#kressin

Text

Isabella Kressin, “Girls Swimming” (2022)

Wool, laser print on silk, wax, freshwater pearls

9 x 12 inches

3 notes

·

View notes

Text

Isabella Kressin, Centaurs at the Lake, 2022, Merino wool, alpaca fiber, mulberry silk

326 notes

·

View notes

Text

PORTLAND, Ore. (KOIN) — A former Portland lawyer was sentenced to more than eight years in federal prison Monday after defrauding over 100 clients out of millions of dollars in insurance proceeds, according to the U.S. District Attorney’s Office.

Lori E. Deveny, 57, was also ordered to pay over $4.5 million in restitution to her victims.

“It’s hard to overstate the extraordinary impact Ms. Deveny’s crimes had on the many innocent and vulnerable victims who trusted her. As a former attorney, she had a special responsibility to her clients and to the public, but she repeatedly abused this trust and prioritized her own needs. This is a just sentence for serious crimes,” said Ethan Knight, Chief of the Economic Crimes Unit for the U.S. Attorney’s Office.

“The cruelest thing of all is knowingly providing false hope. Having already suffered losses, Ms. Deveny’s clients deserved an attorney who represented their best interests. What they got instead was someone who inflicted more loss,” added Special Agent in Charge Bret Kressin, IRS Criminal Investigation (IRS-CI), Seattle Field Office. “Today, Ms. Deveny is receiving what she never provided her clients: a picture of reality that those who choose to defraud will face the consequences of their actions.”

Court documents say that between April 2011 and May 2019, Deveny defrauded at least 135 of her clients out of over $3.8 million in insurance proceeds by stealing clients’ identities, forging insurance checks, depositing client funds into her personal bank account and deceiving clients continually by telling them they would eventually receive compensation for their injuries. Many of her victims were particularly vulnerable due to their severe brain and bodily injuries, the U.S. Attorney’s Office said.

Deveny’s scheme also cost Oregon State Bar Client Security Fund, Wells Fargo and the IRS, according to investigators. Due to the state bar making partial restitution payments to some of Deveny’s clients, their security fund lost $1.2 million, one of the largest losses in the organization’s history. Wells Fargo reportedly lost $52,000 due to a forged check and the IRS lost over $621,000 when Deveny didn’t report the money she stole on her tax returns.

Deveny used the proceeds to pay more than $150,000 on foreign and domestic airline tickets, more than $173,000 on African safari and big game hunting trips, $35,000 on taxidermy expenses, $125,000 on home renovations, $195,000 in mortgage payments, more than $220,000 in cigars and related expenses, $58,000 on pet boarding and veterinary costs, $41,000 on recreational vehicle expenses, $50,000 for a Cadillac vehicle, and $60,000 on stays at a luxury nudist resort in Palm Springs, Calif.

“While serving as an attorney, Ms. Deveny brazenly stole money that should have gone to pay for health care for her clients for serious injuries and ailments. Instead, that money funded things like big game hunting trips to Africa and home remodeling. She took advantage of people who were physically and emotionally hurting by forging insurance checks, stealing the funds and lying to her clients about the payouts,” said Kieran L. Ramsey, Special Agent in Charge of the FBI Portland Field Office. “These actions not only got her disbarred but are now putting her behind bars. The FBI applauds our partners at IRS-CI and the U.S. Attorney’s Office, as we continue to bring to justice those who commit this kind of unconscionable financial fraud that harms the people in our shared community.”

A grand jury returned a 24-count indictment on Deveny on May 7, 2019, charging her with mail, bank, and wire fraud, as well as aggravated identity theft, money laundering and filing a false tax return. She pled guilty to one count each of mail, wire, and bank fraud, and also plead guilty to money laundering, filing a false tax return and two counts of aggravated identity theft on June 27, 2022.

28 notes

·

View notes

Photo

Retrato de Barbara Kressin (anónimo holandés, 1544)

4 notes

·

View notes

Text

FAQs About The California Employee Retention Credit

California employers are encouraged to take advantage of the California Employee Retention Credit before it expires. But what is this tax credit? Who qualifies? Is ERC taxable in California? In this article, Dominion Enterprise Services’ CPA Skyler Kressin breaks down the ERC and how it can benefit your business.

Like many business owners, California employers were subjected to extreme challenges during 2020 and 2021 and even extending into 2022. Business operations often were fully or partially suspended due to state or local health orders, revenue swings occurred unexpectedly, labor shortages abounded, and the unknowns related to global economic conditions created a difficult environment for businesses of all stripes due to COVID-19.

In the midst of these difficult times, various federal programs were created to mitigate these challenges, including the CARES Act and the American Rescue Plan Act. Each of these had provisions for relief, such as advance payment programs or forgivable business loans such as the Payment Protection Program (PPP loan).

While many businesses took advantage of these relief provisions, the sheer volume of legislation signed into law in the last several years has resulted in some of the key relief provisions for employers to be overlooked in the effort to keep the lights on and business flowing.

One such relief provision that consistently has been overlooked was created specifically for employers who continued to pay wages and federal employment taxes throughout the official “pandemic period” (March 12, 2020, through the third quarter of 2021) in the form of an employer tax credit, officially called the Employee Retention Credit (ERC).

The good news is, for California employers specifically, this federal tax credit may be much easier to obtain than for those who own and operate businesses in other states, due to how eligibility works.

High-level Features of the ERC for California Employers:

• The credit is up to $26,000 per employee for a fully eligible employer.

• The credit is a federal refundable tax credit, meaning you can claim a refund directly in the form of a check from the IRS, and the ERC is NOT a loan or grant through a bank like the PPP.

• That said, the other relief programs, (such as the PPP) do interact with the ERC but importantly, do NOT make you ineligible for the ERC as was previously widely believed – even those who received both rounds of PPP funding are still potentially eligible for the ERC.

• The claim is made through federal payroll tax filings and entails tax calculations customarily performed by tax professionals.

• The eligible filing period for the ERC begins to expire in April 2023 as the statute of limitations for refunds begins to sunset.

Who is Eligible for the ERC?

Eligibility for the ERC is determined on a calendar quarter basis (corresponding to each federal filing period) and can be achieved in one of two ways:

1. Gross Receipts Test

Employers must show a specified percentage decline in gross receipts, quarter-over-quarter when comparing a given quarter in 2019 to the same quarter in 2020 or 2021. For example, the quarter ending December 31, 2019, compared to the quarter ending December 31, 2020, must show a specific percentage decline. Specifically, 2020 needs to show a decline of 50% in at least one quarter, and 2021 needs to show a decline of 20% in at least one quarter – BOTH compared to the equivalent quarters in 2019.

2. Trade or Business Operations Disruption Test

This test is where there may be advantages for the California Employee Retention Credit as opposed to the relative eligibility in other states. Eligibility under this test all hinges on whether direct state or local government orders restricted business operations for employers during the pandemic period. California was one of the more restrictive jurisdictions as compared to other U.S. states and localities, so ERC eligibility is more likely to be achieved for California employers than in other jurisdictions.

As with all federal legislation and tax law, there are nuances and fine print to the above eligibility tests that go beyond the scope of this article and edge cases that require parsing through grey areas. This is where working with a qualified and licensed tax professional who specializes in tax credits comes into play. Many who are otherwise eligible for the ERC may be leaving money on the table, or otherwise working off an incomplete assessment of the full scope of their eligibility.

Is ERC Taxable in California?

Another benefit of the ERC is that, in general, it is not taxable on your California income tax return, as per FTB Publication 1001. That said, given it is a federal credit, it does directly impact your federal income tax filing and may result in the need to modify your federal income tax filing.

Dominion Can Help

Dominion Enterprise Services, PLLC is a full-service licensed CPA firm, with broad experience in helping California employers with various tax credits and consulting and has broad familiarity with the Employee Retention Credit specifically for the state and local legislative and regulatory environment in California during the pandemic period.

Our model is based on a transparent assessment of the facts and circumstances of each business we work with and working with existing tax preparers and payroll providers in ensuring the maximum claim for the ERC in California is pursued under the law.

Given the unique regulatory landscape of California, don’t miss out on this opportunity to claim the California Employee Retention Tax Credit before the eligible filing period ends in April 2023. If you would like us to help with this process, please click on the button below and fill out our quick, one-minute questionnaire.

#dominion enterprise services in usa#employee retention credit for business in usa#employee retention tax credit in usa#tax consulting services in usa#new employee retention credit rules in usa

0 notes

Photo

🌟💥 Art Alert! 💥🌟 Sam Kressin Art has taken eBay by storm, and the people are speaking – LOUD and clear! Swipe ➡️ to see the RAVE reviews! But why read about it when you can experience the Kressin phenomenon firsthand? Hit that 'Follow' button on eBay for a dose of artistic anarchy as Sam unleashes original masterpieces one after the next at prices that scream 'steal'! Don't sleep on it Get a Kressin original, and let your walls do the bragging. Here's the Link; https://www.ebay.com/str/samkressinart/Original-Paintings/_i.html?store_cat=41024500010 🎨🚀

#SamKressinOnFire#ArtRevolution#eBayGold#SamKressinArt#GouachePainting#WatercolorPainting#TraditionalArtist#PaintEveryDay#Paintingbyme#DrawingByMe#DrawEveryDay#ArtistOnInstagram#quicksketchartist#sketchingart#indiaink#brushandink#OriginalArtForSale

1 note

·

View note

Text

isabella kressin

i can easily make something similar using gesso transfers and pronto-plate prints onto different paper/fabric. stock and collaging it all together....

TO BUY:

gesso,

pronto plates & solution

0 notes

Text

Scott Kressin, the founder of LeadLead, LLC, announces AI Mortgage Lead Generation Software

http://dlvr.it/Sn0qqF

0 notes

Text

Scott Kressin, the founder of LeadLead, LLC, announces AI Mortgage Lead Generation Software

http://dlvr.it/Sn0pqB

0 notes

Text

Scott Kressin, the founder of LeadLead, LLC, announces AI Mortgage Lead Generation Software

http://dlvr.it/Sn0nQx

0 notes

Text

Isabella Kressin, Fantome, 2021, Wool, mulberry silk 17 x 21.”

15 notes

·

View notes

Text

Drie keer is scheepsrecht; nieuwe cao werknemers TESO

De 130 werknemers van TESO hebben eindelijk een nieuwe cao. Nadat de leden van de vakbonden twee eerdere voorstellen van hun werkgever hadden weggestemd, gingen ze vanavond unaniem akkoord met het aangepaste voorstel. Acties bij de exploitant van de veerboot tussen Den Helder en Texel zijn nu definitief van de baan.

Lutz Kressin, bestuurder FNV Streekvervoer: ‘Ik ben echt heel trots op onze leden. Ze zijn eensgezind en vastberaden gaan staan voor hun rechten. Met als resultaat een cao die recht doet aan hun inzet. En de werkgever is met het overgrote deel van de eisen uit het ultimatum, dat de FNV op 16 juni jl. aan TESO stelde, akkoord gegaan.

Minimaal 9,75% loon erbij

Voor 2022 is een loonsverhoging van 5% afgesproken en in 2023 krijgen de werknemers er minimaal 4,75% bij. Wel met daarbij de afspraak dat als de algemene loonindex hoger uitvalt, de werkgever dit verschil aanvult.

Speciale afspraken auto-opstellers

Voor de auto-opstellers zijn extra afspraken gemaakt. Zo krijgen zij in 2022 nog eens een extra loonsverhoging van 5% en recht op een week vrij in de zomerperiode. Die laatste afspraak geldt ook voor de lokettisten. Kressin: ‘Het loon van de auto-opstellers loopt achter bij dat van hun collega’s. Met deze extra verhoging is dat verschil kleiner geworden.’

Gezond pensioen halen

Werknemers die tien jaar of langer in dienst zijn, kunnen zeven jaar voor hun AOW-leeftijd gebruikmaken van een regeling om gezond hun pensioen te halen. Dat was vijf jaar. Ze kunnen 20% minder werken, met behoud van 90% loon en 100% pensioenopbouw. En een flink aantal werknemers kan een nabetaling van de onregelmatigheidstoeslag (ORT) tegemoet zien. Kressin: ‘De werkgever heeft toegezegd dat ze dit met terugwerkende kracht, tot 2 november 2015, zullen uitbetalen.’

130 werknemers

Bij TESO werken 130 werknemers. De nieuwe cao met een looptijd van twee jaar gaat, met terugwerkende kracht, in per 1 januari 2022

Bron: FNV; foto: https://creativecommons.org/licenses/by-sa/3.0/

Read the full article

0 notes

Photo

Lambert Sustris

Portrait of Barbara Kressin, 1544

16 notes

·

View notes

Photo

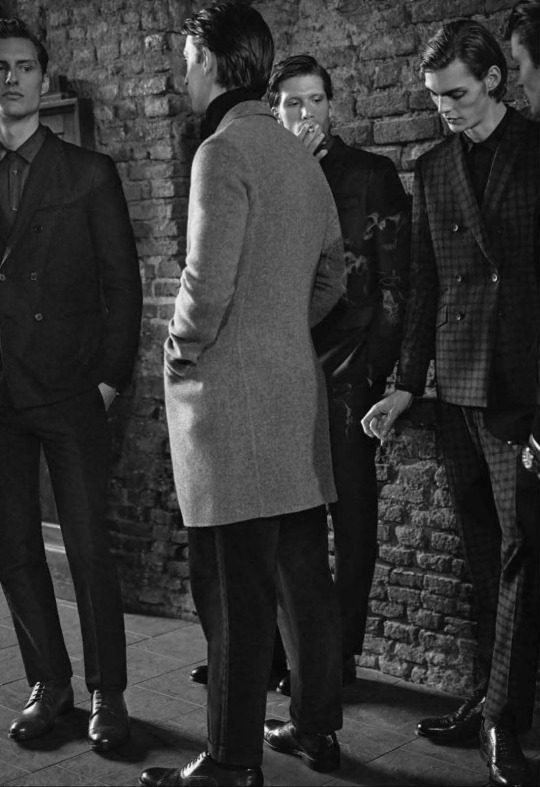

Mats Van Snippenberg, Gordon Bothe, Gianluca Albonico, Kressin & Max Townsend photographed by Tim Clark and styled by Nicolo Andreoni for GQ Italia December 2016

#mats van snippenberg#gordon bothe#gianluca albonico#kressin#max townsend#male model#tim clark#nicolo andreoni#gq italia#mens fashion#menswear#photography#model#fashion#editorial

101 notes

·

View notes