#opc registration in india

Explore tagged Tumblr posts

Text

#OPC registration in chennai#OPC registration in chennai online#Online OPC registration in chennai#OPC registration online in chennai#OPC registration in India#OPC registration in Tamilnadu#OPC registration

0 notes

Photo

(via A Complete Guide For Beginner On OPC Registration)

#Company Registration#Online Company Registration#OPC Registration#One Person Company Registration#Company Registration in India#OPC Registration in India

0 notes

Text

0 notes

Text

Understanding MOA and AOA in One Person Company: A Comprehensive Guide

In India, the concept of One Person Company Registration in India was introduced in 2013 under the Companies Act, 2013. OPC is a type of company where only one person is required to incorporate and manage the company, and it is ideal for small entrepreneurs and startups who wish to limit their liability but still want to enjoy the benefits of a company.

One of the crucial steps in setting up an OPC is to draft its Memorandum of Association (MOA) and Articles of Association (AOA). In this blog, we will understand what MOA and AOA are and their significance in the context of an OPC.

Memorandum of Association (MOA):

MOA is a legal document that contains the fundamental and essential details of a company, such as its name, objects, registered office, liability, and capital structure. It defines the scope of the company's activities and the rights and responsibilities of its members.

For an OPC, the MOA must state that the company is an OPC, and the name of the nominee director must also be mentioned in the MOA. The MOA must be signed by the sole member of the OPC, who shall also be deemed to be the first director of the company.

Articles of Association (AOA):

AOA is a document that outlines the internal rules and regulations of the company, such as the appointment and powers of directors, the conduct of meetings, the issue and transfer of shares, and the distribution of profits. AOA is an important document that governs the company's operations and protects the interests of its members.

For an OPC, the AOA must provide for the nomination of a person by the sole member, who shall, in the event of the member's death or incapacity to contract, become a member of the OPC. The AOA must also specify that the sole member of the OPC shall appoint a nominee director, and in case of death or incapacity of the sole member, the nominee director shall become a member of the OPC.

Benefits of MOA and AOA on One Person Company

MOA (Memorandum of Association) and AOA (Articles of Association) are important legal documents that are required to be prepared and filed with the Registrar of Companies (ROC) at the time of incorporation of a One Person Company (OPC) in India. Here are some of the benefits of MOA and AOA in OPC:

Legal protection: MOA and AOA provide legal protection to the OPC by defining its objectives and activities, as well as the rights and responsibilities of its stakeholders. They serve as the constitution of the company, and any action taken by the company must be in accordance with the provisions contained in these documents.

Clarity and transparency: MOA and AOA help in bringing clarity and transparency to the operations of the OPC. They define the powers and limitations of the company, the management, and the shareholders, thereby avoiding any confusion or conflicts that may arise later on.

Ease of doing business: Having MOA and AOA in place makes it easier to do business, as it provides a clear framework for decision-making and governance. It also helps in obtaining various licenses, registrations, and permits required for the business.

Liability protection: MOA and AOA provide liability protection to the shareholders of the OPC. The liability of the shareholders is limited to the extent of their investment in the company, and they cannot be held personally liable for any debts or liabilities of the company.

Flexibility: MOA and AOA can be amended as per the changing needs of the company. This provides the OPC with flexibility in its operations and allows it to adapt to changing market conditions.

In summary, MOA and AOA are important legal documents that provide clarity, transparency, liability protection, and flexibility to the OPC. They are essential for the smooth functioning and growth of the company.

Significance of MOA and AOA for OPC:

MOA (Memorandum of Association) and AOA (Articles of Association) are two important documents required for the registration of a One Person Company (OPC).

The Memorandum of Association outlines the scope of activities that the OPC can undertake. It defines the company's objectives, the range of activities it can engage in, and the capital it is authorized to raise. In short, MOA defines the company's mission and purpose and sets the limits within which it must operate.

On the other hand, the Articles of Association lay down the rules and regulations that the OPC will follow while conducting its business operations. It specifies the internal management of the company, including the powers and responsibilities of the directors and shareholders, the procedures for holding meetings, the process for appointing and removing directors, and the distribution of profits and dividends.

Both MOA and AOA are important legal documents that help to define the scope and structure of a One Person Company. They set out the company's objectives, its internal management structure, and the limitations on its activities. These documents play a crucial role in the smooth functioning of the company and in avoiding any legal disputes or conflicts in the future. Therefore, it is important to draft these documents carefully and ensure that they comply with all legal requirements.

Conclusion

In conclusion, MOA and AOA are essential documents that must be drafted and executed with utmost care and attention to detail to ensure the successful incorporation and operation of an OPC. It is advisable to seek the help of a professional to draft these documents to avoid any legal issues in the future.

#OPC#One person Company#OPC Registration#One Person Company Registration#OPC in India#OPC Consultant#OPC registration Online#OPC Registration in India

0 notes

Text

Documents Required For OPC Registration in India.

Thinking about incorporating a Company in India? Incorporating OPC in India requires careful planning and a bunch of key documentation. You must know what papers you’ll need to make it official. Here’s a simple guide to the important documents which are required forOPC registration in India:

1) Documents required for the Company’s Registered office address To prove where your company’s office is located when you incorporate it, or after incorporation of the company within 30 days, you need to submit the following documents:

a) In case the Premise is owned by either any one of the Directors/ proposed Directors of the Company or is owned by the Company itself

Electricity Bill in the name of Director(s)/ Proposed Director(s) of the company (in case the premises is owned by the director(s) proposed director(s) of the company. (or) Electricity Bill in the name of the Company (In case the premise is owned in the name of the company.)

2. A copy of the RoR (Record of Rights) in case demanded by the Registering Authority (CRC).

b) In case the Premise is neither owned by any of the directors or proposed directors of the Company nor is owned by the company itself (i.e., rented or leased),

A utility bill like Gas/Telephone/Electricity bill, should contain the name of the owner and the complete address of the premises.

A copy of the lease or rental agreement with the owner mentioned in the utility bill for the above-mentioned premises. Make sure it’s notarized and has your company’s name on it.

You need to obtain permission, like a No Objection Certificate (NOC), from the landlord, who is the individual identified on the utility bill or property documents, to grant consent for your company to use the premises as its office.

Note: Please note that all utility bills shall not be more than two months old as of the date of submission.

2) Documents required for promoters and nominees of the OPC

a) who are Indian nationals:

PAN card: A self-attested copy of the PAN card belonging to the proposed promoter and nominee of the one-person company is a necessary document for OPC registration. Ensure that the PAN card accurately displays the holder’s father’s name and date of birth.

Address proof: A self-attested copy of one of the following documents belonging to the proposed promoter and nominee of the one-person company is required for OPC registration.

Aadhaar Card

Driving Licence

Voter Identity Card

Passport (if any)

3. Residential Proof: Residential proof refers to the current address proof of the proposed promoter and nominee of the one-person company, which should not be more than 2 months old. A self-attested copy of one of the following documents belonging to the proposed promoter and nominee of the OPC is necessary for company registration.

Bank Statement

Electricity Bill

Telephone Bill

Mobile Bill

4. Passport Size Photograph: Two passport-size photographs of both the promoter and the nominee of the OPC are required for registration.

b) who are Non-Resident Indians (NRIs):

As per the Companies (Incorporation) Second Amendment Rules, 2021, w.e.f. 01–04–2021, only a natural person who is an Indian citizen (whether resident in India or otherwise) can establish an OPC in India. Companies or LLPs cannot create an OPC.

Here the term “Resident in India” denotes that the promoter must be a resident of India, meaning they should have lived in India for at least 120 days in the previous calendar year.

An individual holding Indian citizenship but residing outside India for an extended period due to employment, business, education, or other reasons is termed a Non-Resident Indian (NRI).

If a non-resident Indian (NRI) is proposed as a promoter of a one-person company incorporated in India, then He/She must provide the same documents required for Indian nationals, as listed above in this article.

Additionally, all documents should be duly notarized or apostilled in the country where the NRI is a resident.

Conclusion:

In conclusion, adherence to the documentation requirements outlined by the Companies Act, 2013 is paramount for smooth company registration processes. By meticulously furnishing the necessary documents, companies uphold legal standards and ensure transparency in their operations. Such compliance not only satisfies regulatory obligations but also reinforces the foundation for ethical and effective corporate governance, promoting accountability and strategic foresight within the organization.

Would you like to register a company in Bhubaneswar? Hurry up! Legal Terminus can provide valuable assistance in smoothly and efficiently handling the registration process. Our experts ensure a hassle-free and timely transition, helping you fulfill your legal and regulatory obligations effectively. Reach out to us now to take advantage of our expert services and free consultation.

#bhubaneswar#company registration#companyregistrationinbhubaneswar#company registration in india#opcregistrationinbhubaneswar#opc registration#opcregistrationinindia#opc

0 notes

Text

Certainly, here's information about the registration process for a One Person Company (OPC) in India:

One Person Company (OPC) Registration in India

A One Person Company (OPC) is a legal structure that allows a single individual to own and manage a business as a separate legal entity. It provides limited liability protection while maintaining the simplicity of a sole proprietorship. Here's a step-by-step guide to registering an OPC in India:

Step 1: Choose a Name for Your OPC

Choose a unique and meaningful name for your OPC. Ensure the name complies with the naming guidelines provided by the Ministry of Corporate Affairs (MCA). You can check the name's availability on the MCA website.

Step 2: Obtain Director Identification Number (DIN)

The sole member of the OPC needs to obtain a Director Identification Number (DIN). This can be done by filing Form DIR-3 online with the MCA.

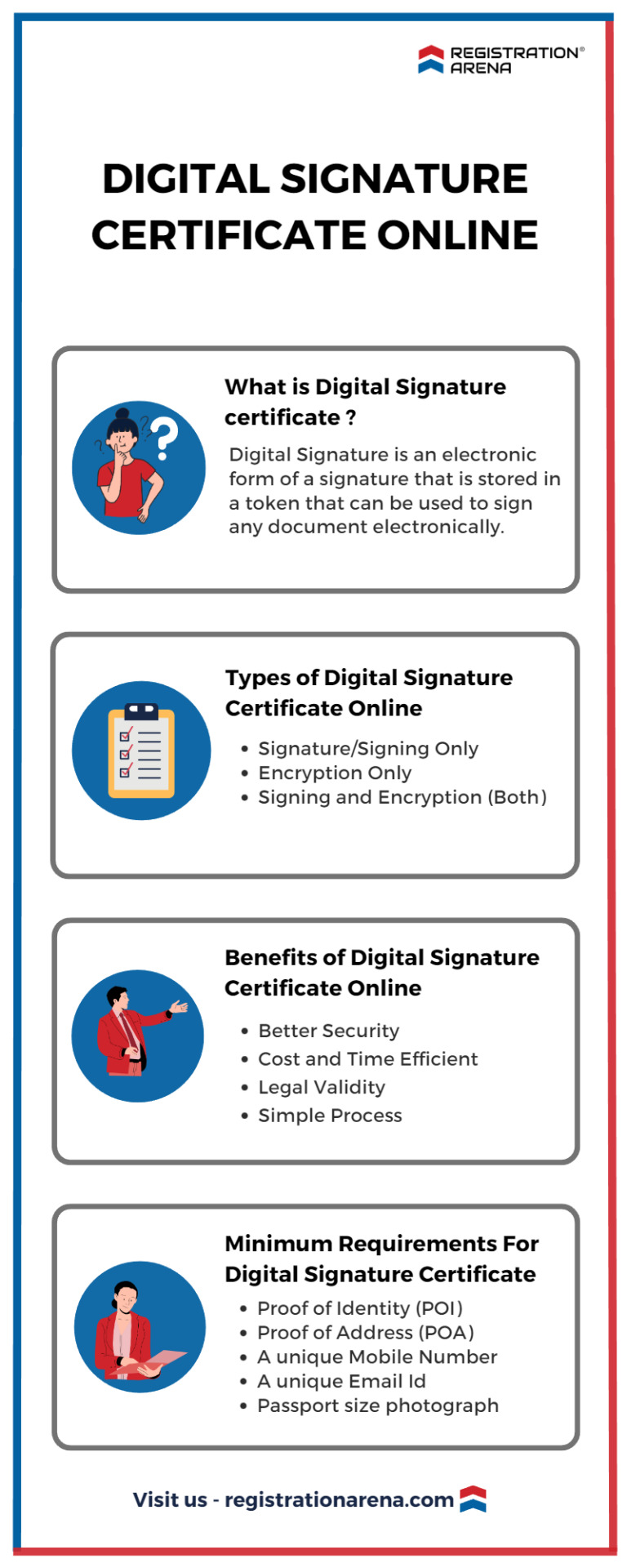

Step 3: Obtain Digital Signature Certificate (DSC)

Since the registration process is online, you need to obtain a Digital Signature Certificate (DSC) for the sole member. The DSC is required for digitally signing documents during the registration process.

Step 4: Prepare and File the Incorporation Documents

File the required documents with the Registrar of Companies (ROC) to incorporate your OPC. The key documents include:

Memorandum of Association (MoA): This document outlines the company's main objectives and business activities. Articles of Association (AoA): This document defines the internal rules and regulations governing the company's operations. Consent to Act as Director and Declaration: The sole member needs to provide their consent to act as a director of the OPC and make a declaration of compliance with the Companies Act. Step 5: Payment of Fees and Stamp Duty

Pay the necessary fees and stamp duty as per the prescribed rates. The fee amount varies based on the authorized capital of the OPC.

Step 6: Certificate of Incorporation

Once the ROC reviews and approves the documents, you will receive the Certificate of Incorporation. This document officially establishes your OPC as a separate legal entity.

Step 7: PAN and TAN Application

Apply for a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for your OPC. These are essential for tax-related purposes.

Step 8: Compliance Requirements

After incorporation, ensure you comply with annual filing and other statutory requirements, such as filing financial statements and annual returns.

Benefits of OPC Registration:

Limited Liability: The member's liability is limited to the extent of their investment in the company. Separate Legal Entity: The OPC has its own legal identity, distinct from the owner. Single Ownership: A single person can form and manage the company. Ease of Transfer: Shares can be transferred to another person, ensuring business continuity. Enhanced Credibility: An OPC enjoys greater credibility among suppliers, customers, and lenders.

Conclusion:

Registering a One Person Company in India is a streamlined process that offers the advantages of limited liability and separate legal identity while being managed by a single individual. It's recommended to seek professional assistance to navigate the legal requirements and ensure a smooth registration process.

#one person company registration in chennai#one person company registration#opc registration#opc registration in chennai#one person company registration in india#kanakkupillai#chennaifilings

0 notes

Link

To register a One Person Company (OPC) in India, follow these steps:

1. Obtain a Digital Signature Certificate (DSC) and Director Identification Number (DIN). 2. Choose a unique name for your OPC and reserve it with the Ministry of Corporate Affairs (MCA). 3. Prepare the necessary documents, including the Memorandum of Association (MOA) and Articles of Association (AOA). 4. File the incorporation documents and pay the required fees to the MCA. 5. Once approved, the ROC will issue a Certificate of Incorporation, and your OPC will be officially registered.

Legal Pillers can assist you throughout the entire OPC registration process, ensuring a smooth and hassle-free experience. Contact them for expert guidance and support.

#one person company registration#opc registration#opc company#opc registration process#one person company registration process#opc registration online#one person company in india

0 notes

Text

A DSC or ID is also referred to as a digital signature certificate online. To digitally sign official documents, the issuing authority must possess an active digital certificate. A digital certificate is issued by a certificate authority. Third-party certificate authorities offer the option to either purchase a DSC online or apply for a digital signature online. The risk of duplication or alteration of the signed document can be minimized by Digital signatures. DSC users are provided with a unique token password to authenticate, verify their identity and sign the respective document

#llp registration#private limited company registration#opc registration#startup india registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#digital signature certificate online#legal advisers#legal consultation#legal services

0 notes

Text

Are you confused about which company type suits your business plan the most? Here’s a complete guide to Company registration.

Reach us for Company Registration Online in India, We'll be more than happy to help you !

Auriga Accounting pvt.ltd

Auriga accounting always help for all type of business

Kindly Contact On +91-7982044611/+91-8700412557, [email protected] Or Visit Our Website :WWW.AURIGAACCOUNTING.IN

Company Registration

Nidhi Company Registration

Proprietorship Firm Registration

Partnership Registration

One Person Company ( OPC) Registration

Private Limited Registration

LLP Registration

Public Limited Registration

Section 8 Company Registration(NGO)

Producer Company Registration

Common Services

Shop Act Registration

Udyog Adhar ( MSME) Registration

Food License Registration

Income Tax Return ( Business )

Income Tax Return ( Salary)

GST Registration

ISO Certificate

Trademark Registration

Digital Signiture

ESI & PF Registration

12A & 80G Registration

Import Export Code Registration

Professional Tax Registration

Income Tax , GST Consultant , TDS And TCS Work, Import Export Consultant, Tax Audit, Company Registration, ROC Filing & Others Services.

#aurigaaccounting#auriga_accounting#companysecretary #registration #pvtltdcompany #entrepreneur #mca #trademark #trademarkedsetups #trademarks #importexport #company #corporate #incorporation #companyregistration #startup #startupindia #startupindiastandupindia #startups #startupindiahub #india #business

#Are you confused about which company type suits your business plan the most? Here’s a complete guide to Company registration.#Reach us for Company Registration Online in India#We'll be more than happy to help you !#Auriga Accounting pvt.ltd#Auriga accounting always help for all type of business#Kindly Contact On +91-7982044611/+91-8700412557#[email protected] Or Visit Our Website :WWW.AURIGAACCOUNTING.IN#Company Registration#Nidhi Company Registration#Proprietorship Firm Registration#Partnership Registration#One Person Company ( OPC) Registration#Private Limited Registration#LLP Registration#Public Limited Registration#Section 8 Company Registration(NGO)#Producer Company Registration#Common Services#Shop Act Registration#Udyog Adhar ( MSME) Registration#Food License Registration#Income Tax Return ( Business )#Income Tax Return ( Salary)#GST Registration#ISO Certificate#Trademark Registration#Digital Signiture#ESI & PF Registration#12A & 80G Registration#Import Export Code Registration

0 notes

Text

Company Formation by MASLLP: Your Partner in Starting a Business

Starting a company is an exciting venture, but the process can be complex and time-consuming. This is where professional guidance comes in handy. MASLLP offers expert company formation services, designed to streamline the process and ensure compliance with all legal requirements. Whether you are a local entrepreneur or an international business looking to establish a presence in India, MASLLP has the expertise to assist you at every step.

Why Choose MASLLP for Company Formation? Expertise in Legal Procedures MASLLP specializes in handling the intricate legal requirements involved in setting up a company. From filing necessary documents to obtaining essential licenses, MASLLP ensures that your business is established in compliance with India's regulatory framework.

Customized Solutions Every business has unique needs, and MASLLP tailors its services to meet your specific goals. Whether you're forming a private limited company, a public limited company, or a limited liability partnership (LLP), MASLLP provides guidance based on your business model and objectives.

End-to-End Support MASLLP offers comprehensive services from the initial consultation through to post-formation compliance. This includes drafting Memorandum of Association (MOA) and Articles of Association (AOA), securing digital signatures, and helping with PAN/TAN registration.

The Company Formation Process Setting up a company in India requires a series of steps that MASLLP manages efficiently:

Choosing the Right Structure The first step is determining the right business structure—Private Limited, LLP, or a One-Person Company (OPC). MASLLP provides advice on the best structure based on liability, tax, and regulatory requirements.

Name Approval MASLLP assists in selecting a suitable name for your business and ensures it complies with the Ministry of Corporate Affairs (MCA) guidelines.

Incorporation Documentation The legal team at MASLLP helps prepare and file all necessary documents, such as the Director Identification Number (DIN), Digital Signature Certificate (DSC), and incorporation forms with the MCA.

Post-Incorporation Compliance Once your company is established, MASLLP ensures you meet all post-incorporation compliance requirements, such as obtaining necessary licenses, registering for Goods and Services Tax (GST), and maintaining statutory records.

Benefits of Company Formation with MASLLP Time Efficiency: With MASLLP managing the paperwork, you can focus on growing your business rather than worrying about legal hurdles. Compliance Assurance: Ensures that your company is set up in full compliance with Indian law. Professional Expertise: MASLLP’s team of legal and financial experts guide you through every phase of company formation. Conclusion For entrepreneurs looking to establish a company in India, MASLLP offers a seamless, efficient, and expert-driven service. Their deep understanding of the legalities involved in company formation makes them the ideal partner for anyone looking to start a business. Whether you're a startup, an established business, or an international firm, MASLLP ensures your company formation process is smooth and compliant.

#accounting & bookkeeping services in india#businessregistration#audit#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

3 notes

·

View notes

Text

Company Incorporation Consultants in Delhi by SC Bhagat & Co.

Starting a new business in Delhi can be a rewarding venture, but it also comes with its own set of legal and administrative challenges. One of the critical steps in building your business is the incorporation process, which requires careful attention to various regulations. This is where professional assistance from SC Bhagat & Co., a leading company incorporation consultant in Delhi, becomes invaluable.

Why Choose Professional Company Incorporation Consultants? Incorporating a company involves several legal procedures, such as:

Selecting the correct business structure Filing the necessary paperwork with regulatory authorities Complying with tax laws Obtaining approvals and licenses The process can be complex and time-consuming for new entrepreneurs. SC Bhagat & Co. helps streamline this procedure, ensuring compliance with all legal requirements while minimizing delays.

Services Offered by SC Bhagat & Co. As one of the top company incorporation consultants in Delhi, SC Bhagat & Co. offers a range of services that cater to startups, small businesses, and large corporations. These include:

Business Structure Advisory Choosing the right business structure is crucial for long-term success. The firm provides guidance on various business entities, including:

Private Limited Company Limited Liability Partnership (LLP) One Person Company (OPC) Public Limited Company SC Bhagat & Co. ensures that you opt for the structure best suited to your business goals and tax advantages.

Registration Services From company name reservation to filing of incorporation documents, SC Bhagat & Co. handles the entire registration process. They assist with:

Drafting Memorandum and Articles of Association (MOA/AOA) Digital signature certificates (DSC) Director Identification Number (DIN) Filing with the Ministry of Corporate Affairs (MCA) Their comprehensive approach makes the process seamless and efficient.

Compliance and Taxation Support Once incorporated, companies are required to meet various compliance standards, including:

GST registration and filing Annual financial statements Regulatory audits SC Bhagat & Co. offers ongoing support to ensure your business stays compliant with both state and central laws, thus avoiding penalties and legal hurdles.

Legal Advisory and Licensing Navigating the legal landscape in India can be tricky. SC Bhagat & Co. also provides assistance in obtaining the necessary business licenses and permissions, such as:

Trade license Import-export code (IEC) Professional tax registration Why SC Bhagat & Co. Stands Out With years of experience in the field, SC Bhagat & Co. has become synonymous with trust and expertise in company incorporation consulting in Delhi. Here’s why they stand out:

Expert Team: Their team consists of highly qualified professionals, including chartered accountants and legal experts. Personalized Service: They tailor their services according to the specific needs of your business. Quick Turnaround: Their efficient processes ensure timely incorporation and compliance. Post-Incorporation Support: Even after your company is set up, SC Bhagat & Co. provides continuous support for your legal and financial needs. Conclusion Incorporating a company is a significant step in the journey of entrepreneurship. With the expert guidance of SC Bhagat & Co., you can rest assured that all legal and regulatory requirements will be handled efficiently, allowing you to focus on growing your business. If you're looking for reliable company incorporation consultants in Delhi, SC Bhagat & Co. should be your first choice.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

2 notes

·

View notes

Text

#OPC registration in Coimbatore#OPC registration in Coimbatore online#online OPC registration in Coimbatore#OPC registration in Tamilnadu#OPC registration in India#OPC registration#OPC registration Online in Coimbatore

0 notes

Text

A Beginner's Guide to OPC Registration

Are you ready to turn your entrepreneurial dream into reality as a solo founder? Registering a One Person Company (OPC) could be the perfect starting point for your business journey. OPCs provide a strong foundation for aspiring entrepreneurs by offering the advantages of limited liability and a separate legal identity. If you're new to OPC registration, fear not! This guide will walk you through the process step by step, making sure about a smooth and successful registration experience.

Process of OPC Registration Online

Understanding OPC: Before diving into the deep ocean of registration process, it's essential to understand the concept of OPCs. Unlike sole proprietorships, OPCs offer limited liability protection, that means that your personal assets are separate from your business liabilities. This structure provides credibility and security, which is essential for establishing trust with clients and partners.

Selecting a Unique Name: First of all, for OPC registration you have to select a unique name for your company. Make sure that your chosen name complies with naming guidelines and isn't already in use by another entity. Once you've decided a name for your company, reserve it via Ministry of Corporate Affairs (MCA) portal.

Obtaining Digital Signature and DIN: After that, you have to acquire a Digital Signature Certificate (DSC) and Director Identification Number (DIN), which are mandatory for OPC directors. These can be obtained online through the MCA portal by submitting all the necessary documents.

Document Preparation: Then, you should have to gather all the required documents, including address proof, identity proof, and proof of registered office, for OPC registration. Make sure that all documents are accurate and up to date to avoid any delays in the registration process.

Filing for OPC Registration: Once you have all the necessary documents in order, you can file for OPC registration via MCA portal. Submit all the required documents and pay the registration fee, then wait for verification.

Upon successful verification, you'll receive the Certificate of Incorporation, officially establishing your OPC. Congratulations! You're now ready to start your entrepreneurial journey confidently with OPC Registration Online, along with the benefits of limited liability and a solid legal foundation. Remember to fulfill all the ongoing compliance requirements and prepare your OPC for long-term success.

#Company Registration#Online Company Registration#Online Company Registration in India#Company Registration in India#One Person Company#OPC#OPC Registration#OPC Registration Online#OPC Registration Online in India

0 notes

Text

0 notes

Text

The Benefits and Requirements of Registering an OPC Company in India: Your Go-To Guide

Introduction to OPC Company in India

An individual can manage a corporation with limited liability by using the One Person corporation (OPC) unique corporate structure. The Companies Act of 2013 governs OPCs in India. This business form provides benefits similar to a private limited company while easing the burden of compliance for small entrepreneurs. If you are considering starting your own business in India, registering an OPC could be a suitable option for you.

Benefits of Registering an OPC Company

There are several advantages to registering an OPC in India. Firstly, as the sole owner of the company, you enjoy limited liability protection. This means that your assets are separate from the business liabilities, safeguarding your wealth in case of any financial distress faced by the company. The ease of having a distinct legal entity—which enables the business to hold assets, sign contracts, and file or defend legal actions under its name—is another benefit of an OPC.

Another significant benefit is that OPCs have perpetual succession, meaning the company continues to exist even in the event of the owner's death. This ensures a smooth transition of assets and ownership, avoiding any disruption to the business. Furthermore, an OPC enjoys greater credibility among suppliers, customers, and financial institutions, enhancing business opportunities and access to funding.

Requirements for OPC Company Registration in India

To register an OPC in India, certain requirements must be fulfilled. Firstly, only a natural person who is an Indian citizen and resident can form an OPC. This means that foreign nationals and non-residents are not eligible to register an OPC. Additionally, an individual can only incorporate one OPC at a time. If an individual already has an OPC, they cannot be a nominee or director in another OPC.

The minimum capital requirement for an OPC is INR 1 lakh. This capital can be self-funded by the owner or contributed by external sources. The owner must also appoint a nominee who will take over the affairs of the company in case of the owner's death or inability to carry out the responsibilities. The candidate had to be a resident and citizen of India. Lastly, an OPC is required to maintain proper books of accounts and get them audited annually, irrespective of turnover.

Step-by-Step Guide for OPC Company Registration

Obtain a Digital Signature Certificate (DSC): The first step is to obtain a DSC for the proposed director and nominee. This is required for online filing of documents with the Ministry of Corporate Affairs (MCA).

Obtain Director Identification Number (DIN): Both the owner and nominee need to apply for DIN, which is a unique identification number for directors. The MCA site allows for online completion of this task.

Name Approval: Choose a unique name for your OPC and submit it for approval to the MCA. The name should comply with the naming guidelines prescribed by the MCA.

Prepare and File Incorporation Documents: Once the name is approved, prepare the incorporation documents including Memorandum of Association (MOA) and Articles of Association (AOA). These documents outline the objectives and rules of the company. File these documents along with the required forms and fees on the MCA portal.

PAN and TAN Application: After the incorporation documents are approved, apply for a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for your OPC. These are required for tax compliance.

Obtain Certificate of Incorporation: Upon successful verification of documents, the MCA will issue the Certificate of Incorporation, officially recognizing your OPC as a registered company.

Bank Account and GST Registration: Open a bank account in the name of your OPC and register for Goods and Services Tax (GST) if applicable for your business.

Documents Required for OPC Company Registration

To register an OPC in India, the following documents are required

Identity proof of the owner and nominee (Aadhaar card, passport, or voter ID)

Address proof of the owner and nominee (bank statement, electricity bill, or telephone bill)

Passport-sized photographs of the owner and nominee

Proof of ownership or lease agreement for the registered office address

NOC from the building's registered office owner

Memorandum of Association (MOA) and Articles of Association (AOA)

Duly filled and signed forms for DIN and DSC

Choosing a Suitable Name for Your OPC Company

Choosing a suitable name for your OPC is crucial as it represents your brand and identity. The name should be unique, easy to remember, and not violate any existing trademarks or copyrights. It is advisable to conduct a thorough search on the MCA portal to ensure the availability of the desired name. Additionally, the name should comply with the naming guidelines provided by the MCA, such as avoiding any offensive or misleading terms.

Role of an OPC Registration Consultant

Registering an OPC involves several legal and procedural requirements. Engaging an OPC registration consultant can simplify the process and ensure compliance with the applicable laws. A consultant can assist in obtaining DSC and DIN, preparing the necessary documents, filing them with the MCA, and guiding you through the entire registration process. Additionally, they can provide valuable advice on structuring the company, tax planning, and ongoing compliance requirements.

Important Points to Consider Before Registering an OPC Company

Before proceeding with OPC company registration, it is important to consider the following points:

Understand the responsibilities and obligations of a director of an OPC.

Evaluate the financial viability and sustainability of your business idea.

Research and analyze the market potential and competition for your product or service.

Develop a comprehensive business plan outlining the objectives, strategies, and financial projections.

Familiarize yourself with the ongoing compliance requirements and tax obligations for OPCs.

Comparison between OPC and Other Types of Companies

OPCs have certain unique features that distinguish them from other types of companies. Unlike sole proprietorship, OPCs offer limited liability protection, ensuring the personal assets of the owner are safeguarded. Compared to partnerships, OPCs provide a separate legal entity, allowing the company to enter into contracts and own property in its name. When compared to private limited companies, OPCs have fewer compliance requirements and are more suitable for small entrepreneurs.

Conclusion: Is OPC Company Registration Right for You?

Registering an OPC in India offers numerous benefits and provides a favorable business structure for small entrepreneurs. The limited liability protection, perpetual succession, and separate legal entity status make OPCs an attractive option for those looking to start their own business with reduced compliance burdens. However, it is essential to carefully evaluate your business idea, consider the requirements and obligations, and seek professional advice before proceeding with OPC company registration. With proper planning and guidance, an OPC can be a stepping stone to entrepreneurial success in India.

#opc registration#OPC#One person company#registration#company#company registration india#company formation#Startups#Entrepreneurship#SmallBusiness#LegalAdvice#BusinessRegistration#LegalConsultation#StartupAdvice#BusinessDevelopment#OPCRegistration

0 notes

Text

Comprehensive Guide to One Person Company (OPC) Registration in India | Legal Terminus

Before the Companies Act of 2013 came into force, starting a company alone by an individual wasn’t an option. People had to go for sole proprietorship because setting up a company needed at least two directors and members. For a Private Company, you needed 2 Directors and 2 Members, and for a Public Company, it was 3 Directors and 7 Members. So, if you were alone, you couldn’t start a Company.

But when the Companies Act 2013 came into force, it introduced something new: One Person Company (OPC). An OPC is simply a company started and managed by one person. It gets the benefits of being a company, like staying in business forever, having limited liability, and being its own legal person. Now, with just 1 Director and 1 member (who can be the same person), an individual can form a company. This way is easier in terms of following rules compared to a private company. So basically, an OPC allows a single individual, whether residing in India or abroad, to start a business that combines the benefits of a company with the simplicity of a sole proprietorship.

Eligibility Criteria for Registering a One Person Company (OPC)

Before registering a One-Person company (OPC), it’s important to understand the eligibility criteria and limitations set by the Companies Act. Here are the key requirements:

Natural Person and Indian Citizen: Only a natural person who is an Indian citizen (whether resident in India or otherwise) can establish an OPC in India. Companies or LLPs cannot create an OPC.

Resident in India: The promoter must be a resident of India, meaning they should have lived in India for at least 120 days in the previous calendar year.

Minimum Authorized Capital: There is no minimum authorized and paid-up capital requirement.

Note: Additionally, an individual can establish only one OPC, and an OPC cannot have a minor as a member.

Legal Provision

Nominee Appointment: The promoter must appoint a nominee when incorporating the OPC. This nominee will become a member of the OPC if the promoter dies or becomes incapacitated.

Restrictions on Certain Businesses: OPCs cannot be involved in financial activities such as banking, insurance, or investments.

Advantages of OPC Registration

An OPC is a company started and managed by a single person. It enjoys the benefits of a company, such as perpetual existence, limited liability, and a separate legal identity. With just one director and one member (who can be the same person), an individual can form a company. This approach is simpler in terms of compliance compared to a private company. Following are the benefits/advantages of OPC.

1. Limited Liability: One of the main advantages of registering an OPC is the limited liability protection it offers. This ensures that the owner’s personal assets are protected in case of business losses or legal issues.

2. Single Ownership: An OPC is owned and managed by a single individual, giving complete autonomy and control over business decisions without needing external partners or shareholders.

3. Separate Legal Entity: As like a private limited company an OPC becomes a separate legal entity distinct from its owner after registration. This separation makes it easier to access funding, enter contracts, and seize business opportunities.

4. Perpetual Existence: OPCs also enjoy perpetual succession, meaning that the death or incapacitation of the owner does not affect the continuity of the company. In such cases, the nominee becomes the member of the company. This feature ensures stability and longevity for the business.

5. Minimal Compliance Requirements: Compared to other business structures, OPCs have relatively fewer compliance obligations, making them ideal for small-scale entrepreneurs who prefer simplicity and flexibility.

Disadvantages Of OPC

Single Point of Failure: The reliance on a single individual for management and decision-making can be risky if that person becomes unavailable or incapable.

Restriction on Business Activities: OPCs cannot engage in certain financial activities, such as banking and insurance, and it cannot be converted to a company with charitable objects mentioned under Section 8 of the Companies Act, 2013.

Limited Growth Potential: An OPC can have only one member, limiting its ability to raise capital and expand.

Registration process for an OPC:

Decide a Unique Name for your OPC:

Choosing a unique name for your One Person Company (OPC) is a crucial step in defining your brand identity. You can also read the following naming guidelines for more information.

1-Names which resemble too closely the name of an existing company — Rule-8;

2-Undesirable names — Rule 8A;

3-Word or expressions which can be used only after obtaining previous approval of the Central Government.- Rule 8B;

Please note that your proposed name should not fall under the above categories. This step is important because it helps ensure your name is available for registration. Once you’ve picked your company name, you can apply for name approval through the SPICe+ Part-A RUN (Reserve Unique Name) service on the MCA portal.

Legal Terminus offers comprehensive name search services to help you find the perfect name for your company.

To complete the incorporation process for your One Person Company (OPC), file the application along with the necessary documents, including Form SPICe Part-B (Simplified Proforma for Incorporating Company Electronically), SPICe-MoA, SPICe-AoA, SPICe-INC-9, and AGILE-PRO-S. Ensure to include the requisite fees. Submit these documents electronically, along with the requisite fees, through the MCA portal for verification and approval.

Conclusion:

Setting up a One Person Company (OPC) comes with many benefits, like limited liability, being your own boss, and having a separate legal identity. Though there are some rules to follow and paperwork to handle, getting registered is not too complicated. By going through the registration process step by step and making sure you follow the law, you can start your business on the right foot. With hard work and a drive for success, OPCs can do really well and add value to India’s business scene. Remember to seek professional guidance if needed and comply with all legal requirements to ensure a seamless registration process. With determination and perseverance, you can turn your business idea into a reality and contribute to the vibrant entrepreneurial ecosystem of India.

Would you like to register a One Person Company (OPC)? Hurry up! Legal Terminus can provide valuable assistance in smoothly and efficiently handling the registration process. Our experts ensure a hassle-free and timely transition, helping you fulfill your legal and regulatory obligations effectively. Reach out to us now to take advantage of our expert services and free consultation.

#bhubaneswar#company registration#companyregistrationinbhubaneswar#company registration in india#india#opc#opc registration#opcregistrationinindia#opcregistrationinbhubaneswar#onepersoncompany

0 notes