#One person Company

Explore tagged Tumblr posts

Text

How do Partnership Firm Taxes Differ from Other Business Models?

Understanding the tax implications of different business models is crucial for entrepreneurs. Whether you’re exploring partnership firm registration, public limited company formation, or OPC registration, choosing the right structure can directly impact your tax liabilities, compliance requirements, and financial outcomes. Read:

Partnership Firm Taxes Differ from Other Business Models

#legal services#legal#tax#Partnership Firm#partnership firm registration#benefits of registration of partnership firm#opc registration#one person company#public limited company formation#company incorporation#public limited company registration#company registration

0 notes

Text

One Person Company Registration | Single Person LLC | OPC Setup

A One Person Company (OPC) is a unique business structure introduced under the Companies Act, 2013, designed for a single entrepreneur who wishes to operate as a separate legal entity. Similar to a Single Person LLC, this structure offers the benefits of limited liability while allowing a single promoter to control the company. The 1 person company registration process is straightforward, requiring basic documentation and compliance with regulatory norms. YKG Global ensures a seamless experience for registering a One Person Company, from documentation to incorporation. Whether you're looking to set up a Single Person Company registration or explore the benefits of an OPC, our experts are here to assist you.

#business#consulting#company registration#taxation#success#investing#business registration#foreign company#finance#accounting#one person company#single person llc#register one person company#single person company registration

0 notes

Text

Simplifying Compliance: Understanding AGM for OPC

One Person Companies (OPCs) are a modern commercial enterprise shape in India, designed for single marketers who want restrained legal responsibility and corporate popularity without the complexity of multi-member setups.

This article simplifies the compliance factor of AGM for OPC, outlining the key legal provisions and sensible insights.

What is an AGM?

An Annual General Meeting (AGM) is every year accumulating in wherein an agency's shareholders assess its monetary overall performance, approve accounts and discuss destiny plans. In most organizations, an AGM is a mandatory compliance requirement under the Companies Act, 2013.

Is AGM Mandatory for OPC?

The Companies Act, 2013, in particular exempts OPCs from accomplishing an AGM. Since OPCs have the handiest shareholders, the need for such a meeting does now not rise.

Compliance Simplified: How OPCs Manage AGM-Related Requirements

Although OPCs are exempt from conserving AGMs, they must nonetheless follow unique prison duties:

Filing Financial Statements

OPCs are required to document monetary statements, which include the stability sheet and profit and loss account, with the Registrar of Companies (ROC) yearly.

Board Meetings

OPCs have to hold as a minimum one board assembly every six months, with an opening of no less than 90 days between two meetings, if the company has more than one director.

Maintenance of Records

All resolutions passed by the sole member need to be recorded in a minutes book, ensuring transparency and compliance.

Benefits of AGM

Exemption for OPC The AGM exemption reduces administrative burdens for OPCs, allowing single-member entrepreneurs to be cognizant of growing their businesses.

Key benefits consist of:

Time and Cost Savings: No need to put together AGM notices, and agendas, or arrange bodily meetings.

Simplified Decision-Making: All decisions are directly recorded, bypassing formal voting processes.

Streamlined Compliance: Minimal legal formalities as compared to other employer types.

Common Mistakes to Avoid

While the exemption eases compliance, OPCs ought to make certain the following to keep away from penalties:

Timely Filing: Ensure economic statements and annual returns are filed before due dates.

Accurate Record-keeping: Maintain particular information of resolutions and commercial enterprise selections to offer in case of scrutiny.

Understanding Exemptions: Misinterpreting compliance exemptions can lead to prison headaches. Seek professional advice whilst unsure.

Conclusion

The exemption from undertaking an AGM for OPC is an extensive compliance advantage, reflecting the simplicity of the OPC shape. By know-how and adhering to associated necessities, OPC owners can streamline their operations while ensuring prison compliance.

0 notes

Text

One-Person Company (OPC) Registration in India: Key Features and Benefits for Solo Entrepreneurs.

One Person Company (OPC) is a unique business structure introduced under the Companies Act, 2013, designed for individuals who want to run a company independently without needing partners. It offers the benefits of limited liability, ensuring that the owner's personal assets are protected from business liabilities. OPC enjoys a separate legal entity status and is easy to manage, with fewer compliance requirements compared to other forms of companies.

Features and Benefits of OPC:

Single Owner: Only one individual can own and operate the business.

Limited Liability: The owner's assets remain protected from company debts.

Separate Legal Entity: The company is distinct from the individual, offering more credibility.

Simplified Compliance: Lesser paperwork and regulatory requirements compared to private limited companies.

Easy to Incorporate: OPC registration is a straightforward process with minimal documentation.

Continuity: Nominee provision ensures a smooth transition in case of the owner’s death.

These features make OPC an ideal choice for solo entrepreneurs seeking the benefits of a corporate structure.

At MSME Story, we offer affordable and all-inclusive services for one-person company (OPC) registration in India. Specializing in hassle-free OPC registration, our dedicated team handles all legal formalities and ensures compliance with MCA regulations, allowing you to focus on growing your business.

0 notes

Text

company registration in Surat

#register one person company online#company registration services#accounting services in surat#legal services in surat#one person company

0 notes

Text

If you own a One Person Company (OPC), you must ensure its compliance with the annual requirements set by the Companies Act, 2013. Annual compliance of One Person Company is a legal obligation that includes filing of several mandatory documents and forms with the Ministry of Corporate Affairs (MCA) of India. We are One of the best one-person Company (OPC) Annual Compliance filing service Provider company we maintain your OPC annual Compliance at an affordable cost.

0 notes

Text

A One Person Company (OPC) in India allows a single individual to operate a company with limited liability protection. Introduced under the Companies Act, 2013, OPCs offer several advantages for solo entrepreneurs.

Key Benefits

Limited Liability Protection: Separates personal assets from business liabilities, reducing financial risk.

Ease of Formation and Compliance: Simple registration process and less compliance compared to other company types.

Sole Ownership and Control: Full control over operations and decision-making, leading to efficient management.

Enhanced Credibility: Recognized as a separate legal entity, boosting trust with customers and partners.

Business Continuity: Nominee system ensures smooth operation in case of the owner's incapacitation or death.

Access to Funding: Easier to obtain loans and credit facilities compared to a sole proprietorship.

Tax Benefits: Avail various tax exemptions and deductions, reducing taxable income.

Professional Image: Demonstrates commitment and seriousness, enhancing business reputation.

0 notes

Text

A Comprehensive Guide to LLP, Private Limited Company, and One Person Company Registrations

Under the Companies Act 2013, the government offers a variety of business structures. Selecting a suitable business structure for your business depends on various factors and its operations. Private Limited Company Registration, a Limited Liability Partnership Registration formally known as an LLP or One Person Company Registration, is the most common type of business entity. Knowing the difference between a Private Limited Company, LLP, and OPC is essential to understanding which structure suits your business.

What is a Limited Liability Partnership Company Registration

A Limited Liability Partnership (LLP) is a hybrid business structure that combines elements of partnerships and corporations. It allows for a partnership structure where each partner's liabilities are limited to the amount they have invested in the business.

Features of Limited Liability Partnership Company Registration

Membership: LLP requires a minimum of two partners, and there is generally no upper limit on the number of partners.

Limited Liability: Partners in an LLP have limited liability, meaning they are not personally responsible for the business's debts beyond their investment in the LLP.

Flexibility in Management: LLP offers flexibility in management allowing partners to decide the tasks by whom.

Low Cost and Less Compliances: The cost of LLP registration is less as compared to other forms of business such as private companies and private limited companies. The compliances for the LLP need to be filed only twice a year i.e. Annual return and a statement of accounts and solvency.

No Requirement of Minimum Capital Contribution: To form an LLP there is no need for minimum capital There is no requirement of having a minimum paid-up capital before incorporation. You can start it without any capital.

What is a Private Limited Company Registration

A Private Limited Company is a privately held company by stakeholders. In this case, the liability arrangement is that of a limited partnership, wherein the liability of a shareholder extends only up to the number of shares held by them.

Features of Private Limited Company Registration

Membership: At least two shareholders are required to form a private limited company. However, it is a small entity, so the maximum limit is fixed at 200.

Limited Liability Structure: The liability of each member in a private limited company is limited. In any loss, members do not need to sell their assets.

Separate Legal Entity: Private Limited companies are separate legal entities from their shareholders, which means that if the company is insolvent or all the members of the company die, the company still exists in the eyes of the law.

Minimum Paid-Up Capital: A private limited company is required to have and maintain a minimum paid-up capital of ₹1 lakh.

What is a One Person Company Registration

Registering a One-person Company benefits entrepreneurs who desire a limited liability with a separate legal entity. OPC is a business structure that allows a single person to function as a company and retain full control. With the benefits of sole proprietorship and legal protection of a private limited company in an OPC, the individual serves as both the director and shareholder.

Features of One-Person Company Registration

Single Ownership: One of the standout features of an OPC (One Person Company) is its single ownership. This unique feature of OPC allows the sole entrepreneur to own and manage the entire business.

Separate Legal Entity: One of the fundamental features of an OPC is its separate legal identity. A company is recognized independently from its owner as per separate legal entity which means a business can enter into contracts, own assets, and incur liabilities in its name.

Indian Ownership: Only Indian citizens are eligible to establish OPC, ensuring that the roots of the business remain in the country.

Restricted Transfer of Shares: The transferability of shares in OPC is restricted. It prevents the company from easily changing hands, contributing to stability and control retained by a single owner.

Perpetual Succession: This feature of OPC ensures the continuity of the company beyond its owner. In case of the owner's demise or incapacitation, the nominee director steps in, ensuring the seamless continuity of business.

0 notes

Text

In-depth Guide on One Person Company

An One Person Company (OPC) is legally constituted with only one shareholder, who is acknowledged as the company’s sole member. OPCs typically emerge when there is a single founder or promoter involved in the company. Because of the numerous advantages they offer, entrepreneurs and businessmen launching a new venture often opt for this business structure instead of sole proprietorships.

If you want to register your One Person Company you can visit our official website https://structuredbiiz.com/

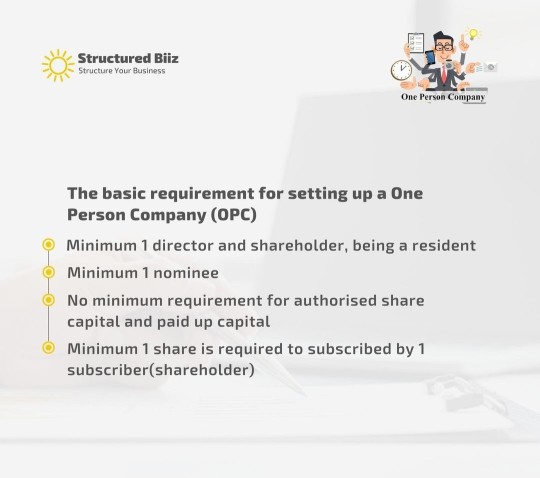

Requirements for One Person Company (OPC) Formation

At least one director and shareholder must be a resident.

Minimum one nominee is required.

The authorized capital should be a minimum of 1 lakh.

There is no minimum requirement for paid-up capital.

Features of One Person Company (OPC)

Distinct Legal Identity: An OPC possesses a distinct legal identity, separate from its owner. This autonomy enables the company to engage in contracts, own assets, and assume liabilities under its own name.

Mandatory Incorporation: Unlike other business structures, OPC formation is mandatory and governed by the Companies Act. This formal process ensures adherence to legal standards, enhancing transparency and accountability.

Single Ownership: A defining characteristic of OPCs is their single-member ownership structure. This arrangement allows a sole entrepreneur to own and manage the entire business, facilitating efficient decision-making without the complexities of a multi-member board.

Indian Ownership: OPCs mandate Indian ownership, restricting establishment and operation to Indian citizens and residents. This requirement ensures the business remains firmly rooted within the country's jurisdiction.

Limited Liability Protection: OPCs offer limited liability protection, a significant draw for entrepreneurs. This safeguard shields the owner's personal assets, limiting their liability to the extent of their investment in the company. Such financial insulation is a valuable advantage for individual business owners.

Requirements for One Person Company

Unique and Meaningful Name: A company's name is its primary identifier, crucial for building brand value. It must be distinctive yet indicative of the company's purpose.

Registered Office Address: An OPC must have a designated office for conducting business and official correspondence. The location, whether rented or owned, must be secure and lockable to safeguard important documents.

Adequate Capital Investment: Capital investment is essential for the smooth operation of an OPC. Since there's only one shareholder, the invested amount must be sufficient to sustain business operations effectively.

Single Shareholder Ownership: OPCs are characterized by a single shareholder who holds 100% ownership of the company. The shareholder, an Indian citizen, whether resident or non-resident, is entitled to all profits earned by the company.

Directorship Requirement: While the sole owner doesn't manage the company directly, they must appoint at least one director. An OPC can have up to 15 directors, with at least one being a resident in India for more than 120 days during the previous financial year.

Limitations of One Person Company (OPC)

1. Ineligibility for Certain Conversions: OPCs cannot be converted into Section 8 Companies (Not for Profit) or Non-Banking Financial Companies (NBFCs).

2. Resident Shareholder Requirement: Only residents of India, who have stayed in the country for 182 days or more in a year, are permitted to be shareholders of OPCs. Non-residents are not allowed to establish OPCs.

3. Restriction on Multiple OPCs: Each individual is limited to either owning one OPC or being nominated as a nominee in one OPC. Consequently, one person cannot simultaneously hold shareholder or nominee positions in multiple OPCs.

4. Conversion Limitation Period: An OPC cannot be converted into a regular company until two years have elapsed from the date of incorporation, except under specific circumstances. These exceptions include instances where the paid-up capital exceeds Rs. 50 lakh or the average annual turnover for the immediately preceding three consecutive financial years exceeds Rs. 2 crore.

5. Unsuitability for Investor Funding: OPCs are not recommended for entrepreneurs seeking investment from external investors.

1 note

·

View note

Text

Looking for One Person Registration

In India,One person company is one of the simplest enitiies of the corporate entities to manage.OPC is the combination of Sole-propriertorship and Corporate form of business.Under Company Act, it has been provided various exemptions in many compliances requirements.In comparsion with private company,the compliance requirements are less in OPC.OPC registration is easy and affordable.For enterprenuers and sole-proprietors who wish to enyoy perks of limited liablity and seperate legal entity,OPC registration provides new business oppurtunities.OPC eliminates the hassles of choosing a right partner,when launching a new business as a registered entity.

0 notes

Text

Register your company as a One Person Company (OPC) through Registration Guru.

For more information Call us:- 9811536872 Visit us:- https://registrationguru.in/one-person-company-registration Email us:- [email protected]

1 note

·

View note

Text

How Does Startup India Registration Empower Emerging Entrepreneurs?

India is witnessing a significant rise in entrepreneurial ventures, with innovative startups emerging across industries. To support this dynamic ecosystem, the government introduced the Startup India initiative, a flagship program aimed at nurturing entrepreneurship.

Startup India Registration Empower Emerging Entrepreneurs

0 notes

Text

A Beginner's Guide to OPC Registration

Are you ready to turn your entrepreneurial dream into reality as a solo founder? Registering a One Person Company (OPC) could be the perfect starting point for your business journey. OPCs provide a strong foundation for aspiring entrepreneurs by offering the advantages of limited liability and a separate legal identity. If you're new to OPC registration, fear not! This guide will walk you through the process step by step, making sure about a smooth and successful registration experience.

Process of OPC Registration Online

Understanding OPC: Before diving into the deep ocean of registration process, it's essential to understand the concept of OPCs. Unlike sole proprietorships, OPCs offer limited liability protection, that means that your personal assets are separate from your business liabilities. This structure provides credibility and security, which is essential for establishing trust with clients and partners.

Selecting a Unique Name: First of all, for OPC registration you have to select a unique name for your company. Make sure that your chosen name complies with naming guidelines and isn't already in use by another entity. Once you've decided a name for your company, reserve it via Ministry of Corporate Affairs (MCA) portal.

Obtaining Digital Signature and DIN: After that, you have to acquire a Digital Signature Certificate (DSC) and Director Identification Number (DIN), which are mandatory for OPC directors. These can be obtained online through the MCA portal by submitting all the necessary documents.

Document Preparation: Then, you should have to gather all the required documents, including address proof, identity proof, and proof of registered office, for OPC registration. Make sure that all documents are accurate and up to date to avoid any delays in the registration process.

Filing for OPC Registration: Once you have all the necessary documents in order, you can file for OPC registration via MCA portal. Submit all the required documents and pay the registration fee, then wait for verification.

Upon successful verification, you'll receive the Certificate of Incorporation, officially establishing your OPC. Congratulations! You're now ready to start your entrepreneurial journey confidently with OPC Registration Online, along with the benefits of limited liability and a solid legal foundation. Remember to fulfill all the ongoing compliance requirements and prepare your OPC for long-term success.

#Company Registration#Online Company Registration#Online Company Registration in India#Company Registration in India#One Person Company#OPC#OPC Registration#OPC Registration Online#OPC Registration Online in India

0 notes

Text

Can OPC be Converted into a Private Limited Company?

Yes, an OPC (One Person Company) can be converted into a private limited company under certain circumstances, as provided for in the Companies Act, 2013, and the rules prescribed by the Ministry of Corporate Affairs (MCA). Here's an overview of the conversion process:

Eligibility: To convert an OPC into a private limited company, the OPC must have completed two years from the date of its incorporation.

Minimum Requirements: The OPC must have a minimum of two directors and a minimum of two shareholders at the time of conversion.

Passing Special Resolution: The sole shareholder of the OPC must pass a special resolution for conversion into a private limited company. This resolution must be approved by the member of the OPC and filed with the Registrar of Companies (ROC).

Application for Conversion: Once the special resolution is passed, the OPC needs to file an application for conversion with the ROC within a specified period, along with necessary documents and forms prescribed by the MCA.

Documents Required: The documents required for conversion typically include the special resolution, the altered memorandum of association and articles of association reflecting the new status as a private limited company, a declaration by the director(s) confirming compliance with the conversion requirements, and any other documents as required by the ROC.

Approval: Upon receipt of the application and necessary documents, the ROC will verify the same. If everything is found to be in order and compliant with the applicable laws, the ROC will approve the conversion, and the OPC will be deemed to be a private limited company from the date of approval.

Amendments to PAN, TAN, and other Registrations: After conversion, the company must make necessary amendments to its PAN (Permanent Account Number), TAN (Tax Deduction and Collection Account Number), GST (Goods and Services Tax) registration, and other registrations as required.

It's important to note that the conversion process involves adherence to specific timelines, procedures, and compliance requirements as laid down by the Companies Act and regulations issued by the MCA. Therefore, it's advisable to seek professional guidance from legal and financial experts to ensure smooth and compliant conversion from an OPC to a private limited company.

#efiletax#business#one person company#private company#taxes#OPC be Converted into a Private Limited Company

0 notes

Text

What is OPC? An One Person Company is a type of company established by a single individual, who acts as both the shareholder and the director. Eazybahi Solutions guide you.

One Person Company (OPC) was introduced to encourage entrepreneurs who are capable of starting a venture on their own but are deterred by the requirement of having at least two members, as mandated for a private limited company. OPC, as the name suggests, allows a single individual to establish and run a company, thereby providing a distinct legal identity and limited liability protection. Governed by the Companies Act, 2013, OPCs offer a simplified framework for solo entrepreneurs to operate within the corporate structure.

0 notes

Text

Why OPC Company Registration is the Best Choice for Solo Entrepreneurs in India

What is OPC Company Registration?

As a solo entrepreneur in India, you may be wondering what the best choice for registering your company is. One option that stands out is OPC (One Person Company) registration. OPC company registration in India is a legal structure that allows a single individual to operate as a separate legal entity. This means that as a solo entrepreneur, you can enjoy the benefits of limited liability and legal recognition that come with a registered company. OPC registration provides a unique opportunity for solo entrepreneurs to establish a business entity that is separate from themselves, offering credibility and protection.

Advantages of OPC Company Registration in India

There are several advantages to opting for OPC company registration as a solo entrepreneur in India. First and foremost, limited liability is a key benefit. By registering your company as an OPC, you are protecting your assets from any liabilities that may arise from your business operations. This means that your assets, such as your house or savings, will not be at risk in case of any financial or legal issues faced by your company.

Another advantage of OPC company registration is that it provides a separate legal entity status to your business. This means that your company will have its own legal identity, distinct from your identity. This legal recognition helps in gaining trust and credibility in the market, making it easier to attract clients, investors, and business partners. Additionally, OPC registration allows you to avail yourself of various tax benefits and incentives offered by the government of India, such as exemptions on capital gains and simplified compliance requirements.

Requirements for OPC Company Registration in India

To register your OPC company in India, you need to fulfill certain requirements. Firstly, the company must have only one shareholder and one director. This means that as a solo entrepreneur, you can be the sole shareholder and director of your OPC. Secondly, the company's name must end with "Private Limited." Thirdly, you need to have a registered office address in India where all official correspondence will be sent.

Furthermore, it is important to note that only a natural person who is an Indian citizen and resident in India for at least 182 days in the previous calendar year can form an OPC. Also, an individual can only incorporate one OPC at a time. These requirements ensure the integrity and authenticity of OPC registration in India.

A step-by-step process for OPC Company Registration

The process of OPC company registration in India involves several steps. This is a step-by-step tutorial to assist you in easily completing the registration process:

Obtain a Digital Signature Certificate (DSC): A DSC is required for online filing of documents. A DSC is available from accredited organizations.

Obtain a Director Identification Number (DIN): The next step is to apply for a DIN, which is a unique identification number for directors. This can be done online through the Ministry of Corporate Affairs (MCA) portal.

Name Approval: Choose a unique and suitable name for your OPC and apply for name approval through the MCA portal. The name ought to adhere to the MCA's naming requirements.

Drafting and Filing Documents: Prepare the necessary documents, such as the Memorandum of Association (MOA) and Articles of Association (AOA), and file them with the Registrar of Companies (ROC) along with the required fees.

Payment of Fees: Pay the prescribed fees for OPC registration through the MCA portal.

Certificate of Incorporation: Once all the documents are verified and fees are paid, the ROC will issue a Certificate of Incorporation, which signifies the official registration of your OPC.

Documents Required for OPC Company Registration

To register an OPC in India, you need to submit certain documents along with the application. Here is a list of the essential documents required for OPC company registration:

Identity proof of the director/shareholder: This can be a PAN card, Aadhaar card, or passport.

Address proof of the director/shareholder: This can be a recent utility bill, bank statement, or passport.

Passport-sized photographs of the director/shareholder.

Proof of registered office address: This can be a rent agreement, lease agreement, or ownership proof of the premises.

Signed and notarized copies of the Memorandum of Association (MOA) and Articles of Association (AOA).

Consent to act as a director and file the declaration of compliance.

Any other documents as required by the ROC during the registration process.

Ensuring the accuracy, completeness, and proper attestation of all documents is crucial to prevent any potential delays or rejections during the registration process.

Benefits of Choosing OPC Company Registration for Solo Entrepreneurs

Opting for OPC company registration as a solo entrepreneur in India can offer numerous benefits. One of the key benefits is limited liability protection, which ensures that your assets are safeguarded in case of any financial or legal issues faced by your company. This gives you comfort and lets you concentrate on expanding your company without worrying about losing your assets.

Another benefit is the legal recognition and credibility that comes with OPC registration. Being a registered company gives your business a professional image, making it easier to attract clients, investors, and business partners. It also allows you to enter into contracts and agreements on behalf of your company, enhancing your business opportunities.

Additionally, OPC registration provides tax benefits and incentives offered by the government of India. As an OPC, you can avail exemptions on capital gains, simplified compliance requirements, and various tax deductions. This can result in significant cost savings and improved profitability for your business.

Comparison between OPC and other types of company registration in India

When considering company registration options in India, it is important to compare OPC with other types of company registration to make an informed decision. While OPC is suitable for solo entrepreneurs, other types of company registrations, such as Private Limited Company and Limited Liability Partnership (LLP), may be more suitable for businesses with multiple partners or shareholders.

A Private Limited Company offers the advantage of limited liability protection and separate legal entity status, similar to an OPC. However, it requires a minimum of two shareholders and two directors, which may not be feasible for solo entrepreneurs. On the other hand, an LLP is suitable for businesses where partners want to have limited liability protection, but also want flexibility in terms of management and decision-making.

Choosing the right type of company registration depends on your specific business needs, future growth plans, and the number of individuals involved in the business. It is recommended to consult with a professional OPC registration consultant to understand the nuances and make an informed decision.

Choosing a reliable OPC Registration Consultant

As the process of OPC company registration in India involves legal and technical complexities, it is advisable to seek the assistance of a reliable OPC registration consultant. An OPC registration consultant can help you navigate the registration process smoothly and ensure compliance with all legal requirements. They can assist you with document preparation, name approval, filing of documents, and other formalities.

When choosing an OPC registration consultant, consider their experience, reputation, and track record. Look for consultants who have a deep understanding of the OPC registration process and are well-versed in the legal framework. It is also important to clarify the fees upfront to avoid any surprises later.

Common mistakes to avoid during OPC Company Registration

While registering an OPC in India, it is crucial to avoid common mistakes that can lead to delays or rejections. Here are some common mistakes to avoid during the OPC company registration process:

Choosing an inappropriate name: Ensure that the name you choose for your OPC complies with the naming guidelines specified by the MCA. Avoid using names that are similar to existing companies or trademarks.

Incomplete or inaccurate documents: Double-check all the documents to ensure accuracy and completeness. Erroneous or absent information may cause delays or rejections.

Non-compliance with legal requirements: Stay updated with the latest legal requirements and ensure compliance at every stage of the registration process. Failure to comply with legal requirements can result in penalties or rejection of your application.

Lack of professional guidance: Seeking professional guidance from an OPC registration consultant is essential to avoid mistakes and ensure a smooth registration process.

By being aware of these common mistakes and taking necessary precautions, you can streamline the OPC company registration process and avoid unnecessary complications.

Conclusion: Why OPC Company Registration is the Best Choice for Solo Entrepreneurs in India

In conclusion, OPC company registration is the best choice for solo entrepreneurs in India due to its numerous benefits and advantages. By registering your company as an OPC, you can enjoy limited liability protection, separate legal entity status, tax benefits, and credibility in the market. OPC registration provides a unique opportunity for solo entrepreneurs to establish themselves as separate legal entities, gaining trust and recognition in the business world.

To ensure a smooth and hassle-free registration process, it is advisable to seek the assistance of a reliable OPC registration consultant. They can guide you through the process, help with document preparation, and ensure compliance with all legal requirements.

If you are a solo entrepreneur in India, and looking to establish your business with limited liability and legal recognition, OPC company registration is the ideal choice. Make the right move today and register your OPC to unlock the benefits and opportunities that come with it.

To Know More About OPC Company Registration Read Out Our Other Blog Also

#one person company#opc#opc registration#company#registration#company registration#one person company registration#opc company#Company formation#company filling

0 notes