#philippine real estate investment

Explore tagged Tumblr posts

Text

Angeles City: Rising Star in Philippine Real Estate 🇵🇭

Angeles City Updates

Angeles City, a part of the thriving Pampanga Golden Triangle, is witnessing a surge in real estate interest. Here’s what’s driving this trend: Economic Hub: The city is a magnet for IT-BPM businesses, creating job opportunities and attracting residents.Infrastructure Boom: Investments in hotels, resorts, and commercial areas are modernizing the city and boosting its appeal.Residential Growth:…

View On WordPress

#banking in the philippines#how to invest in real estate#married in the philippines#Philippine Real Estate#philippine real estate 2022#philippine real estate investing#philippine real estate investment#philippine real estate market bubble#philippine real estate news#philippine real estate update#Philippines#Real Estate#real estate investing philippines#Real Estate Philippines#real estate property philippines#real estate proprty philippines

0 notes

Text

SM Investments Corporation acquiring 184 hectares of land in Muntinlupa City

Something significant could happen within the City of Muntinlupa in the near future as SM Investments Corporation (SMIC) is acquiring 184 hectares of land there as part of a property-for-shares swap with subsidiary Intercontinental Development Corporation (ICDC), according to a Manila Bulletin business news report. To put things in perspective, posted below is an excerpt from the Manila Bulletin…

#Asia#Blog#blogger#blogging#business#business news#Carlo Carrasco#City of Muntinlupa#economics#economy#Economy of the Philippines#enterprise#geek#Intercontinental Development Corporation (ICDC)#investing#investment#journalism#land#Manila Bulletin#Metro Manila#Muntinlupa#Muntinlupa City#National Capital Region (NCR)#NCR#news#Philippines#Philippines blog#Pinoy#real estates#SM Investments Corp. (SMIC)

0 notes

Text

One Delta Terraces by DMCI Homes | Modern Resort-Inspired Condo in Quezon Avenue corner West Avenue, Quezon City

0 notes

Text

𝗖𝗢𝗡𝗗𝗢𝗠𝗜𝗡𝗜𝗨𝗠 𝗙𝗢𝗥 𝗦𝗔𝗟𝗘

For more details and viewing, please call. ☎️𝗖𝗼𝗻𝘁𝗮𝗰𝘁 𝗡𝗼: +639913542867 ☎️𝗖𝗼𝗻𝘁𝗮𝗰𝘁 𝗡𝗼: +639913542867 ☎️𝗖𝗼𝗻𝘁𝗮𝗰𝘁 𝗡𝗼: +639913542867

For more details and viewing, please call. ☎️𝗖𝗼𝗻𝘁𝗮𝗰𝘁 𝗡𝗼: +639913542867 ☎️𝗖𝗼𝗻𝘁𝗮𝗰𝘁 𝗡𝗼: +639913542867 ☎️𝗖𝗼𝗻𝘁𝗮𝗰𝘁 𝗡𝗼: +639913542867

𝗕𝗮𝗰𝗸

#philippines#pilipinas#filipino#pinoy#Pilipino#real estate#real estate agent#property#property for sale#residential property#property investment#condo#condos#condominium#condominiums#condo living#condo for sale#condo for rent#bedroom#metro manila#manila#taguig#taguig city#bgc#bonifacio global city#makati#makati city#quezon city#realestate#realestateagent

1 note

·

View note

Text

Selecting the right real estate agent is crucial for a successful property transaction. An experienced agent with a strong track record in the local market brings valuable expertise and negotiation skills, making them an asset in your real estate journey. Effective communication is equally important, ensuring that you are well-informed throughout the process and that your questions and concerns are promptly addressed.

For More Information - https://filipinohomes.com/agent-list.php

0 notes

Text

Beach front -500 sq.m titled lot 4 Sale -Cabarsican Bacnotan La Union👣 -With 1 small house & 1 big house -With 1 regular size of swimming pool.🤽♀️🏃♂️

#real estate for sale#properties#residential for sale#for sale lot#for sale house#properties in baguio city#properties in benguet#farm for sale#investment#retirement#dream place#dream house#philippines#mountains#la union lot for sale#beach house in la union for sale#lot for sale in la union#house for sale in la union#retirement place#investment house and lot

0 notes

Text

t it, quoting an ancient adage Xi himself once cited, “The wise adapt to the times, and the astute respond to circumstance.”

Beijing’s high-stakes strategy for navigating a second Trump administration involves, in the words of national security heavyweight Donald Rumsfeld, both the known and the unknown in different quantities. Up top is the most familiar—the “known knowns,” and chief among these is tariffs.

Unlike in 2016, Beijing now faces Trump’s return with a sharper sense of what to expect, thanks to his prior policies. Chief among anticipated challenges are Trump’s intensified “reshoring” agenda and potential tariffs—such as 10-20% on all imports and an additional 60-100% on Chinese imports. These would pose direct threats to China’s export-driven economy at a time when the country is still struggling with a slow recovery, real-estate instability, and weakened consumer demand.

Chinese experts foresee a hardline cabinet in a second Trump term, with figures like trade hawk Robert Lighthizer indicating a more protectionist, confrontational approach. Unlike Trump’s first administration, where voices like Steve Mnuchin occasionally tempered his policies, a unified hawkish team would likely leave little room for moderation. Yet Beijing has been preparing—even if not always successfully—its “dual circulation” strategy aims to boost domestic consumption and curb export reliance, but results have stalled: Domestic demand lags, and export levels remain steady. This strategic pivot is evident in a surge of Chinese investment in Southeast Asia, as Beijing seeks to diversify its supply chains and shield its economy from trade shocks.

To reinforce its position, Beijing has ramped up countermeasures against U.S. companies, shifting from firing warning shots to dealing concrete blows. Skydio, the largest U.S. drone manufacturer, faces critical supply chain disruptions after China sanctioned it over sales to Taiwan’s National Fire Agency, forcing the company to ration batteries. PVH Corp., the parent company of Calvin Klein and Tommy Hilfiger, now risks placement on China’s “unreliable entity list” for allegedly boycotting Xinjiang cotton, jeopardizing growth in a key market. Intel is also under scrutiny as the Cybersecurity Association of China pushes for an investigation into alleged security flaws, threatening Intel’s hold in a market that accounts for nearly a quarter of its revenue. These sanctions and probes reveal a bolder stance, showing that Beijing’s arsenal for retaliation is far stronger than it was during Trump’s first term.

Chinese experts also see potential blowback for the U.S. economy. A 60% tariff could push U.S. inflation upward, potentially forcing the Federal Reserve toward further rate hikes. Within Chinese policy circles, some view this inflationary risk as a possible check on Trump’s ambitions, noting that rising borrowing costs and asset volatility could dampen his support base for aggressive tariffs.

Beyond tariffs, Beijing is keenly aware of the limitations faced by alternative manufacturing hubs in Southeast Asia and Latin America. Regional bottlenecks—such as labor shortages, infrastructure challenges, and resource constraints—may prevent these regions from fully absorbing production shifts away from China. Ironically, these limitations could exacerbate U.S. inflation if Trump’s tariffs disrupt established supply chains without viable alternatives.

Trump’s anti-globalization stance is familiar, but the ideological shifts it ignites fall into what strategists call “unknown knowns”—factors that are understood but whose full impact remain uncertain. For Beijing, Trump’s isolationist rhetoric resonates with a rising tide of populism across Europe and parts of Asia, such as Italy, Hungary, and the Philippines, creating ideological undercurrents that both challenge and complicate China’s global aspirations.

Some nationalist voices in China view Trump’s “America First” approach as an opportunity. The logic is simple: If the United States pulls back from global frameworks or retreats from alliances like NATO, other nations may look to China as an alternative. But Beijing’s seasoned policy experts approach this notion with sober realism. While China recognizes the potential for Western alliances to fragment, it also understands that a wholesale “pivot” toward Beijing is unlikely.

European leaders may be frustrated with Trump’s isolationism, but they remain wary of China’s growing influence—especially given Beijing’s reluctance to condemn Russia’s actions in Ukraine. This perceived tacit support for Russia has deepened European skepticism, fueling doubts about whether China’s expanding reach aligns with Europe’s strategic interests.

Beijing’s advisors are also attuned to the fact that the same populist forces driving Trump’s comeback are gaining ground in Europe. Economic strains have spurred protectionism. This sentiment has tangible economic implications: Calls for tariffs on Chinese electric vehicles and other trade protections, particularly in high-value sectors, reflect Europe’s intensifying desire to shield its own industries.

For Beijing, the ideological dimensions of a second Trump term present new complications. While the United States retreating from its traditional global role could create openings, Europe is unlikely to align more closely with China. China’s strategy is to avoid positioning itself as a direct alternative to Trump’s America. Instead, Beijing is casting itself as a pragmatic, stable partner amid the uncertainties triggered by Trump’s disruptions.

Xi’s administration has underscored this practical stance to emerging economies across Africa, Latin America, Southeast Asia, and parts of Europe, promoting investment incentives, visa-free entry, and a revitalized Belt and Road Initiative focused on green and future-industry infrastructure. Beijing’s aim is to strengthen its reputation as a dependable economic partner for countries seeking growth and stability, without appearing to exploit the ideological rifts Trump’s isolationism has exposed across the West.

Xi is accelerating China’s push for self-reliance, especially in technology—a strategy captured in a phrase popular among Chinese advisors: “以不变应万变” (“respond to ever-changing circumstances with a steady core”). The drive toward self-sufficiency isn’t new; “Made in China 2025” set the stage. But recent directives from the Third Plenum and Xi’s call to foster “new productive quality forces”—a frequently repeated Xi-ism—have pushed this ambition further, centering on breakthroughs in next-generation technologies—artificial intelligence, robotics, and semiconductors. This vision aims not only to reduce dependency on Western technology but to assert China’s dominance in frontier industries, with an eye to leading the fourth industrial revolution. For Xi, this is more than economic strategy; it is the fundamental answer to China’s domestic pressures and the ultimate trump card in its rivalry with the United States.

This quest for self-sufficiency also extends to forging stronger economic ties with the global south. Xi’s aim goes beyond building alternative trade networks to Western influence; he envisions a sanction-proof supply chain and financial network—a new global market immune to Western pressures that can fuel China’s ambitions independently.

Then there’s the “known unknowns”—the predictably unpredictable, something very much at the forefront with Trump. A defining feature of Trump’s political style is his highly transactional approach, adding a layer of unpredictability to what might otherwise be straightforward policies. Beijing has observed this pragmatism up close, recognizing that Trump’s business instincts often outweigh ideological commitments, occasionally opening doors for negotiation.

When the United States imposed sanctions on Chinese telecom giant ZTE, for example, Xi personally spoke with Trump, leading to a reversal of the sanctions. For Beijing, this underscored that Trump’s flexibility could be influenced by high-profile gestures that he perceives as personal acknowledgments—a dynamic Beijing sees as potentially useful.

Beijing also understands Trump’s showbiz background and his strong emphasis on image and ego. In 2017, Xi hosted Trump and his family with an unprecedented reception at the Forbidden City, a site traditionally reserved for China’s emperors, infusing the event with a level of grandeur rarely extended to foreign leaders. This carefully curated spectacle played to Trump’s appreciation for high-profile events and deepened his positive impression of Xi. This “personalized diplomacy” showcased Beijing’s understanding of Trump’s sensibilities and laid a foundation for a cooperative rapport between the two leaders.

With this in mind, Chinese advisors are prepared to pursue similar transactional openings in a second Trump term. Behind the scenes, Beijing is nurturing ties with influential American business figures who could serve as informal intermediaries to Trump’s inner circle. Elon Musk, for instance—whose Tesla operations are deeply tied to China’s market—may emerge as a potential bridge between U.S. business interests and Chinese policymakers.

Some advisors are also advocating for figures like former ambassador Cui Tiankai, who has previously established a rapport with Trump’s family, particularly his son-in-law Jared Kushner and daughter Ivanka Trump. Cui’s connections could offer Beijing a valuable “track 1.5” channel for backdoor diplomacy, adding an extra layer of access and influence.

Still, Beijing is cautious about relying too heavily on Trump’s transactional tendencies. Recent remarks suggesting Taiwan should pay more for U.S. protection have sparked mixed reactions in China. Some view it as an opening to ease U.S. support for Taiwan, while others see it as a mere bargaining chip Trump could discard at any time. For Beijing, these mixed signals create a delicate balancing act: While it may aim to leverage Trump’s pragmatism, it knows any perceived concession could be revoked at a moment’s notice. In navigating Trump’s dealmaking style, China proceeds with cautious optimism, fully aware of his unpredictability.

Beyond Trump’s familiar transactional style, Beijing is on high alert for wild cards that could upend its plans. The nature of unknown unknowns is the impossibility to know what you’re missing, but there are some drastic, but not predictable, changes that could shake up U.S.-China relations. A sudden shift in U.S.-Russia relations, for example, could have major implications for Beijing. A closer alliance between Trump and Russian President Vladimir Putin might strain China’s relationship with Moscow, potentially isolating Beijing within the global power structure. Likewise, unexpected maneuvers by Trump in the Indo-Pacific could unsettle China’s carefully managed ties with regional powers like Japan, South Korea, and India.

A critical constraint on China’s ambitions lies in Washington’s tightening grip on technology exports, an escalating tactic that has introduced more unknowns into Beijing’s strategic calculus. While the general U.S. intent is clear—limiting China’s access to advanced technologies—the extent to which Washington will go remains uncertain. Recent export controls target crucial fields like semiconductors and AI, threatening to curb China’s technological progress at a pivotal time.

Chinese analysts interpret these moves not just as competitive hurdles but as a calculated strategy to stall China’s ascent in strategic areas, particularly AI and quantum computing, which are critical to both economic growth and military strength. As Beijing watches for new layers of restriction, the scale and impact of U.S. actions remain fluid, injecting a destabilizing uncertainty into China’s tech trajectory. To brace for these unknowns, Xi’s broader vision is to shape an economy resilient enough to withstand unpredictable global shifts—whether driven by Trump 2.0 or other forces—without risking economic upheaval or, worse, destabilizing Chinse Communist Party (CCP) control. Trump’s return may add urgency, but Beijing views him as more a symptom of a chaotic world order than its cause, which only reinforces Xi’s long-held belief in fortifying China’s self-reliance. For Xi, bolstering resilience across technology, supply chains, and education is about safeguarding China from external shocks and cementing the stability essential to the CCP’S rule.

In truth, Xi’s groundwork for managing “Trump-style” disruptions began long before Trump’s first term. China’s approach has always hinged on minimizing vulnerabilities to external pressures, a direction deeply embedded in Xi’s worldview. Yet this pursuit of resilience walks a fine line. Strengthening defenses could deepen China’s isolation—a shield that may paradoxically create new weaknesses. Gains in domestic supply chains and tech independence mark real progress, but much of Xi’s vision remains aspirational. Beijing is racing to secure these defenses, understanding that, in a world increasingly defined by upheaval, China’s strength will be measured less by its rapid growth and more by its capacity to endure through turbulence.

9 notes

·

View notes

Text

The NFT Video Games Revolution: What To Watch For In 2023 - GameTyrant

The next-gen of video games is going to blow players away: NFT video games. However, these have been around for quite a while, but 2023 will likely bring them the deserved attention. It is not surprising that NFTs have found their way into gaming since they have penetrated various industries, including fashion, movies, and real estate. Focusing on gaming, we will discuss how NFTs could shape this sector’s future and how players will benefit from this innovation. First, this kind of asset gives gamers a unique chance to increase their own profits, not those of the game’s developers. Second, players enjoy complete ownership of their digital assets regardless of what happens to the gaming company. Plus, enthusiasts can finally immerse themselves in a virtual world of thousands of possibilities, which allows them to take up even more exciting roles in their games, customize their experience and in-game items, and receive the rewards of their invested time and money. Without a doubt, blockchain is no longer just about virtual currencies. It has given rise to a range of digital assets, including NFTs representing in-game collectibles. Some of these assets have seen real success in the last few months as investors have noticed their gain potential. Therefore, when checking the Ethereum price, you may also want to look at gaming tokens. Apart from exposing you to new virtual lands, this is also an excellent method to diversify your investment portfolio. Here is what you need to know about gaming NFTs: You have probably heard that NFTs are the latest revelation in the gaming sector, and while it is indeed true, what are these NFT games after all? The simplest explanation would be that NFT games are blockchain-based, allowing players to exploit a new form of in-game collectibles. That being said, people can handle land, avatars, clothing pieces, or any other game features in the form of non-fungible tokens, use them to advance through the game, or further sell them on the marketplace to maximize their gains. Since NFTs have long been considered works of art, enthusiasts are now calling video games the ‘seventh art.’ NFT games are often called P2E games because they are based on a play-to-earn model. Thus, players can earn tangible rewards as they complete the various game missions. Collecting in-game items through the gaming journey is the main goal of people immersing themselves in this kind of activity, as this is generally the only way to cover their investments. The acceptance of NFT standards also lets developers preserve the uniqueness and rarity of these in-game collectibles, which is why some digital gaming goods are more expensive than others. As for how to access these assets, there are basically three strategies: unlocking and earning new items, purchasing items on third-party or native marketplaces, or breeding new characters. Whichever method you pick, we assure you that you will have exclusive ownership rights over these treasures. It is indeed possible to earn real-life money from these games, but we don’t recommend making this a top priority. Just like cryptocurrencies, NFTs are also volatile, so it would be all in vain to earn massive rewards as you complete tasks and missions if the assets start to lose their value due to developers failing to hold their gamer base. So, to put it simply, people in the Philippines making a considerable income playing Axie Infinity are a rather exceptional case. Earning money from games like Axie Infinity means you must recover your upfront cost first. Did you know that you need three Axies (the value of these cute little monsters can range from $30 to $100)? So yes, we advise you to play better for your own pleasure instead of making high expectations of gains. Since NFT games are all the rage in today’s playing environments, it becomes obvious that developers don’t cease to create more and more games. And while it’s excellent news that this area is expanding, it could be daunting for a newbie to navigate through the sea of NFT-related games available. Well, that’s why we’re here. Consider this round-up of definitely worth trying games in 2023 (apart from the ever-present Axie Infinity): Alien Worlds If you’re a fan of outer space and faraway galaxies, Alien Worlds might be your thing. This is a unique chance to explore planets, conquer lands, and engage in battles, which will eventually bring you revenue in the form of NFTs. Alien Worlds’ native token is Trillium (TLM), a valuable asset in this fascinating multiverse as it gives players access to additional gameplay and control over decentralized autonomous organizations (DAOs). The Alien Worlds metaverse is all about adventure, imagination, and perseverance, so if you boast any of these, ensure you give this NFT game a try. Dogami If you don’t dispose of enough room in your house to adopt a dog, Dogami is a viable solution for you. This ‘Petaverse’ allows animal lovers to own adorable dogs and nurture them to adulthood. And what makes this game stand out is that it boasts more than 300 distinct DOGAMI breeds, each distinguishing through its own traits (due to the NFT mechanic) and coming in four different rarities - diamond, gold, silver, and bronze. By playing Dogami and participating in the various game modes, you will earn rewards in the form of DOGA tokens. STEPN STEPN is the ultimate fitness game, so if you’ve always wanted to move by walking or running, this game is a great start. We know, we know - it’s all in a virtual world. But continually improving yourself in this video game will further motivate you to do the same in the real-life, tangible world. So, all you need to do to get started with STEPN is buy a pair of virtual sneakers inside this Web app. And don’t forget: the STEPN shoes not only lead you to massive potential gains but also to self-improvement. Let walks and jogs be part of your norm! So, are NFT games a thing or not? All names, trademarks, and images are copyrighted by their respective owners /// Copyright / DMCA Notice Copyright © 2015-2022 GameTyrant Entertainment LLC All Rights Reserved Read the full article

2 notes

·

View notes

Text

Joshua Freed - Runs the Real Estate Investment Group

Joshua Freed is a family man who lives in Florida with his wife and five children. He runs the real estate investment group, Equity Capital, Inc. where he serves as CEO. Mr. Freed supports missions around the world and actively engages with his church in such activities as installing wells in Kenya and building houses in the Philippines. Mr. Freed is a member of both Kiwanis and the Rotary Club.

#florida#ceo#joshua freed#joshuafreed#rotary club#ceo of equity capital inc#washington#equity capital inc#usa

2 notes

·

View notes

Text

Discover Prime Opportunities to Buy Land in the Philippines

Looking to buy land in the Philippines? Discover prime real estate opportunities with Ayala Land Premier. From residential lots to commercial properties, we offer a wide range of premium land options in some of the most sought-after locations across the country. Visit ayalalandpremierluxuryhomesph to explore the best investment opportunities today!

0 notes

Text

Under Foreclosure Duplex in Dau Homesite, Mabalacat

Own a duplex in Dau Homesite for a steal! Under foreclosure, perfect for investors or starting out. Cash only. Inquire today!

📍 BLOCK-49-A LOT LOT-3-A MAHINHIN DAU HOMESITE SUBD., BO. DAU, MABALACAT, PAMPANGA Property Features Property ID: 0790452TYPE: DuplexSTATUS: Under foreclosure, Occupied📐 Lot: 64.00 square meters | Floor: 35.00 square meters✅ AS-IS-WHERE-IS Basis 🏦 TERMS and PRICING 🏷️ Price: LIMITED OFFER: PHP 540,000 ✅ CASH ONLY❌ Not applicable for INSTALLMENT, BANK OR PAG-IBIG FINANCING❌ Exclusive of Taxes…

#Angeles City#Angeles City Foreclosed#angeles city property#bdo foreclosed properties#bpi foreclosed properties#Broker JM#clark foreclosed property#foreclose properties#Foreclosed Properties#foreclosed properties for sale#Foreclosed Property#foreclosed property listing#foreclosed property nang bfs#Foreclosure#foreclosures#foreclosures angeles city#investing#jm listings#jm real estate#land bank foreclosed properties#philippines foreclosed property#philippines property#pnb foreclosed properties#Real Estate#Real Estate Investing#under foreclosed properties

0 notes

Text

Discovering Career Opportunities: Your Guide to Job Openings in Metro Manila

Metro Manila, the Philippines' primary business hub, continues to be a powerhouse of employment opportunities across diverse industries. As the nation's capital region, it offers an extensive range of job openings that cater to various skill sets and experience levels. The metropolitan area, comprising multiple cities including Makati, Bonifacio Global City, Ortigas, and Quezon City, serves as home to numerous multinational corporations, local enterprises, and startups.

The current job market in Metro Manila reflects the region's dynamic economy. The business process outsourcing (BPO) sector remains one of the largest employers, offering positions ranging from customer service representatives to specialized technical support roles. Financial districts, particularly in Makati and BGC, host numerous banks, investment firms, and insurance companies that regularly seek financial analysts, accountants, and investment professionals.

JOBYODA has established itself as a comprehensive platform for discovering these opportunities in Metro Manila. The platform connects job seekers with leading companies across the metropolitan area, providing access to positions in various industries. Through JOBYODA, professionals can explore openings in technology firms, manufacturing companies, retail establishments, and service-oriented businesses that continually expand their operations in the region.

The technology sector in Metro Manila has seen remarkable growth, creating numerous job openings for software developers, IT professionals, and digital marketing specialists. This growth has been further accelerated by the increasing adoption of digital solutions across industries. Companies are actively seeking professionals who can help drive their digital transformation initiatives, creating opportunities for both experienced professionals and fresh graduates with relevant technical skills.

Manufacturing and logistics companies in Metro Manila's industrial areas regularly post job openings for production supervisors, quality control specialists, and supply chain managers. These positions often require technical expertise combined with management skills, offering career growth opportunities for professionals in these fields. The retail sector also maintains a strong presence, with shopping centers and commercial establishments throughout Metro Manila providing positions in sales, marketing, and operations management.

For fresh graduates, Metro Manila offers numerous entry-level positions across different sectors. Many companies provide training programs and career development opportunities, making it an ideal starting point for young professionals. The concentration of educational institutions in the metro area also creates opportunities in the academic sector, from teaching positions to administrative roles.

JOBYODA's platform simplifies the job search process in Metro Manila by providing detailed job descriptions, company information, and application tracking features. Job seekers can filter opportunities based on location within Metro Manila, allowing them to find positions that align with their preferred work location and commuting preferences. This is particularly important given the metropolitan area's traffic situation and varying accessibility of different business districts.

The healthcare sector in Metro Manila continues to expand, creating openings for medical professionals, healthcare administrators, and support staff. The presence of major hospitals and healthcare facilities throughout the metro area ensures a steady demand for qualified professionals in this field. Similarly, the construction and real estate sectors maintain active hiring practices, seeking architects, engineers, and project managers to support ongoing development projects.

For those seeking job opportunities in Metro Manila, it's essential to understand that the job market is competitive but rewarding. Companies often offer competitive compensation packages, including benefits that help employees manage the cost of living in the metropolitan area. Through JOBYODA, job seekers can access these opportunities and connect with employers who value talent and professional growth.

Metro Manila's position as the country's primary business center ensures a continuous flow of job openings across industries. Whether you're a seasoned professional looking for career advancement or a fresh graduate starting your professional journey, the metropolitan area offers diverse opportunities for career growth and development. With the right resources and platform like JOBYODA, finding your next career opportunity in Metro Manila becomes a more manageable and focused process.

0 notes

Text

Affordable 3 Storey Townhouse in Quezon City | 3 Bedrooms | 4 Toilets and Baths

#houseandlotforsale#houseandlotforsaleinquezoncity#houseandlotinquezoncity#investing#investment#passive-income#philippines#real-estate#real-estate-investing

1 note

·

View note

Text

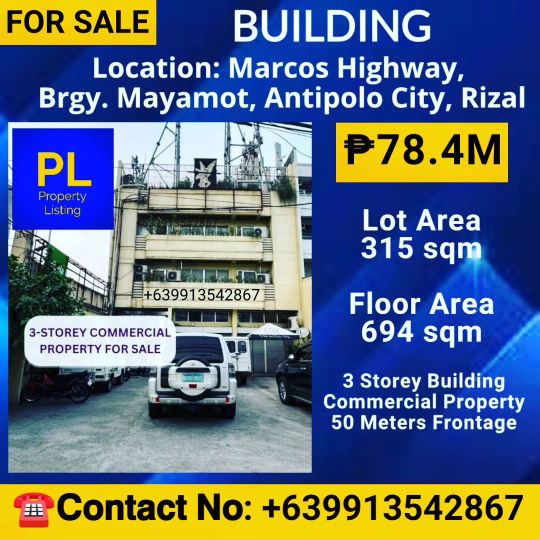

𝗕𝗨𝗜𝗟𝗗𝗜𝗡𝗚 𝗙𝗢𝗥 𝗦𝗔𝗟𝗘

📍Airport Road, Baclaran, Paranaque

Near Baclaran Church, NAIA Terminal

📍Marcos Highway, Antipolo, Rizal

𝗕𝗮𝗰𝗸

#philippines#pilipinas#metro manila#manila#real estate#real estate agent#property#properties#commercial property#building#buildings#investment#business#office#commercial space#warehouse#pasay city#antipolo#rizal#office space

0 notes

Text

Revolutionizing Real Estate: Navigating Classified Ads on AdQuickly.com

The real estate market can be complex and fast-moving, but with AdQuickly.com, navigating this landscape becomes significantly simpler and more efficient. Whether you’re a seasoned investor, a real estate agent, or a first-time homebuyer, AdQuickly.com offers a comprehensive platform for classified ads that makes finding or listing properties straightforward and effective. This blog post explores how to leverage AdQuickly.com for your real estate needs, ensuring you maximize your opportunities in the housing market.

Optimal Property Listings on AdQuickly.com

AdQuickly.com’s platform is designed to enhance the visibility and detail of real estate listings, making it easier for buyers and sellers to connect.

Rich Listings with Comprehensive Details

For sellers, AdQuickly.com allows you to create rich, detailed listings that include high-resolution images, videos, and virtual tours of your properties. These tools help potential buyers get a thorough sense of the property, increasing the likelihood of engagement and inquiries.

Advanced Search Filters for Buyers

Buyers can utilize AdQuickly.com’s advanced search filters to narrow down their property search based on various criteria such as location, price, property type, square footage, and the number of bedrooms and bathrooms. This targeted search helps streamline the finding process, saving time and focusing only on listings that meet specific needs.

User-Friendly Interface for All

AdQuickly.com prides itself on its user-friendly interface, making the platform accessible to everyone from professional real estate agents to private sellers and buyers. The easy navigation ensures that posting and searching for listings is hassle-free.

Strategies for Using AdQuickly.com in Real Estate

Whether you’re buying, selling, or just browsing, here are some effective strategies to enhance your real estate experience on AdQuickly.com.

For Sellers:

•Highlight Unique Features: Make sure to highlight any unique or highly desirable features of your property, such as a renovated kitchen, scenic views, or energy-efficient appliances.

•Stay Responsive: Be prompt in responding to inquiries from potential buyers to keep their interest alive and to facilitate faster transactions.

For Buyers:

•Stay Updated: Regularly check AdQuickly.com for new listings to catch the best deals as soon as they come on the market.

•Contact Sellers Directly: Utilize the platform’s direct messaging feature to contact sellers with any questions or to express interest, facilitating quicker communication.

Conclusion

AdQuickly.com offers a dynamic and effective platform for all your real estate classified needs. With its comprehensive listing capabilities, advanced search filters, and user-friendly interface, AdQuickly.com is an indispensable tool for anyone looking to buy, sell, or rent properties. Whether you’re expanding your investment portfolio or searching for your dream home, AdQuickly.com ensures that your real estate transactions are as smooth and successful as possible.

Find Local Classified Ads in Areas Mentioned Below:

Australia

Bangladesh

Bolivia

Brazil

Canada

Colombia

France

Germany

Guernsey

India

Indonesia

Ireland

Japan

Malaysia

New Zealand

Philippines

Russia

Singapore

Spain

Switzerland

United Arab Emirates

United Kingdom

United States

Vietnam

0 notes

Text

Welcome to your reliable and best real estate investment in philippines ! We understand that property investment is a significant decision, and we are here to make the process smooth, seamless, and rewarding for you. With years of industry experience, we pride ourselves on offering expert guidance and comprehensive solutions tailored to your unique needs.

Trusted real estate partner in the Philippines. Expert guidance, vast property selection, and personalized service for your dream investment. Contact us now!"

0 notes