#open banking in india

Explore tagged Tumblr posts

Text

#API Banking India#Connected Banking#bank api provider#banking api provider#banking api provider india#banking api providers india#banking api providers#api banking solutions company#banking api india#open banking api india#api banking india#open banking api providers#api banking solutions#open banking in india#api banking platform#api banking#api service provider#api banking services#open banking api#open banking api platform

0 notes

Text

How to Open a Bank Account in UAE from India in 2025

Discover how to open a UAE bank account from India with our step-by-step guide. Learn requirements, documents, account types, and expert tips for Indian nationals. Ensure a smooth application process with insights on eligibility, paperwork, and banking options tailored for expats and residents.

0 notes

Text

Explore UPI Transaction Limits: Find Out Your Maximum Transfer Capacity

UPI has grown in popularity throughout India, with over 250 million users. This extensive popularity reflects its ease of use and convenience, which has made it the favored payment method for numerous transactions. Whether paying for groceries, transferring funds, or paying bills, the seamless integration of the UPI money transfer app into daily life highlights its importance in modern financial operations. However, knowing the limits of UPI transactions can be important to managing your payments effectively. Curious about how much you can actually transfer? Stay here to learn the UPI transaction limits.

How Much Amount Can Be Transferred Through UPI?

When using UPI, it is important to know the transaction limits to manage your payments effectively. The NPCI has set a daily transaction limit of ₹1 lakh for UPI payments. However, this UPI limit can vary depending on the bank. Some banks may impose additional weekly or monthly caps on UPI transactions. The daily limit is the maximum amount you can send using UPI in a single day. The payment limits may also differ based on the type of transaction, whether it is a bill payment, merchant payment, or wallet transfer. Understanding these limits helps ensure that you stay within the permissible range for smooth and uninterrupted transactions.

Transaction Limit for Education and Healthcare

Excellent news for students, parents, and patients! The Reserve Bank of India has proposed significantly increasing the transaction limit for UPI payments to educational institutions and hospitals. This means you can now use UPI to make payments of up to Rs 5 lakh rather than the prior maximum of Rs 1 lakh. This feature intends to speed up larger transactions, making it easier to pay tuition, medical bills, and other major expenses via UPI. This approach is expected to significantly help those dealing with large payments in the education and healthcare sectors.

Benefits of Increased UPI Transaction Limits for Education and Healthcare

The increase in the UPI transaction limit to Rs 5 lakh is expected to significantly improve the convenience and ease of making payments for education and healthcare services. Here is how it benefits different stakeholders:

Students and Parents:

Better Higher Education Payments: Easily pay for higher education fees without the need for multiple transactions.

Large Payment Management: Handle large payments for boarding schools or tuition fees in one go, reducing hassle.

Increased Flexibility: Enjoy greater flexibility and convenience when managing various educational expenses.

Hospitals and Patients:

Efficient Handling of Medical Bills: Pay larger medical bills without the need for cash or breaking the payment into smaller transactions.

Smooth Emergency Payments: Make emergency payments quickly and efficiently during critical situations.

Enhanced Patient Experience: Improve the overall experience for patients by reducing payment-related stress and improving hospital efficiency.

Final Words Understanding UPI quick money transfer limits and using the increased cap for education and healthcare can greatly enhance your financial management. With the ability to make larger payments seamlessly, you can handle significant expenses more efficiently. Stay informed about these limits to ensure smooth, hassle-free transactions, and enjoy the benefits of greater flexibility in your daily financial activities.

#easy net banking app#account check karne wala app#instant fd account setup#online fd app#digital banking india#bank balance check karne wala app#quick fd account creation#bank best fixed deposit rates#open fd#upi transaction tracking#transfer payment mobile#quick fd account#best fd account interest rate#current fd rates#current fixed deposit rates#net banking money transfer#highest bank fixed deposit rates#upi transfer app#upi registration#create new upi id#upi money transfer app#upi money#rtgs money transfer app#upi create

0 notes

Text

Unlocking Convenience: The Power of Kotak Mobile Banking App in the Digital Banking Era

In the age of Digital India, banking has transcended traditional boundaries, offering unparalleled convenience and efficiency. Kotak Mahindra Bank stands at the forefront of this digital revolution with its innovative mobile banking app. Let's delve into the myriad benefits of the Kotak Mobile Banking App and how it's transforming the way we bank online.

Seamlessly Bank Online with Kotak Mobile Banking App

Gone are the days of long queues and paperwork. With the Kotak Mobile Banking App, banking becomes a seamless and hassle-free experience. Whether you're on the go or relaxing at home, access your accounts, pay bills, and manage transactions with just a few taps on your smartphone. Say hello to convenience as you embrace the power of digital banking at your fingertips.

Open Bank Account with Ease

The Kotak Mobile Banking App simplifies the process of opening a bank account, making it accessible to everyone. Say goodbye to cumbersome paperwork and lengthy procedures. With the app's intuitive interface, you can open a bank account in minutes, right from the comfort of your home. Experience the joy of instant account opening and step into the world of digital banking effortlessly.

Empowering UPI Payments with Kotak

Say hello to fast and secure payments with the Kotak Mobile Banking App's UPI payment feature. Whether you're splitting bills with friends or making online purchases, UPI payments offer unparalleled convenience. Link your bank account seamlessly, generate UPI IDs, and experience instant fund transfers like never before. With Kotak, sending and receiving money is as easy as a few taps on your smartphone.

Embracing Digital Banking with Kotak

The Kotak Mobile Banking App epitomizes the essence of digital banking in India. With its cutting-edge features and user-friendly interface, it caters to the diverse needs of modern-day consumers. From net banking functionalities to e-banking services, Kotak leaves no stone unturned in providing a comprehensive digital banking experience. Join the digital revolution with Kotak and embark on a journey of seamless banking.

Conclusion

In conclusion, the Kotak Mobile Banking App emerges as a beacon of convenience and efficiency in the realm of digital banking. With its robust features, secure transactions, and user-friendly interface, it redefines the way we bank online. From opening bank accounts to making UPI payments, Kotak empowers individuals to take control of their finances with ease. Embrace the future of banking with Kotak and unlock a world of possibilities at your fingertips.

Experience the convenience of Kotak Mobile Banking App—your gateway to digital banking in India.

#bank online#open bank account#upi payment app#net banking app#payment bank#mobile banking#digital india banking app#digital banking app#e banking#digital banking india#payment app

0 notes

Text

Excellent reasons to use the finance app

Everyone aspires to manage their money and expenses, but only some people succeed. For most of the people, it is a problematic thing. It is a fact that managing finances and controlling spending is a difficult task. Going from page to page or receipt to receipt to keep track of costs over a week or a month could not be more enjoyable. Some readers could claim that an Excel spreadsheet will enable them to complete the task. Some people may find it difficult to complete the work because only some are proficient in using spreadsheets and applying formulas to the columns. So, people have now decided to use the finance app because it does not require any formula to use its features. This post explains about the reasons to use the finance app:

Calculation will be on the fingers

You don't need to worry about the costs while using personal finance software because you can create your budget with just one click. It aids in budget optimization for expenses like food, rent for a home, utilities, transportation, loan EMI, and other necessities. You can easily keep track of your savings, credits, and debits.

Saving time

To conduct a transaction or see an account balance, one must frequently travel to a bank only during regular business hours. Everything may be done whenever a user thinks about it with the greatest financial app, and you don't have to travel anywhere. Making a deposit or an online payment can be done without standing in a long line at the bank.

Avoid Late Fees

Late fees ruin many people's lives. You occasionally forget to pay a bill, and other times, you need more cash to take care of specific costs before they are due. You will be charged a late fee whether it was your fault or not. If visiting the institution's customer service department to request a reduction in the late fee does not work, you can use a finance app to prevent late penalties in the future. So that you always remember to pay your bills, many apps can keep track of their due dates.

Stay organized

People are more likely to be organized and on top of personal money when they have the information to monitor their accounts daily. There is always no doubt regarding an account balance due to the precision of apps, which is almost real-time. Tracking all receipts and expenditures is easy and efficient.

You can enjoy a user-friendly interface

Modern technologies have made personal finance apps user-friendly. They provide an intuitive user interface that allows quick access to all pertinent financial data for personal and professional purposes. Additionally, various capabilities available in these personal finance apps can assist in ensuring financial transparency. They can complete activities like forecasting the cash flow for asset management and even filing a VAT return. The management of corporate affairs and the corresponding money depends on these operations.

Bottom line

Finally, those mentioned above are about the reasons to use the finance app. If you struggle to calculate your mutual fund, using a finance app will be a great option. It helps you manage all your financial activities without making any errors and these apps offer numerous benefits to improve your financial situation.

#finance app#instant personal loan#instant account opening bank#digital banking india#money transfer app#contactless banking#digital india banking app

0 notes

Text

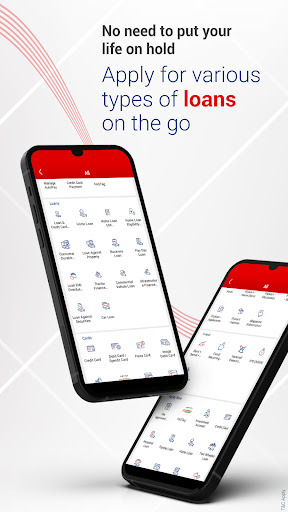

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Digital Savings account or an 811 digital bank account by visiting your nearest branch.

#digital savings account#online digital account opening#online digital bank account opening#digital account opening#digital banking india#digital banking#digital account

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

#best mobile banking app#banking app#mobile banking apps in india#free online bank account#account opening form online

1 note

·

View note

Text

How to Make Your Banking More Connected with API Banking India?

The banking and financial services industry in India has evolved at a staggering pace within a short duration of time. One of the trusted and innovative breakthroughs in the banking industry right now is API Banking. What is the impact of API Banking India on the delivery of banking services?

The banking industry has to adapt to the emerging requirements of consumers alongside fighting against their competition for success. Interestingly, APIs have provided the opportunity for open banking, which would provide more personalized and seamless banking across different platforms. Let us learn more about how API banking works and its role in promoting connected or seamless banking.

Definition of API Banking

Before you find out how API Banking encourages connected banking, it is important to learn the fundamentals of APIs in banking. APIs or Application Programming Interfaces can help third-party applications use a specific interface for accessing a general set of services and tools. Subsequently, multiple businesses or platforms could use banking services alongside offering the same services to their customers.

In 2016, the Reserve Bank of India launched the Unified Payments Interface or UPI. It served as a major tool for enhancing the popularity of banking APIs. As a matter of fact, some of the top banks in India offer a broad assortment of API banking services in different categories. Third-party organizations and platforms could explore multiple ways of using banking APIs to their advantage.

How Can APIs Enable Connected Banking?

The answer to the question points to the flexibility for serving customers who live away from the branch or the ones who prefer online banking. As the demand for online banking gains momentum, it is reasonable to believe that API Banking India will grow in the future. More people have been using financial technology applications in response to the global pandemic in 2020 and its aftermath. Banking API integration on fintech apps has emerged as a promising solution for accessibility of banking services. Businesses in the banking industry could connect with fintech businesses and use technical tools to improve accessibility of their services.

APIs could enable connected banking as API services provide access to core banking data. As a result, APIs could help in removing barriers between businesses and ensuring that all of them can access the same data. Another important highlight which proves the capability of API banking for creating connected customer experiences is the integration of legacy systems with API banking. For example, an organization could integrate ERP systems with API banking for direct management of cash payables and receivables through their ERP.

Is API Banking the Future?

The growing adoption of API banking is a sign of a major transformation in the banking industry. As the world of banking embraces new technologies, API banking provides an easy way for businesses to access banking services. With a simple API, businesses could leverage banking services alongside offering the same to their customers. As a result, customers would not rely on different payment gateways, and they could complete financial transactions directly on the platform. Call FidyPay at 6232082424 to learn more about API banking and find the ideal solutions for creating a new generation of seamless banking experiences.

#API Banking India#COnnected Banking#api banking services#api platform#banking api india#open banking api india#open banking api providers#api banking solutions#open banking in india#api service provider#open banking api#open banking api platform#api open banking

0 notes

Text

API platform in banking

Empowering financial evolution, fostering innovation, and enhancing operational efficiency through our banking API platform. Explore the future of banking tech today.

0 notes

Text

Kotak Mahindra Bank’s official mobile banking application for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

If you are an existing Kotak customer, you can use the 250+ features of the app to Bank, Pay bills, Invest, Shop and access services. One of our recent additions to the 250+ features is our new Pay Your Contact feature, where you can now send money to anyone using just their mobile Number

#credit card on upi#instant fd account setup#open fd online#fund transfer status#transfer payment bank#money transfer bank account#emi card to bank transfer#fd account#upi money transfer app#fixed deposit account#highest fd rates in bank#digital banking india

0 notes

Text

Why is digital banking the future?

The banking sector has changed significantly throughout the years due to the introduction of digital technologies. Since customers may now access banking services from anywhere and at any time, thanks to the growth of digital banking, the sector has become more effective and practical. Digital banking is on pace to become the industry norm due to the rapid development of digital technologies. You should make the best out of Digital Account Opening App today itself because digital banking is the future; the below points are justifications for the statement:

Banking on mobile

Customers now prefer to use their cell phones to make banking transactions, which has increased the popularity of mobile banking. Because it is so convenient and straightforward to use, mobile banking, with the help of theDigital Account Opening App, has gained popularity among many users. According to statistics, 1.75 billion people will use mobile banking by 2024. As mobile banking services gain popularity, banks that need to be more active in adopting them risk losing consumers.

Transactions without paper

Typical manual processes are expensive, cumbersome, and ineffective. Replace these internal systems with more productive paperless ones as part of an organization's digital transformation ambitions. In addition to being more effective, paperless transactions are also easier to manage. If you centralize your operations and preserve a digital record of every financial transaction, your processes will be considerably more effective and improve your record-keeping. Instead of employing a one-size-fits-all approach, services may be adapted to each customer's needs.

Automation

Creating a system where software intelligence performs routine and repetitive tasks, reducing the cost of human labor, is known as workflow automation. Organizations could streamline mundane processes by implementing a workflow management system, freeing resources for more crucial activities. This also frees up human resources and their limitations, allowing them to concentrate on higher-level strategic planning. This can result in a lower cost of service or larger margins for these businesses.

AI

The way traditional financial institutions operate internally and provide customer services is changing as AI-driven banking quickly establishes itself as the norm. As an illustration, AI-driven chatbots are now being utilized to provide customer care at banking branches, promptly responding to simple questions. Banks can use big data analytics to understand their clients' spending patterns better and provide tailored advice on products like investments or debt consolidation. AI algorithms also aid in automating some standard internal procedures, such as audit trails for fraud prevention and regulatory compliance. AI would become a dominant force in the banking sector by developing new business models and providing users with better user experiences and quicker decision-making capabilities.

A cloud service

Companies that provide financial services are beginning to shift their operations to the cloud in more significant numbers. More scalability is provided. As a result, they are making it easier to satisfy growing client demand. In addition, they are more secure and simpler to construct than present systems.

Bottom line:

It is the world of digitalization and technology; you are just living in it. Also, the Credit Card Apply App is available today; you can apply online and can, get access to it and can enjoy all the benefits it offers.

#online bank account opening app#open online bank account#apply online bank account#best mobile banking app#mobile banking apps in india

1 note

·

View note

Photo

And that’s not all! Mid-month cash crunch or an emergency? Get your salary in advance! Kotak Payday Loan is available with just a few taps. Repay the loan when your salary gets credited next month. Features of Payday Loan: • Get a loan within seconds starting at Rs.3,000 • Pay interest as low as Re.1 per day • Avail loan with no documentation Eligible users can apply from the ‘Apply Now’ section.

#Digital Account App#Bank Open Account Online#Online Open Bank Account App#Digital India Banking App#Online Digital Account Opening#Bank Account Check#Money Transfer#Banking App#kotak#kotka 811

1 note

·

View note

Note

I saw how you said that describing the PRC as capitalist betrays a lack of understanding of capitalism and I actually really liked how well you explained that being against capitalism isn't proper Marxism/communism so I was wondering if you could open that post on understanding capitalism a bit more! Only if you're okay with it, of course!

Eventually I should do a real proper Effortpost on this with all the graphs and figures to really drive home the point that I'm making, but very briefly since it's getting late here:

In Marx's time, capitalism was an emergent societal mode of production that was closely entertwined with the enclosure movement and the industrial revolution. On the level of labor, it saw the decline of peasant and artisan labor and the rise of proletarianization, and with it the tendencies of mechanization and rationalization of production (e.g. de-skilling of manufacturing and measurement of efficiency by the labor-hour)

On a consistent historical level, from Marx's time to ours, capitalism has been characterized by the role of liquidity holders (e.g. banks, joint stock companies, investment funds &c) in investigating growth industries and investing in them for the purpose of greater profit. Notably: the demand from financial actors for returns on their balance-sheets is constant, regardless of the state of the development in any given productive market. Meanwhile the nature of industrial development is that it happens in fits and starts, in great surging advances followed by relatively stagnant plateaus. The results of this mismatch are twofold:

First, as Lenin chronicled, it leads for a demand to engage in imperialist expansion to open new markets and seek new profits that way. The other, arguably larger and more important frontier however is that of speculation. Because the inflation of the value of an asset creates purchasing power in and of itself in the short term, which is maintained on balance sheets so long as the arrears on credit derived on it keeps getting paid on a notional path to amortizaiton.

The tendency in capitalism since Marx's time has been the ever-growing importance of these two dynamics and the gradual receding of the importance of low-elasticity economic activity like manufacturing goods.

The tendency of imperialist expansion within capitalism has created a networked global bourgeoisie throughout the financial capitals of the world who extract rentier profits from the various rural peripheries of the global south, and the speculative nature of investment capital in the late 20th and early 21st century defines the quality of the "capitalist develpment" we see in bourgeois states in the contemporary global south: namely, extremely uneven development between rural and urban, trapping of the labor force in a holding-pattern of low-pay low-skill work such as textile production or low-end manufacturing (e.g. Bangladesh and Malaysia) while their capitals enjoy wealth near that of the imperial core, with relatively very high-paying jobs in the knowledge industries (this should ring a bell with India lol). Any country that is actually ruled by its bourgeoisie will follow this pattern, because financialized paper profits are larger (in nominal terms) than the highly investment-intensive industrial development that has gone on in the PRC under the stewardship of the Party. However the result is that the PRC has relatively low inequality among middle-income countries and the technological benefits of the industrialization led by cities is beginning to flow to rural China, which is what allowed them to lift 800 million people out of extreme poverty, something that has yet to happen in actually capitalist bourgeis states like India.

148 notes

·

View notes

Text

Now that Ram Mandir has been opened can I honestly share what I feel? No, I'm not on the side of the extremist Hinduism nor am I on the leftists I just want to take a neutral stand here.

To everyone saying it's just a political agenda and Modi is using Ram mandir to appease the Hindu vote bank. Yes, and? I think we all (even the Hindus) know what game he's playing here. My house was conflicted yesterday. My mother and nani (grandma) were sobbing on finally getting Ram lalla's darshan yesterday on TV, my nanu (grandpa) wasn't supporting any of it. And I was torn. Torn between celebrating a historic moment and rationalizing whether it even deserved to be celebrated. His return deserved to be celebrated yes but the extreme Hindus who shower flowers with one hand and with the other hand throw stones on innocent Muslims of today who never took away our beloved Ram ji away in the first place. Would Ram ji have wanted this? He would've wanted us to celebrate yes but not at the cost of harming others. I condemn the acts of discrimination against the minor sects of society, everyone who's got to suffer because of this. In Mahabharata too, the minority (Pandavas) had to go through hell but they emerged victorious in the end coz they were right. However, I'd also like to state that it's not that simple here. People calling out Islamophobia, I'm with you. People calling out Hinduphobia, I'm ALSO with you. All lives matter no matter if they are Hindu or Muslim or Christian or Palestinian. "Hinduphobia doesn't exist" It does. Ofc not at the scale of the terrifying Islamophobia in India but it does. In other Islamic etc countries, it does. Just like how Islamophobia exists in countries where Islam folk are in minority. But does that give Hindus a license to endorse and impose themselves any more than the colonizers and invaders did? No.

You can't blame innocent Muslims for what Mughal invaders did centuries ago any more than you can blame Vibhishan for what his own brother Raavan did. But whoever is on the side of wrongdoing no matter their caste, creed or religion is just as much of a criminal like Karna was with Duryodhana even though he was a Pandava by birth.

Yk I've grown up in my remote, countryside hometown where they play azaan in mosques every day morning and evening and kid me since then became so used to it that it would feel like something is missing if I'd not hear it in the background somewhere while swinging around near the trees or while just walking on the terrace and watching the distant sunset. I'm a Hindu but well, that's just personal nostalgia.

Not all muslims are terrorists. Not all Hindus are fascists. But for those who are, I'd let Karma take care of you all.

I stand with humanity.

Jai Shri Ram 🙏

Allahu Akbar 🙏

#desiblr#desi#ram mandir#ayodhya#hinduism#hindublr#islam#islamophobia#hinduphobia#india#hindutva#desi culture#religion#desi aesthetic#desi tag#desi dark academia#desi girl#desi stuff#desi academia#just desi things

323 notes

·

View notes

Text

in the illustrious history of balrogballs making a joke on Tumblr and then writing a whole ass fic around it, from breakfast blowjob productions, comes a new instalment:

balrogballs joking about a Bollywood Silmarillion adaptation where the Fëanorians are South Asian coded and Elrond, due to his kidnap fam upbringing, has the FUNNIEST colonial hangover known to mankind…

… and then a month later working on a period-AU oneshot set 20 years after the fall of the British Raj, where Surrey-based Elrond returns to India for the first time since he and Elros - the lost children of two British colonial officers - had been taken away from the notorious freedom fighters who found them and raised them.

enjoy an excerpt!

When he and Elros were eight years old, Maglor Fëanorian had told him about the walls of the West. Well, he didn't tell him but Elros had read it in a diary Maedhros kept during his days as a student in London, because Elros was the kind of child who shamelessly used other people’s diaries as storybooks.

So that was where Elrond Peredhel read about the walls of the West. How the bitter water from their seas runs through all the rivers on earth, how high they can rise to keep out outsiders, how they flow from the heart of London and twirl out across the world like barbed wire, propelled by the sea. The walls of Maglor’s house in Kozhikode, Elrond used to think, must have been too high on the cliffside for the sea to reach. As pockmarked as they were, they had always welcomed him and Elros with open arms and a kiss.

On most weeks, when Maedhros got home from another Congress meeting or some revolutionary circle or the other (it goes without saying that none of Maedhros’ comrades knew that he and his brother had taken in not only two grey-eyed British children, but the grey-eyed British children of the sisterfucking chutiya Viceroy’s sisterfucking chutiya secretary), he would always bring them a bag of hot, roasted peanuts.

A bag each! A bag each, because Maedhros just knew things like that, just knew that twins treasured every little thing they didn’t have to share. Even nothing-things like bags of peanuts. On those nights, when Maedhros put down a cushion and sat against the wall, spine to stone, Elrond would lean into his carefully-guarded, coiled-tight body and fall asleep to songs about the walls of the west. They had been very young. They had been young enough to call Maedhros ‘Baba’ and Maglor ‘Abbajaan’, and persist until it meant something.

The house was near the sea. The house that once would have been breathed in, had the sea yawned: these days, it is enveloped by the petrol-diesel-tar of the apathetic Sand Banks Road. Elrond can, had he wanted to, walk to six phone shops, even though he only has one phone. He tries to be content with the knowledge that Kunjiraman Vakeel Palam still exists: that he has to cross it every day to get to his house. The house by the sea. The one in which he and Elros and Maedhros and Maglor had lived and loved with no expectation of being loved back. Two violent freedom-fighters, and the left-behind spawn of the sisterfucking chutiya Viceroy’s sisterfucking chutiya secretary. The setup to a bad joke, the bones of a little life, wrapped in the cloying, earthy red around the house. At some point, a slow, jagged cat had wandered in and never left. He was the thinnest, reddest cat the fourteen-year-old Elrond had ever seen, half an ear missing, and mean for the sake of being mean.

He and Elros had taken half a year to name it. Were you supposed to give an Indian cat an Indian name? It was Maglor who put his foot down in the end. He didn't think he could live with a cat called Ramachandran. That’s simply “too Orientalist, Elrond, even for you. Someone would probably beat you up in school if you and your grey eyes went around telling people you owned a cat named Ramachandran, and I am telling you now I will not just turn a blind eye to it, I will be personally sending sweets to the child’s house”.

So they named it Rusty, and Rusty it was to everyone except Maedhros, who called it nothing, because “a cat that runs away from small rats does not deserve a name.”

35 notes

·

View notes

Photo

The Temples of Pattadakal

The history of Pattadakal goes back to a time when it was called Kisuvolal, a valley of red soil. It even found a mention in Ptolemy's Geography in the 2nd century CE. Presently Pattadakal is located in the district of Bagalkot, state of Karnataka, India. The Chalukyas of Badami (ancient Vatapi) or Early Chalukyas (543-753 CE) built a large complex of temples for royal commemoration and coronation in Pattadakal. This complex is on the left bank of the Malaprabha River which runs further north to meet the river Krishna. It was accorded World Heritage Status by UNESCO in 1987.

Pattadakal literally means 'coronation stone' and bears testimony to the later phase of evolution of the distinctive Early Chalukyan architecture. The gestation phase of this development which took place in Aihole, Badami (the ancient capital), Alampur, and Mahakuta finds its culmination here. It is in the last few decades, during the successive reigns of Vijayaditya (696-733 CE), Vikramaditya II (733-746 CE) and Kirtivarman II (746-753 CE), that several temples were gradually constructed in this fertile valley. A Jain shrine was constructed much later, after the collapse of the empire by their successor Rashtrakuta Dynasty (8th-10th centuries CE) in the 9th century CE.

Temple Architecture

The basic plan of a temple runs thus: the garbha griha (sanctum sanctorum) opens to an antarala (vestibule) and houses the murti (enshrined image) on a pitha (pedestal). An expansive pillared mandapa (hall) adjoins the antarala. A shikhara (superstructure) rises on top of the garbha griha and contains an amalaka (a ribbed stone) with a kalash (pot with mango leaves and a coconut) at its finial. The vimana then comprises both the garbha griha and shikhara.

Temples built here are all dedicated to Shiva and face east. However, depiction of religious motifs through free-standing sculptures and reliefs is not limited to Shaivism but recruits images generously from the Hindu pantheon. Other than the nine Shaiva temples in the compound, there is one Jain temple located almost a kilometre to the west dedicated to the 23rd Tirthankar, Parsvanatha.

Continue reading...

20 notes

·

View notes