#hire accounting staff in canada

Explore tagged Tumblr posts

Text

#Best Finance and Accounting Outsourcing Services Company in Canada#Hire Accounting & Finance in canada#hire accounting service in canada#hire accountant near me#hire accounting in canada#hire accounting staff in canada#hire accountant online in canada

0 notes

Text

National Day for Truth and Reconciliation has always been something that doesn't sit right with me, but this year I find myself being especially bothered.

From the jump, Canada has decided to hold itself accountable for what it's done to us by giving itself the day off. Meanwhile Indigenous folks are forced to:

Perform our indigeneity and trauma for a largely non-Indigenous audience.

Be constantly reminded of our traumas - and non-Indigenous people's ignorance or performative sympathy - every time we open up our e-mails, social media, and more.

Provide support to our friends, family, and community to make up for the programs and services that are shut down.

Still do homework, go to school/work, pay rent and more on October 1st.

IRL I'm a counsellor, one of two specifically hired to serve a particular Indigenous population at a large institution that I don't feel safe enough to name. While this used to be a day of healing and community, this year I have noticed a significant shift in the way that my clients are experiencing this event. In the weeks leading up to this day, and likely the week after, many of my clients have come to me mid-breakdown and talked about how this day has become more painful, more burdensome, and more effort for them as it has continued.

I'll just be honest. I would have had the day off today. I probably should have kept that boundary but when another Indigenous person, not a counsellor, in my workplace asked me to provide counselling supports during an event on this day I felt like I couldn't say no. It was like pulling teeth to get my leaders to ask a second counsellor to work the event with me. I'm getting lieu time, but I think the second counsellor is not.

The event I'm providing counselling at today is for the general public, or in other words, for non-Indigenous people. My clients won't be there because they don't want to perform. My clients will be struggling and healing with their own families, communities and ceremonies on this day. I won't be with my own family because of this event, and I won't be working for my clients - who are also my community- because our services are closed.

So yes, it's my responsibility as an Indigenous person to learn how to say no to these things. Last year I had an Indigenous supervisor who fielded this request and helped me to maintain my boundaries. She retired and has been replaced by a non-indigenous person who doesn't have the contextual knowledge to understand the conflictual relationship Indigenous people have with the asks that come related to this day.

But, beyond my individual responsibility to protect myself and my clients - why is my institution holding this event in the first place? Why not host an event that actually benefits Indigenous clients and staff - or pay the extra stat pay to keep services open so Indigenous clients still have access to the things that help them through such a difficult day?

I'm tired and angry already and it isn't even 11:00am.

P.S.

For those who aren't aware there is a difference between the national holiday and "Orange Shirt Day" despite the Canadian government's effort to bulldoze over the one created by an Indigenous woman in favour of their white-washed day off.

#orange shirt day#every child matters#rants#weepyrants#truth and reconciliation#national day of truth and reconciliation#canada#residential schools#weepyirl

8 notes

·

View notes

Text

[110723 tsv reddit post]

Responding to Allegations

Hi Twosetters,

Thank you for your patience in waiting for our response. We are well aware of the allegations of worker exploitation that have been circulating our subreddit in the past few weeks. We take such issues very seriously, as we believe this to be a grave matter. Therefore, we needed time to conduct an internal investigation to evaluate the validity of these claims.

It’s tricky because we need to balance the confidentiality and privacy of our existing team members with the transparency and information that we think needs to be communicated. Quite frankly, these are internal matters, and any disputes should have gone through professional and/or legal channels. However, the other party has unfortunately chosen to conduct themselves in an unprofessional way and have put us in a position where we have to respond publicly.

At TwoSet, we’ve always had the vision of spreading our love for classical music as our guiding star. Very early on, we realised that this could not be done without a solid team behind us and this vision. From the videos to apparel to touring – all of this is the hard work of our amazing staff members.

As we come from very humble beginnings, we are not perfect, and it’s not always easy – we’re not a massive media company. But we have always known the importance of having a long-term sustainable team that we can achieve our mission with.

That means sticking up for our staff. Sometimes, inevitably, we make incorrect hires who spread toxicity and negativity, gaslight and blame others, and end up causing much more burden and stress on others in the team. The OOP was one such person we had to let go after repeated incidents of them speaking in a very rude and disrespectful manner to another team member. It’s disappointing that this person is now going further by trying to tarnish TwoSet’s reputation, thus hurting the remaining team and putting at risk everything we have accomplished.

It is for them, our team, that we take this so seriously. In the past, we have taken unjust criticism and shrugged off the negativity, not because we have anything to fear or for lack of accountability, but because we understood that giving attention to negativity often just sparks more drama and room for misunderstanding. It becomes a situation where people are fighting for the sake of fighting, and nobody remembers why anymore.

In order to ground this conversation, let’s always keep in mind - why are we having this discussion? We believe at the end of the day, it’s about constructive criticism and accountability; how do we (Brett and Eddy) improve to make TwoSet an increasingly better place to work at for all members? Many of the claims have not come from an intention to instigate any real meaningful change, but instead have been an attempt to vilify us. We know we are public figures and that’s part of what it means to be on the internet these days, but please remember that if we do get cancelled, many of our amazing team members will also lose their jobs.

Now, we really appreciate the majority of TwoSet fans who understand that these things are private matters and should be dealt with internally. We don’t want this to devolve into a situation where everyone is just trying to get more receipts on each other, because at the end of the day, nobody is perfect and we all make mistakes. But we also understand that in the public sphere, unlike in court, it isn’t always innocent until proven guilty, and we feel that we have to share our side of the story in order to protect the team at TwoSet.

A summary and response to claims made against us:

Only hiring from “third world (asian) countries”:

Over 50% of our staff are NOT from third world countries. Some of our core team members are from countries such as Singapore, Canada, and Australia.

Only hiring “girls”:

While the majority (not all) of our staff are currently women, this is not by any design. Our team consists of amazingly talented people selected for their individual merit and fit for the position, not any specific characteristic.

Being expected to respond at unreasonable hours:

Due to time zones, constant travelling, and the international nature of our team, messages are often sent outside of what may be considered reasonable work hours for the person receiving it. However, we have never expected or pressured anyone to respond immediately. While we will make more effort in the future to think ahead for individual time zones, sometimes it really just means we have to get a message out before we sleep on our side of the world so that it can be read when the other person gets up for work in the morning.

Underpaying or not paying staff:

In the beginning (Kickstarter days), we admittedly had to pay on the lower end as we simply did not earn enough from YouTube - something we always made clear. However, we have been continually trying to raise the compensation of team members as we grow. We also recently implemented a yearly official salary review process and determined that two staff members deserved a raise which we proactively offered.

In other cases where staff have come to us asking for raises, we always operate from a principle of fairness and remain open to negotiation, taking factors such as industry benchmarks, experience, working hours, and contribution into consideration. Most importantly, we have always paid what was agreed upon.

It has also been alleged that we underpay staff despite them voicing their concerns to us. We wish to reiterate that we have never disregarded a staff’s concern about payment. We always welcome open and transparent conversation, and do what we believe is fair and right. One poster who claimed to have been underpaid happily agreed to the amount offered with no indication of dissatisfaction with the remuneration. We will not share any screenshots due to legal confidentiality, but many of those joining the bandwagon have made emotionally charged and factually inaccurate claims that would not hold up in court.

As to the confusion of paid volunteers, we offered a small amount of compensation to subtitlers who volunteered their time to create subtitles for videos as a ‘thank you’ for their work, but it was never a formal position offered with our team. Having recognised the confusion this has caused, we have changed our policies and will no longer have any paid volunteer positions in the future.

Being asked to take on multiple responsibilities:

This is something we are working really hard to solve. Often in a small startup, things change at a rapid pace, especially as we love to innovate and try new projects all the time. We have always asked if a team member is willing to help through these periods of growth and change, whether that’s through covering for certain roles or taking on new responsibilities and opportunities for learning. In situations where they expressed that they do not wish to do so, we have respected it.

We now know that some people may not feel comfortable saying no and to fix this, we are in the process of clearly defining every process and role in relation to how we operate.

—

So far, we have only addressed the claims that the OOP made and briefly touched on why they were let go, but it should be noted that their actions have breached the terms of their NDA and can be constituted as defamation. What they have done risks the wellbeing and hard work of everyone else on the TwoSet team, not to mention every fan who has believed in and supported us on this journey.

Ultimately, we truly want the best outcome for us and everyone we have worked with. We will be the first to admit that, as two violinists with no formal education in business or management processes, it has been a huge learning curve. We are trying to be better, and are always open to constructive feedback.

It has become clear that the amount of negativity and misinformation has been affecting the mental wellbeing of our team and the community in the past few weeks. Therefore, we will be deleting any posts or comments that we come across that contain misinformation or hateful intentions. We will of course still welcome open discourse and constructive feedback.

Finally, we want to thank our fans again for your understanding and support. We have read many of your comments, and it is clear that the majority of you understand that these are just false allegations on the internet. We understand it takes an act of trust to follow and support anyone and we take this responsibility really seriously. Thank you for having our backs.

Brett & Eddy

56 notes

·

View notes

Text

Choosing the Right Accounting Recruitment Firm for Your Needs

Finding the right accounting recruitment firm can be a daunting task, especially when you want to ensure your organization’s needs are met with precision and professionalism. With so many options available, many organizations face the dilemma of choosing the best one. In this blog, we'll share some tips to help you select the right accounting recruitment firm for your needs, ensuring your organization gets the top-notch talent it deserves.

Understand Your Needs

The first step in choosing the right accounting recruitment firm is understanding your specific needs. Are you looking for temporary staff, permanent hires, or executive-level professionals? Different firms specialize in different types of placements. For example, BJRC Recruiting excels in providing temporary and permanent accounting staff across Canada and the US, from entry-level to executive roles. Knowing your needs helps you narrow down your options and find a firm that specializes in your particular area.

Check the Firm’s Specialization

Not all recruitment firms are created equal. Some firms may focus broadly on various industries, while others specialize in particular sectors such as accounting and finance. A firm specializing in accounting recruitment will have a deeper understanding of the skills and qualifications necessary for these roles, allowing the team to be more adept at matching candidates with your specific job requirements.

Evaluate Their Recruitment Process

A thorough recruitment process is crucial in finding the best candidates. Ask potential firms about their recruitment strategies. Do they use advanced tools and techniques for screening candidates? How extensive is their vetting process? It’s important to ensure you’re working with a reputable firm that ensures every candidate is rigorously screened, from verifying credentials to assessing technical skills and cultural fit. This will save you time and money in the long run, as you'll know you’re getting a candidate who fits your needs right from the start.

Consider Their Industry Knowledge

A firm with extensive industry knowledge can be a significant asset. They will be aware of the latest trends in accounting, understand regulatory changes, and know what skills are in high demand. This insight can help them source qualified candidates who are also up-to-date with industry standards.

Look for Proven Track Records

Experience and success rates are key indicators of a recruitment firm’s reliability. Look for firms with proven track records in placing candidates in the roles and positions you’re hiring for. Client testimonials, case studies, and success stories can give you an idea of their performance.

Assess Their Network and Reach

A firm with a broad network can access a larger pool of candidates. This is particularly important in specialized fields like accounting, where top talent may not be actively seeking new opportunities. Firms like BJRC Recruiting leverage their extensive networks to find passive candidates who might be a perfect fit for your organization but are not actively applying for jobs.

Prioritize Communication and Support

Effective communication is essential for a smooth recruitment process. Choose a firm that values clear, consistent communication and offers excellent support throughout the hiring process. This will help ensure that the recruitment firm understands your needs and wants and is on the same page as your organization before they start screening candidates. Choosing the right accounting recruitment firm is crucial to finding the best talent for your organization. By following these tips, you’ll be able to secure a firm that understands what you’re looking for and has experience and knowledge in hiring for the role you’re looking to fill. BJRC Recruiting is here to help with all your accounting hiring needs across Canada and the US. Our specialized expertise and commitment to excellence help ensure you’ll find the perfect candidates to meet your organizational goals.0

Contact us to learn more about how we can assist you in finding top accounting talent.

Know more https://bjrcrecruiting.com/2024/05/23/choosing-the-right-accounting-recruitment-firm-for-your-needs/

#Accounting Recruitment Toronto#Accounting Recruiters Toronto#Top Accounting Recruiters Toronto#Recruitment Agency Toronto

3 notes

·

View notes

Text

Building off of "dems actually do want socialism", a lot more of the remaining policing budget should go into forensic accounting...

just to be awful: If you want to get really freaky, canada, switch the national fiat to digital only, and train an algorithm that detects anomalous "cash" activity nationwide. The rest of the policing budget after being defunded/disarmed and focusing on accounting, basically goes into net guns and net gun training and then you use peoples cell phones (embed them in our bodies?) to track them for good low-risk netting circumstances. Then you try them and put an ankle bracelet on them if theyre under some form of house arrest--which replaces prisons. Assets are seized by the state to pay fines etc associated with the law/s broken, as is typical; fines for high-level financial and environmental crimes are steeply raised and disproportionately take up enforcement time. Lawbreakers can work a regular paid job from home and cover their own general food & shelter costs while under incarceral surveillance eg doing data entry, support staff work for a state-run homegrown twitter called cbcter, whatever. the relevantly disabled will receive disability as usual to cover costs. those who refuse to work under house arrest but who technically can, will find their sentences extended(/privileges curtailed), at cost to the taxpayer--the phone numbers, crimes and sentence status of lawbreakers will be made publicly accessible); firing someone under house arrest when they can still do their job remotely is criminalized and finding any new jobs to cover living expenses is handled internally thru preexisting state-run work placement programs. Big new hiring sector in the bracelet monitoring etc, get them to monitor eachother, jk lol. Prisoners dilemma. What you need is a whole normative society of people who feel adequately invested in upholding the law because of what theyre concretely recieving for being law-abiding, and thats your hiring pool for the bracelet monitors. Re examples of concrete rewards, ubi would be even bigger for state-allegiance than healthcare (or weed legalization and drug decrim), and we're obsessed with how great healthcare is in this country as is. Losing UBI while serving time to society for laws broken would be a hell of a hard pill for anyone used to ubi... like, since you want to do the weird neoliberal socialism so much. Here's my pitch.

Basically no faction of society currently has a stake in being law-abiding, particularly law-enforcement workers. its a very interesting time, as usual

1 note

·

View note

Text

GST Compliance Solutions Simplifying Complex Tax Regulations

In an era of rapid cross-border business growth, understanding and complying with tax laws has become more difficult than ever. The Goods and Services Tax (GST) is one such tax regime that is changing the way business is done, especially in countries like India, Australia and Canada. However, complex GST rules can often overwhelm business owners, especially small and medium enterprises (SMEs). This is where GST compliance solutions come in, helping businesses navigate the complexity of tax compliance with ease.

In this article, we will explore various aspects of GST compliance, challenges faced by businesses and how GST compliance solutions can simplify this complex tax law. Whether you are a business owner, an accountant, or just anyone interested in understanding GST, this comprehensive guide will provide valuable insight.

Understanding GST: A Brief Overview

GST or Goods and Services Tax is an indirect tax on the supply of goods and services. It is a comprehensive, multi-channel, destination-based tax that has replaced earlier indirect taxation by both the central and state governments The main objective of GST is to provide the tax system facilitated and created a single market by increasing taxes.

Key Features of GST:

Exceptions: GST includes VAT, service tax, excise duty, and various other taxes.

Multi-stage: GST is collected at every stage of the supply chain from manufacturing to end-consumption.

Destination: Taxes are collected where goods are consumed rather than produced, ensuring that revenue is distributed based on consumption.

Importance of GST Compliance

Complying with GST rules is important for businesses to avoid penalties, maintain good reputation and ensure smooth operations. Non-compliance can result in significant fines, legal challenges, and business outages. Therefore, companies need to understand the intricacies of GST and abide by the rules and deadlines.

Highlights of GST Compliance:

Timely filing of GST Returns: Companies must file GST returns on a regular basis, based on their income and other factors. Missing the deadline can result in penalties and interest.

Accurate Records: Maintaining accurate records of all transactions, invoices and returns is essential for GST compliance. This ensures that the Investment Tax Credit (ITC) has been properly claimed.

Proper Tax Accounting: To avoid underpaying or overpaying tax, businesses should accurately account for GST on their goods and services.

E-invoicing Compliance: E-invoicing is a must for businesses with fixed invoices. It involves the generation of invoices in a standardized manner, which are then uploaded to an official channel for verification.

Common Challenges in GST Compliance

Despite the benefits of GST, compliance can be a challenge for businesses, especially SMEs. Some common complications are:

Complex Tax Laws: GST laws can be complex, and are frequently amended and updated. Keeping up with these changes can be challenging, especially for small businesses with limited resources.

Multiple Registrations: Multinational companies may need to register for GST in each country, increasing the administrative burden.

Input Tax Credit (ITC) Reconciliation: Reconciling input tax credits with supplier data can be time consuming and errors are prone.

Costs of Compliance: The costs of hiring staff, investing in software and managing compliance processes can be high, especially for SMEs.

Technology Implementation: Adopting new technologies such as e-invoice compliance software can be challenging for businesses that are not tech savvy.

How GST Compliance Solutions can Help

The GST compliance solution is designed to simplify the process of GST compliance. This solution uses technology to automate aspects of GST compliance, reducing the burden on businesses and ensuring consistency.

Benefits of GST Compliance Solution:

Automation of Processes: GST compliance solutions automate tasks such as return filing, invoice generation, tax calculation etc., reducing the risk of human error.

Real-time Updates: This solution provides real-time updates on changes in GST laws, ensuring that businesses are in compliance with the latest regulations.

Simplified ITC Reconciliation: GST compliance solutions simplify the process of matching input tax with supplier data, reducing the chances of contradiction will come to him.

Lower Costs: By automating compliance processes, companies can reduce hiring costs and control manual processes.

Ease of Use: Many GST compliance solutions are user-friendly, making it easy for businesses to adopt and integrate into their existing systems.

Top Features to Look for in a GST Compliance Solution

When choosing a GST compliance solution, it’s important to consider the features that will best meet your business needs. Here are some of the top things to look for:

Return Filing Automation: Look for solutions that automate GST returns, reducing the time and effort required to meet compliance deadlines.

Invoice Integration: Make sure the solution supports e-invoicing, so you can create and upload invoices in the required format.

ITC Reconciliation: A good GST compliance solution should provide tools to reconcile input tax with supplier data, thereby reducing errors.

Real-time Compliance Alerts: Choose a solution that provides real-time alerts of compliance deadlines, regulatory changes, and important updates.

Easy-to-use Interface: The solution should be easy to use, with an intuitive interface that allows regulatory tasks to be picked up and managed efficiently.

Options: Look for customizable solutions to meet the specific needs of your business, such as handling multiple GST registrations or integration with your existing accounting software.

Data Security: Make sure the solution offers robust data security features such as encryption and regular backups to protect your sensitive information.

Choosing the Right GST Compliance Solution for your Business

Choosing the right GST compliance solution is important to ensure your business is GST compliant. Here are some tips for making the right choice:

Determine your Business Needs: Start by looking at the specific compliance requirements of your business, such as the number of transactions, the complexity of your business, and the level of expertise required.

Compare Features: Compare features of various GST compliance solutions and find one that provides you with the functionalities you need, such as return filing, e-invoicing, and ITC matching.

Ensure Scalability: Ensure the solution can scale with your business as it grows, accommodates increased transaction volumes and other compliance requirements.

Consider Costs: Determine the cost of the solution, including any setup fees, subscription fees, and ongoing maintenance costs. Find solutions that provide value for money without compromising quality.

Read Reviews and Testimonials: Look for reviews and testimonials from other companies that have implemented the solution. This provides insight into the effectiveness and reliability of the solution.

Request a Demo: If possible, request a demo of the solution to see how it works and whether it meets your business needs.

GST Compliance Solutions: Best Practices

Once you’ve identified a GST compliance solution, it’s important to use it effectively to maximize your returns. Here are some best practices to follow.

Train Your Team: Make sure your team is properly trained on how to implement GST compliance solutions. This will guide them through the process more effectively and reduce the chances of error.

Integrate Existing Systems: Integrate GST compliance solutions into your existing accounting and ERP systems to streamline processes and improve data accuracy.

Check Compliance Regularly: Check your GST compliance process regularly to make sure everything is running smoothly. Use the reporting features of the solution to track compliance status and identify any issues.

Stay Updated On Changes: Stay up-to-date with any changes to GST laws and regulations, and ensure your GST compliance solutions are updated accordingly.

Take Professional Advice: If you are unfamiliar with any aspect of GST compliance, seek advice from a tax professional. They can help you navigate complex regulations and ensure your business stays compliant.

Future GST Compliance: Trends to Watch

As technology continues to evolve, so will the tools and solutions available to comply with GST. Here are some things to watch out for in the future in terms of GST compliance:

AI and Machine Learning: AI and machine learning are set to play a key role in automating GST compliance processes, improving accuracy and reducing the time required for compliance tasks.

Blockchain Technology: Blockchain has the potential to transform GST compliance by providing a secure, transparent and immutable record of transactions. This can reduce fraud and improve the accuracy of compliance data.

Cloud-Based Solutions: Cloud-based GST compliance solutions provide flexibility, scalability and accessibility, making it easy for businesses to manage compliance from anywhere.

Enhanced Government Digitization: Governments are increasingly adopting digital technologies for tax collection and compliance. Companies will need to stay updated on these developments and ensure their compliance solutions align with government policy.

Enhanced Data Analytics: Advanced data analytics tools will help businesses gain deeper insights into their GST compliance processes, allowing them to spot trends, identify issues and make informed decisions.

Conclusion

GST compliance is key to running a successful business, but it can be difficult and time-consuming. Fortunately, GST compliance solutions are available to simplify the process, reduce errors and ensure your business remains compliant with the latest regulations. By understanding the basics and applying best practices when looking for GST compliance solutions, you can confidently navigate the complexities of GST and focus on growing your business.

0 notes

Text

CTV News

Why it's 'very hard' to find work in Canada

Published Sept. 17, 2024 2:53 p.m. ADT

For every vacant job in Canada, there are 2.4 unemployed people.

That was the picture recorded from April to June in Canada, according to Statistics Canada’s second-quarter report on job vacancies.

Vacancies have steadily fallen since the glut of nearly one million open posts in 2022. At the time, one in three businesses had trouble hiring staff due to a labour shortage. Two in five had issues finding skilled staff, and one in four would have to fight to keep them.

The agency says available wages, which may have been lower than what prospective employees were willing to accept at the time, could have limited hiring. Some businesses also said they were weathering a spike in retirements among boomer-aged workers.

Since then, vacancies have dropped. Unemployment has gained steadily to 6.6 per cent from the 4.8 recorded in the summer of 2022. Last quarter, there were just 580,000 available jobs in Canada -- a far cry from one million.

The drop in vacancies can be attributed in large part to few openings for jobs requiring high school education or less, according to StatCan. There were 30 per cent fewer vacancies than last year in those fields, accounting for 70 per cent of the overall decline.

The trades, transport and equipment operators and related occupations saw the largest losses in vacancies over the last year. By the end of the second quarter, open jobs in those fields were 30 per cent fewer than the year before.

The deepest losses were among transport trucking jobs, construction helpers and labourers, material handlers, and residential commercial installers and servicers.

How did we get here? Low wages and 'lousy' jobs

“It’s very hard to find a job in Canada today,” said Jim Stanford, economist and director for the Centre for Future Work, a non-partisan policy think tank.

He called Canada’s job market “unacceptably weak,” arguing the government and the central bank overreacted to pandemic “shock.”

During the early pandemic years, Stanford recalled, the Canadian government largely halted immigration and the regular operations of several industries.

Vacancies skyrocketed once the government ended lockdowns and lifted restrictions, he said. However, Canada’s workforce changed.

“Canadians did not give up on work,” Stanford told CTVNews.ca. “When those jobs disappeared, they figured out what to do. … They went and got more training.”

And when the jobs reappeared, many expected better wages, he says.

Source: Statistics Canada

“Employers in those industries cried, saying people ‘don’t want to work,’” and demanded the government take measures to remedy the worker shortage, he continued. In response, the Liberal government eased rules on temporary foreign workers, among other measures.

The Temporary Foreign Workers Program allows businesses to hire foreign staff in the absence of Canadian labour.

Since then, the program has drawn the ire of international spectators. Notably, the United Nations called it a “breeding ground for contemporary slavery.”

To remedy the influx of foreign workers, the Liberals have since announced cuts to the program. Stanford said the Bank of Canada should continue to lower interest rates to reduce costs on Canadians and ease the strains of post-pandemic economic recovery.

And if the government is capable of reducing unemployment and increasing job vacancies, “employers will cry again,” he said.

“Next time we hear that cry, we should ignore it.”

With files from The Canadian Press

0 notes

Text

The Growing Demand for Canadian Virtual Assistants

In today's fast-paced business environment, companies are increasingly seeking efficient solutions to manage their administrative tasks and operational workloads. Canadian virtual assistants have become a preferred option for businesses looking to outsource tasks without sacrificing quality. Offering a wide range of services, these professionals provide administrative, technical, and creative assistance remotely, allowing businesses to focus on core operations. The demand for virtual assistants in Canada has surged, as more organizations realize the benefits of accessing skilled professionals without the need for in-house staff.

What Virtual Assistant Firms Offer

With the rise of remote work, virtual assistant firms have emerged as key players in supporting businesses across various industries. These firms provide clients with a pool of skilled professionals who are well-versed in handling everything from scheduling appointments to managing social media accounts. Virtual assistant firms streamline the hiring process by matching businesses with the most suitable candidates based on their specific needs. This ensures that companies can access specialized support without the overhead costs associated with traditional hiring methods.

The Importance of Executive Assistant Training in Canada

As businesses grow, the need for more advanced administrative support increases. Executive assistant training Canada programs are designed to equip individuals with the skills needed to handle high-level executive tasks. From managing complex calendars to organizing large-scale meetings and events, executive assistants play a critical role in ensuring the smooth operation of an executive's day-to-day activities. Training programs in Canada offer tailored courses that focus on the unique challenges faced by executives in today’s business world, ensuring that assistants are well-prepared to meet the demands of their roles.

Benefits of Hiring a Virtual Executive Assistant in Canada

For companies seeking more personalized administrative support, hiring a virtual executive assistant Canada offers numerous advantages. These professionals are trained to provide high-level support to executives, including managing confidential information, handling communications, and coordinating with internal and external stakeholders. By hiring a virtual executive assistant, businesses can ensure that their executives receive dedicated support without the geographical limitations of hiring locally. This flexibility allows companies to tap into a broader talent pool, ensuring they find the right fit for their executive team.

Why Choose an Executive Assistant Company in Canada

For businesses looking for a more comprehensive solution to their administrative needs, working with an executive assistant company Canada offers significant benefits. These companies specialize in providing executive-level administrative support, ensuring that businesses receive top-tier services tailored to their specific needs. By partnering with an executive assistant company, businesses can enjoy the convenience of having highly trained professionals manage critical tasks while focusing on their growth and strategic objectives. Additionally, these companies ensure that the executive assistants they provide are well-equipped to handle the complexities of the role, thanks to their extensive experience and training.

How Virtual Assistants Can Support Business Growth

Virtual assistants, whether general or executive-level, play an integral role in helping businesses grow by taking on essential administrative duties. With a skilled virtual assistant managing routine tasks such as email correspondence, calendar management, and client communications, business leaders can focus on strategic initiatives. This allows companies to operate more efficiently, ultimately leading to increased productivity and profitability. Furthermore, the ability to scale support services up or down depending on business needs makes virtual assistants a flexible and cost-effective solution.

Adapting to the Remote Work Environment

As remote work becomes more prevalent, businesses must adapt by incorporating virtual teams into their operations. Virtual assistants, particularly those trained in handling executive responsibilities, are well-positioned to thrive in this environment. With cloud-based tools and communication platforms, virtual assistants can seamlessly integrate into a company’s workflow, providing real-time support regardless of their physical location. This shift to remote work also allows businesses to access talent from across Canada, giving them the opportunity to find the best professionals suited to their specific requirements.

Enhancing Efficiency with Specialized Administrative Support

One of the key advantages of hiring virtual assistants is the ability to access specialized support. Unlike general administrative staff, virtual assistants often have expertise in specific areas such as social media management, content creation, or customer service. For businesses looking to improve efficiency, hiring virtual assistants with the right skill set can result in faster task completion and higher-quality output. Additionally, businesses can choose to delegate tasks based on the assistant's strengths, ensuring that work is completed by someone with the relevant expertise.

The Future of Virtual Assistants in Canada

As more businesses realize the potential of virtual assistants to streamline operations and reduce costs, the demand for these professionals is expected to continue growing. Virtual assistant firms and executive assistant companies are likely to expand their offerings, providing businesses with even more tailored solutions for their administrative needs. Furthermore, advancements in technology will only enhance the ability of virtual assistants to deliver high-quality support, making them an indispensable part of the modern workforce.

0 notes

Text

Why Are US Businesses Choosing Offshore Accounting Services?

As businesses face increasing pressure to optimize costs and maintain competitiveness, many US companies are turning to offshore accounting services. This strategic move offers a range of benefits that are hard to ignore. Below, we explore the key reasons why offshore accounting services are becoming the preferred choice for US businesses.

Cost Savings with Offshore Accounting Services

One of the most compelling reasons US businesses opt for offshore accounting services is the significant cost savings. Hiring in-house accountants can be expensive, considering salaries, benefits, and office space. Offshore accounting services allow companies to tap into skilled professionals at a fraction of the cost, without compromising on quality. This financial advantage is especially appealing to small and medium-sized enterprises looking to maximize their budget.

Access to a Global Talent Pool

Offshore accounting services open the door to a vast pool of talent from around the world. Countries like India, the Philippines, and Malaysia are home to highly skilled accountants with expertise in various financial regulations and practices. By choosing offshore accounting services, US businesses can benefit from this global talent, ensuring their financial tasks are handled by experienced professionals.

Round-the-Clock Service Availability

Another reason US businesses are leaning towards offshore accounting services is the advantage of round-the-clock availability. With time zone differences, offshore teams can work on financial reports, tax preparations, and other accounting tasks overnight, ensuring that critical financial data is ready by the next business day. This 24/7 service capability enhances efficiency and keeps businesses running smoothly.

Focus on Core Business Activities

By outsourcing accounting tasks to offshore accounting services, US companies can free up valuable time and resources. This allows business leaders and their teams to focus on core activities such as strategy, marketing, and customer service. Offshore accounting services handle the financial intricacies, enabling businesses to operate more effectively and achieve their growth objectives.

Scalability and Flexibility

Offshore accounting services offer scalability and flexibility that are hard to match with in-house teams. As businesses grow or experience fluctuations in workload, offshore teams can easily scale up or down to meet demand. This adaptability ensures that companies can manage their accounting needs efficiently without the hassle of hiring and training new staff.

Compliance with International Standards

Many offshore accounting services are well-versed in international accounting standards and regulations. This expertise ensures that US businesses remain compliant with global financial practices, reducing the risk of errors and penalties. Offshore accounting services provide a level of professionalism and accuracy that can significantly benefit companies operating in multiple markets.

Enhanced Data Security and Confidentiality

Reputable offshore accounting services prioritize data security and confidentiality, using advanced technologies to protect sensitive financial information. US businesses can trust that their data is in safe hands, allowing them to focus on their operations without worrying about potential security breaches.

For a more comprehensive solution, consider outsourcing firms that offer both affordability and quality. Invedus Outsourcing is an excellent choice, providing access to skilled virtual accountants at competitive rates.

They have a strong client base in the USA, UK, Canada, and Australia, ensuring a proven track record of delivering high-quality web solutions. With Invedus, you can benefit from their expertise and experience while keeping costs in check.

0 notes

Text

World’s first LGBTQ+ alcohol-free brew-masters are making an impact

In the U.K., a couple of unconventional brew masters have shot to the top of the non-alcoholic craft beer business with their Drop Bear Beer Company and some fresh takes on stouts, lagers, and pale ales. Based in Swansea, Wales, Joelle Drummond and her wife Sarah are defying the stereotypes associated with craft beer, from the products they’re creating to how they run their workplace — not to mention what typical British brew-masters look like. “I believe from all the research I’ve been able to do that we’re actually the world’s first LGBTQ+ alcohol-free brewery,” Drummond told Pink News. The couple concocted their first home brew in 2019 and made a decision early on to “live by their values” as they built Drop Bear, which is available throughout the U.K. and in Canada and New Zealand. “I’ve been constantly searching for ways that we can help more in a really impactful way, with conversation, visibility, and awareness,” Drummond said. Part of that push is a commitment to hire LGBTQ+ employees in a space not traditionally associated with them; half the staff at Drop Bear is queer. The company also partners with the charity Galop, which supports LGBTQ+ victims. Proceeds from the company’s limited-edition Pride beer this year will support the group. Other firsts for Drop Bear include a designation as Wales’ first certified B-corp brewery (awarded to companies that meet high standards of social and environmental performance, transparency, and accountability), and as the world’s first carbon-neutral alcohol-free brewery, according to Drummond. Their selections are also vegan and gluten-free. Drummond says that the key to the company’s success has been tapping into the “sober-curious” movement, which finds Gen Z and younger generations more willing to set alcohol aside in social situations. “We’re very much about not preaching to people on their drinking habits, just providing a really cool craft beer option if they decide to not drink or just to cut down,” Drummond says. Some of those popular options include Bonfire Stout, Tropical IPA, Yuzu Pale Ale, and New World Lager. For Drummond, the couple’s fresh takes on non-alcoholic brew — among offerings from more than 1,700 microbreweries in the U.K. — are only as good as the company’s commitment to their principles and representation. Queer women “having visibility in leadership roles,” said Drummond, “is more essential than people realize.” http://dlvr.it/T5ztvk

0 notes

Text

Popularity of US CMA Course in India | Zell Education

The Growth in Popularity of US CMA Course in India

Overview

The Certified Management Accountant (CMA) credential provided by the Institute of Management Accountants in USA has gained significant attraction all over India since its advent, almost ten years ago. The field of financial planning, analysis, control and decision support are provided by the CMA qualification. It prepares management accountants and finance for action required in the strategic management within a global economy that is increasingly becoming dynamic. Lets discuss the popularity of US CMA course in India.

According to IMA, as of 2022 in terms of number CMA holders across the world India is second after US. The popularity of US CMA amongst India’s accounting professionals is indicative that the fleeing population prefers to occupy jobs globally, and for higher salary. The number of CMA course and certification registrations has been increasing at over 20% year-on-year, showing clear interest in the program. Important factors are pushing more Indian accounting and finance professionals to earn the US CMA designation.

Increasing MNCs Establishing Presence in India

India has seen a steady rise in multinational companies (MNCs) setting up operations in the country over the past two decades due to economic liberalization and market-friendly policies. MNCs now contribute significantly to India’s GDP and job creation.

The popularity of US CMA certification can be attributed to its worldwide recognition and strategic financial planning concepts relevant to business expansion. Many of these MNCs have their headquarters in the US or have global shared services centers based there. They prefer to hire candidates with US certifications like the CMA due to the following reasons:

Uniformity in Accounting Practices: Adoption of US certifications leads to alignment of Indian operations with the global accounting practices followed within the organization. This enables smoother functioning.

Performance Benchmarking: Global finance teams are able to set goals objectively, measure performance, and compare results across different country operations.

Talent Development: Structured training helps staff develop expert finance skills as per globally benchmarked standards regardless of their geographical location. This aids in succession planning and talent mobility across regions.

The increased presence of US MNCs and alignment of Indian arms to US corporate culture has significantly boosted the popularity of credentials like the CMA in India in the last 5-7 years.

Worldwide Recognition

The US CMA qualification is recognized and valued worldwide, especially in countries like the United States, Canada, the Middle East and China. This gives it a global edge and international mobility for certified professionals. Owing to the popularity of US CMA in the workforce, many B-schools have started offering preparatory courses for the exam.

Portability Across Countries

CMA-certified accountants enjoy swift visa processing and ease of getting work permits across global economic hubs like:

1. United States: The IMA-CMA certification is licensed by all 50 American states and considered at par with other US accounting credentials like CPA, CFA etc. It is the fastest pathway for immigration to the USA through programs like H1B and EB2. Over 100,000 CMAs are currently employed in America.

2. Canada & Australia: Management accountants with a US CMA are prized by Canadian employers for accounting, strategy and financial planning roles across various industries. Certified CMAs also get extra migration points while applying for PR visas as skilled professionals. The same is the case with Australia.

3. Middle East: Countries like UAE, Qatar, Saudi Arabia and Oman are actively recruiting senior finance professionals and CXOs holding the reputed CMA qualification from the USA, offering lucrative tax-free salary packages.

4. China & Hong Kong: The majority of Fortune 500 companies have offices in China. They prefer employing CMA credential holders for uniformity in global accounting practices and seamless collaboration between regional teams.

Globally Benchmarked Program

The US CMA course is administered by the IMA (Institute of Management Accountants), the world’s leading finance association dedicated solely to management accounting and financial management professionals.

The 2-part CMA exam is competency-based and tests real-world application of knowledge on Financial Planning & Analysis, Corporate Finance, Decision Analysis, Risk Management, Investment Decisions and Professional Ethics.

It meets the highest global benchmarks in rigor and quality of the curriculum. Partnerships with renowned business schools like McGill Executive Institute (Canada) further bolster its pedigree as a gold standard in financial planning and analysis.

These reasons have exponentially boosted the global reputation of the US CMA certification in the last decade and expanded its scope beyond American shores into every major world economy.

A Short-Term Professional Program

The US CMA course is designed as a flexible and structured certification that can be completed alongside full-time work in just 12-16 months. The popularity of US CMA among entrepreneurs is growing as it helps them make key investment and financing decisions for rapid growth.

Self-Paced Learning: Professionals can self-learn the subjects at their convenience without needing to enroll in full-time classes. Study manuals, online classes, mock tests and expert mentorship provide a structured framework.

Exam-Based Testing: The evaluation methodology is exam-based, objective and focuses on practical real-world applications of knowledge through analysis of scenarios and problems.

2 Parts: There are two exam parts, each having two papers – multiple choice questions and essay-type descriptive questions. Candidates can give the parts one by one at their own pace.

Accessible from Anywhere: CMA allows professionals from any geography to improve their skills by giving online proctored exams in their city. This removes geographical barriers.

CMA-certified professionals need just two years of relevant work experience in fields like budgeting, financial planning & analysis, management accounting, costing etc.

This can be completed along with self-paced exam preparation over 1.5 years. So, within 12-16 months of signing up, financial executives can fulfill all CMA requirements without needing to take a career break.

Career Prospects with Top-Tier Employers

The US CMA opens up rewarding career opportunities both in India and abroad. Surveys show certified management accountants earn 35%-45% higher compensation compared to non-credentialed peers. Despite the growing popularity of US CMA courses, enrollments remain male-dominated, though experts encourage more women to acquire this strategic financial skillset.

In India, CMA-certified professionals are increasingly valued by large corporates, multinationals, consulting firms, banks and accounting practices for the following roles:

Financial Planning Managers

Cost Accounting Managers

Investment Analysts

Business Analysts

Business Development Managers

Finance Controllers

Commercial Managers

Top global recruiters like Amazon, Deloitte, E&Y, Goldman Sachs, JP Morgan Chase, Walmart, Shell and IBM actively hire and reward CMA credential holders with lucrative salary packages.

Kickstart Your Entrepreneurial Journey with a Head Start

For professionals aspiring to launch their ventures, the CMA course provides a strong foundation across all critical areas to set up and manage a company as certified management accountants.

Financial Planning: Prepare accurate cash flow statements, balance sheets, working capital projections, cost & profitability analysis and funding requirements for smooth business operations.

Costing: Expertise in decision-making concepts like target costing, life cycle costing and value analysis to maximize profitability and efficiency.

Regulatory Compliance: Knowledge of tax codes and laws across GST, corporate and labor laws applicable for business entities in India for legal compliance.

Technology Integration: Learn manufacturing, retail and service industry best practices to optimize performance via emerging digital technologies like AI, predictive analytics, blockchain etc.

Strategic Thinking: Understand market dynamics to identify new growth avenues, competition mapping, trends analysis and craft differentiated business strategies.

Leadership Skills: IMA’s management accountant code of ethics instills principles of trust, accountability, transparency and integrity to lead by example.

With the popularity of US CMA, IMA’s India chapter is actively organizing information seminars and preparation workshops in metro cities. This 360-degree skillset positions certified CMAs as the ethical backbone for corporates and gives entrepreneurs a strategic head start to set up, manage and scale their own companies.

Conclusion

The rising popularity of US CMA courses in India is attributable to the country’s integration with the global economy and the increased presence of MNCs with bases in America. The course is widely respected worldwide for its rigorous curriculum. It expands the career prospects of Indian candidates beyond geographical borders while helping global corporations benchmark professional competencies. The exam-based structure also makes it a convenient and fast-track option for working professionals to upgrade their finance skills and earnings potential without a career break. No wonder it is emerging as the preferred global finance credential for smart Indian millennials looking to take their careers to new heights both within and outside India.

FAQs

Does US CMA have value in India?

Yes, the US CMA credential is highly valued in India due to the rising presence of MNCs with US headquarters who prefer to align their global operations with American business culture and accounting practices. It provides uniform training in finance concepts to Indian employees, enabling easier performance management across geographical locations.

Does US CMA have scope?

The US CMA certification has immense scope in India as well as abroad. Surveys show CMA-certified professionals earn 35-45% higher than non-credentialed peers. Top global and Indian corporates across banking, financial services, information technology and manufacturing sectors actively recruit and reward CMA credential holders for a variety of strategic finance roles.

Is US CMA worth doing?

Yes, US CMA is absolutely worth pursuing for Indian finance professionals looking for global job mobility and higher earning potential. The course expands career opportunities abroad while opening up senior management roles with attractive salary packages across top Indian and multinational corporations.

Where is CMA most demanded?

The US CMA credential is highly in demand in India, the United Arab Emirates (UAE), China, Canada, Australia and New Zealand due to rising globalization and the presence of multinational companies in these countries. Job surveys show that certified management accountants tend to earn higher remuneration compared to non-credentialed accounting and finance professionals in these regions.

Anant Bengani, brings expertise as a Chartered Accountant and a leading figure in finance and accounting education. He’s dedicated to empowering learners with the finest financial knowledge and skills.

0 notes

Text

Reach Out to Us by Phone, Online, Or In Person at Our Office Located in Calgary

We are involved with CRA-related taxation for a lot of years. We have represented clients in voluntary disclosures, collections, assessments, bankruptcy, appeals, and taxpayer relief cases in the past.

We are regularly asked if we handle tax cases. Luckily, we periodically work with some of the best tax lawyers in Calgary. For most files, including payment agreements, unfiled tax returns, audits, and objections, there are no judicial actions. Our Tax consultant Calgary area of expertise is handling these files outside of court. Actually, we receive a lot of referrals from tax attorneys who would rather not take on this type of work. Often, the cost of hiring a tax attorney to resolve a tax dispute is greater than the amount of the contested tax bill. We try to solve the issue in a way that is far more effective and economical. Generally speaking, we recommend suing the Canada Revenue Agency and engaging with a tax lawyer only after exhausting all of our regular avenues of engagement with them.

A chartered accountant

With years of combined experience in general company and individual tax services, as well as expatriate and non-resident tax services, we are a team of Tax consultant calgary. Our staff has a comprehensive understanding of the Income Tax Act and can help you with any tax-related matters. By creating the best tax plan to lower your tax liability, they free up your time so you can focus on achieving your personal and professional goals.

To get in contact with us, give us a call right now or use the form below. A trained member of our staff will calculate the best possible price and get back to you right away.

Our highly skilled tax consultants manage your personal or corporate expenses in a way that automatically reduces your tax returns. By providing advanced accounting services in Calgary, where our staff of skilled accountants completely handles the records of your business's sales, purchases, and other operations, we hope to keep you stress-free.

We also have tax-savvy accountants who have completed the Institute of Chartered Accountants' In-Depth Tax Course. These experts provide help with income tax planning, indirect tax, corporate restructuring, family trusts, and estate preparation, among many other specialized services. Our employees put a great deal of effort into expanding their industry-specific knowledge. We truly believe that understanding our clients' needs and how they operate is essential to provide them with the best service possible that is suitable for their business.

0 notes

Text

A Trip Through Tribunal History in Celebration of the Hundredth Anniversary of Judicial 3000

It is hard to believe that there was a time when humans lived without “Judicial 3000”. “Judicial 3000” is of course an artificial intelligence program which calculates information to the closest degree in order to determine the fairest solution to various legal conflicts. To celebrate the hundredth anniversary of this program, the staff at the “The Bob Loblaw Law Blog” are looking back at a much more complicated and tenacious time in legal history when mere human mortals sat around and decided various legal and fairness issues. To do this we the staff at the ”The Bob Loblaw Law Blog” traveled to planet Westlaw where we were granted access to various different tribunal hearings. Two caught our attention and we decided to share those with our gracious readers today.

Obviously, we have all heard our history teacher bots talk about the issue of policing in the 2000s, all of which culminated in the tense North American Black Lives Matter protests in the year 2020. The relationship between the citizenry and police was tense particularly within marginalized groups in the earth state formally known as Canada. This remains an important time in history and as such we decided to bring you a glimpse into one of the ways in which such issues were handled. Namely, we bring you an October 17th, 2023, hearing from the Ontario Civilian Police Commission (OCPC).

According to its own website, OCPC was among three civilian police oversight agencies in Ontario. The other two are Special Investigation Unit and Office of the Independent Police Review Director. Before politician-bots ran a strictly centralized government and “Judicial 3000” dealt out remedies for injured parties in a variety of fields, certain legislative documents gave power to administrative tribunals to resolve conflicts. The OCPC got its powers and duties from the Police Services Act, section 22(1) which empowered the board members to uphold prescribed standards of police services. While that is the source of its power, the source of the OCPC’s existence is the Adjudicative Tribunals Accountability, Governance and Appointments Act of 2009. This document chronicles the course of conduct expected of tribunals.

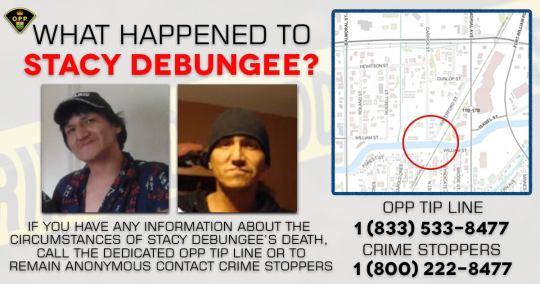

Essentially, the narrative the police adhered to was that Mr. Debungee had been drunk and fallen into the Bay. So, what’s the issue here? Well, the issue is that the death was suspicious and the result of murder. The bigger issue? A private investigator hired by the family discovered this and not the police officer in charge of the investigation. This is where complaints against the police officer began to be filed. From the Office of the Independent Police Review Director to our very own OCPC where appeals are sought.

According to the Ontario tribunal website, the OCPC had two divisions, one that is adjudicative and one that is investigative. The former deals with appeals of disciplinary matters, budgetary disputes and other functions while the latter deals with public complaints on the conduct of members within the police force. The hearing our blog had access to was an adjudicative one. The OCPC panel was hearing an appeal from the decision of a police disciplinary hearing for Officer Shawn Harrison. We were only able to recover records until November 2023 and by that point the board had not yet made a decision on this hearing. Bad news for those interested to hear the final verdict, spoiler alert; we do not know.

The mentioned OCPC website explained that the OCPC had the authority to confirm, vary or revoke a decision of the hearing officer. It also has the authority to replace the decision with one of its own or call for a new hearing to take place. Therefore, we can assume that three hundred years ago, the OCPC had decided on one of these options especially considering that the OCPC does not, according to its own website, resort to alternative dispute resolution due to its jurisdiction.

Shawn Harrison v Thunder Bay Police Services – OCPC Hearing:

This hearing began with a little bit of confusion, counsel for Shawn Harrison, the police officer, admitted to neglect on the part of his client but wanted to appeal the issue in order for the neglect charges to remain but in a much more constrained manner. The counsel for Debungee had a hard time with this but finally, they were able to see eye to eye on the matter and move on. David Butt, Mr. Harrison’s lawyer, rested his appeal on four arguments. He first argued that errors were made in the analysis of guilt in the charge of neglect of duty. Then he argued that there was too much reliance on unconscious racial bias. Mr. Butt admitted that there were huge discrepancies in how police officers treat cases involving Indigenous victims and criminals. He went as far as to suggest that systematic changes should be made. He ended this part of his argument by saying that while all that is true, we should not be over-extending this kind of analysis to every case.

On one hand, racism is a rampant issue on the other it has nothing to do with this case. For us at the blog, this was a confusing argument, one that would definitely confuse even our own “Judicial 3000”. Alas, we move on to Mr. Butt’s third argument, he found that the verdicts his client had received were inconsistent. Fourth, he took issue with the penalty.

At some point, Mr. Butt launches into an example to draw comparisons to the events at hand, at which point one of the panel members stops him and tells him that this example is not helpful and that she was not following it. In this way, the panel seemed involved and proactive, even paying attention to small details and arguments. Panel members would chime in when they found holes in the argument or untruths. It was in those moments that this process most resembled how our “Judicial 3000” machine operates, without bias and with an eye only to finding the truth. This was impressive for mere mortals.

Are Human Tribunals Fair?

On the surface, the OCPC seems like a procedurally fair tribunal. Both sides were given the chance to speak, present their arguments and interject where their point of view was needed. As mentioned before, there was no decision made in this hearing that was available to us, but the members seemed to operate without bias, or at least without obvious and determinable bias. Further, 80% of the application and appeals that they receive is scheduled for a hearing within 90 days. Although for the modern reader who is used to the 30-minute turnaround time of the “Judicial 3000” this might seem like an eternity, 90 days was a fair window of time for complaints to be dealt with during the year 2023. Having access to timely decisions for legal problems was one of the hallmarks of a fair legal system in the 21st century.

In terms of internet and media coverage (yes the internet was by 2023 invented and widely used), while Shawn Harrison’s conduct had been widely covered by various online news sources, no information could be found online by our team about this particular hearing. The OCPC itself is mentioned in a few recent news articles chronicling recent officers who have been subject to penalties. In most of the news articles we read the decision of the hearing officer which had been appealed was upheld by the OCPC. Aside from that though, while the time frame in history we are looking at was a period in which there were many calls to hold police officers accountable for racist behaviour, not much attention is given to this administrative board that does just that. Perhaps, one explanation is that administrative remedies are of such a technical legal nature that even their existence is not known by most of the population of the state formally known as Canada.

Tribunal Members:

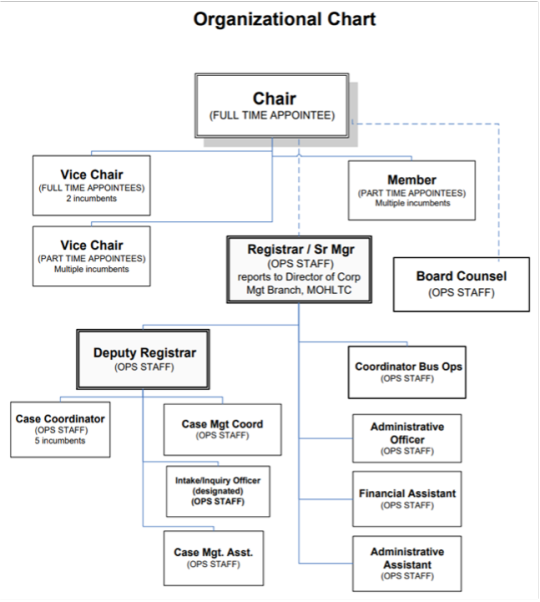

We at the “Bob Loblaw’s Law Blog” thought it would be interesting for the reader to know more about the members who serve on this tribunal. Lest you forget that the OCPC is not a AI program and was actually operated by human beings who made the ultimate decision. Eleven humans, all with differing backgrounds, served on this tribunal. One Associate Chair, three Vice Chairs, five members, one Executive Chair and finally one alternative Executive Chair. Members are required to comply with procedural fairness, and natural justice requirements and to act impartially. Each member is required to sign a document promising that they will uphold the requirements of fairness. Members are also bound by the OCPC Rules of Practice. The members seem to come from a background of law and some but not all were involved with their community in various ways. For example, Sean Weir, the Executive Chair, was an elected Councillor of the Town of Oakville and a director of the Hospital in the town. Member Laura Hodgson was involved with Ottawa’s Centre for Refugee Action and Tungasuvvingat Inuit. Most of the members have been in their position since 2022 or 2023 and their terms will end within the next two to three years.

But let us move on now to another hearing we were able to get our hands on. Another important and contentious topic in the history of humankind is that of control over decisions made in relation to their own well-being in terms of physical and mental health. After all, the creatures that roamed the planet Earth 300 years ago were mortals who often experienced illnesses of different kinds and had to make decisions for themselves on the recovery path they desired. The issues that arose from disagreements between the individual and a healthcare professional about the capacity of the patient to consent were dealt with by the Consent and Capacity Board (CC Board).

Consent and Capacity Board Overview

The Hearing

In the hearing that the writers at our blog were able to watch there were three members present. While they did not identify whether they were the legal expert, physician or member of the community, by the line of questioning each pursued it would be easy to make a guess. As advised by the rules of the Consent and Capacity Board we are not at liberty to share the names of the those involved. However, we can share with you that the hearing was concerning a patient in a Kingston mental health facility who had refused to take medication despite the fact that this doctor believed he was experiencing a manic episode and should be on medication. This November 6th, 2023, hearing was to determine whether the doctor would be allowed to proceed in prescribing medication to the patient without the patient’s consent. The patient himself was presented along with his legal representative, his doctor and three members of the Consent and Capacity Board. The doctor began the session by speaking about the client’s bi-polar diagnosis and mentioned previous examples of his manic behaviour. The doctor finished by asserting that his patient did not have the capacity to make decisions regarding his treatment.

For his part, the patient’s lawyer tried to make holes in the doctor’s findings by questioning whether or not the doctor had taken the necessary steps to explain to the patient his situation and his required medication. The lawyer argued that the doctor had undermined his duty to fully explain the treatment process under the false assumption that the patient himself was not capable of consenting. The members did not interject during testimonies but then proceeded to ask each side appropriate and clarifying questions. It was obvious that public safety was an important concern for the Board. A lot of the questions they asked were regarding the patient’s past public displays of violence.

Is the CC Board Procedurally Fair?

Then they began questioning the patient himself. This felt like a procedurally fair decision on the part of the tribunal members because it was obvious that the patient was frustrated by the fact that for most of the hearing, others were speaking on his behalf. He seemed happy to be able to speak for himself. Though he often went off-topic the members questioning him were very patient with him and took his words very seriously. The tribunal’s decision to have a doctor, a legal expert and a community member on the panel is also a very important step towards ensuring fairness. This way it is not the opinion and concerns of one professional group that dominates the line of questioning in each hearing.

The CC Board seems to operate in a way that is procedurally fair in terms of access to justice, for example following an involuntary admission or when a patient is found to not have the capacity for decision-making, the patient can get an advisor from the Psychiatric Patient Advocate Office. Advisors from this office help explain the legal recourse available to the patient and they will complete the paperwork for a CC Board hearing. Based on information available to us from 2023 documents and websites it is obvious that the CC Board, more than the OCPC, is concerned about treating individuals who seek guidance through their procedure with fairness. This is important because the population that they help is particularly vulnerable to exploitation and unequal treatment. On average the tribunals determine the limits of the rights of citizens on a larger scale than courts do.[1] Therefore, fairness is a much more important consideration.

In the CC Board, fairness is guaranteed by making sure that conference hearings are available, making sure that patients have access to legal representatives, and that there are interpreters available for those who need it.

How is the CC Board Perceived?

As opposed to the previous tribunal, the Consent and Capacity Board receives a lot of media attention. Based on a few articles we perused, the general population's understanding is that the Consent and Capacity Board deals with really complicated disputes. It seems that a lot of the decisions, unlike the OCPC, are appealed and it falls on the courts to affirm the Board’s decision. Specifically, an appeal of a CC Board decision can be pursued at the Superior Court of Justice based on a question of fact or law.

As mentioned before, the CC Board is very strict about keeping information confidential, so the results of the hearing are not released to the public. However, from the way that the members were interacting with the patient in the hearing we can assume that they might decide that the patient does not have the capacity to make decisions regarding their treatment. The CC Board does not always make a decision themselves. According to the Consent and Capacity Board rules of practice s20.7; if all parties wish to resolve matters by dispute resolution, then the Board can make that order upon request.

0 notes

Text

Baby Time (Cronos)

1985: Birth, Mondale loses.

1986: Dr. Spock, Gypsy assassin.

1987: Uncle Sam, Leibenschilitz alliance, "Lennox".

1988: Disney, Duvaliers; "Jack the Ripper" is black.

1989: Berlin Wall, INTERPOL; horse farts, Slovenia shut down.

1990: Lockerbie, Libyan kid porn deleted; "Dream Chair", Dr. Facilier.

1991: Mozart, Warren Buffet; CNN investment.

1992: Islamic Prophecy, Knightfall; daughter with Maces, "Bane", MI-6.

1993: South Park, Avenging Conseince; Detective-Sergeant Dave MacNeal, NORAD boot, author.

1994: Star Trek: TNG, Riker written; Mike Judge passed contract, INTERPOL, MTV.

1995: Cillian Murphy contract, Irish Mob, hired by White Wolf; convert to Satanism, Ba'athist form, "The Omen".

1996: Sexual molestation of Ted Blanchard, covered by Will Morgan, Jefferson Davis; Hopkinton Nordic Alliance begins, diner fund; first air of South Park, for Barack Obama.

1997: Lodge program to kill grandparents revealed, "Damn-Yankee" recruited to MI-6, as "Cypher", "The Matrix".

1998: GTA 3 camera, "all crime is now gay"; Gamespy, Quakeworlder Labs.

1999: Y2K bug, computer clock; Chinese circus shut down, by Mitnick, for kidnapping clowns.

2000: Death of Alice Charlebois nee O'Neill, by Thomas Menino, Canadian spy.

2001: David Charlebois, nominated as undercover cop, by Brett Mulvey, teacher's union; state police "outfits"' targeted, as Attleboro spies, against Massachusetts drug rights for children; death ensue for centuries, "Christ".

2002: Written description of Heath Ledger, as Batman; Heath Ledger accepts contract, from James Holmes and Christopher Nolan; Warner Brothers.

2003: Return to James Madison's law, against baby foot theft; first murder, invention of Narcodan.

2004: Unions replaced with business unions; John McCain against, declared racist by George W. Bush, for wanting free stuff.

2005: 7/7 bombings planned, though Green Berets; David Charlebois, swings summit, towards NYPD and IDF and USMC simultaneously, for War in Iraq.

2006: Hopkinton PD, uncovers labor slavery at Colella's Supermarket; Hamburg, indicted for Rice a Roni beet slavery, "Redneck Rampage".

2007: First print set of Assassin's Creed submitted, as French advertisement to Saint's Row; Catholicism, cool again, like with sack of Gauls.

2008: Staff mails collected, "Gotham City MUSH"; contract disputes, on "Law and Order: Gotham City", to return Masouz family to honor, to avenge Masouz family; IDF, suspects that America, isn't Canada; "Chet", David Charlebois, frames Batman, as Boston Strangler, hunting Harry Potter.

2009: Chemically castrated, for causing "Hard Candy"', teachers outed as terrorists for killing politicians, the jumping kid.

2010: FBI snitches ExSec, as 9/11, temp agencies; Trump is enraged, prints his television shows, and wrestles. Korean Northern logic; last name, is country of origin. Has sexually assaulted women.

2011: "Chet", is fired from M3, for siding against Metro-Terror, murders begin to tally, of spymasters, for Philip J. Morris. Offensive song, printed to heat, to avenge Sandra MacDonald, NSA, killed by Jeffrey Lange, over military service; Jeffrey, "Dr. Leo"', converted to German Neo-Nazi, Lutheran, by new wife, "Sarah Storm". Sarah Storm, had been rejected, by "Chet", for being online contact, instead of RL.