#i think i might stick to sai from now on and go to CSP for effects mostly...

Explore tagged Tumblr posts

Photo

Goodnight!! 🦌🐇✨

base by @/damso_2018 on twt!

#Aster#my art#OC#maka#The sock from the base changed to a plushie thanks to my beloved tho#God bless#Astell#<- implied wink wink nudge nudge#pls give this some attention cuz i'm so proud of the shading. u guys wont believe#i think i might stick to sai from now on and go to CSP for effects mostly...

57 notes

·

View notes

Note

Random ask but been bugging me a bit. What do you mean when you scan drawings? Like I've seen artists always mention about how they scan traditional drawing and upload them to their computer but like how??? Again sorry for the random ask, my baby brain is trying to gain big kid knowledge and experience lol.

I wh--

wha

what are they teaching you guys in school I

first let me preface this by saying you don’t ever have to be sorry to ask a question and even though i’m having an internal crisis about my age it is absolutely not your fault for not knowing and i am happy to answer and happy to help and i am not in any way trying to embarrass or poke fun at anyone but myself and also good thing you asked this this year when i actually have access to my trusty old scanner again lol.

groovy public service announcement with hip and modern music in the bg: learn to use a scanner not just for doodling but also for life!! old people will be amazed and astounded by your command of technology in a professional setting, it’s a life skill at any age. Using it for doodles is a great motivator.

meet scanner-kun

Step One: Draw a Drawing

i’m using scrap paper because i’m lazy and because sometimes fitting a sketchbook in a scanner is a hassle because you might have to hold it in place. (There are sketchbooks like grumbacher which come with removable tabs that i’d recommend for stuff you want to scan but dont want to tear out of your sketchbook.)

(its edward prince of the magpies)

Step Two: Pop it in your All in One Printer/Scanner that you totally definitely maybe have (or borrow someone else’s, you can do this for free at your local library and tbh their scanners are probably bigger) And Make Sure It’s Facing the Right Way Please

Step Three: Find the cables for your all in one printer/scanner that has been in storage for 3 years and actually hasn’t met your computer and needs to be introduced to it and thus you need to download the scanner app and oh my god this took slightly longer than expected aaaaaaaaaaaaaaa

(a newer printer/scanner would be easier but mine is an oldboi and my computer has had some issues in the past so it’s a few apps short of a brain) (Oldboi scanner connects to laptop-kun via a USB cable because it pre-dates wireless printers that are much more common these days)

There is a button on the scanner I could press, but it’s probably actually better and easier to do it by opening the scanner app on the computer because you should preview your scan first in order to crop it and make sure it all fits and isn’t at a weird angle etc etc.

Step Four: Preview your image and make any adjustments necessary. I’ve cropped it but I’m not messing with the settings (the resolution would be important if you plan to print the image later and you might want to change it from colour to greyscale, but if you forget you can still do this in your editing program of choice really easily.

Step 5: Hit that scan button

and voila, your scanner has created an image that you can save, put on a usb stick, email to yourself, print, or whatever.

The scanner did a pretty good job of ignoring the big smudge i’d made by accident near his face, but I will want to open this up in an editing program like CSP to make my sketch easier to see. Scanning tends to wash things out a little (and with reflective material it doesn’t always show up well)

My guess is that fewer people have printer/scanners these days because so much “scanning” can be done with a phone - there are scanner apps you can download to your phone that are a little more precise than just using the camera app and can take scans of things larger than would fit in a printer/scanner, I just don’t have patience for them and haven’t really used them.

Step 6: drink and contemplate your own antiquity

am i really that old does everyone just use their phone these days

Step 7: Editing your drawing

I won’t go into this because it depends on what program you use to edit but It usually helps to adjust the brightness/contrast of the lineart layer (I have this under Edit > Tonal Correction but it might be in a different spot in other programs)

and if your program also has level correction that’s really helpful with cleaning up lineart

as you can see it’s picked up all the gross smudges - so i move around these arrows to try to get them as clear as possible : ) I think the arrows are for white, grey and black respectively (or at least, bright, midtone, and dark).

in csp what I would do is hit “convert brightness to opacity” which should make all the white areas transparent so you can colour under the line art. You can usually achieve something similar by changing the layer to “Multiply” in other programs.

voila! Now you can use the sketch as is, draw over it or under it, make copies, whatever you want.

9 notes

·

View notes

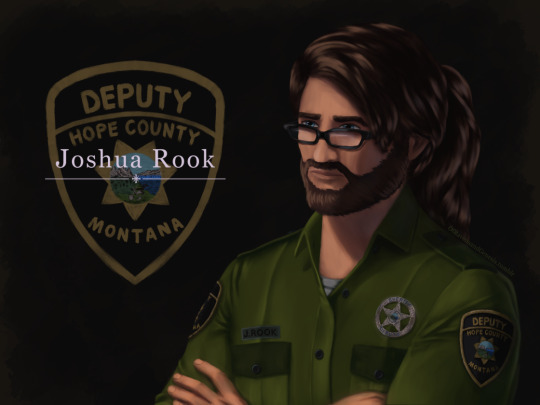

Photo

IT IS FINISHED no seriously, this took ages. First couple of days were fine and motoring along with progress, then I was laid out for a week-ish with health problems. Then once I was well enough again I was back to being fixated on finishing this piece of my lad Joshua here for another handful of days, so I’m super glad this is done now. More talk about the painting, details and process under the cut:

Art Entry 01, Joshua Rook, Junior Deputy of Hope County. Regarding the painting’s execution, stylistic choices, practiced methods, and speculation on further experimentation for skill and stylization. _____________________________ Honestly I thought that the uniform’s large swatches of green fabric would be more difficult than it actually was. Turns out that was the easier part compared to the shoulder patch and metal badge. x’D The metal badge design is based off of and inspired by a custom-ordered cosplay badge design I found while looking for references, in this post here (link,) from v-i-d-e-n-o-i-r’s blog and Far Cry 5 cosplay. There are some differences in the painting’s rendition above, namely I flattened the middle section and made it all concentric polished metal instead of painted and the great seal rendition in the middle doesn’t have silver lineart either. Those choices are as much for aesthetic reasons of eliminating the blue ring so it was all a fairly simple mono-material-looking surface as it was for simplifying having to forego painting the foreshortening that a spherical dome might entail. Also just because the rest of the metal turned out looking good enough that an additional bit of shiny metal seemed like it’d fit right in for this. That being said, the badge design that inspired this one is rad and awesome looking—and I totally didn’t realize it wasn’t quite like the badges from in-game assets until after I’d painted it. x’D So, I decided to stick with this one since it’s simpler and has cleaner lines, and less engraving to pick out highlights on. Metal is very hit or miss for me to get right, so I’m very pleased with how this one came out! :D I think I did well on that one. The shoulder patch originally I was looking at real world references and ended up changing the shape once I actually looked at in-game references on Staci and Joey—who I discovered have slightly different details on their uniforms, like the font for their name tags—Staci’s has an old-timey-looking-font with serifs, Joey’s is a non-serif more modern-style font. Some pictures have them having different buttons on their uniforms either in color or shape (the former being exported assets, the latter being in-game gifs/screenies/etc.) This is also how I learned that the little landscape with the shovel, pickaxe and plough/plow are part of the great seal of Montana. I had no flipping idea that was what it was, looking at the patches in-game. The cosplay community does some great work for that, for which I’m grateful. I ended up looking up references of what the state seal’s design was so as to see the smaller details, and to find out what the motto meant ”Oro y Plata,” meant, leading to etymology googling adventures from there, as usual. All important details to paint though I think here, since Joshua’s deputy uniform is symbolically significant to him and will remain so throughout his story as part of his internal conflict for a couple of reasons. One thing I knew I should’ve done from the start, and reminded myself to do, was the fact that I should paint all skin sections at the same time, so as to ensure they all came out the same shades. I did not do this. x’D I’ll have to actually try to do that next time honestly. Same with the hair sections, while I like how they came out, I do feel the differences between the three major segments in terms of brushwork is not as coherent as I’d like, even if beard hair is not necessarily similar in how it lays to scalp hair, particularly with length and such taken into consideration. Still, not bad. Could’ve used more refs for the backlighting and figuring out how the highlights would fit best on the ponytail, but I think the hair curves turned out nice there in particular. Overall, Joshua’s hair ended up messier than I’d thought with how the locks all end up looping this way and that across his head, but it does actually fit him well as a character for his hairstyle to be messy and loosely held together, but functional. It did end up longer than I’d intended, so we have him likely ending up with a nerdy Jesus hairstyle when it’s down. x’D (Thanks to @undead-gearhead for that mental imagery, I shall take great amusement in that should I get around to drawing Joshua with his hair down.) Aside from that, I think I’m slowly improving on figuring out how to paint glasses, though I’m thinking in the future I should test more layered reflective light on them or something where the frames are in contact or close to skin, particularly around the glasses’ bridge across the nose and such. Then there are the other deviation details added—like using dark green instead of the black for the uniform accents. The faded black looks great in-game, but I do think the buttons pop more against dark green instead for this painting. I’m a little bit surprised how well the button-placket section came out, Clip Studio Paint crashed when I painted the first rendition of it, sadly losing all that work. I thought it’d be okay but turns out it didn’t quite get to auto-save that recently enough, but the second go around turned out quite well I think, possibly better. I was originally planning to try to put more textured brushwork across the flat sections of the uniform material, but decided to skip it for speed—I’ll test that elsewhere perhaps, though I think it came out well with the watercolor brushes layered on top of one another like that as is. Among the other smaller details, there’s some tweaks and such for how Joshua’s eye shape, eyebrows, nose shape, hairline etc came out compared to references of Greg Bryk in his role as Joseph Seed. I think Joshua did come out looking like he’s obviously related to the Seeds as I was hoping for, but I’m kind of on the fence that people would look at him and automatically assume it’s Joseph specifically that he’s descended from. I hope so, but either way, that’s how he’s written in-fic. x’D Overall, I would consider this painting a success, though as usual I do wish it’d been faster to finish. I do think this was good practice for detail work, and metal shading, also: buttons. Still haven’t figured out how to paint lips with more pink or red tones, I don’t like the way they look when painted sadly, unless it’s lipstick. That may end up being a stylistic element perhaps, along with how I paint the lines for fingernails and other such details. Fun fact: I have to leave the shading on the eyes for last, or else my brain goes “The eyes are done! We’re done! Call it a day.” I’m not sure why, but so far, leaving them as flats until the end seems to work a treat for keeping me focused on finishing the rest of the work with less mental dissonance. Now if only I could figure out why despite knowing I should do all the exposed skin portions at the same time, I don’t follow through on that naturally as far as inclinations go. Maybe it’s a layer organization thing and perception of wanting, say, the cloth to be done first before working “down” to the hands and such in the sense of working from the head down? I’ll have to think on that some more and test things in the next painting. Perhaps color coding the order of layers to paint will help? CSP does have a nice layer-icon-color function that I’ve dabbled with here and there. There are so many brushes, I really do need to test out more of them, I use, what, four or five total, but primarily somewhere around two or three. Hm, but what to do with texture, and how to utilize it so? Hmmm, as far as personal appeal for methodology goes, I might prefer to use textures in select pieces for more emotional emphasis? If I can figure out how to do that in a messier speed-paint style of things. Rougher textures for conflict, for example. That sounds like an interesting idea to explore, I’ll have to remember that for a later piece. Maybe more heavily textured brushes will also help with the mental itch to refine things to a cleaner-level of refining instead of leaving it in a more organically rough state. Hm, maybe it’s a “mental texture” aversion or something, as far as an interplay between the brush’s texture and the flow of the linework/brushstroke. Perhaps more uneven brushes echo that in a complimentary fashion to better allow less mental discomfort for me personally when trying to paint in a faster, looser fashion? Honestly, very tempting to go try that out sooner rather than later on some art ideas I have, but I’ve been missing my writing very much of late with two time-demanding paintings back to back. So, ideas for a later time to experiment with.

#Far Cry 5#FC 5#Far Cry 5 AU#FC 5 AU#deputy joshua rook#my art#ofravensandgenesis's art#art talk#chatter#writing about art#writing about fanart#queue

23 notes

·

View notes

Note

Hope 2020 is off to a good start for you! I was wondering if, providing you find the time, you'd give us a behind the scenes look into your creative process? I know via previous asks what tablet and program you use, but your art is so unique, I'd love to know more about what goes into it. Do you sketch first? Do you use references (e.g. for poses)? What brushes you use to get that traditionally drawn look in most of your art? The step by step process from sketch to colored art? I really love it!

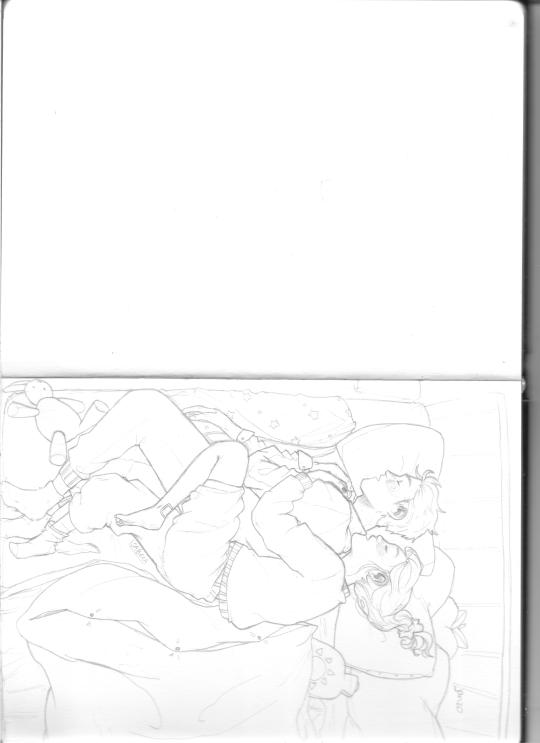

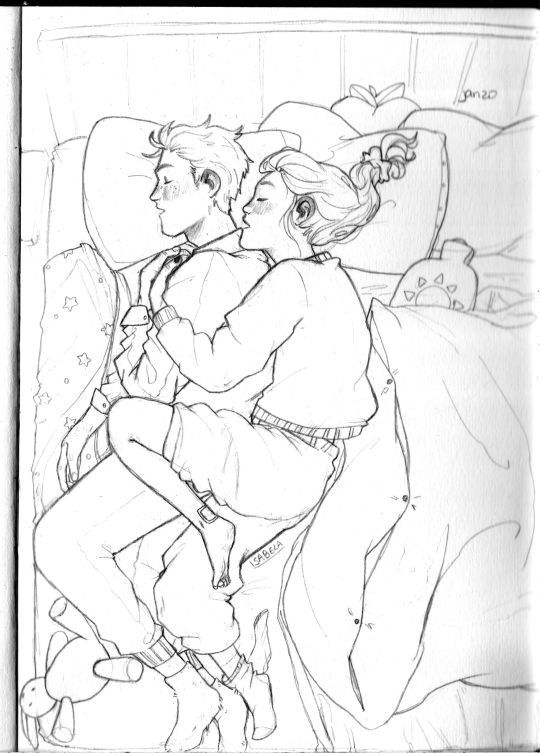

hello! you too💖 thank you so much! there’s nothing really that special that i do, but i can try and give you an insight!

i tend to sketch first on a normal sketchbook, i use mechanical pencil. sometimes, i go through a pencil phase again but it doesn’t last long lmao. i use references a lot! i do tend to draw from my head too but i find that using references helps the drawing look more natural and accurate! and you can adapt whatever pose you’re using to the vibe you want. my pinterest is at rosyumie and my inspo tumblr is at ilhxyz. there’s a ton of albums there for characters but i use it often. i tend to search for whatever i’m looking especific too.

as for my process, as i said i sketch first. at my home, our printer has less settings so i just use x1200 res, jpeg and greyscale. at uni, i do 300dpi, jpeg, high quality. afterwards, you could use photoshop (or even csp probably has these settings) but i use pixlr to adjust the levels of darkness and brightness. i find that i don’t need this as much when i scan stuff at uni but at home is very necessary. the main reason i use it is because it makes the size of the photo smaller, like a scanned picture can be like 5MB and sai hates big files like those so i have to make them smaller. i tried switching to ps but it only made the file larger and i didn’t wanna fuss too much so i just stick to what i know. also, sai doesn’t give you much room to edit photos and i need it for the lineart to be crisper.

this is the straight out of the scanner. which looks pretty good because i took the time with the lineart haha

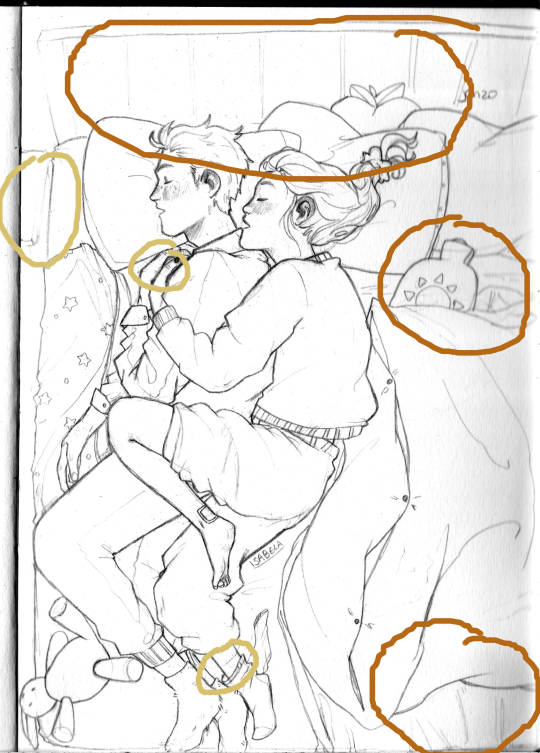

this is what it looks like after i edit the levels. this way makes it easier for me to clean stuff up (even tho there’s that smudge on the right. when this happens i lighten the image enough to match and do lineart on top). i clean the images by erasing.

with this brown orange highlight i had to lighten and redo the lineart. with the greeny-yellow ones i erased to look neater (the leg/hands) and at the top i erased that completely and did new lineart. with this piece, i knew sunday’s head was something i had to adjust because it’s bit too big for her body and in comparison to beckett’s that looks a bit small. i also topped up the lineart on her ponytail. cleaning stuff is what takes me a while to do.

when all of the lineart is clean and done, because i erased a lot of the image, i add a white layer on top of the sketch, make it multiply and transfer down the layer so it’ll fill in those erased bits.

to add a color to the lineart i use the overlay layer with the color i want and then transfer it down. i move on to flats!

i have beck’s and sunday’s color palette saved now because of the triplets. afterwards it’s just a bunch of multiply layers and overlays and luminosity! i guess i could go on on another post since this is massive already! (if you want of course)

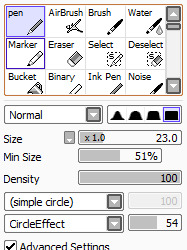

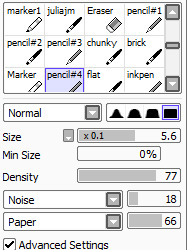

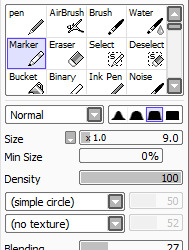

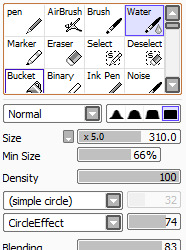

as for brushes, i use the normal default pen tool to color flats. i think i might have added texture to it actually.

for lineart i use this pencil one.

i use the default marker tool for blush, blending if i need to. it was the main brush i used for the queen of cordonia drawing i did (to blend).

and last but not least, the water tool. used to blend shadows and blush and highlights.

i have many other brushes but these are basically all i need and use 95% of the time. i hope this helps!

39 notes

·

View notes

Text

Markets Live: Monday, 10th September 2018

11:06 am

Good morning, welcome, hi. You might've noticed a ghost session appear briefly where the headline claimed it was Friday.

11:07 am

.............. so ................... let's ignore all macro and overview and stuff to get straight into plastics.

RPC Group PLC (RPC:LSE): Last: 824.80, up 141.2 (+20.66%), High: 857.40, Low: 800.00, Volume: 3.27m

11:09 am

So. Bloomberg did a ...... story? Let's call it a story? on RPC over the weekend about it considering strategic options including a possible sale,

Which as you'll remember followed Standard Life Aberdeen, 10% shareholder, telling the Sunday Telegraph that the company is “highly vulnerable” to a takeover

11:10 am

That story also mentioned sector peer Berry Global ..... which, yeah, okay.

So today, we get .... confirmation? Let's call it confirmation.

11:11 am

The Board of RPC Group Plc ("RPC" or the "Company") notes the recent media speculation and confirms that preliminary discussions are taking place with each of Apollo Global Management and Bain Capital which may or may not result in an offer for the Company.

"Media speculation" ........ heh. Good. Fine. Words don't mean anything anymore, so fine. Good.

So ................ the backdrop here is that RPC's been kicked for 18 months solid.

11:13 am

Largely on the idea that it's a rollup that uses acquisitions to fudge bad and deteriorating cashflow.

However! We have two potential bids out there! Apparently!

11:15 am

For a company whose core business doesn't really do cashflow generation in any demonstrable way and is already levered at 2x. Classic PE target, clearly.

Okay, so reversing out of my cynicism a little and starting at the top -- RPC's cheap against peers.

11:16 am

RPC’s international peers trade on a FY1 EBITDA multiple of 9.9x and an FY2 EBITDA multiple of 9.1x. Putting RPC’s FY19E EBITDA of £613.9 million on 9.9x and using FY19E net debt of £1,065 million implies a per share equity value of 1,262p, an 85% premium to the last close. The peers in our universe are Amcor, AptarGroup, Berry, DS Smith, Pact Group and Silgan.

And also note the bids all over the sector recently.

There have been a number of M&A transactions in international packaging in recent months. These include Amcor's offer for Bemis at 11.7x EBITDA pre-synergies, Transcontinental's offer for Coveris at 9.7x EBITDA pre-synergies and AptarGroup’s bid for CSP Technologies for 13.0x EBITDA presynergies.

11:18 am

Peel Hunt makes similar arguments about valuation ......

The right price and what the offer will be are not always going to be the same (Tomkins’ shareholders might remember what happened in 2010). Applying the Amcor/Bemis maths for its August approach. the implied Bemis price was $57.75, which was a PE of 20.7x and an EBITDA multiple of 11.7x, which fell to 8.9x post synergies. The Bemis price at Friday’s close was $49.80, so a current PE of 17.8x and an EBITDA multiple of 10.1x. If we crudely overlay the current Bemis valuation onto RPC we get to 1,330p on a PE basis and 1,230p on an EBITDA basis. This compares to RPC on a PE of 9.1x and EBITDA multiple of 6.4x.

There's a couple of important caveats to all that though.

11:19 am

First, it's difficult to think of a buyer for RPC other than private equity.

(Some might argue that it's difficult to think of a buyer for RPC including private equity. But I said I'd wind back the cynicism a bit.)

PE's trickier to make the numbers work.

11:20 am

Amcor’s ongoing bid for Bemis would seemingly rule them out while Berry Global, with a current market capitalisation of $4.5bn, is probably not big enough unless it possibly joined up with a private equity player to generate hard synergies. It would not be a surprise to see additional private equity players appear.

The next month will be pivotal for RPC. If there is no bid, the bears will take hold, while if there is a bid we expect it to come at a healthy premium to Friday’s close of 684p but accept that the Bemis read across is ambitious given the lack of hard synergies available to the private equity bidders.

11:20 am

Something about this one reminds me of FirstGroup-Apollo ............

As in, you had PE interest in a company sending out obvious distress signals

11:22 am

That leaked very, very early in the process.

Though it did result in a second indicative offer, albeit one management couldn't accept.

... and that was followed by reports last week of interest from elsewhere, which the market completely dismissed as soon as it crossed the tape.

11:24 am

FirstGroup PLC (FGP:LSE): Last: 98.87, up 4.07 (+4.30%), High: 99.40, Low: 93.45, Volume: 2.42m

.... anyway, Northern Trust Capital Markets is sticking to its guns here.

RPC (Sell): Still view a buyout as unlikely, an opportunity to sell

11:25 am

Concerns are mostly repeating previous stuff about cash conversion and phantom profit growth

Limited synergies, cost savings programmes coming to an end: RPC is the largest EU plastic packaging manufacturer, with 5% market share.

11:26 am

While the company has been investing increasingly outside of Europe (ex-EU is 23% of sales up from 6% when Vision 2020 strategy started), it is largely a European business and the largest in the region.

Most of the cost savings programmes [e.g. plant closures] have happened in Europe and the most recent and largest cost saving programme is coming to an end in FY19.

11:27 am

.............. with existing assets, we think

11:28 am

................ the ability for private equity

................. to increase operating margins further from here

...................... without incurring large cash costs is limited.

11:29 am

(Apologies that I had to quote it like that. The ludicrous ML spam filter kept rejecting the final sentence, for no apparent reason.)

As we have stated, a takeover/buyout is the main risk to our sell thesis. That risk is higher today given RPC is in early discussions with two buyers. However, given the importance to buyout firms of cash generation and stable profit growth, our central view remains a detailed look at the cash generation at RPC will not lead to an acquisition.

There, Mr McGuire. Rather more than one word on plastics.

11:30 am

Debenhams PLC (DEB:LSE): Last: 10.83, down 1.97 (-15.39%), High: 12.14, Low: 10.34, Volume: 11.47m

11:30 am

The gist being that they're looking at a CVA to exit shops and restructure debt.

11:33 am

The Times version of the same story adds that credit insurers have reduced cover to suppliers by 1/3, having already reduced cover by 1/3 in July.

Quick line from Liberum, one of the few brokers that still follow.

Liberum view: The company has not made any comment, at this stage, in relation to the press reports, although if the rumours are true it would not come as a great surprise to us. On the negative, it would suggest Debenhams' turnaround strategy to date has not been enough to improve its financial performance to help alleviate the ongoing pressures that have led to three profits warnings and a greater than 50% cut to consensus over the past 9 months. The group continues to rank poorly when looking at a variety of quality metrics – three year forecast EPS CAGR -25%, fixed charge cover (EBIT basis) 1.2x, operational gearing of over 20x and net debt:EBITDA 2.0x. If a positive were to be taken from this newsflow, we believe it is that management is now potentially looking at much more drastic action, which could bring about a more appropriately sized store estate and cost base quicker. This is exactly what we think is required for any successful turnaround to set the business on a path to achieve long-term sustainable profit growth.

11:34 am

And since we've reached the midpoint of today's ML, you're going to have to indulge me in an anecdote.

So. I was in Westfield Shepherds Bush yesterday, on the hunt for school shoes.

And since it's September, needless to say, every school shoe rack in every decent shop had been picked over. That led us to Debenhams.

11:37 am

They had some on the shelf! And since the shop was completely deserted, we had time to find a left and a right that were the same size (which was less easy than you'd assume; it was a lot of orphan shoes).

So ....... success ............ went to the till.

And waited 15 minutes as the lone till jockey signed up the people in front to a loyalty card.

11:39 am

Then, finally, getting to the front, they ring through at a third less than the ticket price.

Why? "Dunno." Is there any kind of promotion going on? "Dunno."

So, fine, super. Not going to argue. And without even paying the extra 5p they're packed up in a big plastic bag that says Merry Christmas from Debenhams.

11:41 am

It's this kind of flawless execution that has made Debenhams what it is.

Anyway, we're now at the stage of looking at secondary effects.

11:42 am

Intu Properties PLC (INTU:LSE): Last: 149.90, down 0.1 (-0.07%), High: 150.75, Low: 148.35, Volume: 816.97k

Reits have been running pretty poor all month

And you have to imagine that rent negotiation won't be easy from here. Westfield, as mentioned, is allegedly your AAA-rated mall ....

11:44 am

...... but it has about a fifth of its blocks fallow and is anchored on the South side by a Debenhams and a House of Fraser. If that's your AAA-rated, what's happening at the B and Cs?

Caz wrote a bit about this last week.

We remain of the view that it is unlikely prime mall portfolios will see negative like-for-like rental growth in a benign economic environment. However, we acknowledge the asymmetric risk in the direction of rents, and now see investor expectations of rental growth as the main driver of yield shift and valuation changes, even if positive rental growth is recorded. Using DCF analysis across four rental scenarios, we have revised down our capital growth for UK shopping centres from an average of -1% to -4% pa for our five-year forecast period. NAVs come down by an average of -9.5% for each year in the same period and PT’s come down by an average of 12.5% for those companies exposed to UK retail.

11:45 am

In terms of UK exposure ......

Close to 100% exposed Intu sees a downgrade of -20.5% to 175p and 100% exposed CapReg -24% to 57p. More diversified BLND sees a downgrade of just 2.7% (715p) and LAND -6.7% to 1120p. We remain OW LAND, HMSO and CapReg, Neutral Intu and BLND.

11:47 am

(@hornblower: nah, don't think we'll bother.)

Well done to Ben on shaking out Revolution.

11:48 am

Revolution Bars Group PLC (RBG:LSE): Last: 123.50, down 3.5 (-2.76%), High: 135.00, Low: 122.00, Volume: 643.35k

Why confirmation took until shortly before 6pm on Friday is anyone's guess.

11:49 am

And the shares were already up, what, 11% by Friday's close

Here's Canaccord to talk us through where things stand.

At last, it looks like there's been an outburst of common sense in the RBG boardroom. It's a shame it's taken another 12 months to get to this stage following the collapse of Stonegate's opportunistic bid for Revolution last year. We retain our BUY recommendation and 190p target price.

11:50 am

You'll remember the Stonegate bid was 203p and failed to get 75% acceptances.

Stonegate then ruled itself out of returning, though I don't think that's binding in any technical sense should they change their mind.

11:51 am

Since then RBG's share price has virtually halved, we downgraded our RBG forecasts in June and we expect trading to have continued to be poor after a difficult summer. After nine months without a CEO, RBG has just appointed Rob Pitcher from M&B and the prelims in October could have been a baptism of fire for the new bar-tender without the helpful distraction of talks with Deltic.

There are merits to putting the businesses together. In brief there are (1) c.+£7m of synergies to be captured, (2) RBG can use Deltic's cashflow to build out the bars business, (3) both businesses are too small and (4) Peter Marks, CEO of Deltic, is well-placed to become CEO of the enlarged business.

RBG is valued on a PE of 11.1x, an EV/EBITDA of 5.3x and FCF yield of 14.2% for FY18E changing to 8.7x, 4.6x and 17.3%, respectively, for FY19E. Our 190p share price target is based on an EV/EBITDA of c.7.5x and a c.10% FCF yield for FY18E. We do not strip out pre-opening costs from our EPS (Dil. Adj) forecasts as (1) we view them as an ongoing cost of business and (2) this treatment is consistent across our universe of stocks. Last year, we wrote that Stonegate's 203p/share offer valued RBG on a trailing exit EV/EBITDA multiple (including pre-opening costs added back) of 6.4x. Assuming £7.7m of synergies identified by Deltic then the exit multiple drops to a measly 4.4x.

11:52 am

A sensible, fair approach to the process could create a c£35m EBITDA business with an enhanced management team, c0.5x net EBITDA and good growth opportunities.

Peel notes fewer synergies this time around but argues that it still makes sense to stick the businesses together, as three-quarters of Revolution's sales happen pre midnight.

Which makes it vertical integration, in a sense.

11:55 am

Also notes trading's likely to have been garbage for both through the summer.

We expect both RBG and Deltic had a difficult summer, without which both companies should be growing profitability. Late-night businesses tend to suffer during heatwaves, but typically only c20% of annual profits are earned between June and August.

11:55 am

Both boards are displeased that RBG has been forced to make this statement. This is disruptive for the staff, as it was last year. After last year’s events, the last thing either company needs is for this to be played out yet again in the public arena.

............... ah well. Tiny violins at the ready.

As RBG is potentially acquiring Deltic, this transaction could occur without altering Stonegate’s lock up, which expires on 17 October 2018. However, this is early days, and RBG’s shareholders need to be on board. Then, the transaction should effectively be an equity merger, with the three main decisions being: equity split; management split; and head office location. After last year’s events, this needs to be simple, and low cost, and without further leaks.

11:57 am

@Rabbit: sorry, I know nothing about Allied Minds.

Allied Minds PLC (ALM:LSE): Last: 79.50, up 5.9 (+8.02%), High: 79.50, Low: 75.00, Volume: 91.23k

11:59 am

They're up on three subsidiary announcements, which I'll summarise here.

· Federated Wireless announced two important milestones in commercializing shared spectrum: the submission of its proposal for Initial Commercial Deployments on the Citizens Broadband Radio Service (CBRS) spectrum band to the FCC, and the introduction of a new training program for Certified Professional Installers (CPI) of Citizens Broadband Radio Service Devices (CBSDs)

· BridgeSat raised $10.0 million in Series B financing led by Boeing HorizonX Ventures, proceeds from the transaction will be applied to accelerate the build out of BridgeSat's optical ground station (OGS) network

· HawkEye 360 completed second closing of its Series A-3 funding round raising aggregate proceeds of $14.9 million, led by Raytheon Company, the Series A-3 round included participation from the Sumitomo Corporation of Americas, Razor's Edge Ventures, Shield Capital Partners, Space Angels, and Allied Minds

Delayed H1 due September 28th, isn't it?

12:00 pm

Not sure why anyone would want to take a view before that.

And while in smalls, Abcam

12:00 pm

Abcam PLC (ABC:LSE): Last: 1,273, down 211 (-14.22%), High: 1,384, Low: 1,009, Volume: 2.14m

FY beats but 2019 margin guidance amounts to a soft warning.

36% EBITDA margin in 2019 is 2-3 percentage points below consensus

12:02 pm

Not huge downgrades as a result. But when you're at 45 times 2018 and 2019 it doesn't need huge downgrades

(@vv75: yes. Anything sub FTSE 250 is a small cap.)

12:03 pm

we make less than 1% changes to our 2019 and 2020 EPS forecasts, and believe that investors should take the strong revenue guidance positively. However, with consensus margins having drifted higher than management had previously intimated, we expect consensus EPS to fall into line with our forecasts, implying a c3% reduction for FY 2019. We reiterate our Buy rating and 1,640p price target.

And a bit more detail on the cut.

New guidance is for 11% constant currency growth in FY 2019 (including more than 20% growth in recombinant antibodies and immunoassays) and low double-digit growth in the mid-term (previously 9-11%), with the gross margin expected to continue to rise gradually. The company had previously indicated that operating leverage would be reinvested in the business, and it has now been more explicit, guiding to a 36% EBITDA margin in FY 2019. This is 2-3ppt lower than consensus, and likely to offset the stronger revenue outlook in the near term.

12:04 pm

Having encountered setbacks in its ERP system, Abcam is now taking a more phased approach, but this means a further £16m cost in FY 2019, and additional expenses in FY 2020. With an additional £12m of payment for Spring Bio in FY 2019 that we had failed to model, our period-end net cash estimate falls to £108m, from £138m.

The downgrade at EBITDA level's about 10%, note.

Oh, hang on, Panmure say exactly that.

12:05 pm

We expect changes to estimates to reduce EBITDA consensus by around £7m, taking circa 10% from EPS. The fall in expected profitability is due to increased investment in the ERP system, beyond what that previous forecast, as a slower phased rollout of the system is planned for 2019. In addition, further investment in stocking and manufacturing systems is expected, aiming improve the rate delivery of product to customers; an area where Abcam has consistently been weak.

In our view Abcam is trading at a level which required outperformance in FY2018, rather than just in line, and guidance at least meeting FY 2019 consensus. We expect the disappointment in the numbers to result in a rapid fall in the shares.

12:07 pm

Abcam shares trade at very elevated levels on 44.7x FY19 P/E compared to peers on 33x FY1 P/E, a 35% premium. We believe the expected downgrades to FY19 and FY20 numbers will cause a contraction in this premium

.... or were, but are now under review.

12:07 pm

Okay, that'll do for today.

12:09 pm

Which reminded me that Sackler was a nomination in last year's Person of Interest awards -- https://ftalphavil...2017-the-longlist/ ............... And we're happy to have contributed even slightly to the tarring and feathering of his family name.

12:13 pm 12:13 pm

Source: https://ftalphaville.ft.com/marketslive/2018-09-10/

0 notes

Text

Direct Mail vs. Email

There isn't a week that goes by that an agent tells me that they have decided to keep in touch with their past clients and sphere database primarily by an email newsletter. That email may be created by their company or it may be custom-created in MailChimp or Constant Contact, but the more important issue is that they have decided NOT to mail.

The reasons they give for making this change are predictable:

It's cheap or free.

It's easy. (Especially if their company puts it together or it is done automatically.)

It may be "hands off."

Some of the content is better-delivered and received in an e-format.

They say that their clients prefer an enewsletter.

While I agree that some content is absolutely better-delivered and received in an e-format (more on that below), I will say that reasons 1-3 should be thrown out the window. Easy and generic is NOT a substitute for your voice. And unless you have taken a poll of all your clients and they all opted in to an enewsletter instead of print, then option #5 just doesn't hold water.

Now, I am not saying you need to get rid of your enewsletter. In fact, it can be a strong component of your client connection plan! Let's start by looking at different types of content that is great for an enewsletter format:

Commentary on online articles with links to those original articles

Videos

Listings with links to online info

Some action you want the recipient to take online such as filling out a survey or form

Invitations to events with RSVPs online

Information on online MLS information that requires the ability to browse in an online format (for example, some companies have a neighborhood market summary that is sent out monthly)

I like that when an email is sent out, it's effectiveness can be tracked. You can get a sense of what resonates with people and you can make adjustments.

While electronic newsletters are indeed good for sending certain types of content, there are a number of challenges with only sending out an email newsletter:

SPAM Here is a fact that might surprise you. According to Statista, billions of emails are sent every day and SPAM makes up 57% of all email. SPAM filters have to be robust in order to block nefarious emails from getting through and unfortunately marketing emails are mistaken for SPAM all the time. You may think that you are sending out 100 emails, but how many of those ACTUALLY wind up in the inbox?

Competition Today's inbox is work. The average worker receives well over 100 emails a day, requiring us to prioritize our inboxes constantly. How many of you begin your day with deleting as many marketing emails as possible? Unfortunately, that is most of us. Unless you can make your email newsletter so compelling it makes it through the first round of deletion, you are spending a lot of time creating something that will actually be seen by fewer and fewer people.

Less Sticking Power According to MailChimp, real estate industry emails have an average open rate of 19.67% and a click rate of only 1.8%. That means if you sent out 100 emails, only 1.8% of people will click on a link. Compare that to all the people who will open your mail.

Because of these facts I do have concerns about agents who are opting to only do an enewsletter. I am also concerned that these numbers may get even worse in the coming years as the number of emails generated worldwide every day is expected to rise.

Let's go back to print marketing. Here are some print marketing facts compiled by Accudata that should have you rethinking about the role physical mail in your marketing plan:

56% of all consumers trust print more than any other ad they see (printinthemix.com)

90% of Millennials think direct mail is reliable (yes folks, Millennials) (Pitney Bowes)

98% of consumers open their mail daily – forming a kinesthetic relationship to the piece you are sending out. Compare that to the click that is required for deleting or opening an email.

Remember, mail is tangible. It has a shelf-life. Furthermore, when information taps into to multiple senses, it is more likely to be remembered. With email, you only have visual (unless of course you have added video). But with print, you are adding at least another layer (touch) but you also have a different visual experience – one in which the paper can be turned over and viewed at different angles.

There are so many print marketing success stories I have heard over the years. Stories of agents arriving at a home to do a listing presentation and the seller pulls out a file folder full of past mailings. Stories of agents being able to find a very specific home for a buyer due to their mailing efforts. Three listing presentations that were a result of a single mailing to 100 people. I can go on and on about the power of mail!

"But Denise, I have 600 people in my database. I can't afford to mail to that many people."

OK, fair point. I agree that if you are concerned about your budget, you may want to take a look at the quality of your database. If I were selling real estate and I was concerned about a marketing budget, I might decide to only mail to certain folks, but then make sure I sent my email newsletter to my whole database. How do you determine quality? Here is how I would do it:

Past Clients Past clients always stay on the list unless you don't want to work with them again.

Potential Clients These are folks who have indicated they might do business with you in the next year or so. They stay on the list.

Referrers If you have received a referral from someone, keep them on the list.

Then it is just a matter of determining who else is worth the monthly investment to keep on your list. Community associates? People you met at an open house five years ago? Friends and family members? Lenders? I like to use this metric to determine whether they stay on your direct mail list or not: Are they worth spending $18 a year to market to? If not, convert them to your enewsletter list for now, but don't be cheap. You should be mailing to at least 100 people in your database every month.

Remember, $18 a year to market to say, an average of 250 people (I would say that is the average number of people in typical database of an agent we coach) is $4500. That isn't much when you consider the amount that agents are spending to market to people they don't know or generate online leads.

In my experience, the most effective communication plans are multi-faceted. Print mail combined with email marketing combined with social media – text, graphics, and video. The goal is to reach more people in the way they want to be reached with the information they want to read/hear/view. So don't limit yourself to one type of communicating. Instead, create a simple-to-follow system that incorporates physical information and online information!

Want to learn more? Sources:

http://www.accudata.com/print-for-marketing-campaigns/

https://www.statista.com/statistics/420391/spam-email-traffic-share/

https://mailchimp.com/resources/email-marketing-benchmarks/

https://www.msp-pgh.com/print-marketing-works-in-digital-world/

Follow Denise on Facebook

Follow Denise on Twitter

By Denise Lones CSP, M.I.R.M., CDEI - The founding partner of The Lones Group, Denise Lones, brings nearly three decades of experience in the real estate industry. With agent/broker coaching, expertise in branding, lead generation, strategic marketing, business analysis, new home project planning, product development, Denise is nationally recognized as the source for all things real estate. With a passion for improvement, Denise has helped thousands of real estate agents, brokers, and managers build their business to unprecedented levels of success, while helping them maintain balance and quality of life.

#client connections#client content#client database#database mailer#advertising#print marketing#digital marketing#direct mail#email#farming#geographical farming#geofarming#mailers#spam#real estate#Denise Lones#The Lones Group#Zebra Report

0 notes