#lenders for flipping houses

Explore tagged Tumblr posts

Text

#accolend#fix and flip#fix and flip loans#fixer upper#flipping#fix and flip lenders#fix & flip loans#fix and flip financing#fix flip lenders#loans for flipping houses#fix and flip houses#fix and flip homes#home flipping loans#lenders for flipping houses#home loans for flipping houses#fix loans#flip loans

1 note

·

View note

Text

How finfluencers destroyed the housing and lives of thousands of people

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

The crash of 2008 imparted many lessons to those of us who were only dimly aware of finance, especially the problems of complexity as a way of disguising fraud and recklessness. That was really the first lesson of 2008: "financial engineering" is mostly a way of obscuring crime behind a screen of technical jargon.

This is a vital principle to keep in mind, because obscenely well-resourced "financial engineers" are on a tireless, perennial search for opportunities to disguise fraud as innovation. As Riley Quinn says, "Any time you hear 'fintech,' substitute 'unlicensed bank'":

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

But there's another important lesson to learn from the 2008 disaster, a lesson that's as old as the South Seas Bubble: "leverage" (that is, debt) is a force multiplier for fraud. Easy credit for financial speculation turns local scams into regional crime waves; it turns regional crime into national crises; it turns national crises into destabilizing global meltdowns.

When financial speculators have easy access to credit, they "lever up" their wagers. A speculator buys your house and uses it for collateral for a loan to buy another house, then they make a bet using that house as collateral and buy a third house, and so on. This is an obviously terrible practice and lenders who extend credit on this basis end up riddling the real economy with rot – a single default in the chain can ripple up and down it and take down a whole neighborhood, town or city. Any time you see this behavior in debt markets, you should batten your hatches for the coming collapse. Unsurprisingly, this is very common in crypto speculation, where it's obscured behind the bland, unpronounceable euphemism of "re-hypothecation":

https://www.coindesk.com/consensus-magazine/2023/05/10/rehypothecation-may-be-common-in-traditional-finance-but-it-will-never-work-with-bitcoin/

Loose credit markets often originate with central banks. The dogma that holds that the only role the government has to play in tuning the economy is in setting interest rates at the Fed means the answer to a cooling economy is cranking down the prime rate, meaning that everyone earns less money on their savings and are therefore incentivized to go and risk their retirement playing at Wall Street's casino.

The "zero interest rate policy" shows what happens when this tactic is carried out for long enough. When the economy is built upon mountains of low-interest debt, when every business, every stick of physical plant, every car and every home is leveraged to the brim and cross-collateralized with one another, central bankers have to keep interest rates low. Raising them, even a little, could trigger waves of defaults and blow up the whole economy.

Holding interest rates at zero – or even flipping them to negative, so that your savings lose value every day you refuse to flush them into the finance casino – results in still more reckless betting, and that results in even more risk, which makes it even harder to put interest rates back up again.

This is a morally and economically complicated phenomenon. On the one hand, when the government provides risk-free bonds to investors (that is, when the Fed rate is over 0%), they're providing "universal basic income for people with money." If you have money, you can park it in T-Bills (Treasury bonds) and the US government will give you more money:

https://realprogressives.org/mmp-blog-34-responses/

On the other hand, while T-Bills exist and are foundational to the borrowing picture for speculators, ZIRP creates free debt for people with money – it allows for ever-greater, ever-deadlier forms of leverage, with ever-worsening consequences for turning off the tap. As 2008 forcibly reminded us, the vast mountains of complex derivatives and other forms of exotic debt only seems like an abstraction. In reality, these exotic financial instruments are directly tethered to real things in the real economy, and when the faery gold disappears, it takes down your home, your job, your community center, your schools, and your whole country's access to cancer medication:

https://www.theguardian.com/world/2012/jun/08/greek-drug-shortage-worsens

Being a billionaire automatically lowers your IQ by 30 points, as you are insulated from the consequences of your follies, lapses, prejudices and superstitions. As @[email protected] says, Elon Musk is what Howard Hughes would have turned into if he hadn't been a recluse:

https://mamot.fr/@[email protected]/112457199729198644

The same goes for financiers during periods of loose credit. Loose Fed money created an "everything bubble" that saw the prices of every asset explode, from housing to stocks, from wine to baseball cards. When every bet pays off, you win the game by betting on everything:

https://en.wikipedia.org/wiki/Everything_bubble

That meant that the ZIRPocene was an era in which ever-stupider people were given ever-larger sums of money to gamble with. This was the golden age of the "finfluencer" – a Tiktok dolt with a surefire way for you to get rich by making reckless bets that endanger the livelihoods, homes and wellbeing of your neighbors.

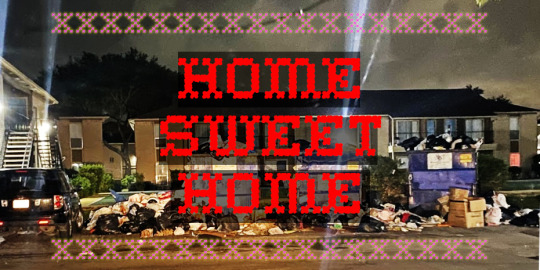

Finfluencers are dolts, but they're also dangerous. Writing for The American Prospect, the always-amazing Maureen Tkacik describes how a small clutch of passive-income-brainworm gurus created a financial weapon of mass destruction, buying swathes of apartment buildings and then destroying them, ruining the lives of their tenants, and their investors:

https://prospect.org/infrastructure/housing/2024-05-22-hell-underwater-landlord/

Tcacik's main characters are Matt Picheny, Brent Ritchie and Koteswar “Jay” Gajavelli, who ran a scheme to flip apartment buildings, primarily in Houston, America's fastest growing metro, which also boasts some of America's weakest protections for tenants. These finance bros worked through Gajavelli's company Applesway Investment Group, which levered up his investors' money with massive loans from Arbor Realty Trust, who also originated loans to many other speculators and flippers.

For investors, the scheme was a classic heads-I-win/tails-you-lose: Gajavelli paid himself a percentage of the price of every building he bought, a percentage of monthly rental income, and a percentage of the resale price. This is typical of the "syndicating" sector, which raised $111 billion on this basis:

https://www.wsj.com/articles/a-housing-bust-comes-for-thousands-of-small-time-investors-3934beb3

Gajavelli and co bought up whole swathes of Houston and other cities, apartment blocks both modest and luxurious, including buildings that had already been looted by previous speculators. As interest rates crept up and the payments for the adjustable-rate loans supporting these investments exploded, Gajavell's Applesway and its subsidiary LLCs started to stiff their suppliers. Garbage collection dwindled, then ceased. Water outages became common – first weekly, then daily. Community rooms and pools shuttered. Lawns grew to waist-high gardens of weeds, fouled with mounds of fossil dogshit. Crime ran rampant, including murders. Buildings filled with rats and bedbugs. Ceilings caved in. Toilets backed up. Hallways filled with raw sewage:

https://pluralistic.net/timberridge

Meanwhile, the value of these buildings was plummeting, and not just because of their terrible condition – the whole market was cooling off, in part thanks to those same interest-rate hikes. Because the loans were daisy-chained, problems with a single building threatened every building in the portfolio – and there were problems with a lot more than one building.

This ruination wasn't limited to Gajavelli's holdings. Arbor lent to multiple finfluencer grifters, providing the leverage for every Tiktok dolt to ruin a neighborhood of their choosing. Arbor's founder, the "flamboyant" Ivan Kaufman, is associated with a long list of bizarre pop-culture and financial freak incidents. These have somehow eclipsed his scandals, involving – you guessed it – buying up apartment buildings and turning them into dangerous slums. Two of his buildings in Hyattsville, MD accumulated 2,162 violations in less than three years.

Arbor graduated from owning slums to creating them, lending out money to grifters via a "crowdfunding" platform that rooked retail investors into the scam, taking advantage of Obama-era deregulation of "qualified investor" restrictions to sucker unsophisticated savers into handing over money that was funneled to dolts like Gajavelli. Arbor ran the loosest book in town, originating mortgages that wouldn't pass the (relatively lax) criteria of Fannie Mae and Freddie Mac. This created an ever-enlarging pool of apartments run by dolts, without the benefit of federal insurance. As one short-seller's report on Arbor put it, they were the origin of an epidemic of "Slumlord Millionaires":

https://viceroyresearch.org/wp-content/uploads/2023/11/Arbor-Slumlord-Millionaires-Jan-8-2023.pdf

The private equity grift is hard to understand from the outside, because it appears that a bunch of sober-sided, responsible institutions lose out big when PE firms default on their loans. But the story of the Slumlord Millionaires shows how such a scam could be durable over such long timescales: remember that the "syndicating" sector pays itself giant amounts of money whether it wins or loses. The consider that they finance this with investor capital from "crowdfunding" platforms that rope in naive investors. The owners of these crowdfunding platforms are conduits for the money to make the loans to make the bets – but it's not their money. Quite the contrary: they get a fee on every loan they originate, and a share of the interest payments, but they're not on the hook for loans that default. Heads they win, tails we lose.

In other words, these crooks are intermediaries – they're platforms. When you're on the customer side of the platform, it's easy to think that your misery benefits the sellers on the platform's other side. For example, it's easy to believe that as your Facebook feed becomes enshittified with ads, that advertisers are the beneficiaries of this enshittification.

But the reason you're seeing so many ads in your feed is that Facebook is also ripping off advertisers: charging them more, spending less to police ad-fraud, being sloppier with ad-targeting. If you're not paying for the product, you're the product. But if you are paying for the product? You're still the product:

https://pluralistic.net/2021/01/04/how-to-truth/#adfraud

In the same way: the private equity slumlord who raises your rent, loads up on junk fees, and lets your building disintegrate into a crime-riddled, sewage-tainted, rat-infested literal pile of garbage is absolutely fucking you over. But they're also fucking over their investors. They didn't buy the building with their own money, so they're not on the hook when it's condemned or when there's a forced sale. They got a share of the initial sale price, they get a percentage of your rental payments, so any upside they miss out on from a successful sale is just a little extra they're not getting. If they squeeze you hard enough, they can probably make up the difference.

The fact that this criminal playbook has wormed its way into every corner of the housing market makes it especially urgent and visible. Housing – shelter – is a human right, and no person can thrive without a stable home. The conversion of housing, from human right to speculative asset, has been a catastrophe:

https://pluralistic.net/2021/06/06/the-rents-too-damned-high/

Of course, that's not the only "asset class" that has been enshittified by private equity looters. They love any kind of business that you must patronize. Capitalists hate capitalism, so they love a captive audience, which is why PE took over your local nursing home and murdered your gran:

https://pluralistic.net/2021/02/23/acceptable-losses/#disposable-olds

Homes are the last asset of the middle class, and the grifter class know it, so they're coming for your house. Willie Sutton robbed banks because "that's where the money is" and We Buy Ugly Houses defrauds your parents out of their family home because that's where their money is:

https://pluralistic.net/2023/05/11/ugly-houses-ugly-truth/#homevestor

The plague of housing speculation isn't a US-only phenomenon. We have allies in Spain who are fighting our Wall Street landlords:

https://pluralistic.net/2021/11/24/no-puedo-pagar-no-pagara/#fuckin-aardvarks

Also in Berlin:

https://pluralistic.net/2021/08/16/die-miete-ist-zu-hoch/#assets-v-human-rights

The fight for decent housing is the fight for a decent world. That's why unions have joined the fight for better, de-financialized housing. When a union member spends two hours commuting every day from a black-mold-filled apartment that costs 50% of their paycheck, they suffer just as surely as if their boss cut their wage:

https://pluralistic.net/2023/12/13/i-want-a-roof-over-my-head/#and-bread-on-the-table

The solutions to our housing crises aren't all that complicated – they just run counter to the interests of speculators and the ruling class. Rent control, which neoliberal economists have long dismissed as an impossible, inevitable disaster, actually works very well:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

As does public housing:

https://jacobin.com/2023/10/red-vienna-public-affordable-housing-homelessness-matthew-yglesias

There are ways to have a decent home and a decent life without being burdened with debt, and without being a pawn in someone else's highly leveraged casino bet.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/22/koteswar-jay-gajavelli/#if-you-ever-go-to-houston

Image: Boy G/Google Maps (modified) https://pluralistic.net/timberridge

#pluralistic#zirp#weaponized shelter#the rents too damned high#finfluencers#qualified investors#the bezzle#heads i win tails you lose#houston#Brent Ritchie#Matt Picheny#Koteswar Jay Gajavelli#Koteswar Gajavelli#Applesway Investment Group#maureen tkacik#Arbor Realty Trust#MF1 Capital#Benefit Street Partners#bezzle#Swapnil Agarwal#Slumlord Millionaires#KeyCity Capital#Financial Independence University#Elisa Zhang#Lane Kawaoka#Fundamental Advisors#AWC Opportunity Partners#Nitya Capital

263 notes

·

View notes

Text

A Beginner's Guide to Fix and Flip Lending for Real Estate Investors

Investing in real estate has long been a proven methodology for personal wealth development, and one of the hottest vehicles recently has been the fix-and-flip strategy. The essence of this strategy is purchasing properties, improving them to create additional value, and repurchasing at a profit. However, financing is one of the most crucial aspects of this strategy. Thus, this blog will be about everything fix-and-flip lending, especially what it is all about and how it can be maximally utilized in Alabama.

What is fix-and-flip lending?

Fix-and-flip lending usually refers to short-term loans for property investors who wish to buy, renovate, and sell houses. Such loans usually amount to the purchase price of the property as well as some part of the renovation costs. Fix and flip loans differ from conventional mortgages in that they are easier and faster to get, and they are designed to suit the investor who wants to conclude projects in a short period of time.

Key Features of Fix and Flip Loans

Short-Term Duration

Fix and flip loans typically have a term of from 6 to 18 months, so that, fittingly, this is the period to which most investors would require renovating and selling their property.

Flexible Loan Amounts

These often lend the amount required by the investor for the purchase price of property and renovation costs. Such systems suffice to make it easier for the investors in concentrating upon adding value to their projects.

Interest Rates

Similar to any other type of loan, fix-and-flip loans have a higher interest payment compared to traditional mortgages. Such is because of the nature of these loans being short-term and riskier.

Quick Approval Process

These loans can be approved and funded in a hurry so that investors can immediately get to act in very competitive real estate markets.

Benefits of Fix and Flip Lending

It would deliver the following features for fix-and-flip lending as a real estate investor.

Funds Accessibility: Even if an investor lacks cash at hand to buy and renovate the entire real estate property, he/she may get the loan from the lender.

Project-specific Funding: The loan is based on a project, covering purchase costs as well as renovation costs.

Market Flexibility: For instance, the opportunity for dynamic housing markets exists, such as in Alabama.

Fix and Flip Lending in Alabama

Real estate in Alabama offered lucrative opportunities for fix-and-flippers who would invest in their affordable price and real demand for renovated homes. Such projects flourished throughout the state. Birmingham, Huntsville, Mobile, and other cities have emerged as continuously moving places with many prospective buyers looking for homes that resemble what they have recently seen.

It takes a good plan before any investor can venture into the Alabama fix and flip lending business. For consideration include the following:

Trends in the Local Market: Understanding specific neighborhoods' property valuation and buyers' preferences is crucial.

Cost of Renovations: Precise estimations go a long way in preventing excess spending.

Loan offers: Working with a lender who understands real estate in Alabama will ease the financing process.

How to Get Started with Fix and Flip Loans

Monitor and Detect Prospective Properties:

Properties that have got an apparently high potential for value addition and alteration but actually are found under serious disfigurements, neglect, and severe repairs are also great resale or wholesale properties.

Consider the Best Lender:

With reputed lenders like Zeus Commercial Capital, borrowing in a sometimes chaotic world turns very smooth and simple. They get real estate investor needs and things naturally offering them special and tailor-made solutions.

Draw Up an Impressive Framework:

And often the biggest and, of course, most impressive models have multi-million-dollar budgets and timelines put down into one place and include, among other things, purchase price, renovation fees, and contingency allowances.

Marketing the Loan:

Forward your loan application with all supporting documents, like the project plan, estimated costs, and property details.

Perform the Renovation:

Bring that reliable contractor on board and keep the renovations within your budget and time schedule.

Sell the property:

When all the renovations are done, put the property up for sale as best as possible.

Conclusion

It allows you to renovate and sell an asset or part of it. Fix-and-flip financing is great for all types of real estate investors who want to have financial flexibility in transforming potential projects into profits. And Alabama's booming real estate market offers some great opportunities for fixing and flipping.

Whether you are an experienced investor or just getting started, understanding the basics of fix and flip lending would be your first step toward success. Working with a knowledgeable lender such as Zeus Commercial Capital will help you navigate this journey and achieve your investment objectives.

2 notes

·

View notes

Text

The Most Common Indicators of Illegal Property Flipping

Illegal property flipping is a term used to describe a fraudulent real estate practice in which an individual or group of individuals buy properties to quickly resell them at a much higher price. This practice often involves inflating the value of the property through various means, such as submitting false or misleading appraisals or using straw buyers. The goal of illegal property flipping is to make a quick profit without making any improvements or adding any value to the property. However, this practice can have severe negative consequences for both the housing market and the unsuspecting buyers.

What are The Common Indicators of Illegal Flipping?

The practice of property flipping may involve fraudulent schemes and unethical activities. But you should be aware of the indications. Here is a thorough explanation of the most common indicators of illegal property flipping:

Misleading Documents

Predatory Lending

False Evaluation

Concealment of Defects

Flips With no Repairs or Improvements

Negative Consequences of Illegal Flipping on Buyers

Flipping, when done the right way, can have severe consequences on a buyer. These may include the following:

Financial Losses

Legal Issues

Negative Impact on Community

Foreclosure Risk

Property flipping is legal, given that no misleading statements are made or signed. Whenever you decide to invest in a property, read all the paperwork and contracts. The contract you provide to the lender is a statement of facts. But, it should be devoid of any false assertions.

If there is honesty and integrity, the process is legal. If not, identify the signs of illegal property flipping and take appropriate action. To get a consultation on property flipping and want to know more about the process of property flipping, visit our website or the link mentioned below.

Source: illegal property flipping

6 notes

·

View notes

Text

How to Sell Your Home for Cash and Get Paid Fast?

Selling your home for cash is a great option if you want a quick, hassle-free transaction without dealing with mortgage approvals or lengthy closing processes. Whether you’re facing financial difficulties, relocating, or just want a fast sale, here’s how you can sell your home for cash and get paid quickly.

1. Understand How Cash Sales Work

A cash sale means the buyer pays the full amount upfront without needing a loan. Cash buyers are often real estate investors, home-buying companies, or individuals who have the funds available. Since there’s no need for bank approvals or mortgage underwriting, the sale can close much faster—sometimes in as little as a few days.

2. Find a Reliable Cash Buyer

To sell your home quickly for cash, look for reputable cash buyers. These can include:

Real estate investors who flip homes for profit

Cash home-buying companies that purchase properties in any condition

Individuals looking for investment properties

You can find cash buyers through online searches, real estate networks, or companies that advertise “We Buy Houses for Cash.” Make sure to check reviews and verify the buyer’s reputation before proceeding.

3. Get a Fair Cash Offer

Once you find potential buyers, request cash offers. Most cash buyers will inspect the property and make an offer based on its condition and market value. Be aware that cash offers are often lower than traditional market prices since buyers are taking on the risk and may need to make repairs. However, in exchange, you get a guaranteed, fast sale.

4. Negotiate and Accept the Best Offer

Compare offers from multiple cash buyers to ensure you get the best deal. Some may offer more flexibility with closing dates or cover some of the closing costs. Don’t hesitate to negotiate, especially if you receive multiple offers. Once you find a suitable deal, accept the offer and proceed to closing.

5. Skip Repairs and Paperwork Hassles

One of the biggest advantages of selling for cash is that most buyers purchase homes as-is. This means you don’t need to spend time or money on repairs, staging, or listing your property. Additionally, cash buyers often handle most of the paperwork, making the process even easier for you.

6. Close the Deal Quickly

With cash transactions, closing can happen in as little as a week. Since there’s no mortgage lender involved, the process moves faster. The buyer will complete a title search to verify ownership, and both parties will sign the necessary documents. Once everything is finalized, you’ll receive your payment—often via wire transfer or certified check.

Conclusion

Selling your home for cash is one of the fastest ways to get paid without the complications of traditional real estate transactions. By finding a reputable buyer, securing a fair offer, and closing quickly, you can sell your home with minimal hassle and get the money you need fast.

0 notes

Text

Mortgage For Investment Property - Tips For Savvy Real Estate Investors

Buying property to let is a good business venture provided one follows some guidelines. However, getting a loan for investment properties or managing other people’s money has certain issues than when financing the home.

In a way, you are an investor who is seeking good mortgage rates that would increase the cash flow in your property. These tips are presented in this article in an attempt to guide people into making the right choices in investment property loans.

So, continue reading before you look for investment mortgage lenders.

Investment Property Loans

When it comes to paying for a mortgage, one should evaluate several types of loans to determine the best fit. The usual categories of loans used for rental houses are conventional loans, FHA loans, VA loans, portfolio loans, and fix and flip loans.

These can include the down payment that’s needed, the interest rates and loan terms, the origination fees and other closing costs. Plug in the numbers to find out the expected cash inflows for each of the loans you are anticipating to take.

Although it may be possible to come up with a distinctive loan product that meets the needs of the borrowers, seeking advice from qualified real estate agents or lenders with a focus on such loans may also be beneficial in determining the best loan product to offer.

Debt-To-Income Ratio Strategies

To borrow money, your DTI ratio is a critical consideration, which indicates that controlling this value is crucial for obtaining a good mortgage rate. Reducing existing balances or high interest rates credit cards can help to improve on your DTI.

Strategize the timing of the major purchases capable of reducing the DTI until after closing of the investment loan. A good number of job letters or proof of rental income of steady earnings of the existing properties count to your DTI also.

Hire The Right Professionals

It is important to assemble a team of experienced professionals who are knowledgeable in the relevant fields and industries as well as those who possess the right attitude towards their work, the clients, and the project as a whole.

Therefore, it is important to consult an expert real estate agent, reputable lender, reliable accountant and professional property manager when financing and managing an investment property.

An accountant can advise on tax issues about the investment assets. A PMC can deal with tenant selection, repair and maintenance concerns and collecting rents to ease the land lording responsibilities.

Costs That May Be Encountered

Aside from the initial costs of the down payment and closing costs, a rental property holder has ongoing costs such as property taxes, insurance, association fees, maintenance, damages, occasional rehabilitation, taxes, management fees, and more.

Factor all these incidental expenses into your calculations before proceeding further on this strategy. Having sufficient cash reserves is vital in ensuring that cash flow is maintained as a strong positive for every quarter.

Interact with other experienced real estate investors and best mortgage for investment property with operations within the target market to determine reliable initial estimates of the carrying costs on the property.

New Financing Options

If you do not meet the criterion that would make you a good candidate for a conventional big-ticket mortgage, do not despair but look for other ways of rounding up the cash for your rental property.

Hard money loans are easier to get than a bank loan but they have higher interest and very high costs of setting up the loan. Private lending networks are a way to crowdfund your activity, as you can attract funds from several accredited investors at once.

Or you could invite investments partners to invest with you through a joint venture. Entering into a partnership with family members could also be another plan. Consult real estate legal advisors so that proper legal frameworks can be adopted in most of the partnerships.

Conclusion

While securing an investment property can be slightly less complicated than a primary mortgage, it does need more attention. Source the right professionals, effectively add up the cost and structure your debt appropriately.

Carry out relevant research before approaching the underwriting process in order to identify loan products used for the purpose of financing rental housing in the relevant market.

#investment mortgage lender#best home mortgage rates#home mortgage loans#reverse mortgage companies#home loan mortgage rates

0 notes

Text

President Trump has announced his nomination of private equity executive Bill Pulte for director of the Federal Housing Finance Agency (FHFA), the agency that sets policy for Fannie Mae and Freddie Mac, which provides government-backed guarantees of most U.S. mortgages.

Fannie Mae and Freddie Mac make homeownership cheaper by buying qualifying mortgages and taking on the risk of default, which then allows mortgage lenders to make more loans. As participants in the subprime lending bubble, Fannie and Freddie made poor choices that rendered them insolvent as independent companies during the 2008 economic crisis, so the FHFA placed them both under government conservatorship. Trump plans to remove both companies from conservatorship, and he will rely on Pulte to carry this out.

Private equity has a long track record of destroying entire industries from nursing homes to restaurants and even pet stores. Some of the worst of it is their track record in taking over huge swaths of the housing market to manipulate prices and maximize their own profits. Handing over the Federal Housing Finance Agency to a private equity executive is the housing equivalent of privatizing Medicare: great for billionaires, not so much for the rest of us.

The FHFA’s mission to enhance equitable access to housing markets clashes with private equity’s profit-maximization motives. As a private equity executive, Pulte has deep ties to the for-profit real estate industry, which has exacerbated the shortage of affordable housing and created significant conflicts of interest. Pulte is likely to favor policies that benefit corporations and big investors rather than homeowners, renters, or smaller community lenders.

Running the FHFA requires expertise in housing policy and regulatory oversight. Pulte’s own business experience does not include managing large regulatory agencies or setting policy. His experience running his family’s company does not make him an expert in regulating multi-trillion-dollar enterprises like Fannie Mae and Freddie Mac.

In private equity, decision making is dominated by the short-term making of profits through such strategies as cost-cutting or rapidly flipping assets, which can be counter-productive in the long term. FHFA’s mandate is to ensure housing affordability and stability, especially during periods of economic downturn.

The FHFA's task is to prioritize the public good over private gain. The opposite of Pulte’s priorities in the private equity world: to maximize returns for private equity firms. The public must be able to trust that the FHFA is acting in accordance with the public good, to overcome discriminatory practices such as redlining, and to create more affordable housing.

Keep Fannie Mae and Freddie Mac free of undue corporate influence. Bill Pulte has neither the regulatory expertise nor the public-minded priorities that are required to head the FHFA. Tell your senators to reject his nomination now. >>>

0 notes

Text

President Trump has announced his nomination of private equity executive and philanthropist Bill Pulte for director of the Federal Housing Finance Agency (FHFA), which sets policy for the government-sponsored mortgage companies Fannie Mae and Freddie Mac.

As the guarantors of most mortgages in the U.S., Fannie Mae and Freddie Mac provide liquidity, stability, and affordability to the mortgage market. They make loans more affordable by reducing risk for lenders and investors. Following the housing market crash in 2008, the FHFA placed both companies under conservatorship. Trump plans to remove both companies from conservatorship, and he will rely on Pulte to carry this out.

Private equity has a long track record of destroying entire industries from nursing homes to restaurants and even pet stores. Some of the worst of it is their track record in taking over huge swaths of the housing market to manipulate prices and maximize their own profits. Handing over the Federal Housing Finance Agency to a private equity executive is the housing equivalent of privatizing Medicare: great for billionaires, not so much for the rest of us.

As a private equity executive, Pulte has deep ties to the for-profit real estate industry, creating conflicts of interest, as the FHFA’s mission to enhance equitable access to housing markets may clash with profit-maximization motives. Pulte is likely to favor policies that benefit corporations and big investors rather than homeowners, renters, or smaller community lenders.

Keep Fannie Mae and Freddie Mac free of undue corporate influence. Send your Senators a direct message urging them to vote NO on Bill Pulte for Director of the FHFA.

Running the FHFA requires expertise in housing policy and regulatory oversight. Pulte’s own business experience does not include managing large regulatory agencies or setting policies. His experience running his family’s company does not grant him expertise in the technical aspects of regulating multi-trillion-dollar enterprises like Fannie Mae and Freddie Mac.

In private equity, decision making is dominated by the short-term making of profits through strategies such as cost-cutting or rapidly flipping assets, which can be counter-productive in the long term. This is very different from the FHFA’s mandate to ensure housing affordability and stability, especially during periods of economic downturn.

Similarly, Pulte’s philanthropic work, focused on individual acts of charity, is high profile but leads to short-term solutions. This is very different from the kind of public policy thinking that we need to craft long-term strategies to address the housing crisis, and make housing more affordable and accessible in markets across the country.

In general, the FHFA's task is to prioritize the public good over private gain. This is just the opposite of Pulte’s priorities in the private equity world: to maximize returns for investors. The public must be able to trust that the FHFA is acting in accordance with the public good to overcome discriminatory practices such as redlining and to create more affordable housing.

Bill Pulte has neither the regulatory expertise nor the public-minded priorities that are required to head the FHFA. Tell your senators to reject his nomination now.

@upontheshelfreviews

@greenwingspino

@one-time-i-dreamt

@tenaflyviper

@akron-squirrel

@ifihadaworldofmyown

@justice-for-jacob-marley

@voicetalentbrendan

@thebigdeepcheatsy

@what-is-my-aesthetic

@ravenlynclemens

@thegreatallie

@writerofweird

@bogleech

@anon-lephant

@mentally-quiet-spycrab

@therealjacksepticeye

0 notes

Text

7-Figure Flipping with Private Money Insights From Bill Allen and Jay Conner

Private Money Academy Conference:

Free Report:

Bill Allen, a retired Navy Test Pilot and real estate professional, is the CEO and owner of 7 Figure Flipping and host of the 7 Figure Flipping Podcast.

He leads the top house-flipping and wholesaling mentoring groups in the world. Just a few years ago, he was stuck flipping one or two houses per year and doing all the work himself, but since then, he’s built a systematized business that runs without him.

His wholesaling and flipping company, Blackjack Real Estate, is based in Nashville, TN, and does business virtually across the Southeast. Bill has been investing as a limited partner in apartment syndications since 2018. In 2020, he focused on becoming a general partner. Since then, he has grown his portfolio to over 2,000 apartment doors and has taken 18 buildings full cycle.

Timestamps

00:01 Raising Private Money Without Asking For It

05:10 Trust as Key in Real Estate

07:25 Who Invests in Newcomers?

10:27 Securing Investors with Superior Returns

15:25 Support in Career Transitioning

17:00 Seek Guidance from Bill Allen

22:52 Private Lending Stories on Social Media

26:31 Conquering Fear of Rejection

29:06 Strategic Investment Inquiry Approach

32:32 Real Estate and Investment Plans

33:39 Real Estate Investment Annuities

35:00 Connect with Bill Allen:

https://www.instagram.com/billallenrei

37:09 Private Money Investment Guide: https://www.JayConner.com/MoneyGuide.

Have you read Jay’s new book: Where to Get The Money Now?

It is available FREE (all you pay is the shipping and handling) at

What is Private Money? Real Estate Investing with Jay Conner

https://www.JayConner.com/MoneyPodcast

Jay Conner is a proven real estate investment leader. He maximizes creative methods to buy and sell properties with profits averaging $67,000 per deal without using his own money or credit.

What is Real Estate Investing? Live Private Money Academy Conference

youtube

YouTube Channel

Apple Podcasts:

Facebook:

#youtube#flipping houses#private money#real estate#jay conner#real estate investing#raising private money#real estate investing for beginners#foreclosures#passive income

0 notes

Text

How the Digital Economy is Redefining Real Estate, Debt, and Stocks: A Tech-Driven Revolution

✨ Introduction ✨

Okay, so the digital economy isn’t just a buzzword—it’s literally flipping entire industries upside down. Real estate, debt, and stocks? All getting the tech treatment thanks to blockchain, artificial intelligence (AI), and digital platforms. The vibe? Faster, smarter, and way more accessible for everyone—not just Wall Street bros or real estate moguls.

🏠 1. Real Estate, But Make It Digital 🏠

1.1 Real Estate Transactions: The Glow-Up Remember when buying or renting property felt like an endless spiral of paperwork, fees, and existential dread? Yeah, digital platforms said “Nope.” Now it’s faster, cheaper, and way less chaotic.

1.2 Tokenization: Fractional Ownership, Baby Blockchain has basically turned real estate into something you can slice like pizza. Digital tokens let you invest in a fraction of a property, so you don’t need to sell a kidney to get into the market.

1.3 Data Analytics: The Real Estate Crystal Ball 🔮 AI is out here analyzing market trends with god-tier precision. Want to know if that hip neighborhood is about to become the next big thing? AI’s got you.

💳 2. Debt, But Make It Digital 💳

2.1 DeFi: Banks? Never Heard of Them. Decentralized Finance (DeFi) is like, “Why involve banks when we have smart contracts and blockchain?” Now people can lend and borrow directly, no middlemen taking fat fees.

2.2 AI Risk Assessment: Smarter Than Your Average Banker AI scans mountains of financial data and spits out precise risk scores. Basically, lenders are getting Jedi-level intuition about who’s gonna pay them back.

2.3 Transparency: No More Shady Contracts With blockchain, debt agreements are locked in and verifiable. Fraud? Ghosted. Uncertainty? Also ghosted.

📈 3. Stocks, But Make It Digital 📈

3.1 Algorithmic Trading: Like Day Trading, But on Steroids Algorithms are running trades faster than your reflexes when you drop your phone. Precision? Check. Speed? Double-check.

3.2 Open Access: No More Gatekeeping 🗝️ Online platforms have basically democratized the stock market. You don’t need a six-figure salary or a Wall Street buddy to start investing.

3.3 Blockchain for Stocks: Trust, But Verify ✅ Every stock transaction on blockchain is locked in, transparent, and tamper-proof. Fraudsters, cry about it.

🎯 Conclusion 🎯

The digital economy isn’t coming—it’s here. Real estate, debt, and stock markets are evolving into smarter, faster, and more transparent systems. Whether you’re an investor, a borrower, or just someone curious about what’s happening, one thing’s clear: adapting to this change isn’t optional—it’s essential.

🙋♀️ FAQ Time! 🙋♂️

1. What’s property tokenization? Think of a house as a pizza. Tokenization slices it into digital pieces so more people can invest in smaller amounts.

2. How does DeFi work? It’s like borrowing money, but without a bank nosing into your business—just smart contracts and blockchain vibes.

3. What’s algorithmic trading? Super-smart software makes lightning-fast stock trades without getting emotional about market dips.

4. How does AI help with credit? AI analyzes loads of data to predict if someone’s likely to pay back a loan. Way smarter than traditional credit scoring.

5. How does blockchain make stock trading better? Every transaction is locked, transparent, and impossible to mess with. Basically, it’s bulletproof.

For more spicy insights, check out 👉 https://www.ekoketoken.com/blog ✨

#DigitalEconomy#Blockchain#AI#RealEstateTech#DeFi#StockMarket#Innovation#TechRevolution#FinanceFuture#SmartInvesting#Tokenization#AlgorithmicTrading#FinancialTransparency#DigitalTransformation#FutureOfFinance

1 note

·

View note

Text

“Quick Closings and Instant Relief: The Power of Selling for Cash”

Introduction

In today's fast-paced world, the need for quick financial solutions has never been more pressing. Whether it's due to unforeseen circumstances like medical emergencies or simply the desire to relocate without the burden of mortgage payments, individuals often find themselves in situations where traditional home selling methods just won't cut it. Enter cash sales—an increasingly popular option that offers not just expediency but significant https://truewaysellmyhousefastmiami.com/ relief from financial stress. In this article, we will explore how selling your property for cash can lead to quick closings and instant relief, highlighting its many advantages and answering common questions.

Quick Closings and Instant Relief: The Power of Selling for Cash

When we think about selling a home, the first thing that comes to mind is often an arduous process filled with paperwork, inspections, and open houses. But what if you could bypass all that hassle? Selling your home for cash allows you to do just that!

Why Choose Cash Sales?

Cash sales can drastically reduce the time involved in closing a deal. Traditional home sales typically involve waiting for buyer financing approval, which can stretch into weeks or even months. With cash sales, buyers have already secured their funds, allowing for swift transactions. This means less waiting around and more immediate relief—from both financial obligations and emotional stress.

The Process of Selling for Cash Understanding Cash Buyers

Cash buyers typically fall into two categories: individuals looking to purchase a property outright or investors seeking properties to flip or rent out. Both types of buyers appreciate the simplicity of cash transactions.

How the Process Works Initial Consultation: Sellers generally start with an initial consultation where they discuss their needs. Property Evaluation: The buyer evaluates the property condition and market value. Offer Presentation: A cash offer is made based on this evaluation. Closing Day: Once terms are agreed upon, closing can happen in as little as 7-10 days. Benefits of Quick Closings Avoiding Complex Transactions

One significant advantage of a cash sale is avoiding complex transactions involving lenders or third parties. This simplicity translates directly into faster closings.

Less Stressful Experience

Selling your home can be one of life’s most stressful experiences; however, with cash sales, many sellers report feeling relieved from day one.

youtube

youtube

Immediate Financial Relief

Receiving cash upfront means you can tackle other financial obligations immediately—be it paying off debts, covering emergency expenses, or making a fresh start elsewhere.

Common Misconceptions about Cash Sales "Cash Offers Are Always Lowball Offers"

Many sellers believe that cash buyers will always offer significantly lower prices than market value. While some investors do aim for bargains, many motivated buyers are willing to pay fair prices for the right property.

"I’ll Miss Out on Potential Profits"

0 notes

Text

" How Debt Works in the Real Estate Market: A Detailed Overview "

Debt plays a crucial role in the real estate market, influencing everything from how buyers purchase properties to how investors finance developments. Here's a comprehensive explanation of how debt functions in real estate, broken down into its various components, including the types of debt, the role of lenders, and how it impacts the broader real estate market.

1. Types of Debt in Real Estate

Debt in real estate generally falls into two categories: mortgage debt and investment debt. Each serves a different purpose but plays a pivotal role in property transactions.

A. Mortgage Debt

Mortgage debt is the most common form of debt for homebuyers and commercial property owners. When an individual or entity borrows money to purchase property, the lender holds the debt until it is repaid with interest.

B. Investment Debt

Investment debt is used by real estate investors or developers to finance the purchase or development of property. This can include:

2. How Debt Financing Works in Real Estate Transactions

In real estate transactions, debt is primarily used by individuals, developers, and companies to purchase properties they cannot afford upfront with cash.

A. Real Estate Financing Process

B. Leverage in Real Estate Investment

One of the key reasons why debt is used in real estate is leverage. Leverage refers to the use of borrowed funds to amplify potential returns on investment.

3. The Role of Lenders and Financial Institutions

Banks, credit unions, and other financial institutions are the primary sources of debt financing in real estate. They provide the capital necessary for buyers and investors to acquire properties, and they benefit by charging interest on the loans they issue.

A. Mortgage Lenders

Mortgage lenders provide loans for individuals looking to purchase homes. These can be banks, credit unions, or online lenders. The terms of the loan are set by the lender, and the borrower is required to repay the loan with interest over an agreed-upon term.

B. Commercial Lenders

Commercial lenders specialize in providing loans to businesses or real estate developers for larger commercial properties. These loans are typically more complex than residential mortgages, often involving larger sums of money, more stringent credit requirements, and shorter loan terms.

4. The Impact of Debt on the Real Estate Market

Debt affects the real estate market in several ways:

A. Housing Market Activity

B. Property Prices

Debt influences property prices because the availability of cheap financing can increase the purchasing power of buyers, driving up demand and, consequently, property prices. On the flip side, high levels of debt can also increase the risk of defaults, potentially leading to price corrections during economic downturns.

C. Investor Leverage

Real estate investors often use debt to acquire multiple properties and expand their portfolios. While leverage can amplify profits, it also increases risk. If property values fall or rental incomes decrease, highly leveraged investors may struggle to meet their debt obligations.

5. Risks of Debt in Real Estate

While debt enables real estate purchases and investments, it also comes with certain risks, especially when leverage is used. Some common risks include:

A. Default Risk

If the borrower cannot make their loan payments, the lender may initiate foreclosure, resulting in the loss of the property.

B. Interest Rate Risk

For adjustable-rate loans, changes in interest rates can lead to higher monthly payments, which may strain borrowers' finances.

C. Over-leverage

If an investor takes on too much debt relative to their income or property value, they may struggle to repay loans, particularly during market downturns.

Visual Representation

Here’s an infographic summarizing how debt works in the real estate market:

Conclusion

Debt is an essential component of the real estate market, making homeownership and investment possible for a wide range of buyers. By understanding how different types of debt work, how leverage affects returns, and the potential risks involved, individuals and investors can make informed decisions that align with their financial goals. Whether you're a homebuyer or a seasoned investor, managing debt wisely is key to thriving in the real estate market.

1 note

·

View note

Text

How to Finance Commercial Real Estate Deals in DC

Investing in commercial real estate DC offers an exciting opportunity to capitalize on the vibrant economy and diverse market of the nation’s capital. However, financing these deals can often be complex and challenging. Whether you are a seasoned investor or a newcomer to the commercial real estate market, understanding the various financing options available is crucial to success. This article will explore the diverse methods of financing commercial real estate deals in Washington DC, guiding you through the key considerations and strategies to make informed decisions.

Understanding the Financing Landscape

The first step in financing your commercial real estate deal is to understand the financing landscape. Commercial real estate is typically categorized into several types, including office buildings, retail spaces, industrial properties, and multifamily housing. Each type may require different financing structures and considerations.

When considering financing, it’s essential to evaluate your investment goals, the type of property you wish to acquire, and your financial situation. Are you looking for long-term investment potential, or are you interested in flipping properties for a quick return? Understanding your objectives will help you determine the most suitable financing options.

Traditional Bank Loans

One of the most common methods for financing commercial real estate deals in DC is through traditional bank loans. These loans are typically offered by banks and credit unions and can provide competitive interest rates and favorable terms. However, securing a traditional loan may require a solid credit history, a detailed business plan, and a substantial down payment.

When applying for a traditional bank loan, lenders will assess your creditworthiness based on your personal and business financials. They will also evaluate the property itself, including its location, potential for income generation, and overall market conditions. Having a well-prepared financial package that includes cash flow projections, property valuations, and market analysis can significantly enhance your chances of approval.

One key aspect to remember is the loan-to-value (LTV) ratio. Most lenders will require an LTV ratio of around 70-80%, meaning you will need to provide a down payment of at least 20-30% of the property’s purchase price. This not only demonstrates your commitment to the investment but also mitigates the lender's risk.

Government-Backed Loans

For investors looking for more flexible financing options, government-backed loans can be an excellent choice. The Small Business Administration (SBA) offers various loan programs tailored to help small businesses acquire commercial real estate. The SBA 7(a) and 504 loan programs are particularly popular among investors.

The SBA 7(a) loan program can be used for various purposes, including purchasing real estate, while the 504 loan program specifically focuses on financing fixed assets like commercial property. These loans often come with lower down payment requirements and longer repayment terms, making them attractive to many investors.

However, the application process for these loans can be lengthy, requiring extensive documentation and adherence to specific guidelines. It’s crucial to prepare a comprehensive business plan that outlines your investment strategy, projected cash flow, and purpose for acquiring the property to enhance your chances of approval.

Private Financing and Hard Money Loans

If traditional financing options are unavailable or not suitable for your needs, private financing is another avenue worth exploring. Private lenders, which can include individuals or investment groups, often offer loans with less stringent requirements than traditional banks. This can be particularly helpful for investors looking to secure quick funding for their commercial real estate DC investments.

Hard money loans are a subset of private financing and are secured by the property itself. These short-term loans typically have higher interest rates but can provide fast access to capital, allowing investors to act quickly in competitive markets. While hard money loans can be beneficial for short-term projects, it’s essential to have a clear exit strategy, as these loans often come with shorter repayment terms.

Equity Partnerships

Forming equity partnerships represents another effective strategy for financing commercial real estate deals. In this scenario, you partner with other investors who contribute capital in exchange for an ownership stake in the property. This arrangement allows you to reduce your financial burden while still participating in the investment.

Establishing a successful equity partnership requires careful planning and clear agreements between all parties involved. It’s crucial to define roles, responsibilities, and profit-sharing arrangements upfront to prevent misunderstandings later on. Additionally, presenting a solid business plan that outlines your investment strategy and anticipated returns will help attract potential partners.

Equity partnerships can also provide access to additional expertise and resources. Partnering with individuals who have experience in commercial real estate can enhance your chances of success and make navigating the complexities of the market easier.

Preparing Financial Documentation

Regardless of the financing option you choose, preparing comprehensive financial documentation is essential. Lenders and partners will want to see your financial history, including personal and business credit reports, tax returns, and cash flow statements. A well-prepared financial package can help demonstrate your credibility and enhance your chances of securing financing.

In addition to financial documentation, creating a detailed business plan is crucial for outlining your investment strategy. This plan should include market analysis, anticipated expenses, revenue projections, and a clear exit strategy. Presenting a solid plan instills confidence in lenders or partners, making them more likely to invest in your commercial real estate project.

Understanding the Market Dynamics

Washington DC is characterized by unique market dynamics that can significantly influence your financing decisions. Factors such as supply and demand, vacancy rates, and economic trends all play a crucial role in determining the potential success of your investment.

Conducting thorough market research will help you identify the best neighborhoods and property types for your investment. For example, certain areas may experience consistent demand for office space due to their proximity to government buildings, while neighborhoods with a growing population may offer opportunities for multifamily housing. Aligning your financing strategy with market trends can enhance your chances of achieving profitable returns.

Exploring Alternative Financing Options

In addition to the traditional financing methods mentioned, there are alternative financing options that have gained popularity in recent years. Crowdfunding platforms allow investors to pool funds from multiple individuals to finance commercial real estate projects. This approach can be particularly beneficial for those looking to invest in commercial real estate DC without taking on the full financial burden themselves.

Real estate investment trusts (REITs) also provide an opportunity for investors to enter the commercial real estate market without directly purchasing properties. REITs are companies that own, operate, or finance income-producing real estate and allow individuals to invest in them through the purchase of shares. This approach offers liquidity and diversification, appealing to those who may not want to manage properties directly.

Working with Professionals

Navigating the complexities of financing your commercial real estate deals can be overwhelming. Working with professionals can help streamline the process and ensure you make informed decisions. Consider enlisting the expertise of a commercial real estate broker, attorney, or financial advisor who specializes in real estate transactions. These professionals can provide valuable insights, assist with negotiations, and help you navigate the regulatory landscape.

Additionally, establishing relationships with lenders and financial institutions can be beneficial. A good rapport with lenders can lead to more favorable terms and quicker approvals, which can be crucial in a competitive market where timing is often everything.

Conclusion

Financing commercial real estate deals in Washington DC involves a multifaceted approach. With various options available, from traditional bank loans to equity partnerships and alternative financing methods, it is essential to assess your financial situation, investment goals, and the specific property you are considering. By understanding the financing landscape, preparing thorough documentation, and working with professionals, you can successfully navigate the complexities of commercial real estate financing.

Ultimately, the key to successful investment lies in thorough research, strategic planning, and leveraging the right resources. Washington DC offers a wealth of opportunities for savvy investors, and with the right financing strategy, you can unlock the potential of this dynamic market.

#commercial property for sale in dc#commercial real estate dc#washington dc commercial real estate#real estate agent in washington dc

0 notes

Text

Miami Real Estate Trends: The Rise of Fast Cash Sales

Introduction

In the sell my house fast vibrant and ever-evolving Miami cash home buyers landscape of Miami real estate, a significant trend has emerged that has caught the eye of investors, homeowners, and real estate agents alike: fast cash sales. As the market fluctuates and adjusts to new economic realities, understanding these trends becomes crucial for anyone looking to navigate the complex world of property buying and selling in Miami. This article will delve deep into the phenomenon of fast cash sales, exploring its rise, implications for buyers and sellers, and how it shapes the overall Miami real estate market.

Miami Real Estate Trends: The Rise of Fast Cash Sales

Fast cash sales have gained traction in Miami for several reasons. Traditionally known for its luxurious properties and high-value transactions, Miami has seen an influx of investors looking for quick turnarounds. But what exactly constitutes a fast cash sale? Simply put, it's a transaction where a buyer pays cash upfront without financing through a bank or mortgage lender. This method streamlines the buying process, allowing for quicker closings and fewer contingencies.

Why Are Fast Cash Sales on the Rise?

Several factors contribute to the growing popularity of fast cash sales in Miami:

Market Demand: With rising home prices and competitive bidding wars becoming commonplace, many buyers are opting to pay cash to enhance their purchasing power.

Investment Opportunities: Investors looking to flip properties or rent them out find that fast cash purchases allow them to act quickly in securing desirable properties.

Economic Climate: In uncertain economic times, sellers may prefer cash offers as they are typically more reliable than financed offers which can fall through.

youtube

Property Condition: Many distressed properties are sold as-is and attract buyers who can pay cash without needing extensive inspections or appraisals.

The Benefits of Fast Cash Sales

Fast cash sales offer numerous advantages:

youtube

Speed: Transactions can close in days rather than weeks or months. Less Risk: Sellers face less risk since there’s no chance of financing falling through. Negotiating Power: Cash offers often come with less negotiation back-and-forth due to their straightforward nature. Drawbacks of Fast Cash Sales

While there are clear benefits, there are also drawbacks:

Limited Buyer Pool: Sellers may restrict themselves by only considering cash buyers. Potentially Lower Offers: Some sellers may receive lower offers due to the expedited nature of cash transactions. Who is Buying with Cash?

Understanding who engages in fast cash sales is key:

Real Estate Investors: Often seeking quick flips or rental opportunities. Wealthy Individuals: Buyers looking for primary residences or vacation homes who prefer not having monthly mortgage payments. The Impact on Home Prices

Cash sales can significantly influence home prices in various ways:

Driving Up Comp

0 notes

Text

How to Negotiate a Cash Offer on a House?

Negotiating a cash offer on a house can be a bit different from negotiating a traditional offer that involves financing. While a cash offer can often be more attractive due to its simplicity and quick timeline, you still want to ensure you’re getting the best possible deal. Here are some key strategies to help you negotiate a cash offer effectively.

1. Know the Market Value of Your Home

Before entering into negotiations, it’s essential to have a clear understanding of your home’s market value. Research comparable properties (comps) in your neighbourhood, and consider getting a professional appraisal or consultation from a real estate agent. Knowing the fair market value gives you a solid foundation to determine if the cash offer is reasonable. This knowledge will help you avoid undervaluing your property and give you leverage during negotiations.

2. Understand the Buyer’s Motivation

Cash buyers are often investors, real estate companies, or individuals looking for a quick and easy transaction. Understanding their motivations can help you tailor your negotiation strategy. For example, if the buyer is an investor, they may be seeking to flip the property for profit, and their offer might reflect the cost of repairs and renovations. If they’re looking for a quick closing, they might be willing to pay a bit more for a fast and hassle-free deal. Ask the buyer why they’re interested in a cash purchase to gauge their flexibility.

3. Evaluate the Terms Beyond the Offer Price

While the cash offer price is important, it’s equally important to consider the other terms of the deal. A higher offer may come with contingencies or other conditions, such as the buyer requiring repairs or a longer closing timeline. On the other hand, a lower offer may have fewer contingencies, such as buying the property “as-is” without any additional demands. Assess the full package, including the closing date, contingencies, and any flexibility on the buyer’s side. A deal with fewer conditions might make up for a slightly lower price.

4. Don’t Be Afraid to Counteroffer

It’s a common misconception that cash offers are non-negotiable. While cash offers can be more straightforward, that doesn’t mean you have to accept the first price. If the offer is below your expectations, consider making a counteroffer. Explain the reasoning behind your price, whether it’s based on market value, upgrades you’ve made to the property, or the fact that the offer is too low to cover your costs. A reasonable counteroffer can keep the negotiation moving forward without scaring the buyer away.

5. Consider Closing Costs and Fees

In a cash transaction, closing costs are often lower than in a financed sale, as there are no lender fees involved. However, you may still have to pay other costs like title insurance, transfer taxes, and attorney fees. Be sure to factor these into the negotiations. Sometimes a buyer might offer a slightly lower price but be willing to cover some of these closing costs, which could offset the difference.

6. Be Ready to Walk Away

If the buyer’s offer doesn’t meet your expectations and there’s no room for negotiation, don’t be afraid to walk away. There are plenty of other buyers, and while a cash offer is attractive for its speed and simplicity, you shouldn’t settle for less than your home’s worth. Let the buyer know you’re considering other options, and they may be more inclined to raise their offer to stay competitive.

7. Hire a Real Estate Agent or Attorney

If you're unsure about the negotiation process, consider hiring a real estate agent or attorney who specializes in cash transactions. They can provide expert advice, negotiate on your behalf, and ensure you’re making informed decisions throughout the process. While there may be some costs associated with hiring professionals, their experience could ultimately help you get a better deal.

Conclusion

Negotiating a cash offer on your house can be a straightforward process if you approach it with knowledge and strategy. Understanding your home’s value, evaluating the full terms of the offer, and being ready to negotiate can ensure that you get a fair deal. With the right preparation and mindset, you can successfully negotiate a cash offer that meets your needs and goals.

0 notes

Text

How to Navigate the Complexities of Real Estate Investment in the USA by Experienced Real Estate Professionals like Craig Dipetrillo

Real estate investment in the United States offers lucrative opportunities but comes with its own set of challenges. From market fluctuations to legal regulations, understanding the complexities involved is crucial for both seasoned investors and newcomers. This blog will outline key steps and strategies for navigating the U.S. real estate market effectively, helping you make informed and profitable investment decisions.

Understanding the Real Estate Market

Before diving into real estate investment, it is essential to have a solid understanding of the market dynamics. The U.S. real estate market is vast, with varying conditions depending on the state, city, or even neighborhood. Urban areas may offer higher returns but come with more competition and higher initial costs, while rural locations might provide more affordable options with greater potential for long-term appreciation.

A thorough market analysis is crucial. This involves studying current trends, historical data, interest rates, and projected growth. Having knowledge of demand and supply, as well as an understanding of demographic trends, can help you choose the right investment location. Additionally, working with experienced real estate professionals like Craig Dipetrillo will provide you with valuable insights into the current market landscape.

Choosing the Right Investment Strategy

Real estate offers different investment strategies, each suited for distinct goals and risk tolerances. Common strategies include buy-and-hold investments, flipping houses, and investing in rental properties. For long-term wealth accumulation, rental properties can be an excellent choice, providing consistent cash flow while building equity. However, they also come with property management responsibilities.

For investors looking to make quicker profits, house flipping can offer high returns but involves more risk, renovation costs, and time as pointed out by real estate professionals such as Craig Dipetrillo. Another strategy is investing in Real Estate Investment Trusts (REITs), which allow you to invest in property portfolios without direct involvement in managing the assets. It’s essential to assess your risk tolerance, financial goals, and time commitment when selecting the right strategy.

Financing Your Real Estate Investment

Securing financing is often one of the most challenging aspects of real estate investment. Many investors rely on traditional mortgages, but there are other options available, including hard money loans, private lenders, and partnerships. Each financing option comes with its own terms, interest rates, and eligibility requirements.

For first-time investors, it is crucial to explore different financing methods and select one that aligns with your investment strategy. Understanding the impact of interest rates, down payments, and the overall cost of borrowing will help you make informed decisions. Moreover, building a good credit score and securing pre-approval for loans can make the financing process smoother and more efficient as noted by experienced real estate professionals including Craig Dipetrillo.

Conducting Thorough Due Diligence

One of the most critical steps in real estate investment is conducting due diligence before finalizing any deal. This involves a detailed examination of the property’s condition, legal status, financial history, and potential for growth. Investors should have properties inspected by professionals to assess structural issues, and they should review local zoning laws to avoid any legal hurdles.

Real estate professionals like Craig Dipetrillo convey that researching the property’s location and evaluating the local economy, crime rates, schools, and overall desirability are all crucial factors. Due diligence ensures that the property will not only provide a solid return on investment but also help avoid costly mistakes and unforeseen challenges in the future. Thorough research and the help of experts like real estate agents and attorneys will safeguard your investment.

Navigating Legal and Tax Implications

Investing in real estate in the USA involves understanding the legal and tax requirements, which can vary depending on the property type and location. For example, if you plan to buy rental properties, you need to comply with tenant laws, fair housing regulations, and eviction procedures. Additionally, you’ll need to account for local property taxes, which can vary widely by state and municipality.

It is also essential to understand the tax benefits and implications of real estate investment. Certain tax deductions, such as depreciation and mortgage interest deductions, can help reduce taxable income. Consulting a tax professional can help you develop strategies to minimize taxes while maximizing the potential returns from your real estate investments. Ensuring that your investment complies with all local laws is essential for protecting your financial interests and avoiding costly fines or lawsuits.

Managing and Maintaining Properties

Once you’ve acquired an investment property, effective management is crucial for maximizing returns. If you choose to rent the property, managing tenants, ensuring timely rent collection, and maintaining the property’s condition are key components of a successful investment. Many investors opt to hire property management companies to handle day-to-day tasks, especially if they have multiple properties or lack the time to manage them directly.

Regular maintenance is essential to preserving the value of your investment as underscored by experienced real estate professionals such as Craig Dipetrillo. This includes routine inspections, repairs, and addressing tenant concerns promptly. Additionally, understanding the local rental market, including rental rates and demand, will help you price your property competitively. Proper property management will keep tenants satisfied and ensure that your investment remains profitable in the long term.

Navigating the complexities of real estate investment in the USA requires a strategic approach, a solid understanding of the market, and attention to financial, legal, and management details. Whether you’re considering buying rental properties, flipping houses, or exploring alternative investment options like REITs, careful planning and due diligence are critical. By understanding the intricacies of financing, choosing the right strategy, and managing properties effectively, you can set yourself up for success in the U.S. real estate market.

0 notes