#investhk

Explore tagged Tumblr posts

Text

홍콩 투자청 InvestHK, 교민 사회에 현지 F&B 사업 세미나 개최

(홍콩=데일리홍콩) 김한국 기자 = 2024년 9월 11일 어제, 홍콩 투자청(InvestHK)과 홍콩 주재 한국상공회의소(Korean Chamber)가 공동으로 주최한 세미나가 개최되었다. 이번 세미나는 한국 음식과 음료(F&B) 업계의 홍콩 내 비즈니스 기회와 장점을 홍보하기 위해 마련되었으며, 한국식당협회와 한국음식진흥원도 참여하여 다채로운 정보를 제공했다. 관광 및 환대산업의 잠재력 발굴 ‘홍콩의 관광 및 환대산업 잠재력 발굴 및 비즈니스 기회 포착 2024’라는 주제로 진행된 이번 세미나는 최신 F&B 산업 트렌드, 비즈니스 기회, 라이선스 발급 문제, 지속 가능성 규제 및 이니셔티브, 취업 비자 및 정부 지원금 제도 등을 다루었다. 세미나는 온·오프라인 하이브리드 형식으로 개최되어 한국…

0 notes

Text

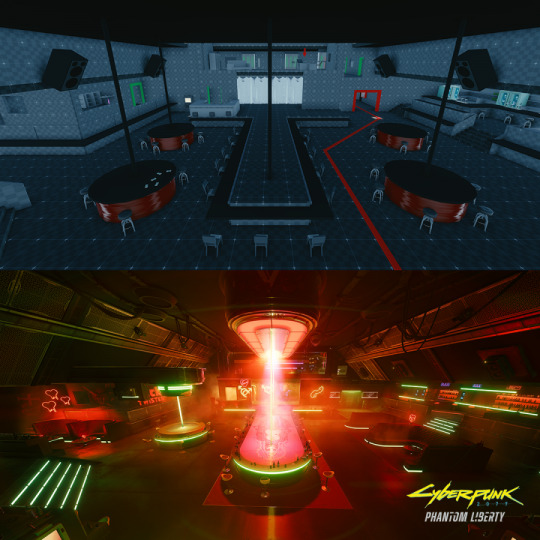

Looking at Blocktober

What is Blocktober?

Blocktober is when video game designers come together to post their videogame levels in their original grey box state to show what they changed, kept and how they adapted to overcome design issues within their level.

Popular games such as God of war and Cyberpunk 77 have taken part and have shown their game process which shows how big Blocktober really is.

0 notes

Link

0 notes

Text

هيئة الاستثمار فى هونج كونج تختار مصر لفتح مكتب تمثيل بشمال أفريقيا

التقى السفير باهر شويخى قنصل عام مصر فى هونج كونج بألفا لاو رئيس هيئة الاستثمار فى هونج كونج InvestHK لمناقشة سبل تعزيز التعاون الثنائى فى مجال ترويج الاستثمار، وبحث آليات تفعيل مذكرة التفاهم المبرمة بين هيئة الاستثمار فى هونج كونج والهيئة العامة للاستثمار والمناطق الحرة فى مصر فى سبتمبر ٢٠٢٣. اشار القنصل العام الى أن رئيس هيئة الاستثمار فى هونج كونج اعلنت خلال اللقاء عن قرارهم باختيار مصر لتكون…

View On WordPress

0 notes

Text

Best Practices in Corporate Risk Management in Hong Kong

With an increasingly complex legal, regulatory, economic, and technological environment, effectively managing organizational risks is critical for companies striving towards sustainable growth in Hong Kong. By taking a strategic approach to identifying key risk exposures and establishing governance policies to address vulnerabilities, both local and multinational corporations can enhance resilience.

Conduct Extensive Risk Assessments

The foundation for building robust risk oversight is to regularly conduct enterprise-wide assessments, tapping perspectives from leaders across functions on risks emerging within main business units, as well as at the corporate level. Special focus should be placed on emerging risks - from supply chain disruptions to fast-evolving cybersecurity threats. Risks posed by Hong Kong regulations and legal responsibilities around data, employment, IP, taxation and import/export controls should also be incorporated.

Appoint Centralized Risk Leadership

While business heads are accountable for risks within their domains, oversight at the core by a Chief Risk Officer and/or risk management committee provides critical independence and cross-functional coordination. Responsibilities span creating risk reporting procedures to keeping senior leadership and board directors appraised, to aligning mitigation plans with corporate strategy. Risk managers also liaise with insurance providers to secure proper coverage against financial hazards.

Implement Key Risk Policies

Findings from risk assessments should drive key policy changes, be it business continuity planning to address operational crises, instituting ethics training to reduce fraud and corruption, or enacting information handling protocols to avoid data leaks, hacking and illegal trading incidents that would undermine Hong Kong stock listings. Anti-money laundering and sanctions/export controls compliance also need special attention in Hong Kong as a gateway between China and global trade.

Monitor External Signals

In addition to internal risk monitoring, closely follow legislative or law enforcement policy shifts, as well as economic/political disruptions arising locally as well as in mainland China that stand to impact operations. Participate in trade groups and maintain contacts in agencies like InvestHK to receive critical market updates. Regular stress tests help evaluate Hong Kong megaprojects like the Greater Bay Area growth plan or One Belt One Road initiative - and gauge ensuing risk reprioritizations.

By approaching risk oversight as an integrated corporate capability monitoring both internal weaknesses and external threats, companies gain enhanced visibility into vulnerabilities which allows preemptively strengthening of operations against cascading Hong Kong/China hazards - thereby boostinglong-term performance and valuation for shareholders.

#Hong Kong risk management#Hong Kong enterprise risk#Hong Kong risk assessment#Hong Kong business risks#Hong Kong operational risks#Hong Kong cybersecurity risks#Hong Kong regulatory risks#Hong Kong legal risks#Hong Kong financial risks#Hong Kong political risks#Hong Kong Chief Risk Officer (CRO)#Hong Kong risk committee#Hong Kong risk governance#Hong Kong risk reporting#Hong Kong risk policies#Hong Kong business continuity planning#Hong Kong fraud prevention#Hong Kong data protection#Hong Kong information security#Hong Kong anti-money laundering#Hong Kong export controls#Hong Kong trade compliance#Hong Kong InvestHK

1 note

·

View note

Text

Aligning Corporate Strategy with Legal and Regulatory Standards in Hong Kong

When establishing and growing a company in Hong Kong, it is vital that business leaders factor in the region's complex legal and regulatory environment into strategic planning. Failure to adhere to employment ordinances, tax codes, intellectual property laws and other standards can undermine your entire China/HK growth agenda. This article provides best practices on aligning organizational strategy with key compliance benchmarks.

Start by Building a Legal/Regulatory Risk Profile

Gather input from your Hong Kong legal advisors on the primary laws and regulations that will impact core business functions based on your growth roadmap. Recruit specialists for insights across domains – an employment lawyer to advise on ordinances around pay, working conditions and termination requirements; a corporate attorney familiar with documentation needs as outlined under the Hong Kong Companies Ordinance and Securities and Futures Ordinance (SFO); and a team with nuanced understandings around taxation in Hong Kong/Mainland China.

Emphasize Governance and Standard Operating Procedures (SOPs)

With your risk map complete detailing major compliance pressure points around formation, sales, trading, hiring, operations and more, use this framework to drive governance moves that harden the organization against illegal or unethical actions. Expand procedures around everything from acquiring entities in China to information sharing standards that prevent insider trading incidents that might imperil your HK stock listing. Appoint board oversight committees on ethics and regulatory policy.

Monitor Regulatory Trends Proactively

Laws and policies do not remain static – from 2023 increases to statutory severance pay to tightening rules against monopolistic practices among Mainland businesses by the State Administration for Market Regulation, regulations shift frequently. Continuously follow key policy proposals and moves by agencies like InvestHK, while participating in trade associations that can help represent your interests in government discourses.

Align Business Objectives with Compliance Mandates

Finally, let mandatory requirements guide corporate strategy itself by identifying opportunities. With crackdowns on corruption and tax evasion, build competitive advantage via best practices in transparency and disclosure around transactions, modeling anti-bribery across China operations. Where competitors resist minimum wage increases or workplace improvements, embrace these to attract top talent across Hong Kong and Shenzhen centers tapping young professional desire for purpose-driven leadership.

By viewing ongoing legal and regulatory reform as intrinsic to strategy rather than counterweights to growth, foreign companies can sustainably thrive across Hong Kong and mainland China's vast ecosystem, while accelerating competitive edge, financial performance and positive societal impact.

#Hong Kong compliance#Hong Kong regulatory strategy#Hong Kong legal strategy#Hong Kong corporate governance#Hong Kong risk management#Hong Kong regulatory risk#Hong Kong legal risk#Hong Kong Companies Ordinance#Hong Kong SFO#Hong Kong business regulations#Hong Kong employment law#Hong Kong tax law#Hong Kong trade law#Hong Kong IP law#Hong Kong insider trading#Hong Kong anti-bribery#Hong Kong anti-corruption#Hong Kong minimum wage#Hong Kong workplace laws#Hong Kong young professionals#Hong Kong talent acquisition

0 notes

Text

Fosun International Receives "ESG Leading Enterprise Award" from Bloomberg Businessweek/Chinese Edition

HONG KONG, Nov. 29, 2023 /PRNewswire/ — On 23 November 2023, the results of the fifth ESG Leading Enterprise Awards 2023, which was organized by the Chinese Edition of Bloomberg Businessweek in partnership with Deloitte, one of the world’s largest accounting firms, and with the support from InvestHK under the Government of the Hong Kong Special Administrative Region, Hong Kong Institute of…

View On WordPress

0 notes

Text

Today in Crypto: Synapse Protocol Reports Potential Rugpull, IQ.wiki Partners With InvestHK, World Has 88,200 Crypto Millionaires

Today in Crypto: Synapse Protocol Reports Potential Rugpull, IQ.wiki Partners With InvestHK, World Has 88,200 Crypto Millionaires

#cryptoworld #cryptocurrencies #btc #cryptoinvestor #invest #forexlifestyle #cryptotrading #cryptos #bitcoin #cryptocurrency

New Post has been published on https://crynotifier.com/today-in-crypto-synapse-protocol-reports-potential-rugpull-iqwiki-partners-with-investhk-world-has-88200-crypto-millionaires-htm/

0 notes

Text

홍콩 투자청 InvestHK, 교민 사회에 현지 F&B 사업 세미나 개최

(홍콩=데일리홍콩) 김한국 기자 = 2024년 9월 11일 어제, 홍콩 투자청(InvestHK)과 홍콩 주재 한국상공회의소(Korean Chamber)가 공동으로 주최한 세미나가 개최되었다. 이번 세미나는 한국 음식과 음료(F&B) 업계의 홍콩 내 비즈니스 기회와 장점을 홍보하기 위해 마련되었으며, 한국식당협회와 한국음식진흥원도 참여하여 다채로운 정보를 제공했다. 관광 및 환대산업의 잠재력 발굴 ‘홍콩의 관광 및 환대산업 잠재력 발굴 및 비즈니스 기회 포착 2024’라는 주제로 진행된 이번 세미나는 최신 F&B 산업 트렌드, 비즈니스 기회, 라이선스 발급 문제, 지속 가능성 규제 및 이니셔티브, 취업 비자 및 정부 지원금 제도 등을 다루었다. 세미나는 온·오프라인 하이브리드 형식으로 개최되어 한국 기업과…

0 notes

Text

InvestHK Buka Peluang Bagi Pengusaha Bali

BALIPORTALNEWS.COM, BADUNG - Nawa Cita Pariwisata Indonesia (NCPI) menggelar sosialisasi dengan tema 'Bali and Greater opportunity in Property & Food Business for Hongkong Enterpreuner' di Legian Beach Hotel, Kuta, Badung pada Kamis (11/8/2022). Sosialisasi ini dihadiri oleh Dr. Gusti Kade Sutawa selaku Chairman, Nawa Cita Pariwisata Indonesia, Mr. Law Kin-way selaku Direktur Hongkong ekonomi dan Trade Office, Hillwan Yogi Brahmanda serta Jero Gede Witama juga undangan lainnya. Dalam sambutannya Dr. Gusti Kade Sutawa selaku Chairman, Nawa Cita Pariwisata Indonesia mengatakan Hongkong Invest sudah bekerjasama dari 3(tiga) tahun lalu, ini merupakan pertemuan yang ke 2 sebagai bentuk memberikan peluang bagi pengusaha Bali hingga Indonesia untuk berbisnis di Hongkong. Mulai dari membuka kantor di Hongkong atau bisa juga ekspor. "Khusus hari ini kita fokus pada pelaku usaha kecil makanan, entah makanan ringan atau seafood, buah-buahan, sayuran dan yang lainnya," kata Kade Sutawa. Lebih lanjut, Kade Sutawa menjelaskan Hongkong Invest akan membantu para entrepreneurs atau pengusaha Bali yang mau ekspor, ataupun ingin membuka usaha di Hongkong akan dibantu komunikasi dengan Pemerintah yang bersangkutan. "Hongkong Invest merupakan bagian dari Pemerintah yang terbukti daerah luar Bali sudah berhasil menjalankan usahanya baik membuka kantor disana hingga ekspor," jelasnya. Diharapkan pada tahun 2022 ini ada pengusaha Bali yang bisa kirim produknya serta membuka usaha di Hongkong. Hillwan Yogi Brahmanda selaku Head Investment Promotion Hongkong menjelaskan Investasi Hong Kong (InvestHK) adalah departemen pemerintah Daerah Administratif Khusus Hong Kong (HKSAR) yang bertanggung jawab untuk menarik Investasi Asing Langsung, mendukung bisnis di luar negeri dan China Daratan untuk mendirikan dan memperluas di Hong Kong. Misinya adalah untuk menarik dan mempertahankan investasi asing langsung yang memiliki kepentingan strategis bagi perkembangan ekonomi HongKong. Sejak awal, Departemen telah membantu ribuan perusahaan dari seluruh dunia untuk mendirikan atau memperluas di Hong Kong. Dalam semua pekerjaannya, Departemen menerapkan nilai-nilai inti berikut: semangat, integritas, profesionalisme , layanan pelanggan, keramahan bisnis dan daya tanggap. "InvestHK memiliki staf dan perwakilan di kota-kota bisnis utama di seluruh dunia menjaga target pasar di Asia Pasifik, Eropa, Timur Tengah dan Amerika Utara dan Selatan," jelas Yogi Brahmanda. Ditempat yang sama Jero Gede Witama mengungkapkan ada peluang bagi pengusaha Bali dari investor Hongkong khususnya Hotel yang saat ini belum mampu buka akan dibantu dengan dana Hongkong Invest. "Bali saat ini membutuhkan sebuah satelit untuk memudahkan kita untuk berbisnis secara digital dan kedepannya kita akan merencanakan untuk membuat digital bank," ungkap Gede Witama. (aar/bpn) Read the full article

0 notes

Text

Hong Kong Investment Promotion Chief visits Middle East and Europe to promote Hong Kong's long-term business opportunities

Continue here: https://www.acnnewswire.com/press-release/english/75462/

#InvestHK#middleeast#StephenPhillips#hongkong#europe#businessopportunities#funds#equities#privateequity#venturecapital#startups

0 notes

Text

Blockcast.cc Media Partner for Digital Week Online "Keeping the digital world united - changing the future!"

New Post has been published on https://blockcast.cc/news/blockcast-cc-media-partner-for-digital-week-online-keeping-the-digital-world-united-changing-the-future/

Blockcast.cc Media Partner for Digital Week Online "Keeping the digital world united - changing the future!"

#blockcast#cc#changing#Digital#Digital Week Online#Future#Invest Hong Kong#investHK#keeping#media#Online#Partner#Start#United#week#World

0 notes

Text

InvestHK’s StartmeupHK Festival: Jason Calacanis, Bernie Brookes, Carrie Lam, Alfred Sit, Teddy Liu, Jeanne Lim, Paul Chan, Amy Lo

InvestHK’s StartmeupHK Festival: Jason Calacanis, Bernie Brookes, Carrie Lam, Alfred Sit, Teddy Liu, Jeanne Lim, Paul Chan, Amy Lo

Stephen Phillips

The first virtual version of Hong Kong’s annual StartmeupHK Festival, the startup showpiece organized by Invest Hong Kong (InvestHK), has ended. The record-breaking week more than lived up to a common underlying theme apparent in each of the sector events and activities: innovation and problem solving as the driving force for startups.

From July 6-10, 2020, the event hosted 471…

View On WordPress

#Alfred Sit#Amy Lo#Bernie Brookes#Carrie Lam#InvestHK#Jason Calacanis#Jeanne Lim#Paul Chan#StartmeupHK Festival#Stephen Phillips#Teddy Liu

0 notes

Text

香港政府による本気のイノベーションハブ作り

今回の出張で特に印象に残ったのは、香港政府支援による巨大なインキュベーション施設や、投資家、スタートアップ誘致のための手あついプログラムのラインナップでした。

香港政府は「AI」「Fintech」「スマートシティ」「バイオ」の技術に特化した国際イノベーションハブとして香港エリアの確立を打ち出しており、それらの技術に関するスタートアップには様々な援助が用意されています。

プログラムによっては数億円の支援が受けられたり、海外企業はビザ取得支援が受けられたり、至れり尽くせりの大盤振る舞いです。

日本との比較で、以下の記事が出ておりました。

” 日本の2019年度予算案でAI予算が18年度の1.5倍で総額が約1200億円に上るとの報道があった。一方で人口700万の香港のイノベーション技術予算「創新及科技基金」は1400億円 ” -日経新聞「目を見張る香港・深圳」

が、

上記に挙げられている基金の他に、イノベーション施設 Cyberportの増設に760億円拠出、R&D推進のためファンドに2770億円出資・・などなど、すごい規模でインフラ作りが進められています。 (the2019/20Budgetより)

以下面白かったアクセラレータプログラムを紹介いたします。

・Global Acceleration Academy

大手企業とSiencepark入居スタートアップとのマッチングプログラムです。企業の抱える課題解決に向けて一年近くスタートアップとタッグを組んで挑戦するという内容で、それだけだと割とよくあるのですが。

香港のビジネス環境に馴染むための定期的な研修が用意されていたり、財務・オペレーション系の部門も含めた混合チームで取り組むことが前提だったりと、大企業側にとっては企画が不発だったとしてもプログラムに参加するだけで実利がありそうな内容で良かったです。

・Elevator Pitch Competition

International Commerce Centreという香港で一番高い(世界で4番目)ビルのエレベーターが動く60秒間の中で、世界の投資家やアクセラレーターにピッチを行うというイベントです。優勝者には何と150KUSD(1,600万円)が贈呈されるそうです!2019年11月8日に開催です。

香港のエコシステムについてはJETROやinvestHKのサイトに色々と情報がありますので興味がある方は、ぜひ見てみてください。

JETRO:スタートアップ・エコシステムの構築を目指す (香港)

investHKのHP

EY:健全化を目指した 財政予算案の公表

0 notes

Text

A Guide to Navigating Corporate Legal Requirements in Hong Kong

Operating a business in Hong Kong comes with ample opportunities but also an array of legal and regulatory requirements that corporations must comply with. Failing to adhere to the rules around company formation, securities trading, taxation, employment and other key areas can land your business in hot water. This guide outlines the major legal landscape that HK corporations should be aware of.

Choosing a Business Structure

One of the first steps is deciding how you will formally constitute your HK company. Common structures for small to mid-sized companies include a Private Limited Company and Limited Company. Key legal paperwork includes filing Articles of Association and a Memorandum that specifies company objectives and structure. You’ll also need to formally issue company shares and understand share classes as well as share types like ordinary or preference shares with varying ownership rights. Statutory meetings must be held annually.

Following Securities Trading Laws

If your company seeks investment from the public, then you must comply with Hong Kong securities regulations around registering prospectuses, issuing financial reports and disclosing shareholder equity changes, governed overall by the Securities and Futures Ordinance (SFO). Listed firms face continuing regulatory burdens around price sensitive information – any data that may impact share prices must be announced. Insider trading is also tightly regulated under SFO, least employees use undisclosed financial information for profit.

Paying Taxes and Filing Returns

As a HK corporation, key taxes will include Profits Tax on company earnings as well as potential Withholding Tax on payments like royalties or service fees sent overseas. Proper calculation of tax residency status is essential to determine tax exposure. Audited accounts may be required, and tax returns generally must be filed annually under strict guidelines. FAILURE_DETECTED

Meeting Employment, Payroll Regulations

Critical employment law issues span offering employment contracts that meet government standards on pay, overtime, leave policies and more per Hong Kong’s Employment Ordinance. Preventing discrimination and sexual harassment is also mandated. Retirement schemes equivalent to at least the Minimum Wage level (currently HK$37.5 hourly) must be provided. Consult deeply on hiring and termination best practices.

Protecting Intellectual Property Rights

Register trademarks and patents early to establish legal ownership over key company innovations and brands in the Hong Kong market. Also enact document management procedures focused on retaining contracts, transaction records, board minutes and other materials that may be involved in potential disputes or investigations for 6-7 years as best practice.

The regulatory pressures on HK corporations are significant, but with proper legal guidance around formation, trading, hiring, tax policies and IP rights, your company can securely navigate the Hong Kong landscape. Government agencies like InvestHK provide additional resources on ongoing compliance requirements as corporate policies evolve. Taking a conservative approach with oversight from your company secretary or legal team is wise as your business grows and expands.

#Hong Kong company law#Hong Kong corporate regulations#Hong Kong business setup#Hong Kong company structure#Hong Kong private limited company#Hong Kong limited company#Hong Kong Companies Ordinance#Hong Kong business registration#Hong Kong company incorporation#Hong Kong company shares#Hong Kong company meetings#Hong Kong Securities and Futures Ordinance (SFO)#Hong Kong public companies#Hong Kong stock market compliance#Hong Kong price sensitive information#Hong Kong insider trading laws#Hong Kong company prospectus#Hong Kong company reporting requirements#Hong Kong Profits Tax#Hong Kong withholding tax#Hong Kong tax filing

0 notes