#mobile banking in kenya

Explore tagged Tumblr posts

Text

Mobile Banking in Kenya: Open a Business Bank Account with SBM Bank

Discover the ease of mobile banking in Kenya with SBM Bank. Open a business bank account and manage your finances effortlessly through our business banking online services. SBM Bank offers convenient solutions to open a business bank account in Kenya, ensuring seamless financial operations for your business. Enjoy secure and efficient mobile banking, designed to meet the needs of modern businesses. Experience the future of banking with SBM Bank today.

#Mobile Banking In Kenya#Business Bank Account Kenya#Open A Business Bank Account#Business Banking Online

0 notes

Text

Effortless Banking at Your Fingertips: Exploring SBM Bank's Business Banking Online Account

Discover the convenience of managing your business finances seamlessly with SBM Bank's business banking online account. Experience secure transactions, real-time monitoring, and a user-friendly interface designed to meet the unique needs of businesses in Kenya. Elevate your banking experience with the power of technology and the reliability of SBM Bank's innovative digital solutions.

#bank account from home#best bank to open a business account in kenya#mobile banking in kenya#mobile online banking app#banking apps in kenya

0 notes

Text

Convenient Mobile Banking with SBM Kenya

Enjoy seamless banking on the go with SBM Kenya's mobile app. Experience hassle-free access to your accounts, transfer funds, pay bills, and manage finances securely, all from the convenience of your smartphone. Experience banking like never before, with SBM Kenya's feature-rich mobile app.

#loan calculator kenya#mobile banking in kenya#best bank to open a business account in kenya#banking from mobile app

0 notes

Text

Manage Your Finances with Ease: Mobile Banking, Loan Calculators, and Top Banks in Kenya

In today’s fast-paced world, managing your finances has never been easier with business mobile banking and banking from mobile app solutions. Whether you're on the go or working from home, banking mobile apps provide seamless access to your accounts, payments, and transactions. For those looking to secure financing, use a personal loan calculator, home loan calculator, or mortgage calculator to plan your financial commitments. Choosing the top bank in Kenya and the best bank in Kenya is crucial for reliable services and competitive rates. Furthermore, consider the best banking customer service when selecting a bank, ensuring that your banking experience is smooth and hassle-free. Embrace the convenience of mobile banking and financial planning tools to make smarter financial decisions.

#Business Mobile Banking#Banking from Mobile App#Banking Mobile App#Personal Loan Calculator#Top Bank in Kenya#Best Bank in Kenya#Home Loan Calculator#Mortgage Calculator#Best Banking Customer Service#Mobile Banking Kenya#Loan Calculators#Kenya Banking Services#Digital Banking#Financial Planning#Online Banking Kenya

0 notes

Text

List of 12 More Mobile Lenders approved by CBK

The Central Bank of Kenya (CBK),on Monday, January 30 published a list of 12 more approved Digital Credit Providers – DCPs CBK stated in a statement that the mobile lenders had been approved out of 381 applications filed since March 2022. Following the licensing of ten credit providers in September 2022, the total number of approved DCPs will be 22. They include: 1. Inventure Mobile Limited…

View On WordPress

0 notes

Text

National Wildlife Photo Contest: Bright Spots.

I picked the photos I liked best. Click/tap on the caption to see the others.

BABY ANIMALS, First Place, Glenn Nelson, Seattle, Washington.

Nelson identifies with these juvenile barred owl siblings, declared invasive in the Pacific Northwest. A lifelong U.S. citizen born in Japan, “my community was forcibly removed from about the same habitat [as the owls] for merely resembling the enemy during World War II,” he says. Nelson sees the owls, photographed in July 2023, as “charismatic fauna that open people to relationships with other beings and nature.”

BIRDS, First Place, Joshua Galicki, Claiborne, Maryland.

Both Galicki and his subject, a great blue heron, were poised at the right place and the right time to preserve this moment of subtle beauty: Galicki from his kayak in a cove near his home on the Chesapeake Bay and the heron about to grasp a loblolly pine branch on shore. “The sun was setting, and a few last rays of light touched the heron at a fantastic angle,” he says of the July 2023 image.

LANDSCAPES & PLANTS, Second Place, Nancy Hajjar, Lone Pine, California.

The “beautiful swirling orange lenticular cloud” captured by Hajjar of Funchal, Portugal, in April 2021 only looks otherworldly. Lenticular clouds—formed by air flowing over high mountain ranges, such as California’s eastern Sierra Nevada—are frequently compared to, and sometimes mistaken for, flying saucers.

MAMMALS, First Place, Rachael Innes, San Pedro, California.

“I was fortunate to be able to follow an urban fox family from the day the kits emerged until they left to start their own lives,” says Innes of Torrance, California. In this August 2023 photo, she captured two red fox kits—and their shadows—playing at an old coast guard station in San Pedro, near the foxes’ cliffside den.

MAMMALS, Second Place, Donna Bourdon, Maasai Mara, Kenya.

Bourdon of Decatur, Tennessee, observed four days of wildlife river crossings in Kenya in September 2023, including a roughly 10,000-strong throng of wildebeests and zebras. “Once the first wildebeest made the leap of faith, the entire herd pushed forward, and there was no turning back,” she says. Above, a sole wildebeest faces her camera head-on, waiting its turn to ascend the far bank of the river, even as “the risk of being trampled and drowned is extremely high.”

MOBILE, First Place, Steffen Foerster, Falkland Islands.

When Foerster of Sunnyside, New York, saw a colony of king penguins about to pass him on a Falkland Islands beach in December 2023, he had professional camera equipment at his fingertips. And yet, he reached for his cell phone with its ultrawide lens “for a much more expansive scene”—a split-second decision that caught “an unforgettable experience.”

YOUNG NATURE PHOTOGRAPHERS, First Place, Karsyn Sterns, San Gerardo de Dota, Costa Rica.

Talk about a story arc: Accompanied by her dad, 13-year-old Sterns traveled to Costa Rica in March 2023 from her home in Dumfries, Virginia, with the goal of observing the aptly named resplendent quetzal. “I was especially happy to have seen and photographed this bird,” she says. We say, mission accomplished.

YOUNG NATURE PHOTOGRAPHERS, Second Place, Edwin Liu, Mississauga, Canada.

A friend told the budding photographer Liu, 17, that a great blue heron fished every evening in a Mississauga park. When Liu visited in October 2023 but didn’t see the bird within an hour, he grew restless and abandoned the park pond, only to encounter the bird in the bordering farmland. Ten minutes later, he watched the heron catch a vole. “When the heron hunts, it is indeed more patient than the photographer,” Liu says.

PORTFOLIO, First Place, Sonny Parker, Yukon, Canada.

While Dall sheep—native to alpine pockets of northwestern North America, from Canada’s British Columbia, Northwest Territories and Yukon up into Alaska—have evolved to stave off a host of predators, they now face a different threat: a rapidly changing climate. In the past, events such as lambing were timed precisely to optimal conditions, but as seasons become less predictable, “the sheep are struggling to stay synchronized,” says Parker, who lives in Haines Junction, Canada. In photos from May 2021 to January 2024, Parker documented the sheep throughout the year, including during winter, when the animals’ dense fur keeps them warm in temperatures as frigid as 40 below zero degrees F.

3 notes

·

View notes

Text

Title: "Gen Z Hustle: How Side Gigs and Digital Innovation are Shaping Kenya's Youth Culture"

Introduction In the bustling streets of Nairobi, young Kenyans are busy making their mark in innovative ways that go beyond traditional careers. The rise of digital technology and Kenya’s rapidly evolving economic landscape have cultivated a unique “side-hustle culture” among Generation Z, who are actively reshaping work, community, and creativity. From influencing on social media to e-commerce and even venturing into cryptocurrency, these young hustlers are defining a new Kenyan dream that is all about resilience, creativity, and financial independence.

Side-Hustles in the Age of Social Media One of the most prominent changes in Kenya’s youth culture is the significant shift from relying solely on formal employment to embracing digital side hustles. On Instagram, Twitter, and TikTok, young Kenyans are building personal brands as influencers, marketers, and content creators. This trend is largely driven by the power of social media platforms, where personalities like Azziad Nasenya and Flaqo have transformed social media virality into flourishing careers.

Platforms like TikTok and Instagram allow young Kenyans to reach broad audiences with content that resonates—comedy skits, motivational videos, makeup tutorials, and dance challenges. With brands now recognizing the influence of digital personalities, many Kenyan influencers are finding opportunities to collaborate with companies for product endorsements and advertisements. These partnerships bring a sense of visibility and empowerment that has been less accessible in traditional industries.

For 24-year-old David Mwangi, a content creator and social media strategist, the allure of influencing lies in its accessibility and potential for growth. “You don’t need a big budget to get started; you just need creativity,” he explains. David’s experience reflects the sentiment of many Gen Z Kenyans who see social media not just as a pastime but as a pathway to sustainable income.

The E-commerce Boom and the Rise of Small Online Shops In addition to influencing, e-commerce has become a major outlet for Kenyan youth looking to earn extra income. Platforms like Jumia, Kilimall, and Facebook Marketplace provide easy avenues for young entrepreneurs to start online businesses, selling anything from thrifted clothes and beauty products to locally made crafts and accessories. Kenya’s mobile payment system, M-Pesa, has also simplified transactions, allowing e-commerce to thrive even without widespread use of credit cards.

With rising unemployment rates and limited job opportunities, many young Kenyans are using digital tools to build businesses from scratch. Some youth groups have formed collectives to sell items in bulk, often buying directly from manufacturers or importing from abroad to resell at a profit. This trend, known locally as biashara za mtaa (local businesses), has created a bustling informal economy that operates largely online.

For 23-year-old Aisha Ahmed, the journey started with a Ksh 5,000 loan from her older brother. Now, she runs an online shop that specializes in selling affordable, stylish handbags through Instagram. “People think starting a business requires a lot of capital, but what really matters is finding something people need and building a brand around it,” she says.

Crypto, Forex, and the Financial Revolution Another intriguing aspect of Kenya’s Gen Z hustle culture is the growing interest in cryptocurrency and Forex trading. Although controversial, the allure of quick profits and financial independence has drawn many young people into these new financial frontiers. Kenya’s tech-savvy youth have quickly adapted to apps like Binance and Paxful, learning the intricacies of cryptocurrency trading and often mentoring each other online.

Crypto’s appeal among Gen Zers lies in its promise of empowerment and financial freedom—an opportunity to circumvent traditional banking systems. However, the lack of regulation and high risks involved have left many young Kenyans facing steep learning curves and financial losses. Despite the volatility, online communities and forums dedicated to Forex and crypto trading continue to grow, attracting young people with a “high risk, high reward” mentality.

Karanja, a 22-year-old business student, views crypto as a game-changer: “It’s the future of money,” he asserts. He has spent months learning about blockchain technology and considers it a long-term investment. Karanja’s experience highlights the optimism surrounding digital currency in Kenya, despite the risks and controversies.

Challenges Facing the Digital Hustlers While side-hustle culture has opened new opportunities, it comes with significant challenges. The competitive nature of digital influencing and e-commerce can be cutthroat, with many young people finding it hard to stand out. Mental health issues, such as stress and burnout, are becoming common among young hustlers as they juggle multiple gigs alongside their education or formal jobs.

For those in crypto and Forex, the risks are even higher. Cases of scams and Ponzi schemes have left many young investors in debt, leading some to lose faith in the industry altogether. The lack of regulation around cryptocurrency also means that youth are vulnerable to fraudsters, who often take advantage of their desire for quick financial gains.

The New Face of the Kenyan Dream Despite the challenges, side-hustle culture has become a defining feature of Gen Z in Kenya. This trend signifies a shift in how young Kenyans view success, replacing the traditional path of formal employment with a vision that values independence, innovation, and adaptability. It’s a cultural revolution rooted in digital innovation, resilience, and the determination to succeed on their own terms.

For Kenyan youth, the hustle is more than just a means to an end—it’s a way to redefine their place in society. As Aisha puts it, “It’s not just about making money; it’s about taking control of your future.”

4 notes

·

View notes

Text

Armed gangs have tried to seize control of Haiti’s main international airport, exchanging gunfire with police and soldiers in the latest attack on key government sites.

An explosion of violence has taken place in the country, including a mass escape from the country’s prisons.

The Toussaint Louverture International Airport was closed when the attack occurred, with no planes operating and no passengers on site.

It is the biggest attack on the airport in Haiti’s history.

Last week, the airport was struck briefly by bullets amid ongoing gang attacks, but gangs did not enter the airport nor seize control of it.

The attack occurred just hours after authorities in Haiti ordered a night-time curfew following violence in which armed gang members overran the two biggest prisons and freed thousands of inmates over the weekend.

A 72-hour state of emergency began on Sunday night. The government said it would try to track down the escaped inmates, including from a penitentiary were the vast majority were in pre-trial detention, with some accused of killings, kidnappings and other crimes.

“The police were ordered to use all legal means at their disposal to enforce the curfew and apprehend all offenders,” said a statement from finance minister Patrick Boivert, the acting prime minister.

Gangs already were estimated to control up to 80% of the capital Port-au-Prince. They are increasingly co-ordinating their actions and choosing once unthinkable targets such as the Central Bank.

Prime Minister Ariel Henry travelled abroad last week to try to salvage support for a United Nations-backed security force to help stabilise Haiti in its conflict with the increasingly powerful crime groups.

Haiti’s National Police has roughly 9,000 officers to provide security for more than 11 million people, according to the UN. They are routinely overwhelmed and outgunned.

The deadly weekend marked a new low in Haiti’s downwards spiral of violence. At least nine people had been killed since Thursday - four of them police officers - as gangs stepped up co-ordinated attacks on state institutions in Port-au-Prince, including the national football stadium.

But the attack on the National Penitentiary late Saturday shocked Haitians who are accustomed to living under the constant threat of violence.

Almost all of the estimated 4,000 inmates escaped. Three bodies with gunshot wounds lay at the prison entrance on Sunday.

Among the few dozen people who chose to stay in prison are 18 former Colombian soldiers accused of working as mercenaries in the July 2021 assassination of Haitian president Jovenel Moise.

“Please, please help us,” one of the men, Francisco Uribe, said in a message widely shared on social media. “They are massacring people indiscriminately inside the cells.”

Colombia’s foreign ministry has called on Haiti to provide “special protection” for the men.

A second Port-au-Prince prison containing around 1,400 inmates was also overrun.

Gunfire was reported in several neighbourhoods in the capital. Internet service for many residents was down as Haiti’s top mobile network said a cable connection was slashed during the rampage.

After gangs opened fire at Haiti’s international airport last week, the US embassy said it was halting all official travel to the country. On Sunday night, it urged all American citizens to depart as soon as possible.

The Biden administration, which has refused to commit troops to any multinational force for Haiti while offering money and logistical support, said it was monitoring the rapidly deteriorating security situation with grave concern.

The surge in attacks follows violent protests that turned deadlier in recent days as the prime minister went to Kenya seeking to move ahead on the proposed UN-backed security mission to be led by that East African country.

Jimmy Cherizier, a former elite police officer known as Barbecue who now runs a gang federation, has claimed responsibility for the surge in attacks. He said the goal is to capture Haiti’s police chief and government ministers and prevent Mr Henry’s return.

The prime minister, a neurosurgeon, has shrugged off calls for him to resign and did not comment when asked if he felt it was safe to come home.

Why is there violence in Haiti?

Some of Haiti’s most powerful gang leaders say their goal is bringing down Henry.

The country has failed to hold parliamentary and general elections in recent years and there are no elected officials. Henry was sworn in as prime minister with the backing of the international community after the July 2021 assassination of President Jovenel Moïse. The latest round of attacks began in February after Henry pledged to hold long-awaited general elections by mid-2025.

A map of Port-au-Prince in Haiti

Henry’s whereabouts were not public Monday. When asked in Kenya if it was safe for him to return to Haiti, Henry shrugged.

Who is responsible for the violence?

Jimmy Chirizier, a former elite police officer known as “Barbecue” who is considered one of Haiti’s most powerful gang leaders, announced as gunmen began to attack infrastructure that he would try and capture the country’s police chief and government ministers.

Four police officers were killed when their stations came under siege.

Cherizier said last summer that he would fight any international armed force if they committed abuses, and he urged Haitians to mobilize against the government.

Other gang leaders also appear to be involved in recent attacks.

Johnson Andrï best known as “Izo” and leader of the 5 Seconds gang, appears in a video posted on TikTok wielding a heavy mallet in his right hand as he pretends to punch his face with his left hand.

Izo’s gang is considered an ally of G-Pep, archenemy of Barbecue’s gang federation, but alliances have been shifting in recent days.

A report released last month by the Global Initiative Against Transnational Organized Crime found that “for the gangs, the development of alliances is a fluid phenomenon.”

It also noted how “only the most powerful gangs — such as Izo’s or Chïrizier’s — are usually able to operate or profiteer outside their fiefdoms.”

Barbecue is leader of a gang federation known as G9 Family and Allies, and he has previously launched powerful attacks that have crippled the country. In late 2022, he seized control of an area surrounding a key fuel terminal in the capital of Port-au-Prince for almost two months.

Why have the gangs become so powerful?

An estimated 200 gangs exist in Haiti, with 23 main ones believed to be operating in the metropolitan area of Port-au-Prince.

Up until recent years, they controlled some 60% of the capital, a number that has since grown to 80%, according to U.N. officials.

Smuggled firearms and ransom payments to kidnappers have allowed gangs to become more financially independent. That has increased their power as the state has weakened, and an underfunded and under-resourced police department has been unable to contain them.

“Present-day gangs enjoy a much higher degree of military capacity than those a decade ago,” according to the Global Initiative report. “This has largely been driven by the gangs’ ability to acquire high-caliber weapons.”

A 2023 U.N. report stated that recovered weapons destined for Haitian ports include “.50 caliber sniper rifles, .308 rifles, and even belt-fed machine guns.”

The Independent is the world’s most free-thinking news brand, providing global news, commentary and analysis for the independently-minded. We have grown a huge, global readership of independently minded individuals, who value our trusted voice and commitment to positive change. Our mission, making change happen, has never been as important as it is today.

9 notes

·

View notes

Text

Kenya/IMF: Align Economic Reform with Rights

(Nairobi) – The Kenyan government and International Monetary Fund should work together to ensure that the IMF program and its implementation align with human rights, Human Rights Watch said today. The focus should be on progressive revenue generation and accountability over public funds.

Following the recent nationwide protests, President William Ruto declined to sign Finance Bill 2024, which included regressive tax measures that risked undermining rights. Any alternative measures should relieve economic pressures by addressing the root causes of protesters’ anger.

“The widespread outrage sparked by proposed taxes on goods like sanitary pads and cooking oil in a country where corporate tax evasion is endemic should be a wake-up call to the Kenyan government and the IMF that they cannot sacrifice rights in the name of economic recovery,” said Sarah Saadoun, senior researcher on poverty and inequality at Human Rights Watch. “Economic sustainability can only be achieved with a new social contract that raises revenues fairly, manages them responsibly, and funds services and programs that allow everyone to realize their rights.”

Finance Bill 2024, in the context of an IMF program with Kenya, was expected to raise US$2.7 billion in additional revenues in the upcoming fiscal year, in part to meet IMF targets. The bill included several new tax provisions, such as removing exemptions from certain food items and a mobile money transfer tax, that would increase the cost of essential goods and services and fall heaviest on Kenyans with lower and middle incomes, as well as already marginalized groups such as women.

The IMF program was approved in 2021 to support Kenya’s response to the Covid-19 pandemic and global inflation, as well as devastating cycles of droughts and floods made worse by climate change. An increase in interest rates has also forced the government to spend upward of half its tax revenues to service debt.

The Kenyan government has other options to raise revenue progressively and enhance trust in the government, Human Rights Watch said. Kenya’s tax-to-GDP ratio is around 15 percent, which is the minimum threshold according to the World Bank for a viable state and economic stability.

3 notes

·

View notes

Text

Happy Fossil Day!

National Fossil Day is an annual celebration held to highlight the scientific and educational value of paleontology and the importance of preserving fossils for future generations. - National Park Services

As we are a server who bases our lore very heavily on fossils, from the prehistoric environment down to our characters, the saber-toothed cats, we thought we’d hop in and celebrate this day with some fun facts about fossil animals you could possibly encounter here in the Baobab!

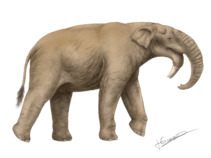

Deinotherium

The heavy-weight representative of TuskClan’s megafauna is colloquially known as simply “The Elephant”, though you may be quick to spot that these are no modern-day African Elephants. Instead, the proboscideans that you’d encounter out on the savanna are based on the famous extinct genus of DeinotheriumI, a close relative of modern elephants. They are known for their distinct tusk-shape, curving downwards instead of the modern elephants outward tusk!

An artistic reconstruction of the species D. bozasi

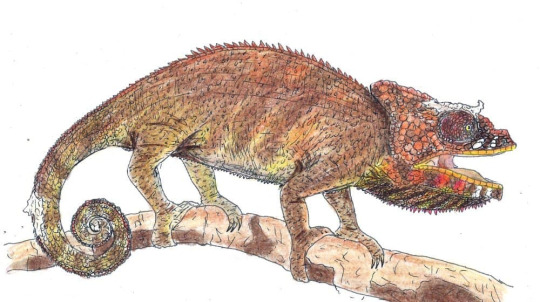

Caluma Benovskyi

Chameleons are some of the most recognizable reptiles on the planet, known for their prehensile tails and independently mobile eyes. Not much is known of the fossil chameleons of Africa, but there have been discoveries that show that there were indeed these funky little reptiles climbing around SunClan’s forests, changing colors to try and hide from even the most observant saber.

an artistic reconstruction of Caluma Benovskyi

Euthecodon

Out in the waters of BevyClan, especially in the crocodile lake, you’re likely to find yourself face-to-snout with one of the fiercest archosaurs left on the planet, the crocodile. The genus Euthecodon comprise of three species of long-snouted crocodiles, these beasts appear to have convergently evolved their signature snouts with modern-day gharials, and had originally been thought to have been an ancestor of the croc-cousins, though research has more heavily suggested that BevyClan is indeed home to true crocodiles.

photo taken at a zoo in the Netherlands, of the Euthecodon’s closest living relative, Mecistops

Alongside these fun fossil creatures, sabers in the baobab clans have found some unique collectibles today, be it strange bugs in tree-sap in SunClan's fallen trees, ridged shells in the cub islands of BevyClan, or odd reptilian teeth in TuskClan's sand dunes! Maybe doing a bit of research could help our sabers understand what the world was like before they were in it, and what the Baobab region looked like many moons ago....

Sources and fun extra reads!

Black, Riley. “An Extinct “Anchor-Tusked” Proboscidean.” Science, 24 July 2009, www.nationalgeographic.com/science/article/an-extinct-anchor-tusked-proboscidean.

“Calumma Benovskyi, a New Fossil Chameleon from Kenya.” Www.chameleons.info, www.chameleons.info/l/calumma-benovskyi-a-new-fossil-chameleon-from-kenya/. Accessed 11 Oct. 2023.

Čerňanský, Andrej, et al. “The Only Complete Articulated Early Miocene Chameleon Skull (Rusinga Island, Kenya) Suggests an African Origin for Madagascar’s Endemic Chameleons.” Scientific Reports, vol. 10, no. 1, 10 Jan. 2020, p. 109, www.nature.com/articles/s41598-019-57014-5, https://doi.org/10.1038/s41598-019-57014-5.

commondescentpc. “Episode 66 – Elephants.” The Common Descent Podcast, 28 July 2019, commondescentpodcast.com/2019/07/27/episode-66-elephants/. Accessed 11 Oct. 2023.

“Euthecodon.” Wikipedia, 17 Mar. 2023, en.wikipedia.org/wiki/Euthecodon. Accessed 11 Oct. 2023.

Hitchcock, Edward. Elementary Geology: By Edward Hitchcock. Google Books, M. H. Newman & Company, 1847, books.google.com/books?id=dZiyAAAAIAAJ&pg=PA154&dq=dinotherium+++bank+++anchor&ei=-bFpSu_sCJKOyASrnpWgBA#v=onepage&q&f=false. Accessed 11 Oct. 2023.

“National Fossil Day (U.S. National Park Service).” Www.nps.gov, www.nps.gov/subjects/fossilday/index.htm. Accessed 11 Oct. 2023.

#discord warrior cat rp#discord warrior cat roleplay#discord wcrp#discord rp#warrior cats#sabertooth tiger#clansbeforetime#wcrp#clans before time#sabertooth cat#chameleon#crocodile#elephant#fossil#national fossil day#national fossil day 2023#fossil teeth#fossil shells#fossil in amber

6 notes

·

View notes

Text

Manage your finances from anywhere with Kenya's online banking options!

Experience convenient banking from home in Kenya with SBM Bank. Easily open an online business bank account tailored to suit your needs. Use our personal loan calculator Kenya to plan your finances effectively. SBM Bank offers seamless online services to ensure you manage your finances effortlessly from the comfort of your home. Enjoy secure and efficient banking solutions designed for both individuals and businesses.

#Business Internet Banking#Mobile Banking In Kenya#Business Bank Account Kenya#Open A Business Bank Account

0 notes

Text

Sbm Bank Kenya: Mobile Banking that Puts You in Control

Experience the pinnacle of control with SBM Bank Kenya's mobile banking. Seamlessly manage your finances on-the-go with a user-friendly interface designed for your convenience. From effortless transactions to real-time monitoring, take charge of your banking needs at your fingertips. SBM Bank Kenya empowers you to navigate your financial journey securely and efficiently, ensuring your convenience is always a priority.

#business banking online#business internet banking#business mobile banking#banking for business#mobile banking in kenya#banking apps in kenya

0 notes

Text

Unlocking Forex Trading Opportunities for African Investors

Africa’s growing interest in global financial markets has positioned Forex trading as a promising avenue for wealth creation. With increasing internet penetration, mobile accessibility, and economic shifts, African investors have unparalleled opportunities to trade currencies. However, success in this highly competitive market demands strategic planning, professional guidance, and knowledge of offshore brokers. This guide explores essential strategies, the benefits of asset management, and tips for selecting reliable brokers tailored for African traders.

1. Why Forex Trading Appeals to African Investors The Forex market’s accessibility and profit potential attract traders across Africa. Key reasons include:

Low Entry Barriers: Many brokers offer accounts with minimal initial deposits, allowing entry for individuals with varying budgets.

High Liquidity: Forex trading provides ample market liquidity, ensuring traders can enter and exit positions easily.

24/5 Market Availability: Investors can trade at any time, accommodating different time zones and schedules.

Local Growth Drivers

Mobile Trading Platforms: High mobile adoption in countries like Nigeria, South Africa, and Kenya makes Forex trading more accessible.

Regulatory Advancements: Improved regulation across regions fosters safer trading environments.

2. Leveraging Forex Trading and Investment Management Consultancies A Forex trading and investment management consultancy offers invaluable expertise, especially for African investors navigating international markets. Here’s how:

Tailored Trading Strategies: Professional consultancies analyse global markets and develop strategies customised to your financial goals.

Comprehensive Market Analysis: Gain insights into technical and fundamental market drivers.

Risk Mitigation Plans: Structured frameworks help balance risks and returns, reducing exposure to volatile market conditions.

Portfolio Diversification: Asset management services enhance portfolio performance by allocating funds across multiple currency pairs and other instruments.

3. The Importance of Asset Management Effective asset management is crucial for long-term success. It encompasses:

Risk Management: Using stop-loss orders, position sizing, and diversification to protect capital.

Analysis-Driven Decisions: Applying both technical and macroeconomic analysis to stay ahead of market trends.

Setting Realistic Goals: Balancing ambition with achievable profit targets and maintaining a disciplined trading approach.

Partnering with a Forex trading and investment management consultancy streamlines these processes by integrating market expertise with personalised strategies.

4. Choosing Offshore Forex Brokers for African Traders While some African countries have local Forex brokers, many traders turn to offshore options for better trading conditions. Offshore brokers often provide:

Higher Leverage: Allowing greater market exposure with a smaller investment.

More Trading Instruments: Access to diverse markets, including cryptocurrencies and commodities.

Advanced Trading Platforms: State-of-the-art tools for analysis and automated trading.

What to Look for in Offshore Brokers

Regulation: Reputable offshore brokers are licensed by bodies like the Financial Conduct Authority (FCA) or Australian Securities and Investments Commission (ASIC).

Security of Funds: Look for brokers with segregated accounts to protect your deposits.

Transparent Policies: Ensure clear information on spreads, commissions, and withdrawal processes.

Support for African Traders: Brokers offering customer service and payment options tailored to Africa, such as mobile money or local bank transfers.

5. Actionable Tips for African Forex Traders

Start with Education: Leverage free resources, webinars, and training programmes available online.

Practice on a Demo Account: Understand market movements without risking real money.

Develop a Trading Plan: Set clear rules for entry, exit, and risk tolerance.

Stay Disciplined: Avoid emotional trading and stick to your strategy.

Monitor Regulatory Changes: Keep track of local and international regulatory developments.

6. The Future of Forex Trading in Africa The Forex market in Africa is evolving rapidly, driven by technological innovation and increased financial literacy. Mobile apps, artificial intelligence, and algorithmic trading systems are reshaping how African traders participate in global markets. By working with experienced consultancies like PipInfuse, traders can stay ahead of these trends and maximise their potential.

Forex trading offers vast potential for African investors willing to learn, strategise, and invest wisely. Success comes from leveraging professional support, embracing asset management, and choosing reliable brokers. With continuous education, discipline, and innovation, African traders can unlock financial growth and prosperity in the global Forex market.

Ready to take your trading to the next level? At PipInfuse, we empower you with expert strategies, market insights, and educational resources to make informed decisions. Join our community and unlock your potential in Forex trading. Start your journey today with PipInfuse!

#forex trading#learn forex trading#Forex trading consultancy#Investment management consultancy#forex education#forex expert advisor#forex market#pipinfuse#forex signals#forex trading in Africa

0 notes

Text

TENDER FOR PROCUREMENT OF SOFTWARE LICENSES AND SUPPORT FOR MOBILE APPLICATIONS PROTECTION SOLUTION FOR CBK

CENTRAL BANK OF KENYA TENDER JANUARY 2025 INVITATION TO TENDER The Central Bank of Kenya invites sealed tenders for – procurement of software licenses and support for mobile applications protection solution (GuardSquare) for Central Bank of Kenya for a period of Three (3) years – Tender Ref. Number CBK/070/2024-2025. 2. A complete set of tender documents containing detailed information can be…

0 notes

Text

Explosive Growth in Mobile Money Market: Projected to Surge from USD 17 Billion to USD 119 Billion by 2034

The global mobile money market had a value of US$ 106.8 billion in 2022 and was projected to grow by an impressive 22.6% CAGR to US$ 816.6 billion by 2032. The global mobile money industry is anticipated to expand on an unstoppable note in the projected period with confidence around the security of the payment apps.

To facilitate international transfers to cash facilities and phone credit, the banks and financial sectors launched MTN mobile money. Paying with a digital or web-based approach helps wallet mobile money providers maintain service security and build relationships with a wide range of active and interested users. Mobile wallets are another way that NFC-capable phones are being utilised to boost sales.

At the same time, the fact that there are concerns regarding data security can’t be ignored. This factor could restrain the mobile money market going forward. Future Market Insights has entailed these facts with future perspectives in its latest market study entitled ‘Mobile Money Market’. It has its indigenous team of analysts and consultants to execute using an eagle’s eye view in its primary, secondary, and tertiary modes of research.

To Get Sample Copy of Report Visit

“With convenience quotient (CQ) at its peak, the global mobile money market is expected to go great guns in the forecast period”, says an analyst from Future Market Insights.

Key Takeaways from Mobile Money Market

North America holds the largest market share with new channels coming up in the US on the continuous basis.

Europe holds the second-largest market share with the UK and Germany leading from the front. The scenario is expected to remain unchanged in the forecast period.

The Asia-Pacific is expected to grow at the fastest rate in the mobile money market going forward. The pandemic did change certain things forever; with usage of plastic money being at the forefront. Platforms like PayTM, PhonePay, GooglePay started getting adopted with immediate effect, particularly by the millennials. The older generations also started getting accustomed to this way of transaction gradually. The region is home to two densely populated countries – India and China. With majority of population herein opting for cashless transaction, the mobile money market is bound to grow by leaps and bounds in the forecast period.

Competitive Analysis

Google LLC, in 2019, did team up with Citigroup for implementing Google Pay (mobile wallet money). This platform has gained prominence especially during and after the pandemic (wherein touchless transaction was looked for).

PayPal, in November 2019, entered into partnership with Paykii for launching Xoom (PayPal’s Jamaica-based international money transfer service). The consumers based out of Canada, the UK, the US, and also 37 markets all across Europe, since then, are able to use Xoom’s easy and fast money transfer service for securely paying insurance, loan, water, mobile network, cable, internet, telephone, and electricity bills in Jamaica.

Airtel Africa, in October 2019, entered into collaboration with Mastercard for offering mobile money services all across 14 regions of Africa. Mastercard virtual card does facilitate Airtel Money that does away with a bank account with the objective of making payments at the global as well as local level.

Orange Romania’s Orange Money, in August 2019, tabled the ‘My Reserve’ lending platform. The customers are thus getting benefitted from transparent and simple lending tool, that too, without additional fees and commissions. The interest rate offered is 14% with fixed rates.

Kenya-based Safaricom, in May 2019, entered into partnership with Vodacom for acquiring IP rights of M-Pesa mobile financial services platform. As such, Fuliza (an M-Pesa overdraft facility) was put forth in Kenya that has 8.8 Million+ users.

What does the Report state?

The research study is based on mode of payment (NFC, mobile billing, SMS, USSD or STK, and others), types of purchase (airtime transfers & top-ups, money transfers & payment, merchandise & coupons, travel and ticketing, and likewise), industry vertical (BFSI sector, energy & utilities sector, retail sector, healthcare sector, hospitality & tourism sector, media & entertainment sector, SCM (supply chain management) & logistics sector, IT & telecommunication, and likewise).

With smart and secure GUI (graphical user interfaces) consolidating, various central and government banks are significantly encouraging citizens to accept mobile money.

Key Segments

By Mode of Payment:

NFC

Mobile Billing

SMS

USSD or STK

Others

By Types of Purchase:

Airtime Transfers & Top-ups

Money Transfers & Payment

Merchandise & Coupons

Travel and Ticketing

Others

By Industry Vertical:

Banking, Financial Services, and Insurance (BFSI) Sector

Energy & Utilities Sector

Retail Sector

Health Care Sector

Hospitality & Tourism Sector

Media & Entertainment Sector

Supply Chain Management (SCM) & Logistics Sector

Telecommunication & IT Sector

Others

By Region:

North America

Latin America

Europe

Asia Pacific

Middle East and Africa (MEA)

0 notes

Text

Empowering Communities with Comprehensive Health Insurance Solutions

The Africa health insurance market size is anticipated to reach USD 50.3 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 5.26% from 2023 to 2030. The advantages of healthcare insurance in private and public sectors and the increase in the number of day care procedures are some of the factors driving the growth. Furthermore, an increase in healthcare expenditure is also a major factor propelling this growth.

Improving accessibility through expanded distribution and digital innovation is a major factor driving the regional market growth.In Africa, the transition to digital channels is already underway, and with it, new demands for service quality. Many insurers are currently beginning to digitize customer journeys.This trend has been accelerated by the COVID-19 epidemic, which has increased demand for digital and remote channels. It is anticipated that this trend will continue after the crisis. In several African nations, there will probably be a net rise in online and mobile banking of between 20 and 40 percent post-crisis.

Furthermore, key companies in the Africa health insurance industry undertake various strategic initiatives such as introducing new policies, partnerships, mergers, and acquisitions to expand and adoption of their insurance policies in the region. For instance, in June 2022, Santam acquired a South African insurance startup, JaSure.JaSure provides customers with digital insurance, which allows them to decide what they want to insure and when. This initiative was expected to strengthen the company’s position in the market.

Moreover, in July 2023, Sanlam entered into a partnership with Aetna Internationalto offer Africa’s most comprehensive health insurance plan. This new insurance plan will provide a wide range of advantages, a sizable direct billing medical network, adaptable payment alternatives, and improved member experiences with local in-country assistance.

Collaboration with governing agencies and regulatory organizations to help shape and boost the market’s growth. Many African nations are already taking advantage of new legislation, which has shown to be an expanded role of broader insurance penetration.The opportunity for insurers to work with regulators on issues like social security, solvency, and compliance requirements, as well as the tax advantages of life savings and pension products, is substantial.

On the other hand, because of the need for specialist risk-management capabilities and significant investment in security and information collecting, which has left the business fragmented and dependent on foreign investment, market penetration for life insurance has been gradual. The major market share of the continent's health insurance industry is made up of five nations: South Africa, Namibia, Kenya, Morocco, and Egypt.

Africa Health Insurance Market Report Highlights

Based on distribution channels, the brokers and individual agents dominated the market and accounted for the largest revenue share of over 67.54% in 2022. Brokers and agents serve as the client's long-term representatives for the duration of the policy about any changes

Direct sales distribution channel is expected to hold a significant revenue share in the coming years owing to the high advantages of direct-to-consumer sales for insurance carriers

Based on duration, the life-time coverage dominated in terms of revenue share in 2022 owing to the wide benefits offered by these insurance plans. The advantages include building tax-advantaged cash value, the same insurance premium for a lifetime

By region, South Africa dominated the market in 2022. This is attributed to robust government support and the growing number of key players

Segments Covered in the Report

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Africa health insurance market report based on duration, distribution channel, and region:

Africa Health Insurance Duration Outlook (Revenue, Billion, 2018 - 2030)

Life-time Coverage

Term Insurance

Africa Health Insurance Distribution Channels Outlook (Revenue, Billion, 2018 - 2030)

Direct Sales

Brokers and Individual Agents

Bankers

Others

Africa Health Insurance Regional Outlook (Revenue, USD Billion, 2018 - 2030)

Francophone Africa

Anglophone West Africa

Southern Africa

North Africa

East Africa

Angola

South Africa

Order a free sample PDF of the Africa Health Insurance Market Intelligence Study, published by Grand View Research.

0 notes