#npa resolution

Explore tagged Tumblr posts

Text

CIRP (Corporate Insolvency Resolution Process) - FinLender

FinLender has more than 10 partners, all senior professionals and Ex Bankers having combined experience of more than 100 years in various fields. The knowledge pool and experience of these partners can handle all kinds of challenges that come under IBC 2016 and providing meaningful resolution to stressed assets.

#bankloan#business#Debt Resolution#Debt Restructuring#Finlender#investment#LoanforNPA#NPA#NPA and OTS Finance#PreparationofResolutionPlan#Venture Capital Funding#Equity Capital in India#NPA Resolution & Restructuring#NPA Resolution#OT

0 notes

Text

Why addressing NPAs is essential for ensuring sustainability and progress

Non-performing assets (NPAs) are a major concern for businesses and financial institutions. An NPA occurs when a borrower fails to repay a loan or debt within the stipulated period, resulting in a financial asset losing its ability to generate income.

Addressing NPAs is not just about recovering outstanding debts, it is critical to ensuring the sustainability and progress of businesses.

Here’s why it’s essential to address NPAs:

Reduced Cash Flow and Increased Financial Stress:

One of the most immediate and direct effects of NPAs on businesses is a reduction in cash flow. When businesses have outstanding debts that are not being repaid, the money that would have been used for operations is tied up. This creates liquidity problems, making it difficult for the business to pay for operational expenses, salaries, raw materials, and other essential costs. With a significant portion of the company's capital locked in bad loans, businesses struggle to meet their financial obligations, which affects their ability to pay creditors, suppliers, or employees.

Higher Borrowing Costs and Strained Relationships with Lenders: Financial institutions are less likely to lend to businesses with a history of non-performing loans, Resulting in higher interest rates on loans.

Lenders may lose confidence in the business and impose stricter terms or even demand immediate repayment of outstanding loans.

Loss of Business Opportunities and Damage Reputations:

The absence of capital can throttle growth, whether developing into new markets, investing in the latest technology, or launching new products. Additionally, businesses may struggle to secure strategic partnerships or investors, as they are perceived as financially unstable. Negative publicity related to NPAs or legal proceedings can harm the company's brand image, making it harder to draw or retain new clients.

Risk of Insolvency and Increased Regulatory Scrutiny:

In the worst-case scenario, businesses with significant NPAs may face insolvency or bankruptcy. If the business cannot recover from the financial strain caused by non-performing loans, it may be forced to liquidate assets, restructure, or even close down. This could lead to loss of jobs, legal issues, and financial instability for stakeholders.

Financial institutions and businesses with high NPAs may face increased scrutiny from regulators. In some cases, regulators may impose penalties, fines, or other sanctions on businesses that fail to manage their debts effectively.

How NPA Consultants Pvt Ltd will help you in Effective NPA Management?

Key Services and Strategies

Guidance to handle the pre / post NPA pressure of banks, recovery agents.

Do not make any commitments on assumption and in absence of any clear roadmap.

Do not increase your debt trap.

Do not rely on verbal assurances.

Do not neglect any notices issued. reply suitably.

Avail timely professional aid to handle it.

Borrow time legally.

Seek timely professional aid for replying to the notices issued, initiate legal proceeding for any illegal action, save mortgaged assets, and for any other banking, legal or financial issues.

NPA account funding.

If there is a good business proposition backed by security, funding for NPA accounts can be arranged through various channels.

Get waiver in interest / principal amount under One Time Settlement (OTS) and how much?

The banker shall assess the realisable value of the security charged/ other attachable assets and net worth of the borrower/ promoters/guarantors. present status of the borrower unit/ company and its financial performance while working out the OTS. we make you eligible for getting the best settlement terms.

Wilful default classification and its consequences?

When there is a default in repayment obligations by the unit (company/individual) to the lender even when it has the capacity to honour the said obligations. There is deliberate intention of not repaying the loan, amounts to wilful default. The funds have been diverted or have been siphoned off and not been utilised for the purpose for which it was availed. When the asset bought by the lenders’ funds have been sold off without the knowledge of the bank/lender. In such cases Lenders can classify as WILFUL DEFAULT

Major Consequences:

- No additional facilities should be granted by any bank / FI to the wilful defaulters. In addition, the promoters of companies where banks/FIs have identified siphoning / diversion of funds, misrepresentation, falsification of accounts and fraudulent transactions would be debarred from institutional finance and floating new ventures for a period of five years from the date the name of the wilful defaulter is published in the list of wilful defaulters by the RBI.

- Publication of photographs of wilful defaulters (on a case-to-case basis) in newspapers.

- Criminal proceedings against wilful defaulters,

- Under section 29A of the Insolvency and Bankruptcy Code, 2016, a wilful defaulter cannot be a resolution applicant.

1. Debt Advisory

Customized Solutions: Assessing debt structures and providing tailored advice to optimize repayment terms and reduce financial burdens.

Strategic Negotiations: Facilitating discussions with lenders to secure favourable terms, including One Time Settlements (OTS).

2. Corporate Restructuring

Streamlining Operations: Reorganizing business structures to enhance efficiency and financial stability.

Optimized Capital Allocation: Realigning resources to address critical areas and improve cash flow.

3. Mergers & Acquisitions

Strategic Partnerships: Identifying and facilitating mergers or acquisitions to infuse capital and expand market reach.

Value Creation: Leveraging synergies to enhance operational performance and reduce financial strain.

4. Private Equity

Growth Capital: Securing private equity investments to strengthen financial standing and fund expansion plans.

Value-Added Support: Collaborating with investors who bring expertise and resources to scale operations effectively.

5. Revival of Sick Industries

Turnaround Strategies: Developing and implementing plans to revitalize struggling industries and restore profitability.

Stakeholder Collaboration: Engaging with lenders, vendors, and employees to align efforts for recovery.

6. Managing Corporate Litigations

Legal Expertise: Addressing disputes and mitigating risks arising from financial distress through effective legal representation.

Proactive Resolution: Ensuring swift and amicable resolutions to minimize disruptions and safeguard reputation.

Why Choose NPA Consultants Pvt Ltd?

NPA Consultants specializes in NPA management and related matters under the IBC, including CIRP, resolution plans, liquidation, and corporate restructuring. With a network of 40 resolution professionals and 25 legal firms, we provide expert guidance to borrowers and resolution professionals. We also advise nationalized and cooperative banks on NPA matters.

Our services for MSMEs include pre- and post-NPA guidance, borrower rights education, and alternate financing solutions for viable businesses. We facilitate amicable settlements with banks and provide one-stop solutions for banking, legal, and financial matters.

Our team comprises seasoned experts, including former senior officials from RBI, IDBI, ICICI, and other leading banks. Under the leadership of Dr. Visswas, we deliver innovative solutions even in critical cases, supported by a dynamic team of advocates and financial professionals.

NPA Consultants also offers ancillary services like valuations, risk management, and feasibility assessments. Since the introduction of IBC in 2016, we have facilitated resolutions and liquidations, including a USD 100 MN case.

With over 20 years of experience, we have advised 2000+ SMEs, handled cases ranging from USD 1 MN to USD 100 MN, and established synergies with banks and financial institutions. Our expertise ensures win-win outcomes for borrowers and lenders, making us a trusted partner in the field.

For more information or to request a consultation, visit NPA Consultants website: https://www.npaconsultant.in/

To stay updated with the latest posts, follow us on social media:

📸 Instagram - https://www.instagram.com/npaconsultants/

📘 Facebook - https://www.facebook.com/npaconsultant

🐦 Twitter (X) - https://x.com/npaconsultant

🔗 Linkedin - https://www.linkedin.com/company/npa-consultant-pvt/

▶️ Youtube - https://www.youtube.com/@drvpfinworld

Contact: NPA Consultants Pvt Ltd +91 89282 89070 https://www.npaconsultant.in/

Digital Partner:

TVM INFO SOLUTIONS PVT LTD

Contact: TVM Info Solutions Pvt. Ltd.

+91- 90045 90039

Follow us on Social Media

🌐 Website - https://tvminfo.com/

📸 Instagram - https://www.instagram.com/tvm_infosolution/

📘 Facebook - https://www.facebook.com/people/Tvm-Info-Solutions-Pvt-Ltd/61555896761755/

🔗 Linkedin - https://in.linkedin.com/company/tvminfo

▶️ Youtube - https://www.youtube.com/@tvminfosolutions

#TackleNPAs#SustainableFinance#ProgressWithPurpose#NPAResolution#FinancialStability#EconomicGrowth#DebtRecoverySolutions#ReviveBusinesses#RestructureForSuccess#SustainableProgress#NPAs#sustainability#progress#debt recovery#restructuring#financial stability#economic growth#business revival#resolution strategies#sustainable finance.

0 notes

Text

INCAB's Financial Creditors Face Scrutiny in NCLT Hearing

Jamshedpur Cable Company’s Insolvency Case Takes Unexpected Turn Allegations of illegitimate creditors and discrepancies in claimed liabilities cast doubt on INCAB’s insolvency proceedings, potentially impacting resolution. JAMSHEDPUR – A National Company Law Tribunal (NCLT) hearing in Kolkata saw dramatic developments in the case of Jamshedpur-based cable company INCAB, as the legitimacy of its…

#Axis Bank#बिजनेस#business#corporate debt resolution#financial creditor legitimacy#ICICI Bank#INCAB insolvency case#insolvency proceedings#Jamshedpur cable company#NCLT Kolkata hearing#NPA controversies#Vedanta resolution plan

0 notes

Text

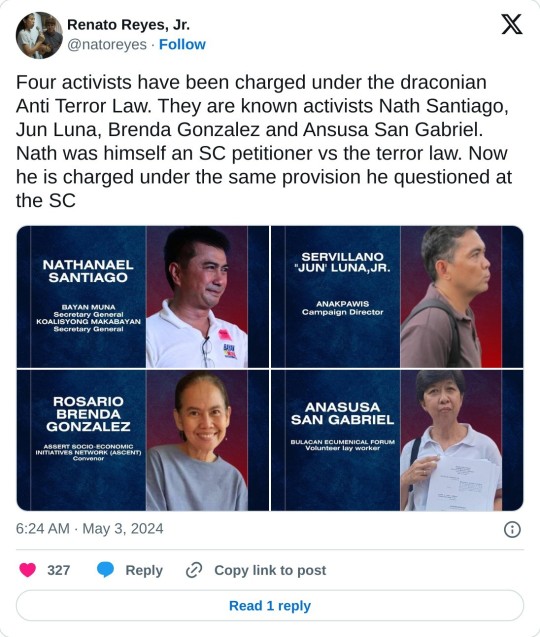

ABS-CBN: Bayan Muna condemns terrorism charge vs activists

Party-list group Bayan Muna has condemned the filing of anti-terrorism charges against its secretary general, Nathanael Santiago, as well as Anakpawis Campaign Director Servillano Luna, Jr., ASCENT Convenor Rosario Brenda Gonzalez, and Bulacan Ecumenical Forum volunteer Anasusa San Gabriel.

“The use of trumped-up charges, in conjunction with red-tagging, creates a toxic environment that undermines the principles of justice and human rights. We strongly and firmly reject these reprehensible tactics and demand an end to the harassment and persecution of activists and members of the political opposition,” Bayan Muna said.

In the counter-affidavit filed by Santiago before the Nueva Ecija Office of the Provincial Prosecutor, he denied the charges for attempted murder and murder under the Anti-Terrorism Act as well as violation of the Philippine Act on Crimes Against Humanitarian Law, Genocide and other Crimes Against Humanity.

Santiago said at the time of the supposed crime, he was working as Bayan Muna secretary general at the office of the party-list group in Quezon City.

Similarly, in the counter-affidavit of Gonzalez, she said was busy for a book launch during the first three weeks of October, with photos and testimonies attached.

2024 May 3

Activist Renato Reyes Jr. on Twitter @natoreyes:

Four activists have been charged under the draconian Anti Terror Law. They are known activists Nath Santiago, Jun Luna, Brenda Gonzalez and Ansusa San Gabriel. Nath was himself an SC petitioner vs the terror law. Now he is charged under the same provision he questioned at the SC

This marks the first time national leaders or personalities have been charged under the ATL. The complaints were filed by the AFP in Nueva Ecija, They claimed the 4 participated in an armed encounter between the AFP and NPA - a completely blatant lie and a fabrication.

In 2020 we warned that the ATL will be abused by state forces to stifle dissent and suppress progressive organizations. That is exactly what is happening now with the filing of these trumped up “terror” charges in different regions.

Imagine being charged with terrorism, and not knowing you were facing charges because they sent subpoenas to a different address, to another activist already reported missing. Then finding out there’s already a resolution even without the fiscal hearing your side.

Late February na lang nila nalaman na may kaso pala sila sa Nueva Ecija. Buti nakapaghabol ng motion at nakapag file ngayong araw ng kanilang counter-affidavit. Inaabuso ang “terror law” laban sa mga aktibista, at kahit sa mga totoong rebolusyonaryo. [It was only in late Feb that they found out about these cases against them. It was fortunate that they were able to file counter-affidavits in time. The "terror law" is being abused to thwart activists, even the true revolutionaries.]

2024 May 3

6 notes

·

View notes

Text

Marco Valbuena | Chief Information Officer | Communist Party of the Philippines

August 01, 2023

The Marcos regime and its military and police forces must be roundly condemned for the increasingly malevolent use of the deceitfully named Anti-Terrorism Law (ATL) in their heightened campaign of suppression against various democratic forces, critics, and political opponents.

Over the past few weeks, human rights defenders and members of cause-oriented organizations have been “designated” as “terrorists” by the Anti-Terrorism Council or charged in court for “terrorism” in a patently arbitrary manner, without due process and in utter violation of broadly accepted standards of judicial processes.

The ATL is now being used as a tool for suppression with impunity. The most recent victim of the draconian ATL is Hailey Pecayo, a 19-year old human rights worker, who earned the ire of the Armed Forces of the Philippines (AFP) for having actively exposed the role of the military for the killing of a nine-year old child in Batangas last year. She is now being charged by the AFP under the ATL, together with other members of their human rights group.

Before Pecayo, at least six others, including Windel Bolinget and three other members of the Cordillera People’s Alliance (CPA), were tagged as “terrorists” by the ATC. In a much earlier resolution, Dr. Natividad Castro, a medical doctor working for the Karapatan Alliance in Mindanao, was similarly tagged by the ATC. It is particularly noteworthy that the ATC resolutions against Bolinget and Castro both came after courts dismissed false charges filed by the AFP linking them to armed actions of the NPA.

The use of the ATL as a tool of suppression has now reached absurd and brazen levels with the ATC “designating” Congressman Arnolfo Teves and 12 others accused of perpetrating the March 4 killing of former Negros Oriental Governor Noel Degamo. Marcos officials have resorted to using the ATL against Teves after failing to build up a court case him. Aiming the ATL against Teves also serves as warning of the extent that Marcos will use the law for his purposes.

The CPP denounces the use of the ATL as a weapon of political suppression. The Party also expresses its continuing protest against the “terrorist designation” of the CPP, the New People’s Army and the National Democratic Front, of its leaders and representatives, and others being linked to the revolutionary cause.

Despite the September 21, 2022 ruling of the Manila Trial Court dismissing the petition filed by the government to declare the CPP and NPA as “terrorists” under the Human Security Act (the former name of the ATL), the Marcos regime and its agents insist on pinning the “terrorist” tag as part of its systematic campaign against all patriotic and democratic forces.

In light of the heightened attacks against the broad democratic sectors using the ATL, the Filipino people’s demand for the abrogation of the draconian law has become even more urgent. All democracy-loving people must make a stand and lend their voice to the struggle to defend the people’s rights and freedoms against state repression.

The Party supports the Filipino people’s clamor to end the so-called “war on terror” which, in fact, is a camouflage for unbounded state terrorism. This fascist framework has long been abused by the Philippine ruling class state, in order to justify the systematic erosion of the people’s civil and political rights.

The military and security establishment has used the “war on terror” to claim extraordinary powers to assert domination over society, take control of the functions of civilian agencies of government and carry out any and all acts of state suppression with gross impunity.

#the philippines#filipino#pw#CPP#marxism leninism maoism#MLM#marxism#revolution#national democratic front#national democratic revolution#national democracy#natdem#maoism#maoist#communism#communist#socialism#revolutionary

8 notes

·

View notes

Quote

1.概要 3月26日、外務省、警察庁、財務省、経済産業省は、「北朝鮮IT労働者に関する企業等に対する注意喚起」を公表しました。 2.参考資料 令和6年3月 26 日 北朝鮮 IT 労働者に関する企業等に対する注意喚起 国際連合安全保障理事会北朝鮮制裁委員会専門家パネルは、これまでの国際 連合安全保障理事会決議に基づく対北朝鮮措置に関する報告書において、北朝 鮮は、IT 労働者を外国に派遣し、彼らは身分を偽って仕事を受注することで収 入を得ており、これらが北朝鮮の核・ミサイル開発の資金源として利用されてい ると指摘しています。 また、2022 年5月 16 日、米国が、国務省、財務省及び連邦捜査局(FBI)の 連名で、このような北朝鮮 IT 労働者による活動方法や対応策等をまとめたガイ ドラインを公表したほか、同年 12 月8日、韓国が、外交部、国家情報院、科学 技術情報通信部、統一部、雇用労働部、警察庁、公正取引委員会の連名で、同様 のガイドラインを公表しました。さらに、2023 年 10 月 18 日、米国及び韓国が 共同で北朝鮮 IT 労働者に関する追加的な勧告を行うための公共広告(PSA)を 発表するなど、北朝鮮 IT 労働者に関してこれまでに累次の注意喚起が行われて います。 我が国に関しても、北朝鮮 IT 労働者が日本人になりすまして日本企業が提供 する業務の受発注のためのオンラインのプラットフォーム(以下「プラットフォ ーム」という。)を利用して業務を受注し、収入を得ている疑いがあります。ま た、北朝鮮 IT 労働者が情報窃取等の北朝鮮による悪意あるサイバー活動に関与 している可能性も指摘されており、その脅威は高まっている状況にあります。 この点、北朝鮮に関連する国際連合安全保障理事会決議は、加盟国において収 入を得ている全ての北朝鮮労働者の送還を決定するとともに、いかなる資金、金 融資産又は経済資源も、北朝鮮の核・ミサイル開発の利益のために利用可能とな ることのないよう確保しなければならないと規定しているほか、このような北 朝鮮 IT 労働者に対して業務を発注し、サービス提供の対価を支払う行為は、外 国為替及び外国貿易法(昭和 24 年法律第 228 号)等の国内法に違反するおそれ があります。 各企業・団体においては、経営者のリーダーシップの下、北朝鮮 IT 労働者に 対する認識を深めるとともに、以下に挙げるような手口に注意を払っていただ きますようお願いいたします。また、プラットフォームを運営する企業において は、本人確認手続の強化(身分証明書の厳格な審査、テレビ会議形式の面接の導 入等)、不審なアカウントの探知(不自然な情報の登録が通知されるシステムの 導入等)といった対策の強化に努めていただきますようお願いいたします。 【北朝鮮 IT 労働者の手口】 ○ 北朝鮮 IT 労働者の多くは、国籍や身分を偽るなどしてプラットフォーム へのアカウント登録等を行っています。その際の代表的な手口として、身 分証明書の偽造が挙げられます。また、日本における血縁者、知人等を代 理人としてアカウント登録を行わせ、実際の業務は北朝鮮 IT 労働者が行っ ている場合もあります。この場合、当該代理人が報酬の一部を受け取り、 残りの金額を外国に送金している可能性があるほか、当該送金には、資金 移動業者が用いられることがあります。 ○ 北朝鮮 IT 労働者は、IT 関連サービスの提供に関して高い技能を有する 場合が多く、プラットフォーム等において、ウェブページ、アプリケーシ ョン、ソフトウェアの制作等の業務を幅広く募集しています。 ○ 北朝鮮 IT 労働者の多くは、中国、ロシア、東南アジア等に在住していま すが、VPN やリモートデスクトップ等を用いて、外国から作業を行ってい ることを秘匿している場合があります。 ○ そのほか、北朝鮮 IT 労働者のアカウント等には、次のような特徴がみら れることが指摘されています。業務上関係するアカウントや受注者にこれ らの特徴が当てはまる場合には、北朝鮮 IT 労働者が業務を請け負っている 可能性がありますので、十分に注意してください。 (主にプラットフォームを運営する企業向け) □ アカウント名義、連絡先等の登録情報又は登録している報酬受取口座 を頻繁に変更する。 □ アカウント名義と登録している報酬受取口座の名義が一致していな い。 □ 同一の身分証明書を用いて複数のアカウントを作成している。 □ 同一の IP アドレスから複数のアカウントにアクセスしている。 □ 1つのアカウントに対して短時間に複数の IP アドレスからのアクセス がある。 □ アカウントに長時間ログインしている。 □ 累計作業時間等が不自然に長時間に及んでいる。 □ 口コミ評価を行っているアカウントと評価されているアカウントの身 分証明書等が同一である1。 (主に業務を発注する方向け) □ 不自然な日本語を用いるなど日本語が堪能ではない2。また、そのため テレビ会議形式の打合せに応じない。 □ プラットフォームを通さず業務を受発注することを提案する3。 □ 一般的な相場より安価な報酬で業務を募集している。 1 口コミによる評価を向上させるため、関係者間で架空の評価を行っている場合が想定さ れます。 2 機械翻訳を用いている場合が想定されます。 3 手数料負担の軽減、契約関係の継続等を目的としていることが想定されます。 □ 複数人でアカウントを運用している兆候がみられる4。 □ 暗号資産での支払いを提案する。 【問合せ先】 北朝鮮 IT 労働者の関与が疑われる場合には、プラットフォームの管理責任 者に相談するほか、関係機関に御相談ください。 ・ 警察庁警備局外事情報部外事課 [email protected] ・ 外務省北東アジア第二課 [email protected] ・ 財務省国際局調査課対外取引管理室 [email protected] ・ 経済産業省商務情報政策局情報技術利用促進課 [email protected] 【参考資料】 〇「安保理北朝鮮制裁委員会専門家パネル2023年最終報告書(Final report of the Panel of Experts submitted pursuant to resolution 2680 (2023)」(令和6年3月7日安保理提出) https://undocs.org/S/2024/215 ○「Guidance on the Democratic People’s Republic of Korea Information Technology Workers」(令和4年5月 16 日) https://ofac.treasury.gov/media/923126/download?inline ○「Additional Guidance on the Democratic People's Republic of Korea Information Technology Workers」(令和5年 10 月 18 日) https://www.ic3.gov/Media/Y2023/PSA231018 ○「Advisory on the Democratic People’s Republic of Korea Information Technology Workers」(令和4年 12 月8日) https://www.mofa.go.kr/eng/wpge/m_25525/contents.do 4 北朝鮮 IT 労働者は、チームで活動しているとの指摘があり、応対相手が時間帯によって 変更されることなどが想定されます。

「北朝鮮IT労働者に関する企業等に対する注意喚起」の公表 (METI/経済産業省)

2 notes

·

View notes

Text

Emilio: "BASTOS TO A."

(( XDD ayan e, binawalan e sa trading. XDD di sila prends. ))

Anyway, Philippines and North Korea relations:

"During the Korean War, the Philippines allied with South Korea, against North Korea.

Efforts to establish formal ties between the two countries began as early as the 1970s, but such efforts saw no significant development by the 1980s. Factors hindering such efforts include the Philippines' traditional anti-communist foreign policy at that time as well as suspicions that North Korea had been supporting the Communist Party of the Philippines and its armed wing, the New People's Army (NPA).

Limited North Korean support to the NPA was alleged by a 1990 report of the Patterns of Global Terrorism by the United States Department of State.

It was also reported in the early 2010s, that North Korea proposed to establish a resident embassy in Manila, which Philippine officials rejected. The rejection was reportedly due to Philippine authorities' suspicion on North Korean diplomats as they were deemed to have a reputation to conduct "extra-diplomatic activities" such as smuggling and counterfeiting in other foreign countries. Philippine Foreign Secretary Siazon insisted that North Korea had never made such request. However, he remained open to the expansion of diplomatic ties between the two countries.

The Philippines, as an ally of South Korea and the United States, remains concerned and continues to condemn North Korea's nuclear missile tests which is considered to be in violation of United Nations Security Council resolutions banning North Korea to use ballistic technology in any purpose."

SOURCE: https://en.wikipedia.org/wiki/North_Korea%E2%80%93Philippines_relations

Send Questions / Asks @ CURIOUSCAT: https://curiouscat.live/PlanetPuto BLOG: http://ask-emilz-de-philz.tumblr.com If you enjoy my work, please consider supporting me at: http://ko-fi.com/haimacheir ;w;b

10 notes

·

View notes

Text

How NPA Loan Takeover Can Benefit You

In the world of finance, the term Non-Performing Asset (NPA) is often associated with defaults, financial instability, and negative consequences. However, the process of npa loan take over is a critical debt resolution strategy that can provide significant advantages to borrowers who are struggling to meet their loan obligations. While an NPA loan typically indicates a failure to repay the debt on time, the process of takeover offers a fresh start, better terms, and an opportunity to regain financial stability.

If you're facing an NPA loan situation or simply exploring the option, understanding how NPA Loan Takeover Can Benefit You is essential for managing your financial health. Let’s explore what NPA loan takeover is, how it works, and how it can help you regain control over your debt and financial future.

What is an NPA Loan? Before discussing the benefits, let’s clarify what an NPA loan is. A Non-Performing Asset (NPA) refers to a loan that is no longer generating income for the lender. In other words, the borrower has failed to make regular payments for 90 days or more, causing the loan to be classified as non-performing. Banks and financial institutions classify loans as NPAs when the borrower is unable to service the debt, making the loan problematic for both the borrower and the lender.

These loans can include various types of credit, such as home loans, personal loans, car loans, business loans, or even credit card debts. When a loan turns into an NPA, it can hurt the borrower’s credit score, lead to penalty charges, and result in potential legal actions from the lender to recover the outstanding amount. However, one option available to borrowers is the NPA loan takeover, which can provide significant advantages.

What is NPA Loan Takeover? How NPA Loan Takeover Can Benefit You is a process where a third-party lender, or an asset reconstruction company (ARC), assumes responsibility for your existing NPA loan. The new lender takes over the loan and often restructures it, providing you with a fresh repayment plan under more favorable terms. The purpose of an NPA loan takeover is to help borrowers clear their debts, relieve financial stress, and give them a path to recovery.

There are various ways an NPA loan takeover can be executed:

Debt Resolution Schemes: Some financial institutions offer programs where NPAs can be transferred to another lender willing to restructure the loan and offer more manageable terms. Asset Reconstruction Companies (ARCs): Banks may sell their NPAs to ARCs, which then take over the loan and work out a way to recover the debt. Loan Restructuring: In some cases, borrowers may negotiate a takeover of their NPA loan to a new financial institution with better terms, such as lower interest rates or extended repayment periods. How NPA Loan Takeover Can Benefit You If you're facing an NPA situation, a loan takeover can offer substantial benefits to help you navigate through your financial challenges. Here's how How NPA Loan Takeover Can Benefit You:

Better Repayment Terms One of the most significant benefits of How NPA Loan Takeover Can Benefit You is the potential for better repayment terms. When your loan is classified as an NPA, the lender may impose high interest rates, late fees, or even aggressive collection tactics. These added costs can make it harder for you to repay your debt.

With an NPA loan takeover, the new lender may offer more favorable terms, such as:

Lower interest rates Longer repayment periods to reduce the financial burden Flexible repayment schedules that better suit your financial capacity This can provide you with much-needed relief, allowing you to repay your debt more comfortably without the constant pressure of escalating charges.

Improved Credit Score Potential An NPA loan can cause significant damage to your credit score. Since NPAs indicate that you have failed to meet your debt obligations, credit bureaus may lower your credit rating, which can affect your ability to get loans in the future.

When you opt for an NPA loan takeover, How NPA Loan Takeover Can Benefit You is reflected in your ability to improve your credit score. As you start making timely payments under the new loan terms, your credit score can begin to recover. The new lender might also report your positive payment history to the credit bureaus, which can gradually rebuild your creditworthiness and increase your chances of obtaining credit in the future.

Lower Interest Rates One of the major problems with NPAs is that they often come with high interest rates, particularly if the original loan was structured under unfavorable terms. These high-interest rates make it difficult for borrowers to pay off the loan, leading to further debt accumulation.

When you undergo an NPA loan takeover, the new lender may offer you a loan with a significantly lower interest rate. This can help reduce your overall debt burden, as lower interest rates mean smaller monthly payments and less financial strain. In the long run, a reduced interest rate can also save you money, making the debt more manageable.

Extended Loan Tenure Another advantage of an NPA loan takeover is the possibility of extending the loan tenure. Often, borrowers who find themselves in financial distress are struggling to meet short-term repayment obligations. By extending the loan tenure, the new lender can make the loan more affordable by lowering the amount due each month.

While extending the loan tenure might increase the total interest paid over time, it can provide significant immediate relief by lowering your monthly payment amount. This can be crucial in preventing further defaults or legal actions from the original lender.

Debt Restructuring Opportunities In some cases, an NPA loan takeover can also involve debt restructuring. The new lender may offer to reduce the principal amount or even provide a grace period, during which you are not required to make any payments. This restructuring allows you to reset your financial obligations and create a more manageable plan for repayment.

By restructuring the debt, you gain a clear path forward without the overwhelming burden of previous loan conditions. It can also help you avoid aggressive collection practices, asset seizures, or legal actions from your current lender.

Avoiding Legal Action When your loan becomes an NPA, the original lender may resort to legal measures to recover the debt. This could lead to foreclosure of assets, wage garnishments, or other legal actions that can negatively impact your financial standing.

One of the key benefits of How NPA Loan Takeover Can Benefit You is that it can help you avoid these extreme legal actions. The new lender may be more open to negotiation and may work with you to find a resolution that avoids the need for such aggressive steps. This peace of mind allows you to focus on getting back on track financially without the looming threat of legal consequences.

Opportunity for Financial Rebuilding Ultimately, How NPA Loan Takeover Can Benefit You is not just about managing the debt—it’s about rebuilding your financial health. By taking advantage of the takeover, you’re getting a fresh start. With more manageable payments, a potential reduction in interest rates, and an improved repayment schedule, you can start the process of financial recovery.

This fresh start allows you to regain control of your finances, reduce debt stress, and take steps to avoid future financial pitfalls.

Conclusion How NPA Loan Takeover Can Benefit You is a crucial consideration for borrowers struggling with non-performing loans. This process provides a valuable opportunity to ease financial burdens, avoid legal complications, and create a path toward financial recovery. By securing better loan terms, improving your credit score, and gaining a fresh start, you can regain control over your financial future.

If you’re facing an NPA loan, explore your options for a loan takeover. Consult with financial experts or lenders to determine the best way forward and take advantage of the benefits this process can offer. With the right approach, an NPA loan takeover can be the key to unlocking a brighter financial future.

0 notes

Text

Debt Recovery Lawyers and Legal Advisors in Bangalore

In today’s fast-paced business world, recovering debts efficiently is crucial for financial stability. Unpaid debts can disrupt cash flow, impact business operations, and create legal complexities. If you are struggling with debt recovery in Bangalore, expert legal assistance is essential.

At HNCK AND ASSOCIATES, our experienced debt recovery lawyers and legal advisors ensure that individuals and businesses recover outstanding dues legally and effectively. We specialize in litigation, arbitration, and alternative dispute resolution methods to recover debts quickly.

Understanding Debt Recovery

Debt recovery is the process of collecting unpaid debts from individuals or businesses. It involves legal and non-legal strategies to ensure rightful payments are made. Without proper legal assistance, debt recovery can become time-consuming and stressful.

Legal advisors play a key role in helping creditors recover outstanding amounts while ensuring compliance with laws such as:

The Recovery of Debts and Bankruptcy Act, 1993

The Insolvency and Bankruptcy Code, 2016

The Negotiable Instruments Act, 1881

Having expert debt recovery lawyers in Bangalore ensures that legal procedures are followed correctly, preventing unnecessary delays or complications.

Types of Debt Recovery

Debt recovery varies based on the nature of the debt, debtor profile, and legal enforceability. Below are the different types of debt recovery that legal professionals handle.

1. Secured Debt Recovery

Secured debts are backed by collateral such as property, vehicles, or financial assets. If the debtor defaults, creditors can seize the collateral to recover the outstanding amount.

Legal Methods for Secured Debt Recovery:

Mortgage enforcement: Recovering loans through foreclosure or auction.

Repossession: Claiming assets used as collateral.

Bankruptcy proceedings: Initiating legal action if the debtor is unable to repay.

2. Unsecured Debt Recovery

Unsecured debts do not have collateral backing them. Credit cards, medical bills, and personal loans fall into this category. Recovering unsecured debts can be challenging without legal intervention.

Legal Methods for Unsecured Debt Recovery:

Demand notices: Official letters requesting repayment.

Negotiations and settlements: Working out feasible repayment plans.

Filing civil suits: Taking legal action against defaulters.

3. Corporate Debt Recovery

Businesses often face issues with unpaid invoices, credit sales, or breach of contract payments. Corporate debt recovery ensures businesses reclaim their dues.

Legal Strategies for Corporate Debt Recovery:

Mediation and arbitration: Resolving disputes outside the court.

Legal demand notices: Warning defaulters before legal action.

Commercial litigation: Suing companies that fail to clear dues.

4. Bank Loan and Financial Institution Recovery

Banks and NBFCs (Non-Banking Financial Companies) face non-performing assets (NPAs) when borrowers default on loans. Legal professionals help recover these loans effectively.

Legal Approaches for Financial Institution Recovery:

SARFAESI Act, 2002: Allows banks to auction assets of loan defaulters.

Debt Recovery Tribunals (DRTs): Special courts for loan recovery cases.

Lok Adalats: Alternative dispute resolution for small loan cases.

5. Consumer Debt Recovery

Individuals who have lent money without formal agreements often struggle to recover their dues. Legal intervention helps recover such debts efficiently.

Methods for Consumer Debt Recovery:

Sending legal notices: Warning defaulters to make payments.

Filing small claims cases: Suing for smaller unpaid amounts.

Police complaints for fraud cases: Taking legal action against intentional defaulters.

Role of Debt Recovery Lawyers and Legal Advisors

Debt recovery lawyers provide professional legal assistance to creditors and financial institutions. Their expertise ensures that recovery is done lawfully while safeguarding the interests of the creditor.

1. Drafting and Sending Legal Notices

A formal legal notice is the first step in debt recovery. It notifies the debtor about the pending amount and the consequences of non-payment.

2. Negotiation and Settlement

Not all debt cases need litigation. Lawyers help negotiate repayment plans and settlements that benefit both parties.

3. Filing Cases in Debt Recovery Tribunals

For corporate and bank-related debt recovery, cases are filed in Debt Recovery Tribunals (DRTs) or National Company Law Tribunals (NCLTs) for effective resolution.

4. Execution of Court Orders

Once a court judgment favors the creditor, legal advisors ensure its execution, including asset attachment and liquidation.

5. Handling Arbitration and Mediation

To avoid lengthy court procedures, arbitration and mediation help resolve disputes amicably while ensuring fair compensation.

Why Choose HNCK AND ASSOCIATES for Debt Recovery in Bangalore?

Choosing the right legal firm is crucial for successful debt recovery. HNCK AND ASSOCIATES stands out due to its professionalism, expertise, and client-focused approach.

1. Experienced Debt Recovery Lawyers

Our team has extensive experience handling complex debt recovery cases across various industries.

2. Strong Legal Strategies

We use a mix of litigation, negotiation, and alternative dispute resolution to ensure successful debt recovery.

3. Transparent and Ethical Approach

We ensure complete transparency in legal proceedings, keeping clients informed at every stage.

4. Quick and Efficient Resolutions

Delays in debt recovery can impact financial health. Our team prioritizes fast and effective legal solutions.

5. Expertise in Banking and Corporate Debt Recovery

We specialize in handling bank loan defaults, corporate debts, and financial disputes efficiently.

Steps to Take for Debt Recovery

If you are facing challenges in recovering debts, following a structured approach ensures better success rates.

Step 1: Assess the Debt

Determine whether the debt is secured or unsecured and check the repayment terms.

Step 2: Contact the Debtor

Reach out through reminders, calls, and emails before initiating legal proceedings.

Step 3: Send a Legal Notice

If informal recovery methods fail, a legal notice warns the debtor of potential legal action.

Step 4: File a Case in Court or Tribunal

If the debtor refuses to pay, our lawyers will file a case in the appropriate court or tribunal.

Step 5: Execute the Court Order

Once a judgment is passed in favor of the creditor, we ensure the execution of recovery actions.

Conclusion

Debt recovery is a complex process that requires legal expertise and strategic action. Whether you are an individual lender, a business owner, or a financial institution, hiring professional debt recovery lawyers and legal advisors is essential.

At HNCK AND ASSOCIATES, we provide tailored solutions to recover outstanding debts efficiently. Our expertise in legal proceedings, arbitration, and corporate law ensures the best possible outcomes for our clients.

If you need legal assistance with debt recovery in Bangalore, contact HNCK AND ASSOCIATES today for professional support and effective results

0 notes

Text

[ad_1] Paromita Das GG News Bureau New Delhi, 28th Dec. A Reversal of Opinions: Raghuram Rajan, the former Governor of the Reserve Bank of India (RBI), has been a vocal critic of the Modi government during his tenure at the central bank. His frequent disagreements with the government, particularly over monetary policies and handling of the economy, earned him the tag of being a “darling of the opposition.” However, in a surprising turn of events, Rajan recently lauded the Modi administration for its effective management of Non-Performing Assets (NPAs), a key challenge for the Bharatiya banking system. This unexpected praise comes after years of sharp criticisms and is worthy of scrutiny, considering Rajan’s pivotal role in the banking reforms during his tenure at RBI. Understanding the NPA Crisis: The Historical Context: To comprehend the significance of Rajan’s recent remarks, it is essential to revisit the context of Bharat’s NPA crisis. NPAs are loans that have gone unpaid for an extended period, and their rise in the Bharatiya banking system has been a long-standing issue, primarily beginning after the global financial crisis of 2008. Rajan noted that projects funded by banks before the crisis started facing significant setbacks post-2008 due to factors such as corruption, delays in permits, and mismanagement. These factors caused a steep rise in NPAs, especially in public sector banks. Rajan’s 2015 Asset Quality Review (AQR) was a watershed moment in addressing this crisis. The AQR helped to clean up the balance sheets of banks by ensuring that bad loans were promptly identified, with the necessary provisioning made. According to Rajan, this was crucial for alleviating the growing financial insecurity surrounding public sector banks. He recalled how he took his proposal for an AQR and the end of the moratorium on bad loans to Arun Jaitley, the then Finance Minister, who approved it without hesitation. This marked a turning point in the fight against NPAs. The Modi Government’s Response, A Shift in NPA Management: Rajan’s praise for the Modi government’s handling of NPAs aligns with recent updates from Finance Minister Nirmala Sitharaman. According to her, between 2014 and 2023, the government’s initiatives helped recover more than ₹10 lakh crores from bad loans. The gross NPA ratio fell to a 12-year low of 2.8 percent by the end of the fiscal year 2024. These figures are a direct reflection of the government’s ongoing efforts to manage bad loans and prevent further escalation of the NPA crisis. Rajan acknowledges that the implementation of AQR was a pivotal step. However, the Modi government’s broader policy initiatives played a crucial role in reducing NPAs over time. One of the most significant steps was the introduction of the Insolvency and Bankruptcy Code (IBC) in 2016. This law gave authorities the power to take control of defaulting companies from their promoters, thereby protecting the interests of creditors. Additionally, wilful defaulters were barred from participating in the resolution process, ensuring that there would be greater accountability. Additional Measures to Tackle NPAs: Alongside the IBC, the government took several other steps to address the NPA issue. One such measure was the amendment to the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act (SARFAESI Act) of 2002, allowing banks to auction the assets of defaulters. This was complemented by the establishment of the National Asset Reconstruction Company Limited (NARCL) to resolve stressed assets over ₹500 crore. The government also provided a ₹30,600 crore guarantee to back NARCL’s receipts, further enhancing the efficiency of the recovery process. Public sector banks were also restructured through the establishment of Stressed Asset Management Verticals, such as the one in the State Bank of India (SBI), to manage and recover loans more effectively. These verticals allowed banks to monitor loans more closely, ensuring that any potential defaults were caught early.

Moreover, the RBI implemented a system of Early Warning Signals (EWS) to trigger timely remedial actions for loans at risk of default. A Positive Outlook: Rajan’s Acknowledgment: Raghuram Rajan’s acknowledgment of the Modi government’s success in reducing NPAs is notable, especially considering his earlier critiques. He conceded that the government’s approach, including the AQR, the IBC, and other reforms, helped set the stage for the reduction in bad loans. As he put it, “Eventually the situation is back on track,” signifying a recovery after years of financial distress. Rajan’s perspective carries weight given his experience and expertise in managing the Bharatiya economy, and his remarks add credibility to the government’s claims of progress. Conclusion: The Long Road Ahead: While the reduction in NPAs under the Modi government is a significant achievement, experts agree that the work is far from over. The underlying issues that contribute to the creation of bad loans—such as poor project planning, delays in clearances, and systemic corruption—continue to be challenges for Bharat’s banking sector. Therefore, while Rajan’s praise is deserved, it also highlights the complexity of tackling NPAs and the need for continued vigilance. The government’s strategy of combining regulatory reforms, legal frameworks, and institutional restructuring has certainly yielded results. Yet, with Bharat’s banking sector still grappling with certain vulnerabilities, it is essential to keep refining these measures. Raghuram Rajan’s shift in stance reflects a recognition of these efforts, providing a balanced view of the Modi government’s handling of one of the most significant financial challenges in Bharat’s economic history. The post Raghuram Rajan’s Remark on Modi Government’s NPA Management: A Shift in Perspective appeared first on Global Governance News- Asia's First Bilingual News portal for Global News and Updates. [ad_2] Source link

0 notes

Text

[ad_1] Paromita Das GG News Bureau New Delhi, 28th Dec. A Reversal of Opinions: Raghuram Rajan, the former Governor of the Reserve Bank of India (RBI), has been a vocal critic of the Modi government during his tenure at the central bank. His frequent disagreements with the government, particularly over monetary policies and handling of the economy, earned him the tag of being a “darling of the opposition.” However, in a surprising turn of events, Rajan recently lauded the Modi administration for its effective management of Non-Performing Assets (NPAs), a key challenge for the Bharatiya banking system. This unexpected praise comes after years of sharp criticisms and is worthy of scrutiny, considering Rajan’s pivotal role in the banking reforms during his tenure at RBI. Understanding the NPA Crisis: The Historical Context: To comprehend the significance of Rajan’s recent remarks, it is essential to revisit the context of Bharat’s NPA crisis. NPAs are loans that have gone unpaid for an extended period, and their rise in the Bharatiya banking system has been a long-standing issue, primarily beginning after the global financial crisis of 2008. Rajan noted that projects funded by banks before the crisis started facing significant setbacks post-2008 due to factors such as corruption, delays in permits, and mismanagement. These factors caused a steep rise in NPAs, especially in public sector banks. Rajan’s 2015 Asset Quality Review (AQR) was a watershed moment in addressing this crisis. The AQR helped to clean up the balance sheets of banks by ensuring that bad loans were promptly identified, with the necessary provisioning made. According to Rajan, this was crucial for alleviating the growing financial insecurity surrounding public sector banks. He recalled how he took his proposal for an AQR and the end of the moratorium on bad loans to Arun Jaitley, the then Finance Minister, who approved it without hesitation. This marked a turning point in the fight against NPAs. The Modi Government’s Response, A Shift in NPA Management: Rajan’s praise for the Modi government’s handling of NPAs aligns with recent updates from Finance Minister Nirmala Sitharaman. According to her, between 2014 and 2023, the government’s initiatives helped recover more than ₹10 lakh crores from bad loans. The gross NPA ratio fell to a 12-year low of 2.8 percent by the end of the fiscal year 2024. These figures are a direct reflection of the government’s ongoing efforts to manage bad loans and prevent further escalation of the NPA crisis. Rajan acknowledges that the implementation of AQR was a pivotal step. However, the Modi government’s broader policy initiatives played a crucial role in reducing NPAs over time. One of the most significant steps was the introduction of the Insolvency and Bankruptcy Code (IBC) in 2016. This law gave authorities the power to take control of defaulting companies from their promoters, thereby protecting the interests of creditors. Additionally, wilful defaulters were barred from participating in the resolution process, ensuring that there would be greater accountability. Additional Measures to Tackle NPAs: Alongside the IBC, the government took several other steps to address the NPA issue. One such measure was the amendment to the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act (SARFAESI Act) of 2002, allowing banks to auction the assets of defaulters. This was complemented by the establishment of the National Asset Reconstruction Company Limited (NARCL) to resolve stressed assets over ₹500 crore. The government also provided a ₹30,600 crore guarantee to back NARCL’s receipts, further enhancing the efficiency of the recovery process. Public sector banks were also restructured through the establishment of Stressed Asset Management Verticals, such as the one in the State Bank of India (SBI), to manage and recover loans more effectively. These verticals allowed banks to monitor loans more closely, ensuring that any potential defaults were caught early.

Moreover, the RBI implemented a system of Early Warning Signals (EWS) to trigger timely remedial actions for loans at risk of default. A Positive Outlook: Rajan’s Acknowledgment: Raghuram Rajan’s acknowledgment of the Modi government’s success in reducing NPAs is notable, especially considering his earlier critiques. He conceded that the government’s approach, including the AQR, the IBC, and other reforms, helped set the stage for the reduction in bad loans. As he put it, “Eventually the situation is back on track,” signifying a recovery after years of financial distress. Rajan’s perspective carries weight given his experience and expertise in managing the Bharatiya economy, and his remarks add credibility to the government’s claims of progress. Conclusion: The Long Road Ahead: While the reduction in NPAs under the Modi government is a significant achievement, experts agree that the work is far from over. The underlying issues that contribute to the creation of bad loans—such as poor project planning, delays in clearances, and systemic corruption—continue to be challenges for Bharat’s banking sector. Therefore, while Rajan’s praise is deserved, it also highlights the complexity of tackling NPAs and the need for continued vigilance. The government’s strategy of combining regulatory reforms, legal frameworks, and institutional restructuring has certainly yielded results. Yet, with Bharat’s banking sector still grappling with certain vulnerabilities, it is essential to keep refining these measures. Raghuram Rajan’s shift in stance reflects a recognition of these efforts, providing a balanced view of the Modi government’s handling of one of the most significant financial challenges in Bharat’s economic history. The post Raghuram Rajan’s Remark on Modi Government’s NPA Management: A Shift in Perspective appeared first on Global Governance News- Asia's First Bilingual News portal for Global News and Updates. [ad_2] Source link

0 notes

Text

Interim Finance Under IBC - Distress Funding or Distress Finance

We assist in raising financial debt raised by resolution professional during the CIRP to retain the going concern nature of the entity until the plan is approved by the CoC and subsequently by NCLT. The IBC classifies interim finance as “insolvency resolution process cost” which gets the highest priority in a resolution plan or in Liquidation.

Website Link :: https://finlender.com/interim-finance-under-ibc/

0 notes

Text

How NPA Consultants Can Guide You Through Complex Corporate Restructuring

Corporate restructuring is a critical process for businesses facing financial or operational challenges. It involves reorganization of a company's financial and operational structure to restore profitability, enhance efficiency, and ensure long-term sustainability. However, navigating this process is far from straightforward, requiring a blend of financial acumen, operational insight, and legal expertise. This is where the role of NPA Consultants becomes indispensable.

At NPA Consultants, we specialize in guiding businesses through the complexities of corporate restructuring. Backed by a team of seasoned professionals from the fields of law, finance, and banking, and under the mentorship of Dr. Visswas, we provide comprehensive solutions tailored to the unique needs of our clients. Here’s how we can assist you:

1. Debt Restructuring Expertise

Debt restructuring is often at the core of corporate turnaround strategies. Our services include:

Depth Analysis and Financial Health Assessment: We conduct a detailed analysis of your company's financial situation to identify the most viable restructuring strategies and determine the best course of action, ensuring that the restructuring process is both effective and sustainable.

Negotiation with Creditors and Vendors: Reaching a consensus that benefits all parties requires experience, expertise, and the ability to develop a well -structured plan. Our team excels at creating such plans, always keeping the company’s long-term viability and profitability in mind.

Tailored Solutions: Every company is unique, and Our solutions are designed specifically for the client’s industry, financial structure, and market conditions. We know that a one-size-fits-all solution is rarely effective, especially in today’s dynamic and complex economic environment.

2. Corporate Revitalization through One-Time Settlements (OTS)

For businesses struggling with non-performing assets (NPAs), a well-structured OTS can be a game-changer. We offer:

Legal Framework Tools: We create tools to strengthen your bargaining position during negotiations with financial institutions and banks.

Execution of OTS Plans: Our team structures and executes mutually beneficial OTS deals, saving you time, energy, and resources compared to prolonged litigation.

Economic Downturn Strategies: During periods of economic stress, banks may be more amenable to OTS offers. We leverage such opportunities to your advantage.

3. Private Equity and Growth Capital

Corporate restructuring often requires fresh capital to fund operational changes or strategic investments. Our private equity services include:

Capital Sourcing: We facilitate growth capital through partnerships with private equity firms and finding the right partners who not only bring in growth capital but also provide significant value addition in the scaling up of the process.

Specialized Services for NPAs: With extensive global networks, we provide customized solutions for businesses grappling with NPAs.

4. Legal and Compliance Support

Legal challenges can significantly complicate the restructuring process. Our legal experts provide:

SARFAESI Act Assistance: We help safeguard mortgaged assets and address legal objections.

Support for Recovery Under RDDBFI Act' 1993: Our team handles recovery matters through the Debt Recovery Tribunal (DRT) and Appellate Tribunal (DRAT).

Insolvency and Bankruptcy Guidance: We assist with cases under the Insolvency and Bankruptcy Code (IBC), ensuring efficient resolution and revival of your business.

Why Choose NPA Consultants?

Comprehensive Expertise: Our multidisciplinary team brings together professionals from law, finance, and banking to deliver holistic solutions.

Proven Track Record: With years of experience and a deep understanding of the challenges businesses face, we’ve successfully guided numerous companies through restructuring processes.

Tailored Solutions: We understand that no two businesses are alike. Our solutions are customized to meet your unique requirements.

Efficient Execution: We focus on achieving results swiftly and efficiently, minimizing disruptions to your business operations.

Transform Challenges into Opportunities

Corporate restructuring can be a daunting prospect, but with the right guidance, it’s an opportunity to transform your business and lay the foundation for sustained growth. At NPA Consultants, we are committed to helping you navigate these challenges with confidence and clarity.

Visit www.npaconsultant.in to learn more about our services and how we can assist you in your corporate restructuring journey. Let’s work together to redefine your business’s future.

For more information or to request a consultation, visit the NPA Consultants website: https://www.npaconsultant.in/

To stay updated with the latest posts, follow us on social media:

📸 Instagram - https://www.instagram.com/npaconsultants/

📘 Facebook - https://www.facebook.com/npaconsultant

🐦 Twitter (X) - https://x.com/npaconsultant

🔗 Linkedin - https://www.linkedin.com/company/npa-consultant-pvt/

▶️ Youtube - https://www.youtube.com/@drvpfinworld

Contact: NPA Consultants Pvt Ltd +91 9892855900 / +91 89282 89070 https://www.npaconsultant.in/

Digital Partner:

TVM INFO SOLUTIONS PVT LTD

Contact: TVM Info Solutions Pvt. Ltd.

+91- 90045 90039

Follow us on Social Media

🌐 Website - https://tvminfo.com/

📸 Instagram - https://www.instagram.com/tvm_infosolution/

📘 Facebook - https://www.facebook.com/people/Tvm-Info-Solutions-Pvt-Ltd/61555896761755/

🔗 Linkedin - https://in.linkedin.com/company/tvminfo

▶️ Youtube - https://www.youtube.com/@tvminfosolutions

#CorporateRestructuring#NPAConsultants#DebtRestructuring#FinancialStability#BusinessTransformation#OperationalEfficiency#DebtAdvisory#LegalCompliance#SMEFinance#BankingSolutions#InsolvencyResolution#BusinessRevival#CorporateFinance#TurnaroundStrategy#MSMEGrowth#RestructuringExperts

0 notes

Text

Finlender is a leading financial services company in India, specializing in NPA and OTS finance, private equity, project finance, and corporate finance. We offer comprehensive solutions in debt funding, stressed account funding, startup funding, and alternative investments. Our expertise extends to debt resolution services, including one-time settlements, NPA resolution, corporate insolvency resolution processes, and debt restructuring. Additionally, we provide advisory and management consultancy, interim finance under IBC, and investment banking services such as mergers and acquisitions, buyouts, and IPO advisory. Our funding essentials encompass pitch decks, project reports, business plans, financial models, credit rating advisory, valuations, and TEV & LIE reports. Partner with Finlender to fuel your business growth with tailored financial solutions.

1 note

·

View note

Text

Over the past decade, India’s public sector banks *(PSBs)* have transformed from institutions burdened by *non-performing assets (NPAs)* into pillars of *financial stability.*

This recovery was driven by strategic interventions, including the Asset Quality Review *(AQR)* of 2015, which exposed systemic inefficiencies.

The government’s *four-pronged* strategy—Recognition, Resolution, Recapitalization, and Reform—ushered in landmark initiatives like the Insolvency and Bankruptcy Code *(IBC)* and the Enhanced Access and Service Excellence *(EASE)* framework.

These measures improved asset recovery, professionalized governance, and enhanced operational resilience.

With NPAs reduced *from 14.6% in FY18 to 5.2% in FY23* , PSBs now face new challenges in *unsecured retail lending* .

Balancing growth and risk management remains key to sustaining their *vital role in India’s economy.*

http://arjasrikanth.in/2024/12/20/banks-from-breakdowns-to-breakthroughs-in-indias-financial-saga/

0 notes

Text

Insolvency and Bankruptcy Code — IBC-BOON OR BANE

Introduction

The Insolvency and Bankruptcy Code (IBC), 2016 has been enacted to merge the existing laws related to insolvency and bankruptcy. The IBC involves standard steps which is viable and understandable. So, everyone, be it creditors, debtors, companies, or shareholders etc. shall have a standard perform for any matters relating to insolvency.

“The IBC has been a real game changer in the Indian economy’s business reform initiatives in the last twenty five years. Ease of doing business is ironically the base premise for enacting the comprehensive Code to exit from the business.”

The IBC has made a spectacular progress in short span. The recent orders issued by the Adjudicating Authorities are beginning to have profound impact on defaulting business owners as the message is loud and clear “settle dues or cede control”.

Why was IBC enacted?

Initially there was Presidency Towns Insolvency Acts, 1909 which was applicable in Kolkata, Chennai and Mumbai and the Provincial Insolvency Act 1920 for the rest of India, for regulating the insolvency laws. The Act applied to individuals and partnerships but exempted corporations from within its ambit. Post Independence, the bankruptcy and insolvency were specified in Constitution and with the passage of time there were numerous acts which governed Insolvency and bankruptcy issues such as the Sick Industrial Companies (special provision) Act, 1985 (“SICA”), SARFAESI Act, 2002, the Recovery of Debts due to Banks and financial institutions Act, 1993 (“RDDBFI Act”), Companies Act, 1956 as well as Companies act, 2013.

But these regulations have not yielded satisfactory results. These regimes were high fragmented, borne out of multiple judicial forums resulting in lack of clarity and certainty of jurisdiction. Further, we had various adjudicatory bodies/Tribunals to deal with such issues and matters under different Acts stated above.

So, this led to the unclear knowledge about the authority as to whom the parties should approach in the related matters. Hence, this resulted in overlapping of decisions. There was no common regulatory authority to regulate the rights of the secured or unsecured creditors, employees etc. or to determine the priority of their claims. Large number of stressed assets such as NPAs with low recovery rates due to a lack of enabling environment for the enforcement of creditor’s rights. Moreover there was no adequate or credible data regarding the assets, indebtedness etc. of companies which further heighten the problems. Hence large number of legislations and non-statutory guidelines have made the recovery of debt a complex and time consuming process.

The IBC is a welcome overhaul which has directly addressed in resolving the insolvency and bankruptcy issues of corporates and simultaneously serving creditors and public financial institutions by helping them in recovery of bad and distress loans and ultimately tackling Non Performing Assets. The Main objective of Code is distribution of the effects of a debtor in the most expeditious, equal and economical mode. The Code lays down the complete procedure of Insolvency Resolution process which involves collating claims and reviewing the requisite financial and other relevant records of the company. The introduction of this Code has brought in ample opportunities for professionals ranging from being appointed as official liquidator to managing the financial health of corporates in case of distressed assets.

Present Scenario

Today we have IBC, 2016, which provides a…

Read more: https://www.acquisory.com/ArticleDetails/52/Insolvency-and-Bankruptcy-Code--IBC-BOON-OR-BANE

0 notes