#forex trading in Africa

Explore tagged Tumblr posts

Text

Unlocking Forex Trading Opportunities for African Investors

Africa’s growing interest in global financial markets has positioned Forex trading as a promising avenue for wealth creation. With increasing internet penetration, mobile accessibility, and economic shifts, African investors have unparalleled opportunities to trade currencies. However, success in this highly competitive market demands strategic planning, professional guidance, and knowledge of offshore brokers. This guide explores essential strategies, the benefits of asset management, and tips for selecting reliable brokers tailored for African traders.

1. Why Forex Trading Appeals to African Investors The Forex market’s accessibility and profit potential attract traders across Africa. Key reasons include:

Low Entry Barriers: Many brokers offer accounts with minimal initial deposits, allowing entry for individuals with varying budgets.

High Liquidity: Forex trading provides ample market liquidity, ensuring traders can enter and exit positions easily.

24/5 Market Availability: Investors can trade at any time, accommodating different time zones and schedules.

Local Growth Drivers

Mobile Trading Platforms: High mobile adoption in countries like Nigeria, South Africa, and Kenya makes Forex trading more accessible.

Regulatory Advancements: Improved regulation across regions fosters safer trading environments.

2. Leveraging Forex Trading and Investment Management Consultancies A Forex trading and investment management consultancy offers invaluable expertise, especially for African investors navigating international markets. Here’s how:

Tailored Trading Strategies: Professional consultancies analyse global markets and develop strategies customised to your financial goals.

Comprehensive Market Analysis: Gain insights into technical and fundamental market drivers.

Risk Mitigation Plans: Structured frameworks help balance risks and returns, reducing exposure to volatile market conditions.

Portfolio Diversification: Asset management services enhance portfolio performance by allocating funds across multiple currency pairs and other instruments.

3. The Importance of Asset Management Effective asset management is crucial for long-term success. It encompasses:

Risk Management: Using stop-loss orders, position sizing, and diversification to protect capital.

Analysis-Driven Decisions: Applying both technical and macroeconomic analysis to stay ahead of market trends.

Setting Realistic Goals: Balancing ambition with achievable profit targets and maintaining a disciplined trading approach.

Partnering with a Forex trading and investment management consultancy streamlines these processes by integrating market expertise with personalised strategies.

4. Choosing Offshore Forex Brokers for African Traders While some African countries have local Forex brokers, many traders turn to offshore options for better trading conditions. Offshore brokers often provide:

Higher Leverage: Allowing greater market exposure with a smaller investment.

More Trading Instruments: Access to diverse markets, including cryptocurrencies and commodities.

Advanced Trading Platforms: State-of-the-art tools for analysis and automated trading.

What to Look for in Offshore Brokers

Regulation: Reputable offshore brokers are licensed by bodies like the Financial Conduct Authority (FCA) or Australian Securities and Investments Commission (ASIC).

Security of Funds: Look for brokers with segregated accounts to protect your deposits.

Transparent Policies: Ensure clear information on spreads, commissions, and withdrawal processes.

Support for African Traders: Brokers offering customer service and payment options tailored to Africa, such as mobile money or local bank transfers.

5. Actionable Tips for African Forex Traders

Start with Education: Leverage free resources, webinars, and training programmes available online.

Practice on a Demo Account: Understand market movements without risking real money.

Develop a Trading Plan: Set clear rules for entry, exit, and risk tolerance.

Stay Disciplined: Avoid emotional trading and stick to your strategy.

Monitor Regulatory Changes: Keep track of local and international regulatory developments.

6. The Future of Forex Trading in Africa The Forex market in Africa is evolving rapidly, driven by technological innovation and increased financial literacy. Mobile apps, artificial intelligence, and algorithmic trading systems are reshaping how African traders participate in global markets. By working with experienced consultancies like PipInfuse, traders can stay ahead of these trends and maximise their potential.

Forex trading offers vast potential for African investors willing to learn, strategise, and invest wisely. Success comes from leveraging professional support, embracing asset management, and choosing reliable brokers. With continuous education, discipline, and innovation, African traders can unlock financial growth and prosperity in the global Forex market.

Ready to take your trading to the next level? At PipInfuse, we empower you with expert strategies, market insights, and educational resources to make informed decisions. Join our community and unlock your potential in Forex trading. Start your journey today with PipInfuse!

#forex trading#learn forex trading#Forex trading consultancy#Investment management consultancy#forex education#forex expert advisor#forex market#pipinfuse#forex signals#forex trading in Africa

0 notes

Text

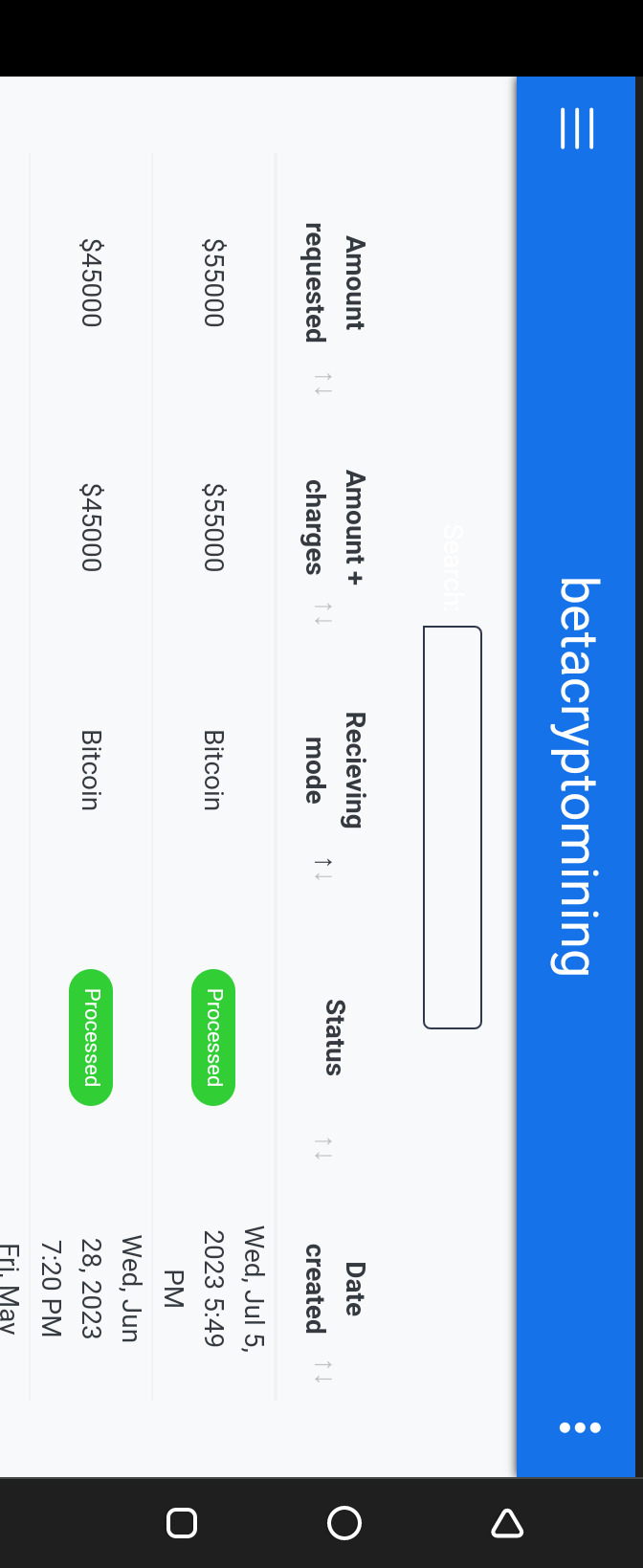

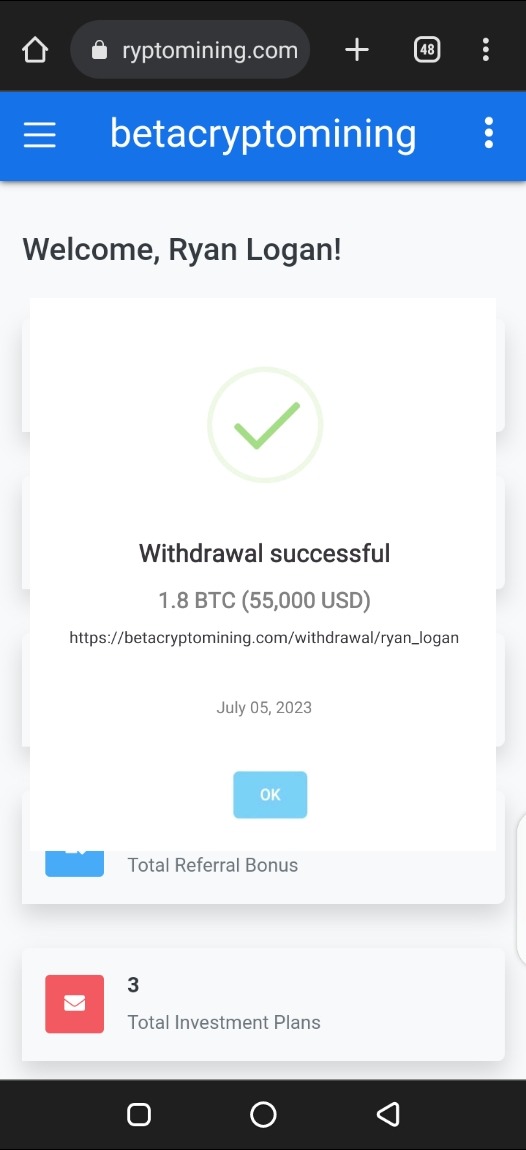

With This Platform You Can Make $5000 Weekly

Crypto trading platform you should not joke with, profit very high with their professional trading bot. 👇👇

#crypto trading#cryptocurrency news#btc latest news#workfromhome#work in progress#forexmarket#forex#forextips#trader#binance trading bot#binance clone script#binance clone software#binance smart chain#binance news#cryptocurrency news latest#coinbase#bitcoin latest news#south africa rugby#south africa luxury tours#zimbabwe#south america#westerncape#southernafrica#indonesia#indonesia vs argentina#malaysia tourist visa#malaysia business visa#malaysia vandi#malaysia boleh#philippines bl

13 notes

·

View notes

Text

News from Africa, 8 June

Seventeen nations in West Africa and the Sahel have signed the "Lomé Declaration on Fertilizers and Soil Health" to combat the escalating food crisis exacerbated by the impacts of climate change.

2. Forex markets took a dim view of South Africa's decision to grant diplomatic immunity to all attendees of the BRICS summit, including Vladimir Putin,

The decision has increased tensions with the US and EU, potentially leading to billions of rands in lost trade.

The South African Reserve Bank has warned that the government's stance toward Russia increases the risk of sanctions being imposed on the country, which may hold dire consequences for the entire financial system.

3. Attendees at a meeting of FAO and MFMRN representatives in Swakopmund heard that Namibia's 1922 plan of action for small-scale fisheries lacks sufficient funding.

#fertilizer#food crisis#climate change#Sahel#forex#Rand#trade#diplomatic immunity#Russia#South Africa#funding#fisheries#Namibia#Africa

6 notes

·

View notes

Text

A broker that I have found to be the best and have the greatest experience with would have to be exness as they provide stable spreads. 0 commission on withdrawals. Instant withdrawals. 0 swaps on overnight positions. Instant execution. Crypto trading 24/7 and you can receive up to 40 % rebates on all your trades if you sign up using my link or referral code. tm0inm0i

#crypto cryptocurrency bitcoin ethereum blockchain btc cryptotrading cryptonews eth cryptocurrencies nft bitcoinnews bitcoins#onlinemarket#how to trade forex#cryptocurrency#tradingtips#stocks#regulation#money#trade#bear market#forex#us market#stock market#south korea#south africa#south america

6 notes

·

View notes

Text

MetaTrader 4 South Africa: Unlocking Trading Potential with Solis Markets

MetaTrader 4 South Africa is a game-changer for traders seeking advanced trading solutions. This powerful platform provides South African traders with exceptional tools for market analysis and trade execution. MetaTrader 4 South Africa offers real-time data, comprehensive charting options, and the ability to implement automated trading strategies, making it a top choice for those aiming to excel in the forex market.

Solis Markets stands out as a leading online trading platform, enhancing the MetaTrader 4 South Africa experience. With its expert support, Solis Markets caters to both novice and experienced traders, ensuring a seamless trading journey. Their commitment to providing secure and reliable trading environments means you can focus on optimizing your trading strategies using MetaTrader 4 South Africa’s advanced features.

Whether you're a beginner exploring the world of forex or an experienced trader looking to refine your strategies, MetaTrader 4 South Africa through Solis Markets offers the tools and support necessary for trading success. Experience the best of both worlds with MetaTrader 4 South Africa and Solis Markets—your gateway to mastering the forex market.

0 notes

Text

Important Stock Market Terms You Must Learn

For those who are just starting started with Trading on the Stock Market, it can feel like a nightmare. After all, you're going to invest time and energy in a market that you're not too acquainted with. There are many obstacles to overcome in addition to the rising coemption in this industry. You should be conversant with a few key stock market words because of this, possibly.

Knowing what these terms truly mean will help you as a beginner make better use of them. Consequently, without further ado, here are some crucial stock market words you should be aware of:

Dividend & Broker

A dividend can be a portion of a business's revenues that is paid out to stockholders. Dividends can provide a constant flow of income for stockholders.

On the other hand, brokers are individuals or organizations specialize in the selling and buying of stocks, mainly on behalf of their clients. The specializations of a stock market broker may vary depending on your requirements.

Margin & Index

Margin is a type of loan that allows investors to buy more stock than they would be able to with their own money. While it can increase potential returns, it can also lead to significant losses.

An index is a collection of stocks that are used to track the overall performance of a specific market or sector. The Dow Jones Industrial Average and the S&P 500 are two prominent examples of indexes.

Volatility & stocks

Volatility refers to the degree of variation in stock prices over a particular period. High volatility can result in significant gains or losses, while low volatility can lead to more stable returns.

Conversely, stocks are units of possession in a corporation. When you buy a share, you become a part-owner of the corporation and are titled to a fraction of its profits. Stocks are traded on the stock market, and their prices vary based on resource and order.

Market Capitalization & Bear Market

Before you start in the trading line, make sure you know that market capitalization refers to a business' overall outstanding shares' worth. It is possible to identify it by multiplying the number of outstanding shares with the current stock value.

Did you know what bear market is? Well, it’s a period when stock prices are falling, usually due to a weak economy and negative investor sentiment.

Bull Market & Exchange

A bull market is a period when stock prices are on the rise, usually due to positive investor sentiment and a strong economy. Conversely, exchanges are specialized portals where you can purchase and sell stocks. Some well-known stock exchanges include the New York Stock Exchange (NYSE) and NASDAQ.

The Bottom Line:

In a nutshell, both beginning and experienced traders must grasp the important keywords involved before Trading on the Stock Market. You can make informed choices and possibly enjoy significant rewards by keeping yourself informed and abreast of the most recent news and trends. However, it's crucial to keep in mind that trading on the stock market can be risky, so it's crucial to conduct adequate research and seek the counsel of experts when necessary.

1 note

·

View note

Text

FP Markets Review ☑️ Top Forex Brokers Review (2025)

Welcome to our in-depth FP Markets Review, where we explore everything you need to know about this well-established forex and CFD broker. Whether you're a seasoned trader or just starting your trading journey, this review will provide valuable insights into FP Markets' services, features, and its position in the competitive forex market of 2025. As part of our analysis, we’ll also touch on the broader forex market landscape and how FP Markets compares to its competitors. This review is brought to you by Top Forex Brokers Review, your trusted source for unbiased and detailed broker evaluations.

FP Markets Overview

Company Background

FP Markets, founded in 2005, is an Australian-based broker with a strong reputation for reliability and transparency. Over the years, it has grown into a global brand, offering a wide range of trading instruments and services. Headquartered in Sydney, FP Markets has achieved several milestones, including expanding its regulatory footprint and introducing advanced trading platforms to cater to a diverse clientele.

Regulation and Security

FP Markets is regulated by multiple top-tier authorities, including:

Australian Securities and Investments Commission (ASIC)

Cyprus Securities and Exchange Commission (CySEC)

Capital Markets Authority of Kenya (CMA)

Financial Sector Conduct Authority in South Africa (FSCA).

This robust regulatory framework ensures that FP Markets adheres to strict financial standards, providing a secure trading environment. Additionally, the broker segregates client funds from its operational capital, further enhancing safety and trustworthiness.

Services and Features

Trading Platforms

FP Markets offers a variety of trading platforms to suit different trading styles and preferences:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5): These industry-standard platforms are known for their advanced charting tools, automated trading capabilities, and user-friendly interfaces. They are available on desktop, web, and mobile devices.

cTrader: This platform is ideal for traders who value the depth of market visibility and advanced order capabilities. It also supports algorithmic trading through cAlgo.

IRESS Platform: Designed for trading equities, indices, and futures CFDs, IRESS offers a high level of customization and transparency in market pricing.

TradingView Integration: FP Markets integrates with TradingView, a popular platform for technical analysis and social networking among traders.

Account Types

FP Markets provides several account types to cater to different trading needs:

Standard Account: Aimed at beginners, this account requires a minimum deposit of AUD 100 and offers spreads starting at 1.0 pips with no commissions.

Raw Account: Designed for experienced traders, it also requires an AUD 100 minimum deposit but offers spreads from 0.0 pips with a commission of $3.50 per lot per trade.

IRESS Accounts: These include Standard, Platinum, and Premier accounts, each with varying minimum deposits and brokerage fees. They are tailored for active traders and offer Direct Market Access (DMA).

Islamic Accounts: Swap-free accounts adhering to Sharia law are available for both MetaTrader and IRESS platforms.

Range of Tradable Instruments

FP Markets boasts an impressive range of over 10,000 tradable instruments, including:

Forex: Over 70 currency pairs, covering both major and exotic pairs.

Shares: Access to more than 13,000 global shares.

Indices, Commodities, and Cryptocurrencies: A wide selection of indices, commodities like gold and oil, and cryptocurrency CFDs 9.

Leverage and Spreads

FP Markets offers competitive leverage options, with forex leverage up to 500:1. The Raw ECN account provides spreads starting from 0.0 pips, making it an attractive choice for cost-conscious traders

Additional Services

FP Markets goes beyond trading by offering:

Educational Resources: Webinars, trading guides, and video tutorials to help traders improve their skills.

Market Analysis: Daily market updates and insights to keep traders informed.

Customer Support: 24/7 multilingual support via live chat, email, and phone.

User Reviews and Feedback Customer Satisfaction

FP Markets generally receives positive feedback from users, particularly for its:

Competitive Pricing: Low spreads and transparent fee structures are frequently praised.

Platform Variety: The availability of multiple platforms like MetaTrader, cTrader, and IRESS is well-received.

Customer Support: The broker's 24/7 multilingual support is highly rated.

Common Criticisms

Some users have noted areas for improvement, such as:

Limited features in the proprietary mobile app compared to industry leaders.

Higher spreads on the Standard account, which may not be ideal for traders seeking commission-free options.

Forex Market Landscape in 2025

Geopolitical and Economic Factors

The forex market in 2025 is shaped by several key trends:

Geopolitical Tensions: Ongoing conflicts and rising tensions between major powers like the US and China are driving market volatility.

US Political Climate: The return of Donald Trump to the White House is expected to influence the US dollar through policies like tariffs and increased spending.

Central Bank Policies: Interest rate adjustments by central banks like the Federal Reserve and the European Central Bank are pivotal in shaping currency values.

Technological and Regulatory Developments

AI in Forex Trading: The integration of AI tools is democratizing market analysis, enabling traders to make more informed decisions.

Regulatory Changes: Enhanced oversight in forex trading is improving transparency but may increase operational costs.

Implications for FP Markets

FP Markets is well-positioned to thrive in this dynamic landscape by leveraging its advanced trading platforms and robust regulatory compliance. Its focus on emerging markets and technological innovation further strengthens its competitive edge

Competitive Analysis

Top Competitors

FP Markets faces competition from brokers like IC Markets, Pepperstone, and XM. While these brokers also offer competitive pricing and advanced platforms, FP Markets stands out for its extensive range of tradable instruments and strong regulatory framework

Strengths and Weaknesses

Strengths: Regulatory compliance, competitive pricing, and platform variety.

Weaknesses: Limited mobile app features and higher spreads on Standard accounts

Conclusion

FP Markets is a reliable and well-regulated broker that offers a comprehensive range of services and features. Its competitive pricing, extensive platform offerings, and robust regulatory framework make it a strong choice for traders in 2025. While there are areas for improvement, such as mobile app features and Standard account spreads, the overall user feedback is positive. For traders seeking a secure and versatile trading environment, FP Markets is undoubtedly worth considering.

2 notes

·

View notes

Text

The Current State of Forex, Cryptocurrency, and Gold Trading: An Overview

by Ulan Terrene

In the fast-paced world of trading, navigating through the complex dynamics of Forex, cryptocurrency, and gold requires a deep understanding of the markets. This article aims to provide a comprehensive view of these trading realms.

Quick plug: In the vast labyrinth of trading, I’ve found my guiding light — Decode. As a connoisseur of Forex, cryptocurrency, and gold, this platform is my master key, unlocking the treasures of the financial markets. Its sophistication whispers to my experienced mind, while its simplicity beckons beginners into the dance. With Decode, I tread confidently on the shifting sands of trading. Join me, won’t you?

The Landscape of Forex Trading

The Forex market, the largest and most liquid financial market globally, witnesses the United Kingdom leading the charge, accounting for 38% of global foreign exchange turnover. The United States and Singapore follow suit, with contributions of 19% and 9% respectively.

Out of the 10 million forex traders worldwide, the largest segment, 3.2 million, are from Asia, with Europe and North America contributing 1.5 million each. Africa and the Middle East boast 1.3 million and 1 million traders, respectively, while South America and Central America together make up nearly a million. The smallest contingent, with 190,000 traders, resides in Oceania.

The demographics of Forex traders reveal that men make up 89% of the traders, while women, though fewer in number (11%), outperform men by 1.8%, exhibiting a preference for long-term strategies over short-term risk. Interestingly, a considerable segment of Forex traders are younger than expected, with 55% of them falling under the age of 44.

Regulatory Measures and Trading Platforms

Regulation and oversight are fundamental to Forex trading, ensuring that traders engage with fully licensed brokers. Top-tier financial regulators worldwide advocate for a strong legal framework, stringent licensing requirements, robust investor protection measures, and regular audits and inspections.

The growth of Forex trading platforms since 1996 has democratized access to foreign exchange markets. MetaTrader 4 (MT4), launched in 2005, remains the most popular platform, even after the introduction of MetaTrader 5 in 2010.

Forex Trading in Australia

Australia leads the world in CFD/FX trading on a per-capita basis, with over 100,000 Australians executing one or more FX or CFD transactions in 2021. The average deposit by Australian traders into their FX/CFD account was $8,400 during January-October 2021.

The Emergence of Cryptocurrencies

The release of Bitcoin in 2009 marked a significant milestone in the trading world, heralding the advent of decentralized currencies. Since then, the crypto market has grown to include over 6,600 other cryptocurrencies. Despite market fluctuations, these highly volatile and potentially profitable cryptos, usually traded against major fiat currencies, continue to attract speculators.

The Impact of the COVID-19 Pandemic

The COVID-19 pandemic heightened global interest in Forex trading, which peaked in May 2020. Volume was 34% higher than the same month in 2020, with significant increases observed in the UK (up 137%) and Australia (up 67%). As the pandemic receded, the popularity of Forex trading saw a slight decline.

Final Thoughts

While it’s challenging to provide exact figures on the average profit or loss made by individual Forex traders, or the number of people who quit Forex trading, it’s important to note that trading Forex can be highly risky. Market volatility, coupled with a lack of preparation or understanding of the markets, often leads to significant losses. Hence, traders should be well-versed in risk management and never trade more than they can afford to lose.

Given the diverse landscape of Forex trading, it’s crucial for anyone interestedin this field to thoroughly understand the markets’ dynamics. Whether it’s the demographic distribution of traders, the regulatory oversight, the popular trading platforms, or the unique trends in different regions like Australia, every facet of the trading world contributes to the overall picture.

The emergence and growth of cryptocurrencies have added another layer of complexity and opportunity to the trading world. These digital assets, while highly volatile, offer potential profits for savvy traders willing to navigate their intricacies. However, as with all forms of trading, a clear understanding of the risks involved and an effective risk management strategy are key to success.

The impact of global events on the trading world is another important consideration. The COVID-19 pandemic, for instance, significantly boosted interest in Forex trading. Traders must stay informed about such developments to adapt their strategies accordingly.

In conclusion, the world of trading Forex, cryptocurrencies, and gold is constantly evolving, driven by factors ranging from demographic trends and regulatory changes to technological advancements and global events. As traders, we must strive to stay ahead of the curve, continually learning and adapting to navigate these exciting markets effectively.

2 notes

·

View notes

Text

Best Reasons to Trade with Top Forex Brokers in South Africa

The forex trading landscape in South Africa has gained remarkable traction over the years, establishing itself as one of the leading markets in the global forex industry. The country's strong regulatory framework, competitive trading conditions, and access to top-tier brokers make it an attractive destination for traders looking for reliability and security. If you are searching for the best forex brokers in South Africa, this guide will provide you with an in-depth look into what sets them apart and highlight some of the top brokers that can help you achieve trading success.

Why Choose Forex Brokers in South Africa?

1. Regulatory Strength and Security

The Financial Sector Conduct Authority (FSCA) is the chief regulatory body supervising forex trading in South Africa, ensuring compliance and market integrity. The FSCA ensures that Forex Brokers Review adhere to strict financial and ethical standards, offering traders a secure environment free from fraudulent activities. When choosing a broker in South Africa, regulatory compliance should be a top priority to safeguard your investments.

2. Competitive Trading Conditions

The best forex brokers in South Africa offer tight spreads, high leverage, and rapid trade execution speeds. These elements allow traders to maximize their profit potential while keeping costs low. Some of the leading brokers, such as FP Markets, Blackbull, Eightcap, Octa, FX Pro, IC Markets, and FBS, provide cost-effective trading solutions with transparent fee structures.

3. Access to a Wide Range of Trading Instruments

A diverse portfolio is crucial in forex trading, and South African brokers offer a variety of asset classes, including major and minor forex pairs, commodities, indices, cryptocurrencies, and CFDs. This variety allows traders to diversify their investments and reduce risk while taking advantage of different market opportunities.

youtube

4. Advanced Trading Platforms and Analytical Tools

To succeed in forex trading, traders require sophisticated trading platforms with comprehensive analytical tools. The most reputable South African brokers provide access to MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, platforms known for their user-friendly interfaces, advanced charting features, automated trading capabilities, and customizable trading options.

5. High Leverage and Cost-Efficient Trading

Leverage is a vital factor in forex trading, enabling traders to control larger positions with a smaller capital investment. Many South African brokers offer leverage as high as 1:500, allowing traders to amplify their potential profits. Additionally, these brokers provide low spreads and commission-free trading, making it more cost-effective to execute trades.

6. Reliable Customer Support and Local Payment Options

Customer support plays a significant role in forex trading, and the best forex brokers in South Africa offer 24/5 or 24/7 multilingual support via live chat, email, and phone. Moreover, South African traders benefit from localized payment methods, such as bank transfers, credit/debit cards, and e-wallets, ensuring quick and secure transactions.

7. A Flourishing and Stable Financial Market

South Africa has one of the most developed financial sectors in Africa, making it an ideal environment for forex trading. The combination of a stable economy, well-regulated brokers, and a growing community of traders makes it an attractive destination for both beginner and experienced forex traders.

Top Forex Brokers in South Africa

Below is a list of the best forex brokers in South Africa, known for their top-notch services and competitive trading conditions:

1. FP Markets

FP Markets is a globally recognized forex broker offering low spreads, fast execution, and a wide range of tradable assets. With strong regulation and ECN-style trading, it is an excellent choice for professional traders.

2. Blackbull Markets

Blackbull Markets is known for its deep liquidity, low-latency execution, and institutional-grade trading conditions. It is a preferred broker for traders who require superior execution speeds and premium services.

3. Eightcap

Eightcap provides a cost-efficient trading environment, multiple asset offerings, and advanced trading tools. It is suitable for both beginners and seasoned traders who want access to cutting-edge technology.

4. Octa

Octa is a trusted forex broker offering zero-commission trading, user-friendly platforms, and competitive spreads. It is an excellent choice for traders seeking affordability and efficiency.

5. FX Pro

FX Pro is a well-established broker that provides multi-asset trading, various account types, and innovative trading tools. It is ideal for traders looking for versatility and strong market access.

6. IC Markets

IC Markets is a leading ECN broker offering ultra-low spreads, deep liquidity, and high-speed trade execution. It is highly recommended for scalpers and high-frequency traders.

7. FBS

FBS is a popular forex broker offering high leverage, commission-free accounts, and extensive educational resources. It is an excellent choice for both beginner and advanced traders.

Conclusion

South Africa continues to solidify its position as a top forex trading destination due to its strong regulatory oversight, competitive trading conditions, and access to world-class trading platforms. If you are searching for the best forex brokers in South Africa, consider reputable brokers such as FP Markets, Blackbull, Eightcap, Octa, FX Pro, IC Markets, and FBS. These brokers offer secure, efficient, and cost-effective trading solutions, ensuring a seamless trading experience for all traders. Whether you are new to forex trading or an experienced investor, South African brokers provide the ideal environment to help you succeed in the forex market.

0 notes

Text

Gulf Brokers DMCC’s Scandal Exposed

Gulf Brokers DMCC is the name of a broker located in Dubai, United Arab Emirates. The company has obtained a license from the Securities and Commodities Authority and is also a corporate member of the DGCX (Dubai Gold and Commodities Exchange).

Please find their contact number at +971 42 42 4120, and their office address at Gulf Brokers DMCC, Office no. 905, the Palladium Tower, Cluster C, JLT Dubai, UAE. This broker’s website is very easy to navigate. There are no standout bargains.

Furthermore, there appears to be a lack of incentives for users to create an account on their platform, which raises suspicions. Additionally, the company consistently emphasizes its licensing from the SCA and its role as a broker for the Dubai Gold and Commodities Exchange.

Gulf Brokers DMCC Lacks Valuable Information

You can find a comprehensive list of the advantages Gulf Brokers DMCC offers to its clients on its website. However, the benefits they provide are the minimum you can expect from a forex broker located in the UAE. The company emphasizes its commitment to providing fast trade execution and 24/7 customer service. Isn’t that a common offering among all forex brokers?

They claim to offer additional benefits such as safeguarding your money and ensuring regulatory oversight by the SCA. I have completed my task. The business does not offer any attractive trading terms or promotions to entice customers. The trading conditions website of Gulf Brokers DMCC also highlights the same four benefits.

The company states in its legal documents that it has the authority to bill you for the various services it provides. However, the specific amount of this fee remains uncertain. Furthermore, Gulf Brokers DMCC fails to provide clear details regarding the services it would charge for.

The only positive aspect of Gulf Brokers DMCC is the fact that it has a SCA license. Unfortunately, that is not enough to establish the broker’s credibility.

Can Gulf Brokers DMCC be trusted?

The owners of this business seem to have questionable intentions, evident from the lackluster and uninformative nature of their website, as well as their tendency to withhold important information from customers.

This broker seems to be exploiting the potential of the mostly untapped market in the Middle East. The business fails to highlight any unique qualities that distinguish it from its competitors. Maybe because it doesn’t have any. In addition, it fails to provide any information regarding its pricing and remains silent on the specifics of its trading terms.

It is advisable to minimize your involvement with Gulf Brokers DMCC. There are plenty of other brokers available in the UAE, so you don’t have to stick with the worst one.

Unveiling Gulf Brokers DMCC

The OffshoreLeaks investigation uncovers the activities of organized crime networks, such as Gulf Brokers DMCC, responsible for multiple fraudulent schemes targeting investors in countries such as India, Cambodia, Indonesia, and others. These networks are based in the UAE.

It took nearly a year for OffshoreLeaks to expose the fraudulent activities of Gulf Brokers DMCC. The extensive research involved collecting all relevant information about Gulf Brokers DMCC, its affiliated companies, and the individuals involved through thorough examination of numerous documents and conversations with multiple reliable sources.

Since 2018, this network of organized criminals has been involved in various trading fraud schemes that have had a significant impact on multiple nations, resulting in substantial financial losses and loss of life.

Unfortunately, in many cases, individuals are left with no choice but to accept the financial loss they have experienced. Gulf Brokers DMCC focuses on attracting investors from South-East Asia, Africa, and countries where brokers are not commonly registered. Gulf Brokers DMCC is a company registered in Seychelles with limited liability. Considering a trip to Seychelles? Me neither.

This suggests that your money is not assured, regulated, or protected by the government. You are transferring funds to an offshore account and relying on their investment expertise. They don’t, and we have the evidence to prove it.

OffshoreLeaks has recently uncovered the identities of the individuals leading this group and possesses extensive records of their criminal history, along with detailed personal information about their close connections. This information includes specifics such as their preferred vehicles, frequented restaurants, and romantic partners. We are disclosing all of this information, except for the images and names of the individuals.

This is because it is against the law unless OffshoreLeaks.com decides to release this information to the public.

Gulf Brokers DMCC Domain Analysis

Investigate whether Gulf Brokers DMCC is regulated and whether they are providing trading advice or investment opportunities, as this may potentially violate legal regulations.

These types of websites, commonly referred to as “HYIPs” (high-yield investment programs), have gained notoriety for deceiving consumers with grandiose claims and ultimately leaving them empty-handed.

Gulf Brokers DMCC seems to focus on attracting customers primarily in Europe and the USA by reaching out through phone calls and social media platforms such as TikTok and Instagram. Many phishing call centers are located in South India. The information will be disclosed in a report by OffshoreLeaks.com.

One of the associates involved in Gulf Brokers DMCC’s fraudulent operation is Copreus Pvt Ltd from Sri Lanka. -Victoria Partners -ZPH Marketing

How does the scam work?

Aside from assessing the brokerage in advance using the information available on its website, having knowledge of how scams work is crucial in the trading industry. Here are the three standard steps:

You will be directed to a website where you need to provide your personal information, including your address, email address, and phone number, after clicking on an advertisement that claims to offer immediate financial gain. Once you’ve shared your personal information, brokers will give you a call and try to convince you to invest with them, promising great returns. After carefully considering their pitches, you decide to deposit an amount between $200 and $250. The scammers quickly pocket a substantial commission from this initial deposit.

Once they have finished with you, experienced con artists will begin to exert pressure on you to provide additional funds. They claim that it is the sole method to enhance your trading profits. It would be wise to reconsider your current situation and minimize any further losses by withdrawing your remaining funds.

Regrettably, individuals who engage in fraudulent activities do not consider such concepts. They will now attempt to persuade you to stay and not leave immediately. The reason behind this is quite evident: traders have a limited timeframe to request a chargeback from their bank and get a refund. The primary objective of the “recovery department” is to trick individuals into missing a crucial timeframe, ultimately destroying any possibility of reclaiming their funds.

Conclusion

Gulf Brokers DMCC attempts to present itself as trustworthy but fails to establish a sense of trustworthiness. They exaggerate their services and hide important selling terms. It would be preferable to find someone else since they don’t even provide details about their fees.

1 note

·

View note

Text

Top Trading Strategies by Alfridah Kgabo Matse for Maximizing Profits

Alfridah Kgabo Matse is a well-known trader in South Africa, recognized for her expertise in financial markets and her ability to develop winning trading strategies. With years of experience in forex, stock trading, and commodities, Alfridah Kgabo Matse has built a reputation for making calculated investment decisions that yield significant returns. In this blog, we will explore her top trading strategies that help maximize profits while minimizing risks.

1. Understanding Market Trends

One of the key principles that Alfridah Kgabo Matse follows is staying updated with market trends. The financial markets are highly volatile, and understanding the direction in which they are moving is crucial for making informed trading decisions.

How to Analyze Market Trends:

Use Technical Analysis: Study price movements using indicators like Moving Averages, RSI (Relative Strength Index), and Bollinger Bands.

Monitor Economic News: Global events, economic reports, and political changes impact market trends.

Follow Market Sentiment: Analyzing trader sentiment through volume changes and market indices can provide insights into future movements.

2. Risk Management Strategies

Even the most experienced traders face losses. However, Alfridah Kgabo Matse emphasizes effective risk management to protect capital and sustain long-term profitability.

Risk Management Techniques:

Setting Stop-Loss Orders: Automatically exits a trade when the price reaches a predefined level to limit losses.

Using Position Sizing: Allocating only a percentage of the trading account to each trade to avoid excessive exposure.

Diversification: Investing in multiple asset classes (forex, stocks, commodities) to spread risk.

Avoiding Overtrading: Sticking to a well-planned strategy rather than making impulsive trades.

3. Technical and Fundamental Analysis

A good trader combines both technical and fundamental analysis to make well-informed trading decisions. Alfridah Kgabo Matse integrates both methods to ensure she is trading based on real market conditions rather than speculation.

Technical Analysis Tools:

Candlestick Patterns: Helps predict price movements based on past behavior.

Moving Averages: Identifies trends and potential reversals.

MACD (Moving Average Convergence Divergence): Used to confirm buy or sell signals.

Fundamental Analysis Techniques:

Company Financials: Evaluating the financial health of companies before investing in stocks.

Economic Indicators: Interest rates, inflation, and employment data impact the forex market.

News Events: Global economic shifts and geopolitical tensions can affect market prices.

4. The Power of Discipline and Patience

One of the biggest reasons traders fail is due to emotional decision-making. Alfridah Kgabo Matse strongly advocates for discipline and patience in trading.

How to Develop Trading Discipline:

Follow a Trading Plan: Establish entry and exit points before making a trade.

Stick to a Strategy: Avoid jumping between strategies without proper testing.

Control Emotions: Fear and greed often lead to irrational decisions; stick to logic and analysis.

Learn from Mistakes: Every loss is an opportunity to refine and improve the trading approach.

5. Leveraging Technology in Trading

Technology plays a significant role in modern trading. Alfridah Kgabo Matse uses various tools and software to enhance efficiency and accuracy.

Useful Trading Technologies:

Automated Trading Systems: Uses AI and algorithms to execute trades based on pre-set conditions.

Trading Bots: Helps execute trades faster than manual trading.

Economic Calendars: Keeps track of important financial events and their impact on the market.

Trading Apps: Platforms like MetaTrader 4/5, TradingView, and ThinkorSwim provide real-time data and charting tools.

6. Developing a Strong Trading Psychology

Apart from technical skills, Alfridah Kgabo Matse highlights the importance of mental strength and psychology in trading.

Psychological Traits for Successful Trading:

Patience: Waiting for the right trade setup instead of rushing into trades.

Confidence: Trusting your analysis and not getting influenced by market noise.

Adaptability: Adjusting strategies based on market conditions.

Resilience: Handling losses professionally and staying motivated.

7. Building a Long-Term Investment Mindset

While day trading and short-term trading can be profitable, Alfridah Kgabo Matse also stresses the importance of long-term investments.

Benefits of Long-Term Investing:

Compounding Growth: Reinvesting profits leads to exponential gains.

Lower Trading Costs: Reduced frequency of transactions minimizes fees.

Less Stress: Long-term positions eliminate the need for constant market monitoring.

Better Risk Management: Long-term investments generally experience lower volatility.

Conclusion

Alfridah Kgabo Matse is a name that stands out in the trading community, not just in South Africa but globally. Her trading strategies, focused on market analysis, risk management, and discipline, serve as a blueprint for aspiring traders. By implementing these proven techniques, traders can enhance their chances of maximizing profits while minimizing risks. Whether you are a beginner or an experienced trader, adopting Alfridah Kgabo Matse strategies can help you navigate the complexities of financial markets with confidence and success.

1 note

·

View note

Text

Unlocking the Potential of Forex Trading in Africa: Regulatory Landscape and Opportunities

#Forex trading in Africa#African Forex market#Forex brokers in Africa#Forex regulations in Africa#South Africa Forex market#Nigerian Forex market#Kenya Forex regulation#Somalia Forex trading#mobile Forex trading in Africa#African Forex traders#African Forex brokers#Forex education in Africa#untapped Forex markets in Africa

1 note

·

View note

Text

Immediate Edge Exchanging Outline: Key Parts in South Africa

Happening to including the Immediate Edge site for a surprisingly long time, we saw two or three key parts that make it stand isolates from other exchanging stages and crypto exchanging bots.

It would be great for we really to explore.

Immediate Edge Exchanging Thinking Immediate Edge ought to perform exchanges with amazing rate. In particular, it utilizes High-Rehash Exchanging (HFT) methodology obliged by cutting edge assessments.

The exchanging stage is prepared to do quickly executing many exchanges each second, ACpitalizing on exchange chances when there's a limit the cost of a mechanized ACsh on different trades - and in the crypto market, this happens a gigantic piece of the time.

Different Resource Exchanging Immediate Edge clients will a lot of love to understand that they ACn get to extraordinary business regions like stocks and Forex, as well as crypto, things, starting there, the sky is the limit.

Restored Security Shows Immediate Edge treats security in a serious way - and this is certainly one of the most stunning benefits of the appliACtion.

They set up a couple truly take a gander at systems to safeguard client information continually.

The wary construction merges solid firewalls to stop any unapproved access, SSL encryption to guarantee information is passed on safely, and Two-Segment Endorsing (2FA) to support the result of every single Immediate Edge record.

Different Part Systems Saw Immediate Edge has an easy to use banking structure set up for speed and comfort.

The stage keeps a collection of part choices to suit different client inclinations. Immediate Edge sees segments through Credit/Charge ACrds, Bank Moves, and Motorized Wallets like PayPal and Skrill, adding to the comfort for its clients.

Free Demo Record Accessible Immediate Edge gives a demo account join that awards clients to investigate the stage by driving exchanges with virtual ACsh with no ensured monetary dangers.

It's a dazzling choice in the event that you are don't know whether the appliACtion is great for you. Essentially look at its demo structure and gotten comfortable with how it feels - you ACn change to a genuine ACsh account at whatever point you are prepared.

the whole week Client affiliation Immediate Edge's client affiliation pack is accessible persevering, the whole week, through live talk. This predictable help assists with giving a normal and safe experience, understanding that they ACn get with supporting at whatever point required.

0 Secret Expenses The Immediate Edge compensation model turns its clients getting ACsh. The stage essentially takes a 2% cut from the benefits crossed its affiliations. There are no secret expenses or record support charges, basiAClly the 2% benefits commission and the $250 least store.

This suggests that a little piece of the advantage from signifiACnt exchanges is taken as a help charge, guaranteeing that the stage's remuneration is with introducing to client achievement.

https://www.immediateedges.net/

https://www.facebook.com/immediateedge.app.official/ https://www.instagram.com/immediateedgeappofficial/ https://twitter.com/ImmediateEdge2 https://www.pinterest.com.au/immediateedgeofficialapp/

1 note

·

View note

Text

News from Namibia and South Africa, 19 May

Commenting on US-South African relations in New York, SA Deputy Minister of Finance, David Masondo, has denied that South Africa favours Russia.

2. In remarks at the opening session of the Pan-African Parliament in Midrand, South Africa, this week, the African Union Chair, Azali Assoumani, urged representatives to work towards a more united Africa.

The Second Ordinary Session of the Sixth Pan-African Parliament got underway this week in Midrand, South Africa, under the theme, “Accelerating the implementation of African Continental Free Trade Area (AfCFTA) to galvanize stakeholders capable of promoting and broadening support for pro-poor implementation and overall climate action.

3. And, speaking at the Pan-African Parliament's Summit on Climate Policy and Equity, Kenyan President, William Ruto, said that African leaders are sometimes forced to attend international meetings in foreign powerful countries because of blackmail.

4. Accommodation for Chinese nationals is superior to the accommodation provided for Namibian nationals at a lithium mine near Uis, a Committee of the Namibian Parliament has found.

5. The Development Bank of Namibia (DBN) is in the process of developing and establishing a venture capital fund as part of the national SME Financing Strategy.

6. Oshakati town council in Namibia has tabled a provisional budget which will see tariff increases for some services as it seeks to balance the budget.

To ensure the full realization of the 2023/24 budget, [Mayor, Leonard Hango,] called on all town residents to pay and honour their municipal bills. He mentioned that revenue collection methods will be regularly modified and intensified to minimize and control bad debt defaults, as has been done since 2022.

#foreign relations#South Africa#US#Russia#Forex#arms trade#united Africa#free trade#peace and prosperity#climate change#PAP#President Ruto#blackmail#leaders#lithium#Kenya#mining#Chinese nationals#accommodation#venture capital#SMEs#development#budget#services#debt default#Oshakati#Namibia

0 notes

Text

BRICS Expansion: A Turning Point for Global Markets

As someone who’s been immersed in trading and global markets, the announcement of Indonesia joining the BRICS coalition immediately caught my attention. This is no small development — it’s a seismic shift in the geopolitical and economic landscape. BRICS, now including Brazil, Russia, India, China, South Africa, and Indonesia, is challenging the US-led global financial system. It’s moments like these that remind me why I chose to enhance my trading skills with ORION Wealth Academy.

At ORION, I’ve learned to look beyond the headlines and truly understand how macroeconomic trends ripple through the markets. The inclusion of Indonesia — Southeast Asia’s largest economy — brings unique trading opportunities and potential currency shifts that we, as traders, need to stay ahead of. What does this mean for the Japanese Yen? What about the USD, which has been the backbone of global trade for decades? These are the kinds of questions that ORION has taught me to approach with curiosity and strategy.

One thing ORION emphasizes is that shifts in global alliances, like BRICS expansion, aren’t just abstract political events — they’re actionable trading insights. For example, BRICS nations have been advocating for reduced reliance on the US dollar. This could lead to increased prominence for currencies like the Chinese Yuan or Indian Rupee. What does that mean for those of us trading forex? It could mean new opportunities, but also new risks. Thanks to the strategies I’ve learned at ORION, I feel better equipped to handle both.

And then there’s the commodity angle. ORION helped me understand the deep connection between currencies and commodities. With BRICS nations potentially moving toward trading oil and other key commodities in alternative currencies, the market dynamics for oil, gold, and even agricultural products could shift. This is the kind of forward-thinking perspective that ORION instills in its traders — seeing the connections, anticipating the moves, and being prepared to act.

One of the most important lessons I’ve taken from ORION is the value of staying informed. In a rapidly changing world, knowledge isn’t just power — it’s profit. The trading tools, insights, and community support I’ve gained from ORION have allowed me to navigate volatile markets with more confidence. Whether it’s adjusting strategies for forex pairs like USD/JPY or monitoring new trends in emerging market currencies, I feel more prepared than ever.

As BRICS flexes its economic muscles, the trading landscape is bound to change. But with the right knowledge and preparation, these changes aren’t something to fear — they’re opportunities waiting to be seized. Thanks to ORION Wealth Academy, I’m ready to adapt, evolve, and find success in whatever the markets throw at me next. 🌍📈

#forexmentor#forexmarket#crypto currency#forexmoney#currencyexchange#us currency#forex#forextrading#currency#forexsignals

0 notes

Text

Ahikirizye Daniel Buys Range Rover Velar on 24th Birthday

Today, 7th Jan. 2025 is the birthdate of Ahikirizye Daniel, one of East Africa’s most successful forex traders. To commemorate the occasion, Ahikirizye has made a special purchase—a luxury Range Rover Velar, a symbol of his remarkable journey and success in the world of trading. We caught up with him to talk about how he feels as a fully grown adult. 1. Can you tell us a bit about the journey of…

0 notes