#instant approval business loan

Explore tagged Tumblr posts

Text

instant approval business loan

What are the types of Business Loan

Introduction

Business loans are a crucial financial tool for entrepreneurs and business owners. They provide capital to support various aspects of business operations and expansion. Understanding the different types of business loans available is essential for making informed financial decisions. In this article, we'll explore various types of business loans, each tailored to specific business needs, so you can choose the right one for your venture.

1. Term Loans

Term loans are one of the most common types of business loans. They involve borrowing a lump sum of money from a lender, which is then repaid over a specified term, often with a fixed interest rate. Term loans are ideal for financing long-term investments, such as equipment purchases, real estate, or business expansion. They offer predictable monthly payments, making it easier to manage your budget.

2. SBA Loans

Small Business Administration (SBA) loans are government-backed loans designed to support small businesses. These loans come in various forms, including 7(a) loans for general purposes, 504 loans for real estate and equipment, and micro-loans for small funding needs. SBA loans typically offer favorable terms, such as low interest rates and longer repayment periods, making them attractive to small businesses.

3. Business Lines of Credit

Business lines of credit provide a flexible source of funds that businesses can access as needed. Similar to a credit card, you're approved for a maximum credit limit, but you only pay interest on the amount you use. This type of loan is particularly useful for managing short-term cash flow fluctuations, covering unexpected expenses, or taking advantage of business opportunities.

4. Equipment Financing

Equipment financing allows businesses to purchase or lease equipment, machinery, or vehicles. The equipment being financed typically serves as collateral for the loan. This type of loan is ideal for businesses that need to acquire assets without depleting their working capital. The equipment itself secures the loan, which can lead to more favorable terms and interest rates.

5. Invoice Financing

Invoice financing, also known as accounts receivable financing, helps businesses improve their cash flow by selling outstanding invoices to a lender at a discount. This allows you to access a portion of the invoice amount immediately rather than waiting for your customers to pay. It's a valuable option for businesses with slow-paying customers or those looking to reinvest capital quickly.

6. Merchant Cash Advances

Merchant cash advances are a short-term financing option where a lender provides a lump sum in exchange for a percentage of your daily credit card sales plus a fee. This type of loan is suitable for businesses with high credit card sales volumes, such as retail or restaurant establishments. While it provides quick access to capital, merchant cash advances can be expensive due to the associated fees.

7. Commercial Real Estate Loans

For businesses seeking to acquire, develop, or refinance commercial real estate, commercial real estate loans are essential. These loans can come in various forms, including commercial mortgages, construction loans, and refinancing options. The terms and interest rates vary based on the specific type of loan and the lender, and they are often used for purchasing or renovating office space, retail locations, or industrial properties.

8. Business Credit Cards

Business credit cards offer revolving credit lines that businesses can use for various expenses. They're not traditional loans but provide a flexible source of funding. Business owners can use credit cards to manage daily expenses, earn rewards, and build their business credit. However, it's crucial to manage credit card debt responsibly to avoid high-interest charges.

9. Microloans

Microloans are small, short-term loans often offered by non-profit organizations or government agencies to assist startups and small businesses. These loans can be used for various purposes, including working capital, equipment purchase, or inventory financing. Microloans are particularly helpful for businesses with limited credit history or those in need of modest funding amounts.

10. Startup Loans

Startup loans are specifically designed for new businesses. Since startups often lack a financial track record, these loans may rely on the personal credit history and assets of the business owner. They can provide the capital needed to launch a new venture, cover initial expenses, or fund product development. While obtaining startup loans can be challenging, they can be a valuable resource for entrepreneurs.

Conclusion

Business loans are not one-size-fits-all; they come in various forms to address specific financial needs. Choosing the right type of loan for your business is crucial, as it can significantly impact your financial stability and growth. Consider your business goals, creditworthiness, and the purpose of the loan when making your decision. Moreover, it's advisable to consult with financial advisors or loan specialists to ensure you select the most appropriate financing solution for your specific situation. With the right business loan, you can fuel growth, manage cash flow, and achieve your entrepreneurial aspirations. Get instant approval of the Business Loan and quick disbursal in your account.

#instant approval business loan#business loan startup#online loan for business#loan for online business#apply business loan#instant business loan#online apply for business loan#apply online business loan#online apply business loan#apply business loan online#interest rate on business loan in India#lowest business loan interest rate#business loan online instant approval#business loan apply online#quick business loan

0 notes

Text

Comprehensive loan services by loan experts India: Your reliable financial partner Loan expert

India is a major financial services provider who is committed to help individuals and businesses access to the best loan options to suit their needs. With a team of experienced professionals, they provide expert guidance, competitive interest rates and hassle -free loan approval. Loan Experts India services cover a wide range of financial requirements including home loans, personal loans, business loans, and more.

Types of loan services by loan experts India

1. Retail loan

Retail loans are individual or consumer loans provided to individuals for various financial requirements, such as home procurement, vehicle financing, education or personal expenses. These loan come with flexible repayment options and competitive interest rates.

Types of retail loan include:

1 Personal loan - unsafe loan for personal expenses such as travel, medical emergency or marriage costs.

Home Loan - Financial assistance for buying or construction of a house with long -term repayment tenure.

Car loan - Loans to buy new or used vehicles with low EMI and minimal documentation.

Education Loans - In India, abroad with funds or repayment flexibility for higher education in India. Retail loans are ideal for salaried individuals, self-employed professionals and pensioners in search of financial assistance for individual needs.

2. Msme trade loan Micro, small and medium enterprises (MSME)

These loans can be used for business expansion, machinery procurement, working capital or inventory stocking. Many MSME loans are supported by government encouragement, making them a cost -effective financing solution.

Major features of MSME loan:

• Quick dysbersal to get businesses timely financial assistance.

• Flexible repayment tenure from 1 to 10 years.

• Depending on business needs, loan amount from 50,000 to ₹ 10 crore.

• Collateral-free option under government schemes such as CGTMSE (Credit Guarantee Fund for Micro and Small Enterprises).

loans are financial solutions designed to support small business owners, startups and entrepreneurs in the expansion of their businesses.

3. Government loan schemes

Government loan schemes provide financial assistance to individuals, businesses and startups under various initiatives by the Government of India. The objective of these schemes is to promote entrepreneurship, housing, education and rural development.

Popular government loan schemes include:

• Pradhan Mantra Mudra Yojana (PMMY) - Mut provides currency loan up to 10 lakhs for small businesses.

• Pradhan Mantri Awas Yojana (PMAY) - Home loan subsidy for affordable housing.

• stand-up India scheme-Loans for women and SC/ST entrepreneurs to start business.

• Startup India Scheme - Financial Assistance for Startup with Tax Benefits and Easy Funding Access.

Government loan schemes provide low interest rate, subsidy and comfortable eligibility criteria, making them accessible to a large population.

4 Bank auction properties

Bank auction properties refer to real estate assets by banks due to loan omission. These properties are auctioned at concessional prices, which offers buyers an opportunity to invest in real estate at minimum-and-market rates.

Major benefits of buying bank auction properties:

Prices lower than market value, making it a cost -effective investment.

Properties available in major places including residential, commercial and industrial property.

Transparent procurement process with bank participation, reducing the risks of fraud.

Funding options available through home loans, making property acquisition easier.

Buyers should conduct proper hard work, legal verification and financial planning before purchasing auctioned properties to avoid legal complications.

Benefits of Choosing Loan Experts India India

Specialist counseling: Get guidance from industry professionals who understand the complications of loan processes. Our experts provide analogous advice, helping to navigate financial options and choose the best solution based on their needs.

Nationalized bank participation: We collaborate with major nationalized banks to provide you safe, reliable and competitive loan options. Our strong participation ensures better interest rates, transparent processes and rapid approval.

End-to-end support: For loan disbursement and post-lone assistance from initial consultation, we provide full support at every stage. Our team handles documentation, talks and followers to make the entire process smooth and trouble free.

Customized loan solution: Every financial requirement is unique, and therefore our loan solutions. We assess your specific requirements and tailor loan schemes that are best suited for your financial goals, repayment capacity and future growth prospects

Tips for a Successful Loan Approval

Maintaining a Good Credit Score

A strong credit score is important to obtain loans with favorable conditions. Regularly paying bills, keeping credit use low, and avoiding many loan applications can help maintain a healthy credit score, which increases the chances of your loan approval.

Choosing the Right Loan Amount and Tenure

Selecting the appropriate loan amount and ensures the repayment tenure financial stability. Borrowing within your repayment capacity and selecting for a suitable tenure helps to balance EMI, reducing financial stress, reducing interest costs.

Understanding the Terms and Conditions

Before taking the loan, carefully review the terms and conditions including interest rates, processing fees, pre -payment fees and punishment. Understanding these details helps to avoid hidden costs and ensures a smooth borrowing experience.

1 note

·

View note

Text

How to Get a Personal Loan If You Are a Non-Salaried Individual?

Introduction

A personal loan is a popular financial tool that provides quick funds for various needs such as medical emergencies, home renovation, education, travel, or business expansion. However, most lenders prefer salaried individuals due to their stable income and financial security. This raises an important question: Can a non-salaried individual get a personal loan?

The good news is that self-employed professionals, freelancers, business owners, and gig workers can still qualify for a personal loan. Although the approval process may be slightly different, several banks and NBFCs (Non-Banking Financial Companies) offer personal loans to non-salaried individuals based on their income stability, credit history, and financial documents.

In this guide, we will explore the eligibility criteria, required documents, best lenders, and tips to increase your chances of securing a personal loan if you are a non-salaried individual.

Challenges Faced by Non-Salaried Individuals in Getting a Personal Loan

Since a personal loan is unsecured, lenders assess the applicant’s ability to repay the loan before approval. Non-salaried individuals, including business owners, freelancers, and consultants, often face the following challenges when applying for a personal loan:

❌ Irregular Income – Unlike salaried employees who receive a fixed monthly salary, self-employed individuals may have fluctuating income, making it harder to prove financial stability. ❌ Higher Interest Rates – Lenders consider non-salaried borrowers as high-risk applicants, leading to higher interest rates. ❌ Strict Eligibility Criteria – Banks and NBFCs may require additional documents such as income tax returns (ITR), business proof, or GST filings. ❌ Shorter Loan Tenure – Some lenders offer shorter repayment terms to non-salaried borrowers, increasing monthly EMI burden.

Despite these challenges, non-salaried individuals can still qualify for a personal loan by meeting the lender’s requirements and improving their financial profile.

Eligibility Criteria for a Personal Loan as a Non-Salaried Individual

Each lender has different eligibility criteria, but general requirements include:

✔️ Minimum Age – Applicant must be between 21 to 60 years. ✔️ Income Stability – Must have a stable income source from business, freelancing, or investments. ✔️ Credit Score – A credit score of 700+ increases approval chances. ✔️ Business Vintage – For self-employed individuals, the business must be operational for at least 2 years. ✔️ Banking Transactions – Strong banking history with regular income deposits is required. ✔️ Loan Amount – Based on financial profile, lenders offer loans from ₹50,000 to ₹50 lakh.

If you meet these criteria, you stand a good chance of getting a personal loan as a non-salaried borrower.

Documents Required for a Personal Loan Without a Salary Slip

Since non-salaried individuals cannot provide salary slips, lenders require alternative financial documents such as:

📌 Identity Proof – Aadhaar Card, PAN Card, Passport, or Voter ID. 📌 Address Proof – Utility Bills, Rental Agreement, or Driving License. 📌 Income Proof – Income Tax Returns (ITR) for the last 2 years (mandatory for self-employed). 📌 Bank Statements – Last 6-12 months’ bank statements to show consistent cash flow. 📌 Business Proof (if applicable) – GST registration, business license, or shop establishment certificate. 📌 Form 16 or Audited Financial Statements – For professionals such as doctors, lawyers, and consultants.

Having the right documents ready can speed up the loan approval process and improve your chances of getting a personal loan.

Best Personal Loan Options for Non-Salaried Individuals

Several banks and NBFCs offer personal loans to self-employed individuals, freelancers, and business owners. Here are some of the best lenders:

1. HDFC Bank Personal Loan for Self-Employed

✅ Loan Amount – ₹50,000 to ₹40 lakh ✅ Interest Rate – 10.75% - 20% per annum ✅ Tenure – 12 to 60 months ✅ Eligibility – Minimum 2 years of business stability required

2. Bajaj Finserv Flexi Personal Loan

✅ Loan Amount – Up to ₹35 lakh ✅ Interest Rate – Starts at 12% per annum ✅ Tenure – Up to 5 years ✅ Special Feature – Withdraw funds as needed and pay interest only on the utilized amount

3. ICICI Bank Personal Loan for Self-Employed

✅ Loan Amount – ₹50,000 to ₹25 lakh ✅ Interest Rate – 11.25% onwards ✅ Tenure – Up to 6 years ✅ Eligibility – Minimum ₹2 lakh annual income required

4. Fullerton India Personal Loan for Freelancers

✅ Loan Amount – Up to ₹10 lakh ✅ Interest Rate – Starts at 15% ✅ Tenure – Up to 48 months ✅ Eligibility – Must show steady freelance income

These lenders provide tailored personal loans for non-salaried individuals with competitive interest rates and flexible repayment options.

How to Improve Your Chances of Loan Approval?

If you are a non-salaried individual, follow these tips to increase your chances of getting a personal loan:

✔️ Maintain a Strong Credit Score – A credit score above 700 increases approval chances and lowers interest rates. ✔️ Show Consistent Income – Ensure that your bank statements reflect regular deposits to prove income stability. ✔️ Reduce Existing Debt – Lower your Debt-to-Income (DTI) ratio to get better loan terms. ✔️ Apply for a Smaller Loan Amount – If your income is inconsistent, opt for a lower loan amount to improve approval chances. ✔️ Choose a Reputed Lender – Apply with lenders offering personal loans for non-salaried borrowers. ✔️ Add a Co-Applicant or Guarantor – If your income is low, adding a co-applicant (such as a family member) improves loan eligibility.

By following these strategies, non-salaried individuals can successfully secure a personal loan with minimal hassle.

Final Thoughts: Can Non-Salaried Individuals Get a Personal Loan?

Yes! Non-salaried individuals, including self-employed professionals, freelancers, and business owners, can get a personal loan without collateral. While the process may be slightly different, banks and NBFCs offer personal loans based on income stability, credit score, and financial history.

To improve approval chances: ✔️ Maintain a strong credit score ✔️ Ensure steady income deposits in your bank account ✔️ Keep necessary documents ready ✔️ Compare loan offers for the best interest rates

If you are a self-employed borrower looking for the right personal loan, explore options from leading banks and NBFCs at www.fincrif.com for expert insights!

#personal loan#personal loan online#nbfc personal loan#fincrif#personal loans#bank#loan apps#loan services#finance#personal laon#Personal loan#Personal loan for self-employed#Personal loan without salary slip#Non-salaried personal loan#Personal loan for freelancers#Personal loan eligibility#Loan for business owners#Instant personal loan for self-employed#Best personal loans for non-salaried individuals#Loan without income proof#Unsecured personal loan#How to get a personal loan without a salary slip#Best lenders for self-employed personal loans#Can freelancers get a personal loan in India?#How to apply for a personal loan as a business owner#Minimum income required for a personal loan#Personal loan options for self-employed professionals#Tips to improve personal loan approval chances#Low-interest personal loans for self-employed individuals

1 note

·

View note

Text

Income-Based Loans Services | Income Based Loans Online

Access flexible income-based loans online. From payday to installment and mortgage loans, get funding tailored to your income, no credit check needed!

#income-based loans#income based loans#income based loans online#income based loans only#income based payday loans#income based installment loans#income based mortgage loans#income based loans texas#loans based on income not credit score#no credit check income based loans#income based loans no credit check#income based loans near me#best income based loans#income based loans no credit check instant approval#online income based loans#income based business loans#income based loans no credit check near me

0 notes

Text

youtube

नमस्ते अलवर के व्यापारियों, दाधीच फिनसर्व से 24 घंटे के भीतर बिजनेस लोन प्राप्त करें|

नमस्कार, क्या आप अलवर में बिजनेस लोन की तलाश कर रहे हैं लेकिन आपको नहीं पता कि कहां और कैसे अप्लाई करें।दाधीच फिनसर्व है जो आसान प्रक्रिया के जरिए 24 घंटे के अंदर लोन अप्रूव कर देती है। और अगर आप भी लोन लेना चाहते हैं तो हमने आपको इस वीडियो के जरिए समझाया है कि बिजनेस लोन अप्लाई करने के लिए आपको क्या-क्या चाहिए होगा। तो इंतजार किस बात का, अभी हमारी वेबसाइट पर जाएं और बिजनेस लोन के लिए अप्लाई करें, धन्यवाद।

आज ही संपर्क करें दाधीच फिनसर्व:+91-9119241400 और जानकारी के लिये हमारी वेबसाइट चैक करे।

Website:- www.dadhichfin.com

#business loan#loan approval#personal loan#loan provider#loan provider in alwar#instant personal loan#instant loan#apply now#get approved loan#Youtube

0 notes

Text

#Business Loan Instant#Easy Loan for Business#Business Loan Available#Business Loan Online Instant Approval#Private Finance Business Loan#Need Loan for New Business#Company Loan Interest Rates#Business Loan Providers In India

0 notes

Text

How to Apply for a Home Loan in Noida

Apply for a Home Loan in Noida: A Comprehensive Guide Are you planning to buy your dream home in the bustling city of Noida? Owning a house is a significant milestone in everyone's life, but sometimes the financial aspect can be a challenge. Thankfully, there are various options available to help you fulfill your dream, and one such option is applying for a home loan. we will walk you through the process of applying for a home loan in Noida, ensuring that you have the knowledge and confidence to navigate the sometimes complex world of home loan applications.

How to Begin Your Home Loan Journey Research and Compare Lenders Before diving into the home loan application process, it's crucial to do thorough research and compare different lenders. Look for institutions that offer competitive interest rates, flexible repayment options, and excellent customer service. Take into consideration factors such as reputation, customer reviews, and the loan eligibility criteria. By gathering all the necessary information, you can make an informed decision about which lender suits your needs best.

Determine Your Loan Eligibility The next step in applying for a home loan in Noida is determining your eligibility. Lenders usually assess your eligibility based on factors such as your income, credit score, employment history, and existing liabilities. It's essential to have all the required documents ready, including your income proof, bank statements, ID proof, and address proof. Additionally, assess your own financial situation to determine the loan amount you can comfortably afford without straining your monthly budget.

The Home Loan Application Process

Fill Out the Application Form Once you have chosen a lender and confirmed your eligibility, the first formal step towards getting a home loan is filling out the application form. Make sure to provide accurate information and double-check all the details before submitting the form. Any errors or omissions can delay the loan approval process.

Submit the Required Documents After submitting the application form, you will be required to provide the necessary documents to support your application. This typically includes: Proof of Identity (such as an Aadhaar card, PAN card, or passport) Proof of Address (electricity bill, passport, or ration card) Income Proof (salary slips, income tax returns, or Form 16) Bank Statements (for the last six months) Employment Proof (such as an appointment letter or employment contract)

Ensure that you have all these documents readily available in their appropriate formats to streamline the application process. Await Credit Appraisal Once your application and documents are submitted, the lender will conduct a credit appraisal. During this stage, they will assess your creditworthiness by verifying your financial history, credit score, and repayment capacity. This process can take a few days to a couple of weeks, depending on the lender's internal procedures. Apply for Personal Loan in Noida

Property Appraisal and Legal Documentation Simultaneously, the lender will conduct a property appraisal to determine its value and marketability. This step ensures that the property you intend to purchase meets the lender's criteria. Additionally, the legal documentation of the property will be thoroughly reviewed, including title deeds and ownership records.

Loan Sanction and Disbursement Upon the successful completion of the credit appraisal and property assessment, the lender will sanction the loan amount. The terms and conditions of the loan, including the interest rate and repayment tenure, will be finalized. After ensuring that all legal formalities are met, the loan amount will be disbursed either directly to the seller (in the case of a resale property) or to the builder (for an under-construction property).

Tips to Simplify the Home Loan Application Process Maintain a good credit score: A higher credit score increases your chances of loan approval and can help you secure a better interest rate.

Save for a down payment: Save a significant amount for the down payment to reduce the loan amount and increase your eligibility. Clear existing debts: Pay off any outstanding debts or loans to improve your debt-to-income ratio, enhancing your creditworthiness. Consult a financial advisor: If you are unsure about any aspect of the home loan application process, consider seeking guidance from a professional financial advisor who can provide expert advice tailored to your specific circumstances. In Conclusion Applying for a home loan in Noida may seem like a daunting process, but with proper research, preparation, and guidance, a Credit Card Balance Transfer loan in Noida, can be a smooth and rewarding experience. By following the steps outlined in this article and staying organized throughout the process, you will be well on your way to achieving your dream of owning a home in Noida. So, why wait? Start your home loan journey today and turn your dream into a reality.

Looking to apply for a home loan in Noida? This comprehensive guide walks you through the process, eligibility criteria, and tips for a smooth experience. If you are looking Apply for a Loan Against Property in Noida. Visit our website link: https://finaqo.in/

#Apply for a Home Loan in Noida#apply for overdraft facility in noida#personal loan balance transfer online in noida#credit card balance transfer facility in noida#pre approved personal loan apply online in noida#instant apply for loan against property in noida#Apply for Loan Against Property in Noida#Apply for Home Loan in Noida#Apply for Business Loan in Noida

0 notes

Text

The Benefits of Choosing Depfin Finance for Your Personal Loan Needs

Depfin Finance is a reliable and trustworthy source for satisfying your personal loan needs. They provide competitive interest rates and flexible repayment options to make the process easy and seamless for you. For more information, visit: https://depfinfinance.blogspot.com/2023/05/the-benefits-of-choosing-depfin-finance.html

0 notes

Text

🚨Scammer Alert🚨 + 🔎Scam Exam(ination)🔍

Seen as: Recruitment to join the Illuminati Scam Type: Identity Theft / Fraud

Post updated: 2/14/25

Accounts running this scam: templeoflight66 symbolsand-shadow mysticmason googlescholarsecretsandsybmols illuminatiinsights thehiddenodex

-----

Before we dive into this scam, please note that this scam is very dangerous as it reportedly deals with identity theft and concludes with the theft and use of your stolen information for nefarious purposes.

As it should go with any stranger you talk to on the internet, you should never willingly give out any of your personal information such as: real name, date of birth, address, phone number, credit card/bank information, photos of yourself or your bank, credit, social security card, ect, to a stranger on the internet who promises you money.

1 - How it starts.

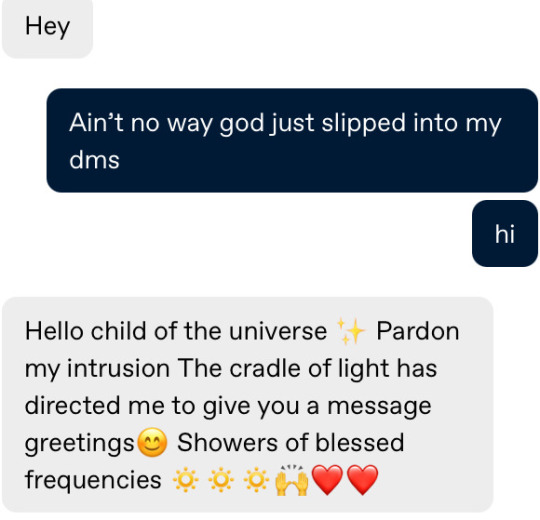

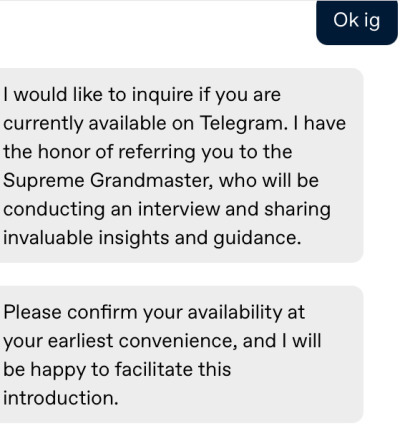

This scam typically starts by someone receiving an email, or in the images we will be examining today, a tumblr user receiving a DM- or, well, several DM's, from users who were trying to 'bless them with good tidings of the universe' and that it was 'a sign from the almighty' and 'it was fate' and all that nonsense... to try and then recruit them to join the Illuminati.

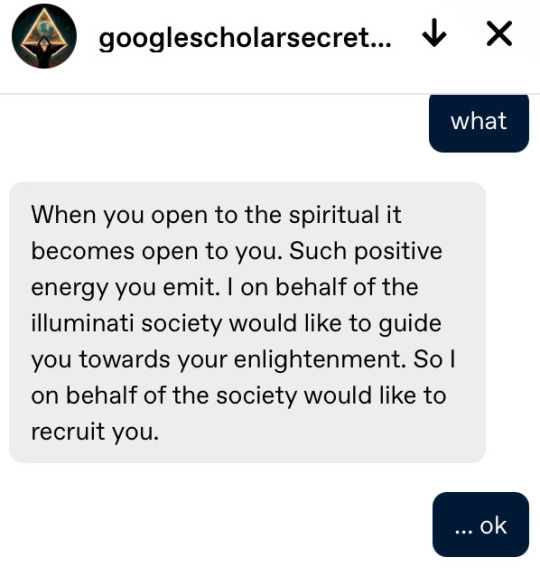

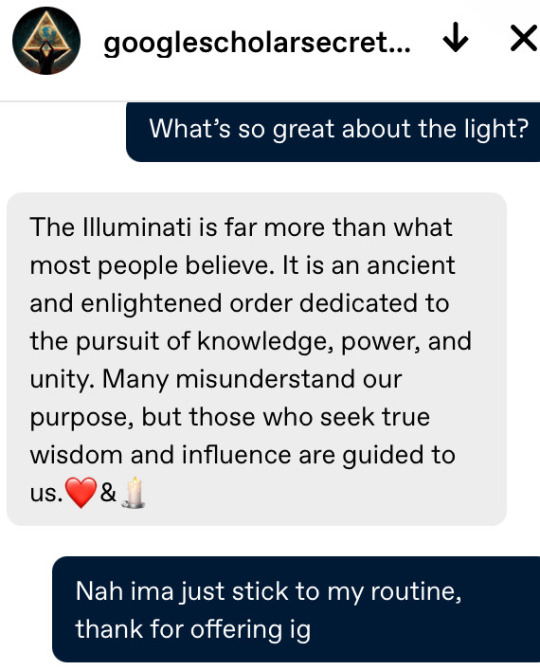

The following images were provided by an anonymous user of their conversation with googlescholarsecretsandsybmols:

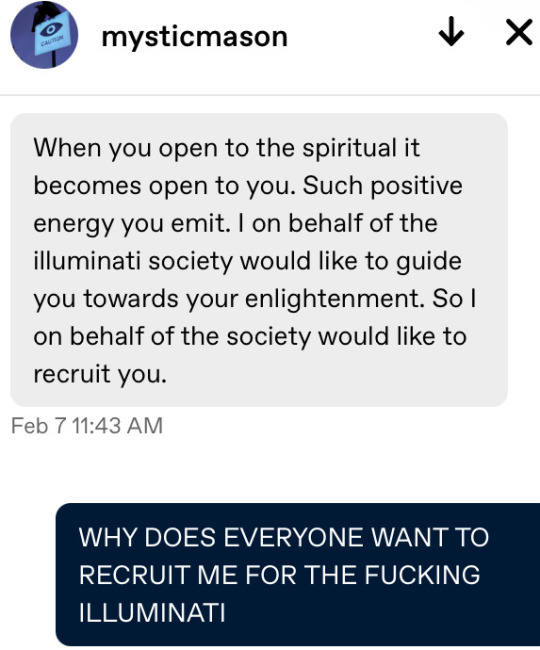

Here is anonymous's contact with mysticmason:

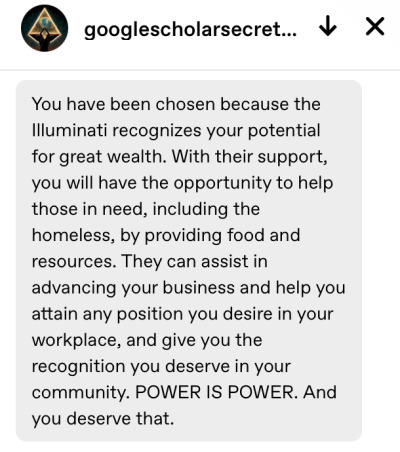

🚩Notable red flags🚩

Their blogs are full of generic AI generated images, philosophical scripture/nonsense, links to Illuminati websites/content that seem suspicious.

The offer of the impossible.

Wealth (of an undisclosed amount) to help the homeless with food and resources. Some 'means' of aiding your business and/or helping you attain any job position you desire in your work place. Some ✨magical✨ means of granting you recognition in your community. (As if they can suddenly make people change their opinions of you...)

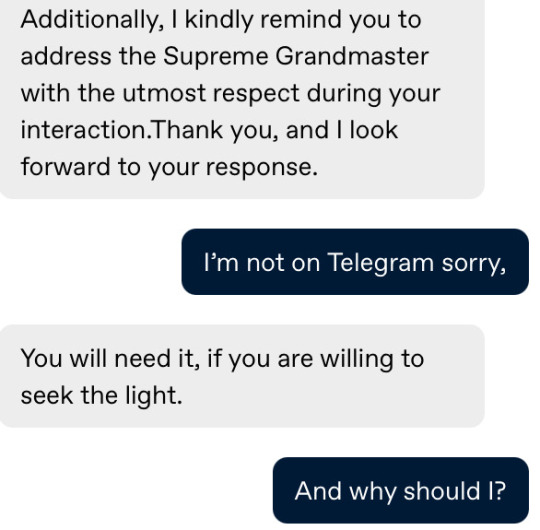

Then instant request/demand that they need you to use Telegram for communication.

Telegram is a service that a lot of scammers use, and they use it because they can easily communicate with other scammers (and victims) there, and run their scams through it without it usually being able to be used as evidence should something like Identity Theft occur.

2 - How this scam works.

This scam works by... well, what I find to be the most obvious tactic that a lot of scammers use:

The life changing offer of a lot money... You just need to do a little something in return... ;)

From here I will be pulling information from this article from Bitdefender, one of the most well known and well trusted Antivirus brands on the market today. (That I use in fact! :D)

In regards to the emails- the original method this scam was spread:

The spam emails were traced to IP addresses in Nigeria (40%), South Africa (16%), the US (14%), the Netherlands (13%), and Argentina and Brazil (with 5% each).

Here are a list of benefits the Illuminati claims they can offer you if you join, taken from the Bitdefender article as well:

A new house bought in any country of your choice.

A monthly salary of $200,000

A blessing for joining which includes 10 million dollars.

A "magic talisman" that can cure any kind of illness or infection.

The power to prosper and improve.

Free access to Bohemians grove.

First class/VIP treatment at any airport in the world.

One-year appointment approval with the top 10 world leaders.

Appointments with world celebrities of your choice.

A personal car with your name customized on it.

The seven-book of Moses to learn the language of ORIS for "powers".

And a lot more!...

You just have to buy the required items for you to become an initiate member into the 'brotherhood.'

Which is when they'll have you fill out a sheet with all of your personal information, work occupation, wage earnings, as well as request a photograph of you and/or your license for 'verification'.

If you do, they will steal your identity, use it to register for things like loans, ruin your credit, and your life is practically ruined. :(

Final Thoughts:

As I mentioned prior, you should never send this kind of information to anyone on the internet for any kind of reason if you do not know who you are speaking to on the other end, aka they're a stranger.

All these kinds of scams go off of are words, as that's all they are.

A promise made of just words.

No different than the free money or sugar baby/daddy scam where they promise you $3000 a month, all you have to do is 'send me $100+ to verify you want to do this.'

I know how life changing a lot of money can be, but do try to be logical and think about these things, for your sake and others!

Take care everyone.

#scam#scams#scam alert#scammer#scam awareness#scammers#scam warning#online scams#psa#internet safety#public service announcement#illuminati scam#templeoflight66#symbolsand-shadow#mysticmason#googlescholarsecretsandsybmols#illuminatiinsights#illuminati#conspiracy#thehiddenodex

27 notes

·

View notes

Text

Need an urgent loan of ₹5,00,000? My Mudra is here to help! Get instant approval with a quick and hassle-free application process. Whether it's for business expansion, working capital, or emergency expenses, we offer fast disbursal, minimal paperwork, and flexible repayment options. With My Mudra, you can secure the funds you need without long waiting times or complicated procedures. Our competitive interest rates and seamless online process make borrowing easy and stress-free. Apply now and get your ₹5,00,000 loan approved in no time with My Mudra—your trusted financial partner!

2 notes

·

View notes

Text

2025 Guide to Eloanwarehouse Payday Loans

People still seek payday loans in 2025. If you are looking for trustable online Payday Loans eLoanWarehouse best solution, then Eloanwarehouse is the right path. It could be an unforeseen medical bill, an auto repair, or some other critical need that requires immediate payment and next payday loans can help you get there through to the following payday. This article will explain everything you must know about payday loans from Eloanwarehouse in 2025, encompassing the way in which they work, the advantages, risks, and how you could apply for one.

What Are Payday Loans?

Now, before we discuss how Eloanwarehouse places you in contact with payday loans, it’s important to understand what payday loans are and how they can benefit you.

Payday Loans Explained:

A payday loan is a short term loan that can give you quick access to a small to moderate amount of money (typically $100–$1,000). The loan is typically due on or before your next payday. These loans can be used to meet emergency expenses when you lack other sources of funds.

Short-Term Financing:

Payday loans are usually due in two weeks. This shorter repayment period can be perfect for anyone who has to pay for something right now and is confident they will be able to pay back the loan quickly.

How Eloanwarehouse Can Help You Get a Payday Loan

And finally, Eloanwarehouse is a sort of online marketplace, connecting borrowers to numerous payday loan lenders. Eloanwarehouse is not like a typical bank; its process is quick and easy to ensure you get the payday loan suitable for your needs. Here’s how it works:

Simple Application Process: A payday loan application can be done online from home. Yes, that is because it requires nothing than an internet connection and a few minutes to find an application form on the web.

Instant Loan Offers: Once you send your application to Eloanwarehouse, it connects you with its pool of trusted payday lenders. You have all the lenders making you an offer, then you can compare terms and take the one that suits you best.

Quick application and fund transfers: After you have accepted a loan offer, the approval process is generally in a matter of minutes. In many cases, the money is deposited directly into your bank account within a few hours or by the next business day.

Reasons to opt for Payday Loans from Eloanwarehouse in 2025

eloanwarehouse became one of the top choices for payday loans for several reasons. Here are the details about the benefits:

Fast Access to Cash

The fast processing of cash is one of the primary reasons why people use payday loans. Eloanwarehouse knows the importance of getting funds fast, and most payday loan applications get approved and funded on the same day, and within one business day. This can be important if you need to access funds for an emergency quickly.

Simple Application Process

No more complex forms and lengthy انتظار. Applying for a payday loan with Eloanwarehouse is a simple process. Its quick online application can be filled out in a couple of minutes, with far less information than would be required for a traditional loan.

Wide Network of Lenders

When you apply through Eloanwarehouse, you get matched with multiple lenders which of course makes it possible for you to get the loan offer that matches your needs and financial situation. With what you have to choose from, you are able to shop around for interest rates, amounts of loans, terms of repayment, and other factors to pick the option that suits you most.

Secure and Reliable

Security is of the utmost importance when applying for a payday loan. They encrypt all sensitive data and use the latest technologies to keep your information safe. The site also works with reputable lenders so you can be assured you are working with trustworthy companies that follow fair lending practices.

Flexible Repayment Terms

The repayment terms depend on the lender. This can be particularly helpful for borrowers worried about making repayment on the initial due date, as Eloanwarehouse can connect you with lenders who may offer flexible repayment terms.

Eloanwarehouse Might Offer A Pay Day Loan – A 2025 Guide To Apply

Eloanwarehouse makes applying for a payday loan a simple process. Here’s how you can apply:

Step 1 The official Eloanwarehouse site

Visit Eloanwarehouse Official Site The interface is navigator friendly, and it gives you guidance on how to apply.

Step 2: Complete the Application Form

On this website, you’ll see the online application form requesting basic information, including:

Your full name

Date of birth

Contact information

Employment status

Income details

The transfer of funds bank account details

Step 3: Application Submission

After you have completed your application form, you should carefully read it to confirm that all information is correct. Then, submit the application. Eloanwarehouse will submit your information to its lender network.

Step 4: Review Loan Offers

Once you submit your application, you’ll get loan offers from different lenders. You will receive an offer for each one with the loan amount, interest rates, fees, and repayment terms. Spend as much time as needed to examine each written offer.

Step 5: Accept the Loan Offer

After you’ve looked over the loan offers, choose the one that will serve you best. After accepting, the lender will process your loan request.

Step 6: Receive Funds

After your loan has been approved, you can receive the funds directly into your bank account. Depending on the lender and when you apply, funds may be available the same day or the next business day.

Step 7: Repay the Loan

The last step is to pay off your payday loan. Make sure you know the terms of your loan repayment and pay it on time to avoid additional fees and interest charges.

In 2025, Is Eloanwarehouse a Secure Platform for Payday Loans?

Yes, Eloanwarehouse is a safe and secure platform to borrow payday loans. This means that your personal information and financial details are scrambled and unreadable to third parties. Eloanwarehouse is also a network of trusted partners offering payday loans from reputable payday lenders that meets both state and federal regulations, an added bonus that means you are dealing with reputable companies that conduct themselves in an ethical manner.

It’s always a good idea to read through the terms and conditions carefully before you accept a payday loan offer, so that you’re aware of exactly what you’re signing up for.

Before Taking Out a Payday Loan from Eloanwarehouse

Payday loans may help you find immediate relief, but there are some risks involved. These are some issues to think about before applying for a payday loan:

High Interest Rates: Payday loans have high-interest rates in general as compared to other types of credit. When you make the call to borrow money, make sure you include how much the loan is going to cost.

Short Term Repayment: Payday loans typically need to be paid back within two weeks or when you receive your next paycheck. Be certain that you’ll be able to pay back the loan on time to avoid late fees and a hit to your credit score.

Avoid Undue Debt: Only borrow what you can comfortably pay back. Over-borrowing results in further debt and financial suffering tumblr.

Conclusion

Best Payday Loans Online 2025 | Eloanwarehouse | Less Stressful Choices Fast, effortless, and secure application, vast network of trusted lenders, flexible loan terms — it is a solution to urgent financial need. As with all loans, however, it’s critical to borrow responsibly, understand what you’re buying, and make payments on time to avoid extra fees and charges.

If you need quick funds and are considering a payday loan, head over to Eloanwarehouse’s website today and start the application process. So if its contracts you need then check them out today!

SEO Optimization Tips:

Main Keywords: Add keywords such as “payday loans have cleared from Eloanwarehouse,” “Eloanwarehouse payday loan form.” “Urgent payday loans 2025” and “payday loan lenders” into the content.

Title: (What Can I Learn About Payday Loans in 2025 | Eloanwarehouse) Meta Description: Learn everything you need to know about payday loans from Eloanwarehouse in 2025. “Quick, safe and flexible payday loans with simple online applications.”

Internal Links: Link to related blog posts such as “How to Manage Payday Loans,” or “What to Know Before Borrowing Payday Loans.”

Explore the Internal Limits: Determine what payday loan type you want to avoid.

2 notes

·

View notes

Text

How to apply quick Business Loan

In the dynamic world of business, opportunities can arise at any moment, and often, seizing those opportunities requires immediate capital. Whether you're a startup looking to expand, a small business in need of working capital, or an established company seeking to take advantage of a new venture, quick business loans can provide the financial boost you need. This article will guide you through the process of applying for a quick business loan, offering insights and tips to help you secure the funding you require.

1. Know Your Business Needs

Before you start applying for a quick business loan, it's crucial to assess your financial needs. Determine the exact amount you require and the purpose of the loan. Are you looking to cover day-to-day expenses, purchase equipment, expand your operations, or fund a specific project? Having a clear understanding of your needs will help you select the right loan type and amount, ensuring you don't borrow more or less than necessary.

2. Choose the Right Lender

Selecting the right lender is a critical step in obtaining a quick business loan. There are various options available, including traditional banks, online lenders, credit unions, and alternative financing sources. Each has its advantages and disadvantages. Traditional banks typically offer lower interest rates but involve more stringent application processes. Online lenders, on the other hand, provide quicker access to funds but may come with higher interest rates.

Consider your business's financial situation and creditworthiness when choosing a lender. Research their loan products and terms to find the best match for your needs.

3. Review Your Credit Score

One of the most significant factors lenders consider when approving business loans is your credit score. Your credit score reflects your financial history and reliability as a borrower. A higher credit score generally results in more favorable loan terms, including lower interest rates. Before applying for a loan, obtain a copy of your credit report and review it for any discrepancies or issues that need to be resolved.

If your credit score is less than ideal, take steps to improve it. This may involve paying down outstanding debts, making timely payments, and managing your credit responsibly. A better credit score can significantly enhance your chances of securing a quick business loan.

4. Prepare Your Business Documents

Lenders will require various documents to evaluate your loan application. These documents typically include:

- Business plan: An outline of your company's mission, goals, and financial projections.

- Financial statements: Balance sheets, income statements, and cash flow statements.

- Tax returns: Personal and business tax returns for the past few years.

- Business licenses and permits: Ensure all your legal paperwork is up to date.

- Bank statements: Provide bank statements to demonstrate your company's financial stability.

- Collateral information: If you're applying for a secured loan, list the assets you're willing to pledge as collateral.

Having these documents organized and ready for submission will expedite the loan application process.

5. Choose the Right Loan Type

Different types of business loans are available, each with unique terms and conditions. Common options include:

- Term loans: Fixed-rate loans with set repayment terms.

- Lines of credit: A flexible credit line that allows you to borrow as needed.

- SBA loans: Government-backed loans with favorable terms for small businesses.

- Equipment financing: Loans specifically for purchasing equipment.

- Merchant cash advances: Advances based on your business's credit card sales.

Select the loan type that aligns with your business needs and financial situation. Consult with your lender to determine the most suitable option.

6. Complete the Loan Application

Once you've chosen a lender and loan type, you'll need to complete the loan application. Be prepared to provide detailed information about your business, personal finances, and the loan's purpose. Carefully fill out the application, ensuring that all information is accurate and complete.

7. Develop a Strong Business Pitch

To increase your chances of getting approved for a quick business loan, it's essential to create a compelling business pitch. This should outline your business's history, future prospects, and how the loan will be used to achieve specific goals. Lenders want to know that your business is a good investment and that they can trust you to repay the loan.

8. Consider Collateral

If you're applying for a secured loan, you'll need to offer collateral to back the loan. Collateral can be real estate, equipment, inventory, or other assets. Make sure you're comfortable pledging these assets, as they may be at risk if you're unable to repay the loan.

9. Understand the Terms and Fees

Before finalizing your loan application, carefully review the loan's terms and fees. This includes the interest rate, repayment schedule, any origination fees, and prepayment penalties. Ensure you understand all the financial implications of the loan, and don't hesitate to ask your lender for clarification on any terms that are unclear.

10. Submit Your Application

Once your application is complete and you're satisfied with the terms and conditions, submit it to the lender. Some lenders may provide an online application process for quick business loans, while others may require in-person meetings or phone interviews. Follow the lender's specific submission instructions to expedite the process.

11. Follow Up

After submitting your application, stay in contact with your lender to ensure a smooth loan processing experience. Be prepared to provide any additional documents or information they may request. Timely responses and cooperation can significantly impact the speed at which you receive a decision on your loan application.

12. Be Patient

While it's called a "quick" business loan, the speed of approval and funding can vary depending on the lender and the complexity of your application. Some lenders may provide funding within days, while others might take a few weeks. Be patient during the process, but continue to follow up with your lender as necessary.

Conclusion

In conclusion, obtaining a quick business loan involves careful planning, research, and preparation. By understanding your business needs, selecting the right lender, and presenting a strong application, you can increase your chances of securing the necessary financing to achieve your business goals. With the right approach, a quick business loan can be a valuable tool for driving growth and success in your company.

#business loan online instant approval#business loan startup#online loan for business#loan for online business#apply business loan#instant business loan#online apply for business loan#apply online business loan#online apply business loan#apply business loan online#interest rate on business loan in India

0 notes

Text

How To Get A Cash Offer For Your Home?

Selling a home can be a complex and time-consuming process, but receiving a cash offer can simplify it. Cash buyers offer the advantage of a fast, straightforward sale with fewer contingencies, making it an attractive option for homeowners who want to sell quickly or avoid traditional real estate processes. Here’s a guide on how to get a cash offer on a home.

Understand the Benefits of a Cash Sale

A cash offer is an agreement where the buyer offers to purchase your home without requiring financing through a mortgage. This means there are no loan approval processes, and the deal can proceed faster. The advantages of a cash sale include:

Quick closing: Cash transactions can close in a matter of days, unlike traditional sales that take weeks.

No lender requirements: Without the need for bank approval, there’s less paperwork and fewer delays.

Fewer contingencies: Cash offers typically come with fewer conditions, such as home inspections or appraisals.

No repairs needed: Many cash buyers purchase homes as-is, so you don’t need to make costly repairs.

Find Cash Buyers

To get a cash offer, you first need to find potential buyers who are interested in purchasing your home with cash. There are several avenues to explore:

Real estate investors: Many investors specialize in buying homes for cash. These buyers are often experienced in fast, hassle-free transactions.

Real estate wholesalers: Wholesalers often act as intermediaries who find cash buyers and help facilitate the sale. They typically look for distressed properties and sell them at a markup to investors.

Online platforms: Websites like Zillow, Redfin, or Opendoor can help you get connected with cash buyers or companies that specialize in buying homes directly for cash.

Local homebuyers: You can also reach out to local investors or businesses that advertise cash-for-homes services in your area.

Get Your Home Appraised

Before receiving a cash offer, it’s essential to know the value of your property. While cash buyers might not require formal appraisals, knowing your home’s value ensures you don’t accept an offer that’s too low. You can:

Hire a professional appraiser: An appraiser will provide an accurate estimate of your home’s market value based on its condition, location, and comparable sales in the area.

Use online valuation tools: Websites offer instant home value estimates, though these are less accurate than professional appraisals.

Request Multiple Cash Offers

It’s a good idea to request offers from several cash buyers to ensure you get the best deal. A competitive market may allow you to negotiate a higher cash offer. Keep in mind that investors typically offer less than the market value since they need to account for potential repairs and resale.

Review the Offer Carefully

Once you receive cash offers, evaluate the terms of each one. Consider:

Price: Does the offer meet your expectations or come close to the appraisal value?

Closing timeline: Cash buyers can close quickly, but it’s important to confirm the timeline and ensure it aligns with your plans.

Contingencies: Although cash offers typically come with fewer contingencies, be sure to read the fine print for any conditions that could affect the sale.

Negotiate if Necessary

If you receive a cash offer that’s lower than expected but the buyer is serious, you may have room to negotiate. Some buyers might be willing to increase their offer or offer other incentives, such as paying for closing costs.

Finalize the Sale

Once you accept an offer, the buyer will typically send a purchase agreement, and you’ll need to sign the contract. Afterward, you’ll work with the buyer and a title company to finalize the sale, complete the necessary paperwork, and receive payment.

Conclusion

Getting a cash offer for your home can simplify the selling process and lead to a fast, efficient sale. By understanding the benefits, researching potential buyers, and carefully evaluating offers, you can make the best decision for your circumstances and sell your home quickly with minimal hassle.

2 notes

·

View notes

Text

How to Finance Your New Business with a Personal Loan?

Introduction

Starting a new business requires capital for various expenses, including renting office space, purchasing equipment, hiring staff, and marketing. While traditional business loans are an option, they often come with strict eligibility criteria and lengthy approval processes. A personal loan can be an excellent alternative for funding a startup due to its quick approval, minimal documentation, and flexible usage.

This guide will explain how aspiring entrepreneurs can use a personal loan to fund their new business, the advantages and risks involved, and tips for smart financial management.

Why Use a Personal Loan for Business Financing?

✔️ No Collateral Required – Unlike business loans, personal loans are unsecured, meaning no need to pledge assets. ✔️ Quick and Easy Approval – Many lenders offer instant personal loan approvals with minimal paperwork. ✔️ Flexible Fund Usage – Use the funds for office setup, marketing, inventory, or operational costs. ✔️ Suitable for New Entrepreneurs – Startups and self-employed individuals may not qualify for business loans but can easily access personal loans. ✔️ Competitive Interest Rates – With a good credit score, borrowers can secure low-interest personal loans.

Top Lenders Offering Personal Loans for Business Use

Several banks and NBFCs provide competitive personal loans that can be used for business financing:

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

Axis Finance Personal Loan

Axis Bank Personal Loan

InCred Personal Loan

Steps to Finance Your Business with a Personal Loan

1. Assess Your Business Funding Needs

Before applying for a personal loan, determine the amount needed for: ✔️ Office space and infrastructure ✔️ Inventory and supplies ✔️ Marketing and branding ✔️ Employee salaries ✔️ Operational expenses

2. Check Your Personal Loan Eligibility

Lenders approve personal loans based on factors like: ✔️ Credit score (750+ recommended) ✔️ Stable income source ✔️ Debt-to-income ratio ✔️ Employment status (salaried/self-employed) ✔️ Age (typically 21-60 years)

3. Compare Personal Loan Offers

Compare interest rates, loan tenure, processing fees, and prepayment charges across multiple lenders to find the best option.

4. Apply Online or Visit a Branch

Most lenders offer online personal loan applications with fast approval. Ensure you provide accurate documents, such as: ✔️ Identity proof (Aadhaar, PAN, Passport) ✔️ Address proof (Utility bill, Voter ID, Driving License) ✔️ Income proof (Salary slips, ITR, Bank statements) ✔️ Employment proof (Offer letter, Business registration for self-employed)

5. Loan Disbursal and Business Setup

Once approved, the loan is disbursed within 24-48 hours, allowing you to start using the funds for business growth.

Smart Ways to Use a Personal Loan for Business

1. Invest in High-Impact Areas

Prioritize loan usage for high-ROI areas like: ✔️ Marketing campaigns to attract customers ✔️ Purchasing essential inventory ✔️ Developing a business website and branding ✔️ Hiring skilled employees

2. Maintain a Strong Repayment Plan

✔️ Choose a loan tenure that balances EMI affordability and total interest paid. ✔️ Set up auto-debit for EMI payments to avoid penalties. ✔️ Consider early repayments if you earn higher profits.

3. Avoid Using Personal Loans for Risky Investments

✔️ Do not use loan funds for stock market trading or high-risk ventures. ✔️ Avoid unnecessary luxury expenses that don’t contribute to business growth. ✔️ Keep a portion of the loan as a financial buffer for emergencies.

Challenges of Using a Personal Loan for Business

🚫 Higher Interest Rates Than Business Loans – Personal loans may have slightly higher interest rates than secured business loans. 🚫 Impact on Personal Credit Score – Business struggles may affect your ability to repay, impacting personal finances. 🚫 Shorter Loan Tenure – Personal loans usually have a maximum tenure of 5 years, whereas business loans offer longer repayment periods. 🚫 Limited Loan Amount – Personal loans typically range from ₹50,000 to ₹25 lakhs, which may not be sufficient for large-scale business investments.

Alternatives to Personal Loans for Business Financing

If a personal loan doesn’t meet your business funding needs, consider: ✔️ Business Loans – Specifically designed for startups and SMEs. ✔️ Government Schemes – Check for loans under Mudra Yojana or Startup India. ✔️ Angel Investors or Venture Capital – Seek investors for equity funding. ✔️ Crowdfunding – Raise funds from online platforms. ✔️ Loan Against Fixed Deposit or Property – Use assets to secure a lower interest rate.

Final Thoughts: Should You Use a Personal Loan for Business?

A personal loan can be a great funding solution for small business startups when used wisely. It offers quick access to funds, flexible usage, and no collateral requirements, making it an attractive option for entrepreneurs.

However, carefully assess your repayment capacity, interest rates, and business needs before borrowing. Ensure you have a clear business strategy and repayment plan to avoid financial stress.

For the best personal loan options with low EMIs and flexible terms, visit:

Apply for a Personal Loan

With the right approach, you can successfully finance your new business and achieve long-term financial growth.

#fincrif#finance#personal loan online#bank#loan apps#nbfc personal loan#personal loan#personal laon#loan services#personal loans#Personal loan for business#Startup financing options#Business funding with personal loan#Best personal loan for entrepreneurs#Unsecured loan for startups#Small business financing#Quick loan for new business#Low-interest personal loan#Personal loan eligibility for business#Best bank for personal loan#Instant loan approval for business#How to get a business loan#Loan for business expansion#Startup capital financing#Best NBFC for personal loan#Online personal loan for entrepreneurs#How to apply for a personal loan#Personal loan vs business loan#No-collateral business loan#Best lenders for personal loans

0 notes

Text

Take Advantage of the Assistance to Meet Your Urgent Needs Same Day Payday Loans

Same day payday loans could help you get your emergency finances under control if you're experienced in using a same day payday lending business to handle unforeseen expenses. Many lenders offer an easy-to-use service that enables hard-working Americans to obtain fast cash and repay it over time with a manageable payback schedule that works for them.

When you have no choice than to seek your employment, family, or friends for a same day funding loans, lenders may offer an alternative loan in cash because some people would rather not to divulge their current financial situation. The qualifications are as follows: you need to be a citizen of the United States, be at least eighteen years old, have an open checking account linked to your Social Security number, and perform a permanent job that pays a minimum of $1000 in a steady income.

It is also acceptable for people to gain as much as possible from same day payday loans without any reservations if they are dealing with bad credit elements such as defaults, arrears, foreclosure, late payments, and country court judgments (CCJs), IVAs, or insolvency, among others. With the flexibility of a two- to four-week repayment schedule, these loans allow you to get amounts ranging from $100 to $1000. You can use this loan to pay for a variety of expenditures, including those related to healthcare, power, groceries, unpaid bank overdrafts, and other expenses.

How Can I Obtain An Instant Fast Cash Loans Online?

It's simple to obtain fast cash loans online. Simply fill out the online application by providing your bank, job, and personal details. Within minutes, you will know if you are authorized. If you accept the terms of repayment, the funds will be transferred into your bank account by the following day. The money is then yours to do with as you like. Just remember to return the loan on schedule to avoid penalties.

You can be authorized in a matter of minutes if you submit an online application. One of our representatives will then give you a call to go over the procedure and confirm the information you provided. From that point on, you have the option of receiving your fast cash loans online via electronic check the following business day or on your debit card, enabling same-day funding.

Can I increase my Payday Loans amount after I accept the loan agreement terms?

Your maximum loan amount is based on your income. If you have taken out a loan for less than your maximum or you have paid down some of your principal through payments, then you can refinance and receive more money.

We offered with immediate approval for qualified applicants are known as payday loans online same day. You can obtain $100 to $1,000 sent to your bank account as soon as the same day with Nueva Cash. In contrast to certain typical payday loans, you don't have to wait days or weeks to be accepted. All you need is a phone number, a checking account, and three months of consistent work experience or more, as well as a minimum monthly salary of $1,000. You can even improve your credit by making on-time payments on the loan, which you will repay in manageable installments.

https://nuevacash.com/

3 notes

·

View notes

Text

What is Microcredit – Definition, Types and How it Works

Overview of microcredit and its significance

Microcredit, a revolutionary financial concept, extends its impact far beyond traditional banking. At its core, microcredit aims to uplift individuals, particularly those in underserved communities, by providing them with access to modest loans. These loans, often minimal in value, empower budding entrepreneurs, mostly women, to establish or expand small businesses, fostering economic self-sufficiency. The significance of microcredit lies not only in its financial assistance but also in its potential to break the cycle of poverty, promote gender equality, and fuel local economic growth. By bridging the gap between financial institutions and marginalized individuals, microcredit redefines the realm of possibilities, creating a pathway towards empowerment and inclusive development.

The role of microcredit in financial inclusion and poverty alleviation is paramount. Microcredit acts as a potent tool to extend financial services to those who have traditionally been excluded from mainstream banking due to lack of collateral or formal credit history. By offering small loans to individuals and communities with limited access to financial resources, microcredit enables them to start small businesses, generate income, and improve their living standards. This empowerment not only reduces dependency on informal moneylenders but also contributes to poverty alleviation by creating sustainable livelihoods. Moreover, microcredit often targets women, recognizing their potential to drive economic growth and social progress. As microcredit bridges the financial gap and promotes entrepreneurship at the grassroots level, it plays a pivotal role in fostering economic inclusion and uplifting disadvantaged communities.

Explaining microcredit as small-scale financial assistance

Microcredit operates as a lifeline of small-scale financial assistance that brings economic possibilities within reach for individuals who would otherwise be excluded from conventional banking systems. It revolves around extending modest loans, often without requiring extensive collateral or credit history, to those who lack access to formal financial services. These loans act as catalysts, enabling recipients to initiate micro-enterprises, pursue vocational training, or address immediate financial needs. The beauty of microcredit lies in its adaptability and accessibility, aligning with the diverse aspirations and circumstances of its beneficiaries.

Central to the concept of microcredit is its focus on low-income individuals and aspiring entrepreneurs. Microcredit institutions recognize that economic opportunities should not be confined by financial constraints. By specifically targeting those who lack the resources to secure conventional loans, microcredit creates a direct avenue for upward mobility. It empowers individuals to harness their skills, talents, and aspirations to create sustainable businesses that contribute to local economies. This inclusive approach fosters a sense of ownership and self-reliance among borrowers, gradually uplifting communities and promoting equitable growth.

Types of Microcredit

Group-based Microcredit :- Epitomized by the Grameen Bank model, introduces a collaborative approach to financial empowerment. Originating from the visionary efforts of Muhammad Yunus, this innovative concept recognizes the strength of collective responsibility in propelling economic progress. In this model, borrowers form small groups, where members act as both peers and guarantors for each other's loans. This setup fosters a sense of community and mutual support, while also reducing default risks. The Grameen Bank model's success lies not only in providing access to funds but also in nurturing a spirit of entrepreneurship and camaraderie, resulting in improved livelihoods and transformed social dynamics.

Individual microcredit :- Individual microcredit is a tailored approach to financial empowerment, catering to the unique aspirations and needs of individual borrowers. Unlike group-based models, individual microcredit extends loans to borrowers without the need for collective guarantees. This allows for more personalized financial solutions, enabling borrowers to pursue ventures that align with their skills and goals. Individual microcredit recognizes the diverse spectrum of entrepreneurship, providing resources for small-scale businesses, vocational training, and even basic needs. By offering autonomy and flexibility, this model fosters self-reliance and encourages borrowers to unleash their potential, ultimately contributing to local economic growth and self-sustainable development.

Agricultural Microcredit :- Agricultural microcredit is a pivotal tool in cultivating rural prosperity by providing financial assistance to farmers and agriculturists. This specialized form of microcredit recognizes the crucial role of agriculture in economies and livelihoods. It aims to address the unique challenges faced by those engaged in farming, offering loans for crop cultivation, livestock rearing, and equipment purchase. By extending credit to enhance agricultural productivity, this model enables farmers to invest in their land, improve yields, and increase income. Agricultural microcredit not only bolsters food security but also uplifts rural communities, fostering sustainable agricultural practices, reducing poverty, and contributing to the overall well-being of farming households.

The Process of Microcredit

The process of microcredit involves a structured approach to ensure effective utilization of funds and borrower empowerment:

1. Application and Assessment of Borrowers

Borrowers initiate the process by submitting loan applications, detailing their financial needs and intended use of funds. Microcredit institutions meticulously evaluate these applications, considering factors like income, creditworthiness, and the proposed business venture. This assessment aims to ascertain the feasibility of the borrower's plans and the ability to repay the loan. Additionally, some institutions emphasize financial education, equipping borrowers with essential knowledge to manage funds responsibly.

2. Loan Disbursement and Terms

Once borrowers are approved, microcredit institutions disburse the loans, often in small amounts tailored to the borrower's needs. The terms of the loan, including interest rates, repayment schedule, and any associated fees, are clearly communicated. Transparent terms ensure borrowers understand their financial obligations and can plan repayment effectively. Loans may be disbursed directly or through community-led mechanisms, depending on the model adopted.

3. Repayment and Recycling of Funds

Repayment begins according to the agreed-upon schedule. Microcredit Institutions often incorporate flexible repayment options aligned with borrowers' cash flows, which can vary due to seasonal income patterns. As borrowers repay their loans, the funds are recycled within the microcredit system. Repayments contribute to replenishing the available pool of funds, allowing more individuals to benefit from microcredit. This sustainable practice ensures a continuous cycle of lending and borrowing, creating a positive impact on borrowers' lives and the community as a whole.

The process of microcredit underscores the importance of financial literacy, responsible borrowing, and collaborative efforts to empower individuals and promote economic growth.

Impact of Microcredit

Microcredit's impact on empowering women and marginalized communities is undeniable. In societies where traditional norms may restrict women's economic participation, microcredit provides a transformative avenue. By gaining access to financial resources, women can launch their businesses, gain independence, and contribute to their families' well-being. This empowerment extends beyond financial realms, fostering self-confidence, decision-making abilities, and leadership skills. As women thrive economically, their status within their families and communities often elevates, catalyzing a positive cycle of change. Moreover, microcredit's targeted approach towards marginalized groups ensures that those often left on the fringes of development have the opportunity to break free from the cycle of poverty. It levels the playing field, granting them access to resources and the means to shape their destinies, ultimately creating more equitable societies.

The impact of microcredit extends beyond individual empowerment, permeating into local development. As borrowers launch businesses and invest in their communities, a ripple effect of economic growth occurs. These small-scale enterprises contribute to job creation, enhance local markets, and stimulate economic activity. Microcredit's focus on sustainability encourages borrowers to make environmentally conscious choices, fostering responsible practices that benefit both their businesses and the ecosystem. Additionally, as microcredit institutions often operate within the same communities they serve, they become hubs of knowledge, offering financial education, training, and technical assistance. This leads to enhanced skills, better business practices, and improved overall development. Through this intricate interplay of economic empowerment and local development, microcredit shapes the path towards vibrant, resilient communities.

Challenges and Criticisms Regarding High Interest Rates and Potential Debt Traps One significant challenge and criticism surrounding microcredit revolve around the issue of high interest rates and the potential for borrowers to fall into debt traps. While microcredit aims to provide access to finance for underserved populations, some microfinance institutions operate with interest rates that can be comparatively high due to the inherent risks involved and the costs of administering small loans. This can create a burden for borrowers, especially in situations where the terms are not fully understood or where borrowers lack the financial literacy to manage their debts effectively. In some cases, borrowers may take multiple loans to repay existing ones, leading to a cycle of indebtedness commonly referred to as a debt trap. To ensure the positive impact of microcredit, it is imperative for microfinance institutions to strike a balance between maintaining their financial sustainability and safeguarding borrowers from over-indebtedness, while also providing comprehensive financial education and support to borrowers.

Challenges and Criticisms Regarding creating Sustainable Livelihoods and Local Development Challenges and Criticisms regarding creating sustainable livelihoods and local development through microcredit primarily revolve around ensuring the long-term viability of the initiatives. One criticism is that while microcredit can jumpstart small businesses and generate income, the absence of broader infrastructural support and market linkages may limit the sustained growth of these enterprises. Additionally, the impact of microcredit on local development can be affected by external factors such as economic fluctuations, changing market demands, and even political instability. Critics argue that without comprehensive community development strategies, the effects of microcredit may remain localized, failing to contribute significantly to broader economic transformation. To address these challenges, microcredit programs should collaborate with local authorities and institutions, focus on skill-building and capacity enhancement, and foster linkages to larger markets. A holistic approach that combines microcredit with complementary interventions can lead to more robust and enduring local development outcomes. Conclusion

In conclusion, the concept of microcredit embodies a powerful force for change, transcending traditional financial models to empower individuals, families, and communities. Its impact goes beyond the realm of economic transactions, touching lives, fostering entrepreneurship, and igniting hope. As we've seen through the lens of "Mpower Credcure" and other microcredit institutions, this approach has the potential to create a symphony of transformation, lifting the marginalized, nurturing businesses, and nurturing sustainable livelihoods. The ripple effects of microcredit reverberate through gender equality, poverty reduction, and local development, painting a picture of inclusive economies that resonate with shared prosperity. The journey of microcredit is far from complete; it beckons for further exploration, innovation, and collaboration to unlock its full potential as a catalyst for building societies where every individual's aspirations can be realized, echoing the ethos of empowerment that "Mpower Credcure" and similar entities stand for.

#business loan company list#need financer for business#best business loan bank in india#Loan for New Company#apply for instant personal loan#personal loan quick approval#best personal loan offer#housing loan procedure#best home loan provider in india

0 notes