#overdraft against shares

Explore tagged Tumblr posts

Text

HOW CAN I GET A LOAN AGAINST SHARES?

#loan against shares#loan against shares interest rate#loan against shares meaning#loan against shares in hindi#overdraft against shares#lien on shares#personal finance#pledge shares#pledged shares#loan against securities#loan against mutual funds#loan against sip#loan against stocks#stock market#share market#shares of a company#bank loans#personal loan#demat shares#loan against demat shares#assetyogi#asset yogi#richard ehrlich#scott ehrlich

0 notes

Text

#Rurash Financials#Loan Against Shares#Loan against Securities#Fastest Loan Approvals#OverDraft Facility

0 notes

Text

Born to kill

Summary: Lyle thinks about his tattoo

Idea from Me and @thevanityofthefox chatting!

Lyle lovers come get yalls pain! 〒▽〒

Born to kill

He had this tattoo over his heart, bold type face, black ink, simple. He bore it through war-zones, spraying hot lead into the dust, praying he'd hit something, someone. Watching friends and enemies alike succumb to the machine of war. He barely remembered the burn, the needle jabbing in and out in a foreign tattoo parlor that smelled of stale alcohol. Maybe it was just him, the nights whisky still clinging to his tongue as his brothers in arms cheered him on. Then again burning on his chest as he watched them torn to shreds in oncoming fire.

Then he was home. Cold in the grey smog that clung to the buildings, the shaded streets bellow. The run down paint chipped bar had offered him a place behind its sticky counter. The closest thing to honor his service got him. Nightly patrons chatting loudly, throwing away what scraps they earned for whatever he was pouring. He barely made enough to keep a roof over his head but he was happier than he'd ever remembered being. He was happy because he had them.

His girls. A beautiful, sharp, hard working woman, who never failed to make him glad he survived till now. Even when they spat venom at one another. Her touch soothing his soul, her kiss that made him thankful for the cramped flat they shared. Just meant she was always near, just in arms reach to be tugged into his arms.

Then there was his daughter. A wild little thing, with ever messy hair struggling to stay tied up. Her hands always sticky and her face always caked in something. Brilliant eyes shining brighter than any jewel and a big gaped tooth smile that took up half her face or more.

Right now she was stained in pen ink. He'd scraped every penny of tips up all month and got her them. They weren't great, streaking dry ink that smelled too chemically but she didn't care, they marked the paper well enough. Old bank statement, overdrafts and red inked notices, made to blue and purple grassed fields with smiling moons.

In all his years he'd never seen real nature like it, neither had she but her school had shown her pictures of Pandora. Lyle had insisted it was a necessary expense. He'd never gone and she was just so bright, already learning her letters. He'd been almost 12 before he'd had a handle on them, his brother a harsh and inattentive teacher.

His wife grumbled, trying her hardest the convince herself the money was needed elsewhere. Lyle could see in her face though, how their daughter's delight meant more to her. She pecked her nest of hair before kissing Lyle where he rested on the battered couch.

"Please brush her hair before you go to bed." She smiled wearily before going to get ready for her night shift. Lyle scooped his squirming child up into his lap, tickling her sides as she squealed in delight.

"We gonna get your hair all nice before Mummy leaves right?" He chirped fighting the weight of his eyelids. She nodded emphatically playing with his dog tags as he teased out the knots.

She stood in his lap fingers playing against his chest. Lyle took note of the tickling feelings, peering down at her tiny finger nails. They followed the letters over his heart and he felt it freeze. Her stained cheeks hallowed as she silently sounded it out. O, R, N.

Lyle felt shame build in him. How could explain to her what he'd done, who he'd been. She was too young, her bright eyes hadn't seen what he had. He couldn't bare them glassing over, her hopeful shine dimming even a fraction.

She tapped from foot to foot on his leg, never aware of the weight of her feet. The pain as she stomped down briefly distracted Lyle. How many years out in war zones and he'd been felled by a 4 year old.

In her tiny fist she brandished her pen, scribbling over the last word. Lyle couldn't tilt his chin low enough to see but he felt her movements. Scraping over then smoothly as her shaking hand would allow she penned something new, engraving it with force.

"What've you written there buttercup?" He cooed, scooping her up under one arm when her hand stopped. She squealed in laughter under his arm as he carried like that to the mirror. In the warping plastic he saw her work-

Born to kill HUG

Scribbled in wobbling letters. He stilled at the sight. His tired eyes, loose comfortable joggers and a little glitter from something still on his bare softening chest. Then his laughing child still kicking under his arm. He pulled her up, letting her sit against his side swiping hair off her face. He smiled at her through the mirror, both admiring her work.

"Honey come see my new tattoo!" He smiled as his daughter wriggled and laughed into his neck.

"Babes I told you we don't have money for-" She paused in the door frame, hands still in her hair tying it. She barked a sudden laugh, snorting and grabbing the door frame. Lyle's chest feels so full, warm and light as he laughs with her.

She takes their daughter into her arms, kissing her cheeks.

"Oh baby it's lovely! Maybe we've got a little artist one our hands!" She jokes, pressing more pecks into her hair and she laughs.

Lyle's alone now, tracing the tattoo in the dark. He came here for them. The recruiter had set it all up, every pay cheque made it home to them. He'd smiled at his daughter's growing form, just a few more years then he'd be back he kept telling himself. He'd see her graduate and grow up, fall in love, everything, just next rotation.

There was no next rotation now. His large blue body shifted in bed, his hand clutching at his chest. Tracing over the words written there, trying to claw new ones. In his mind he could still feel her fingers tracing, even as he screamed inside. Begged the memory to warm him instead of leaving him so cold.

He still felt the pit in his stomach, the sinking feeling as they explained what was happening. There'd been such a huge payout when he died, surely that'd been enough to see them through? He felt numb lying in the small bed, his eyes raw. Lyle couldn't know for sure if they were okay and there was no going home now.

85 notes

·

View notes

Note

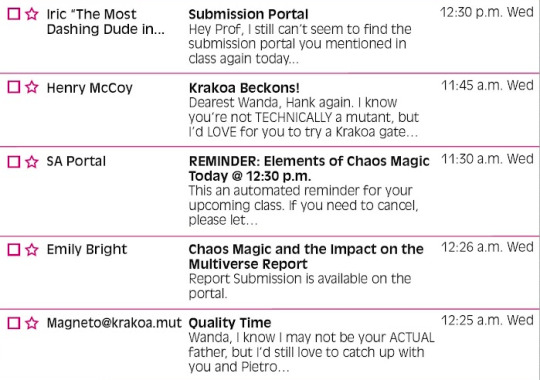

Thinking back to that email to Wanda during Beast’s X-Force era from Strange Academy

Like Hank asking Wanda to visit Krakoa to see if she was mutant enough to get through the gates. It was really friendly, which (given Hank’s behavior at the time) probably means he was either being devious and underhanded or the SA author didn’t know he was evil but I’ve kind of taken it to mean that even at his lowest, hanks still got a lot of affection and respect for Wanda. At the very least, he recognizes her value as an ally in ways Xavier clearly doesn’t

"It's a poor spymaster that reveals his hand while it's still in play."

This comes from Strange Academy #5!

So, it's a weird one, because we know for a fact that editorial have NOT been doing their due diligence on making sure that X-Force Beast's villainy is being reflected in other books. This comes to mind.

Shoutout to my girl Rainbow Rowell, once again showing off her knowledge of Beast lore and sticking up for my guy. She's consistently been his best writer for the past, like, five years, even in books that he's not in.

But yeah! This was 2022, this was post-Terra Verde, Kurt knows that X-Force Beast slaughtered a small country - but he's still on first name basis and recalling cute bits of gossip that Hank's shared with him. Editorial didn't seem to care about catching that and pointing it out.

Which means the Wanda email here is . . . interesting, especially since it comes from a non-Krakoan email address (notice that Erik's email is specifically a Krakoan domain here), indicating that it's Hank's old, personal email. Now, that could just be a sign of X-Force Beast using every trick up his sleeve to try and lull Wanda into a false sense of security, but . . . I don't know, I kinda don't think so.

The way I write X-Force Beast, he remembers, ACUTELY, who fucked him and who didn't. Scott, Jean, Bobby, Warren, on the shitlist, same with Logan, same with Ororo, same with Kitty/Kate - he remembers their infractions against him like a bank remembers overdraft. He doesn't pretend to be nice to them, because as far as he's concerned, they haven't earned that. They get all of his vitriol. But Wanda?

Wanda never has. Wanda's always been good to him.

My personal version of X-Force Beast maybe wouldn't be this nice - "dearest" isn't a word he'd use except in simpering sarcasm - but I do think he'd be scientifically interested enough in the answer, and warm enough to Wanda, that he'd be at least polite. All that Pretender cult bullshit that Exodus peddles probably pisses him right the fuck off, too, so that's even more incentive to be nice to her.

5 notes

·

View notes

Text

Hi Tumblr!

I am an absolute brand new at making TTRPGs, but I am also poor and had my bank refuse my rent payment because it overdrafted my account too much.

I try to make a point of not asking for help, but my roommate is already refusing to pay his full share of rent and I'm not going to see any work money for another week. The $85 in my pocket is supposed to last until then, and honestly it might just get me there considering I have to feed myself and a cat.

So what I'm offering is this

Pick-Possuming: A Game of Crimes & Critters

It is a 2d6 TTRPG for 3-5 players and 1 GM where players take on the role of "trash animals" like opossum and raccoons to vomit heists against the corrupt power hungry humans similar to Leverage, Robin Hood, and other media.

I have the game set at $3 both on my Itch.io and KoFi, and would love if you'd even take a look outside of me needing help.

Of course if you really just want to help a queer out my KoFi is open to donations.

#ttrpg#ttrpg design#indie games#kofi request#signal boost#trash animals#leverage#robin hood#the bad guys

3 notes

·

View notes

Text

Understanding Overdraft Fee Class Action Lawsuits

Overdraft fees are a significant concern for many bank account holders, leading to disputes and legal actions. This article provides an in-depth analysis of the overdraft fee class action lawsuit, focusing on how such lawsuits address issues related to bank overdraft fees, and the process involved in an overdraft fee lawsuit. We will also explore the broader context of bank overdraft fees lawsuits and the implications of an overdraft class action lawsuit.

What Are Bank Overdraft Fees?

Bank overdraft fees occur when a bank account holder spends more money than is available in their account. This results in the bank covering the shortfall but charging a fee for the service. Overdraft fees can quickly accumulate, leading to significant financial strain for account holders. Understanding the nature and implications of these fees is crucial for navigating legal recourse.

1. Types of Overdraft Fees

Bank overdraft fees can be categorized into several types:

Standard Overdraft Fees: Charged when transactions exceed the account balance.

Extended Overdraft Fees: Applied if the account remains overdrawn for an extended period.

Overdraft Protection Fees: Fees associated with linking accounts or credit lines to cover overdrafts.

2. Common Complaints About Overdraft Fees

Account holders often lodge complaints about:

Unclear Terms: Lack of transparency about how fees are charged.

Repeated Fees: Multiple fees for a single overdraft occurrence.

High Charges: Excessive fees compared to the transaction amount.

The Overdraft Fee Class Action Lawsuit

An overdraft fee class action lawsuit is a legal action taken by a group of individuals against a bank or financial institution. This type of lawsuit addresses grievances related to overdraft fees on behalf of multiple plaintiffs.

1. Grounds for a Class Action

The basis for an overdraft fee class action lawsuit often includes:

Unfair Practices: Allegations that the bank's practices related to overdraft fees are unfair or deceptive.

Violation of Regulations: Claims that the bank has violated banking regulations or consumer protection laws.

Misleading Disclosures: Accusations that the bank has not properly disclosed fee structures or policies.

2. Benefits of a Class Action Lawsuit

Collective Bargaining: Provides a platform for individuals to collectively challenge unfair practices.

Cost Efficiency: Reduces legal costs per plaintiff by sharing expenses.

Increased Leverage: Enhances the ability to negotiate settlements or pursue judicial remedies.

Filing an Overdraft Fee Lawsuit

An overdraft fee lawsuit involves several critical steps:

1. Evaluating the Case

Assess whether there is a valid claim based on:

Fee Structures: Reviewing the bank’s overdraft fee policies.

Legal Violations: Determining if there has been a breach of relevant laws or regulations.

2. Gathering Evidence

Collect necessary evidence, including:

Account Statements: Documentation of overdraft charges.

Communication Records: Any correspondence with the bank regarding overdraft fees.

3. Legal Representation

Engage a lawyer experienced in handling overdraft fee lawsuits to:

Provide Legal Advice: Offer guidance on the viability of the case and potential outcomes.

File the Lawsuit: Handle the legal paperwork and represent the plaintiff in court.

Understanding Bank Overdraft Fees Lawsuits

Bank overdraft fees lawsuits address various issues related to the fairness and legality of overdraft fees charged by banks. These lawsuits often seek to challenge the practices of financial institutions and may result in significant legal changes or settlements.

1. Key Legal Issues

Legal issues in bank overdraft fees lawsuits may include:

Fee Legality: Whether the fees comply with applicable laws and regulations.

Disclosure Practices: The adequacy of disclosures related to overdraft fees.

Contractual Terms: The fairness of the terms and conditions agreed upon by account holders.

2. Potential Outcomes

Outcomes of such lawsuits can vary, including:

Settlements: Financial compensation or changes to fee structures as part of a settlement agreement.

Court Rulings: Judicial rulings that may mandate changes in banking practices or provide compensation to affected individuals.

The Process of an Overdraft Class Action Lawsuit

An overdraft class action lawsuit follows a structured process:

1. Certification

The court must certify the class, which involves:

Commonality: Determining if the plaintiffs share common legal issues or facts.

Adequacy: Ensuring that the class representatives can adequately represent the group.

2. Discovery

During discovery, both parties exchange information, including:

Depositions: Testimonies from witnesses and experts.

Documents: Exchange of relevant documents and records.

3. Settlement or Trial

The case may end in:

Settlement: Negotiated agreements to resolve the lawsuit without going to trial.

Trial: A court trial where a judge or jury decides the outcome based on presented evidence.

Recent Developments in Overdraft Fee Litigation

Recent trends in overdraft fee class action lawsuits include:

1. Regulatory Changes

Increased Scrutiny: Regulatory agencies are paying closer attention to overdraft fees and practices.

New Regulations: Introduction of new laws or amendments to existing regulations to protect consumers.

2. Consumer Awareness

Educational Campaigns: Increased efforts to educate consumers about their rights and how to challenge unfair overdraft fees.

Advocacy Groups: Active involvement of consumer advocacy groups in raising awareness and supporting legal actions.

#overdraft fee class action lawsuit#bank overdraft fees#overdraft fee lawsuit#bank overdraft fees lawsuit#overdraft class action lawsuit

0 notes

Text

rehab day thirty eight

pj top I’ve been living in p much the whole time I’ve been in treatment (before all of the image peels off) and today’s quote from one of my home screen pinterest boards cos it’s very fitting

todays focus has been - radical honesty

and it’s a way that I want to continue to live and be because it’s so freeing and having faith in a higher power to guide me and trusting that I am where I am supposed to be right now doing what I’m meant to be doing and things will work out exactly how they are supposed to is so comforting and beautiful, I feel a real security in faith. I don’t know what I’m doing almost any time ever but I can find the answers that I need through meditation, prayer, fellowship meetings Buddhist teachings and the big book. That’s incredibly reassuring. Detaching from my ego and connecting to a higher power, being the best p version of myself that I am able to be by turning my will and actions over to the universe, collective consciousness and indiscriminate love. Feels amazing. Feels refreshing.

I shared in group therapy about last night, the change of perspective and renewed commitment to the program, sobriety and living a purposeful, fulfilling life. Recovery isn’t just quitting drugs, it’s working the program too.

I had a 1:1 with my counsellor who is aware of the situation between me and ☀️👶 and she’s strongly advised against it for fear that we will both relapse if things end, one of us falls off and drags the other down with them etc - she believes that the most loving thing to do would be to let him go and focus on his recovery. I believe that we can and will do this together, whether that be just as friends or if it develops to a relationship. Either way, we have a connection that I cannot deny and refuse to run from. I think the world of this man- he is beautiful, intelligent, hilarious, loving, supportive, committed to his recovery, honest about his thoughts and feelings and his presence is like pure light, I’m absolutely smitten and can speak to him about any and everything. I don’t want either of us to get hurt but we have promised that we will be honest with one another about where we’re at and how we’re feeling. I trust him. I trust myself. The majority of my 1:1 was spent debating this - but eventually we moved on to discuss extending again - there’s no more funding available to me and family can’t offer any more financial support, I am only just (as of today) out of my overdraft and can’t afford to go back into it so I’m heading home in 4 days (for real this time) and to be honest I feel ok about it, I’m looking forward to continuing on this journey and have found online addiction counselling and therapy that I am going to explore in more depth tomorrow. I’m going to go to yoga, painting classes, fellowship meeting, make new sober friends, get more involved in the Buddhist centre as I have wanted to do for so long and actually just start living again- without drugs, outside of that torturous cycle of addiction - really living. I’m going to miss life here but I will hold this experience close to my heart forever.

We had an impulsivity workshop in which we discussed various coping mechanisms and the importance of taking a step back before making decisions and really considering where they can/will take us, the consequences and impact before taking any action. Was incredibly helpful.

Saw and spoke to ☀️👶 at the end of the day, we had a big hug and another and another, he makes me feel full of light and magic. We spoke on the phone and he sent me some pictures and videos before he served up the dinner he had made for everyone (in his house, unfortunately we aren’t in the same one)

one of the counsellors came over to the house to discuss the creepy pervy man we live with and how to deal with that. He also acknowledged the romance in the air and said it’s “obvious” we have feelings for each other and has been apparent for weeks now - someone could’ve told me? I wish we’d started this journey together sooner and made the most of our time here together but everything happens for a reason whatever that may be.

Watched (most of) a horror film with the housemates then had an hour long phone call with ☀️👶 (from here on out he’s gonna be referred to as P because the emojis aren’t working for me ok cool) until my phone died mid call - called him back and had some over the phone sex lol I was so shy how do people do it sober?! watched him cum, listened to him moan and dirty talk, it was fit - now it’s gone midnight again and I’m exhausted goodnight x

#he also has the most massive dick I’ve ever seen like 4 or 5 of my hands and I can’t wait to get on it#but I admire him as a person before any of that#his hugs feel wonderful and his kisses are magical#I feel in my heart that this can and will be a wonderful thing#my ex has asked that I call him and we arrange to meet for a coffee#I said yes and I feel ok about it#that chapter is closed but I do still care deeply for him and it will be nice to catch up

0 notes

Text

Maximizing Benefits: Paying Monthly Bills with Your Credit Card

Digital convenience has changed monthly expense management. Credit cards are extensively used for bill payments because they simplify the payment process. Apart from ease, pay bills with credit card simplifies financial administration by consolidating payments into one transaction. It also lets people earn credit card incentives like cashback or points, turning everyday transactions into savings or future purchases. Credit cards for bill payments also reduce the need to share sensitive banking information frequently, making online transactions safer.

Protection Against Disputes and Billing Errors

Credit cards safeguard consumers from billing problems and disputes. If you have service provider concerns or discover fraudulent payments, credit card issuers allow you to challenge transactions and reverse charges during investigations. This protection can save time and effort compared to other payment options. Credit cards often have zero liability rules, protecting you from fraudulent transactions. Many issuers offer dedicated dispute support teams, making resolution easier. These protections give peace of mind and encourage credit card use for many transactions.

Financial Tracking and Spending Insights

Many credit cards include features and apps that can help you better understand your spending habits and financial patterns. Paying bills with a credit card lets you track expenses, categorize spending, and examine your budget. This enhanced visibility into your financial behavior can highlight areas where you might save or make adjustments. These systems also provide alerts for unusual activities to improve security and avoid fraud. They can also provide specific ideas and recommendations based on your spending habits, guiding you towards better financial management. Reviewing these findings often can improve your financial health and decision-making.

Utilizing Introductory Offers and Promotions

Credit cards with 0% APR offers on balance transfers or purchases can help consolidate debt or manage large expenses. Strategic bill payments can avoid interest and speed up debt repayment, depending on the card's terms. These incentives might also help you manage your budget and save for other necessities. These deals can help you pay off debt faster and enhance your credit score. You must also remember the promotion's expiration date to settle the balance before higher interest rates apply.

Managing Cash Flow and Timing

Paying your credit card bills allows you to successfully manage cash flow by choosing when to make payments within the billing cycle. This is especially useful if your income or expenses vary during the month. You can strategically manage finances by coordinating bill payments with cash inflows. This method prevents overdrafts and other unnecessary fees by maintaining sufficient funds for other financial responsibilities. It lets you use credit card issuer’s grace periods, which may lower interest rates over time.

Paying bills with a credit card offers more than convenience. Responsible use can boost your credit score by reducing credit utilization and showing consistent payment behavior. This strategy gives you greater financial flexibility to manage cash flow and defer payments to match your revenue plan. To optimize bill payments with a credit card, analyze your financial goals and choose a card that matches your spending. Automated payments and purchase protections simplify financial management. Keep an eye on fees and interest rates to maximize benefits without overspending. These tactics might help you use credit card bill payments to be financially stable and earn rewards.

0 notes

Text

This Credit Union Will Double The Money That Navy Federal Gives You : How To Join Jovia Credit Union

youtube

Introducing Hova Financial Credit Union: Your Ticket to Improved Credit and Funding

Hi there, Houston McMiller here, your friendly neighborhood Credit Specialist. Today, I'm excited to share with you a credit union that could be a game-changer for those of you who have struggled to get approved by Navy Federal or are simply looking for a better banking option.

Enter Hova Financial Credit Union:

Visa Advantage and Visa Signature: Hova Financial offers these popular credit card options without charging a balance transfer fee.

Secured Credit Card: This credit union also provides a secured credit card option, which can be a valuable tool for building credit.

Personal Loans: Hova Financial offers personal loans ranging from $250 to $50,000 with competitive interest rates and flexible repayment terms up to 60 months.

Overdraft Line of Credit: One of the standout features of Hova Financial is their overdraft line of credit, which can provide a valuable safety net for your finances.

The Advantage of Hova Financial's Vantage 4 Credit Scoring

What sets Hova Financial apart is their use of the Vantage 4 credit scoring model, which offers several benefits:

More Lenient Criteria: Vantage 4 does not count factors like evictions, medical bills, and judgments against your credit profile, giving you more leverage.

Expanded Reporting: Vantage 4 allows you to include authorized users, rental payments, subscription payments, and utility payments to boost your credit profile.

Business Financing Options with Hova Financial

Hova Financial also caters to the needs of small business owners:

Business Bank Accounts: The credit union offers business bank accounts to support your entrepreneurial endeavors.

Business Credit Cards: Hova Financial's business credit cards can provide up to $50,000 in funding, which is more than what is typically offered by Navy Federal.

Alternative Funding Options: Funo

For those of you who need funding but don't want to go through a credit check, consider exploring Funo, a merchant cash advance provider that offers up to $10,000 in funding. Funo's requirements are quite simple, focusing on proof of income rather than credit history.

If you're tired of missing out on opportunities due to lack of funding or credit, let's connect. Click the link in the description to schedule a one-on-one consultation, and let's work together to get you the funding you need to achieve your goals.

YouTube Source: https://www.youtube.com/watch?v=tb6jjQLIipI YouTube Channel: https://www.youtube.com/channel/UCwTiSgSSNPiNANoB2cREAAg Related Content: https://www.pinterest.com/pin/745416175854919814/ https://andrecarpetcleaning.blogspot.com/

0 notes

Text

Financial Instruments Against Which You Can Take a Loan - Abhi loans

When you're in need of financial assistance, there are various assets you can leverage to secure a loan. In this blog, we'll explore the financial instruments against which you can take a loan, providing you with options to access the funds you require.

1. Gold

One of the most common and accessible assets to secure a loan against is gold. Gold loans involve pledging your gold jewelry, coins, or bars as collateral in exchange for funds. Gold loans are known for their simplicity, quick processing, and high loan-to-value (LTV) ratios, making them an ideal choice for short-term financial needs.

2. Fixed Deposits (FDs)

Fixed deposits are a low-risk investment option offered by banks and financial institutions. You can take a loan against your fixed deposit account, using it as collateral. FD loans typically have lower interest rates compared to unsecured loans, and they allow you to access funds without breaking your fixed deposit.

3. Life Insurance Policies

If you have a life insurance policy with a cash value component, such as a whole life or universal life policy, you may be able to take a loan against the cash value. This type of loan is typically low-cost and allows you to access funds while keeping your policy intact.

4. Public Provident Fund (PPF)

PPF is a long-term savings scheme offered by the Indian government. After a specific lock-in period, you can take a loan against your PPF account. PPF loans are relatively easy to obtain, and they provide a cost-effective source of funds.

5. Mutual Funds

Mutual funds are a popular investment option for wealth creation. Some financial institutions offer loans against mutual funds, allowing you to leverage your investment portfolio without liquidating your holdings. The loan amount is typically a percentage of the mutual fund's net asset value (NAV).

6. National Savings Certificates (NSCs)

NSCs are government-backed savings instruments that offer competitive interest rates. You can use NSCs as collateral to secure a loan, providing you with access to funds while your NSCs continue to earn interest.

7. Shares and Stocks

If you own shares or stocks, you can pledge them as collateral to obtain a loan. This type of loan is known as a Loan Against Securities (LAS). LAS allows you to access funds without selling your shares, potentially benefiting from future stock price appreciation.

8. Recurring Deposits (RDs)

Similar to fixed deposits, you can also take a loan against your recurring deposit account. RD loans offer a quick and hassle-free way to access funds, and they don't require you to break your recurring deposit.

9. Employee Provident Fund (EPF)

If you're employed and have been contributing to the Employee Provident Fund (EPF), you may be eligible for a loan against your EPF balance. EPF loans are typically offered at favorable interest rates and can be a convenient source of funds during financial emergencies.

10. Bonds

Government bonds, corporate bonds, and debentures can also be used as collateral for loans. The loan amount is typically a percentage of the face value of the bonds. Bond loans may have competitive interest rates and can be a viable option for investors.

11. Fixed Maturity Plans (FMPs)

Fixed Maturity Plans are close-ended debt mutual funds with a fixed investment tenure. Some financial institutions offer loans against FMPs, allowing you to access funds while your investments mature.

12. Exchange-Traded Funds (ETFs)

ETFs are investment funds that are traded on stock exchanges, similar to stocks. Some lenders offer loans against ETF holdings, allowing you to leverage your ETF portfolio without selling your shares.

13. Savings Accounts

Certain banks offer overdraft facilities or personal loans against the balance in your savings account. This can be a convenient way to access funds without liquidating your investments.

Conclusion

Abhi Loans offers a wide range of loan options that use your existing financial instruments as collateral, including gold, fixed deposits, life insurance policies, and mutual funds. We help you make informed decisions by considering factors such as loan amount, interest rates, and repayment terms, ensuring that you choose the right solution to meet your financial goals and needs. Contact us today to unlock opportunities and get the most out of your financial assets.

0 notes

Text

How to arrange money quickly for short-term needs during emergency

Short-term finance can be a life saver during an emergency. It is important to know the ways in which one can access it. Here are the features and benefits of each.

Credit cards

Finance is available up to a pre-approved limit and outstanding amount can be converted into EMIs. This is a convenient option if repayments are made by due date. The interest is very high for delays.

Loan against securities (LAS) Investors can avail of short-term loans at lower interest rates compared to unsecured loans, if they hold marketable securities like shares, mutual funds, bonds or FDs. Peer-to-peer finance P2P lending platforms connect borrowers directly with individual lenders, providing competitive rates for those with good credit scores.

Short-term loans Banks and financial institutions offer short-term unsecured loans that have a quick application and approval process. Repayment tenures range from a few weeks to a few months. Typically, banks offer their accountholders pre-approved, hassle-free loans up to a pre-defined amount.

Overdraft facility Banks usually allow their current account-holders to withdraw more money than the available balance. This short-term credit line is ideal for temporary cash-flow gaps. Interest is charged only on the amount used, making it cost-effective.

Main Source:- https://economictimes.indiatimes.com/wealth/save/how-to-arrange-money-quickly-for-short-term-needs-during-emergency/articleshow/102671351.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Re-Post :- https://ciel.co.in/article/4435_How_to_arrange_money_quickly_for_short-term_needs_during_emergency.html

0 notes

Text

When you want to access funds while keeping your investments intact, a loan against securities offers a smart financial solution.

Rurash Financials has streamlined the disbursement process to provide a convenient and flexible overdraft facility.

Here's how it works:

We will set up an overdraft account with a personalised drawing limit tailored to your needs.

This limit hinges on the quality and quantity of the shares and securities you pledge to us. The great news is that you will continue to own these investments throughout the loan period. This means you can benefit from the potential dividends and income generated from these assets, which will be automatically reinvested to enhance your wealth.

The perks of this loan option are remarkable.

With an incredibly low-interest rate starting at 9%, you will enjoy cost-effective borrowing. Plus, your investments' value can continue to grow, ensuring ongoing appreciation. This strategy even opens the door to leveraging your existing portfolio to invest in higher-yield opportunities, further contributing to your financial growth.

Getting started is both easy and straightforward.

Within just 24 hours of setting up your account and pledging your securities, you can apply for an overdraft facility. And unlike traditional loans, you won't be tied to EMIs. Instead, you will pay interest on the amount borrowed each month, allowing more financial flexibility.

Our process is designed to be hassle-free.

There are no prepayment charges or lock-in periods, and you can switch pledged securities for other approved options from our extensive list of over 800 securities.

When comparing a Loan Against Securities to unsecured loans, the advantages become evident.

You can access funds while keeping your investment portfolio intact. Interest rates are significantly lower than unsecured loans and credit cards. Additionally, you will only need to service the interest, eliminating EMI payments.

For the application,

We require a few essential documents, including your photo ID, address proof, bank statements, securities proof, passport-size photographs, security cheques, and a statement of holding.

Loan Against Securities from Rurash Financials empowers you to fulfil your immediate financial needs while preserving your valuable investments. With its customised drawing limits, low-interest rates, and minimal hassle, this solution is tailored to meet your financial goals effectively.

To know more, connect with us today or write to [email protected]

#loan against securities#loan against shares#rurash financials#loan against securities eligibilty criteria

0 notes

Text

“Outlaws: The Good Thief” Podcast Debuts: Greece's Robin Hood

Stealing from the rich and giving to the poor is a meme that never grows old. Today, we simply have too much of the rich stealing from the poor, whether it's Ticketmaster's service fees or large banks overdraft fees, or even the cell phone companies and their "activation fee."

This newly-released, eight-part podcast should energize that "Robin Hood" gene in all of us.

Kaleidoscope, a New York-based podcasting company, and iHeartPodcasts have announced the launch of a new eight-part series today, Outlaws: The Good Thief, tells the thrilling true story of Vassilis Paleokostas, Greece’s modern-day Robin Hood who, over a twenty-year span orchestrated some of the country’s most inventive bank heists and escapes. Much like Robin Hood, Paleokostas became a national folk hero by positioning himself as a crusader against corruption in a time of great economic insecurity, and by sharing his spoils with the mountain folk he grew up with. To this day, he remains at large, having escaped not once but twice from Greece’s maximum security prison, Korydallos, by helicopter. Listeners can hear the first episode now, here.

This is the first season of Outlaws, another Kaleidoscope original anthology series following in the footsteps of “Obsessions,”and is voiced by Miles Gray, co-host of iHeartPodcasts’ “The Daily Zeitgeist” and “Mad Boosties.”

Through rare access to Paleokostas’ co-conspirators, his mentor, and several high ranking police officers and officials charged with hunting him down, this podcast will reveal how a poor kid from the mountains became one of Interpol's most wanted. Along the way, the show taps classmates, journalists, and even a former prime minister to understand the truth about Vassilis Paleokostas: Does the man measure up to the myth? Why does his legend have such a hold on his country? And most importantly, who is keeping his secrets?

Oz Woloshyn and Mangesh Hattikudur, Kaleidoscope’s co-founders, commented, “Vassilis Paleokostas is like a cross between a real life action hero and a philosopher. His bank robberies and escapes read like they belong on the silver screen. But he is also a socialist trying to fix a broken system. He’s like a cat burglar for the people, who also wants to get rich along the way!”

“We are proud to continue our collaboration with Kaleidoscope on their impressive slate of scripted podcasts,” said Will Pearson, President iHeartPodcasts. “‘The Good Thief’ is popcorn podcasting at its finest - incredibly cinematic and exciting storytelling that is perfect for summer and reason enough for getting lost in the magical world of Greece.”

“Outlaws: The Good Thief” is Kaleidoscope’s fifth series release with iHeartPodcasts following “Obsessions: Wild Chocolate,” “Skyline Drive,” “The Last Soviet” and “Silenced: The Radio Murders.”

Outlaws: The Good Thief will release a new episode every Wednesday, with the final episode dropping August 30, 2023.

Who knows? Vassilis Paleokostas may be living in your neighborhood, and can save you from your local Karen.

0 notes

Text

Reasons To Hire a Business Financial Advisor

Operating a business requires attention to detail and continuous change of strategies to experience growth. Raising the capital necessary becomes essential when one wants to expand and be at par with the closest competitors. Exploring all options and acquiring knowledge about debt & equity financing, in particular, is essential. These are two principal funding methods that work for businesses of every capacity. Choosing between them is not always a need, though. Instead, one can use both types of funding as required to take the business to the next level. It is important to know the meaning and purpose of both financial options and be knowledgeable about the necessity and the benefits associated with specific types of financing. Some of the things that have to be learned include the following:- Debt Financing This is a simple process of borrowing the required sum from a lender and injecting it into the business. The amount is repaid over time with interest and fees according to the terms & conditions. The interest rate may vary from time to time or remain fixed as decided by the lender. This type of funding can be of various forms, including:- · commercial mortgages · asset financing · business loans · working capital facilities, namely overdrafts & invoice finance The debt can be secured against an asset of the borrower or be unsecured as well. The lenders are most willing to provide the funding when it is secured by an asset. This reduces the risks for the lender. Equity Financing Selling a portion of the business equity to the lender in exchange for funding is known as equity financing. While this may seem problematic yet the borrower is pleased to see that it involves no repayment. The lender or the investor claims a business share instead. The accumulated profits from the equity share can enable the investor to recover the sum by selling shares. This process ensures a good ROI preferred by a majority of lenders. The question of choosing one over the other depends on several factors, including the business circumstances. There is no right or wrong type of funding, as both come with distinct pros and cons. Some of the reasons to opt for debt funding are:- · Get a reliable cash flow to further an existing business model · The business owner wants to be in charge · The obligations will be short-term, with the lender-borrower relationship terminating once the debt is repaid · The repayment sum is known in advance, causing the borrower to strategize and budget efficiently · People seeking equity financing find it beneficial for the following reasons:- · There is no asset to put up as collateral with the financial history being restrictive · There is no pressure to repay the loan · A greater sum can be raised from the equity that comes in handy for business expansion A business entity is free to use a combination of both debt and equity to obtain the required funding. It makes sense to make the right decision by consulting an experienced business financial advisor who is well aware of business complexities and can provide the best solution.

0 notes

Text

The Basic Guide to Taking a Loan against Shares

Selling out your shares or liquidating your assets is not the only option to cater to your urgent fund requirements. You may better deal with the situation by pledging your stock market investment against the funds you want to raise. And this concept of taking a loan is known as a loan against shares or a loan against securities.

Redeeming your equity shares in haste could lead to financial losses, and your investment efforts and plans may go in vain. If you are in the dilemma of how to raise instant funds against your stock market investments without liquidating them, here is all you need to know about loans against shares. But first, let us understand what a loan against shares or securities is.

A look into a loan against shares

A loan against shares is a type of loan against securities that gives borrowers the advantage of raising quick funds against their stock market investment. While taking such a loan, the borrower pledges his equity shares as collateral to a bank or financial institution. Loans against mutual funds, stocks, shares, and other financial securities work as overdraft facilities, allowing borrowers to pay interest only on the amount they have drawn. The process is quick and safe.

How it work?

The lender opens an OD account in your name and circulates the interest rate based on the amount you withdraw during the period of utilisation. You need not pay the interest on the entire amount. The best part is you get steady cash in your account after pledging your shares as collateral. Plus, you continue to acquire the benefits from your investment.

The loan size

The loan size is usually up to 50% of the value of the shares pledged. However, in some cases, the lender can consider giving you a higher amount, depending on the type of share.

The interest rates

Interest rates on loans against securities depend upon the type of securities pledged; and the type of loan applied, i.e., whether it is a term loan or an overdraft. For overdraft, the interest rate goes up to 16%. It is prudent to compare the interest rates of different institutions and negotiate for the best.

The loan tenure

The duration of a loan against stocks and shares generally range from 6 to 36 months. Borrowers may also choose to extend it by paying the interest of the previous amount or pledging more shares as collateral based on their requirements.

Charges & fees applicable

Some institutions levy certain charges, such as processing fees, foreclosure charges, pledging fees, etc., for loans against shares. Some lenders, including Abhi Loans, relieve you from the worry of pre-payment charges. They give you the freedom to pay at will. So, it is advisable to head to such a lender.

Where can you go to take a loan against shares?

If you are seeking a lender that offers low EMIs, instant approval, flexible amounts, and a paperless application process, there could be no better option than Abhi Loans.

The Process

The application process for a loan against shares is super easy. You need not hand around or visit multiple premises. You may even apply it online, as most financial institutions have a digital presence nowadays. And if you choose Abhi Loans as your lender, you may get the loan against shares in four easy steps, with disbursal in just 4 hours.

Documents required

Taking a loan against shares requires bare minimal documentation. You need to submit a PAN card, address proof (Aadhaar/Driving License/Passport/Voters Id), a passport-size photo, and bank proof.

This handy guide shows that taking a loan against shares is quick, safe, and straightforward. By keeping these points in mind, you will be able to make a better decision when applying for a loan against securities.

0 notes

Photo

More like buy now pain later, amirite?

Here are some of the ways BNPL isn’t just kinda shifty and gross, but verifiably predatory, empirically evil, and absolutely nothing new. (Coincidentally, Verifiably Predatory, Empirically Evil, and Absolutely Nothing New was the alternate title for our podcast.)

BNPL sneaks around regulatory agencies

Most forms of consumer lending in the United States are regulated by state and federal laws of one form or another. But the extent to which BNPL is regulated is kind of up in the air.

For example, the Truth In Lending Act (TILA) handles almost all traditional loans. Its purpose is to protect you against “inaccurate and unfair credit billing and credit card practices.”

Yet TILA only kicks in for loans of five installments or more. Remember how I said almost all buy now pay later loans are broken into four installments? Yeah. That’s intentional.

BNPL mostly operates just below the threshold of regulatory scrutiny. That way BNPL customers are left with little legal recourse to fight back against their shittier business practices. Which brings me to…

BNPL comes with exorbitant fees

On its surface, buy now pay later looks like a generous interest-free loan. But make one misstep and they’ll slap you with ALL THE FEES.

Late fees! Return payment fees! Missed payment fees! Account reactivation fees! Rescheduling fees! Prepayment penalty fees—is there no justice?!?! Some late fees are at least $20, and others charge an interest rate of 30% on late payments. Others offer long-term payment plans at 25% APR! Which really kind of negates the frugal benefits of buying now and paying later.

And lest you think it’ll be easy to avoid fees, Lending Tree found that 42% of all BNPL customers make at least one late payment… and are penalized accordingly.

But that’s not even where most of the buy now pay later apps get their profits.

BNPL is better for merchants than consumers

Buy now pay later apps make most of their money from charging merchants to include them on their checkout pages—a cost of 2-8% of customers’ purchases (for context, credit card companies charge a merchant fee of 1.3-3.5%). And retailers are happy to share a cut with BNPL apps! Because customers buy more when they use BNPL.

In addition, the retailer’s problem of “cart abandonment” (when you fill an online shopping cart then get spooked by the total price and just decide to buy nothing instead) is reduced with BNPL. It’s a devil’s bargain between vendors and BNPL apps to get people to buy more, spend more, and stop abandoning carts. Which leads me to…

BNPL makes you more likely to overspend and overdraft

Studies show people are easily seduced by smaller dollar amounts. Four payments of $25 each just looks cheaper than $100, y’know?

When you make multiple purchases with BNPL, it can be hard to keep all those payments straight. That’s why BNPL users are more likely to overspend, paying money they don’t have in their bank accounts, which leads to expensive bank overdraft fees. In fact, 70% of BNPL customers admitted they have spent more than they otherwise would if they paid for everything upfront.

Which sucks, but at least all these lil’ BNPL loans are helping to bulk up your credit score, right? … right?

BNPL is more likely to hurt your credit than help it

Far from helping you build credit, buy now pay later is actually more likely to hurt your credit score.

Recall our lesson on the recipe for a good credit score. Three of the ingredients are 1) a low utilization rate (don’t max out your credit card limit), 2) credit accounts that have aged like a fine wine (the older the better), and 3) not opening too many accounts too quickly.

Let’s say you make a $100 purchase with BNPL and pay it off over four months. To the credit reporting bureaus, that’s basically the equivalent of opening a credit card with a $100 limit, maxing it out immediately, and then canceling it four months later. And if you frequently use BNPL, the bean counters behind your credit score interpret that as you doing this credit-risky thing over and over again!

And you best believe the credit reporting bureaus know the instant you miss a payment.

Read more.

138 notes

·

View notes