#i would be getting a MINIMUM $20k salary increase......

Explore tagged Tumblr posts

Text

just was contacted by a recruiter for another job that would literally be life changing if i got it. its really difficult to not give my hopes up

#i would be getting a MINIMUM $20k salary increase......#and im more than qualified for it.#god being patient is so hard#h.txt

8 notes

·

View notes

Note

Omfg your retarded! It’s obvious if you stepped outside. Minimum wage hasn’t been raised in years. Rent never stops increasing. Student loans are a death sentence. I just want to be able to afford to fucking live and not question being alive everyday of my life

I see where you're coming from and I understand why those conditions and challenges would make you feel the way you do. All of those in aggregate surely would feel like an impossible barrier to ever overcome.

You are absolutely correct that minimum wage has not been raised in years in most parts of the country and for most individuals, changes in legislation appear to be the only path to a higher income, but you underestimate how much control you truly have in obtaining a higher income. I do not know your journey thus far in life, but what I have observed in a lot of struggling individuals that express similar sentiments that you are mentioning is that they view success as an all-or-nothing pursuit. Now what I mean by this is that a lot of people have a vision of what they want their life to be and they are chasing the it as their next step in life, but instead they should be figuring out what are all the steps to get to their goal of success and viewing each step as an incremental win or success in itself.

e.g. If your goal is $100k and you're at $20k, then you don't need to feel stuck trying to go straight to $100k. You can make it a multi-step journey of progression from $20k -> $30k -> $40k ... $100k

Once gain you are absolutely correct about rent, but the key is that you consistently allow your income to increase too and yes, this is absolutely easier said than done, but you have potential to do it!

Now student loans can definitely be dangerous and relative to your current income, it seems astronomical to manage, but this is because it's meant to be relative to college graduate incomes and to be paid off over a decade. To put this into perspective, the median student loan balance for graduates is close to $35k, which is a little bit more than a new car and usually at a significant lower interest rate (~4.66%), which would equate to $365 monthly payment or $4380 per year. Meanwhile, median starting salary of college graduates upon graduating is the average starting salary for the graduating class of 2022 is $55,260. Even if you ignore raises, that still puts them at ~$51k (after paying student loans), so they generally have being standards of living than those with no student loans earning a significantly lower income.

Regardless of all that information and even if you want to ignore it, at the very least please don't ever question being alive!

21 notes

·

View notes

Text

personal shit

but i got laid off last year right before the holidays which is the shittiest time in the world to lay someone off because absolutely nobody hires you at the end of the year because that’d be wild to hire before the new budget and also everyone’s just out for the holidays. My boss was very respectful about it and gave me privacy and like blocked the window to my office with his body so nobody could look and see me crying which was very nice. But the CEO had a stick up his butt about there had always only ever been two IT people before and he felt that having three was a waste of money. Ben the other sysadmin had been with the company (not in IT though another department) for 5 years which left only me on the chopping block. Even though I consistently closed the most tickets and put the most work in. And he said it was nothing about my work and that he’d recommend me to any contact that asked for a sysadmin and he’d be happy to answer any reference calls for me. And honestly a week after new years, i got a very sexy new job making 20k more than i was and doing like 10% of the work? so it worked out very much in my favor but it was a very deeply shameful fact for me that I was unemployed for two months. it felt like i failed my wife and it was awful for my mental health i couldn’t sleep i was straight up hallucinating and had trouble telling what was cooked up by my depression soup brain and what was real. Looking back on it I think I might have schizophrenia or something that emerges due to stress because things were not good during those two months.

And also the unemployment website said to keep track of all work search activities because they might randomly request a history of your work search activities but to not upload it unless specifically requested. So it was the week of new years and new job postings were still pretty slow so I spent deadass a whole day of 12+ hours making an excel spreadsheet and going back through dice and linkedin and all the other random job applications and documenting every single job I applied for and every interview I went on. There were fucking 500 entries. Not even 2.5 months unemployed and I had 500 work search activities. The minimum to claim unemployment is 3 a week. And I was doing 50 a week (just a cool 17 times more than required) like I was putting the work in on searching for work. It was a major point of pride that I was going so far above and beyond but it also fucked me up that I was putting myself out there so much and not getting any traction. And I remember thinking wow it’d be funny if now that I put all this time into documenting all my work search activities if i would get a job offer because then obviously i wouldn’t claim the unemployment any longer and thus wouldn’t need the list that the work search commission nebulously may or may not ever call for.

And literally the next day I had an interview go extremely well (all my stories and answers were well honed by the hundred other interviews at this point) and they were in a rush to hire someone by next monday so literally a few hours after the interview they sent me a job offer on like a wednesday and asked if there was anyway to go ahead and do the paperwork and drug test by the end of that week. And I was like well hey i won’t have to interview any more so getting to cancel those freed up my days. So the next day I did all the paperwork online and went in peed in a cup that morning and then had a follow up interview with them that afternoon and they were so impressed that I helped them get this done in their accelerated timeframe that they game me like a $5k raise. I had already signed and submitted the job offer but they voided and sent over one with the increased salary. It’s with an MSP so it’s a company that just does IT for other companies. But it has like the most room for growth possible for someone like me. They have a team of 500k app developers so if i want to start doing that they’ll show me how. But the gig I have right now is a 5 year contract to be the helpdesk guy on site at this union. But we’re outsourcing all the mundane remote helpdesk stuff so I literally just have to do the onsite support but it’s an office of like 20 people. It’s the cushiest gig I’ve ever had.

First IT job was doing everything for 150 users, then I asked for a raise after 5 years of the same salary and was denied so I moved to that last company and was there for 1 year. It was 250 users that I had to do everything for (that also had a history of ransomware attacks and I overhauled their whole security and then they fucking laid me off that same year wild) but for 10k more. And now it’s 20 people for 20k more. So anyway I’ve been here for a month now. The first couple weeks were really hectic settling in so that’s why I’ve been offline mostly. But incredibly grateful for this opportunity. The whole point of this was to actually say that since I’m working for a union right now the mindsets of my coworkers is such a heelturn than what I’m used to. All my users before have been very entitled old white dudes. So I’m used to having to have them spew random vitriol out of nowhere and having to pretend that their incredibly hurtful words is totally fine. But working for a union is great everyone here is very pro worker. You can leave early if you need to. We were watching a senate hearing and everyone’s rooting for the worker’s rights side and it’s just such a liberating feeling to work somewhere that shares your point of view.

#about me#sorry for the personal dump lmao#anyway stacey watch out since our lives run in parallel don't want you to be blindsighted#long post

12 notes

·

View notes

Text

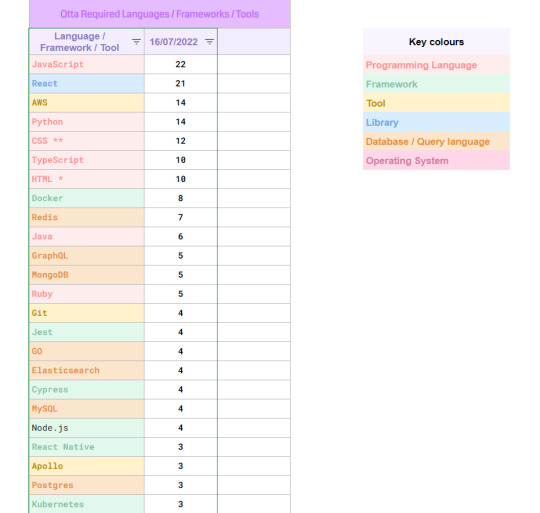

Tech jobs requirements prt 1 | Resource ✨

I decided to do my own mini research on what languages/frameworks/tools and more, are required when looking into getting a job in tech! Read below for more information! 🤗🎀

The website I have used and will be using for this research is Otta (link) which is an employment search service based in London, England that mostly does tech jobs. What they take into consideration are:

ꕤ Where would you like to work? (Remote or in office in UK, Europe, USA and, Toronto + Vancouver in Canada)

ꕤ If remote, where you are based?

ꕤ If you need a visa to work elsewhere

ꕤ What language you can work in? (English, French, Spanish, etc)

ꕤ What type of roles you would like to see in your searches (Software Engineering, Data, Design, Marketing, etc)

ꕤ What level of the roles you would like? (Entry, Junior, Mid-Level, etc)

ꕤ Size of the company you would like to work in (10 employees to 1001+ employees)

ꕤ Favourite industries you would like to work for (Banking, HR, Healthcare, etc) and if you want to exclude any from your searches

ꕤ Favourite technologies (Scala, Git, React, Java, etc) and if you want to exclude any

ꕤ Minimum expected salary (in £, USD $, CAD $, €)

With this information, I created a dummy profile who is REMOTE based IN THE UK with ENTRY/JUNIOR level and speaks ENGLISH. I clicked all for technologies and industries. Clicked all the options for the size of the company and set the minimum salary at £20k (the lower the number the more job posts will appear) I altered my search requirements to fit these job roles because these are my preferred roles:

ꕤ Software Developer + Engineer

ꕤ Full-Stack

ꕤ Backend

ꕤ Frontend

ꕤ Data

I searched 40 job postings so far but might increase it to 100 to be nice and even. I will keep updating every week for a month to see what is truly the most in-demand in the technology world! I might be doing this research wrong but it's all for fun! ❀

🔥 Week 1 🔥

ꕤ Top programming languages ꕤ

1. JavaScript

2. Python

3. CSS (styling sheet)

4. TypeScript , HTML (markup language)

5. Java

ꕤ Top frameworks ꕤ

1. Docker

2. Jest, Cypress, Node.js

3. React Native

4. Kubernetes

ꕤ Top developer tools ꕤ

1. AWS

2. Git

3. Apollo

4. Metabase

5. Clojure

ꕤ Top libraries ꕤ

1. React

2. Redux

3. NumPy

4. Pandas

ꕤ Top Database + tools + query language ꕤ

1. Redis

2. GraphQL, MongoDB

3. GO , Elasticsearch, MySQL

4. Postgres

5. SQL

#resources#resource#programming#computer science#computing#computer engineering#coding#python#comp sci#100 days of code#studying#studyblr#dataanalytics#deeplearning

171 notes

·

View notes

Text

Homelessness & Politics

Been doing some more reading on homelessness and I was curious as to why blue states have more homelessness than red states.

And you’re probably thinking, “well, blue states are more populous and have big cities”, but even on a per capita basis, blue states have around 5x as many UnHoused (UH) people as red states.(More on the absolute vs relative numbers soon...) So why are the numbers so different between red and blue states?

So, a few thoughts:

1. We may not be getting accurate counts of the total population of UH people in every state - particularly red states which seem less concerned about it.

2. Kinda macabre, but it’s possible that the mortality rate for UH people is higher in red states due to lack of social services. iow, the UH people in red states may be dying more, and that keeps their population lower. I tried to find data on this, but again, most places - esp red states - don’t really track this data. So for now, it’s just a hypothesis.

3. Homelessness is the result of other factors, some of which may differ between states, such as housing demand vs availability as well as income distribution and inequality. For instance, it may be easy to buy land in wyoming cause it’s huge and only 37 people live there so prices are dirt cheap. In contrast, housing demand in cities is typically very high. Additionally, there’s more inequality in cities, with salaries ranging from minimum wage (or even sub-min wage) to tech and finance bros earning 7 figure salaries. This imbalance drives up housing costs since the rich people can afford more of the limited, in-demand space, than poorer people - esp as the level of inequality increases.

4. Lastly, I know there’s a lot of talk about UH people moving to the coast for the benefits those places offer, but, firstly, once again, it’s a fraction of the overall UH population. But secondly, I honestly don’t know how true it is. There may be other explanations for UH people moving places. For instance, Seattle has a lot of benefits, but we apparently only bring in a quarter as many people from out of state as california. Why? It could be that the weather in cali is just more forgiving than in other places, like rainy seattle. Additionally, many UH people use panhandling to meet their needs. If you live somewhere with 10x as many people, it would seem you’d be likely have 10x as many interactions and bring in 10x as much money. So, those are other reasons why the fraction of UH people that move elsewhere might do so, aside from direct gov’t benefits.

5. So, something I hear all the time is people complaining that the homeless are just people coming in from outside the state for the liberal benefits. In Seattle, where I live, only 5.5% of our unhoused come from outside King County. In LA, it’s as high as 18% - which is a lot, but still only a fraction of the total numbers. Still, this can have a big effect because of population size differences.

For instance, Washington State is bordered by conservative Idaho. WA has around 20k UH people. Idaho has around 2k. Assuming the 5.5% from out-of-state applies across WA, then 5.5% of WA’s 20k UH equals 1,100 people. A pretty small amount of WA’s whole UH population. But if those 1,100 came, for instance, from Idaho, it would represent a huge percentage of Idaho’s population. Idaho has around 2k UH, so if we add 1,000, we’re essentially increasing their unhoused numbers by 50%. And while WA would still have a lot more unhoused people, when we compare the states, this alone makes a big difference: In absolute numbers, it changes the ratio between the two states: From: 20,000 vs 2,000 = 10:1 To: 19,000 vs 3,000 = 6:1

or, looking at per capita numbers:

WA Idaho Population: 7.6M 1.7M UH pop: 20k 2k Ratio: 1UH/380ppl 1UH/890ppl Iow: WA has 230% more UH/capita Post-Adjustment: UH pop: 19k 3k Ratio: 1UH/400ppl 1UH/595ppl (Notice that the WA numbers didn’t move much, but the idaho numbers moved dramatically.) Now, WA only as 150% more UH/Capita. Still bad, but wayyy less bad in comparison.

Here’s what this looks like for California assuming, conservatively, 10% are from out of state. Let’s say half from nevada and half from arizona. Cali Arizona Population 39.5M 7.2M Unhoused : 150k 11k UH/Pop: 263ppl/UH 654ppl/UH Ratio: 1 : 2.4

Post-Adj: UH: 135k 18.5k* *note: half of the 15k cali lost went to nevada, so arizona only gets 7.5k more) UH/Pop: 292k ppl/UH 389 ppl/UH Ratio: 1 : 1.3 In other words, instead of Cali having more than twice as many UH/capita, it would only have 30% more. Still bad, for sure, but a significant difference.

Keeping these various points in mind, there may be a variety of reasons for the differences in UH numbers between red and blue states which may not be tied to politics at all. Blue states may, in fact, have worse outcomes here, though it may be due to reasons beyond their control. Similarly, red states may not necessarily be “doing things better” than blue states, and may be benefiting from their poorer economies, smaller city sizes, and outward migration. I’d love to see a study which examined these and other factors. But either way, the crisis of unhoused people is serious and getting worse, and likely to continue. we gotta fix this problem.

57 notes

·

View notes

Text

Best 10 Accounting Myths

So many occasions I am out at a cafe, store, or outing and someone in my family or group of buddies suggests "You're the accountant, how a lot is this?" and wants me to determine anything in my head. I am going to allow you all in on a minor magic formula... I am not a mathematician, I am an accountant. If my calculator is not in close proximity to, don't request me to determine anything. I am going to permit you in on a number of a lot more secrets as nicely. Read beneath to discover the leading ten Accounting myths I have put with each other. #1 Accounting Fantasy Accounting is about math. This could not be more than the reality. Sure, you use math, but so does an engineer, salesman, advertising individual, garden man, hair stylist, and so forth. If you want to get paid out, you will have to estimate the amount you are owed, the alter if paid in money, your commission percentage, and many others. Accountants use math similarly. Accounting is accounting for belongings, liabilities, earnings, costs, and so on... of course nonetheless, the "meat and potatoes" of accurate accounting is investigation and storytelling. Do you take pleasure in placing a puzzle with each other? Properly, in accounting, when you look via people quantities you are searching for holes to set that right piece into. You have to use individuals numbers to inform the proprietor of a company, shareholder, lender, or supervisor what they suggest how they can use them and what to count on in the foreseeable future. It's analytics, not algebra. #2 Accounting Fantasy Accountant = Tax Preparer or IRS Agent. Oh so incorrect, mistaken, incorrect. Realize that when you enter a major tax franchise or chain your taxes are most very likely currently being ready by a educated "tax preparer" NOT an accountant. The true definition of an accountant is a single who has a diploma in Accounting. Sure, I geared up taxes proper out of higher education when I worked for a community CPA company, but the only explanation that I was necessary to do this kind of was since the companion I worked for experienced a handful of tax consumers. Mainly, I audited firms. This does not indicate a tax audit. This means that I went in, looked at their publications and place-checked for accuracy. Soon after this, we would give them a report on necessary improvements and regions that looked great. This is a extremely brief summary of a organization audit. Several accountants work in personal businesses compiling financials for the managers and house owners, some operate in fraud analyzing where they support companies detect or look into fraud, even though other individuals merely check with on numerous subject areas. Be watchful when somebody claims they are an accountant. I listen to bookkeepers and secretaries say this all the time and they never know the big difference amongst a journal entry and the coffee pot. Not to undermine secretaries and bookkeepers. I regard them all and I significantly recognize their function as I have several functioning on my staff, but they are NOT accountants. I will not inform my clients that they are this kind of. This is not a fair description of who they are and their qualifications. #3 Accounting Fantasy Accounting is for Men only. In every single organization exactly where I have been utilized or worked with, the ratio of women to men is possibly 50% or increased in the women's favor. As a subject of simple fact, most are dominated by females. Indeed, I have seen primarily gentlemen in the government positions, but ladies are growing rapidly in this area as properly. As several businesses see that women can balance household and work [most times greater than you guys], they are respecting the abilities and qualifications of ladies in these fields. Now men, you are not becoming pushed out. This is a great location for the two sexes to show their likely. Just never expect your gender to establish your location in the accounting globe. #4 Accounting Fantasy Accountants are introverted or uninteresting and truly do not like functioning with buyers. Even a tax accountant has to be a people-individual. We all have to perform with consumers, personnel, distributors, client's customers, etc. I enjoy this subject simply because of the men and women conversation. I love to speak [I'm certain my husband would concur] and I love to instruct. To consider accounting and flip it into comprehensible language for my customers who range from Funeral Residences to Hair Stylists. I get to train them how their figures can inform them the stories they want to listen to and what their futures could maintain. My colleagues and friends in college had been wonderful and we were all accounting college students. We went out for beverages, went dancing at golf equipment, went to the lake swimming and skiing, worked out at local fitness centers, and so forth and so forth. Life is not dull for us at all and as a organization proprietor and accountant now, I can assure you that my life is something but unexciting. I have two tiny kids, a spouse (company associate), staff, loved ones, buddies, clubs and organization meetings and the listing goes on. If I have time to take treatment of chores, this is a perk in the 7 days. #5 Accounting Fantasy Modest Firms do not need to have accounting or it can just hold out until finally it's get to be too much for me to manage myself. Ok, so this implies that as a modest enterprise owner, you would say that you will not require to budget, forecast financials, know about developments in your company, or know the latest, best tax rewards. I have clients that are as modest as a one-guy services business making only about 20K a yr. Every single business wants an accountant viewing their again. Now, this individual or company demands to be reputable and competent, but you need them, all the exact same. A enterprise are not able to and ought to not be run based on whether or not there is income in the lender at that present time. At the finish of the year, how do you know whether or not you are likely to report a decline or cash flow to the IRS? You require to report as a lot loss as you can to spend as minor taxes as you can or you are just dishonest your self. Numerous tax corporations will charge you an arm and a leg if you go in with a box or in some situations, a trash bag, complete of receipts and say, "Listed here. Make sure you do my taxes." They have to charge you the time they are going to allocate to thumbing by means of these receipts and most likely they will not take the time to be sure they put every small nickel and dime they can to losses so you spend as small as achievable in taxes. Bokföringsbyrå Stockholm will be adhering to your financials the whole year and everything need to be neat and clean appear time to file your taxes. Also, your accountant must be able to give you month to month financials that inform you in which you can enhance in an location, have reports prepared for achievable financial loans, support you make fiscal choices, aid you make the most of recent tax rewards, and notify you if your organization will craze towards decrease or larger revenue in certain months based on heritage. This is all necessary information and after my customers occur into my services, they are shocked that they ended up at any time able to operate their company without my services. #6 Accounting Fantasy An Accountant will expense me an arm and a leg. Properly, this might be the case if you go to a high-greenback agency, but while searching for an lawyer, if you retain the services of Robert Shapiro, it would not be inexpensive both. You have to uncover the appropriate agency or specific for you. Check out references, qualifications, and services. Be positive the value matches the industry standards in your area and be positive they make you come to feel very good about working with them. You must be number 1 to them and you must be capable to discover a certified individual or firm to work with. My agency is acknowledged for reduced rates due to the fact this is the way I created it. I desired to develop a company in which I could cater to little and commence-up companies yet be reasonably priced for them as properly. I have always priced my services significantly less than the price of choosing a full-time staff and occasionally I have gone a lot, much much less based on the consumer, their needs, and their monetary situation. Get in touch with me or e mail and we can discuss to see if we can aid you or at minimum level you in the appropriate course. #seven Accounting Myth I pay out enterprise expenditures out of my very own pocket. It really is really no huge offer. Improper. If you possess or function a organization, it is a company, not your wife or husband. You need to have to observe when you have paid an bills out of your very own pocket. This is funds that could be returned to you tax-totally free. For instance, I have a consumer that I achieved with just lately. She owns a beauty salon. She does not have a enterprise financial institution account and all bills are paid out by means of her personal account. Now, she requires the earnings into that very same account. Her husband is a total-time employee in yet another firm. 1st, there is no way to explain to if she is really making a revenue or not. Second, she is paid out a wage. Her salary is taxable. If her business is breaking even, she has been spending double the taxes she need to have. She was in no way reimbursed for her out-of-pocket costs appropriately which need to have been TAX-Cost-free. She should be ready to at least be refunded for the expenses she has compensated for out of her own pocket [tax-cost-free] ahead of using a income which is taxable. As her accountant, I have advised her to open up a business financial institution account. At this stage she will deposit revenues into this account and shell out invoice from listed here. If there is not adequate money to shell out charges, she will shell out them out of her very own pocket but she will be confident to notify us when she does this. We record this as reimbursements that are owing back again to her tax-totally free and she will obtain this money again when the business money movement permits for this. #8 Accounting Fantasy I never have time and never need to have to established goals for myself and my company. Each firm I have ever known, read through about, or been included in has employed objective-location as an intricate portion of managing their business. Life as we know it moves at a head-spinning velocity. No issue the business, shifting instances can cause chaos and in many cases set a company out of enterprise if they do not remain up-to-day with developments, technology, and buyer details. Sit down and create out 10 targets for by yourself and your organization. When finished, put these objectives in priority purchase from greatest to cheapest. Set them in a spot in which you will continually be reminded of your goals. Each and every month sit down and assessment these goals. Compose down what you have carried out to come closer to each 1 and if you have reached any of them. As you get to your ambitions, cross them off the list. Do not eliminate them. This offers you a sense of accomplishment and displays you that your challenging function is paying out off. #9 Accounting Myth I really don't require accounting reports to know how my enterprise is carrying out. If you are busy, this does not suggest that your enterprise is performing effectively. You need stories to tell you if your prices are the place they want to be in comparison to expenses you are incurring. You require to run stories to display dilemma locations like theft, loss, squander, rewarding regions, and so forth. As soon as you run these reviews, you then need to comprehend how to use them. If you run a report that displays that you have a major spot of waste in your production method, you then need to arrive up with a answer to the dilemma and both uncover a way to reap cash flow from the waste materials, uncover a way to reuse the material, or much better the method to reduce the amount of waste. In the service industries, reviews can present how time is allocated. If time is allocated inadequately, income is being lost and as 99% of businesses in the region, I am certain you are making an attempt to make a income. These studies can aid reveal the issue spot and assist to change worker duties or routines in a way that will provide income back again or enhance the revenue of your business rapidly and efficiently. #10 Accounting Myth I can take care of my accounting myself. I have QuickBooks. Ha! This one particular actually makes me chuckle a minor. QuickBooks is an great plan and one that I use on a everyday basis, but it does not just take the require for an accountant away. As a subject of reality, most open up QuickBooks only to turn out to be overcome and baffled. Obtaining this program is extremely good and can become an amazing tool, but your accountant requirements to help you established it up, educate you on how you can and need to use it, and come in periodically to be confident almost everything is in get, run studies, and resolve issue places. You can be superb in company but except if you know how to operate the accounting side of your enterprise properly, you need to really do oneself a favor and at least get suggestions from an accountant on this approach.

1 note

·

View note

Text

6 Reasons that You Must Never Ever Provide Cash To Buddies Or Household

6 Reasons Why You Should Never Ever Lend Money To Pals Or Family

#toc background: #f9f9f9;border: 1px solid #aaa;display: table;margin-bottom: 1em;padding: 1em;width: 350px; .toctitle font-weight: 700;text-align: center;

Content

Do You Need To Borrow Money?

Determining Whether You Need To Be Borrowing Money

Do You Truly Need To Spend The Cash At All?

Good Cash Borrowing Versus Bad Money Loaning

youtube

Do You Required To Borrow Money?

As long as you have great credit and excellent reasons to borrow money, a financial institution will usually be greater than happy to extend a loan to you. It'll come with a clear repayment plan and also rates of interest that aren't too high in the grand scheme of things. From charge card to long-term mortgage funding, UK credit customers rely upon numerous finance options to achieve their cash goals.

Determining Whether You Need To Be Loaning Money

When healthcare expenditures strain your home budget, your financial consultant can help you sort out your alternatives. Commonly, when an organisation trades on credit terms, capital can be extended as suppliers require to be paid in advance of getting settlement from customers. As well as when an organisation is experiencing rapid growth, this can become a lot more of an issue, indicating that regular loaning is needed to ensure that enough money is offered in any way times to satisfy daily dedications.

Which app gives loan instantly?

To apply for an instant cash loan with NIRA, you must be an Indian citizen and between 21-65 years of age. You will also need to have a college degree, be working for a minimum of 6 months and earn a salary of Rs 20k or above per month. You do not need a CIBIL score to apply for a quick cash loan through NIRA.

Do You Really Required To Invest The Cash Whatsoever?

In the past, many countries have taken and tested innovative and brand-new means and principles to enhance monetary gains from trading companions. The capacity of the country to use its sources to increase its wide range is never poor. The lendings likewise permit lenders to change prices at established times in the future. Declining to pay updated rates of interest would certainly suggest councils are compelled to repay the loan in full.

Can You Save Up Or Make Use Of Some Financial Savings Rather Than Borrowing Money?

They can be or make minimum payments supplied another three-month repayment vacation. People getting help must not have their credit card suspended. In most cases car loans were required to aid settle other financial debt; 13% of participants required the cash to aid with home mortgage payments or lease, 11% to assist pay off bank card and also 4% to repay a short term loan provider. As long as you're taking into consideration the loaning as a short-term solution, you can't fail with a credit card. Utilized correctly, they'll assist you rebuild your credit score while likewise letting you borrow money to make acquisitions.

Customers looking for car loans can determine the real passion paid to loan providers based on their marketed rates by using the Interest Calculator.

It is important to understand the distinction in between APR as well as APY.

In the 2015 as well as 2017 documents of Globe Financial institution, a number of African nations have huge financial obligations not just with China but likewise with other lender countries.

To find out more about or to do computations entailing APR, please go to the APR Calculator.

The rate typically published by financial institutions for conserving accounts, cash market accounts, and also CDs is the yearly percent return, or APY.

Also, when you borrow from an enjoyed one, you typically can obtain 100% of the needed amount and take pleasure in lower rates of interest (or no rate of interest whatsoever). The most unfavorable part of loaning from a person you understand is that your individual partnership could be harmed permanently if the situation goes south. Simply use online, providing details of your earnings and expenditures, submit your application, inspect your e-mail as well as obtain cash in your checking account!

It's up to you to determine the expense of different loaning alternatives, prior to making credit commitments. On the internet resources make it feasible to compare numerous lending choices, identifying the most reliable, cost effective methods to borrow money.

Amongst several popular areas to borrow money, on-line credit opportunities provide quick money, immediately. If you're facing a monetary dilemma, or see a cash flow shortage in advance, fix your urgent financing requires with a top lending institution today. Bank card business and also on-line lending institutions supply places to borrow money.

You can use them to purchase anything from your food purchasing to brand-new cars and trucks-- but be careful, the interest rates are usually quite high. If you don't assume you'll have the ability to repay the total you have actually borrowed within a few months (preferably one month) after that you could be better off borrowing cash from an additional source. While lending institutions argue emphasis on the high APR is a misrepresentation as the cash is not lent over a year, critics say the fundings target the most monetarily at risk, whose financial debts can conveniently snowball out of hand. In March, a record by the Office of Fair Trading found cash advance loan providers make most of their money from missed payment fees and also passion accumulated.

A supervisor's loan account enables you to pay yourself beyond your regular income by borrowing cash to repay at the end of the fiscal year using dividends. Debtors seeking to take a ₤ 5,000 personal loan repayable over a 24-month period can consider Tesco Bank, which uses the lowest APR of 3.4%. Both its Telephone Personal Loan and Online Personal Loan provide this APR and also the overall amount repayable on these car loans is ₤ 5,176.32. This kind of credit is a bit harder to get than the previous two that we have reviewed in this guide.

If you need to borrow money, it is best to stay clear of payday loans, doorstep lending institutions as well as loan sharks, which will cost you a great deal of money. Lendings from credit unions are much cheaper, easy and risk-free to access, and also there are no hidden charges or penalties. The marketplace is flooded with lots of options for credit, from cash advance, guarantor loans, credit cards, overdraft accounts to obtaining money from loved ones, yet exactly how do you recognize what is the best item for you? Each product has its own benefits and also downsides and what is right for you will depend completely on your circumstances. Nevertheless, if you need to borrow money quickly and securely, why not attempt our brand-new solution to your credit needs-- The Polar Credit Line.

There are various other ways to borrow money, and also they all come with their downsides as well as positives. Review our types of credit article to work out which choice is best for you. If you're thinking about getting a payday loan, we appropriate recommend you read our post about them here, as the significant rates of interest these companies bill can set you off on a financial debt spiral terrifyingly fast. There was a time when you needed to see a bank or credit union to get an individual loan.

Along with on the internet banks, you can connect to a peer-to-peer lender (P2P). Certainly personal loan rates of interest can usually be quite high contrasted to safe finances. Be sure to check the details of the loan prior to you make an application for it as well. Clearly this relates to any kind of type of loan, but individual financings sometimes have very early settlement costs, which are not excellent if you discover yourself in a setting to pay off your financial obligation entirely. The major advantage of obtaining a loan from a good friend or family member is that your "lender" is more likely to be adaptable regarding payment setups.

How can I get a 50000 Loan in one day?

Cleo Plus paid features Cleo Cover lets you borrow up to $100 if you need a bit cash to get by or if your checking account is in danger of going into the red. No interest is charged on the loan amount, so long as you repay what you borrowed within three to 28 days later.

#Geld lenen#Lenen#Snel Geld Lenen Zonder Gedoe#Snel Geld Lenen#Lening Aanvragen#Direct Geld Lenen#Lening Afsluiten#Geld Lenen Zonder Gedoe#Goedkoop Geld Lenen#Online Geld Lenen#Lening#geld lenen berekenen#Goedkoop Geld Lenen Lage Rente

0 notes

Text

6 Reasons Why You Must Never Provide Money To Friends Or Household

6 Reasons You Ought To Never Ever Lend Cash To Pals Or Family

#toc background: #f9f9f9;border: 1px solid #aaa;display: table;margin-bottom: 1em;padding: 1em;width: 350px; .toctitle font-weight: 700;text-align: center;

Content

Do You Need To Borrow Money?

Determining Whether You Need To Be Loaning Money

Do You Really Need To Invest The Money Whatsoever?

Do You Need To Borrow Money?

As long as you have great credit as well as excellent reasons to borrow money, a bank will usually be more than satisfied to prolong a loan to you. It'll feature a clear payment strategy and also interest rates that aren't too expensive in the grand plan of things. From credit cards to long-term home loan financing, UK credit consumers trust different financing alternatives to achieve their cash goals.

Choosing Whether You Ought To Be Loaning Cash

When health care expenses strain your home budget plan, your economic expert can assist you figure out your options. Often, when a company trades on credit terms, cash flow can be extended as suppliers require to be paid in advance of obtaining settlement from consumers. And also when a company is experiencing fast growth, this can become a lot more of a problem, suggesting that constant loaning is required to make sure that sufficient cash is available in any way times to satisfy day-to-day commitments.

Which app gives loan instantly?

To apply for an instant cash loan with NIRA, you must be an Indian citizen and between 21-65 years of age. You will also need to have a college degree, be working for a minimum of 6 months and earn a salary of Rs 20k or above per month. You do not need a CIBIL score to apply for a quick cash loan through NIRA.

Do You Truly Need To Spend The Money Whatsoever?

In the past, many nations have taken and also examined cutting-edge and brand-new principles and also means to boost economic gains from trading companions. The ability of the country to utilize its resources to increase its wide range is not at all negative. The loans additionally allow loan providers to alter prices at established times in the future. Refusing to pay upgraded interest rates would certainly indicate councils are forced to pay back the loan completely.

They can make minimal repayments or be supplied one more three-month payment vacation. Individuals receiving assistance ought to not have their bank card suspended. Oftentimes lendings were taken to assist repay other financial debt; 13% of participants needed the money to help with home loan repayments or rent, 11% to assist pay off charge card and 4% to settle a short-term lending institution. As long as you're considering the borrowing as a short-term remedy, you can not go wrong with a bank card. Used correctly, they'll aid you reconstruct your credit score while likewise letting you borrow money to make purchases.

Good Money Loaning Versus Bad Money Borrowing

youtube

Customers looking for loans can determine the actual rate of interest paid to loan providers based upon their promoted rates by using the Passion Calculator.

It is very important to understand the difference between APR and also APY.

In the 2015 and also 2017 records of World Financial institution, a variety of African nations have huge financial debts not just with China but additionally with other creditor nations.

For more information concerning or to do estimations including APR, please check out the APR Calculator.

Higher rate of interest of concerning 55% from the private sectors motivated Africa to go to China for car loans, which is around only 17%.

The rate typically released by financial institutions for saving accounts, cash market accounts, and also CDs is the yearly percentage yield, or APY.

Also, when you obtain from a loved one, you commonly can obtain 100% of the required amount as well as delight in lower rates of interest (or no passion in any way). If the circumstance goes south, the most unfavorable component of borrowing from a person you recognize is that your personal partnership could be damaged permanently. Just use online, giving details of your earnings as well as expenditures, submit your application, inspect your email and also get money in your bank account!

It depends on you to gauge the price of numerous borrowing alternatives, before making credit commitments. On the internet resources make it feasible to contrast different offering alternatives, recognizing the most efficient, cost effective means to borrow money.

Among a number of prominent locations to borrow money, on the internet credit opportunities give fast money, without delays. If you're facing a financial crisis, or see a capital shortage in advance, solve your immediate financing requires with a leading loan provider today. Charge card companies and on the internet loan providers supply locations to borrow money.

You can utilize them to buy anything from your food purchasing to brand-new autos-- but beware, the interest rates are commonly fairly high. If you do not assume you'll have the ability to repay the sum total you've borrowed within a couple of months (preferably one month) after that you may be much better off borrowing money from an additional source. While lenders suggest focus on the high APR is a misrepresentation as the cash is not offered over a year, doubters state the loans target one of the most financially prone, whose financial debts can easily snowball out of hand. In March, a record by the Workplace of Fair Trading found payday loan providers make the majority of their cash from missed repayment costs and also interest built up.

A supervisor's loan account permits you to pay on your own beyond your normal wage by obtaining cash to pay back at the end of the fiscal year through dividends. Consumers looking to take a ₤ 5,000 individual loan repayable over a 24-month period can consider Tesco Financial institution, which offers the most affordable APR of 3.4%. Both its Telephone Personal Loan as well as Online Personal Loan supply this APR as well as the total quantity repayable on these car loans is ₤ 5,176.32. This kind of credit is a bit harder to obtain than the previous 2 that we have actually talked about in this overview.

If you need to borrow money, it is best to stay clear of payday advance loan, doorstep lending institutions as well as shylock, which will cost you a great deal of money. Lendings from cooperative credit union are more affordable, easy as well as safe to access, and also there are no surprise costs or fines. The market is inundated with lots of alternatives for credit, from payday advance, guarantor lendings, charge card, overdrafts to borrowing cash from loved ones, however just how do you know what is the most effective item for you? Each product has its own advantages and disadvantages as well as what is right for you will certainly depend entirely on your situations. Nonetheless, if you need to borrow money promptly as well as securely, why not attempt our all new option to your credit needs-- The Polar Credit Line.

There are various other means to obtain cash money, as well as they all include their negatives and positives. Review our kinds of credit short article to exercise which choice is best for you. If you're thinking about obtaining a payday loan, we appropriate suggest you read our short article concerning them here, as the significant rate of interest these firms bill can establish you off on a financial obligation spiral terrifyingly quick. There was a time when you had to go to a financial institution or credit union to take out a personal loan.

How can I make $200 in one day?

mPokket is one of the most popular platforms for instant personal loans to college students. Students need to download the app and submit photos of their student ID and Aadhaar card. They can request any amount of loan, starting at Rs. 500, and get it instantly into their bank account or Paytm wallet.

Along with on-line financial institutions, you can reach out to a peer-to-peer loan provider (P2P). Obviously individual loan rates of interest can frequently be fairly high contrasted to safe loans. Make certain to check the details of the loan before you obtain it also. Clearly this applies to any type of kind of loan, however individual finances often have very early payment fees, which are not ideal if you locate yourself in a setting to repay your financial obligation entirely. The main benefit of obtaining a loan from a good friend or relative is that your "lending institution" is more probable to be adaptable about payment arrangements.

#Geld lenen#Lenen#Snel Geld Lenen Zonder Gedoe#Snel Geld Lenen#Lening Aanvragen#Direct Geld Lenen#Lening Afsluiten#Geld Lenen Zonder Gedoe#Goedkoop Geld Lenen#Online Geld Lenen#Lening#geld lenen berekenen#Goedkoop Geld Lenen Lage Rente

0 notes

Photo

It is greed, though.... Let's consider this. So about every $9,826 (in an 8 hour shift) the employee gets $98 (that's them making $12.25 which isn't even the min wage that most pay). So let's assume they work 40 hours (which I'm sure they don't). In one week this employee is responsible for bringing in $49,130 and only receiving $490. Granted there is other labor to pay for, and 49,130 isn't straight profit but when you consider this is only one week, there is definitely some skew for those higher ups receiving money on the backs of that employee.

196,520 (1 month) is generated money in a 4 week month (to make it easy I just did it by 4 weeks.)

1,960 is what the employee brings in.

So at the end of one Quarter that store alone makes 589,560

The employee makes 5,880 at the end of the Q.

Let's say you pay 10 employees (that's assuming they all make ~12.25/hr the restaurant has 530,760.

Food cost and paper cost is 250,000 (I added around 25K for cushion to make sure I don't skew things in favor of my argument.) So 280,760 remains in profit after a high labor.

There is some franchising fees so subtract 15% and you have 238,646.

Even if you take away 100k for bills (3 months worth which is way, way, wayy overshooting here) you have a 138,646 profit.

Let's take another 20k away for the manager's salary (which again is overkill. The average is around 50k/year including bonuses). 118,646 in profits for 3 months for the guy up top vs 5,880 for 3 months.

Let's make it a year long.

474,584 /yr for the owner.

23,520 /yr for the employee

Yeah, I'd say that's greed. And this is to the benefit of the owner, not the employee

Most Owners have multiple McDonalds. When I talk about greed I don't just mean the pay difference in pay between the employee (that brings in the revenue and keeps the business rolling) and the owner that takes it in.

I also mean the inability for the working class to invest due to the hoarding of wealth by the rich.

The fact that in the year 2000 min wage was $5.15 which is ~$8.50 in today's money, but the current fed min wage is $7.25.

Min wage has not been kept up for inflation. It's only changed when absolutely "necessary."

Wage inequality continues to grow. The "top brass" is gaining income from wages that should be dispersed to the working class when you factor in everything.

So yes, this most definitely is greed. And anyone with a little bit of knowledge on economic growth, the trend in wage inequality increasing, and medium pay among the working class and top brass would know that.

----granted, the OG example is kind of a poor example and doesn't dive into the actual reasons why greed can be attributed here.

The value of today's worker is less than the value of the same worker 30+ years ago and most of it is attributed to greed and narrative push.

There is a strong disconnect here. The CEOs will convince you that your fellow worker doesn't deserve the same as you but in reality they're just scapegoating because you deserve more too.

If minimum wage met the same growth as CEO's in the past few decades minimum wage would be well over $15, and that's adjusting for inflations. Where does that money go? Not to the worker so yes, this is greed.

1K notes

·

View notes

Text

6 Reasons Why You Must Never Ever Offer Cash To Pals Or Family members

6 Reasons that You Must Never Ever Provide Money To Pals Or Family

#toc background: #f9f9f9;border: 1px solid #aaa;display: table;margin-bottom: 1em;padding: 1em;width: 350px; .toctitle font-weight: 700;text-align: center;

Content

Do You Required To Borrow Money?

Making a decision Whether You Ought To Be Loaning Cash

Do You Truly Need To Spend The Money Whatsoever?

Do You Need To Borrow Money?

As long as you have great credit as well as excellent reasons to borrow money, a financial institution will generally be greater than satisfied to expand a loan to you. It'll feature a clear repayment strategy and rate of interest that aren't too expensive in the grand plan of points. From credit cards to long-lasting home loan funding, UK credit consumers rely upon various money alternatives to attain their money goals.

Making a decision Whether You Ought To Be Borrowing Money

When health care expenditures strain your household spending plan, your monetary advisor can help you figure out your options. Commonly, when a company trades on credit terms, capital can be extended as distributors require to be paid ahead of getting payment from customers. And also when a business is experiencing quick development, this can come to be a lot more of a trouble, implying that continuous loaning is required to make sure that enough money is readily available in any way times to meet everyday dedications.

youtube

Which app gives loan instantly?

To apply for an instant cash loan with NIRA, you must be an Indian citizen and between 21-65 years of age. You will also need to have a college degree, be working for a minimum of 6 months and earn a salary of Rs 20k or above per month. You do not need a CIBIL score to apply for a quick cash loan through NIRA.

Do You Really Required To Invest The Cash At All?

In the past, numerous countries have taken and examined new and ingenious methods as well as ideas to increase monetary gains from trading companions. The capability of the nation to use its sources to increase its riches is not bad. The finances also permit lending institutions to alter prices at set times in the future. Declining to pay updated rate of interest would imply councils are required to repay the loan in full.

They can make minimal repayments or be provided an additional three-month settlement vacation. People getting assistance must not have their credit card suspended. In many cases lendings were taken to aid settle other debt; 13% of respondents needed the cash to assist with home mortgage payments or rent out, 11% to help pay off credit cards and 4% to settle a short term lender. As long as you're considering the loaning as a temporary service, you can not go wrong with a credit card. Used appropriately, they'll assist you reconstruct your credit score while additionally allowing you borrow money to make purchases.

Excellent Money Borrowing Versus Bad Money Borrowing

Consumers seeking finances can compute the real interest paid to lending institutions based on their promoted rates by utilizing the Rate of interest Calculator.

It is necessary to recognize the distinction between APR and also APY.

In the 2015 and also 2017 documents of World Bank, a variety of African nations have huge financial debts not just with China however likewise with various other creditor countries.

Higher rates of interest of about 55% from the economic sectors prompted Africa to head to China for car loans, which is around only 17%.

The price usually released by financial institutions for saving accounts, money market accounts, and CDs is the annual percentage yield, or APY.

Likewise, when you obtain from a liked one, you commonly can obtain 100% of the needed amount and also take pleasure in reduced interest rates (or no rate of interest at all). If the situation goes south, the most regrettable part of loaning from somebody you know is that your individual connection can be damaged permanently. Simply use online, providing information of your earnings and expenditures, submit your application, examine your e-mail as well as obtain money in your bank account!

It's up to you to gauge the expense of numerous borrowing alternatives, before making credit commitments. On the internet sources make it possible to compare numerous lending options, identifying the most efficient, affordable means to borrow money.

Amongst several prominent places to borrow money, online credit possibilities offer fast cash, right away. If you're dealing with a financial dilemma, or see a cash flow shortfall ahead, fix your urgent financing requires with a leading loan provider today. Charge card business and also on the internet lending institutions give locations to borrow money.

You can utilize them to purchase anything from your food buying to new cars and trucks-- yet beware, the rates of interest are usually rather high. If you do not think you'll be able to settle the total you've borrowed within a couple of months (ideally one month) then you may be far better off obtaining money from an additional source. While lending institutions suggest emphasis on the high APR is a misrepresentation as the cash is not provided over a year, doubters claim the finances target the most economically at risk, whose financial obligations can quickly grow out of control out of hand. In March, a record by the Workplace of Fair Trading discovered payday lenders make most of their money from missed out on settlement fees and also interest accrued.

A director's loan account permits you to pay yourself beyond your typical salary by obtaining money to repay at the end of the fiscal year by means of dividends. Debtors looking to take a ₤ 5,000 personal loan repayable over a 24-month period can take into consideration Tesco Bank, which uses the most affordable APR of 3.4%. Both its Telephone Personal Loan and Online Personal Loan provide this APR and also the complete quantity repayable on these loans is ₤ 5,176.32. This form of credit is a little bit harder to get than the previous two that we have actually gone over in this overview.

If you require to borrow money, it is best to stay clear of cash advance, front door lenders as well as loan sharks, which will cost you a lot of money. Finances from cooperative credit union are more affordable, risk-free and easy to accessibility, and also there are no covert charges or charges. The marketplace is swamped with several alternatives for credit, from payday advance, guarantor finances, credit cards, over-limits to borrowing money from loved ones, yet just how do you know what is the most effective item for you? Each item has its own benefits and drawbacks as well as what is right for you will certainly depend totally on your circumstances. However, if you need to borrow money quickly and also firmly, why not try our brand-new service to your credit needs-- The Polar Credit Limit.

There are various other ways to borrow money, as well as they all feature their downsides and also positives. Read our kinds of credit post to work out which choice is best for you. If you're considering obtaining a cash advance, we correct recommend you review our write-up about them below, as the big rates of interest these firms charge can set you off on a financial obligation spiral terrifyingly quick. When you had to go to a financial institution or credit union to take out an individual loan, there was a time.

How can I make $200 in one day?

mPokket is one of the most popular platforms for instant personal loans to college students. Students need to download the app and submit photos of their student ID and Aadhaar card. They can request any amount of loan, starting at Rs. 500, and get it instantly into their bank account or Paytm wallet.

Along with online financial institutions, you can reach out to a peer-to-peer lender (P2P). Naturally personal loan rate of interest can usually be fairly high compared to secured fundings. Make certain to inspect the details of the loan before you get it too. Obviously this puts on any sort of loan, but individual fundings often have very early settlement costs, which are not ideal if you locate on your own in a position to settle your financial obligation totally. The main benefit of obtaining a loan from a buddy or relative is that your "lender" is more probable to be flexible concerning settlement plans.

#Geld lenen#Lenen#Snel Geld Lenen Zonder Gedoe#Snel Geld Lenen#Lening Aanvragen#Direct Geld Lenen#Lening Afsluiten#Geld Lenen Zonder Gedoe#Goedkoop Geld Lenen#Online Geld Lenen#Lening#geld lenen berekenen#Goedkoop Geld Lenen Lage Rente

0 notes

Text

Repair Your Credit Legitimately

"In the previous year I have had an enormous quantity of customers and experts (Lenders, CPA's, Realtors, Lawyer, and Wealth Management Companies) asking for clearness about the options offered to individuals suffering hardships in this economy. Obviously thy desire the most useful solution for every different situation. Although we deal with many incredibly talented and experienced specialists in this continuously altering home mortgage and finance economy it is hard for numerous to stay up to date with choices offered. Staying abreast of the rules and choices within their own industry is a great deal of let alone all the other locations that impact their customers and potential customers.

All of these opportunities might be a good option in the right scenario however may be a dreadful option and a substantial waste of money if all options aren't understood. I will try to drift off from excessive detail to keep the confidentiality of each person.

We spoke with a lady in her 40's living in NY with a house she owned in FL. She was unable to get any earnings from her Florida residential or commercial property for various factors. She was renting in NY and working 2-3 tasks to cover the expenses. Her income had to do with $38,000.00. Her Florida home deserved 40% less than her mortgage. She owed $50,000.00 in charge card financial obligation and she remained in and out of the health center with different medical problems. She was very psychological (as a lot of have to do with altering their scenario).

youtube

We have actually seen time and time again great individuals attempting to stay above water for way too long. They wind up paying 10's of $1000's more than necessary because they hesitate of the word ""INSOLVENCY"". The factor she pertained to us was to tidy up her credit so she could improve interest rates on her charge card debt and maybe re-finance her home. Her credit was a mess with lots of accounts late, charge offs, and collections.

Here were her choices: Credit Remediation would cost her over $2,800.00 and if she had a new late while doing so (which she would have due to the fact that she was having trouble paying her costs) her score would drop significantly and whatever payment she made to us would be money tossed out the window. One new late payment decreases ball game anywhere from 50-100 points depending on how high the score is prior to the brand-new late. She can't refinance her mortgage loan since your home was worth much less than her existing home mortgage and her credit was so bad that the banks would not authorize her anyway. She already tried a loan mod and could not get authorized.

Financial obligation Debt consolidation, which is non for revenue business, would have decreased her interest on charge card financial obligation and had her pay the lenders small payments month-to-month (through them)over a longer period of time. Her $50,000.00 debt would become $65,000.00 with the interest and brand-new length of payment strategy to her creditors. It could take 5-10 years to pay off the debt. After completing the program she would require credit repair work which would cost an extra $2,800.00 and take up to a year. Her total cost would be around $67,500.00 and the time element might be 5-10 years.

Debt Settlement; A business would settle the debt for a minimized quantity (usually 40% of financial obligation). This ran out the concern given that she required the funds to pay her financial institutions in one shot and did not have savings. She would have needed about $20,000.00 to $30,000.00 readily available to pay the charge card financial obligation once it was settled. If she had the swelling sum funds she would have needed to pay the federal government taxes on the $20,000.00 - $30,000.00 she conserved since it is viewed as earnings.

Then she would need to tidy up her credit which would cost her $2,800.00. So she would be paying in total if she saved $30,000.00 and she went to a normal debt settlement business (they would have charged her 15% of what they saved her): $20k for financial obligation+ $4,500.00 debt settlement company+$8,400.00 to the IRS if she remained in a 28% tax bracket. Total paid $32,900.00 + $2,800.00 to tidy up credit = $35,700.00 This entire procedure would probably take 1-2 years.

If she offered your home in a short sale she would be forgiven the quantity the Bank lost.

- Home mortgage $300,000- Sold house for $160,000- Government forgives the tax on the $140,000 earnings bank forgave on her mortgage- Goes to bankruptcy and pays $1500-$1800 for Attorney- Wipes out debt of $50,000 to credit card companies- Plus one year later on we clean up her credit which costs her roughly $2800 and it takes 6-12 months to finish.

Her total expense has to do with $4,500.00 to erase $190, 000.00 of financial obligation and start over. It took her 4 more months and cost her another $4,000.00 considering that she attempted to stay afloat and pay her home loan and credit card financial obligation up until she was willing to accept the insolvency choice. It was the stigma (fallacy) of insolvency that stopped her at first. You can get a mortgage about 2 years after bankruptcy or earlier (speak to your mortgage expert). We discovered later on that she had utilized the increasing value on her home, before the market crashed, to take a loan of $60k. She actually generated income on her house.

Another example: a Designer owns a home that has actually held its worth but his mortgage was still nearly the value of his house. His salary went from $175,000.00 to $40,000.00 in the in 2015. He has $85,000.00 in charge card financial obligation and had late payments in the previous 8 months. His rates of interest with the creditors sky rocketed and they decline to reduce them. He is struggling to pay the charge card payments and living under unbelievable tension and fear. He never thought he might go to personal bankruptcy given that he owned a house. He is the only earnings earner in the household and has 2 youngsters in private school. He came to us for suggestions and we linked him to an insolvency Lawyer and a possible loan mod too. This was his best alternative and he was relieved he didn't have to give up his home.

I talked to an elderly man whose business just liquified. He has a house with a little loan and big value. He has savings but his better half was ill with a chronic disease and he was suffering from anxiety. He owed $40,000.00 in credit card debt and had a 750 credit score. He and his partner were not making any earnings. After speaking to him for a while I found out that he did not require his credit and was not worried about his ratings lowering. He was not a prospect for Bankruptcy and it made sense for us to negotiate his financial obligation. The financial institutions would not even speak to us up until he was 4 months late and his credit report dropped. It was a tough circumstance for him and his wife because they were bombarded with pestering telephone call (even after informing their financial institutions to stop calling them) day and night. They believed it out and we had the ability to save them about $24,000.00. They were extremely happy and relieved at the end of the procedure. It did cost them $2,000.00 for our services and the taxes paid on their savings to the IRS. Remember each situation is different in terms of taxes paid and should be talked about with your CPA.

An expert with a family owning a house upwards of $1,000,000.00 in Long Island. After owning the house for a year he took a loan on the increased worth to remodel (about 29 months ago). He has a salary of over $250,000.00 and is the only income earner in his household. He called to inquire about Debt Settlement after he had discussed this option with a Financial obligation Settlement Business that had contacted him. He owed over $175,000.00. They more than likely found him on a list the credit reporting agencies offered looking for high debt individuals. He was hardly covering his home loan and having a difficult time paying his credit card debt. His rate of interest on the charge card debt were hiked up due to the fact that his balances were extremely high if not at the limitations. He was informed by a Financial obligation Settlement Company that his credit would not be destroyed (even though he would have to stop paying his financial obligation) and he would most likely not need to pay taxes on his cost savings.

He would have to put loan into a bank account through them up until he saved up adequate money for the Settlement Business to pay the financial institutions 40% of what he owed. They would take their charge first and when he had sufficient cost savings they would start to negotiate his debt. The majority of this was incorrect. If you do not pay your bills on time you will have late payments on your credit report END OF STORY. He really required to check out getting a loan modification first because the quantity of his mortgage was, most likely, more than his residential or commercial property worth. If he had lots of settled accounts with late payments he might not have actually gotten approved for the loan mod. We referred him to an Attorney to discuss his home mortgage situation and recommended him versus financial obligation settlement until he examined the loan mod choice initially. He likewise needed to find out what the pacific national funding tax implication would be if he had $100,000.00+ contributed to his $250,000.00 earnings after his credit card debt was settled for less.

A woman earning $100,000.00 with $30,000.00 of charge card debt and very high costs. Her balances are extremely near limitations and some over the limitations. She desires to pay her financial institutions however can't deal with the high rate of interest and increased minimum https://en.search.wordpress.com/?src=organic&q=https://www.daveramsey.com/blog/debt-consolidation-truth payment. She owns a condominium in Manhattan with a little equity and had a piece of property upstate with a worth of $30,000.00. She was rejected a loan versus her residential or commercial property because of low ratings from her extremely high balances on her revolving credit card financial obligation and although her property was on the marketplace it was not selling. Debt Debt consolidation might be the finest option for her considering that her interest rates could be minimized to 6% rather than the 23% she is paying presently. She will pay them a small fee plus a decreased month-to-month payment which they will deliver to her financial institutions.

It is essential that she understands Consolidation Business might make her decreased regular monthly payments late or put a mark on her credit profile specifying she remains in a debt combination strategy. This mark affects the ratings negatively. She can likewise ask the DC Company to keep this info off her credit profile and to make sure payments are made on time however there is no warranty this will occur. We have seen the scores drop significantly since of these marks. The credit can constantly be cleaned up in the future when she gets a manage on her financial obligation. If she is conserving 17% interest on her $30,000.00 and her payments are not extracted for ten years it might be a good choice in this scenario.

All these examples show the various choices readily available and the battles we are seeing in this economy. Something we find once again and once again is the misunderstanding that a personal bankruptcy is so much even worse for the credit than anything else. If you have excellent credit history and you have a new late payment ball game will drop 70-100 points. If you continue to have more lates ball game will drop further. If your rating is currently really low an insolvency will not drop it much lower. Credit history are driven by what is taking place now. As the unfavorable details on the credit report age ball game increases. We can likewise improve the credit a year after insolvency. Once your credit history are low it is pointless to stress over ball game if you can't pay your expenses and are having problem with standard requirements.

Credit history can always be improved. It is unfortunate to see a person struggling to pay credit card financial obligation prior to feeding themselves. Insolvency is there for a factor and can be a terrific tool in these difficult times. It is necessary for consumers to look for out information prior to deciding to move on. Talking with a Bankruptcy Attorney, Debt Debt Consolidation Business, Mortgage and Loan Mod expert, a great Realtor for short sale details, and a Credit Restoration company are very important to make an educated choices. There are some professions that will not work with a person with a personal bankruptcy on their record so when seeking information make sure to ask about this possibility and how it relates to your career."

0 notes

Text

How Bad Credit Consolidation Loans Can Assist Those With Poor Credit

"In the previous year I have had a huge quantity of customers and professionals (Bankers, Certified Public Accountant's, Realtors, Attorneys, and Wealth Management Companies) requesting for clearness about the choices available to people suffering hardships in this economy. Obviously thy desire the most useful service for each various scenario. Although we handle lots of very gifted and well-informed specialists in this constantly altering home loan and financing economy it is hard for many to stay up to date with options available. Staying abreast of the rules and options within their own market is a lot of not to mention all the other areas that impact their customers and prospects.

All of these opportunities might be a good option in the ideal scenario but may be a dreadful option and a substantial waste of cash if all choices aren't understood. I will attempt to drift off from too much detail to keep the privacy of each individual.

We spoke with a female in her 40's living in NY with a home she owned in FL. She was not able to get any income from her Florida property for various reasons. She was leasing in NY and working 2-3 jobs to cover the expenses. Her income had to do with $38,000.00. Her Florida home was worth 40% less than her mortgage. She owed $50,000.00 in charge card debt and she remained in and out of the hospital with numerous medical issues. She was extremely psychological (as most have to do with altering their circumstance).

We have seen time and time again great individuals attempting to stay above water for method too long. They wind up paying 10's of $1000's more than needed due to the fact that they hesitate of the word ""PERSONAL BANKRUPTCY"". The factor she concerned us was to tidy up her credit so she could get better interest rates on her charge card financial obligation and maybe refinance her house. Her credit was a tinker numerous accounts late, charge offs, and collections.

Here were her alternatives: Credit Restoration would cost her over $2,800.00 and if she had a new late in the process (which she would have since she was having difficulty paying her bills) her score would drop considerably and whatever payment she made to us would be loan tossed out the window. One brand-new late payment decreases the rating anywhere from 50-100 points depending upon how high the score https://en.wikipedia.org/wiki/?search=https://www.daveramsey.com/blog/debt-consolidation-truth is prior to the brand-new late. She can't refinance her mortgage given that your house deserved much less than her present mortgage and her credit was so bad that the banks would not approve her anyway. She currently attempted a loan mod and might not get authorized.

Debt Combination, which is non for profit companies, would have reduced her interest on charge card debt and had her pay the financial institutions small payments month-to-month (through them)over a longer time period. Her $50,000.00 financial obligation would end up being $65,000.00 with the interest and brand-new length of payment strategy to her lenders. It could take 5-10 years to settle the financial obligation. After finishing the program she would require credit repair which would cost an extra $2,800.00 and use up to a year. Her overall expense would be around $67,500.00 and the time element might be 5-10 years.

Financial obligation Settlement; A business would settle the financial obligation for a reduced amount (typically 40% of debt). This was out of the concern since she needed the funds to pay her creditors in one shot and did not have savings. She would have needed about $20,000.00 to $30,000.00 readily available to pay the credit card debt once it was settled. If she had the swelling sum funds she would have had to pay the government taxes on the $20,000.00 - $30,000.00 she saved given that it is deemed earnings.

Then she would need to clean up her credit which would cost her $2,800.00. So she would be paying in overall if she saved $30,000.00 and she went to a normal financial obligation settlement company (they would have charged her 15% of what they conserved her): $20k for debt+ $4,500.00 financial obligation settlement company+$8,400.00 to the IRS if she remained in a 28% tax bracket. Overall paid $32,900.00 + $2,800.00 to clean up credit = $35,700.00 This entire process would most likely take 1-2 years.

If she sold the house in a short sale she would be forgiven the quantity the Bank lost.

- Mortgage $300,000- Offered house for $160,000- Government forgives the tax on the $140,000 income bank forgave on her home loan- Goes to bankruptcy and pays $1500-$1800 for Attorney- Wipes out debt of $50,000 to charge card business- Plus one year later we tidy up her credit which costs her approximately $2800 and it takes 6-12 months to finish.

youtube

Her total expense is about $4,500.00 to clean out $190, 000.00 of financial obligation and start over. It took her 4 more months and cost her another $4,000.00 since she tried to remain afloat and pay her home loan and credit card debt up until she wanted to accept the bankruptcy choice. It was the preconception (misconception) of personal bankruptcy that stopped her initially. You can get a home mortgage about 2 years after bankruptcy or earlier (speak with your home mortgage professional). We discovered later that she had actually utilized the increasing worth on her home, prior to the market crashed, to take a loan of $60k. She really generated income on her house.