#loan leads for dsa

Explore tagged Tumblr posts

Text

Leadgiver Finserv Private Limited is involved in generating Quality Loan Leads for HL, PL, BL and LAP and distributing the Quality Leads to DSAs connected with us, for growing the Loan Disbursement of DSA, which will finally grow their business by 10x. It is handled by DCF Financial Services. Contact us on: 7433969696

our website : leadgiverfinserv.in

2 notes

·

View notes

Text

Direct Selling Agents (DSAs) are essential players in the financial sector, bridging the gap between borrowers and lenders. They simplify the loan application process by offering a variety of loan products and expert guidance. If you're seeking the best loan DSA in India, here’s a list of the top 10 DSA in India that excel in service and reliability.

1. My Mudra Fincorp

My Mudra Fincorp is widely recognized as one of the best corporate DSAs in India. With a strong presence nationwide, they specialize in personal loans, business loans, and home loans. Their transparent processes and fast approvals make them a top choice for borrowers.

2. Paisabazaar

A popular platform for financial services, Paisabazaar is also a trusted DSA for loans. They connect borrowers with leading banks and NBFCs while offering a seamless application experience.

3. BankBazaar

BankBazaar is a well-known digital marketplace for financial products, making it a reliable name among the top DSA in India. Their efficient online platform allows users to compare and apply for loans effortlessly.

4. Andromeda Loans

Andromeda is one of the oldest and most established DSAs in the country. They work with various financial institutions to provide customers with the best loan options tailored to their needs.

5. CreditMantri

CreditMantri specializes in helping individuals with low credit scores secure loans. As a best loan DSA in India, they focus on improving credit profiles and finding suitable loan products for customers.

6. IndiaLends

IndiaLends is a tech-enabled loan platform that acts as a DSA for leading banks and NBFCs. They offer personal loans, credit cards, and other financial products through their efficient system.

7. Finbucket

Finbucket provides a wide array of loan products and is considered a top DSA in India. Their services are user-friendly, with a focus on delivering the best offers to their clients.

8. LoanTap

LoanTap is an innovative platform catering to modern borrowers' needs. Their easy processes and variety of loan options make them a preferred DSA for many customers.

9. Rubique

Rubique uses technology to simplify the loan application process. They provide customized loan solutions, making them a leading name in the best corporate DSA in India category.

10. iServe Financial

iServe Financial offers end-to-end assistance for loans, making them one of the best loan DSAs in India. Their experienced team ensures smooth loan approvals and excellent customer service.

Conclusion

Choosing the right DSA can make the loan process seamless and hassle-free. The best loan DSA in India not only provides multiple options but also ensures transparency and efficiency in the application process. Whether you're looking for personal, home, or business loans, these top 10 DSA in India are worth considering for their expertise and trusted services.

0 notes

Text

Home Loan DSA in Ahmedabad - Adiyogi Enterprise

The Leading Home Loan DSA in Ahmedabad

Adiyogi Enterprise has established itself as a trusted name in the financial landscape, particularly as a premier Home Loan DSA in Ahmedabad. With a commitment to helping individuals achieve their dream of homeownership, Adiyogi Enterprise simplifies the complex home loan process for its clients. In today’s world, where property prices continue to rise, home loans are indispensable for turning the dream of owning a house into reality.

Adiyogi Enterprise offers a range of services, from guiding clients through the home loan application process to providing comprehensive financial solutions. Their expertise ensures that customers receive personalized support tailored to their financial goals.

Understanding Home Loan DSA

A Direct Selling Agent (DSA) is responsible for introducing prospective customers to financial institutions. In the context of home loans, a DSA like Adiyogi Enterprise acts as a bridge between the borrower and the lender, streamlining the loan application process.

Role of a Home Loan DSA:

Facilitation: They help applicants navigate the paperwork and documentation required for home loan approval.

Guidance: Provide expert advice on choosing the right loan products based on individual needs.

Time Savings: A DSA reduces the time and effort involved in dealing with multiple banks and lenders.

Benefits for Borrowers:

Expert Knowledge: DSAs have extensive knowledge of the lending market and can find the best deals.

Personalized Solutions: Tailored advice ensures that borrowers secure loans with favorable terms.

Simplified Process: DSAs handle most of the application work, making the process stress-free for borrowers.

Top Home Loan DSA in Ahmedabad

Adiyogi Enterprise is a standout name when it comes to Home Loan DSA in Ahmedabad. Established with the mission of empowering individuals with financial solutions, the company has built a reputation for excellence.

Why Adiyogi Enterprise?

Experienced Team: The founders and team members bring years of expertise in financial services.

Customer-Centric Approach: They prioritize customer satisfaction and strive to provide seamless service.

Strong Network: Adiyogi Enterprise collaborates with leading banks and financial institutions to offer the best home loan options.

Comprehensive Financial Solutions

Adiyogi Enterprise goes beyond home loans by offering a variety of financial services that address diverse needs. These services include:

Loan Consultation: Expert advice on personal, business, and vehicle loans.

Investment Planning: Guidance on building a secure financial future through strategic investments.

Insurance Solutions: Protect your assets and secure your family’s future with tailored insurance plans.

By providing a one-stop solution for all financial needs, Adiyogi Enterprise ensures that clients can address multiple financial goals under one roof. This holistic approach complements their home loan offerings, making them a trusted partner in achieving financial stability.

The Home Loan Process with Adiyogi Enterprise

Adiyogi Enterprise simplifies the home loan process into a few easy steps. Here’s how you can Apply Home Loan in Ahmedabad with their guidance:

Initial Consultation: Discuss your requirements and get an overview of available loan options.

Eligibility Assessment: Their team evaluates your eligibility based on income, credit score, and other factors.

Document Collection: Submit necessary documents like income proof, identity proof, and property details.

Application Submission: The DSA submits your application to the appropriate lender.

Loan Approval: After thorough verification, the loan is approved, and the funds are disbursed.

Documentation Requirements:

Proof of identity (Aadhaar, PAN, Passport)

Proof of income (salary slips, bank statements, ITR)

Property-related documents

Tips for a Smooth Process:

Keep all documents organized and updated.

Be honest about your financial details to avoid delays.

Maintain a good credit score to secure better interest rates.

Advantages of Choosing Adiyogi Enterprise

Adiyogi Enterprise stands out for its dedication to offering clients the best possible service.

Customized Solutions: Tailor-made loan options to suit individual needs.

Expert Guidance: Experienced professionals provide clarity and insights.

Wide Network: Access to multiple lenders ensures competitive interest rates.

Hassle-Free Experience: From application to disbursement, they handle it all.

Compared to other providers in Ahmedabad, Adiyogi Enterprise excels in transparency, customer care, and efficient service.

Frequently Asked Questions (FAQs)

1. Who can apply for a home loan with Adiyogi Enterprise?

Anyone with a stable income, good credit history, and the required documentation can Apply Home Loan in Ahmedabad through Adiyogi Enterprise.

2. What are the interest rates for home loans?

Interest rates vary based on the lender and borrower’s profile. Adiyogi Enterprise helps clients secure the most competitive rates available.

3. How long does the loan approval process take?

The timeline depends on documentation and verification. With Adiyogi Enterprise, the process is expedited, usually taking 7-10 working days.

4. Can self-employed individuals apply for a home loan?

Yes, Adiyogi Enterprise caters to both salaried and self-employed individuals, offering customized solutions.

The Importance of Financial Literacy

Making informed financial decisions is key to achieving long-term stability. Adiyogi Enterprise emphasizes financial literacy by offering resources and tools for its clients.

Resources Provided:

Loan calculators to estimate EMIs

Guides on managing home loan repayments

Tips for improving credit scores

Educating borrowers ensures they make confident choices and avoid common pitfalls in the home loan process.

Conclusion

Adiyogi Enterprise is a trusted Home Loan DSA in Ahmedabad, known for its customer-centric approach and expertise in financial solutions. Whether you want to Apply Home Loan in Ahmedabad or explore other financial services, their experienced team is ready to guide you every step of the way.

Visit our website for more details or contact us directly at +91-9624-9999-44

#Home Loan DSA#Home Loan DSA in Ahmedabad#Best Home Loan DSA in Ahmedabad#Apply Home Loan in Ahmedabad#Home Loan Interest Rate

0 notes

Text

Entrepreneurship is thriving, and businesses are constantly in need of financial assistance to scale and grow. One of the most accessible ways to cater to this need while building a lucrative career is by becoming a Direct Selling Agent (DSA) for business loans. With platforms like My Mudra, the process has become more streamlined and convenient, allowing you to start your journey as a DSA loan agent registration online from the comfort of your home.

What Is a DSA Agent?

A DSA (Direct Selling Agent) is a person or entity that connects potential borrowers with financial institutions, helping them secure loans. In return, the DSA earns a commission for every successful loan disbursement. This commission-based model offers a flexible and rewarding career path, especially for individuals who are proactive and have a knack for networking.

Why Choose My Mudra?

My Mudra is a trusted platform that bridges the gap between financial institutions and aspiring DSAs. With its user-friendly interface and extensive network of lenders, it empowers individuals to start their DSA journey seamlessly. Here’s why My Mudra stands out:

Easy Onboarding ProcessBecoming a business loan DSA with My Mudra is straightforward. The platform guides you through the registration process, requiring minimal paperwork and documentation.

Wide Range of Loan ProductsMy Mudra offers access to various loan products, including business loans, personal loans, home loans, and more. This diversity allows you to cater to different customer needs.

Attractive Commission StructureAs a DSA with My Mudra, you can earn high commissions on every successful loan you facilitate. The transparent commission structure ensures that your efforts are well-rewarded.

Digital PlatformMy Mudra provides a fully digital platform, enabling you to track leads, applications, and payouts in real-time. This enhances efficiency and keeps you updated at every step.

Support and TrainingMy Mudra offers extensive training and resources to help you understand the nuances of loan products and customer management. This ensures that even newcomers can excel in the role.

Steps to Become a Business Loan DSA Agent Online with My Mudra

Here’s how you can start your journey:

Visit the My Mudra WebsiteGo to the My Mudra official website and navigate to the DSA Registration section.

Fill Out the Registration FormProvide your basic details, such as name, contact information, and location. Ensure all details are accurate to avoid delays in approval.

Submit Required DocumentsUpload the necessary documents, including your PAN card, Aadhar card, and bank details, to verify your identity and eligibility.

Complete the AgreementOnce your documents are verified, you’ll need to sign a DSA agreement detailing the terms and conditions of your role.

Start Generating LeadsAfter approval, you’ll receive access to the My Mudra platform, where you can start generating leads and connecting borrowers with lenders.

Benefits of Becoming a DSA Agent

Flexible Working HoursAs a DSA agent, you can work at your own pace and schedule, making it ideal for freelancers or those looking for additional income.

Low InvestmentStarting as a DSA requires minimal investment, and the returns are substantial if you’re dedicated.

Career GrowthOver time, successful DSAs can build a strong network and even expand into other financial services.

Empower EntrepreneursBy helping businesses secure loans, you play a vital role in supporting entrepreneurship and economic growth.

Conclusion

Becoming a business loan DSA agent with My Mudra is a golden opportunity for individuals who want to build a rewarding career in the financial sector. With its easy-to-use platform, excellent support, and lucrative incentives, My Mudra ensures that you have all the tools to succeed.

If you’re ready to embark on this exciting journey, visit the My Mudra website today and take the first step toward becoming a successful business loan DSA agent!

0 notes

Text

The financial sector is a robust and dynamic industry with numerous opportunities for individuals looking to earn a stable income. One such lucrative opportunity is becoming a Direct Selling Agent (DSA) for personal loans. A DSA acts as a referral agent for financial institutions, helping them source new clients for various loan products. Among the many platforms offering this opportunity, My Mudra stands out as a leading name in the market, providing an easy and efficient way for individuals to become DSAs. In this article, we’ll explore how you can become a Personal Loan DSA loan agent registration with My Mudra, the benefits of doing so, and the steps involved in the registration process.

What is a Personal Loan DSA?

A Direct Selling Agent (DSA) is an individual or entity that works on behalf of financial institutions like banks or non-banking financial companies (NBFCs) to promote and sell their loan products. DSAs are responsible for sourcing potential customers, guiding them through the loan application process, and ensuring that all required documents are submitted to the lender. In return for their services, DSAs earn a commission based on the loan amount disbursed through their referrals.

Personal loans are one of the most sought-after financial products, as they can be used for various purposes, including debt consolidation, home renovation, medical emergencies, and more. As a Personal Loan DSA, you will be helping individuals and businesses secure the funds they need while earning a significant income.

Why Choose My Mudra to Become a Personal Loan DSA?

My Mudra is a well-established financial services platform in India, offering a wide range of loan products, including personal loans, business loans, and more. The platform has built a strong reputation for its transparency, customer-centric approach, and quick loan disbursals. Here are some compelling reasons to choose My Mudra to become a Personal Loan DSA:

1. Easy and Quick Registration Process

My Mudra offers a seamless loan DSA registration online process for aspiring DSAs. You can complete the registration in just a few steps, and the platform provides all the necessary tools and resources to help you get started quickly. The user-friendly interface ensures that even individuals with limited technical knowledge can navigate the process with ease.

2. Wide Range of Loan Products

As a My Mudra DSA, you will have access to a diverse range of loan products, including personal loans, business loans, and more. This allows you to cater to a broad customer base with varying financial needs, increasing your chances of earning commissions.

3. Attractive Commission Structure

One of the key benefits of becoming a DSA with My Mudra is the attractive commission structure. DSAs earn a percentage of the loan amount disbursed through their referrals. The higher the loan amount, the higher the commission. My Mudra ensures that DSAs are fairly compensated for their efforts, making it a financially rewarding opportunity.

4. Comprehensive Training and Support

My Mudra provides comprehensive training and support to all its DSAs. Whether you are new to the financial sector or an experienced professional, you will receive the necessary guidance to excel in your role. The platform offers training modules, webinars, and one-on-one support to help you understand the loan products, the sales process, and how to effectively communicate with potential customers.

5. Marketing and Promotional Support

As a My Mudra DSA, you will have access to marketing and promotional materials that can help you attract more clients. The platform provides brochures, flyers, and digital marketing tools that you can use to promote the loan products and generate leads. This support can significantly enhance your chances of success as a DSA.

6. Flexible Working Hours

One of the biggest advantages of becoming a Personal Loan DSA is the flexibility it offers. You can work at your own pace and set your own hours, making it an ideal opportunity for individuals looking for a side income or those who prefer working independently. Whether you want to work part-time or full-time, My Mudra allows you to choose a schedule that suits your lifestyle.

7. No Need for Prior Experience

You don’t need any prior experience in the financial sector to become a My Mudra DSA. The platform welcomes individuals from all backgrounds, as long as they have a passion for sales and a desire to succeed. My Mudra’s training and support will equip you with the knowledge and skills needed to thrive in the role.

Steps to Become a Personal Loan DSA with My Mudra

Becoming a Personal Loan DSA with My Mudra is a straightforward process that can be completed online. Here are the steps involved:

1. Visit the My Mudra Website

Start by visiting the official My Mudra website. On the homepage, you will find a section dedicated to loan DSA partner registration. Click on the “Become a DSA” link to get started.

2. Fill Out the Registration Form

You will be required to fill out an online registration form with your personal details, including your name, contact information, and address. Make sure to provide accurate information, as this will be used for communication and verification purposes.

3. Submit the Required Documents

As part of the registration process, you will need to submit certain documents, such as your PAN card, Aadhar card, and bank account details. These documents are required for identity verification and commission disbursement. My Mudra takes data privacy seriously, so you can be assured that your information will be handled securely.

4. Complete the Training

Once your registration is complete, you will have access to My Mudra’s training resources. It is important to go through the training modules to understand the loan products, sales process, and compliance requirements. The training is designed to equip you with the knowledge and skills needed to succeed as a DSA.

5. Start Sourcing Clients

After completing the training, you can start sourcing clients for personal loans. Use the marketing and promotional materials provided by My Mudra to reach out to potential customers. You can leverage your personal and professional networks, as well as online platforms, to generate leads.

6. Guide Clients Through the Loan Process

As a DSA, your role is to guide clients through the loan application process. This includes helping them fill out the application form, collecting the required documents, and submitting the application to the lender. My Mudra’s platform makes it easy to track the status of applications and stay in touch with clients throughout the process.

7. Earn Commissions

Once a loan is approved and disbursed, you will earn a commission based on the loan amount. My Mudra’s transparent commission structure ensures that you are fairly compensated for your efforts. The commission will be credited to your bank account as per the payment cycle.

Tips for Success as a My Mudra DSA

While becoming a Personal Loan DSA with My Mudra is a great opportunity, success in this role requires dedication and strategic planning. Here are some tips to help you succeed:

1. Leverage Your Network

Your personal and professional network can be a valuable source of leads. Reach out to friends, family, colleagues, and acquaintances to let them know about the loan products you are offering. Word-of-mouth referrals can be a powerful tool in generating business.

2. Stay Informed

The financial sector is constantly evolving, with new products, regulations, and market trends emerging regularly. Stay informed about the latest developments in the industry by attending webinars, reading financial news, and participating in My Mudra’s training sessions. This knowledge will help you better serve your clients and stay ahead of the competition.

3. Focus on Customer Service

Providing excellent customer service is key to building long-term relationships with clients. Be responsive, attentive, and transparent in your dealings with customers. Address their concerns promptly and provide them with accurate information. A satisfied customer is more likely to refer others to you, helping you grow your business.

4. Utilize Digital Marketing

In today’s digital age, having an online presence is essential for success. Utilize digital marketing strategies such as social media marketing, email campaigns, and content marketing to promote your services. My Mudra provides digital marketing tools that you can use to reach a wider audience and generate more leads.

5. Set Goals and Track Progress

Setting clear goals and tracking your progress is crucial for success as a DSA. Determine how many clients you want to source each month, how much commission you aim to earn, and what strategies you will use to achieve these goals. Regularly review your progress and make adjustments as needed.

Conclusion

Becoming a Personal Loan DSA Agent online with My Mudra is an excellent opportunity for individuals looking to earn a steady income in the financial sector. With its easy registration process, comprehensive training, and attractive commission structure, My Mudra provides all the tools and resources you need to succeed in this role. By following the steps outlined in this article and implementing the tips for success, you can build a rewarding career as a DSA and help others achieve their financial goals. Whether you are looking for a full-time opportunity or a side income, My Mudra offers the flexibility and support to help you thrive.

#personal loan DSA#DSA loan agent registration#loan DSA registration online#loan DSA partner registration

0 notes

Text

Creating Personalized Loan Solution: Steps Perform thorough client assessments

Create Customized Loan Solution: Approach

Make a thorough assessment of the client Understand the client's financial position, goals, and concerns. Gather deep insight into income, credit history, current liabilities, and future financial plans.

Various Loan Products Get to know about other loan products offered, for example, personal, business, and home loans. A broad portfolio will have an appropriate solution for anyone.

Use technology wisely Use advanced financial technologies to understand the underlying issues and wants of the clients. Data analytics and CRM software would be some tools that help manage client interactions besides effective personalizing services.

Transparency: Builds Trust Detailed information regarding loan products should be itemized: interest rates, fees, terms of repayment, and any other relevant details for the borrower.

Tailor-Made Repayment Plans Offer flexible payment plans based on the financial capability of the client. Flexible plans provide more opportunities for the repayment of the loan.

Ongoing Support Follow-up support should be given after the disbursement of the loan. Offer financial advice, reminders on repayments, and help in case of any issues.

Benefits of Customization to DSAs and Clients

For DSAs:

Customer Loyalty: Personalization of service leads to a deep relation with the clients, hence the rate of repeat and retain business. Reputed Image: DSA agents offering customized solutions enhance their reputation and draw in a bigger clientele. Personal DSA Advantage: Personalized services make DSA unique, so it is not comparable with others, and this would elicit better business results.

For Customers

Better Financial Fit: It gives customers loan products closer to their financial needs hence more satisfaction. Better outcomes in finance: Customized solutions will enable the clients to manage their money better and help them reach their financial goals. Trust and Confidence: Clear and transparent communication has built confidence and trust for the clients in their own decisions regarding their finance.

Conclusion

DSAs in the competitive landscape for loan services should be looking at how to think out of the box for an extra competitive edge. Solutions in loans for people will help to attend to those requirements and engage with them in a sustainable manner. The ways to make DSAs more successful in their markets and hence offer increased levels of service are through: client understanding, product combination, technology utilization, providing transparency in information, personalized repayments, and extended support after the loan is repaid. Personalized Loan Solutions benefit customers and position DSAs as trusted advisors to the financial industry.

0 notes

Text

Personal Loan DSA | Bajaj Partners

Bajaj Partners is an intuitive platform designed for personal loan DSA (Direct Selling Agents) to streamline the loan application process. This user-friendly portal enables DSAs to manage leads, submit loan applications, and track their status effortlessly. By leveraging advanced technology, it ensures quick and efficient loan processing, enhancing productivity and customer satisfaction. Bajaj Finserv’s dedicated support and comprehensive training programs further empower DSAs, helping them to expand their business and provide better financial solutions to their clients.

0 notes

Text

Online Bank Loan DSA Registration For Car Loan | +91-9084945327, 8077409095

Online Bank Loan DSA Registration

No Joining Fees High Commission Monthly / Payout

Get a DSA partner registration to start your journey as a DSA loan partner. Discover your latent potential of turning leads into deals. Work with renowned banks to sell their products hassle-free. All you need is knowledge of the loan scheme and decent communication skills.

The DSA is a bridge between a loan provider and someone who needs it. In addition, the DSA loan partner is given various responsibilities, including getting potential leads, collecting loan applications and documents, verifying the application through a preliminary check. Thereafter, ensuring the authenticity of the documents. Not only this, you also have to upload the documents along with the application form to get a DSA code to allow the tracking of applications.

How to get DSA Partner Registration?

To become a DSA loan partner, you should be having the comprehensive understanding of various loan products along with interest rates, eligibility (age, educational qualification, credit record, experience, etc.) and repayment options.

Once you correspond to the eligibility criteria, you can register online by providing all your basic and necessary details to become DSA registration. Upload your identity documents or other documents to complete the process of DSA registration.

Attain the necessary training to understand the basics of how to become a loan partner and get certified by qualifying for the destined exam. Once done, you can simply get an agreement signed that talks about the intricate terms and conditions. And it's done.

After getting registered, you can start offering loans in the name of the bank. This will help you generate leads and build a network. Be reasonable with your marketing skills. Use your DSA code to track your deals.

For more information contact us at +91-9084945327, 8077409095

0 notes

Text

Corporate DSA Channels: Navigating the Future of Finance with Trust and Technology

The Trust Factor in Financial Interactions:

Local Trust Networks:

Corporate DSA Channels leverage local trust networks through their independent agents. DSAs, deeply embedded in their communities, establish personal relationships, fostering trust and credibility. This localized approach builds a foundation of reliability that extends from the agent to the corporate entity.

Transparent Communication:

Trust is nurtured through transparent communication. Corporate DSA Channel / DSA Channels prioritize clear and honest communication channels between DSAs and clients, ensuring that individuals have a comprehensive understanding of the financial products and services being offered.

Commitment to Client Satisfaction:

The commitment to client satisfaction is a cornerstone of trust-building. Corporate DSA Channels prioritize customer-centric approaches, addressing queries promptly, resolving concerns effectively, and ensuring a positive client experience that reinforces trust.

Technological Integration for Efficiency:

Digital Onboarding Processes:

Corporate DSA Channel / DSA Channels streamline client onboarding through digital processes. From document submission to account setup, the integration of technology reduces friction in the onboarding journey, making it more efficient and user-friendly.

Data Analytics for Personalization:

Technology enables Corporate DSA Channels to harness the power of data analytics. By analyzing client data, these channels can personalize financial offerings, tailoring products and services to meet individual needs and preferences.

Mobile Applications for Accessibility:

The development of mobile applications enhances accessibility. Clients can conveniently access their financial information, initiate transactions, and communicate with DSAs through user-friendly mobile interfaces, fostering a seamless and connected experience.

Striking the Balance: Trust in the Digital Age

Security Measures for Client Data:

Trust and technology coexist harmoniously when robust security measures are in place. Corporate DSA Channels prioritize the protection of client data through encryption, secure servers, and stringent cybersecurity protocols, ensuring the integrity of financial transactions.

Educational Initiatives on Technology Use:

To maintain trust, Corporate DSA Channel / DSA Channels embark on educational initiatives. These programs inform clients about the safe use of technology, cybersecurity best practices, and the benefits of digital tools, empowering them to navigate the digital landscape with confidence.

Challenges and Opportunities:

Balancing Personalization with Privacy:

The challenge lies in balancing the personalization of services with respect for privacy. Corporate DSA Channels address this by implementing privacy-focused policies, ensuring that clients feel empowered and in control of their personal information.

Adapting to Rapid Technological Changes:

The ever-evolving nature of technology presents both challenges and opportunities. Corporate DSA Channel / DSA Channels view this dynamism as an opportunity for continuous improvement, embracing emerging technologies to stay at the forefront of financial innovation.

Conclusion:

Corporate DSA Channel / DSA Channels epitomize the harmonious interplay between trust and technology in the financial realm. By weaving a tapestry of localized trust networks, transparent communication, and technological efficiency, these channels are navigating the future of finance with resilience and adaptability. As technology continues to advance, Corporate DSA Channels stand as beacons of trust, guiding individuals and businesses towards a connected, secure, and personalized financial future.Discover unparalleled options for loans and Credit Card tailored to your preferences with Arena Fincorp. As a leading digital lending platform in the Loan & Finance sector, we provide industry-best choices, allowing you to select loans that match your needs, determine your preferred interest rates, and set terms according to your preferences. Experience extraordinary – our cutting-edge technology ensures swift application processing, enabling customers to receive funds in their accounts in as little as 12 hours, with minimal documentation required .

0 notes

Text

Exploring the Opportunities of Loan Business and Loan DSA Business

Introduction

In a world of financial uncertainties, loans have become an integral part of many individuals and businesses. Whether you need capital for a new venture, a home purchase, or simply to meet your immediate financial needs, loans have become a reliable solution. And when it comes to the distribution of these loans, the loan DSA (direct selling agent) business has emerged as a promising avenue. In this article, we will delve into the loan business and the loan DSA business, exploring the opportunities and potentials they offer.

Understanding Loan Business

Loan business encompasses the broad spectrum of activities related to providing loans to individuals and businesses. This sector plays a pivotal role in facilitating economic growth by ensuring access to capital for various purposes, such as education, housing, and entrepreneurial endeavors.

Key components of the loan business include:

Lending Institutions: Traditional banks, credit unions, online lenders, and microfinance institutions all participate in the loan business, offering a variety of loan products tailored to different needs.

Loan Types: Loans are not one-size-fits-all. Common types include personal loans, business loans, mortgage loans, student loans, and auto loans.

Risk Assessment: Lenders evaluate borrowers' creditworthiness through a variety of metrics, including credit scores, income, and collateral.

Interest Rates: The interest rates on loans vary depending on factors like credit history and the type of loan. It's how lenders make a profit.

Loan DSA business

The loan DSA business is an evolving and lucrative sector in the financial services industry. Direct-selling agents act as intermediaries between borrowers and lenders, helping potential loan applicants connect with financial institutions. This business model offers several advantages, such as:

Flexibility: Loan DSAs can work independently or with multiple financial institutions, providing flexibility in terms of clientele and work arrangements.

Income Potential: Commissions earned by loan DSAs can be substantial, and as the loan portfolio grows, so does their income.

Minimal Overhead: Starting a Loan DSA business typically requires minimal capital investment. It can be operated from home, eliminating the need for physical office space.

Expanding Market: As more people seek loans for various purposes, the market for loan DSA businesses continues to grow.

Tips for Success in the Loan DSA Business

If you're considering venturing into the loan DSA business, here are some essential tips for success:

Build a Strong Network: Establish and nurture relationships with financial institutions to access a variety of loan products.

Continuous Learning: Stay updated with the latest financial products and industry regulations to serve your clients better.

Ethical Practices: Maintain transparency and honesty in your dealings to build trust with clients and lending institutions.

Marketing and Lead Generation: Invest in digital marketing and lead generation strategies to attract potential loan applicants.

Conclusion

The loan business and the loan DSA business are both indispensable parts of the modern financial landscape. They provide the necessary capital for personal and business growth while also offering opportunities for entrepreneurs to flourish. As you explore the possibilities within these domains, remember that success requires dedication, a commitment to ethical practices, and a keen understanding of the evolving financial market.

So, whether you're a borrower in need of financial assistance or an aspiring Loan DSA entrepreneur, the loan business holds a world of opportunities waiting to be explored.

Read More: Unlocking the Potential of DigitalSevaPortal: Your Gateway to Digital Services

0 notes

Text

Guide to Becoming a DSA Agent

DSA or Direct Selling Agent is a person who works on behalf of banks and non-banking Financial Companies (NBFCs).

A Direct Selling Agent connects loan-seeking customers to banks and NBFCs. Once they find leads, they ensure the customer of a smooth process; educate them about the loan interest rates and repayment process. Once the customer finds a good deal, the DSA directs them to the concerned bank or NBFC.

What does a DSA get in return? DSA works on commission. This payout varies depending on the type of loan granted and the loan amount.

What is the process of DSA loan agent registration?

To become a Direct Selling agent, the concerned person has to apply for a DSA loan agent registration. Here is how a person can apply for a DSA loan agent:

Choose a bank or NBFC for which you want to act as a DSA loan agent.

Visit their official website to apply or the bank or NBFCs physical address to enquire about the process.

Either way, you must fill out a registration form and submit it.

Once submitted, you will be asked to make a payment. Find out about the commission rate you will be getting at this stage.

Once the payment is made and the registration form is submitted, the bank or NBFC contacts you.

Hereby, you need to verify the documents for DSA registration.

The legal team does the job of verifying the information. They also consider the credit score and past credit history of the applicant.

Once the verification is successful, the DSA agreement is sent to the applicant.

The applicant needs to sign and send it back.

That’s it. You will receive your unique DSA ID soon before you hunt prospective customers needing loans. Some banks or NBFCs also name DSA as a Loan Partner Program.

What are the skills needed for a DSA loan agent?

A DSA loan agent’s job is to convince customers to take loans. Skills needed to perform such a job include:

• Good communication skills

Anyone with good communication skills can become a successful DSA loan agent. Depending on the number of clients you bring in, a person can work as a DSA partner on a full-time or part-time basis.

• Good knowledge of loans

Such a person should have a good knowledge of the different loans (personal, business, house, car, etc.). This enables agents to guide the customers toward the right path if they need the loan. A DSA agent should be able to provide them with the best options available to reap maximum customer benefits.

Who can become a loan DSA partner?

Anyone above 21 (student, freelancer, salaried, self-employed) can apply for DSA registration and earn extra.

At Finway, dsa loan partner are provided 5% commissions of the total earnings of their team. Furthermore, applying as a DSA agent with Finway mobile app, FLAP is super easy.

0 notes

Text

Loan DSA

With the help of Digitalvaportal's Loan DSA, you can expand your loan company. You may access a plethora of options and resources thanks to our robust platform, which links you with leading lenders and borrowers. We can help you whether you want to increase your audience or improve your process. Join today to learn more about what Loan DSA can do for you

0 notes

Photo

Loan DSA Registration

Please contact us to get onboarded

for more details contact us on

9970666919

http://easylending.in/

#loan dsa#dsa loan agent registration#deals of loan dsa login#loan dsa in mumbai#loan dsa franchise#loan dsa in pune#loan dsa partner#loan dsa apply#loan leads for dsa#dsa loan company#loan dsa apply online#loan dsa near me

0 notes

Photo

IN THESE TIMES

THE FOUNDATIONS OF THE ESTABLISHED ORDER ARE CRACKING.

The day after democratic socialist Alexandria Ocasio-Cortez won her Democratic primary last June, the Merriam-Webster Dictionary reported a 1,500 percent increase in searches for the word “socialism” on its website. Overall, socialism and fascism have become its most-searched words—a telling commentary. In the midterm elections, Ocasio-Cortez and another charismatic democratic socialist, Rashid Tlaib (D-Mich.), won seats in the House, and universal healthcare emerged as a potent, unifying issue that helped deliver Democrats control of that chamber.

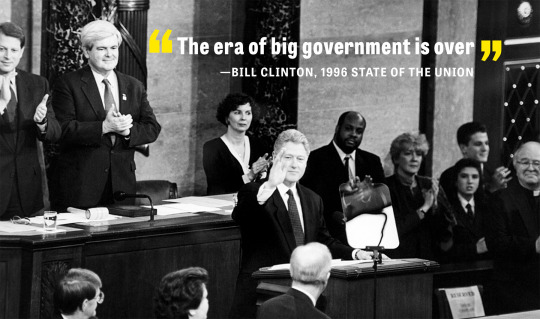

The cornerstone of the passing era is hostility toward taxes, regulation and public investment. The era began with the election of President Ronald Reagan in 1980, but it was a Democratic president, Bill Clinton, who expressed its motto most memorably. “The era of big government is over,” Clinton proclaimed in his 1996 State of the Union. The white flag of surrender has flown over the Democratic Party ever since, with an all-too-brief interlude during Barack Obama’s first presidential campaign.

Perversely, it was a demagogic Republican who sensed the emergence of a new era and rode its currents to the White House. He may be a liar and a charlatan, but Donald Trump’s election-turning insight was that voters don’t want smaller government. They want government that works for them—and not for corporations. In addition to xenophobia and white Christian nationalism, Trump campaigned on massive infrastructure investment, “great” healthcare for everyone, taking on the pharmaceutical industry and “draining the swamp” of political corruption. Similar (but authentic) platforms of robust public investments and checks on corporate power have turned Ocasio-Cortez and Bernie Sanders into political sensations.

At least on paper, even the Democratic Party seems to be catching on that corruption—defined as the capture of government by wealth and special interests—is the new “big government.” In May, Democratic leadership released a three-page plan for “fixing our broken political system and returning to a government of, by, and for the people,” promising to beef up ethics laws and “combat big money influence.” If these promises are to be anything more than empty gestures, though, there is a long way to go. A May analysis by OpenSecrets showed that incumbent congressional Democrats had taken an average of $29,000 apiece from lobbyists since 2017, while Republicans had taken $30,000. In August, the Democratic National Committee overturned a ban on contributions from fossil fuel companies.

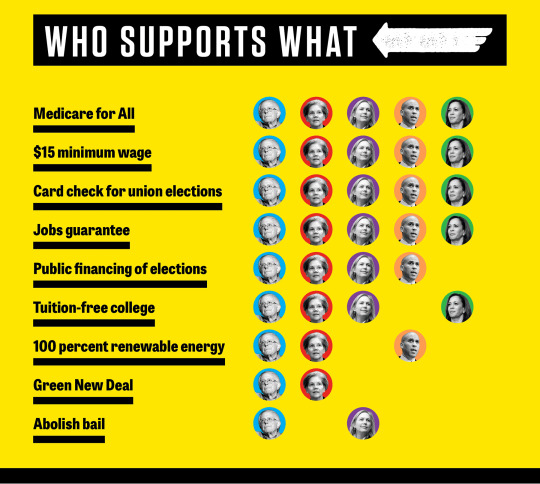

Universal healthcare is a case study in how the current system saps the energy for pushing major legislation through Congress. The majority of Democrats claim to want Medicare for All, but centrist Democrats, beholden to the insurance and hospital industries, are content to tweak Obamacare; they only support universal coverage by some vague mechanism, at some uncertain point.

Progressives, meanwhile, began rallying behind specific legislation in 2015: Medicare for All bills in the House and Senate. Local chapters of organizations like Democratic Socialists of America (DSA) and National Nurses United began pushing for single-payer bills in individual states, helping move the issue into the national debate.

That split within the Democratic Party, multiplied across a range of issues, is an unmistakable sign of transformation. The Left is in a phase of intense institution-building similar to that of the Right in the 1970s and ’80s, with new and newly energized think tanks—Demos, Data for Progress, the Roosevelt Institute and the Democracy Collaborative, among others—and an electoral infrastructure made up of groups like DSA, People’s Action, Justice Democrats, Our Revolution and Working Families Party.

This progressive resurgence is reflected, as well, in the landscape of the 2020 Democratic presidential primary. The five probable contenders in the Senate—Bernie Sanders, Cory Booker, Kirsten Gillibrand, Kamala Harris and Elizabeth Warren—have among the Senate’s most left-leaning voting records, and they’re vying to distinguish themselves by introducing progressive legislation.

Gillibrand is the most striking example, and the best measure of where the Democratic Party’s energy lies. Once a centrist, she has tacked steadily left in recent years and is now one of the party’s leading voices for the #MeToo movement and immigration reform, in addition to becoming an energetic economic populist. In April, for example, she introduced a bill to require that post offices offer basic banking services, like checking and savings accounts and low-interest loans. It’s a partial solution to the abuses of the payday loan industry that could help the estimated 9 million “unbanked” people in the United States.

The effects of all this, as with the effects of the “Reagan revolution” of 1980, will take decades to fully manifest. But they will likely radiate out and reshape our politics for a generation and beyond.

“VALUE VOTERS”

The Republican ascendancy of the past 40 years has been driven by a network of institutions bankrolled by wealthy donors and corporate interests, harnessed to the conservative movement’s passion for a few key issues, especially its hatred of abortion, same-sex marriage and public education. Over the decades, the Heritage Foundation and other quasi-scholarly institutions, in sync with popular rightwing media operations, have given conservatives a unified agenda and framed it as an apocalyptic battle between good and evil. Broadly, the goal was to radically limit the federal government’s involvement in the economy and vastly expand its power to legislate Christian Right morality.

In the 1990s, the Democratic establishment’s “third way” exposed the party’s lack of a similar set of principles. The heart of the third-way paradigm was the idea that the Democratic Party could survive the libertarian and “values voter” onslaught only by meeting the GOP halfway, tacking between right-wing interests and the common good. Bill Clinton’s most influential policy successes, like the North American Free Trade Agreement, the welfare reform bill of 1996 and deregulation of the financial services sector, tended to serve corporate interests while betraying working-class and minority voters.

The Occupy movement of 2011, which pushed economic inequality front and center, was the first sign of a tectonic shift in our politics. The Sanders campaign of 2015-16 was the second. Both cast inequality as a moral outrage, with the same urgency and fierceness that evangelicals bring to the abortion debate. Writing in the Guardian, Sanders denounced oligarchy and called income inequality “the great moral, economic and political issue of our time.”

And it isn’t only about economic inequality. The nation’s moral imagination is broadening as inequality writ large takes center stage. We know too much about the consequences of climate change, especially in the most vulnerable communities, for it not to be a moral issue. The same is true of access to quality education. The many videos of police abuse, the stories of sexual assault, and the protests and movements they spawned—#MeToo, Black Lives Matter, NFL players taking a knee— have helped to galvanize and focus the progressive resurgence, along with Trump’s demonization of racial and religious minorities and his pride in sexual assault and misogyny.

“The old perceived trade-off, between appealing to a broad middle of the electorate and having a transformative agenda, is becoming outdated as progressives coalesce around ideas that speak to the people who’ve been excluded from our system,” says Adam Lioz, political director at Demos Action. “It’s an exciting moment in progressive politics, in that candidates recognize that putting forward a bold platform is actually the pragmatic thing to do.”

This is how new political eras emerge. Just as the capture of government by special interests in the 19th century provoked the rise of the Progressive movement, the pervasive corruption of our politics is now reinvigorating it. The evangelical Right's passion hasn’t faded, but its focus on sex and reproduction no longer dominates national discussions about morality. To talk about inequality and corruption is to talk about right and wrong, fairness and justice. We are all “values voters” now.

Translating progressive values and votes into policy is the task ahead. That can seem like a nearly hopeless prospect, given the current makeup of Congress and the Supreme Court. But it starts with putting forward a strong agenda to frame the debate. That’s what the conservative movement did for the Republican Party in the 1970s and ’80s. Across a range of issues—notably economic injustice, climate change, state violence against minorities and corrupt elections—it’s what the progressive movement is doing for the Democratic Party right now.

ECONOMIC INJUSTICE

With about 28 million people still uninsured in the United States—and with medical bills the leading cause of bankruptcy—the radical inequalities of the healthcare system remain one of the nation’s great moral failures. The number of cosponsors of the single-payer Medicare for All bill in the House, HR 676, is a measure of how decisively leftward the consensus has shifted. From 2013 to 2015, the number of cosponsors fell by one, from 63 to 62. It has since nearly doubled, to 123.

The campaign for a higher minimum wage, led most prominently by Fight for $15, has, since 2014, put struggles of minimum-wage workers front and center, winning a $15 wage in at least 35 cities, states and counties. In 2017, Democrats in the House and Senate introduced the Raise the Wage Act, which would hike the federal minimum wage to $15 by 2024 and index it to the median wage after that.

Warren and Sanders are the highest-profile progressive advocates in this realm. If either runs in 2020, they will help to set the terms of the debate. Warren has already released a proposal requiring that 40 percent of a corporation’s board of directors be elected by workers, known as “codetermination.” It would also require that social interests, not just shareholder interests, be a key factor in corporations’ decision making.

Warren’s proposal has no chance of becoming law anytime soon, but it has planted a flag for a radical idea (in the U.S. context), attracted media coverage, provoked discussion and shaped the debate over how capitalism is practiced. It’s a prime example of how ideas become mainstream, legislative agendas are formed, and a party out of power remains relevant.

(Continue Reading)

#politics#the left#in these times#progressive#progressive movement#2020 election#democrats#democratic party#bernie sanders#elizabeth warren#alexandria ocasio-cortez#democratic socialism

109 notes

·

View notes

Text

Best Factoring Firms Of 2023

By utilizing our freight invoice factoring program, you will get rather more than just an improved money circulate. Express Freight Finance also offers collections and credit score management as a part of our overarching service. We will provide collections on all freight invoice factoring providers, providing you with an expedient turn on freight bills of around 32 days. When attempting to do this independently, most trucking corporations experience a median flip of about forty five to 50 days. Additionally, our program for freight invoice factoring will give you entry to our credit score checking companies.

That just isn't the case with factoring, as the corporate purchasing your invoices is more interested in your clients’ creditworthiness than yours. Port cities, particularly Miami, are very depending on commerce with Latin America. Several financial factors come into play, including forex fluctuations towards their overseas counterparts, which exacerbate a necessity for factoring receivables. Often, billing begins after the shipment is delivered, which could be a prolonged process. The result is that many import-export businesses start accounts receivable factoring. About Us – At Florida Business Capital we specialize in offering accessible bill factoring financing to businesses working in Florida.

Instead, Credible matches you with the most effective potential lenders in its network based mostly in your utility and business information. Although your terms and costs rely in your particular loan offers, your APR could be as little as four.5%. However, your particular terms and costs are primarily based in your credit score, time in business, and a quantity of other other monetary elements. Invoice factoring happens when a business sells its invoices to a factoring company at a discount in change for instant money.

When you have cash for bills, your corporation will run extra easily. Freight factoring is an answer to money move problems & one other form of financing to get cash superior for the hundreds you have completed. We have a glance at the standard of your receivables and your potential for sustained progress, not your assets and web value. Because we finance your receivables, you surrender no fairness, create no new debt and don't have any mortgage cost.

If it wasn’t for Ernane, I’m undecided the place I’d be right now with my enterprise. I can rent more technicians now and I’ve grown the enterprise by about 20 %. Less than two years old, this manufacturer of industrial packaging was unable to safe a conventional line of credit from their local community florida factoring company banks as a outcome of an absence of operating history. Miami is named a paradise location for vacationing, retiring, and establishing businesses. Its weather, location, and rich culture make it one of the most visited cities within the United States for tourism and enterprise.

Whether you're a producer primarily based in Florida or are importing merchandise from overseas, DSA Factors has the expertise and data you should help you develop your small business. “Company headquarters and companies in tech, aviation, life sciences, and the marine industries proceed to determine on to find and grow in Greater Fort Lauderdale/Broward County. Our community’s rating on the Business Facilities list florida factoring company is further validation of our efforts to attract high-wage jobs,” stated Broward County Mayor Steven Geller. Power Funding may even operate as part of your billing division, handling collections, cost processing, and extra. If you lead a enterprise in Miami, Orlando, or wherever else in Florida, Power Funding is here to offer you worry-free and debt-free financing through Invoice Factoring.

While the client is legally required to pay, that doesn't all the time imply they pay on time, or that it is easy to secure fee from them. In troublesome circumstances, a late paid invoice might imply an absence of cashflow or interruption of your ability to pay your small business prices, including payroll. That is why it's crucial to find a resolution to ensure your invoices both receives a commission on time or can reliably be was usable money.

Our factoring companions can approve you for funding in as little as 3 to 5 business days with the appropriate paperwork – a a lot shorter listing than is required by traditional lenders. Invoice factoring works if you serve dependable, well-paying clients with strong credit historical past – even when your individual credit score historical past is much less steady. Florida could also be nicely often recognized as a Spring Break destination florida factoring company, however at DSA Factors we know Florida as home to many of our purchasers in a variety of industries similar to furniture, lighting, giftware, and more. DSA Factors is proud that we now have been factoring for Florida primarily based companies for over 30 years. There are many South Florida factoring companies to select from, however what makes Bankers Factoring unique? Firstly, we're one of many few employee-owned factoring companies.

Factoring companies base approval on the credit of your purchasers, since they're the ones liable for invoice payment. Once you complete a factoring utility, a Florida factoring company can approve you for funding within 3 days or less. After the initial approval course of, you’ll receive a cash advance within 24 hours each time you submit an invoice. When your buyer submits payment for the invoice, the factoring company will remit the remaining balance back to you, minus a small charge for bill factoring.

0 notes

Text

Top DSA App for Selling Loans & Insurance

Discover the leading app for DSAs to effectively sell financial products, such as loans and insurance, boosting sales and enhancing customer engagement in the B2B market

0 notes