#its digital PROOF of ownership

Explore tagged Tumblr posts

Text

My thinking is that it isn't an ethics problem specifically, but a lack of a liberal arts education more generally. There's a lot of universities out there that basically only teach what the student "needs" to know for their job, with maybe some minimal gen ed requirements.

The college I went to required me, a CS major, yes to take a CS-centered ethics class, but I also had to take two semesters of a language class, and a writing-intensive class, and (had I not done it before I transferred) history and more.

I suspect that when people only study what they "need" to know for their career, it creates a kind of tunnel vision where their chosen field is a hammer and every problem that could possibly exist is a nail. Exposure to fields that are not your own really drives home how everything is complicated and how you're not qualified to "solve" every problem in the world just because you can write some code.

The AI issue is what happens when you raise generation after generation of people to not respect the arts. This is what happens when a person who wants to major in theatre, or English lit, or any other creative major gets the response, "And what are you going to do with that?" or "Good luck getting a job!"

You get tech bros who think it's easy. They don't know the blood, sweat, and tears that go into a creative endeavor because they were taught to completely disregard that kind of labor. They think they can just code it away.

That's (one of the reasons) why we're in this mess.

#and honestly if your classmates were praising crypto or NFTs#thats not because 'CS majors are lacking ethical education'#its because they're morons#because even disregarding ethics#NFTs are just fucking stupid#it's not digital ownership#its digital PROOF of ownership#which means exactly jack shit if you dont ACTUALLY own the thing#in any meaningful way

18K notes

·

View notes

Text

The Emergence of NFTs: Transforming Digital Ownership and Creativity

Non-Fungible Tokens (NFTs) have revolutionized the way we think about digital ownership, art, and collectibles. By leveraging blockchain technology, NFTs provide a way to create, buy, sell, and own unique digital assets with verifiable provenance and scarcity. This article explores the world of NFTs, their impact on various industries, key benefits and challenges, and notable projects, including a brief mention of Sexy Meme Coin.

What Are NFTs?

NFTs, or Non-Fungible Tokens, are unique digital assets that represent ownership of a specific item or piece of content, such as art, music, videos, virtual real estate, and more. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible and can be exchanged on a one-to-one basis, NFTs are indivisible and unique. Each NFT is recorded on a blockchain, ensuring transparency, security, and verifiability of ownership.

The Rise of NFTs

NFTs gained mainstream attention in 2021 when digital artist Beeple sold an NFT artwork for $69 million at Christie's auction house. This landmark event highlighted the potential of NFTs to transform the art world by providing artists with new revenue streams and collectors with verifiable digital ownership.

Since then, NFTs have exploded in popularity, with various industries exploring their potential applications. From gaming and music to real estate and fashion, NFTs are creating new opportunities for creators, businesses, and investors.

Key Benefits of NFTs

Digital Ownership: NFTs provide a way to establish true digital ownership of assets. Each NFT is unique and can be traced back to its original creator, ensuring authenticity and provenance. This is particularly valuable in the art and collectibles market, where forgery and fraud are significant concerns.

Monetization for Creators: NFTs enable creators to monetize their digital content directly. Artists, musicians, and other content creators can sell their work as NFTs, earning revenue without relying on intermediaries. Additionally, smart contracts can be programmed to provide creators with royalties each time their NFT is resold, ensuring ongoing income.

Interoperability: NFTs can be used across different platforms and ecosystems, allowing for interoperability in the digital world. For example, NFTs representing in-game items can be traded or used across multiple games and virtual worlds, enhancing their utility and value.

Scarcity and Collectibility: NFTs introduce scarcity into the digital realm by creating limited editions or one-of-a-kind items. This scarcity drives the collectibility of NFTs, similar to physical collectibles like rare coins or trading cards.

Challenges Facing NFTs

Environmental Impact: The creation and trading of NFTs, especially on energy-intensive blockchains like Ethereum, have raised concerns about their environmental impact. Efforts are being made to develop more sustainable blockchain solutions, such as Ethereum's transition to a proof-of-stake consensus mechanism.

Market Volatility: The NFT market is highly speculative and can be volatile. Prices for NFTs can fluctuate significantly based on trends, demand, and market sentiment. This volatility poses risks for both creators and investors.

Intellectual Property Issues: NFTs can raise complex intellectual property issues, particularly when it comes to verifying the rightful owner or creator of the digital content. Ensuring that NFTs are legally compliant and respect intellectual property rights is crucial.

Access and Inclusivity: The high costs associated with minting and purchasing NFTs can limit accessibility for some creators and collectors. Reducing these barriers is essential for fostering a more inclusive NFT ecosystem.

Notable NFT Projects

CryptoPunks: CryptoPunks are one of the earliest and most iconic NFT projects. Created by Larva Labs, CryptoPunks are 10,000 unique 24x24 pixel art characters that have become highly sought-after collectibles.

Bored Ape Yacht Club: Bored Ape Yacht Club (BAYC) is a popular NFT collection featuring 10,000 unique hand-drawn ape avatars. Owners of these NFTs gain access to exclusive events and benefits, creating a strong community around the project.

Decentraland: Decentraland is a virtual world where users can buy, sell, and develop virtual real estate as NFTs. This platform allows for the creation of virtual experiences, games, and social spaces, showcasing the potential of NFTs in the metaverse.

NBA Top Shot: NBA Top Shot is a platform that allows users to buy, sell, and trade officially licensed NBA collectible highlights. These video clips, known as "moments," are sold as NFTs and have become popular among sports fans and collectors.

Sexy Meme Coin (SXYM): Sexy Meme Coin integrates NFTs into its platform, offering a decentralized marketplace where users can buy, sell, and trade memes as NFTs. This unique approach combines humor and finance, adding a distinct flavor to the NFT landscape. Learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of NFTs

The future of NFTs is bright, with continuous innovation and expanding use cases. As technology advances and more industries explore the potential of NFTs, we can expect to see new applications and opportunities emerge. From virtual fashion and digital identities to decentralized finance (DeFi) and beyond, NFTs are poised to reshape various aspects of our digital lives.

Efforts to address environmental concerns, improve accessibility, and ensure legal compliance will be crucial for the sustainable growth of the NFT ecosystem. Collaboration between creators, platforms, and regulators will help build a more robust and inclusive market.

Conclusion

NFTs have ushered in a new era of digital ownership, creativity, and innovation. By providing verifiable ownership and provenance, NFTs are transforming industries ranging from art and entertainment to gaming and virtual real estate. While challenges remain, the potential benefits of NFTs and their ability to empower creators and engage communities make them a significant force in the digital economy.

For those interested in the playful and innovative side of the NFT market, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to explore this exciting project and join the community.

253 notes

·

View notes

Text

+005: Tetris Forever is marketing disguised as a documentary

CANON FIRE is made possible by the generous contributions of readers like you. Support more writing like this on Patreon. Thank you!

The latest in Digital Eclipse’s game/documentary hybrids, Tetris Forever presents a view of history that omits so much it’s nearly historical revisionism. Ironically, for a documentary about a Soviet export, Tetris Forever is more concerned with its capitalist success than anything else.

Multiple chapters are spent on the saga of Henk Rogers’ acquisition of the rights to the game, the business deals that led to its financial success, and the total ownership that the Tetris Company finally achieved.

Rogers talks about buying out the remains of the Soviet ministry of computer technology, shutting down a successful Tetris clone keychain, taking ownership of Bombliss from designer--and Pokemon founder--Tsunekazu Ishihara, and it's presented as if they were inspirational stories, not ruthless business decisions. He even adds that he paid Ishihara 100 Yen per unit, “because it was the right thing to do”, even though he legally didn’t need to.

Tetris Forever’s narrative is not the story of Tetris, but the Tetris Company. It’s a story of great men doing great things, mythmaking for people who have very literally already bought in. You can see it in the collection’s roster of games, which only includes titles developed by Bullet Proof Software, games that Rogers had a hand in directly, and are outright owned by the Tetris Company.

For as much as they hype up the Game Boy as a key to the Tetris’ worldwide success, its absence leaves a gaping hole in what’s supposed to be a historical collection. Even if it's already well known to many, its absence makes it hard to take Tetris Forever seriously as a historical archive.

Alongside Tengen Tetris, which they fought a protracted legal battle to bury, and NES Tetris, which has exploded in popularity recently with a number of world records, a growing competitive scene and a recreation in Tetris Effect, there’s several milestone releases that are not only not playable, but not given little focus in the documentary.

The greatest of these omissions is easily SEGA Tetris. While Tetris dominated the console space in the West, SEGA’s arcade entry was highly influential in Japan, becoming the de facto representative of the series there, spinning off into competitive entries, and becoming the groundwork for several fan games of the time, and eventually Tetris the Grand Master.

Together with TGM, SEGA Tetris would play a huge part in defining the “feel” of Tetris. Mechanics like lock delay, ghost pieces and wall kicks were created here, in arcades, then rolled into the official Tetris Guideline, the blueprint of what a modern Tetris game should look like. Rogers himself has said as much in other interviews.

In leaving out those entries, Tetris Forever buries a slew of other stories. The stories of how a collaboration between ex-Street Fighter devs and Japanese comedians would change the series forever, how feedback from an office lady led to a game defining mechanic, and how the game would make an international name for itself years after its release due to streaming.

Instead SEGA Tetris is limited to a single paragraph, a short video of Tetsuya Mizuguchi talking about watching it in arcades, and a summary basically saying “it’s influential” TGM and Arika are given even less, with the only comment being that TGM is known for its speed. It’s about the same level of attention as they give to the times they made Tetris cabinets that were REALLY BIG.

And where are the stories of the NES game champions? THe ridiculous limitations that make the NES version uniquely difficulty to play, the absurd techniques that players developed to get around the physical limitations of the controller they play with?

Where are the showcases of speedruns and high level competition? Why aren’t there interviews with the devs of different titles, like the experimental N64 entries from H2O Entertainment, or the composer of the CDI Tetris? Digital Eclipse had a chance to showcase the diversity of people and ideas that have touched Tetris, but all of that is barely mentioned, if at all.

Licensing was surely a factor here, but as Tetris Forever points out, the Tetris Company has fought many battles over rights. Why stop when it's time to tell your story?

Instead what we get itls historical revisionism by exclusion. A story canonizing what we already know, and leaving out the contributions of the many hands that have touched the game in the decades since its success.

Tetris Forever would have you believe that's Tetris’ success is the story of Alexi Pajitnov discovering a diamond, and Henk Rogers convincing everyone it was valuable. But a gem's value isn't in its raw material but the refining process--something I'm sure the son of a gem merchant like Rogers would know.

Tetris’ refinements have come as a result of decades of community contributions. From fans making works in both official and unofficial capacities. Tetris is the story of a conversation between a game and its players. It's a cultural phenomenon built by many hands.

Perhaps, comrades, that's the real legacy of what they once called THE SOVIET MIND GAME.

22 notes

·

View notes

Text

The Open Art Guild Project: a proposal to empower collectively owned art

Over the last few decades we have seen the degradation of copyright, the blatant manipulation of intellectual property law in order to monopolise wealth and the exploitation of artists in favour of an economy of artistic landlordship: massive corporations holding the prole artist hostage to their increasingly unoriginal library of content produced not to encourage creative enlightenment, but to hold on to properties that ought to be already in the public domain. The capitalist owns the IP, so the capitalist keeps getting richer, while the artist is more and more oppressed, overworked, underpaid, scammed out of their rightful intellectual property, deplatformed, and automated away whenever possible. This is unsustainable, and the arrival of new technologies for digital art automation has overflowed that unsustainability to its breaking point. We cannot continue down this path.

The Open Art Guild is my proposal to remedy this. This proposal consists of two main parts: a copyright standard, designed for the fair distribution of income and the collective ownership of intellectual property; and a distribution platform, planned to empower artists big and small to profit from said intellectual property without being under the thumb of corporations or fighting one another under senseless infighting caused by bourgeois class warfare. The artist should not fight the artist over ownership of rights. The big artist should not see the small artist as a threat, nor should the small artist see the big artist as an obstacle to their own growth. Through mutual empowerment, both may prosper.

The Open Art Guild License

The Open Art Guild License is built upon the current Creative Commons 4.0 License. This license is irrevocable until the work qualifies for public domain according to all relevant legislations, provided that the artist remains a member of the Guild. In order to participate in the Guild, an artist shall follow the following precepts:

The artist shall only publish works under the OAG License that have licenses available to the public. This means public domain, open source, Creative Commons and works created by other members of the Guild. Works derived from privately owned media, such as fanart of intellectual properties not part of the Guild, shall be excluded from the Guild. If the artist did not have permission to use it before, or if the artist only has individual permission, the work will not qualify for Guild submission.

All works created under the OAG License shall be free to adapt, remix, or reuse for other projects, even commercially, provided that the artist doing so is also an active member of the Guild, that the projects derived from it are also under the OAG License, and that the artist follows through with their dues and obligations.

Whenever the format permits, the artist shall provide the assets used for the works in their raw form in a modular fashion, including colour palettes, sound assets, video footage, code, screenplays, subtitles, and any other elements used in the creation of their work, in order to facilitate their reuse and redistribution for the benefit of all other artists.

The artist waives their right to 30% of the total profit generated by works submitted to the guild, regardless of where it is published. This revenue shall be redistributed in the following manner:

10% shall be designated towards the maintenance of the Open Art Guild platform. In absence of a platform that follows the requirements to belong to the Guild, this percentage shall be donated towards a nonprofit organisation of their own choosing dedicated to the protection and distribution of art in any of its forms. Some examples may include Archive.org, Archive Of Our Own, Wikimedia, or your local art museum or community center. Proof of donation shall be made publicly available. The artist shall empower the Guild, as the Guild has empowered the artist.

10% shall be designated towards the Open Art Guild legal fund. In the absence of a fund dedicated to the protection of the OAG, this percentage shall be donated towards a nonprofit organisation dedicated to the protection of the legal rights of artists in any of their forms. Some examples may include Creative Commons, the Electronic Frontier Foundation, the Industrial Workers of the World, or another artist union like the WGA. Proof of donation shall be made publicly available. The artist shall protect the Guild, as the Guild shall protect the artist.

10% shall be designated towards the Open Art Guild creator fund. In the absence of a fund dedicated to redistribute the profits of the OAG, this percentage shall be donated to other members of the Guild, prioritising small creators. Alternatively, it may be directed towards the recruitment of new members to the Guild via donation and an invite. Proof of donation shall not be required, but the receiving artist(s) is(are) encouraged to declare in their own platform that the donation was received. The artist shall give to the Guild, as the Guild has given to the artist.

The artist shall continue to create Guild submissions for the duration of their membership, with a minimum of one submission per month in order to guarantee their continued support. The artist shall live off of labour, not property.

In return for these duties, the artist shall receive:

Permission to adapt, remix, or reuse any of the works in the Guild’s archive for their own derivative works, fan fiction, remixes, collages, or any sort of transformative application, provided dues and obligations are in order.

Protection of their intellectual property as part of the collective works of the Guild by the legal fund designated and sustained by all paying members, to prevent non Guild members from trying to exploit their works unauthorised.

If an artist strikes a deal for non-Guild adaptation, the proportional dues shall also be paid to the Guild fund and members by the non-Guild institution in charge. Said deal shall not be allowed an exclusivity clause, and all works derived from a Guild work shall follow through with their dues in perpetuity. If the non-Guild entity chooses to terminate the business relationship, all intellectual property rights over the adaptation shall irrevocably be granted to the Guild as compensation, guaranteeing the distribution to the creators and the legal fund, as well as the follow-through with whatever payment terms the Guild artist has agreed to.

No Guild artist shall prosecute another Guild artist for use of works under the OAG License, provided that the derivative work also follows the OAG License terms. If these terms are violated, amicable resolution shall be sought by both parties. If litigation becomes inevitable and compensation is required, said compensation will also require the 30% dues to fund the Guild and its members, no matter which way it sides. In no case shall an artist, Guild or non-Guild, be left without recourse.

If an artist becomes unable or unwilling to continue to pay their dues, the artist shall be given an option to suspend or cancel their membership. If a membership is suspended, the artist will be excluded from the creator fund until their dues are renewed. No compensation shall be required of the artist for the suspension period, and all protections other than the creator fund shall still apply. If a membership is cancelled, all works published by the artist under the OAG License shall automatically be granted a Creative Commons 4.0 License instead, in order to protect Guild members from litigation by non-Guild members.

Membership that has been cancelled shall be renewable at any time, provided that the former Guild artist has not engaged in predatory litigation against Guild member or the Guild itself. The Guild shall determine what constitutes predatory litigation on a case-by-case basis. Licenses that were lost during cancellation shall not be given back, as CC4.0 is irrevocable, but new works shall still qualify for OAG Licenses.

These protections shall not be conditional to the artist’s moral values or the content of the works created. All works that do not break the laws applicable to the jurisdiction from which they were submitted shall be treated with the same respect and granted the same rights and obligations, in perpetuity and throughout time and space within the known multiverse. The Guild shall not exist to police art, but to promote it.

Open Art Guild License Template

All submissions of Guild works and projects shall include the following legend, both in English and in the publication language when applicable. Point 4 may be omitted if the artist chooses not to submit the work for dataset training.

This work was created and published under the Open Art Guild license, and has been approved for reuse and adaptation under the following conditions:

For personal, educational and archival use, provided any derivative works also fall under a publicly open license, to all Guild members and non members.

For commercial use, provided redistribution guidelines of the Guild be followed, to all active Guild members.

For commercial use to non Guild members, provided any derivative works also fall under a publicly open license, with the explicit approval of the artist and proper redistribution of profit following the guidelines of the Guild.

For non commercial dataset training of open source generative art technologies, provided the explicit consent of the artist, proper credit and redistribution of profit in its entirety to the Guild.

Shall this work be appropriated by non Guild members without proper authorisation, credit and redistribution of profit, the non Guild entity waives their right to intellectual property over any derivative works, copyrights, trademarks or patents of any sort and cedes it to the Creative Commons, under the 4.0 license, irrevocably and unconditionally, in perpetuity, throughout time and space in the known multiverse. The Guild reserves the right to withhold trade relations with any known infractors for the duration its members deem appropriate, including the reversal of any currently standing contracts and agreements.

#Open Art Guild#OAG#intellectual property#copyright law#ip law#fair use#open source#creative commons#public domain#anti capitalist#worker solidarity#collective action#redistribution of wealth#class solidarity#late stage capitalism#wga strong#sag strike#anti ai#generative art#artificial intelligence#fan art#fandom

22 notes

·

View notes

Text

“Now, the Best Should Be Our Standard” — Col. Rajyavardhan Rathore

In a world where mediocrity is often tolerated, the call to elevate our standards is both timely and essential. Col. Rajyavardhan Rathore’s statement, “Now, the best should be our standard,” is more than just a motivational slogan — it’s a vision for a future built on excellence, innovation, and unwavering commitment to progress.

This philosophy extends to every sphere of life, from governance and infrastructure to individual aspirations and community development. Let’s explore what this powerful statement means and how it can serve as a guiding principle for growth.

The Pursuit of Excellence: Why It Matters

Striving for “the best” is not just about achieving success; it’s about setting benchmarks that inspire others and create a ripple effect of progress. Here’s why adopting excellence as a standard is crucial:

Fostering Innovation: When we aim for the best, we push the boundaries of what’s possible, encouraging creativity and breakthroughs.

Building Trust: High standards in public service and governance earn the trust and respect of citizens, laying the foundation for a stronger society.

Driving Sustainable Development: Excellence ensures that resources are utilized effectively, resulting in long-term benefits for communities.

Inspiring Generations: A culture of striving for the best motivates future generations to dream bigger and achieve more.

Leading by Example: Col. Rajyavardhan Rathore’s Vision

As a leader, Col. Rajyavardhan Rathore embodies the principle of setting and meeting high standards. His initiatives in various sectors reflect a relentless commitment to bettering lives and ensuring that the communities he serves have access to the very best.

Take, for example, the installation of hand pumps in Jhotwara. While this may seem like a basic need, the approach to ensuring quality and sustainability underscores his vision of excellence. It’s not just about installing pumps — it’s about building a resilient and reliable system that truly serves the people.

Applying “The Best Standard” in Key Areas

Education: Providing world-class education ensures that young minds are equipped to compete on a global stage. From upgrading school infrastructure to introducing cutting-edge digital learning tools, the best should be the benchmark in shaping future leaders.

Healthcare: Accessible, high-quality healthcare can transform lives. By improving hospitals, equipping them with the latest technologies, and training medical professionals to excel, we can ensure the well-being of every citizen.

Infrastructure Development: Projects like roads, public facilities, and water systems must not only meet the immediate needs of the community but also be durable and future-proof. The best standard in infrastructure goes beyond functionality — it ensures efficiency, sustainability, and aesthetic value.

Sports and Youth Development: As a former Olympic medalist, Col. Rathore knows the value of excellence in sports. Investing in world-class training facilities, coaching, and talent identification programs can help young athletes achieve their full potential.

Governance and Public Service: Transparency, accountability, and responsiveness should define governance. The best standard here means a government that is not just functional but transformative, empowering citizens at every level.

Challenges to Overcome

Achieving excellence is not without its hurdles. Limited resources, resistance to change, and deeply ingrained practices of settling for “good enough” are common barriers. However, these challenges can be addressed through:

Visionary Leadership: Inspiring individuals and teams to align with a shared goal of excellence.

Community Engagement: Encouraging citizens to take ownership and actively participate in raising standards.

Leveraging Technology: Using advanced tools and systems to optimize efficiency and outcomes.

A Call to Action

Adopting “the best” as our standard is not an overnight transformation — it’s a collective journey. It begins with mindset shifts, where every individual, organization, and institution takes pride in aiming higher and delivering better.

Whether it’s in public service, education, sports, or personal goals, Col. Rathore’s words challenge us to rethink what we accept as “good enough” and instead pursue greatness. This pursuit will not only elevate individual achievements but also strengthen the fabric of our society as a whole.

The Legacy of Excellence

When the best becomes our standard, we don’t just achieve more — we inspire more. We create a culture where progress is continuous, where quality is non-negotiable, and where every effort contributes to a brighter future.

Col. Rajyavardhan Rathore’s vision is a powerful reminder that true leadership is about setting examples, raising the bar, and ensuring that no one is left behind in the pursuit of excellence. It’s a call for all of us to aim higher and do better — for ourselves, for our communities, and for generations to come.

So let’s make “the best” our standard, not just in words, but in every action we take. Together, we can build a future that lives up to this ideal.

4 notes

·

View notes

Text

NFTs: Redefining Art in the Digital Era

Art has always been a mirror to the world—a timeless reflection of culture, emotion, and imagination. As we step into the digital age, art is evolving beyond physical boundaries, and NFTs are at the forefront of this transformation. At Shottokee, we’re building a bridge between artists and collectors, empowering them to explore a world where creativity meets innovation.

The Rise of NFTs

NFTs (Non-Fungible Tokens) are more than just digital collectibles—they’re a revolution in how we perceive ownership, creativity, and value. Unlike traditional art, NFTs live on the blockchain, ensuring authenticity, transparency, and permanence.

At Shottokee, we curate NFT art that stands out. Each piece is unique, designed to resonate emotionally while showcasing the limitless potential of digital creativity.

Why NFTs Matter

NFTs empower creators and collectors alike:

For Artists: NFTs offer a new platform for expression and financial independence, with built-in royalties ensuring artists earn from every sale.

For Collectors: NFTs provide a chance to own rare, one-of-a-kind pieces that are verifiably authentic and future-proof.

For the World: NFTs are reshaping how we interact with art, making it more inclusive, accessible, and boundary-breaking.

At Shottokee, our mission is simple: to celebrate creativity and connect it with those who value it most. We’re more than a marketplace—we’re a community where innovation thrives, and art finds its rightful place in the digital realm.

The art world is changing, and NFTs are leading the way. Whether you’re an artist, a collector, or someone curious about the intersection of art and technology, Shottokee is here to guide you on this journey. Let’s redefine what it means to create, collect, and cherish art.

2 notes

·

View notes

Text

Rocket Spin: Redefining the Boundaries of Digital Play

Introduction

In the ever-evolving landscape of digital entertainment, few platforms have had as profound an impact as Rocket Spin. With a vision that goes beyond conventional gaming, Rocket Spin is redefining what it means to play in the digital age. Through innovative technology, immersive experiences, and a commitment to pushing the boundaries, Rocket Spin is setting new standards for the future of online gaming.

1. Breaking New Ground with Innovative Technology

AI-Driven Personalization

Rocket Spin stands at the forefront of gaming innovation with its use of artificial intelligence (AI). The platform leverages AI to analyze player behavior and preferences, offering personalized gaming experiences that adapt in real-time. This level of customization ensures that every player’s journey is unique, providing a tailored experience that keeps gamers engaged and satisfied.

Virtual Reality (VR) for Total Immersion

Rocket Spin is pioneering the use of virtual reality (VR) in gaming, creating fully immersive environments that transport players beyond the screen. With VR, players can explore new worlds, interact with characters, and experience games in ways that feel incredibly real. This cutting-edge technology is redefining the boundaries of what’s possible in digital play, offering experiences that are as captivating as they are groundbreaking.

2. Expanding the Horizons of Gaming

An Unmatched Game Library

Rocket Spin offers an extensive library of games that cater to all types of players. From high-intensity slots and live dealer games to intricate strategy games and VR adventures, the platform has something for everyone. Each game is designed with top-tier graphics, engaging narratives, and smooth gameplay, ensuring that players have access to the best that digital gaming has to offer.

Cross-Platform Integration

Understanding the importance of flexibility in today’s digital world, Rocket Spin ensures that its games are accessible across multiple devices. Whether you’re on a desktop, mobile, or VR headset, Rocket Spin provides a seamless experience, allowing players to enjoy their favorite games anytime, anywhere.

3. A New Standard of Fairness and Security

Blockchain-Powered Transparency

In an industry where trust is crucial, Rocket Spin utilizes blockchain technology to ensure transparency and security. Blockchain provides a tamper-proof record of all transactions and digital asset ownership, giving players confidence in the fairness and integrity of the platform. This commitment to security sets a new standard in the gaming industry, making Rocket Spin a trustworthy and reliable platform for all gamers.

Advanced Anti-Cheating Measures

Rocket Spin employs advanced anti-cheating systems to maintain a fair gaming environment. These systems detect and prevent fraudulent activities, ensuring that all players compete on an even playing field. This focus on fairness is integral to Rocket Spin’s mission of providing a gaming experience that is both enjoyable and just.

4. Building a Thriving Digital Community

Social Features that Connect Players

Rocket Spin goes beyond just providing games; it fosters a vibrant community where players can connect, share, and compete. With features like live chat, multiplayer games, and community-driven events, Rocket Spin Casino creates a social environment that enhances the gaming experience. This emphasis on community building is key to Rocket Spin’s success, turning gaming into a shared adventure rather than a solitary activity.

Player-Driven Content and Development

Rocket Spin actively involves its community in the development process, listening to feedback and implementing changes that reflect the desires of its players. This player-driven approach ensures that the platform evolves in line with the needs and preferences of its community, keeping Rocket Spin at the cutting edge of digital gaming.

Conclusion

Rocket Spin is not just a gaming platform; it’s a movement that is redefining the boundaries of digital play. By integrating innovative technology, expanding the horizons of gaming, ensuring fairness and security, and building a thriving community, Rocket Spin is setting new standards for what online gaming can be. As the digital landscape continues to evolve, Rocket Spin will undoubtedly remain at the forefront, leading the way into the future of gaming.

3 notes

·

View notes

Text

Understanding Blockchain Technology: Beyond Bitcoin

Introduction

Blockchain technology, often synonymous with Bitcoin, is a revolutionary system that has far-reaching implications beyond its initial use in cryptocurrency. While Bitcoin introduced the world to the concept of a decentralized ledger, blockchain's potential extends well beyond digital currencies. This article explores the fundamentals of blockchain technology and delves into its various applications across different industries.

What is Blockchain Technology?

At its core, blockchain is a decentralized, distributed ledger that records transactions across many computers in such a way that the registered transactions cannot be altered retroactively. This ensures transparency and security. Each block in the chain contains a list of transactions, and once a block is completed, it is added to the chain in a linear, chronological order.

Key features of blockchain include:

Transparency: All participants in the network can see the transactions recorded on the blockchain.

Immutability: Once data is recorded on the blockchain, it cannot be altered or deleted.

Security: Transactions are encrypted, and the decentralized nature of blockchain makes it highly secure against hacks and fraud.

Blockchain Beyond Bitcoin

While Bitcoin brought blockchain into the spotlight, other cryptocurrencies like Ethereum and Ripple have expanded its use cases. Ethereum, for example, introduced the concept of smart contracts—self-executing contracts where the terms are directly written into code. These smart contracts enable decentralized applications (DApps) that operate without the need for a central authority.

Applications of Blockchain Technology

Finance:

Decentralized Finance (DeFi): DeFi platforms leverage blockchain to create financial products and services that are open, permissionless, and transparent. These include lending, borrowing, and trading without intermediaries.

Cross-border Payments: Blockchain simplifies and speeds up cross-border transactions while reducing costs and increasing security.

Fraud Reduction: The transparency and immutability of blockchain make it harder for fraud to occur, as all transactions are visible and verifiable.

Supply Chain Management:

Tracking and Transparency: Blockchain provides end-to-end visibility of the supply chain, ensuring that all parties can track the movement and origin of goods.

Reducing Fraud: By recording every transaction, blockchain helps prevent fraud and counterfeiting, ensuring the authenticity of products.

Healthcare:

Secure Data Sharing: Blockchain allows for secure sharing of patient data between healthcare providers while maintaining privacy and consent.

Drug Traceability: Blockchain helps track pharmaceuticals through the supply chain, reducing the risk of counterfeit drugs.

Voting Systems:

Secure Elections: Blockchain can provide a transparent and tamper-proof system for voting, ensuring that each vote is recorded and counted accurately.

Increasing Voter Participation: The security and convenience of blockchain-based voting could lead to higher voter turnout and greater confidence in electoral systems.

Real Estate:

Property Transactions: Blockchain can streamline property transactions by reducing paperwork, ensuring transparency, and preventing fraud.

Record-Keeping: Immutable records of property ownership and transactions enhance security and trust in the real estate market.

Challenges and Limitations

Despite its potential, blockchain technology faces several challenges:

Scalability: The ability of blockchain networks to handle a large number of transactions per second is limited, impacting its adoption in high-volume industries.

Energy Consumption: Blockchain, particularly proof-of-work systems like Bitcoin, requires significant energy, raising concerns about its environmental impact.

Regulatory Challenges: The decentralized and borderless nature of blockchain poses regulatory and legal challenges, as governments and institutions seek to manage and control its use.

The Future of Blockchain Technology

The future of blockchain looks promising, with continuous advancements and innovations. Potential developments include improved scalability solutions like sharding and proof-of-stake consensus mechanisms, which aim to reduce energy consumption and increase transaction speeds. As blockchain technology matures, its adoption across various industries is expected to grow, potentially transforming the way we conduct business, manage data, and interact with digital systems.

Conclusion

Blockchain technology, initially popularized by Bitcoin, holds immense potential beyond cryptocurrencies. Its applications in finance, supply chain management, healthcare, voting, and real estate demonstrate its versatility and transformative power. While challenges remain, ongoing innovations and growing interest in blockchain suggest a future where this technology plays a crucial role in various aspects of our lives.

#blockchain#Bitcoin#blockchaintechnology#cryptocurrency#decentralizedfinance#DeFi#supplychain#healthcare#votingsystems#realestate#blockchainapplications#smartcontracts#DApps#digitalledger#blockchainsecurity#blockchainfuture#blockchainadoption#techinnovation#financial education#financial empowerment#financial experts#finance#digitalcurrency#unplugged financial#globaleconomy

4 notes

·

View notes

Text

Interview with an employee of the IT company CarbonFive

Journalist: Good morning, please introduce yourself and tell us about your position at CarbonFive.

CarbonFive employee: Good morning! My name is Michael and I am a Product Development Manager at CarbonFive. My work is related to the study of information technology and user engagement.

Journalist: We are glad that you found time for our interview. Let's start by discussing current issues. Which, in your opinion, are the most significant in the field of information security now?

Michael: Thanks for the interesting question. One of the key problems that worries many users today is the need to confirm authorship of files. The amount of digital materials is growing every day, and it is important to have tools to protect copyrights.

Journalist: This is a really important topic. Is there today a demand for developing a product that would solve this problem?

Michael: Yes, providing proof of authorship on files is really of interest to many users and companies. We see a growing demand for applications that make it easy and secure to prove ownership of digital data.

Journalist: Does your company have plans to develop such an application?

Michael: We understand the importance of this problem and are monitoring its dynamics. Currently, our company is focused on other projects and areas of development. Although we have no plans to develop such an application in the near future, we are always willing to consider new ideas and requests from our users in the future.

Journalist: Thank you for your honest answer, Michael! Your openness is a wonderful quality. We will follow your new projects and wait for interesting news from your company!

2 notes

·

View notes

Text

The Crypto Revolution: Decoding the Secrets of Digital Money

Introduction:

In recent years, the world has witnessed an unprecedented revolution in the realm of finance with the emergence of cryptocurrencies. Digital money, led by Bitcoin and a multitude of other cryptocurrencies, has disrupted traditional financial systems and ignited a wave of innovation and speculation. Here are the best Local Bitcoin Clone Services of 2023.

As the crypto revolution continues to reshape our understanding of money, it becomes essential to unravel the secrets behind this transformative technology. Join us on a journey as we decode the mysteries of digital money and explore the implications it holds for the future of finance.

Chapter 1: Money Redefined 1.1

The Evolution of Currency: From Barter to Fiat 1.2 The Rise of Cryptocurrencies 1.3 Understanding the Concept of Digital Money 1.4 The Advantages and Challenges of Cryptocurrencies

Chapter 2: Blockchain:

The Backbone of Digital Money 2.1 Demystifying Blockchain Technology 2.2 Decentralization: The Power Shift 2.3 Security and Transparency in the Blockchain 2.4 Smart Contracts: Automating Trust

Chapter 3: Bitcoin:

The Pioneer 3.1 The Enigma of Satoshi Nakamoto 3.2 The Birth of Bitcoin 3.3 Mining and the Proof-of-Work Consensus 3.4 Bitcoin's Influence on the Cryptocurrency Ecosystem

Chapter 4: Altcoins and Tokenomics 4.1

Diversifying the Crypto Landscape 4.2 Ethereum and the Rise of Smart Contracts 4.3 Initial Coin Offerings (ICOs) and Token Sales 4.4 Utility Tokens vs. Security Tokens

Chapter 5: Crypto Exchanges and Trading 5.1

Centralized vs. Decentralized Exchanges 5.2 Trading Strategies and Market Volatility 5.3 Wallets and Security Best Practices 5.4 The Role of Regulation in Crypto Trading

Chapter 6: Decentralized Finance (DeFi) 6.1

Unleashing the Potential of Decentralized Finance 6.2 Decentralized Lending and Borrowing 6.3 Automated Market Making and Decentralized Exchanges 6.4 Yield Farming and Staking

Chapter 7: NFTs and the Digital Ownership Revolution 7.1

Non-Fungible Tokens (NFTs): Beyond Cryptocurrency 7.2 The Impact of NFTs on Art, Gaming, and Collectibles 7.3 Tokenizing Real-World Assets with NFTs 7.4 Challenges and Future Prospects of NFTs

Chapter 8: The Future of Digital Money 8.1

Central Bank Digital Currencies (CBDCs) 8.2 Interoperability: Bridging Blockchain Networks 8.3 Privacy and Security Enhancements 8.4 The Socioeconomic Impacts of Cryptocurrencies

Conclusion:

As we conclude our exploration of The Crypto Revolution and its secrets, we discover a world where digital money challenges the status quo and empowers individuals with newfound financial freedom. From blockchain's transformative potential to the rise of Bitcoin, altcoins, DeFi, and NFTs, cryptocurrencies are rewriting the rules of money and ownership.

However, the road ahead is not without challenges, including regulatory uncertainties and technological limitations. Nonetheless, the potential for a more inclusive, transparent, and efficient financial system is within reach. As we stand on the cusp of a new era, the secrets of digital money continue to unfold, leaving us eager to witness the future of finance.

2 notes

·

View notes

Text

The Expansive World of Altcoins: Exploring the Diversity Beyond Bitcoin

Bitcoin, the original cryptocurrency, has long dominated headlines and market discussions. However, the world of digital currencies is vast and diverse, with thousands of alternative coins, or altcoins, each offering unique features and value propositions. Altcoins encompass a broad range of projects, from utility tokens and stablecoins to meme coins and more. This article delves into the rich ecosystem of altcoins, highlighting their significance, various types, and the innovative projects that make up this vibrant space, including a mention of Sexy Meme Coin.

Understanding Altcoins

The term "altcoin" refers to any cryptocurrency that is not Bitcoin. These coins were developed to address various limitations of Bitcoin or to introduce new features and use cases. Altcoins have proliferated since the creation of Bitcoin in 2009, each aiming to offer something different, whether it be improved transaction speeds, enhanced privacy features, or specific utility within certain ecosystems.

Categories of Altcoins

Utility Tokens: Utility tokens provide users with access to a specific product or service within a blockchain ecosystem. Examples include Ethereum's Ether (ETH), which is used to power applications on the Ethereum network, and Chainlink's LINK, which is used to pay for services on the Chainlink decentralized oracle network.

Stablecoins: Stablecoins are designed to maintain a stable value by being pegged to a reserve of assets, such as fiat currency or commodities. Tether (USDT) and USD Coin (USDC) are popular stablecoins pegged to the US dollar, offering the benefits of cryptocurrency without the volatility.

Security Tokens: Security tokens represent ownership in a real-world asset, such as shares in a company or real estate. They are subject to regulatory oversight and are often seen as a bridge between traditional finance and the blockchain world.

Meme Coins: Meme coins are a playful and often humorous take on cryptocurrency, inspired by internet memes and cultural trends. While they may start as jokes, some have gained significant value and community support. Dogecoin is the most famous example, but many others, like Shiba Inu and Sexy Meme Coin, have also captured the public's imagination.

Privacy Coins: Privacy coins focus on providing enhanced privacy features for transactions. Monero (XMR) and Zcash (ZEC) are notable examples, offering users the ability to transact anonymously and protect their financial privacy.

The Appeal of Altcoins

Altcoins offer several advantages over Bitcoin, including:

Innovation: Many altcoins introduce new technologies and features, driving innovation within the cryptocurrency space. For example, Ethereum introduced smart contracts, enabling decentralized applications (DApps) and decentralized finance (DeFi) platforms.

Specialization: Altcoins often serve specific niches or industries, providing targeted solutions that Bitcoin cannot. For instance, Ripple (XRP) focuses on facilitating cross-border payments, while Filecoin (FIL) aims to create a decentralized storage network.

Investment Opportunities: The diverse range of altcoins presents numerous investment opportunities. Investors can diversify their portfolios by investing in projects with different use cases and growth potentials.

Notable Altcoins in the Market

Ethereum (ETH): Ethereum is the second-largest cryptocurrency by market capitalization and has become the backbone of the DeFi and NFT (Non-Fungible Token) ecosystems. Its smart contract functionality allows developers to create decentralized applications, leading to a thriving ecosystem of financial services, games, and more.

Cardano (ADA): Cardano is a blockchain platform focused on sustainability, scalability, and transparency. It uses a proof-of-stake consensus mechanism, which is more energy-efficient than Bitcoin's proof-of-work. Cardano aims to provide a more secure and scalable infrastructure for the development of decentralized applications.

Polkadot (DOT): Polkadot is designed to enable different blockchains to interoperate and share information. Its unique architecture allows for the creation of "parachains," which can operate independently while still benefiting from the security and connectivity of the Polkadot network.

Chainlink (LINK): Chainlink is a decentralized oracle network that provides real-world data to smart contracts on the blockchain. This functionality is crucial for the operation of many DeFi applications, making Chainlink a vital component of the blockchain ecosystem.

Sexy Meme Coin: Among the meme coins, Sexy Meme Coin stands out for its combination of humor and innovative tokenomics. It offers a decentralized marketplace where users can buy, sell, and trade memes as NFTs (Non-Fungible Tokens), rewarding creators for their originality. Learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of Altcoins

The future of altcoins looks promising, with continuous innovation and increasing adoption across various industries. As blockchain technology evolves, we can expect altcoins to introduce new solutions and disrupt traditional systems. However, the market is also highly competitive, and not all projects will succeed. Investors should conduct thorough research and due diligence before investing in any altcoin.

Conclusion

Altcoins represent a dynamic and diverse segment of the cryptocurrency market. From utility tokens and stablecoins to meme coins and privacy coins, each category offers unique features and potential benefits. Projects like Ethereum, Cardano, Polkadot, and Chainlink are leading the way in innovation, while niche coins like Sexy Meme Coin add a layer of cultural relevance and community engagement. As the cryptocurrency ecosystem continues to grow, altcoins will play a crucial role in shaping the future of digital finance and blockchain technology.

For those interested in the playful and innovative side of the altcoin market, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to explore this exciting project and join the community.

107 notes

·

View notes

Text

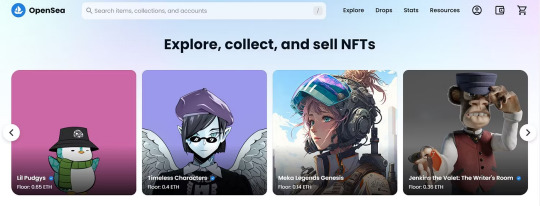

The 5 Best Marketplaces to Mint an NFT for Free in 2023

Readers like you help support MUO. When you make a purchase using links on our site, we may earn an affiliate commission. Read More.

NFTs are all the rage, with many crypto enthusiasts looking for the next big project to invest in. Non-fungible tokens are simply unique tokens that you can use to verify an individual’s ownership of a digital asset, such as artwork.

Minting an NFT means turning a digital file into a digital asset and launching it on the Ethereum blockchain. The digital asset is then stored on the blockchain and nobody can then remove or modify it. Before you mint an NFT, it’s important to choose a viable marketplace. There are several NFT marketplaces that you can choose from, including those that offer free minting options.

1. OpenSea

OpenSea is a popular NFT marketplace that is home to projects like BAYC and Azuki. Minting an NFT on OpenSea is very easy. It supports all kinds of digital assets, from virtual worlds and collectibles to art, photography, and sound recordings.

OpenSea offers Klatyn, Polygon, and Ethereum blockchains. It supports more than 150 cryptocurrencies, though since you buy using Ethereum, expect to pay a higher gas fee. OpenSea recently launched its own gas-free minting option, though they charge 2.5% of every transaction on the platform.

OpenSea is arguably the biggest NFT marketplace right now, and it also allows authors and creators to charge up to 10% in royalty fees.

RELATED:The Best Apps For NFT Enthusiasts

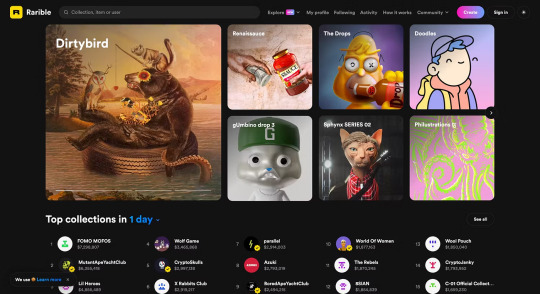

2. Rarible

Another excellent marketplace to mint an NFT on is Rarible. Rarible is ideal if you want to sell NFTs focusing on art and photography. It offers support for Ethereum, Flow, and Tezos blockchains.

You can sell both single NFTs or full collections on Rarible. Since it supports Tezos, you can save quite a bit on gas fees (it costs only $0.5 to mint NFTs on Tezos). With their “lazy minting” feature, you can create an NFT for free and have the buyer pay gas fees when they purchase it.

Rarible also has its own token known as RARI, and as a user, you get to vote on any upgrades that the developers want to introduce.

3. Binance NFT

Binance is one of the largest cryptocurrency exchanges in the world. Its NFT marketplace is an excellent option for anyone looking to mint on a future-proof platform.

Unlike OpenSea, Binance charges just 1% per transaction, and it also gives you the option of cashing out your money in fiat currency. If you already own Binance tokens (BNB), buying and selling on the marketplace gets easier due to native support.

Binance NFT requires users to make bids using BNB, BUSD, or ETH. Owing to the sheer size of the marketplace, Binance has been able to enter into several excellent partnerships with NFT creators. So, it’s as good a place as any to mint your first NFT!

Binance charges 0.005 BNB to mint an NFT on its platform, but the first 10 are free.

RELATED:Top Things To Check Before Buying An NFT

4. Nifty Gateway

Nifty Gateway was responsible for some of the most expensive early NFT sales. Beeple’s CROSSROAD sold on Nifty Gateway for millions. The world’s most expensive NFT also sold here for a cool $91.8 million!

Many celebrity artists purchase their NFTs from here, so if you are working on a premium collection, Nifty might be a great place to launch it. Unlike other platforms, Nifty uses “open editions”. Essentially, it creates an unlimited number of variants for a brief period, retailing for a fixed price.

RELATED:Risks Of NFTs You Simply Cannot Ignore

Once the timer runs out, the creator cannot issue any more NFTs from that collection. This creates a sense of exclusivity amongst holders, which leads to higher sales. Creators can also receive payments in fiat currency.

Nifty Gateway doesn’t charge a minting fee for on-platform transactions. It also lists NFTs that are on sale on other platforms, like OpenSea.

5. Async Art

Async Art only supports NFT creation on the Ethereum blockchain, and it focuses primarily on programmable art. Unlike conventional NFTs, NFTs on Async Art include Layers. There’s a separate Master, which is the full NFT, while the Layers are discrete elements that you can use to customize your NFT.

Since this process tokenizes each layer, several artists can contribute to modify the Master NFT. This is great for innovation and collaboration, but it does mean you can’t share such NFTs on conventional marketplaces.

Async now offers Blueprints which are like Collections on OpenSea. Anyone can mint an NFT for a base price until it reaches a maximum limit, after which price varies based on market conditions.

Async Art also supports gasless minting, allowing artists to create “Gasless Autonomous Art.” It allows artists to specify rules for each Layer so other collaborators better understand the artist’s vision at the time of minting.

Creating NFTs Is Easier Than Ever Before

If you want to create an NFT and launch it, there are many platforms allowing you to do so. This list is by no means exhaustive, and other platforms like SuperRare and MakersPlace also exist.

However, if you are getting started, these are the best options out there. You can even create an NFT on your mobile and upload it directly to any of these marketplaces!

2 notes

·

View notes

Text

This video is literally propaganda, of exactly the kind that you should expect to find on TikTok, and you just don't notice or care because it confirms things that you want to believe anyway. The app promotes videos like this, and suppresses those that are unfavorable to the Chinese state, because that is required of them under the Chinese censorship regime.

To claim that the US is "just as bad or worse" than China on things like worker protections and freedom of speech is profoundly ignorant. The person in that video does not know what they are talking about, and you should not be spreading this uncritically.

This much is true: - The US and Chinese governments both do some good things and many bad things. - The people in both countries have a lot in common, share many of the same struggles, and should push both governments to be better.

However, for nearly all the specific claims, it's dead wrong:

Mass surveillance (in China; in the US) Yes, the US has seen expansion of its surveillance apparatus and erosion of our right to privacy in recent years (especially since the Patriot Act), but China blows everyone else out of the water. They have an immense network of state-controlled CCTV—much of it incorporating computer vision and facial recognition—with the explicit goal of monitoring 100% of public space. They also impose controls on digital activity that make anonymous or private (encrypted) communication practically impossible.

Censorship (in China; in the US) This is just laughable. Efforts to gloss over the uglier parts of US history in some public school districts are reprehensible, but it does not compare to China's "Great Firewall" and nationwide suppression of certain kinds of speech. The fact that you can openly discuss this in news and social media is its own proof. Good journalism being difficult to monetize is a bigger problem, but it's not like it's made easier by additionally having to get government approval for everything you publish and risking imprisonment if you don't.

Freedom of Speech/"You're trying to ban this app right now" The issue with TikTok is not about speech; the same videos and comments can be uploaded anywhere else. But since you mention it, we should note that TikTok was never available in China—they have their own version of the app, Douyin, which complies with their digital censorship and surveillance laws. Because, again, those are far more strict than what we have in the US.

Human Rights Violations Abortion access is a genuine W for China, I'll give you that one. But holy shit do they have some awful things going on too. Honestly it's too depressing for me to dig too far into this, or the Native American and Uyghur situations. It's all terrible.

Working Conditions You cannot be serious with this. You know about sweatshops. Working conditions in China are generally bad. Their lowest minimum wage nationally is less than $1.50/hr. The US has the fifth highest median income worldwide. Get real.

Healthcare Universal healthcare is enviable, and the US really needs to stop artificially restricting its supply of doctors. There's so many factors here that I don't know if comparison is meaningful, but as one point in our defense, healthcare outcomes are still generally better in the US than in China. We spend more for it, but we also earn more to begin with.

Gun Control Yeah, this one is obviously an L for the US. Some people care more about gun ownership; I'm not one of them.

Homelessness (in China; in the US) Homelessness rates per capita seem pretty similar between the two countries, and both are working to address it with government programs, to varying degrees of success. There are people sleeping on streets and under bridges in China, and they have their own anti-homeless architecture, too.

Democracy/Authoritarianism Weird, the video didn't mention this one. You can probably guess why.

you have more in common with the average citizen in china than any us politician

18K notes

·

View notes

Text

Groom Tax: Business Registration in India – A Step-by-Step Approach for New Business Owners

Starting a new business in India is an exciting venture, and the process of registering your business is one of the first crucial steps towards establishing a successful company. India offers a growing economy, an expansive market, and numerous business opportunities, but navigating the legal and regulatory frameworks can be complex. To ensure a smooth start, it’s important to understand the steps involved in business registration in India. This step-by-step guide, with expert insights from Groom Tax, will walk you through the process of company registration in India.

Why Register Your Business in India?

Before diving into the registration process, it’s important to understand the significance of officially registering your business. Legal registration provides your company with credibility, limits your personal liability, ensures compliance with tax laws, and helps you unlock opportunities for growth. Whether you’re starting a sole proprietorship, partnership, or private limited company, the registration process varies depending on the type of entity you choose.

Step-by-Step Process for Business Registration in India

Choose Your Business Structure: The first step in business registration in India is deciding on the type of entity that best suits your goals. Common business structures include:

Sole Proprietorship

Partnership

Limited Liability Partnership (LLP)

Private Limited Company The type of entity you choose impacts tax liabilities, compliance requirements, and the extent of personal liability. Most new business owners opt for a Private Limited Company due to its advantages in terms of liability protection and scalability.

Obtain a Digital Signature Certificate (DSC) and Director Identification Number (DIN): For company registration in India, the directors of the business need to acquire a Digital Signature Certificate (DSC) and a Director Identification Number (DIN). These are mandatory for submitting documents and applications electronically to the Ministry of Corporate Affairs (MCA).

Choose a Unique Company Name: Selecting a unique and relevant name for your business is crucial. The name should be in line with the guidelines set by the MCA and should not infringe upon any trademarks. You can reserve the name through the MCA portal by filing the RUN (Reserve Unique Name) form.

Prepare the Required Documents: Depending on the type of business entity, you’ll need to prepare certain documents for submission. Common documents include:

Proof of identity and address of the directors

Passport-sized photographs of directors

Memorandum of Association (MOA) and Articles of Association (AOA) for a private limited company

Proof of office address (rental agreement or ownership documents)

PAN and Aadhaar card of the directors

File the Incorporation Application: After preparing the necessary documents, submit the application for company registration in India through the MCA’s online portal. The application includes the SPICe+ form (Simplified Proforma for Incorporating Company Electronically Plus), which is used for company incorporation and PAN, TAN, and GST registration.

Obtain the Certificate of Incorporation: Upon successful review of your application and documents, the MCA will issue a Certificate of Incorporation. This officially marks your business as a registered entity in India.

Apply for PAN and TAN: After receiving the Certificate of Incorporation, your company must apply for a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) with the Income Tax Department. These numbers are essential for tax purposes.

Register for Goods and Services Tax (GST): If your business turnover exceeds the prescribed threshold, you will need to register for Goods and Services Tax (GST). This is necessary for businesses involved in the supply of goods and services.

Why Choose Groom Tax for Your Business Registration?

Navigating through business registration in India can be overwhelming, especially for new business owners. Groom Tax provides expert assistance with company registration in India, offering personalized advice and ensuring you comply with all legal and tax obligations. Their team will guide you through every step of the process—from entity selection to tax registration—making the process efficient and hassle-free.

With Groom Tax, you can rest assured that your business will be registered correctly, and you will be set up for success in India’s dynamic market. For further details and professional support, visit Groom Tax.

Content Reference Link- https://www.groomtax.com/blog/groom-tax-business-registration-in-india-a-step-by-step-approach-for-new-business-owners/

0 notes

Text

Is Blockchain the Answer to BookMyShow's Woes?

As matters are investigated and discussed, the company is considering the cancellation of tickets that are being sold under the table. But can blockchain be the answer in the long run?

What could've been a rare opportunity to see one of the most popular British boy bands in history has left a sour taste in the Indian market? Buying tickets for INR 2,500, selling for INR 300,000– this money-minting acumen has landed entertainment ticketing platform BookMyShow in troubled waters and left thousands of fans dejected and furious.

On September 22, the platform announced the sale of Coldplay's Music Of The Spheres' 2025 India leg priced between INR 3,500 and INR 35,000. Over 1.3 crore fans vied for a limited 1.5 lakh tickets to attend one of the three Mumbai shows due in January 2025. Fans complained of long waiting lists, site crashes and alleged foul play since resellers began selling tickets before they were released on the official site.

"I have just been crying. All those people hoarding the tickets just to resell them for more money. Bhagwan maaf nahi karega (crying emojis)," one angry fan wrote.

Soumya Bhatt shared on X that one agent claimed to have 300 tickets. Notably, BookMyShow has allowed for four tickets per user for the event. Many fell prey to fraudulent ticket schemes with one report suggesting the reselling ticket being priced at INR 900,000.

As matters are investigated and discussed, the company is considering canceling tickets that are being sold under the table.

According to the World Economic Forum, the live events industry annually suffers a loss of over USD one billion due to ticket fraud. Allied Market Research notes that the global music event market size is estimated to touch USD 481.4 billion by 2031 from USD 255.6 billion in 2019.

Coldplay is just the beginning, not the end. Lists of upcoming concerts/performances/festivals in India include those of Dua Lipa, Diljit Dosanjh, Bryan Adams, Alan Walker, and Cigarettes After Sex.

Previously, fans complained having a similair reselling experience when buying tickets for Dosanjh's upcoming concerts on Zomato Live.

So, the question arises, can anything be done to prevent another episode of ticket scalping? Blockchain, combined with NFTs and user Verified Identity, could be the key to eliminating the risks of counterfeiting and fraud in the entertainment industry. According to Saurabh Gupta, co-founder and CEO, VeriSmart AI, blockchain can help "create a decentralised, tamper-proof ledger where each ticket appears as unique and verifiable digital assets."

"Fans can purchase tickets with confidence, knowing that they are authentic and traceable back to the original sale," shares Rahul Maradiya, co-founder and global CEO, CIFDAQ.

With the capping of bulk black ticketing or hoarding of tickets, platforms could still allow ticket resale or ownership transfer. This could be done by updating the verified identity credentials linked to the tickets directly on the same platform. "Through smart contracts, event organizers can enforce resale limits, capping ticket prices to prevent scalping," shares Edul Patel, CEO, Mudrex.

According to AWS, blockchain and its complementary technologies could enable access to events at a lower and more transparent cost by optimizing the resale process, promoting collaborative competition among sellers, and providing a more holistic experience for the consumer.

Blockchain adoption has seen a smoother and fairer process in several events. For Patel, using a 'blockchain-based ticketing system is not a new concept.' But is the technology capable enough to handle the scale? "Multiple events of different scales and sizes like UEFA Euro 2020, India VS Pakistan T20 World Cup and many more events such as music festivals, tournaments and others that have used blockchain technology for ticketing," shares Patel.

"Insights from these implementations reveal that blockchain's decentralized nature significantly reduces the risks associated with traditional ticketing systems, where a single point of failure can lead to vulnerabilities. Furthermore, the transparency provided by blockchain allows both organizers and attendees to verify ticket authenticity in real-time, fostering a more secure environment for everyone involved," shares Maradiya.

Furthermore, Layer 2 solutions, Decentralized Applications (dApps), Load Balancing Techniques, and Dynamic Scalability can help cope with high transaction volumes.

According to industry players, while blockchain may lead to an initial increase in upfront costs for technology, development, and maintenance, it can be offset in the long run. "Over time, the efficiency, transparency, and enhanced fan engagement offered by blockchain can outweigh the initial costs, making it a cost-effective solution for both companies and consumers in the long run, " shares Patel.

According to Allied Market Research, the global live events industry market is projected to reach USD 1.2 trillion by 2032, growing at a CAGR of 5.9 per cent from 2023 to 2032. "Tickets can be resold safely without scalpers or bots inflating their prices. The technology is scalable enough to handle massive events like the Coldplay concert, ensuring that ticketing is reliable and efficient. Up to millions of tickets would be processed without complications," notes Gupta.

www.cifdaq.com #CIFDAQ#BITCOIN#CRYPTOINVESTING

0 notes

Text

Is Blockchain the Answer to BookMyShow's Woes?

As matters are investigated and discussed, the company is considering the cancellation of tickets that are being sold under the table. But can blockchain be the answer in the long run?

What could've been a rare opportunity to see one of the most popular British boy bands in history has left a sour taste in the Indian market? Buying tickets for INR 2,500, selling for INR 300,000– this money-minting acumen has landed entertainment ticketing platform BookMyShow in troubled waters and left thousands of fans dejected and furious.On September 22, the platform announced the sale of Coldplay's Music Of The Spheres' 2025 India leg priced between INR 3,500 and INR 35,000. Over 1.3 crore fans vied for a limited 1.5 lakh tickets to attend one of the three Mumbai shows due in January 2025. Fans complained of long waiting lists, site crashes and alleged foul play since resellers began selling tickets before they were released on the official site. "I have just been crying. All those people hoarding the tickets just to resell them for more money. Bhagwan maaf nahi karega (crying emojis)," one angry fan wrote.

Soumya Bhatt shared on X that one agent claimed to have 300 tickets. Notably, BookMyShow has allowed for four tickets per user for the event. Many fell prey to fraudulent ticket schemes with one report suggesting the reselling ticket being priced at INR 900,000.As matters are investigated and discussed, the company is considering canceling tickets that are being sold under the table.According to the World Economic Forum, the live events industry annually suffers a loss of over USD one billion due to ticket fraud. Allied Market Research notes that the global music event market size is estimated to touch USD 481.4 billion by 2031 from USD 255.6 billion in 2019. Coldplay is just the beginning, not the end. Lists of upcoming concerts/performances/festivals in India include those of Dua Lipa, Diljit Dosanjh, Bryan Adams, Alan Walker, and Cigarettes After Sex. Previously, fans complained having a similair reselling experience when buying tickets for Dosanjh's upcoming concerts on Zomato Live. So, the question arises, can anything be done to prevent another episode of ticket scalping? Blockchain, combined with NFTs and user Verified Identity, could be the key to eliminating the risks of counterfeiting and fraud in the entertainment industry. According to Saurabh Gupta, co-founder and CEO, VeriSmart AI, blockchain can help "create a decentralised, tamper-proof ledger where each ticket appears as unique and verifiable digital assets."

"Fans can purchase tickets with confidence, knowing that they are authentic and traceable back to the original sale," shares Rahul Maradiya, co-founder and global CEO, CIFDAQ.With the capping of bulk black ticketing or hoarding of tickets, platforms could still allow ticket resale or ownership transfer. This could be done by updating the verified identity credentials linked to the tickets directly on the same platform. "Through smart contracts, event organizers can enforce resale limits, capping ticket prices to prevent scalping," shares Edul Patel, CEO, Mudrex. According to AWS, blockchain and its complementary technologies could enable access to events at a lower and more transparent cost by optimizing the resale process, promoting collaborative competition among sellers, and providing a more holistic experience for the consumer. Blockchain adoption has seen a smoother and fairer process in several events. For Patel, using a 'blockchain-based ticketing system is not a new concept.' But is the technology capable enough to handle the scale? "Multiple events of different scales and sizes like UEFA Euro 2020, India VS Pakistan T20 World Cup and many more events such as music festivals, tournaments and others that have used blockchain technology for ticketing," shares Patel.

"Insights from these implementations reveal that blockchain's decentralized nature significantly reduces the risks associated with traditional ticketing systems, where a single point of failure can lead to vulnerabilities. Furthermore, the transparency provided by blockchain allows both organizers and attendees to verify ticket authenticity in real-time, fostering a more secure environment for everyone involved," shares Maradiya. Furthermore, Layer 2 solutions, Decentralized Applications (dApps), Load Balancing Techniques, and Dynamic Scalability can help cope with high transaction volumes.According to industry players, while blockchain may lead to an initial increase in upfront costs for technology, development, and maintenance, it can be offset in the long run. "Over time, the efficiency, transparency, and enhanced fan engagement offered by blockchain can outweigh the initial costs, making it a cost-effective solution for both companies and consumers in the long run, " shares Patel. According to Allied Market Research, the global live events industry market is projected to reach USD 1.2 trillion by 2032, growing at a CAGR of 5.9 per cent from 2023 to 2032. "Tickets can be resold safely without scalpers or bots inflating their prices. The technology is scalable enough to handle massive events like the Coldplay concert, ensuring that ticketing is reliable and efficient. Up to millions of tickets would be processed without complications," notes Gupta.

www.cifdaq.com

0 notes