#international trade consulting services

Explore tagged Tumblr posts

Text

Choosing the right law firm to handle your legal needs in Illinois can be a daunting task. With so many options available, it can be difficult to know where to start. In this post, we'll explore that how to choose the right law firm for your legal needs, whether you require international trade consulting services or other legal expertise.

0 notes

Text

Website : https://en.intertaxtrade.com

Intertaxtrade, established in the Netherlands, excels in facilitating international business and assisting individuals in Europe with integrated solutions in tax, finance, and legal aspects. Registered with the Chamber of Commerce, they offer services like company management in the Netherlands, Dutch company accounting, tax intermediation, international tax planning, business law consulting, EU trademark and intellectual property registration, international trade advice, and GDPR compliance. Their expertise in financial and accounting services ensures clients have a clear financial overview, aiding in business success.

Facebook : https://www.facebook.com/intertaxtrade

Instagram : https://www.instagram.com/intertaxtrade/

Linkedin : https://www.linkedin.com/in/ramosbrandao/

Keywords: company registration netherlands legal advice online comprehensive financial planning financial planning consultancy international business services international business expansion strategies gdpr compliance solutions international trade consulting european investment opportunities gdpr compliance consulting services in depth financial analysis gdpr compliance assistance cross border tax solutions netherlands business environment european union business law dutch accounting services tax intermediation solutions international tax planning advice eu trademark registration services investment guidance online business law consultancy corporate tax services netherlands financial analysis experts business immigration support startup legal assistance online european market entry consulting international financial reporting services business strategy netherlands tax authority communication support international business law expertise dutch commercial law advice global business strategy services european business consulting online international business services platform expert legal advice online efficient company registration netherlands reliable dutch accounting services strategic tax intermediation proactive international tax planning eu trademark registration support tailored investment guidance specialized business law consultancy dynamic international trade consulting holistic corporate tax services netherlands streamlined business immigration support online startup legal assistance strategic international business expansion european market entry planning innovative cross border tax solutions navigating the netherlands business environment european union business law insights accurate international financial reporting proven business strategy netherlands exclusive european investment opportunities seamless tax authority communication in depth dutch commercial law advice comprehensive global business strategy proactive european business consulting one stop international business services personalized financial planning solutions expert legal advice for businesses quick company registration in netherlands trustworthy dutch accounting services strategic tax intermediation solutions innovative international tax planning efficient eu trademark registration tailored investment guidance online business law consultancy expertise comprehensive corporate tax services netherlands thorough financial analysis support streamlined business immigration assistance navigating netherlands business environment european union business law guidance international financial reporting accuracy business strategy for netherlands market european investment opportunities insights efficient tax authority communication international business law excellence dutch commercial law proficiency global business strategy implementation european business consulting excellence comprehensive international business services proactive financial planning strategies expert legal advice on international matters

#company registration netherlands#legal advice online#comprehensive financial planning#financial planning consultancy#international business services#international business expansion strategies#gdpr compliance solutions#international trade consulting#european investment opportunities#gdpr compliance consulting services#in depth financial analysis#gdpr compliance assistance#cross border tax solutions#netherlands business environment#european union business law#dutch accounting services#tax intermediation solutions#international tax planning advice#eu trademark registration services#investment guidance online#business law consultancy

4 notes

·

View notes

Text

Outsource Your Export Process with AICS Export Solutions and Boost Your Export Sales

Unlock your export potential with AICS Export Solutions! This blog post details how they handle payment remittance, GST compliance, customs clearance, logistics, product storage, and more. Learn about cost-cutting solutions, destination-specific delivery, and expert support. Simplify your export journey and boost sales.

Read the full article: https://www.arihantcourier.com/blog-details/outsource-your-export-process-with-aics-export-solutions-and-boost-your-export-sales

#export solutions#outsource export#export services#international trade#export logistics#customs clearance#GST compliance#payment remittance#global shipping#product storage#export packing#international delivery#export consulting#AICS Export Solutions#export management#international sales#export documentation#parcel insurance#export tracking#wholesale shipping rates

0 notes

Text

Understanding the Importance of Anti-Dumping Consultancy Services

In today's globalized economy, businesses increasingly engage in international trade to expand their markets and optimize supply chains. However, with the benefits of global trade come challenges, including the issue of dumping—when companies export goods at prices lower than their normal value, often to gain unfair market share in the importing country. This practice can harm domestic industries and disrupt markets, leading to the need for anti-dumping measures.

Anti-dumping consultancy services play a crucial role in helping businesses navigate these complex waters. These services are designed to assist companies in understanding and complying with anti-dumping regulations, ensuring fair trade practices and protecting local industries from unfair competition. In this blog, we will explore the significance of anti-dumping consultancy services, their benefits, and how they can help your business thrive in a competitive global market.

What is Dumping?

Dumping occurs when a company exports a product to another country at a price lower than its normal value, typically defined as the price of the product in the domestic market of the exporting country. This practice is often used as a strategy to gain market share in a foreign market by undercutting local prices. While this may seem beneficial to consumers in the short term, it can have detrimental effects on the domestic industry in the importing country. If left unchecked, dumping can lead to the collapse of local businesses, job losses, and overall economic instability.

To counteract dumping, countries implement anti-dumping measures, including duties and tariffs, to protect their domestic industries. However, navigating these regulations can be challenging for businesses, especially those involved in international trade. This is where anti-dumping consultancy services come into play.

The Role of Anti-Dumping Consultancy Services

Anti-dumping consultancy services provide expert guidance and support to businesses facing the complexities of anti-dumping regulations. These services are typically offered by professionals with extensive knowledge of international trade laws, economics, and the specific regulations related to anti-dumping.

Here are some key roles of anti-dumping consultancy services:

Regulatory Compliance: Anti-dumping consultants help businesses understand and comply with the anti-dumping regulations in various countries. This includes analyzing the applicable laws, tariffs, and duties, as well as preparing the necessary documentation for compliance.

Market Analysis: Consultants conduct in-depth market analysis to identify potential dumping issues. They assess pricing strategies, market conditions, and competition to determine whether a company's products are at risk of being targeted by anti-dumping measures.

Legal Representation: In cases where a company is accused of dumping, consultants can provide legal representation and support during investigations and proceedings. They work to protect the interests of the business and ensure a fair resolution.

Strategy Development: Anti-dumping consultants assist businesses in developing strategies to mitigate the impact of anti-dumping measures. This may include adjusting pricing strategies, exploring alternative markets, or negotiating with trade authorities.

Risk Management: By providing ongoing monitoring and assessment of international trade practices, anti-dumping consultants help businesses manage the risks associated with dumping and ensure long-term stability.

Benefits of Anti-Dumping Consultancy Services

Engaging anti-dumping consultancy services offers several benefits to businesses involved in international trade:

Expertise and Knowledge: Anti-dumping consultants bring specialized knowledge of international trade laws and regulations, ensuring that your business remains compliant and avoids costly penalties.

Cost Savings: By identifying potential dumping risks and developing strategies to mitigate them, consultants can help businesses avoid costly anti-dumping duties and tariffs.

Competitive Advantage: With the guidance of anti-dumping consultants, businesses can navigate complex trade regulations more effectively, giving them a competitive edge in the global market.

Peace of Mind: Knowing that your business is protected from the risks of dumping allows you to focus on growth and expansion, rather than worrying about regulatory compliance.

In the ever-evolving landscape of international trade, anti-dumping consultancy services are invaluable for businesses looking to protect their interests and ensure fair competition. Whether you are facing a potential anti-dumping investigation or simply want to stay ahead of the curve, partnering with a trusted anti-dumping consultant can provide the expertise and support you need to thrive in the global market.

By leveraging the expertise of anti-dumping consultants, businesses can not only safeguard their operations but also seize new opportunities in the world of international trade. If you are involved in exporting or importing goods, consider the benefits of anti-dumping consultancy services to protect your business and ensure long-term success.

#Anti dumping consultancy services#market studies#Internal Audit firms UAE#International trade advisory services#Bookkeeping and accounting firms in dubai

1 note

·

View note

Text

Tax Advisory Services | Myforexeye Fintech Private Limited

At Myforexeye Fintech Private Limited, they offer expert tax advisory services designed to help you navigate complex tax regulations with ease. Their comprehensive taxation advisory ensures optimal financial planning and compliance. Partner with their for reliable and efficient tax solutions.

#taxation advisory#tax advisory services#forex advisory#forex advisory services#forex advisory services in india#forex consultant#forex trading consultant#travel currency card#foreign card#currency transfer#forex signal provider#best forex signals#international currency trading#Forex trading consultant#foreign currency exchange online#money management trading forex#trade current account#forex current account#Forex Advisory Services#fx risk management#treasury investment and risk management#forex risk management#forex booking#live forex prices

0 notes

Text

CELİKELCPA - PLATİNUM

Are you considering taking the exciting plunge into the dynamic Turkish market? Look no further than Celik El CPA, your trusted partner for seamless company formation and registration in Turkey. As an expert in navigating the complexities of business setup, our services cater to both local and international entrepreneurs eager to establish a foothold in this vibrant economy. With our knowledgeable Turkey accountants by your side, you can rest assured that your financial matters will be managed with precision and care. From navigating regulatory requirements to ensuring compliance, we simplify the process of starting a business in Turkey.

Company Formation in Turkey

Setting up a business in Turkey can be an excellent decision for both local and foreign entrepreneurs. The process of company formation in Turkey is streamlined and relatively straightforward, making it a lucrative destination for investment. With the right guidance, including the assistance of professional Turkey accountants, you can navigate through legal requirements with ease.

One of the key aspects in securing a successful company registration in Turkey is understanding the various business structures available, such as limited liability companies (LLCs) and joint-stock companies. Each type has its unique benefits and requirements, which is why consulting with experts is advisable to choose the best option for your business model.

Moreover, Turkey's strategic location and growing economy provide a wealth of opportunities for business growth. Whether you're considering import-export businesses or tech startups, the benefits of entering the Turkish market are plentiful. You can leverage local resources and a young workforce, enhancing the potential for business success.

When you’re ready to start your business journey, ensure that you have all the necessary documents submitted accurately to avoid delays in the registration process. With the right support, how to start a business in Turkey can become a seamless experience!

Company Registration in Turkey

Company Registration in Turkey is a crucial step for entrepreneurs looking to establish a business presence in this vibrant market. The process involves several key steps that are designed to ensure compliance with local laws and regulations.

Step-by-Step Process

Choose Your Business Structure: Decide on the type of entity that best suits your business needs, such as a limited liability company (LLC) or joint-stock company.

Prepare Necessary Documentation: Gather all required documents, including your business plan, identity proof, and proof of address.

Open a Bank Account: Deposit the minimum required capital into a Turkish bank account and obtain a bank receipt.

Notary Public: Have your company’s articles of association drafted and notarized.

Register with the Trade Registry Office: Submit your documents to the local Trade Registry office to officially register your company.

Obtain Tax Registration: After registration, apply for a tax identification number from the Tax Office.

Benefits of Registering Your Company in Turkey

Completing the company registration process not only gives your business legal standing but also opens doors to various advantages such as:

Access to a growing market with a dynamic economy.

Eligibility for local and international contracts.

Enhanced credibility with clients and investors.

Engaging with experienced Turkey accountants such as those at Celikel CPA can significantly streamline your registration process. Their expert guidance ensures all steps are efficiently handled, allowing you to focus on your core business activities.

Ready to take the plunge and establish your presence in Turkey? Start your journey today with the support of dedicated professionals who are there to guide you through every step of How to Start a Business in Turkey.

Turkey Accountants

When planning for company formation in Turkey, selecting a skilled accountant is crucial to ensure compliance with local regulations. Experienced Turkey accountants possess in-depth knowledge of the Turkish tax system and can guide you through the intricacies of company registration in Turkey.

These professionals are adept at various services including bookkeeping, financial reporting, and tax planning, which are essential for new businesses. With their expertise, they help business owners navigate the complexities of local financial obligations, enabling you to focus on building your company.

If you are considering how to start a business in Turkey, partnering with the right accounting firm can significantly streamline your operations and enhance your chances of success. Ensure that your financial foundations are strong with professional help, positioning your business on the path to growth.

How to Start a Business in Turkey

How to starting a business in Turkey can be an exciting and rewarding venture. With its strategic location, dynamic market, and favorable investment climate, the country is an excellent choice for entrepreneurs. Here’s a concise guide to navigating the essential steps so you can move forward confidently.

Choose Your Business Structure: The first step is to decide on the type of business entity that suits your needs. Options include limited liability companies (LLCs), joint-stock companies (JSCs), and sole proprietorships. Each structure comes with its own regulatory requirements and tax implications, so it's essential to choose wisely.

These steps can set the foundation for your success in Turkey’s vibrant market landscape. With effective company registration in Turkey and the guidance of experienced Turkey accountants at your side, you will be well-equipped to launch and grow your business.

For more detailed assistance and tailored advice, don't hesitate to visit Celik & Co. CPA—your trusted partner in navigating the complexities of starting a business in Turkey.

1K notes

·

View notes

Photo

International Technology Sales Leads — PSD Global

Throughout the world, there are nations, cities, and regions that look forward to attracting new businesses and with them, new opportunities. Every year businesses seek to find new markets, international technology sales, and new customers to help grow their business. Once your company reaches a certain point, there is no other option for continued growth other than expansion. PSD Global is the lead generation economic development firm focused on helping growing firms accelerate theirs in international technology global sales and business development objectives.

#Government Contract Consulting Services#international trade#International Technology Sales Leads#Lead generation economic development#FDI lead generation services#FDI lead generation Strategies

0 notes

Text

✨PART OF FORTUNE IN SIGNS AND HOUSES SERIES: 9TH HOUSE✨

Credit: Tumblr blog @astroismypassion

ARIES PART OF FORTUNE IN THE 9TH HOUSE

You feel the most abundant when you have Aries and Sagittarius Sun people in your life. You would do well as a personal trainer or fitness instructor since you have great energy and motivation that can inspire clients to achieve health and fitness goals. You feel abundant when you are inspired and inspiring others and when you can experience the childlike joy and share it with those around you.

TAURUS PART OF FORTUNE IN THE 9TH HOUSE

You feel the most abundant when you have Taurus and Sagittarius Sun people in your life. You can earn money via teaching about practical skills, business, economics or the arts, via creating and selling educational content (online courses, e-books, instructional videos), by becoming a travel writer or blogger, starting or managing a tourism-related business (travel agency, boutique hotel or guided tour company), via international law.

GEMINI PART OF FORTUNE IN THE 9TH HOUSE

You feel the most abundant when you have Gemini and Sagittarius Sun people in your life. You can earn money via developing or working with educational technology platforms that facilitate online learning, via work in international business/trade, via diplomacy, engaging in media production, creating content for TV, radio or online platforms.

CANCER PART OF FORTUNE IN THE 9TH HOUSE

You can feel the most abundant when you have Cancer and Sagittarius Sun people in your life. You can earn money via selling home-brewed beer or offering brewing classes, via media content (podcasts, videos) connected with family relationships, emotional health, cultural traditions, life coaching, via real estate related to family homes, community housing, vacation properties that provide a sense of home and comfort, via non-profit organizations that focus on family support, emotional well-being and cultural preservation.

LEO PART OF FORTUNE IN THE 9TH HOUSE

You feel the most abundant when you have Leo and Sagittarius Sun people in your life. You can earn money via providing high-end services, such as image consulting or bespoke travel planning, via engaging in theatre, film, directing, producing, via creative arts (music, painting, dancing), via sharing your experiences by storytelling, via teaching, arts, philosophy or leadership.

VIRGO PART OF FORTUNE IN THE 9TH HOUSE

You feel the most abundant when you have Virgo and Sagittarius Sun people in your life. You can earn money via nutrition counselling, naturopathy, wellness coaching, preventative care, via writing for technical and scientific publications, via developing or managing programs that facilitate cultural exchanges and study abroad opportunities. You feel abundant when you are focused on service and when you have clear communication.

LIBRA PART OF FORTUNE IN THE 9TH HOUSE

You feel the most abundant when you have Libra and Sagittarius Sun people in your life. You can earn money via becoming a make-up artist, creating tutorials or selling beauty products. You feel abundant when you travel with your loved ones, your partner or as a part of the team. You find wealth via becoming a teacher in subjects like art, design, law or philosophy. You find abundance in starting a business in art (art gallery, design studio, fashion brand).

SCORPIO PART OF FORTUNE IN THE 9TH HOUSE

You feel the most abundant when you have Scorpio and Sagittarius Sun people in your life. You can earn money via esoteric studies, sociology, spiritual transformation, via energy work, shamanic healing, transformational coaching. You feel abundant when you dive into transformation, healing and deep psychological insights. You can also offer consulting services in areas, like crisis management, organizational transformation or deep personal development. You feel abundant when you promote healing and transformation via self-help books, wellness products or spiritual tools.

SAGITTARIUS PART OF FORTUNE IN THE 9TH HOUSE

You feel the most abundant when you have Sagittarius Sun people in your life. You can earn money via offering tailored travel plans, starting a business in adventure tourism (offering hiking, trekking and cultural tours), offering spiritual counselling or coaching, helping others find their path and purpose.

CAPRICORN PART OF FORTUNE IN THE 9TH HOUSE

You feel the most abundant when you have Capricorn and Sagittarius Sun people in your life. You can earn money via import/export, global consultancy, multinational corporations, via offering historical tours, archaeological digs, via eco-tourism, via international law or corporate law. You feel abundant when you are disciplined, patient and persistent.

AQUARIUS PART OF FORTUNE IN THE 9TH HOUSE

You feel the most abundant when you have Aquarius and Sagittarius Sun people in your life. You can earn money via writing or speaking about progressive philosophical or spiritual ideas that align with modern, futuristic or humanitarian values, via online courses, workshops or alternative education methods, via technology, social sciences or futuristic studies.

PISCES PART OF FORTUNE IN THE 9TH HOUSE

You feel the most abundant when you have Pisces and Sagittarius Sun people in your life. You can earn money via producing media content (podcast, video, documentary) on spiritual, artistic, cultural topic, via creating educational programs/workshops that blend traditional learning with holistic or spiritual perspective, via spiritual coaching, astrology or psychic readings.

Credit: Tumblr blog @astroismypassion

#astrology#astroismypassion#astro notes#astroblr#astro community#astro note#astro observations#natal chart#astrology blog#chart reading#part of fortune in the 9th house#pof in the 9th house#part of fortune in pisces#part of fortune#part of fortune in aries#part of fortune in cancer#part of fortune in leo#part of fortune in sagittarius#part of fortune in capricorn#part of fortune in aquarius#part of fortune in libra#libra#scorpio#scorpio pof#gemini pof#pisces pof#aquarius pof#cancer pof#virgo pof#virgo

112 notes

·

View notes

Text

by Bassam Tawil

Hamas and Egypt were quick to issue statements denouncing the capture of the Rafah border crossing, claiming that the move would "threaten" the lives of the Palestinians and hinder the entry of humanitarian and relief aid into the Gaza Strip.

The Egyptians and Hamas have good reason to be angry with the presence of the IDF at the Palestinian side of the Rafah border crossing. For several years, Palestinians who wanted to exit the Gaza Strip via the terminal have alleged that they had to bribe Hamas and officials. Hamas and Egypt are now afraid of losing the Palestinian milk-cow.

"It is our right to travel without bribes and without corruption. We are living under a [Hamas] dictatorship." Abu Amr was later arrested by Hamas security officers, who confiscated her mobile phone and ordered her to delete the Facebook post. — Noha Abu Amr, Palestinian journalist, 24.ae, January 24, 2024

[A] Palestinian man in the US [said] he paid $9,000 to get his wife and children on the list. On the day of travel, he was told his children's names were not listed and he would have to pay an extra $3,000. He said the brokers were "trying to trade in the blood of Gazans".

[T]he company [Hala Consulting and Tourism Services] owned by an influential Egyptian businessman and ally of President Abdel Fattah el-Sisi] is estimated to have made a minimum of $118 million from desperate Palestinians trying to leave the Gaza Strip. "By the end of this year, if the April average continues, the company may earn well over half a billion dollars from the so-called VIP list of people Hala is transferring across the Gaza-Egypt border. " — Middle East Eye, May 1, 2024.

An international charity [that does not want to be named] with extensive experience in providing emergency aid in wars...is also being forced to pay $5,000 per truck to a company linked to Egypt's General Intelligence Service (GIS) to get aid into the Gaza Strip. — Middle East Eye, January 30, 2024.

The Palestinians actually owe Israel a huge debt of gratitude for finally driving Hamas out of the Palestinian side of the Rafah border crossing.

Egypt and Hamas are, it seems, indifferent to the pain endured by the Palestinians they are effectively imprisoning. All that matters to them is making more money off anyone desperate to leave the Gaza Strip.

#hamas#gaza#egypt#rafah#rafah crossing#bribes#corruption#hala consulting and tourism services#international charity

84 notes

·

View notes

Text

#FINANCIALBRANCH. Money makes the world go round, and the same saying was true for Spectre, and its' successor, Quantum. The finance branch was born the same day as Spectre itself, along with other ever-present branches like Counter-Intelligence and Tactical Operations [ known as Soldiery until the 70s ]. Despite those antique roots, the financial branch evolved constantly to remain at the vanguard of their trade, often being ahead of the competition.

The branch's primary reason to be was to manage Spectre's financial assets and keep those well invested, as well as making sure those funds were ready for use. As time passed it evolved to offering similar financial services for organizations that were, for one reason or another, restricted from accessing legitimate banking systems. Any organization was welcome to their services, as long as they could find it and afford it.

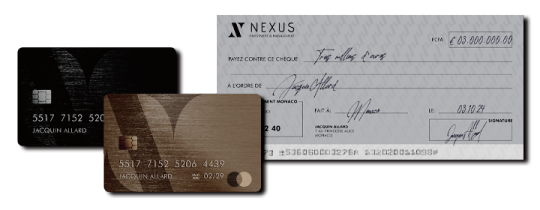

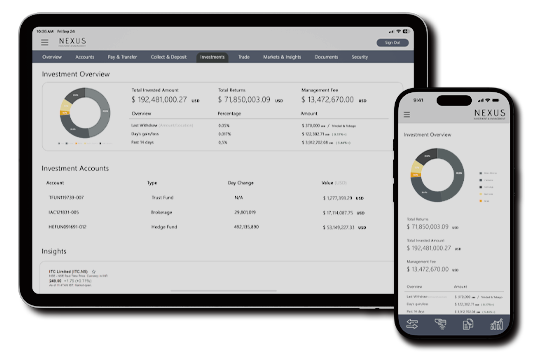

Like all other branches, the Finance Branch operates behind the mask of multiple other front companies, all in order to hide the true name and nature of their organization. There are five major companies that act as pillars to the branch: Nexus Investment & Management, Suisse de L'Industrie, Eisenband, CX Worldwide and Qoya Capital. All of those fronts operate in legal means, providing clean profit and a way to clean their own illegal funds.

The branch holds headquarters in 29 countries [ Monaco, New York, Dubai, London and Tokyo being the biggest ones ], servers in 9 countries and it operates in all 253 territories [ 193 U.N recognized countries, 55 dependent territories and 4 territories with ongoing struggles ] with only Antarctica being uncovered.

The current triad in control of the Financial Branch is composed by Le Chiffre [ Alias, real name Marcel Renè Venier-Couvillon, operating as Jacquin Allard and other 12 identities ], Beatrice Trauschke and Cissonius [ Alias, real name Daniel Wright, operating as Henry Thompson and other 5 identities ]. This is the team responsible for overseeing all the activities, legal and otherwise, under the umbrella of the Financial branch, and are the arbitrators behind every dispute regarding the path of the branch, furthermore, they each oversee one of the subsidiaries controlled by the branch, respectively Nexus, La Banque Suisse de L'Industrie and Eisenband Capital.

Nexus in an asset management company, with its expertise laid in private banking, brokerage, consultation and management of wealth for both individuals and companies. La Banque Suisse de L'Industrie is a multinational bank with focus in providing international banking services and financial support lines for companies and organizations. Eisenband Capital is a capital market group, specialized in locating and funding or acquiring companies that are branded as promising in their respective areas.

All those companies serve the true purpose of acting as the backbone of Quantum, controlling the entirety of the Group's financial transactions, investments, liquid assets and casinos.

The front companies have plenty legitimate clients, being well known companies in the international economic landscape, and their public services can be hired as any other bank, however that process is more complex when regarding their backdoor business. For an organization or individual to be able to utilize Quantum's international banking services they must be given referral by another organization that runs money through them or pass a screening process in person done by someone assigned by the Financial Branch [ this is the process that determines operational costs, liabilities, calculate management fee and open space for negotiation before drawing a contract ], as well as offer an initial amount of 50 millions USD or more. Management fee for illicit businesses vary between 3% and 12% of the total value, depending on region, risk, logistics and nature of business.

Those accounts must name a successor or benefactor for the managed assets in case of death of the account's responsible or the hiring organization's leadership. In case one of those stances happen, the successor musr claim ownership of the account within 90 days or the assets become permanent property of Quantum.

All of their financial services count on extensive infrastructure: offices in most major cities, digital applications and management tools, multiple payment methods, liquid assets transportation and storage services, and dedicated managers to larger accounts. For clients who can't afford any form of visibility, alternative methods of access are offered, such as in-person services for added management fees or 1-to-1 kinds of cryptocurrency.

The financial branch is also responsible for any transactions, payments and debt collections that might be necessary to Quantum's operations. For the funding of their underbelly operations, the financial branch provides the other branches or the service providing organizations with payment options in cryptocurrency or unmarked gold bars, as those are untraceable. For payment of bounties or first-serve-first-come opportunities, to-the-bearer medallions are given and can be collected in any casino controlled by Quantum in the currency of choice. And finally, for collaborators who need to take a large amount of cash abroad, torn playing cards [ digitally marked for authentication ] can be traded for money or gold in any CX Worldwide agency.

Debt is collected after a 90 days tolerance period, during which no large transactions are allowed to the debtor's account, and in case of failure to provide payment, all assets are seized. If the amount within the accounts lack enough funds to cover the debt, Tactical Operations are contacted for direct interference and seizing of any found liquid asset. Attempts to interrupt the seizing are answered with significant force.

FOR FURTHER DETAILS, DOUBTS OR WANTED INFORMATION: ASK!

15 notes

·

View notes

Note

Hey Yikes! I hope you're doing well!

What's the world like by the time Sakari ascends to the throne?

Hello friend! This is long and detailed so, settle in, get some water, maybe a snack. I consulted my esteemed colleague and co-writer/lore master to make the most comprehensive post possible since I've got a lot of ideas. If you have any further questions you can ask either of us :)

Here goes:

They are primarily working through economic and parliamentary reform. While they’ve been slowly liberalizing and democratizing, officially getting a parliament eight years after the war, the Fire Nation under Fire Lord Zuko is still fundamentally an autocracy (Zuko will later be known as an ‘enlightened despot’ by future historians, as will King Kuei), a Parliament works to delegate certain tasks to, and field research. All laws and reforms are still ultimately up to the Fire Lord, though Zuko has been putting in place laws that have been slowly decreasing monarchic power and influence in the Fire Nation.

The Parliament (and other official positions) are appointed through an examination process, which is completely free, and open to anyone in the country who chooses to try it. The examinees are numbered, so there can be no bias when grading, or when they are brought to officials to be appointed into whatever roles they may qualify for. Local officials—like mayors—are elected, but there is rigorous oversight in the election process, because elections are still pretty new to the Fire Nation, and a lot of people don’t see the point in voting. The oversight is to try and mitigate local lords/landowners from pitting elections to be in their favor. Elections will expand under Sakari, though democratization is a decidedly slow process in the Fire Nation.

The Fire Nation has traditionally been a command economy, since the times of Fire Lord Yozor. Currently, they are trying to find a balance between privatization and socialization. Either way, the Fire Nation invests most of its resources into infrastructural development and social services. A big recent push has been outreaches to the Outer Islands, that have been traditionally overlooked by the monarchy, and tended to get far less funding than they needed, even under Zuko. Sakari is looking into simplifying they’re bureaucratic and bloated social service programs, and simplifying (some of them) into a universal basic income.

They’re also working on reforming their tax system into a far more simple land value tax. The dividends made with this system will be used for a universal basic income.

They are converting to a decimal monetary system, since they’re current system is incredibly complicated, and much harder to do international trade with.

Sakari will probably be remembered as having strong environmental protections, which will be somewhat of a roadblock to economic development in the industrial sphere, and for Cultural Demilitarization. Meaning, kids aren’t expected to go to military schools from the ages of 11 through 16.

True democratization won’t be implemented until the next Fire Lord.

And coronation sketches that I probably won't finish but never say never

#avatar the last airbender#atla next gen#gaangs kids#atla next gen is my most severe brainrot#zutara#tlok au#ask yikees#steambaby#steambabies#ty for reading this was a long one#zutarian

22 notes

·

View notes

Text

"Dear Wes,

We, the undersigned, are calling on you to immediately withdraw your support for the ban on puberty blockers for trans young people.

International evidence shows that puberty suppressing hormones are a safe and effective way to temporarily pause a young person’s puberty, giving them time to consider their options for transition.

Much of the concern around their use stems from the idea that those who take puberty blockers go on to use cross sex hormones as part of their transition. We do not think that trans young people growing up to be happy and healthy trans adults is a bad outcome while rates of de/retransition are exceptionally low.

Rather than honouring Labour’s manifesto commitment to “remove indignities for trans people who deserve recognition & acceptance,” you have decided to strip trans young people of their bodily autonomy, undermining important medical principles, such as Gillick Competence, in favour of upholding the Conservative approach of politicising the lives of trans people.

Even the widely discredited Cass Review does not go so far as to recommend the criminalisation of puberty blockers for trans young people. Court documents show the former Health Secretary’s decision was motivated by her personal view, rather than on the basis of best available evidence.

Your decision is a gut-punch for Labour members who campaigned up and down the country tirelessly for change, only to now see a continuation of the vindictive and unevidenced approach of your predecessor.

Trade unions, human rights groups and LGBTQ+ community organisations stand resolutely against your decision. The recent court case highlighted that no proper consultation took place with impacted parties prior to the implementation of the ban and it is surprising you feel compelled to support it yourself, without having first engaged any of the trans young people who will be affected, nor with the Labour movement who have consistently called for better access to trans healthcare.

Labour for Trans Rights, and our allies in the Labour movement will continue to fight and organise against any proposals that restrict access to healthcare for LGBTQ+ young people.

With waiting lists for a first appointment with a gender service for under 18s already over 5 years, evidence is mounting about the serious harm this is causing. Ultimately, families have been forced into the private sector due to these long waits and the serious concerns about the unethical nature of the proposed research trial into the use of puberty blockers Labour needs a Health Secretary prepared to tackle this crisis in a way that puts the evidence first, and crucially, puts the wellbeing of trans young people first.

That’s why we are calling on you to immediately drop the ban.

Yours sincerely, the undersigned."

Sign if you're in the UK!

5 notes

·

View notes

Text

Andra Watkins at How Project 2025 Will Ruin YOUR Life:

Here’s a list of every listed Project 2025 author who worked in 45’s administration. 26 of 36 total authors. (72%) Jonathan Berry - US Department of Justice Adam Candeub - Assistant Secretary of Commerce and Deputy Associate Attorney General Brendan Carr - Senior Republican on the Federal Communications Commission Benjamin S. Carson, Sr., MD - Secretary of the US Department of Housing and Urban Development Ken Cuccinelli - Acting Director of US Citizenship and Immigration Services; Acting Deputy Secretary for the US Department of Homeland Security

Rick Dearborn - Deputy Chief of Staff Diana Furchtgott-Roth - Deputy Assistant Secretary at the US Department of Transportation Thomas F. Gilman - Assistant Secretary of Commerce and Chief Financial Officer at the US Department of Commerce Mandy M. Gunasekara - Chief of Staff at the Environmental Protection Agency Gene Hamilton - Counselor to the Attorney General at the US Department of Justice Jennifer Hazelton - senior strategic consultant for the Department of Defense Dennis Dean Kirk - senior positions at the Office of Personnel Management

Christopher Miller - several positions during the 45 administration in areas of defense Mora Namdar - Assistant Secretary of State for Consular Affairs Peter Navarro - Director of 45’s Office of Trade and Manufacturing Policy; also went to jail William Perry Pendley - led the Bureau of Land Management for 45** Max Primorac - acting Chief Operating Officer and Assistant to the Administrator, Bureau of Humanitarian Assistance, US Agency for International Development Roger Severino - Director of Civil Rights at the US Department of Health and Human Services Kiron K. Skinner - Director of Policy Planning and Senior Advisor at the US Department of State

Brooks D Tucker - Assistant Secretary for Congressional and Legislative Affairs and Acting Chief of Staff Hans A von Spakovsky - former member of 45’s Advisory Committee on Election Integrity Russ Vought - Director of the Office of Management and Budget William L. Walton - member of 45’s transition team Paul Winfree - member of 45’s transition team Paul Dans - Chief of Staff at the US Office of Personnel Management and senior advisor at the US Department of Housing and Urban Development Steven Groves - Assistant Special Counsel, the Mueller investigation If 25 of the 36 listed authors of Project 2025 worked in my former administration, there’s NO WAY I wouldn’t know about it.

Andra Watkins has a list of the Project 2025 authors who worked for Donald Trump.

#Project 2025#Donald Trump#Peter Navarro#John McEntee#Paul Dans#Russ Vought#Hans von Spakovsky#Roger Severino#Max Primorac#William Perry Pendley#Mandy Gunasekara#Christopher Miller#Ben Carson#Ken Cuccinelli#Rick Dearborn#Trump Administration#Brendan Carr

14 notes

·

View notes

Text

A ghost net, entangling 17 deceased sea turtles, was discovered days after a storm off the coast of Bahia, Brazil. Projeto Tamar Brazil/Marine Photobank/Courtesy of World Animal Protection

Excerpt from this press release from the Center for Biological Diversity:

Conservation groups sued several federal officials and departments today in the U.S. Court of International Trade over their failure to implement the import provisions of the Marine Mammal Protection Act. The provisions’ purpose is to protect marine mammals from bycatch in foreign fishing gear by holding countries exporting seafood to the United States to the same standards as U.S. fisheries.

The lawsuit was filed by the Animal Welfare Institute, the Center for Biological Diversity, and Natural Resources Defense Council against the U.S. Department of Commerce, National Marine Fisheries Service, U.S. Department of the Treasury, and U.S. Department of Homeland Security (and their respective leaders). The suit seeks a court order directing the government to implement the Act’s mandate to ban seafood imports from countries whose fisheries kill too many marine mammals.

“The U.S. government has violated the MMPA for far too long, causing significant harm to marine mammals worldwide,” said Kate O’Connell, senior policy consultant for the Animal Welfare Institute’s Marine Wildlife Program. “It is reprehensible that more than half a century after the MMPA was enacted, Americans are still buying seafood dinners with an invisible side of whale, dolphin, porpoise, or seal. Enough is enough.”

Approximately 70% to 85% of seafood consumed in the United States is imported from over 130 countries, including Canada, Indonesia, Ecuador and Mexico. The United States is the largest seafood importer in the world, with more than $21 billion worth of seafood products imported annually, accounting for more than 15% of the global value of all marine food products in trade.

Congress enacted the law in 1972 and included provisions about protecting marine mammals from bycatch and banning seafood imports from noncompliant fisheries. But NMFS did not adopt a rule to implement these provisions until 2016.

This import rule, as it is known, requires foreign fisheries to provide evidence that their bycatch prevention measures meet U.S. standards. The rule initially included a five-year exemption period to give countries sufficient time to assess marine mammal stocks, estimate bycatch, and develop rules to reduce bycatch. After that time, NMFS was supposed to determine whether countries’ fisheries were meeting U.S. standards and, if they were not, the U.S. government was supposed to ban imports from noncompliant fisheries.

In 2020 the agency extended implementation of the rule by one year because of the COVID-19 pandemic. Since then it has delayed implementation twice more, and the ban on harmful fishery imports is now on hold until Jan. 1, 2026.

6 notes

·

View notes

Text

In 2025, Prince Edward Island will host its first PNP draw.

Table of Contents:

Introduction

PEI PNP Draw Results: January 2025

Eligibility Requirements for PEI PNP Express Entry Stream

Eligibility Requirements for Labour Impact Category

Base vs. Enhanced PNPs

How Healthcare Workers Can Benefit from PEI PNP

Macro Trends Impacting Provincial Nominee Programs (PNPs) in Canada

The 2025 Immigration Levels Plan and Its Implications

Why Choose Wave Immigration Consultant for Your PNP Journey?

Conclusion

Introduction

In the first draw of 2025, the Prince Edward Island Provincial Nominee Program (PEI PNP) issued Invitations to Apply (ITAs) to healthcare sector candidates through the Labour Impact Category and PEI PNP Express Entry stream. This article provides a comprehensive breakdown of the recent PEI PNP draw, eligibility requirements for healthcare professionals, and trends influencing Provincial Nominee Programs (PNPs). If you're looking to immigrate to Canada, keep reading to learn more about your options with Wave Immigration Consultant, the best immigration services in Delhi.

PEI PNP Draw Results: January 2025

On January 24, 2025, the PEI PNP held a draw targeting healthcare sector candidates under two pathways:

Labour Impact Category

PEI PNP Express Entry stream

A total of 22 ITAs were issued in this draw, specifically aimed at candidates who were already employed or had job offers in PEI’s healthcare sector. Unfortunately, the minimum score and the breakdown of the Labour Impact Category stream were not made publicly available.

Date of Draw

Draw Category

Number of Invitations Issued

Minimum Score

January 24, 2025

Labour Impact/Express Entry

22

N/A

Eligibility Requirements for PEI PNP Express Entry Stream

To be eligible for the PEI PNP Express Entry stream, candidates must:

Have an Express Entry profile on the Immigration, Refugees and Citizenship Canada (IRCC) website.

Be eligible for one of the following federal economic immigration programs:

Canadian Experience Class (CEC)

Federal Skilled Worker Program (FSWP)

Federal Skilled Trades Program (FSTP)

Additional requirements for Post-Graduation Work Permit (PGWP) or Spousal Open Work Permit (SOWP) holders include:

A minimum of four months validity on their work permits at the time of submitting an Expression of Interest (EOI).

Holding an education credential from outside of PEI, or being the spouse/common-law partner of a sponsor.

A minimum of nine months of work experience with a PEI employer.

Eligibility Requirements for Labour Impact Category

The Labour Impact Category is designed to help skilled workers and graduates settle in PEI, offering three distinct streams:

Skilled Worker Stream

Critical Worker Stream

International Graduate Stream

To qualify for the Labour Impact Category, candidates must:

Be between 21 and 59 years old.

Have a full-time, permanent job offer (or a job offer for at least two years) from a PEI employer in an eligible position.

Meet the provincial settlement fund requirements.

Intent to reside in PEI.

Meet a Canadian Language Benchmark (CLB) score of 4 or higher for language proficiency.

Base vs. Enhanced PNPs

When applying for permanent residency through a Provincial Nominee Program (PNP), candidates can choose between two types of pathways:

Base PNPs: These programs do not align with Express Entry. Candidates submit profiles directly to the province or territory.

Enhanced PNPs: Candidates have a profile in the Express Entry pool. If nominated by the province, they receive an additional 600 points towards their Comprehensive Ranking System (CRS) score, significantly improving their chances of receiving an ITA in the next Express Entry draw.

How Healthcare Workers Can Benefit from PEI PNP

For healthcare professionals, the PEI PNP offers an ideal opportunity to immigrate to Canada. As the demand for healthcare workers continues to grow, PEI actively seeks professionals in this field. Healthcare workers who are already working in PEI or have job offers from PEI employers are eligible for consideration under both the Labour Impact Category and PEI PNP Express Entry.

With the rising need for healthcare professionals in Canada, now is the perfect time to explore options like the PEI PNP. Wave Immigration Consultant, known for its personalized services, can assist you in navigating this process.

Macro Trends Impacting Provincial Nominee Programs (PNPs) in Canada

The 2025-2027 Immigration Levels Plan has had a significant impact on Canada’s Provincial Nominee Programs. As part of the new plan, the PNP admissions target has been reduced for 2025 from 110,000 to 55,000, which will influence the number of ITAs issued across Canada’s provinces.

This reduction may impact the number of candidates selected in future PNP draws, making it even more important for aspiring immigrants to maximize their chances of being invited through programs like PEI PNP.

The 2025 Immigration Levels Plan and Its Implications

The 2025 Immigration Levels Plan has set a new allocation for permanent residency admissions under the PNP at 55,000. This allocation will be distributed among the various provinces and territories. As such, it’s crucial to stay updated on these changes and adjust your immigration strategy accordingly.

The shift to a lower allocation underscores the importance of acting quickly, especially for professionals in high-demand fields like healthcare. Wave Immigration Consultant can help you plan your next steps to align with these shifting trends.

Why Choose Wave Immigration Consultant for Your PNP Journey?

When navigating the complexities of Canadian immigration, working with a reputable consultant can make all the difference. Wave Immigration Consultant is proud to be recognized as one of the best immigration services in Delhi, offering personalized, expert guidance through every step of the application process. Whether you’re applying under the PEI PNP or any other immigration stream, we have the expertise to help you achieve your Canadian immigration goals.

Conclusion

The recent PEI PNP draw has opened up exciting opportunities for healthcare professionals looking to immigrate to Canada. With the recent shift in Canada’s immigration levels and the reduction in PNP admissions for 2025, it's important to stay informed and take action quickly. Wave Immigration Consultant offers tailored advice and support for candidates looking to apply through the PEI PNP and other Canadian immigration streams.

Start your journey towards permanent residency in Canada today by partnering with the best immigration services in Delhi—Wave Immigration Consultant. Reach out to us for expert assistance with your PEI PNP application.

Corporate Office : 2nd Floor, Right Side, Building No. 5, Kehar Singh Estate Westend Marg, Lane No. 2, Saidulajab, Saket New Delhi 110030.

#consultant service#immigration services#wavevisas#canada immigration#canadaimmigration#consultant#visa

2 notes

·

View notes

Text

America First Trade Policy

Issued January 20, 2025.

Section 1. Background. In 2017, my Administration pursued trade and economic policies that put the American economy, the American worker, and our national security first. This spurred an American revitalization marked by stable supply chains, massive economic growth, historically low inflation, a substantial increase in real wages and real median household wealth, and a path toward eliminating destructive trade deficits.

My Administration treated trade policy as a critical component to national security and reduced our Nation's dependence on other countries to meet our key security needs.

Americans benefit from and deserve an America First trade policy. Therefore, I am establishing a robust and reinvigorated trade policy that promotes investment and productivity, enhances our Nation's industrial and technological advantages, defends our economic and national security, and -- above all -- benefits American workers, manufacturers, farmers, ranchers, entrepreneurs, and businesses.

Sec. 2. Addressing Unfair and Unbalanced Trade. (a) The Secretary of Commerce, in consultation with the Secretary of the Treasury and the United States Trade Representative, shall investigate the cause of our country's large and persistent annual trade deficits in goods, as well as the economic and national security implications and risks resulting from such deficits, and recommend appropriate measures, such as a global supplemental tariff or other policies, to remedy such deficits.

(b) The Secretary of the Treasury, in consultation with the Secretary of Commerce and the Secretary of Homeland Security, shall investigate the feasibility of Establishing and recommend the best methods for designing, building, and implementing an External Revenue Service (ERS) to collect tariffs, duties, and other foreign trade-related revenues.

(c) The United States Trade Representative, in consultation with the Secretary of the Treasury, the Secretary of Commerce, and the Senior Counselor for Trade and Manufacturing, shall undertake a review of, and identify, any unfair trade practices by other countries and recommend appropriate actions to remedy such practices under applicable authorities, including, but not limited to, the Constitution of the United States; sections 71 through 75 of title 15, United States Code; sections 1337, 1338, 2252, 2253, and 2411 of title 19, United States Code; section 1701 of title 50, United States Code; and trade agreement implementing acts.

(d) The United States Trade Representative shall commence the public consultation process set out in section 4611(b) of title 19, United States Code, with respect to the United States-Mexico-Canada Agreement (USMCA) in preparation for the July 2026 review of the USMCA. Additionally, the United States Trade Representative, in consultation with the heads of other relevant executive departments and agencies, shall assess the impact of the USMCA on American workers, farmers, ranchers, service providers, and other businesses and make recommendations regarding the United States' participation in the agreement. The United States Trade Representative shall also report to appropriate congressional committees on the operation of the USMCA and related matters consistent with section 4611(b) of title 19, United States Code.

(e) The Secretary of the Treasury shall review and assess the policies and practices of major United States trading partners with respect to the rate of exchange between their currencies and the United States dollar pursuant to section 4421 of title 19, United States Code, and section 5305 of title 22, United States Code. The Secretary of the Treasury shall recommend appropriate measures to counter currency manipulation or misalignment that prevents effective balance of payments adjustments or that provides trading partners with an unfair competitive advantage in international trade, and shall identify any countries that he believes should be designated as currency manipulators.

(f) The United States Trade Representative shall review existing United States trade agreements and sectoral trade agreements and recommend any revisions that may be necessary or appropriate to achieve or maintain the general level of reciprocal and mutually advantageous concessions with respect to free trade agreement partner countries.

(g) The United States Trade Representative shall identify countries with which the United States can negotiate agreement on a bilateral or sector-specific basis to obtain export market access for American workers, farmers, ranchers, service providers, and other businesses and shall make recommendations regarding such potential agreements.

(h) The Secretary of Commerce shall review policies and regulations regarding the application of antidumping and countervailing duty (AD/CVD) laws, including with regard to transnational subsidies, cost adjustments, affiliations, and "zeroing." Further, the Secretary of Commerce shall review procedures for conducting verifications pursuant to section 1677m of title 19, United States Code, and assess whether these procedures sufficiently induce compliance by foreign respondents and governments involved in AD/CVD proceedings. The Secretary of Commerce shall consider modifications to these procedures, as appropriate.

(i) The Secretary of the Treasury, the Secretary of Commerce, the Secretary of Homeland Security, and the Senior Counselor for Trade and Manufacturing, in consultation with the United States Trade Representative, shall assess the loss of tariff revenues and the risks from importing counterfeit products and contraband drugs, e.g., fentanyl, that each result from the current implementation of the $800 or less, duty-free de minimis exemption under section 1321 of title 19, United States Code, and shall recommend modifications as warranted to protect both the revenue of the United States and the public health by preventing unlawful importations.

(j) The Secretary of the Treasury, in consultation with the Secretary of Commerce and the United States Trade Representative, shall investigate whether any foreign country subjects United States citizens or corporations to discriminatory or extraterritorial taxes pursuant to section 891 of title 26, United States Code.

(k) The United States Trade Representative, in consultation with the Senior Counselor for Trade and Manufacturing, shall review the impact of all trade agreements -- including the World Trade Organization Agreement on Government Procurement -- on the volume of Federal procurement covered by Executive Order 13788 of April 18, 2017 (Buy American and Hire American), and shall make recommendations to ensure that such agreements are being implemented in a manner that favors domestic workers and manufacturers, not foreign nations.

Sec. 3. Economic and Trade Relations with the People's Republic of China (PRC). (a) The United States Trade Representative shall review the Economic and Trade Agreement Between the Government of the United States of America and the Government of the People's Republic of China to determine whether the PRC is acting in accordance with this agreement, and shall recommend appropriate actions to be taken based upon the findings of this review, up to and including the imposition of tariffs or other measures as needed.

(b) The United States Trade Representative shall assess the May 14, 2024, report entitled "Four-Year Review of Actions Taken in the Section 301 Investigation: China's Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property, and Innovation" and consider potential additional tariff modifications as needed under section 2411 of title 19, United States Code -- particularly with respect to industrial supply chains and circumvention through third countries, including an updated estimate of the costs imposed by any unfair trade practices identified in such review -- and he shall recommend such actions as are necessary to remediate any issues identified in connection with this process.

(c) The United States Trade Representative shall investigate other acts, policies, and practices by the PRC that may be unreasonable or discriminatory and that may burden or restrict United States commerce, and shall make recommendations regarding appropriate responsive actions, including, but not limited to, actions authorized by section 2411 of title 19, United States Code.

(d) The Secretary of Commerce and the United States Trade Representative shall assess legislative proposals regarding Permanent Normal Trade Relations with the PRC and make recommendations regarding any proposed changes to such legislative proposals.

(e) The Secretary of Commerce shall assess the status of United States intellectual property rights such as patents, copyrights, and trademarks conferred upon PRC persons, and shall make recommendations to ensure reciprocal and balanced treatment of intellectual property rights with the PRC.

Sec. 4. Additional Economic Security Matters. (a) The Secretary of Commerce, in consultation with the Secretary of Defense and the heads of any other relevant agencies, shall conduct a full economic and security review of the United States' industrial and manufacturing base to assess whether it is necessary to initiate investigations to adjust imports that threaten the national security of the United States under section 1862 of title 19, United States Code.

(b) The Assistant to the President for Economic Policy, in consultation with the Secretary of Commerce, the United States Trade Representative, and the Senior Counselor for Trade and Manufacturing, shall review and assess the effectiveness of the exclusions, exemptions, and other import adjustment measures on steel and aluminum under section 1862 of title 19, United States Code, in responding to threats to the national security of the United States, and shall make recommendations based upon the findings of this review.

(c) The Secretary of State and the Secretary of Commerce, in cooperation with the heads of other agencies with export control authorities, shall review the United States export control system and advise on modifications in light of developments involving strategic adversaries or geopolitical rivals as well as all other relevant national security and global considerations. Specifically, the Secretary of State and the Secretary of Commerce shall assess and make recommendations regarding how to maintain, obtain, and enhance our Nation's technological edge and how to identify and eliminate loopholes in existing export controls -- especially those that enable the transfer of strategic goods, software, services, and technology to countries to strategic rivals and their proxies. In addition, they shall assess and make recommendations regarding export control enforcement policies and practices, and enforcement mechanisms to incentivize compliance by foreign countries, including appropriate trade and national security measures.

(d) The Secretary of Commerce shall review and recommend appropriate action with respect to the rulemaking by the Office of Information and Communication Technology and Services (ICTS) on connected vehicles, and shall consider whether controls on ICTS transactions should be expanded to account for additional connected products.

(e) The Secretary of the Treasury, in consultation with the Secretary of Commerce and, as appropriate, the heads of any other relevant agencies, shall review whether Executive Order 14105 of August 9, 2023 (Addressing United States Investments in Certain National Security Technologies and Products in Countries of Concern) should be modified or rescinded and replaced, and assess whether the final rule entitled "Provisions Pertaining to U.S. Investments in Certain National Security Technologies and Products in Countries of Concern," 89 Fed. Reg. 90398 (November 15, 2024), which implements Executive Order 14105, includes sufficient controls to address national security threats. The Secretary of the Treasury shall make recommendations based upon the findings of this review, including potential modifications to the Outbound Investment Security Program.

(f) The Director of the Office of Management and Budget shall assess any distorting impact of foreign government financial contributions or subsidies on United States Federal procurement programs and propose guidance, regulations, or legislation to combat such distortion.

(g) The Secretary of Commerce and the Secretary of Homeland Security shall assess the unlawful migration and fentanyl flows from Canada, Mexico, the PRC, and any other relevant jurisdictions and recommend appropriate trade and national security measures to resolve that emergency.

Sec. 5. Reports. The results of the reviews and investigations, findings, identifications, and recommendations identified in:

(a) sections 2(a), 2(h), 3(d), 3(e), 4(a), 4(b), 4(c), 4(d), and 4(g) shall be delivered to me in a unified report coordinated by the Secretary of Commerce by April 1, 2025;

(b) sections 2(b), 2(e), 2(i), 2(j), and 4(e) shall be delivered to me in a unified report coordinated by the Secretary of the Treasury by April 1, 2025;

(c) sections 2(c), 2(d), 2(f), 2(g), 2(k), 3(a), 3(b), and 3(c) shall be delivered to me in a unified report coordinated by the United States Trade Representative by April 1, 2025; and

(d) section 4(f) shall be delivered to me by the Director of Office of Management and Budget by April 30, 2025.

Sec. 6. General Provisions. (a) Nothing in this memorandum shall be construed to impair or otherwise affect:

(i) the authority granted by law to an executive department or agency, or the head thereof; or

(ii) the functions of the Director of the Office of Management and Budget relating to budgetary, administrative, or legislative proposals.

(b) This memorandum shall be implemented consistent with applicable law and subject to the availability of appropriations.

(c) This memorandum is not intended to, and does not, create any right or benefit, substantive or procedural, enforceable at law or in equity by any party against the United States, its departments, agencies, or entities, its officers, employees, or agents, or any other person.

#us politics#us government#executive orders#trade#foreign trade#PRC#people's Republic of china#commerce

2 notes

·

View notes