#hbl bank

Explore tagged Tumblr posts

Text

Finland's housing market divide is worsening, reports Helsingin Sanomat.

The paper suggests many properties will never find a buyer, even if the economy improves.

According to HS, Finland has up to a million homes — both old and newly built ones — in areas losing population and demand. This represents about a third of all housing in the country. Many of these properties are unsellable, even in strong markets, and banks are reluctant to finance their renovations, the paper explained.

The situation is especially problematic since much of Finnish wealth and retirement security is tied up in real estate.

Qualified but unemployed

Hufvudstadsbladet looks at newly qualified midwives struggling to find jobs as Finland sees fewer babies.

"This is the first time that no one graduating has a job lined up," said Pernilla Stenbäck, who has been training new midwives for 15 years at the Arcada University of Applied Sciences.

Several smaller maternity hospitals have recently closed, including ones in Lohja, Porvoo and Raasepori.

Some of the new graduates HBL talked to said they were now looking further afield for work, including Norway. Finnish midwives are also fully qualified to work across the entire EU thanks to harmonised training standards.

"The craft is the same across all of Europe, but especially in the Nordic countries, the status of midwives is similar," Stenbäck told the Swedish-language daily.

Icy roads

Weather service Foreca and the Finnish Meteorological Institute (FMI) both warn of extremely poor driving conditions in most parts of Finland on Monday, reports Ilta-Sanomat.

Widespread snowfall is anticipated across southern and central parts, as well as from Northern Ostrobothnia to southwest Lapland, with accumulations ranging from 10 to 15 centimeters. Later in the day, snow along the southern coast is likely to turn into rain, further hampering driving conditions.

On Monday, daytime temperatures will range from -2 degrees Celsius to 3 degrees in the south and west. In the east, temperatures will be below freezing, ranging from -1C to -11C. In the north, it will be mostly -10C to -16C.

As the week progresses, colder conditions are expected to continue across Finland, with the mercury staying largely below freezing on Tuesday and Wednesday. However, along the southern coast, temperatures may rise slightly, reaching around zero.

4 notes

·

View notes

Text

Banking Careers UBL & HBL Bank Jobs Opportunities

I’m excited to explore the career options at Careers UBL & HBL Bank Jobs in the UK. These top banks offer great services and chances for growth. They’re perfect for those looking to start a rewarding career. UBL UK started in 2001 and is known for its personal and business banking. They offer savings, money transfers, and mortgages. Working here means joining a bank that values its customers and…

0 notes

Text

Difference Between HBL and MBL

Understanding the Difference Between HBL and MBL in Shipping

In the shipping and logistics industry, the terms HBL (House Bill of Lading) and MBL (Master Bill of Lading) are commonly used, yet they serve different purposes. Understanding the distinction between these two documents is crucial for smooth shipping operations.

House Bill of Lading (HBL): The HBL is issued by a freight forwarder or a Non-Vessel Operating Common Carrier (NVOCC) to the shipper. This document acts as a contract of carriage between the shipper and the freight forwarder. It outlines the terms and conditions under which the goods will be transported. The HBL is also a receipt for the goods, confirming that the freight forwarder has received the cargo for shipment. The shipper and consignee details on the HBL usually differ from those on the MBL, as the freight forwarder may consolidate multiple shipments under one MBL.

Master Bill of Lading (MBL): The MBL, on the other hand, is issued by the shipping line or carrier to the freight forwarder or NVOCC. This document serves as a contract of carriage between the carrier and the freight forwarder. It represents the entire shipment being transported on a vessel and includes details of the consignee, shipper, and other key information. The MBL is a crucial document for customs clearance and is often required by banks when processing letters of credit.

Key Differences:

Issuer: The HBL is issued by a freight forwarder or NVOCC, while the MBL is issued by the shipping line or carrier.

Purpose: The HBL acts as a contract between the shipper and freight forwarder, whereas the MBL is a contract between the freight forwarder and the shipping line.

Usage: HBL is used in consolidated shipments, where multiple consignments are grouped under one MBL. The MBL covers the entire shipment on a vessel.

In summary, both HBL and MBL are essential in the shipping process, with the HBL focusing on the relationship between the shipper and freight forwarder, and the MBL between the freight forwarder and carrier. Understanding these differences ensures proper documentation and smooth shipping transactions.

#citrus freight#fruits exports#export insurance#vegetable exports#reefer container#fruits and vegetable exports#cargo insurance#perishable export#perishable goods#marine insurance

0 notes

Video

youtube

HBL Bank Blocked 200000 lakh Account without any Notification

0 notes

Text

On World Sight Day, HBL Mobile Becomes Pakistan’s First Mobile Banking App for Visually Impaired Individuals

http://dlvr.it/SxNxyH

0 notes

Text

HBL Habib Bank Limited Jobs Apply Online

HBL Habib Bank Limited is seeking to hire highly qualified, dynamic, and motivated professionals for vacant positions. Males and Females applicants who are well-qualified and competent can apply for these career opportunities in an inspiring work environment. Selected individuals will be offered handsome salary packages. The minimum qualifications and experience required are given below. These…

View On WordPress

0 notes

Text

UPS Battery Dealers & Suppliers in Mumbai & Thane

Sycom Power Protection Pvt Ltd is well-acknowledged Manufacturer, Supplier, Distributor, Wholesaler and Dealers of APC UPS, Emerson UPS, Numeric UPS, Luminous UPS, Exide Battery, Precision Industrial AC System, Smart Data Center Integrated Solution, Roof Top Solar Panel and On Grid Solar Inverter.

The headquarters of Sycom Power Protection is located in financial capital of India, in Mumbai and have its branches in PAN India. The company had started its complete operation since 1995, by successfully offering turnkey project services in the realm of Electrical, Automation, Instrumentation, Energy Saving and Control with competent & experienced manforce with firm technical background.

We acquire a range of UPS systems produced by globally recognized manufacturers and from pre-verified and genuine UPS dealers.We also offer APC UPS repairing Service for commercial UPS system and batteries as well as offer UPS Maintenance in Thane, Mumbai, India. We further have extended our services as Stabilizer Suppliers, Industrial UPS Suppliers, Rocket Battery Suppliers and Panasonic Battery Suppliers.

Today, Sycom Power Protection Pvt Ltd is a trustworthy channel partner, trader, distributor, wholesaler, retailer, dealer and supplier of a wide range of Quanta (Amar Raja) Batteries, Exide Batteries, SMF Batteries, Panasonic Batteries, Rocket Batteries, NED Batteries, HBL batteries and APC UPS, Emerson UPS and Numeric UPS systems. We also provide batteries and power systems on rent to our esteemed customers.

Being dealers of utmost standards, we trade into global brands of batteries like Exide | Rocket | Emerson | Panasonic |Quanta | Su-kam and many more, at best economical costs.Sycom Power have client base of corporates, industries, commercial shops & establishments, residential buildings, Banking & IT firms, etc. Our company strongly believes in customer satisfaction, timely delivery, longer durability and highest quality of products and services. This has helped us acclaim the top position in power solutions.

Our Website:- https://www.sycompower.com/index.html

1 note

·

View note

Text

Helsingin Sanomat's most popular article on Monday morning is a story about two American women's struggles to land jobs in Finland.

"You could say ten years of my life have gone down the shitter," 40-year-old Theresa, who has a Finnish Master's degree, told HS.

She later went into a different field through an apprenticeship but is now planning on returning to the US with her family.

Ashley meanwhile managed to find a job quickly after moving to Riihimäki from Helsinki, but not in her chosen field. She started her working life in Finland as a cleaner, but she eventually found work in healthcare.

Ashley's husband is Finnish-American and the couple thought moving to Finland would be a fun adventure. Ashley has since gained a Finnish nursing degree and had two kids in Finland.

"It's probably easier to find a job in healthcare compared to many other sectors. I've also been lucky in many ways," she said.

Ukraine getting less help from Finns

lltalehti carries some concerning news for Ukraine.

Donations to NGOs trying to help Ukraine in the face of Russian aggression have declined markedly after a peak in 2022, and some organisations are seeing just a fraction of the funds they collected soon after the full-scale invasion.

The Finnish Red Cross, for instance, collected some 39 million euros in 2022, but so far this year has just 1.5 million euros in donations from Finns.

Unicef, Finn Church Aid and Save the Children all suffered drops in the millions of euros.

One organisation that has bucked the trend is Your Finnish Friends, which was founded to "enable and ensure the continuation of support for Ukraine, to take care of the survival and operating conditions of the Finns helping on the ground, and to support people in returning from the war back to civilian life in Finland."

The association actively raises funds and has seen growth from 30,000 euros donated in 2022 to 370,000 euros in 2023 and 380,000 euros in 2024.

Finnish nightmares

Hufvudstadsbladet writes about a woman's difficulties with Aktia Bank since her father passed away. The bank won't release account funds because the daughter needs to prove that her father did not marry or have any children in Portugal, where he retired at age 68 and lived for six years.

The problem is that it's not possible to obtain a certificate from the Portuguese authorities confirming that the father has neither married nor had children there. Such a register simply doesn't exist.

"We have to find out who the beneficiaries of the estate are," Aktia told HBL, noting that other banks have the same practice.

Experts told the paper that inheritances get complicated if the deceased has lived abroad, particularly in the United States.

According to HBL, it's next to impossible to obtain documentation on "secret families" from the US. A lawyer told the paper of a case where the Finnish authorities eventually accepted the testimony of an American neighbour of the deceased, who swore under oath that he had neither seen nor heard of any other children during the time he knew the family.

2 notes

·

View notes

Text

Divulging the Best Banks in Pakistan: Stays of Money related Steadiness

Pakistan’s keeping money segment may be a significant column of the country’s economy, serving as the spine of money related steadiness and financial development. With a wide cluster of administrations catering to assorted client needs, the keeping money industry in Pakistan has witnessed surprising advancements. In this article, we’ll investigate the finest banks in Pakistan, highlighting their remarkable offerings, imaginative approaches, and commitments to the nation’s monetary scene.

Habib Bank Constrained (HBL): Built up in 1947, Habib Bank Restricted (HBL) has gotten to be a family title in Pakistan’s keeping money division. With a endless arrange of branches and a solid nearness both locally and universally, HBL offers a comprehensive extend of managing an account administrations to people and businesses. The bank is famous for its proficient client benefit, cutting-edge advanced managing an account arrangements, and broad item portfolio. HBL has reliably appeared commitment to advancement and has played a urgent part in driving financial inclusion in Pakistan.

National Bank of Pakistan (NBP): As one of the biggest open division banks within the nation, the National Bank of Pakistan (NBP) has been instrumental in giving keeping money administrations to a wide extend of clients. With its extensive branch arrange and assorted extend of items, NBP offers retail, corporate, and Islamic managing an account arrangements. The bank’s center on innovation integration has brought about within the presentation of helpful administrations such as online managing an account, portable keeping money, and ATMs, making it available to clients over Pakistan.

United Bank Limited (UBL): United Bank Limited (UBL) has reliably been recognized as one of the driving banks in Pakistan, advertising a wide extend of monetary administrations. UBL’s commitment to brilliance is reflected in its personalized client benefit, productive advanced stages, and inventive item offerings. The bank has too made significant strides in advancing money related incorporation through activities such as microfinance and farming financing. UBL’s devotion to client fulfillment and technological headway has earned it a solid notoriety within the advertise.

MCB Bank Limited: MCB Bank Limited has built up itself as a trusted title within the managing an account industry, known for its solid monetary execution and customer-centric approach. The bank offers a wide extend of administrations counting retail managing an account, corporate managing an account, and Islamic keeping money arrangements. MCB Bank has grasped computerized change and presented imaginative stages and administrations, such as web managing an account and versatile managing an account apps, to upgrade client encounter and comfort. Its center on compliance and chance administration has contributed to its notoriety as a steady and solid budgetary institution.

Allied Bank Limited (ABL): Allied Bank Limited (ABL) is recognized for its commitment to client fulfillment and mechanical advancement. The bank offers a comprehensive suite of administrations, counting retail managing an account, corporate keeping money, and rural financing. ABL has made noteworthy ventures in computerized keeping money arrangements, making it less demanding for clients to get to keeping money administrations through online and versatile stages. The bank’s solid monetary execution andaccentuation on client benefit have contributed to its position as one of the beat banks in Pakistan.

Conclusion:

Pakistan’s keeping money division proceeds to advance and adjust to the changing needs of clients and the economy. Habib Bank Restricted (HBL), National Bank of Pakistan (NBP), Joined together Bank Restricted (UBL), MCB Bank Restricted, and Partnered Bank Restricted (ABL) stand out as the best banks in Pakistan, advertising a wide run of administrations, progressed computerized managing an account arrangements, and immovable commitment to client fulfillment.

These banks have not as it were given basic monetary administrations but have moreover contributed to money related incorporation, financial development, and steadiness in Pakistan. Their inventive approaches, broad department systems, and center on innovation integration have upgraded the openness and comfort of managing an account administrations for people and businesses over the nation.

As Pakistan’s managing an account industry proceeds to develop, these driving banks will play a imperative part in forming long-term of the nation’s economy. Through their skill, monetary assets, and commitment to advancement, these banks are well-positioned to back Pakistan’s development goals and contribute to the by and large success of the nation.

Moreover, the most excellent banks in Pakistan have too been at the cutting edge of promoting budgetary education and instruction. They effectively engage in activities to improve money related mindfulness among people and businesses, engaging them to create educated money related choices and move forward their financial well-being.

It is worth noticing that the managing an account segment in Pakistan has experienced noteworthy administrative changes to guarantee straightforwardness, responsibility, and soundness. The State Bank of Pakistan, as the central bank, has played a essential part in cultivating a sound managing an account environment, empowering these beat banks to flourish whereas following to rigid administrative guidelines.

In conclusion, the leading banks in Pakistan, counting Habib Bank Limited (HBL), National Bank of Pakistan (NBP), United Bank Limited (UBL), MCB Bank Restricted, and Allied Bank Limited (ABL), have consistently illustrated their commitment to brilliance, advancement, and client fulfillment. With their broad extend of administrations, mechanical progressions, and commitments to budgetary consideration, these banks are the stays of money related soundness in Pakistan.

As the keeping money segment proceeds to advance in reaction to developing innovations and changing client desires, these banks will stay at the cutting edge of driving advancement, supporting financial development, and assembly the differing money related needs of people and businesses.

Pakistan’s future financial thriving depends intensely on the quality and solidness of its managing an account segment, and these best banks are well-positioned to lead the way. Through their immovable commitment to client benefit, advanced change, and dependable keeping money hones, they are not as it were forming the show but too clearing the way for a brighter and more affluent future for Pakistan’s economy and its individuals.

0 notes

Text

HABIB BANK LIMITED (HBL)

1 note

·

View note

Text

PSL 2023 Match 13 Quetta Gladiators Vs. Islamabad United Score, History, Who Will Win

HBL Pakistan Super League 2023 is here, and we will witness an exciting match between Islamabad United and Quetta Gladiators today. PSL 2023 Match 13 at 7 PM PST Friday, 23 February 2023, is at the National Bank Cricket Arena, Karachi. Islamabad United has won the PSL trophy twice, and Quetta Gladiators lifted it once. Spectators of Karachi can witness the HBL PSL 08 Match 13 in the stadium, and…

View On WordPress

0 notes

Text

HBL PSL 2023 Match 12 Peshawar Zalmi Vs. Islamabad United Score, History, Who Will Win

HBL Pakistan Super League 2023 is here, and we will witness an exciting match between Islamabad United and Peshawar Zalmi today. PSL 2023 Match 12 at 7 PM PST Thursday, 23 February 2023, is at the National Bank Cricket Arena, Karachi. Islamabad United has won the PSL trophy twice, and Peshawar Zalmi lifted it once. Spectators of Karachi can witness the HBL PSL 08 Match 12 in the stadium, and…

View On WordPress

0 notes

Text

PSL 2023 Match 09 Quetta Gladiators Vs. Peshawar Zalmi Score, History, Who Will Win

HBL Pakistan Super League 2023 is here, and we will witness an exciting match between Peshawar Zalmi and Quetta Gladiators today. PSL 2023 Match 09 at 7 PM PST Monday, 20 February 2023, is at the National Bank Cricket Arena, Karachi. Both teams will play their third match today and try to win it to get a better position at the points table. Also, both teams have won the PSL trophy…

View On WordPress

0 notes

Text

PSL 2023 Match 09 Quetta Gladiators Vs. Peshawar Zalmi Score, History, Who Will Win

HBL Pakistan Super League 2023 is here, and we will witness an exciting match between Peshawar Zalmi and Quetta Gladiators today. PSL 2023 Match 09 at 7 PM PST Monday, 20 February 2023, is at the National Bank Cricket Arena, Karachi. Both teams will play their third match today and try to win it to get a better position at the points table. Also, both teams have won the PSL trophy…

View On WordPress

0 notes

Text

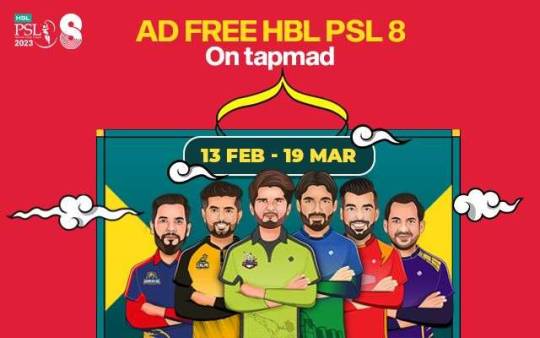

AD Free HBL PSL 8 on Tapmad

It’s officially February, you know what that means? It’s HBL PSL 8 time – so gear up cricket fanatics, like every year, tapmad will be streaming HBL PSL 8 in HD and without any Ads! The HBL PSL 8 will be held in two legs between the Multan Cricket Stadium and National Bank Cricket Arena as matches will be divided amongst them from 13-26 February. After which, the action will move to the Gaddafi Stadium and Pindi Cricket Stadium where the matches will be played from 26 February to 19 March. The opening ceremony will be followed by an opening match by 2021 winners Multan Sultans and the defending champions Lahore Qalandars, both of which, will take place on 13th February in Multan. Players to look out for in this HBL PSL 8: Islamabad United – Alex Hales, Rahmanullah Gurbaz, Shadab Khan, Asif Ali, Fazal Haq Farooqi, Wasim Jr. Karachi Kings – Haider Ali, Imran Tahir, Matthew Wade, Imad Wasim, James FullerJames Vince. Lahore Qalandars – Fakhar Zaman, Rashid Khan, Shaheen Shah Afridi, Dawid Wiese, Hussain Talat, Haris Rauf. Multan Sultans – David Miller, Josh Little (Ireland), Mohammad Rizwan, Khushdil Shah, Rilee Rossouw, Shan Masood. Peshawar Zalmi – Babar Azam, Rovman Powell, Bhanuka Rajapaksa, Mujeeb Ur Rehman, Sherfane Rutherford, Wahab Riaz. Quetta Gladiators – Mohammad Nawaz, Naseem Shah, Wanindu Hasaranga, Iftikhar Ahmed, Jason Roy, Odean Smith. Given Lahore Qalandar’s beautiful win last year where they beat Multan Sultans by 42 runs. This is the perfect opportunity for them to be the first team to win back-to-back titles! Looks like a tournament you wouldn’t want to miss! Especially given that Babar has now moved to Peshawar Zalmi and Shan Masood is in Multan Sultans – this is going to be a tough game! As we previously mentioned, tapmad has acquired the streaming rights for the HBL PSL 8 season. It will be solely on tapmad in HD and without any Ads. Speaking of streaming, tapmad has truly redefined the streaming experience for users in Pakistan by consecutively and successfully streaming one huge tournament after another. They recently streamed Pak vs NZ Test and ODI series, Pak vs Eng T20 series, and much more all of which were in HD and without any advertisements. In case you didn’t know, tapmad is Pakistan’s first OTT platform, with the rights to live streaming over 100 live channels in the categories of entertainment, news, and sports along with several On Demand videos. You can easily download the app, available on both, Android and iOS. Users are required to subscribe before they can access the content. Once subscribed, not only can you enjoy watching the HBL PSL 8 but you also get access to their entire media library which includes multiple channels such as Tensports, F1, etc. How to Subscribe: - Go to https://www.tapmad.com/sign-up?tab=1&packageId=2 - If you’re not already registered, press “Not a subscriber?” - Choose your desired payment method - Enter your credentials - Set your pin - Login and enjoy streaming! Or Download the App: Android: https://play.google.com/store/apps/details?id=com.tapmad.tapmadtv&pli=1 Apple: https://apps.apple.com/us/app/tapmad/id1317253610 Read the full article

0 notes