#next stock market crash prediction

Explore tagged Tumblr posts

Text

3 Exciting US Stock Market Predictions for the Second Half of 2023: Insights for Investors

US Stock Market Predictions for the Second Half of 2023 Navigating the Future: Expert Insights Unveil 3 Key US Stock Market Predictions for the Second Half of 2023 In this post, we have gathered information from Nasdaq’s website and other reliable financial source. in this article We will discuss, 3 Exciting US Stock Market Predictions for the Second Half of 2023, We have condensed this…

View On WordPress

#next stock market crash prediction#stock market forecast for next 3 months#stock market forecast next 6 months#stock market forecast next 6 months 2023#stock market prediction for next 10 years#stock market prediction for next 5 years#stock market predictions 2024#stock market predictions next week#US Stock Market Predictions 2023#What to expect in the US markets for 2023?#Will the stock market be better in 2024?#Will the stock market go up in 2023?#Will US stocks recover in 2023?

0 notes

Text

The decade-old age of fables like Russian collusion, laptop disinformation, or the pangolin/bat cause of COVID is not over; it is just hitting midstream.

For much of April, amid stock downturns, in the classical paranoid style, we were assured by the Wall Street Journal news reporters and the liberal press that Trump had either a) guaranteed an inevitable recession, b) engineered a losing trade war he likely regretted, c) crashed the stock market, d) lost his once majority favorability ratings, e) mostly had a failed first 100 days, or f) all of the above.

Some of us thought these diagnoses and prognoses were absurd. How in mediis rebus, during a radical counterrevolution never quite seen before, could anyone issue such bleak predictions? Would these same observers have said the U.S. was doomed to lose World War II after the bleak first five months of mostly failure in the Pacific, or North Africa, after the utter U.S. army disaster at the Kasserine Pass?

When the Biden administration compiled two consecutive quarters of negative GDP—the supposedly classic definition of a recession—most of these same pundits assured us that the data was meaningless and irrelevant. The same left-wing media throng insisted Biden was in his cognitive prime until hours before he abdicated from the ticket under pressure. They swore to us that Robert Mueller’s “walls were closing in” on Donald Trump, who would legitimately go to jail, buried by 93 lawfare indictments.

As for their polls showing that Trump was all but through after three months in office, almost all of them were not just off in the 2016 presidential race, but again in 2020. And given the chronic temptation to warp polls to create Democratic momentum and fundraising, they rigged their polls yet again in 2024—even when they knew in disgrace that they were ruining their brand. A former Harris campaign official just admitted that internal polls never showed Harris ahead—even as the majority of polls predicted her victory.

So why would anyone believe any of these people? Take the now-defunded Corporation for Public Broadcasting. Its recent NPR/PBS News/Marist poll assured us that 45 percent of the public gave Trump an F for his first 100 days, with only 42 percent expressing approval of his job so far.

But this is the same bunch that also assured us in its final authoritative 2024 election poll, on the very eve before the voting, that Kamala Harris would win the race by 4 points—a lead proverbially “outside the margin of error.” (The next day, she lost the popular vote by 1.5 percent or 2,284,952 votes and the Electoral College by 312-226). The public broadcasting polling partnership was off 5.5 points, perhaps suggesting that it wished to aid the Harris campaign more than either adhering to professional and ethical norms or fearing to lose what little was left of its reputation.

As soon as the Washington Post and the New York Times issued their dismal Trump bias polls, observers quickly pointed out they had, by intent, vastly underpolled those who voted for Trump in 2024. In contrast, the polls with the best 2024 records had Trump’s 100-day approval ratings near even or positive: Rasmussen was 50-49%, and the joint national surveys by Insider Advantage and Trafalgar Group had Trump up at 100 days, 46-44%.

As far as the supposed economic and stock meltdown, the March and April monthly economic reports showed that job growth was not only impressive but well above market expectations, with special emphasis on permanent rather than part-time jobs, even as the number of federal workers went down.

News of massive, multi-trillion-dollar investments and relocations to the U.S. continues. Far from having all the pressure levers in the tariff standoffs, China is starting to realize that the U.S. market is still the center of the world, while its own autocratic party dictatorship—again contrary to pundits’ warnings—is far more vulnerable to rising popular dissent than is a constitutional republic like the U.S.

Inflation in March and April either did not increase or, in fact, declined. Corporate profits were solid. Energy costs went down. Now that we have actually passed Trump’s first 100 days, where is the crashed stock market that supposedly signaled the recession on our doorstep?

The Standard & Poor 500 is back at the level of March 10, roughly where it was before the hysteria—and 12 percent up from a year ago. By May 2, both the Dow and S&P indices showed the longest continued gains in over 20 years. The Dow is now about where it was in September and October before the election—at levels that had not so long ago made investors giddy.

The media-academy nexus is also in hysterics over Trump’s threats of suspending federal funding to higher education unless it makes reforms consistent with Supreme Court decisions and Department of Education guidelines.

Many of us have warned campuses that it would be wiser to compromise, given the public would soon learn of what they had been doing for decades—and would be unpleasantly surprised. After all, private, multibillion-dollar endowed elite campuses took billions of dollars in easy federal money—despite endemic anti-Semitism, flagrant flaunting of U.S. civil rights laws and court decisions by continuing to use racial and gender biases, lucrative but unsavory financial partnerships with illiberal regimes of the Middle East and communist China, spiraling annual tuition costs exceeding the annual rate of inflation, 40-60 percent surcharges and overhead gouging of federal grants, and nonexistence of First Amendment protections for visiting speakers and lecturers, and on and on.

No matter. As soon as Harvard vowed that it would rally its elite brethren campuses against the administration, news predictably began to leak about the culpability and exposure of the real Harvard. Why did it only now and so suddenly rush to end its sister-campus relationship with the terrorist-supporting Birzeit University on the West Bank, or why now replace directors of its radical Center for Middle Eastern Studies program—in a fashion it never had previously dared even after the massacres of October 7?

Then, news of a joint China-Harvard program abroad suddenly surfaced. Allegedly, Harvard had aided members of what some have called a Chinese “paramilitary organization,” despite that group previously being sanctioned for its role in the Chinese state violence conducted against the Uyghurs—a fact that apparently did not surface publicly or perhaps even particularly bother any of the usually hypersensitive and quick-to-demonstrate Harvard students and faculty.

Shortly thereafter, a comprehensive Harvard in-house anti-Semitism report surfaced, documenting in detail the routine harassment of and threats to Harvard Jewish students. In truth, even if it wished to, Harvard now could not control its out-of-control and institutionalized anti-Semitism. It is a bane that Harvard has systematically ignored. It permeates the entire campus and is deeply embedded in the university’s Middle East Studies DEI architecture and recruitment of illiberal foreign students from dictatorial regimes.

The Harvard Law Review (currently being investigated by the Department of Education’s civil rights division) just bestowed a $65,000 fellowship to law student Ibrahim Bhramar. What did Bhramar do to earn such Harvard lucre?

Apparently, he was rewarded either for or despite attacking a Harvard Business School Jewish student during one of the recent anti-Israel campus protests, racking up misdemeanor criminal charges in the process. The prosecutor had noted that Bhramar had conducted “a hands-on assault and battery…and actual interpersonal violence” against the student. Rewarding an anti-Semitic attacker with $65,000 says it all. In 2024, hundreds of Harvard students and faculty disrupted their own graduation, commencing with walkouts and shouts of “free Palestine.”

In sum, despite the Harvard hysteria, it quietly knows what it has been doing, what the stakes are should it lose $2-9 billion in ongoing taxpayer support, and why it would not like full disclosure to the public of both its many excesses and lapses. So, if it is smart, Harvard will likely quietly seek a compromise with the Trump administration.

Finally, we are watching a full Democratic/left-wing meltdown.

Its puerile anti-Trump antics have gone from the clownish to the obscene and violent.

What is the point of disrupting a presidential congressional address by screaming and cane shaking, or of a silly 25-hour pseudo-filibuster? Who believes that smutty sh*t and f*ck congressional videos, or foul-mouthed threats to Trump and Elon Musk (e.g., “dipsh*t,” a**hole”) will win over Independents?

What is the strategic logic behind Democratic governors and senators threatening to cause havoc at Republican officials’ town halls, or to ignite “mass protests” and “disruptions,” so that “Republicans cannot know a moment of peace”?

Does anyone believe that yet a third impeachment of Trump will ensure a Democratic midterm victory?

Or is the correct left-wing playbook to champion a motley array of assassins, spousal abusers, and gang members? Is it wiser then to either laud or ignore attacks on Tesla dealers, owners, and chargers, or wink and nod at blatantly anti-Semitic demonstrations and protests?

Is there anything taboo for the hysterical left?

Yes—it cannot offer the country a simple “Democratic Contract for America”—listing its own solutions to the nation’s existential crises.

There is not a single Democratic blueprint of how to address a $2 trillion budget deficit, $3 billion in daily interest payments, $37 trillion of national debt, or a $1.2 trillion annual trade deficit.

There is no post-Biden corrective agenda to deal with his legacy of 12 million recent illegal aliens, added to the existing 20 million current unlawful immigrants.

Not a single Democratic senator, representative, or party official has put forth any plan to end the Biden-era conflicts in the Middle East and Ukraine.

Nor will they even discuss the challenge of biological males wrecking women’s sporting events, institutionalized campus anti-Semitism, or unlawful race-based chauvinism.

On all these matters, the Democrats and their leftist supporters have offered no counter-proposals, no alternate agendas, and no unique solutions to the nation’s problems—other than boring, profanity-ridden venom and tired performance-art buffoonery.

Reliance on warped polls, untrustworthy and biased reporting, and media sensationalism will not help such poverty of thought and character.

Obscene, hysterical, and clueless is no way to appeal to Americans, Democrats.

19 notes

·

View notes

Text

No one could have seen this coming. Absolutely no one — unless, of course, they had a pulse, a calendar, or a vague understanding of international trade. But for the 74 million Americans who dragged themselves to the polls in 2024 to rehire Donald Trump as President, this was exactly what you ordered — delivered fresh, hot, and right to your crumbling 401(k).

The Dow just plunged 890 points, like a bungee jumper who forgot the cord. The S&P 500, which had already been bleeding for two weeks straight, has now fallen 7.45% since late February — tumbling from 6,147.43 to 5,614.36 like someone chucked their retirement fund off a third-story balcony. The Nasdaq? It's been in a full-blown correction for days now, down over 10% from its recent peak — the kind of nosedive that makes Silicon Valley cry into their kombucha.

And Tesla? Oh, poor Elon Musk. Tesla’s stock got hammered like a frat boy on spring break, collapsing 15% in a single day — its worst performance since September 2020. Musk’s fans thought his bromance with Trump would unlock some economic cheat code — but instead, their electric dreams are getting dragged to hell like a toaster in a bathtub.

But no one could have predicted this, right?

Except... literally everyone who saw Trump’s economic chaos coming from space. Wall Street didn’t get “caught off guard” — they just assumed they could outrun the blast radius. The smart money bet they could milk Trump’s instability long enough to cash out before the market imploded. They thought tariffs were just noise — a showy distraction to keep Trump’s voter base entertained while they quietly skimmed profits off the top.

But now the roulette wheel has stopped spinning, and all those bets are coming due. Trump’s trade war is finally hammering the economy like a sledgehammer in a china shop. Tariffs on China? Up to 20%. Mexico and Canada? They’re on the chopping block next. The Atlanta Fed’s GDP tracker says the economy might already be shrinking, but Trump’s White House is still playing dress-up, calling this mess a “transition.”

Kevin Hassett — still staggering around in public pretending to be an economist — insists everything will calm down by April, as if the stock market works on the same timeline as your dentist appointments. Meanwhile, Trump’s Treasury Secretary Scott Bessent insists this is just a “detox,” like the economy is some booze-soaked college dropout who needs to sweat it out in a basement.

But don’t worry, Trump’s Commerce Secretary Howard Lutnick swears there’s “no recession coming.” That’s adorable — like a man shouting “This ship is unsinkable!” as the water reaches his chin.

Even Trump couldn’t resist throwing out his signature nonsense. “We’re bringing wealth back to America,” he assured Fox News viewers — a statement that probably sounded comforting right up until the moment they checked their portfolios and realized their “wealth” is now buried somewhere next to Jimmy Hoffa.

Meanwhile, Bitcoin is crashing faster than a drunk cyclist — down from $106,000 to $80,000 in just weeks. Turns out even imaginary money isn’t safe when Trump starts swinging his tariff hammer.

But no one could have predicted this. Nope. Not the voters in MAGA hats who believed Trump’s economic “genius” was going to fix America with import taxes and cheap slogans. Not the Wall Street gamblers who thought they could skate through the chaos. Not the investors who thought Elon Musk’s proximity to Trump would protect them.

They all knew. They just thought someone else would take the hit. Now they're sitting in front of their financial wreckage, stunned — like kids who set off fireworks indoors and can’t believe the couch is on fire.

So here’s to the voters who believed in Trump’s master plan — the ones who swore tariffs would turn America into an economic powerhouse and thought a man with six bankruptcies and a golden toilet was some kind of financial wizard. You cheered while Trump slapped tariffs on everything that moved, convinced this chaos was just part of his “genius strategy.” Now you’re staring at your portfolio like a blackjack player who hit on 19 and can’t believe they lost. You wanted this, you begged for this, you voted for this.

And if you’re one of those Wall Street analysts pretending this economic collapse came out of nowhere? Please — you knew. The only people truly shocked by this are the ones who never had a functioning frontal lobe to begin with.

(Fear and Loathing : Closer to the Edge)

#Fear and Loathing#Fear and Loathing: Closer to the Edge#economic news#crash#stock market#S&P#stock market crash

13 notes

·

View notes

Text

UPDATE ON MY WALL STREET TAROT (april edition)!

idk how many of you will recall the reading i did at the start of april about the stock market's predictions for the month, but i thought i'd update you about whether or not i was right.

turns out, i was.

long story short: april was a very volatile and transformative month for investors, there was a massive stock crash after the tariffs were announced on april the 2nd (https://en.wikipedia.org/wiki/2025_stock_market_crash, a timeline is also included in here) but it did bring great opportunities for day traders and those who stayed calm and focused on fundamentals. about the market being neutral but in decline: i am writing this post on the 24th of april so we're still in the middle of tariff induced chaos, volatility still reigns supreme. there have been successful attempts at "neutralizing" said decline, but then it declined again so i guess i was pretty on point lmaoo, the federal reserve tried to stabilize the economy but the immediate impact was limited. guess we'll have to wait out and see what they'll come up with next! i did also mention that investors would play close attention to geopolitical tensions and ofc i won't even bother to yap about what happened with china or with taiwan but: https://www.businessinsider.com/nvidia-stock-drop-trump-trade-war-china-taiwan-semiconductor-2025-4, https://edition.cnn.com/2025/04/16/tech/nvidia-plunge-h20-chip-china-export-intl-hnk/index.html.

about the sectors section: tech and ai: companies like SAP saw significant growth due to AI-focused strategies, despite broader tech sector volatility (https://www.ft.com/content/e072b523-2ae9-4286-a455-8f20e32c6f89), finance: blue chip dividend stocks like J&J and procter and gamble provided stability amidst market turmoil.

tech and ai surged but with temporary hits as i mentioned (not everything is golden), fintech didn't crash but didn't boom either as i predicted, investors fled to safety: dividend blue chips and large cap financials became a haven during volatility, gold has surged as expected during the crash, real estate had localized shifts, but rising interest rate fears kept things flat or slightly bearish, infrastructure stocks tied to domestic manufacturing and supply chain independence got boosts from government rhetoric about reducing reliance on china, renewable energy stocks were mentioned in policy debates, but not enough capital flowed in to cause a true rally (we could consider this a 50/50), people are indeed splurging more selectively on luxury (plus versace got bought by prada, interesting), i won't even mention the government because there's no need to.

overall an accurate prediction, i should have talked more about the big crash but it still doesn't feel as major to me. like yes, it was bad but i believe that we'll re enter a neutral econ condition pretty soon.

#tarot#tarotcommunity#prediction#economy#crisis core#economic growth#stock trading#stock market#investing stocks

13 notes

·

View notes

Text

Depressions, defaults, debt crises and wars are going to sweep the globe, according to Armstrong and his “Socrates” predictive computer program. Armstrong has called every big economic turn in the past three decades. He predicted Trump would win the 2024 Presidential Election in a landslide many months ahead of November. Armstrong called the huge stock crash of 1987 to the day. He predicted the dot com boom and bust in 2000. He was spot on calling for the Great Recession of 2008 and 2009, and now, we are headed for more big turns. Armstrong says,

“The last one turned on May 7th of last year. That was the same day Putin had his inauguration, and it was the same day a couple of Ukrainian colonels tried to assassinate Zelensky. From there, we are turning down into a global recession, which won’t bottom until about 2028. Central banks started cutting rates right after that, and I think Canada was the first. It’s going to be more of a depression in Europe, a very sharp recession in China, and it won’t be as bad in the United States. . . . When you create a debt crisis, that’s what causes a depression. The stock market going down is the least damage to an economy.”

Europe has trillions of dollars of unpayable debt, and Armstrong says, “The leadership knows if they don’t have war, the people will come after them.”

What will be the next big turn? Spoiler alert, it has to do with war in Ukraine and Russia. Armstrong says,

“Europe does not want peace. Look at things the EU has said: that Russia is too big and has to be broken up. I have very good contacts very high up, and they really do think they can conquer Russia. It has $75 trillion in natural resource assets. They will then control that . . . Once they get their hands on that . . . they will rise to the top of countries of the world, like the Roman Empire will be resurrected or something.”

But instead of the EU winning a war against Russia, Armstrong predicts,

“They will lose bigtime. The third time is not going to be the charm. . . . The euro will disappear, not the dollar.”

The timing of the next big turn for war? Armstrong says,

“After May 15, war is turning up (in Ukraine) and it will be turning up into 2026. If I am Putin, there is no way I am signing a peace deal. Putin signed a peace deal (in 2015) and what did they do? They built an army while Russia didn’t.”

Armstrong predicts China will come in on the side of Russia, and there could be as many as “one billion dead and wounded” as a result.

What should the US do? Armstrong says,

“I have been talking to people in Washington, and I have told them to ‘Get the hell out of NATO.’ There are plenty of people warming up to that idea.”

Armstrong predicts if that happens, capital will leave Europe and flow into the US as a safe haven.

Armstrong also thinks gold will hit $5,000 per ounce at the next target, but it will not hit that price until war takes off in Europe and Ukraine.

7 notes

·

View notes

Text

Can Math Predict the Future? Exploring Mathematical Forecasting

The idea of predicting the future using mathematics has fascinated humans for centuries. From forecasting weather patterns to predicting economic trends and even understanding social dynamics, math provides the framework for making sense of the world and anticipating what comes next.

1. Weather Forecasting: A Battle with Chaos

One of the most obvious examples of mathematical forecasting is weather prediction. Meteorologists rely on complex differential equations to model atmospheric conditions. These models, based on physical principles like fluid dynamics and thermodynamics, simulate the behavior of the atmosphere. But here’s the kicker—weather systems are chaotic. This means that tiny changes in the initial conditions can lead to vastly different outcomes, a phenomenon famously described by Edward Lorenz in the 1960s.

Lorenz’s work led to the development of chaos theory, which showed that deterministic systems (those governed by fixed laws) could still be unpredictable due to their sensitivity to initial conditions. This is why forecasts beyond a few days are often inaccurate: small errors compound exponentially, making long-term weather predictions difficult. Still, thanks to sophisticated computing and more accurate data, we can predict weather patterns with reasonable accuracy for about a week, and even then, the models rely heavily on continuous updates and refinement.

2. Exponential Growth and the Spread of Disease

In the world of epidemiology, mathematical models are essential for understanding the spread of infectious diseases. SIR models (Susceptible-Infected-Recovered) use ordinary differential equations to model how diseases spread through populations. These models take into account the rate of infection and recovery to predict the future trajectory of a disease.

The exponential nature of disease spread—especially in the early stages—means that without intervention, the number of cases can explode. For example, during the early stages of the COVID-19 pandemic, exponential growth was apparent in the number of cases. The key to controlling such outbreaks often lies in early intervention—social distancing, vaccinations, or quarantine measures.

Exponential growth isn’t limited to disease, either. It applies to things like population growth and financial investments. The classic compound interest formula,

A = P \left(1 + \frac{r}{n} \right)^{nt}

demonstrates how small, consistent growth over time can lead to huge, seemingly unstoppable increases in value.

3. Predictive Algorithms: Making Sense of Big Data

Data science is at the cutting edge of forecasting today. Algorithms powered by big data are now able to predict everything from consumer behavior to stock market fluctuations and political elections. By identifying patterns in large datasets, these algorithms can forecast outcomes that were previously unpredictable.

For example, Amazon uses predictive models to forecast demand for products, ensuring they have inventory ready for expected sales spikes. Similarly, Netflix uses recommendation systems to predict what shows or movies you’ll watch next based on your previous choices.

Despite all the advances in predictive analytics, uncertainty remains a fundamental part of the picture. Even the best models can't account for random events (think of a sudden market crash or an unexpected global pandemic). As a result, forecasting is always a balance of probability and uncertainty.

4. The Limits of Mathematical Predictions: Enter Uncertainty

At the core of any discussion about forecasting is the recognition that math cannot predict everything. Whether it’s the weather, the stock market, or even the future of human civilization, uncertainty is a constant. Gödel’s Incompleteness Theorem reminds us that even within a well-defined system, there are true statements that cannot be proven. Similarly, Heisenberg’s Uncertainty Principle in quantum mechanics tells us that there’s a limit to how precisely we can know both the position and momentum of particles—unpredictability is embedded in the fabric of reality.

Thus, while math allows us to make educated guesses and create models, true prediction—especially in complex systems—is often limited by chaos, uncertainty, and the sheer complexity of the universe.

#mathematics#math#mathematician#mathblr#mathposting#calculus#geometry#algebra#numbertheory#mathart#STEM#science#academia#Academic Life#math academia#math academics#math is beautiful#math graphs#math chaos#math elegance#education#technology#statistics#data analytics#math quotes#math is fun#math student#STEM student#math education#math community

13 notes

·

View notes

Text

Ibara Saegusa - Private Room Chapter 6

Writer: Nishioka Maiko

Season: Autumn

(Location: Starmony Dorms Courtyard (Evening))

Aira: We did it! It’s been safely completed~♪

You’re amazing, Saegusa-senpai! It looks even cuter and nicer than before it was broken, it even looks brand new! Takamine-senpai would be so happy with this.

Ibara: My my, it’s fortunate that we somehow managed to do it with materials we could find in the dorm.

Aira: All things considered, Saegusa-senpai is so handy. You made this in no time, too. Do you like DIY?

Ibara: It’s not like I like DIY in particular. I spent a long period of time in a place with no entertainment or shops, so I just ended up being able to do it out of necessity.

Aira: Oh. Is that so, that sounds kind of awful…

Ibara: Come on, all we need to do is give it to Takamine-shi back in the dorm room. Let’s go back.

(Location: Starmony Dorm Room (Ibara, Mitsuru, Midori, Tsumugi's Room))

Midori: I’m back……

Mitsuru: I’m back~!

Aira: Ah, Takamine-senpai, Tenma-senpai. Welcome back—

Also…… Takamine-senpai, I’m sorry!

Midori: Eh. W-what? Getting apologised to when I just got back is too scary……!

Aira: The truth is, I borrowed Takamine-senpai’s stepping stool and broke it……

Midori: Stepping stool? The one with the mascot character on it? Why again?

Ibara: It seems that he used it since it was right next to him when he was trying to reach for the tea leaves.

Aira: That’s right. After that, Saegusa-senpai and I rebuilt it while preserving the parts that were left of the mascot character…… This is it.

Midori: Uwaaaaa……♪ It’s great! Even though it was so worn-out before, it looks spick and span! You’ve even painted cute colours over the parts that were peeling off!

Mitsuru: You’re both incredible~! It looks brand new!

Aira: But the fact that I borrowed without asking and broke it still stands, so I’m sorry……!

Midori: No, I really don’t mind that you broke it.

Rather, to think that it can be this pretty when it was so worn-out before. Shiratori-kun, Saegusa-senpai, thank you very much……♪

Mitsuru: Then, you two made this today?

Ibara: Yes. We were fixing it up till around dusk.

Mitsuru: That sounds hard~. You’ve had a hard day, haven't you, Ai-chan?

Aira: Mm…… That may seem like it was the case, but the truth is it really wasn’t.

Mitsuru: Eh?

Aira: Because this whole day today I was able to see a lot of Saegusa-senpai’s surprising sides! It was a beautiful sight for an idol otaku!

(Location: CosPro Conference Area)

(The next day)

Ibara: ………

…… Right. I’ve sent off replies for all the agenda that came in during my day off.

So, what next?

Ah, come to think of it, the prints sent around to be checked got back to me. I need to send a reply to the other party too.

Mm? My personal tablet is ringing. I guess that means it’s telling me about the stock prices changing again.

(…… I’m getting a sense of deja-vu. The last time I checked the market situation at a time like this, the stock price plummeted suddenly.)

Good grief…… Is it going to drop further? I’d really like for it to give me a break. Even a big loss would be considered good—

Hm? What on earth is this……? Since it’s the same situation as the other day, I thought the stock price would plummet again today. Rather, it’s suddenly rising.

(The price has almost returned to what it was before the sudden crash. At this rate, there is a possibility that the stock price will rise even more than before the sharp downward trend.

Furthermore, it looks like the other stocks I own are showing signs of upward movement across the board.)

I wonder what happened……It’s not as if a huge incident has occurred.

That reminds me……

(Flashback to Chapter 1)

Natsume: Maybe you could turn your luck around by reclaiming something familIAR.

(Back to present time)

Ibara: (Could it be because I fixed the stepping stool with Shiratori-shi……?)

………

Hah, that’s ridiculous. If fortune-telling can predict stock price fluctuations, then society will collapse.

It’s probably just that my luck has turned around lately.

Now then. I can focus my efforts on working wholeheartedly.

Even though there was an accident yesterday, contrary to my expectations, it ended up being a good break.

Seems like there’s going to be good progress with today’s work……♪

Previous | Directory

#ensemble stars#enstars#enstars translation#ibara saegusa#aira shiratori#mitsuru tenma#midori takamine#era: !!#type: scout

35 notes

·

View notes

Text

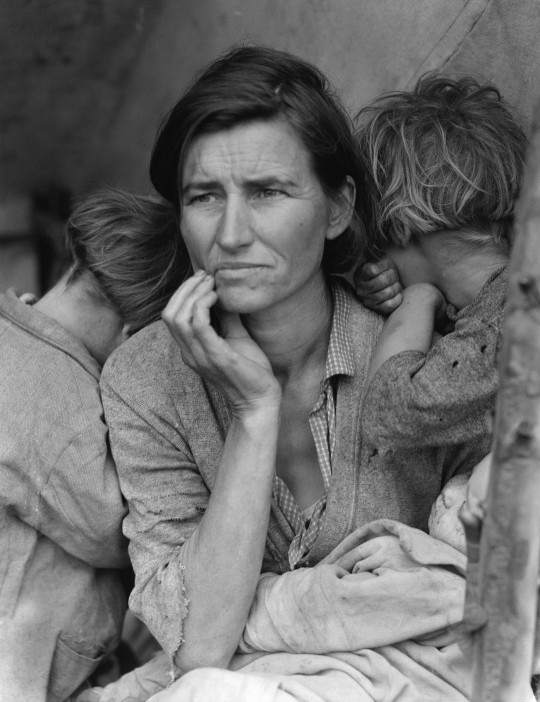

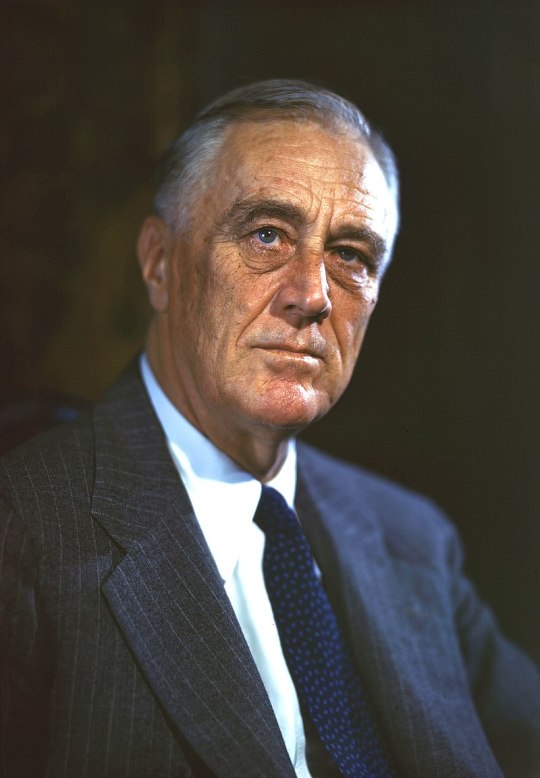

The Great Depression

It’s odd to admit that The Great Depression fascinates me, especially since it was a dark period in American history. But it does fascinate me, enough so that I’ve written several short stories and a couple novels (unpublished) based in the era. How people lived, what they ate, how they entertained themselves – most of all how they survived that period – it intrigues me.

Following WWI, during the Roaring Twenties the economy and America thrived. The present and future appeared bright. A few economists predicted that the good times couldn’t last forever, but the world paid little attention. Throughout 1929, there were signs of a slowing economy, and then on October 24th – what is now known as Black Thursday – the stock market crashed. In the following weeks, it was confirmed that the perpetual party of the 1920’s was over and that a new, bleak era was being ushered in.

For the next decade, America and the rest of the world endured the Great Depression. Images of bank closures and people lined up for soup kitchen often crop up in the history books and on the internet. As well as the famous photograph of the careworn mother and her children. My four grandparents lived through the Great Depression and that part of their lives affected their experiences and behavior. Even late in life, they couldn’t shake off those memories. Growing up, I heard countless stories of those days. My grandmother, Margaret, was very candid about the past. She would have just turned twelve when the stock market crashed and she would have been sixteen in 1933, which was considered one of the worst years during the Depression. Her memories were vivid, painting a picture that the history books couldn’t. She was the third of six children – her eldest brother died as a baby – her father was a boiler maker and her mother a housewife. They were a loving Christian family, which is what I believe brought them through the hardest of times. Grandma and her family never went hungry, however, there were many times they didn’t know they’d make ends meet. Yet somehow, they always did.

Hobos would show up on their back porch. A picture of a cat had been drawn on their fence, signaling to other hobos that a kind lady lived there. And my great-grandmother, Edith, was kind, feeding whoever was hungry. If great-grandpa, Charles was present, the visitor would be welcomed in the kitchen to eat and for a nice conversation. Charles always had a job, unfortunately he didn’t always have work and was often sent home. By 1933, his health began to fail and two weeks before Margaret’s sixteenth birthday, he died. Extended family planned to help, by splitting up the family. So-and-So would take Margaret, So-and-So would take Bettie, So-and-So would take Russel…but Edith was adamant: “We may starve together, but we will stay together.” For the remainder of the 1930s, they banded together to survive.

The weather seemed to turn against the country as well. Dust storms struck all over America, costing lives and ruining livelihoods. It soon became known as the Dust Bowl. Lightening accompanied the storms, and folks would hang chains off the bumpers of their cars to prevent them from being stuck. If caught in a dust storm, one would have to cover their face with a cloth and walk backwards against the gusts. Houses had to be shut up tight, windows closed and key holes plugged to prevent the dust from seeping in. But old houses had their crevices and dust would get in somehow. Decades later, Margaret and others who lived through the Dust Bowl, out of habit would place cups and bowls upside down in the cabinets because that is what they did to prevent dust from collecting on their dishes.

Clothing was rarely store bought. Dresses were made from stylishly printed feed sacks, using patterns, and sewn by hand, or by sewing machine. Sweaters and cardigans were knitted or crocheted. Shoes were worn at work and school, but at home if the weather was seasonable, they went barefoot to preserve their shoes. Clothing was patched and mended and passed from one sibling down to another, then onto another family. Like many of that era, Margaret left high school early to work. She was first a maid, then she worked in a number of factories. Her earnings of $4 a week went to the household. Later during WWII, when she earned $16, she was allowed to keep $4 for herself, and felt she was rich.

Franklin Delano Roosevelt was elected president and was eventually voted into office three more terms, holding the position until his death in 1945. After Herbert Hoover, who was oblivious to the suffering of the American people, many trusted Roosevelt would lead the nation through the dark times. His New Deal, his relief programs, his steadiness, his fireside chats were a beacon of hope. His assurances that they had “nothing to fear but fear itself” spoke volumes. Despite his attempts to alleviate the financial woes and troubles of the 1930s, the US didn’t rise out of the Great Depression until the onslaught of WWII.

Years later, Grandma told me that her life had been a hard one, but it had been good and satisfying. I believe many of that era would say as much. I don’t know if it is the Great Depression that is my favorite era, or if it’s the people who lived during that time. They possessed an indomitable spirit. After the Great Depression, they endured WWII and more or less saved the world. That generation proved to us that whatever trials we may face today, this too shall pass.

9 notes

·

View notes

Text

The prospect that US residents may soon be able to invest in bitcoin through their brokerage, as if it were a regular stock, has prompted a fresh round of hype in crypto circles—and a surge in crypto prices.

Several investment firms, including heavy-hitters like BlackRock and Fidelity, are queuing up to launch a spot bitcoin exchange-traded fund (ETF) in the US. These funds would track the price of bitcoin, making them the closest thing to investing in the crypto token directly without dealing with a crypto exchange or storing crypto manually, a process fraught with risk.

After a bruising 18 months in which crypto prices buckled, high-profile businesses collapsed, and two crypto figureheads were convicted of crimes in the US, the crypto industry is supposed to be cleaning up its act. That the US Securities and Exchange Commission (SEC) appears to be entertaining a spot bitcoin ETF after years of resistance is seen by some as a signal that crypto is moving beyond its free-wheeling years.

The arrival of such a fund in the US—by far the world’s largest ETF market—“is a significant milestone,” says Samson Mow, a prominent bitcoin evangelist and CEO of bitcoin-centric technology firm JAN3, as it will allow investors to hold bitcoin through a conventional financial product for the first time.

While there is broad consensus around the likelihood of an ETF approval among analysts, the idea that it would be symbolic of the industry’s coming of age is contradicted by the frenzy of speculation around what will happen to the price of bitcoin.

On X, crypto influencers with hundreds of thousands of followers are predicting an ETF will send the price of bitcoin soaring, in posts peppered with the rocket ship emoji. The arrival of a spot bitcoin ETF, claims Mow, will unlock a wave of pent-up demand and lead a “torrent of capital” to “pour into bitcoin.” Institutions and other investors that either cannot or choose not to invest in unregulated financial products will seize the opportunity to invest, he says, driving the price far beyond its previous heights.

An ETF might point to a growing acceptance of bitcoin among legacy financial institutions, but the implications for the price of bitcoin are being both mis- and overstated, ETF analysts warn, and the boosterism on display shows that little about crypto has changed.

Twelve applications for spot bitcoin ETFs are awaiting approval from the SEC. Delays are commonplace, but the agency is due to make a call on some of the applications as early as January 1, 2024. The three ETF analysts who spoke to WIRED expect the SEC to green-light a spot bitcoin ETF at some point next year.

In Canada, Germany, and elsewhere, spot bitcoin ETFs already exist. And US investors have had access to bitcoin futures ETFs, the value of which are correlated with the price of bitcoin, since 2021. The approval of a spot bitcoin ETF in the US is significant because it would, for the first time, give US investors access to a close proxy to bitcoin in a familiar and regulated format.

The attention paid to the topic by crypto trade media emphasizes the current fixation in industry circles. Since this summer, when speculation about the arrival of a spot bitcoin ETF began to ratchet up, crypto news site CoinDesk has published dozens of articles and videos on the topic.

In that same period, crypto markets have experienced dramatic swings, and the price of bitcoin has risen by almost a third. In some cases, price swings have been triggered by rumor and misreporting. On October 16, crypto outlet CoinTelegraph issued a retraction and apology after putting out an erroneous post on X announcing the approval of the first spot bitcoin ETF in the US, based on a screenshot posted by an X user, which led to a buying spree that increased the price of bitcoin by 10 percent.

On November 13, a falsified ETF filing relating to a separate cryptocurrency, XRP, caused a 13 percent rise in the token’s price. By the end of the day, those gains had evaporated. The Financial Times calculated that “imaginary bitcoin ETFs” were already worth 30 times the actual spot bitcoin ETFs already in existence worldwide.

Some ETF analysts, like Aniket Ullal of investment research firm CFRA, share the belief that the arrival of an ETF is likely to increase demand for bitcoin as an investment asset. But the effect on price will not be a “short-term spike,” Ullal says, but rather stretch out over multiple years.

Others say it will have the polar opposite effect to that predicted by figures like Mow, and that the price of bitcoin could plummet as investors attracted by the hubbub quickly cash out their winnings. “The idea that there is a huge pile of demand that will somehow materialize is just not true,” argues Peter Schiff, economist and CEO at asset management firm Euro Pacific. “It’s more of a ‘buy the rumor, sell the fact’ situation.”

The “narrative” that an ETF is a “catalyst for growing demand” has attracted speculators, says Bryan Armour, director of passive research strategies for North America at investment research firm Morningstar. “Hype has always been one of the core tenets of bitcoin. It seems like hype is at an all-time high.”

Figures from research firm Fineqia suggest the volume of crypto trading activity has surged in response to speculation over the approval of a spot bitcoin ETF and its market impact. In mid-November, daily trading volume on crypto exchanges reached $31.4 billion, the highest level in more than six months.

“There’s always the possibility that people are hyping it up for their own benefit,” says Mow, who adds that he doesn’t believe the broader crypto industry—which he considers to be separate from bitcoin and describes as a “grift”—is capable of cleaning up its act. “The crypto industry will keep churning out FTXs and people will keep investing because it’s a spectacle,” he says.

But whether or not bitcoin is different—a mature asset whose legitimacy would be “cemented,” as Mow claims, by an ETF approval—the relentless speculation surrounding it will expose investors to risk. “It is wildly volatile and should be handled carefully,” says Armour. But, he adds, people “hear the siren song and buy in.”

3 notes

·

View notes

Text

This Time It Really Might Be Different On October 11, 1987, I first came across the saying “this time it’s different.” According to an article in The New York Times by Anise C. Wallace, Sir John Templeton had warned that when investors say times are different, it’s usually in an effort to rationalize valuations that appear high relative to history – and it’s usually done to investors’ ultimate detriment. In 1987, it was high equity prices in general; the article I cite was written just eight days before Black Monday, when the Dow Jones Industrial Average declined by 22.6% in a single day. A dozen years later, the new thing people were excited about was the prospect that the Internet would change the world. This belief served to justify ultra-high prices (and p/e ratios of infinity) for digital and e-commerce stocks, many of which went on to lose more than 90% of their value over the next year or so. Importantly, however, Templeton allowed that things might really be different 20% of the time. On rare occasions, something fundamental does change, with significant implications for investing. Given the pace of developments these days – especially in technology – I imagine things might genuinely be different more often than they were in Templeton’s day. Anyway, that’s all preamble. My reason for writing this memo is that, while most people I speak with seem to agree with many of my individual observations in Sea Change, few have expressly agreed with my overall conclusion and said, “I think you’re right: We might be seeing a significant and possibly lasting change in the investment environment.” This memo’s main message is that the changes I described in Sea Change aren’t just usual cyclical fluctuations; rather, taken together, they represent a sweeping alteration of the investment environment, calling for significant capital reallocation.

gonna go out in a limb and predict a market crash (i.e. djia down more than 10%) eight days from the publication of this memo (i.e. next thursday the 19th)

3 notes

·

View notes

Text

As much as this got me excited, it's almost kind of disinformation :(

Yes it did drop, this is technically correct

But when you look at bigger time scales, this is really no big deal to them. Their entire stock cycle looks like this, and so far they've only dropped to about baseline the past 5 years.

Also, tesla executives sold billions in stock during this and basically turned it into a pump and dump.

So they are continuing to line their pockets and we need to keep attacking this harder and longer before we make a real difference.

The big red crash is only this year, 2025. The next one is over 5 years, and the last one is over the life of the company. Source: https://www.tradingview.com/symbols/NASDAQ-TSLA/

This is the source about the stock sales:

I want to take special note of this part

She was sued by the shareholders for excessive compensation. THE FUCKING SHAREHOLDERS who's only purpose for existing is initial funding and then stealing the profits of the workers' labor for rest of the life of the company, ya know, the greediest fuckers in capitalism, SUED HER FOR EXCESSIVE COMPENSATION. They settled for 1 billion. She made 43 billion on selling tesla stock since February 3rd.

We need to keep dropping the stock until these fuckers actually hurt

likes to charge, reblogs to cast

115K notes

·

View notes

Text

Leading the New Era of Trading: The Revolutionary Advantage of Tick-Level Data

In the battlefield of finance, every millisecond of decision delay can lead to a quiet transfer of wealth. While ordinary investors focus on candlestick charts to find trends, top traders have already gained insights into the market's finest pulses through Futures APIs and Stock APIs. This millisecond-level data granularity is the ultimate weapon in modern financial competition.

1. Tick Data: The Atomic-Level Reduction of Market Truth

Traditional minute-level candlesticks are essentially compressed "blurry snapshots," erasing crucial information such as volume distribution and order flow dynamics. In contrast, tick-level data interfaces provide every transaction record (price, volume, timestamp), allowing you to observe the market as if under a microscope:

Capturing Liquidity Black Holes: Identifying hidden traces of large order splits and iceberg orders

Tracking Fund Flows: Analyzing real intentions of major institutions through individual transaction data

Decoding Market Sentiment: Predicting shifts in buying and selling power from changes in quote frequency

Research shows that strategies built on tick data improve the Sharpe ratio by 58% compared to traditional volume-price models, while reducing maximum drawdown by 42%.

2. The Lifeline of High-Frequency Trading: Three Empowering Dimensions of Tick Data

Leap in Strategy Precision

When algorithmic trading needs to predict price fluctuations for the next 15 seconds, minute-level data is like analyzing an F1 racing trajectory in standard definition. The Alltick API offers tick-level data interfaces that support:

Nanosecond-level timestamp synchronization

Depth snapshots of 50 bid/ask levels

Alerts for abnormal volatility

Quantum Leap in Risk Control

In extreme market conditions, tick data serves as a radar to avoid "flash crash traps":

Real-time detection of liquidity drops

Dynamic calculation of instantaneous deviations from VWAP (Volume Weighted Average Price)

Identification of subtle shifts in cross-market arbitrage spreads

Revolution in Backtesting Credibility

Historical backtesting based on tick data can recreate real market frictions:

Precisely calculating slippage

Simulating priority rules of exchange matching engines

3. Alltick API: The Engineered Foundation of the Tick Data Revolution

Accessing tick data is just the starting point; turning it into a trading advantage requires robust data interface infrastructure:

Lightning-Fast Transmission Architecture

27 global edge computing nodes with end-to-end latency < 5 milliseconds

Stream engines processing over 2 million tick events per second

Intelligent Data Services

Machine learning-driven anomaly detection for tick data

Real-time generation of asset correlation heatmaps

Developer Toolkit

Support for multiple access protocols

Multi-language SDKs available

Activate Your Tick Data Privileges Now

The Alltick API is now open for free trial access, allowing you to experience:

Full-range tick-level historical data downloads

Real-time data stream stress testing tools

Exclusive market microstructure analysis reports

In an era where algorithmic trading evolves to microsecond competition, tick data is no longer an "optional accessory" but a vital organ for survival in the market. Choose Alltick's data interfaces to ensure that every strategy is built on the atomic truth of the market—because true trading advantage starts with seeing what others cannot.

0 notes

Text

💔 When the Crypto Market Plays Hard to Get

Ah, crypto—the wild west of finance where your investment can go from moon to doom before you can even refresh your portfolio. 🌕📉 Lately, it feels like we’re all just waiting for the next big regulatory wave to crash on our digital shores. Spoiler alert: it’s coming. 😱

Stocks are wobbling under the weight of impending 25% tariffs on imports. While some of us name our pets after $BTC and $ETH, others are sweating through their shirts wondering if their investments will sink faster than my sanity on a Monday morning. ☕💸

⚖️ Regulatory Rollercoaster: Hold On Tight!

Regulatory uncertainties are like that annoying friend who borrows your favorite hoodie and never returns it—always there, but never reliable. Experts are predicting rough waters ahead, with market analysts blaming everything from government policy tweaks to global trade shake-ups. Tariffs are causing a chain reaction that even our best memes can’t buffer. 🤦♂️💥

📉 Indices in a Tailspin

The S&P 500 and NASDAQ? A real-life example of "watching paint dry"—except it’s red, and it's burning a hole in our collective pockets. Consumer confidence is plummeting like it’s auditioning for a sad Netflix movie, and yeah, you guessed it, $DOGE isn’t coming to save us this time. 🐶🚀

🔄 History Repeats: The 2020 Plot Twist

Feeling déjà vu? Parallels are being drawn to 2020 tariff shenanigans, and it looks like traders are responding with all the cautious enthusiasm of a cat near a vacuum cleaner. 🐾💨 If you’re not recalibrating your portfolio strategies, are you even a crypto investor? #LifeChoices

“Countdown to tariffs with a 25% tariff on autos and imports from countries buying oil from Venezuela scheduled to go into effect on April 2, 2025.” - Traders on CNBC's 'Fast Money'

In the words of that classic meme: "I can't even." If you want to keep your sanity intact and your wallet semi-stable, check out our deep dive into the thrilling world of crypto market volatility amidst regulatory uncertainty. It’s a roller coaster you don't want to miss! 🎢💵 Click here for more insights!

Disclaimer: This website provides information only and is not financial advice. Cryptocurrency investments are risky. We do not guarantee accuracy and are not liable for losses. Conduct your own research before investing.

✨ Let’s talk volatility below! What’s your take on these tariffs? Are you doubling down or getting out while you still can? 💬 Drop your thoughts! ✌️

#Crypto #Investors #Tariffs #MarketVolatility #RegulatoryUncertainty #CryptoCommunity #BTC #ETH #DOGE #InvestSmart

0 notes

Text

The decade-old age of fables like Russian collusion, laptop disinformation, or the pangolin/bat cause of COVID is not over; it is just hitting midstream.

For much of April, amid stock downturns, in the classical paranoid style, we were assured by the Wall Street Journal news reporters and the liberal press that Trump had either a) guaranteed an inevitable recession, b) engineered a losing trade war he likely regretted, c) crashed the stock market, d) lost his once majority favorability ratings, e) mostly had a failed first 100 days, or f) all of the above.

Some of us thought these diagnoses and prognoses were absurd. How in mediis rebus, during a radical counterrevolution never quite seen before, could anyone issue such bleak predictions? Would these same observers have said the U.S. was doomed to lose World War II after the bleak first five months of mostly failure in the Pacific, or North Africa, after the utter U.S. army disaster at the Kasserine Pass?

When the Biden administration compiled two consecutive quarters of negative GDP—the supposedly classic definition of a recession—most of these same pundits assured us that the data was meaningless and irrelevant. The same left-wing media throng insisted Biden was in his cognitive prime until hours before he abdicated from the ticket under pressure. They swore to us that Robert Mueller’s “walls were closing in” on Donald Trump, who would legitimately go to jail, buried by 93 lawfare indictments.

6 notes

·

View notes

Text

youtube

URGENT! NEXT BIG BUYING! TESLA! SMCI! DJT! PLTR! APPLE! GOLD! XRPUSD! COIN! MORE! | Will Knowledge In this video, I go over stock market price predictions on stocks like Nvidia stock, pltr stock, tesla stock, sofi stock, intel stock, hims stock, apple stock, and more! ✅GET ALL MY TRADE ALERTS & PRIVATE TRADING LIVESTREAMS✅ 👉 Website: https://ift.tt/SHkJOvV SELLOFF SALE IS LIVE! HUGE DISCOUNT!!! ✅ Your A1 Analysis waitlist is now live! join below! ✅ 👉 Website: https://ift.tt/k2iBDsH ✅ Subscribe To My Channel For More Videos: https://www.youtube.com/@WillKnowledge/?sub_confirmation=1 ✅ Important Links: Use my same platform (Trading view) To have the exact same levels! 👉 https://ift.tt/QXVCyWP This is an affiliate code, I will receive compensation from you signing up! ✅ Stay Connected With Me: 👉 Instagram: https://ift.tt/BqZlHOE ============================== ✅ Other Videos You Might Be Interested In Watching: 👉 Double Your Money in 2 Minutes! Stock Market Tips to Turn $1,000 into $1,000 | Will Knowledge https://www.youtube.com/watch?v=Qrw_a6EuHtg 👉 Best Stocks to Buy Now: NVIDIA, Tesla, Nike, Meta, Gold, and More! | Will Knowledge https://www.youtube.com/watch?v=6jl_siqD09A 👉 Stock Market Crash Alert: Key Levels You Must Watch! | Will Knowledge https://www.youtube.com/watch?v=JLsh_-HZoOE 👉 Top Buys: Tesla, Nvidia, AMC, Apple, and More Stock Market Analysis! | Will Knowledge https://www.youtube.com/watch?v=PTM98qWBfd8 ============================= ✅ About Will Knowledge: Hello Team! This channel is about investing in the stock market, trading options, and general knowledge of the market tools to use to your benefit so we can all spread the wealth. For collaboration and business inquiries, please use the contact information below: 📩 Email: [email protected] 🔔 Subscribe to my channel for more videos: https://www.youtube.com/@WillKnowledge/?sub_confirmation=1 ===================== #stockmarket #stocks #trump Disclaimer: These videos are for educational and entertainment purposes only and should not be construed as financial advice or a recommendation to buy or sell any security or investment. I am not a financial advisor, and the information provided is not intended as investment recommendations. It does not constitute and should not be construed as financial or investment advice or an offer to purchase or sell securities. The content is not personalized or tailored to a specific person or group of persons, nor to their personal investment or financial needs. You should consult a financial adviser or other investment professional authorized to provide investment advice. Investing comes with risks, including the risk of loss. Please consult with a licensed financial professional before making any financial decisions. I shall not be held liable for any losses incurred from investing or trading in the stock market, including attempts to mirror my actions. Remember, unless investments are FDIC insured, they may decline in value and/or disappear entirely. Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use © Will Knowledge via Will Knowledge https://www.youtube.com/channel/UCXnjHTVPeCp7hNEj_15Gx4w April 11, 2025 at 05:00AM

#stockmarket#stockmarketinvesting#marketanalysis#investmentstrategies#wealthbuilding#financialeducation#stocktradingtips#financialfreedom#Youtube

0 notes

Text

URGENT! NEXT BIG BUYING! TESLA! SMCI! DJT! PLTR! APPLE! GOLD! XRPUSD! COIN! MORE! | Will Knowledge

https://www.youtube.com/watch?v=C9fi3XAIJjI In this video, I go over stock market price predictions on stocks like Nvidia stock, pltr stock, tesla stock, sofi stock, intel stock, hims stock, apple stock, and more! ✅GET ALL MY TRADE ALERTS & PRIVATE TRADING LIVESTREAMS✅ 👉 Website: https://ift.tt/ylnOd5o SELLOFF SALE IS LIVE! HUGE DISCOUNT!!! ✅ Your A1 Analysis waitlist is now live! join below! ✅ 👉 Website: https://ift.tt/COUltYM ✅ Subscribe To My Channel For More Videos: https://www.youtube.com/@WillKnowledge/?sub_confirmation=1 ✅ Important Links: Use my same platform (Trading view) To have the exact same levels! 👉 https://ift.tt/yEmnRSF This is an affiliate code, I will receive compensation from you signing up! ✅ Stay Connected With Me: 👉 Instagram: https://ift.tt/2MzJfrY ============================== ✅ Other Videos You Might Be Interested In Watching: 👉 Double Your Money in 2 Minutes! Stock Market Tips to Turn $1,000 into $1,000 | Will Knowledge https://www.youtube.com/watch?v=Qrw_a6EuHtg 👉 Best Stocks to Buy Now: NVIDIA, Tesla, Nike, Meta, Gold, and More! | Will Knowledge https://www.youtube.com/watch?v=6jl_siqD09A 👉 Stock Market Crash Alert: Key Levels You Must Watch! | Will Knowledge https://www.youtube.com/watch?v=JLsh_-HZoOE 👉 Top Buys: Tesla, Nvidia, AMC, Apple, and More Stock Market Analysis! | Will Knowledge https://www.youtube.com/watch?v=PTM98qWBfd8 ============================= ✅ About Will Knowledge: Hello Team! This channel is about investing in the stock market, trading options, and general knowledge of the market tools to use to your benefit so we can all spread the wealth. For collaboration and business inquiries, please use the contact information below: 📩 Email: [email protected] 🔔 Subscribe to my channel for more videos: https://www.youtube.com/@WillKnowledge/?sub_confirmation=1 ===================== #stockmarket #stocks #trump Disclaimer: These videos are for educational and entertainment purposes only and should not be construed as financial advice or a recommendation to buy or sell any security or investment. I am not a financial advisor, and the information provided is not intended as investment recommendations. It does not constitute and should not be construed as financial or investment advice or an offer to purchase or sell securities. The content is not personalized or tailored to a specific person or group of persons, nor to their personal investment or financial needs. You should consult a financial adviser or other investment professional authorized to provide investment advice. Investing comes with risks, including the risk of loss. Please consult with a licensed financial professional before making any financial decisions. I shall not be held liable for any losses incurred from investing or trading in the stock market, including attempts to mirror my actions. Remember, unless investments are FDIC insured, they may decline in value and/or disappear entirely. Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use © Will Knowledge via Will Knowledge https://www.youtube.com/channel/UCXnjHTVPeCp7hNEj_15Gx4w April 11, 2025 at 05:00AM

#stockmarketinvesting#learnhowtotrade#entrepreneur#education#generalknowledge#stockmarket#willknowledge#money#explore

0 notes