#OPC Consultant

Explore tagged Tumblr posts

Text

Understanding MOA and AOA in One Person Company: A Comprehensive Guide

In India, the concept of One Person Company Registration in India was introduced in 2013 under the Companies Act, 2013. OPC is a type of company where only one person is required to incorporate and manage the company, and it is ideal for small entrepreneurs and startups who wish to limit their liability but still want to enjoy the benefits of a company.

One of the crucial steps in setting up an OPC is to draft its Memorandum of Association (MOA) and Articles of Association (AOA). In this blog, we will understand what MOA and AOA are and their significance in the context of an OPC.

Memorandum of Association (MOA):

MOA is a legal document that contains the fundamental and essential details of a company, such as its name, objects, registered office, liability, and capital structure. It defines the scope of the company's activities and the rights and responsibilities of its members.

For an OPC, the MOA must state that the company is an OPC, and the name of the nominee director must also be mentioned in the MOA. The MOA must be signed by the sole member of the OPC, who shall also be deemed to be the first director of the company.

Articles of Association (AOA):

AOA is a document that outlines the internal rules and regulations of the company, such as the appointment and powers of directors, the conduct of meetings, the issue and transfer of shares, and the distribution of profits. AOA is an important document that governs the company's operations and protects the interests of its members.

For an OPC, the AOA must provide for the nomination of a person by the sole member, who shall, in the event of the member's death or incapacity to contract, become a member of the OPC. The AOA must also specify that the sole member of the OPC shall appoint a nominee director, and in case of death or incapacity of the sole member, the nominee director shall become a member of the OPC.

Benefits of MOA and AOA on One Person Company

MOA (Memorandum of Association) and AOA (Articles of Association) are important legal documents that are required to be prepared and filed with the Registrar of Companies (ROC) at the time of incorporation of a One Person Company (OPC) in India. Here are some of the benefits of MOA and AOA in OPC:

Legal protection: MOA and AOA provide legal protection to the OPC by defining its objectives and activities, as well as the rights and responsibilities of its stakeholders. They serve as the constitution of the company, and any action taken by the company must be in accordance with the provisions contained in these documents.

Clarity and transparency: MOA and AOA help in bringing clarity and transparency to the operations of the OPC. They define the powers and limitations of the company, the management, and the shareholders, thereby avoiding any confusion or conflicts that may arise later on.

Ease of doing business: Having MOA and AOA in place makes it easier to do business, as it provides a clear framework for decision-making and governance. It also helps in obtaining various licenses, registrations, and permits required for the business.

Liability protection: MOA and AOA provide liability protection to the shareholders of the OPC. The liability of the shareholders is limited to the extent of their investment in the company, and they cannot be held personally liable for any debts or liabilities of the company.

Flexibility: MOA and AOA can be amended as per the changing needs of the company. This provides the OPC with flexibility in its operations and allows it to adapt to changing market conditions.

In summary, MOA and AOA are important legal documents that provide clarity, transparency, liability protection, and flexibility to the OPC. They are essential for the smooth functioning and growth of the company.

Significance of MOA and AOA for OPC:

MOA (Memorandum of Association) and AOA (Articles of Association) are two important documents required for the registration of a One Person Company (OPC).

The Memorandum of Association outlines the scope of activities that the OPC can undertake. It defines the company's objectives, the range of activities it can engage in, and the capital it is authorized to raise. In short, MOA defines the company's mission and purpose and sets the limits within which it must operate.

On the other hand, the Articles of Association lay down the rules and regulations that the OPC will follow while conducting its business operations. It specifies the internal management of the company, including the powers and responsibilities of the directors and shareholders, the procedures for holding meetings, the process for appointing and removing directors, and the distribution of profits and dividends.

Both MOA and AOA are important legal documents that help to define the scope and structure of a One Person Company. They set out the company's objectives, its internal management structure, and the limitations on its activities. These documents play a crucial role in the smooth functioning of the company and in avoiding any legal disputes or conflicts in the future. Therefore, it is important to draft these documents carefully and ensure that they comply with all legal requirements.

Conclusion

In conclusion, MOA and AOA are essential documents that must be drafted and executed with utmost care and attention to detail to ensure the successful incorporation and operation of an OPC. It is advisable to seek the help of a professional to draft these documents to avoid any legal issues in the future.

#OPC#One person Company#OPC Registration#One Person Company Registration#OPC in India#OPC Consultant#OPC registration Online#OPC Registration in India

0 notes

Text

Process of closing an LLP in India

The Limited Liability Partnership (LLP) is a trendy type of business entity, established in 2008 by the Limited Liability Partnership Act, that integrates the features of a company and a partnership. In earlier articles, we discussed the documents mandated for LLP registration and the registration process itself.

This article aims to assist you with the procedure for closing an LLP in India.

Although LLPs offer several benefits over other kinds of business entities, such as ease of incorporation and limited liability for members, these advantages do not necessarily translate into flourishing business operations. This article will explain the Strike Off method of closure and provide an overview of other closure options.

The process to close a Limited Liability Partnership

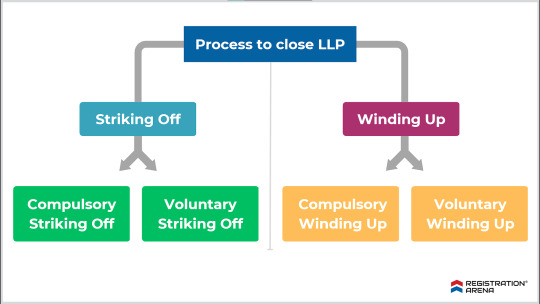

An LLP can be closed in two ways:

1. Strike-off method-

a. Voluntary Strike Off

The LLP should not have been engaged in commercial activities for a period of at least one year.

The LLP must file an application in Form 24 LLP with the Registrar of LLPs to apply for voluntary strike-off status.

The LLP should have completed all compliance requirements by the date of filing for closure. However, it is only required to file annual returns until the end of the year when commercial activities are discontinued.

The LLP must have obtained the approval of all parties involved, including members, creditors, and any regulatory authorities under whose domain the LLP works.

The LLP should not have any assets or liabilities as of the date of preparation of financial statements.

The process to close LLP through Strike Off method

In order to move forward with the Strike Off process, the LLP must follow the steps outlined below:

The LLP must plan a meeting of all partners to pass a resolution to strike off the name.

The LLP must pay all outstanding debts and liabilities before proceeding with the Strike Off process.

The meeting of partners must permit a designated partner to file the application for Strike Off.

The designated partner must file an application in e-Form 24 and submit it to the Registrar. The application must have the approval of all members.

Read more to know about the Procedure of Closing LLP in India

#closure of llp#llp registration#private limited company registration#opc registration#nidhi company registration#startup registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#legal services#legal consultation

0 notes

Text

Company Formation by MASLLP: Your Partner in Starting a Business

Starting a company is an exciting venture, but the process can be complex and time-consuming. This is where professional guidance comes in handy. MASLLP offers expert company formation services, designed to streamline the process and ensure compliance with all legal requirements. Whether you are a local entrepreneur or an international business looking to establish a presence in India, MASLLP has the expertise to assist you at every step.

Why Choose MASLLP for Company Formation? Expertise in Legal Procedures MASLLP specializes in handling the intricate legal requirements involved in setting up a company. From filing necessary documents to obtaining essential licenses, MASLLP ensures that your business is established in compliance with India's regulatory framework.

Customized Solutions Every business has unique needs, and MASLLP tailors its services to meet your specific goals. Whether you're forming a private limited company, a public limited company, or a limited liability partnership (LLP), MASLLP provides guidance based on your business model and objectives.

End-to-End Support MASLLP offers comprehensive services from the initial consultation through to post-formation compliance. This includes drafting Memorandum of Association (MOA) and Articles of Association (AOA), securing digital signatures, and helping with PAN/TAN registration.

The Company Formation Process Setting up a company in India requires a series of steps that MASLLP manages efficiently:

Choosing the Right Structure The first step is determining the right business structure—Private Limited, LLP, or a One-Person Company (OPC). MASLLP provides advice on the best structure based on liability, tax, and regulatory requirements.

Name Approval MASLLP assists in selecting a suitable name for your business and ensures it complies with the Ministry of Corporate Affairs (MCA) guidelines.

Incorporation Documentation The legal team at MASLLP helps prepare and file all necessary documents, such as the Director Identification Number (DIN), Digital Signature Certificate (DSC), and incorporation forms with the MCA.

Post-Incorporation Compliance Once your company is established, MASLLP ensures you meet all post-incorporation compliance requirements, such as obtaining necessary licenses, registering for Goods and Services Tax (GST), and maintaining statutory records.

Benefits of Company Formation with MASLLP Time Efficiency: With MASLLP managing the paperwork, you can focus on growing your business rather than worrying about legal hurdles. Compliance Assurance: Ensures that your company is set up in full compliance with Indian law. Professional Expertise: MASLLP’s team of legal and financial experts guide you through every phase of company formation. Conclusion For entrepreneurs looking to establish a company in India, MASLLP offers a seamless, efficient, and expert-driven service. Their deep understanding of the legalities involved in company formation makes them the ideal partner for anyone looking to start a business. Whether you're a startup, an established business, or an international firm, MASLLP ensures your company formation process is smooth and compliant.

#accounting & bookkeeping services in india#businessregistration#audit#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

3 notes

·

View notes

Text

Company Incorporation Consultants in Delhi by SC Bhagat & Co.

Starting a new business in Delhi can be a rewarding venture, but it also comes with its own set of legal and administrative challenges. One of the critical steps in building your business is the incorporation process, which requires careful attention to various regulations. This is where professional assistance from SC Bhagat & Co., a leading company incorporation consultant in Delhi, becomes invaluable.

Why Choose Professional Company Incorporation Consultants? Incorporating a company involves several legal procedures, such as:

Selecting the correct business structure Filing the necessary paperwork with regulatory authorities Complying with tax laws Obtaining approvals and licenses The process can be complex and time-consuming for new entrepreneurs. SC Bhagat & Co. helps streamline this procedure, ensuring compliance with all legal requirements while minimizing delays.

Services Offered by SC Bhagat & Co. As one of the top company incorporation consultants in Delhi, SC Bhagat & Co. offers a range of services that cater to startups, small businesses, and large corporations. These include:

Business Structure Advisory Choosing the right business structure is crucial for long-term success. The firm provides guidance on various business entities, including:

Private Limited Company Limited Liability Partnership (LLP) One Person Company (OPC) Public Limited Company SC Bhagat & Co. ensures that you opt for the structure best suited to your business goals and tax advantages.

Registration Services From company name reservation to filing of incorporation documents, SC Bhagat & Co. handles the entire registration process. They assist with:

Drafting Memorandum and Articles of Association (MOA/AOA) Digital signature certificates (DSC) Director Identification Number (DIN) Filing with the Ministry of Corporate Affairs (MCA) Their comprehensive approach makes the process seamless and efficient.

Compliance and Taxation Support Once incorporated, companies are required to meet various compliance standards, including:

GST registration and filing Annual financial statements Regulatory audits SC Bhagat & Co. offers ongoing support to ensure your business stays compliant with both state and central laws, thus avoiding penalties and legal hurdles.

Legal Advisory and Licensing Navigating the legal landscape in India can be tricky. SC Bhagat & Co. also provides assistance in obtaining the necessary business licenses and permissions, such as:

Trade license Import-export code (IEC) Professional tax registration Why SC Bhagat & Co. Stands Out With years of experience in the field, SC Bhagat & Co. has become synonymous with trust and expertise in company incorporation consulting in Delhi. Here’s why they stand out:

Expert Team: Their team consists of highly qualified professionals, including chartered accountants and legal experts. Personalized Service: They tailor their services according to the specific needs of your business. Quick Turnaround: Their efficient processes ensure timely incorporation and compliance. Post-Incorporation Support: Even after your company is set up, SC Bhagat & Co. provides continuous support for your legal and financial needs. Conclusion Incorporating a company is a significant step in the journey of entrepreneurship. With the expert guidance of SC Bhagat & Co., you can rest assured that all legal and regulatory requirements will be handled efficiently, allowing you to focus on growing your business. If you're looking for reliable company incorporation consultants in Delhi, SC Bhagat & Co. should be your first choice.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

2 notes

·

View notes

Text

Guide to the Company Formation Process in India

Starting a business in India involves a well-defined process to ensure compliance with legal regulations. Whether you’re planning to set up a private limited company, LLP, or any other business structure, understanding the steps involved is crucial for a smooth incorporation process.

1. Choosing the Right Business Structure

Selecting the appropriate business entity is the first step in the company formation process in India. Popular structures include:

Private Limited Company (ideal for startups and small businesses)

Limited Liability Partnership (LLP)

Sole Proprietorship

One Person Company (OPC)

Each structure has its own advantages and limitations, such as tax benefits, liability protection, and funding opportunities.

2. Reserving the Company Name

To incorporate a company in India, it’s essential to choose a unique name that complies with the naming guidelines under the Companies Act, 2013. The RUN (Reserve Unique Name) service on the Ministry of Corporate Affairs (MCA) portal helps you reserve your desired name.

3. Obtaining Digital Signature (DSC) and DIN

Digital Signature Certificate (DSC): All directors must have a DSC to sign electronic documents.

Director Identification Number (DIN): Apply for DIN through the SPICe+ form, which streamlines the incorporation process.

4. Filing the Incorporation Application

The incorporation process is simplified using the SPICe+ (Simplified Proforma for Incorporating a Company Electronically) form on the MCA portal. The SPICe+ form integrates services like:

PAN and TAN application

GST registration

EPFO and ESIC registration

Bank account opening

Essential documents include:

Memorandum of Association (MoA)

Articles of Association (AoA)

Proof of registered office address

ID and address proof of directors and shareholders

5. Issuance of Certificate of Incorporation

Once approved, the Registrar of Companies (RoC) issues a Certificate of Incorporation (COI), which includes a unique Corporate Identification Number (CIN). This marks the official formation of your company.

6. Post-Incorporation Compliance

After incorporation, several steps are necessary to begin operations legally:

Apply for GST registration.

Open a company bank account.

Maintain compliance with labor laws, such as EPFO and ESIC.

File annual returns with the RoC.

Benefits of Registering a Company in India

Legal recognition and credibility.

Limited liability protection for directors.

Easier access to funding and bank loans.

Tax benefits and exemptions for startups.

Conclusion

The company formation process in India may seem complex, but by following the legal steps and using government-provided services like SPICe+, the process becomes streamlined. With proper planning and documentation, you can successfully establish your business and enjoy the benefits of a formal corporate structure.

Auditor in India best tax consultants in india Company Formation in India free company registration in india online company registration in india Startup Services in India Statutory Auditor in India

#company formation in india#auditor in india#goods and services tax consultant in india#best chartered accountants in india#income tax consultant in india#best chartered accountant firm#auditorinindia#best tax consultants in india#chartered accountant in india#goods and services tax consultant in delhi

0 notes

Text

Effective Role Of OPC Registration For Fundraising

OPC Company Registration provides an opportunity for a single person to start a company but with limited liability and corporate personality. Contact our consultants to learn more about One Person Company Registration.

0 notes

Text

Guide to Registering OPC in Bangalore for Startups

It is advisable to consult with a professional, such as a company secretary or a chartered accountant, to guide you through the registration process and ensure compliance with the latest regulations. Remember that processes and requirements may change, so checking the Ministry of Corporate Affairs' official website for the latest information is crucial.

https://www.kanakkupillai.com/one-person-company-registration-online-in-bangalore

0 notes

Text

Company Registration in Gurgaon: Simplify Your Journey with Adya Financial

Gurgaon, now officially known as Gurugram, has become one of India’s prime business destinations. With its flourishing infrastructure, dynamic business environment, and a hub of multinational companies, Gurgaon offers excellent opportunities for businesses of all sizes. Whether you’re a startup, an established company looking to expand, or an entrepreneur with a new venture idea, setting up your company in Gurgaon can be a strategic move. But company registration can be complex and time-consuming. This is where Adya Financial steps in, offering efficient, reliable, and tailored company registration services in Gurgaon.

Understanding Company Registration in Gurgaon

To operate legally in India, every business entity must be registered under specific regulations and guidelines. Gurgaon, being part of Haryana, follows the legal framework for company registration outlined by the Ministry of Corporate Affairs (MCA) in India. The process includes several steps, each requiring precise documentation and adherence to legal norms. Company registration is not just about acquiring a legal status but also about gaining credibility, making it easier for businesses to access loans, attract investors, and build trust with customers.

With Adya Financial’s company registration services in Gurgaon, businesses can navigate this process seamlessly and ensure that all requirements are met.

Benefits of Company Registration in Gurgaon with Adya Financial

Legal Protection and Liability Shielding: Registering your business provides legal protection for your assets and separates personal assets from business liabilities. Adya Financial’s team helps ensure that your company registration in Gurgaon meets these criteria.

Professional Business Image: Registering your company enhances credibility and trust, which can positively impact your client relationships and vendor interactions.

Tax Benefits and Financial Advantages: Registered companies often enjoy certain tax benefits and can claim expenses related to business operations, making tax planning more manageable.

Easy Access to Capital: A registered company can attract more investors and raise funds. Adya Financial’s expertise in Gurgaon ensures that your company registration process is done smoothly, setting up a solid foundation for future growth.

Types of Companies You Can Register in Gurgaon

Adya Financial assists with registering various types of companies in Gurgaon, including:

Private Limited Company (Pvt. Ltd.):- The most popular option, a private limited company limits shareholder liability to their shares, offers flexibility, and can attract investments. It’s ideal for small to medium-sized businesses.

Public Limited Company:- For larger companies planning to raise funds from the public, a public limited company is an excellent choice. Adya Financial can guide you through the specific requirements for registering this type of company in Gurgaon.

Limited Liability Partnership (LLP):- LLPs offer the dual benefits of limited liability for partners and the flexibility of a partnership structure. It’s popular among professional services firms and startups.

One Person Company (OPC):- A unique option for solo entrepreneurs, the OPC structure is ideal if you want full control of the company but still enjoy limited liability.

Sole Proprietorship and Partnership Firms:- For those looking for a simpler business structure, a sole proprietorship or partnership firm may be suitable. Adya Financial provides comprehensive support to register these business structures in Gurgaon.

Step-by-Step Guide to Company Registration in Gurgaon with Adya Financial

Consultation and Business Structure Selection:- Adya Financial begins with a detailed consultation to understand your business requirements and suggest the ideal structure.

Obtaining Digital Signature Certificate (DSC) and Director Identification Number (DIN):- A DSC and DIN are essential for registering a company. The DSC allows for digital authorization, and the DIN is a unique identifier for directors.

Name Approval through the RUN Service:- Choosing the right company name is crucial. Adya Financial assists in submitting a name for approval via the MCA’s Reserve Unique Name (RUN) service, ensuring it aligns with legal requirements.

Drafting of Memorandum and Articles of Association:- These foundational documents outline the company’s objectives and operational guidelines. Adya Financial’s experts ensure that your MoA and AoA meet all regulatory standards.

Application for Incorporation:- Adya Financial submits the company registration application through the MCA portal, attaching all required documentation.

Issuance of Certificate of Incorporation:- Once approved, the Certificate of Incorporation is issued, officially establishing your company. This document includes the Corporate Identification Number (CIN), which is required for various business transactions.

Why Choose Adya Financial for Company Registration in Gurgaon?

Adya Financial offers a complete range of company registration services in Gurgaon, from consultation to post-registration support. Here are the key benefits of working with Adya Financial:

Expert Guidance: With years of experience in company registration, Adya Financial understands the intricacies of the process and stays up-to-date with changes in regulations, ensuring that your business remains compliant at all times.

End-to-End Support: From documentation to obtaining licenses, Adya Financial handles every step, allowing you to focus on growing your business.

Customized Solutions: Every business is unique, and Adya Financial tailors its services to suit your specific needs, making the registration process smoother and faster.

Transparent Pricing: Adya Financial offers competitive pricing with no hidden charges, so you know exactly what you’re paying for.

Timely Process Completion: Time is of the essence, and Adya Financial ensures that the company registration in Gurgaon is completed within a timeframe that aligns with your business goals.

Required Documents for Company Registration in Gurgaon

Here’s a checklist of documents required for company registration in Gurgaon:

Identity Proof: PAN card and Aadhar card of all directors/shareholders.

Address Proof: Passport, driving license, or bank statement.

Proof of Registered Office: Utility bills, property tax receipt, or rent agreement for the registered office.

Digital Signature Certificate: DSC is necessary for digitally signing documents.

Adya Financial assists in gathering, verifying, and submitting these documents as part of their company registration services in Gurgaon.

Post-Registration Services by Adya Financial

After successful registration, Adya Financial continues to support your business with post-registration services to ensure you’re fully compliant. These include:

Tax Registration and GST:- Adya Financial helps with obtaining a GST registration, mandatory for businesses exceeding specific revenue thresholds.

Compliance Filings:- Registered companies are required to file annual returns, financial statements, and other documents with the MCA. Adya Financial ensures timely filings and assists with all compliance needs.

Accounting and Bookkeeping Services:- Proper accounting is crucial for maintaining transparency and legal compliance. Adya Financial provides expert accounting services to streamline your financial processes.

Trademark and Intellectual Property Protection:- Protecting your brand and intellectual property can be vital for long-term success. Adya Financial offers trademark registration and IP protection services.

Legal and Regulatory Compliance:- Adya Financial assists with additional compliance matters, such as environmental clearances, import-export licenses, and industry-specific permissions.

Tips for a Successful Company Registration in Gurgaon

Choose the Right Structure: Adya Financial can advise you on the best structure that aligns with your business goals and growth projections.

Plan for Compliance: Ensure that all compliance requirements are met, both during and after registration. Adya Financial’s comprehensive services help with both initial and ongoing compliance.

Keep Documentation Ready: Delays often happen due to incomplete documentation. By preparing these documents in advance, Adya Financial can expedite the registration process.

Stay Updated with Regulatory Changes: Laws and regulations change frequently, and non-compliance can lead to fines. Adya Financial’s team stays updated to ensure that your business remains compliant.

Frequently Asked Questions (FAQs) on Company Registration in Gurgaon

1. How long does it take to register a company in Gurgaon?

With Adya Financial’s efficient services, the company registration process typically takes 10-15 business days, depending on documentation and approvals.

2. Can a foreigner register a company in Gurgaon?

Yes, foreign nationals can register a company in Gurgaon, and Adya Financial provides assistance with meeting all regulatory requirements.

3. What are the fees for company registration services in Gurgaon?

Adya Financial offers transparent and competitive pricing. The fees vary based on the type of company structure and any additional services required.

4. Do I need a registered office in Gurgaon for company registration?

Yes, a registered office in Gurgaon is mandatory. Adya Financial can help with the documentation needed for office registration.

Conclusion: Start Your Business with Confidence

Registering a company registration in Gurgaon doesn’t have to be a complex and daunting process. Adya Financial’s professional company registration services in Gurgaon ensure that your business is set up with a strong legal foundation and all necessary compliance. From choosing the right structure to ongoing support, Adya Financial is committed to helping you every step of the way. Contact Adya Financial today and embark on your business journey with confidence and peace of mind.

0 notes

Text

Simplifying Company Registration in India: A Quick Guide

Thinking of starting a business in India? Here's a concise guide to registering your company:

1. Choose Your Structure:

Decide on the right structure for your business, like Private Limited Company, LLP, Sole Proprietorship, or OPC.

2. Pick a Name:

Select a unique business name that complies with MCA guidelines and is available for use.

3. Obtain DIN and DSC:

Directors need a Director Identification Number (DIN) and a Digital Signature Certificate (DSC) for online transactions.

4. Prepare and Submit Documents:

Gather required documents like MOA, AOA, identity, and address proofs, and submit them to the ROC with the necessary fees.

5. File Application Online:

File your company registration application online via the MCA portal for a streamlined process.

6. Stay Compliant:

After registration, stay compliant with ongoing requirements like maintaining registers and filing annual returns.

For expert assistance with company registration, visit [Maksim Consulting](https://maksimconsulting.com/company-registration-india). Start your journey to business success in India today!

#registering company in india#india company registration#open company in india#start a company in india

0 notes

Text

Company Registration Made Simple: Establish Your Business Today!

The process of establishing a business is always exhilarating; however, the initial challenge is often the registration of the company. When establishing a Private Limited Company, LLP, or One Person Company (OPC), it is essential to understand the process and prerequisites. This section will provide you with a comprehensive overview of the fundamentals of company registration and illustrate how BizSimpl Consultancy can simplify each stage.

What is the necessity of registering a company? There are numerous advantages to registering your business:

Legal Recognition: It establishes your business's legal identity and recognition. Limited Liability Protection: The proprietors' liability is limited to the company's assets. Enhanced Credibility: Investors and partners regard registered businesses as reliable. Tax Benefits: Registered enterprises are eligible for specific tax incentives. Given the importance of each component, it is imperative to ensure that your venture is protected and that these benefits are secured through proper registration.

Types of Company Registration There is a diverse array of business registration structures in India:

Private Limited Company (PLC): A preferred structure for small to medium-sized companies with limited liabilities. Limited Liability Partnership (LLP): Combines the benefits of a partnership with the protection of limited liability. A one-person company (OPC) is a business entity that permits a single individual to operate with limited liability. A public limited company is an exceptional option for larger enterprises that have the potential to raise capital from the public. BizSimpl Consultancy offers customized guidance on the structure that is most aligned with your objectives, thereby empowering you to make well-informed decisions.

A Step-by-Step Guide to Company Registration in Bangalore The process of registering a company in India is multifaceted and involves the approval of a name, the issuance of a certificate, and the completion of legal documentation. BizSimpl simplifies the voyage in the following manner:

Choosing a Business Structure BizSimpl's consultants provide consultations to assess your business objectives, budget, and expansion strategies in order to recommend the most appropriate business structure.

Name Approval Process It can be challenging to choose a unique company name because of legal restrictions and availability. BizSimpl offers assistance in the process of undertaking reviews and obtaining name approvals from the Ministry of Corporate Affairs (MCA).

Digital Signature Certificate (DSC) and Director Identification Number (DIN) BizSimpl oversees all legal documentation and collaborates with relevant authorities to enhance the DSC and DIN applications.

Developing Documents and Submitting Forms Appropriate documentation is essential for the successful registration of a company. BizSimpl's legal professionals ensure that all forms, including the Memorandum of Association (MoA) and Articles of Association (AoA), comply with the MCA's regulations.

Submission and Follow-Up Upon completion, BizSimpl submits the documents to the Registrar of Companies (RoC) and maintains a consistent level of follow-up to expedite the approval process.

Certificate of Incorporation Until the Certificate of Incorporation is issued and the legal formalities are finalized, BizSimpl provides assistance to clients in the final phases of the process. Your organization is now officially registered and equipped to conduct business operations, as evidenced by the certificate.

What are the benefits of choosing BizSimpl Consultancy for company registration? BizSimpl Consultancy is your dedicated partner in navigating the complexities of company registration. We differentiate ourselves by the following:

Proficient Professionals: Our team is equipped with a comprehensive comprehension of business registration laws, ensuring that compliance is maintained at every stage. End-to-End Support: BizSimpl manages the entire process, from the initial consultations to the post-registration support, thereby saving you time and resources. Our services are customized to accommodate the unique needs of your organization, as we acknowledge that each business is unique. Fees that are transparent: BizSimpl is dedicated to providing cost-effective services that are free of any hidden fees, ensuring that our clients are informed of the costs at every stage. The Solutions Provided by BizSimpl to Common Obstacles to Company Registration The registration of a company can be a daunting procedure due to the numerous legal and technical considerations. The following are frequently encountered challenges:

Protracted Documentation: The process of ensuring that documentation adheres to legal standards can be time-consuming. Comprehending Compliance: Compliance requirements are frequently difficult for new business owners to comprehend. Delays in Name Approval: Registration may be delayed as a result of the process of obtaining a distinctive name that is consistent with legal regulations. BizSimpl's proactive approach addresses these issues by providing guidance and prompt solutions to prevent delays. Our services are intended to streamline the procedure and enable you to concentrate on the expansion of your business.

Assistance Following Registration BizSimpl provides ongoing assistance with the following services after your company has been registered:

GST Registration Assistance with Tax Filing Bookkeeping and Accounting Statutory Compliance

Are you prepared to register your company? With BizSimpl Consultancy, the process of company registration is simplified and stress-free. While you concentrate on your business vision, allow us to manage the technical aspects. If you are interested in establishing a Private Limited Company, LLP, or OPC, BizSimpl has you covered.

0 notes

Text

Formation of Wholly Owned Subsidiary In India

A Wholly Owned Subsidiary refers to a company whose shares or voting rights are totally owned by the parent company.

A Wholly Owned Subsidiary (WOS) is distinct from a subsidiary since the former signifies that the parent company holds 100% of the whole shares or voting rights, while the subsidiary implies the parent company holds 51% or more of the subsidiary company.

In India, a Private Limited company can be established by Foreign companies to conduct business or invest, which would be considered a Wholly Owned Subsidiary. However, this is subject to government regulations on Foreign Direct Investment (FDI) and other applicable provisions.

Requirements of Wholly Owned Subsidiaries

At least one director to be a resident of India: A Wholly Owned Subsidiary company must have at least one director who is a resident of India.

The term "resident" refers to an individual director who has lived in India for an equivalent of or more than 182 days in the preceding year.

No Minimum Capital: As per MCA guidelines, there is no minimum capital required to create the company.

Minimum one shareholder (and nominee) and 2 directors: As per Section 3(1)(b) of the Companies Act, 2013, it is crucial for every company to have at least one shareholder and one nominee shareholder, along with a minimum of two directors.

How to Form a Wholly Owned Subsidiary in India

Application for Name approval of Wholly Owned Subsidiary – Part A of formation

Retain Original Name: The foreign company can decide to keep its original name for the subsidiary in India to carry forward its goodwill.

Add India as a Suffix: The foreign company can add India as a suffix to its original name to indicate its status as a subsidiary in India.

Use Registered Trademark: If the foreign company has a registered trademark in another country, it can use the same trademark for the subsidiary in India.

Choose a New Name: The foreign company can also pick a new name for the subsidiary if it wishes to do so.

Read more to know about the formation of WOS in India

#wholly owned subsidiary#llp registration#private limited company registration#opc registration#nidhi company registration#startup registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#legal consultation#legal services

0 notes

Text

The Power of Nature: NUTRiHERBS Organic Grape Seed Extract Capsules

In a world increasingly focused on wellness and natural remedies, NUTRiHERBS Organic Grape Seed Extract Capsules stand out as a potent option for those seeking a natural boost to their health. Let’s dive into what makes these capsules a powerful addition to your wellness routine

What is Grape Seed Extract?

Grape seed extract (GSE) is derived from the seeds of grapes, particularly from the Vitis vinifera variety. It’s packed with antioxidants, particularly oligomeric proanthocyanidin complexes (OPCs), which are known for their powerful health benefits. These compounds are celebrated for their ability to combat free radicals in the body, supporting overall health and wellness.

Why Choose NUTRiHERBS Organic Grape Seed Extract?

Quality You Can Trust: NUTRiHERBS is committed to quality. Their organic grape seed extract is sourced from premium grapes, ensuring that you receive the best nature has to offer. The brand adheres to strict quality control measures, providing products that are both effective and safe.

Rich in Antioxidants: Each capsule is loaded with antioxidants that help neutralize free radicals, which can contribute to cellular damage and aging. This makes GSE a great ally for maintaining youthful skin, promoting heart health, and supporting overall well-being.

Supports Heart Health: Grape seed extract has been linked to improved cardiovascular health. It may help lower blood pressure, reduce cholesterol levels, and improve circulation, making it an excellent addition to a heart-healthy lifestyle.

Enhances Skin Health: The antioxidants in grape seed extract can help protect the skin from UV damage and improve its elasticity. Regular supplementation may lead to a more radiant complexion and a reduction in signs of aging.

Promotes Healthy Inflammation Response: GSE may also support a healthy inflammatory response in the body, which is crucial for maintaining overall health and well-being. This can be particularly beneficial for those with active lifestyles or those seeking relief from occasional discomfort.

How to Incorporate NUTRiHERBS Organic Grape Seed Extract into Your Routine

Taking NUTRiHERBS Organic Grape Seed Extract Capsules is simple. Just follow the recommended dosage on the packaging, typically one to two capsules daily. For optimal absorption, consider taking them with meals.

Conclusion

Incorporating NUTRiHERBS Organic Grape Seed Extract Capsules into your daily routine is a step towards better health. With their rich antioxidant content and numerous health benefits, these capsules can support everything from heart health to skin vitality. As always, consult with a healthcare provider before starting any new supplement, especially if you have existing health conditions or are pregnant.

Explore the power of nature with NUTRiHERBS and elevate your wellness journey today!

0 notes

Text

Business Interview | Week 3 - 4

“Behind every thriving business is a story of passion, perseverance, and vision.”

On September 14th, we interviewed five local businesses in Cagayan de Oro to uncover those stories. From guitar repair shops keeping the music alive to architectural firms turning dreams into reality, we explored the challenges they face, the strategies they use to stay competitive, and their plans for the future. These interviews revealed more than just business facts—they highlighted the heart and soul that drives these entrepreneurs. Let’s delve into the journeys of these extraordinary endeavors and know the characteristics that sets them apart.

Founded: 2011

Location: Baconga St, Cagayan de Oro

Owner: Jimji Jay Babiera (registered under his wife’s name [Tessa Babiera])

Type of Business: Sole Proprietorship

Business Model: B2C

Employees: 2

Registration: Department of Trade and Industry (DTI)

Industry: Musical Instrument Repair

Page: https://www.facebook.com/Cagayanguitarrepairshop

JiRock Guitar Repair Shop was born from a desire to cater to the needs of musicians. Offering professional guitar repair and modification services, this family-run business has established itself as a trusted name in the music industry. Despite its modest setup, the shop prides itself on offering top-tier services to musicians across Cagayan de Oro. Though currently limited to a single location, the business is eyeing expansion in the near future.

Founded: 2007

Location: Baconga St, Cagayan de Oro

Owner: Zoilo Jimmy O. Babiera

Type of Business: Sole Proprietorship

Business Model: B2B, B2C

Employees: 2

Industry: Heavy machinery and construction

Registration: Department of Trade and Industry (DTI)

Hydraulic Hose and Fittings provides specialized equipment and services for the heavy machinery and construction sectors. With 17 years of experience, the company offers products like hydraulic hoses, fuel systems, and backhoe services. They also offer consumers to purchase products in quantities that are appropriate for their needs. Their dedication to provide competitive pricing and high-quality products has allowed them to establish a robust market presence, thereby establishing them as a successful and dependable business.

Founded: February 2024

Location: Lapasan Highway Cagayan de Oro

Owner: Robinson Chua

Type of Business: Sole Proprietorship

Business Model: B2B, B2C

Employees: 3 (project-based workers)

Industry: Architectural and Construction Services

Registration: Department of Trade and Industry (DTI)

Page: https://www.facebook.com/design8ion.architects

Driven by his passion for architecture, Robinson Chua founded Design8ion Architectural Services earlier this year. Though new to the scene, the firm already employs three project-based workers, providing consultations, designs, floor plans, and construction supervision. Robinson’s vision is to deliver architectural services that are made with heart and passion, ensuring clients receive not just quality, but artistry in every project.

Founded: 1989

Owner: Zoilo Jimmy O. Babiera

Business Model: B2B, B2C

Business Type: One Person Corporation (OPC)

Location: Baconga St, Cagayan de Oro

Page: https://www.facebook.com/JimscoCalibrationCenter

Starting as a sole proprietorship before transitioning into a one-person corporation in 2020, Jimsco has been serving Cagayan de Oro for 35 years. Specializing in diesel injection pump calibration and nozzle reconditioning, Jimsco is well-regarded for its quality services, honesty, and client-focused approach. Zoilo’s commitment to providing top-notch services has earned the business loyal customers, with plans to expand further operations.

Founded: 2022 (CDO branch), established since 1995

Location: Centrio Ayala, Cagayan de Oro

Owner: Helen B. Go

Business Model: B2C

Business Type: Sole Proprietorship

Employees: 3 (at Centrio Ayala)

Industry: Party Supplies

Branch Locations: Centrio Mall, SM Uptown, SM Downtown, Cogon, Cebu, Ilo-ilo, Bacolod, and Ormoc

Registration: Department of Trade and Industry (DTI)

Page: https://www.facebook.com/hannahspartyneeds

Hannah’s Cake Decors & Party Needs is a go-to destination for celebrations, from birthdays to weddings. Renowned for providing high-quality party supplies, especially its range of vibrant balloons, making every celebration memorable. Their mission is to bring joy to every occasion by offering affordable yet premium products. With a vision to be a global partner for celebrations, Hannah’s continues to thrive through social media promotions and exceptional customer service.

These five businesses highlight the diversity and dedication of entrepreneurs in Cagayan de Oro. From music to machinery, architecture to celebrations, each enterprise brings passion and quality to the services they provide. By supporting local businesses like these, we not only fuel the local economy but also contribute to the continued growth and innovation within the community.

Insight Link:

0 notes

Text

OPC One Person Company Registration - Get License Easy - Expert License Registration Services by India's Leading Consultants - https://getlicenseconsultants.in/opc-one-person-company-registration-consultants-india/

#companyregistration #getlicense #license #registration #consultants #india

0 notes

Text

How to Register a Company in Chennai – Quick Guide

Chennai, known for its vibrant business environment and strategic location in South India, offers entrepreneurs a fertile ground to establish their ventures. If you're considering starting a business in Chennai, understanding the company registration process is crucial to kickstart your entrepreneurial journey smoothly. This guide outlines everything you need to know about company registration in Chennai, from legal requirements to post-registration obligations.

Understanding Company Registration

Company registration in Chennai, as elsewhere in India, is governed by the MCA under the Companies Act 2013. It is a legal process that establishes your business as a separate legal entity from its company owners. This distinction provides limited liability protection to shareholders and enables the company to enter into contracts, own assets, and incur debts in its name.

Types of Companies You Can Register

Chennai allows various kinds of companies to be registered, each with its advantages and suitability depending on your business goals:

Private Limited Company: This type of company is ideal for startups and small—to medium-sized businesses. It offers limited liability to shareholders and ease of raising funds.

Public Limited Company: Suited for larger enterprises looking to raise capital from the public through the sale of shares.

One-person company (OPC): This type of company is designed for single entrepreneurs who wish to limit their liability while enjoying the benefits of a corporate entity.

Limited Liability Partnership (LLP): This type of partnership combines elements of a partnership and a corporation, providing limited liability to partners and flexibility in management.

Steps to Register a Company in Chennai

Step 1: Obtain Digital Signatures

Directors and shareholders must obtain digital signatures, which are required for filing forms electronically with the Registrar of Companies (RoC).

Step 2: Obtain Director Identification Number (DIN)

Company directors must obtain a DIN from the MCA, which is a unique identification number.

Step 3: Name Approval

Choose a unique company name and check its availability. The name should comply with the MCA's naming guidelines.

Step 4: Prepare Documents

Gather necessary documents, such as identity and address proof, a Memorandum of Association (MOA), and Articles of Association (AOA).

Step 5: File Application with RoC

Apply for company registration and the required documents to the RoC in Chennai.

Step 6: Certificate of Incorporation

Upon verifying documents and complying with legal formalities, the RoC will issue a Certificate of Incorporation confirming the establishment of your company.

Post-Registration Obligations

After registering your company in Chennai, ensure compliance with various regulatory and statutory requirements:

Tax Registration: Contact the Income Tax Department to obtain your Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN).

Compliance: File annual returns, maintain statutory registers, and conduct board meetings as per the Companies Act.

Open a Bank Account: You can open a bank account under your company name and manage your finances separately from personal accounts.

Conclusion

Registering a company in Chennai opens vast opportunities in one of India's most dynamic business hubs. Whether you're a first-time entrepreneur or an established business owner, navigating the registration process effectively ensures legal compliance and sets a solid foundation for growth. You are consulting with legal and financial experts to streamline the process and maximise your business potential in Chennai's competitive market.

0 notes

Text

Nature's Plus Herbal Actives

Grape Seed Extract (Alcohol-Free, 25 mg) – An Overview

Introduction

Nature's Plus Herbal Actives Grape Seed Extract is a popular dietary supplement that offers a variety of health benefits derived from its potent antioxidants. Produced by Nature's Plus Herbal, a reputable name in the natural health industry, this particular supplement is alcohol-free and delivers a standardized 25 mg dose of grape seed extract per serving.

Product Overview

Brand: Nature's Plus Herbal

Product Name: Herbal Actives, Grape Seed Extract

Form: Alcohol-free liquid

Strength: 25 mg per serving

Grape Seed Extract Benefits

Nature's Plus Herbal Actives Grape Seed Extract is derived from the seeds of grapes, particularly from the Vitis vinifera species. The extract is rich in antioxidants known as oligomeric proanthocyanidin complexes (OPCs), which have been widely studied for their health benefits. Nature's Plus Herbal Grape Seed Extract offers key advantages, including antioxidant protection, cardiovascular support, skin health improvements, anti-inflammatory effects, and immune system support.

Alcohol-Free Formula

The alcohol-free formulation of Nature's Plus Herbal Actives Grape Seed Extract makes it an ideal choice for individuals who prefer to avoid alcohol-based supplements. Nature's Plus Herbal ensures that this liquid form allows for easy absorption and dosage flexibility, catering to personal health needs.

Dosage and Usage

Nature's Plus Herbal Actives provides a standardized dosage of 25 mg per serving, ensuring consistent potency and efficacy with every use. By following the recommended dosage or consulting a healthcare provider, users can make the most of Nature's Plus Herbal Grape Seed Extract for both daily supplementation and targeted wellness support.

Quality and Safety

Nature's Plus Herbal is committed to delivering high-quality supplements through rigorous quality control processes. The Herbal Actives line, including the Grape Seed Extract, reflects Nature's Plus Herbal's dedication to purity, potency, and safety, making it a trusted choice in the supplement industry.

Conclusion

Nature's Plus Herbal Actives Grape Seed Extract (Alcohol-Free, 25 mg) is a convenient and high-quality supplement designed to provide the health benefits of grape seed extract. With its powerful antioxidant properties, Nature's Plus Herbal Grape Seed Extract supports cardiovascular health, enhances skin vitality, and promotes overall well-being, making it a valuable addition to any wellness routine.

0 notes