan: Define entry, exit, and stop-loss levels before the release. - Limit Leverage: Volatility can magnify gains but also losses. Don’t let greed sabotage your account. - Pro Tip: Use pending orders to automate your trades and avoid emotional decision-making. Advanced Ninja Tactics for CPI News Trading 7. Combine CPI with Correlated Assets Currencies aren’t the only assets impacted by CPI. Commodities like gold and oil often react strongly to inflation data. Use these correlations to diversify your trades. - Example: A hot US CPI number might strengthen the USD while pressuring gold prices. Trade both assets to hedge your bets. 8. The Time Zone Advantage: Trade Global CPI Reports Don’t limit yourself to US CPI data. Other economies, like the Eurozone, UK, and Japan, release CPI reports too. Trading these can offer additional opportunities. - Pro Tip: Focus on economies with diverging monetary policies for maximum impact. For example, if the ECB is dovish and the US Fed is hawkish, a hot Eurozone CPI might still result in EUR weakness. Insider Secrets: Turning Knowledge into Profits - Don’t Overtrade: One good trade is better than five mediocre ones. Focus on quality setups. - Backtest Your Strategy: Analyze past CPI releases to refine your approach. - Use Tools Wisely: Platforms like StarseedFX’s Smart Trading Tool can help you optimize lot sizes and manage risk. Summary of Ninja-Level Insights - Decode CPI data by comparing it to market expectations and central bank rhetoric. - Use technical tools like Fibonacci retracements for strategic entries. - Fade overreactions for high-probability setups. - Diversify by trading correlated assets like gold and oil. - Exploit global CPI reports for around-the-clock opportunities. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

New Post has been published on RANA Rajasthan Alliance of North America

New Post has been published on https://ranabayarea.org/spinning-top-candlestick-pattern-overview/

Spinning Top Candlestick Pattern Overview, Formation, How To Trade

The long shadows, on the other hand, indicate that both bulls and bears were active during the period, but neither could secure a victory. Much like other candlestick formations, a spinning top candlestick is composed of a shadow, body, and tail. The significance, though, has to do with the length and their relationship to each other. The next phase after a bearish spinning top pattern will be an uptrend, downtrend, or sideways trend. A bearish spinning top pattern or a bear market is generally termed a downtrend.

Neither the bulls nor the bears could establish any influence on the market as this is evident with the small real body.

So when spotting a Spinning Top candlestick pattern, look for a single candlestick with a short body between two long shadows.

You can practise trading using the spinning top chart pattern with an IG demo account.

Therefore, the subsequent candle needs to be analyzed alongside the spinning top to determine whether this uncertainty leads to a continuation reversal of the trend.

The first candle is represented as a small green body that is engulfed by a subsequent long red candle.

If the price is within a range, trade by buying at support and selling at resistance. In conclusion, the Spinning Top candlestick is a useful pattern that signals market indecision. By understanding its formation and trading it effectively, you can enhance your trading strategy and potentially maximize your profits. In conclusion, understanding candlestick patterns like the spinning top is crucial for informed trading decisions. Delving into its formation and implications enhances analytical skills, offering valuable insights into market dynamics. Another important event in the history of bearish terms in the stock market is the 2008 recession.

Hundreds of markets all in one place – Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more. However keeping in mind the 2nd rule, i.e. ‘be flexible, verify and quantify’ even if there is a wafer-thin body, the candle can be considered a Doji. Fundamental analysis will help you identity which stocks to invest in primarily.

What is a Bearish Spinning Top?

A spinning top candlestick is a relatively easy-to-identify candlestick pattern in the market that spinning top candle is usually a sign of indecision among buyers and sellers. In this article, we will look at what the candle spinning topper pattern mean and how to trade it. Since the spinning top indicates indecision, it is crucial to wait for a confirmation signal before buying.

The long upper shadow and lower shadow in the given image suggest that the market was highly volatile during the time period. The highest price point of the day and the lowest price point of the day are significantly distanced. The real body of the bullish spinning top is small suggesting that the opening and closing price of the day is almost similar. The closing price has to be slightly above the opening price (although almost similar) to call it a bullish spinning top. However, their appearances are almost the complete opposite of each other. While the spinning top candlestick pattern has a short body and long wicks, the marubozu has a long body with little to no wicks.

Trading platforms

However, to play safe, he could test the waters with only half the quantity. If the trader wants to buy 500 shares, he could probably enter the trade with 250 shares and wait and watch the market. If the market reverses its direction, and the prices start going up, then the trader can average up by buying again. If the prices reverse, the trader would most likely have bought the stocks at the lowest prices. The difference between a bullish spinning top and a bearish spinning top is the direction of the trend they indicate. The term bullish has been used in the stock market since the 18th century.

The spinning top illustrates a scenario where neither the seller nor the buyer has gained. If the spinning top occurs at the bottom of a downtrend, it could signal that a bullish reversal may happen. Conversely, if the spinning top occurs at the top of an uptrend, it could suggest a bearish reversal. Spinning top candlesticks are common, which means many patterns will be inconsequential. Spinning tops frequently occur when the price is already moving sideways or is about to start.

A spinning top in isolation doesn’t provide much information, but its context relative to the trend does. Alternatively, you can practise trading with a cost-free City Index demo account. Analyzing how Spinning Tops have influenced the price action of an asset in the past can offer insights into how similar setups might unfold in the future. AltFINS provides a leading cryptocurrency screening tool capable of analyzing over 3,000 altcoins using 120 different indicators across five time frames. It includes Pre-set Filters, which are predefined and optimized strategies and patterns designed for quick access to the most popular filters, such as the Spinning Top Candlesticks pattern.

The great depression of 1929 was reported as the most prolonged depression of the modern world. The great depression was triggered by a bearish market trend and was persistent for about 10 years. Many individuals purchased overinflated assets at prices higher than their absolute value. Such a rise caused companies to resort to excess production, leading to excess supply in the market. This caused the average price level to fall significantly, causing deflation, the effects of which penetrated the stock market as well.

Latest Financial market insight articles

A good move would be 6%, so the white spinning top falls well short of that. In short, these candles show both price movement but also incorporate volume which determines the width of the candle. A spinning top or (Koma) is a candlestick which the body of the candlestick is smaller than the lower and upper wicks. The only difference between the two is that the Doji pattern opens and closes at the same point. Some of the top recommended tools that you hould use in trading are the bullish and bearish engulfing, hammer, triangle, VWAP, and evening and morning stars, respectively.

Hundreds of markets all in one place – Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.

This enables participation in bullish and bearish markets, allowing traders to capitalise on opportunities following spinning tops indicating upward or downward price movements.

Here, we can see a EUR/USD daily chart with a few spinning tops on it – but we’ve highlighted two.

After all, if they were successful, the day would have resulted in a good blue candle and not really a spinning top.

In short, these candles show both price movement but also incorporate volume which determines the width of the candle.

Investments in securities market are subject to market risks, read all the related documents carefully before investing.

I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Virtual Assets are volatile and their value may fluctuate, which can lead to potential gains or significant losses. If you do not understand the risks involved, or if you have any questions regarding the PrimeXBT products, you should seek independent financial and/or legal advice if necessary. The spinning top basically conveys indecision in the market, and neither the bulls nor bears can influence the market. The standard settings for MACD are 12 and 26-period EMA and are customized. Moving Average Crossovers are also known as MACD crossovers, and they occur when the MACD (Fast) line crosses the signal (Slow) line.

Stay on top of upcoming market-moving events with our customisable economic calendar. Discover the range of markets and learn how they work – with IG Academy’s online course. In other words, the market has explored upward and downward options but then settles at more or less the same opening price – resulting in no meaningful change. Here, the price attempted to breakout above the previous swing high, but failed and reversed intraday, which served as an entry trigger.

0 notes

Text

Bitcoin Takes a Breather After Doji Candle in a Cautious Pre-Fed De-Risking

BTC takes a breather after an indecisive Tuesday, as the Fed is expected to cut rates Wednesday while signaling slower easing next year. Bitcoin (BTC) is taking a breather, experiencing selling pressure after Tuesday’s indecisive price action marked by a Doji candle. This seems to be a classic case of traders de-risking in anticipation of an expected hawkish Fed rate cut later Wednesday. The…

View On WordPress

0 notes

Text

US Government’s 20k BTC Transfer to Coinbase Prime Signals Potential Bitcoin Price Dip

Key Points

Bitcoin’s price shows signs of short-term weakness after failing to reach the hyped $100k target, with a shift in investments to altcoins.

The U.S. Government has transferred 20k BTC to Coinbase Prime, sparking speculation of potential sell-offs.

Bitcoin (BTC) displayed a promising performance during the first three weeks of November. However, the price closed last week with a Doji Dragonfly candlestick, indicating a potential slowdown in the bullish momentum.

Despite the hype, Bitcoin did not reach the $100k target. This was largely due to the shift of retail and whale investors towards the altcoin industry in recent days.

Investment Shifts and Market Weakness

Last week, Bitcoin’s investment products experienced a net cash outflow of $457 million. In contrast, Ethereum’s products recorded a net cash inflow of approximately $634 million. This significant rotation of crypto cash to the altcoin market has prompted Bitcoin’s price to show potential short-term weakness.

Furthermore, the liquidation of long crypto traders, which amounted to over $434 million in the past 24 hours, could cause a long squeeze in the short term.

The U.S. Government’s Bitcoin Holdings

On-chain data provided by Arkham Intelligence reveals that the United States holds 188,309 Bitcoins, worth more than $18 billion. The U.S. government made several Bitcoin transfers today, indicating potential sales before President-elect Donald Trump’s inauguration.

The Bitcoin address associated with the U.S. government deposited 19,800 BTC, roughly $2 billion, into Coinbase Prime. This follows the U.S. Supreme Court’s decision last month that cleared the way for the liquidation of the Silk Road BTC stash.

The U.S. government has made several Bitcoin deposits to Coinbase Prime this year, leading to speculation about potential sell-offs. The Biden administration, like the upcoming Trump administration, has shown no interest in holding Bitcoin.

The upcoming Biden administration plans to pass crypto-friendly regulations, such as adding Bitcoin as a reserve currency to hedge against the escalating debt crisis. The political rivalry between President-elect Donald Trump and outgoing President Biden could result in a midterm bearish outlook for Bitcoin holders.

Experts suggest that the Biden team might be trying to hinder the Trump administration’s efforts to hold the current Bitcoin trove. Conversely, the U.S. government under President Trump might purchase 1 million BTC coins and hold them for the next 20 years.

However, the U.S. Marshals Service has decided to use Coinbase Prime for custodial services, reducing the risk of potential sell-offs.

Despite the political uncertainty, the overall demand for Bitcoin remains high due to ongoing institutional FOMO. MicroStrategy Inc. (NASDAQ: MSTR) contributed to this demand by purchasing an additional 15.4k BTC units on Monday.

Market data from Coinglass shows that the overall supply of Bitcoin on centralized exchanges has been decreasing exponentially over the past few months. As of December 2, it reached a multi-year low of about 2.27 million BTC units.

0 notes

Text

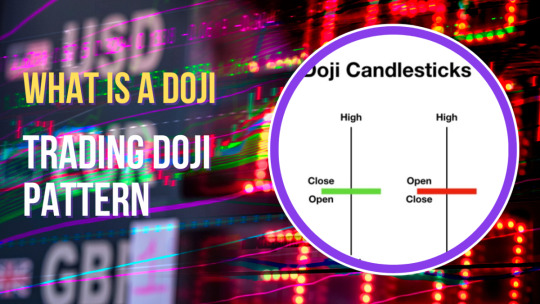

Doji Candlestick Pattern and Trading Doji

The doji pattern is a candlestick pattern commonly used in technical analysis to indicate indecision in the market. It occurs when the opening price and the closing price of an asset are very close to each other, resulting in a candlestick with a very small real body. The doji pattern can have different shapes, but the common characteristic is that it has a small real body, a long upper and…

View On WordPress

#candlestick patterns#Candlesticks#Doji#dragonfly doji#gravestone doji#learn technical analysis#long legged doji#Patterns#stock markets#stock trading#technical analysis#trading doji

3 notes

·

View notes

Text

Mastering Candlestick Patterns: A Beginner’s Guide for Forex Traders

Candlestick patterns are powerful tools for Forex trading, providing crucial insights into price action and market sentiment. This beginner-friendly guide explains how to identify and use basic patterns like bullish and bearish engulfing, doji, hammer, and shooting star to predict market movements. Combining candlestick analysis with technical indicators, understanding market context, and practicing risk management can enhance your trading strategies. Whether you’re new to Forex trading or looking to refine your approach, mastering candlestick patterns is essential. Partnering with the Best Forex Broker ensures access to the right tools, educational resources, and a reliable trading platform for long-term success.

0 notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the unofficial start of summer ahead and just 4 trading days left in May, equity markets were mixed with tech strong, large caps flat and small caps lower. Elsewhere looked for Gold ($GLD) to continue to consolidate in the uptrend while Crude Oil ($USO) resumed a short term downtrend. The US Dollar Index ($DXY) might resume the short term move lower while US Treasuries ($TLT) remained in a downtrend. The Shanghai Composite ($ASHR) looked to pause in the short term move higher while Emerging Markets ($EEM) might be confirming a failed break out higher.

The Volatility Index ($VXX) looked to remain very low and stable making the path easier for equity markets to the upside. The charts of the $SPY and $QQQ looked strong, especially on the longer timeframe. On the shorter timeframe the QQQ was also strong with the SPY in consolidation. The $IWM continued to be the outlier, consolidating at a higher range.

The week played out with Gold finding support and holding in a narrow range while Crude Oil consolidated rose early in the week before giving back the gain later. The US Dollar held over support while Treasuries moved higher in the downtrend. The Shanghai Composite held at support while Emerging Markets rocketed to the downside.

Volatility rose up off the recent lows but but only to 14. This put pressure on equities and the large caps and tech names responded with a 4 day move lower. The small caps found support mid week and bounced in consolidation. This resulted in the SPY, IWM and QQQ ending back below their 20 day SMA’s. What does this mean for the coming week? Let’s look at some charts.

SPY Daily, $SPY

The SPY came into the week consolidating at the all-time high but after a bearish engulfing candle failed to confirm Friday. It held Tuesday and then started to move lower on Wednesday. Thursday it crossed below the 20 day SMA for the first time since May 2nd and dropped again Friday before a strong move higher the last 30 minutes of the day. The RSI is dropping at the midline but in the bullish zone with the MACD crossed down and positive. So far this could just be a momentum reset, with no threat to the uptrend yet.

The weekly chart shows a more damaging pattern as the doji last week is confirmed as a reversal with a move lower this week. This happened as the RSI stalled at a lower high showing a divergence. The price is far from the 20 week SMA and the last pullback found support there. The MACD is crossed down and moving lower but positive. There is support at 520.50 and 517.50 then 513.50 and 510 before 503.50 and 501.50. Resistance higher is at 524.50 and 530. Digestion in Uptrend.

SPY Weekly, $SPY

With the month of May in the books, equity markets showed some signs of weakness following divergences last week. Elsewhere look for Gold to continue its consolidation in the uptrend while Crude Oil consolidates in a narrow range after a pullback. The US Dollar Index continues to drift to in broad consolidation while US Treasuries continue their downtrend. The short term move higher in the Shanghai Composite looks to be at risk of reversing while Emerging Markets enter a short term downtrend.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. The charts of the SPY and QQQ look strong on the longer timeframe, but with a possible momentum reset continuing in the short run. On the shorter timeframe both the QQQ and SPY have reset to their 20 day SMA’s where they often find support. How they react next week could tell if this week was meaningful or not. The IWM continues to be the laggard, stalled near the top of a 2 year range. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview May 31, 2024

Start of Summer Annual Sale! Hi all the Start of Summer Annual Sale is on at Dragonfly Capital. Get an annual subscription for 38.2% off or pay quarterly for 15% off. Both auto-renew at that discounted rate until you decide to leave.

9 notes

·

View notes

Text

A Doji Candlestick is one of the most important patterns in trading, signaling market indecision. When the opening and closing prices of an asset are nearly the same, it creates a candle with little to nobody. This pattern can indicate potential reversals or continuations in market trends.

Learn how to interpret Doji candles to enhance your trading strategy!

#HolaPrime#DojiCandlestick#TradingPatterns#MarketIndecision#ForexTrading#ForexMarketAnalysis#CandlestickPatterns#TechnicalAnalysis#TradingStrategies#InvestSmart#PropTrading#TraderLife#best prop firms#prop firms#top rated prop firm#transparency#evaluation#payout#withdrawal

0 notes

Link

0 notes