#ntpc e procurement

Explore tagged Tumblr posts

Text

BOQ in Tender, Importance, and Types: tender information

You need a Bill of Quantities (BOQ) to bid on something. People, tools, and things on this list can help you finish the work. It tells you how much of each thing you need and how much it costs. The BOQ is a very important tool for keeping tendering legal, open, and fair.

What is BOQ in Tendering?

The number of this item Number BOQ stands for "Bill of Quantities." The list tells you what each work is, how many there are, and how much they should cost. The list is being made. A bid is one way to find out how much a work costs. This helps people figure out how much it will cost and see how the prices of different sellers compare.

There is an expert (number surveyor, engineer, etc.) who makes the BOQ before the bids are sent out. This way, all prices are based on the same amount of work. This keeps prices from going up or down too much.

What the BOQ means and why it's important in BIDs

When people bid, BOQ is used for many things, like

1. Prices that are easy to understand

It's simple to learn how to bid in BOQ because the style doesn't change. The price shouldn't change because everyone buys the same paper.

2. A good idea of how much it will cost

With BOQ, you can get a better idea of how much the work will cost. There will be less fighting, and the project will cost more than expected.

3. A level playing field

Because BOQ divides everything into things, work, and services, everyone who bids is on the same team. This makes everything fair and clear.

4. Finding out the best way to spend money

BOQ helps project managers plan and make budgets for their money. This keeps the work prices in the range that was agreed upon.

5. Taking better care of business deals

You can keep track of how things are going and make sure the person is getting paid while the work is being done if the BOQ is well-written.

6. Making sure there are no fights

When the BOQ has clear amounts and information about the work, both the project owner and the worker can understand each other better. We can't fight or make claims anymore.

Several types of bid forms

People use a different type of BOQ for each work and way it will be bought. These are the main kinds:

1. Based on what BOQ

This type of BOQ comes with a detailed list of everything, along with numbers, unit measures, and rough prices. It gets a lot of work in the areas of building, machines, and electricity.

2. One-Time BOQ

This kind only gives one price for the whole work, not prices for each part. It's good for work where the work is clear and doesn't change often.

3. A simple BOQ

In this way, each item is not shown on its own. Instead, it links work together, like digging, building a base, or putting on a roof. It's used for big building work.

4. BOQ based on work done

This BOQ is not based on sources or parts, but on work. A lot of people use it to plan and carry out projects.

5. Rate-Only BOQ

They should say how much it costs instead of how many they need. During the tender, this is what you do if you don't know how much something costs.

6. In the form of a BOQ

On the initial bill of quantities, there are still some items whose prices have not been set. This will happen when the work is done. People are being asked to bid on work where it's not clear what needs to be done.

Steps Involved in Preparing BOQ

There is a set of steps that must be followed to make sure that the answers are correct and easy to understand. These are the most important steps:

1. How to Figure out the Work's Scope: A list of all the parts of the project, like the tools, materials, and people who will work on it.

2. Measurement and Quantification: Writing down all the things you need to do along with their exact sizes and units is a good way to measure and count.

3. Specification Detailing: you should give detailed accounts of each piece of work.

4. To figure out rates: look at market prices, business standards, or work that have already been done.

5. Review and Finalization: Before sending the BOQ out for bids, make sure it doesn't have any mistakes.

Who does BOQ work for when it comes to managing contracts?

The BOQ is used as a guide for the following during the deal:

Tracking project progress: A project's progress is tracked to make sure that the work is done as planned.

Contractor payments: Checks that promises of payment are correct based on the work that was actually done.

Taking care of variations: This helps you choose whether to accept requests for changes and add more work.

How to settle fights: This is a guide for how to settle arguments when they happen.

Challenges in BOQ Preparation and Usage

It can be hard to get ready for the BOQ, even though it has perks, such as

Not enough or the wrong information: When measurements are off, costs can vary.

How much things cost: When market prices change, it might be harder to get exact cost estimates.

Changes to the project scope: If the project scope changes in ways that weren't planned for, the BOQ may not be as useful.

Mistakes that people make: Inefficient bidding can be caused by mistakes in measuring the amount.

Conclusion

Before the bids are made, the BOQ makes sure that the prices, details, and business are correct. Things can be bought faster, with less risk, and with less trouble if the right kind of BOQ is used. They can save money, make better bids, and make sure the work goes well if they understand what the BOQ is and how it works for prices. Read our site often to find out more about what the government gets and how bids work. At Bidhelp.co, you can find people who can help you with bids. For more details visit : https://blog.bidhelp.co/

#chandigarh e tender#lakshadweep tender#puducherry tender#tntenders gov in#ntpc eprocurement#ntpc e procurement

0 notes

Text

Government e Marketplace GeM

Visit for more information: https://gem.gov.in/contactUs

National Thermal Power Corporation Limited (NTPC), a prominent Public Sector Undertaking under Ministry of Power, has issued a sizeable purchase order for procurement of Mine Development and Operations Services through GeM. The contract, valued at of ₹13,868 Crore, marks the highest bid value awarded on GeM in this fiscal year, as of October 16, 2023. NTPC Limited has consistently relied on GeM for sourcing quality products and services, while optimising their public spending. The portal’s vast offerings have well-equipped it to meet the dynamic needs of buyers like NTPC Limited! Department of Commerce, GoIMinistry of Power, Government of IndiaNTPC Limited

0 notes

Text

Government e Marketplace GeM

Visit today for more information: https://gem.gov.in/

Country’s number one power generation company, NTPC Limited attained number one spot too in procurement of goods & services from #GeM. NTPC also recorded highest ever single procurement ₹20,420 Crore Mine Development & Operations Services (MDO) through GeM.

0 notes

Photo

General Elections in India are in progress. Simultaneously tenders are also being published all over India by various departments. Tender Tags eprocurement, procurement, procurement, e procurement, eprocurement karnataka, e procurement karnataka, e procurement tenders, e tender, e-procurement, haryana eprocurement, eprocurement login, e procurement tender, e proc, e tendering, eprocurement ap, eprocurement delhi, tender eprocurement, telangana eprocurement, eprocurement karnataka login, e procurement ap, delhi e procurement, e procurement delhi, ntpc eprocurement, e procurement login, eprocurement ntpc, eprocurement mes, , RISING, bel e procurement, defence eprocurement portal, ap e procurement.gov.in, ap e procurement online tenders, www.eprocurement.gov.in.karnataka, uktenders e-procurement, eprocurement karnataka govt tenders list, tata steel eprocurement, ntpc eprocurement, eprocurement tamilnadu, cpp portal, eprocurement ntpc, eprocurement system government of india, eprocurement punjab, eprocure gov in, defence eprocurement, eprocurement karnataka login, eprocurement mes, telangana eprocurement, eprocurement login, eprocurement, eprocurement portal, eprocurement karnataka, eprocurement up, e procurement tenders Call +91 92760 83333 for more details

1 note

·

View note

Text

Largest order ever placed on GeM till now ~ ₹20,400 Crore by @NTPC under Mine Development & Operations Service (MDO), a unique category used for the first time on GeM. With this, GeM surpassed the GMV milestone of ₹1.5 lakh crore in FY 2022-23, 2 months sooner than the FY end! Government e Marketplace (GeM) is a 100 percent Government owned & National Public Procurement Portal. GeM is dedicated e market for different goods & services procured by Government Organisations / Departments / PSUs.

0 notes

Text

GeM Investigates How To Add Works To The Portal

According to a senior source, the public procurement portal GeM has released an approach paper for stakeholder engagements as it looks into ways to bring works to the platform to expand its coverage.

The Government e-Marketplace (GeM) platform, was launched in 2016 for the online purchasing of products and services by all central government ministries and departments. Currently, only registered goods and service suppliers can buy products and services through this platform.

Construction projects include creating roads and structures, as well as establishing large plants and other facilities. There isn’t yet any way to purchase these works on the GeM platform. The GeM portal does not list large contractors who perform these services. Therefore, to investigate options for including these works on the platform, we have released an approach paper for stakeholder engagements, GeM CEO Talleen Kumar told PTI.

He claimed that by allowing the purchase of these works, the platform would become a national portal for many purchases by the states, the federal government, and other government organisations. GeM would approach the centre for further action after gathering opinions from all stakeholders, including the governments of the states and the federal government.

In a letter to all state and union territory chief secretaries and central government secretaries, Kumar stated that GeM’s current responsibility is to provide a platform for the purchase of goods and services for federal and state government organisations. However, the organisation is currently working to develop a national unified procurement system that will provide a single platform for the purchase of goods, services, and works.

The bid documents now are in use by the public works departments of five states, the Ministries of Defense and Railways, NTPC, IOCL, CPWD, NHAI, NHIDCL, and PGCIL have undergone a thorough study by GeM. The approach paper shares the results of the examination of 47 bid documents for works contracts that these organisations used in the recent past.

The purchasing entities (PEs) will create their unique bid documents by selecting from a library of standard bid document templates thanks to technology. GeM has asked ministries and departments that may be involved in the procurement of works for their opinions, feedback, and suggestions. They should be able to share their opinions by December 28 of this year. Since its beginning, GeM, according to Kumar, has caused a paradigm shift in the way PEs buy products and services.

It offers a national platform with over 7.5 lakh vendors and service providers, over 17 lakh products, and a transaction value of over Rs 71,900 crore. As a result, the MSME sector’s reach has increased while transaction times and costs for acquiring goods and services have decreased. He added that initially; the builder is suggested to be used just for works contracts utilising National Competitive Bidding (NCB) procedures, but we expect it to bring about improved economy, efficiency, and openness in the procurement of works.

“It should hold broad stakeholder engagements to complete the strategy for bringing works procurement on GeM. This approach paper took a start in that regard,” said the CEO. Since August 2019, over 1,490 software processes have been built or improved to provide a variety of features and functionalities for transparent, practical, and affordable purchases via the portal.

0 notes

Text

Light Vehicle Leasing Market 2021- Know the Analysis and Trends upto 2030

The inventive mobility leasing solutions such as electric vehicle (EV) leasing is gaining traction in the light vehicle leasing market. Government bodies, who are constantly striving towards reducing environmental pollution, are promoting the adoption of electric vehicles. For instance, in August 2019, Energy Efficiency Services Ltd (EESL), a joint venture collectively owned by four government-owned entities including Power Finance Corporation Ltd. (PFC), Rural Electrification Corporation Limited (REC), Power Grid Corporation of India Limited and NTPC Limited announced the procurement of 10,000 electric cars to be leased out to government departments. Similar electric vehicle initiatives are being undertaken by regulatory bodies in China and Japan to promote automotive leasing, which is supplementing the growth of Asia Pacific light vehicle leasing market. The simultaneous development in the EV charging infrastructure is anticipated to further boost the market growth. About 92 public chargers have been installed across major States in India, while as on August 2020, 1 million public charging plugs were collectively deployed in China and Europe. Hence, favorable government initiatives towards adoption of e-mobility solutions showcases positive growth prospects for the light vehicle leasing market participants over the forecast period.

Access the Full Report @ https://www.absolutemarketsinsights.com/reports/Asia-Pacific-Light-Vehicle-Leasing-2020-%E2%80%93-2028-773

The outbreak of the novel coronavirus has adversely impacted the sales of automobiles globally. In order to overcome the challenges in terms of sales volume brought about by the pandemic induced economic downturn, automotive manufacturers are considering the adoption of vehicle leasing model to cater the demand requirement of consumers within their budgetary considerations. Maruti Suzuki India Limited (MSIL), an India-based automotive manufacturer, for instance announced plans to lease out light vehicles to the retail customers through their dealership network in the country. The company through this scheme, plans to provide the urban consumers with an alternative option given that the affordability of consumers at large have been adversely impacted due to the pandemic. The rapid spread of the virus has constrained the public transport sector and also ride hailing services market to an extent. Thus, the prevailing situation showcases growth opportunities for Asia Pacific light vehicle leasing market over the coming years.

In terms of revenue, Asia Pacific light vehicle leasing market was valued at US$ 14,180.8 Mn in 2019 and is anticipated to grow at a CAGR of 3.8% over the forecast period (2020 – 2028). The study analyses the market in terms of revenue across all the major countries.

The detailed research study provides qualitative and quantitative analysis of Asia Pacific light vehicle leasing market. The market has been analyzed from demand as well as supply side. The demand side analysis covers market revenue across all the major countries. The supply side analysis covers the major market players and their regional presence and strategies. The geographical analysis done emphasizes on each of the major countries across Asia Pacific.

Key Findings of the Report:

Operating lease of light vehicles is anticipated to register highest growth rate over the forecast period in the Asia Pacific light vehicle leasing market. The growing need among consumers to procure mobility benefits without undertaking risks associated with future resale value is expected to boost the segment’s growth.

Corporate end users in the region are largely opting for fully-maintained leasing services, which is propelling the segment’s growth in the Asia Pacific light vehicle leasing market

China held the highest market share in Asia Pacific light vehicle leasing market in 2019. The matured used car market in the country along with growing awareness of the leasing business model is supplementing the country’s growth in the market. However, India is anticipated to register highest CAGR over the forecast period.

Some of the players operating in the Asia Pacific light vehicle leasing market are ALD Automotive Private Limited, ALTERNATIVA, Arval Belgium NV/SA, Avis Rent A Car, Daimler Fleet Management Singapore, Drive.SG Pte. Ltd., Driveline Fleet Ltd., DriveMyCar, ExpatRide International, Flexi Lease, Hitachi Capital Vehicle Solutions, Lease2Go, LeasePlan, Mountsville Pty Ltd., ORIX New Zealand Ltd, Singapore Mobility Corporation Pte Ltd, SmasIndia.com and Tokyo Century Corporation amongst other market participants.

Asia Pacific Light Vehicle Leasing Market:

By Type

Operating Lease

Finance Lease

By Offering

Fully-Maintained Leasing Services

Non-Maintained Leasing ServicesTyre Servicing and Management Insurance Services Repair & Maintenance Services Registration Services Others

By Vehicle Type

Convertible

Coupe

SUV

Hatchback

Sedan

Vans

Others

By Vehicle Condition

New Car

Pre-Used

By Vehicle Propulsion

Diesel

Gasoline

Electric

Hybrid

By Lease Duration

Less than 12 Months

13 Months to 36 Months

37 Months to 48 Months

More than 48 Months

By End Users

Individuals/Private

CorporateSmall and Medium Enterprises Large Enterprises

By Country

China

Japan

India

New Zealand

Australia

South Korea

Southeast AsiaIndonesia Thailand Malaysia Singapore Rest of Southeast Asia

Rest of Asia Pacific

Contact Us:

Company: Absolute Markets Insights

Email id: sales@absolutemarketsinsights.com

Phone: +91-740-024-2424

Contact Name: Shreyas Tanna

Website: https://www.absolutemarketsinsights.com

0 notes

Text

Renewable energy Articles, Solar PV – Latest Solar Power News, Solar Energy | Energetica India Magazine

ACME, ReNew Win MSEDCL’s 500 MW Solar Auction

Two major Indian solar energy companies, ACME Solar Holdings and ReNew Solar Power has emerged as the lowest bidders in the state-owned Maharashtra State Electricity Distribution Company Limited’s (MSEDCL) 500 MW solar photovoltaic (PV) projects auction, by quoting a tariff of Rs 2.42/kWh and Rs 2.43/kWh respectively.Under MSEDCL auction, ACME Solar Holdings won 300 MW of capacity at a tariff of Rs 2.42/kWh, while ReNew Solar Power won 200 MW of capacity at a tariff of Rs 2.43/kWh.By receiving overwhelming response from bidders, the tender was oversubscribed by 3,565 MW, and other bidders who applied for the tender includes – TP Saurya, Avaada Energy, NTPC, Power Mech Projects, Torrent Power, Azure, Maharashtra State Power Generation Co, Cyclic Energy Power, and Maharashtra State Road Development Corporation.As per the tender, state discom MSEDCL will procure the clean energy generated from the solar projects under a 25-year power purchase agreement (PPA).In May this year, TP Saurya Ltd, the renewable energy arm of Tata Power, had emerged as the lowest bidder in the e-reverse auction of state-owned Maharashtra State Power Generation Co Ltd (MAHAGENCO), by quoting a tariff of Rs 2.51/kWh.As per Mahagenco, TP Saurya Ltd emerged as the L1 bidder by quoting a tariff of Rs 2.51/kWh, while Satlaj Jal Vidyut Nigam Ltd (SJVNL) and NTPC Renewable Energy Ltd remained the L2 and L3 bidders with a quoted tariff of Rs 2.53/kWh and Rs 2.82/kWh respectively.In January this year, MAHAGENCO had issued an e-reverse auction notification with a tariff cap of Rs 2.83/kWh to set up 250 MW solar PV capacity at Dondaicha Solar Park in Dhule district of Maharashtra.In this regard, it had issued a request for proposal (RFP) for the selection of solar power developers (SPD).25-year power purchase agreement (PPA), MAHAGENCO will procure the power generated from the solar projects, and will sell to MSEDCL.Besides, the successful bidder will have to build the capacity won within 15 months from the effective date of the PPA.

We are here to bring you the latest solar power news, Renewable energy, Solar Energy, Solar PV, Read news on this category, Hundreds of Articles and more, and everything else that you need to and want to know about the solar industry.

#Solar PV#Indian solar energy companies#ACME Solar Holdings#ReNew Solar#Maharashtra State Electricity Distribution Compan#Solar photovoltaic (PV) projects

0 notes

Text

All you need to know about the Bidding Process for Procurement of Power

Written by Arun Mehta, pursuing Certificate Course in Electricity and Renewable Energy Laws offered by Lawsikho as part of his coursework. Arun works as a Specialist in Scheduling and Forecasting at Rewa Ultra Mega Solar Limited, Bhopal. Additionally, he has a MBA degree in Power Management.

Introduction

Prior to the Electricity Act, 2003, the entire electricity sector business was primarily confined to the government owned generation companies and state government owned electricity boards. The Act ushered in an era of liberalization, privatization, transparency and competition in the sector. Gradually, the sector witnessed a series of reforms such as unbundling of state utilities, privatization of generation, entry of private players in transmission and increasing competition in generation as well as retail supply of electricity. Increasing competition has yielded significant benefits in terms of capital costs and operational efficiency resulting in more cost effective power for consumers.

Earlier, since the State Electricity Boards handled the entire gamut of activities, power was procured either from state owned generating plants or central generating stations operated by CPSUs such as NTPC, NHPC and the tariff of electricity was mainly decided by the State Governments. Later, the task determining tariffs for procurement of electricity was given to the Central and State Regulatory Commissions through the Regulatory Commissions Act, 1998[1].

With the advent of Electricity Act, the sector witnessed immense private sector participation. Eventually, the sector has become so competitive that even the regulators (CERC and SERC) are gradually distancing themselves from tariff determination and adopting tariff discovered through market principles, i.e. though competitive bidding of power.

This article discusses the regulatory background, power market structure in India, various modes of power procurement and key features of the guidelines issued by the government for competitive procurement of power.

Throughout the article, the words “Act” and “discom” are synonymously used with Electricity Act, 2003 and distribution companies, respectively.

Regulatory Background

Relevant Provisions in the Electricity Act, 2003

The Electricity Act introduced key enabling provisions that have facilitated procurement of power through competitive bidding. As per Section 61 and 62 of the Act tariff determination is under the ambit of Central or State Regulatory Commission. However, the Act gives precedence to tariff determined through competitive bidding under Section 63, reproduced below:

“Section 63. Determination of tariff by bidding process

Notwithstanding anything contained in section 62, the Appropriate Commission shall adopt the tariff if such tariff has been determined through transparent process of bidding in accordance with the guidelines issued by the Central Government.”

Further, in Section 61, the following provisions support procurement of power through competitive bidding:

“Section 61. (Tariff regulations):

The Appropriate Commission shall, subject to the provisions of this Act, specify the terms and conditions for the determination of tariff, and in doing so, shall be guided by the following, namely: –

(b) the generation, transmission, distribution and supply of electricity are conducted on commercial principles

(c) the factors which would encourage competition, efficiency, economical use of the resources, good performance and optimum investments;

(e) the principles rewarding efficiency in performance;

(i) the National Electricity Policy and tariff policy “

The Act has also introduced various measures for opening up of the power market, which act as enablers in moving towards an electricity market based on commercial principles. Some of key measures that have encouraged a competitive power market are:

Delicensing of generation under Section 7 of the Act, with the exceptionof hydro projects, thereby encouraging private sector participation in generation.

Introduction of open access through which any entity, viz. generator, discom or industrial consumer can buy or sell power through the use of transmission or distribution network. Open access has been instrumental in bringing the sector from a monopoly operated by the State Electricity Boards to a vibrant and competitive sector. The Act gives the right of open access to industrial consumers for procurement of electricity from their own captive plants through the interstate or intrastate transmission network and also mandates the Central & State transmission utility or any transmission licensee to provide open accessto generators (above 250 MW for thermal, 50 MW for hydro and 5 MW for renewable sources)[2] or consumer above 1 MW[3]

Unbundling of state electricity boards into separate generation, transmission and distribution companies, thereby uncovering inefficiencies, promoting transparency and private sector participation in all the three segments. As per Section 172(c) of the Act, the assets, rights, liabilities etc. of State Electricity Boards established under the Electricity (Supply) Act, 1948 are transferred to the State Government, which prepares a transfer scheme as per Section 131 of the Act, through which the SEBs are unbundled.

National Electricity Policy and National Tariff Policy

The National Electricity Policy stipulates competition in the power market aimed at consumer benefits[4] and the National Tariff Policy aims to provide electricity to consumers at reasonable and competitive rates, ensure financial viability of the sector and attract investments and Promote competition, efficiency in operations and improvement in quality of supply[5].

Under its general approach to tariff, The National Tariff Policy of 2016 mandates procurement of power through competitive bidding. The relevant sections are quoted below:

“ 5.1 Introducing competition in different segments of the electricity industry is one of the key features of the Electricity Act, 2003. Competition will lead to significant benefits to consumers through reduction in capital costs and also efficiency of operations. It will also facilitate the price to be determined competitively. The Central Government has already issued detailed guidelines for tariff based bidding process for procurement of electricity by distribution licensees.

5.2 All future requirement of power should continue to be procured competitively by distribution licensees except in cases of expansion of existing projects or where there is a company owned or controlled by the State Government as an identified developer and where regulators will need to resort to tariff determination based on norms provided that expansion of generating capacity by private developers for this purpose would be restricted to one time addition of not more than 100% of the existing capacity.

5.3 The tariff of all new generation and transmission projects of company owned or controlled by the CentralGovernment shall continue to be determined on the basis of competitive bidding as per the Tariff Policy notified on6thJanuary, 2006 unless otherwise specified by the Central Government on case to case basis. “

Power Procurement in India

Power Market Structure in India

The present power market is a vibrant market with both government and private players in the generation sector (also called Independent Power Producers). The erstwhile State Electricity Boards (with the exception of Kerala SEB[6] and partly Himachal Pradesh SEB[7]) have now unbundled into State Generation, Transmission and Distribution Companies. Apart from these, there are industrial/commercial/captive open access consumers. The structure of the Indian power market is shown in the Figure below:

Figure 1: Structure of Indian Power Market [8]

Modes of Power Procurement

Power procurement by discoms can be classified as long, medium or short term based on the duration for purchase of power. Further, they can be classified as PPAs (bilateral or competitive bidding) and procurement from traders or power exchanges (short term, day ahead or contingency).

The usual mode of procurement of power is through long term PPAs of 25 years, where tariffs are determined based on rates discovered through reverse auctions. Typically, long term PPAs are the most preferred mode since they provide long term certainty and reduce risks to both generators as well as discoms. For the generators, the risk is reduced due to certainty of revenue for 25 years and for discoms, the risk is reduced in terms of constant source of power supply and less risk exposure to volatility in fuel prices.

The Ministry of Power released Guidelines for Determination of Tariff by Bidding Process for Procurement ofPower by Distribution Licensees in 2005, which defined two mechanisms of procurement of power through competitive bidding Case 1 and Case 2. Case 1 projects are those where the location, technology or fuel are not specified and most of the approvals, clearances, land acquisition for the project has to be carried out by the private developer. For Case 2 project, generally the location is specified, fuel, including the fuel linkages are established/facilitated by the government and various approvals, water availability etc. are facilitated by the government[9]. Thus, the risk with developer is higher in Case 1 projects and lower for Case 2 projects as some risk is shared by the government. Even the terminology for procurement of power is slightly different, Power Purchase Agreement for Case 2 projects and Power Supply Agreement for Case 1 projects, implying that the onus of procuring the power is on the discom/utility in the former, whereas in the latter the onus is on the developer to supply power.

The Power Procurement Process

The steps of power procurement process are outlined as follows[10]:

Preparation of Bid Documents

Site identification and land acquisition

Environment and Forest Clearance

Fuel arrangement and water linkage

Detailed Project Report consisting of all information related to the project, including hydrological, geological, meteorological and seismological data

Other related information

Bidding Process

Preparation of Bid Documents: The quantum of power to be procured is decided by the procurer (discom) on the basis of demand forecast available from the latest Electric Power Survey, published by the CEA, in case of deviation from the forecast, approval of the appropriate commission is sought. The bid documents are required to be prepared by the procurer in line with the Model Bidding documents issued in 2013 for DBFOT power projects for Case 2 projects[11] and DBFOO model documents for Case 1 projects[12].

Site identification and land acquisition: In Case 2 projects, as the site is pre-identified. Land acquisition and related clearances are required to be taken by the procurer prior to the issue of bid documents.For Case 1 projects, the site selection and land acquisition are required to be done by thebidder/developer, for which documentary evidence indicating land acquired and pending land is required to be submitted along with bidding documents.

Environment and Forest Clearance: Environment and Forest clearance (if applicable) is required to be taken by the procurer prior to issue of bid documents for Case 2 projects. For Case 1 projects, the proposal for environment/forest clearance is to be submitted by the bidder/developer.

Fuel arrangement and water linkages:For Case 2 bids, the fuel linkages, if available, are specified by the procurer prior to the issue of bid documents. For Case 1 projects, the bidder is required to have fuel linkage or coal block allocation or fuel supply agreement for gas which should typically suffice for the entire duration of the PPA.

Grid connectivity: For Case 2 projects, typically grid connectivity for long term access is the responsibility of the procurer. For Case 1 projects, grid connectivity is responsibility of the bidder. However, it would be the responsibility of the bidder in case bid documents do not specify grid connectivity.

Detailed Project Report: For Case 2 projects, detailed project report (or feasibility report) with details on site specifications, water availability, soil type, geological, hydrological and seismological information is made available to bidders before issue of bid documents, which bidders can ascertain through site visits. In Case 1 projects, the DPR is required to be submitted by the developer with the bidding documents.

Other related information: ln case the bidder is a trading licensee (power trader), it is required to submit a copy of the PPA signed with the generator for the required capacity. Availability of fuel and transmission linkages need to be ascertained by the trader, prior to bidding.

Bidding process: The bidding process for procurement under both Case 1 and Case 2 projects is a two stage process. The first stage is a Request for Qualification (RFQ) wherein the technical and financial credentials of the bidders are evaluated. Only those bidders who qualify the first stage then submit a financial (tariff) proposal in the Request for Proposal (RFP) stage. For thermal plants, the financial bid comprises of a fixed charge and a fuel charge (for some projects, especially renewable projects, the financial bid comprises only of a single tariff). The bidder quoting the lowest financial bid is awarded a Letter of Award, followed by signing of Power Purchase Agreement (Case 2 project) or Power Supply Agreement (Case 1 project).

Contents of RFQ and RFP documents

The Ministry of Power has released Model Bidding documents for Case 2 projects under DBFOT (Design Build Finance Operate and Transfer) and Case 1 projects under DBFOO (Design Build Finance Own and Operate). For both type of projects, the bidding process is a two stage process. A typical RFQ document has the following contents[13]:

Information about the utility, location of plant (for Case 2 projects), indicative project cost (only for Case 2 projects) and payment cost for the RFQ process

Information on the bidding documents including the RFQ, PPA and other documents issued from time to time

Brief description and schedule of the bidding process

Requirements on formation of SPV Financial, technical and operational eligibility requirements

Evaluation criteria for techno-commercial evaluation

Formats for submitting information relating to technical and financial parameters

On the basis of evaluation in the RFQ stage, in the RFP stage, selected bidders submit bank guarantee for bid security, legal documents including power of attorney for consortiums or joint ventures and financial bid which is either atwo-part tariff, i.e. fixed charge and fuel charge for thermal plants or a single part tariff. The bidder quoting the lowest tariff is selected. Further, the RFP contains rules for selection if multiple bidders quote the lowest tariff or lowest tariffs are quoted by different bidders for different capacities.

Power Purchase Agreements

Power Purchase Agreements (PPAs)are contracts signed between selected bidders and procurers. Usually, such agreements are capacity (MW) based, some renewable energy based projects also have energy (MU) based PPAs. The PPA plays an important role in ensuring cost competitiveness of power, since it not only contains payment related clauses but also clauses pertaining to obligations of the supplier and procurer, default events, liquidated damages applicable to both parties and force majeure clauses. The PPA minimizes developer risk through letter of credit and other payment security arrangements and also sets obligations through generation clauses. The key elements and features of a model PPA are as follows[14]:

Conditions Subsequent clause: Conditions Subsequent are conditions to be fulfilled by the seller/generator and the procurer within a certain period post signing of PPA. Conditions Subsequent for the seller include signing of fuel supply agreement, necessary clearances and permits, long term or medium term access as applicable and signing of EPC contracts for supply and erection of boiler, turbine and balance of plant. For the procurer, the Conditions Subsequent involves obtaining long term or medium term access to the grid, if applicable.

Contract Performance Guarantee: Contract performance guarantee is a bank guarantee submitted by the seller as a security which can be encashed by the procurer if the seller is unable to supply the contracted amount of power within a given period of time.

Guarantee of offtake: The offtake of power from the generating plant is guaranteed by the procurer up to the available or contracted capacity, whichever is lower.

Defining of injection and delivery points, open access, transmission charges and scheduling clauses for scheduling and dispatch of energy.

Billing and payment clauses, including Letter of Credit and escrow arrangements for payment security of seller.

Force Majeure clauses: Define force majeure events that are beyond the control of parties and the remedies available to the parties on occurrence of such events

Change in law clause: Allows pass through of increase in capital costs due to change in law which impacts the capital or operational costs substantially, for instance through an increase in tax rates.

Event of default clause: Provide for compensation, including termination compensation to either party on default from its obligations.

Conclusion

The power sector has evolved from a regulated state monopoly to an open market with more access to private players. While the market has certainly become more competitive, yet there are certain risks that need to be addressed. For thermal projects, certain factors such as fuel and land availability and payment delay by utilities are some of the risks that are still pertinent to developers. Such risks can be addressed through inputs and suggestions from the developers and incorporating them in the bidding documents. Achieving the objectives of efficiency, quality and reliability of power and optimum utilization of resources as set by the Electricity Act would require estimating and incorporating all possible risks and making the bidding documents as inclusive as possible.

[1]Section 13 (a) and Section 22(1) (a) of The Electricity Regulatory CommissionsAct, 1998 (repealed)

[2]Section 2 (1) (b) of (Grant of Connectivity, Long term Access and Medium term open access in interstate transmission and related matters) Regulations, 2009

[3]Kumar, S. (n.d.)Open Access, Retrieved from http://bit.ly/2SH1dMK

[4]Section 5.7 of National Electricity Policy, 2005

[5]Section 4.0 ,Objectives of the National Tariff Policy, 2016

[6]KSEB Limited Overview. (2015) Retrieved from http://www.kseb.in/index.php?option=com_content&view=article&id=50&Itemid=493&lang=en

[7] HPERC, History of HPSEBL, 4th APR Order for 3rd MYT Period (FY15-19) & Determination of Tariff for FY19 & True Up of FY16, Retrieved from http://bit.ly/2ABFhf1

[8]Tata Power Trading Company Ltd. (n.d.) Presentation on Power Procurement: Planning, Regulations and Practices.

[9] Forum of Regulators (2017). Competitive Tariff vis-a-vis Cost plus Tariff- Critical Analysis. Retrieved from http://bit.ly/2SBwl0a

[10] Ministry of Power (2005) Guidelines for Determination of Tariff by Bidding Process for Procurement of Power by Distribution Licensees

[11]Ministry of Power (2013) Guidelines for Procurement of Electricity from Thermal Power Stationssetup on DBFOT basis

[12]Ministry of Power (2013) Guidelines for Procurement of Electricity from Thermal Power Stations setup on DBFOO basis

[13] Ministry of Power (2013) Model Request for Qualification for Power Purchase Agreement for DBFOT Power Projects

[14] Standard Power Purchase Agreement for Procurement of Power Under Case – 1 Bidding Procedure Through Tariff Based Competitive Bidding Process, as per Guidelines issued by the Government of India for Determination of Tariff by Bidding Process for Procurement of Power by Distribution Licensees

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skills.

The post All you need to know about the Bidding Process for Procurement of Power appeared first on iPleaders.

All you need to know about the Bidding Process for Procurement of Power syndicated from https://namechangersmumbai.wordpress.com/

0 notes

Text

All you need to know about the Bidding Process for Procurement of Power

Written by Arun Mehta, pursuing Certificate Course in Electricity and Renewable Energy Laws offered by Lawsikho as part of his coursework. Arun works as a Specialist in Scheduling and Forecasting at Rewa Ultra Mega Solar Limited, Bhopal. Additionally, he has a MBA degree in Power Management.

Introduction

Prior to the Electricity Act, 2003, the entire electricity sector business was primarily confined to the government owned generation companies and state government owned electricity boards. The Act ushered in an era of liberalization, privatization, transparency and competition in the sector. Gradually, the sector witnessed a series of reforms such as unbundling of state utilities, privatization of generation, entry of private players in transmission and increasing competition in generation as well as retail supply of electricity. Increasing competition has yielded significant benefits in terms of capital costs and operational efficiency resulting in more cost effective power for consumers.

Earlier, since the State Electricity Boards handled the entire gamut of activities, power was procured either from state owned generating plants or central generating stations operated by CPSUs such as NTPC, NHPC and the tariff of electricity was mainly decided by the State Governments. Later, the task determining tariffs for procurement of electricity was given to the Central and State Regulatory Commissions through the Regulatory Commissions Act, 1998[1].

With the advent of Electricity Act, the sector witnessed immense private sector participation. Eventually, the sector has become so competitive that even the regulators (CERC and SERC) are gradually distancing themselves from tariff determination and adopting tariff discovered through market principles, i.e. though competitive bidding of power.

This article discusses the regulatory background, power market structure in India, various modes of power procurement and key features of the guidelines issued by the government for competitive procurement of power.

Throughout the article, the words “Act” and “discom” are synonymously used with Electricity Act, 2003 and distribution companies, respectively.

Regulatory Background

Relevant Provisions in the Electricity Act, 2003

The Electricity Act introduced key enabling provisions that have facilitated procurement of power through competitive bidding. As per Section 61 and 62 of the Act tariff determination is under the ambit of Central or State Regulatory Commission. However, the Act gives precedence to tariff determined through competitive bidding under Section 63, reproduced below:

“Section 63. Determination of tariff by bidding process

Notwithstanding anything contained in section 62, the Appropriate Commission shall adopt the tariff if such tariff has been determined through transparent process of bidding in accordance with the guidelines issued by the Central Government.”

Further, in Section 61, the following provisions support procurement of power through competitive bidding:

“Section 61. (Tariff regulations):

The Appropriate Commission shall, subject to the provisions of this Act, specify the terms and conditions for the determination of tariff, and in doing so, shall be guided by the following, namely: –

(b) the generation, transmission, distribution and supply of electricity are conducted on commercial principles

(c) the factors which would encourage competition, efficiency, economical use of the resources, good performance and optimum investments;

(e) the principles rewarding efficiency in performance;

(i) the National Electricity Policy and tariff policy “

The Act has also introduced various measures for opening up of the power market, which act as enablers in moving towards an electricity market based on commercial principles. Some of key measures that have encouraged a competitive power market are:

Delicensing of generation under Section 7 of the Act, with the exceptionof hydro projects, thereby encouraging private sector participation in generation.

Introduction of open access through which any entity, viz. generator, discom or industrial consumer can buy or sell power through the use of transmission or distribution network. Open access has been instrumental in bringing the sector from a monopoly operated by the State Electricity Boards to a vibrant and competitive sector. The Act gives the right of open access to industrial consumers for procurement of electricity from their own captive plants through the interstate or intrastate transmission network and also mandates the Central & State transmission utility or any transmission licensee to provide open accessto generators (above 250 MW for thermal, 50 MW for hydro and 5 MW for renewable sources)[2] or consumer above 1 MW[3]

Unbundling of state electricity boards into separate generation, transmission and distribution companies, thereby uncovering inefficiencies, promoting transparency and private sector participation in all the three segments. As per Section 172(c) of the Act, the assets, rights, liabilities etc. of State Electricity Boards established under the Electricity (Supply) Act, 1948 are transferred to the State Government, which prepares a transfer scheme as per Section 131 of the Act, through which the SEBs are unbundled.

National Electricity Policy and National Tariff Policy

The National Electricity Policy stipulates competition in the power market aimed at consumer benefits[4] and the National Tariff Policy aims to provide electricity to consumers at reasonable and competitive rates, ensure financial viability of the sector and attract investments and Promote competition, efficiency in operations and improvement in quality of supply[5].

Under its general approach to tariff, The National Tariff Policy of 2016 mandates procurement of power through competitive bidding. The relevant sections are quoted below:

“ 5.1 Introducing competition in different segments of the electricity industry is one of the key features of the Electricity Act, 2003. Competition will lead to significant benefits to consumers through reduction in capital costs and also efficiency of operations. It will also facilitate the price to be determined competitively. The Central Government has already issued detailed guidelines for tariff based bidding process for procurement of electricity by distribution licensees.

5.2 All future requirement of power should continue to be procured competitively by distribution licensees except in cases of expansion of existing projects or where there is a company owned or controlled by the State Government as an identified developer and where regulators will need to resort to tariff determination based on norms provided that expansion of generating capacity by private developers for this purpose would be restricted to one time addition of not more than 100% of the existing capacity.

5.3 The tariff of all new generation and transmission projects of company owned or controlled by the CentralGovernment shall continue to be determined on the basis of competitive bidding as per the Tariff Policy notified on6thJanuary, 2006 unless otherwise specified by the Central Government on case to case basis. “

Power Procurement in India

Power Market Structure in India

The present power market is a vibrant market with both government and private players in the generation sector (also called Independent Power Producers). The erstwhile State Electricity Boards (with the exception of Kerala SEB[6] and partly Himachal Pradesh SEB[7]) have now unbundled into State Generation, Transmission and Distribution Companies. Apart from these, there are industrial/commercial/captive open access consumers. The structure of the Indian power market is shown in the Figure below:

Figure 1: Structure of Indian Power Market [8]

Modes of Power Procurement

Power procurement by discoms can be classified as long, medium or short term based on the duration for purchase of power. Further, they can be classified as PPAs (bilateral or competitive bidding) and procurement from traders or power exchanges (short term, day ahead or contingency).

The usual mode of procurement of power is through long term PPAs of 25 years, where tariffs are determined based on rates discovered through reverse auctions. Typically, long term PPAs are the most preferred mode since they provide long term certainty and reduce risks to both generators as well as discoms. For the generators, the risk is reduced due to certainty of revenue for 25 years and for discoms, the risk is reduced in terms of constant source of power supply and less risk exposure to volatility in fuel prices.

The Ministry of Power released Guidelines for Determination of Tariff by Bidding Process for Procurement ofPower by Distribution Licensees in 2005, which defined two mechanisms of procurement of power through competitive bidding Case 1 and Case 2. Case 1 projects are those where the location, technology or fuel are not specified and most of the approvals, clearances, land acquisition for the project has to be carried out by the private developer. For Case 2 project, generally the location is specified, fuel, including the fuel linkages are established/facilitated by the government and various approvals, water availability etc. are facilitated by the government[9]. Thus, the risk with developer is higher in Case 1 projects and lower for Case 2 projects as some risk is shared by the government. Even the terminology for procurement of power is slightly different, Power Purchase Agreement for Case 2 projects and Power Supply Agreement for Case 1 projects, implying that the onus of procuring the power is on the discom/utility in the former, whereas in the latter the onus is on the developer to supply power.

The Power Procurement Process

The steps of power procurement process are outlined as follows[10]:

Preparation of Bid Documents

Site identification and land acquisition

Environment and Forest Clearance

Fuel arrangement and water linkage

Detailed Project Report consisting of all information related to the project, including hydrological, geological, meteorological and seismological data

Other related information

Bidding Process

Preparation of Bid Documents: The quantum of power to be procured is decided by the procurer (discom) on the basis of demand forecast available from the latest Electric Power Survey, published by the CEA, in case of deviation from the forecast, approval of the appropriate commission is sought. The bid documents are required to be prepared by the procurer in line with the Model Bidding documents issued in 2013 for DBFOT power projects for Case 2 projects[11] and DBFOO model documents for Case 1 projects[12].

Site identification and land acquisition: In Case 2 projects, as the site is pre-identified. Land acquisition and related clearances are required to be taken by the procurer prior to the issue of bid documents.For Case 1 projects, the site selection and land acquisition are required to be done by thebidder/developer, for which documentary evidence indicating land acquired and pending land is required to be submitted along with bidding documents.

Environment and Forest Clearance: Environment and Forest clearance (if applicable) is required to be taken by the procurer prior to issue of bid documents for Case 2 projects. For Case 1 projects, the proposal for environment/forest clearance is to be submitted by the bidder/developer.

Fuel arrangement and water linkages:For Case 2 bids, the fuel linkages, if available, are specified by the procurer prior to the issue of bid documents. For Case 1 projects, the bidder is required to have fuel linkage or coal block allocation or fuel supply agreement for gas which should typically suffice for the entire duration of the PPA.

Grid connectivity: For Case 2 projects, typically grid connectivity for long term access is the responsibility of the procurer. For Case 1 projects, grid connectivity is responsibility of the bidder. However, it would be the responsibility of the bidder in case bid documents do not specify grid connectivity.

Detailed Project Report: For Case 2 projects, detailed project report (or feasibility report) with details on site specifications, water availability, soil type, geological, hydrological and seismological information is made available to bidders before issue of bid documents, which bidders can ascertain through site visits. In Case 1 projects, the DPR is required to be submitted by the developer with the bidding documents.

Other related information: ln case the bidder is a trading licensee (power trader), it is required to submit a copy of the PPA signed with the generator for the required capacity. Availability of fuel and transmission linkages need to be ascertained by the trader, prior to bidding.

Bidding process: The bidding process for procurement under both Case 1 and Case 2 projects is a two stage process. The first stage is a Request for Qualification (RFQ) wherein the technical and financial credentials of the bidders are evaluated. Only those bidders who qualify the first stage then submit a financial (tariff) proposal in the Request for Proposal (RFP) stage. For thermal plants, the financial bid comprises of a fixed charge and a fuel charge (for some projects, especially renewable projects, the financial bid comprises only of a single tariff). The bidder quoting the lowest financial bid is awarded a Letter of Award, followed by signing of Power Purchase Agreement (Case 2 project) or Power Supply Agreement (Case 1 project).

Contents of RFQ and RFP documents

The Ministry of Power has released Model Bidding documents for Case 2 projects under DBFOT (Design Build Finance Operate and Transfer) and Case 1 projects under DBFOO (Design Build Finance Own and Operate). For both type of projects, the bidding process is a two stage process. A typical RFQ document has the following contents[13]:

Information about the utility, location of plant (for Case 2 projects), indicative project cost (only for Case 2 projects) and payment cost for the RFQ process

Information on the bidding documents including the RFQ, PPA and other documents issued from time to time

Brief description and schedule of the bidding process

Requirements on formation of SPV Financial, technical and operational eligibility requirements

Evaluation criteria for techno-commercial evaluation

Formats for submitting information relating to technical and financial parameters

On the basis of evaluation in the RFQ stage, in the RFP stage, selected bidders submit bank guarantee for bid security, legal documents including power of attorney for consortiums or joint ventures and financial bid which is either atwo-part tariff, i.e. fixed charge and fuel charge for thermal plants or a single part tariff. The bidder quoting the lowest tariff is selected. Further, the RFP contains rules for selection if multiple bidders quote the lowest tariff or lowest tariffs are quoted by different bidders for different capacities.

Power Purchase Agreements

Power Purchase Agreements (PPAs)are contracts signed between selected bidders and procurers. Usually, such agreements are capacity (MW) based, some renewable energy based projects also have energy (MU) based PPAs. The PPA plays an important role in ensuring cost competitiveness of power, since it not only contains payment related clauses but also clauses pertaining to obligations of the supplier and procurer, default events, liquidated damages applicable to both parties and force majeure clauses. The PPA minimizes developer risk through letter of credit and other payment security arrangements and also sets obligations through generation clauses. The key elements and features of a model PPA are as follows[14]:

Conditions Subsequent clause: Conditions Subsequent are conditions to be fulfilled by the seller/generator and the procurer within a certain period post signing of PPA. Conditions Subsequent for the seller include signing of fuel supply agreement, necessary clearances and permits, long term or medium term access as applicable and signing of EPC contracts for supply and erection of boiler, turbine and balance of plant. For the procurer, the Conditions Subsequent involves obtaining long term or medium term access to the grid, if applicable.

Contract Performance Guarantee: Contract performance guarantee is a bank guarantee submitted by the seller as a security which can be encashed by the procurer if the seller is unable to supply the contracted amount of power within a given period of time.

Guarantee of offtake: The offtake of power from the generating plant is guaranteed by the procurer up to the available or contracted capacity, whichever is lower.

Defining of injection and delivery points, open access, transmission charges and scheduling clauses for scheduling and dispatch of energy.

Billing and payment clauses, including Letter of Credit and escrow arrangements for payment security of seller.

Force Majeure clauses: Define force majeure events that are beyond the control of parties and the remedies available to the parties on occurrence of such events

Change in law clause: Allows pass through of increase in capital costs due to change in law which impacts the capital or operational costs substantially, for instance through an increase in tax rates.

Event of default clause: Provide for compensation, including termination compensation to either party on default from its obligations.

Conclusion

The power sector has evolved from a regulated state monopoly to an open market with more access to private players. While the market has certainly become more competitive, yet there are certain risks that need to be addressed. For thermal projects, certain factors such as fuel and land availability and payment delay by utilities are some of the risks that are still pertinent to developers. Such risks can be addressed through inputs and suggestions from the developers and incorporating them in the bidding documents. Achieving the objectives of efficiency, quality and reliability of power and optimum utilization of resources as set by the Electricity Act would require estimating and incorporating all possible risks and making the bidding documents as inclusive as possible.

[1]Section 13 (a) and Section 22(1) (a) of The Electricity Regulatory CommissionsAct, 1998 (repealed)

[2]Section 2 (1) (b) of (Grant of Connectivity, Long term Access and Medium term open access in interstate transmission and related matters) Regulations, 2009

[3]Kumar, S. (n.d.)Open Access, Retrieved from http://bit.ly/2SH1dMK

[4]Section 5.7 of National Electricity Policy, 2005

[5]Section 4.0 ,Objectives of the National Tariff Policy, 2016

[6]KSEB Limited Overview. (2015) Retrieved from http://www.kseb.in/index.php?option=com_content&view=article&id=50&Itemid=493&lang=en

[7] HPERC, History of HPSEBL, 4th APR Order for 3rd MYT Period (FY15-19) & Determination of Tariff for FY19 & True Up of FY16, Retrieved from http://bit.ly/2ABFhf1

[8]Tata Power Trading Company Ltd. (n.d.) Presentation on Power Procurement: Planning, Regulations and Practices.

[9] Forum of Regulators (2017). Competitive Tariff vis-a-vis Cost plus Tariff- Critical Analysis. Retrieved from http://bit.ly/2SBwl0a

[10] Ministry of Power (2005) Guidelines for Determination of Tariff by Bidding Process for Procurement of Power by Distribution Licensees

[11]Ministry of Power (2013) Guidelines for Procurement of Electricity from Thermal Power Stationssetup on DBFOT basis

[12]Ministry of Power (2013) Guidelines for Procurement of Electricity from Thermal Power Stations setup on DBFOO basis

[13] Ministry of Power (2013) Model Request for Qualification for Power Purchase Agreement for DBFOT Power Projects

[14] Standard Power Purchase Agreement for Procurement of Power Under Case – 1 Bidding Procedure Through Tariff Based Competitive Bidding Process, as per Guidelines issued by the Government of India for Determination of Tariff by Bidding Process for Procurement of Power by Distribution Licensees

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skills.

The post All you need to know about the Bidding Process for Procurement of Power appeared first on iPleaders.

All you need to know about the Bidding Process for Procurement of Power published first on https://namechangers.tumblr.com/

0 notes

Text

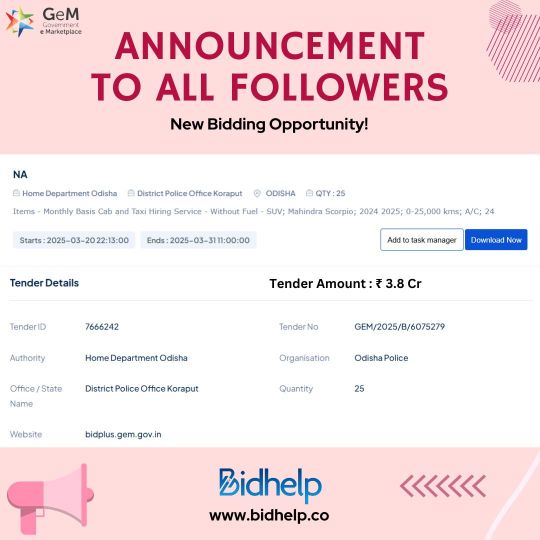

BIG ANNOUNCEMENT FOR BIDDERS!

New Tender Alert on GeM!

💼 Department: Home Department Odisha 📍 Location: District Police Office Koraput 🚖 Service: Monthly Cab & Taxi Hiring (Mahindra Scorpio, SUV) 💰 Tender Value: ₹3.8 Cr 🛒 Quantity: 25 📅 Bidding Deadline: 31st March 2025

🔗 Apply Now: www.bidhelp.co More Details: https://www.bidhelp.co/bid/details/905354

GovernmentTender #BidNow #GeM #TenderAlert #bidhelp #bizhelp #MSME #TenderOpportunities #BiddingSuccess #StartupIndia

#gujarat tender#maharashtra e tenders#eproc rajasthan#eprocure ntpc#cppp e procurement#cppp eprocure#e procurement odisha#odisha tender

0 notes

Text

Government e Marketplace GeM

Visit today for more information: https://gem.gov.in/

National Thermal Power Corporation Limited (NTPC), a prominent Public Sector Undertaking under Ministry of Power, has issued a sizeable purchase order for procurement of Mine Development and Operations Services through GeM. The contract, valued at of ₹13,868 Crore, marks the highest bid value awarded on GeM in this fiscal year, as of October 16, 2023. NTPC Limited has consistently relied on #GeM for sourcing quality products and services, while optimising their public spending. The portal’s vast offerings have well-equipped it to meet the dynamic needs of buyers like NTPC Limited!

0 notes

Text

Discoms’ outstanding dues to power gencos rise nearly 32% to Rs 88,311 cr in January

Power producers’ total outstanding dues owed by distribution firms rose nearly 32 per cent to Rs 88,311 crore in January 2020 over the same month previous year, reflecting stress in the sector.

Distribution companies (discoms) owed a total of Rs 67,012 crore to power generation companies in January 2019, according to portal PRAAPTI (Payment Ratification And Analysis in Power procurement for bringing Transparency in Invoicing of generators).

The portal was launched in May 2018 to bring in transparency in power purchase transactions between the generators and discoms.

In January 2020, the total overdue amount, which was not cleared even after 60 days of grace period offered by generators, stood at Rs 76,192 crore as against Rs 51,453 crore in the same month of the preceding year.

According to the latest data on the portal, outstanding dues in January has decreased over the preceding month. In December 2019, the total dues of discoms stood at Rs 86,948 crore.

However, the overdue amount in January increased over the preceding month, from Rs 75,930 crore in December 2019.

Power producers give 60 days to discoms for paying bills for the supply of electricity. After that, outstanding dues become overdue and generators charge penal interest on that in most cases.

In order to give relief to power generation companies (gencos), the Centre enforced a payment security mechanism from August 1, 2019. Under this mechanism, discoms are required to open letters of credit for getting power supply.

The central government has given three months moratorium to discoms for paying dues to power generating companies (gencos) in view of lockdown till April 14 to contain COVID-19 across the country. The government has also waived off the penal charges for late payment of dues in the directive issued earlier this week.

Discoms in Rajasthan, Uttar Pradesh, Jammu & Kashmir, Telangana, Andhra Pradesh, Karnataka and Tamil Nadu account for the major portion of dues to power gencos, the data showed.

Overdues of independent power producers amount to 25.94 per cent of the total overdue of Rs 76,192 crore of discoms in January. The proportion of PSU gencos in the overdue was 39 per cent.

Among the central public sector power generators, the NTPC alone has an overdue amount of Rs 11,007.50 crore on discoms, followed by NLC India at Rs 4,731.13 crore, Damodar Valley Corporation at Rs 4,614.49 crore, NHPC at Rs 2,548.85 crore and THDC India at Rs 2,129.53 crore.

Among private generators, discoms owe the highest overdue of 3,421.68 crore to RKMP (RKM Powergen Pvt Ltd) followed by Adani Power at Rs 3,201.68 crore, Bajaj Group-owned Lalitpur Power Generation Company Ltd at Rs 2,212.66 crore and GMR at Rs 1,930.16 crore.

The overdue of non-conventional energy producers like solar and wind, stood at Rs 6,618.20 crore in January.

if(geolocation && geolocation != 5 && (typeof skip == 'undefined' || typeof skip.fbevents == 'undefined')) { !function(f,b,e,v,n,t,s) {if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)}; if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)}(window, document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '338698809636220'); fbq('track', 'PageView'); }

Source link

The post Discoms’ outstanding dues to power gencos rise nearly 32% to Rs 88,311 cr in January appeared first on Invest Ops.

from Invest Ops https://ift.tt/2UsFxHC

0 notes

Text

NTPC forays into electric bus business

Kolkata: NTPC Vidyut Vyapar Nigam Ltd (NVVN), a wholly-owned subsidiary of NTPC, has signed an agreement with the Department of Transport of Andaman & Nicobar Islands for deployment of electric buses in the Union Territory.

Under the project, the company is offering complete transport solution, including twenty air-conditioned electric buses of nine meters each in phase I. Apart from deployment of electric buses, NTPC and Andaman administration are collaborating for setting up public charging infrastructure in the Island. Electric buses are all set to start running on a commercial basis by August 2020.

Introduction of electric buses in the island will go a long way in protecting the diverse ecology by completely eliminating tailpipe emission; low levels of sound from e-buses shall also significantly reduce noise pollution. Further, comfortable seating, smooth driving, GPS enabled buses are anticipated to bring in features like security and comfort for commuters. This initiative will lead to an increase in overall usage of public transport in the island mentioned a statement made by the company.

Last year, NVVN, had expressed its intention of procuring and operating 250 air-conditioned (AC) electric buses. The electric buses were meant for Jabalpur, Bhopal, and Indore in Madhya Pradesh.

The plan was to introduce 50 buses in Jabalpur and 100 each for Bhopal & Indore under ‘Faster Adoption and Manufacturing of Electric Vehicles in India Phase II (FAME India Phase II) program.

if(geolocation && geolocation != 5 && (typeof skip == 'undefined' || typeof skip.fbevents == 'undefined')) { !function(f,b,e,v,n,t,s) {if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)}; if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)}(window, document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '338698809636220'); fbq('track', 'PageView'); }

Source link

The post NTPC forays into electric bus business appeared first on Investium.

from Investium https://ift.tt/2TveRFD

0 notes

Link

Advance Ruling Order No.STC/AAR/02/2018 Raipur, Dated 14th June, 2018

AUTHORITY FOR ADVANCE RULING - CHHATTISGARH Behind Raibhawan, Civil Lines. Raipur (C.G.) 492001 Email ID - gst.aar-cg(5)gov.in PROCEEDING OF THE AUTHORITY FOR ADVANCE RULING U/s. 98 OF THE CHHATTISGARH GOODS AND SERVICES TAX ACT, 2017

Members Present are : 1. Shri S.K.Buxv Joint Commissioner. O/o Commissioner, State Tax Chhattisgarh, Raipur 2. Shri Rajesh Kumar Singh, Joint Commissioner. O/o Principal Commissioner. CGST & Central Excise, Raipur Sub:- GST Act, 2017 - Advance Ruling U/s 98 - Regarding Determination of tax liability to pay tax on man power. Read:-Application dated 05.04.2018 from M/s Utility Powertech Ltd., NTPC Plant Area, Seepat, Bilaspur, C.G. [GSTIN: 22AAACU3458P1Z1] PROCEEDINGS [U/s 98 of the Chhattisgarh Goods & Services Tax Act, 2017 (herein- after referred to as CGGST Act, 2017)] The Applicant M/s Utility Powertech Ltd. Sipat Bilaspur, having GSTIN 22AAACU3458P1Z1, engaged in providing manpower supply services to NTPC BHEL Power Projects Pvt. Ltd. (NBPPL), Mannavaram in Andhra Pradesh, (GST No. 37AACCN9505A1ZQ.) has filed the application U/s 97 of the Chhattisgarh Goods & Services Tax Act, 2017, seeking advance ruling on the following points:- a. Whether the applicant is required to charge IGST or CGST and SGST on the manpower supply services provided to M/s NTPC BHEL Power Projects Pvt Ltd. (NBPPL), Mannavaram in Andhra Pradesh. b. Whether such transaction will be categorized as an intrastate or interstate transaction? c. If the applicant charge IGST on such transaction, considering the transaction as interstate, will the IGST charged, be available as input tax credit to M/s NBPPL against their output tax liability subject to Section 17 (5). 2. Facts of the case:- I. The applicant M/s Utility Powertech Ltd., Sipat, Bilaspur, (C.G.) having multiple registrations under GST in various States has been awarded a contract for manpower supply at Mannavaram (Andhra Pradesh) by M/s NTPC BHEL Power Project Pvt. Ltd., [NBPPL], Mannavaram (Andhra Pradesh). II. M/s Utility Powertech Ltd., C.G. procures manpower for NTPC Power Project, Mannavaram (A.P.) and deputes such manpower at Mannavaram. III. Thus M/s Utility Powertech Ltd., Sipat, Bilaspur(C.G.) is the supplier of services and M/s NBPPL Mannavaram (A.P.) is the recipient of such services. 3. Contention of the applicant:- Since the applicant is registered at Bilaspur (C.G.) and their place of supply is at a place outside the State of Chhattisgarh, the applicant holds this transaction as interstate and intends to issue invoices regarding supply of manpower services to M/s NBPPL, Mannavaram (A.P.) by charging IGST on the same. 4. Personal Hearing: - In keeping with the established principles of natural justice, personal hearing in the matter was extended to the applicant. Shri Mahavir S. Jain, CA and Shri Naresh P Nahar CA authorized by the Resident Manager of the applicant, M/s Utility Powertech Ltd., Sipat, Bilaspur, (C.G.), appeared before us for hearing on 24.5.2018 and reiterated their above contentions. 5. The legal position, Analysis and Discussion:- The provisions for implementing the CGST Act and CGGST Act, 2017 are similar. The Applicant, based at Seepat, Bilaspur (CG) has been awarded a contract for manpower supply at Mannavaram (Andhra Pradesh) by M/s NTPC BHEL Power Project Pvt. Ltd., Mannavaram (Andhra Pradesh).The applicant has submitted that considering such supply of manpower service as interstate transaction, it wants to issue invoices charging IGST, upon NBPPL and wants to have an advance ruling as to whether the IGST so charged on such invoices issued by them will be available as ITC, to M/s NBPPL against their output liability. Now we sequentially discuss the provisions that are applicable in the present case:- U/s. 96 of CGGST Act, 2017'.-Authority for advance rulingSubject to the provisions of this Chapter, for the purposes of this Act, the Authority for advance ruling constituted under the provisions of a State Goods and Services Tax Act or Union Territory Goods and Services Tax Act shall be deemed to be the Authority for advance ruling in respect of that State or Union territory. U/s 97(2) of CGGST Act, 2017:- The question, on which the advance ruling is sought under this Act, shall be in respect of- (a) classification of any goods or services or both; (b) applicability of a notification issued under the provisions of this Act; (c) determination of time and value of supply of goods or services or both; (d) admissibility of input tax credit of tax paid or deemed to have been paid; (e) determination of the liability to pay tax on any goods or services or both; (f) whether applicant is required to be registered; (g) whether any particular thing done by the applicant with respect to any goods or services or both amounts to or results in a supply of goods or services or both, within the meaning of that term. U/s 103 of CGGST Act, 2017:- Applicability of advance ruling - 1. The advance ruling pronounced by the Authority or the Appellate Authority under this Chapter shall be binding only - a. On the applicant who had sought it in respect of any matter referred to in sub-section (2) of section 97 for advance ruling; b. On the concerned officer or the jurisdictional officer in respect of the applicant. 5.1 The applicant has sought advance ruling regarding:- (i) Labour supply service to the firm situated in Andhra Pradesh and considering it as interstate transaction wants to charge IGST on invoices issued to NTPC BHEL Power Project Pvt. Ltd., Mannavaram (Andhra Pradesh). (ii) Availability of Input Tax Credit (ITC) to NTPC BHEL Power Project Pvt. Ltd., Mannavaram (Andhra Pradesh) regarding IGST charged by the applicant. 5.2 Thus the applicant has sought advance ruling on determination of tax liability to pay tax on manpower service which in fact is very much directly linked to place of supply in the instant case. Further advance ruling has also been sought by the applicant on the availability of ITC to M/s NTPC BHEL Power Project Pvt. Ltd., Mannavaram (Andhra Pradesh), which is registered in Andhra Pradesh on the said tax liability at Andhra Pradesh, i.e. at a place outside the State of Chhattisgarh. 5.3 In terms of section 96, 103(1) (a) and 103 (1) (b) of CGGST Act, 2017 Authority for Advance Ruling, Chhattisgarh is not the proper authority to pronounce the ruling regarding the availability or otherwise of ITC to a firm which is registered and situated at a place outside the State of Chhattisgarh. Similarly, section 97(2) (c) of CGST Act, 2017 stipulates that ruling as regards time and value of supply of goods or services or both, can only be raised before AAR for advance ruling. It is precisely for this very reason also, that determination of place of supply has been kept out of the purview of Authority for Advance Ruling (AAR) stipulated under the provisions of section 97(2) of the CGGST Act, 2017. In view of the above deliberations and discussions, we come to the considered conclusion that the application dated 05.04.2018 filed by M/s Utility Powertech Ltd., NTPC Plant Area, Seepat, Bilaspur C.G. [GSTIN: 22AAACU3458P1Z1], seeking advance ruling on the points mentioned above merits rejection, being out of the purview of matters or questions specified in sub-section (2) of section 97 of CGGST Act, 2017 read with section 96, 103(1) (a) & 103 (1) (b) of CGGST Act, 2017. Place:- Raipur Date:- 14.06.2018 Seal:- S. K. Buxy Rajesh Kumar Singh (Member) (Member)

0 notes

Photo

Latest News from https://is.gd/Ky9BWm

Power Grid inks pact with L&T Metro Rail Hyderabad to set up electric car charging points

Hyderabad: Hyderabad Metro Stations would soon double up as electric car charging stations. Central government planning to set up charging points for electric vehicles at every 3 km in major cities. This comes in wake of the smart cities project and growing population in the city. After from the cities, centre also is looking to set up similar stations on busy national highways in the country at every 50kms.

Electric Car Charging Stations (Image for representation purpose only)

Central government is likely to offer financial incentives to those interested in offering necessary infrastructure for electric charging stations. It will also help in procuring land from various municipal bodies for the project. This move comes in light with the growing market for electric vehicles and the need to set up electric charging points for commuters.

Public sector companies operating in the energy sector such as NTPC Limited, Power Grid Corporation of India Limited (PGCIL) and Indian Oil Corporation Limited are expected to commence the procedure to set up charging stations at a number of sites in selected cities.