#premium credit card

Explore tagged Tumblr posts

Text

Best Premium Credit Cards in India

When it comes to managing finances, the choice of your credit card can create a significant difference. Premium credit cards offer a host of benefits that enhance your lifestyle with wide financial flexibility.

What are Premium Credit Cards?

Premium credit cards are high-end credit cards designed for frequent travelers and individuals who want to enjoy various rewards and benefits. These cards usually come with higher annual fees and more extensive reward programs. Your premium credit card benefits can also include superior travel insurance, luxury hotel experiences, and much more. Premium credit cards are designed for the most money-spending powers and are usually regarded as exclusive benefits card issues to few, which comprises higher credit limits, distinct rewards programs, and additional benefits. Including some of its special benefits such as lounge access for airports, concierge services, and numerous insurances.

Advantages of Applying for Credit Cards

Prior to getting into the best premium credit cards, it is important to understand the benefits of applying for a credit card. Here are some key benefits:

1. Convenience and Flexibility Benefits It makes transactions a lot easier to do without cash with the help of a credit card. It is convenient either online or over the counter in a store for payment. 2. Rewards and Cashback Benefits The reward programs which sometimes offer cashback are very common with premium credit cards. Here, you get points for every purchase you make through them. These can be redeemed in travel agencies, mall shops, and many other services. 3. More Secure Credit cards offer the extra-layered security such as fraud protection, and the option to dispute any fraudulent transaction along with discretion; thus providing a safe purchase environment.

4. Saves Credit History Proper management of a credit card contributes to a good credit history, which is very vital for acquiring loans and other financial products in the future.

5. Special Deals and Rebounds Premium cards issued to customers provide offers, discounts, and even invitation to events, making it even more valuable.

Best Premium Credit Cards in India

The following are the best premium credit cards in India distinguished by huge benefits, rewards, and special features:

1. HDFC Regalia Credit Card Key Features:

Reward Points: Get 4 reward points for every ₹150 spent. Airport Lounge Access: Complimentary access to airport lounges in India and abroad. Health and accidental death insurance cover overseas. This HDFC Regalia Credit Card is ideal for people constantly traveling and those often preferring rewards and benefits.

2. ICICI Bank Sapphiro Credit Card

Key Features

Cashback Offers: Cashback is going to be provided on online shopping and dining. Luxury Benefits: Luxury hotel offers and exclusive golf privileges with many more. Global Acceptance: Accepted at thousands of places throughout the world ensuring smooth and unobstructed transactions. This credit card is ideal for those who really like the luxuries in life and want to make the most out of their spends.

3. SBI Card ELITE Key Features:

Reward Points: 5 reward points for each ₹100 spent on grocery, dining, and international transactions Welcome Benefits: Attractive gifts with vouchers and discounts Airport Lounge Access: Complimentary access to domestic and international airport lounges. The SBI Card ELITE is meant for providing massive rewards and benefits to any individual who frequently spends on traveling and dining. 4. Axis Bank Privilege Credit Card Key Features:- Dining Privileges: Get up to 20% discount on premium restaurants. Reward Points: 2 reward points for every ₹200 spent. Annual Fee Waiver: It also provides annual fee waiver once one crosses a particular spend threshold. The Axis Bank Privilege Credit Card is perfect for foodies and those who love eating out.

5. American Express Platinum Travel Credit Card

Key Features:

Travel Benefits 1.5 Membership Rewards® points for every ₹50 spent Travel Insurance International travel insured to their heart's content. Luxury Hotel Stays get special discounts at super luxurious hotel stays. The American Express Platinum Travel Credit Card is for somebody who travels and enjoys a luxurious and premium experience.

How to Decide on the Best Luxury Credit Card

Before you decide to get a premium credit card, consider the following factors:

1. Spending Patterns Determine how often you spend money in certain categories. Select a card that offers rewards which you can most often earn, such as travel, dining, or shopping categories.

2. Annual Fees and Fees Review annual fees for the card. Your rewards program should offer more value than costs in order to make sure you get the best out of your credit card.

3. Rewards Program Find card rewards programs that are appealing and fitting your lifestyle. There may be some cards that return more cash back, while others give you more vacation awards.

4. Any bonus and Privileges Some perks will include lounge privileges, insurance cover, and access to concierge services to make it a holistic experience.

Conclusion

The right premium credit card will intensify your management of finances and lifestyle. Among the best premium credit cards in India, convenience has always been the given factor. Reward privileges and other rewards make up the most exciting part of the offer. Hence, know the benefits of credit cards to make the right decision for yourself according to the spending and financial goals you are targeting.

0 notes

Text

I AM ONCE AGAIN ASKING FOR A LINK does anyone have the steven universe movie 💔

#saur mad at wco for making you pay premium for movies now UGH#like sorry but ion trust y'all w my credit card info 😭😭#ASAP BC ME AND IZZY WERE GONNA WATCH IT TONIGHT 😭💔

4 notes

·

View notes

Text

Explore the top 5 premium credit cards offering exclusive benefits, rewards, and luxury experiences to elevate your spending power.

0 notes

Text

#not youtube premium coming out 10 minutes after doing an order on chewy#god ill never pay off this credit card gidjfjdj#katie.txt

0 notes

Text

Best Credit Cards for Train Travel in India - Our Money Guide

Explore the Best Credit Cards for Train Travel in India offering exclusive benefits for railway bookings. Get discounts, reward points, and more with cards from leading banks. Find the perfect card for your travel needs with Our Money Guide

#best credit cards in india#sbi credit cards#credit cards in india#top premium credit cards#bob credit cards

0 notes

Text

i love how one of the big draws for tumblr premium is "no ads!!!!!" as if ad block doesn't already exist and isn't free

#tumblr premium#also i love how they're STILL trying to make fetch happen with this tumblr blaze feature#tumblr still hasnt gotten a handle on spam/porn bots and yet they expect us to give them our credit card info lol#tumblr blaze#words#lmao#all of the other premium features are lame as hell too#nobody cares about tumblrmart and most people aren't reaching the post limit every day (or ever tbh)

0 notes

Text

Not that I expect much at all, but do all cell service providers gotta be so scammy?????

#luv ya verizon#love how i can't get the auto pay discount on any credit card anymore#and how hotspot comes at a premium now#i actually need that for my job#at least i got to keep my number when i changed accounts

0 notes

Text

Discover the Perfect Valentine's Day Gift: The ECCO Pot Bag

View On WordPress

#credit card slots#ECCO DriTan™ technology#ECCO Pot Bag#fashion-forward#lightweight accessory#magnetic closure#microfiber lining#minimalist Danish design#pebbled Viola leather#premium hardware#urban exploring#Valentine&039;s Day gift#water-efficient tanning

1 note

·

View note

Text

Like a good neighbor, statefarm is there

#i keep getting spotift ads#abt to steal kunikidas credit card so i can get premium...#right after the statefarm ad i got one for condoms#bsd#bsd dazai#bsd roleplay#dazai#roleplay

1 note

·

View note

Text

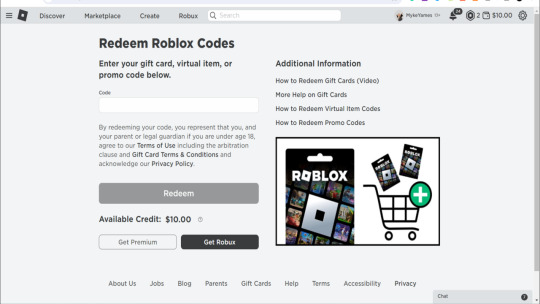

How Do You Redeem a Roblox Gift Card Code/Pin

Roblox is an online 3D gaming platform featuring a number of players from all over the world who can play simultaneously, share their experiences and imagination and create their own games. Roblox helps aspiring developers to monetize their games, including those for children. While most Roblox games are free to play, some games must be purchased with Robux which is Roblox’s virtual…

View On WordPress

#get robux#How do you redeem a Roblox gift card code#how to redeem roblox gift card#mykeyames#redeem code roblox#redeem roblox gift card#Roblox#roblox credit#roblox gift card#roblox gift card redeem codes#Roblox Premium subscriptions#roblox virtual currency#Roblox&039;s virtual currency#robux#Robux icon#robux package#Robux purchase#Robux virtual money#Use Roblox codes#www.roblox/redeem code

0 notes

Text

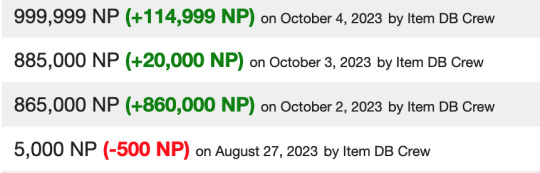

in further neopets discord news, oh boy is there drama in my awful virtual pet game website today. strap in if you want way too much information on neopets’ broken economy

for some context, an event has just launched called the faerie festival. this is the first event to be run by the ‘new’ TNT (aka. the neopets team aka. the staff) since the leadership change, and they've said in recent editorials that this year’s faerie festival is going to be a combo of two previous popular events:

the faerie quest event, wherein people can get a free quest from a faerie every day in exchange for a reward (something that’s normally limited to random special events and therefore quite rare)

the charity corner, a highly requested event that hasn’t run since 2020, where you can donate random items to get points that can then be exchanged in a prize shop

there’s a LOT of ultimately worthless items on neopets that people gather from doing dailies and things, but charity corner actually gave a use to hoarding all of these, so people have wanted it back for ages. people have been going out of their way to hoard extra junk items for like 2 months now, after TNT teased the event in an editorial

this event was originally meant to start on 20th august, but got delayed 2 weeks, presumably because of issues behind the scenes. people were generally a bit disappointed but relieved if this meant they were going to get a proper, well prepared event without bugs

flash forward to 2nd october, the actual start of the event. nothing actually opens up for several hours on the day- that’s somewhat waved off by the fact that staff presumably need to be in the office to launch everything, a midnight launch isn’t expected

but, eventually, it opens!

well… kinda. there’s one page with one dialogue scene available and a link to an event page for spending neocash (the premium currency that costs irl money). the faerie quest page is giving out free daily quests, which is nice, but literally just the same as they did back in 2020. where’s the item recycling part? did this really need 2 weeks of delay?

the next day, the FAQ page for the event is published neopets support site (but not announced via news). still no sign of the actual event starting- seems like that might not be until moday?

as well as multiple grammatical errors, the FAQ had a few… concerning elements. most notably:

only 10 items could be donated per day

points would be awarded based on the rarity of the item, with the maximum rarity being r200-500, worth 15 points each

this meant people's hoarding of junk items for months was... essentially useless

r200-500 items basically means either hidden tower items (rare, expensive items that can only be bought in an account age locked shop with a purchase limit of 1 per day) orrrr….. neocash items. In other words, players could either spend an exorbinate amount of their in-game currency to buy up items to donate, or they could just hand over their credit card and pay to win

people were Not Happy about this

not long after info spread and the outcry started (and a sizeable number of people cancelled their premium membership in protest), the FAQ was quietly updated to remove mention of donating neocash items. that took away to pay to win element at least

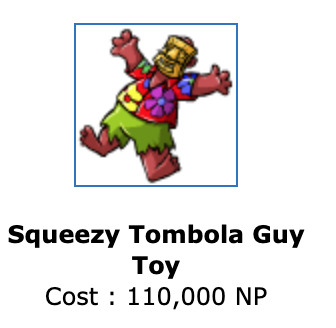

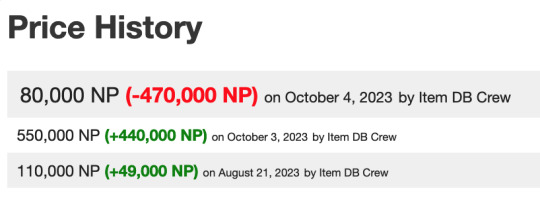

however, now there was a new problem. a tombola man problem.

i mentioned already that the highest rarity items are pretty rare and expensive. one of the least expensive of these is an item called the Squeezy Tombola Guy Toy. you can probably see where this is going already

because you can only buy a maximum of one tombola guy per day from the hidden tower, your only option if you want to buy more than that in a day is to go to user shops. however, in light of the event, people had already started buying and hoarding tombola guy toys. equally, others were buying them purely to sell at a profit. this made the perfect storm and caused the price of the tombola guy toy, which was normally 110k NP, to explode up to 500k, 600k, even 700k within just one day

BUT THEN THE FAQ GOT UPDATED AGAIN. surprise, you can now donate 30 items per day! also they just got rid of the highest rarity tier altogether. the maximum you can get for an item is now 8 points, for rarity r102-r179.

this has now made the squeezy tombola guy toys useless. unless you’re a collector they don’t serve any function beyond that of a normal neopets toy (of which there’s thousands of much cheaper options). the price has now plummeted down to BELOW what it originally was and many users now have piles and piles of the dolls sitting in their inventory, mocking them

so what now? well, because no one ever learns, everyone is now flocking to what is now the cheapest high-rarity item eligible for donation. most are going for omelettes, which have a few different options at r102+. these have also inflated by like 400% from before the event, but unlike the squeeze tombola guys, these are only worth a few thousand neopoints, so not as bad a potential loss in comparison

it’s worth noting that while all this is going on in preparation for the recycling event, neopets is also experiencing insane inflation in a lot of other items right now, including those required for people to complete faerie quests. for example, a Griefer, which cost 5000 np just last week, is now worth selling for 1 MILLION

So yeah. 3 days into the event and that’s where we are so far. who knows what tomorrow might bring

6K notes

·

View notes

Note

You tell them you paid $200 to put premium air in your tires.

Anon! I am SCREAMING! This prompt has me cackling in the best way possible. I know that this comes from a TikTok trend, and I've seen a few of the videos under this prank, and they're absolutely hilarious. I had a very fun time with this one. Giggled during the world writing process. Presented in four drabbles. Enjoy!

Task Force 141 x Reader

For the masterlist and how to submit your own request, click HERE

Content & Warnings: swearing, humor, pranks

Word Count: 400

ao3 // taglist // main masterlist // imagines & what if masterlist

John Price

“Love,” breathes John, placing his hands on either side of you. “You did what?”

“The low tire pressure light came on—”

“I know that. After.”

“I stopped at the shop you always take my car to. They offered me premium air.”

John takes a shuddering breath. “Premium air?”

“Yes,” you beam. “I got a good deal.”

“A good deal?” he repeats.

“Half off! Two hundred dollars.”

John blinks. His face growing pale. “What?”

You wave your hand flippantly. “It’s usually four hundred.”

“Four hundred?” John’s voice spikes, almost cracking.

“Helps with suspension!”

“Fucking hell. Show me the bloody receipt.”

John "Soap" MacTavish

Johnny twists in the driver seat, staring you down. “You did what?”

“I put premium air in the tires. It was a deal. Came with the oil change.”

Johnny’s mouth drops open. Closes. Opens again. “Premium air,” he says, almost absently.

“They only charged me two hundred.”

“Two hundred?” chokes Johnny.

“Why?” you ask innocently. “Is that bad?”

“Bloody hell, love,” he groans, leaning back in his seat, closing his eyes.

“Used your credit card for the points, too!” you beam, giving Johnny your best smile.

Johnny sighs and starts the car. “You’re lucky you’re cute and I love you.”

Kyle "Gaz" Garrick

“Baby, listen.”

“It’s great, isn’t it? It’ll help with the balance.”

“The balance?” asks Kyle. He mutters your name and then rubs his hands over his face.

“Should I not have gotten the premium air upgrade?” you ask.

Kyle is hanging by a thread. He breathes deep, and holds his hands out in front of him.

“Do you have the receipt?

“No.”

“Where did you take the car?”

You frown. “I did it for you. Are you not happy?”

Kyle sighs. “I love you. I am grateful. Just tell me where you went. I only want to talk with them.”

Simon "Ghost" Riley

“I said the tires needed to be rotated.”

“I know,” you say. “But they made me an offer. Said it was a good deal.”

“Premium air?”

“Yes,” you shrug. “And?”

Simon goes red in the face. “How much did they charge for ‘premium air?’”

“Two hundred.”

Simon stares up at the sky. “And how much did they charge you for the tire rotation.”

“One fifty.”

“Fucking hell,” he mutters. “Get in the fucking car.”

“Why?” you snap. “Did I do something wrong?”

Simon sighs loudly. “No. Just want to talk to the fucking wanker that sold you premium fucking air.”

taglist:

@km-ffluv @glitterypirateduck @tiredmetalenthusiast @miaraei @cherryofdeath

@sapphichotmess @saoirse06 @ferns-fics @unhinged-reader-36 @miss-mistinguett

@ravenpoe67 @tulipsun-flower @sageyxbabey @mudisgranapat @ninman82

@lulurubberduckie @leed-bbg @yawning-grave81 @azkza @nishim

@haven-1307 @voids-universe @itsberrydreemurstuff @spicyspicyliving @keiva1000

@littlemisscriesherselftosleep @statixx-x @umno-yeah @blackhawkfanatic @talooolaaloolla

@sadlonelybagel @daemondoll @iloveslasher @sammysinger04 @dakotakazansky

@suhmie @jaggersinclair @jackrabbitem @lxblm @beebeechaos

@no-oneelsebutnsu @kidd3ath @certainlygay @thewulf @lovely-ateez

@pearljamislife @ash-tarte @eternallyvenus @spookyscaryspoon @vrb8im

#task force 141 x reader#task force 141 imagine#task force 141#task force 141 fanfiction#task force 141 fanfic#task force 141 fic#task force 141 fluff#task force 141 x you#simon riley#simon ghost riley fanfiction#simon riley x reader#simon ghost riley x reader#simon riley x you#simon riley fanfic#simon ghost riley fanfic#simon ghost riley#ghost simon riley#simon ghost x reader#ghost call of duty#ghost mw2#ghost cod#ghost x reader#john mactavish imagine#john mactavish fanfiction#captain john price#john soap mactavish#john price#john price imagine#john price x reader#john price cod

2K notes

·

View notes

Text

Premium Credit Cards Luxury Benefits and Fees

Premium credit cards offer a world of luxury with top-tier benefits, perfect for users seeking exclusive perks. These cards often include access to airport lounges, dedicated concierge services, and premium travel insurance, enhancing every travel experience. They also provide reward points on high spending, offering discounts on dining, shopping, and travel. Many premium credit cards come with unique benefits, such as complimentary memberships to hotel loyalty programs, exclusive event access, and personal assistance for booking and reservations.

While the rewards are impressive, premium credit cards often have higher annual fees compared to standard cards. The fees, however, are often offset by the value of the benefits, especially for frequent travelers and luxury lifestyle enthusiasts. Additionally, these cards may offer an option to waive or reduce fees based on spending. Selecting a premium credit card requires assessing both the benefits and costs to ensure it matches your lifestyle and spending habits. Ideal for those who want more than just transactions, these cards redefine convenience and luxury, creating an elevated experience for their users.

0 notes

Note

On insurance: I still live with my parents and don't know a lot yet about the sorts of things adults usually have to spend money on. I've always been skeptical of things like insurance and credit cards because it seems to me they wouldn't be selling that if they didn't expect to make money from it. I talked to my cousin a while ago about credit cards and basically came to the conclusion that they do that because they're betting on the customer getting sloppy and letting their debts stack up, and the way you beat that and get money from credit card companies is just by being careful.

I'm a little more confused about insurance though because it seems much more straightforwardly like a gamble they will simply not take if it won't pay off for them. Like, you don't go to a casino because every game they play at a casino is one they've done the math on and have determined that statistically most people will lose money on most of the time. Is insurance not kinda the same? Where they estimate the risk and then charge you an amount calculated to make sure it probably won't be worth it for you?

I know if you have a car you legally need car insurance so everyone knows you can pay for another car if you crash into someone, and I gather that here in the US at least health insurance companies have some kinda deal with hospitals so that the prices go down or something, and there's a reason I don't fully understand why not having health insurance is Really Bad. But we get to pet insurance, or like when I buy a concert ticket and it offers ticket insurance in case I can't make it to the show, and surely if they thought they were gonna lose money on that they just wouldn't sell it, right? Or they'd raise the price of it until it became worth the risk that something bad actually will happen? Wouldn't it only be worth it to buy insurance if you know something the insurance company doesn't?

So the deal is that most people don't use their insurance much, and often insurance companies will incentivize doing things that will make you use your insurance less.

So, for example, you can get a discount on car insurance if you have multiple cars because people who insure multiple cars are more likely to be responsible drivers (the ability to pay for multiple cars stands in as a representation of responsibility here). The longer you go without an accident, the lower your premiums get because that means that you are not costing your insurance company anything but you are paying into the system. The car insurance company's goal is to have the most responsible, safest drivers who never get into car accidents because they can predict (roughly) how much they're going to have to pay out to their customers and they want the number they pay out to be lower than what's paid in. So they try to discourage irresponsible drivers by raising their rates and encourage responsible drivers by giving them discounts.

Health insurance companies often do the same thing: I recently got a gift card from my health insurance company because I had a visit from a nurse who interviewed me about my overall health and made sure I had stable blood pressure and access to medications. It is literally cheaper for my insurance company to give me a $100 giftcard and hire a nurse to visit me than it is for me to go to my doctor's office a couple of times, so they try to make sure that their customers are getting preventative care and are seeing inexpensive medical professionals regularly so that they don't have to suddenly see very expensive professionals after a long time without care.

Insurance in the US has many, many, many problems and should be replaced with socialized healthcare for a huge number of reasons but right now, because it is an insurance-based system, you need to have insurance.

We're going to use Large Bastard as an example.

Large Bastard had insurance when he had his heart attack and when he needed multiple organs transplanted. He didn't *want* to be paying for insurance, because he thought he was healthy enough to get by, but I insisted. His premium is four hundred dollars a month, and his out of pocket maximum is eight thousand dollars a year. That means that every year, he pays about $5000 whether he uses his insurance or not, and if he DOES need to use the insurance, he pays the first $8k worth of care, so every year his insurance has the possibility of costing him thirteen thousand dollars.

The bill for his bypass surgery was a quarter million dollars.

The bill for his transplant was over one and a half million dollars.

His medication each month is around six hundred dollars. He needs to have multiple biopsies - which are surgeries - each year, and each one costs about twenty thousand dollars.

Without health insurance, he would very likely be dead, or we would be *even more* incapable of paying for his healthcare than we are right now. He almost ditched his insurance because he was a healthy-seeming 40-year-old and he didn't think he'd get sick. And then he proceeded to be the sickest human being I've ever known personally who did not actually die.

Health insurance costs a lot of money. It costs less money for people who are young and who are expected to be healthy. But the thing is, everybody pays into health insurance, and very, very few people end up using as much money for their medical expenses as Large Bastard did. There are a few thousand transplants in the US ever year, but there are hundreds of millions of people paying for insurance.

This ends up balancing out (sort of) so that people who pay for insurance get a much lower cost on care if they need it, hospitals get paid for the care they provide, and the insurance company makes enough money to continue to exist. Part of the reason that people don't like this scheme is because "insurance company" could feasibly be replaced by "government" and it would cost less and provide a better standard of care, but again, with things as they are now, you need to have insurance. Insurance companies are large entities that are able to negotiate down costs with the providers they work with, you are not. If you get hit by a car you may be able to get your medical bills significantly reduced through a number of means, but you're very unlikely to get your bills lower than the cost of insurance and a copay.

Because of the Affordable Care Act, which is flawed but which did a LOT of good, medical insurance companies cannot refuse to treat you because of preexisting conditions and also cannot jack up your premiums to intolerable rates - since Large Bastard got sick, he has had the standard price increases you'd expect from aging, but nothing like the gouging you might expect from an insurance company deciding you're not worth it.

Pet insurance works on the same model. Millions of people pay for the insurance, thousands of people end up needing it, a few hundred end up needing a LOT of it, and the insurance companies are able to make more money than they hand out, so they continue to exist. This is part of why it's less expensive to get pet insurance for younger animals - people who sign up puppies and kittens are likely to be paying for a very long time and are likely to provide a lot of preventative care for their animals, so they're a good bet for the insurer. Animals signed up when they are older are more likely to have health problems (and pet insurance CAN turn animals away for preexisting conditions) and are going to cost the insurance companies more, so they cost more to enroll (and animals over a certain age or with certain conditions may be denied entirely).

This weighing risk/reward is called actuarial science, and the insurance industry is built on it.

But yeah it's kind of betting. The insurance company says "I'll insure ten thousand dogs and I'm going to bet that only a hundred of them will need surgery at some point in the next year" and if they're correct, they make money and the dogs who need surgery get their surgery paid for out of the premiums from the nine thousand nine hundred dogs who didn't need surgery.

Your assessment of credit is correct: credit card companies expect that you will end up carrying a balance, and that balance will accrue interest, and the interest is how they make the money.

And it is EASY to fuck up financially as an adult. REALLY EASY. But you are still likely to need a good credit score so you will need a credit history. That means that the correct way to use a credit card is to have a card, but not carry a balance.

To do this, never buy anything on the card that you can't afford. In order to avoid needing the card for emergencies, start an emergency fund that is at least 3 months of your total pay *before* you get a credit card. That seems like a *lot* of savings to have, but from the perspective of someone who has had plenty of mess-ups, it's a lot easier to build up a $10k emergency fund than it is to pay off a $10k credit card debt.

If you don't understand how interest works on credit cards, or why a 10k savings is different than a 10k debt, here are some examples working with $10k of debt, 23% interest (an average-ish rate for people with average credit), and various payments.

With that debt and that interest, here's how much it costs and how long it would take to pay off with $200 as the monthly payment:

Fourteen years, and it would cost you about twenty four thousand dollars in interest, for a total amount paid of about thirty four thousand dollars.

To save $10k at $200 a month would take four years and two months.

Here's the same debt at $300 a month:

4.5 Years and it costs about six grand (again, just in interest - sixteen thousand dollars total). Saving ten thousand dollars at three hundred dollars a month would take just under three years.

Here's the same debt at $400 a month:

3 years, about $4000 dollars (fourteen thousand dollars total). Saving ten thousand dollars at $400 a month takes just over two years.

The thing is, with all of these models you're going to end up paying one way or another. Insurance vs out of pocket is you weighing the risk of losing a fair amount of money by signing up but not using the system, or potentially losing a catastrophic amount of money by not signing up.

For credit cards they really only work if you know you're never going to need them for an emergency, because an emergency is what you're not going to be able to pay off right away. I didn't have an emergency fund when Large Bastard had his heart attack and needed surgery, or when we moved between states suddenly, or when we moved between states suddenly AGAIN and needed to pay storage costs, or when Large Bastard needed a transplant, or when Tiny Bastard got in a fight with my MiL's dog, and the fact that I didn't have an emergency fund is still costing me a lot of money.

So, young folks out there: what's the takeaway?

Get insurance. Get the best deal possible, which usually ends up being the one you sign up for early. You may think you can let it ride without insurance, but man in the six months between when I graduate college (and lost my school insurance) and when care kicked in after 90 days at my job I got electrocuted and needed to go to the ER. If that hadn't been a worker's comp payout I would have had thousands of dollars in bills. Something could happen. You could break your leg, you could get hit by a car, you could suddenly find out that you actually have heart disease at twenty, you could develop cancer. Have insurance, you need insurance. You legally need car insurance in the US, and you financially need health insurance. If you have a pet, I think it's a good idea for them to have pet insurance.

Credit cards are not for emergencies, they are not for fun, they are not for buying things that are just ever so slightly out of your budget, they are for taking advantage of the credit card company and managing to get by in a system that demands you have a credit score. ONLY put purchases on your credit card that you already have cash for. Before you get a credit card, build up an emergency savings so that you aren't tempted to put emergency charges on your card.

If you DO end up with an interest-bearing debt, pay it off as fast as possible because letting it linger costs you a LOT of money in the long run.

Stay the fuck away from tobacco and nicotine products they are fucking terrible for you, they are fucking expensive, and they are not worth it put the vapes down put the zyns down put the cigarettes down I will begin manifesting in your house physically i swear to fuck. Knock that shit off and put the cash that you'd be spending on nicotine into a savings account.

Take care, sorry everything sucks, I promise that in some ways it actually sucks less than it did before and we're working on trying to make it suck even less but it's taking a while.

759 notes

·

View notes

Text

How to choose a मोबाइल बैंकिंग account without struggle

Many years ago, it was not easy to find legit मोबाइल बैंकिंग platforms or sites. It was just an impossible thing to do. However, these online banks have taken over. Additionally, most major financial institutions provide the finest online banking experience. That is definitely one thing that counts. With the many options that avail these days for you to have fun with banking, there is nothing wrong. Do not rush to choose just any bank. Do your best to choose the right bank to ensure your every need is met as it should be.

Some guidelines to help you with deciding

1. Is the online bank insured. There are different and authorized licensing bodies that when a मोबाइल बैंकिंग is linked to represents safety for you. So, you need to check to find out if that is the case. The only banks that require consideration are banks that are insured and have evidence you can verify. That is definitely one thing you need to be interested in. without the legit license, you do not need to join that online bank.

2. Check out their interest rates. The best online बैंक खाता for you should be that one that makes it possible for you to have the best interest rates. Always remember that you want a good online bank and not other stuff. You need to be ready to make the right decisions to ensure nothing goes wrong where interest rates come in. Shop around the internet to find out these interest rates and you will definitely be a happier you. If the interest rates are not checked and compared, you are the one who will end up losing.

3. No minimums and no charges or fees. If the account will require you paying fees then it is not the best. You should also do not need to be pressured to keep any minimum balance in your account all the time when you need your money.

4. Customer service should be 24/7. You should be able to get the online bank to assist you all the time. Most people do not know that the right client service experience is the best. You do not want to deal with a bank that doesn’t see your problems as a matter of concern. During or outside of normal business hours, you should be able to get the assistance you need. When you need help and there is no one available, it doesn’t help at all. That is why you need to decide precisely.

5. Any incentives. The best बैंक खाताonline should come with the finest incentives for you. These incentives will help make your use of the account exciting. Always have it in mind that the best incentives doesn’t mean the bank online is the best. However, it helps you to gain more from the bank.

You should be sure that the bank provides you with the finest mobile banking features too. This will make it very easy for you to access your bank wherever and whenever you are.

Conclusion

Understanding how the right online बैंक खाता can help you is all that matters. So, choose to check out these out to keep you on the right direction. Having the right help through tips will keep you from falling into the same ditch that others fell into. That counts much.

#kotak#Kotak811#Money Transfer App In India All Bank#Rtgs Money Transfer#Money Transfer App International#Rtgs Money Transfer App#Kyc Mobile App#Fund Transfer#Dth And Mobile Recharges#Book Flights And Hotels#Pay Credit Card Bills#Digital Banking India#Money Transfer Bank App#Premium Mobile Banking#Kyc Bank Account#Apply For Credit Cards#Payment Banks In India

1 note

·

View note

Text

Your car spies on you and rats you out to insurance companies

I'm on tour with my new, nationally bestselling novel The Bezzle! Catch me TOMORROW (Mar 13) in SAN FRANCISCO with ROBIN SLOAN, then Toronto, NYC, Anaheim, and more!

Another characteristically brilliant Kashmir Hill story for The New York Times reveals another characteristically terrible fact about modern life: your car secretly records fine-grained telemetry about your driving and sells it to data-brokers, who sell it to insurers, who use it as a pretext to gouge you on premiums:

https://www.nytimes.com/2024/03/11/technology/carmakers-driver-tracking-insurance.html

Almost every car manufacturer does this: Hyundai, Nissan, Ford, Chrysler, etc etc:

https://www.repairerdrivennews.com/2020/09/09/ford-state-farm-ford-metromile-honda-verisk-among-insurer-oem-telematics-connections/

This is true whether you own or lease the car, and it's separate from the "black box" your insurer might have offered to you in exchange for a discount on your premiums. In other words, even if you say no to the insurer's carrot – a surveillance-based discount – they've got a stick in reserve: buying your nonconsensually harvested data on the open market.

I've always hated that saying, "If you're not paying for the product, you're the product," the reason being that it posits decent treatment as a customer reward program, like the little ramekin warm nuts first class passengers get before takeoff. Companies don't treat you well when you pay them. Companies treat you well when they fear the consequences of treating you badly.

Take Apple. The company offers Ios users a one-tap opt-out from commercial surveillance, and more than 96% of users opted out. Presumably, the other 4% were either confused or on Facebook's payroll. Apple – and its army of cultists – insist that this proves that our world's woes can be traced to cheapskate "consumers" who expected to get something for nothing by using advertising-supported products.

But here's the kicker: right after Apple blocked all its rivals from spying on its customers, it began secretly spying on those customers! Apple has a rival surveillance ad network, and even if you opt out of commercial surveillance on your Iphone, Apple still secretly spies on you and uses the data to target you for ads:

https://pluralistic.net/2022/11/14/luxury-surveillance/#liar-liar

Even if you're paying for the product, you're still the product – provided the company can get away with treating you as the product. Apple can absolutely get away with treating you as the product, because it lacks the historical constraints that prevented Apple – and other companies – from treating you as the product.

As I described in my McLuhan lecture on enshittification, tech firms can be constrained by four forces:

I. Competition

II. Regulation

III. Self-help

IV. Labor

https://pluralistic.net/2024/01/30/go-nuts-meine-kerle/#ich-bin-ein-bratapfel

When companies have real competitors – when a sector is composed of dozens or hundreds of roughly evenly matched firms – they have to worry that a maltreated customer might move to a rival. 40 years of antitrust neglect means that corporations were able to buy their way to dominance with predatory mergers and pricing, producing today's inbred, Habsburg capitalism. Apple and Google are a mobile duopoly, Google is a search monopoly, etc. It's not just tech! Every sector looks like this:

https://www.openmarketsinstitute.org/learn/monopoly-by-the-numbers

Eliminating competition doesn't just deprive customers of alternatives, it also empowers corporations. Liberated from "wasteful competition," companies in concentrated industries can extract massive profits. Think of how both Apple and Google have "competitively" arrived at the same 30% app tax on app sales and transactions, a rate that's more than 1,000% higher than the transaction fees extracted by the (bloated, price-gouging) credit-card sector:

https://pluralistic.net/2023/06/07/curatorial-vig/#app-tax

But cartels' power goes beyond the size of their warchest. The real source of a cartel's power is the ease with which a small number of companies can arrive at – and stick to – a common lobbying position. That's where "regulatory capture" comes in: the mobile duopoly has an easier time of capturing its regulators because two companies have an easy time agreeing on how to spend their app-tax billions:

https://pluralistic.net/2022/06/05/regulatory-capture/

Apple – and Google, and Facebook, and your car company – can violate your privacy because they aren't constrained regulation, just as Uber can violate its drivers' labor rights and Amazon can violate your consumer rights. The tech cartels have captured their regulators and convinced them that the law doesn't apply if it's being broken via an app:

https://pluralistic.net/2023/04/18/cursed-are-the-sausagemakers/#how-the-parties-get-to-yes

In other words, Apple can spy on you because it's allowed to spy on you. America's last consumer privacy law was passed in 1988, and it bans video-store clerks from leaking your VHS rental history. Congress has taken no action on consumer privacy since the Reagan years:

https://www.eff.org/tags/video-privacy-protection-act

But tech has some special enshittification-resistant characteristics. The most important of these is interoperability: the fact that computers are universal digital machines that can run any program. HP can design a printer that rejects third-party ink and charge $10,000/gallon for its own colored water, but someone else can write a program that lets you jailbreak your printer so that it accepts any ink cartridge:

https://www.eff.org/deeplinks/2020/11/ink-stained-wretches-battle-soul-digital-freedom-taking-place-inside-your-printer

Tech companies that contemplated enshittifying their products always had to watch over their shoulders for a rival that might offer a disenshittification tool and use that as a wedge between the company and its customers. If you make your website's ads 20% more obnoxious in anticipation of a 2% increase in gross margins, you have to consider the possibility that 40% of your users will google "how do I block ads?" Because the revenue from a user who blocks ads doesn't stay at 100% of the current levels – it drops to zero, forever (no user ever googles "how do I stop blocking ads?").

The majority of web users are running an ad-blocker:

https://doc.searls.com/2023/11/11/how-is-the-worlds-biggest-boycott-doing/

Web operators made them an offer ("free website in exchange for unlimited surveillance and unfettered intrusions") and they made a counteroffer ("how about 'nah'?"):

https://www.eff.org/deeplinks/2019/07/adblocking-how-about-nah

Here's the thing: reverse-engineering an app – or any other IP-encumbered technology – is a legal minefield. Just decompiling an app exposes you to felony prosecution: a five year sentence and a $500k fine for violating Section 1201 of the DMCA. But it's not just the DMCA – modern products are surrounded with high-tech tripwires that allow companies to invoke IP law to prevent competitors from augmenting, recongifuring or adapting their products. When a business says it has "IP," it means that it has arranged its legal affairs to allow it to invoke the power of the state to control its customers, critics and competitors:

https://locusmag.com/2020/09/cory-doctorow-ip/

An "app" is just a web-page skinned in enough IP to make it a crime to add an ad-blocker to it. This is what Jay Freeman calls "felony contempt of business model" and it's everywhere. When companies don't have to worry about users deploying self-help measures to disenshittify their products, they are freed from the constraint that prevents them indulging the impulse to shift value from their customers to themselves.

Apple owes its existence to interoperability – its ability to clone Microsoft Office's file formats for Pages, Numbers and Keynote, which saved the company in the early 2000s – and ever since, it has devoted its existence to making sure no one ever does to Apple what Apple did to Microsoft:

https://www.eff.org/deeplinks/2019/06/adversarial-interoperability-reviving-elegant-weapon-more-civilized-age-slay

Regulatory capture cuts both ways: it's not just about powerful corporations being free to flout the law, it's also about their ability to enlist the law to punish competitors that might constrain their plans for exploiting their workers, customers, suppliers or other stakeholders.

The final historical constraint on tech companies was their own workers. Tech has very low union-density, but that's in part because individual tech workers enjoyed so much bargaining power due to their scarcity. This is why their bosses pampered them with whimsical campuses filled with gourmet cafeterias, fancy gyms and free massages: it allowed tech companies to convince tech workers to work like government mules by flattering them that they were partners on a mission to bring the world to its digital future:

https://pluralistic.net/2023/09/10/the-proletarianization-of-tech-workers/

For tech bosses, this gambit worked well, but failed badly. On the one hand, they were able to get otherwise powerful workers to consent to being "extremely hardcore" by invoking Fobazi Ettarh's spirit of "vocational awe":

https://www.inthelibrarywiththeleadpipe.org/2018/vocational-awe/

On the other hand, when you motivate your workers by appealing to their sense of mission, the downside is that they feel a sense of mission. That means that when you demand that a tech worker enshittifies something they missed their mother's funeral to deliver, they will experience a profound sense of moral injury and refuse, and that worker's bargaining power means that they can make it stick.

Or at least, it did. In this era of mass tech layoffs, when Google can fire 12,000 workers after a $80b stock buyback that would have paid their wages for the next 27 years, tech workers are learning that the answer to "I won't do this and you can't make me" is "don't let the door hit you in the ass on the way out" (AKA "sharpen your blades boys"):

https://techcrunch.com/2022/09/29/elon-musk-texts-discovery-twitter/

With competition, regulation, self-help and labor cleared away, tech firms – and firms that have wrapped their products around the pluripotently malleable core of digital tech, including automotive makers – are no longer constrained from enshittifying their products.

And that's why your car manufacturer has chosen to spy on you and sell your private information to data-brokers and anyone else who wants it. Not because you didn't pay for the product, so you're the product. It's because they can get away with it.

Cars are enshittified. The dozens of chips that auto makers have shoveled into their car design are only incidentally related to delivering a better product. The primary use for those chips is autoenshittification – access to legal strictures ("IP") that allows them to block modifications and repairs that would interfere with the unfettered abuse of their own customers:

https://pluralistic.net/2023/07/24/rent-to-pwn/#kitt-is-a-demon

The fact that it's a felony to reverse-engineer and modify a car's software opens the floodgates to all kinds of shitty scams. Remember when Bay Staters were voting on a ballot measure to impose right-to-repair obligations on automakers in Massachusetts? The only reason they needed to have the law intervene to make right-to-repair viable is that Big Car has figured out that if it encrypts its diagnostic messages, it can felonize third-party diagnosis of a car, because decrypting the messages violates the DMCA:

https://www.eff.org/deeplinks/2013/11/drm-cars-will-drive-consumers-crazy

Big Car figured out that VIN locking – DRM for engine components and subassemblies – can felonize the production and the installation of third-party spare parts:

https://pluralistic.net/2022/05/08/about-those-kill-switched-ukrainian-tractors/

The fact that you can't legally modify your car means that automakers can go back to their pre-2008 ways, when they transformed themselves into unregulated banks that incidentally manufactured the cars they sold subprime loans for. Subprime auto loans – over $1t worth! – absolutely relies on the fact that borrowers' cars can be remotely controlled by lenders. Miss a payment and your car's stereo turns itself on and blares threatening messages at top volume, which you can't turn off. Break the lease agreement that says you won't drive your car over the county line and it will immobilize itself. Try to change any of this software and you'll commit a felony under Section 1201 of the DMCA:

https://pluralistic.net/2021/04/02/innovation-unlocks-markets/#digital-arm-breakers

Tesla, naturally, has the most advanced anti-features. Long before BMW tried to rent you your seat-heater and Mercedes tried to sell you a monthly subscription to your accelerator pedal, Teslas were demon-haunted nightmare cars. Miss a Tesla payment and the car will immobilize itself and lock you out until the repo man arrives, then it will blare its horn and back itself out of its parking spot. If you "buy" the right to fully charge your car's battery or use the features it came with, you don't own them – they're repossessed when your car changes hands, meaning you get less money on the used market because your car's next owner has to buy these features all over again:

https://pluralistic.net/2023/07/28/edison-not-tesla/#demon-haunted-world

And all this DRM allows your car maker to install spyware that you're not allowed to remove. They really tipped their hand on this when the R2R ballot measure was steaming towards an 80% victory, with wall-to-wall scare ads that revealed that your car collects so much information about you that allowing third parties to access it could lead to your murder (no, really!):

https://pluralistic.net/2020/09/03/rip-david-graeber/#rolling-surveillance-platforms

That's why your car spies on you. Because it can. Because the company that made it lacks constraint, be it market-based, legal, technological or its own workforce's ethics.

One common critique of my enshittification hypothesis is that this is "kind of sensible and normal" because "there’s something off in the consumer mindset that we’ve come to believe that the internet should provide us with amazing products, which bring us joy and happiness and we spend hours of the day on, and should ask nothing back in return":

https://freakonomics.com/podcast/how-to-have-great-conversations/

What this criticism misses is that this isn't the companies bargaining to shift some value from us to them. Enshittification happens when a company can seize all that value, without having to bargain, exploiting law and technology and market power over buyers and sellers to unilaterally alter the way the products and services we rely on work.

A company that doesn't have to fear competitors, regulators, jailbreaking or workers' refusal to enshittify its products doesn't have to bargain, it can take. It's the first lesson they teach you in the Darth Vader MBA: "I am altering the deal. Pray I don't alter it any further":

https://pluralistic.net/2023/10/26/hit-with-a-brick/#graceful-failure

Your car spying on you isn't down to your belief that your carmaker "should provide you with amazing products, which brings your joy and happiness you spend hours of the day on, and should ask nothing back in return." It's not because you didn't pay for the product, so now you're the product. It's because they can get away with it.

The consequences of this spying go much further than mere insurance premium hikes, too. Car telemetry sits at the top of the funnel that the unbelievably sleazy data broker industry uses to collect and sell our data. These are the same companies that sell the fact that you visited an abortion clinic to marketers, bounty hunters, advertisers, or vengeful family members pretending to be one of those:

https://pluralistic.net/2022/05/07/safegraph-spies-and-lies/#theres-no-i-in-uterus

Decades of pro-monopoly policy led to widespread regulatory capture. Corporate cartels use the monopoly profits they extract from us to pay for regulatory inaction, allowing them to extract more profits.

But when it comes to privacy, that period of unchecked corporate power might be coming to an end. The lack of privacy regulation is at the root of so many problems that a pro-privacy movement has an unstoppable constituency working in its favor.

At EFF, we call this "privacy first." Whether you're worried about grifters targeting vulnerable people with conspiracy theories, or teens being targeted with media that harms their mental health, or Americans being spied on by foreign governments, or cops using commercial surveillance data to round up protesters, or your car selling your data to insurance companies, passing that long-overdue privacy legislation would turn off the taps for the data powering all these harms:

https://www.eff.org/wp/privacy-first-better-way-address-online-harms

Traditional economics fails because it thinks about markets without thinking about power. Monopolies lead to more than market power: they produce regulatory capture, power over workers, and state capture, which felonizes competition through IP law. The story that our problems stem from the fact that we just don't spend enough money, or buy the wrong products, only makes sense if you willfully ignore the power that corporations exert over our lives. It's nice to think that you can shop your way out of a monopoly, because that's a lot easier than voting your way out of a monopoly, but no matter how many times you vote with your wallet, the cartels that control the market will always win:

https://pluralistic.net/2024/03/05/the-map-is-not-the-territory/#apor-locksmith

Name your price for 18 of my DRM-free ebooks and support the Electronic Frontier Foundation with the Humble Cory Doctorow Bundle.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/03/12/market-failure/#car-wars

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#if you're not paying for the product you're the product#if you're paying for the product you're the product#cars#automotive#enshittification#technofeudalism#autoenshittification#antifeatures#felony contempt of business model#twiddling#right to repair#privacywashing#apple#lexisnexis#insuretech#surveillance#commercial surveillance#privacy first#data brokers#subprime#kash hill#kashmir hill

2K notes

·

View notes