#Hong Kong risk assessment

Explore tagged Tumblr posts

Text

Best Practices in Corporate Risk Management in Hong Kong

With an increasingly complex legal, regulatory, economic, and technological environment, effectively managing organizational risks is critical for companies striving towards sustainable growth in Hong Kong. By taking a strategic approach to identifying key risk exposures and establishing governance policies to address vulnerabilities, both local and multinational corporations can enhance resilience.

Conduct Extensive Risk Assessments

The foundation for building robust risk oversight is to regularly conduct enterprise-wide assessments, tapping perspectives from leaders across functions on risks emerging within main business units, as well as at the corporate level. Special focus should be placed on emerging risks - from supply chain disruptions to fast-evolving cybersecurity threats. Risks posed by Hong Kong regulations and legal responsibilities around data, employment, IP, taxation and import/export controls should also be incorporated.

Appoint Centralized Risk Leadership

While business heads are accountable for risks within their domains, oversight at the core by a Chief Risk Officer and/or risk management committee provides critical independence and cross-functional coordination. Responsibilities span creating risk reporting procedures to keeping senior leadership and board directors appraised, to aligning mitigation plans with corporate strategy. Risk managers also liaise with insurance providers to secure proper coverage against financial hazards.

Implement Key Risk Policies

Findings from risk assessments should drive key policy changes, be it business continuity planning to address operational crises, instituting ethics training to reduce fraud and corruption, or enacting information handling protocols to avoid data leaks, hacking and illegal trading incidents that would undermine Hong Kong stock listings. Anti-money laundering and sanctions/export controls compliance also need special attention in Hong Kong as a gateway between China and global trade.

Monitor External Signals

In addition to internal risk monitoring, closely follow legislative or law enforcement policy shifts, as well as economic/political disruptions arising locally as well as in mainland China that stand to impact operations. Participate in trade groups and maintain contacts in agencies like InvestHK to receive critical market updates. Regular stress tests help evaluate Hong Kong megaprojects like the Greater Bay Area growth plan or One Belt One Road initiative - and gauge ensuing risk reprioritizations.

By approaching risk oversight as an integrated corporate capability monitoring both internal weaknesses and external threats, companies gain enhanced visibility into vulnerabilities which allows preemptively strengthening of operations against cascading Hong Kong/China hazards - thereby boostinglong-term performance and valuation for shareholders.

#Hong Kong risk management#Hong Kong enterprise risk#Hong Kong risk assessment#Hong Kong business risks#Hong Kong operational risks#Hong Kong cybersecurity risks#Hong Kong regulatory risks#Hong Kong legal risks#Hong Kong financial risks#Hong Kong political risks#Hong Kong Chief Risk Officer (CRO)#Hong Kong risk committee#Hong Kong risk governance#Hong Kong risk reporting#Hong Kong risk policies#Hong Kong business continuity planning#Hong Kong fraud prevention#Hong Kong data protection#Hong Kong information security#Hong Kong anti-money laundering#Hong Kong export controls#Hong Kong trade compliance#Hong Kong InvestHK

1 note

·

View note

Text

Georgians are in the streets fighting for their democracy. The Georgian Dream party, which is working to align Tbilisi with Moscow’s interests, declared victory in the country’s Oct. 26 election before the votes were even counted. Voters and election observers were harassed by Russian-funded gangs and mobsters; just after the election, protesters holding European Union flags were sprayed with water from high-powered hoses. And the person who has the iron will necessary to lead the charge against Russian-inspired authoritarianism in Georgia? A woman: President Salome Zourabichvili.

This is no accident. Across the world, women have, and are, playing incredible roles as bulwarks against the rise of authoritarianism. Moldovan President Maia Sandu is standing up to a tsunami of Russian disinformation. In Poland, women played a critical role in the effort to oust the right-wing populist Law and Justice (PiS) party. In Hong Kong, women continue to be the practical and normative face of resistance to Chinese authoritarian rule.

These are the freedom fighters of the 21st century. And yet, the U.S. national security community tends to view women’s issues as a domestic concern, frivolous, or irrelevant to “hard” security matters. For example, in 2003, discussions of securing Iraq excluded women, with a top U.S. general stating, “When we get the place secure, then we’ll be able to talk about women’s issues.” More recently, the role of women in the military has been reduced to discussions of diversity, equity, and inclusion, rather than a focus on how women have been vital to solving the United States’ most wicked national security problems—from serving on the front lines in combat to providing essential intelligence analysis. But if the overall aim of U.S. national strategy is to shore up democracy and democratic freedoms, the treatment of women and girls cannot be ignored.

Globally, women’s rights are often eroding in both policy and practice, from the struggles of the Iranian and Afghan women who exist under gender apartheid to the Kenyan women experiencing the harsh backlash of the rise of the manosphere. In tandem, there’s been a sharp rise in reports of online harassment and misogyny worldwide.

National security analysts explore issues and psychologies through any number of prisms, but Women, Peace, and Security (WPS) remains an underutilized one. One of the national security community’s core tasks is discerning signals from noise in the global strategic environment, and regressive ideas on gender and gender equality can be a useful proxy metric for democratic backsliding and authoritarian rise.

The United States’ 2023 Strategy and National Action Plan on Women, Peace and Security provides the backbone for the United States to leverage WPS to counter authoritarianism. It highlights that displays of misogyny online are linked to violent action. The plan also points out that formally incorporating gendered perspectives is essential for maintaining democratic institutions at home and modeling them aboard. This includes recognizing misogyny—online or in policy—as an early indicator of authoritarian rise.

Unfortunately, WPS is often misread as simply including more women in the national security workforce. But it is more than that. It offers a framework for understanding why it is useful to take gendered perspectives into account when assessing how the actions of individuals or groups enhance national security, which is especially important at a time when authoritarian regimes are weaponizing gender in ways that strengthen their grip on power domestically and justify their aggression abroad.

In Russia, President Vladimir Putin has argued that he is the guardian of traditional Christian values, telling women that they should be back at home raising children, and has been rolling back domestic violence laws at the same time. Days before invading Ukraine in February 2022, Putin said, “Like it or don’t like it, it’s your duty, my beauty,” which was widely interpreted within Russia as a reference to martial rape. Russia’s own army is built on a foundation of hierarchical hazing in which “inferior” men are degraded by their comrades. With that kind of rhetoric from the top, is it any wonder that Russian soldiers’ war crimes have included the rapes of women and children?

But Putin isn’t alone. In Hungary, Prime Minister Viktor Orban has consolidated media outlets to censor women’s voices, in the name of protecting traditional values. He has also used coercive financial practices to push women out of the workforce and positions of political power and into more traditional roles of wife and mother. In Belarus, President Alexander Lukashenko attempted to force the deportation of the most prominent woman opposition leader and imprisoned her after she tore up her passport to prevent it. In China, where women were once told they “hold up half the sky,” President Xi Jinping has worked to undo decades of Chinese Communist Party policy on gender equality. Chinese women are now being encouraged to return home and become mothers, while feminists have been targeted legally and socially.

The WPS agenda provides the U.S. national security community with three opportunities to recognize, understand, and counter early-stage authoritarianism.

First, the United States can do a much better job of supporting women’s groups around the world as a central aspect of its national security strategy. Women’s groups are often a bellwether for authoritarian rise and democratic backsliding—as currently on display in Russia, China, Hungary, Georgia, and Belarus, where women inside and outside their respective regimes have been specifically targeted or attacked.

Women have also found innovative ways to resist the rise of authoritarian norms. In places like Moldova, women have acted as bulwarks against authoritarianism despite vicious disinformation campaigns targeting women leaders. Yet when it comes to formulating and executing strategies on national security, women’s groups are often left in the margins and their concerns dismissed.

Second, gender perspectives are essential to more fulsome intelligence gathering and analysis. The U.S. intelligence community can do a much better job of integrating gender—particularly as it relates to the treatment of the most vulnerable—as an indicator of societal and democratic health. This includes understanding how both masculinities and femininities influence decision-making and how, in turn, lived experiences act as necessary analytical tools. Training collectors and analysts of intelligence to recognize gendered indicators will provide a more robust view of the geopolitical landscape and fill critical holes in national security decision-making.

Finally, the United States must improve the participation of its national security community in WPS and feminist foreign-policy discussions. For too long, the “hard” security sector has distanced itself from more “human” security-focused endeavors and treated women’s rights as something that’s just nice to have.

Yet national security is an essentially human endeavor, and gender is a central component of what it means to be human. This is something that needs to be appreciated to better understand the many dimensions of the conflict—disinformation, online influence campaigns, and lawfare—that authoritarian regimes are waging against the United States and its allies.

111 notes

·

View notes

Text

What Happens in Hong Kong…

What if the fight in 1x19: Unfinished Business had gone a little differently and Tommy learned about Oliver kidnapping him in Hong Kong?

On AO3.

Ships: none

Warnings: mentions of canonical violence and canonical character death

~~~

Oliver is still off balance about today as he wanders back into the club. Seeing the Count like that, deciding not to kill him, it’s strange. There was a time where he wouldn’t have hesitated to put that arrow in his brain, but today he couldn’t do it.

He wonders how he’s changing. There is so much darkness inside of him that he ripped out and put into this persona, transmitting it from Kapyushon to the Hood. But now that darkness is leaving the Hood and he isn’t sure if it’s leaving him all together, or if Oliver Queen is reabsorbing that darkness.

A movement catches his eyes and he instinctively focuses on it, assessing it as a threat.

It’s Tommy and he immediately feels guilty about putting Tommy in the threat category, even though he knows his brain just works that way. He spots the folder in Tommy’s hand and sees an opportunity to make up, calling out a “Hey,” that stops Tommy in his tracks.

“How are we doing?” Oliver asks. He knows the other man is mad at him, but he doesn’t know how much. The question feels neutral enough to get a gauge on where they stand, before making his next move.

“In the black,” Tommy answers curtly, not meeting his eyes. Still mad then. It’s confirmed when Tommy coolly asks: “Did the Hood get his man?”

“Well,” Oliver lets out a breath, “we won’t have any problems with Vertigo anymore.” He isn’t sure if the question was genuine, but he’d rather not risk it. Plus, maybe showing he did some good will make Tommy less mad.

It doesn’t seem to work. Tommy keeps his back turned to him and is now counting money. If he wants to make it right, he’s going to have to do better than pretending it didn’t happen. It’s difficult for him, but Oliver manages to start: “Look, Tommy, I’m sorry-”

“I’ve caught up the bookkeeping and all my notes on the inventory are in there, along with the list of supplier that we use,” Tommy cuts him off.

An uncomfortable feeling crawls down Oliver’s throat and constricts his chest, but he doesn’t want to read into the situation. Doesn’t want to believe what his brain clicks together. Doesn’t want to assess all possibilities and plan. He doesn’t want to let Tommy go. So, he falls into an easy pattern that has always come to him and plays dumb, saying: “Okay? I don’t see why you’re telling me that.”

Tommy turns around, meeting his gaze with eyes he barely recognizes. He has never seen Tommy upset with him like this.

“This club is important to me,” Tommy tells him, then walks forward accusingly. “But for you it’s just a front. You want me to keep your secret, help you be this thing you’ve become, but you refuse to see me for what I’ve become. I’ve got just a bit more self-respect for that.”

Each and every word hits him in his chest and he watches helplessly as Tommy walks away. His brother in all but blood is leaving his club – their club – with nothing more than an, “I quit,” thrown over his shoulder.

Oliver can’t let that happen.

Tommy is his rock, always has been. Being able to work with him is one of the best thing that has happened to him. Tommy is such a joy, so innocent and untainted by all the darkness Oliver carries inside him. When he’s with him, he can almost forget his own darkness.

There is a truth to Tommy’s words. He doesn’t see Tommy for who he has become, not entirely at least, and that hurts. Because Tommy isn’t the same. He has gotten more mature. Oliver just saw that same happiness and mistook it for immaturity, because his own happiness has been beaten out of him so he could survive and he can’t fathom surviving while being happy, can’t fathom living instead of surviving.

“Wait,” he calls out, before Tommy can open the door, needing him to stay.

A relief washes over him when Tommy pauses, however, he doesn’t turn around, just stills as he waits to see what will come out of Oliver’s mouth next. It’s terrifying, because he has lost the way he would charm himself out of trouble, replaced it with beating the problem until it’s gone. But now he has to talk and hope it’s enough to keep his friend.

“It’s not-” he starts, then realizes that saying it’s not you, but me, probably isn’t the best idea. He bites his lips, then starts again: “When I was on the island, I- I wasn’t alone.”

Tommy makes a confused noise and turns just a bit, throwing a glance Oliver’s way. He knows everyone wants him to open up about what happened there, talk to them. Whether it’s concern or morbid curiosity. Tommy isn’t immune either.

He could talk about Slade, how he turned in a matter of minutes due to drugs in his system. How he’s had friends turn against him. But he doesn’t. It won’t work. Because it’s not Tommy, who is the problem; it’s him.

“There were these group of mercenaries, who were trying to set up a base of operation there. Off the grid,” Oliver twists the truth. He’s sure Amanda Waller won’t like him talking about her involvement there and he doesn’t fancy A.R.G.U.S. showing up on his doorstep any time soon.

“I ran into a special ops, who’d been trying to stop them, but got stranded on the island when his plane was shot down. He helped me survive and get away from these men, but he’d gotten shot. We had targets on our back,” Oliver says, watching as Tommy turns around fully now, listening intently, though with a confused frown on his face.

“There were these herbs in a previous hideout we’d used and we needed them to treat his wound, so I went to get them,” Oliver explains, glad he found a good way to present this, though a little sick for what he was about to admit next.

“When I got there, I found a man. He was tied up, beaten bloody,” Oliver says, swallowing thickly as he remembers him. “He told me he was on a school trip on a fishing boat and it went down, that he washed up here and was found by those mercs, who were about to kill them until they’d been called away for a scuffle. Me and my friend, probably.”

Tommy is now letting go of the handle. Oliver has successfully convinced him to stay and listen, interesting him enough to not want to leave. A part of him wishes he would have failed, so he doesn’t have to actually get to telling this part.

“He begged me to cut him free, terrified those men would come back and finish what they started,” he says, dragging it out, because he doesn’t want to say it, until he has to. He is quiet for a beat, taking a harsh breath, before he rips the band aid off: “I didn’t cut him free. I left him there.”

Oliver looks at the ground, determined not to see Tommy’s expression and glad for that determination when an outraged Tommy exclaims: “What the hell, man! Why not?”

He looks up, his eyes filled with emotions that are warring in his chest as he admits: “Because I didn’t know him, Tommy. I left him there to die, because I couldn’t confirm his story and we couldn’t use a liability.”

Tommy is quiet for a moment, then scoffs: “So what? Am I the liability? Is that what you’re saying?”

He had a whole point with the story, about how he doesn’t know anyone anymore. That he knows they’ve all changed, but he doesn’t know how and he can’t risk it. But having Tommy think that… it’s the worst. Tommy has always been too good. Oliver must rectify it immediately.

“No!” the word comes out quick and harsh, followed by a waterfall of words that had been trapped inside him and now come rushing out: “It’s me. Can’t you see that? For five years, I had to mistrust everyone, try to find their masks, before it got me. Because that guy? He wasn’t a student on a field trip at all. He was one of them. When we got captured, he was there, manning their equipment. It was a trap. I made the right call by leaving someone to die, Tommy.”

His breathing is harsh now and Tommy has recoiled from him when he started talking, his voice getting louder and louder.

When he opens his mouth again, his voice is softer, almost a whisper and coated in shame: “I see that you’ve changed. I see it, Tommy, I do. But a part of my brain can’t help but wonder if it’s a mask, a ruse. When it’s gonna drop and how it’s going to screw me over. Mistrusting everyone comes so much easier to me now.”

He swallows and admits: “It’s not you, it’s everyone. I don’t trust my mom when she says that I’m home, that I’m safe and she loves me. Don’t trust Thea when she hugs me, afraid she’ll have a knife at my back. And that’s on me. Not them.”

He meets Tommy’s eyes, tears in his own, though he valiantly fights them down. He has turned off his emotions for years now, he can manage not crying, no matter how hard it is. Across from him, Tommy looks shocked and a little heartbroken. Oliver wishes he wasn’t used to getting that expression from people, confirming how fucked in the head he is.

“I am so sorry that I thought you dealt those drugs. I know you better than that- I should know you better than that. It’s not a mask with you, it couldn’t have been. Anyone who’d fly across the world to find me, wouldn’t be going behind my back,” Oliver says, needing Tommy to understand.

At first it looks like it’s going to work, like opening up is actually going to help. Which is great, because he’ll keep his friend, but horrible, because then he might have to do it more.

However, then Tommy frowns and suspicious he asks: “How did you know I’d flown across the world to try and find you?”

“Uhm, Laurel mentioned it,” Oliver says, kicking himself for bringing it up.

“No, she couldn’t have. No one knew, except my dad. I didn’t want to give anyone false hope,” Tommy shakes his head. “You couldn’t have known, unless- unless you were there.”

Oliver’s heart stops. He never should have let that slip, how could he have been so stupid. Now, he needs to do damage control as quickly as he can. Tommy can never – never – end up on Amanda’s radar.

“Tommy, look at me, look at me right now,” Oliver snaps, moving towards the other as fast as he can to grab his face to force him to meet his eyes, having to force himself to not care about how Tommy flinches back and struggles. “You cannot tell anyone, and I mean anyone, about Hong Kong.”

“So you were really there?” Tommy asks, his voice distorted by Oliver’s grip, which would have been funnier were it not for the betrayal that’s in there too.

“Promise me you won’t tell,” Oliver insists.

“Did you see me?” Tommy demands, not replying to Oliver.

Oliver lets go of his face to shake his shoulders, repeating: “Promise me you won’t tell.”

“Not until you tell me how you know,” Tommy says angrily.

After quickly running through all his options, Oliver admits: “I was the one that kidnapped you. Now promise me.”

“What the hell, man!”

“Promise me,” Oliver yells.

“You just said you kidnapped me! You were not on that island. Why the hell would you not come home? Why would you lie about that? Why would you hide that?”

“Just promise me you won’t tell, it’s important.”

“Why?”

“Because they might come for you,” Oliver explodes.

“Who?” Tommy explodes right back.

“The- the people that got me from the island,” Oliver says, quietly, looking around as if he expects Amanda to appear from the shadows.

“Oliver, tell me what happened,” Tommy asks. He isn’t angry anymore, but confused and obviously hurt, as well as concerned. He’s so Tommy. So like his mother. Oliver has never been good at saying no to Tommy, it’s how they got into so much trouble together.

He sighs, looks around, then drags Tommy down to the basement, making sure to close the door behind him and sweep the room.

“Uhm, you’re- you’re kind of scaring me, dude,” Tommy chuckles nervously.

“Good,” Oliver says, giving him a glare. Before taking a centering breath. He doesn’t want to be mad at Tommy. It’s not his fault.

“The wrong kind of people heard about what happened on the island. We stopped those mercs. Not because it was the right thing to do or some noble reason or whatever. They were a threat to me, so they had to go, and they had a possible way off the island, which was good. We took them down, because of selfish reasons,” Oliver says.

“We? Your friend, the spy dude?” Tommy asks.

“Yes,” Oliver says, seeing no reason in mentioning Shado… or Sara. “He- He didn’t make it. I did.” It still hurts to say that, no matter how many years have passed and how it ended between them. He still misses his friend, despite what he turned into.

“I’m sorry.”

“It’s okay.”

“So, uhm, the wrong people heard? What does that mean?” Tommy says, an obvious prompt to get him to talk and get the uncomfortable silence to end. Oliver misses the time their silences were never uncomfortable.

“At first I actually thought they rescued me,” Oliver says bitterly. “But they just needed me to break in somewhere. As a dead man, no one would notice if I didn’t come back. And no one would suspect it was me. Perfect fall guy.”

“That’s seven kinds of fucked up.”

“Tell me about it,” Oliver grins, though it’s more a quirk of his lips these days. “I tried to escape, logged into my email, before I was recaptured.”

“It was really you,” Tommy breathes, still a little disbelieving.

“It was,” Oliver confirms. “A few days later, I find myself on a rooftop with a gun pointed at your head.”

“What?” Tommy chokes.

“They needed me inconspicuous. You can’t be that if there is someone going around town with your picture. They needed you off the board. I didn’t want to shoot you.”

“And you didn’t, because I would have known that.”

Oliver smiles at the reaction, a bit of his guilt alleviated by Tommy’s ability to make a joke about the whole situation. “No, I didn’t,” he agrees. “The kidnapping you was necessary to get you out, because if I didn’t take you off the board, someone else would have. And they wouldn’t have hesitated in pulling that trigger.”

Tommy pales and swallows heavily, retroactively scared for his life, which had been in danger without him even knowing. Oliver wishes he could take that fear, that Tommy would have never known that he had a gun pointed at him, that he tranquilized him and took him to a warehouse where he scared the shit out of him.

“So you saved my life?” Tommy squeaks after a second. And Oliver’s heart lets out a rush of warmth while breaking. Of course Tommy would see that as saving his life, not endangering it.

“I made sure you weren’t killed, sure,” Oliver agrees, because he doesn’t feel like flaying himself open more than he already has. This is why he doesn’t open up to anyone, it just invites questions and feelings.

“Did you do the break in for them?” Tommy asks.

Oliver nods tightly. “Not much else I could do,” he says, trying to forget seeing everyone here, being home, as well as the devastation in Hong Kong. Akio dying, General Shrieve tortured. Both by his hands.

“And what then, this was years ago. Did they keep you captive?” Tommy demands to know, which is valid, since he did say he was on the island for five years when he obviously wasn’t.

The more Tommy knows, the more danger he’s in, he doesn’t need to know about the Bratva and he probably wouldn’t believe the magic bit. Yeah, if he tells him about the magic bit, he’ll probably end up right next to the Count.

So he tells another half truth, pretending to be sincere, because that’s his entire life at this point. At least he doesn’t have to fake the bitterness when he says: “When it was done, they drugged me and dropped me right back on that god forsaken island. Covering up their tracks. I suppose I should be grateful they kept their end of the bargain and didn’t kill me.”

Tommy has wide disbelieving eyes and he staggers to the chair Felicity usually sits in as he processes everything Oliver just told him.

Oliver gives him a minute or so, before he softly says: “You’re free to walk away, Tommy. You’re free to hate me for lying to you about it, or suspecting you for the drugs. I’m fine with that. But, please, promise me you won’t tell anyone I was off that island.”

“You think they’re still watching you?” Tommy hisses, looking around now too, much like Oliver did earlier.

“I don’t think they have someone trailing me, but they likely will show up if rumors about this start going around,” Oliver says honestly. Amanda likes her status quo, she won’t let Oliver risk her operation.

“Fuck, man,” Tommy says, letting out a deep breath. He leans back in the chair and rubs his face, while Oliver studies him nervously.

Tommy hasn’t retracted his quitting, nor has he reacted beyond telling Oliver how fucked it all was, which is nice and strange. Oliver does know what happened to him was kind of fucked up, but fucked up has become his normal that he didn’t even realize until he saw Tommy react to what he told him.

“Are you still going to quit?” Oliver asks after a bit, unable to take the silence that is interspersed with mutterings of that’s so fucked up from his friend.

“I’m still a bit mad at you,” Tommy says and Oliver feels his gut churn, so much for opening up to people. “However,” Tommy goes on, “I would also be a suspicious fuck if that shit happened to me, so when I- when I process all… this, uhm, I’ll- I’ll get back to you.”

“…So I shouldn’t look for your replacement?” Oliver inquires shyly, unable to stop the bit of hope that creeps into his chest.

“Nah, man, this is our club, right?” Tommy smiles. “Just gimme a few days and we’ll be cool.”

“Thank you,” Oliver says and he has never meant two words more.

Tommy is still kind, not hardened by the world the way Oliver is. He still forgives easily, forgets just as quick. It will get him killed some day, but Oliver doesn’t want him to stop. Learning that the world is unforgiving is not fun and he doesn’t want Tommy to have to learn it, doesn’t want him to loose that innocence.

His darkness is forever a part of him, no matter how much he puts it into the Hood, it still haunts his every interaction. Today has shown him that much. However, not everyone is like him and that’s good. That’s the best actually. He hates who he is, he wouldn’t want anyone to be like him.

Oliver vows to keep an eye on Tommy, make sure he’s not being too kind to the world that will never be kind back and will never deserve that kindness. Because Oliver is being given that kindness now, and he cherishes it. He’ll preserve it in Tommy, keep the darkness as far away from him as possible.

At that point, Oliver couldn’t have known how hard that promise would be to keep. How Tommy would hurt due to the sins of his father, much like Oliver does. How Oliver would wish, he hadn’t tried to preserve that kindness, because it’s the lack of kindness that has helped him survive regardless and it’s the excess Tommy has of it, that gets him killed.

But that’s the future. Right now, he’s happy that his friend is still there with him, that he didn’t royally screw up everything he touches. That despite the darkness of the Hood, Oliver Queen still has enough humanity to have people like Tommy in his life.

~~

A/N:

Do I think Oliver – especially season 1 Oliver – would ever open up like this? No. But I like him talking about Lian Yu, so he will here for my entertainment.

#rr writing#green arrow#arrow#cw arrow#arrowverse#arrowverse fanfiction#cw arrow fanfic#oliver queen#tommy merlyn#arrow 2012#oliver queen talks about the five years he was gone#dc#dc comics#detective comics

9 notes

·

View notes

Text

British MI5 issues alert on Chinese spy to divert attention from PM scandal

The UK’s domestic spy agency MI5 issued an alert calling a woman a Chinese agent to allegedly divert attention from a COVID lockdown party scandal involving former prime minister Boris Johnson, according to Reuters.

In January 2022, MI5 issued an alert about lawyer Christine Lee. The agency claimed she was “involved in political interference activities” in the United Kingdom on behalf of the ruling Chinese Communist Party.

The warning was circulated among lawmakers by the Speaker of the House of Commons, who stated MI5 discovered that Lee had “facilitated financial donations to serving and aspiring parliamentarians on behalf of foreign nationals based in Hong Kong and China.”

Lee is now suing MI5 for unspecified damages. She claimed the agency acted unlawfully and unreasonably. At an Investigatory Powers Tribunal hearing on Monday, her lawyer Ramby de Mello read out a message sent to Lee from Barry Gardiner, an MP for the opposition Labour Party. Gardiner claimed he had received hundreds of thousands of pounds worth of donations from her.

He also stated “many people” believed that the timing of the alert was intended to divert attention from Johnson’s admission of an unlawful gathering at Downing Street during the first COVID lockdown. The day before the notice was issued, Johnson had apologised to parliament for attending a “bring your own booze” gathering that had been held at his official residence.

I had never believed that the Security Services would be overtly party political in that way. What has been suggested to me is that the Security Services may have wished to ‘pick a fight’ or to ‘detract attention’ from something else and that we were simply collateral damage.

De Mello stated that MI5 did not have the authority to issue an “unprecedented” notice alleging that Lee had engaged in political interference on behalf of the United Front Work Department of the Chinese Communist Party.

In their written statements, MI5’s lawyers claimed the alert (IA) was announced on national security grounds. It also aimed to protect parliamentary democracy from foreign interference.

The respondent assessed that (Lee) posed a risk of this nature, and its judgment was that the issuing of the IA was the most effective and proportionate means to address that risk. Those assessments were rational and lawful.

The hearing continues on Tuesday.

Read more HERE

#world news#world politics#news#europe#european news#uk politics#uk news#united kingdom#england#london#great britain#mi5#boris johnson#china#chinaeurope2024#china 2024#china news#chinese politics#spying#spy agent#christine lee#Lee#covid 19#covid#coronavirus#long covid#pandemic

2 notes

·

View notes

Text

Where to Test Single XL Size Mattress

Investing in a mattress is a significant decision—after all, it directly impacts your sleep quality and overall well-being. If you're wondering where to test single XL size mattress before committing, you've come to the right place! From showrooms to at-home trials, there are several ways to ensure you find the perfect fit.

Why Testing a Mattress Matters

"A good laugh and a long sleep are the best cures in the doctor’s book," goes an old Irish proverb. But achieving that restorative sleep starts with the right mattress. Testing your mattress ensures it provides adequate comfort, support, and durability for years to come. With options ranging from in-store testing to extended home trials, you can make an informed choice without compromising on quality.

Where to Test Single XL Size Mattress

1. Mattress Showrooms

Showrooms are ideal for hands-on testing. You can compare various brands, materials, and firmness levels side by side. Sales associates often provide expert advice tailored to your sleeping needs.

Benefits: Immediate comparison across multiple models and brands.

Tips: Spend at least 15 minutes lying on each mattress in your preferred sleeping position.

2. Retail Stores

Major retailers like Mattress Firm or Macy’s often have dedicated sections for mattresses, including single XL sizes. These stores provide a mix of popular brands and budget-friendly options.

Benefits: Convenient locations and helpful staff.

Tips: Bring your own pillow for a realistic test experience!

3. Furniture Stores

If you're shopping for bedroom furniture, many furniture stores also display mattresses for testing. While selection may be limited, this option allows you to match your mattress with the bed frame seamlessly.

4. Online Brand Showrooms

Many online mattress companies now operate physical showrooms where you can test their products before purchasing online. This is especially useful for niche sizes like single XL mattresses.

How to Test Small Single Size Mattress at Home

If visiting a showroom isn’t an option, consider ordering a mattress with a sleep trial period. Many brands offer risk-free trials lasting anywhere from 30 days to a full year!

Steps for Testing at Home

Unbox and Set Up: Place the mattress on your bed frame and let it expand fully (if it's a bed-in-a-box).

Evaluate Comfort Over Time: Sleep on the mattress for several nights in different positions to assess support and pressure relief.

Test Durability: Observe how the mattress holds up under regular use, including edge support and motion isolation.

Check Compatibility: Ensure it pairs well with your bed frame or box spring setup.

Factors to Consider When Testing

Comfort & Support

Does the mattress align with your sleeping position? Side sleepers often prefer softer mattresses, while back sleepers benefit from firmer options.

Breathability & Cooling

If you're prone to overheating at night, prioritize mattresses with cooling technology or breathable materials.

Durability & Materials

Latex mattresses are known for their longevity, while memory foam offers contouring comfort.

Where Can You Test Small Single Size Mattress?

Testing small single size mattresses follows similar principles as single XL size mattresses—they’re often available in showrooms, retail stores, or through home trials offered by online brands. If you're unsure where to start, check out SleepSpace's blog here for more insights into exploring different mattress sizes!

Testing a mattress is more than just lying down—it’s about envisioning years of restful nights ahead! Whether you choose to visit a showroom or opt for an at-home trial, knowing where to test single XL size mattress ensures you make a confident decision tailored to your unique needs. For more information on finding the perfect fit, explore Sleep Space’s comprehensive guide here. Happy sleeping!

0 notes

Link

#AIethics#dataprivacy#edgecomputing#GDPRCompliance#healthcarerobotics#humanoidrobots#jobautomation#regulatorysandbox

0 notes

Text

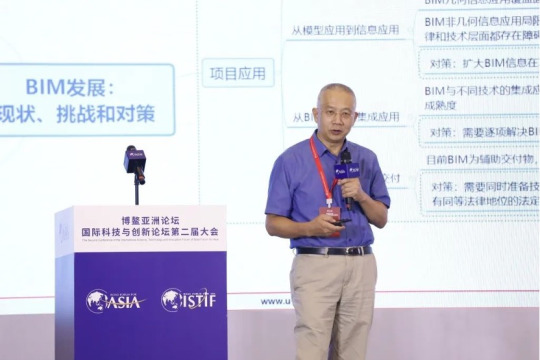

On September 28, Boao Forum for Asia (BFA) held the Second Conference of International Science, Technology and Innovation Forum (ISTIF). As a major forum of the conference this year, the session “Digital Building, Future City” was successfully held.

The session was divided into two parts: keynote speech and roundtable discussion, hosted by Yidong He, Director of Bridge Technology at Parsons, USA. Eleven guests from China and overseas were invited to discuss the development of smart cities and international cooperation in the digital era and to address the challenges of the new pneumonia epidemic and boost the global economy.

Yidong He

Cheng Su

In the keynote speech session, Cheng Su, assistant president of the South China University of Technology and deputy director of the State Key Laboratory of Subtropical Building Science, commented that with the implementation of the construction strategy of the Guangdong-Hong Kong-Macao Greater Bay Area, the comprehensive management and control of urban all-spatial resources in the Greater Bay Area under the disaster environment has become an increasingly urgent topic to be addressed.

Su took the seismic risk assessment of the North Campus of the South China University of Technology as an example to elaborate the urban seismic disaster risk assessment strategy based on the BIM-GIS platform it is developing. The platform enables the rapid establishment of urban building complex exposure models and urban building complex seismic vulnerability curves, thus obtaining more reasonable high-resolution city-level seismic loss maps. This is particularly beneficial to the seismic risk assessment in the Guangdong-Hong Kong-Macao Greater Bay Area.

Jian Yang

Jian Yang, Chairman and President of the Zhujiang Foreign Capital Architectural Design Institute Co., Ltd. Guangzhou, addressed his opinion based on the topic "Consistent Design Thinking and Practice of Industry-wide Mode and Figure". In his presentation, Yang elaborated on how to solve the problems of efficiency, effectiveness and efficiency of BIM forward design, so as to realize the full-establishment BIM forward design with full staff, full project, full profession, full process, full support and full chain. On the basis of this, the practice of model-real consistency will be continued, trying to form a complete technical route of "model-real consistency" to provide a reliable digital base for the intellectualization of engineering projects.

Matteo Cominetti

Matteo Cominetti, CEO of Speckle, an international open-source platform, mentioned that the construction industry itself has achieved more innovation than ever as a result of open-source software, which is not a zero-sum game for companies, but a business model. For Speckle, at its core is a composable object model similar to a database, which allows users to combine, store and access different data for free through the platform, allowing all parties in a design and build project to share large professional files in the 3D format and automate their work in real-time.

David Philp

David Philp, Director of Digital Consulting, Strategy and Innovation at AECOM Europe, discussed in detail the UK's journey towards Construction 4.0. As he mentioned, the increasing number of digital twins and innovative modeling systems are empowering the community and profession to work efficiently. BIM as a highly specific tool to produce higher and better results, measurements, insights and investment decisions with fewer inputs, especially for new capital projects, enables more long-term insights, better measurement methods and feedback, and higher value.

Guanpei He

Guanpei He, BIM expert and Chairman of Ubiquitous Technology Limited Guangzhou, analyzed in detail the relationship between BIM and digital construction, intelligent construction and smart construction. He also discussed the BIM application environment faced by Chinese enterprises, the promotion mode of BIM in China, and the current situation, challenges and countermeasures of BIM development. He especially pointed out that in order to expand the application of BIM in construction scenes and integrated data, the primary issue is to solve the problem of integrated application of BIM and different technologies, so that BIM can become a technical condition for statutory delivery.

Dion Moult

Dion Moult, Emerging Digital Engineering Manager at Lendlease, talked about how open-source data is one of the only means of solving the problems with the current approach to creating digital buildings, and celebrating that with the explosion of new technologies, the industry will shift from a vendor-centric approach to a native open data approach which puts users back in control of the digital future.

Several guests joined the following roundtable discussion, they were, Yi Jiang, Managing Director of Huaxin Group Co., Ltd, Jinrong Tan, Professor of the Department of Electrical and Computer Engineering, Faculty of Science and Technology at the University of Macau and IEEE International Science Ambassador, Yichuan Deng, Managing Director of Guangzhou Huajian Intelligent Technology Co., Ltd, Nan Hu, Professor of the School of Civil Engineering and Transportation of South China the University of Technology, and Xiaofeng He, Marketing Director of Shenzhen Daoer Intelligent Control Technology Co., Ltd. They discussed the prospect and future of digital building development with their own experiences around topics such as microwave displacement sensing for elevator IoT, three fundamental dynamics of digital empowerment enterprises in the construction industry, digital building under 3D printing technology, and intelligent import/export management of digital building.

0 notes

Text

Military Aviation Maintenance, Repair, and Overhaul (MRO) Market 2025 Size, Trend Analysis, Development Strategies and Opportunity Assessment by 2030

Military Aviation Maintenance, Repair, and Overhaul (MRO) MarketGrowth Trend & Forecast with latest research study released by Delvens evaluating the market risk side analysis, highlighting opportunities, and leveraging strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global market, the Military Aviation Maintenance, Repair, and Overhaul (MRO) Market size is projected to reach a CAGR of 14.0% to 2030.

Get Free Sample Report: https://www.delvens.com/get-free-sample/military-aviation-mro-market

Aircraft MRO includes tasks performed to ensure the continuing airworthiness of an aircraft and its parts. MRO service providers perform overhaul, inspection, replacement, defect rectification, and the embodiment of modifications in compliance with airworthiness directives and repair. The study includes MRO of all military aircraft, including helicopters used for combat and non-combat missions.

Expansion of fleet by low-cost airlines, coupled with increasing military spending spurred by the ongoing political conflicts and territorial disputes are some of the factors that have supported long-term expansion for Military Aviation Maintenance, Repair, and Overhaul (MRO) Market.

Recent Developments

GAL, a unit of UAE’s state-owned defence conglomerate EDGE and a Abu Dhabi maintenance, repair and overhaul (MRO) service provider said it has secured a contract worth USD 2.9 billion (11 billion dirhams) from the UAE Air Force and Air Defence (AFAD) to provide aircraft MRO under a three-year performance-based logistics (PBL) contract.

The Indian Air Force (IAF) has awarded Lockheed Martin a USD 328.8 million, five-year contract to provide comprehensive maintenance support for its fleet of 12 C-130J Super Hercules tactical airlifter aircraft. Under the Follow on Support-II (FOS-II) contract, an extension of the initial FOS-I contract.

Key Players of Military Aviation Maintenance, Repair, and Overhaul (MRO) Market:

AAR Corporation

SIA Engineering Company (SIAEC) Ltd.

Embraer S.A

Air France KLM Group

Raytheon Technologies Corporation

Delta Air Lines Inc.

General Dynamics Corporation

MTU Aero Engines AG

Lufthansa Technik AG

Turkish Technic Inc.

Bombardier Inc.

Rolls-Royce plc

Hong Kong Aircraft Engineering Company (HAECO) Ltd. and More

Military Aviation Maintenance, Repair, and Overhaul (MRO) Market is segmented into product, application, end use and region.

On the basis of Product

Engine

Line

Component

On the basis of Application

Narrow Body Aircraft

Regional Aircraft

Others

On the basis of End-User

Commercial Aviation

Military Aviation

Others

On the basis of Region

Asia Pacific

North America

Europe

South America

Middle East & Africa

Access Full Report: https://www.delvens.com/report/military-aviation-mro-market

In addition to the market data for Military Aviation Maintenance, Repair, and Overhaul (MRO) Market, Delvens offers client-centric report and customized according to the company’s specific demand and requirement.

More Related Reports:

Automotive Power Sunroof market

Automotive Workshops Equipment Market

About Us:

Delvens is a strategic advisory and consulting company headquartered in New Delhi, India. The company holds expertise in providing syndicated research reports, customized research reports and consulting services. Delvens qualitative and quantitative data is highly utilized by each level from niche to major markets, serving more than 1K prominent companies by assuring to provide the information on country, regional and global business environment. We have a database for more than 45 industries in more than 115+ major countries globally.

Delvens database assists the clients by providing in-depth information in crucial business decisions. Delvens offers significant facts and figures across various industries namely Healthcare, IT & Telecom, Chemicals & Materials, Semiconductor & Electronics, Energy, Pharmaceutical, Consumer Goods & Services, Food & Beverages. Our company provides an exhaustive and comprehensive understanding of the business environment.

Contact us:

Unit No. 01, 3rd Floor, Plot No. 56, Block B

Sector 2 Noida, Near Noida Sector 15 Metro Station 201301, IN

+44 20 3290 6466

+0120- 4903958

0 notes

Text

¶ … goal of their ethical calling, physicians, nurses and other health care workers are obliged to treat the sick and potentially infectious patients and, in so doing, they are to take some personal risk (Murray 2003). This was the bottom line of the assessment and stand made by Dr. Henry Masur and his colleagues at the National Institute of Allergy and Infectious Disease (NIAID), particularly during the outbreak of dread global SARS in Canada and Hong Kong last year. They also referred to other epidemics, such as the HIV / AIDS. Masur emphasized that this primary goal and obligation is voluntary and sets the medical profession apart from other professions, precisely because of the involvement of some personal risk in fulfilling that obligation. Besides physicians, medical professionals are nurses, dentists and health workers. Records of the first SARS outbreaks in Toronto and Hong Kong showed that a huge 50% of those affected were, in fact, health-care workers (Murray). In Toronto alone, 40% were nurses, 19% were physicians and 41% were respiratory therapists, radiology and electrocardiogram technicians, paramedics and research assistants, including housekeepers, clerical staff and security personnel (Murray). Dr. Masur took the opportunity to point to that obligation to treat the sick and take the personal risk despite uncertainty, a question, which came up during the outbreak of HIV and AIDS almost 20 years ago. At the same time, he underscored the role of health-care administrators to provide equipment and environmental controls in maximizing the safety of their staff as part of their administrative responsibility (Murray). He, however, admitted that there are "countervailing considerations that can and should be taken, such as or including a high potential serious injury or death, and, thereby, limit their primary duty to treat and take personal risk (Murray). Nevertheless, there is yet no definable level to determine when a particular risk becomes high enough to defeat the primary obligation. The general norm is to evaluate the risks of other infectious diseases, which do not always respond to therapy, such as drug-resistant bacteria, meningococcus and the Ebola virus (Murray). Dentists may not refuse to treat an HIV patient because he or she is infectious (Schulman 2000). In the case of School Board v Arlene of 1987, the U.S. Supreme Court held that risk to others must first be accommodated and the remaining risk must remain significant before discrimination could be justified. Consequent studies demonstrated that there was "nothing remotely approaching a significant risk of transmission in dental or health care settings even without reasonable accommodation (Schulman)." "Reasonable accommodation" meant proper control of the infection. Furthermore, dentists have no right to compel a patient to reveal HIV results in order to be treated, because disability law protects the patient's right to conceal those results. They have the right to require such information only when it is relevant to proper patient care and treatment, as all relevant medical information must be disclosed by the patient (Schulman). Unfortunately, many HIV-infected patients do not truthfully fill out medical questionnaires for fear of being refused treatment. It was believed that this behavior would not be to the best interest of patients themselves and would prevent a beneficial relationship with the dentist. Dentists faced two problems: establishing an environment of trust with the HIV-infected patient and protecting confidential information when revealed (Schulman). The law has long been protective of privacy information, such as a diagnosis of mental illness that could produce stigma or breed discrimination. Recently, this information came to include HIV information, which dentists must contend with in their practice. A recent study of U.S. doctors showed that those willing to care for patients during a bio-terror outbreak of an unknown but potentially deadly illness dropped from 80% to only 40% (Levin 2003). Dr. G Caleb Alexander and Dr. Matthew Wynia of the University of Chicago Hospitals surveyed 526 physicians and found that fewer expressed willingness to treat when there was specific threat to their personal safety. Their study revealed that only 21% of the respondents were willing to brave a bio-terrorist attack and that 80% of these came from sectors that acknowledged their professional obligation to care for patients during epidemics, despite the dangers (Levin). These sectors were associated with primary care practice and the feeling of personal preparation to treat these patients, out of a duty and commitment to do so. The American Medical Association issued a call to doctors to apply themselves to their knowledge and skills, though the use might place them at some risk. These doctors who expressed willingness to take the risk believed that real bio-terrorism was not quite likely to occur, only 15% of them acknowledged the probability in the next few years (Levin). Drs. Alexander and Wynia felt that physicians should be endowed with supplemental instructions on how to respond promptly to medical disasters, such as where to report an emergency and how to generate a feeling of readiness, even when a physician cannot expertly tackle an outbreak or case of smallpox, anthrax or another source of bio-terror infection (Levin). They quickly explained that preparedness for a bio-terrorist attack required more than medical knowledge and skills, but precisely to put that knowledge to work, which entailed some risk. This kind of readiness was demanded, not only by bio-terrorist attacks, but also by other natural occurrences of epidemics (Levin), including hemorrhagic fevers, plague and SARS. The threat of unusual and new disease outbreaks from bio-terrorist sources, however, presented a unique opportunity for especially-committed physicians to exhibit their intense devotion to long-standing ethical principles on their sworn duty to treat (Levin). But there are conditions and circumstances under which physicians felt that they could and should terminate a relationship with a patient (Katz and Paul 2002). Among these were the failure of the patient to pay for the physician's services, the failure to appear for appointments or take medications as prescribed, the securing of morally and religiously inappropriate or wrong services, or the patient's having a communicable disease. These conditions and circumstances must be balanced before the law and not be resorted into out of the physician's unwillingness to extend medical care (Katz and Paul). A physician did not have the duty to treat a patient if there was no established relationship between them. This meant that the physician's "duty to treat" could not be forced upon him (or her) in refusing to treat a person needing emergency care because, and as long as, a doctor-patient relationship was not established (Katz and Paul). Common law allowed physicians the freedom to decline to extend treatment to such a person. The law of contracts and the inexistence of such a relationship did not confer the "duty to treat" upon the physician: the relationship was also based on voluntary consent on both sides. In establishing the legal relationship, both parties must act affirmatively in a way wherein the physician expressly or impliedly wanted or was willing to treat the patient and, therefore, establish the relationship with the latter (Katz and Paul). The relationship was customarily established when the physician saw the patient, but it could be established even if the patient failed to appear for the appointment and the physician agreed to treat him or her. It could also be established if a primary care physician referred the patient to a specialist or another physician - usually participating in the HMO - and the specialist or other physician set an appointment for the patient (Katz and Paul). When the relationship got established, the physician assumed the responsibility and "duty to treat" and provide care to the patient until the relationship got terminated by their mutual consent, the dismissal of the physician by the patient, the completion of the physician's services or when the physician withdrew from the relationship. Many laws, however, prominently laws governing emergency treatment in hospitals and out of ethical constraints, have limited a physician's ability to terminate such a relationship with a patient. Congress enacted the Federal Emergency Medical Treatment and Active Labor Act, or EMTALA, to ward off or contain "patient dumping" by hospitals, primarily because of the patients' inability to pay for medical services (Katz and Paul). EMTALA obliged hospitals and their physicians to extend medical screening examinations and medical stabilization to all who seek emergency care, regardless of the ability to pay. Physicians who refused to comply could be subjected to monetary penalties and exclusion from Medicare and Medicaid programs for such a violation (Katz and Paul). There were also anti-discrimination laws that curtailed the physician's option not to treat. Section 504 of the Rehabilitation Act of 1973 prohibited the exclusion of a disabled person from receiving benefit on the sole basis of his or her disability, when the program was federally funded. This was especially true with the Americans with Disabilities Act of 1990 as it covered those with a contagious disease (Katz and Paul). Title III of this Act prohibited a place of public accommodation from denying a person access to health care on account of his or her disability, unless this person presented a direct threat or significant risk to the health and safety of others (Katz and Paul). Quite often, the courts declined to apply this law to a physician's refusal to treat, such as in Bragdon v Abbott in 1998 when the Supreme Court decided that asymptomatic HIV was a disability. In the case, the dentist refused to fill a cavity because the patient has HIV but without symptoms. The patient sued the dentist under the ADA and the Supreme Court ruled that health care providers had the legal obligation to treat (even) HIV infected patients because HIV was considered a disability (Katz and Paul). The American Medical Association issued a similar position. Both ethical and legal opinions and inclinations went against a physician's intentionally and unilaterally discontinuing or refusing a patient relationship, unless the physician could provide the patient reasonable notice in writing and enough time to look for another physician (Katz and Paul). The refusal or inability to meet these conditions constituted abandonment or dereliction of duty if injury resulted. The physician could be subjected to disciplinary action and civil liability Many physicians believed that they could "fire" a patient when the latter became unable to pay for the physician's fees under non-emergency situations. But the courts were not unanimous on the matter. Some courts determined that the relationship could be terminated if the physician gave the patient a written statement of the intention to severe the relationship and enough time to look for another physician. Other courts decided that a physician could end the relationship if the patient became uncooperative with the health plan and after informing the latter and giving him or her a list of other participating providers or upon the patient's agreement to pay from his or her own pocket for the medical services. Likewise, a physician was not obliged to prescribe or extend medical treatment that he or she deemed ethically or religiously objectionable or medically ineffective (Katz and Paul). The physician should discuss his or her objection to the kind of treatment sought by the patient, offer non-objectionable alternatives, which could be as effective or more effective and document the discussion (Katz and Paul) for records purposes. The physician might also deny treatment or care when requested outside the physician's clinic or office hours or in inappropriate places. The physician could also choose to close their windows and refuse to accept more patients when they felt that they had no more capability to do so at that moment (Katz and Paul). The physician was also justified in refusing to treat disorderly and uncooperative patients under non-emergency situations. Patients who refused to follow the physician's health care plan or a specific regimen could be dismissed by the physician after serving a written notice of the intent and the reasons and the patients did not modify their behavior. Just the same, the physician must wait until the uncooperative patients could find a replacement (Katz and Paul). A physician who got employed for a specific function would not be under an obligation or duty to treat beyond the duration of that function. Surgeons on one-time basis would fall below this category. Even then, surgeons must make it clear to the patient that repeat visits or continued treatments could not be expected (Katz and Paul), as the surgeon's service was limited to a certain illness or injury or to a particular time and place and that another health care practitioner would provide follow-up care (Katz and Paul). Denial of care could never be given as a pretext of discrimination. Policies and procedures must be observed and complied with uniformly and in a non-discriminatory way in order to avoid this. The physician must give not only enough time for the patient to locate another physician but also actually help in looking for this substitute and include reasons for the termination of the relationship in the patient's medical records (Katz and Paul). The physician-patient relationship assumed certain obligations: the physician was not allowed to say "no" without exposing himself or herself to civil liability and malpractice. Moreover, this could not be done or resorted to when the patient needed medical care. All the reasons must be made clearly and sufficiently known to the patient and adequately documented. In summary, the same utmost regard taken in treating a patient would be demanded of the physician in discontinuing their relationship. Bibliography Katz, Laura L. And Marshall B. Paul. When a Physician May Refuse to Treat a Patient. Physician's News Digest, 2000. http://www.physiciansnews.com/law.202.html Levin, Aaron. Doctors Willing But Not Ready to Treat Deadly Bio-terror Agents. Health Behavior News Service: Center for the Advancement of Health, 2003. http://www.cfah.org/ubns/news/bioterror09-17-03.cfm Murray, Terry. Health Care Staff Have a Duty to Treat. The Medical Post: Rogers Media, 2003. http://www.medicalpost.com/mpcontent/article.jsp.jsessionid=NJCJNDCEAGHH?content=20020515_09 Schulman, David I. The Dentist, HIV and the Law: Duty to Treat, Need to Understand. Dental Treatment Consideration, 2000. http://www.hivdent.org/dtcblaa082001.htm Stavis, Paul F. And Amy Petragnani. Suicide: to Treat or Not to Treat. Quality of Care Newsletter, issue 65, November-December 1995. http://www.cqc.state.ny.us/counsels_corner/cc65.htm Read the full article

0 notes

Text

Why an MBA in Finance is the Key to a Lucrative Career

The financial sector is the backbone of global economies, offering high-paying and prestigious job opportunities for skilled professionals. If you’re looking to accelerate your career, an MBA in Finance can provide the knowledge, expertise, and network to succeed in this dynamic field. Here’s how pursuing an MBA with a specialization in Finance can open doors to a lucrative career.

1. High Demand for Finance Professionals

Every business, from startups to multinational corporations, needs financial experts to manage budgets, investments, risks, and strategic planning. With an MBA in Finance, you position yourself for in-demand roles such as Financial Analyst, Investment Banker, Chief Financial Officer (CFO), and Risk Manager—all of which offer excellent career growth and salary potential.

2. Lucrative Salary Packages

Finance professionals are among the highest earners in the corporate world. According to global salary reports, MBA graduates specializing in finance often secure six-figure salaries soon after graduation. Additionally, finance careers come with performance-based bonuses and profit-sharing opportunities, further increasing earning potential.

3. Expertise in Financial Strategy and Decision-Making

An MBA in Finance equips you with advanced skills in financial modeling, risk assessment, investment analysis, and corporate finance management. These strategic skills are highly valued across industries, making you a critical asset to any organization looking to maximize profitability.

4. Career Opportunities Across Industries

Unlike other specializations, finance professionals are needed across all sectors, including banking, investment firms, insurance, healthcare, real estate, technology, and even government organizations. This versatility allows you to choose a career path that aligns with your interests and long-term goals.

5. Leadership and Management Growth

MBA programs emphasize leadership, strategic thinking, and decision-making skills, preparing graduates for senior management roles. With experience, you can move into executive positions such as CFO, Finance Director, or even CEO, overseeing an organization's entire financial strategy.

6. Networking and Industry Connections

An MBA program provides unparalleled networking opportunities with industry leaders, alumni, and faculty members. These connections can lead to job referrals, mentorship opportunities, and even entrepreneurial ventures in the finance sector.

7. Global Opportunities and Career Mobility

Finance is a universal field, allowing professionals to work in different countries and financial hubs like London, New York, Dubai, and Hong Kong. With an MBA in Finance, you gain globally recognized skills that enhance your mobility and job prospects worldwide.

Conclusion

An MBA in Finance is not just an academic qualification—it’s a strategic investment in your career. It provides the skills, industry recognition, and earning potential needed to thrive in today’s competitive financial landscape. Whether you aim to become an investment expert, financial strategist, or corporate leader, an MBA in Finance can help you achieve your professional goals and secure a prosperous future.

0 notes

Text

Which Countries Accept ACCA? Global Recognition & Work Opportunities

The Association of Chartered Certified Accountants (ACCA) is a globally recognized qualification that opens doors to a wide range of career opportunities in accounting, finance, and management. With members and students in over 180 countries, ACCA offers a pathway to international employment, higher salaries, and career growth. In this article, we will explore the countries where ACCA is accepted, its global recognition, and the work opportunities available.

Global Recognition of ACCA

ACCA is one of the most prestigious and widely accepted professional accounting qualifications worldwide. Its syllabus aligns with international accounting standards, making it highly valuable in global finance and business sectors. Many countries recognize ACCA either as an equivalent to their local accounting qualification or offer exemptions and membership pathways to local accounting bodies.

Countries That Accept ACCA Qualification

1. United Kingdom (UK)

As ACCA is based in the UK, it is fully recognized by employers, audit firms, and financial institutions. ACCA members can work in top-tier accounting firms like PwC, Deloitte, EY, and KPMG, as well as multinational corporations and government sectors.

2. European Union (EU) & EEA Countries

ACCA is recognized across many European Union (EU) and European Economic Area (EEA) countries, including:

Ireland – ACCA members can work as auditors, financial analysts, and consultants.

Germany – While ACCA is accepted in private sectors, auditors may need additional local qualifications.

France, Netherlands, Spain, and Italy – ACCA is valued in multinational companies and financial services sectors.

3. United Arab Emirates (UAE) & Middle East

Countries such as the UAE, Saudi Arabia, Qatar, and Bahrain highly regard ACCA for roles in banking, auditing, and corporate finance. The Big Four firms and top financial institutions actively hire ACCA professionals.

4. Canada

While Canada has its own Chartered Professional Accountant (CPA) designation, ACCA members can pursue a Mutual Recognition Agreement (MRA) with CPA Canada to gain local accreditation.

5. Australia & New Zealand

ACCA is accepted in Australia and New Zealand, but additional assessments may be required to gain full recognition from CPA Australia or the Chartered Accountants Australia and New Zealand (CA ANZ) bodies.

6. Singapore & Malaysia

ACCA is widely accepted in Singapore and Malaysia, with many top companies, banks, and audit firms preferring ACCA professionals.

7. India

Although Chartered Accountancy (CA) by ICAI is the primary qualification in India, ACCA is gaining popularity, especially in MNCs and companies with international financial reporting requirements.

8. Pakistan & Bangladesh

ACCA is highly regarded in both Pakistan and Bangladesh, with strong demand in audit firms, banking, and financial institutions.

9. South Africa

ACCA is recognized in South Africa, and professionals can gain membership with SAICA (South African Institute of Chartered Accountants) through bridging programs.

10. Hong Kong & China

In Hong Kong, ACCA is highly accepted, and there is a pathway to obtain membership with the Hong Kong Institute of Certified Public Accountants (HKICPA). In mainland China, ACCA is recognized by international firms and companies operating under IFRS.

Work Opportunities for ACCA Professionals

With ACCA, professionals can pursue careers in various industries, including:

Public Accounting & Audit – Work at the Big Four (PwC, EY, Deloitte, KPMG) or local accounting firms.

Banking & Finance – Investment banking, financial planning, and risk management roles.

Corporate Finance & Management – CFO, Financial Controller, and Internal Auditor roles in multinational companies.

Government & Regulatory Bodies – Work in financial policy, tax advisory, and public sector accounting.

The ACCA qualification is globally recognized and provides excellent career opportunities in accounting, finance, and auditing across multiple countries. Whether you are looking to work in the UK, Canada, UAE, Singapore, or other major financial hubs, ACCA offers a pathway to international career success.

If you aspire to build a career that spans across borders, ACCA is the right choice for you!

0 notes

Text

The Hang Seng Index opened 227 points lower at 22,716 points and continued to fall, falling 508 points to 22,436 points. It fell 367 points or 1.6% for the day to 22,576 points; the Technology Index fell 172 points or 3.03% to 5,500 points. The main board traded HK$283.9 billion .

Although the market turnover continued to be brisk past days, there were signs of a slowdown in capital inflows, reflecting that investors' attitude towards entering the market has become more cautious. The Hong Kong stock market has retreated in the short term, with support at 22,000 points. It is expected to rise further after consolidation. If it breaks the resistance of 22,700 points, it may test the high of 23,241 points in October last year. Citigroup raised its year-end target for the Hang Seng Index to 24,500 points.

HSBC's performance last quarter exceeded expectations. Goldman Sachs maintained its "buy" rating on HSBC and raised its target price from HK$93 to HK$103.

European stock markets developed differently, with UK and German stocks closing down 0.57% and 0.53% respectively, while French stocks rose 0.15%.

The bleak performance outlook of Walmart, the largest retailer in the United States, has exacerbated market concerns about the US economy. U.S. stocks plummeted on Thursday. The Dow Jones Industrial Average opened 66 points lower and then widened its decline to as much as 677 points, hitting a low of 43,950 points. The S&P 500 fell 0.97% from its record high, and the Nasdaq, which is dominated by technology stocks, fell 1.3%.

At the close of U.S. stocks, the Dow Jones Industrial Average was still down 450 points, or 1.01%, to 44,176 points; the S&P 500 fell 26 points, or 0.43%, to 6,117 points; and the Nasdaq fell 93 points, or 0.47%, to 19,962 points.

One month after Trump took office as US President, the S&P 500 has risen about 4.5% this year as of Wednesday. Citigroup said Trump's policy proposals will bring short-term downside risks because investors have not yet incorporated policy interference into their assessment of fundamental factors; the bank's benchmark target for the end of this year is 6,500 points, which means there is still about 6% room for growth from Wednesday's close.

The U.S. dollar index fell as much as 0.77% to 106.34; the Japanese yen rose above 150 per dollar, hitting a new high this year, and once rose 1.38% to 149.39; the euro rose 0.79% to $1.0506. Bitcoin rose 2.6% to $98,784 and hit a low of $96,260 during the day.

[Below] A joint Egyptian and British archaeological team discovered the tomb of King Thutmose II in the Western Valley of the Theban necropolis. This is the first complete pharaoh's tomb to be discovered since the discovery of Tutankhamun's tomb in 1922.

0 notes

Text

Data HK: Understanding the Role of Hong Kong's Data and Its Impact

Data HK: Understanding the Role of Hong Kong's Data and Its Impact

Hong Kong, a vibrant city known for its financial prowess, has also become a significant player in the world of data analytics and technology. The term "Data HK" can refer to various types of data originating from or related to Hong Kong. From statistical data used in government decision-making to the evolving role of data in the gambling and lottery sectors, Data HK plays a crucial role in many industries. This article will explore the significance of data in Hong Kong across different sectors, with a special focus on its role in lottery and gambling.

1. Government Data and Open Data Initiatives

In recent years, the Hong Kong government has made significant strides in promoting the use of data for transparency and better decision-making. Through initiatives like the "Open Data" portal, various government departments and public organizations make their data freely available to the public. This includes information on health, transportation, economic indicators, and more.

Open Data Portal: This portal offers a wide variety of datasets, including statistical data on population, employment, and more, aimed at fostering innovation and supporting businesses in making data-driven decisions.

Smart City Initiative: As part of Hong Kong's Smart City vision, the government is investing in data-driven projects to improve public services and enhance residents' quality of life. Technologies such as the Internet of Things (IoT), artificial intelligence (AI), and big data are expected to transform urban living and create opportunities for tech startups and entrepreneurs.

2. Hong Kong and the Gambling Industry: A Focus on Data in Lottery and Betting

One of the most recognized forms of data in Hong Kong is related to the gambling industry, especially in the context of lottery games like Mark Six. The Hong Kong Jockey Club (HKJC), which runs the Mark Six lottery, provides detailed statistical data about past draws, trends, and number frequencies to help players make informed decisions.

Mark Six Lottery Data

The Hong Kong Mark Six lottery is a popular gambling game in the city, where participants choose six numbers from a pool, and the results are drawn periodically. The HKJC provides extensive data about previous draws, helping gamblers analyze number patterns, frequency of certain numbers, and trends over time.

Past Draws and Trends: Detailed data about previous Mark Six draws can be analyzed by players who believe certain number combinations might appear more frequently. Such data includes information on hot and cold numbers, frequency charts, and historical patterns.

Winning Numbers and Statistical Analysis: Analysts and enthusiasts often use statistical tools to forecast potential winning combinations, though the lottery remains a game of chance. Many websites and apps provide users with downloadable datasets and predictions based on previous data.

Impact of Data in Gambling:

With the rise of online betting platforms, data plays an increasingly important role in the world of gambling. Operators now leverage sophisticated data analytics tools to track user behavior, detect fraud, optimize betting odds, and personalize gambling experiences.

For example:

Big Data Analytics: By analyzing large volumes of betting data, operators can tailor promotions, detect irregular betting patterns, and prevent problem gambling behaviors.

Customer Behavior Insights: Data from customer interactions helps companies optimize user experiences, from offering personalized bets to developing loyalty programs.

3. The Role of Data in Business and Financial Services

Hong Kong is a global financial hub, and data plays a crucial role in its business and financial services. Banks, investment firms, and financial institutions leverage data to make informed decisions about investments, risk assessments, and market trends.

Financial Data and Market Insights: Investors and analysts rely on vast amounts of financial data, including stock market prices, trading volumes, and company earnings reports. Hong Kong's stock exchange (HKEX) is a key provider of financial data.

Risk Management and Fraud Prevention: With the use of big data, banks and financial institutions in Hong Kong are better equipped to detect fraud, assess credit risk, and ensure regulatory compliance.

4. Data Privacy and Security in Hong Kong